September 11 Market Update

Weekly numbers courtesy of the VREB.

| Sep 2017 |

Sep

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 183 | 781 | |||

| New Listings | 321 | 1050 | |||

| Active Listings | 1949 | 2061 | |||

| Sales to New Listings | 57% | 74% | |||

| Sales Projection | — | ||||

| Months of Inventory | 2.6 | ||||

A weak start to the month compared to last year. We are down 16% in sales while new listings are about the same as last year. We are still cruising along at 5% less total inventory but the difference is becoming immaterial.

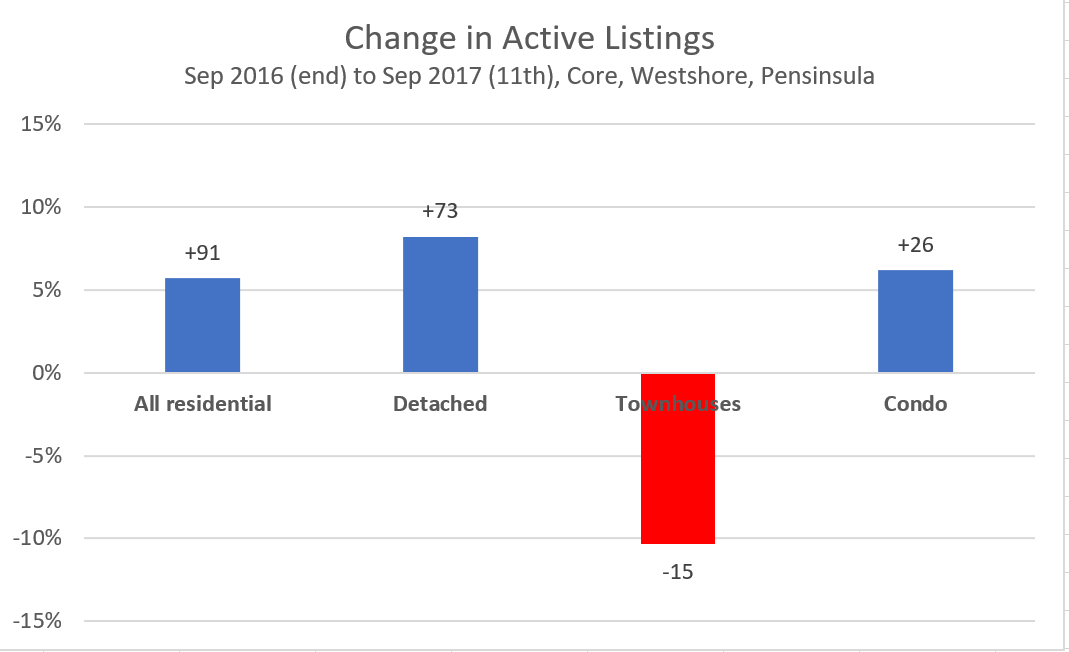

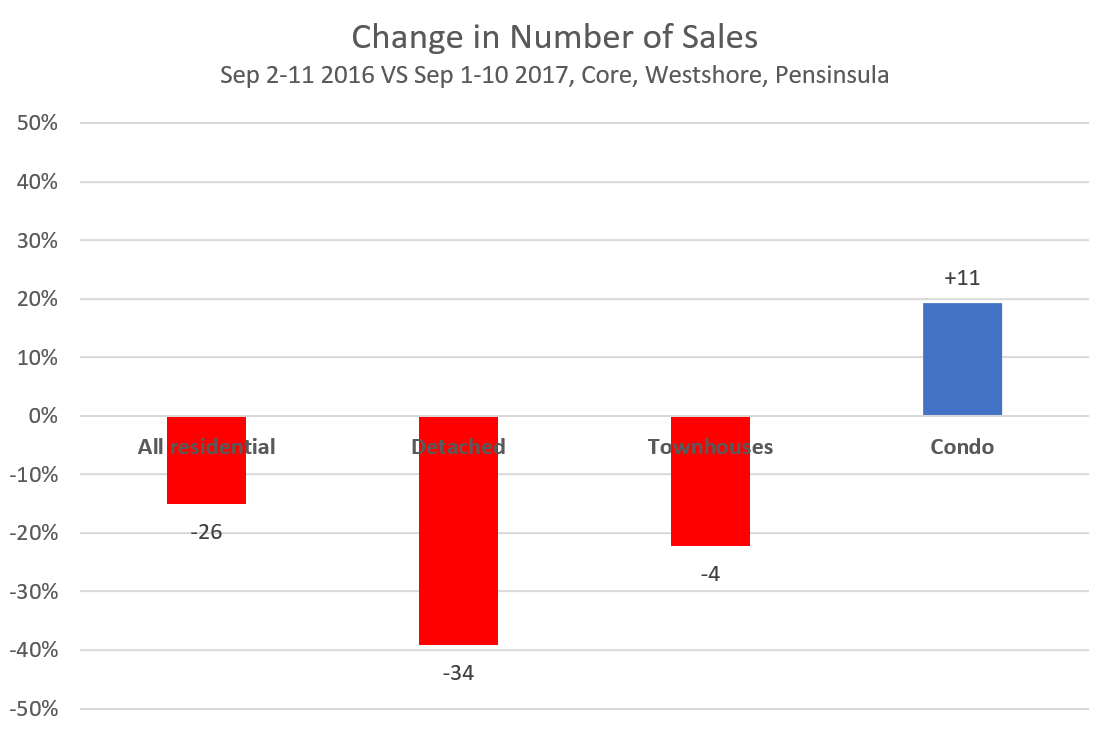

It also doesn’t tell the whole story. Looking at the areas most people are interested in (residential listings in the core, westshore, and peninsula), total inventory as well as inventory for detached houses and condos are up. Only the number of townhouse listings are down by 15 from last September.

Meanwhile comparing the same days of September to last year, sales are down substantially for all those categories except condos.

It’s not a lot of days to compare, but it’s pretty clear that the low inventory is not the reason that sales are down from last year, and they are slumping because of a reduced demand at current prices. We should expect market conditions to continue to improve for buyers overall and especially in the detached market going forward.

Months of inventory jumped up a bit in the first week, but sometimes the first week is a little unreliable due to the low numbers, so we’ll see if this continues.

New post: https://househuntvictoria.ca/2017/09/14/market-value/

Did anyone see the new potential ‘tent city’ popping up on the edge of Topaz Park along Blanshard? There’s a visible sign from the road that says “homes not hate” attached to one of the tents.

Maybe some of the handful of foreclosure/bankruptcy folk from this week have found a new home?

At least this week the New Greenocrat’s made an announcement of more social housing… Here’s an existing modular building in Van in this article… http://www.vancourier.com/news/housing-for-homeless-among-social-commitments-from-ndp-1.22629595

From: https://beta.theglobeandmail.com/news/british-columbia/bc-ndps-first-budget-begins-remake-of-province-but-puts-off-most-expensive-promises/article36230695/

“There is $145-million in new money for modular housing units for the homeless and $13-million for affordable rental housing this year. Those amounts are slated to increase in the next few years to a total of half a billion dollars for thousands of new units;”

My only question is… I wonder where are they going to put all this new modular/social housing in the CRD? Distributing it throughout neighbourhoods/communities and not concentrating it in one area would be a good idea…

Now this is more like it… when one compares to 1513 Bank St which is now listed at $1,798k – which is probably still overpriced for what that is. 1641 Wilmot Pl. in OB was listed at the same as Bank St, but sells in just two days for $1.930k.

This is what I’m talking about when a rare quality home comes up in the core. It shows that there are discerning folk who obviously are still out there w/ the means (bidding war). Tired of looking at all the junk in the core… tired of old places that need extensive reno’s which abound in this town – Like 2584 Lincoln Rd, totally dated with it’s one bathroom, but still priced over a million! Then, there’s that mysterious ‘cache’ that comes from being steps from the OB village… Myself, I’d rather be near the beach, but it takes all kinds…

Does anyone have screenshots of of this guy’s website before it got shutdown by the Toronto Real Estate Board? All I can find with Google are a couple references, such as this:

https://public.tableau.com/profile/shafquat#!/vizhome/HousingPricesinToronto/MLS

…and this:

https://www.linkedin.com/pulse/cost-housing-toronto-shafquat-arefeen?articleId=6174635114132185088#comments-6174635114132185088&trk=prof-post

News Story:

http://m.metronews.ca/#/article/news/toronto/2017/09/13/toronto-real-estate-board-shuts-down-local-man-s-data-project.html

HHV has many nefarious world improvement plans yet to be unveiled.

And the owner of seattlebubble bought their house at the very bottom of that market.

Depends I suppose if the rated max capacity is the issue, or the long term ability to supply power (i.e. water flow). Yes solar alone cannot solve max capacity issues. However even a small battery buffer could smooth out the peak (which is dinner time in winter in BC).

By the way, BC Hydro is going to introduce a voluntary time of use rate at some point soonish. That will also encourage peak demand reductions

@ Island Scott

“I don’t think it’s cost effective for Hydro to pay 10 cents per kilowatt/hour for it.”

Looks like Hydro have been trying to make a buck trading power and losing their shirt, or rather our shirts, in the process.

They’d probably do well to install some combined cycle gas turbines that generate power when required for around 5 cents a unit. We have lots of gas but no export customers so we might as well burn it ourselves.

I’m sending you a hug, Introvert because you need one. As a parent, I see how cyber bullying can be destructive not just to the person being attacked but to the bully as well. Most children learn to be bullies by being bullied by their parents. That linkage has to be broken by someone and that’s why I chose to make the break.

Life is better without the bitterness.

Correction, 9 are bankruptcy, 2 are foreclosure. That’s still a new trend of consumer debt problems as I haven’t seen that many bankruptcies in one week. Never seen the list that long for debtors having their shit confiscated by the courts either. 14 of those.

“For those that are watching, the number of foreclosure applications in Victoria is on the rise.

Has it gone from one all the way to two?”

Actually it has gone from zero for a very long time to 2, then 4 last week and 11 this week. If you were using a chart it would be showing a major foreclosure trend developing but some people are too fucking ignorant to look it up should it dare upset their bird shit seat.

Precisely.

Just Jack, I’m wiping away tears of laughter as I type. It’s a soap opera.

And what is Introvert but a persona for you to hide behind.

John Dollar is a persona that has never gotten into ugly character assassination. That’s how Just Jack was killed off by you. You dragged Just Jack down into the gutter. And that’s not a comfortable place to be.

I am a better person than that. And that is why Just Jack is not John Dollar.

And if in the future I should chose to change my blog name or anyone should chose a different name, which is my and their privilege, I will do so but at this time my conscious is clean. I have treated all bloggers, including you, with respect.

I suppose it bothers you a great deal, having spent all that time logging Just Jack’s comments. But the comments of Just Jack are outdated and now irrelevant and are not the comments of John Dollar no matter how hard you try to tie them together. John Dollar is a fictional persona that I created to be fair, equitable, reliable and reasonable to all.

They are separate personas.

Now what about you?

It’s way too easy on online forums for good discussion to generate into snarkiness or outright insults. I try to use this test before posting – Would I say this to someone’s face during a friendly but heated debate over a beer? (I’m sure I have still been overly snarky at times)

HHV is still an oasis of relative politeness and respect by the standards of many blogs. Let’s keep it that way.

Leo S, I didn’t say we cannot take advantage of solar, I said I don’t think it’s cost effective for Hydro to pay 10 cents per kilowatt/hour for it. The generators/turbines, transmission cables, transformers, staffing and so on still need to be sized for peak load.

When will you abandon John Dollar and hide behind your next anonymous persona (a.k.a. fleeing the wreckage)?

omg, here is Seattle’s equivalent to HHV, complete with comments and everything:

http://seattlebubble.com/blog/

Yep, that’s the one 🙂 The simplicity and power of that opening line just gets you thinking about yourself and your innate imperfectness. It made for a good dinner conversation.

PS, this just in. Apparently China is relaxing some of its capital controls.

Caveat is correct. Hydro is the ideal storage mechanism. No batteries required. When solar production is high you just let less water through the turbines and build up water levels. Then open it up around dinner time to hit peak. BC is perfectly positioned to take advantage of solar power.

Introvert you spend too much time on this blog trying to do harm to others.

Dalai Lama:

https://twitter.com/dalailama/status/561109313154842626?lang=en

“To be aware of a single shortcoming within oneself is more useful than to be aware of a thousand in somebody else. Rather than speaking badly about people and in ways that will produce friction and unrest in their lives, we should practice a purer perception of them, and when we speak of others, speak of their good qualities.”

Dalai Lama quotes (Head of the Dge-lugs-pa order of Tibetan Buddhists, 1989 Nobel Peace Prize, b.1935)

It’s hard to imagine a battery as effective at storing energy as BC Hydro’s massive reservoirs. Seems like the huge storage capacity and near instantaneous dispatchability of BC Hydro’s assets make BC a pretty ideal place to take advantage of intermittent renewables such as wind and solar. Store a bit more water when wind and solar are kicking in. Let more water go when they are not.

I’ll readily admit that I have next to no knowledge of operating an electrical grid, so maybe I am missing something.

I don’t take lessons from walls.

Good job. We look forward to seeing the new you.

Thanks.

Just google the Courts of British Columbia and then look under Supreme Court and select Victoria, Vancouver and/or New Westminster.

My partner and I were at the Tibetan Kitchen last night, and I saw the following excerpt of a saying on the wall. Just loved it.

The quote goes on, but man. Sure got me thinking…

I had no idea culture-shifting was part of HHV’s mandate!

Fair enough.

Has it gone from one all the way to two?

Actually, we all have better things to do. Like point out your deficiencies, for example.

I did? I have that kind of power?

Killing your bad theories is not the same as killing the blog, however much it feels that way to you.

It’s good for us to be aware of your prejudice against children.

All good points, islandscott. Also, if home battery storage technology ever takes off (see: Tesla’s Powerwall) that will forever alter BC Hydro’s business and its relationship to us.

@ IslandScott

“I’m betting that Hydro will at some point reduce the 10 cents per kilowatt/hour for solar. Hydro must be losing money on this considering the infrastructure delivery costs. ”

The value of power depends on when it is available. Peak demand in many parts of the US is around midday in the summer when AC demand is at max. That is when solar power peaks too, so depending on where, if anywhere, BC Hydro is selling surplus power around midday in the summer, solar power might be worth 10 cents a kwh.

However, I share your skepticism, if only because if the power were worth that much there will be investment in industrial-scale solar power farms in more ideal locations than BC with costs per installed watt far below any roof-top system. Thus would the value of the power be driven down way below the cost of roof-top solar in BC.

Still, while Hydro are paying ten cents a unit, roof-top solar probably will work for some people here.

@john Dollar

Could you provide a link to Victoria’s foreclosure applications? This is a sad stat. to watch, but interesting and relevant one with increasing interest rates.

Thanks.

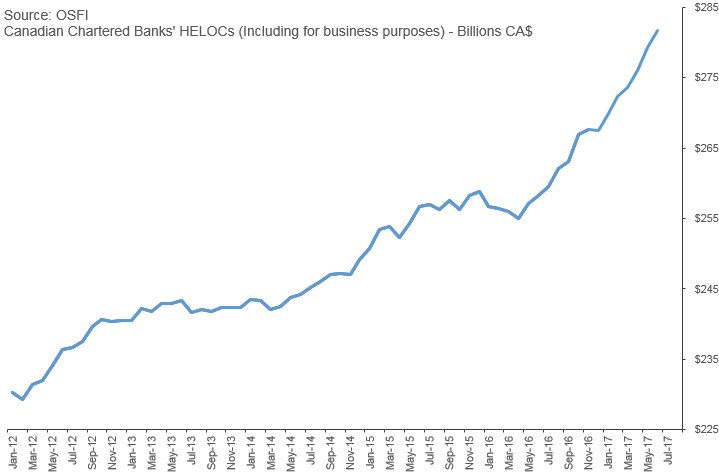

The HELOC is like a get out of jail card in Monopoly. Lose your job or be underemployed you can live on the equity of your home.

Sure there is a maximum limit but how does that prevent you from going into pre-foreclosure when you no longer can make the payments and there is no financing room available to borrow against your house.

The legal fees and bank charges will keep adding another hundred thousand dollars onto the mortgage until there is nothing left of the equity.

For those that are watching, the number of foreclosure applications in Victoria is on the rise. You can look at the court cases every Monday and Thursday in Victoria’s Court house. The lower limit on HELOC’S hasn’t kept these home owners out of court. And in my opinion, it is going to get worse as sale volumes decline and more people get into trouble. As the percentage of properties under duress increases in proportion to the total, the properties under duress. that have to sell in the next 90 days, forms market value.

Regarding the solar farm –

I’m betting that Hydro will at some point reduce the 10 cents per kilowatt/hour for solar. Hydro must be losing money on this considering the infrastructure delivery costs. Also factor in that Hydro cannot just accept too much solar; they still need to provide power during peak power use times when solar has no output. Without storage Hydro still needs the ability to actively power the whole province without solar, so their savings is not 10 cents per kilowatt/hour once solar reaches some threshold. For example, if 50% of power was supplied by solar, Hydro would still need the same infrastructure they currently have. They would only save a little on fuel and maintenance costs.

The BC Hydro Public Power Legacy and Heritage Contract Act requires Hydro to purchase power even at a loss. With the landscape changing to solar and wind, I wonder if that Act will change.

Man I can’t keep up with the comments these days.

@Introvert

The downside is it would encourage a culture of allowing your fingers to outpace your mind. 🙂 Also technical challenges of deferred visibility that aren’t easy to solve.

@Marko

That would kind of defeat the purpose of paying an agent then. Good service to have, for the DIY buyers. If you don’t trust your agent to review strata docs honestly, maybe time to fire them.

@totoro

I guess that depends on what house prices are doing. You can leverage up to invest in real estate, and that is a brilliant plan until there is a sustained period of house price declines. Then you may have been better off blowing that HELOC on a Tesla instead of a rental property.

Motivational poster for misanthropy. But the logic is sound.

I am not as smart as a lot of people in the market but if I was speculating I would be looking to take my profits and get out right about now.

We have had two small interest rate increases with more to come. The number of buyers from the mainland has dropped off a lot as near as I can tell. Prices have at best plateaued and are certainly not going up in leaps and bounds.We have a government that certainly leans towards bringing in various speculation taxes. There just seems to be more downside than up. The prudent thing would be to grab the profits and bank them. But I am not a big risk taker.

Introvert, you killed Just Jack years ago. Just as you’ve tried for years to kill this blog.

Time to grow up.

“Introvert, you suck and your analysis is completely wrong because you don’t cite any supporting sources.”

Some version of this has been said to me on this blog so many times over the years. I laugh each time, because all the links to Internet news articles and Garth excerpts in the world can’t make what these people think will/want to happen, happen.

But don’t be seduced by what can be quantified, when what can be quantified has little predictive value, as history shows.

Therefore, we might as well make ourselves feel at home in the uncertainty and rejoice in throwing anecdotes about, revel in posing unsubstantiated hypotheses, and delight in making baseless predictions.

Oooh, your intentional mistakes are so upsetting. Nice job, Just Jack.

I agree. I’d rather have it than not though – otherwise it’s just a “sky is falling” or “to the moon” statement. At least the argument can be (often) quantified and debated.

Even with numbers that support growth or decline, we have no idea what real estate prices will do. Case in point, before our recent 30-40% run-up, no one saw “numbers” that supported this outcome.

Yes, is this the same Moody’s that gave AIG a triple-A credit rating before it went bankrupt in 2008?

Precisely. It’s all just wild guesswork, like much of economics.

The explanation is partly here:

Seems like they do have a crystal ball, but I’m not sure it works here. My guess is not.

http://www.businesswire.com/news/home/20170425005270/en/Moody%E2%80%99s-Analytics-Earns-Fourth-Crystal-Ball-Award

@ JD:

PANIC

I would argue that price predictions are of comparatively little value unless there’s numbers that support growth or decline. The predictive record for almost any agency that outputs them is pretty bad.

So why does Vancouver hold steady, while Victoria declines? And why 5%, and not 1% or 25% Why does Toronto grow, despite a glaring disconnect from the economy underpinning the housing? More QE? More speculation? More wealthy FIs? Mass migration? Just curious what their metrics were and how they enabled their conclusions. I haven’t actually read the report; the article was of course just an overview.

The data seems a bit odd this morning for houses in the core. I’m showing a surge in new listings at the rate of 2.75 new listings for every sale that’s driving the months of inventory up to a four year high for Septmber.

Maybe someone else could check this for me as it seems uncharacteristic for this month as new listing historically decline at this time.

That wasn’t how I understood his response. My assertion was that public sector employees overall earn more than private sector employees. His assertion was that I was dreaming because he could make more in the private sector. I agree that might be the case for him, but it is not generally the case.

James – even the quote you provided supports this. I’m not sure how my quote was incorrect given that it is exact, but then there is the pension, hours of work and benefits and retirement age to consider as well.

I agree the reports could be subject to bias. I looked at the CUPE report, prepared by a CUPE staff economist, as the Fraser Report was prepared by their in-house economist, which makes a couple of good points but also fails to account for pension, benefits, hours of work, date of retirement in a credible way at all imo despite the availability of this data in stats can reports. Even CUPE agrees there is a greater gender wage gap in the private sector and lower skilled jobs are much better compensated in the public sector.

And, yes, back to housing. Moody’s is predicting 5-year decline in Victoria house prices. Toronto is predicted to rise.

http://www.cbc.ca/news/business/canada-housing-moodys-1.4287522

How dare you bring the discussion back to real estate 🙂

I can’t beet you Introvert. I’ve decided to join you.

This surely is the beginning of the end for Victoria real estate. Or not.

Septmeber is a beautiful time of year, don’t you think?

ya they’re rare in Info Systems. Even then, a lot of Leads are 24s. Tonnes of IS 13s and 18s. Low pay, if you ask me. The advantage over private generally is comparative security both in job and retirement. Depends on your own wants and needs, I guess – which side works for you.

You’re right. I’ve never written an original word.

Just a brief note on the market for houses this month in the core. There have only been 51 sales in the last 13 days. If this pace continues we may be near a ten year low for house sales in the core for Septmeber.

Nobody makes a 30 unless they’re team leads. At that point, there’s not much developing going on, and you’d be paid much higher still for that in the private sector.

Your assertation was that “Public employees earn a wage premium for the same private sector position”. I am a public employee, I would make way more in the private sector.

You’re quoting the Fraser institute, first off, and secondly you’re doing it wrong:

You really must like the taste of your own vomit.

Leo, I’m always flirting with the idea. Things that give me pause, in no particular order:

• up-front costs are still significant

• possible diminished desirability upon re-sale

• our west-sloping roof when south-sloping is ideal

• my perception that a roof with solar panels mounted on it surely has to be more likely to leak

• how to restructure our tenancy agreement (don’t want our tenant, who pays percentage of Hydro now, to go nuts using electricity when we’re running a net surplus)

Yup. Many tech positions in BCGov have to add a “TMA” (temporary market adjustment) to the base pay to even begin to make it competitive. Many don’t, though. Even where they do, it can be a struggle as they tend to top out at Grid 30.

Marko most people that I know with suites don’t declare. Those people I know need that extra income though so that’s probably why…. Makes me think a little less of them though…

totoro quotes Fraser institute and CFIB neither of which I would regard as an unbiased source on this issue. The Fraser Institute supports researchers that deny the health effects of air pollutants (i.e. McKitrick) and deny climate change (too many “researchers” to list). While each piece of work needs to be judged on its own merits a source that has repeatedly demonstrated a questionable allegiance to truth should be scrutinized extra hard.

I can quote you a CUPE report that finds that the public sector premium is very small and mostly accounted for by higher wages for low paid jobs like cook, cleaner, admin etc. CUPE is obviously a highly biased source on this issue as well.

James’s contention that IT professionals can make more in the private sector is not “brain vomit” it is well supported by facts.

Computer and information systems managers

Public sector average = 79,690

Private sector average = 101,546

Public sector “premium” = -21.5%

Says one who plagiarizes his comments!

There are classes of proofreading ability, too.

You mean remuneration, genius.

That’s not a bad idea, but we would also need to know other information, such as that doctor’s overhead costs to run the clinic, before anyone could make an informed judgment on relative fairness.

Good one Introvert. I would love to put solar on the roof but unfortunately it is significantly shaded so doesn’t make a lot of sense currently. You should look into it, probably better return that those GICs you have.

This is awesome:

Home solar farm is a worthwhile investment

http://www.timescolonist.com/opinion/columnists/peter-nix-home-solar-farm-is-a-worthwhile-investment-1.22685005

So many people on this blog don’t want to upset the doctors. I disagree, their re-numeration should be scrutinized equally with others who get paid by the government.

One thing I would like to see is the cost of a visit to your doctor. What they charge the medical plan.

If you want a system of accountability and responsibility then the public should know what these cost are. That would mean a print out of what services the medical plan was billed for and then you can check to see if you received them.

Otherwise making the grandiose statements that the doctors are over or under paid is subjective. Because you don’t know what they are being paid for what kind of work they have performed.

As a side note. I was speaking with an informed source that was saying how lucrative it has become for doctors writing prescriptions for the new “Farmacies”.

Oh god. More accusations that I’m making things up or living in a bubble. Accusations based on no research into the data whatsoever as far as I can tell, but a generalization from anecdotal personal experience that is statistically unreliable. Please, I implore you, research your assertions first. Just a few clicks away is all the data you need. There is no secret vault or magic power involved. Just a tiny bit of time. If you find reliable data that supports your information then we can have an interesting discussion instead of dealing with brain vomit masquerading as logic.

This is a fact based on reliable data. Your particular profession might be better compensated if you moved to the private sector as an employee or independent contractor, but most are not. Overall the differential is over 10% and much more when you consider the benefits.

http://www.cfib-fcei.ca/english/article/6069-government-wages.html

https://www.fraserinstitute.org/sites/default/files/comparing-government-and-private-sector-compensation-in-canada.pdf

Yes, that is fine. The future is yet to unfold and maybe there will be other workarounds or motivating factors besides a reduction in productivity that will mitigate the impact a bit. Certainly people go into business for themselves for reasons other than increased income, but those benefits are also weighed against after tax income differentials and risk by most who go on to have successful businesses, in my experience and opinion.

I’m looking at productivity a bit differently I think? I agree with the input output thing – basic ROI. What I think the impact will be is that more small business owners will spend fewer hours working, re-invest less in the business and other investments, and the hours that they do work will be maximized for ROI. A big part of this will be tax efficiency. The incentive to work more, take more risk, and, in particular, to create more jobs by hiring employees is reduced.

As an example, if the changes go through Marko’s income is going to decline pre-tax, but might only decline a bit post-tax. Without the changes he be incentivised to continue growing his business and working rather than taking time off, with or without his lower return efforts. Even if he cuts out less productive stuff he is still working and earning less as a result of the tax changes. And presumably investing less and spending less as well.

You don’t get them because you are not permitted to pay into them, nor is your corporation permitted to contribute to them on your behalf unless you become an employee of the corporation and don’t own 40% or more of the voting shares.

A self-employed person or an incorporated small business owner who owns 40% or more of the shares can’t set up a private pension for themselves. No RSP match either. They can’t contribute to EI and be covered for wage replacement if their business goes under. No CPP permanent disability either because you don’t qualify via the rules. If you are a single self-employed person or only have one employee forget medical and dental benefits to0 – you don’t qualify for a private plan. You can get private life insurance and very, very expensive private disability insurance with many limitations.

Definitely a LOT of people like to display their wealth in subtle or unsubtle ways. In my experience though few want to brag openly about the size of their portfolio or the magnitude of their paycheck. And those that do are generally considered gauche idiots.

Anecdote alert – The relative handful of upper 1 percenters that I know all live pretty normal lives that are more or less indistinguishable from the regular well to do.

@Marketpumper $923,000

What are you guys talking about. If you equate class with income, then there’s no room for debate. Above a certain income your in a certain class. What’s more, very few people in North America are hesitant to boast about the income and net worth.

But if by class you mean breeding, culture, power, or whatever, then what has that to do with income?

J.K. Rowling has a way greater income than the Queen, but no one would say she’s of a higher class than ERII, she’s just a story teller who hit a winning streak. Like so many rich celebs, she’s a tiresome liberal hypocrite with no class whatever.

This morning Jack Knox explores the median household incomes of the municipalities in our region:

Head to Highlands, where the earnings are good

http://www.timescolonist.com/news/local/jack-knox-head-to-highlands-where-the-earnings-are-good-1.22692584

Indeed, no one wants to call themselves upper class (or be called it). But some people are upper class whether they define themselves as such or not.

Agreed.

Agreed.

Marko, that is very sensible from a work/life balance perspective.

But were earnings your primary consideration, you’d probably be better off trying to earn as much money as possible instead of trying to avoid falling into certain tax brackets.

I think we all agree doctors deserve to earn a lot of money (more than most). What’s at question is whether maintaining tax loopholes is a sensible way to help doctors (and others) out.

We really don’t.

You’re dreaming. I can make way more as an independent contractor (i charge out currently at $100 an hour) than I do as a developer in the public sector. Any developer here today could get a least a $50 000 bump by leaving, they don’t do it for other reasons that you’ve listed.

You don’t get any of those things because you don’t pay into them.

Dropping your most economically marginal business opportunities is NOT decreasing your productivity. Spending less time and focusing on your best economic opportunities increases your productivity.

Let’s say Andrew Scheer is elected in 2019 and reverses every tax change the Liberals have made. Would you go back to mere posting? It is still (899-350) – taxes, but now the taxes are perhaps several multiples of ten less.

totoro

I am completely in agreement that small business owners are important to the economy. I also agree that relatively few have the aptitude to start and run a successful business. I am in awe of several of my friends who have built amazing businesses and after all their hard work I certainly don’t begrudge that they earn many, many multiples of my salary. That is a deserved payoff for their hard work.

Where we disagree is how much impact these changes will have on people’s desire to start and maintain businesses. You think it will be a huge impact. I think it will be minor. We could both quote experts to support our opinions.

Anecdote alert – Of the many folks I know who start and run businesses few of them were primarily motivated by money to start or take over the business. Not that they don’t want to make money – they do. However they did not balance the financial pros and cons of public sector work first before going into business. Their reasons for starting/running businesses are varied: want to call the shots, love the work they do, have ideas that they can best pursue in their own business, loyalty to clients, taking over a family business.

Do you mean work less? That is not less productive. May even be more productive. Productivity is output per unit input. In this case the input is their labour. Productivity would only fall if their output fell more than their labour.

Even without these tax changes many physicians work fewer hours than doctors 20 years ago. Many factors leading to that. One of them is a healthy demand for work life balance. Many highly paid professionals would increasingly like to take some of their “wealth” in the form of leisure or time spent with young family rather than dollars.

Can anyone tell me what 4115 Holland Ave, Victoria, BC, V8Z 5K3 sold for?

MLS# Listing ID 382758

I don’t see it that way. Just another fact to consider by those who might want to work for themselves and start small businesses. Add it to the tax and other risk pile.

I agree that small business is defined as businesses with less than 1oo employees and that these businesses provide about 75% of all private sector jobs in BC. I didn’t realize the stat I used included medium sized businesses as well. 98% of businesses in Canada have less than 100 employees.

Perhaps you can agree that 75% of all private sector jobs means that the owners of small businesses are important to the economy and there needs to be enough incentive to create and maintain such businesses. You may not agree that these tax changes will impact that. My best guess is that they will. I do also believe that these changes will eventually impact house prices and other types of investments negatively as well, which some might support.

Perhaps you can also agree that not everyone has the aptitude or interest or skill set required to own and operate their own business. Many people don’t want this responsibility to start with or couldn’t handle it if they had it. There needs to be enough incentive to attract the type of person who is able to grow and maintain a business successfully for the system to work well. These types of skills are readily transferable to upper level management in government or other institutions with stable jobs and benefits.

There are significant differences that should be separately analyzed from a tax policy perspective, but the tax changes impact them all, and add in other incorporated professionals, all incorporated small businesses including farmers.

The specific ways in which they are impacted and how they will respond to those impacts will vary based on the circumstances, but everyone is going to weigh the ROI on effort and determine whether working harder and having employees is really worth it any more.

If the changes go through established doctors and professionals will likely become less productive and pay less tax. Newly qualified physicians are way less likely to head to the north to set up a practice or become GPs. They are going to work in a walk-in in an urban center where they have set hours and no continuing care obligations or hospital rounds. Or they are going to take hospital positions. Or they are going to go to the US. Or they’ll be locums and take long periods of time off in between gigs if they don’t have big student loans to pay off.

Other professionals and entrepreneurial sorts will respond in similar ways. Why work hard and create jobs that require the management of others if you are paying up to 93% in income tax? No thanks. I’ll stay at home and garden, spend time with family and live within the slightly less after-tax means for far less work and stress by keeping my business even smaller and using a few contract staff when I need it. There already is a bit of incentive in the system to do just this.

As for tax fairness, if government really wants to set a fair system they wouldn’t just be evaluating incorporated entities to create a potential gain of 25 million, they’d be evaluating all lucrative tax measures that reduce the divide between the various wealth brackets, including the use of trust funds and taxation of stock options and the principle residence exemption as well. And, in my opinion, one of the biggest ones: inheritance. The US taxation rate is 40%. In Canada it is nothing.

While perhaps unrelated and definitely a slightly unfair narrative shift given that they are largely figureheads, Trudeau had a trust fund and Mourneau is a potential beneficiary of his wife’s trust fund. Mourneau also owns 30 million in stock in the family business and both inherited significant amounts. It would be interesting to see if either of them rearranged their affairs, particularly in relation to their minor children, prior to the announcement of these changes.

http://o.canada.com/news/justin-trudeau-admits-that-he-won-the-lottery-with-1-2-million-inheritance-and-successful-speaking-business

http://nationalpost.com/news/politics/conflict-of-interest-screen-enforced-on-bill-morneau-to-keep-him-from-participating-in-family-business

Tax Changes in a nutshell Pros/Cons

https://balancedpolitics.org/taxing_rich.htm

Having worked in both public and private sectors; the higher the taxes, the greater the disincentive for entrepreneurs to take on greater risk. Not to mention increased INEFFICIENCIES in our economic system (e.g. people working less). Less risks generally means less innovation, less innovation substantially reduces the PIPELINE for future tax revenues. Pick any successful large company in Canada and research how they were started = most owners risked the shirt off their backs to get where they are to create the enterprises they have today.

Totoro’s points IMO are valid and easily substantiated via wide bodies of research.

I don’t think Trudeau is stupid, so he should be wise to counsel; innovation + people working hard fuel the economy; and let’s not do anything to jeopardize that.

Pundits who believe in a wealth distribution, though noble in nature, is fraught with obstacles. One needs only look at how it worked for Communism to see it’s inevitable outcome.

People can accept in the JOBS section, salary commensurate with skills and experience, that you get paid on meritocracy. People should also be able to accept that people with higher skills/experience should expect to take home more at a pari-pasu tax rate as themselves. 🙂

Most landlords of secondary suites do not declare their rental income and they don’t declare their capital gains when they sell their ‘principal residence’. It’s time to crackdown on tax cheats.

The majority of people I know and have come across declare rental income.

As far as capital gains on suites within primary residences we still don’t have a clear answer for this.

Most specialists at least would be properly considered “upper class” based on earnings.

Having worked in ICU, CVU, etc., at VIHA…..a lot of these specialists really deserve what they make. I worked quite closely with intensivist in particular and even if I hypothetically had the skillset I don’t think I would last too long under the stress.

The last few rounds of tax increases have directly impacted me but overall it has been positive primarily due to time off travelling. First of all, Trudeau increased personal tax which lead me to taking time off work (less productivity) and then incorporating (less productivity as my accounting is now more complicated and I have less time to sell homes). Now follow it up with these new federal changes plus the new provincial budget tax increases!

Instead of losing sleep over like my doctor friends I’ve just slowly adapted. For example, I stopped doing cash back and my buyer business dropped off. Only accounting for MLS recorded buyers deals for easy of numbers

2013 – 38

2014 – 37

2015 – 37

2016 – 28

So buying end dropped 20%, but I am making substantially more because I am no longer doing the cash back business model. The crappy thing about the 50% cash back model is the 50% you do make hustling the government takes 50% of that so you basically work for 1/4 🙂 I’ll pass on that.

With these new round of rules I’ve decided in the New Year I am just going to totally scrap my mere posting business and double my time off from about 6 weeks to 12 weeks off. Driving out to Langford to mere post a home for $899 (minus $350ish in expenses) on a Saturday afternoon is just not worth it anymore when it is actually $899-$350 expenses minus get slaughtered on taxes at the end of the day as well. Might as well just not offer it and further decrease productivity.

If I was a GP I think I would adapt as well. I would take some botox courses, offer injections, and cut back on seeing actual sick patients or just make sure I work less, don’t incorporate, stay under the $150,000, and max out on RRSPs and things aren’t so bad on the tax front. Don’t open a practice so when you start getting close to a $150,000 you can stop your walk-in clinic schedule and take off for a few months 🙂

I think the key is to live well within your means then you can adapt easily. If you make 300k a year and you live a 250k lifestyle it is difficult to cut back to 150k to avoid taxes.

Most specialists at least would be properly considered “upper class” based on earnings. However I have never met or heard of a Canadian not called Conrad Black who has admitted being “upper class”. I know many families that are 5 percenters and I know three families that are most likely 0.5 to 0.1 percenters. All of them consider themselves “upper middle class”.

Agreed on the second point. I think most doctors deserve what they earn. Some GPs probably deserve to make more. Some particular specialties probably overpaid a bit.

Did anyone see what totoro did with that comment. Subtly shifted the narrative. It is no longer about equalizing tax treatment between persons doing identical work inside and outside of a private corporate structure (both private sector). Nope. It is about lazy overpaid government workers vs those hardy John Galts and Howard Roarks among the ranks of the self employed.

No need to exaggerate. The actual small business percentage is 74.8 in BC http://www.ic.gc.ca/eic/site/061.nsf/eng/h_03018.html#point2-1. The figure you cited includes enterprises of up to 500 employees which meet neither the actual definition of a small business nor common ideas of what a small business is.

All this aside lumping incorporated doctors with start up small businesses is ludicrous. I’m not bashing MD’s here, but they have a state enforced monopoly and nearly bottomless demand for their services paid for by the state. Kind different than my struggling coffee shop.

Everyone is complaining about the new tax rules but when will all three levels of government start taxing ‘landlords’ and RE flippers?

CMHC estimates there are about 50,000 rental units in Greater Victoria and about 40% are secondary suites; that’s 20,000 secondary suites. Most landlords of secondary suites do not declare their rental income and they don’t declare their capital gains when they sell their ‘principal residence’. It’s time to crackdown on tax cheats.

If 50% of secondary suites rental income is not reported, that equals about $120 million of untaxed income per year in just the Grester Victoria region (50% of 20,000 x $1000/mo x 12 months). The capital gains tax would add millions more in untaxed income.

All three levels of government should be treating landlords the same way they treat other small business owners by auditing and enforcing existing business and taxation laws.

This is very true. Income sprinkling is basically totally BS in many cases. If we want to lower tax burden on Small business then let’s do it, don’t look the other way at loopholes being exploited as some kind of defacto incentive and say job done.

@ Vicinvestor 1983

“Firstly, the tax rules were negotiated with physicians in lieu of fee increases & benefits.”

Rubbish. The Federal Finance Department does not negotiate physicians fees and benefits. That’s a provincial responsibility.

“Second, I want the anti-MD mobs to explain why doctors do not deserve an upper middle class life”

As far as I’m aware, no one said anything about what doctors deserve. The issue is whether doctors and other owners of CCPC’s should pay less tax than people doing similar work but receiving their income directly rather than via a corporation. There is a longstanding principle that whether a business is incorporated or not should not affect the tax liability of the owner.

The generally understood reason for creating a business entity through incorporation is to limit the personal liability of the owner(s). If there is a substantial tax advantage also, then every business owner will be compelled to incorporate, thereby creating unnecessary expense and complication for people who can just as well operate their business as a proprietorship.

As for doctors “having excelled academically their entire lives, and worked their asses off” you overlook the fact that in every medical school cohort there is one student who ranks dead last in their medical studies, either because they have little aptitude for the profession or because the failed to “work their asses off.”

In which connection:

“Research suggests that about 70,000 patients a year experience preventable, serious injury as a result of treatments. More shocking, a landmark study published a decade ago estimated that as many as 23,000 Canadian adults die annually because of preventable “adverse events” in acute-care hospitals alone.”

Maybe our doctors need to work a little harder to avoid so many embarrassing errors. And just to give them more time to concentrate on what they are doing, I suggest they be relieved of their monopolistic control over drug prescription.

This could be achieved through the creation of a new profession of certified medical diagnostician. A medical diagnostician, or CMD, would take a university level course in medical diagnostics, which would include intensive training in the use of artificially intelligent systems in medical diagnosis. Thus qualified, the CMD, would prescribe medication or refer clients to medical services as required.

Freed of the daily routine of patient consultations, doctors could get on with what they all say, when seeking entry to medical school, that they really want to do, namely, help people. With CMD’s undertaking the daily diagnostic work, while dealing with the malingerers and drug fiends, doctors will be free to get on with patching and stitching up the wounded, and otherwise actually practicing the healing arts.

That way, they’d be too preoccupied with their professional responsibilities to worry about schemes of tax avoidance.

I would argue that most doctors fall into the upper class.

Doctors do deserve their upper class life, and I doubt these tax changes will take that away from them.

@cs

“But doctors, en masse, obsessed as their are with their own importance and expectation of very large incomes,”

Firstly, the tax rules were negotiated with physicians in lieu of fee increases & benefits. Thus, any tax changes are a pay cut & negation of the previous agreements.

Second, I want the anti-MD mobs to explain why doctors do not deserve an upper middle class life given the amount of schooling and responsibility. These are people who have excelled academically their entire lives and worked their asses off.

I don’t think you are reading too much into it. If you are talking about inheritance that would be fine. Earned income? Not only incorrect but the whole premise is based on a fantasy. A harmful fantasy. While we don’t all have an equal playing field to start with, to denigrate the role of individual effort in this manner is offensive.

Anyone else kind of annoyed by the tagline on the CBC page about census income data? “How does the financial hand you’ve been dealt compare to that of your fellow Canadians?”

http://www.cbc.ca/news2/interactives/census/2016/income/

Seems kind of bizarre to characterize income as something that is due to chance like a casino. No wonder people resent high income earners, just got there by dumb luck apparently. Maybe I’m reading too much into this.

Never mind how much doctors earn and how many years of schooling it requires, look at how much Christy Clark’s pals are making on their way out the door. Obscene.

Clark Clique scored huge golden parachutes

http://thebreaker.news/news/golden-parachutes/

Not me saying it caveat. Google is at your fingertips but you seem to have difficulty researching the facts. Thirty percent of small businesses don’t survive two years and 84% of small business owners use their own resources to finance the business – usually a HELOC.

BTW the highest rate of small business employment in the private sector is in BC at 93.6% of all jobs. The net positive employment change between 2005 and 2015 (1.2 million jobs) in Canada was 87.7 percent attributable to small businesses. Small businesses contribute 33% towards BC’s GDP.

Here are some links.

https://canadabusiness.ca/starting/before-starting-your-business/is-entrepreneurship-for-you/small-business-survival/

Amazing that the federal government is recognizing the importance of small business, yet not supporting the growth of small business when removing tax incentives:

http://www.ic.gc.ca/eic/site/061.nsf/eng/h_03018.html#toc-04

No-one said totally safe. The risk of losing a permanent position in the private sector is about 3% and about .5% in the public sector. If you are going to throw stuff out look at the facts first.

“But don’t you get it Hawk. Small business is terribly risky per totoro. ”

I always thought you started a small business so you’re the boss and get to say “you’re fired” ? 😉

Public employees earn a wage premium for the same private sector position of over 10% plus they have better benefits, more time off, and a great pension. Compared to the self-employed with no pension or benefits it is no contest on that front.

This is what makes the self-employed upset with the changes. They thought there was a way to plan for the differential if they worked hard and were successful on their own merits and they accepted that if they failed there is no pension or EI to bail them out and it would be their responsibility. And no CPP disability or medical EI either if they become permanently disabled along the way and no paid maternity leave either.

Turns out the government wants to equalize the federal employee who might be doing not too much and at almost zero risk of job loss with the business owner employing five people and taking a minimal salary for five years to grow their business.

I find this a ridiculous move to mediocrity. I agree with paying a fair amount of taxes, I appreciate the medical care and paved roads and generally functional government. I do not appreciate the disincentive to creative entrepreneurs or top performers who would like to create a start-up or innovate the way things are done.

But don’t you get it Hawk. Small business is terribly risky per totoro. But having a “permanent” job working for one of those businesses – totally safe (If this wasn’t HHV I’d say “safe as houses”)

Cue totoro telling us how the lumpen-proletariat are spoiled by having EI.

I disagree. Politically a tax tweak or reform that disproportionately affects powerful stakeholder groups should at least come in a package that creates some winners. Otherwise all the public will hear is the protests of the powerful group. The current tweak – and despite the great gnashing of teeth it is a tweak in the big picture – does NOT create any specific “winners”.

Sure we are all winners. In a general sense all Canadians benefit from a fairer tax system. And the changes will reduce the frictional cost of corporations set up for purely tax avoidance reason (the hit in the pocketbook to accountants). But these are diffuse benefits that won’t exactly motivate people to speak out in favour, let alone man the barricades.

“totoro is putting on a clinic right now!”

In what ? A lot of links ? Anyone with a brain can see the trend for a long time now is less full time permanent status, less benefits and more part time work to save corporations(shareholders) and government money. If you work for a small business you’re at the mercy of the economic shifts that can happen quickly and less likely to get a raise as well. Is it any wonder why wage growth is so low ?

Yes, there needs to be an incentive somewhere and I’d be fine if it didn’t require hard to understand tax planning at great expense that compromises those who have relied upon it. And I agree the accountants will lose on fees here but another route will probably emerge.

“Microsoft president says tech company views Vancouver as a second home”

Microsoft left Victoria after less than 2 years. Kinda says it all.

Oh and they didn’t do a lousy job of rolling them out. The accountants did a fantastic job of dragging them through the mud because they stand to lose the most. For every family that loses $30k in tax, there is a partner in a CPA firm that loses 20 clients no longer willing to pay for tax planning and maybe 10x that in fees.

The retained earnings taxation thing is tough since those dollars were earned under old rules. Fair is fair. But the other two are prospective and allow continued enjoyment of lower overall family tax rates.

What is happening right now is that rules put in place for one thing (capital accumulation) are being abused for another (lowering overall family tax rates).

I think the best thing to do is apply the kiddie tax treatment to anyone that doesn’t contribute to the business and simply ban the capital gains trick. The retained earnings thing is tough because of the timing issues.

Backbone or not, if the government wants to explicitly encourage a certain type of activity, they should do it explicitly, like the SRED program, not through backdoor loopholes only available after $20,000 in incorporation costs and “tax planning”.

I agree on the capital gains conversion. Seems unfair.

I disagree with the income sprinkling. Income sprinkling helps entrepreneurs mitigate the burdens of starting, operating and growing a business. Entrepreneurs and small business owners lack a safety net such as pensions or benefit plans. They create jobs, pay taxes and are the backbone of 70% of the private sector economy. It seems reasonable to continue to allow income sprinkling to provide incentive and help mitigate the risk of such business threats as market upheaval or recessions – perhaps with some additional restrictions or limits but not a prohibition. Many business owners have planned their future, and paid large fees to do so, based on the current rules and changing them now without a longer transition period seems somewhat unfair.

I disagree to changes on retained earnings taxation.

Whether or not you support these tax changes the Liberals have done a lousy job rolling them out.

1) They gave the impression that people taking advantage of the current rules are cheats, which is not so.

2) They should have coupled this with something positive like an overall tax rate reduction or a bump up in the basic exemption. That would have created a wide constituency of support that would have opposed and partially neutralized the well funded opposition to the changes.

https://www.thestar.com/business/tech_news/2017/09/12/microsoft-president-says-tech-company-views-vancouver-as-a-second-home.html

https://news.vice.com/story/the-rich-are-set-to-go-to-war-over-trudeaus-tax-changes

This is a decent article. The biggest problem with trying to make these changes is that people of influence are generally people who benefit from these loopholes. I have heard a ton of:

“Don’t make these changes because we are doctors and you’ll die because we’ll leave”

“Don’t make changes because we are accountants and know about these things” (and forget to mention maybe 50% of our practice revenues come from rich folks exploiting these very loopholes)”

“Don’t make these changes because we’re the media and are paid by rich folks exploiting these loopholes.

I don’t care who you are or what you do, why should your wife or kids be more valuable for tax purposes than mine? Sprinkling for corps is total BS. So is the cap gains conversion.

Does anyone remember what happened to the family tax credit/ income splitting thing that Harper pushed through and trudeau repealed a few years ago? Well this is slightly different but for many enabled the exact same thing – less taxes by pushing income to family members that has nothing to do with how much money you make. Accounting smoke and mirrors and that’s it

Defending these opaque loopholes is not the right way to go about this – closing them and then resolving the consequences later is (if there are in fact any which I doubt there will be)

totoro is putting on a clinic right now!

That is part of the definition used. The full definition vs. temporary is as follows:

https://stats.oecd.org/Index.aspx?DataSetCode=TEMP_I

The only effect it will have at this point is that money I had retained in my corporation for my childrens’ education will be subject to a higher tax rate. I have removed most of my retained earnings to invest personally already. Someone who has significant retained earnings or who is hoping to sell their business and has a family trust will be severely impacted.

I didn’t say they were paid on an hourly basis, I said they earn 150/hour at the hospital. Hospitalists actually earn 153/hour: https://ca.indeed.com/viewjob?jk=7ac46940b3dbf7e3&q=Royal+Jubilee+Hospital&l=British+Columbia&tk=1bpul2m951d4p0fn&from=web

And there are other ways of billing on a fee for service contract, alternative payment plan or other blended remuneration which also occur.

http://www.cbc.ca/news/canada/british-columbia/bc-doctor-shortage-medical-fees-1.4100251

Being paid an hourly wage does not magically turn you into an employee. Hospitals often have contracts with their physicians that are carefully worded to retain their independent contractor status which depends on many factors.

If you are lucky. If you have an aging set of high needs patients you might not find it so easy to do.

Or they would head to the US. That is what I would do if I had a big student loan to pay off and didn’t want to manage a practice myself.

I personally would not be a GP in the current system. It is not about the university system. The working conditions and remuneration and use of nurse practitioners needs to change for this to become attractive again imo.

The tax changes are not helping at all. Not one bit.

“At the Royal Jubilee Hospital doctors earn $150 per hour and work 40 hour weeks.”

That’s not how it works, they are paid on a fee per service basis.

If they were paid hourly, they would not be able to incorporate(suppose they could as a personal service corporation) but they would likely receive benefits, pensions, sick days, etc.. Costing the tax payer WAY more money than the current situation.

totoro, what effects, if any, would Morneau’s tax changes have on you? Just curious.

Yes, there is a tax deferral which I’m arguing should be retained to allow for retirement planning and income smoothing and reinvestment in business. I disagree with any changes to this.

Depends if they are paid out as salary or dividends.

Salary is taxed at the regular rate but becomes and expense for the corporation. If you are paying it at a time when you are no longer earning income doesn’t help you much.

On eligible dividends you pay a gross up to turn that income back into pretax income — because the corporation has already paid taxes on it — then, you receive a tax credit to make it fair for everyone. Both you and the corporation aren’t being double-taxed and the CRA subsidizes you for the tax the corporation already paid on your dividends but the end game in my experience is that the same amount of tax is generally paid whether taken as salary or dividends and sometimes one is slightly better than the other. The bad thing with dividends is that you get no RRSP room and none of the deductions from income plus no EI or CPP.

Here is an explanation:

http://www.taxtips.ca/dtc/smallbusdtc.htm

That is true. But if there were more medical graduates some of them would necessarily become family practitioners because other alternatives wouldn’t be there.

Mostly true, though often you can still give them away. Many reasons why this is the case and taxation is not the main reason.

Damper on growth? Excellent news! Then interest rates will freeze, or drop back to rock-bottom.

And you, Hawk, must be part of the common folk—what with your 500% annual stock market returns while living at the Oak Bay Beach Hotel.

be aware that “permanent” in the context of employment statistics means no pre-determined termination date

Er, no. Absolutely not the problem. There are plenty of doctors graduating each year yet, in B.C., about 700,000 people, or 15 per cent of the population, have no family doctor.

At the Royal Jubilee Hospital doctors earn $150 per hour and work 40 hour weeks. They pay no overhead (for rent or staff) and do not have to run their own practice. A regular family doctor would need to earn $400,000 a year to match their salary and that’s not possible.

For a doctor graduating now there is little incentive to become a family practitioner. You can’t even sell a family practice anymore – you can’t give them away. Even less value if the tax rules change.

@ Totoro

“And then all the money is taxed again when withdrawn at the personal income tax rate.”

Not sure what money you are referring to. Do you mean the retained earnings, when they are no longer retained? In that case, the CCPC owner is simply paying tax that they deferred by retaining profits within the corporation, profits on which the unincorporated proprietor would have paid the full marginal tax rate at the time the income was earned. Moreover, when corporate profits, whether just earned or long retained within the corporation are paid out to the owner(s)/shareholder(s), there is a tax adjustment, is there not, reflecting the fact that corporation tax has already been paid?

And thank you for subsequently providing the information.

Then maybe the other link that sets out that 70.3% of Canadians have full-time permanent employment might be more helpful and the stats that identify why the remainder do not. There are other studies on this available online. Plus the stats can info.

The medical associations are excellent at extracting monopoly rents from their privileged position. In the US they have perfected this.

Before I post anything I usually research the factual basis for it, or I state that it is my opinion. This is not my opinion, it is supported by the facts. I post the link to the data below which sets out that 70.3% of Canadians have full-time permanent employment. Those that don’t generally are self-employed or young or don’t have specific education or, in my opinion, are choosing part time employment or located in a region with high unemployment which is not Victoria.

It tells me that the economy is growing and that at least a portion of productivity increases are being captured by rising middle class incomes. Those are both good things. It tells me next to nothing about individual income stability.

Passive income earned on retained earnings (already paid 15%) in a corporation is already taxed at the top marginal tax rate already at about 50%. RE or stocks held in a corporation fall in this category. And then all the money is taxed again when withdrawn at the personal income tax rate. I do agree with shutting down the capital gain tricky tax conversion – seems not quite fair.

Read the definitions. Those stats include everyone – even minor unemployed children and other dependents.

The origins of the tax inequity between CCPC owners on the one hand and proprietors, contractors and employees on the other is explained thus:

The need for this change is obvious, since without it, a doctor or other business person who is not incorporated, and who, therefore, pays tax on investment income at the top marginal rate, is taxed more heavily than the incorporated business person. It is in other words, a simple matter of tax fairness. Equal tax rates for all Canadians.

But doctors, en masse, obsessed as their are with their own importance and expectation of very large incomes, seem incapable of assimilating this simple principle of equity.

An additional proposed tax change is designed to prevent a doctor from paying their spouse for services not rendered as a means to split income and thus reduce overall tax liability. Of course, if a husband or wife is employed in the business or professional practice of their spouse they may be paid a salary, provided only that the salary received is commensurate with the work performed.

But this obviously sound principle, is, apparently, to a doctor, impossible to understand. Or if doctors understand it, they cannot, as entitled beings, accept it. Instead they twitter idiotically about quitting the profession or leaving the country.

In response, good riddance to such idiots is really all that needs to be said.

There is no shortage of doctors. Or if there is, it is an entirely artificial shortage caused by (a) doctor-controlled medical schools limiting admissions to ensure a lack of competition within the profession; and (b) the medical profession’s monopolistic control over the distribution of drugs.

And read stats.

The vast majority (70.3%) of Canadian workers have full-time permanent employment.

The main source of income volatility/instability is…. self-employment. 15.3% of people are self-employed. Instability is also, as you would expect, disproportionately felt by younger folks (15-24) starting out and those with no higher education. Some of these folks are involuntarily employed part time (5.3%) or in a temporary job (11.3%) which creates income instability.

The average Canadian employee has much more income stability than a self-employed person does.

The fact that the median family income in Victoria does not decrease but increases you should tell you something about individual income stability. In addition, the 70% home ownership rate is partly based on income-based qualification.

https://hillnotes.ca/2016/01/27/precarious-employment-in-canada-an-overview-of-the-situation/

The median “family” income is 89k a big difference.

@ Totoro:

” The median income in Victoria is $89,600″

You’re out by a factor of almost three. The median BC income in 2015 was $32,850.

Ahhhh, I see what you did there. If the posters below are arguing that people have tenuous employment, (ie where incomes aren’t necessary stable, and a growing number of those types do not have some or all of the ancillary benefits – one of the motives of having part time, temp or contract employees), and you counter with the above, I don’t think that’s fair.

A 5.3% unemployment rate, or X median income is not the same measurement, or type of measurement, that speaks to the social issue they are referring to. If you want to debate them, do it on the same terms. Your obvious command of the English language might intimidate some and convince others, but the reality is no one has a pass to adjust the terms of dialogue to suit simple and repetitive contradiction.

totoro – I know you are smart enough to recognize that a 5.3% unemployment rate doesn’t mean that the other 94.7% of the workforce has stable employment. Nor that a stable median implies that individual members of the workforce don’t have major fluctuations in income.

“totoro “The average Canadian employee has …….. a stable income.”

you may be a teensy bit out of touch in your Oak Bay bubble”

Yep, living in bubble land separates one from the common folk.

Have you looked at the stats? BC’s unemployment rate is 5.3%. The median income in Victoria is $89,600. This median does not vary wildly from year to year. It goes up.

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/famil107a-eng.htm

Not too much tax incentive to do this as contract workers pay taxes and the write-offs are not really significant imo. They don’t pay EI and CPP and are not eligible for EI benefits and don’t get CPP credits for these years. Most often it comes up when a disgruntled contractor is let go and claims they were actually an employee and they want payment for overtime or something like that.

Very well written. If you have not walked in the shoes of a business owner I don’t think you can really understand the risk and responsibility level. The incentive needs to be there in the system somewhere if you want farmers and doctors and small businesses and entrepreneurs and people with high level abilities to invest themselves and their assets into the economy and create and maintain jobs.

you may be a teensy bit out of touch in your Oak Bay bubble

This the only thing me and Trudeau agree on. Go for it make them pay their taxes. Employees have to so should they. Next go after the contract workers who are really employees.

The average Canadian employee has EI, maternity leave, paid vacations, no personal capital at risk in their employer, and a stable income. If they lose their job they are entitled to notice or payment in lieu and can sue for wrongful dismissal. The average entrepreneur, small business owner, or farmer has none of this, yet they create jobs for employees and grow the economy.

The answer is that the potential for reward current system makes the risk and investment worthwhile for those who have the aptitude for business or professional services.

Actually, no.

The majority of profitable small businesses in Canada do have retained earnings, which they paid tax on at 15% and pay tax on again at their personal tax rate when they withdraw it. Many small business owners are using this to smooth out income and plan for retirement and education costs for their children. Something that might be greatly affected by the proposed changes.

And lawyers, like accountants, who are incorporated are in the minority. Most lawyers are employees and earn higher than average income (national average 104k) but also are taxed as employees. Those lawyers that do incorporate generally own or are a partner in a firm with employees or are worried about liability.

Family doctors, however, earn an average of 241k prior to all their expenses which can take up to 40% of the gross. Specialists earn much more. The majority of doctors are incorporated so they are disproportionately affected by the proposed changes, as are farmers.

The businesses most likely to have retained earnings to invest based on profit margins (not number overall) are accounting and tax services (always on the top), management companies, real estate services (agents and brokers), automotive equipment and leasing, law firms, dentists, health practitioners, office administration services, commercial equipment leasing services, specialized design services, and physicians.

From my perspective as a retired entrepreneur I’m not going to feel much effect from the changes, but they would have affected me quite a bit had they happened earlier. Had they been in place when I started up I would have received different advice from my accountant and I probably would not have hired employees.

Well that is the nub of the issue right there. Maybe we are overtaxed overall but I see no reason why a professional or business that incorporates should get a tax advantage over a professional or business that chooses not to incorporate.

If we need more tax breaks for the rich to entice them to stay in Canada does it have to be through the route of incorporation?

I find the arguments attacking the tax changes by decrying the impact on “mom and pop” businesses to be quite dishonest. The VAST majority of businesses do not accrue large sums of money for passive investments. It may not be ALL about doctors and lawyers, but it mostly is.

Good quote CE. The Hell with the doctors.

More important would be to demand a doubling in the measly the basic personal tax exemption of a mere eleven thousand and something. After all, everyone, however poor, pays GST, PST, gas tax, property tax, liquor tax, tobacco tax. And soon, presumably, governments will be encouraging everyone to smoke marijuana so they can collect a grass tax.

Here is a good article that puts the teeth-gnashing about the tax changes in perspective.

http://nationalpost.com/news/andrew-coyne-why-the-liberals-proposed-tax-changes-are-taking-a-pounding

A familiar mix of government incompetence and opposition shamelessness — together with a large dollop of special-interest shinola — have combined to turn a package of relatively modest tax changes into a government-shaking PR disaster.

There are lots of valid critiques of Finance Minister Bill Morneau’s proposals. But these have been lost in a cross-country meltdown among doctors and small business owners out of all proportion to any increase in tax they might suffer.

Indeed, among the early propaganda triumphs in the whole controversy is the notion that the measures in question are in fact aimed at these two groups. Vast clouds of steamy rhetoric have been exhaled on impassioned tributes to their value to the economy, the hardships they endure, and so on, followed by righteous fury at the manifest injustice of requiring them to pay the same tax as others earning the same or less income.

worth reading the whole article

@ Beancounter:

” the government better make sure a readily visible set of incentives exists for individuals to take the risk and pay the ultimate cost of an enterprise which leads to real job creation. ”

If you’ve ever worked in government or held an academic appointment, you’d know that there are huge incentives to take the risk of starting a business quite apart from the financial. During my business career, whenever things looked bleak, I would think about how it had been working under the direction of a brain-dead bureaucrat, or a power-mad dean, and then I’d realize how lucky I was to have some other way, however tough, to make a living.

But you are of course right that our tax system is an outrage, and governments at every level do everything possible to screw up the economy and undermine public welfare, whether it be rats, squirrels, raccoons and deer in Oak Bay (did you ever notice how few deer there are to be seen when you take a hike in the woods, while dozens are to be found browsing the lawns of Oak Bay), the squandering of our once great forest resource, or the grotesque offshoring of taxable income by the moneyed elite, every effort is made to ruin the country. But then as Adam Smith remarked, “there is a lot of ruin in a country.”

You haven’t to date because tax planning has allowed these individuals to plan for retirement. You are certainly hearing a lot about this now that this is at risk. Look online.

If the changes took into account the disproportionate cost in lost wages and tuition to become a professional and the lack of EI, maternity or a pension plan into the calculation then we’d be closer to fairness. In addition, there are economic reasons to support entrepreneurship which creates jobs. No such analysis has been done by government as far as I can tell.

Plumbers do pretty well based on the stats but, yes, if they are entrepreneurs employing others there should be the possibility of above-average reward. Having employees is a huge PITA. No reasonably well-informed person would choose to have employees unless there was a chance of above-average compensation as a result.

The rhetoric in society about capitalism is one that is told by the majority who are employees, not employers. Employers and entrepreneurs don’t get to go home and leave their work behind – ever.

And incorporated plumbers are not running a “way riskier business” if you look at investment in education and level of responsibility for life and limb.

I don’t encourage my son to become a GP. I’ve seen what that level of responsibility costs.

My understanding is that if you make over 100k it has been worth it to incorporate. Not to mention if you are in a business with risk of being sued it makes sense to do it.

Actually, no it is not imo. Not once you weigh in the time and money spent on school to become a doctor, for example, and for entrepreneurs, the many years spent with little or no RRSP room accruing as they build a business or forgo salary in a bad year.

What about them? They will have a pension and may be incorporated as well.

I don’t hear the doctors and lawyers etc. lobbying for all Canadians to have equivalent retirement security to public servants.

I would willingly agree that the public service has overly generous pension provisions relative to the average Canadian (that partly pays for those generous pensions). The answer to that is not to create or maintain a set of tax breaks that are not available to average Canadians and only favours the relatively wealthy.

From one beancounter to another Beancounter: I call bs on your risk discussion. People go into business knowing full well that there is risk, and I guarantee you no-one starts a business thinking “I might go broke, but if I hit it big, sweet! I won’t have to pay tax!!” No, most people going into business never actually make enough money to make it worthwhile incorporating. What the loopholes now do is reward the winners and nothing for the average Joe plumber. In other words, it does nothing to remove the risk, only amplifies rewards for those needing them the least.

Totoro – doctors and other professionals don’t have a public pension, but RRSP is sufficient enough to deal with this. Besides, what about doctors that receive a salary, they garbage to you? What about doctors that don’t make over $200,000 so do not incorporate? What about plumbers that run a way riskier business than your doctor counting 5-minute visits?

You do realize that self-employed people often have very uneven income. It is not just about doctors. Many entrepreneurs starting out are not going to earn the 145k a year needed to max the rsp contribution. They need all extra cash to grow their company and will be taking minimal salaries for years likely. And some years will be good and some won’t – if you are successful.

And many self-employed people are taking dividends and not income. You get zero rsp room on a dividend. Many female physicians, for example, use the retained earnings to fund maternity leaves for which they are not otherwise covered.

From my perspective there are too many limitations and not enough incentive left in the system to support investment in business never mind the impact on other types of investments.