Mid Year Predictions Roundup

Every year here on househunt we make predictions for the housing market in for the coming year. Given we have data for the first 6 months, let’s see how it’s shaping up. Predictions were based on the number of sales for the year, the annual average single family price and the condo price, as well as the Bank of Canada rate.

Let’s start with sales. Predictions ranged from a low of 6200 to a high of 12,000 for the year. So far we are at 4981 from January to June so to hit the low estimate the market would have to collapse to 200 sales/month for the rest of the year, and to hit the high target we would need almost 1200/month. Neither particularly realistic.

The proportion of sales that happen in the first half of the year has ranged from 47% when the market was accelerating in 2014, to 67% when it was collapsing in 2008. With a gradually slowing market like we have now, we should expect that more than half of the sales have happened already. Given that, the average guess of 9200 should be pretty damn close to the final total.

I’m still OK with my guess of 9000.

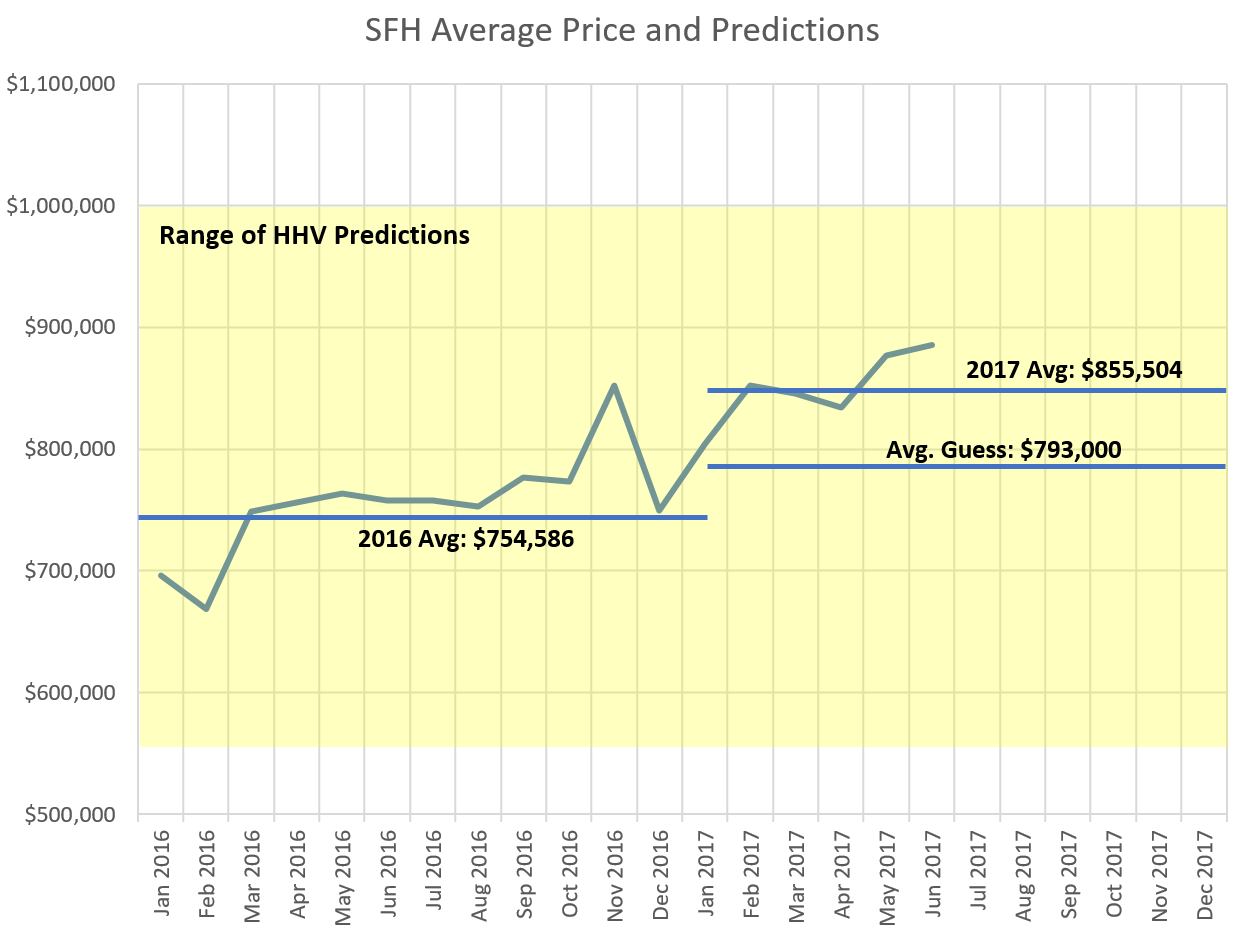

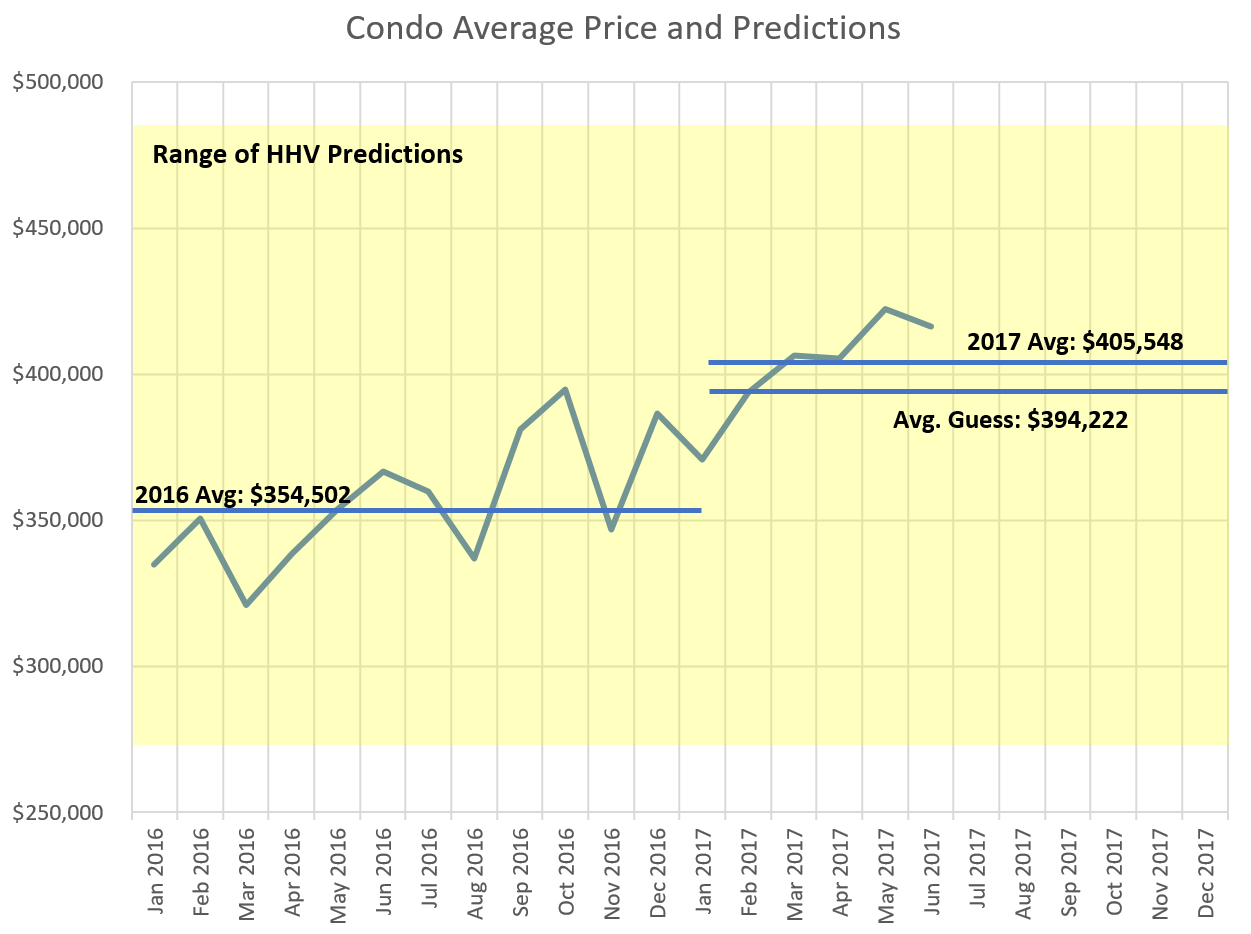

Next up, prices. Remember the guess was for the average annual price, which makes it a bit difficult since it’s not the price at the end of the year. Currently our year to date average price for single family homes is $855,504 while for condos it is $405,548. Once again we got a wide range of guesses, from $560,000 to $1M for detached homes, and $275,000 to $485,000 for condos.

In general guesses were too low on prices, with current year to date averages already exceeding what we collectively guessed for the full year. Unless there is a significant price correction (very unlikely in the next 6 months) most people will have undershot their guesses. Most likely in line for the honor of best guess are users AG, South, and plumwine for SFH, and Michael, Ash, or gwac for condos.

Here are all the predictions made in January:

| User | Annual Sales | SFH Average | Condo Average | BoC Rate | Teranet June | Teranet Dec |

|---|---|---|---|---|---|---|

| Leo S | 9000 | $835,000 | $400,000 | .50% | 184 | 193 |

| Marko Juras | 8200 | $770,000 | $365,000 | .75% | -- | -- |

| CuriousCat | 8500 | $650,000 | $375,000 | .25% | -- | -- |

| AG | 9500 | $850,000 | $410,000 | .50% | -- | -- |

| Michael | 8900 | $830,000 | $420,000 | .75% | 182 | 192 |

| Caveat emptor | 9200 | $785,000 | $390,000 | .50% | 180 | 185 |

| JD | 10750 | $845,000 | $485,000 | .75% | -- | -- |

| Bearkilla | -- | $950,000 | -- | -- | -- | -- |

| Hawk | -- | $575,000 | -- | -- | -- | -- |

| South | 10200 | $923,000 | $478,000 | 1.0% | 190 | 196 |

| Gwac | 12000 | $1,000,000 | $475,000 | 1.0% | 195 | 205 |

| oopswediditagain | 7200 | $650,000 | $280,000 | .25% | -- | -- |

| Entomologist | 9500 | $815,000 | $395,000 | .75% | -- | -- |

| Ash | 8700 | $820,000 | $430,000 | .50% | -- | -- |

| Vicbot | 9800 | $775,000 | $390,000 | .75 | -- | -- |

| Dasmo | 10000 | $790,000 | $390,000 | .50% | -- | -- |

| Local Fool | 8400 | $705,000 | $368,000 | .75% | -- | -- |

| numbers hack | 8500 | $805,000 | $390,000 | .50% | 180 | 185 |

| CS | 6500 | $560,000 | $275,000 | 3.0% | -- | -- |

| VicRenter | 8000 | $800,000 | $380,000 | .50% | -- | -- |

| plumwine | 12000 | $925,000 | -- | .75% | ||

| ACTUAL | 8932 | $843,532 | $420,789 | 1.0% | 190 | ~200 |

On rates, it was an even 7:7 split on whether the BoC would raise rates or not, and of course they did. With B20 rules, the new government, a possibly collapsing Toronto, it will be interesting to see what the remainder of the year brings us.

Update: Monday numbers

| July 2017 |

July

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 187 | 384 | 588 | 759 |

972

|

| New Listings | 315 | 582 | 842 | 1076 |

1127

|

| Active Listings | 1972 | 1961 | 1963 | 1958 |

2161

|

| Sales to New Listings | 59% | 66% | 69% | 71% |

86%

|

| Sales Projection | — | 778 | 797 | 806 | |

| Months of Inventory | 2.2 | ||||

So, I’m not that familiar with the Victoria market but if you go to Realtor.ca it shows a couple dozen homes in the Victoria area for under $650,000.

Is there a flight to quality? Are these homes in terrible areas? Why would you buy a condo when you could have land?

There are 28 listings and 4 are houseboats, lol. What’s the story?

Agree

gwac

August 1, 2017 at 3:15 pm

Vreb July

Benchmarks all up still.

https://www.vreb.org/pdf/VREBNewsReleaseAndSummary.pdf

Gwac, I think that it is difficult to gauge the various markets by the reports from the associated Real Estate Boards. I’m not sure who or what sources that you can actually depend on but a review of several unbiased sources might be more relevant.

https://en.wikipedia.org/wiki/United_States_housing_bubble

“A May 2006 Fortune magazine report on the US housing bubble states: “The great housing bubble has finally started to deflate … In many once-sizzling markets around the country, accounts of dropping list prices have replaced tales of waiting lists for unbuilt condos and bidding wars over humdrum three-bedroom colonials.”[28]

The chief economist of Freddie Mac and the director of Joint Center for Housing Studies (JCHS) denied the existence of a national housing bubble and expressed doubt that any significant decline in home prices was possible, citing consistently rising prices since the Great Depression, an anticipated increased demand from the Baby Boom generation, and healthy levels of employment.[55][56][57] However, some have suggested that the funding received by JCHS from the real estate industry may have affected their judgment.[58] David Lereah, former chief economist of the National Association of Realtors (NAR), distributed “Anti-Bubble Reports” in August 2005 to “respond to the irresponsible bubble accusations made by your local media and local academics”.[59]

Among other statements, the reports stated that people “should [not] be concerned that home prices are rising faster than family income”, that “there is virtually no risk of a national housing price bubble based on the fundamental demand for housing and predictable economic factors”, and that “a general slowing in the rate of price growth can be expected, but in many areas inventory shortages will persist and home prices are likely to continue to rise above historic norms”.”

Vreb July

Benchmarks all up still.

https://www.vreb.org/pdf/VREBNewsReleaseAndSummary.pdf

Luke: … “they may shoot themselves in the foot at the ballot box w/ the 70% of people who are homeowners, and then we’d be back with the Liberals!”

You are absolutely right regarding the shift to the Liberals, Luke but by then it will be far too late. The dynamics in pretty much every market are turning negative and it won’t take much to push the B.C. markets into a more violent spiral. Perhaps it will be the NDP changes, perhaps it will be the OSFI changes.

The biggest priority for those homeowners that lose considerable equity certainly won’t be changing the government but it will happen and even that government won’t be able to save the market.

Too many irrational “bulls” suggest that if house prices dropped by 30/40/50 % or more, then everyone would jump in and push prices higher. My big question is; who the heck would be left to buy and where were all of these people in Florida, California, Nevada and Arizona.

Those markets collapsed and all of those smart “bulls” weren’t buying. All of a sudden it was the Canadians with their newfound real estate wealth (debt) snapping up those great deals.

Introvert: “Sooner or later, all nations are going to have to get comfortable with a no-growth economy as the planet’s resources can’t sustain infinite growth.”

Don’t see why that is necessarily so. It depends on whether we continue to have a competitive free market and unconstrained technology development. Pierre Trudeau wanted to strangle innovation in the lab, and it is quite likely that our civilization will, like the Mediaeval Chinese Empire, have a Trudeau-esque government that blocks further economic development.

Otherwise, the drive to do more with less can surely continue for hundreds and perhaps thousands of years. Just think whats coming in the immediate future. Artificial intelligence: No need to commute to work any longer. Parcel delivery by drone, underground pneumatic tube, or whatever: No need to go shopping any longer. Holidays? No need to fly to Hawaii, there’ll be an indoor swimming beach in every community open year-round. Then there’s virtual reality, Moon tourism, and Martian exploration. It seems to me that a five or six-fold increase in gdp per person is quite possible during the next 100 years, achievable with less pollution and less resource consumption, although that will depend on political will, not technological possibility.

Luke, I think you highlight an important factor regarding public support for “X” housing policy and the large proportion of homeowners.

Polls that indicate this or that level of support are fickle, and can change in an instant. I suspect that many homeowners recognize that current prices are not only unsustainable but ultimately destructive economically – however if their homes start falling in value drastically in response to policy measures, that poll result could change very quickly.

Thinking, “ya, prices need to come down” in concept is a separate matter from watching your own equity (and in many cases, retirement plans) actually vanish before your very eyes. It’ll be very interesting what their policy review nets.

Good thing they put a bit more thought into this than what happened with the Grenfell tower fire in London. I can’t think of many worse ways to die than being burned to death and not able to escape.

Imagine what all the other folks living in all the other similar towers across the UK were thinking after this happened… Indeed, I think it would cross my mind even if I were living in a highrise here. https://www.theguardian.com/uk-news/2017/aug/01/grenfell-tower-fire-psychological-trauma-mental-health

Thanks Marko for the Fair St. sale price. I actually guessed correct on that one! But, that price is crazy for what the buyers get, and also considering they had to add GST that is huge…

I’m a homeowner and I support the foreign tax going province wide – even though it may cause home prices to soften or decline – for society, that would be a good thing. I do think, however, that many foreign buyers will still find ways around the tax (i.e. students, work permits, setting up untraceable companies, etc). The effect on Victoria if it’s expanded here may be more psychological than anything else, since foreign buyers (with exception perhaps of Gordon Head or areas near UVic) still make up a relatively small percentage here. I don’t think the current prices (for renting or buying these days) are good for our society as a whole – too many people are suffering as a result of this – I hear the stories of woe from various people almost every day. Higher prices only benefit homeowner’s if we sell and move somewhere else cheaper (and apparently, not many want to do that given our current lack of inventory). If prices decline here and one wants to move locally, they will be paying less to buy as well, and there will probably be more inventory to choose from than there is now – that would be a good thing.

I was more talking more about weather or not the new Gov’t brings in additional measures that may cause prices to decline even more than just expanding the foreign buyers tax. For ex., we can see what the Ontario Gov’t has just done, and now – what effect that’s having on their market. If our Gov’t does too much too soon here, and that then causes prices to decline dramatically – they may shoot themselves in the foot at the ballot box w/ the 70% of people who are homeowners, and then we’d be back with the Liberals! We will have to wait and see what they do though, and then what effect, if any, it has – I’m thinking we’ll find out pretty soon, probably in the fall.

Toronto RE agents and the downturn…Can be extrapolated here with the 1500 agents (I think that is the number)

48k agents in Toronto 13k in Chicago

Already, many realtors are struggling in the crowded market. Nearly half of Toronto’s licensed realtors did fewer than two deals last year, according to Brian Torry, general manager at Bosley Real Estate in Toronto. Less than a third did five or more transactions.

“It is a tough industry to break into,” said Jared Gardner, 38, who got his real estate license last year and works in the Toronto area.

Fleming believes many agents are already making less than minimum wage once license, membership and brokerage fees are paid, and it can only get tougher if sales continue to dry up.

Full story

http://www.bnn.ca/canada-s-realtors-brace-for-the-end-of-the-housing-boom-1.819173

Thanks Leo

Looks safe. Cost is a bit more than concrete. Seems quicker and more environmentally friendly.

Very interesting. I wonder what sound proofing is like.

859 Bank St: Sold $825,000

Delayed offer, sold at full ask but not over.

Introvert: “Sooner or later, all nations are going to have to get comfortable with a no-growth economy as the planet’s resources can’t sustain infinite growth.”

A very good point, and one that Dame Ellen McArthur would agree with. A link below is for a TED talk well worth spending 16 minutes with. This intrepid sailor compares a finite ship’s stores to the finite resources of our planet in a most compelling presentation.

https://www.youtube.com/watch?v=ooIxHVXgLbc

Hello. Could someone please tell me what the house on Bank Street sold for? I can’t recall the address, but it was something like 824. Thank you1

Nothing much: https://www.firefightingincanada.com/structural/timber-tower-24422

What happens if this building catches fire? Interested to see the impact of a fire on this building vs a concrete building.

Brock Commons, at 173 feet, the World’s tallest wooden building, completed in 70 days.

Here’s a technology the NDP could do much to promote if they manage to hang onto office. Largely prefabricated off site, rapidly assembled buildings of this kind could provide the large number of low-cost rental units the Government has said they will provide, while creating a new manufacturing industry with significant export potential.

A tighter credit market would strangle new construction much like it did in 2008.

That’s a lot of unemployed construction and indirect workers on government assistance and a lot of home owners upside down in their mortgages. Owing more than the house would sell at.

One of the reasons why there are so many fires this season. In order to increase net profits it was necessary to reduce expenses on brush clearing. A very short sighted policy as we are now paying heavily for it.

‘Day of reckoning’ looms for Canada’s consumer debt bomb

For years now, Canadians have been warned about their record debt levels, by the Bank of Canada, groups such as the International Monetary Fund, credit rating agencies and others.

The latest comes from BCA Research, whose recent study, released after the Bank of Canada’s mid-July rate hike, warns that “a credit-driven downturn in spending is a highly probable event for the Canadian economy over the long run, rather than a risk.”

“While we agree that the Bank of Canada is on a path to gradually raise interest rates over the coming year and that the economy is currently in good shape, the odds are good that tighter policy (and/or other factors) will eventually inflict considerable damage to the Canadian economy via the housing market and its impact on highly leveraged consumers,” Mr. LaBerge said.

“…fiscal policy is forecast to become a persistent drag on growth, and it is even possible that the sharp deceleration in fiscal thrust set to occur next year could act as the proximate cause of serious problems in the Canadian housing market,” Mr. LaBerge said.

https://www.theglobeandmail.com/report-on-business/top-business-stories/day-of-reckoning-looms-for-canadas-consumer-debtbomb/article35853823/

@ NH

Re: Furniture making

“Question is…why can’t we do that in BC?”

I remember sometime in the 80’s the then BC Provincial Chief Forester mentioning that Ikea were buying lodgepole pine in BC and selling it back to us as furniture.

I suspect the reason then, as now, for the weakness of local manufacturing is due to the challenge of marketing. To make money out of furniture manufactured from BC lumber, it may require something like a continental market, and that’s where the big boys in Sweden or China beat BC’s small timers, and on that scale, almost everyone in BC is a small timer.

Our greatest advantage is in the production of fibre, since we have so much room to do it and, until this point, have spent very little relatively speaking on forest management. That may be where the greatest opportunity for developing the industry lies: in more intensive management on the five or ten million hectares of the province’s most productive land, with the objective of increasing not only the volume but the quality of timber, e.g., through pruning trees to increase the volume of clear lumber, and through genetic improvement for wood quality, etc.

My own view is that we could go a long way in that direction by privatizing land, at least by way of crop rotation length leases. But despite my having discussed it at every level in the Ministry of Forests for just about ever, I have never come across anyone in the least bit interested. It’s the tradition of the country (to piss away the resource), as one Deputy Minister told me.

Thus the industry continues to do more and more clever things with lower and lower quality wood. For that reason, the value of the BC forest industry’s output continues to decline as a share of the provincial GDP.

But isn’t China just dumping its excess capacity onto the world market? Their local market pays the hard and variable cost of manufacturing but the rest of the world only pays the variable costs for the good. Which is supported by their government fixing their exchange rate.

Try to do that in Canada and other countries would slap a tariff on us.

…and the other shoe drops. So, you expressed an opinion based on “many others” and that this nebulous group believe Victoria RE is “undervalued”.

What you have done is raised an opinion on a questionable premise, and when I probed that further, you quickly switched the focus and told me “markets are unknowable, only educated guesses”. Well, okay – it’s not incorrect I suppose.

But in that, you still fail to answer my question – and you quietly imply that that your guess is an educated one, or based off of an educated one – but word it slippery enough to allow for plausible deniability later on.

Then I tell you that factors that effect a market aren’t unknowable, but of course the specifics of each can interact in many different ways – which does make predicting difficult. I provide some factors which I believe are bearish indicators that suggest unsustainability.

You respond by falsely equating my assertion that market factors are knowable, with a prediction. You then conclude employing this vapid logic and throw on a vague sprinkling of ad hominem by equating me with someone that you believe has no credibility.

Which brings us back to square 1. You never answered my question. 🙂

@CS

If you are wondering about cost…to setup something like that would cost less than 2 out of the 3 lots if you were to subdivide your OB property into townhouses haha. That puts it into perspective.

For that type of investment, you could easily get $25MM revenue from the investment.

@CS

BC needs to put some of those $ to supporting industries that we have a strategic advantage in. As we are in a related industry, the cost of processing wood is not cheaper in China when you factor transportation and financing costs.

What is sorely lacking in BC is the equipment to turn this to a finished product. Here is one factory in China and you look at the machinery they have:

http://hzaisenfurniture.en.made-in-china.com/product/VXlJCfZMZARb/China-Modern-Designed-Wood-Bookcase-for-Office-Furniture.html

Quote:

In order to provide our client with high quality product, our company use high end machine imported from Germany and the latest automatic production line. Punching Machine, Edging Machine, CNC molding Machine, Heat Pressing Machine, PVC Thermopile Machine. Painting machine, Painting room etc. We always place high emphasis on training our technicians, our strong R&D design capability, strict QC system and 100% in-time delivery make our clients satisfy and trust us.

The processing equipment is German and it is automated. Question is…why can’t we do that in BC? Simple answer is lack of talent and $ for someone to do it in BC. As per a post a few weeks ago, my friend was trying to pull off something like this on a smaller scale on the South Island. He spent 1 full year on bureaucracy and he got absolutely nowhere. You can’t blame people for not trying, but the bottom line is the environment created by all levels of government are not condusive in pulling off something like this.

I wish this was not the case, but it is just a small anecdote of some of the challenges faced when trying to create new jobs/industries on the Island.

You’re giving life advice there too cowboy.

Markets are extremely complex systems. If their forces were knowable everyone would be rich.

Many think (and have thought) that we can reasonably surmise what’s going on. Hawk comes to mind. And apparently you, too.

You know what they say about people that assume…

And all signs point to no on that one there partner.

“I’m assuming they will tread carefully on bringing in measures that may adversely effect the housing market – and they won’t want to upset the 70% of people who are homeowners (and a large proportion of voters) in this province… Right?”

I don’t think the province agrees with you on that statement. 75% of BC residents support a foreign buyers tax and the number is higher in Vancouver. I think most people would also support other measures to cool the market like a speculation tax. Gordon Head seems like it is being driven by foreign buyers and would likely see the largest price drops as a result.

https://www.biv.com/article/2017/4/most-canadians-support-foreign-buyer-tax-poll/

Earthquakes

5 years after their earthquake in 2010. Prices rose

30%. So the big one is no guarantee of a price crash sending prices to 0. 🙂

http://i.stuff.co.nz/the-press/business/your-property/71647522/christchurch-house-prices-up-30-per-cent-since-quakes

Precisely. And this is my point. Is the above reason to suspect that this will continue unabated over the next decade, up to and exceeding 1500k for GH homes? Keep in mind if we’re at 1500k, Vancouver will probably be a lot higher still. Generally speaking, housing prices are reflective of what banks are willing to lend to borrowers. If banks will continue expanding credit conveyance without limit, then I would be bullish. History and mathematics demonstrate, at least to me, that credit does not expand without limit.

Not sure it’s unknowable. There are only so many forces available that can inflate a market. Excessive credit is chief among them. It’s like the saying, “It’s never different this time, only the details”. Some details can be murky. Broadly…not so much. I think we can reasonably surmise what’s going on.

My point continues to be, there is no credible evidence to suggest that this up and up trajectory can be maintained over time, and metrics including income, interest rate levels, and consumer debt ratios all suggest that the opposite is true. I don’t believe that Victoria’s economy supports its current housing prices, and if I’m correct, it renders them ultimately unsustainable. This market runs on loose credit, hype and fear.

Well if the big one hits in 10 years (~4% chance) then you might be right Bearkilla.

In 10 years a house in Victoria will be worth 0. You heard it hear first bears. Save up the sheckles. You can own one day too.

It’s unknowable. All we have are educated guesses.

One might ask the same of Vancouver. What forces caused it to appreciate from eye watering levels of 2008 when many thought it was a bubble to current levels? Foreign capital, local speculation, restrictive zoning, easy credit, corruption, money laundering, etc etc.

Don’t get me wrong I’m not saying it will happen here (I don’t think it will), just saying it can happen due to various difficult to quantify factors.

1861 San Juan for sale again with a new coat of paint. Sold in the spring for $911k after being listed for $749k. Not in the system yet but curious to see what they will ask. Can’t imagine that a flip could possibly be profitable after such a short time when the existing one was already so high.

That prices can detach from local incomes, or “fundamentals” is not in doubt. There’s ample evidence demonstrating that this can and does occur. But that’s not what I’m asking.

I am asking what “forces” caused Victoria’s rapid appreciation, and can continue to support it into the next decade.

How could Victoria prices continue to appreciate? By detaching from local incomes. In the past they have been tempered by local incomes and while prices have appreciated, they haven’t gone wildly out of whack with local incomes on a monthly payment basis due to dropping interest rates and increasing incomes. If we pull a Vancouver all bets are off. Maybe we are there now, maybe not.

My question to you is legitimate. What you just wrote above in response is a rudimentary mixture of argumentum ad populum and begging the question, and provides no logical support to your conclusion.

If you don’t want to answer the question, it’s probably better to just ignore it. 🙂

Considering that many currently regard Victoria as undervalued, I think prices have room to grow in the short- and medium-term.

I personally wouldn’t go that far.

Sooner or later, all nations are going to have to get comfortable with a no-growth economy as the planet’s resources can’t sustain infinite growth.

You are correct CS, the next correction has begun with increased price slashes being the first sign as stupid land sales dry up. The market is lulling the bulls into complacency as all bull markets do.

Canadian Real Estate Prices Will Fall

https://betterdwelling.com/canadian-real-estate-prices-will-fall-28-2020-according-model/

As a casual reader of this blog, I had the impression that house prices rarely fall. However, GWAC’s chart at 1.49 pm (based on data for Toronto, it seems) shows that for 24 of the last 63 years — or more than one third of the time, house prices were flat or falling. There were three periods of more or less continuously falling prices, between intervals of more or less continuously rising prices. On average, the declines lasted 8 years and the magnitude of the declines averaged about 30%. We have just experienced a long steep run up in prices, which suggests that we may be at the threshold of almost a decade of declining prices. A 30% decline would take the median Victoria SFH price back under $600 K.

sold for $1.1m I just can’t believe it still…

Does anyone know what the Fair St. house in Henderson OB sold for recently? Was listed (reduced) to $1.5m + GST.

Sold for $1,475,000

Every time I drive by that very ordinary 1970’s box on Fleet St. just off Mckenzie that sold for $1.1m I just can’t believe it still…

Does anyone know what the Fair St. house in Henderson OB sold for recently? Was listed (reduced) to $1.5m + GST. Had virtually no yard or privacy, was strata. New build but not the greatest quality imo. Had sump pumps…ugh. It’s the last one on the four home cul-dec-sac off Fair St. to sell…

http://www.huffingtonpost.ca/2017/07/31/b-c-foreign-buyer-tax-is-under-review-new-housing-minister-say_a_23058586/

Definitely going to be interesting to see what the ‘New Greenocrats’ do with regard to the review of the foreign buyer tax, and proposed vacant homes tax – and what will they do re. fraud and speculation? Will they bring in new measures Province wide? Will they eliminate the foreign tax and replace w/ something else? Or, just implement it Province wide in current form? I’m assuming they will tread carefully on bringing in measures that may adversely effect the housing market – and they won’t want to upset the 70% of people who are homeowners (and a large proportion of voters) in this province… Right? Assumptions have been wrong before…

Check out the video at the end of the Huff post article (once you wait through the useless advertisement) and it reveals how the Gov’t doesn’t know who owns half of Vancouver’s priciest homes. Setting up an untraceable company is easier in Canada than virtually anywhere in the world. (apparently, only in Kenya or a few select States is it easier than here). I wonder how many of those Uplands homes are owned by untraceable companies?

What has happened to Japan house prices without growth? Still going up…Not sure why

https://www.globalpropertyguide.com/Asia/Japan/Price-History

James

Not in that field. They are banging atoms or something together is that not the end result.

Go on…

China is actually 10 years or so away from the same demographic shift.

James

I am referring to something other than electrical power. That supplies energy at a fraction of the cost to business and homes that does not require massive infrastructure.

Teleporting? 🙂

Power is ridiculously cheap in BC currently, people just waste it with old drafty houses w/ single pane windows.

3D printing is more expensive than mass production

Nanotech is going to be worse than plastic when it enters the water system, huge unintended consequences there

I’ve got no problem w/ space mining.

Technologically computer processors aren’t even getting better at the same rate (Moore’s law is failing), don’t really know where we go from here w/r to advancement. We’re pretty close to hitting the limit on component size reduction anyway.

Japan is an example of older population without population growth. It is hard to grow an economy.

Local

Only one I can think of is Cheap power. I am sure there are other stuff out there I have not thought of.

Considering most people actually see the world population topping out at 10 billion before starting to contract based on current birth rates, I sincerely doubt it.

World population went from 1.6 billion in 1900 to 6 billion in 1999. It went up by 4 times in 100 years. it won’t even double in this century.

China is already below replacement level and India will be below by the end of this decade.

So then the question is, what forces drove 500k prices to 800k in just a few years, and can those forces continue to operate in a manner that would reliably drive prices to 1500k in a decade? We already know it isn’t fundamentals driving it.

To me, the answer is simple. Debt. Credit expansion. Old and new variants of the same tools that have fueled every asset bubble in human history – and always end up the same way. I don’t think there’s a credible argument that has been raised, or can be raised, that can say what has been going on here, can continue ad infinitum.

Intro – no joke – if you believe what you’re saying, if I were in your position I would be accessing my equity or other liquid assets to purchase as much RE as I possibly could. It would be almost madness not to.

Gwac, there’s some really interesting stuff out there on growth and technical revolutions (stagnation then an invention creates a paradigm shift). It’s definitely a huge driver. Hard to say if future ones will be as profound, because the last ones were so basic – electricity, clean water, refrigeration, transport networks…if that makes sense. 3D printing perhaps? Nanotech? Space mining? Gives me more hope than the idea of investing in wheelbarrows to carry cash to buy bread… 😛

We need a technical revolution to continue the growth. Last 100 years was not like any other, agree on that LF. Massive population growth added to it. Can that continue before real bad stuff happens..

House prices went way up over the 20th century. Biggest span of economic and technological growth humanity has ever seen (I think). It made sense. People could afford it.

That curve, at least in the western world, is gone. Which leads to people saying, “the Chinese will keep our house price growth curve going”, to which my admittedly flaky intuition says…no it won’t.

That’s what I was thinking.

Around ten years ago it was hard for most to conceive of $800,000 houses in Gordon Head. Just as $1.5M seems bonkers ten years from today.

Consider buying your ticket, folks. No ticket, no gain.

try to explain this and how people afford homes. This is in 2016 dollars. Homes have grown a lot more than inflation.

I guess one way to read this is either we are in for a decline in prices or inflation is about to hit if we use history and the tops.

http://www.torontohomes-for-sale.com/account/461083ac0e597a15/pages/2578_13.gif

Local Fool it may be ludicrous. How much was a house in 1917. 2k to 5K? All I can say is owning a house will be for the richer people in the future assuming populations continue to grow and there is not some sort of large population loss.

I just used her post. She started at 800k for 2017 – work forward to 2027, so I just doubled her value every 10 years afterwards. Simplistic.

So, a compounding calculator would yield more accurate numbers providing the input was correct. Nonetheless, it adds up to ludicrous values.

Check out this graph from Toronto. Not sure why but I find it fascinating. One thing I get is good luck timing the real-estate market.

http://www.torontohomes-for-sale.com/account/461083ac0e597a15/pages/2578_12.gif

what are you starting at 7% equals 99% increase compounded. I though we were starting at a 1m for the box. Start a 1m I want to see that 1b.

Just before she ran off screaming, user db employed a similar, dangerous extrapolation to the above:

However simple mathematics revealed, that at 7% annual growth, house prices would be as follows:

2027: 1,600,000

2037: 3,200,000

2047: 6,400,000

2057: 12,800,000

2067: 25,600,000

2077: 51,200,000

2087: 102,400,000

2097: 204,800,000

2107: 409,600,000

2117: 819,200,000

Your grandkids will be buying billion dollar homes, folks. 😀

https://househuntvictoria.ca/2017/03/16/whos-buying-in-victoria/

7% yearly growth equals a 10 year double. Not totally out of the realm of possibilities.

My guess is 1.5m

You’re in dreamland.

Agree, LF and GWAC. And Weimar Germany ended in hyperinflation.

Best thing now, probably, would be to invest in a wheelbarrow to carry all those near worthless $50’s when you go for a loaf of bread after the QE floodgates are opened wide. Otherwise a house with a backyard big enough to grow food.

Maybe the strategy is a new market melt-down to shake out the rubes. Then the serious money will get back in with huge QE-facilitated leverage as the big corporations pay down debt with inflated dollars, thereby reviving profits and reinflating stock prices.

That’s how it worked in pre-Nazi Germany. The big corporations, Krupp, ig Farben, etc., paid off their debts with worthless hyper-inflated Deutschmarks, and even paid their employees with money they printed themselves, what our banks do today, or at least what they do for the money they lend you.

@ CS,

That’s a bleak outlook. I guess I should buy gold or something. I’ll go from being a bear to a doomer.

I think there’s a real conflict at the heart of the global system. On the one hand, you have “inflate or die”, on the other, a huge amount of new, cheap labor flooding the global marketplace. Neither is going to go away, IMO, and both would appear to be in opposition to each other.

On the inflate or die side, it’s going to get increasingly difficult to keep the “growth” up – I would imagine endless QE would result in increasing volatility in markets – not steady up and steady down – but way up, way down, in a sort of uncontrollable series of convulsions that when you run a trend line through – shows a net deflation. Scary.

You may be right – QE, QE and QE. But it won’t work in the end. And if they flood the market with another 50T as numbers hack supposes, I shudder to think of what our financial future looks like. Unaffordable real estate could become the least of our worries…

Ah, Ten Mile Point . . . . lived there for many years when I was based in Victoria. Extended family has been looking to buy there. Lovely place.

Each property is quite unique; some are large, expensive, new homes with no views. Others are modest 40’s cottages on waterfront acreages. Generally, the lot sizes tend to be large.

If you look at the area by the price per square foot of land, Ten Mile Point is still cheaper than South Oak Bay or Uplands, I would think.

CS

Another words its one big pyramid scheme that eventually leads to hyper inflations. Best thing to own is real-estate and guns. 🙂

On a serious note our attach on our own resource sector is not smart in the long run. Helps pay for those social programs.

@ LF:

Yeah, and what will the bankers and political wankers do then? Flood the world with more digits, I mean money, obviously.

What else can they do? Does Justin Trudeau strike you as a big brain likely to come up a new way forward? Or will it just be more gender equity, and loose money?

We have hardly any economy left except government bureaucracy and real estate. We even export raw logs, because they can cut them up more cheaply in China than we can do it ourselves.

QE is the answer to all the ills that result from the offshoring, that began with the Free Trade Agreement. We’ve wiped out hundreds of thousands of high wage jobs with big multiplier effects, while transferring wealth to the investor class that bet their savings on the globalized corporations.

In place of unionized jobs in industry, the regular Joe can get a low-wage job serving coffee or in the largely non-union construction industry, building MacManshions for the nouveau riche.

And if the economy begins to flag and markets crash, just print more money. That way, real wages sink, real interest rates sink and people with their wits about them load up with more debt and more RE as the only sector of the economy capable of making further gains, makes further gains.

We are in the Weimar period of Western civilization. Eventually, a catastrophe will sweep away the whole rotting carcass and replace it with something different. But no one seems to have any idea what that will be.

Canadian economy’s addiction to real estate fees is ‘stunning,’ says analyst

Canada’s addiction to real estate goes far beyond our obsession with talking about it. Our economy actually relies more on the fees associated with buying and selling houses than it does on agriculture, fishing, forestry and hunting combined.

“This is a stunning 1.9 per cent of GDP,” said Macquarie analyst David Doyle. “It’s really concerning, it’s really unhealthy.”

Doyle points out that the U.S. was relying big time on home ownership transfer fees in 2005, when its real estate market peaked. But even then, those fees made up only about 1.5 per cent of U.S. GDP.

In Canada, upcoming data will likely show those fees have already started to fall, as the number of home sales across the country fell in June by the most in seven years.

“The drag on the economy that’s going to flow from [higher rates], I think, will prove to be much more severe than it’s been in the past,” Doyle said.

http://www.msn.com/en-ca/money/topstories/canadian-economys-addiction-to-real-estate-fees-is-stunning-says-analyst/ar-AAp95Ca?li=AAggFp5

FYI: Salt Spring man opts to protect ‘lovely’ land with covenant

http://www.timescolonist.com/news/local/salt-spring-man-opts-to-protect-lovely-land-with-covenant-1.21474003

We would love to do the same if we had a piece of land like it.

And if I were a betting man, I’d say on a trajectory such as that which you’re asserting, the likelihood of a major debt and financial crisis in this country would essentially be certain.

But it wouldn’t matter then, would it. RE would have no connection to the local economy anymore – global credit would no longer push things at the margin, it would be the market.

I call complete shenanigans on your bet. I don’t think we’ll get anywhere close to what you’re prosthelytizing. Then again, my last prediction was a complete failure, so failure may yet turn out to be my style. 😛

Nice has a premium. More people that want nice/afford the higher the premium goes up. 🙂

@bitterbear

not an economist, but did have a chance to read bits and pcs last year on a long flight. Interesting to say the least; and lots of divergent views from 3rd parties as expected.

My view is that there is just simply too much “cash” chasing “too few ideas”. When we started humbly decades ago, it was savings, friends + family, and a miniscule chance of a bank loan for funding. There were no fancy grants/rebates/investment funds etc… to give you money. There were NO SALARIES until your idea was successful. It is not like that today, there are all these unicorns around that do something that might have a PERCEIVED VALUE in the FUTURE…haha.

So how does that affect RE? R>G? Well you have a lot of 5% or 1% people who are in the capital preservation of their lives and they don’t want risky…so what do they do? You guessed it, park a % of their assets into hard assets. As the saying goes, I can always “kick it”. This is a small, yet contributing factor to the RE run up.

Given the heated environment concerning RE, people have to understand this is a WORLDWIDE problem for large cities and desirable places to live. Look at any index plotting RE values in any city, and most have gone up the same or more than Victoria. It is not the fault of the foreigners, or whatever the “blame du jour” is, etc… look no further than monetary policy.

For example, So a better dwelling article says the Chinese will invest $1Trillion in RE worldwide over the next decade. Well the CBs have already made $12T by the end of 2016…by 2026, wouldn’t be surprised if this would be $50T?

The SUPPLY of RE is finite or doesn’t grow very fast. What will have more of an effect on already expensive RE prices? $1Trillion in foreigner money or another $50Trillion floating in the system?

Those unfortunately are the trends. So if I was a betting man, the likelihood of a GH SFD being @ $2M+ in a decade is much more likely than it being @ $500k.

Been through there 1000 times. In grad school I would often drive to the end of Tudor or White Rock and write my papers down there. Quiet. I suppose you can guess my perspective on whether it’s worth such a stupendous amount of money, though. But it’s nice, I’ll give you that.

It’s a good step for sure, but I wonder how effective that fear is for those speculators who model the risk properly. If only x% of people get audited with a penalty of y% and you’re likely to profit z% if you don’t get caught, etc.

Love to see them go after every speculator and every person who sold a second or third home. I am sure many who had recreational properties never declared the gain.

I hate taxes but everyone needs to play under the same rules.

CRA Targets Vancouver speculators. They don’t need to get them all, they just need to put the fear of the tax audit into them.

http://vancitycondoguide.com/cra-targets-speculators-vancouver-real-estate/

Local Fool drive through Ten point. You will see and feel the 700k difference. That is paradise my favorite place.

I think the waterfront skews the area, waterfront is a greater % than OB.

Ooh interesting John Dollar. Do you have that breakdown for other munis, esp Victoria?

Any notion of what accounts for the $710,000 over SE CB? Is that just due to the size of the lots/homes? More sizzle?

The ubiquitous Gordon Head box with its mortgage helper suite has now become the symbol of upper-middle income for those of less means in life.

That’s just rationalization by a few of the disconnect between the high price of housing and reality. Here are the median prices for the neighborhoods of Saanich East. Notice where Gordon Head is.

Map Area Sale Price, Median

SE Ten Mile Point $2,000,000

SE Cadboro Bay $1,290,000

SE Blenkinsop $1,235,000

SE Broadmead $1,192,125

SE Cordova Bay $1,050,500

SE Arbutus $1,050,000

SE Sunnymead $960,500

SE Lambrick Park $939,000

SE Gordon Head $910,000

SE Mt Doug $900,000

SE Queenswood $900,000

SE Mt Tolmie $880,800

SE Cedar Hill $830,000

SE Maplewood $813,000

SE Lake Hill $808,000

SE Camosun $801,500

SE High Quadra $799,000

SE Swan Lake $759,800

SE Quadra $749,900

And west of Tyndall are the favellas so fancy Gordon Head is a relatively small area.

We’re addicted to fees for stuff that should be mostly automated

http://www.cbc.ca/amp/1.4226630

I would say upper-middle-income. Also, south of the Feltham/Edgelow line, it’s the land of investors; a disproportionate number of properties in this part of Gordon Head are entire-home rentals catering to UVic students.

@Leo: Nah, I don’t think I’d like to live there even if I had the means. Money like that separates people. I’m happy to live more modestly. I can see how you might think I was suggesting that based on my comments though, but it certainly wasn’t what I was trying to say. Just trying to be vague on the bank amount.

I think once that ordinary 70s box got in Gordon Head got listed for a million everyone woke up a bit and gave their heads a shake at the insanity.

Thanks Marko. It is great buyers are rational and prudent.

If there is an offer delay setup organized realtors will have the strata documents available for review prior to the offer day/time. Often too the buyer is familiar with the complex; I’ve had several buyers buy units in buildings they rent in in the last few years.

In conclusion, I wouldn’t say buyers are making unconditional offers on condos they are not familiar with. Often with condos you’ll get 3-4 offers but they are all conditional.

Numbers Hack:

r>g

Interesting observation Introvert. Gordon Head is the land of the middle income families. That’s what makes it so important to watch.

Month Sale Price, Median

Jan $985,000

Feb $840,000

Mar $918,000

Apr $905,500

May $900,000

Jun $995,000

Jul $840,000

Month Sale Price to Assessed Value Ratio

Jan 129.0%

Feb 122.4%

Mar 123.7%

Apr 131.5%

May 121.5%

Jun 129.6%

Jul 115.9%

Of course the data is weak for this month with so few sales in July. It could just be a seasonal fluctuation.

I’m one of those believers that think a housing correction will start in the first time buyer market which is condos and starter homes. But this is such a strange market, I wonder if it could start with middle income families that have stretched their finances too far by owning too many rental houses and condos?

Wow, my prediction beat even Hawk’s for wrongness.

Good data, Numbers Hack. They show that all’s right with the world. Globalization is delivering the profits of offshoring and outsourcing to the investor class, as intended, while driving down real wages, which helps the investing class with the servant problem.

Many sales going for under asking in Gordon Head lately. The market is softening, for sure.

Beautiful Sunday, though!

Consumers are not the only ones feasting on a smorgasbord of debt:

http://www.transform-network.net/uploads/RTEmagicC_bischoff2017_graph_05_kl.jpg.jpg

Mostly courtesy of CBs

http://www.taxresearch.org.uk/Blog/wp-content/uploads/2016/12/Screen-Shot-2016-12-22-at-07.03.51-550×341.png

and you wonder why the general populace is crying foul as the spoils have been unevenly distributed and the trickle down effects of so much “more” money in in the system

http://www.hangthebankers.com/wp-content/uploads/2014/09/Average-household-income.jpg

The same can be said for Oak Bay, depending on where in Oak Bay we’re talking. For example, if you live around St Patrick and Beach Dr, you are quite car-dependent.

But if you live on Oakwood St in Gordon Head, you’re within a five-minute walk of most every amenity you listed.

Overall, however, I would agree that Oak Bay probably has more real estate within easy walking distance of amenities than Gordon Head—and it probably has more than most neighbourhoods/municipalities in Greater Victoria.

“*Exclusively offered to buyers who qualify, Buyer must be employed and file T4’s have a minimum beacon score of 650 and the home purchase price must be less than 1Million Dollars in the Greater Victoria Area”

I have seen the above comment on a number of homes for sale listed on Used Victoria. They are advertising for zero down. Why the 1 Million max? What’s the significance of 1 Million? What’s the deal here, anyone?

Marko: You said the condo market is red hot. Do the buyers study the bylaw/24 months of meeting minutes before putting down the offer?

SFH, even is a dump, you can patchwork and spend only when you have the money. In a condo, the strata can call for special assessment for big ticket items (elevator, envelopes) anytime….

Anyone predicted NDP + Green won?