How do you want to pay for that?

One might think that part of the price increases in the last two years have been fueled by gains in income. After all, we have an active tech industry and more younger people sticking around, so surely incomes must be going up, right? Those $900,000 houses aren’t too bad if you’re making $200,000 a year.

Well the new labour survey numbers are out, and unfortunately it doesn’t look like that has really been happening. Average incomes were the same in 2015 as they were 6 years earlier, just keeping up with inflation. And once you take into account the measurement error, there isn’t much of a trend over 10 years.

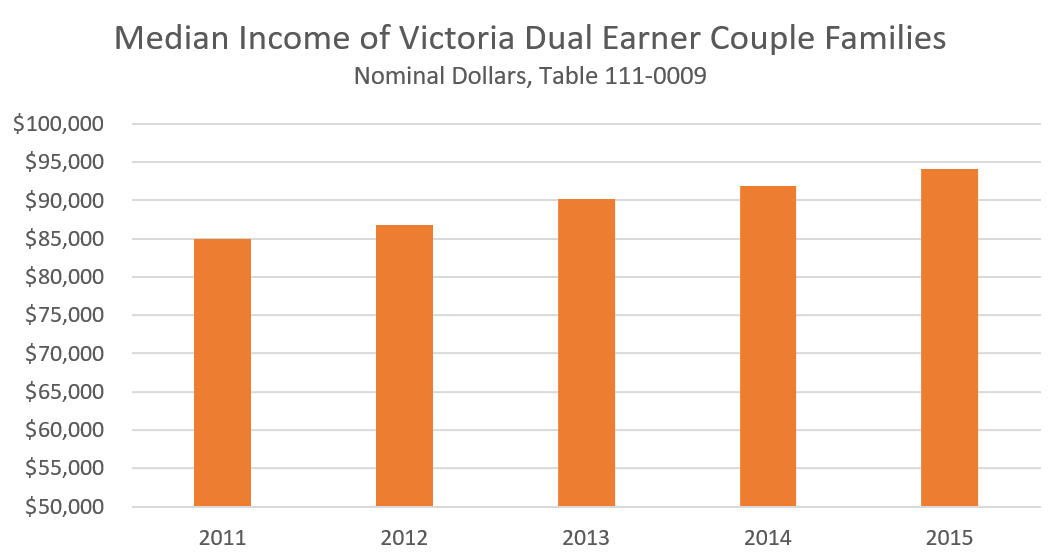

Even those dual income households we hear so much about are not that impressive. About half of our 100,000 families are dual earners, and the median family was earning $94,000 pre-tax in 2015. Enough to buy a house townhouse costing about $475,000 with 5% down. And if the B20 rules hit in the fall, it won’t even help to beg borrow or steal the 20% down payment anymore as everyone will be subject to the stress test.

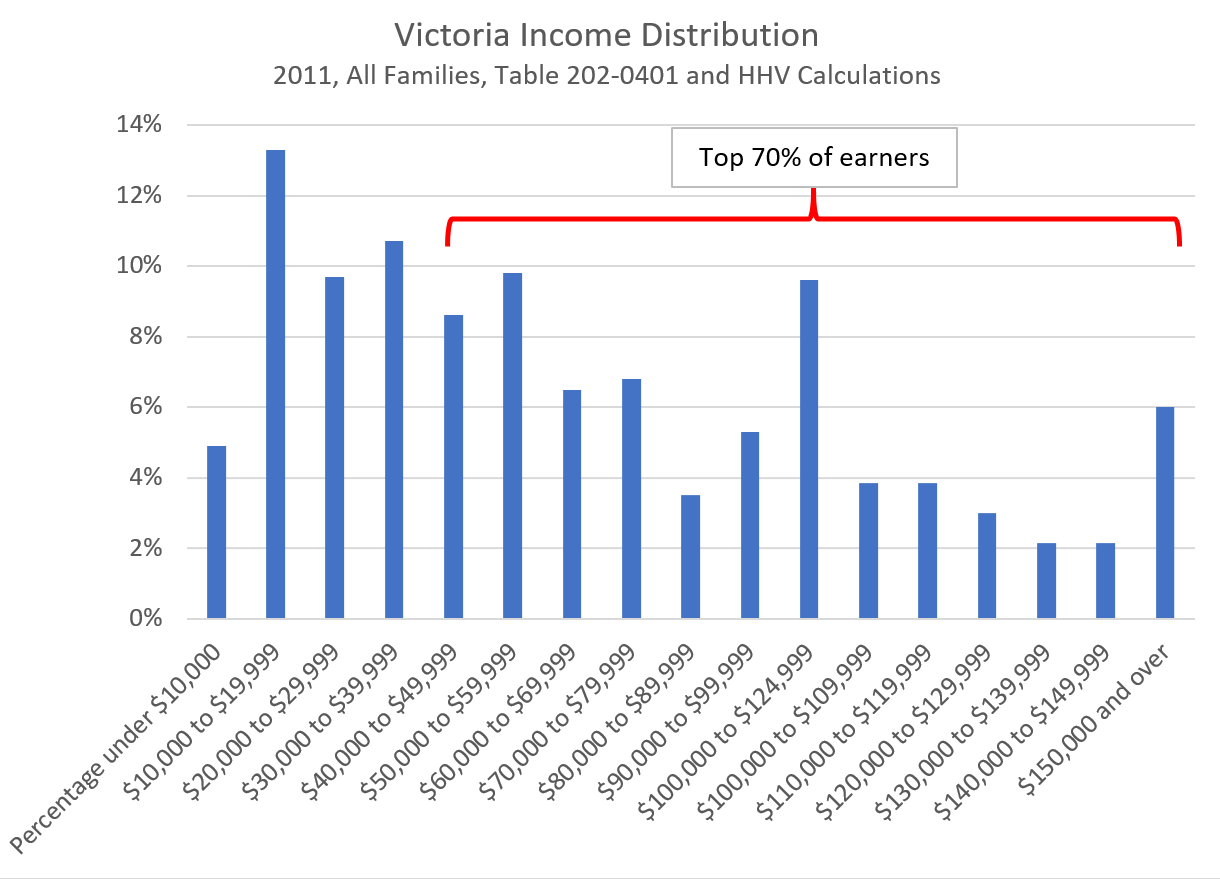

The 2016 census data isn’t out yet to show the income distribution (scheduled for September), but here are the 2011 numbers. If we make the very crude assumption that with an approximately ~70% ownership rate, the top 70% of earners are likely to be the home owners, we get down to some pretty small numbers for family income.

Of course most owners bought years ago and don’t have to worry about buying their million dollar Oak Bay warshack on their $40,000/year pension. But it indicates that the incomes for the higher earning segment that would have traditionally bought a house just aren’t sufficient to get into the market anymore. And as the older population that bought their houses for a fraction of the price on normal incomes decades ago passes away, they will have to be replaced by a much wealthier contingent. Right now to get into the 1% of high earners in Victoria you have to be making $227,000. That will hardly get you qualified for a somewhat better house in the core.

Unless prices drop, there will have to be either a mass shift to families in condos, or the ownership rate will drop going forward.

Pretty easy to calculate the mortgage a bank will normally approve someone at. With a credit score over 800:

Income x 0.44 = what they figure you can manage

so 6% should be around 160k/yr(?) so a bank can assume you can shoulder a little under 6k/mo in debt and housing costs. After your down payment, house insurance, utilities, and property tax I assume he probably qualified for a little under 1.2m (assuming you had downpayment and closing costs) for a total purchase of a little over 1.4m.

Pretty much exactly as he said. Can’t buy waterfront or Uplands, but should qualify for anything else in town. Of course, you’d have to be pretty crazy to actually borrow 1.2m on an income of 160k(there’s plenty of crazy out there. for evidence see: our current market).

But Wolf “grew up in a modest 1,400 square foot home in a quiet suburb of a major Canadian city and am looking for similar”. So obviously the Uplands fits the bill 😀

@Wolf

You said “My household is in the highest 6% (w/ no debt or credit issues) and what the bank will give us versus what homes are available / worth buying simply don’t match up”

Then you said:

“Enough to buy a SFH in the core but not enough to buy a SFH in the Uplands.”

So in other words the only houses worth buying are those in the uplands? High expectations much?

Predictions check in from the beginning of the year: https://househuntvictoria.ca/2017/07/29/mid-year-predictions-roundup

@ Wolf

@CS: Put a row of townhomes in front of your house and I’d be more concerned about your home value, not Barrister’s.

Believe or not, I was proposing to replace my 70-year old house (assessed building value under $100 K) with townhouses.

Or just subdividing the lot into three SFH lots, would likely be quite profitable.

Currently a SFH lot in the area with a tear-down is worth between $950 and 1500 K, whereas two or three SFH lots, or six townhouse lots might be worth, maybe, $several million — enough perhaps for me to migrate to a half acre lot in the Uplands, unless they subdivide there, in which case they could put a dozen or so houses on some existing lots.

Wolf: yeah the difference in purchasing power that isn’t really useful to compare either IMO. Even inflation adjusted, houses were much much cheaper. It is what it is, sadly. Just gotta focus on now and the future.

It’s down to taste, but I find the 50s/60s houses better than most of the 80s/90s ones. But that could just be out of the 100 or so we looked at in person in addition to the myriad other listings we didn’t even bother going to.

@Garden Suitor:

I wasn’t comparing to house prices 30-40 years ago – it’s the diminished purchasing power principle I was trying to illustrate. Say, for example, my parents bought a new home in 1980 with $50K, whereas today a 1950s home is nearly $1 million. The target is not new builds but rather something that’s just not a 1950s junk box. I don’t think looking for something newer than 50-70 years ago is high standards although, to be honest, yes I do have high standards.

@Hawk: Don’t work yourself up Hawk. Totoro won’t even ride on the new Pandora bikes lanes to downtown because she’d have to pass the homeless shelters, which would be a blight on her otherwise exemplary day. The key thing that’s missing from her list, however, is a place of employment (because she’s retired). Of course awhile back the folks here in Oak Bay also argued that they travel as much around the CRD as others yet now they say their community has all the amenities they need and they don’t leave. Very confused as to which is the truth.

“Er, you don’t need a car in Oak Bay imo. You can get by with a bike. I walk everywhere and go weeks without using the car. The neighbourhood walk score is 89. In walking distance is the hospital, my dentist, three grocery stores, two pharmacies, dozens of restaurants and coffee shops, a pub, a hardware store, a garden center, two liquor stores, the ocean, the rec centre, several parks, all levels of school, two flower shops, every major bank, insurance agencies, a walk-in clinic, library, a dollar store, second had stores, seniors activity center, two pet stores, a cobbler, and many hair salons. The only regularly used service not in walking distance is our family doctor.”

Yep, I’ll just haul six or eight bags of groceries on my bike or walking. If I need to go the hospital, the last thing I would be doing is walking, it would be calling 911. Some of these biker people are so clueless that most people can’t ride a bike, don’t feel safe with all the shitty drivers, or have no ambition too. Another ridiculous rant by Miss Perfect.

Wolf: If you have high standards you’ll have to pay for them, sure. What’s the average age of a SFH in the core? How many houses are relatively new builds? Lots of development out west if you’re after a modest new SFH in a burb for a lower price. Plenty of older houses in the core in good condition though.

In any case comparing relative house prices now to 30-40 years ago in Victoria is somewhat useless though. Totally different time. Just gotta work with what we have in front of us in the present.

Yeah we didn’t do 20% down for the same reason as you, so we would have qualified for much less with the new stress test rules.

@CS: Put a row of townhomes in front of your house and I’d be more concerned about your home value, not Barrister’s.

“That sounds doable here”

Sounds like we have different definitions of “worth buying”. Do I want a rickety house older than my parents for 20x more than they paid for something 3-4 decades newer when they were my age? No thanks.

“We’re a fair bit into the 6% bucket according to that chart, with no debts and we were offered a little over 7 figures for a mortgage last year.”

You’re willing to put 20% down. I prefer to invest in the stock market as I do very well there. If/when the new stress test rules come into effect you likely wouldn’t qualify for that even with the 20% down payment. It’ll be interesting to watch that play out.

Well, there’s a good reason there’s so little reference, Richard. While nominal inflation in the CPI will inevitably cause numbers to rise, that same force doesn’t account for “most” of the explosion in housing prices in this city or many others, especially in the last 3 years. In fact, it isn’t even close. Even if that were somehow the case, you’d be seeing inflation based “gains” everywhere in the country – and if inflation were that rampant, we’d be in a horrific national crisis and Uncle Steve would make the interest rates of the early 80’s look like a small warm-up.

Now to be fair – if you’re arguing that the prices of houses are inflating relative to our currency’s purchasing power at any given time (meaning house price inflation being distinct and divergent from overall inflation including wages), then okay – I agree, house price inflation in many of our urban markets is significant and a problem.

However, if you’re trying to assert that current house price inflation is largely accounted for by declining purchasing power of our currency over time (meaning house price inflation is mostly just a reflection of nominal inflation and wages), then I think that argument has its own falsification built right into it. Plus, you would have once again demonstrated my “head in the sand” point, too.

@LF

“Good grief, we’ve got our heads so far in the sand it’s just tragic.”

You sound just like my Dad who thought I was crazy paying $57,000 for my first home. Now people pay that for a modest kitchen renovation.

I’m amazed how little reference there is on inflation, the real reason for most of the prices/costs rising.

Bit of a hyperbolic response to CS there, Barrister 🙂

Reductions in minimum lot sizes seems fair, as does rezoning parts for low rise condos, townhouses, and commercial use. Density and new commercial/community centres to encourage people to stay local and walk.

Re: World destroying Tesla batteries (@ 11.38 am)

Just to make it clear I wasn’t intending a shot at Marko, I exempt* vehicles for business use from my strictures about automobiles, electric or otherwise.

*I also exempt my own, rather more modest, electric car, and since he host’s this blog, Leo’s also.

@ Leo,

“As for envelope homes, they don’t need to be monstrous.”

Leo, I think there’s some misunderstanding here. By “envelope home” I meant one maxed out in all dimensions, like the new house behind us which at around 6000 square feet is probably six times the size of the house it replaced — Nice people, but does anyone really need that much space.

CS: Great idea but maybe we can start by moving a few homeless people into your living room so that you can lead by example.

Go to Hell Barrister. I’m not proposing charity. I am proposing revision of zoning bylaws.

A reduction in minimum lot size in Oak Bay would allow me to subdivide my property into several lots, each worth less than the existing lot but worth in aggregate probably much more than the existing lot. In fact, I have enough frontage for half a dozen town houses. Such additions to the housing stock would lead to a moderation in home prices. That might adversely impact the value of your home. Sorry about that, but I’m prepared to see you pay the price for the greater good.

Fifteen years from now, in all probability, most of the cars will be electric so I dont see the problem with vehicles and environmental impact.

Good grief thank god not many agree with cs outside north Korea. You first comrade.

CS: Great idea but maybe we can start by moving a few homeless people into your living room so that you can lead by example. You dont need all the room that you are using and can do with less than you have.

Oh yeah crazy huge gap between what the banks are willing to lend and what’s financially responsible.

Last I checked this was all voluntary. Even the highest level step (which was somewhere around 2050) wasn’t as strict as passive. In my opinion, there is a chicken and egg problem with new construction in the core. If you are going to build, it will be an expensive undertaking. Therefore you should give careful consideration to the re-sale value of the end product. Currently, that means building larger and more lavish structures.

I’d love to see the general public weigh their housing purchases using other factors (environmental etc.), but currently this isn’t the case.

@Wolf: “Enough to buy a SFH in the core but not enough to buy a SFH in the Uplands.”

I’m in the top 2% or so and was only comfortable taking on the debt required to buy the average home in the core. The bank offered me 7 figures but I would have been crazy to take it. Even making what is good money for this city makes an $800,000 house a financial burden. The family I bought my house from was single income, with the earner having worked for one of the trade unions. My spouse and I are professionals, and we now find ourselves living in what was/still in part is a very blue-collar neighbourhood. It’s a new world out there.

That sounds doable here on a top 6% income, even now. Can’t think that 1400 sqft in the burbs here are out of reach for what the banks would lend you.

Er, you don’t need a car in Oak Bay imo. You can get by with a bike. I walk everywhere and go weeks without using the car. The neighbourhood walk score is 89. In walking distance is the hospital, my dentist, three grocery stores, two pharmacies, dozens of restaurants and coffee shops, a pub, a hardware store, a garden center, two liquor stores, the ocean, the rec centre, several parks, all levels of school, two flower shops, every major bank, insurance agencies, a walk-in clinic, library, a dollar store, second had stores, seniors activity center, two pet stores, a cobbler, and many hair salons. The only regularly used service not in walking distance is our family doctor.

I agree walkability has a lot to do with design. The village concepts for Cook street, Oak Bay Avenue, Cadboro Bay, Estevan, Fernwood and James Bay seem to work pretty well. Gordon Head seems to be built a bit more around the car. The areas around the OB rec center and Jubilee Hospital have the best overall walkability I’m aware of in Greater Victoria given the importance of these two amenities – plus all the rest.

We’re a fair bit into the 6% bucket according to that chart, with no debts and we were offered a little over 7 figures for a mortgage last year.

You want affordable housing then stop building new homes.

What’s been driving prices higher is an economy that has been stimulated by new construction. Get rid of the stimulus and prices will fall.

If you want to pay less for a home you’ll have to wait till the next recession in BC.

In the past the Feds would have raised interest rates to increase unemployment and house prices would have corrected. They couldn’t do this because of problems with the world economy and people kept on buying and hoarding real estate. And Canadians are big time pigs at the trough when it comes to hoarding real estate.

It would have been a good idea to let some of the inflation out of the real estate market and thereby reduce or eliminate the potential of a massive correction. A couple of little price corrections along the way would have been a good idea. But the government was making too much money and didn’t want the party to end.

“Sigh. It’s the Canadian way, and we’ve got to stop it.”

It’s human nature Local. People subconsciously ignore what isn’t in their immediate best interest and cast it out as a ‘distant possibility’. Death, disease, bankruptcy, etc.- people ignore these for sunnier, immediate thoughts, even when they’re reaching for their cigarettes. I don’t blame them either; it’d be depressing to live in constant despair. I think markets are becoming based less on value and more on this human nature. Until that changes I’m choosing to not buy in and reward greed from some who didn’t earn it but instead stumbled upon it like a drunk man in the woods.

“Pat on the back for top 6%! How is life up there?”

Probably quite similar to yours. If you knew me in person you’d think I’m regular folk. I don’t have a Mercedes; I don’t even have a Toyota. I grew up in a modest 1,400 square foot home in a quiet suburb of a major Canadian city and am looking for similar.

“How much will they lend you?”

Sorry Leo, I don’t provide specifics when it comes to financial matters. Enough to buy a SFH in the core but not enough to buy a SFH in the Uplands.

Hawk that site would be amazing. You know how I love aggregated market data 🙂

Speaking of traffic I had to drive through the Oak Bay strip one afternoon this week, and boy was that ever frustrating. So many slow drivers.

Hit me up if you want, hoping to have th data feed sometime in the fall and building out some tools.

How much will they lend you?

Well said CS.

As for envelope homes, they don’t need to be monstrous. In fact the B.C. building step code will lead to all new construction being net zero ready by 2034 so they will by necessity all be something like passive house or close to it.

Maybe Victoria maxes out on ability to produce jobs to keep the excessive current growth levels. I think that’s what happens in a bubble and then it blows up. Like a ponzi scheme.

How many more construction jobs do you want when the cooks are quitting and leaving town ? As the traffic congestion continues to increase then people may stop moving here as Victoria becomes “a nice place to visit but wouldn’t want to live there” destination.

The Malahat is becoming a joke where a traffic jam happens with zero construction on a Friday. Seems to tell me too many people are living here already for what the system can handle. Building upward or outward is just adding to the problem. Maybe they have to start charging to move here. 😉

The only reason people pay high prices to be in the core is that in the core there is easy access to facilities that contribute to the quality of life. Urban planning should thus focus on providing access to facilities that people want at the minimum cost. That means zoning laws that promote density, not sprawl which adds hugely to a city’s carbon footprint by forcing ever greater numbers to make ever greater daily commutes. Ideally, everyone should be so close to the facilities they really need that they don’t need any form of motorized transportation. Places like Oak Bay and Gordon Head are designed for people of the 1950’s, with limitless gasolene to burn and acres of blacktop to burn it on.

Such municipalities are a blot on the planet. They force everyone to drive everywhere because the population density is too low to provide the facilities people want right next to where they live. What’s more, they force poorer people who live beyond the broad garden suburb belt to travel even further than they would otherwise be necessary to get to the downtown resources they need.

It’s those top 6% Greenies who are poisoning the planet with their garden suburbs, their Hawaian holidays, their conference travel and their Tesla roadsters with a battery embodying the energy equivalent of 18.2 tons of carbon dioxide.

Time for a revolution. To start Oak/Gordon Head minimum lot size should be cut to 4000 square feet, same as in Point Grey Vancouver. Then a substantial percentage of each municipality should be rezoned for condos, townhomes and commercial use. Then we’d see some actual life to the place, instead of stupid envelope homes for unimportant people to prove how important they are and how wasteful they can afford to be.

“Good grief, we’ve got our heads so far in the sand it’s just tragic.”

That’s how all bubbles arise. “Buy now before you’re priced out.” Then when everyone’s maxed out, or rising interest rates induce bankruptcies of over-leveraged buyers, greed turns to panic and many rush for the exits driving the price down. It’s never different now, except for the details.

Declining affordability is why you have endless sprawl. People move out of the core to find houses on cheaper land. Change zoning bylaws to allow higher density throughout the core and you have increased affordability and less sprawl.

Last thread, I had opined:

Yet another example in this thread:

Sigh. It’s the Canadian way, and we’ve got to stop it. An entrenched, false belief that no matter how high prices go or how rapidly they get there, no matter how glaringly disconnected from incomes they are, no matter the degree to which consumer debt levels are exploding and making global headlines – “I cannot envision a scenario in which the prices will drop in any meaningful way.” And these people aren’t kidding. They truly can’t.

Good grief, we’ve got our heads so far in the sand it’s just tragic.

Bizznitch, I have contemplated starting one up. We’ll see how my time constraints go in the fall as my commitments pick up.

Luke, interesting to note the writer of the TC debt denier article works for the Fraser Institute. Enuf said.

Interesting insight to the tech wage stuff. Looks like they all want to go to the US eventually. Why not for double the pay.

How migration wars impact Metro Vancouver’s high-tech sector

http://vancouversun.com/news/local-news/how-migration-wars-impact-metro-vancouvers-high-tech-sector

Hawk: We need a website that actively monitors these price slashes.

I think a lot of people out there think things are just rosy atm. I know someone who’s subsidising their mortgage on their third house they bought to the tune of almost $2k/month. This is because in their mind “real estate only goes up”. Going to suck for them when it goes south.

Just another Golden Head slasher to heap on the pile. 1848 San Juan Ave on slash #2 for a total of $52K to $848K.

The James Bay real estate agent flipper still can’t cut it loose. He buys 252 Superior for $679K, puts it up a month later with nothing done to it for $799K, now whittles it down on slash #2 to $779K.

1472 Derby Rd takes a healthy slash of $50K down to $749K. When the fixer uppers have to slash you know it’s just another sign that the speculators are out of the game and those who aren’t will have to whack and hack.

Wolf

Pat on the back for top 6%! How is life up there?

I’d like to see how the 2016 income stats compare to the 2011 income stats. My household is in the highest 6% (w/ no debt or credit issues) and what the bank will give us versus what homes are available / worth buying simply don’t match up. Unbelievable. Guess we should just be working harder..

In response to Leo’s question “how do you want to pay for that?”

Answer: credit card

Young tech talent may end up down in Seattle or the valley, but people with families move back to get away from the lifestyle bubble in some of those areas. Price of living in SV is very high as well. I have 2 ex-valley people who moved back to Victoria in my office.

Also chatted with someone leaving the valley due to trump – next best place not in the US was Victoria. Easy, direct flight to San Fran and same time zone. More affordable than Vancouver.

“Prediction time re: SFH, folks. Prices go up another 15% in the next 12 months, then decline 12% over six years. Seven years from now the average sale price of a SFH will be the same as it is in the core right now.”

Well Chief, I’ m pretty much in agreement with your overall synopsis but I would modify some of your numbers. I think the SFH uptick has pretty well run its course and has more or less reached its peak. In fact in some areas and GH may be a good example, the market may have overshot and it is pulling back from the original exuberance. I see the market having modest gains till this time next year, perhaps another 5-7% gain overall. However some neighborhoods may even experience some modest declines while a few other neighborhoods make up for those declines by actually beating the 5-7% of the City as a whole. I’m basing my analysis on what happened in Calgary when it hit its peak and it was interesting to see how some unexpected neighborhoods continued to increase wheras the whole City stagnated or declined.

I don’t see there being much of a decline certainly not 12% maybe 3-5% and I don’t see it lasting 6 years, 4 years of a plateaued market being more likely.

I think the Government’s new lending rules will have a huge impact and already are being felt even though some of the requirements technically are still only being considered but some of the banks are already following through on the stress testing. These new rules are going to have a dramatic effect on the no. of sales/month but not the average sale price because these new rules are going to discourage people from listing when they realize they won’t qualify for that move-upper home and so they will stay put. So I see the no. of listings remaining tight and as long as that continues there will be little reason for home prices to decline.

Just talked to a small tech startup that moved here from Vancouver because of our cheap housing costs (!) and for lifestyle reasons.

And so it doesn’t sound like I’m pumping, I talked to another company two weeks ago that got bought out by a multinational, and they laid off a good chunk of their local hardware staff and outsourced the work to cheaper countries instead.

So not all positive news, but I do see a lot more tech companies scaling up than scaling down right now.

The census data for 2016 being released in Sept. will fill many of the gaps I alluded to earlier – where we simply don’t have enough local data broken down by individual ‘hoods, after 2011. I look forward to that… hopefully census mapper gets up dated as well.

Bye Bye Chrusty! Wonder if she’ll go back to her old radio job? I knew she couldn’t bear the thought of having to come to Victoria every time they were in session. Also, after the chameleon act she pulled where suddenly she may as well have been NDP, she must’ve miffed many of those who support her.

“I don’t think that will be a problem. Victoria has always attracted a disproportionate number of high-net-worth out-of-town buyers. We call them “locals”—the retired couple from Ottawa who rented for three months while they searched for the right property.”

They’re obviously not buying anything in Golden Head with the 20 odd price slashes of late, nor in the Uplands/Rockland. Must be buying on Bear Mountain/Langford. 😉

Prediction time re: SFH, folks. Prices go up another 15% in the next 12 months, then decline 12% over six years. Seven years from now the average sale price of a SFH will be the same as it is in the core right now.

Thoughts?

I don’t think that will be a problem. Victoria has always attracted a disproportionate number of high-net-worth out-of-town buyers. We call them “locals”—the retired couple from Ottawa who rented for three months while they searched for the right property.

You mean banks may have to actually start prudently evaluating the risk of their loans because they could be on the hook for losses? Oh the horror!

http://www.cbc.ca/news/business/lender-risk-housing-1.4225950

That’s the problem with propping up the bubble for so long, if you are introducing legislation it is either ineffective and politically acceptable, or effective and politically unacceptable. Remember the BC Liberals talking about how they really did want to make houses more affordable but not at the cost of reducing equity for existing homeowners? Laughable.

Yep, $200k is the 1% in Victoria for individuals. Maybe 3% of households make that. Just ain’t enough to drive the market anywhere in particular.

Yes. SFH will continue to get less affordable as the city grows. That is to be expected unless you have endless sprawl.

“There still may be a few that will pay extraordinary prices but they are not the majority of the marketplace. Those few buyers are just economic cannon fodder.”

Blows out all the BS stories on here of everyone they know is making $200K per household, but that’s because of who they hang with, not the real world.

Good riddance Christy. The photo op queen will try to get back into the media spotlight but good luck this time around. Her true despicable self has been exposed.

Christy resigned. I guess liberals are regrouping for a fight in a years time.. By election needs to be called within 6months. Gives NDP 6 months breathing room. Her riding looks like a safe liberal riding. Best thing for the liberals.

Luke ” That is, as long as those assets keep growing.”

I guess we’ll see what happens if the interest rate keeps going up or if BC brings in regulations like Ontario did.

Perplexing isn’t it? Why do house prices rise so much when incomes are more or less stagnant? We are all scratching our heads since it seems to make no sense and one day it has to end… doesn’t it?

It is getting a bit ridiculous now, but I think much of it’s about supply and demand. Simply not enough SFH avail. in the core anymore – no more land – and continued growing population. It’s not normal to own SFH in many cities around the world, and in the core we’re already there or heading in that direction.

On debt, and people financing/ using equity to get investment properties, etc…

I came across this article in the Times Colonist about how concerns on Canadian consumer debt could be overblown…? All that talk about how it’s gonna blow up in our faces could be ignoring the fact that the debt is being used to largely finance growing asset values. That is, as long as those assets keep growing…

http://www.timescolonist.com/opinion/columnists/livio-di-matteo-concerns-over-household-debt-are-overblown-1.21390450

Leo S “Right, but those purchasers don’t drive the market. Once they’re in they’re in. It requires a constant stream of first time buyers or out of town buyers to keep the market afloat.”

What I’ve been told by friends and what I suspect is also happening with others is that with the equity build up in their houses they are purchasing investment properties.

Once they are in, they can still drive the market.

A US company (outside of the tech sector) that I am familiar with in Victoria pays its Canadian employees about 5-10% less in CAD than equivalent positions in the US. So a 15-40% Victoria discount based on recent exchange rates. Houses are much cheaper in the US HQ city.

I suspect that for SFH in the core that most of the demand is driven by out of town buyers and not first time home buyers. I think that the stats showed that 25% of buyers in the core where out of town. I dont know how that breaks down between SFH and condos.

As for young families, I suspect that they will do what they have done for years in Toronto and buy their first home in the exburbs and commute. Somewhere in the last few years Victoria crossed a threshold and it is no longer a small town with cheap housing. The bad news is that the baby boom is just starting to retire (the baby boom in Canada started a few years after the US boom and not in 1946).

Maybe doing a flower count was not such a great idea.

It’ll be interesting to see how our local tech salaries shape up over the coming years. Starting a company here gets you cheaper local talent, and it’s really hard to find experienced people in Victoria. You’d expect that to drive up salaries.

And then you have remote workers who can take advantage of market rate + currency arbitrage. Win win for both parties there, esp if company is based in more expensive market.

An anecdote about tech salaries: an intern makes more than twice as much at a certain large tech company if they work in their US location compared to their Canadian one.

Right, but those purchasers don’t drive the market. Once they’re in they’re in. It requires a constant stream of first time buyers or out of town buyers to keep the market afloat.

Last I checked, Portland’s tech salaries were not that great compared to Seattle/Bay Area, even with COL priced in. But that was some years ago, and it might have changed.

Plus, Trump being in office is a chilling effect for some people in principle, and his crackdown on H1-B and other foreign programs is going to have an effect on how many outsiders US businesses can hire.

Still have to factor in the wealth affect of rapidly rising prices as prospective purchasers have larger down payments due to the sale/refinancing of their home. Yet the size of the mortgage buyers are taking on is getting larger and larger.

Given enough data resources you might be able to calculate when buyers income and down payments will likely top out. Or you could back engineer the analysis and look at the market to see if prices have flattened and that might indicate that the majority of prospective purchasers have reached their buying limit.

There still may be a few that will pay extraordinary prices but they are not the majority of the marketplace. Those few buyers are just economic cannon fodder.