July 24 Market Update

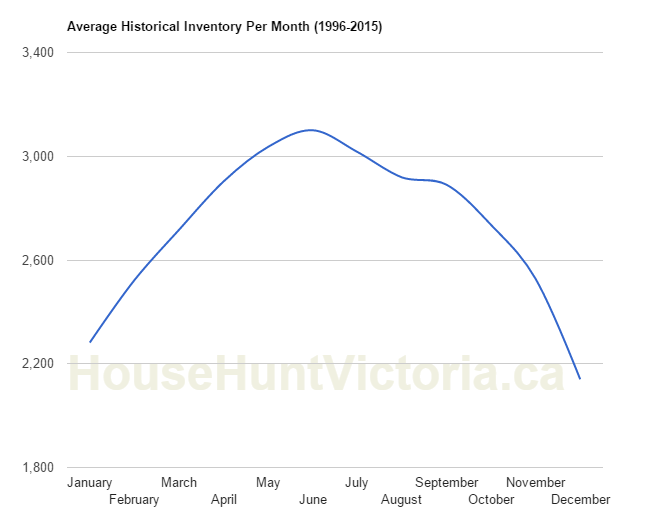

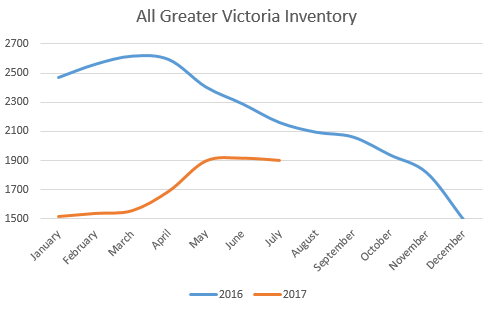

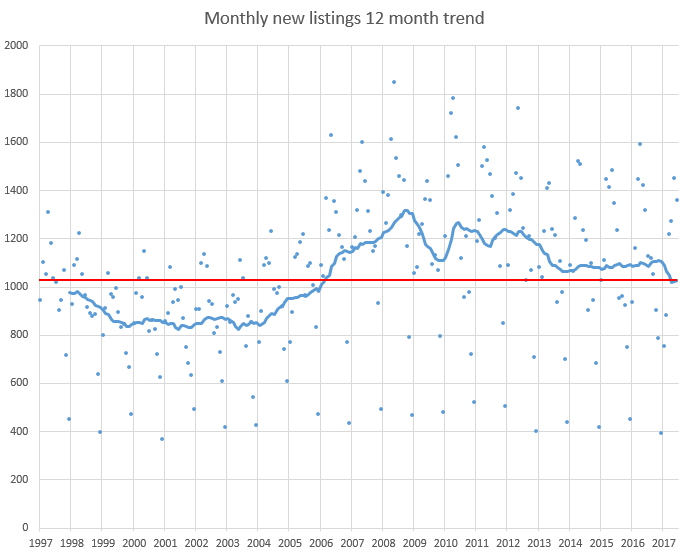

Doesn’t seem like we are going to get any more inventory out this year. It usually peaks in June, drops gradually until September, and drops more sharply after that to the low in December.

2016 was an abnormal year because inventory was drawn down throughout the whole year, whereas this year we are more on track for a normal seasonal pattern. However the pattern is squashed, since we gained only 400 listings from January to June instead of the average of 800.

Also weekly numbers courtesy of the VREB.

| July 2017 |

July

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 187 | 384 | 588 |

972

|

|

| New Listings | 315 | 582 | 842 |

1127

|

|

| Active Listings | 1972 | 1961 | 1963 |

2161

|

|

| Sales to New Listings | 59% | 66% | 69% |

86%

|

|

| Sales Projection | — | 778 | 797 | ||

| Months of Inventory | 2.2 | ||||

A few income stats: https://househuntvictoria.ca/2017/07/27/how-you-gonna-pay-for-that

Not totally sure on the local industry composition. There are a lot of contract positions – BCGOV is a fairly big consumer of local tech services. There’s a lot of startups here too, but in the grand scheme of things, it’s no major corporate tech hub. On an isolated little island city, that’s unlikely to change. You might be able to massage out an argument for Toronto, but nothing in Canada comes close to our neighbors to the south.

If I were local tech talent at the top of my game – I’m going to California, or Oregon. No contest. But I’m fairly mediocre talent at the middle of my game, so I’m probably staying here 🙂

Good points Local. I always thought the tech thing was overblown as per impact on housing. Correct me if I’m wrong but aren’t most private industry tech workers on a contract/self employed situation with no pensions, big benefit packages etc ?

Foreigners priced out of Seattle. First Golden Head, now Seattle ? Crash talk as well.

Foreign buyers drop off as Seattle housing market hits hottest tempo since 2006 bubble

http://www.seattletimes.com/business/real-estate/foreign-buyers-drop-off-as-seattle-housing-market-hits-hottest-tempo-since-2006-bubble/

Are Seattle housing prices headed for a crash?

http://www.seattletimes.com/business/economy/are-seattle-housing-prices-headed-for-a-crash/

Tech salaries in Victoria are lower than other markets, definitely, but house prices and overall COL should also be taken into account instead of just a raw salary comparison. With the run up of the last year though, I wouldn’t be surprised if we’re a bit too expensive in comparison.

Looking at Zillow, the median SFH price of SFO is $1.3mil USD, and the median condo price is $1.1mil USD.

Our median SFH is what, $875k CAD, which is a little under $700k USD.

So we’re a little too expensive compared to SFO. Which is not the best market to be compared to 😐

One of the things you hear some people argue here in relation to house prices, is how the tech industry is booming.

While I don’t have an opinion of the industry one way or another, the “booming” statement itself is often used to express or imply that that industry somehow will support current house prices, or even cause them to rise more. I believe this is false.

Months ago I argued that the “Techtoria” meme was actually more than 30 years old. And it is – indeed, Victoria has always been big on tech. So what? Yes, the industry may be larger than 30 years ago, however, I don’t believe there is any industry in Victoria that comes close to supporting current housing prices, let alone enabling them to rise further.

In tech, if you’re at the top of your game, you’re making a lot. But if you are in that cohort, you almost certainly won’t want to remain here. I just saw a picture via twitter feeds that depicts the level of regional skill-set vis-à-vis their labor costs. While it doesn’t show Victoria, it does show Vancouver and Toronto average tech worker salaries. I don’t suspect Victoria is much different.

Condo listings look like they got a bump up today.

935 Johnson St – 103 slashed $21K to $398K. I thought there were line ups around the block for 2 bdrm condos ?

Back from Calgary. Lovely city, but she ain’t no Victoria.

New Canadian banking rules called ‘game changer’ for real estate tax evasion

http://vancouversun.com/news/local-news/new-canadian-banking-rules-called-game-changer-for-real-estate-tax-evasion

Does anyone know why there’s an OECD index instead of just using the ratio? Is the index simply the ratio * 100?

Another Golden Head slasher, what’s that now ? Over 20 in the past month ? A duplex flipper slashed $50K at 4050 Magdelin St. How many agents can be so wrong in one month ? At least 20. 😉

“Either rents will continue to soar, or prices will drop.”

If the rents soar you’ll flipping your own burger at McRonnies.

I’d need 1.21 jiggawatts, or 1.21 million kilowatts to power the Flux Capicator (it’s what makes time travel possible). My car only generates 183 kilowatts, and I can’t afford Mr. Fusion…

So um, Victoria RE. I think our houses are overvalued and there is too much consumer debt floating around. Either rents will continue to soar, or prices will drop. 😀

https://betterdwelling.com/canadian-real-estate-prices-will-drop-or-rents-will-soar-show-oecd-numbers/

First you’d have to build the time machine to travel to the 90’s 🙂

James

If you looked at an overhead of where I live and where I work, the travel path would basically look like a large U-shape if I took the LS/GG trails. It would be way, way longer by bike. Even if I drove my car roughly parallel to the trails, it would still be quite a bit longer. If no traffic/all green lights, by car via 17S is 13 minutes. Just too quick and easy, plus I get to wave at Marko on the highway on many mornings. Never notices me, though. 😀

Hyperloop would be fantastic. Get to work in about 30 seconds.

Build some parkades on outskirts of downtown, like along Douglas/Government North of Chatham. Have reduced rates compared to downtown ones. Frequent bus service if you don’t want to walk the 3-6 blocks.

Well there’s your problem, LF 😉

That seems weird, unless you’re basically on the pat bay, don’t quite understand how it could be that much of a detour to get to lochside.

http://www.timescolonist.com/news/local/ship-point-revitalization-a-case-of-unpaving-paradise-1.21277682

Except that they’re…

Un-paving paradise and tearing up those parking lots…

They’ll put an amphitheatre in, some food trucks – for a swinging hot spot…

Don’t it always seem to go – you don’t know what you miss till it’s there,

They’ll un-pave paradise, and tear up that parking lot… boo wap wap wap, ooo bop bop bop bop…

(25-30 underground spots won’t be enough to replace those lost I’m guessing…)

The electric skate board guy is going to kill someone or himself one day.

The cops have been at the circle part of the goose where everything intersects. They have been trying to deal with all the illegal stuff. One guy has a homemade ebike that goes about 60km. a lot of gas powered stuff on their lately. NO gas and 32 or 33 km is the max for ebikes

The boards are illegal period right now they require insurance and ICBC will not insure them.

I’ve seen him a couple of times. The boosted boards kind of seem to defeat the purpose personally, since you never actually push at all, at least with electric assisted bikes you actually have to pedal. The e-bikes I have no problem with, the e-scooters that are fully plastic and look like a road vehicle have no business being on the goose.

I hate the ebikes and scooters on the Goose. Their too fast and they disrupt the flow.

The city should incentivize some developers to provide public parking when turning old parking lots into condos.

Has anyone seen that one guy on the goose – he wears a suit, but travels on an electric skateboard. It’s a funny site to see, and that board goes awfully fast too. Don’t normally associate skateboards and suits.

James, I’m in Broadmead. You could take Lochside, but I’d have to take quite a detour to do it. It’s just so much easier to take the car and zip down the Pat Bay, plus I don’t have a bike. I walk the goose during lunch though. 😀

A lot more ebikes on the goose. Not an ebike fan but anything that gets more bikers out of cars is a good thing. I understand the frustration of drivers at loosing lanes but for the society as a whole and where the trends are going also. Bike lanes are a good thing to get more people biking.

Victoria needs to build a couple more car parks. To help with the parking issue.

1743 Blair Ave – Disgusting. Even in GH that place shouldn’t sell about $750k.

2522 Kilgary Place – Should be listed for the Blair Ave price.

638 Kenneth St – Nice looking place. Poor location though and a smallish lot for that location and price.

4863 Stormtide Way – A bit of location and it still includes the original finishings and appliances (circa 1987)

Regardless, someone will pay those or close to those asking prices and that will be the new new normal, bumping up the bottom line for regular folk like me.

“Officials within Prime Minister Justin Trudeau’s government are concerned the Bank of Canada is moving too quickly to raise interest rates, fearing higher borrowing costs could inadvertently trigger a downturn.”

That’s hilarious LeoS. House prices can go to bubble territory because of lowering rates but they raised them too soon ? Agreed, a quarter point is zip, wait til it’s another 4 or 5 hikes over next year or so. 1981 all over again. 😉

Thanks for the counts James – very interesting.

One thing about those maps- they are focused on peak commuting hours. Once you get out to the peninsula and the west shore, “peak hours” on the Goose and Lochside would actually be recreational use on weekends not weekday commuters. I biked out to the ferry with my daughter on a sunny weekend earlier this summer and it was nuts how many people were on the Lochside.

Then we have the US bubble no one is talking about until today. When US long term rates rise with the QE sell off in bonds and things could get a wee bit shaky down south coinciding with Trump getting indicted by years end. Our long terms will rise as well, maybe much faster than anyone expected.

Some interesting charts.

“The Next Housing Bubble”

http://www.zerohedge.com/news/2017-07-27/next-us-housing-bubble-has-arrived

The hand wringing over a miniscule .25% bump is pretty dramatic. Goes to show how dependent our economy is on low rates. Anything approaching more normal rates would be a total disaster for an economy that is driven by consumer debt.

http://business.financialpost.com/news/economy/trudeau-officials-are-said-to-fear-impact-of-speedy-poloz-hikes/wcm/6d71b9d3-5668-4f7f-9421-5684835625e4

One of those unexpected events that will hit the housing in the US as well.

“Fed watchers are also waiting for the central bank to announce when it will start gradually paring its enormous $4.5 trillion US in holdings of Treasury and mortgage bonds, which it accumulated after the financial crisis in a drive to ease long-term borrowing rates. Some say they think the Fed will begin in either September or October to gradually shrink those holdings, a move that’s expected to put upward pressure on long-term borrowing rates, including mortgages.”

http://www.cbc.ca/news/business/federal-reserve-rate-decision-1.4222634

The newsy bit is not that the Fed left rates as expected, but that the Fed’s comments are now being interpreted to indicate the rate hikes could be “more gradual” than earlier indicated – perhaps no more hikes this year.

“In her congressional testimony Yellen didn’t rule out another rate increase this year. But investors have themselves grown more uncertain, with the CME Group’s closely watched gauge foreseeing a 52 per cent chance of another rate increase by year’s end.”

Here are bike counts for the crd. They don’t do total number though, only numbers for intersections during a peak hour travel time (which should be twice a day)

https://www.crd.bc.ca/about/data/bike-counts

Nice place in Glanford at 638 Kenneth St slashed $44K.

Another nice place in Cordova Bay at 4863 Stormtide Way slashed $120K.

Golden Head is getting stranger by the day. 2522 Kilgary Pl jacked the price up $2000.

Then we have the creme de la creme of Golden Head at 1743 Blair Ave slashed $30K. Is Introvert selling out ? He did say his maintenance costs were extremely low. 😉

Not too many train tracks left that they can turn into bike paths. Where do you live? Probably a route to the goose.

In my observation nobody on the roads actually follows all the rules. Most bikers and drivers fail to stop completely at stop signs and to stop at a red before turning left. Most cars speed to some degree. A proportion of bikers jumps the gun on lights or ignores them completely. Many drivers fail to signal for turns and so do bikers. The list goes on….

All that said I find most road users courteous.

It’s tourist season now so there is definitely a higher proportion of confused drivers and oblivious pedestrians downtown. (I am sure in their home countries standing in the middle of a crosswalk taking pictures after the light has turned is a bad idea – why do they think it is OK here?)

They just increased their rates in June, there was no way they were going to increase again in July. Dumb article. They planned on 3 increases this year, and they’ve already had 2. Next one won’t be until late in the year.

The Goose is so great. I wish it came near my place, because it’s right behind my work. Would be a nice bike ride. Dedicated thoroughfares without hobbling existing infrastructure are something I think this city should focus on…

That applies to every segment of traveller. There are many bikers/pedestrians/drivers who need to follow the rules.

I’ve seen fewer cars turning right on reds onto/from Pandora than when the bike lane opened, so that’s nice. I’ve yelled at those cars from a bike and on foot, and honked when driving.

Hi Barrister

I am a hard core biker 365 days regardless of the weather. I save about 3 to 4k a year doing it Parking /gas/ lower insurance. Also good exercise. The counter in the winter hovers around 1000 to 1500 per day on the goose. Pandora will have a review and periodic counts. Someone came out from the city and said ridership has been growing and it is where it was expected. Not sure what that means. These lanes get the less experience/ weaker bikers out. For all the bitching I hear about bikers and the lanes. Only ever had one issue with a driver. Everybody is very courteous to each other. There are a few biker who need to follow rules have to admit that. I just think it is good for the city and the environment to get the bikers biking instead of driving. Without the Goose I would be in my car. Too dangerous otherwise,

@ Jerry

Window Cleaners, we tried a whole bunch but these guys are the best we experienced so far. Check out their homestar rating. Prices are reasonable and do a really good job. Good luck.

Kirby Koochin (Manager)

http://www.aglassact.net

“Gotta think there are thousands of jobs concentrated downtown, or within a 10-15 minute walk of Douglas+Yates. Government workers alone might number in the 4-digits. Would love to see some stats though.”

The four largest government office buildings must house close to 2000 employees alone. 1810 blanshard, 1802 douglas, and 1515 blanshard each are in the 400-500 staff range. And the new government office behind the leg will have over 800 staff(with no one moving from the finance/health buildings I mentioned above). Exact numbers are probably pretty easy to locate for 1810, 1802, and 1515 as those are the offices for Finance and Health.

And the new building(near the leg) I believe has an active tender out right now for moving companies to move their staff.

There are a dozen buildings throughout downtown around st anne’s, on broughton, courtney, bastion square, etc etc that each house another 50-100 staff for all the smaller ministries. But many of those will empty temporarily with the move to the new office building.

Barrister. Counter on goose counts every bike that passes it whatever direction they are travelling. 3000 would be the total for a good weather weekday. Mix of commuters and rec. Usually less on the weekend. Though on really nice weekends I sometimes see totals approaching 3000 as well. 1500 on a winter weekday. Less on really awful days. I’ve noticed the counter misses some bikes. Not sure why. Actual totals could be a few percent higher. I bike Pandora from time to time. Bike usage has increased since the lanes have gone in. Not yet at the level of the goose.

Pandora bike lane is slower because you only get half the green light cycle and because it’s often tough to pass slower cyclists. Yates, Johnson, Fort, etc. faster than driving at peak times usually.

Bikes take from bus and cars both. Plenty of cyclists who own cars and could afford parking downtown instead choose biking for health, cost, time. From where I live it’s a 10 min ride to work. Easily 15 mins in car with traffic and parking in parkade and can be up to double that on bus if timing isn’t right.

GWAC: So what are the daily numbers for Pandora? I see the city doing a count but they dont seem to want to release the number ( I have asked to no avail). By the way I think the galloping goose is a great trial for bikes. While we are at it is there somewhere one can get the actual count? Also does the counter only count one way or does it count people returning as a separate trip? A daily breakdown would also be interesting. Is use highest during normal commuting hours or is it principally used on weekends or during the day, What is the usage during winter months? I think the goose is a good idea regardless but if it is principally used for recreation then the argument regarding reducing traffic is less compelling. But comprehensive numbers for Pandora would be more enlightening.

Gwac, bike lanes probably free up more seats on a bus than cars on the road.

Barrister

Please show me that about bike lanes in an article. I have heard the opposite. Pandora is well used. Bike lanes keep them coming.

More people on their bikes frees up car lanes. Over 3000 use the galloping goose per day. There is a counter at the end of it.

Usage of the bike lanes has been much lower than expected. Faster apparently on side streets.

There are more obs in the TD Center (Toronto) than in all of downtown Victoria.

LeoS , US rates not changed but plans for shrinking the QE bond holdings will push up long term mortgage rates as per AP News.

Douglas,Fort,Yates,Johnson, Wharf , take your pick. Aggravation plus. Shit drivers who block intersections and can’t see they had no hope making it, double parkers etc etc. Been getting worse the last year as I use them regularily. Throw in construction with lane closures and it’s even worse.

Not to forget the new bike lanes where trucks/buses take up both lanes now.

Welp, as a side-effect plenty of people use them for actually biking!

Gotta think there are thousands of jobs concentrated downtown, or within a 10-15 minute walk of Douglas+Yates. Government workers alone might number in the 4-digits. Would love to see some stats though.

Bingo: np, sorry for prematurely whetting your appetite 😉

I didn’t know that. Then those dispensaries should be shut down immediately. Because it isn’t medical Marijuana their selling they’re just dealers and this is what you do to dealers.

https://youtu.be/p1rmRwm2CIc

JD

Oh yeah, which one? I know paramedics.

Uh huh. So why isn’t Chek news or TC etc running stories on fentanyl laced weed? Seems like a good story and something people need to be warned about.

Plenty of stories along the lines of half of MDMA and cocaine tested is laced, but none on weed… if your claims are true, then why isn’t Saint Johns or the VPD etc going to the media?

Didn’t we ban bad puns?

You don’t know where weed is coming from if you buy it from a dispensary either (they aren’t all supplied by licensed growers). Lacing it would be bad for business, but it’s not like a dispensary is going to test their product (I mean, other than sampling it).

US already backing off their rate increase agenda, leaves rates unchanged. http://www.cbc.ca/news/business/federal-reserve-rate-decision-1.4222634

James:

I am a Toronto boy and you are right about the people that lived downtown. The difference is that Toronto had thousands of jobs downtown and Victoria does not have any real concentration of jobs right down town.

John/Jack has been negging Victoria as long as I can remember.

Just Jack:

“Don’t get me wrong, if you have mediocre expectations in life, Victoria is a good as most places to live.”

I don’t think there is much if any evidence that “most” people that move here move away. For one things Victoria’s growth is entirely due to migration. If we were relying on natural population growth (births-deaths) we would be shrinking.

Anecdotally I know a few people that have left, primarily due to job situation not working out. I can only think of one couple moving away specifically because they didn’t like it here. I also know a few couples that have kept Victoria jobs but have moved up Island and telecommute with occasional trips down.

Yeah, aside from Wharf, and the light at the blue bridge, the roads downtown aren’t used for much aside from parking. Don’t know how having more people downtown would add to gridlock, when I lived in downtown Toronto, most people didn’t own cars, and those that did avoided using them as much as possible.

Garden:

The primary purpose of bike lanes is for the city to be able to waive parking requirements in developments.

Where do people experience “gridlock” downtown? I don’t drive through downtown often, but when I do I never experience bad traffic. The one exception is going along Wharf Street in the afternoon evening, especially when there are cruise ships in town.

The places I do find frustrating for traffic are not in the downtown: Douglas getting past Uptown (especially in the evening), Tillicum and Mackenzie on the TCH, Leigh Road on the TCH, Blanshard around Uptown only in the evenings, crossing the Blue Bridge into downtown some mornings. Other than the TCH backups that actually are pretty bad most of these are minor inconveniences.

Garden Suiter

OMG. That looks amazing. I love seafood and now I’m really really hungry. Thanks for the tip!

I hope that bus priority lanes work out to alleviate some of that gridlock. That and getting more biking infrastructure in place.

Where generally did you have in mind?

Liberals did a horrible job I agree. Money is not the full answer though. Need to rethink the whole approach. Dealing with the drug and homeless issue is an investment in the future. Just need to find effective solutions that works over the long haul.

Christy is a reactive not proactive politician.

Good luck Hawk wish you the best where ever you end up…

BTW, just because someone finds Victoria’s changes unappealing is not “hate”. I love this place, I just don’t like the densification of the core as it will create one massive fuck up in the next 5 years with total gridlock worse than today. I’m out to the country once some personal events line up in the next year.

“Hawk sorry thinking the present policies are not working is not redneck.”

Whose been in power for the last 16 years gwac ? You’re liberal(actually conservative/right wing) buddies. Christy turned her back to the problem as it mushroomed until a year ago when election time came around. Funny how that happens.

Meanwhile those who work the streets like Luke see it first hand and try to put a bandaid on it with the limited funds they have.

I’m hoping the NDP/Greens will produce some real action like Portugal to deal with this ASAP, and am confident they will at least try hard unlike Christy’s and her useless AG’s pathetic effort.

No need for anecdotes about people coming or going. The proof is in the population numbers and vacancy rates. Not a swarm of boomers arriving as people have predicted over the years but steady growth for sure.

Bingo:

We are debating whether we want to stay in Victoria, starting to be a bad combination of too Americanized and left coast loony. Sometimes it is just easier to move.

JD

Sorry JD you are right it is obvious that you actually love this city. Hate was never used only true love. My mistake.

My source on the fentanyl laced marijuana comes from a Victoria paramedic.

The person that has to deal with this epidemic everyday and doesn’t have to wait for a study to be finished to confirm what he experiences.

If you don’t know where your joint is coming from, then who’s the dope.

You’re the only person using the word hate.

Go back and read what I wrote. If you find any of the lies you’ve just spouted then quote them.

No intolerance John. You and your friends can hate Victoria all you want. I am just expressing another view. The people I know love it here. I just cannot understand why anyone would stay if they hated it so much. Too each his own. Stay and hate.

JD

Hmm.. all googling of marijuana laced with fentanyl come ups with articles similar to No proof of fentanyl-laced marijuana in Canada

Oh, and Christy Clark claiming it has been found in marijuanna (with no evidence to support her claim).

Pretty quick to show intolerance for others opinions GWAC, that’s part of the Americanization of Canada.

Bingo: check out Local Ocean when you’re down there https://www.localocean.net/

My anecdotal evidence is much like gwac’s: most people I know who moved here don’t want to leave. When I was living in Toronto for years, a significant number of people told me that I was crazy to move there. A handful said they didn’t like Victoria’s slower pace.

I like the coffee, food, and beer cultures here. I’m not as into the music or large public gatherings, but I’m glad it’s happening.

Thanks gwac!

barrister

It’s 2 up 2 down, which is ok but kind of a pita. We can live with that. One of the previous owners ‘suited’ the basement, and it’s crap. The layout is all wrong so we don’t use most of the space (other than my office and the laundry). It just doesn’t integrate with the rest of the house well and has lots of dead space that isn’t functional.

I won’t bore you with the details, but basics are we’ll have bigger bedrooms, a bigger media/family room, smaller laundry, better laid out bathroom and a wet bar area with wiring for a stove (in case the next owner wants a suite or we start hosting dinners that require 2 ovens).

If we start using the space after those changes, we’ll probably stay quite a while. Great neighbours, convenient location. 0 complaints on that front. At least we’ve decided we’re staying in Victoria. Too nice to leave was the consensus (interior and up island were discussed).

I do have a trip south planned though. We’ll see what the wife thinks of Newport and SD and wherever else we hit up (visiting some friends).

Hawk sorry thinking the present policies are not working is not redneck. Policies need to change in order to deal with the problem. Look around the world and see what really works and try it out here. Arresting and releasing and arresting again and buying more building for the homeless are not sufficient policies to solve the issue.

Spending more money on the same useless policies is not the answer,

The illegal drug dealers are lacing pot with fentanyl to develop a new market for harder drugs as they have lost market share to the medical dispensaries.

Ironic that people that can not get access to medical pot are now ten times more likely to overdose by buying off the street. Your kids watch you toke up and want to try it so they buy it illegally and die.

John

Maybe its time you found greener pastures. You have expressed over and over your distaste of this place. Life is short.

I guess we follow different crowds. 🙂

GWAC, I know more that left and are about to leave.

-So much for anecdotal bullshit.

Depends on what you think culture is. Most Canadians think any place that serves beer in a chilled glass is a classy joint and Adidas is formal wear.

John

I have about 50 people I know who have moved here. Not one wants to move back east. 2 did because of Jobs and quickly found a way back from Toronto.

“Victoria DT crime is a result of its politicians/citizens left leaning hug it out policies.”

gwac,

When you post stuff like that it falls under that category. Can’t have it both ways.

Hawk not against any new policy just against the spending more on the old ways, Legalizing drugs from what I have read may be the way to go. A few countries have done it with promising results.

Layoff the names Hawk. Really serves no purpose.

“And that’s what I have consistently found about most of the people that move here. After about 4 or 5 years the novelty wears off and they leave. Victoria is over rated, over priced and way out there at the end of Canada.”

Known a few and less than 4 or 5 years. The traffic congestion downtown is just a shit show these days. Avoid at all costs if you can.

The rednecks like gwac should watch how Portugal has dealt with their addiction problems and in 10 years cut the addicts in half and have mobile methadone.

90% of costs to policing now go to addictions and crime drops huge as they don’t have to steal to stay alive. We’re spending 70% to policing. Legalized drugs to stop the fentanyl crisis is the only route to go.

The National had an excellent segment on it.

https://www.youtube.com/watch?v=uQJ7n-JpcCk

The climate here is relentlessly temperate, and plenty of people want that with bigger city amenities/vibe. Screw charm, I want culture. There are a lot of other smaller cities/villages in our area of the world if you want charm.

Barrister my neighbor said close to the same thing. They used to live in Victoria back in 2005 but left for Ontario due to better wages. Four years ago they came back to Victoria and started a business. Now they want to sell and go back to Ontario. They said Victoria is not what it was prior to 2005 it has become just another North American city without the charm of the past. They even said that with the way Victoria is changing it will be like Hamilton in a couple of years.

And that’s what I have consistently found about most of the people that move here. After about 4 or 5 years the novelty wears off and they leave. Victoria is over rated, over priced and way out there at the end of Canada.

You can live in Oak Bay fantasy world all you want but that is a lot of B&E’s and Thefts from Vehicles for such a small place. Seems to be an increasing problem, not declining.

https://www.oakbay.ca/sites/default/files/police/June%202017.pdf

What is their definition of “Americanized”

I had friends come up from Seattle last week and they said that they were shocked at how “Americanized” the city has become over the last seven years since their last visit here. They still enjoyed Oak Bay but they decided that downtown was a place to avoid. I was about to say something when my wife pointed out that five years ago we used to frequent a number of restaurants downtown but that we no longer go there because of how unpleasant the downtown has become. She is right when I think about it.

This would transform the Cowichan Valley and lead to a new ‘crawl’ on the Pat Bay Hwy (and less traffic on the Malahat). Also, no more need for the Mill Bay ferry. However, my bet is the folks up in North Saanich would never allow it, or at least – would fight it to the bitter end.

My thoughts are it’s a great idea, but upgrades to eliminate traffic lights on the Pat Bay Hwy would also be needed. My friend who lives north of the Malahat won’t come down to visit now b/c of the construction delays. Others who I work w/ who commute from up there must be near expiration (I don’t know how they do it)!

Yep throwing more money at the problem is going to work. Mize well just light is on fire. We all ready spend over 50k per homeless person in Victoria.

Totally true, there is a huge divergence between downtown and anywhere else… that said, parts of the Westshore (in my experience anyway) also have some strange things going on at night.

Maybe I don’t know enough about Helps and her crew’s (at the risk of a GONG) policies, but maybe let’s give the New Greenocrats a chance to do something about the disenfranchised folks who have suffered so long under 16 years of the Liberal policies? I do hope they can make a difference, though an extra $100/ month for IA isn’t the only answer… they have their work cut out for them.

Might interest you to know that Welfare Wednesday and the nights after are among the most crazy nights for incidents around town.

Maybe the NDP can get this done. A bridge. Boys a VV starting up the discussion again this morning. It is needed as the region grows.

https://www.facebook.com/vibrantvictoria/photos/a.10150666653149362.416894.182655059361/10155508509354362/?type=3&theater

Victoria DT crime is a result of its politicians/citizens left leaning hug it out policies.

Rode along with the latter many times. Noise complaints, more than anything.

No. But I’m sure you’re very talented at it.

Victoria’s crime issues are largely concentrated in the downtown core if you look at the crime maps. The Oak Bay and Saanich crime indices are over 200 ie. very safe overall. I was surprised at how poorly some of the Okanagan cities scored.

Local Fool – on the crime you might be surprised that in my job I’m out there all over town on many evenings and have lots of knowledge of what’s going on. I’ve been involved in a few incidents w/ the Vic PD and they do a great job. Also, I tend to avoid the Westshore at night because it’s often even more crazy than downtown. It’s often scary, and yes there are crazy people about (drugged up or mental health issues) – but given my experience working in downtown Vancouver in the past I still find Victoria tame compared to that. Something about the island crazies is different and I can’t quite put my finger on it. I do have an ability to calm people down it’s quite a gift. Maybe I’m living in shangri-la land a bit, but also I’m more prone to be an optimist than anything. Why focus on the negatives? We do have so much to appreciate here so I focus on that… which is why my fav. quote from Churchill was ““For myself I am an optimist — it does not seem to be much use being anything else.”

The other thing the article did say was at least crime is way down from 2006, so that’s a good thing. That said, one day I may find myself in trouble, but it comes w/ the job… which you’re now trying to guess what it is 😉

Recommending annuities to a self-employed DIY landlord is like recommending penny stocks to an 80 year-old retiree in a nursing home.

The investor in question had the foresight to empower himself by investing in real estate early in his career, has been un-tempted to cash in on his current windfall due to tax implications and losing his cash flow and you are recommending annuities?

It should be obvious that 3Richard Haysom is not your mark but perhaps you are just trolling for other fishies…

Thanks JD for the OB stat’s – I found this link on Churchill quotes that you might find interesting. Lots on there could be tied to real estate or for our own current provincial politics…

Some of my fav’s:

“You must put your head into the lion’s mouth if the performance is to be a success.”

“The true guide of life is to do what is right.”

“Can a people tax themselves into prosperity? Can a man stand in a bucket and lift himself up by the handle?”

“How often in life must one be content with what one can get!”

And my most favourite of all… “For myself I am an optimist — it does not seem to be much use being anything else.”

My mum (who lived through the war bombings) always said he was the man who saved England. That man had many more good, and funny, quotes (could’ve had something to do w/ all that whisky he drank and pipes he smoked)…

https://www.churchillcentral.com/quotes

Generally not a new phenomenon. When I started my undergrad years ago, did a bunch of criminology. Victoria at the time was pretty much #1 for violent crime. I believe Thunder Bay ON was worse. I think it slipped from then, but I wouldn’t be surprised if it’s experiencing another uptick. Some of it is probably climate related, as many homeless come in from other areas partly for that reason.

Hawk is right re the scanner. If I could sit down with Luke and have him listen to VPD traffic over an evening, he might be a tad shocked. Our little “paradise” has a wee little secret…

What’s a 2 bed Hillside condo ? $350K versus as SFH at twice that ? Like duhh.

“Apparently Victoria leads the province in violent crime rate and is #8 in the country.”

strangertimes,

Put on the online cop scanner once in awhile, it blows your mind how many whacked out people are in this town and the insane shit we never hear about.

2-bedroom 2-bath condos are nuts right now. Showing a 2 bed 2 bath on Hillside today and there are 12 showings booked for today. I think it might be as people are substituting SFHs they can no longer afford with condos? Similar phenomena in Vancouver, the top end fell off but condos/townhomes still hot.

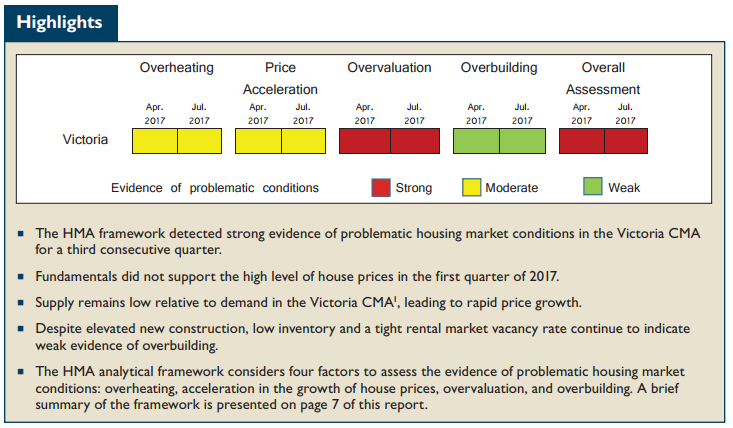

“I don’t see how they can conclude there’s even weak evidence for overbuilding from what they outlined in the report.”

CMHC might want actually leave their office once in a blue moon and see the massive amounts of cranes never seen before, plus all the Westshore building. This why bubbles blow up bad when incompetence runs the system.

Did you catch the segment on CTV VI about the restaurants shutting down in prime seasone because they can’t find cooks with the shitty pay and high cost of living here ? Another canary to think about. Makes you wonder about the quality of the ones still operating.

Apparently Victoria leads the province in violent crime rate and is #8 in the country.

http://vibrantvictoria.ca/forum/index.php?%2Ftopic%2F6252-victoria-tops-violent-crime-list-in-bc-despite-overall-incident-drop-statscan%2F

I don’t see how they can conclude there’s even weak evidence for overbuilding from what they outlined in the report.

New CMHC report out.

https://www.cmhc-schl.gc.ca/odpub/esub/68649/68649_2017_Q03.pdf

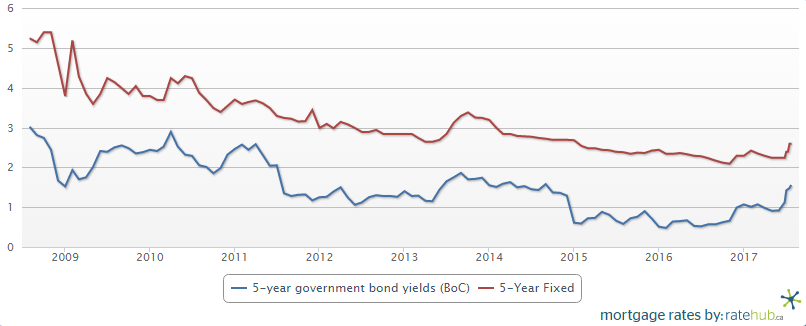

Thx for that chart, Leo. Does seem to be a pretty steady spread of 1.25 to 1.75 between the two.

2% 5yr bond will be about 3.3% 5 year mortgages.

Local Fool 😀

Huh, that is an interesting trendline Hawk. Also the note about how their data collection improved on 01/01/2016, wonder if that affected the results any.

I don’t envy anyone in that situation, and it’s sad that our culture encourages projecting a large lifestyle to the detriment of financially sound behaviour. We’ve always tried to live well within our means, not buying much, and buying used for what we do need. We roadtrip + camp for vacations. Only bought a car (used) recently. It’s easy for us to do as a relatively medium-high income household though and we’re lucky that we have that choice.

Yep it’s real tricky when many are contemplating bankruptcy but don’t want to tell their friends. Old buddy of mine in Van just went into foreclosure, lived large, and now paying large. Bankruptcy most likely next but you would have never known it with all the big talk/business deals, trips and toys.

Google is an interesting predictor too. 😉

https://trends.google.com/trends/explore?date=all&geo=CA-BC&q=file%20bankruptcy

Well, you can never till what will happen. 😀

Yup, just goes to show that predicting the future is tricky at best.

“Whereas perhaps we should have had a correction in 2008 or 2012, we doubled down on credit growth and punched it into the stratosphere.”

Let’s not forget the big one when Harper bailed out the banks for $114 Billion to save the banks asses of bad/shaky mortgages that got flipped into CMHC for the taxpayers to deal with. All done in secret of course to prevent what should have been was a natural correction and credit tightening.

Our banks are just as loose as the US were and falsely paint themselves as the elite of the world in conservative lending. Just ask the employees, they know how this debt bomb got here.

“The recent collapse is the climax, but not the end, of an exceptionally long, extensive and violent period of inflation in security prices and national, even world-wide, speculative fever. This is the longest period of practically uninterrupted rise in security prices in our history…

The psychological illusion upon which it is based, though not essentially new, has been stronger and more widespread than has ever been the case in this country in the past. This illusion is summed up in the phrase ‘the new era.’ The phrase itself is not new. Every period of speculation rediscovers it…During every preceding period of stock speculation and subsequent collapse business conditions have been discussed in the same unrealistic fashion as in recent years.

There has been the same widespread idea that in some miraculous way, endlessly elaborated but never actually defined, the fundamental conditions and requirements of progress and prosperity have changed, that old economic principles have been abrogated… and that the expansion of credit can have no end.”

The Business Week, November 2, 1929

“The jump in the CAD just equated to several percentage increase in interest rates in terms of its effects on the Canadian economy. Look for the BoC to stay on the sidelines for a while.”

In a perfect world, but it isn’t. A rising loonie may effect international investment in real estate but does nothing for the average joe which is why they raised rates.

With Canada predicted to lead the G7 it’s a no brainer the “emergency rates” are going to be history as reality of a bloated bubble and debt bomb kicks in.

Generally, yes. Back in 2012 he opined that it was all over, and housing analyst Ross Kay was of the same view. Of course, they were dead wrong.

To balance that out a bit though, I think some of the expansionary polices put in place around that time had its effect on the housing market. Whereas perhaps we should have had a correction in 2008 or 2012, we doubled down on credit growth and punched it into the stratosphere.

Today, he’s essentially saying the Toronto market is cooked, going down in flames. We’ll see – if it is a bubble burst, then I suspect that’s what will happen. If it’s a market pause, then you might be see something more like Vancouver.

It will be interesting to note OSFI’s M.O. in September. To stress test, or not stress test? That is the question…

Gwac: thx, that makes sense and I figured it was something like that.

Doesn’t he also have a less than stellar record predicting housing market crashes? ie. he’s been predicting a crash any time now for a while? I’ve seen some comments on the internet to that effect but don’t follow him myself.

To bring the high-flying financial discussions crashing down to earth: does anyone have experience of a good window-washing firm?

“Mature trees shading a home will add value to the property as climate change takes its course. My prediction.”

Ah yes! The perfect tree is a well placed deciduous tree near the south west corner of the house. Its full canopy shades the roof in the summer minimizing attic heat gain and then sheds its leaves to allow the sun through for some pleasant heat absorption over the winter months! The only drawback are the leaves in the gutters/eavestroughs in the Fall!

Funny—I moved to Gordon Head partly because it has lots of mature trees.

Mature trees shading a home will add value to the property as climate change takes its course. My prediction.

Canada 5 yr bond at 2% does not equal 5% mortgages. More like 3.5 to 4%.

Also bear in mind that Garth has a less than stellar record predicting interest rates.

The jump in the CAD just equated to several percentage increase in interest rates in terms of its effects on the Canadian economy. Look for the BoC to stay on the sidelines for a while.

Not to mention the impending collapse of BCs biggest industry. Once it’s legal the profits will go to the big commercial growers. Hothouse pothouse. Either way a chunk of money out of the demand side again.

Will be interesting if the new stress test rules are implemented. Normally the “consultation” periods are just a formality but if prices collapse in Toronto and rates rise then they might delay or water them down a bit.

No gas plant, no site C damn and maybe no pipeline plus probably permanent major tariffs on lumber.

BC might be looking at a few headwinds the next few years. If house construction slows for any reason then things could be a little rough here.

Garden

Yes that should happen but competition plays into things and the spread may change up or down from the bond yield. Also all these new rules may make it more expensive for the banks to operate their portfolio so they may increase spreads also. So the answer is yes with other variables.

Does an increase in bond yields scale linearly with an increase in fixed mortgage rates? ie. 5yr bonds going from 0.5% to 2.0% would likely mean 5yr fixed mortgage going from 2.4% to 3.9%?

The Golden Head slashes keep on rolling in at 1848 San Pedro Ave, but this one is for a measly $2000. Seriously ? Why waste everyone’s time, shit or get off the pot.

Interesting Garth quote tonite. He seems to back my prediction that this is the beginning of a much higher run on rates than many are expecting. AKA a bullkilla. 😉

“Because interest rates are going up. Way up. The Canada five-year bond that was 0.5% a year ago is now at 1.65% and on its way to 2%. That’s a 400% increase in debt yield, and it will translate into, yes, 5% mortgages down the road.

Anyone born after 1960 has no idea what this might mean.”

Sort of except for the other safe-type options for investments and the fact that a mortgage can be broken. BTW that was the one the lender voluntarily waived the penalty for switching to RBC low rate variable.

Only way to deal with the malahat and the population growth is find a way to get people up there and down another way. A bridge will eventually have to happen.

Playing with it with more and more construction is not going to solve the issue during rush hour and crashes.

So do the Langford buyers factor this in? http://vancouverisland.ctvnews.ca/construction-causing-hours-long-traffic-jams-on-the-malahat-frustrated-drivers-say-1.3517357

Kind of like choosing a 10 year mortgage term then. 😉

Time to take a look at Oak Bay houses again and see what they have been up to this year.

Since the beginning of the year there have been 152 house sales ranging from a low of $758,777 to a high of $4,400,000. That’s one hell of a spread. Even when you take out the two waterfront sales that only drops the top end down to 4.1 million.

The median price for a home in the land that was once known as a bit of olde England is $1,264,000 . And that will buy you a circa 1950 2,500 square foot home on a 7,300 square foot lot. Basically a property that in most of the rest of the world would be considered a middle income house. Not executive, not custom, not an architectural marvel – just a box – an old box. The same kind of houses you will find in North Surrey or New Westminster or in any other city in North America.

On average it has taken 26 days to sell a house in Oak Bay this year with about 2.25 months of inventory. Sadly new listings have not kept pace with sales this July as summer vacations have kept people from listing their homes and new listings dropped by half this month while sales stayed constant at around one a day.

But contrary to what you might think. The average price, the median price and the median sales to assessment ratio is down this month from June.

Month Sale Price, Median Sale Price to Assessed Value Ratio

Jan $1,550,000 122.8%

Feb $1,288,750 122.0%

Mar $1,149,000 118.5%

Apr $1,238,500 116.7%

May $1,285,000 119.0%

Jun $1,256,500 121.4%

Jul $1,169,750 117.6%

And how about the sale to list price ratio that people love to talk about. Well it has dipped to its lowest point this year with the average property selling at 99.1% of its asking price.

Month Sale Price to List Price Ratio

Jan 100.3%

Feb 98.6%

Mar 97.4%

Apr 100.5%

May 100.0%

Jun 99.6%

Jul 99.1%

In the words of Winston Church there are three things wrong with Oak Bay.

Over rated

Over priced

and

Over here

Cadborosaurus

July 25, 2017 at 2:16 pm

Why lose sleep over leaving cash for your heirs when you’re in the middle of your life? Spend on them now so that they can enjoy it before their own middle age, or better yet raise children to be self-sufficient. Unless your kids are incapable of caring for themselves after you are gone, this seems like such an odd variable when selecting where to invest your money today.

While I agree with everything you wrote, one thing you forgot to take into consideration is life can throw you unexpected curveballs — unexpected health problems, for example, can completely derail someone’s life — and are becoming significantly more common — divorce, etc, so yes, if you can leave a little something to your children, for them to be comfortable, no matter what life throws at them, it’s a nice thing to be able to do.

Yes. Although in Canada you are normally insured for annuity payments up to 2k/month.

If interest rates were higher a lot of guaranteed investments would have higher return.

Yes, although there is zero payout until 55 at the earliest. Someone self-employed and retiring earlier than that will absolutely need to have another source of income.

If you are concerned about risk to the degree that you no longer care about your invested capital, save more and buy a government savings bond instead. Unless you are over 70 even the experts don’t recommend annuities and even then it seems like not a great choice to me for peace of mind.

Here is an example of why (not mine) with math and risk:

http://tpcfinancial.com/blog/annuities-beware/

“Annuities give up return in exchange for absolute security”

Unless the insurer goes bust.

Nothing wrong with annuities in a higher interest rate environment especially if you do not have enough guaranteed income. The last 10 years been better off in a dividend fund. Times may be changing.

Different people have different risk profiles. Just because you don’t like annuities doesn’t make them horrible for everyone. Annuities give up return in exchange for absolute security. You are arguing that it’s better to take more risks which is likely correct but doesn’t change the fact that you’re taking on more risk and some people don’t like that.

Bingo: what is it about the layout that you dont like?

caveat emptor

July 24, 2017 at 11:21 am

http://www.sightline.org/2017/07/05/stop-blaming-foreign-home-buyers/

Interesting report from a Seattle perspective. Not sure I agree with their conclusions WRT Vancouver (only modest foreign buyer impact). The Seattle/Vancouver comparisons are interesting. Seattle is expensive but clearly not in a bubble. Vancouver is clearly in a bubble.

This article sheds some light on the impact of foreign buyers. It states Chinese buyers accounted for 1/3 of the value of sales in 2015. That is not even including Russian/US etc buyers. I think it’s fair to say that a foreign buying spree scared the locals into a local buying spree which led to the current bubble in Vancouver. Now the question is, is that money looking to stay in those homes regardless of a decline in resale prices, or is there going to be a massive exit to a safer investment? Especially now that the money is clean and can go anywhere.

“Petronas LNG, whom was spearheading the 36 billion dollar Pacific NorthWest LNG project in BC has just decided to shelve the entire operation…”

Funny, I called it well over a year ago while many like Mike guaranteed it. Won’t happen in Saanich Inlet either as I predicted. Christy and her gasbags pumped the lies, the sheep bought it and is why they deserve to be sucking the hind one.

Not that anyone should ever be so bold to make calculated predictions based on market economic valuations eh VicInvestor? It’s just not right, dammit. 😉

Bingo

Good luck with whatever you decide.

gwac

No. Not serious enough at this point. I’d hate to fall in love with a place only to not be in the position to make an offer. We have some renos to tie up, then live with them for a bit to see if that settles our urge to move. Our main issue is not loving our layout.

I have gone to a few open houses, but for places friends/family are checking out. I did go to one on a whim since it was a similar house to ours (see how they handled the layout).

You clearly haven’t read through the annuity options, and this is the 3rd time I’ve said it, so I’m done with this conversation. You’re clearly smarter than anyone providing annuities, and it’s a wonder they’ve never thought of these problems. Your solution to having a “pension” is running your own pension fund. Enjoy that retirement.

They’re pricing in an October increase already. 5 year govt bonds are up to 1.63 today.

Putting your money in an annuity would mean you would not be able to spend on them today or leave the money put in the annuity to them either.

As far as why plan to leave anything for your children or help them out while alive? I would like my kids to stay in Victoria if they want to. With the price of housing that seems less likely unless we help and if we’re going to help one we’ll help them all. In addition, we’ll invest a lump sum for each grandkid in a RESP. Just something we want to do.

As far as spending on them now goes, we do if you mean assistance to help them succeed and become self-sufficient. I’m not losing sleep, just following a plan that I’ve thought about.

Why lose sleep over leaving cash for your heirs when you’re in the middle of your life? Spend on them now so that they can enjoy it before their own middle age, or better yet raise children to be self-sufficient. Unless your kids are incapable of caring for themselves after you are gone, this seems like such an odd variable when selecting where to invest your money today.

Bingo you go to the open house?

CS he will take away the second .25 he gave during the oil shock and than we will see.

Story out there today on someone buying $95 oil calls for the end of the year. Wishful thinking but interesting.

The C$ up 10 cents since May and oil up two dollars since yesterday. No need for further rate increases surely.

gwac

Yeah, I love that area. Definitely a desirable street if you are into Broadmead. It’d get over a million no problem if it was updated. Heck, some fresh stain on the cedar and a quick sweep of the driveway would have helped with street appeal. Can’t believe they left that tree trunk just sitting in the back.

The 2 bed on main is going to be a problem for some people, but other than that it seems to have good potential. It’ll be interesting to see what it goes for.

Yeah trees are great blah blah, but NIMBY, you know?

Trees provide oxygen that humans need….Just saying..

Well, mission accomplished then 🙂

“Foreigners like flat and no trees. Interesting….”

WELL, WELCOME TO ALBERTA !!

BC You now have a solution to all those foreign buyers…..START PLANTING TREES EVERYWHERE !!

Thanks Totoro, you’re doing a great job in doing all my bidding!

Bingo

Priced right things are going quickly. Others have been sitting. Interested to see what happens to the Rithetwood one. May need some $ to get it to the next level.

No idea about pondwood.

gwac

One can hope. The spread between my current house and “upgrading” to some 80s Broadmead place will be similar in any market, so I’m more concerned about selection than price. Definitely not the only area we’d consider moving to, but it’s on the list and in the price range. Uplands has awesome landscaping in general, but that’s above my pay grade.

Interesting how long stuff is sitting there now. Dredges or market shifting?

I’m surprised 1043 PONDWOOD LANE has only dropped 20K. Did they relist it? I could have sworn that it has been listed longer than the claimed 24 DOM. Hard to tell from pics, but it looks like water intrusion into the ceiling in the family room (maybe that’s what prompted the roof replacement?). Wonder if it comes with the Christmas tree. Lol. WTF is that about?

If you scroll down you’ll see Vicbot posted that same link as well as the countering information. The link you posted for annuities identifies the fact that experts agree they are best purchased after the age of 70. Even if you put a bit into annuities at that point, what is a self-employed person going to do with their money until then to ensure it keeps up with inflation?

I’ll throw this in as some may want to know more about annuities…

Annuities: Your DIY pension plan

http://www.moneysense.ca/save/retirement/annuities/everything-you-need-to-know-about-annuities/

This make sense. Annuity is also mentioned…

http://www.moneysense.ca/save/investing/investing-in-reits/

But you realize the math and facts right?

Why would an annuity be the best option? Just because someone said they don’t have a pension doesn’t mean that if they have a lump sum to work with they want to recreate the limitations and restrictions of a defined benefit pension through the purchase of an annuity.

Pensions are created with pre-tax employer and employee contributions. A self-employed person is using the proceeds of a rental property to invest for retirement will have paid income tax on the capital gains and any rental profits. They should be considering what gets them a comfortable retirement in the most sensible fashion given that this is post-tax savings with no employer match or other incentives that make pensions a sensible choice for employees to contribute to.

If I am self-employed I need to create an income stream for retirement. Converting my savings into an annuity is locking it in like a pension with all the drawbacks of a pension ie. no lump sum no charitable giving no passing the savings to kids and none of the tax and employer contribution benefits of a pension except a defined monthly benefit which is lower and less flexible than what I can get through a portfolio over time.

In my view everything needs to be analyzed for ROI and risk. I don’t see significant drawbacks with everything? I see lower and higher ROI for the risk.

Does anyone know what 2001 Carrick St. sold for? Yet another one that for some strange reason just disappeared off my PCS sheets!

It was sold in Feb. 2016 for $602,500 but listed recently for $799k and sold … so probably a flip. On the corner of busy Foul Bay Rd, it took a while to sell but finally did go…

Bingo

Only 8 for sale. Was hovering between 14 and 19 during the spring market. I use that neighbour hood as a gauge. Not too cheap not too expensive. It should be one of the first market to see big increases in available of sale when this market turns.

http://www.vicrealestate.ca/broadmead-saanich-east-homes-for-sale.php

Had a chance to catch up on old comments on the previous posts and wanted to answer the ‘troll poll’ question.

Maybe an idea is to put a link for a ‘code of conduct’ so that participants know what is expected and what is or isn’t acceptable? Then, if someone breaches the code of conduct maybe three strikes and they’re out?

Personally, I don’t find bearkilla’s comments offensive, but if there was a code of conduct then people would at least know (including me) what was expected or acceptable. In general, this blog doesn’t get anywhere near as out of hand (with racist comments, etc) as say – the vancouver condo blog which doesn’t seem regulated at all. However, we don’t want to let it get that way either. I find, that on the ‘Greater fool’ blog sometimes Garth goes over the top deleting comments so things could end up too sanitized also. Overall, Leo does a great job and for ex. – took care of the ‘ChineseCanadian’ fake person, that shows if things get out of hand he does take care of it. I have to agree w/ James Soper though that comments wouldn’t go trollish if it wasn’t that way already – that sort of thing can ‘snowball’. Also, I appreciate your reply to me James (maybe I had you pegged wrong). I’ll try and be less ‘aggravating’ in the future (yes, that may be tough for me) 😉

Vicbot

Perfect. Less competition for all the nice treed locations in Broadmead.

Now that I’m older one of the biggest draws for me in a property is mature landscaping. We’ve basically had to start ground up and it’s a lot of work. My parents have beautiful rhodos nearly as old as I am, wonderful ornamental plum trees, well established azaleas, nicely manicured boxwoods.. (well I guess boxwoods don’t take that long to establish).. Anyhow, it takes a lot of time to build up a garden.

If we were to move landscaping is a must have (including trees). That’s my biggest problem with a lot of the new westshore stuff. It’s houses as far as you look without a tree between. The Latoria Walk area is much better in that regard, but it can’t match the older areas closer to town.

Been away camping recently discovering some of the beautiful Gulf Islands, yet another reason to love life here! Also, just generally enjoying summer on the beach, etc, in this most desirable tip of the island (appears I’m not the only one who thinks that – mentioned in that Vic News article).

Interesting article from Vic News, Vicbot… on the absence of trees as an attractant to the Gordon Head area for Asians – that’s odd – I’d say it has more to do w/ proximity to UVic. However, I do have an experience when I lived in Coquitlam back in the mid 2000’s. At that time, Koreans and Chinese in general were moving in to the area en masse, and when the elderly lady next door to me past away, Chinese people bought the small old house and tore it down to build a large house. There were a bunch of beautiful cedars and Mountain ash trees right on the property line and they wanted them gone. That wasn’t happening, but it’s an anecdotal experience that I had that they are not fond of trees in general.

I’m curious – do Asian’s dislike the Broadmead area for this reason? That area has a ton of trees and is very shady, even too shady for me. Richmond, very popular w/ Asians – is flat and has relatively few trees. With the exception of area’s near Uvic, maybe they don’t like Oak Bay all that much because we work so hard to preserve Oak Trees and other trees here? It’s food for thought.

The article goes on to contradict itself… “housing in the Greater Victoria region remains a bargain compared to prices around the world and a safe place for investment”… Really? Later the article states: “Ultimately, high real estate prices across Victoria reflect the forces of supply and demand” So which is it? A bargain compared to some places in the world, yes, but with high real estate prices?… hmmm.

Because the complaint was that you didn’t have a pension.

Also, everything comes with significant drawbacks.

btw, thanks LF for the link to the news article – interesting times indeed!

gwac, I know it sounds strange but it’s actually the case – some have superstitions, and our friends and realtors in Van have many examples of where properties weren’t desirable because of trees (several RE tours of buyers proved this for a few friends), or prized because of the absence of trees. But it’s just one interesting factor in buying/selling.

No I didn’t. I stated that, imo, it is not a good option for someone who is self-employed and does not have a pension. Why would you try to recreate a pension with your own savings when it is makes the least financial sense? What I want is a diversified income stream that allows me to retire and provides flexibility, passes benefits to kids and charity. Way better than a pension than ends when you die or passes for a limited time to a spouse.

I have looked into these options.

Unless I am missing something they all come with significant drawbacks. One being that if you die before collecting benefits your estate might get the greater of your premiums or the balance on the account – basically a depreciated value as there is no ROI on the investment. And if the annuitant outlives the fixed period or exhausts the account before death, no further payments are guaranteed.

Annuities were created for folks that organized their financial lives around their paychecks and have a hard time figuring out how to create a replacement. Early retirees or self-employed folks that have rental properties or a stock porfolio or other income producing set of assets that provide an acceptable paycheck substitute don’t need an annuity and will reduce their ROI and flexibility if they buy one – and everyone can figure out how to do better these days imo thanks to the internet.

A solution for the older retiree in this position seems to be to automate and delegate. Hire property management before you need it to make sure the rental income keeps coming. Automate the bills and have a plan for when you can no longer manage your financial affairs. That way, when you die, all those income producing assets can pass to your heirs or to people and organizations that will carry out your charitable wishes.

Petronas LNG, whom was spearheading the 36 billion dollar Pacific NorthWest LNG project in BC has just decided to shelve the entire operation…

http://business.financialpost.com/commodities/energy/newsalert-pacific-northwest-lng-megaproject-not-going-ahead-2/wcm/f1661f34-d01e-439e-9311-cd404a3fc77d

Can someone please post the stats for Victoria single family home sales July 2017 to date? I’m curious where it’s at compared to last year.

Thx

Send me an email I can set it up or use the form at top right. Or email one of the other 1300 agents in town 🙂 It’s generally all the same system.

The Asian influence in Saanich has been going on for decades, via UVic. In fact, I would suggest that UVic is the primary draw for them. Doubt it’s much to do with the flatness of the topography and absence of trees.

A friend of mine was a client of Gray (not Gary) Rothnie several years ago. Been a realtor in the Saanich area forever. Great guy.

Foreigners like flat and no trees. Interesting…..

Did you see this … Leo & the blog are in VicNews.

https://www.vicnews.com/business/foreign-buyers-prefer-saanich-as-favourite-place-to-buy-real-estate/

One noteworthy quote because, well, it’s a good summary of what people have been saying in person …

“Gary Rothnie of Century 21 Queenwood Reality Ltd. is not surprised. Saanich especially the Gordon Head neighbourhood is popular among foreign buyers from Asia for several reasons, he said. They include its relative flatness, the absence of trees, its proximity to the University of Victoria, and its closeness to Mount Douglas and the Pacific Ocean, he said.”

Seriously go learn something about annuities before you complain about them. There are various options where if you die before the term your beneficiaries get the balance. Also no one said put all your money into an annuity.

Richard Haysom was saying he has an investment property because he doesn’t have a pension, and then you complain that an annuity isn’t a bunch of things that a pension also isn’t.

@Bitterbear

“Can anyone set me up with a PCS for Shawnigan/Cobble Hill? Or can anyone suggest a realtor covering this territory?”

I use this with multiple accounts to get more results!

http://liveinvictoria.com/home/pcs-pro

Have fun.

“I’m not going to use annuities. ”

Keep working til you’re 70 and CPP will pay you around $17000 a year. If you spouse works til 70 that’s $34,000 a year. If you have no other sources of income you’ll get old age security too, say twice $6000 for a combined family income of around $46,000. So if you have some cash, why even consider an annuity? Better, surely, to invest in an insurance company that deals in annuities.

Thanks Vicbot. Even the article that is favour of annuities states that experts recommend not buying them until 70.

I looked at this option and my conclusion was that you shouldn’t buy them ever if you want to leave your beneficiaries money or have access to emergency funds or other types of giving while alive. In addition, given the long-term payouts you’d have to make sure the seller has insurance in case they go out of business. And the rate of return is well below a diversified portfolio.

One caveat might be that if you are diagnosed with early dementia or a similar brain dysfunction that will make you incapable of managing your affairs and you have no-one you trust to act as a POA. An annuity can insulate you from the risk of mismanagement or being taken advantage of.

They certainly are not a good replacement for other types of investments for a self-employed individual who is retiring early imo.

@ Hawk:

We are faced by a conflict between inductive and deductive processes of thought.

The inductive argument is that prices have risen, if not forever, then longer than most first-time buyers have been alive and so must continue to rise. That’s quite compelling. Why abandon the assumption based on the experience of a life-time?

The deductive argument is that the rise in prices was driven by declining interest rates which have now hit near zero, and so have nowhere to go but up. That’s quite compelling to anyone who likes a simple logical argument.

So which line of thought is correct. In the short-run, the market looks set for a dip. But will it then continue onward and upward until the day comes when a loonie is fit only for the bin?

Or is monetary decency about to be restored. Is the endless inflation of the last 100 years now at an end? Indeed, how can declining interest rates fuel more money creation when interest rates are already virtually zero?

Well, be warned. There are such things as negative numbers. When rising rates begin to bite and the economy goes into another spin, will the BoC boldly go into the unknown with a step to the negative side: minus 0.25 to match some European corporate bond rates?

Or there’s the plan of the philanthropic Zuck to give everyone free money, to pay the mortgage or to save one the trouble of going to work.

Like Hawk, I believe there should be some integrity to the monetary system, and that continual debasement has to stop. But if we’re wrong, who’s to say that buying now will not look like genius ten years from now.

I’ve heard arguments for and against, but personally I’m not going to use annuities. Here are articles though:

http://www.moneysense.ca/save/retirement/annuities/everything-you-need-to-know-about-annuities/

“use annuities together with government pensions to meet all non-discretionary spending needs.”

https://www.forbes.com/sites/davidmarotta/2012/08/27/the-false-promises-of-annuities-and-annuity-calculators/2/#60d2dc3f199c

The False Promises of Annuities and Annuity Calculators

Can anyone set me up with a PCS for Shawnigan/Cobble Hill? Or can anyone suggest a realtor covering this territory?

Do you have an example? I just can’t think of one? Especially now with interest rates being so low… The longevity benefit doesn’t seem worth it to me on a financial analysis even if you don’t care to leave money to heirs or charity.

I don’t think most Canadians directly admit they believe that prices go up forever, rather they try to inject a bit of rationale into it that nonetheless leads to a similar conclusion:

“Oh sure, prices may dip here and there, but any correction is bound to be mild and short lived”. As Canadian as beaver tails on the Rideau.

My spell check wanted to change my misspelling of “conclusion” above to “concussion”. I almost accepted the suggestion…

Most people in the private sector don’t have company pensions – those are going extinct.

Also, not everyone should become a landlord – it works for some people given their experience, affinity for numbers, and willingness to deal with difficult situations and variety of people/personalities. Even if you get a property management company, you may not agree with everything they do, or how they’re spending maintenance $, so you have to be a good communicator and negotiator. You may also be forced to sell your property in a down market, for any number of reasons – health, moving for work/family.

By the same token, an annuity isn’t right for everyone, but it might be for some.

Some people prefer REITs, stocks, bonds, GICs, or a mix.

Nothing is risk-free. All these need to be investigated by a person to decide what’s right for them.

Sounds like Vicinvestor and Bearkilla are related posting within minutes. Did you see another Golden Head slasher today for $100K at 4365 Shelbourne St on the nice end by Mt Doug.

When well over 50% of the listings in one the hottest areas the past 2 years have to slash their prices to get the sale you have to be a total idiot to not think the winds of change are in motion and stuck believing prices go up forever.

Did you ever think what killed every other real estate bubble Vicinvestor ? Higher rates, tighter credit. Happening now ICYMI. 😉

Lost me too.

What is true is that you are not going to be cash flow positive on a rental in Victoria and you’d need to be able to hold. It really is not the best market for a rental now – was better a number of years ago.

You are going to be banking on appreciation, which with a 65 year history of appreciation at 7% adjusted for inflation there really does not seem to be a huge risk, no bigger than stocks, except for the buying after a big run up bit. Your holding period would have to be sufficiently long to ride out a flat or down market.

The main thing with rentals is when they start to break even if you are earning other income you are adding the equity payments to this income and paying a higher rate of tax on this with no cash flow to support it and there is capital gains tax which comes at the highest marginal tax rate when you sell.

There are easier ways to make money unless you have extra money to support this and no need to sell. Most people are not in a situation in Victoria to take this on, and many don’t want the hassles.

Who is “they”. You were advising 3Richard and perhaps me or other self-employed people to sell the rental and buy an annuity weren’t you? I don’t know about him but what I want is the best ROI I can get within acceptable risk parameters. I certainly do not want to give up my capital forever for 6% per year until I pass leaving nothing to charity or my heirs. And why would anyone do that when they can get a 4% safe withdrawal rate from a well diversified portfolio and withdraw capital if they need it later? And for as a retiree in my 40s the rate of return on an annuity would be far lower than 6% – if I could get one to pay out at all at this age which is unlikely – don’t know that I’ve seen one that would pay out prior to 55.

If you are in a situation to be able to afford an annuity that provides for your expenses you don’t need an annuity – you need a diversified portfolio.

@Jerry

“You could argue that there is no essential difference in the end. One is gambling, the other never got the whole “times-table” thing.”

You’ve totally lost me! I don’t get the implication. Leverage can be incredibly powerful and profitable.

You’re solving a different problem here.

They want a guaranteed income.

Local Fool: You forgot to mention the “spin” cycle.

There are only two types of individuals who use leverage in order buy a second property and then place it on the rental market as an “investment”:

-people who don’t know how to use a calculator

-speculators

You could argue that there is no essential difference in the end. One is gambling, the other never got the whole “times-table” thing.

A little education for Lawrence Yun. A current market appraisal imposes a hypothetical condition that the property has been listed for sale along with other similar properties that would have been alternatives that a prospective purchaser may have purchased. That’s why an appraisal looks back in time.

What Yun is talking about is a “prospective appraisal” where the appraiser is asked to determine the value of the property in the upcoming 90 days. That’s done for relocation companies and sometimes foreclosures where they want the appraiser to determine the anticipated selling price in the next 90 days or so.

Lenders will only lend on CURRENT market appraisals NOT prospective market appraisals. It isn’t the appraiser that causes the problem it’s the bank’s regulations.

Just because a property sells in an auction at say $775,000 doesn’t mean it is worth $775,000. And that happened last month when an out of town buyer bid $775K but the property was appraised at $665K. The prospective buyer went back to the seller and re-negotiated their offer to $685K which was within reason.

If you get a good appraiser they can save you money. But most of the time they are NOT working for you. Although you pay the fee, they are working for and only responsible to -the bank. That’s why you should hire your own appraiser.