You gotta know when to hold ’em, know when to fold ’em

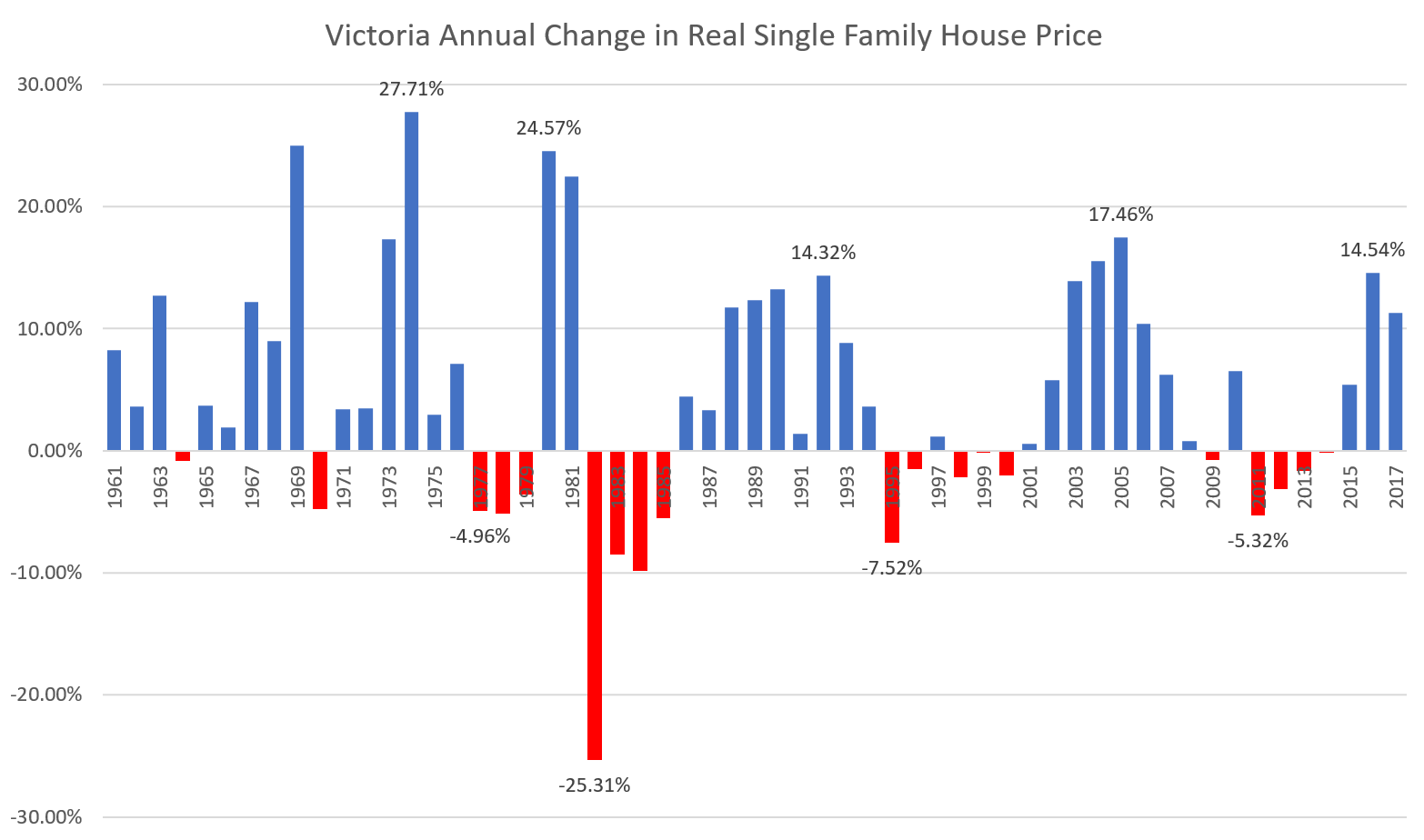

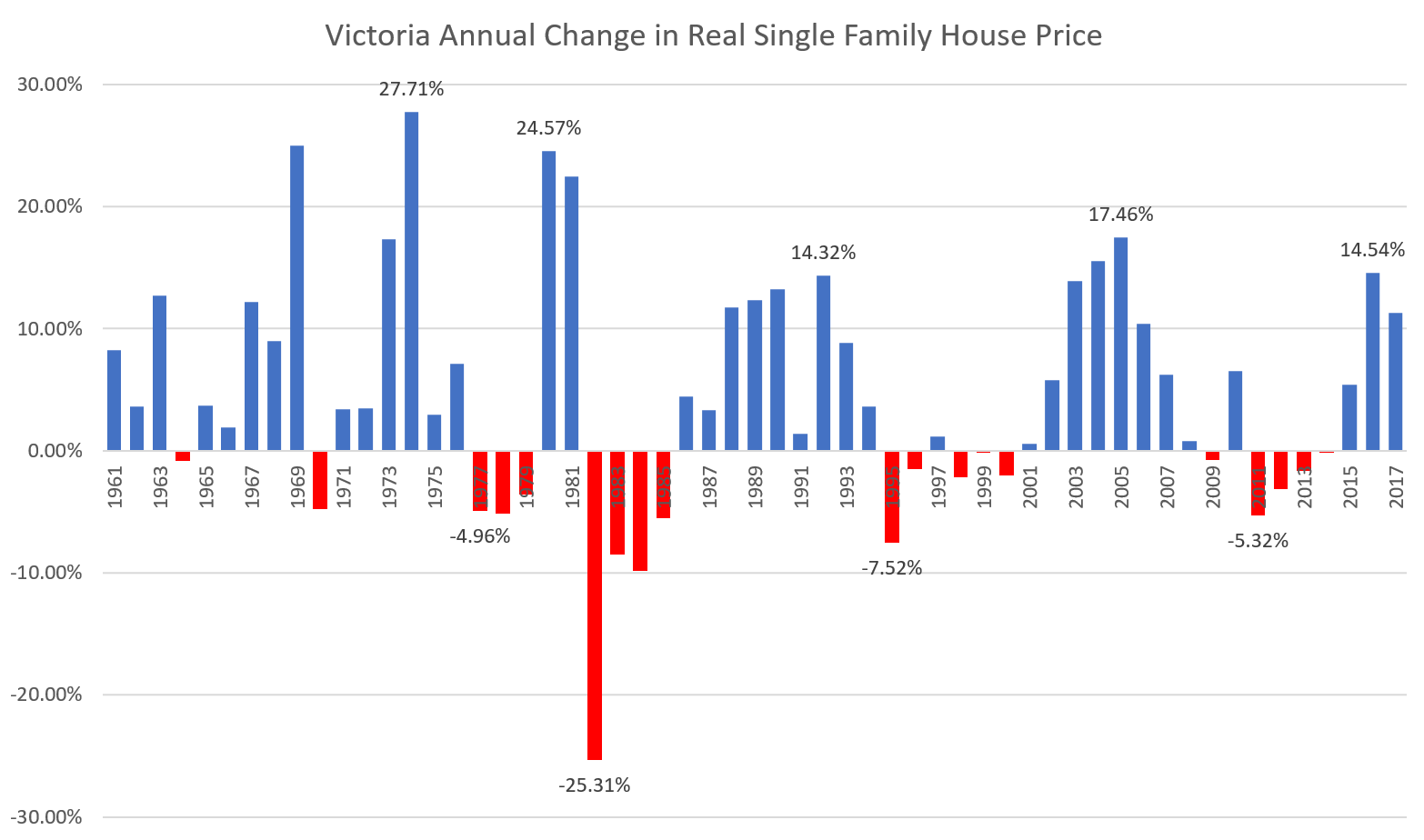

Generally real estate is a slow moving beast. There are no flash crashes here, and without an external stimulus, there is generally plenty of time to catch a market change from hot to slow or vice versa. That said, periodically it can be quite volatile. If we look at the history of the average single family home price, we see individual years where prices jumped or collapsed by almost 30%.

These are all inflation adjusted values, otherwise the picture would be quite distorted in times of high inflation.

So if you’re a bit queasy about the prospect of losing 25% of an asset worth hundreds of thousands of dollars, how long would you have had to hold a single family house in Victoria to avoid losses?

3 years?

Nope, if you had bought in ’81 and sold in ’84 your house would have lost almost 13% in value every year. The late 90s also weren’t super great. How about 5 years?

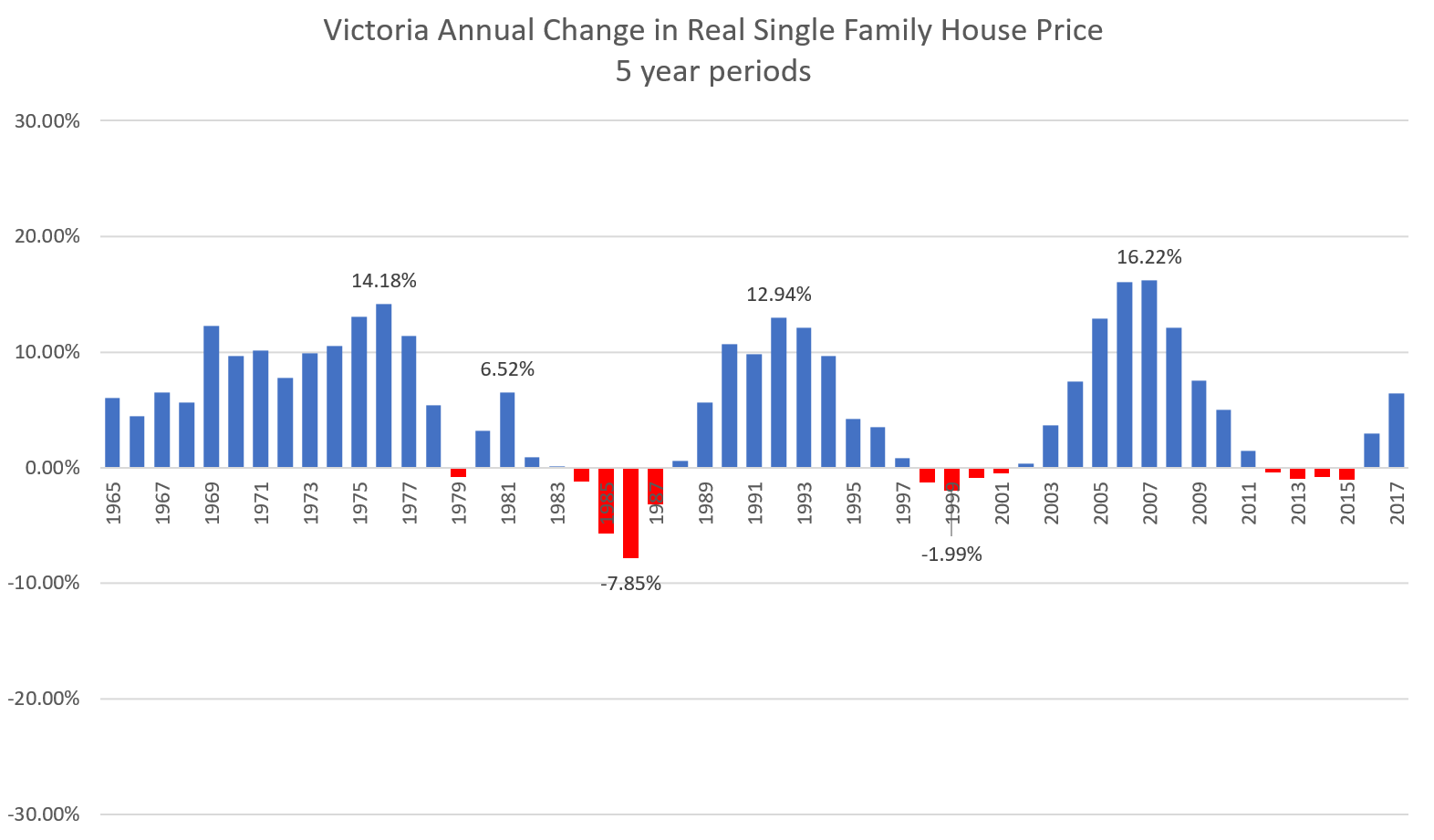

Getting better but still some periods of large negative annual returns. Once you add in the very high transaction costs in real estate, even the 5 year periods of relative flatness look pretty miserable. So 10 years then?

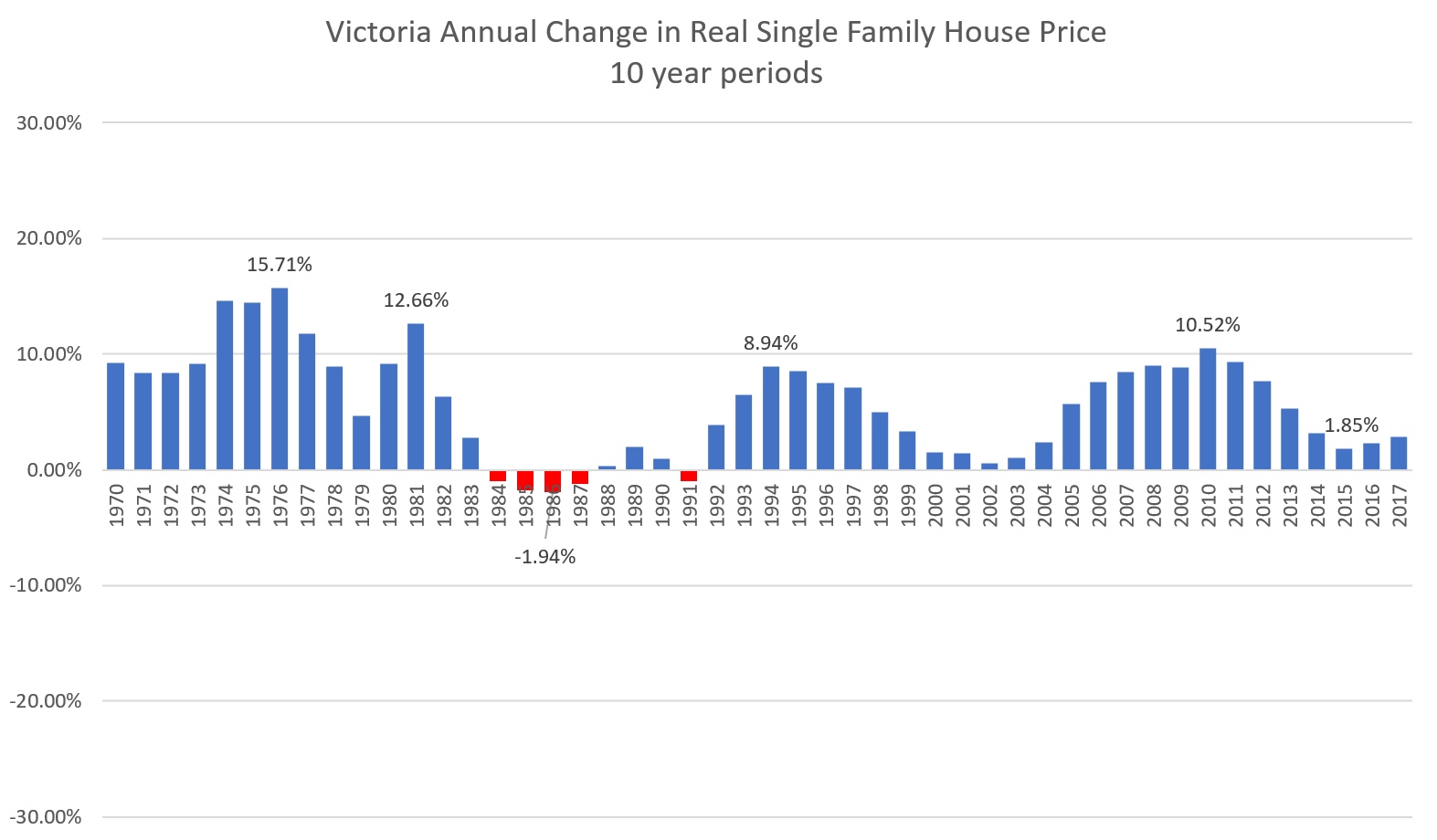

This is better. Outside of the mid eighties, it’s been either a winning or at least not losing proposition to buy and hold a single family home in Victoria for at least 10 years. Problem is, according to some estimates, the average Canadian family moves every 5 to 7 years so most people will move much more often than is good for them financially. For condos, the appreciation is not as good and people tend to stay in them for fewer years so the issue compounds.

And this is looking at the past, mostly during periods of either decreasing interest rates or large societal changes (number of dual income families doubled between 1976 and 2015). Going forward neither of those things will happen again, so as usual, your mileage may vary and past returns are not indicative of future results.

Weekly numbers https://househuntvictoria.ca/2017/08/14/aug-14-market-update/

Hawk: Realtors might have a vested interest in hot markets, but that doesn’t necessarily mean that Marko is distorting reality here. He seems to have integrity from what I know of him.

2920 Cook St #101 slashed $50K.

207-1031 Burdett Ave slashed $20K.

#209 – 3460 Quadra St slashed $10K.

Someone paying $30K over to live in the Glasgow ghetto is not something to be proud about.

There were a dozen others the past month slashed as well that I don’t bother posting.

Every time Marko says something is hot it dies soon after, just like lineups around the blocks of 100 cars pumper posts or agent cards stacked on the coffee table. Signs the condo bubble is about to blow.

They also use land registry data which is months delayed. Dude was on BNN trying to justify things based on downturn that mls is showing.

Teranet struggling to explain why their index doesn’t match market conditions. Now they have an “unsmoothed” index?

In July, the national composite rise was significantly driven by a 2.1% increase in the market with the largest aggregate property value: Toronto. While this looks strong given the current context in the GTA, note that a weakening is occurring in the unsmoothed index for “dwellings other than condos” which is down 1.6%. This abrupt trend reversal in the index of Toronto’s least affordable type of dwelling is consistent with the recent loosening reported in the home resale market.*

You mean like that condo on Glasgow that was listed for the highest price ever in the building and sold today $30,000 over ask? Same unit was listed in November of 2016 for 18 days without a sale and it was listed at $50,000 less than the sale price today.

Older two bed two bath condos are very hot right now and my thoughts are they are a substitute for those individuals that have been priced out of SFH/Townhomes.

“Just submitted an offer for clients on a 1990s condos…..5 offers on it. The sub 500k condo market is insane right now. ”

Funny why there are many slashes on 2 bed condos in the core. Agents have a habit of hyping up a new listing to reel in the sheep and distort reality. Just turn on HGTV.

I caught a couple of episodes of “What’s for Sale? With a View” on Netflix, focused on Canada’s west coast and one on Victoria in particular. I found it interesting to see some local Victoria buyers on the screen, although with the selling prices I think it may have been recorded a couple of years ago. It would be really interesting to see a reality real estate show like this in current (or 2016) market conditions.

https://youtu.be/HCyBLyXLpPI

Not sure you’re correct, but point taken that perhaps I shouldn’t be speaking for “most people.”

However, Saanich does consider Gordon Head to be the whole big area.

Keep in mind, readers, that Just Jack’s track record for predicting how Victoria real estate will “work out” has been awful since he began posting on this blog roughly eight years ago. In fact, anyone who did the opposite of what he counselled over that time is pretty equity-rich right now (and rich-rich if they sold and moved somewhere less expensive).

For all of Gordon Head, Mnt Doug, Arbutus, and Lambrick:

43 active SFH listings

6 sales

2 pending accepted offer

That seems quite slow, but some are still set up for delayed offers (quite rare now) so there may be a few more A/O come Tuesday.

The lender never tells me if the condo will be owner occupied or not. But they do ask for the economic rent. Why ask for the economic rent if the condo is going to be owner occupied?

Some of these new condos get put up on craigslist a week after they close. There is nothing in the contract to purchase stating if they are for home occupation or rental. Some home occupiers are going to be surprised to find that half the new condos in their complex are rentals.

Only thing clients I am working with right now are owner occupiers and I am seeing multiple offers on rental restricted condos.

Marko, most of the refinances I’m doing these days are house owners buying an investment property such as a condo. That’s why you’re busy selling condos under 500K they’ve become the poor man’s investment.

I call it the poor man’s investment because it’s a purchase using the equity in their home to buy an asset with very low if any positive cash flow. You’re incurring a massive debt for an asset that is costly to buy with negligible positive cash flow. This isn’t the same as having $500K in cash that you can diversify into different equities.

This is the Hail Mary approach to investing. Buy a condo, close your eyes, cross your fingers and pray it works out.

And in my opinion, using the equity in their home to buy a condominium is not going to work out well for them. They would be better off to diversify in the stock market. Even mutual funds would be better.

As for equities. Anyone here bought into Silica Sand on the NYSE?

I don’t agree that most people define Gordon Head when they live in Mt. Doug. People do know the difference between Gordon Head and Arbutus or Mt. Doug. And I have never heard them say that they live in Gordon Head. The moment you say to your neighbor. “Oh, I love living in Gordon Head” They’re going to correct you and say “This isn’t Gordon Head, this is Arbutus or Mt. Doug.

Maybe it’s because when people hear “Gordon Head” it’s like saying I live in Surrey. Because Gordon Head, like Surrey, is made up of a houses with basements suites, transient workers and university students. Arbutus and Mt. Doug don’t seem to have the stigma of rental housing associated with them.

The same with Oakland and Fernwood. At one time both of these areas were combined but today people are quick to tell you that they live in Oakland not in Fernwood. Fernwood being more bohemian than Oaklands.

The ER doc story sounds incredibly believable…..makes sense to follow Garth and stress over a $500k mortgage when you pull in 250k/year and have a million in equity for the joy of renting from a Landlord that drops the rent in a zero vacancy environment.

Just submitted an offer for clients on a 1990s condos…..5 offers on it. The sub 500k condo market is insane right now. I do feel that homes are cooling off a bit though.

Thanks Leo. On MLS it shows 36 including Arbutus and Mt Doug. Looks like a lot of competition.

1403 Haultain St slashed $30K. I thought Oaklands was the place to be with line ups around the block?

Yes. Most people, and the municipality of Saanich, define Gordon Head as the whole large area that also includes Lambrick Park, Mt Doug, and approx. half of Arbutus:

http://i.imgur.com/0ID4FVJ.jpg

https://web.archive.org/web/20140709095310/http://www.saanich.ca/discover/artsheritagearc/heritage/pdf/gordon_head.pdf

24 SFH listed in GH (as the VREB defines it which might be smaller than what most people think)

1 has an accepted offer that is indicated in the notes.

And there is one pending sale so far this month.

Leo S. “I suspect it will depend largely on what happens in the major markets. If Toronto is actually crashing, and if Vancouver moderates, I doubt they will bring them in.” <<<<<<<<<<<<<<<<<<<<<<<<<<<

Actually Leo, OSFI isn’t bringing regulations in to cool the housing market. Quite possibly they don’t give a flying fig about the housing market except to the point where it compromises the integrity of the banks that they oversee.

These new regs are to protect the banks interests and if Toronto continues its nosedive it will simply validate the introduction of the new regulations.

They have seen the end run on their previous legislation and they have grave concerns about the lending institutions lack of possible prudent residential mortgage underwriting.

They aren’t trying to slow a market that is already stratospheric, they are ensuring the banks have controls in place for the inevitable.

“In addition, FRFIs should have the necessary action plans in place to determine the best course of action upon borrower default. Such action plans should cover:

• The likely recourses/options available to the FRFI upon default in all relevant

jurisdictions;

• The identification of the parties against whom these recourses may be exercised; and

• A strategy for exercising these options in a manner that is prudentially sound.”

http://www.osfi-bsif.gc.ca/Eng/Pages/default.aspx

The Office of the Superintendent of Financial Institutions (OSFI) is an independent agency of the Government of Canada, established in 1987 to contribute to the safety and soundness of the Canadian financial system.

Wonder if they anticipate market is going down?

http://www.usedvictoria.com/classified-ad/2-houses-for-sale–LANSDOWNE-CAMOSUN—Royal-oak-Broadmead-are-_30358029

Starting to see bit more private sales on used vic compared to a few months ago.

“Where would he go? – He loves it here so much he’s trying to convince everyone else to stay away!”

You catch on quick Luke. 😉

Sidney has a town crier and he was looking pretty close to retirement. You should put in your resume. I’ll give you a character reference. 😉

LeoS, how many Golden Head listings do you see without pending deals? I see over 30 SFH listed which seems like a lot for a small area with a pile of slashes.

Of the 60 single family houses that were listed between $1.2 and $1.6M in April:

29 sold (7 above ask, 6 at ask, 16 under ask up to 10%)

8 are still on the market

23 listings expired or were cancelled

There is a still a chance they won’t go into effect or will be heavily altered before they do. I suspect it will depend largely on what happens in the major markets. If Toronto is actually crashing, and if Vancouver moderates, I doubt they will bring them in. If the market is still overheated by fall they will probably go ahead.

I am also surprised that the new banking regs are not causing more headlines in the media.

Vancouver island coalition to renters and landlords is a great place to go on Facebook to see the nightmares of renters and landlords in this town. One landlord is going through a huge nightmare family was forced to move out of house. Renters creating havoc will not leave room.

Was just at the bank today and the “investment adviser” said that their mortgage lending has dropped off quite a bit. Hmm..

What a great idea! Thanks for the laughs … You know, there’s a guy up in Qualicum Beach who actually has this as a job – don’t know if it exists down here – maybe I should talk to Helps 😉

Where would he go? – He loves it here so much he’s trying to convince everyone else to stay away!

As I said back at the beginning of the year, the market for housing in the core is moving from a shortage/sellers into a balanced market.

Market prices are not likely going to increase while the months of inventory and days-on-market are increasing.

At this time, the projected months of inventory in August for houses in the core is up from July’s 2.8 to 3.65. Last year the MOI for August was 1.86 The same for the average days-on-market (DOM). The DOM has been rising and that is the reason why you’re not reading about as many bidding wars in the city.

And I expect this trend for increasing MOI and DOM to continue for the rest of the year.

At some point in the future, as MOI and DOM increases, home owners are going to look around and see that they there is a good selection of houses to buy and then they will list their homes for sale.

Most of these home owners were the ones that have held off from listing their homes for last the few years. (Pent-up supply). While others decided to spend huge sums of money renovating because there wasn’t anything to buy. That is going to change. And it wouldn’t be unreasonable to expect the number of active listings of houses in the core to come close to doubling from today’s count of 500+/-.

Ooops, would be a bit too much effort for someone claiming to be an ER doctor to make up a story twice and 8 months apart.

“Anyhow, it certainly doesn’t seem like we are facing Toronto’s bust …. as of yet.”

Near 10% price reductions increasing is a pretty good start in an area typically last to the game in any trend. As JD mentioned, Chinese are having problems getting money out of there and I’m sure there’s more than just the 2 deals he experienced. No one boasts publicly they got turned down by the bank too.

Bearkilla’s hood continues to take a beatdown while he stays stuck in the denial stage. 820 Brentwood Hts on it’s second slash for a $75K slashing to $874K. OUCH. That’s like the third one in this hood with nothing but crickets.

Sidney has a stack of slashes the last month or more I haven’t even touched on.

3920 Cadboro Bay Rd is in such denial they slashed a whole $100 for a major reno job needed.

Several more “hot” 2 bed 2 bath condos in the core slashing. Funny how fast the markets change where last week you couldn’t get a viewing, now they are slashing.

Might not have been $3k/mo, but they got a discount.

Leo S. “Who knows. Maybe I’m missing something or the doctor changed some numbers around for the sake of anonymity.”<<<<<<<

That’s an astute observation, Leo.

Mind you, exaggeration always makes for a more entertaining story anyhow. Lol. Perhaps, you could look at those sales again and give us an idea of what kind of sales happened in the over $1,000,000 market. Were they over asking? Were they at asking? Were they 10% or more less than asking?

I did read greaterfool.ca after your post but I didn’t get the sense that he was renting for $3000. and then the landlord dropped the rent to $2000.

“Remember me, the ER doc in Victoria who wrote you last December about whether we should sell our house for $1.4 to 1.5 million, pay off our 500K and rent for $3K / month?”

It sounds like his plan was to sell and rent for what he figured would be around $3000./month. I’m not sure that the devil is in these details. lol

Anyhow, it certainly doesn’t seem like we are facing Toronto’s bust …. as of yet.

Who knows. Maybe I’m missing something or the doctor changed some numbers around for the sake of anonymity.

SFH definitely has slowed down, so a realtor pricing ahead of the market expecting continued momentum could have been surprised.

LeoS , you should post your info on Garth’s blog and call him out.

James, He was probably on a 40 year mortgage with nothing down. Anyone with a decent family income would have paid it off by now with a renter paying a major excelerator.

http://www.cbc.ca/news/canada/british-columbia/increase-in-new-home-prices-reaches-7-year-high-in-metro-vancouver-1.4244437

I hope Vancouver house prices spike higher and quicker than before. Quick appreciation seems to get noticed and new policies get implemented (i.e. Ontario). The quicker it goes up the quicker it comes down. A steady, lower rate of appreciation is much more sustainable in the long run.

An article showing home appreciation is far more click-bait (“hey, I can do that to make money!”). It also doesn’t seem in the best interest of homeowners to have this widely known. I view now as the opportunity for educated folks to get out while the uneducated folks get in. All you have to do is stop, look, and think. It was obvious at the beginning of the year that 2017 would be different than 2016; stocks (even houses) do not appreciate 30+% YOYOY, etc.

All things being equal, I could have bought today. But my numbers wouldn’t be as good, that’s true.

Listen folks, take almost any point in the history of Victoria prices, and at the time, so many people would have considered that to be the “top,” when of course that turned out not to be the case. Right now is one of those points.

Well I clear over 1000 dollars and that’s PER HOUR and I couldn’t even afford my house if I were to buy today. Top that off with all the smoke and I’d say it’s done goyums. Better sell now.

Interesting story, but something doesn’t add up here.

There were no houses listed around April for about $1.5M that sold for around $1.3M after more than 60 days on market that I can see.

Sales in that price range ($1.25M-$1.5M) were:

April 2017: 23

May: 31

June: 29

July: 15

So a big drop in July, but last year was similar, where sales dropped from 32 in June to 19 in July.

2015 sales were less than half of 2017 sales for same months.

Then they rented a place for $3000/month starting sometime between December and July and only a couple months later the landlord dropped $1000/month off the rent because they were such good and “long term” tenants???? Does not compute.

And the good doctor is convinced prices will fall but at the same time thinks his kids will never be able to afford a house?

I do think part of that is just that a 10% increase is a heck of a lot more money than it used to be. You can see that recent appreciation is already slower than it has been. Wonder what it would look like in terms of absolute $ increases

It’s interesting to look at the data for water consumption in the CRD. Hasn’t increased since the early 90s due to water conservation despite large increase in population

Leo S. “You are right that there is very little coverage in the media.”

… or

“Delivery of calm animals to the shooting area is essential”

https://www.nal.usda.gov/awic/humane-methods-slaughter-act

It is B-20 verison 3.0. Here is some coverage https://www.canadianmortgagetrends.com/2017/07/b-20-bombshell/

You are right that there is very little coverage in the media. I don’t think they’ve picked it up yet. Did hit newswire and reuters but not sure why it wasn’t picked up further https://ca.reuters.com/article/businessNews/idCAKBN1AJ1Y7-OCABS

@introvert

Let’s be honest. You couldn’t even afford your current house on your salary, if you hadn’t got in 8 years ago, you wouldn’t be getting in now.

3Richard Haysom: It’s interesting that our current market has had such government interest/reaction wheras I don’t remember any such response in those prior run-ups.<<<<<<<<

Hi Richard, I would suggest that the government had less of a reaction during both prior run-ups (bubbles) because invariably these kind of bubbles are followed by recessions and the biggest tool to fight recession for a government is the lowering of interest rates. They had lots of room in the past.

The 80’s and 90’s recessions were punctuated by periods of dropping interest rates. The BOC is between a rock and a hard place when this bubble blows up. They are certainly going to pay a lot of attention to this bubble because the recession that follows isn’t going to be resolved by dropping interest rates (to where). It just isn’t an option.

When every responsible entity is warning of the level of consumer debt in Canada there isn’t any room left to stimulate the kind of borrowing that we’ve seen to date. Remember consumer spending is the largest component of the GDP. Many people will be closing their pocketbooks to extraneous expenditures when they can’t tap into declining equity.

It turns into a vicious cycle and my pay grade doesn’t afford me the foresight to deal with this challenge. Everybody will be affected in some manner.

http://www.thecanadianencyclopedia.ca/en/article/recession/

“If the economy shows signs of entering a recession, government can reduce interest rates and increase the money supply in the hopes that consumers and businesses will borrow, invest, and spend more.

Join the party.

😀

Introvert: I imagine you’ll make out just okay on your house then based on the gains you’ve realized so far. Little to no risk of feeding Hawk’s potential schadenfreude. We’re in the same boat with a suite downstairs. No anticipation of moving any time soon 🙂

Yeah, seems that way doesn’t it? Also the “run-up” could just be a blip from a longer downward/flat turn from 2011. Who knows.

That’s horrible! What ever will Victoria do?

Victoria doctor bailed and thankful/lucky to get out. No wonder 20 plus Golden Head’ers had to slash to get the sale.

“We waited until April to list our house. But by then there was an invisible softening to the market in Victoria. Home listings when up and sales started to drop. After 60 days on the market there were no bidding wars and showings fell off to one a week with no seconds. It was obvious that where weren’t going to get the $1.5 that we listed for and our realtor was confident it would fetch. The realtor was perplexed and dumb founded. We dropped that price to gain an edge in the market and sold for $1.3. Phew – because sales have ground to a halt in our price range!!

“So we didn’t get the $1.5 that the realtor almost guaranteed us but other things worked out in our favour. ”

http://www.greaterfool.ca/2017/08/11/under-water-in-to/

You are the word nazi Intorovert, so it’s easier for you ignorant types to grasp what’s coming. How about one of those “internet articles” you so despise that explain reality ?

Toronto home sales plunge 40% in biggest drop since the recession

Home prices in Canada’s largest city also posted their biggest monthly drop in at least 17 years in July

http://business.financialpost.com/real-estate/toronto-home-prices-in-record-monthly-drop-as-sales-plunge-1/wcm/1b276698-c8b0-4cb9-a5a6-522557f062fe

We’ve bought and held for eight years, so far (never owned real estate prior). We plan on going the distance with our house as it meets all our needs. When we eventually want/need more space, we’ll stop renting the basement suite—and voila!—we’ll have 1,000 square feet of additional living space and won’t need to buy a new house to achieve it.

With reference to your graph LEO it would seem that our current RE price run-up is comparatively mild to the 1986-1994 and the 2001-2007 price increases. It’s interesting that our current market has had such government interest/reaction wheras I don’t remember any such response in those prior run-ups. One also concludes from comparing the respective price increases that we are either only through the middle of this cycle or if it is about to end it really wasn’t such a great run-up after all.

Oh no! Hawk posted that graph with words on it again! A graph with words is always meaningful, you guys.

Unless they plan on holding for 10+ years, in which case they’ll probably be okay, historically speaking. 🙂

gwac,

Not when land prices in Golden Head are going down. No one wants to pay $1.15 for over an acre in Queenswood ? Along with all these hundreds of drip drip slashes the last month, (as well as almost every Golden Head listing), it shows no one is even low balling these gouges. Classic sign the trap door is about to drop open like Toronto.

http://2.bp.blogspot.com/-ZWsQNhB12M4/Tf161ZP8iFI/AAAAAAAAAu4/iEFXxNao1KU/s1600/800px-Stages_of_a_bubble.png

@Leo S

Q: I have done multiple google searches and it seems strange to me that new B-21 rules being implemented this fall are not being flagged by media etc. Any thoughts on this lack of chatter? Esp. for foreign buyers who will have to prove their incomes, and the fact that mom and dad can no longer just give their kids a 20% down-payment?

Hawk are you moving out of Victoria?

“Seems a shit show is brewing in Toronto. Only the lawyers will win here. Cannot even begin to imagine the stress being involved.”

Victoria lawyers are about to soak up some major bucks as the same thing happens here. No one is immune when a bubble pops, rising rates, stress tests, Home Capital, North Korea etc.

“The desperate words of a man who has been badly burned by foolishly underestimating Victoria real estate.”

Arrogant words from an asshole whose never seen a real bear market. Escalator up, elevator down when extremes are hit like 1981/1982. Enjoy the ride down, it will be a pleasure watching you lose bigtime. 😉

I have some sympathy for people who can’t get financing due to banks’ valuations of the properties. Otherwise, you agreed on a price, so pay it.

Seems a shit show is brewing in Toronto. Only the lawyers will win here. Cannot even begin to imagine the stress being involved.

http://www.ctvnews.ca/canada/non-buyer-s-remorse-toronto-sellers-frustrated-as-home-buyers-tack-on-demands-1.3541706

We’re about to set a record for most consecutive days without measurable rain (54), yet the water level of Sooke Lake Reservoir (Victoria’s drinking supply) is still at 82%.

I think it is if you buy and hold for 10+ years. At least, that’s what history has shown. Also, many believe our current peak prices are still somewhat of a bargain, so that’s worth pondering.

The desperate words of a man who has been badly burned by foolishly underestimating Victoria real estate.

My favourite part of the year, for just that reason! That and a distant smell of someone’s wood-burning fireplace… 😀

Heat is also very bad for seniors. A handful of days out of some years doesn’t negate that Victoria generally has very good air quality with one of the most temperate climates in the world.

I agree the smoke will be the catalyst that will finally crash this market. Get your sheckles back from Goldberg shecklestein bears.

Back to inflow conditions this weekend, so look for clear air, humidity, and a bit of a fall smell in the air here starting Sunday morning. I always get nostalgic when this smell arrives, as I recall all too well the dread of the ‘back to school’ leadup. The trees and gardens of BC need the rain badly, of course, so it’s a good thing. Forecast is currently calling for less precip. than originally anticipated. Fires will pick up again in a week or so. Everyone breathing horrible thick smoke in the interior should get some respite, but this little system won’t be putting out all the fires.

@Hawk,

“Vancouver heating up.”

Fantastic info-graphic (i.e, the map), even if unintended!

“Vancouver heating up.”

Blood on the streets.

http://www.myrealtycheck.ca/

Luke,

Thanks for wasting your time with all your stats but all you had to do was look out your window the last 10 days and not see the mountains nor the ocean as well as taste the foul odor and feel the effects.

If this becomes the new norm it makes no difference to someone from other parts of the country or world. They will go elsewhere before they decipher your bullshit of “it’s better than other places” excuse. Smoke is smoke and it’s bad for one’s health, especially aging seniors.

Trying to put lipstick on a pig is your forte and again, you’re missing your calling as the new town crier.

@ Intro:

If that’s smart thinking, is it smart to buy now, when prices have almost quadrupled in 20 years?

Gotcha, thx!

Thank you for bringing this up again, Hawk. You actually illustrate another positive for Victoria! I’d like to take a bit of time to highlight how great our air quality usually is… As many people already know, it’s extremely unusual to get outflow conditions like we recently had for a few days this summer, or indeed – any time of year. Even with these recent outflow conditions, our air quality has only gone as bad as ‘moderate’ for the most part, which is not all that much risk to health – as this table for the most recent ratings shows… There was only a brief period where it dipped into high – extremely unusual! http://www.env.gov.bc.ca/epd/bcairquality/readings/aqhi-table.xml

Have a look at Kamloops – ouch! They’ve been enduring almost apocalyptic air for most of the summer. Maybe now, some retirees from the interior of BC/Okanagan will be looking towards the often breezy crystal clear air Victoria normally enjoys which already started to return this evening! Vancouverites also may now be tempted to look to our shores – as since they were closer to the interior, they endured smoky conditions much worse than us for that recent brief period as well, but nowhere near as bad as the interior.

As one can see… Victoria has already moved down into a ‘3’ on the air quality readings – which is now considered ‘low’… returning to our normal ‘1’ soon, which is what it is here virtually all the time… http://www.env.gov.bc.ca/epd/bcairquality/readings/flash.html

As for those thinking of going to the prairies, but escaping the winters to go down south, in order to escape forest fire smoke – think again! More often, the forest fire smoke blows eastwards – towards the prairies… Rather than just a few days – the smoke from any BC wildfires in the prairies can often last weeks… or even for much of the summers, as we have seen already this year. Not my idea of a great place to spend the summers in the future..

So now, with climate change upon us, we may also be greeted by even more Albertans in the future… Yay!

This Calgary Forestry Professor, Michael Flannigan of the U of Alberta states that with climate change, they may have to endure far more smoke more often as prevailing winds carry smoke towards the prairies far more often than towards the ocean…In this article he states… “A small silver lining for Albertans: if the next major fire episodes are in Saskatchewan, smoke won’t be a problem, said Flannigan.

“The winds tend to blow from west to east,” he said.

http://www.calgarysun.com/2017/07/17/get-used-to-wildfire-smoke-says-forestry-professor

http://www.cbc.ca/news/canada/calgary/smoke-calgary-skies-ahs-environment-canada-bc-forest-fires-kootenay-banff-1.4208412

Finally, this interactive map w/ links that people can follow if they so choose shows what’s been going on… Currently the smoke is moving well away from the coast once again, as is normal…

http://firesmoke.ca/forecasts/viewer/run/ops/BSC-CA-01/current/

So it’s quite true – Hawk, we did have a bit of smoke from the unusual recent outflow conditions.

However, many people are going to realize in the coming years that we’re better situated to have clear air for the most part during these types of events. With our normal fresh sea breezes- this is CLEARLY the place to be to avoid the worst of any air pollution! 😉 Thank you once again for bringing up another awesome point about this most desirable place to be! I can tell, you really do love this city… 🙂

It would be hard for me to be in negative equity. And my finances don’t require me to be a landlord; I just like having that extra person pitching in to pay off my mortgage even faster!

Because if the housing market appreciates or stays flat it will be one more drag on your return in an industry that already has insanely high transaction costs. If you don’t believe you have a very good chance of staying in a place for 5+ years you probably would be better off not buying than buying with some kind of insurance. And if there was another nationwide collapse the places like ValueInsured will probably go bust (assuming they were able to sign up enough people).

Most importantly though, the big risk in a declining market is not losing your down payment, it is being underwater on the mortgage. If you can’t stomach losing your down payment you shouldn’t be buying, but being underwater and unable to sell if you needed to is a much more serious risk that at least in principle makes more sense to insure against.

“If Victoria crashes hard, maybe I’ll apply Warren Buffett’s stock market principles to real estate and buy a second house while they’re heavily discounted and everyone is scared.”

You mean when you’re in negative equity and can’t find a renter ?

Entomologist: “Canadians, about as informed as any nation on this planet, know what’s going on. In the age of the internet – they know.”<<<<<<<<<<

Clearly they do, they have managed to outdo our American friends in pretty much every aspect of this housing bubble. I guess there is quite the differentiation between knowing and understanding.

Although I do agree with your statements regarding the “average” moving statistics I tend to believe that too many Canadians get their information from the mainstream media. FOMO is not a byproduct of independent internet news/media.

Why, Leo?

Knowing nothing about the terms of such insurance, I’m going to go out on a limb and say that’s a terrible idea and a half

Housing bubble fears stronger in Washington than in any other state

http://www.seattletimes.com/business/real-estate/housing-bubble-fears-stronger-in-washington-than-in-any-other-state/

Also, the article mentions ValueInsured, a company that sells insurance to protect against declining home values. I didn’t know such a thing existed!

If Victoria crashes hard, maybe I’ll apply Warren Buffett’s stock market principles to real estate and buy a second house while they’re heavily discounted and everyone is scared.

A very insightful post, Entomologist.

Yup.

And if there’s a crash in Victoria, things could be bleak for a while. But if you carry on with life and don’t sell, you’ll be fine. Prices will come back, and then some. It’s not as if, after a crash, Canadians will stop regarding Victoria as the California of Canada and one of the best places to live—and to retire.

“Vancouver heating up.”

Most Vancouver core areas medians still under their YOY price. Far from heating up and more like a dead cat bounce AKA the Denial Phase that all is fine when it isn’t. Look at RealityCheck. A bloodbath of slashes.

That would be my estimate as well based on commonly used GDS ratios.

Lots of great info here. Thanks for the graphs Leo.

Learner:

Just to confirm, with good credit and HH income of around $160k shouldn’t you be able to borrow around $800k even at the new rules?

I mean a 620k cap with the info you provided means your bank only believes you can service debt less then 25% of household income.

I few months ago I was approved with an insured loan of higher then that with a minimum down payment with lower household income.

Thanks, all, for the opinions re: the cost of renovations. I forgot to mention that the 50s Hillside house was about 2,000sqft and also had all new stucco and exterior woodwork. So now I really think that my agent was off by a fair amount with his $100,000 guess. It’s crazy what good value that house represents now compared to what I thought of it last year when it sold for something like $750,000.

We’re happy with the house we got this year but we paid close to that for a far less renovated place of the same vintage.

It means that for the 10 year period ending in 1994, the average single family house appreciated at 8.94%/year. So that would be for someone buying in 1984 and selling 10 years later.

Correct. These are all inflation adjusted prices. I think it is important to take into account that in certain periods where you could get 10% GICs, a house that didn’t change in nominal price actually lost a lot of its purchasing power.

Extremely unlikely in my view. We can already see that when Vancouver detached prices were on a tear the first half of last year, we had 4 times the number of buyers come over from Vancouver as normal. This year Vancouver detached was not nearly as hot and Vancouver buyers are down 50%. Google loss aversion. If prices in Vancouver decline, that reduces sales, it doesn’t increase them.

That’s why they should probably read this blog. Granted this advice should be better organized.

He is actually almost bang on correct as far as historical long run performance of the Victoria market. It is about 7% nominal, and by the rule of 72, that means prices double every 10 years. The mistake is assuming this is some sort of natural law that will continue. Even with recent price gains we are averaging less than that in recent decades.

Correct.

Not quite, but they have increased quite a bit:

Average SFH Price 1997: $248,921

Average SFH Price 2017 (to date): $850,015

Factor: 3.4 (and this could increase by end of year).

Average Condo price 1997: $151,361

Average Condo price 2017 (to date): $405,548

Factor: 2.7

This data reaffirms my earlier comments that homes are an easy, safe investment because their value always goes up; it’s merely a matter of time before what it’s worth is more than what was paid. Young families that buy a SFH here will always come out ahead if they’re in it for a 15-20 year period; the risk is for shorter term buyers. This is the reason that I’m not concerned with the cost of the home that I’m purchasing but rather the quality.

Marko looks like a mistake in the 2m part on that link. Maybe your commission is 53k.

At $2 million I’ll honour whatever is up there for a limited time 🙂

@Entomologist. Yes very good points. I wonder how often families are “forced” to move. Another point of course is that even if you are way down on your house, and you sell and buy in the same market you haven’t lost anything outside of the transaction costs.

Leo –

I disagree with the part of the post relating to families moving every 5 to 7 years. That factor is not at all independent of market conditions (prices, ease of selling). Families considering moving, especially in town, will tend to do so when conditions are right for them, including ease of buying/selling, or profiting from regional differences in RE markets.

A small percentage of people moving will be forced to do so – job loss (tends to lead to long distance moves, not in town) and maybe divorce (not really the same as moving, as there sometimes isn’t a seller). Most will time their own move partly as a reaction to market conditions. And if conditions are really unfavorable, they won’t move.

Of course, in major downturns, you get unemployment, leading to job loss and a lot of forced moves. But that has nothing to do with ‘average’ conditions of households moving every 5-7 years.

One of my biggest beefs with modern economics is the assumption that people’s behaviour is not informed by macroeconomic conditions. Canadians, about as informed as any nation on this planet, know what’s going on. In the age of the internet – they know.

Not really. That’s a 3 month moving average which doesn’t really provide a great window into the overall direction of the market.

In aggregate, the amount of money in VanRE has been contracting for some time. Portions of the attached segment continue to remain “buyable” if not affordable, so that’s where FTB’s and speccers are currently piling in. It’s also what’s accounting for much of the recent “gains”.

That’ll eventually hit a ceiling, as condos tend to have less price elasticity than the detached segment. Hyperbolic article, really.

Leo, how does one interpret the 3-, 5- and 10-year graphs? Taking the 10-year one as an example, I see a +8.94% for 1994. What does that mean?

Marko looks like a mistake in the 2m part on that link. Maybe your commission is 53k.

To be honest, I’ve been reading this blog for many years now and I still don’t confidently understand exactly how it all works. Perhaps that’s because I only have an Arts degree.

Take a look at the flow chart (right side) – http://markojuras.com/full-service-listing/

Vancouver heating up.

https://www.bloomberg.com/news/articles/2017-08-10/vancouver-housing-on-fire-with-biggest-price-gains-since-1990

“My own bet is that many will move West, taking much of the city’s economy with them. Then we’ll need rapid transit not from Langford to Victoria, but from Sooke to Langford.”

With forest fire smoke choking Victoria and the island for almost 10 days now and the second time in a few years, I think some would be rethinking their views on how BC is going to play out in the climate change scenario. Especially if your a senior with an overloaded health care system and health issues. If you’re rich you can buy cheap on the prairies for half the year and half the year down south.

Hawk and Leo:

You are right, the market may not be “off a cliff but” it is stabilizing, if not dropping from the new credit tests. We bought 19 months ago in the sketchy area of BG, about to post for sale given market conditions, and the gentrification rate is a bit too lagged compared to Vic West and likely North Park.

Will likely have a 40% return rate on our initial investment, but even with 20% down, we still do not qualify above the 620K mark (looking at two post graduate professionals, with full-time gross 160K HH incomes, and little to no personal debt). The last credit change was July 12th, the next one is October 25 from the BoC, and banks are already using the new B-21 rules, with all financial institutions having a mediatory compliance by fall = a new saga of pricing at least for the near term future Sell now you suckers.

That may be true Deryk, but there are a lot of areas outside of Vancouver that you may buy property without having to quit your job, uproot your family, leave your friends, and move to an island.

Victoria is not a substitute for Vancouver. Our market generally compliments what is happening in Vancouver and its surrounding municipalities. But to sell in Vancouver and buy in Victoria means a radical change in your work, friends, family and lifestyle. Moving from Vancouver to New Westminster doesn’t.

In my opinion, Victoria tends to trail behind the Fraser Valley when BC prices are rising. But when an economic downturn in BC happens again, you might not want to be on an island as it’s likely our market will correct more quickly and in a greater magnitude than New Westminster or Surrey. You may actually find families leaving Victoria to find work in Vancouver and the Fraser Valley as construction stalls in Victoria.

And as an anecdote. I was speaking with someone last week that is leaving Victoria for PEI. Their wages won’t cover their living expenses in the city. A typical government worker in Victoria can no longer afford to buy or rent in the city and now in the Westshore. Rents for houses in Sooke are now $2,200 to $2,500 a month.

“Many of us” were wrong because “we” expected interest rates to return to “normal”, whereas they continued to fall. Now interest rates are near zero, is it reasonable to assume that rates will continue to “fall,” i.e., go below zero both nominally (BoC rate) and inflation adjusted (as already)?

Except on a micro scale, economics is not a science because economies are too complex to predict. Since 1945 RE has been in a continual boom, so those who claimed to know that RE was a perpetually good thing have been proved “right”, i.e., by chance they were correct. Still, economic trends shift. We could be at a turning point driven by one or more of four possible factors:

(1) interest rates staying flat or rising

(2) municipalities finally grasping what they have been too dumb or too much in the clutches of the RE industry to acknowledge, that home prices are largely a function of zoning bylaws, with municipalities such as Oak Bay keeping the hydraulics under prices by their zoning policies.

(3) the construction industry could be about to go high tech. Want a house? Go to some Chinese web site, design your house online and have it factory built and delivered in one piece by one of these.

(4) rapid transit may be about to go underground and supersonic. If the hyperloop and advanced boring technology work out, we could see people being shot from Langford, Colwood and Sooke to Government and Fort in say 30 seconds at the cost of a bus fare. Then commuting ceases to be either an inconvenience or a major cost and the draw of the core is no more.

Doug’s on drugs. His “fuzzy math” forgot to mention interest rates have tanked from mid teens in 1987 to nothing and are now about to go back up with average joe up to his ass in major HELOC debt. It’s crap articles like that, that make the TC no better than puppy training paper.

Vancouver Homeowner Refinancing Surges 27% Year Over Year

Vancouver Homeowners Tapping Into Equity at Alarming Rates

“And if Canadians are anything like their American neighbours, history suggests many homeowners won’t be using that equity to pay off outstanding debts. Expect an increase of shiny new boats, gas guzzling Ford F-150’s, and family vacations down south.”

http://vancitycondoguide.com/vancouver-homeowner-refinancing-surges-27-year-year/

Lots of new slashes this morning, biggest increase in a week. Interesting most are well under the $1 million mark. Signs of banks tightening credit ?

An Oak Bay fixer upper slashed $100K to $799K at 2520 Wootton Cres.

Another flip job only one block from St. Mike’s gets a $43K slash at 3233 Aldridge St.

A Lake Hill flipper at 865 Darwin Ave slashed $25K to $749K.

1739 Bay St slashed $24K to $725K. Only a few months ago they were shoulder to shoulder fighting like dogs to buy on this busy strip by the Jube.

Land seems to be going down too. Waterfront lot in View Royal slashed $150K to $1.49 Million.

Another in Queenswood slashed less for $50K to $1.1 million.

Many more today spread across the VREB. Even South Oak Bay got a $40K slash on the weekend at 857 Victoria Ave.

Even in the last 20 years where there’s been a larger than normal increase, prices haven’t quadrupled since 97.

When the median house price in the city core exceeds ten times the median family income, some folks are going to consider leaving Victoria for somewhere cheaper. With house prices across the continent near all time highs, migration from the high-priced urban areas to places where property is cheap could explode. In fact it is already exploding. For example:

BC has very different problems to Illinois, but crazy house prices that ordinary folk can afford only by committing most of their life-time earnings to a purchase is a real problem that will surely upset complacent assumptions about house prices doubling every decade, while nominal wages double only every 30 years or so.

My own bet is that many will move West, taking much of the city’s economy with them. Then we’ll need rapid transit not from Langford to Victoria, but from Sooke to Langford.

It does seem likely that future returns will moderate relative to the past. On the other hand, in the past, many of us had the same guess—and we were wrong.

@Leo, great data, you just subtracted inflation using CPI? Some takeaways:

1/ 57 years of data

2/ 15 years it went down

3/ 42 years it went up

Interesting to watch the trends…it makes you wonder what between in 1981 and 1982 where house prices could have dropped that much. I doubt interest rates will climb that much, but with the cap on buyers with real incomes and limited to no more foreign buyers (based on the new B-21 rules) + rise in interest rates (check your bond numbers friends) + NDP = troubling times…

Letter to the editor in today’s Times Colonist, “House prices double every 10 years”:

http://www.timescolonist.com/opinion/letters/house-prices-double-every-10-years-1.21762400

?? Who do you hang out with? Also this post is pretty clear, real estate has been a good investment in the past in Victoria in most periods (except early 80s). I suspect the returns will moderate going forward, but probably will remain a reasonable investment unless you happen to buy before a correction and can’t manage to wait it out.

I have both.

And please explain how my copy and paste means I didn’t understand the concept.

Marko, most people don’t have the faintest clue how the buyer’s agent/seller’s agent fees are structured, so they can’t come up with good ideas like this.

To be honest, I’ve been reading this blog for many years now and I still don’t confidently understand exactly how it all works. Perhaps that’s because I only have an Arts degree.

When Vancouver collapses Victoria will too. Why would anyone in Van run to Victoria when they can’t sell their house in Van without incurring a loss? We are not going to be immune to a bubble bursting just because we are on an island.

Yea…no. If Vancouver’s housing prices “collapse”, Victoria will almost certainly follow. You’re not going to have a home in an exclusive Victoria neighborhood rival the cost of an equivalent in Vancouver.

Further – if prices are “collapsing”, then by definition most aren’t getting “their money out before they lose a fortune”, because there’d be no buyers willing to pay their ask. A price collapse in almost all cases follows a large drop in demand, not the reverse.

Finally, if your house is rapidly losing value, packing up and running off to Victoria as some kind of half-baked stop-gap measure would be logistically difficult for most, not to mention it wouldn’t really protect them from anything.

Really interesting Leo, thanks!

I have to laugh at this posting. Honestly!

I’ve been told all my life that buying real estate is bad investment. And yet my family bought a house in kitsilano for $12,000.00 back in 1966 and have been buying and selling houses all our life with great success.

The problem with these charts is that they do not represent real life wise choices. I’ve never bought a house without making sure I understood the basics. For example: I bought a couple of houses in a small town up north because I knew that the rental situation was super hot and an unending stream of high paid workers were willing to pay absolute top rental dollars. I got a super deal on the houses because the local people could not see the value of the place and the future prospects. I doubled my money in two years. The same with other investments in real estate. I look for the unpainted ones. People will pass up on a house that just needs a new paint job and a quick sprucing up. Why people do this I have no idea but everything has to be staged for them….at which point they will quickly pay thousands more for. I saw someone drive up to a house and look at the moss on the roof and say that it obviously needed a ton of work! They totally missed that the house was sitting on a huge property and the bones were very well constructed and all to code. I recognize that we need charts and they have value. But they tend not to give a clear picture of where the real opportunities are. Victoria is still super cheap right now. If Vancouver starts to collapse then those thousands of people will be listing their house there as they rush to get their money out before they lose a fortune and they will be going to buy somewhere else. Victoria will likely be high on their list because houses in Vancouver are at least three times what they are in Victoria. (When you compare houses within the inner core of the city. Think Kitsilano in Vancouver for over 3 million and 1 million in Rockland or Fairfield in Victoria)

I’ve heard all my life that real estate is not a good investment. It’s a common idea among those who don’t own their own house. Even when rents keep going up and up and up and people get shifted out of their home because the landlord sells etc etc.

My advice to young people is buy if you possibly can.

Great analysis

“Nope, if you had bought in ’81 and sold in ’84 your house would have lost almost 13% in value every year”

To confirm my understanding. House prices did not actually fall 13% that includes the inflation factor. As an example if a house stayed the same in value from one year to the next and inflation was 10%. This would show house prices fell 10% in your graphs?