August Numbers – The Benchmark Hits a Snag

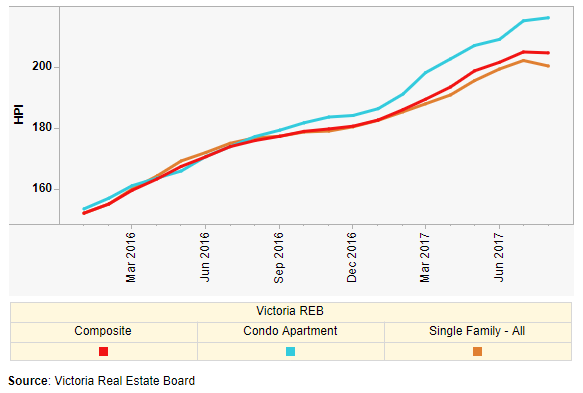

August numbers are out and one thing that jumped out to me is that the MLS Home Price Index benchmark for detached homes is down, which dragged the overall index to a small decline as well.

It’s just one month, but the overall HPI index is generally pretty stable, and the last time we had a decline like this one in the index was mid 2014 when the market was in a balanced state. Generally you don’t expect price declines in a market that from a months of inventory standpoint, is still hot.

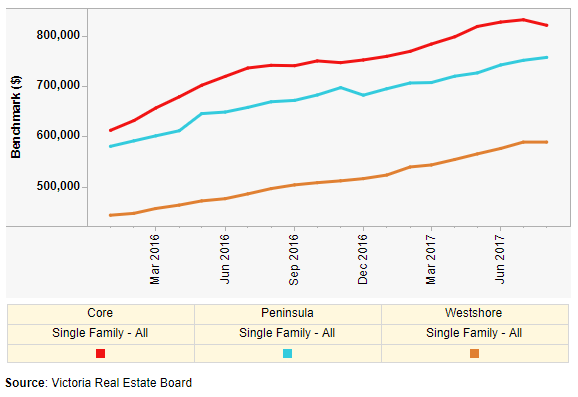

Looking closer at the detached market, it is definitely the core that is dragging it down. The westshore is flat month to month, and the peninsula is still up.

Again, one month is no trend, but this bit of evidence of flat core prices gets added to the flat or declining detached medians and average prices this year and flat sales/assessment ratios as well.

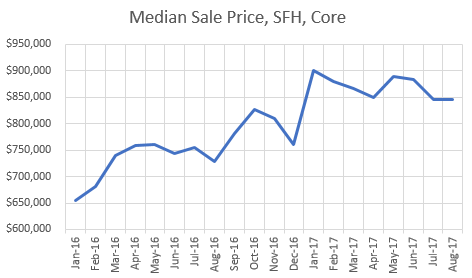

But a price decline still doesn’t make sense to me. All the indicators for the core SFH market are still pointing to a pretty active seller’s market:

- Average sale price to original list price is at 99.4% (versus 95% in a slow August, and just short of the record 100.4% last August). 43% selling at or over ask.

- Active detached inventory in the core in August was relatively low at 460 compared to double that 5 years ago.

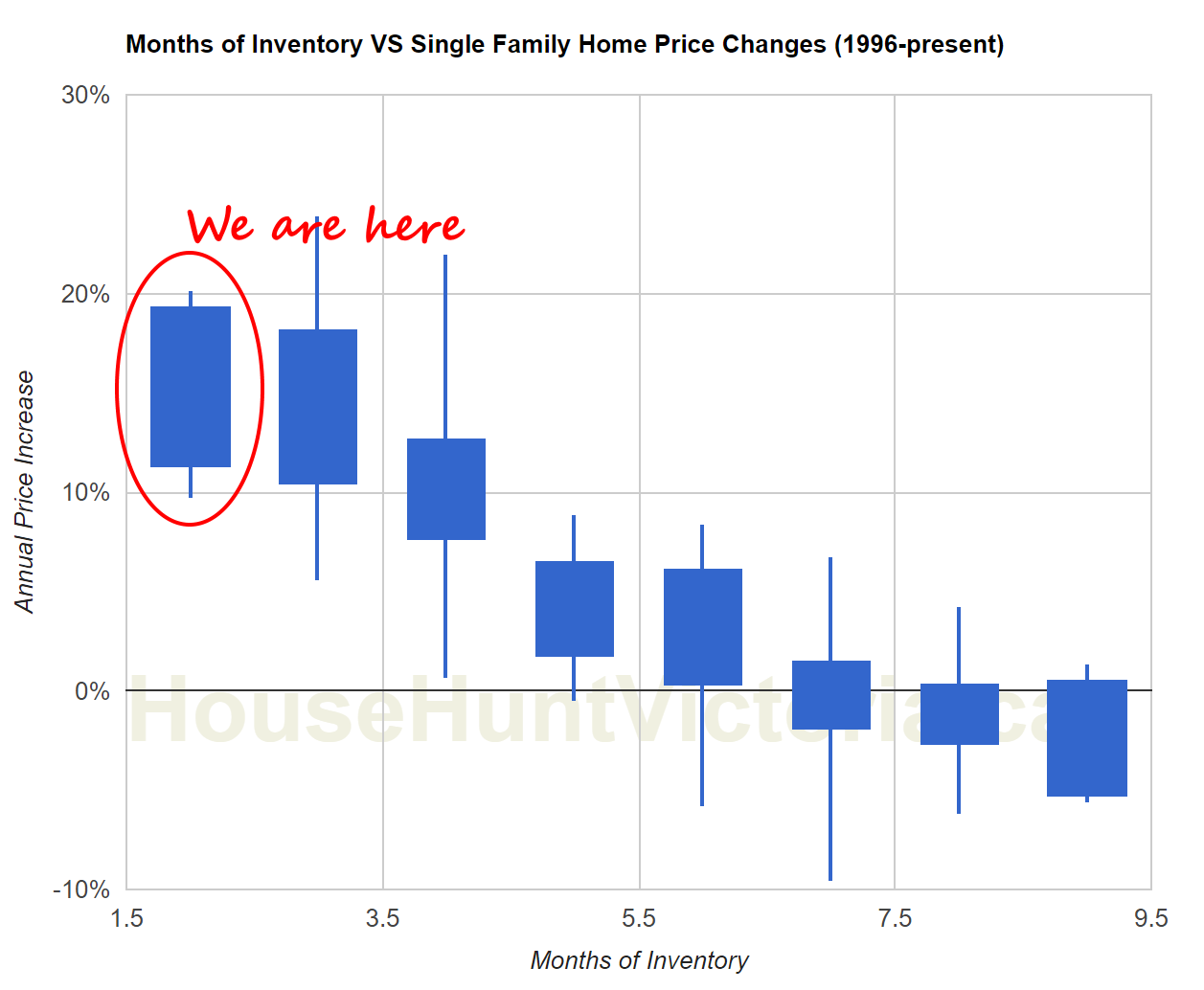

- Months of inventory is up from the spring but at 3 is still solidly in sellers market territory. Same with sales to new listings at 64%.

- Properties are still selling relatively quickly with the median at 16 days to sell.

So I’ll continue to hold the line on this one and see what happens in the fall. Last year we had a few months of declining prices in this segment as well but it was all wiped out by a $140,000 jump in the median from December to January.

The rest of the market continues to appreciate with condos and townhouses seeing the highest rates of increase.

Sales to new listings ratio has backed off from the highs we saw last year, but we won’t know the true level of demand until inventory increases and we can be sure that sales are not being constrained by inventory.

Looking at the monthly conditions, new listings are at approximately the average level for August (however consider that if adjusted for inflation, they would be below average). Inventory is still at a record low, and sales are on the high end but off some 17% from the record August last year.

With unit sales, we are back down to about 2015 levels with a few more condos to make up for the drop in detached sales.

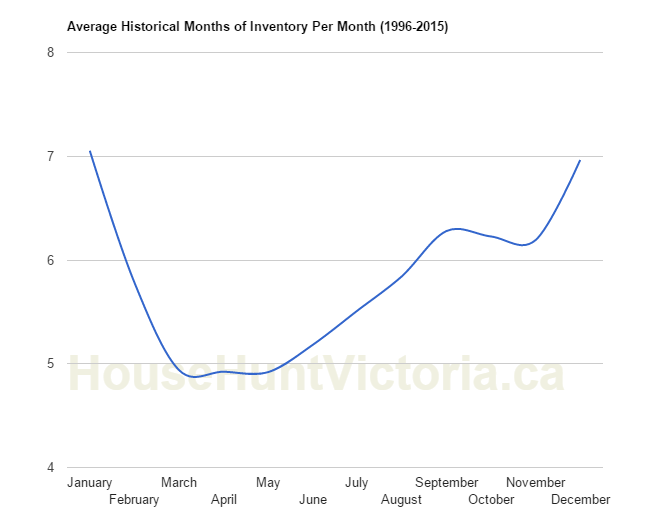

The VREB’s president, Ara Balabanian, expressed surprise at the August numbers in that inventory hadn’t climbed yet. I’m not sure why he is surprised, since inventory typically peaks in June and declines until December. In fact in the last 20 years, we only had inventory increases from July to August in 2008 when the market was actively collapsing, and 2004/5 when it was cooling slightly faster than the seasonal slowdown. The small decrease in inventory in August is totally normal.

Going into the fall, we have on the one side a low unemployment rate (rising somewhat recently) and relatively robust population growth put against the spectre of rising interest rates (maybe next week!) and the new stress tests for all mortgages. Nevermind what new housing policy the province could come up with.

Have a good long weekend folks.

Historically starter houses and newer condominiums in the city core were alternatives for first time home buyers with equivalent pricing.

That’s not the case in the last couple of years as starter homes and pre-construction sales of condominiums have been swarmed by speculators.

The median price for a re-sale condominium built in the last five years is $450,000 and a starter home in the city is $500k to $600K. A difference of some $50k to $150K

As a cross check you could also look at the residual value of a new house built in the city assuming constructions costs of $250 a square foot. Subtract the cost new of the home to get a land value under its current utilization as an improved property. Compare that to the price of a starter home in the same neighborhood that would be attractive to a builder looking for a lot to build on.

I’ll let you do the math on this one, and you can come to your own reasonable conclusion about the price of starter homes in the city being too high or too low relative to new homes and newer condos.

With that kind of a drop in GTA RE prices construction will come to a grinding halt. People are going to lose their shirts.

Sure does. Way down from the spring. YoY is a highly lagging indicator.

Yes it does. In fact, it shows 2 things.

Firstly, this graph shows that the buying demand, which was mostly speculative, has fallen off a cliff. That demand was unsustainable, as was the out-of-control price growth. For a real estate market to go from gains that were virtually unparalleled on Earth to collapse to a hair above inflation is an astounding reversal in a nearly unprecedented period of time.

Secondly, and more to what I think you’re attempting to argue, is that prices are falling at a similar pace. YOY does indeed show an increase, but that argument is actually hiding behind the preposterous gains made in the preceding months of April. The problem is, that began to collapse almost immediately thereafter.

In fact, the drop in aggregate values (RE prices) has been so large that in the space of several months, the market has lost over 20% of its value – despite the typical “stickiness” of RE prices. Now to be fair – that’s not a “crash” according to the generally accepted threshold of 30%, but that’s a mother of a correction that shows no sign of slowing down.

Where it goes next is anyone’s guess, but a spade is a spade.

Huh? That graph doesn’t show a collapse, Leo, it shows a change from a massively appreciating price trend. Rate of change has changed, and prices have declined a couple of percent from spring highs, but like Vancouver, still up YoY.

http://creastats.crea.ca/treb/

That chart is for the City of Toronto, not the GTA however. Doesn’t seem to be a single chart representing GTA, but scanning through the other August charts, I see only a couple “down” for avg and median. Every other area seems to be up YoY to the tune of single digits and a couple of low double digits.

It’ll be interesting to see what happens to the city vs the GTA.

The collapse in Toronto so far is truly astonishing.

http://www.greaterfool.ca/wp-content/uploads/2017/09/CHART.png

http://www.greaterfool.ca/2017/09/06/balanced/

So curious to see if it continues or bounces like Vancouver

59% of BC’ ers living pay check to pay check. Keep on pumping perma bulls. Intorovert might make the millionaire club yet…in his next life. 😉

Sorry you feel that way Rook.

John Dollar I know that people want real estate to be different than any other product or service to the point it defies generally accepted economic principles. But you’re just kidding yourself if you believe that.

I don’t know if I agree. Not a lot of commodities are tied so closely to the countries GDP, or policy makers personal equity. I think those with the power will do all they can to make sure that housing doesn’t cool very much. I don’t think they have all the power to do that, and not sure if they are smart enough, but I think they will try. I don’t imagine there is nearly as much vested interest in a commodity like say, apples or cars.

Marko Juras Unfortunately 2011-2013 it wasn’t easy to find quality trades people. Absolute shortage.

I am not familiar with the going ons in 2013, but is it possible that there wasn’t many tradespeople in the city? It wasn’t booming at that time, so many tradespeople were in Alberta still making coin.

Unfortunately, articles like that one he posted contribute to people thinking they’re “rich”, when in a practical sense they aren’t. They lose their sense of what debt is, a mass raiding of home equity ensues and they buy unproductive liabilities, and presto. It will have to be payed back.

ScotiaBank really needs to change their catch phrase…

Good to know, person reporting the 1000+ deaths said it was hard to hear, line was cutting out.

James

Official news 90% of island destroyed. No official idea on fatalities from the PM office. Fly by has only been done.

…. and not so coincidentally, bubbles identified in those “millionaire” cities.

http://www.environicsanalytics.ca/footer/news/2017/09/05/environics-analytics-wealthscapes-2017-reveals-canadians-financial-fortunes-continue-to-rise

“3. Housing Bubbles Looming in Three Cities: WealthScapes identified a run-up in housing prices in Vancouver, Toronto and Victoria, indicating likely housing bubbles. In Vancouver, average real estate holdings appreciated 21.8 percent to $932,056. In Toronto, they rose 19.7 percent to $839,223. And in Victoria, they increased 19.0 percent to $669, 814. While real estate growth remains strong in other markets—outside of Toronto, Vancouver and Victoria, real estate values rose by 9.1 percent in 2016, to $372,341—the skyrocketing growth in home values in Toronto, Vancouver and Victoria would seem difficult to sustain. “

James that may be fake News. Twitter thinks it may not be real. I really hope so.

Victoria now part of ‘millionaires club’

http://i.imgur.com/Wo8fpr3.jpg

http://www.saanichnews.com/news/victoria-now-part-of-millionaires-club/

Just came out from the PM of A & B , 90% of roads and structures destroyed, 1000+ deaths. This is on an island w/ a population of 1600 people. Absolutely horrifying.

No – you should listen to Donald Trump:

“It looks like it could be something that will be not good. Believe me, not good.”

http://thehill.com/homenews/administration/349422-trump-on-hurricane-irma-not-good

🙂

http://www.nhc.noaa.gov/

Watch-out for fake news. The warning comes after several websites claimed Irma would become a Category 6 storm — which does not exist — that would wipe entire U.S. cities off the map.

You are encouraged to visit the National Hurricane Center’s official website if you are unsure of the source.

Just imagine 185mph sustained. That could be fast enough to blow a wooden house right down.

Barbuda very scary for that little island. No one has heard from them since impact. While we argue some people have some real problems.

Hope Florida and the Caribbean do ok with Irma. Real scary.

Hawk, you’ve also called a market-top a few times since I started posting, and have been wrong.

It’s fair to say that no one here has any idea what they’re talking about, some are just nicer about it than others.

I guess I was wrong in my interest rate hike prediction too, but then my jester suit kind of dissolves any notion of culpability.

Caveat, you were wrong in spades. I called the last two. 😉

Tradesmen were hard to find in Vancouver in March 2016 too and it didn’t stop the market from tanking $300K and sales along with it.

Those excuses wear thin when those busy restaraunts have to close down because of lack of workers who leave or stop coming here due to excessive cost of living.

The business cyle is in the 9th inning where rates historically go up and the consumer has blown his brains out.

Caveat Emptor for the win!

Your prediction was wrong. WRONG. Let’s write that again.

YOU WERE WRONG! Sorry – just feels great to shout sometimes.

(confession – sometimes I’m wrong too. Phew. That felt good).

There’s apparently a lot of sellers in the GTA holding out till September (I guess, that means around now) in the hopes, or even expectation, that the parabolic gains will resume.

One out of three so far:

Interest rates up – check

OSFI looming – TBD

Prov. policy – TBD

Not to mention China: 400,000 auditors, and a restriction of $9,000 per person from $50,000 as of July 1, 2017 …:)

I am going to guess that those of you who have HELOCs see their interest rate jump up within the hour when the BofC makes its announcement. Anyone care to venture how many years will pass before you see a proportionate rise in the interest rate on your savings account?

Happy, happy days for retail banks.

Toronto down again in August.

Avg prices down $175,000 in just a couple of months. Interest rate increases and OSFI requirements should make the trend continue.

The crazy construction costs, the ludicrous rents are all inflationary. The way for the BoC to curb inflation has always been with higher interest rates.

The hard thing for most Victorians and Vancouverites to understand is that the economic power house of Canada isn’t BC. Ottawa will only act when Central Canada is facing run away inflation.

So unless Central Canada has inflationary pressure, Victoria and Vancouver just have to suck it up with crazy prices. We’re the outpost of Canada and acceptable collateral damage from any fall out. Ottawa doesn’t care about you and your piddly house. Central Canada is the hub of Canada and that is Canada. Without the hub there is no Canada.

A couple of points to clear the air:

1) That was not really a prediction.

2) But is was very insightful.

3) Nonetheless it was correct in unspecified ways.

4) Pointing out that I was wrong and the BOC actually did raise rates is nothing more than a personal attack.

Marko

Forcing me to do the work myself. Just chugging along until I can get it done reasonable. Even materials are crazy in price.

The place I had built in 2011. Contractor told me double in price now. Just stupid out there.

Love to see a slowing so I can get a reasonable quote on some work and not a 6 month wait for a quality person.

Unfortunately 2011-2013 it wasn’t easy to find quality trades people. Absolute shortage.

Love to see a slowing so I can get a reasonable quote on some work and not a 6 month wait for a quality person.

Yea obviously the market will slow down soon or later, that is given…..we even may go from $6 billion in sales a year to $3 billion sales a year like 2013. Interestingly enough I still remember downtown restaurants being packed in 2013, still had an awfully difficult time finding trades people to build my houses back then, etc., etc. The world won’t come to an end and tradespeople won’t be begging for work.

That’s not really helpful for the companies that have started up in the last two years. A billion down in a year will have an effect on them and their competitors. They have to cut costs somehow to stay in business. 2013 is a good example of how companies had to down size after 2008. But for the last several years the companies have grown and more companies have started up. Saying that the gross revenue is up from 2013 isn’t going to help them make the payroll as they have to survive in today’s market not 2013’s.

The costs of construction are so astronomically high these days that you need a bump in market prices during the construction period to make it economically viable to build on speculation today. I know that people want real estate to be different than any other product or service to the point it defies generally accepted economic principles. But you’re just kidding yourself if you believe that.

Ento,

Vancouver average prices tanked $300K last March. With Victoria now about to go down the same dark tunnel there will be no hot Asian money to pump it back up like Van. Especially if foreign tax goes province wide and 4 more hikes coming and since most Asians have left. Most core median priced still under YOY.

Funny how BNN has been all defensive about the coming tank job until today. Now they are talking debt problems for consumers and the official Toronto bear market with sales down 45% and average prices 20%. Bubble deniers will be burnt bad.

Regardless, if they hike another .25 in October, I suspect that’s where consumers will really begin to notice. Rates are still very, very low.

Even without a hike in October if the NDP/Greens bring in the foreign buy tax province wide and some other legislation too many head winds against the market at that point probably has to return to something more balanced.

Most HELOCs are variable right? So this hopefully cools off using your home as an ATM business.

If the real estate market was any other business it would be suffering from falling gross revenue and declining sales.

Not really seeing it….we will clear 5 billion total sales $ for the year which will be less than 6 billion from last year but significantly higher than what will be the 3rd best year on record, 2015, at 4.3 billion. For context, 2013 was 2.8 billion.

If the real estate market was any other business it would be suffering from falling gross revenue and declining sales. That the prices are flat or higher means very little. This would be a business in trouble. And that means the business would have to make cuts. In the real estate market that means jobs.

We have more people building homes today than two years ago. That’s a lot of new jobs that were created in the last two years that people will be laid off from as well as fewer and smaller commission checks for those that are indirectly related to construction.

Well, either the BOC is serious about raising the rates, or they’re looking to give themselves more cushion later on.

Regardless, if they hike another .25 in October, I suspect that’s where consumers will really begin to notice. Rates are still very, very low.

Oops,

Sales are way, way, way down yoy for detached houses in metro Vancouver? Thats ok ! as I have been properly informed of recently on this blog, and as any realtor will surely explain, listings are also down. So, the sales to listings metric is stable overall as well as MOI. Continued low sales, nothing to worry about.

FYI: http://www.ctvnews.ca/mobile/business/bank-of-canada-raises-overnight-rate-to-1-per-cent-1.3576893

another .25 BP. Lock in those fixed. 🙁

Leo…I bet construction levels are much higher now than in 2008 … yes, eventually overbuilding could happen then things would need to slow to let the market catch up.

I know what you meant by ‘nothing to do with Victoria’. except it’s what’s happening in Victoria…

Vancouver buyers are down yes… from the big spike we saw last year to more normal levels, and people are still coming from… everywhere… since the population is growing faster than the National average.

Anecdotal… but California plates just appeared on a house that just had a sale close on my street.

Leo lays down the BOOM.

DEFINITION OF INSANITY

“The price per square foot for Vancouver condos increased to $1012, up 19% year over year.”

Hey I thoroughly enjoy Victoria too but your arguments aren’t terribly convincing. Vancouver buyers down some 50% from last year based on last stats, we had a lot of cranes in 2008 as well, and I doubt that the secret of Victoria is suddenly out compared to a few years ago. Victoria is definitely a nice place, but people wax poetic about their city everywhere. The “it’s different” here argument is made in many cities across the country.

Agreed with this. Nothing to do with Victoria, this is the scenario in every growing and densifying city. The long term trend for SFH affordability is for it to worsen. Nothing will stop that. Condos should remain in a range that is affordable for locals given current incomes and interest rates as long as there isn’t rampant speculation. No supply problem there (in the long run).

Just to help you out a little bit, Leo.

For Detached Sales, from January to August, comparing 2017 with 2016 … when they introduced the foreign buyers tax.

– West Vancouver detached sales down 48% year over year

– Vancouver West Side detached sales down 43% year over year

– Port Moody detached down 43%

– Coquitlam detached down 35%

– Burnaby detached down 34%

– Richmond detached down 31%

Overall GVRD detached sales down 32% year over year. Yea, not such a good sign

But who knows, maybe increasing interest rates (possibly tomorrow) and OSFI regs will help pull sales up.

http://globalnews.ca/news/3718867/metro-vancouver-housing-sales-up-in-august/

Exactly, Ento… I just ran into more transplanted Vancouverite’s again this week while chilling at yet another amazingly beautiful local beach – we discussed how great a decision it was to leave Van behind. Also, how more and more people keep discovering that, from all over.

Great comment 3Richard Haysom from this morning… your ‘ODE TO VICTORIA’. My thoughts are that those on here who detract from Victoria do so because they have their own motivations… As Hawk admitted already in a previous post- they simply just don’t want anyone else to come here or know how awesome it is here. They want the small, quiet, quainter and much cheaper Victoria from years ago to come back. They get excited about a blip or snag in the HPI for one measly month. It’s somewhat entertaining, actually.

The Reality is that the secret is out though… one only has to look left right and centre at the construction activity and cranes everywhere around here, to see this in action. The lack of all types of housing vacancies, low unemployment, etc. As long as the population continues to grow above national rates – while the land base stays the same – then more density happens! So, detached SFH will over time get more expensive as real supply (esp. the rare quality homes in good locations that are not on busy roads) dwindles – as more SFH succumbs to density. This is despite what happens w/ interest rates or new regulations (unless either of these are particularly onerous, which I doubt as the new Gov’t would not want to shoot themselves in the foot). Yes, there will be some dips during some months, but the trend over the longer term seems pretty obvious to me. It’s not that I necessarily think that’s a good thing for society overall -it’s simply the way things are these days.

Other things that could derail the local economy or housing… Massive economic collapse worse than ’08 (thanks mostly to one guy w/ a bad haircut). Nuclear war or a major conflict (thanks to two guys w/ bad haircuts), Or… climate change starts accelerating much faster than what we initially expected. Another event that could happen locally of course is that earthquake or tsunami – we’d eventually recover but there’d definitely be some down time from that.

I guess, keep hoping guys??

If we’re presuming no substantive changes to our monetary system, then yes, they likely will – and they will eventually exceed them. I would go so far as to say it’s inevitable. It’s also irrelevant.

The issue is not the price, it’s that price in today’s dollars in relation to today’s economy. If prices for detached homes are 1000k, the average household income is ~300k and interest rates are 6%, I think that could generally be considered reasonable. But if those numbers are 1000k, 75k, and 6% respectively, then there’s an imbalance.

The problem is the economy here doesn’t match the prices today, and further, that some people not only think this isn’t an issue, but it’s in fact sensible. History is not on the side of those people, but they’re in abundant company nonetheless. Only a fool would think it’s logical to have a standard middle class detached here, in 2017, cost 100k, or 1500k.

I don’t see much evidence of prices exhibiting a lot of seasonality.

Vancouver condos completely insane with rapid price rises http://vancitycondoguide.com/vancouver-condo-report-august-2017/

SFH market slowing, into buyers market territory.

http://vancitycondoguide.com/vancouver-real-estate-detached-market-report-august-2017/

Nissan reveals a new Leaf, putting pressure on electric car rivals

http://www.latimes.com/business/autos/la-fi-hy-nissan-leaf-unveil-20170905-story.html

Look out below, Hawk?

Check Vancouver stats. Prices are up across the board from Aug. 2016. (Ok, they’re not up very much.) But there hasn’t been any crash, or decline at all. And both residential composite and single family for Greater Van are up ~60% over 3 years.

Edit: condos and townhouses are indeed up a lot. Houses, less so, but they’re still up.

Ross Kay saying on his podcast that Victoria is where Vancouver was back in March 2016 when it began its major tanking. Look out below.

So “goofballs” is the best comment? Lame.

LOL @JD 🙂

Nah, I’ve had more fulfilling bowel movements than that.

Best comment in a while.

If you want to maintain credibility – then don’t make predictions. I applaud those that do put their credibility on the line. But I don’t agree that the internet is a great repository of credibility. People change their opinions and have the right to do so. What happens though ares those with an agenda use opinions/predictions as a way to discredit someone.

In my opinion, what someone is saying today is of more importance that what they may have thought a decade ago when circumstances and events were completely different. That a few believe the opposite is more telling of them than the dated and now because of the passage of time irrelevant opinion. Yet some just can’t get over it. Maybe they are just compensating for having small hands.

For example, I’ve changed my opinion on GMO foods. I’ve read more about them and have a better understanding. Does that damage my credibility? I don’t think so. How about the person that didn’t believe in climate change a decade ago and still doesn’t today. Are they more credible today?

As John Dollar I have shown respect to the bloggers on this board. I haven’t fallen to the level of a few that prefer to attack the person and not the argument. Too bad they can’t say the same.

True, sorry if I mischaracterized your statements about him.

Eh, could be worth commenting on I guess. Could also make the argument that one should mostly be talking about quantified fundamentals one knows about. I’d love it if the industry tracked price reductions more thoroughly though.

and

Hey, goofballs. Sorry to disturb your goofball sesh. When did I say I never make predictions?

I’m sure they really do believe that. And, after the crash/correction/whatever, renters will frolic among unicorns as they visit open houses in Oak Bay for homes now selling for $500,000.

No two people love useless speech more than FHawk’s News and John Dollar and No Sense.

Garden,

Hundreds of people slashing prices for the first time in years is an observation any agent worth his salt would have commented on versus saying it was a head scratcher why prices dropped. I never said he was pumping.

I thought Marko was very reasonable throughout the interview. He doesn’t strike me as a pumper.

Hawk: Maybe he didn’t touch on the number of slashes because it’s not a quantified stat that is historically tracked, and thus somewhat useless to speak on.

3Richard Haysom: “Spring markets are typically always the high point in RE markets ….”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Hey, where was that advisory in the Spring? Lol.

Spring markets are typically always the high point in RE markets and then they trail downward to September with sometimes a bit of a bump there only to tail off again downwards into the winter months setting up again for gains in the Spring. This is exactly what the Victoria market is doing, very typical, very normal. How come there is no mention of this? Expect Victoria’s market to do just that going forward with modest gains next Spring inspite of the Governments actions.

LOL

Oh come on. Predicting that SOME time in the future the prices in Victoria will be higher than today’s prices is the safest of predictions. Even if prices fall for a few years do you really believe they will never again equal 2017 prices?

“Or in the future, when it’ll be even more.

Now who’s making the predictions?”

Hypocrites abound here James. 😉

Marko forgot to mention all the hundreds of price slashes the last month as to a reason why the prices went down. Not rocket science wether there is low inventory or not. More slashers mean lower prices in a market that’s tapped out on record household debt.

Also no mention of possibility of 4 rate hikes coming as per Scotiabank CEO. I guess Marko didn’t want to spook the masses as no other agents are taking to the airwaves to explain what’s coming.

Now who’s making the predictions?

I still don’t see where that reads as a prediction.

Not that there would be anything wrong with it if it were a prediction as prices did back off after 2011.

To me it appears to be very insightful of what was to happen for the next few years. I don’t know what other economists were saying back then but to be that in tune with the market is admirable.

But let’s not hold back. That Just Jack was a pretty smart guy. Good looks and brains, no wonder some were jealous. I wonder how big of scrap book Introvert has on his wall of Just Jack!

https://youtu.be/Wv4i_EU1jVk

Or in the future, when it’ll be even more.

Only if he sold now.

Marko was on CFAX yesterday, discussing the 1.3% price drop. Here’s the audio clip (skip to about a quarter of the way in):

http://bmradio-a.akamaihd.net/media/Cfax1070/1504571642_marco_juras.mp3

Thanks, Curious Cat. Must be me, then.

I’m using chrome and not having any issues.

1739 Bay St on slash #4 now down $50K from starting point. When the starter houses with a garden suite on a busy street can’t sell you know the game is over. Only 4 months ago they would be shoulder to shoulder fighting to make the winning bid. Amazing how fast things change.

Leo, HHV isn’t loading in Chrome for me today. Wondering if the issue is at my end, or yours.

Unfortunately for revisionist history, the internet is a great archive.

Just Jack/John Dollar has provided a ton of valuable commentary/discussion and data here. But it’s disappointing that he doesn’t own up to his past statements.

Trying to redefine a definite prediction that proved wrong to a hypothetical “worst case scenario” after the fact is not a credibility enhancer.

Predicting real estate markets isn’t quite like predicting eclipses so it is now surprise that most predictions made on this blog* have been wrong.

*my own definitely included

Memory is even more ambiguous.

Ehh… IMO that’s a stretch to read it as a worst case scenario being presented. But language is often ambiguous.

Rook That doesn’t include me. I have a really hard time forgetting and not regretting that we didn’t buy a home in 2012.

Introvert Cautionary tale, folks.

Just to clarify, I regret because renting in this city has been incredibly taxing on my family. Being evicted multiple times in a couple of years is no way to live.

But, I am not buying in the current market either. I could be wrong again about the market, but for more than one reason it is not good for my family to buy right now.

Introvert, I know you disagree with housing bears, but you have to please admit that there is risk mounting in the Canadian housing market as a whole, not excluding Victoria. Victoria is lovely but not immune to fluctuations in markets.

Well, the house lights stay on into winter, with non stop darkness, wind and rain for several months. Homeless people abound, no nightlife, isolation and an expensive ferry if you want to go almost anywhere at all.

At least they do a nice winter display at the Butchart Gardens, so long as a tourist doesn’t jab you in the eye with their selfie stick. The sticks are banned now, but that doesn’t seem to stop many. Good soft serve, though.

Folks often say similar things about the Yukon – those who visit there are swept away into its stunning beauty, the mesmerizing northern lights, the unparalleled splendor of raw, untamed nature unlike anywhere else on earth. They choose to stay.

Victoria is not a bad place per se. If I was from Calgary, I might romanticize over Victoria too. The reality vs the romance are rarely alike, though. It’s really just his personal opinion reflective of personal tastes, regardless of how “unimaginable” comparisons to other locales are to him. Personally, I think the Oregon and California coast beats the pants out of this place. And so what.

Some will share his Victoria sentiment. But others go…ya, Victoria. Cute little town, but…wouldn’t want to actually live there.

Just for fun, here’s a link to a $25,000 Detroit fixer upper, with links to many others:

http://www.realtor.com/realestateandhomes-detail/14141-Edmore-Dr_Detroit_MI_48205_M41965-53475?cid=soc_shares_ldp_fb

I wonder what kind of palace 100k will get me?

Kind of wonder, if that’s a market that would be a good idea to buy investment properties in. Sure, values are depressed, and the prospects look dim. But isn’t that where money can be made? Proper investing is always a long term endeavour, after all.

😀

“That why they’re bears. They’re broke.”

This is where perma bulls arrogance is so prominent on here. Money is not made on houses alone. They are clueless to market tops nor life events in their perfect little bubble worlds.

I’ve doubled my money twice on houses by timing it and this stinks to high heaven of the largest Canadian bubble ever and will end in rivers of tears.

No market can keep paying off their mortgages with their HELOC’s for ever to avoid bankruptcy. As JD stated its only a very small percentage of owners who decide the market direction. The other 95% sit back and hold their guts tight.

Panic borrowing smells like SHTF time is nigh. 😉

Canadians Are Borrowing Against Real Estate At The Fastest Pace Ever

“Over $266 Billion Was For Non-Business Related Reasons

Experts have observed that more homeowners are using these to prevent bankruptcy.”

http://www.zerohedge.com/news/2017-09-04/canadians-are-borrowing-against-real-estate-fastest-pace-ever

@RH

Yeah, nowhere quite like Victoria in the fire season. House lights blazing at noon to dispel the gloom, the sky a lurid yellow, the air pungent with the eye-watering sting of ozone. And, oh yes, Tim’s! And those Frogs thought they had it good with their sidewalk cafés …

JD, thanks for the peninsula numbers BTW.

I think if someone was making a prediction it would be made clear. Besides given what was to happen to prices in the following years, when prices did roll back, it was insightful. But clearly this was a worst case scenario presented and not a prediction.

Introvert knows the difference but has an agenda. He’s the Antonio Salieri to Just Jack.

To be fair you did say “it will happen”. One doesn’t need to use the word “predict” in order to issue a prediction.

ODE TO VICTORIA

So I’m back in Victoria for a couple of weeks from Calgary and this time is no different from the many times before that I have travelled here. You only have to be here a few hours to be reminded what a special place this is. It’s a human condition to grow into complacency and take things for granted. It’s one of the greatest frailties of being human.

I have arrived here in the truly “dog days of summer”. This magnificent heat wave succumbing everything under its effects. Grassy lawns turned into powdery wastelands. Droopy weeds reaching for life through cracked sidewalks. If you had never been here before you would wonder what on earth was all the craze about. But it is the knowledge that in a short few weeks when the gentle rains return all this will turn into a magical lushness as the rest of the country prepares for the drearyness of winter.

As soon as I get here I find myself drawn to all my favorite haunts. Arriving late at night I am compelled to drive down to the inner harbour and take in that amazing sight of all the lights of the Empress and Legislature buildings dancing off the water.

At day break a quick stroll down to Gonzales Beach and marvel at that pretty sight of the homes curving the Bay, the long stretches of beach overseen by the unmistakable form of the Gonzales Hill observatory.

Then it’s into my car to go to Tim’s on Shelbourne taking the most circuitous path possible namely “the scenic route”. I have lived on three continents, Africa, Europe and North America and this drive is one of the most spectacular I have ever seen. This 13 minute drive of exceptional beauty is so mesmerizing that I am addicted to driving it once every day that I stay here. Yes I am the Alberta redneck driving the silver GMC with the “Stampeder” horse logo on my rear window just sucking up the beauty of this amazing place. Yes, complacency can be a numbing phenomena and living here like anywhere gets tiresome and can be taken for granted. But people believe me this is such a beautiful and spectacular place and I have only just scratched the surface of it in my accolades. To me it is unimaginable that you can compare it to any other place in its entirety to any other community in North America let alone Canada. It is uniquely special, so incredibly desireable that I find it impossible to agree with the distractors of this amazing place.

Sidegrading? SIDEGRADING?

I for one could never do that, because if I actually had to say the word out loud I would retch just a little.

I think you’ve made the mistake of assuming bears had then or do now have the means of buying. Of course they don’t. That why they’re bears. They’re broke.

Cautionary tale, folks.

And if you think Rook has regrets, consider what the artist formerly known as Just Jack must be feeling. He’s left many hundreds of thousands of tax-free dollars on the table by not purchasing a property. What were prices in December 2011 when he was running his mouth about a 33% drop? What were prices in 2008 when he was sure the global recession would do us in?

Hope everyone had a very nice weekend and end to the summer.

How would you define a flip? Resale in a certain number of months? 6, 8, 12, 18? Certain degree of renovation? Is renovation required for a flip or is it a flip if you just hold on to it to resell in a quickly increasing market? Was your era condo a flip?

Trevor/Introvert

I don’t see the word predict in any of that. What you have there is not a prediction. That’s just part of a continuous discussion among the bloggers. Part of a thread of discussion taken out of context.

I’ll give you an idea of what a prediction would look like. It would start with ” I predict that …”

I agree speculation is a positive element in a healthy market. It helps to stabilize prices. Only when it becomes excessive and becomes hoarding does it become a problem.

What we need is a hoarding tax not a speculation tax. Own more than three of four residential properties then you should be taxed on all of your gain. Want to be a property baron then buy apartment buildings or commercial or industrial. Housing should not be a privilege of circumstance. Some one buying today should have as much opportunity to buy that you did.

Let’s look back a little farther…

“…which is what happens … and it will…”

http://i.imgur.com/BAmbK4N.jpg

No, I haven’t. I may have discussed crashes in the past or what led up to them but I never “predicted” a crash. You have always had a comprehension problem and low self esteem and that’s why you lash out at others in anger.

Look back to what I said at the start of the year for housing in the core. That’s the market we are in right now. Or when I said that condominium prices were set to rise back in 2016. And they did.

So remind me of what you predicted that actually happened? NOTHING!

Are you regretting not buying in the spring too?

Think back to why you didn’t buy in 2012 or since?

Has that changed? Or are the same reasons that you didn’t buy then still keeping you from buying today?

And if you have subsequently bought saying you regret not buying in 2012 makes it sound like you regret what you did buy. So are you happy with your purchase or not? If you are, then let it go and stop regretting things that were never likely meant to be in the first place.

You could have married the first person you slept with, would you regret that today? Or would you thank God you dodged that bullet.

John Dollar – We live in an age with a short public attention span. And in real estate it’s what happened last month or back in the spring. What happened a year or two ago has little meaning to today’s prospective purchasers.

That doesn’t include me. I have a really hard time forgetting and not regretting that we didn’t buy a home in 2012.

It’s one of the policies where I’m waiting to see what they do. It can do virtually nothing or a lot, depending on how it’s structured. I have heard musings of it being in the 2% range, which I’m not sure how effective that would be.

In 1974, Ontario introduced a 50% spec tax, which hit the brakes really hard. Whatever the number, it will also matter how it’s applied. Does it apply to homes bought in the last year and resold? 2 years? 5?

Speculation actually has a role in a healthy marketplace; without it it’d be more challenging to get things built. Matter of degree then, I should think. Striking the balance may be difficult.

Most definitely. I suspect we will see continued drops in demand n the SFH space going forward. We’ll see how the condo market shapes up though. Vancouver SFH are very slow, but condos are still stupidly active.

Pal, you’ve been predicting a crash directly or obliquely for over eight years now. That’s your track record. You can try to run from it by changing your name on this blog, but your track record is public—and it’s pathetic.

Ok thanks Leo. I just think prices are too high and we are beginning to see the effects…lower demand.

This is a good analogy, it just needs an additional factor to take into account seasonality. Luckily it works by retaining the same water barrel analogy (roughly).

The market is like a barrel of water. The months of inventory is the water level in the barrel. New listings are like the water being poured into the barrel and the sales are the water flowing out of the tap at the bottom. You can have a stable market as long as new listings are keeping up with the outflow from the bottom tap. In addition, the water level normally is lowest in the spring when it’s dry (not quite our climate, bear with me), and rises into fall as it rains more. It is highest in the wettest month, January. So, a stable market isn’t always that months of inventory is not changing, but that it is changing differently than would be expected in the current season. For example, as it starts to rain more, we could open the tap at the bottom and drain more water to keep the water level in the barrel constant even though it should be rising. That is a seller’s market despite constant water level. Or we could have a constant water level by pouring more water in in the spring when it should be dropping. That would be a buyers market despite constant water level.

Make sense?

Historical average MOI by month

Sales is the obvious one. However at very low inventory levels this becomes a bit inaccurate since there may not be enough properties available to buy. To go back to your car analogy, the Chevy Bolt has quite a bit of demand but the Victoria dealer was only allocated about 20 cars for the year, so there were 20 sales. However if they had brought in another 50 cars maybe sales would have been 70 for the year. Or 21. Hard to tell.

So we won’t get a complete picture of demand until we get a bit more inventory. I’d say 2500-3000 is sufficient inventory such that it is no longer constraining sales (right now we are at just under 2000) but that is just a guess.

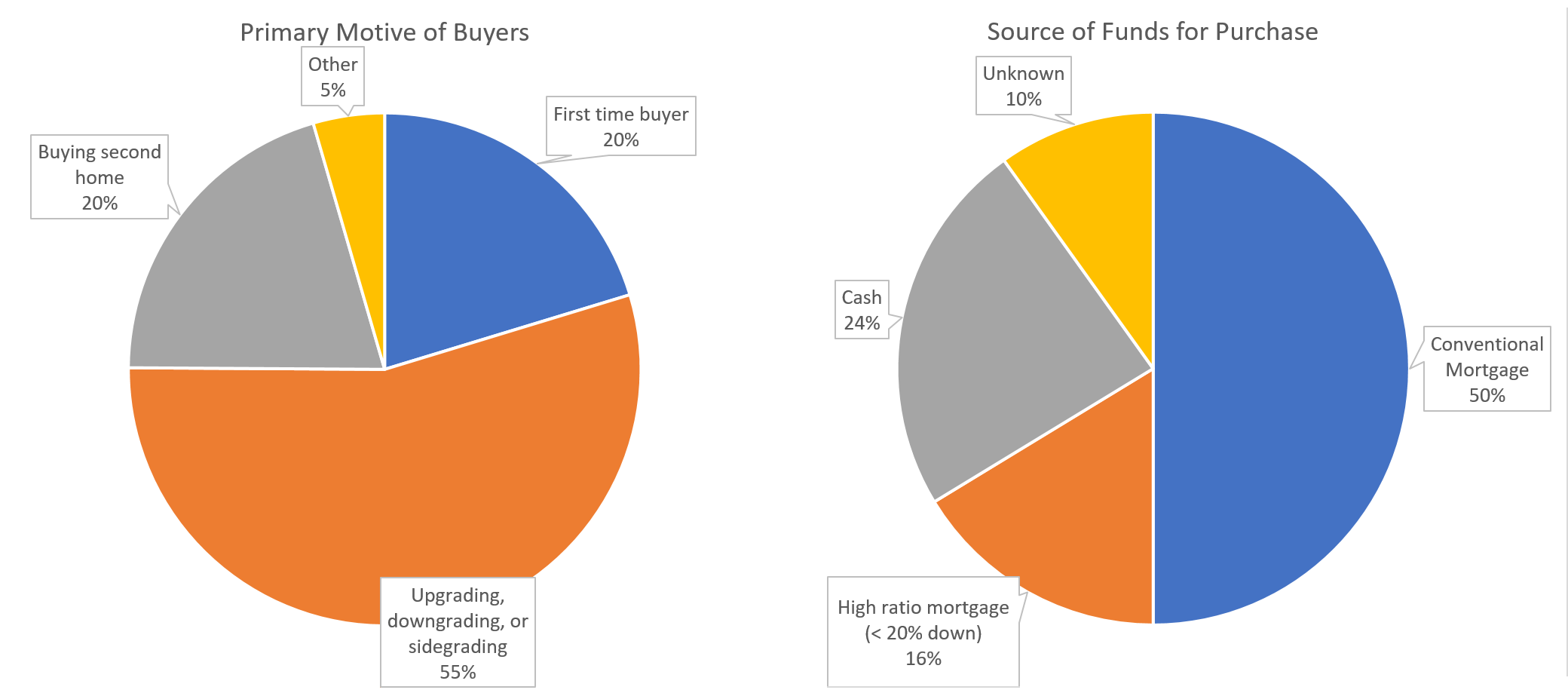

As for first time buyers, the VREB surveys agents on the motivation of their buyers. Take the survey with a grain of salt I don’t think it’s necessarily super accurate but here is their data:

20% first time buyers. That compares to stats I’ve seen from Toronto where they quoted 50% first timers.

Announcement of the B.C. speculation tax coming very soon according to a reddit user who emailed Horgan:

https://www.reddit.com/r/VictoriaBC/comments/6y1kzj/comment/dmk1xmt

Better than yours will ever be.

OK, then. I’m sure you’re right. Your track record on such matters has been stellar, after all.

“Mortgages payments go up by 27% on a simple 2.4% move.”

Even more awesome.”

oops,

This is where the perma bulls are out to lunch. The 21% interest rate excuse shows even more lameness by a professional. Most owners could not handle $1000 plus mortgage increase as well as most of their last few years of profits gone poof with just a couple of points hike.

Vancouver off to a hot start. 😉 142 out of 179 sales are slashes. Average price taking a beating in Richmond.

http://www.myrealtycheck.ca/

One of the regular bloggers said he was interested in what was happening in the Saanich Peninsula.

Primary Year Sale Price, Median Sales, Number of

2007 $555,000 544

2008 $560,000 366

2009 $575,000 486

2010 $605,000 399

2011 $580,000 386

2012 $560,000 365

2013 $555,000 379

2014 $562,250 438

2015 $600,000 571

2016 $710,000 611

2017 $802,000

Compare that to Victoria, Oak Bay and Saanich East where there has been a lot of speculation in houses in the last few years.

Primary Year Sale Price, Median Sales, Number of

2007 $573,000 1653

2008 $600,000 1267

2009 $580,000 1528

2010 $635,000 1243

2011 $630,000 1210

2012 $608,250 1164

2013 $611,000 1255

2014 $620,000 1382

2015 $675,000 1670

2016 $826,000 1855

2017 $930,000

“It’s difficult to guess how many are on the sidelines. Underestimating the number, though, would be a typical mistake bears make.”

This is the excuse the bulls make at market tops. Sales are down YOY and prices have started to fall in the core and they aren’t buying en masse. Those sideliners don’t want to catch the falling knife. If they actually had cash they would have bought one of the 20 plus Golden Head and other prime hood price slashes the last month or so.

170 teachers are going to have a limited time shelf life. Banks want to see they are full time permanent, not classed as temp status to avoid benefits like so many government ministries do these days. They also need to get a year or two of employment behind them before qualifying. $47K doesn’t buy you much either without a whack of cash down.

Introvert: “Yes, if interest rates go to 21%, all my tenants flee, real estate market transactions fall to 500 per year and I can’t make a commission, the 8 years worth of mortgage payments I have saved in RRSPs disappear because the stock market crashes, and the real estate market drops in excess of 50%, and I can’t get a job as a respiratory therapist anymore because health care can’t be funded, then yes I am screwed.”

That is awesome.

“Yes, a jump from 15% to 21% was a market killer but when you take a jumbo mortgage at 2.5% and move it to 4.84% you have effectively met a similar bar.

https://www.cibc.com/ca/mortgages/calculator/mortgage-payment.html

Mortgages payments go up by 27% on a simple 2.4% move.”

Even more awesome.

They won’t be buying any time soon. And at today’s rents they won’t be finding many affordable places in the city to live either.

Speaking of who and how many may be on the sidelines, note that, for example, the Greater Victoria School District hired nearly 140 full-time teachers this spring/summer, as well as 30 teachers-on-call.

First-year full-time teachers have starting salaries, depending on education level, of $47,000 to $57,000.

And that is just for SD61. Saanich hired more teachers, and Sooke, we must assume, hired a bitchload more teachers—all at pay roughly equal to the numbers above.

Yes agreed, thanks. It was more a reference to fundamentals itself, ie the money the economy generates. Of course that itself can be defined one way or another, depending on one’s agenda.

The other two are easy.

Blue is what the healthy human eye perceives when exposed to an EM wavelength of around 465nm. God is what everyone is not, but aspires to be in one way or another.

We’re not there yet. Not even close. But again it’s a bull that is making the comment about a full scale Armageddon.

While most are content to talk about a pull back (5%) or correction (10%)

What fundamental values? There are no such things. It’s a phrase that has no meaning but everyone knows what it is. Except when they are asked to explain fundamental values. It’s like explaining God or the color blue to a blind person. We all know what God and the color blue is – until we have to explain it.

We’re not in any of those categories. Not even close.

It’s difficult to guess how many are on the sidelines. Underestimating the number, though, would be a typical mistake bears make.

It was a good observation.

That is awesome.

Construction is not in OSFI’s mandate but how a project is financed is.

It’s not the business of building it’s the business of getting financial backers. Where there is no limit to how much money the developer can raise from financial backers. The developer is making their money during the construction by charging the financial backers fees. The longer the construction period the better as the developer doesn’t have to pay back the investors until completion. And even then they only receive a portion of the profits. Then throw in other projects into the plan that are not completed and the investor never knows where they are. If the developer wasn’t breaking ground on these project then it would resemble a Ponzi scheme.

Most of us would never go for this kind of an investment. But throw in a Canadian passport. Your get out of jail card if things go bad for you in the home country.

Local Fool: “When are their regs going to be finalized, if not already?”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

People are expecting a fall implementation, but from the horse’s mouth, by the end of this year.

“Following a review of the submissions, OSFI will finalize the guideline and set an effective date for later in 2017. “

Er…is ‘not killing the golden goose” from construction within OSFI’s mandate? I thought the question is more, does increasing deviation from fundamental values and long term trends pose a threat to our financial system…?

I suspect Hawk that a lot of these mega housing and commercial projects are not geared to making money off the sale of the units but drawing in investors.

You could have a complex that might have a gross sell out price of a 100 million but you can sell it to investors for 200 million.

Some projects spend just as much time shuttling potential investors around the site as they do prospective purchasers. It makes one wonder if the developers are in the construction business or the business of over selling the complex to investors. Normally investors at this level are pretty savvy but when you throw in a “free” passport that changes things from building for profit. You’re no longer constrained by the economic viability of the project. In that way you can keep building and building without having to worry too much about the complex being sold out.

This is where OSFI should step in. But they are not going to kill this Golden Goose.

I never thought of it that way. Yikes…and there weren’t HELOCs and 5 credit cards for everyone back then.

When are their regs going to be finalized, if not already?

Personally, I think the idea of being a respiratory therapist is a more socially valuable gig than selling houses, and probably less stress. If he had to fall back on that, I’d say he’s fortunate.

“Yes, if interest rates go to 21%, all my tenants flee, real estate market transactions fall to 500 per year and I can’t make a commission,”

Then, my friend you are in a lot of trouble because the average sized mortgage in the lower mainland back in the 80’s might have been $60,000. Yes, a jump from 15% to 21% was a market killer but when you take a jumbo mortgage at 2.5% and move it to 4.84% you have effectively met a similar bar.

https://www.cibc.com/ca/mortgages/calculator/mortgage-payment.html

Mortgages payments go up by 27% on a simple 2.4% move. Hmmmm that’s exactly the Bank of Canada qualifying rate. Hopefully, nobody took those 1.9% teaser rates. You had better hope that Garth Turner is wrong about renewals.

Respiratory therapist might be a good move, Marco as everyone will be gasping.

With the atrocious cost of construction these days you need market appreciation during construction to make most of these projects economically viable.

When market prices stall or even decline then as a builder you have to start to scale back on projects.

And that’s going to be tricky as the city, province and country rely heavily on the fees they have laden on this golden goose of construction.

Taxes and fees on a house might double the cost of construction. And the different levels of government have grown accustom to getting this paycheque from developers and contractors. None of bureaucrats are going to voluntarily reduce charges if construction slows. And the unions are not going to allow the government to scale back on workers that would now have little to do if construction were to slow.

And that’s why I suspect that OSFI is going to craft their regulations to slow down re-sales but still stimulate new construction – especially new condominiums. You don’t want to kill the Golden Goose prematurely you just want it to die slowly of old age.

Foreigners are fleeing BC.

Via Steve Saretsky:

“A continued trend is rearing it’s ugly head. The well of foreign money is drying up. Perhaps this is temporary, but it’s very real.

This August there were fewer detached home sales in Vancouver’s West side than there were last August, the very month a historical 15% foreign buyers tax was introduced, instantly freezing the market.

Across Greater Vancouver, the expensive detached market appears to be struggling, with many areas now quantifying as a ‘buyers market’ with a sales to actives ratio below 14%. “

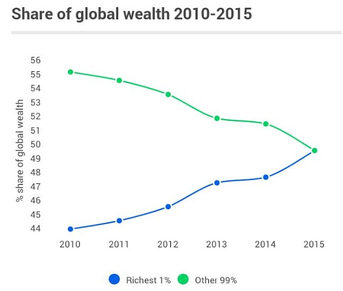

“Buyers that do not have a home already do not have a home to back a HELOC. Those that do have a home already get a HELOC get more homes. This is a market built on speculation. Prices up, rents up. Rich get richer, poor get poorer.”

But then the market maxes out like it is now and begins a long revert to the mean and the wannabe property kings learn a hard lesson in economics and high risk investing as the bank calls for more cash as prices tank.

With the majority of the market being driven by investment buyers and those with equity, eventually they peter out and stop moving as you can only move so many times, buy so many second and third condos, and then the music stops.

Government intervention is here to stay and will persist until it has it’s desired effect, and the NDP should play a huge role in the coming weeks.

Marko can deny all he wants the new OSFI rules will have no effect but he’s a salesman and nothing more. He’s only owned in a one way market during the biggest credit bubble in history, and never a true bear market. Might want to remember that.

You can’t directly measure demand.

Demand is like trying to find a Black Hole in space. You look for the effects of the hole on space not the hole itself.

If house prices have been stable for the past several quarters then the market is in balance. Supply is meeting demand at the current price and the market is in equilibrium.

In our case the market for houses in the core has been in balance for most of this year. Now inventory is starting to creep up and prices have declined. But it isn’t just inventory. It’s how fast new listings are being added relative to sales and how fast properties are being sold/absorbed and that’s the days on market.

When market prices were flat in 2012 and 2013 the market was stable at 5 to 7 months of inventory at those price levels. But at our current price level the market is stable with around 3 months of inventory as long as new listings are replenishing the market at a rate to match those being absorbed.

Think of the market as a barrel of water. The months of inventory is the water level in the barrel. New listings are what is the water being poured into the barrel and the days on market is the water flowing out of the tap at the bottom. You can have a stable market as long as new listings are keeping up with the outflow from the bottom tap. The water level isn’t changing. And that’s what has been happening most of this year.

Absolutely agree about the ‘dream’ of house flipping not equalling the reality when all costs are factored in. Only with a strong housing tailwind can it be a profitable venture in BC, and its easy to have the markets soften while you are mid-project leaving you stranded.

I see a shift in sentiment from the spring, perhaps it’s from watching what’s happening to SFH in greater Toronto and wondering if that could happen here as well. The tide indeed is going out, it just remains to be seen how far it will go.

Ah, good catch. Seems like the developer valued the wall facing at $2000, so a smart discount to get, but I’m not sure how this could be talked about in an article. I think the comments are a better place for people to talk about how they found individual deals.

The general approach of comparing pre-sales to resales on a $/sqft basis to determine if they are worth buying is a good idea for sure.

There are better ways to assign values per floor than just an arbitrary $2,000.

In general, the higher the floor the higher the price. Excluding views and obstructions like buildings. And the compass direction. South West being the most preferred while North the least.

But a downtown location versus a Sooke location will have a different price per floor adjustment. So will a 500 square foot condo to a 1,200 square foot condo in the same building.

In my opinion, a floor adjustment of $2,000 may have been fine in the 1980’s or 1990’s but would be inadequate in today’s market.

Leo S “Sure. But demand is not gone. It is off from the record levels, but still quite high, historically speaking.”

This might be what I am trying to figure out. How do real estate boards objectively measure demand? Just by number of sales? And what is the demand from first time buyers vs that of non first time buyers? Is this data available somewhere?

Prices high, stress tests, rising interest rates, banks tightening = a major drop in demand at the bottom.

Buyers that do not have a home already do not have a home to back a HELOC. Those that do have a home already get a HELOC get more homes. This is a market built on speculation. Prices up, rents up. Rich get richer, poor get poorer.

CREA showing sales down for the last few months and declining. The tide is on the way out. I think we will soon find out who has trunks on.

While we are seriously looking at moving from Victoria it is not because I think that the real estate market is about to crash. Where the market is going simply does not factor into our decision.

Is the market slowing down a bit? Probably . But I am not sure that this is a total surprise. My suspicion is that there has been a drop in the number of out of town buyers. Vancouver saw a major boom in prices that allowed a lot of people to sell out and retire early to Victoria. The pool of people who would do that is limited and I suspect that we are seeing a major drop in numbers. For a totally different reason Victoria also saw a lot of people over the last few years moving from Alberta. I suspect that those numbers are down as well.

We have seen a number of months were the inventory of SFH in the core has pretty well remained the same. Not being a stats guy this would seem to indicate a balanced market to me regardless of the metric as to months of inventory that is used by the VREB. Prices seem to have stabilized over the last few months as well.

Could the market crash here. Possibly it might. Far too much of BC’s economy is built upon the real estate market and very cheap money. A increase of rates of 2% over the next few years is probable. This will have a major impact on first time buyers. Combined with the fact that the local economy does not support real estate prices to begin with then this is a danger sign that I would not ignore.

I am not predicting a crash but rather there are a number of factors that would cause me concern.

Far too many people are buying investment properties at a price that is simply not supported by the rents that they can get. But I don’t have a crystal ball but there is cause for unease in my opinion.

“I lot of posters also haven’t experienced a 8-magnitude earth quake. I have two earthquake kits in my house but beyond that I don’t worry about it. You can only prepare so much.”

You’re absolutely correct but earthquake risk was on my long list of reasons to downsize our holdings. Not overly rationale I agree, but a catastrophic event could have sunk us with tenants able to walk to another province leaving us high and dry with mortgage payments. Not high on the list, but considered.

We intended to hold long term but the pace at which RE increased over the past few years, not to mention the number of “early 30’s” coworkers I have that are into 2 and 3 rental properties (mostly relatively high priced 400′ condos) caused us to reconsider.

No longer asset rich, cash poor, we are keeping our eyes open for unique opportunities and niches in the market that may be or may become relatively under-valued with a small or larger correction. For starters I think those are in waterfront and acreage properties. Although earthquake and tsunami risk moves up my list.

We’ve been looking at distressed properties: foreclosures and grow-ops. There’s a couple decently priced ex grow-ops that I thought interesting but as I read up on it, looks the stigma will follow a property for life. Can a completely remediated Gro house not ever be designated Gro-free so that disclosure can be removed from title? Seems maybe we’re looking for bare land value.

Those house flipping reality TV shows shows were almost criminal in my opinion. They influenced so many people to dive into the RE market thinking so much money was so easily to be had.

I just don’t see that many flips (new construction excluded) in Victoria. PPT, commission, legal fees, current prices, etc., are all significant barriers.

I believe a lot of posters haven’t experienced the “trauma” of a forced sale, seen their neighbours and family being foreclosed on or lost their job because the economy died.

I lot of posters also haven’t experienced a 8-magnitude earth quake. I have two earthquake kits in my house but beyond that I don’t worry about it. You can only prepare so much.

Yes, if interest rates go to 21%, all my tenants flee, real estate market transactions fall to 500 per year and I can’t make a commission, the 8 years worth of mortgage payments I have saved in RRSPs disappear because the stock market crashes, and the real estate market drops in excess of 50%, and I can’t get a job as a respiratory therapist anymore because health care can’t be funded, then yes I am screwed.

Will the real estate market crash? For sure it will. But we are referencing an event 35 years ago and I just don’t see another crash around the corner personally. It could literally be a lifetime before we see a major correction in Victoria so not going to spend every day worrying about.

As I said, my personal strategy is to max out RRSPs every year and the combination of that plus principal repayment really reduces the risk as you get older.

Speaking of house flippers, we need an update on that lady that was into 4 seperate deals and how is that going?! I forget who the blogger was but her situation could become a textbook example of how really badly things can go in a real hurry.

Those house flipping reality TV shows shows were almost criminal in my opinion. They influenced so many people to dive into the RE market thinking so much money was so easily to be had. Infact most of the winners made money on virtue of inflation because of the craze and not that their “improvements” created huge profits. Notice those shows never addressed the tax implications of those profits. They would reference to the fact that “Joe” made $35,000 in six weeks when in reality after the tax smoke cleared (as business income) he’d be lucky to be looking at $20,000 profit.

So to buy a $380,000 home, ply $30,000 in renos into it to net $20,000 only if it sold immediately is an incredibly dicey business to be in and in fact I’m sure most house flippers barely break even and many lose big time and in a changing market the losses will be even greater.

I don’t really understand the analysis there. You noted that prices increased by $2000/floor until the 5th floor, then started increasing by higher rates for higher floors. Where is the mispricing?

Units up to the 5th floor faced a wall, with the exception of one unit that didn’t face the wall….the one I bought.

I don’t really understand the analysis there. You noted that prices increased by $2000/floor until the 5th floor, then started increasing by higher rates for higher floors. Where is the mispricing?

Also you bought the place in June 2014 and sold a few months ago. The value was not in the mispricing, it was in the fact that the entire condo market was relatively cheap in 2014 and there was lots of presale inventory that had to be sold for significantly under the resales. Good timing on the condo buy and sale, but I believe 99% of your return is due to the market appreciating, and not the specific unit.

For example, the chump who bought the studio unit (204) on the second floor of the Era with no parking just sold it for the same price as your 1BR 5th floor unit ($361,000). So, the analysis probably yielded the best value unit in the place at the time, but hanging onto it for a couple extra months would have probably made a bigger difference in profit.

So I am absolutely not opposed to articles about finding value in the market, although I think there is probably more potential to discover value (for yourself) in the detached market where properties are much more diverse and you have more flexibility in terms of renovations or improvements.

I remember talking to some fools who were voting hair lisp because of the tax cuts he promised. A liberal. Still find it hilarious.

Millions of new mortgages were issued in the US as house prices sunk and the economy sunk into recession in 07, 08, 09. Mortgages will still be available to good credits here when and if our home prices tank. But you are correct that money will dry up for marginal credits

@ Leo S

Inventory can go up for more than one reason. The number of offers for sale could rise as readily or perhaps faster, than the number of offers to purchase decline. Panic, in other words, could lead to a very rapid and disorderly rise in inventory and decline in price, as seen in the last several months with SFHs in Toronto.

@ Totoro

I think Garth is talking through his hat, or rather he is talking to his own private interest.

The changes to the taxation of investments within CCPCs, and restrictions on income transfer to spouses, are necessary to insure equity in taxation. There has been a long-standing principle that small businesses and profession practices should be taxed the same whether they are incorporated on not. The proposed legislation will restore this principle. As for payment of spouses, obviously this should be restricted to payment for actual work performed in the business or professional practice at a realistic rate for the work done. Otherwise, such payments amount to tax evasion.

The problem with taxation, that everyone should be concerned about is that it is too high. The Liberals are the spendthrift party and they are apparently intent on raising every penny in tax that they can.

Instead, Trudeau should do as Trump promised to do during the US Presidential election, which was to remove half the working population from the tax rolls altogether. He should then vastly simplify the tax code and limit the top rate to no more than 30%, but include capital gains, including gains on houses, at the full rate, while making mortgage interest tax deductible (as it is for investors in rental property).

Sure. But demand is not gone. It is off from the record levels, but still quite high, historically speaking.

If sales keep declining by a significant chunk every month for 5 years then inventory will build up and Months of inventory will go way up. That puts us in a buyer’s market and yes, prices will decline.

And they won’t be kicking people out that are paying. That would be silly. However they likely would offer somewhat less favourable terms to those people they know are likely not to have other options.

Here’s an interesting article:

House flippers triggered the US housing market crash, not poor subprime borrowers

https://qz.com/1064061/house-flippers-triggered-the-us-housing-market-crash-not-poor-subprime-borrowers-a-new-study-shows/

“the biggest growth of mortgage debt during the housing boom came from those with credit scores in the middle and top of the credit score distribution—and that these borrowers accounted for a disproportionate share of defaults.

As for those with low credit scores—the “subprime” borrowers who supposedly caused the crisis—their borrowing stayed virtually constant throughout the boom. And while it’s true that these types of borrowers usually default at relatively higher rates, they didn’t after the 2007 housing collapse.”

…

“the rise in mortgage delinquencies is virtually exclusively accounted for by real estate investors.”

Your experience in having been there is valuable on this board. Thank you for sharing your story.

Age is probably a factor for a few of the posters, vested interests are clearly present for others.

Regardless, unlike the 1980’s, information is so accessible now there just isn’t a meaningful excuse for ignorance. Unfortunately with human nature, that isn’t good enough. While it’s easier to learn from the mistakes of others, alas, it’s not as good a teacher as direct experience.

Local Fool

September 3, 2017 at 6:39 pm

@oops.

One of the things I’m noticing here is a general lack of awareness of what a real housing correction is, and what it looks like.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

You have done a very good job of summing up the “crash” scenario.

I can see the same thing to a large degree, Local Fool, and I think that a lot of the “lack of awareness” is age related. I believe a lot of posters haven’t experienced the “trauma” of a forced sale, seen their neighbours and family being foreclosed on or lost their job because the economy died.

This is experience that crafts a certain amount of awareness … or it should.

Back in the early 80’s, Marco would have been the first poster to ask “why would the banks increase rates to 21% when they know that would force foreclosures on so many homes?”

I know that I was asking that question when I couldn’t qualify and was forced to sell. I followed the market down from $139,000. to $99,000. One year after selling ($10,000 of equity left), I bought a brand new 1650 sq.ft. rancher for $72,000. It was originally listed at $144,900.

Hence …. oopswediditagain.

I would think that Barrister would be able to add a heck of a lot more experience from the U.S. housing debacle. Mind you it also looks like he’s cashing in his chips. Experience is its own reward. Lol.

Marko: “They know…….lol.

If they hypothetically knew the direction of the market how is risk mitigated by forcing someone that is making regular mortgage payments into a forced sale or foreclosure.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Risk is measured by a “major downturn”. As far as OSFI is concerned Vancouver and Toronto are the greatest risk factors. Forced sales prior to a big unwinding will provide a better/greater mitigation for the banks. Far better to get 75% of their collateral back in the early stages of a crash than 40 – 50% back near the end.

OSFI knows that the “conventional mortgages” that slipped outside of their last legislation are risks because those home owners can’t withstand a 2% rise in mortgage rates. In the case of bundled mortgages, those home owners are probably already in trouble with the recent rate increases.

Keep in mind, Marko, OSFI is more concerned about the possibility of bank failure then Joe Blow’s house. It is the financial system “risk” that is important. Canada has dealt with a couple of big housing crashes in the past and quite frankly the banks weren’t as challenged back then as they are now.

The cushion of CMHC was taken away and OSFI will do whatever it takes to make sure that Canada doesn’t follow the U.S. bank problems.

@oops.

One of the things I’m noticing here is a general lack of awareness of what a real housing correction is, and what it looks like.

It’s not simply a matter of houses becoming cheaper, vultures licking their chops and diving into the market, snapping up all the cheap homes and waiting for the next round of easy millions. If that were how it really was, corrections would be almost meaningless.

Folks, house prices are largely a function of available credit, ie, how much a bank is willing to lend on a house. This amount changes in accordance with the broader credit cycle, which has been pretty skewed due to interventionist policies of the last decade. But the cycle cannot be avoided – as we’re beginning to see now.

Banks simply aren’t in a mood to loan in a correction. Developers aren’t willing to start new projects. Construction jobs disappear, speculators leave town, people lose money, the wealth effect goes into reverse, and the entire economy suffers. It’s part and parcel of a standard issue mean reversion.

I just spent a week in the US and had some interesting conversations about people’s experiences there during the US housing bubble and about what’s going on here in areas of Canada. We are almost hilariously complacent and ignorant up here, and going down there and speaking to others really makes that apparent. At least to me.

Bulls, if you think you’re just going to walk into a bank during a major housing downturn to grab a pile of homes at cut-rate prices, think again. Financing dries up. Your equity gets chewed out. Bears, if you think a downturn is just about lower prices and your easy ticket in, that’s not always true either. You’ll have just as much trouble getting financing, and depending on what field you are in, you may end up out of work anyways. It truly causes pain for everyone.

IMO, BC is especially vulnerable – with an economy that has morphed from an alternating “have vs have not” economy, into one where RE dominates and we simply sell each other houses back and forth at ever higher prices.

What we’ve done to our housing market is not some new release flick, folks. This movie has been played so many times before, but right here, most of us are too intoxicated by extreme prices to appreciate it.

If I was a doctor I’d be looking at moving to the US or working really part-time if these changes go through and I certainly would not start a small business.

I was with a doctor friend on Friday and he made a good point that unlike lawyers, realtors, business owners, etc., doctors have a fixed fee structure so these tax changes aren’t easy to offset. His father, also a doctor, is going to retire early if this legislation is passed.

They know that there is a major “correction” coming and they are going to ensure that the bank risk is mitigated.

They know…….lol.

If they hypothetically knew the direction of the market how is risk mitigated by forcing someone that is making regular mortgage payments into a forced sale or foreclosure.

It just doesn’t make any sense. The bank would have to be banking on the market dropping over 5 years by more than the principal repayment over those years + cost of foreclosure transaction and in addition another assumption that the owner would not be able to make payments at some point.

Marko: “Why does this stress test at mortgage renewal keeping coming up on the blog every 12 months as a topic for the last 10 years? It just doesn’t make common sense.”

This stress test is new legislation, Marko. The previous stress test was put in place by OSFI in regards to CMHC insured mortgages. Then, bright light realtors, mortgage brokers and lenders came up with the end run on the legislation whereas the home buyer begged, borrowed or stole the 20% down for a conventional mortgage to get around the stress testing for CMHC mortgages.

Marko: “Unless you are refinancing (different from straight renewal) exactly which stakeholder (owner, bank, government, etc.) has incentive to stress test and put the owner into foreclosure?”

OSFI has the incentive to stress test the owner because they are responding to the latest end run on their previous legislation. They know that there is a major “correction” coming and they are going to ensure that the bank risk is mitigated. If they did nothing and the “conventional mortgages” (fraudulent) continued then the risk to the banking system increases exponentially.

http://www.osfi-bsif.gc.ca/Eng/osfi-bsif/Pages/hst.aspx

“At the end of 2016, OSFI released the final version of new capital requirements for mortgage insurers that aimed to ensure these firms can withstand a major downturn in the housing market.

The new requirements were more risk sensitive and incorporated key characteristics such as borrower creditworthiness, outstanding loan balance, loan-to-value ratio, and remaining amortization.”

Okay Marko, you want a money maker Here’s a freebee for you.

A-2319 Kemp Lake Road

Do the math.