July 10 Market Update

Weekly numbers courtesy of the VREB.

| July 2017 |

July

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 187 |

972

|

|||

| New Listings | 315 |

1127

|

|||

| Active Listings | 1972 |

2161

|

|||

| Sales to New Listings | 59% |

86%

|

|||

| Sales Projection | — | ||||

| Months of Inventory |

2.2 |

||||

An OK start to the month. 22% fewer sales than this time last year, but only 12% fewer properties on the market. The end result is an approximately equal reading for months of inventory and a lower sales/list ratio.

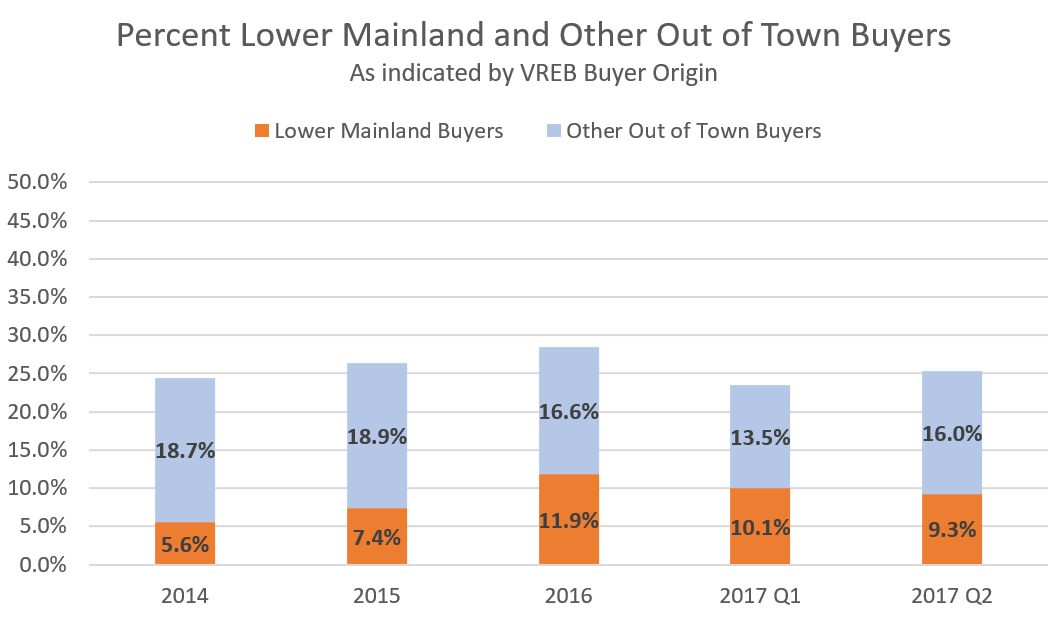

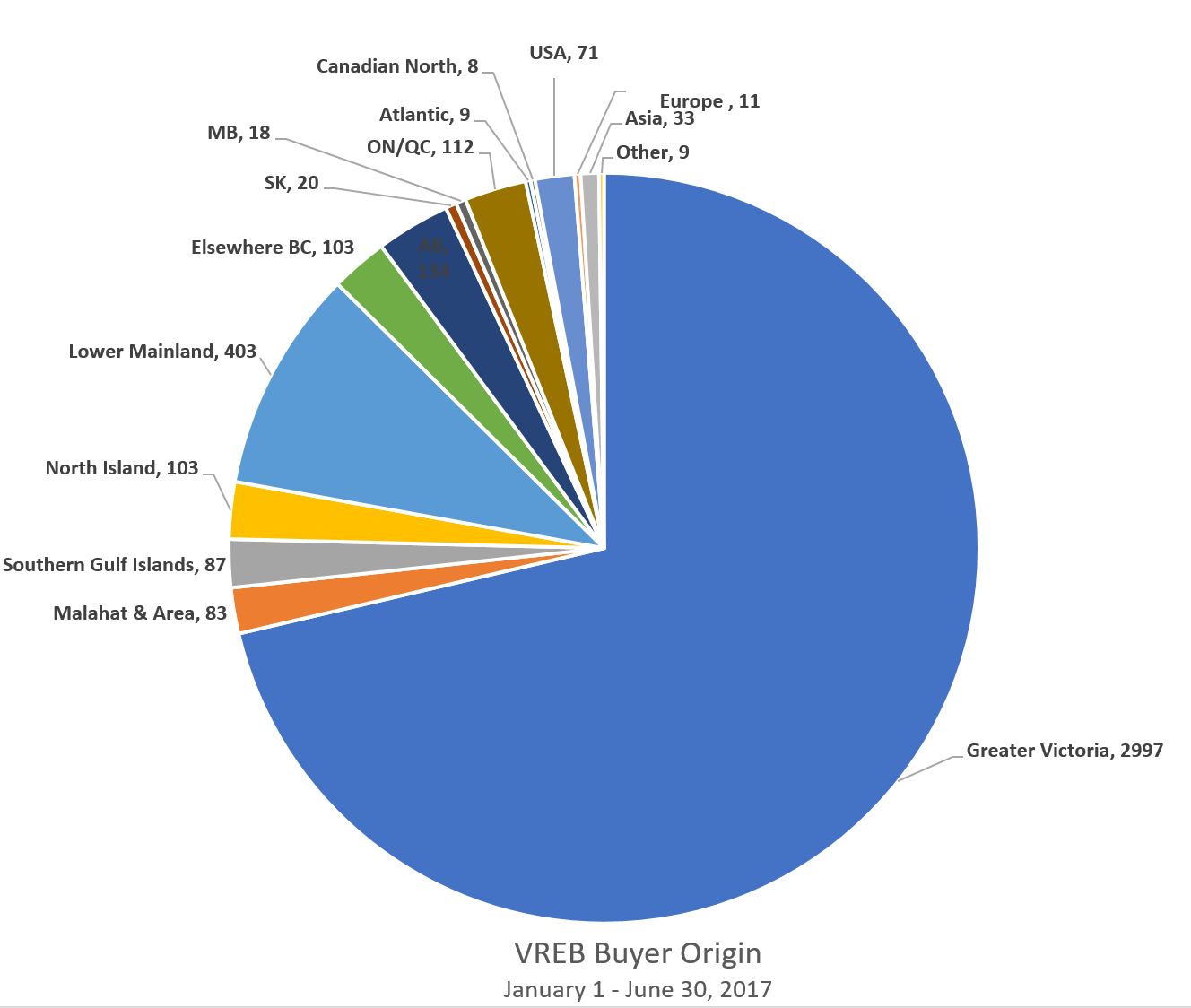

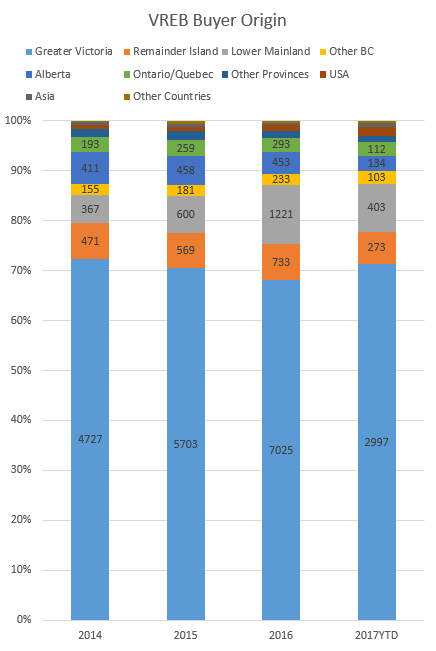

Second quarter buyer origin data is out as well. Remember, the VREB “buyer origin” data represents what the buyers of a property put down on the contract as their address. It does not indicate buyer nationality, and anyone moving here first to rent would be counted as a local. This is different than the foreign buyer data that the province collects at the time of the title transfer. The VREB no longer allows the buyer origin field to be queried so I can no longer make charts like this but they do release the report on the region quarterly instead of annually. Here is the latest data.

It’s clear that lower mainland and out of town buying in general has eased up from 2016, if only a bit. Since sales are down overall, it means the absolute number of out of town buyers should end up around 30% less than in 2016. The full data for the first half of the year looks like this.

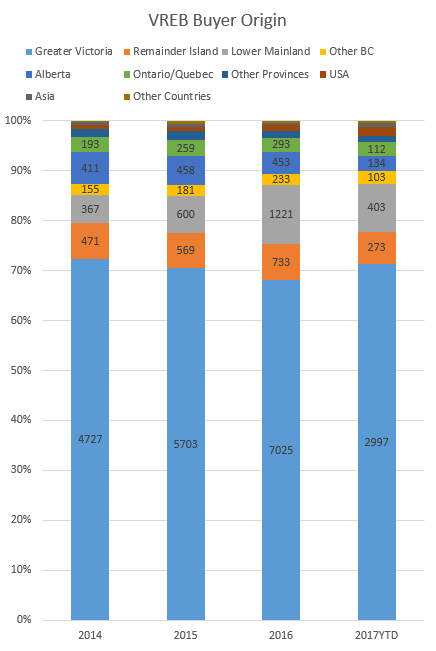

And comparison to previous years:

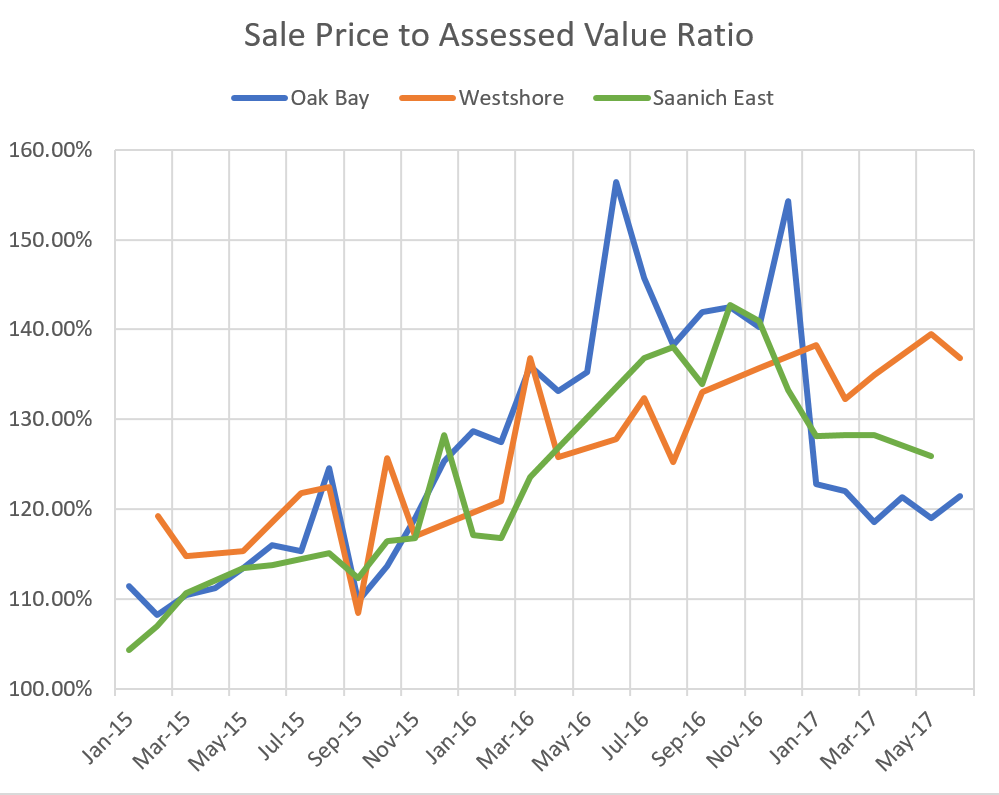

A couple weeks ago reader CS suggested looking at the price to assessed ratios to better determine if the prices are going up or down. I didn’t think it would tell you anything new, since the price/assessed would just be the current value of the house compared to the value of July 1, 2016, but CS pointed out that it could “give a better indication of price trends than the median price when there are month-to-month changes in the number of high-end versus run-of-the-mill house sales”. The data isn’t always wildly reliable because sometimes the assessment value is entered incorrectly in listings, which means the average Sales/Assesment ratio is occasionally thrown off.

The only municipality I found with no obvious errors was Oak Bay (everything is better there, even the data), but for some others I took out incorrect values and interpolated them to get the picture.

Couple things to note:

- Sale Price / Assessed Value represents the average sale price (of SFH) in that month divided by the average assessed value of the sold properties. For example, in June the average Oak Bay detached house sold for 21% more than it’s assessed value (value as of July 2016) while the average Westshore home sold for 37% more than it’s assessed value.

- Sale Price / Assessed Value should sharply come down in January of every year as the new assessments are entered into the system (as seen in January 2017 for Oak Bay and Saanich East above). If sales prices are appreciating rapidly that drop is less or not noticable (as seen January 2016 and for the Westshore in January 2017).

- Westshore sales/assessed ratios appear to continue to increase in 2017 while the ratios for Oak Bay and Saanich East are not.

Hmm.. We’ll call that one point to Gryffindor the flat core theorists. What do you think?

New post: https://househuntvictoria.ca/2017/07/12/rate-reversal/

Better Jobs and Better Affordability

Canada has been stuck in the paradigm of lower real wages and higher asset prices. No where is more pronounced than in expensive urban centers. People either need to make more (e.g. if you are not a public servant) or prices need to be lower (not CPI, but CPI with housing factored in).

One of our friends, who is American, but is beholden by Victoria and wants to retire here; has tried for the last year to setup a mid-size plastic injections + wood manufacturing business in Greater Victoria. Talking about 3 design jobs, 3 admin jobs, 2 sales jobs, and about 10-15 skilled manufacturing jobs. In his niche export market, he can command premium prices and the market is really starting to explode.

So what has he encountered? A bylaws division of a muni that says his business does not qualify for any type of zoning? Min of Enviro that says he needs 3 different licenses, Worker’s Safety saying they need to inspect and re-inspect 3 times over, and Min of Transportation for transporting plastic from Vancouver or Washington state. The list goes on.

He just threw in the towel, as what was once a great lifestyle/work balance option is no longer viable. Time is money and waiting who knows how long to get everything in place. Really unfortunate as all levels of government + local employment could have generated high 7 figures into the local economy. Now I understand when our neighbours from the UK 30-40 years ago called us being “quaint”

They did not increase their prime discounts by 0.25%

Leo, now I’m not so sure about that… Another home in the same Henderson OB ‘hood sold today – this time on a lot almost twice the size of 3553 Redwood Ave, and it was assessed $50k higher than Redwood. Unlike Redwood Ave where they started well over $1.9m and got $1.625k – this home at 2073 Renfrew Rd was listed at $1,198k and they ended up with $1,310k. Yes, the home on Redwood was a bit larger (but not much) – but does that really justify the $315k price difference? Both homes were nicely fixed up, and again – the Renfrew lot was huge. This is why I’m starting to think their tactic of listing really high at Redwood worked out better for them than the Renfrew home where they listed lower (I had thought the Redwood house was only worth around $1.4m, but it sold for well over that, and I think the Renfrew house got around what it was worth in today’s market). So, I think the people who bought the Redwood home overpaid, but the sellers there are smiling… I think this proves their tactic of listing high worked better than the Renfrew house.

Appears you are right about that Marko… listing higher will eventually get a better price – lots of people try that…and then reduce the stupidly high price as Hawk keeps us all well aware. However, he never talks much about the sales, esp. sales over asking…

Barrister – on the way to the beach last weekend I happened to stop by the open house on 2184 Windsor – shocking they got $1,555m for that! I’d say it was really only a very ‘average’ but updated 1950’s house. The bathrooms and kitchen were nicely fixed up by Abstract (same developer as Bowker). The master ensuite was quite something. But, still… I don’t think they’ll see an upside on that price for a long time. Somewhat surprisingly, there was a group of mandarin speaker’s there (maybe they bought it?).

Leo, could you please re-post your gas vs. electric vehicle cost calculator? I can’t seem to find it in the archives. Thanks.

Interesting that most banks increased their prime discounts on variable mortgages meaning no increase for new mortgages. You lose again bear. Maybe next year.

Local,

5% on a house is not a can of beans at the store. It’s real lost money many expected in their pockets listening to the local media/agents say they would have foreigners and Vancouverites lining up around the block. Those are all top hoods as well.

I just dont think that a quarter point is going to either have much effect or send much of a signal. Some fool just paid over 1.5 mil for a McShack on Windsor road on a small lot.

You are probably right and that is probably a good thing. Still I have a feeling that this tightening cycle is going to be pretty minimal precisely because even a small tightening is going to have a big effect under our current conditions. Plus the jump in the loonie amounts to an extra tightening.

Now that rates have finally started up:

1) “info” is finally vindicated. Her predictions were not “wrong”, they were just 5 or 6 years too early

2) Garth will once again claim that all his annual predictions have been correct. This year that statement will be at least 25% true.

Caveat still incredible low historically but the 5 year is 1.5 today and should creep up from here after that rosy economic outlook from the BOC (personally think they have no idea what they are talking about. 3 months ago they were incredible dovish). Sub 3% 5 year mortgages may be a thing of the past soon if the BOC keeps up the talk.

My god you have to go all the way back to the dark days of October 2014 to find a period when 5 year bonds were yielding as much as now.

Fix rate mortgage should see another increase soon. Yields continue upwards.

http://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/

“Loonie up a full cent today. If this keeps up the foreign dollar difference will become less of a reason to invest here.”

…and lower tourism demand in Vic.

Hawk, those aren’t slashes in most cases. I’d barely even call them adjustments.

Those are roughly 5-6% down, give or take a bit. If I go to the store and see 5% off, to me that’s not what I’d a consider a discount. Granted houses are different that way, but still. I think it’s noise.

Even in the hottest of markets I would expect to see some adjustments downwards. It’s possible you might even see some higher prices in the immediate term, as folks attempt to “beat” the increase.

“unicorn mathematics” = “mythematics” also, “Mathemagical”

It’s only in the world of mythematics that a change in BoC rate from 0.5 to 0.75% is considered an increase.

With the Trudeau Liberals doing what Trudeau Liberals always do, which is to piss away billions they don’t have, and currently running a budget deficit of $2 billion a month, the change in bank rate almost certainly amounts to a reduction in real interest rate.

“unicorn mathematics” = “mythematics”

Lots of healthy price slashes today across all areas. Must be trying to beat the interest rate hike effect.

3020 Uplands Rd slashed $250K. The over $2 million will need more than that with all that competition.

1248 Hewlett Pl in South OB slashed $100K down to $1.4 million.

4020 Saanich Road slashed $50K to $929K. Nice place too on the non busy part of that road.

Another Cordova Bay one at 4967 Del Monte Avenue for a $40K slashing at just over a million.

2891 Murray Dr in Shoreline slashed $75K to $1.175 million.

Many more SFH’s slashed and haven’t even got into the condos yet.

Obviously I’m talking about a foreign investor. Why would they want to stay in a flat market? If the dollar goes up, cash out and move on to invest elsewhere with better returns (in real estate or not).

And more of a reason to sell to lock in gains.

Transaction costs are massive; you would need to bank on a minimum of a 10% market drop to make selling and re-buying worth while and we’ve had one YOY drop over 2% in the last 30 years and that was 5% in 1994.

Odds are market goes flat for a very long time.

And more of a reason to sell to lock in gains.

Loonie up a full cent today. If this keeps up the foreign dollar difference will become less of a reason to invest here.

If it gets to 82-83 cents the currency isn’t really a major discount anymore when you factor in exchange commission, etc. so foreign dollars will dry up and might look towards New Zealand and Australia depending on what their currency is doing.

Loonie up a full cent today. If this keeps up the foreign dollar difference will become less of a reason to invest here.

Leo S

Which is still high compared to 2014.

2014 – 367 lower mainland buyers – slow market

2015 – 600 lmb – things heating up

2016 – 1200 lmb – HOT HOT HOT

2017 – ~670 lmb – still hot but the craziness has waned

It’ll be interesting to see what the actual total is for the year (of lower mainland buyers). Will we be back to 2014 levels for 2018?

I wouldn’t want to write anything for critical review based on data as obscure as the sale price/assessed ratios that Leo S has kindly provided in response to my somewhat random suggestion. However, the numbers seem to confirm that the core led on the upswing in prices and is leading in the moderation to leveling or fall in prices. Thus in January 16, OB sale price/assessed was 9% higher than the West Shore, but in January 17 OB was 16% lower than the West Shore. The implication seems to be that any flippers still looking for a new bet should be checking things out in Sooke, Port Renfrew, or perhaps Cape Scott.

Ya it was interesting how Steve mentioned “legacy effects” of low interest rates, and how the economy might not respond in a conventional way to such a small hike.

I suspect he’s referring to the levels of consumer debt and the current psychology Canadians have around acquiring it. I think that many sectors of our economy, housing most of all, has now priced in these rates and perhaps even overshot them. Any climb is going to be noticed.

Yep agree with Leo and Hawks statements. BOC tried to create an export driven economy that failed. Now they have to unwind the housing/debt issue they created. Interesting to see what happens.

The CPI includes “new house prices” as part of the calculation. Problem is they are likely using the New House Price Index (NHPI) which is complete nonsense. http://globalnews.ca/news/3478535/why-is-canadas-inflation-rate-so-low-when-life-is-so-expensive/

“The authors proceeded to note that StatsCan’s New Housing Price Index, which forms parts of the agency’s estimate of shelter costs, registered virtually no change for the Vancouver market since 2008.

“We are also baffled by the reported cumulative increase of only 37 per cent for the Toronto NHPI since 2008 (vs. 118 per cent according to resale market data),” wrote Marion and Arseneau.

They have said their secondary mandate is to ensure economic stability. This rate increase is equivalent to tapping your brakes when you have a tailgater. Just showing people that rates can and do go up, so back off the crazy debt binge.

It’s called kill the bubble. Housing inflation is driving too much of the economy. It’s 2 years too late to save it but they had to look like they tried.

cpi a good article.

https://www.theglobeandmail.com/report-on-business/the-logic-and-lunacy-of-calculating-the-inflation-rate/article25008805/

What is even stranger is how they figure that there is no inflation when housing prices are going up 20% a year. Housing being the single biggest cost to the average Canadian. I suspect that they are in the land of unicorn mathematics.

Not sure when the next one is. The statement is vague.

Hiking interest rates without inflation pressures is a tad strange. They even admit to no inflation pressures.

http://www.bnn.ca/bank-of-canada-raises-rates-for-first-time-since-2010-1.802721

Aaaand interest rates up.

Teranet uses land transfer records as well as far as i know so they are a couple months behind the times

“In June the Teranet–National Bank National Composite House Price Index™ was up 2.6% from the previous month. As with May, it was the largest June rise in the 19-year history of the index and took the composite index to an all-time high, this time for a 17th consecutive month. Home prices were up on the month in 10 of the 11 metropolitan markets surveyed, led by Hamilton (4.1% – a record monthly rise),Toronto (3.7% – also a record) and Quebec City (3.7%). June gains were also imposing in Vancouver (2.5%), Victoria (2.2%), Edmonton (1.8%), Halifax (1.7%), Montreal (1.6%) and Ottawa-Gatineau (1.2%). Prices were up a more modest 0.3% in Calgary and down on the month in Winnipeg (−0.3%). For Toronto it was the 17th straight monthly gain, for Hamilton the 14th, for Victoria the 14th gain in 15 months, bringing all three markets to new records. Though Vancouver prices declined from last October through December, they are at a new high after strong May and June gains. In June Ottawa-Gatineau prices topped their previous peak of last August and Montreal prices their peak of last July. Conditions in both these markets have tightened considerably.

”

I doubt there are any tactics that actually work. A property, reasonably competently described and exposed on MLS for a sufficient period of time will sell for market value regardless of whether it is overpriced or underpriced or correctly priced to start. Delayed offers are great when the house is a bit of a shitbox and you don’t want people to look too closely, or the seller just wants it gone. I don’t think in general it gets a higher price, except in very rare periods where there is mania in the market and the winning bid is far above the next one.

Would be an interesting analysis though on the local market. Do delayed offer situations tend to get more or less than regular listings, or is there a difference?

Remember the comparative graph is scaled to 100%.

We have 6 months of data for 2017 and about 60% of the sales for the year tend to happen in the first 6 months.

2016 we had 198 buyers from other countries. So far this year we have 124, extrapolating that out we should end up around 206. So the numbers are up a bit (while overall sales are down), but not drastically.

Meanwhile we had 1221 Lower Mainland buyers in 2016 and projected to have only 671 this year. So the number of Vancouver buyers has dropped almost in half from last year

Same situation for Alberta buyers so I believe you are right.

Thanks Leo. This is exactly what I was hoping for.

Assuming sales are representative of all prospective buyers, it’s interesting that combined buyers from USA, Asia, and ‘other countries’ are higher YTD in 2017 than the full calendar year of 2016. Assuming that trend continues for the remainder of the year, the number of non-Canadian buyers in 2017 could be near or more than 2014, 2015, and 2016 combined. It might not be a problem at this point but I think there should be a non-Canadian buyers tax. It’s just good policy, in my opinion, and I’d rather get ahead of it now before this potentially becomes an issue.

Also interesting to note that Alberta buyers don’t seem to be keeping pace. My guess is the higher number of Alberta buyers in 2015 and 2016 is due to the downturn in the oil patch, which began in the summer of 2014. Looks like those that have been affected have relocated (to BC or elsewhere) and the Alberta numbers are returning to pre-2014 conditions (i.e. mostly retirees).

I think what helped make 2016 a particularly dreadful year to buy a house was the combined effect of many oil downturn-affected Albertans relocating/early retirements to BC (i.e. Victoria) and folks coming to Victoria from Vancouver, either cashing out or leaving because it’s too expensive. So 2016 was sort of a ‘double whammy’, if you will, instead of the ‘new norm’.

Just my two cents.

If they list their rental address on the contract, yes.

More than a quarter of buyers do just that.

Not that many in this market. I don’t see it as a huge issue actually. In slow markets it puts a cap on the DOM and in all markets it makes the average seem lower than it actually is. But I doubt anyone is being fooled by relists. If you are actually house hunting it’s the first thing that you will notice. The tactic is more superstition or seller driven as Marko said.

Nice! Maybe I should propose that to the VREB.

Thought I would post bear-blogger Danielle Park’s latest entry here – it’s worth reading. There’s no magic or fortune-telling here, just uncommon sense.

“Home sales in Canada’s largest city–Toronto–fell 37% year over year in June. Long overdue buyer exhaustion has finally been triggered after the Feds tightened mortgage insurance requirements last November and Ontario imposed a 15% tax on foreign purchasers in April. Now regulators are considering new rules requiring lenders to stress test uninsured mortgages (prompted by oversized loss risk in the sector).

In addition, on Wednesday, the Bank of Canada is expected to raise its benchmark overnight rate to .75% from .50%. In anticipation, Canada’s biggest banks are also tightening. Royal Bank of Canada raised its fixed rates for 2-,3-, and 5-year term mortgages by .20%.

With some 90%+ of Canada’s economic growth coming from realty transactions and services the past 2 years, we doubt the BOC and banks will raise rates far before declining property prices and a weakening economy cause them to pause once more. But at this point, holding rates lower for longer is not going to repair or even meaningfully patch the financial leak. This is Canada’s payback period due after a decade of reckless credit abuse.

Next up will be a necessary cleansing cycle resulting in lower shelter prices to help restore affordability once more and reset many over-leveraged participants–households and businesses–through bankruptcy, credit restructuring and write downs for lenders. It will also mean lower tax revenues for governments that have become unduly dependent on what has been the one firing economic cylinder since oil prices collapsed last in 2015. This is the downside of too little diversification and unproductive spending.“

Garth has the “Deathwatch” on. It looks like things are going to get ugly, and have already started in Toronto. No wonder all the Victoria flippers are panic selling and whacking prices.

“You bet, says veteran real estate broker Alex Prikhodko, it could be worse. “There are plenty of reasons to believe that this is just the beginning of a long and, for a lot of people, painful down spiral,” says the Toronto realtor. Particularly crushed, he surmises, will be three groups:

“1. Amateur builders (flippers). They are the most vulnerable to price drops, as they are carrying significant debt which they will no longer be able to service and will be forced to sell for whatever they can get.

2.Amateur landlords. Currently rent covers around 45% of a mortgage payment with 20% down. These people were willing to take a hit on mortgage/rent discrepancy for as long as their properties were rising in value, since they would have easily recovered the losses upon resale. This is no longer the case and they are not likely going to keep taking losses by holding onto their depreciating assets.

“3. Mortgage renewals. Anyone who bought in the last 2 years with 20% down or less have already lost their entire down payment and are de facto in underwater mortgage situation will be denied mortgage upon renewal on appraisal.”

http://www.greaterfool.ca/2017/07/11/it-could-be-worse-2/

I’ve been watching this one for a while. When they started at $1,938k I thought they were sniffing glue. Then, they reduced to $1,749k I thought still too high. Then they reduced again to $1,649k, and I thought – still $200k too high. Now, I’m a bit surprised at what they got and wonder if they actually undertook a good selling tactic? Just yesterday I was saying they shot themselves in the foot by starting too high. Now, I’m re-thinking that and wondering if what they did got them a better selling price in the end? Hard to know – but I think it’s definitely one of the highest sales in that ‘hood yet. I wonder now about their tactic and weather or not it paid off for them?

As I’ve said many times before there is no evidence to support underpricing and going for a bidding war resulting in the highest sale price.

Out of 43 listing sales so far this year I’ve only had five go over asking of which 3 were less than $5k and other two $11k and $15k over. Just not a fan of the $200k under list approach; receipt to get burned in my opinion if the right buyer does not materalize in your 3 to 4 day delay.

I still think that part of the solution is to have different tax rates for Canadian home owners and foreign owners. To simply the processing everyone is taxed at the highest rate then it is up to the homeowner to prove Canadian citizenship (or landed immigrant) and that they are the beneficial owner to get the lower rate. Any residential properties owned by any type of corporation would be taxed at the highest rate.

3553 Redwood in Henderson OB sold for $1,625k today… 54% over the July 2016 assessment. Nice fixed up house on large lot w/ 5 beds and 4 baths but that price seems high.

I’ve been watching this one for a while. When they started at $1,938k I thought they were sniffing glue. Then, they reduced to $1,749k I thought still too high. Then they reduced again to $1,649k, and I thought – still $200k too high. Now, I’m a bit surprised at what they got and wonder if they actually undertook a good selling tactic? Just yesterday I was saying they shot themselves in the foot by starting too high. Now, I’m re-thinking that and wondering if what they did got them a better selling price in the end? Hard to know – but I think it’s definitely one of the highest sales in that ‘hood yet. I wonder now about their tactic and weather or not it paid off for them?

Also, remember folks- as of yet there is no foreign buyers tax at all in Victoria…

The Calgary Real Estate Board (CREB) changed it’s policy regarding days on market a few years back. We used to have the same issues with realtors relisting to reset the DOM counter back to zero. Now a listing has to be taken off the market for a minimum of 30 days or must be relisted with a different Realtor to set the DOM counter back to zero. It’s had a huge impact.

I like this idea for sure! When the market was slower re-listing at request of my clients was quite annoying.

“also foreign investors can buy through corporations to avoid taxes or traceability”

Because of family connections I know that foreign buyers also use overseas family connections/investors to buy here. My experience is a family of 3 children emigrated 10 years ago. The parents were given the money by investors to buy their first home, using first time buyer tax advantages. Their children also each bought a home as they became old enough, using foreign investor money. There is no way this would show up in the statistics and the only clue to tracing this kind of transaction would be personal tax records as none of the family earns anywhere near enough to cover the mortgages personally. This is one case where 4 homes were purchased by foreign investors but it is completely hidden from the MLS/government. How many more cases like this are around? Who knows.

” the foreign-buyer tax does not apply to any foreign national who sets up a company in B.C. as long as no more than 25% of the shares are owned offshore, said Christine Duhaime of Duhaime Law in Vancouver, who is considered an expert on Asian real estate.”

https://www.biv.com/article/2017/3/ndp-would-expand-bcs-foreign-buyer-tax/

“Many buyers and their agents, Hyman said, are not being diligent in making sure the seller is a physical or tax resident of Canada, while others are being “cavalier” or “engaging in wilful blindness” about it. The immigration lawyers urged the B.C. government to end the “honour system” that leaves it largely up to sellers to state on real-estate-industry forms whether or not they are residents of Canada for tax purposes. ”

http://www.theprovince.com/news/local+news/house+buyer+beware+landmark+court+ruling+will+shake+real/13187081/story.html

The 15% tax applies to foreign buyers – non-Canadian citizens and non-residents, foreign-registered corporations, or Canadian corporations controlled in whole or in part by foreign nationals or foreign corporations.

In addition, there is no primary resident’s tax exemption for corporations and gains are taxed at the highest possible tax rate as passive business income. Not really a savings normally.

Shareholder and director information for corporations is public information.

Yes interesting numbers on the out-of-town buyers (even though out-of-towners are probably higher due to many renting first, and also foreign investors can buy through corporations to avoid taxes or traceability)

Some of the most valuable things I learned in work: 1) Follow the money, 2) Look at external influences when change happens

During 2015-2016, when prices skyrocketed, the number of out-of-towners was higher, in some segments doubled from 2014. (especially Vancouver, Ontario, other Island)

This makes sense. Given your basic input/output machine, if you apply an external input to a system, it affects the output.

External buyers have access to other income & resources that they can feed into our “system” as pure demand, no additional supply provided by selling an existing home.

Higher demand = higher prices if supply remains the same.

Interesting data but I have one question…

Do non- local buyers become local after renting here for just one month? If that’s the case the figure for non- locals is actually higher and unknown.

For ex. I rented here for seven months before buying and was then counted as local. I think Barrister And probably others on this blog rented before buying and were then local. It’s actually quite difficult to buy here first without renting and getting a feel for what areas you like. It’s more difficult to look at properties from far away.

Leo:

You are right about them not giving accurate numbers but then they wonder why people dont trust real estate agents. It is not just one or two bad eggs the association is dishonest as well.

Not in their members’ interests, so not going to happen.

Comparison to previous years

3Richard:

I am not sure why relisting with a different agent should reset the counter unless in Alberta you are buying the agent as some sort of slave labour?

“Seems like we’ve been talking out people rushing in for years before various credit tightening measures. How much more demand can there be to pull forward?”

The pool has to be weakening with more price slashes the last 2 months and many more relists and slashes. 165% debt loads, 27% in over their heads, government intervention and new stress tests on over 20% DP’s already tells us the banks are tightening credit much faster than previous rate hike environments.

“Days on market stats are also rendered dubious at best as well”

The Calgary Real Estate Board (CREB) changed it’s policy regarding days on market a few years back. We used to have the same issues with realtors relisting to reset the DOM counter back to zero. Now a listing has to be taken off the market for a minimum of 30 days or must be relisted with a different Realtor to set the DOM counter back to zero. It’s had a huge impact.

I wonder if it would be possible for the VREB to keep a running tally, internally at least, of DOM for each particular listing, resetting only when actually bought. Keep the DOM counter that we know and love/hate, but also track the total DOM on market starting with when initially listed and then finally sold.

Leo S:

Thank you for all the hard work on producing the charts. It is a shame that the Vreb refuses to give a breakdown between condos and SFH in their stats as to buyer origin. Doing a breakdown by price tranches would also be informative. I suspect that the 25% figure for non local buyers would look very different for SFH in Oak Bay.

The sales to new listings ratio loses a lot of its meaning when you consider that it is impossible to tell how many of the “new” listings are actually new as opposed to being just relisted. Days on market stats are also rendered dubious at best as well. A house down the street finally sold after being on the market for over three years. Every now and then it was taken off the market for a few days and the days on market counter was reset. When it finally sold it turned up as being 11 days on market. In reality it was on the market for over a thousand days. It certainly leaves me with the impression that the VREB has a limited interest in any sort of accurate reporting. My point is that one has to take a lot of the Vreb stats with a rather large grain of salt.

Haha whoops forgot to pull the Alberta label out. It is there in the dark blue if you look closely.

@Leo

Is the dark blue Alberta buyers? Did you leave out Alberta kinda like Trudeau did in his Canada 150 speech?!!

Would you by any chance have a comparable diagram say for the same period 2015 for buyer origin just before the dramatic price increases?

@Leo

Very informative and well laid out formats for presenting data. Kudos. The board is very fortunate to have someone of your caliber having such a keen interest in Vic RE.

With that said, can’t wait for journalistically inclined to have a headline “25.3% of all Vic RE bought by NON LOCALS in first half of 2017” to sell more newspapers.

Seems like we’ve been talking out people rushing in for years before various credit tightening measures. How much more demand can there be to pull forward?

Thanks for these interesting numbers Leo!

Will be interesting to see what happens in the next little while – do people “rush in” before rates rise, or not?