June Update: A not-so mixed bag

June numbers are out and I’d say they turned out surprisingly strong. Let’s take a look at what happened last month starting with the bullish news and working our way down. First of all, prices for the market as a whole continue to trend up across all detached, condos, and townhouses.

The months of inventory at 1.6 still falls into what the market summary considers “ludicrously hot” (MOI under 2). Despite several individual signs of cooling (we’ll get to that), the overall market shows no particularly convincing signs of slowing down. If we look at the trend, in a cooling market we should see a gradual deceleration of price gains. Instead of that we are seeing steady increases or even continued acceleration. For example, in the last two quarters we saw the 12 month rolling price medians increase as follows.

| Q1 2017 | Q2 2017 | |

|---|---|---|

| Median Single Family House | +$9712 / month | +$12,237 / month |

| Median Condo | +$5170 / month | +$5076 / month |

How many people here are able to save $100,000/year? Not me. That’s why this silly price appreciation has to moderate if we think that local house prices should be supportable by local buyers in the long term. Even if we accept that as the city grows, detached houses in the core will be affordable to an ever shrinking segment of the population, at this rate of appreciation that segment will tend towards zero rather quickly. Right now only the top 25% of local households could qualify for a mortgage on the median detached house with minimum down (it takes a household income of about $150,000 and some $68,000 at closing).

I’m on vacation so I’ll have to cut the analysis a bit short on this one. Here’s a pile of graphs

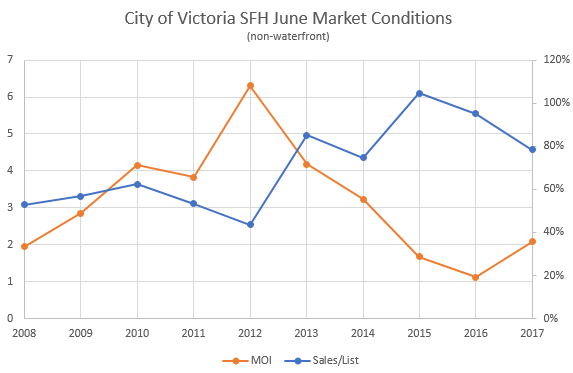

Months of inventory for June still tied for last year as the lowest ever. Don’t be fooled by the turn upwards at the end there, that is just curve fitting.

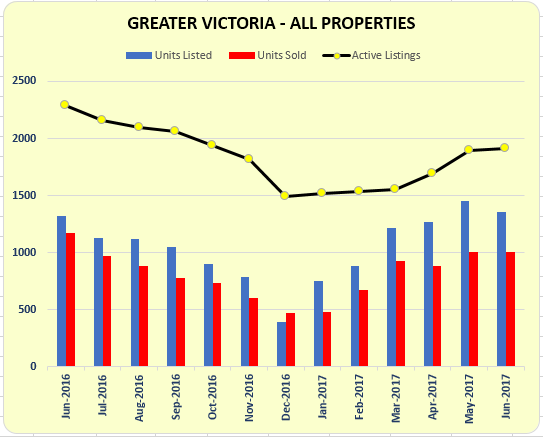

As for the rest, inventory is lower than it has been in any of the last 20 Junes. Sales are the second highest on record, and new listings coming in at around the high third of historical June numbers.

Where’s the weakness in the market? Well months of inventory have flatlined and are no longer continuing to decrease. This is as low as it’s going to go. Sales to list ratio is backing off from the highs reached a few months ago.

Inventory is also trending up a bit recently although not nearly as much as it should be this time of year. There are 1365 Realtors in Victoria and exactly 1358 residential listings. So if you’re selling, don’t be afraid to negotiate folks!

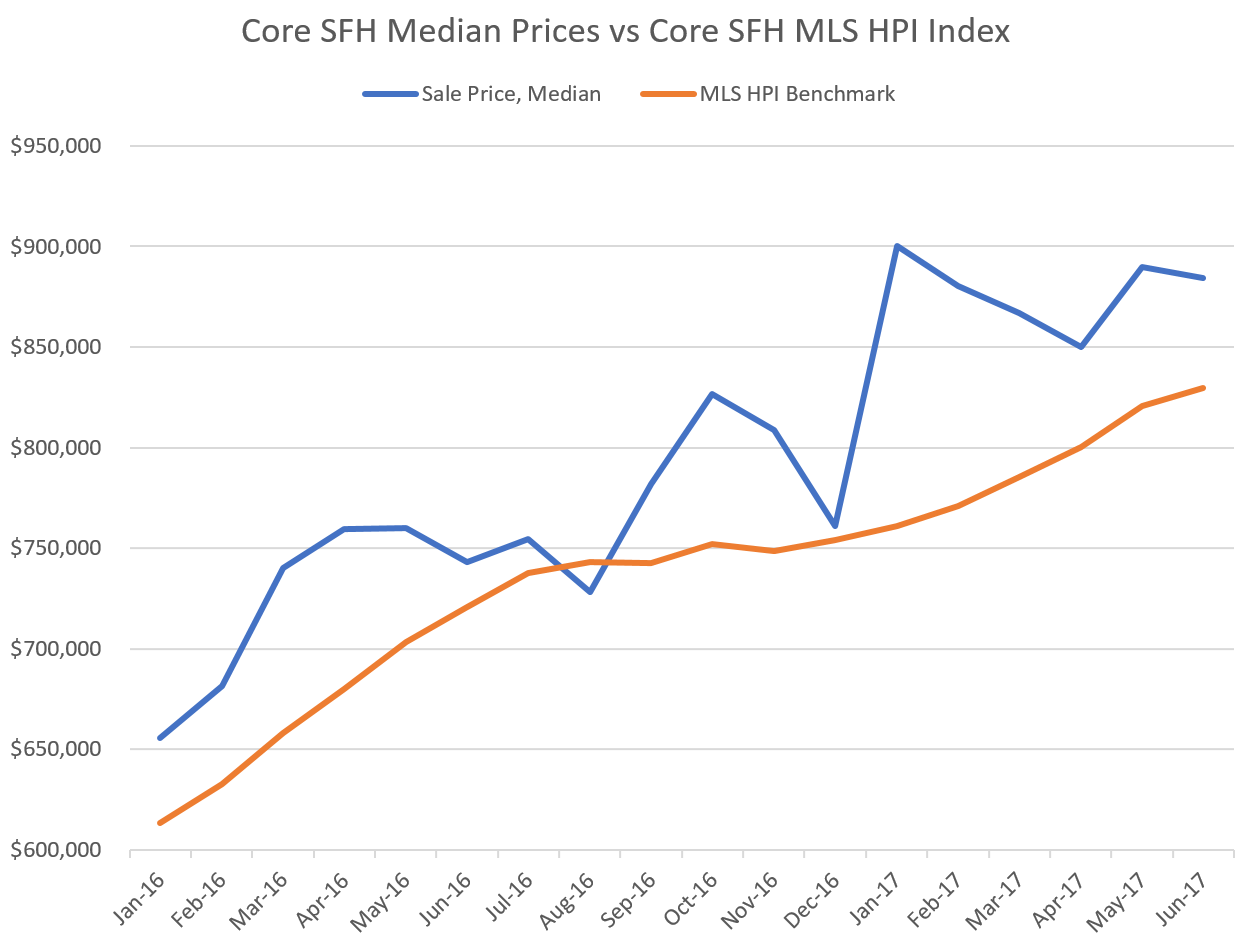

And then there’s the core. If I look around Gordon Head I see more and more listings sitting on the market and not selling. Same goes for Oak Bay. There is no denying that the hottest markets are slowing down. Then there is the recurring theme of flat median prices for detached homes in the core. I’ve previously rejected this as noise (how could there be flat prices in such a hot market?) but it keeps coming up so let’s take another look.

Assuming the MLS HPI can be trusted (more on this later), it doesn’t look all that flat based on that measure. The median prices are wildly volatile which we know, and the massive spike of the median to $900,000 in January makes all subsequent months look like prices aren’t increasing anymore. As always, if I’m missing something here, let me know in the comments.

Of course this might all be yesterdays news. Rates are going up (maybe even for real this time) and we’ll take a look at what that will do to the affordability picture in a future post. Much more importantly, a change in government means the industries funding/corrupting the party in power has also switched and with that we can expect a change in priorities. If you ask me it would do BC good to be just a little less real estate obsessed for a change.

New post: https://househuntvictoria.ca/2017/07/10/july-10-market-update/

Good link Wolf. 40% pay no HELOC principal, 27% are admittedly in over their heads and 2/3 know it’s a bubble that could go south at any time. The future looks bright. 😉

“A generation ago, you’d get a mortgage and pay it off,” she said in an interview. “Now you get a HELOC and treat your home like an ATM.”

Many have been. Almost 40 per cent of people who have them make no regular payments against the principal, FCAC says, which makes them vulnerable as rates rise.

“It’s a hidden problem,” Campbell says, “because with rising house prices many people took out HELOCs with no intention of paying them off. So today, they owe as much on them as they did three or four years ago.”

“There’s no doubt in my mind,” Campbell says, “there’s going to be a domino effect.”

VREB days on market so it does not account for those properties expired and relisted. Realistically that is not a lot of properties though. The stale crap remains stale crap after a relist. Not sure who is being fooled by a relist, their realtor will tell them it has been on the market before.

Leo: “21% Vancouver buyers in Oak bay in 2016”

Any idea how that compares to other municipalities? It’d be interesting to see how the ‘Vancouver Buyers in Victoria’ graph looks for 2017 so far, now that we’re past the spring buying season. Just my opinion, but I see a flattening of that graph to perhaps be a sign of a ‘return to normal conditions’ (less folks either cashing out of Vancouver or leaving because it’s too expensive).

(https://househuntvictoria.ca/2017/03/09/hot-vancouver-money/)

No. Have you actually been to the oak bay dump? Nothing actually sits there for any length of time.

Caption under the headline photo of the “Oak Bay Best Place to Live” article:

“Willows Beach attracts hundreds of thousands of visitors every weekend from around the world and throughout B.C.”

Wow, that’s basically all of the CRD!? Must be some beach. Wonder what the methodology and sample size is for this study. Good to see the Island represented – not surprised – it’s why I’m here.

Trouble brewing with HELOCs?

http://www.cbc.ca/news/business/interest-rates-helocs-canada-debt-1.4192847

Leo:

When you stated the length of time of SFH in Oak Bay, were you relying on the VREB days on market or was this the real days on market?

Thanks Leo. At this rate the sales will be under 600. That would be a major decline.

Another Oak Bay relist and slash of $55K at 2434 Dryfe St for $734K. Price of land must be dropping again, as the house is in nice shape for a starter.

@Wonderment

“I also wonder if a BofC rate hike will dampen the FOMO, which still seems to be burning strong.”

Typically just after a rate increase there is MORE activity as people rush to buy with their pre-approved mortgage rates which the banks hold for their clients anywhere up to 4 months depending on the institution. A rate slow down won’t show till 3-4 months after a rate increase implementation.

68 active SFH listings in Oak Bay. 29 on the market for more than one month. 16 on the market between 2 and 4 weeks, the remaining 23 are relatively fresh.

Thanks Leo.

187 since July 1 (so just over a week).

Listed as cancelled, not sold.

Over 50 decent properties in Oak Bay languishing for months. Your clients must be picky to not make a low ball or they are low income.

How many sales last week ? Must be pretty quiet or we’d hear about the line ups around the block by now. Nothing but crickets in Bearkilla’s hood as the neighbors hack and slash.

Does anyone know what the flip at 2533 Richmond Rd sold for?

It was purchased in Jan 2017 for $690. After whitewashing all the beautiful dark wood trim, it was listed for $850 in June! Just curious how profitable a paint job is?

I also wonder if a BofC rate hike will dampen the FOMO, which still seems to be burning strong.

Had three clients offer on different properties all with a noon today presentation time and none were successful; still seeing 5-7 offers on decent properties.

Barrister you’re right – this might become a piece of art, perhaps a zipline to be installed, a tourist attraction in its own right 🙂 Who on earth thought it was a good idea to design what’s been called an “experimental lift mechanism,” untested in the real large-scale world, at taxpayer’s expense.

I see 242 Beach sold for 1,760; not an exciting house but on a 10,000 square foot lot across from the water. I am sitting here wondering exactly when did that price actually become reasonable to me?

Vicbot:

Actually there is a pretty good chance that the Janion will not be besides a high traffic area after the new bridge gets permanently stuck in the up position shortly after it is opened.

There you have it bears. The market is still nuts. Rents are going up. It’s a complete disaster for you again bear.

Although the Janion seems like it’s well designed, I don’t understand why people would choose to live or stay next to a bridge, where it’s well known (at least in bigger cities) that bridges are one of the noisiest places because of cars crossing the expansion joints, and the inevitable idling as cars wait to cross. I guess that’s why it’s zoned for short term rentals, but it would have been better as a mall.

btw James, I’m still shocked by Wilmot – even if it’s perfectly serene & convenient – the fixes needed to layout, main staircase, & bathrooms are huge. Maybe it’ll be a re-build.

Can you hear the dump with your nose?

I lived across the road from this house for years, you can’t hear the dump/recycle yard at all. It’s a quiet dead end street that’s a 45 second walk from Oak Bay ave.

Leo S

Yep, we’ll see. I can’t see the prices holding once the short-term rug is pulled out. One of my friends sold their unit there recently (before any noise about new STR rules). Bought pre-build, doubled their money or better. Sounds like they got out just in the nick of time.

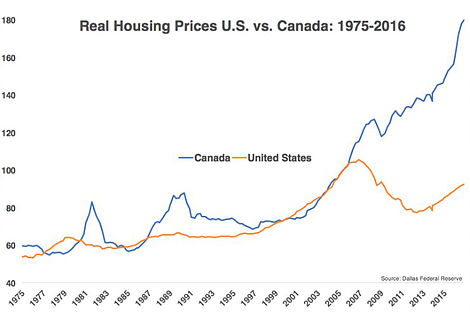

Since it only took 11% of owners to crash the US market this is a no brainer. Like Toronto things could change on a dime.

27% of Canadians already ‘in over their head’ with mortgage payments: MNP

An alarming number of house-poor Canadians are teetering close to the edge in terms of meeting their debt obligations, according to a poll conducted on behalf of MNP. The report from the chartered accountancy firm says even a modest increase in interest rates could push many homeowners over the edge.

“Three in ten home owners say that they will be faced with financial difficulties if the value of their home goes down,” the report read. “Even if home values don’t decline in the near future; more than a quarter of Canadians (27 per cent) who have a mortgage agree that they are ‘in over their head’ with their current mortgage payments.”

http://www.bnn.ca/27-of-canadians-already-in-over-their-head-with-mortgage-payments-mnp-1.800710

West facing yard on 2628 Belmont Ave as well. At asking price it is a great deal.

Mere posting with a $1 cooperating commission would be a much better marking approach compared to usedvictoria but besides the point 🙂

There may be a bit of a bargain to be had at 2628 Belmont ave. Private sale so not sure how much exposure it’s getting. Priced at 680k, same price as recent sales that were basically gut jobs. Sellers clearly priced this one too low imo. Looking at offers tomorrow. Would be interesting to see what they get but I guess we need to wait for BC Assessment to update for the sale?

http://www.usedvictoria.com/classified-ad/Charming-Arts-and-Crafts-Home-For-Sale-By-Owner_29677659.lite?

Either 700 a square foot or a thousand a square foot are simply insane amounts for a condo with second class build quality. I dropped by the sales office for the Wade today and it was totally underwhelming. They claim they are 70% sold and I have no reason to doubt that but I really have to question why anyone would consider this a good investment. I would also be concerned that as near as I can tell the company has not so much as put as shovel in the ground yet.

Janion resales are touching $1000/sqft. Or rather were. We’ll see what happens after the AirBnB rules are implemented

“If half or so of this 3,200 square feet is basement and located in Victoria, Saanich East or Oak Bay, I would say a reproduction cost new would be $200 accounting for the lower quality of finish generally found in basements. That means for a complete gut, the home would have to exhibit 60% depreciation, a complete remodeling without gutting at 40%.

$200 X (100-40) /100 = depreciated cost would be around $80 a square foot for a gutting

$200 X (100-60) /100= depreciated cost would be around $120 a square foot for a complete remodeling.”

Wow, fantastic answer, thanks John Dollar! I know that it’s a pointless method of determining the price (the market does that) but I think it has merit as an intellectual exercise in helping assess what a fair price might be and whether it’s worth fixing up and eventually reselling.

” They haven’t even started construction so I’d be cautious about that one. ”

Too late for the 85% who got sucked in. The last pic is of a small ditch digger by the side of the old building a couple weeks ago. To be built a year from now with no major earth moving seems like a stretch. By that time the condo fad will be long gone as the flippers fight to stay solvent.

Thanks dundiggin for the price on the Dallas Rd house. I guess my PCS sheets don’t go over $2 million. Seems like they got a good price for it. ESP when you consider they had to add GST.

The Wade seems like it has some good concepts going on w the rooftop gardens etc. But the location can be beat. They haven’t even started construction so I’d be cautious about that one. Strange thing I saw in Van is often many people don’t care they are in junkie hoods in these condo towers. Gastown is a great example of that. Just one block or two from zombie apocalypse you find pricey lofts and snazzy tourist based businesses. Just part of living in the city and we now see the same thing here.

I wonder if the Wade will have a “meet your new neighbors day” ?

http://deddeda.photoshelter.com/image/I0000d8E3k.0hdMc

The realtor flip 252 Superior Street slashed another mere $10K. Bought at $689 a month or so ago, started at $795K and still no takers with nothing done to it.

Another Golden Head tiny slasher of only $20K at 4030 Oberlin Pl. What happened to the traffic jams where only land prices go up? Real estate going passe.

I believe I mentioned before the Wade is being backed by a syndicated mortgage company being sued for over $100 million.

Agreed Barrister, who wants to live in junkie town. They aren’t going anywhere anytime soon.

Makes you think the stories of foreign money via VV backing these projects around town as well is larger than first thought making the market much vulnerable to a major shock like Toronto.

If the home is currently being lived in or is in rentable condition then the older improvements still have economic value. A 35 year old house (circa 1980) requiring a complete interior gutting is rare. Usually it isn’t necessary to rip out the interior walls, wiring and plumbing. So I suspect you’re likely mean not opening up the walls unless there has been a fire or a flood in the home.

If half or so of this 3,200 square feet is basement and located in Victoria, Saanich East or Oak Bay, I would say a reproduction cost new would be $200 accounting for the lower quality of finish generally found in basements. That means for a complete gut, the home would have to exhibit 60% depreciation, a complete remodeling without gutting at 40%.

$200 X (100-40) /100 = depreciated cost would be around $80 a square foot for a gutting

$200 X (100-60) /100= depreciated cost would be around $120 a square foot for a complete remodeling.

If the home is not rentable. And I mean the roof is leaking, toxic mold, fire damaged then its 90%. Assuming the structure can be saved.

All of the above is realistically an academic exercise as you can not separate the value of the improvements from the land. While you see this on your government assessment it is only there to show a rough break down for taxation purposes.

Try to think of any other asset where you would do this? The value of a car. Would you say the engine is worth this much and the tires this much so therefore it’s worth this much? Just like a car you look at the value as a whole not what the pieces add up to.

259k for a studio?! Ooh only $700/sqft (assuming floor space is anywhere near close to advertised).

The Wades advertisement seemed to forget to mention the scores of druggies that are in that neighbourhood. I found it sad when I read their banner “That someday everyone will live like this” as if it was a good thing.

“The Wade’ being marketed in China by Rob Scarrow”

The reason why he is marketing it in China is because no one else will buy that ………….p.

366sq ft, suite? My ensuite is bigger than that.

‘The Wade’ being marketed in China by Rob Scarrow.

I know how seeing this makes me feel but I’m curious what you all think?

http://www.macrealty.cn/Home/Index/zxlpxq/id/3.html

Thanks LeoS, that’s perfect. Just one question, is it “all properties” or just SFH?

Since there seems to be separate distinct markets for condos and single family houses, it would be nice to have a graph for each of those two categories.

Thanks again!!

Leo S

Needs more drop shadow and aliasing.

Ha, not where I was thinking at all. Beautiful though.

By the way the affordability report that Ian is talking about is this one: https://www.vancity.com/SharedContent/documents/News/Vancity-Report-Housing-affordability-in-BCs-hottest-markets.pdf

As usual I don’t think median examining median prices and mixing condos and SFH is very useful. Your median property is always going to be a very expensive condo or a very cheap SFH. Neither is representative of what is being bought out there. They should do one chart for condo affordability, one chart for SFH.

Yeah I’m gonna call bullshit on that one.

There were 82 sales in Oak Bay in 2016 to buyers who listed either Vancouver, Burnaby, Surrey, North Vancouver, West Vancouver, New Westminster, Pitt Meadows, Coquitlam, Delta, Langley, White Rock, Maple Ridge, or Richmond as their address in the Buyer City field.

There were 386 sales total. So that makes 21% Vancouver buyers in Oak bay in 2016, not 40%

Impossible to answer that question without physically looking at the property. It’s pretty common for a full gut reno to cost more than rebuilding from scratch. Depends on how much messing around you have to do.

How’s this? Close enough? 🙂

Mukluk asked:

“Hypothetical question: what would you say might be the rough value per square foot of a 35-year old, 3200 sq. ft. house that needs a complete reno from top to bottom, but is otherwise structurally sound? $50/sq. ft.?”

Depends on the quality of the renovation. For example a quality kitchen in a 3200 sq ft house will be about 300 ft.sq. with about 20′ of counter space. So for custom cabinets, Quartz countertop, new floor, window upgrades, electrical, plumbing, kitchen exhaust, and good quality appliances will cost a minimum of $125,000; more if you’re adding a kitchen island. Then the bathrooms will be about $10,000 each.

If you’re talking about a full gut to the bones then you’re cost will be well over $100 per sq ft.

“Are you asking about the cost of doing renovations or the resale value of the structure or ?”

I’m asking what’s the hypothetical dollar value of the structure as it stands right now, with foundation poured, walls up, plumbing and electrical in place but needing renovation.

Every time I listen Ian Watt I expect him to start talking about kitten mittens https://www.youtube.com/watch?v=jP_ze_vmlj8

It’s awesome.

Are you asking about the cost of doing renovations or the resale value of the structure or ?

Hypothetical question: what would you say might be the rough value per square foot of a 35-year old, 3200 sq. ft. house that needs a complete reno from top to bottom, but is otherwise structurally sound? $50/sq. ft.?

North of Enderby, you can see the Enderby cliffs in that picture

For the overall market, yes. For sub-regions, no only manually and i don’t have time to do them all. With the automated data feed, yes.

The graph below is quite different because it is only June data over the years. I find same-month comparisons more effective personally because then you don’t get distracted by seasonal trends. But both are useful.

Haven’t had a chance to read the report but this is interesting

https://www.youtube.com/watch?v=t-yxhl1LhUU

I don’t recall off the top of my head. It was something around the $220 or $240 mark and the city said it was the minimum they would accept, even though the actual cost will be below that.

I wonder what the legality of them charging permits at high-end home construction prices is? In reality everyone is building in the $200 to $350 range but in theory you could built 100% compliant with building code for $120 per foot or so…..vinyl siding, 99 cent laminate flooring, pony walls for stair cases, super cheap kitchen and bathrooms, etc.

LeoS– is it possible for you to start producing a monthly graph similar to the Vancouver Real Estate Org?

http://www.rebgv.org/listed-vs-sold?

It seems you already post similar monthly data, but in a different format. The graph you posted below is excellent, just a bit different than the vancouver chart.

I don’t recall off the top of my head. It was something around the $220 or $240 mark and the city said it was the minimum they would accept, even though the actual cost will be below that.

leo s

Nice. Is that somewhere along the Fraser or Thompson? The hills look familiar, but so much of the interior looks similar.

Heck, some of Yosemite looks like the interior here.

I got my building permit a week ago and when I went to pick it up the city charged me 24K.

What did the city accept as your per sq/ft cost for calculating construction cost/permit cost? I know the home we built in Fairfield last year the inspector refused to take the permit at $150 per sq/ft 🙂

I got my building permit a week ago and when I went to pick it up the city charged me 24K. A portion of that is damage deposits. I’ve just starting buying materials so we’ll see how that compares to 10 years ago.

Back.. Was just off to the interior for a week. This is the kind of real estate I was looking at there.

Assuming you mean city of Victoria… Here is the situation for past Junes. Sales/list on the high side still but down from recent years. Months of inventory up from 2016/2015 but otherwise very low still.

Interesting to see the market in Victoria proper detached homes actually turned around in 2012, well ahead of the overall market.

Leo, aren’t you supposed to be on vacation?

Babysitting a blog seems the opposite of relaxing. Maybe Hawk can be your weekend moderator.

I checked out a house this weekend since I know a few people that are buying (and the house looked interesting, so why not). Bidding war of course, BUUUUT top bid had conditions. That’s an improvement in my opinion. Oh and no delayed offer. Also an improvement. I still wouldn’t want to be a buyer right now.

If I were in the market I’d be waiting for the rate hike, potential new qualification rules and then to see what the NDP do in office regarding housing. I think odds are in favour of things moderating but I’m not losing buying power like people who sold or are new to the market (no fomo).

It’ll be interesting to see what happens this fall. Will the house of cards collapse or will it be flat? Another leg up isn’t impossible, but there are a lot of headwinds.

“Yeah, those that don’t have the crystal ball didn’t correctly predict the last seven or more years in the Victoria housing market. Oh wait, that was everyone.”

Isn’t that why you bought though, you thought it was a good investment so you put your money in real estate? Turns out you were right, above your expectations. I just think it won’t continue that way forever. Speculation/investment works both ways.

I didn’t make a prediction on the last seven years of Victoria real estate.

@dundigg’n

Not sure why your comments keep getting stuck in moderation… looking into it.

@ Luke. 1212 Dallas Rd sold for $2,260,000. Asking price was $2.4 million.

1632 Wilmot Pl – agree that was a shocker – can someone explain. So many things to fix, eg., layout, no handrail on main “staircase/ladder,” bathrooms need gutting, walk through another room and walk up a step to get to the master. It reminds me of things I saw in Van – there, it was proximity to a high school, eg., Oak Bay High, that caused the no-holds-barred offers. Or maybe an eccentric Mr/Ms Fix-It millionaire bought it.

@ Marko:

“Some of the recent rental rates I am seeing on basement suites are insane as well, you need a professional job for the privilege of renting a crappy suite….”

That stirs an old memory.

When in Toronto in 1987, the only affordable accommodation I could find (my salary was better than that of the average U. of T faculty member) was a basement suite where I had to duck my head to get from one room to another. It was then that I decided, if this is success in my profession, I need a change of direction, and booked a flight back to what was then low-cost Victoria, to live happily ever after.

The Toronto property market crashed a year or two later.

Getting back into working and not really seeing any sort of slowdown…..Langford is totally nuts. There was a 70s home listed yesterday morning with no offer delay and by the evening they already had 4 offers on the table. Then went to show a spec box in Happy Valley and there were four parties looking at it at the same time; not even an open house.

I have my fingers crossed interest rates go up next week to cool off the market a bit.

Some of the recent rental rates I am seeing on basement suites are insane as well, you need a professional job for the privilege of renting a crappy suite….the rental towers under construction downtown can’t come soon enough. Tough to say how much inventory will make any sort of dent. The new Hudson rental tower rented out within a couple of weeks or basically just as quickly as they could process the viewings/rental applications.

Thanks for posting Leo. Construction costs are up substantially assuming you can actually find tradespeople to work. Most capable framers are booking jobs 3 to 5 months out on single family homes. As I kept bringing up on the blog 5 years ago absolute shortage of trades; pumping out bachelor of art degrees instead of trades.

Unfortunately society awards flipping paper versus actual production.

1632 Wilmot St in OB – only two houses away from the municipal dump/recycle yard. Apparently they didn’t get the memo about the ‘tide turning?’ Listed at $1,095k but sold for $1,310k.

I don’t get it about that one, but there does seem to be a cache about being near OB village. They can stagger home from the Penny Farthing pub! Still, the place could use some more fixing up – old baseboard heating, windows, boring bathrooms and makeshift suite.

Anyone know what 1212 Dallas Rd in Fairfield sold for? Listed at $2m it took a long time to sell but a sold sign has appeared yet it’s another one that’s disappeared from my PCS sheets!

DId Marko post this? How much does it cost to build in Victoria in 2017.

https://m.youtube.com/watch?v=u3iCRtZKv5Q

$150-$160/sqft for a basic spec house in the west shore

$200/sqft+ in the core for the same kind of place

$300/sqft+ for custom

I think you’re right. The Victoria market is still relatively strong but the tide is turning in sentiment at all levels. The munis and developers are building at record pace and focusing on adding supply. The province, assuming they can hold the politics together will unravel the stimulus from the Libs and crack down on fraud/loopholes. The feds and CMHC are doing their best to pop this thing and rates are rising.

Meanwhile a crash in Toronto will show people with short memories that real estate doesn’t always go up

I also like Zolo. I would like to build something similar for here in fact. The problem I have with Zolo is that I don’t think it represents a useful picture of the market.

For example, what conclusions should we draw from this chart? Prices for 4 bedroom homes have collapsed in Victoria while 5 bedroom homes have been exploding?

Or does this tell us something about price movements in the Victoria market? Prices increased by $500,000 in Victoria from one week to the next, but then dropped back down after 6 months?

The problem is that they just segment the data too small. They do every 2 weeks and divide the data into too many small bits so most of what is left is noise.

Love this article in the Tyee about the CMHC’s response to the BC subprime mortgage lending program. What a horrible program from back to front. Designed purely to gain votes.

https://thetyee.ca/News/2017/07/07/CMHC-Refused-BC-on-Home-Loans/

the core are E/W Saanich, OB, Victoria, Esquimalt, Vic West, and View Royal.

What exactly are the boundaries of the”Core”?

Thanks.

If I gave two people exactly the same data both would come up with the same answer for a median and average. But they wouldn’t come up with the same HPI. And that would make an economist pull his hair out by the roots unless he was paid by the real estate industry to promote the HPI.

And the benchmark home can change. Langford is an example where the benchmark home of 1990 is not the same as the benchmark home today. Back then it would have been a mid 1970’s home on a quarter acre lot. Today it is a semi-custom two level home on a 5,000 square foot lot with granite counter tops and stainless steel appliances. What will the benchmark home be in another 20 years?

The test of how accurate an HPI is or is not has not been done. With a median you can look at today’s median relative to the median of two years ago for your neighborhood. Using a little math that would give you a factor for how much the market has changed. Then if you found a property that re-sold in those two time periods, the time factored analysis and the re-sale analysis should be close to each other.

That’s the test the median analysis would be more successful at passing than the HPI

The HPI is just one of many tools. It shouldn’t be elevated to the status of the one and only method because it has limitations just as the median, the average or the re-sale method popularized by Case-Schiller have.

Why I don’t like it, is that it can not be replicated or verified by another party. And that’s a problem because if it can’t be independently verified then in can be manipulated.

That’s what separates the men from the boys. Normally you can do it with an escape code, e.g., alt + 148 (on the number pad), but for some reason, if you try that here, your comment simply disappears: no umlaut, not comment.

But you can cut and paste, e.g., from CS at 2.45, or from anywhere else on the Web, thus: ö.

Hope that gets you rolling.

Not my words there pardner. Did you click on the link I posted?

Agreed. I don’t have access to that data.

Agreed. Very suspect.

Maybe. Don’t you have access to this data? I’d guess January had some differences from the following months in proportion of high value sales or lack of mid level sales or something like that. Maybe not.

Huh. I’m actually loaded with Laocoon (sic) pronouncements but I am held back by my inability to produce an umlaut. It trips up my rolling sentences.

The benchmark is a composite of parts that make up a home. It’s the same as saying that the typical Canadian family has 2.5 children. I guarantee you that no Canadian family has 2.5 children. Accordingly the typical or benchmark home may not exist either. Which we saw with Oak Bay town houses. The board was determining an HPI for something that didn’t exist.

And whoa there pardner. Not all economist agree with you on the HPI. Even the people who designed the HPI. -the Altus Group explain the limitations of the HPI.

Just because there are only 98 sales doesn’t mean the median is wrong. It depends on the market segment that is being used. Each set of data should have a similar make up of houses.

If you wanted to track how your property has appreciated over time then you should look at data set of similar house sales within a half kilometer radius of your property and plot how that data set has appreciated over time. Altus Group developed the HPI discusses market segmentation at length and an article in the Appraisal Institute of Canada magazine this month discusses the pros and cons of “time adjustments” and how to do them correctly.

It would be incorrect for an appraiser to use the real estate board’s HPI to determine a time adjustment since the HPI may not relate to the property that is being adjusted for changing economic conditions.

Blindly using a median or an average wouldn’t be good either. You would have to make sure that the data your collecting remains consistent over time. You can accomplish this by bracketing the house size, lot size and location. By increasing the quality of the data it isn’t necessary to have hundreds of sales. As few as 20 or 30 will give you a consistent and accurate indication of how prices for that type of home in that location have changed.

This is a useful check to a house estimate that can be done in ten minutes as opposed to the old fashioned way of reviewing comparable house sales and making adjustments for the difference between them which could take a couple of hours to research and correctly calculate.

Which is designed to represent a typical residential property in a particular MLS® HPI housing market which likely falls around the median in most long-term data sets.

The HPI is better for the median house imo and the opinion of economists because they compare like with like and look at the typical house without the skew that can happen with medians and means on a monthly basis.

http://www.rebgv.org/economists-agree-benchmark-prices-are-most-accurate

The HP index follows a hypothetical house of a certain, size and age. If your home is not similar to the benchmark home then “your mileage will vary”.

The HPI isn’t tracking the market it’s tracking a specific benchmark home.

For example Gordon Head homes may be tracking higher yet the median for the market place may not have changed much at all. So which one is a better indicator of the market in general?

If you consider a margin of error of +/- 5% or even +/- 2%, we are flat in both median & HPI for January to June. Then when you look at Leo’s graphs, the overall trajectory since June of last year (a reasonable period to assess trends), we are up.

I don’t think there’s any conclusions that can be drawn at this point. Definitely interest rates will have an impact, and perhaps new BC housing policy and the markdowns, but the low Canadian $ and retirees from bigger cities also have an effect. The future is ours to see, que sera sera – if we’re trying to be poetic 🙂

Yes, although we know there were only 98 sales in January and more than double this amount in March to June. And you are right re. median vs. mean – the distribution of sales would need to be quite different for January. In a skewed distribution, it is quite possible for the median to be inaccurate as a measure of appreciation/depreciation as it is no longer an accurate measure of the middle of the market – the HPI house. I think LeoS has access to the stats so maybe he will weigh in.

“What you need to look at is the overall trend because monthly data can be skewed very easily by a few sales.”

Yeah, but it remains a fact that the overall trend in median price, January to June, is down.

And the point of looking at median prices rather than means is that one or two high-end sales won’t skew the result either “easily” or “very easily,” but should make no more difference than one or two low-end sales.

True, if we had more comprehensive data we could make more definite statements, but with what we have, there is no statistical manipulation that I am aware of that would indicate that in comparing like with like (insofar as that is possible) it is more probable that house prices, in the core, rose rather than fell.

That was a beautiful piece. Moved. And, keep doing it.

No, it is not a fact that prices are lower. The overall monthly medians are lower. You could say that the median price of all houses sold was higher in the month of January, just like June’s median was higher than April so prices must be up since April right?

I don’t think this is true using one month of data in June or one month of data in January as a comparison. What you need to look at is the overall trend because monthly data can be skewed very easily by a few sales. This is why the HPI was developed. If you look at the HPI prices have continued to trend higher each month since November 2016.

If your analysis was correct you should be able to pick any one month, let’s say October 2016, and state conclusively that depreciation was in play the next two months and that prices were falling. They weren’t – the market was actually appreciating. It is just that some higher priced homes were sold in October vs. November and December.

Once we have several months of down prices you might be able to point a trend. One month just doesn’t mean too much overall.

Here are the median prices and the number of sales in the core for detached homes.

Month Sale Price, Median Sales, Number of

Jan $900,000 82

Feb $880,400 138

Mar $867,000 194

Apr $850,000 205

May $890,000 225

Jun $884,500 228

https://youtu.be/bEmjiCoZ6e4

You’ll likely only have to wait until next week to see the .25%. Regardless, actual bond rates have risen double that in the last 2 weeks.

@ LF:

“With a paragraph like that, you and Marc Faber would get along well”

Yeah, if I had the appearance of a very rich man without a proper job, and spoke with the accents of an Austrian banker, I suppose I might try to monetize such verbiage.

As it is, I indulge in one of the few pleasures available to the very old, which is to make Laocoön pronouncements in rolling sentences designed to terrify the young and innocent.

Yes, I would continue to state that prices are not down.

OK. Let’s just say it is a fact that in the core they are lower than in January.

Yes, I would continue to state that prices are not down. Look at the HPI. And as Leo stated above:

One month of data does not make a trend and prices have not continuously declined.

“It seem to me the core has, overall, continued to appreciate..’

In all respects except, since January, price!

“For how much longer I don’t know.”

You mean for how much longer while the overall price trend in the core is down can you continue, without embarrassment, to assert that the trend is up? Or what?

“The most the January stat likely shows is that there were more high end sales in January.”

Certainly there have been many more high-end listing than sales in months subsequent to January, if the Uplands is anything to go by. In fact, with only three Uplands listings at the beginning of the year, your theory that there were more high end sales in January than in subsequent months seems counter intuitive.

In any case, let us remind one and all that, since the beginning of the year, prices in the core were lower in all months than in January, which is contrary to the normal seasonal trend, and thus indicates a seasonally-adjusted price decline.

That the overall Victoria price has nevertheless trended up is consistent with the usual pattern for price increases to ripple out from the urban center, with price declines rippling out likewise. Since the core is, according to seasonally adjusted data, in a decline, the region as a whole looks set for an overall price decline quite soon.

The most the January stat likely shows is that there were more high end sales in January. MOM drops or rises are pretty silly when a couple of very high end sales, or lack of them, can skew the results. January was higher than June, but June was also higher than April and May was higher than any other month prior except January.

It seem to me the core has, overall, continued to appreciate and is not depreciating when I look at the individual sales prices. For how much longer I don’t know.

hawk

That’s the one you predicted a 200K slash on (which I agreed with.. it needs at least that). I don’t understand how they think they can get over a million for that POS and I can’t believe it took so long to drop the price at all. Nicer houses on San Juan have sold for a lot less, quite recently at that.

Is it the realtor, seller or both that are out to lunch?

The seller paid $650,000 Jan 2017! I’d be happy to get 800K in that time frame. Pretty good appreciation for 6 months.

Shocked at the amount of renos gone bad stories I’m hearing lately. Shit contractors being fired, bailing mid-job or just not just showing up after charging outrageous prices. Always a bad sign the end of the cycle is nigh.

With a paragraph like that, you and Marc Faber would get along well, haha. Could be true though. Should that occur, it will be interesting to watch the tonal changes or outright disappearances that will occur amongst the people who post here, or bears become bulls and vice-versa. I’ve already noticed one bull on here has been very quiet lately, but who knows why. Perhaps?

I’m still not convinced that this lunacy is over, but it’s going to be a lot harder soon enough for it to continue, or to raise arguments which are almost always variations on the “different here/this time” theme. Like I always say…it just ain’t so. The most recent attempt seems to be, “BC/Oak Bay most desirable”. Sigh. It’s ultimately not going to help, folks. The cycle will cycle despite recycling the “it’s different” this cycle.

But not in the core, where the highest prices this year were realized in January since when prices have declined despite the normal seasonal trend which would have resulted in an increase of around $60,000. So, in fact, a flat to declining market since January could well be the prelude to a substantial year-to-year decline.

The fact that the overall price has risen since January indicates that the rise in price at the periphery cannot be attributed solely to the normal season fluctuation. What we are seeing, almost certainly, therefore, is evidence that many of first-time buyers have been priced out of the core, which is already flat or falling on a seasonally adjusted basis and likely, therefore, to continue slumping.

Once weakness in the core is generally recognized, the rush to the West shore will most likely peter out, most probably followed by a general market decline if not collapse, as interest rates rise, stock markets sink, regulation of foreign investment in the housing market begins to bite, and unemployment rises as the air goes out of the construction industry.

What struck me about that article is when Binab said, “last year, almost 40 per cent of buyers in Oak Bay were from Vancouver.”

Wow 40%. I wonder if there’s a way to produce these Vancouver stats for the other municipalities. Based on the Vancouver & foreign buyer stats for OB & Saanich, I can see that out-of-town buyers (& low inventories) have had a major influence on prices in those muni’s. (it only takes a small % of higher bidders to drive things up)

Not saying it’s going to stay that way – just an observation of the last 2 years.

Totoro

Not my fault since my wife has been using my crystal ball for a paperweight.

Oak Bay was voted the best place to live in BC and second-best to live in Canada.

http://www.vicnews.com/news/oak-bay-voted-as-best-place-to-live-in-b-c/

It will be interesting to see if rates do rise this year. It seems like most credible sources are saying to expect .25% if they do.

Meanwhile in Victoria, according to Leo’s chart and the HPI prices are continuing to rise. With the change in government, new CMHC stress testing, a possible interest rate hike, and the slowdown in SFH price appreciation in Vancouver, it does seem unlikely that the market will continue like it has. Last time things changed we had seven years of flat. We’ll see what happens this time.

Yeah, those that don’t have the crystal ball didn’t correctly predict the last seven or more years in the Victoria housing market. Oh wait, that was everyone.

You sound nervous plummer. I guess you’ll have a hard time explaining to your recent sheep that a $100K plus loss in a few short months like Toronto is now experiencing is “good value”.

Toronto average prices down $120K since April from $920K to $800K. OUCH! Can’t happen here. 😉

Another Golden Head’er student special at 4367 Torquay Dr only slashed $20K for a mere $839K. Only a few months ago they would be paying $100K plus over. Going to need a bigger slash than that. Real estate is going the way of beanie babies.

John Dollar

July 6, 2017 at 10:57 am

Fact. June house sales in the core were down from 2015 and 2016 but prices are up.

It’s like asking a grocer store owner how is business.

“Great! Prices are up but I haven’t sold anything lately.” I don’t think any business person would say that was great, but in real estate it’s just fine to do so.

To add to this, for Victoria SFH (not acreage/waterfront) looks like June sales are down 16% from June 2016 (but still at 2nd highest level of sales in the last 5 years) and new listings are now at the HIGHEST level they’ve been during the last 5 years (I can’t see further back than that). If this trend continues, looks like prices for SFH’s will be stalling and dropping sooner rather than later.

Com’on, I always like your style. Even the market went up double, you were still screaming the end is near. I like your dedication, tune out the naysayers, believe in yourself and yourself only, ignore what happened outside your penthouse at OBBH.

Hawk, don’t be a chicken, share your insight. Tell us how much you think the market will sink.

“The amount is exceptional here, but the practice of cashbacks is as commonplace nowadays as bidding wars used to be just 3 months ago.”

“Cashbacks”…. hmmm. This smells of serious fraud if there is mortgage financing involved. These buyers and sellers are trodding very dodgy ground and as Russell Peters would say

“there is going to be a whole lot of hurt going on here”! If the lending institution gets wind of a substantial “cashback” they would in all likelihood withhold advancing their funds on closing and that will really create a disaster for all those involved.

The “cashbacks” on deals that had 20% downpayments would now become unconventional mortgages requiring CMHC approval. The lawyers in these deals would be jeopardizing their careers as the banks essentially hold them to ensure that everything is on the up and up when they are entrusted to handle their funds. There is no benefit to lawyers involving themselves in such a transaction so why would they willingly participate? They would only stand to lose.

For those that are interested the following youtube video does a good job of explaining how to purchase a foreclosure in BC. I would add that if you are considering a foreclosure that you work with a Real Estate Appraiser to discuss the low to high value range of the property so that you don’t overpay or start off with too high of an original offer.

https://youtu.be/7VhxEpa-gCA

I suppose that’s the issue. The more the federally regulated lenders have the screws tightened, the more business flows to the provincially regulated credit unions. Hope the province matches the feds so these regs have teeth.

Asked Mike Grace his perspective on the change to the stress test for uninsured mortgages. Here is his reply:

“I would personally applaud this move as it would level the playing field between the big 6 banks and the rest of the mortgage market – in both products and pricing.

There are only a handful of lenders that offer best rates on conventional mortgages using the ‘contract rate’ for qualification – these would mainly be the big banks and credit unions.

Most credit unions on the island however, have lower TDS/GDS requirements, and Loan to Value restrictions which somewhat offsetting the benefit of using the contract rate to qualify.

Where I see this affecting the market in Victoria is in the $1,000,000 to 1,300,000 price range. It has the potential to put a real damper on this segment as most mortgages in this purchase price range likely would be using a contract rate to qualify.”

Why does my opinion suddenly matter to you plummer ? I’ll buy when the time is right. I’m in no rush.

Holy shit. The flipper slashes in the nice hoods continue full bore, must have seen the bad news.

Nice place at 1325 Fairfield Rd whacked $50K to $999K trying to catch the CMHC crowd.

3929 Ansell Rd slashed $50K to $880K.

Another Golden Head’er at 1607 San Juan slashed $52K.

67 San Jose in James Bay taking a $90K beatdown to $749K

3392 Henderson Rd slashed $40K to $1.06 million.

Flippers want out now, must be under some major money squeezes. Make them a low ball, like another 40%. 😉

Wolf how about you ignore my muttering posts and I will ignore your cesspool of negativity. Sound good.

“For the present, like the past 3 years, i see nothing suggesting Victoria RE is declining at all.”

That’s what gets people into trouble. No foresight, but instead a reactionary stance relying on past data/trends and refereed articles that are outdated before they’re even published. This is why some don’t do well in the stock market; things change in a heartbeat and the so-called data doesn’t always point you in the right direction. If you’re relying on this data why not just ask the tobacco companies if smoking is bad for you, or the oil companies their views on climate change (it’s inconclusive by the way). Look at how many comparable homes have come onto the market recently that haven’t sold like they would have a year ago. DOM is increasing and (I believe) will be higher the next few months leading to a deceleration in prices, and once prices decelerate people might consider looking for higher returns elsewhere. What’s happening in Toronto will likely reverberate in the mentality of buyers & sellers here; it’s unfortunate that most people do not see things until it’s too late.

@gwac: thanks for explaining. I find your posts to often be poorly written so it’s hard to tell what you’re talking about sometimes. Usually I just chalk it up to you being a muttering, surly old man. Using the word “vacation” does not make your post any less vague. Many (i.e. almost all) people who move here probably visited while on vacation at some point during their lives; I did this and so did many others I know. Not all vacationers come once and go away like you wish.

Hawk, I can see you are on cloud 9. When will you start shopping? next 12 months 0r wait another 12 years? 35% drop or 75% drop? Which neighborhood will offer the best value after the slaughter you think?

I suspect that we will see a series of incremental mortgage rate increases for the next few years. hard to tell how much that will moderate houses prices overall. What might have a greater impact is that taxes will probably continue to increase at a rate above inflation. Between the two we might see house prices start to slowly move down or at least flatten.

Garth has some wild stuff tonite. Buyers threatening to walk unless seller renegotiates the price down over 20%. OUCH.

Says Alex Prikhodko, founder of Real Estate Bay Realty Brokerage, in Toronto (and blog dog):

“It is a poorly held secret that a lot of buyers, who purchased in March and early April (firm of course) and have closing date approaching, are trying to either get out of closing on their purchases or asking for cash backs from the sellers. It is very typical for buyers to ask for $20, $30 or $50 thousand dollars cash back upon closing or they would walk away and forego their deposits. Most sellers comply, because nobody wants to test the market with 5-6 properties listed for sale on the same street for months without any action.

“What is shocking is that in this particular case, the buyer first asked for $150 thousand cash back upon closing via the letter of direction from his lawyer and just yesterday asked for a FURTHER $200 thousand on top, which the sellers agreed to. We are talking about a firm sale that is reported on MLS as $1.55 million, where in reality the property is sold for a mere $1.2 million, a discrepancy of 22.58%.

“The amount is exceptional here, but the practice of cashbacks is as commonplace nowadays as bidding wars used to be just 3 months ago.”

Remember – this is a sale for $1.2 million which was reported as $1.55 million. Makes you wonder what the real story is…

http://www.greaterfool.ca/2017/07/06/the-perfect-storm-2/

“That would be “sought-after”.

Quite right. Thanks, Irregardless.”

Mr. Perfect needs his jack boots taken away. 😉

“Wow big changes afoot on the mortgage front. Stress test coming for for uninsured (20%+ down payment) mortgages.”

That’s HUGE. The fallout from that could be nasty.

All the core areas of Vancouver of SFH detached median prices are still lower than a year ago.

Agreed LeoS, way too many headwinds as the Toronto listings tripling spreads west and will be a prominent media headline for the next year or more as tales of losers, deals gone bad, law suits etc.

Doesn’t bode well for the bulls as we haven’t heard of “100 cars lined around the block” and “coffee table with stacks of agent cards” in over 4 to 5 months now. The thrill is gone.

http://www.transunioninsights.ca/PaymentShockStudy/

“However, more than 700,000 consumers could struggle with their finances even with a ¼-point hike, and up to one million borrowers may not be able to absorb the increase in their monthly payments if interest rates rise by 1 percent.”

Vancouver land may have been much sought, or indeed sought-after, but it will be less sought after the widely anticipated rate increase.

And a rate increase will boost the loonie, which will discourage some foreign investors, while encouraging others to cash out before the tax implications of Canadian real estate become more complicated.

market will almost certainly take a pause after all this comes together. Too many headwinds piling up I think

Quite right. Thanks, Irregardless.

https://www.theglobeandmail.com/globe-investor/personal-finance/household-finances/rbc-hikes-fixed-term-mortgate-rates/article35577001/

Royal Bank of Canada has hiked rates on its fixed-term mortgages amid rising bond yields and widespread anticipation that the country’s central bank will raise its benchmark interest rate next week.

RBC, which is Canada’s second-biggest bank by assets, boosted its posted rates for two-year, three-year and five-year fixed rate mortgages by 20 basis points each

“And, for anyone who says renting is better than owning, but they’re waiting on the sidelines to buy… in a city unlikely to ever get very much cheaper for either option. I say – seriously, who are you kidding?!”

This will be a great quote to throw back up here in few months. Look at what is happening in Ontario right now. Think of all the pumpers who were saying the exact same thing a little while ago and are now scrambling to take whatever they can get. I think the NDP will announce a barrage of strict housing reforms with little warning all at once similar to the way Ontario did. The NDP have already warned people that there is no way for this housing mess to end well here. I sense a heavy dose of buyers remorse coming soon.

“Land in the Vancouver area will always be highly sought.”

That would be “sought-after”.

CMHC has been cutting back on insured mortgages for years. This extends it to the uninsured crowd which is growing much more quickly

Wow big changes afoot on the mortgage front. Stress test coming for for uninsured (20%+ down payment) mortgages. It’s out for comment now but when has a regulator ever listened to comments?

This will have a big effect. No more beg borrowing or stealing the down payment to avoid the stress test.

RBC hikes fixed-term mortgage rates

Royal Bank of Canada has hiked rates on its fixed-term mortgages amid rising bond yields and widespread anticipation that the country’s central bank will raise its benchmark interest rate next week.

RBC, which is Canada’s second-biggest bank by assets, boosted its posted rates for two-year, three-year and five-year fixed rate mortgages by 20 basis points each (100 basis points equal one percentage point).

That would largely be a function of how willing to lend banks will be in the event it “crashes hard”. My guess is, not very. Vancouver has historically been pricey, and that will probably persist as you say. But there’s a difference between pricey, and what has been happening the last few years.

It’s not just a matter of a RE credit cycle approaching its end (which I believe is the case). This cycle has been influenced and prolonged by aggressive monetary expansion and accommodative federal policies, which has taken Canadians into an unprecedented financial situation with respect to debt. There’s nothing inherently wrong with debt – it can be a great tool that really can promote growth. However, consumers didn’t manage it well, and what we got instead is malinvestment into a few artificially bloated sectors, namely a couple of nasty housing bubbles.

All the talk about engineering a “soft landing” carries a modicum of presumptive arrogance mixed up with a “this time is different” mentality. It doesn’t matter how “cheap” debt is – if consumers amass enough of it, then you better be prepared to face one doozy of a deleaveraging cycle, regardless of what Steve tries to pull out of his hat or what assurances others provide.

So if you’re talking long term with respect to Vancouver revisiting “crazy” values, I think it would take a similar confluence of factors to re-create this issue to the extent that it’s gotten. If you’re talking short term – I suspect there’s not enough credit available in the system to immediately re-ignite it, and I don’t think China is going to fill that little void for us.

Be prepared.

It’s different this time!

Vancouver could crash hard, but I’m confident prices would rebound to high (even crazy) levels again. Land in the Vancouver area will always be highly sought. To a large extent the same goes for the Victoria area.

Spring is the hottest time of year for selling, genius.

That would be, “many-splendoured thing.”

No, the bears are winning because Hawk found some price slashes, remember?

“And, for anyone who says renting is better than owning, but they’re waiting on the sidelines to buy… in a city unlikely to ever get very much cheaper for either option. I say – seriously, who are you kidding?!”

Say that to the poor sap who just bought 3 months ago in Toronto. You’re kidding yourself Luke. Did you apply for the town crier job ?

A lot of buyers pulling out, and a lot of sellers trying to time the top. Can’t happen here, we’re special. 😉

Toronto’s housing market ‘turned on a dime,’ real estate analyst says

Following the Toronto Real Estate Board’s latest data dump Thursday, one real estate analyst says we are probably witnessing the housing bubble burst.

“This is just the market unwinding and correcting itself,” said John Pasalis, president at Realosophy Realty, in an interview with BNN.

http://www.bnn.ca/toronto-s-housing-market-turned-on-a-dime-real-estate-analyst-says-1.798086#_gus&_gucid=&_gup=twitter&_gsc=kELDypg

Islandscott,

Every real estate boom and bust has a history of peak employment and not enough workers to build houses and condos for mainly speculators. This one is the worst I’ve ever seen here.

If the guy in the Uplands invests millions in local projects/businesses then can’t sell his house to take profit then eventually something gives on a larger scale. Since there are multiples languishing more than a couple months taking some healthy price slashes it may well be the canary in the coal mine.

‘Oh give me a home’ and ‘take down a parking lot and put up a paradise’… ideas for dealing w/ social housing/homeless from focus magazine… I don’t wholly agree, but these could be a better use for these aging structures than the current use. And, the ‘oh give me a home’ article has a point about the cost of housing homeless could actually be less than the current costs (policing/healthcare) we contend with by ‘teaching them a lesson’ by leaving them on the streets.

Has anyone besides me noticed how deep that hole is by Fort/Cook for the new 90% sold Black&white development? I guess they’re going down something like four or five stories deep for parking…

Think about this next time you are in one of the city owned multi level parking lots in downtown Vic. If there was a major earthquake you would not want to be there. Could they make better use of this space? Yes.

http://www.focusonvictoria.ca/julyaugust-2017/oh-give-me-a-home-r3/

http://www.focusonvictoria.ca/julyaugust-2017/take-down-a-parking-lot-and-put-up-a-paradise-r15/

And, for anyone who says renting is better than owning, but they’re waiting on the sidelines to buy… in a city unlikely to ever get very much cheaper for either option. I say – seriously, who are you kidding?!

Fact. June house sales in the core were down from 2015 and 2016 but prices are up.

It’s like asking a grocer store owner how is business.

“Great! Prices are up but I haven’t sold anything lately.” I don’t think any business person would say that was great, but in real estate it’s just fine to do so.

“I was in Sidney the other day, construction site had a “Workers Wanted” sign on the fence.”

I don’t get how you see a literal sign of high employment and interpret that as a figurative sign of doom and gloom.

@Barrister –

True, I also wondered how they calculate the benchmark numbers. They do show declines sometimes, so they don’t appear to be pure propaganda. But I’d also like to know how the calculations are derived.

@Hawk –

Yeah, I knew that comment would get a rise out of some. But Oak Bay is like, 10,000 people, Uplands is what – a couple of hundred? A bit of inventory available in a price point irrelevant to 99% of greater Vic. buyers is not an issue that will be keeping me up at night. Or do we really think that someone taking a couple of months to sell a $4,000,000 Uplands property is some sort of bellwether for the market as a whole?

Some lenders are offering rate guarantees on pre-builds that won’t be built for two years from now.

That’s why it’s so crazy out there in new condo sales, since you can be guaranteed today’s rate, two years from now.

Lenders and the governments talk about solving the affordability issue and yet their actions are always increasing the problem.

Another full day of foreclosure applications in the Vancouver Court House. The same with New Westminster Court House.

Victoria has yet to see an increase in foreclosure applications.

“The prices were comparable if not higher than the re-sale market but buyers are ploughing in for the three year wait.”

3 years of losing money on a 400 sq ft closet will be a mighty painful lesson, especially with the NDP /Greens about to lay down some spec/flipper taxes.

I was in Sidney the other day, construction site had a “Workers Wanted” sign on the fence. Helps wants to put up trailers on Government St for workers to live like Fort Mac.

Just like last time around the quality of buildings tanked as they hired any yahoo with a working arm and called you a carpenter or whatever trade you liked. If you can’t see the bubble about to blow, you’re on your own.

“Canada plans to ban some bundled residential mortgages to clamp down on risky lending, a regulator said on Thursday, six months after a Reuters investigation revealed that regulated mortgage providers were teaming up with unregulated rivals to circumvent rules limiting how much they can lend against a property.”

oops,

Isn’t it funny how it takes a Reuters investigation, not our own financial regulators to uncover the same shady practices that crashed the US market ?

When the scumbags start copying the US Big Short tactics you know this thing could blow up at any time and there won’t be anyone there to catch them like Harper did. Warren Buffet only takes deals at 50% off.

Yates on Yates only had one 1-bedroom unit left as of last weekend when I stopped by the showroom. The prices were comparable if not higher than the re-sale market but buyers are ploughing in for the three year wait.

Only a few years ago one could have bought a pre-sale 17th floor 2 bed unit at Promontory with amazing unobstructed views of the inner harbour for the same price as a one bedroom at Yates on Yates, but no one was buying.

“Uplands mansions 2.5 million plus? Who gives a shit.”

If the driver of new money into real estate/investment/condo projects etc, is from rich people and they stop buying in the associated hoods of their incomes, I would be giving a major shit.

Ignoring who back stopped this bubble all the way up and their sudden reluctance to buy into it any further is Economics 101 AKA fire alarm bells.

Maybe this helps to explain some of the policies that allow certain people into the market.

As the months pass by we actually learn how this house of cards is actually built. So much for the “conservative” Canadian lending system.

http://www.cbc.ca/news/business/osfi-bundled-mortgage-loan-ban-1.4192727

“Bundled” or co-lending agreements with an unregulated entity can enable lenders to offer combined mortgages worth up to 90 per cent of a property’s value.

Under federal rules, regulated lenders in Canada are not allowed to lend more than 65 percent of the value of a home to borrowers with bad or nonexistent credit records.

They also cannot lend more than 80 percent of a property’s value – even to borrowers with solid credit – without obtaining government-backed insurance. Under rules rolled out last October, that insurance requires the banks to run income stress tests on borrowers.

@Barrister

“I would suggest a property tax that is at least quadruple the regular tax”

Boy Barrister, you’re one tough cookie!

The problem is, there already is a measure for dealing with foreign investors/speculators but our government (Federal) is a poor enforcer. We should do as the States, that any sale that is not owned/registered to a Canadian citizen 30% of entire proceeds are automatically withheld until all due Capital gains or Business taxes are duely deducted. This should go for ANY incorporated or trust owned RE sale as well.

Ento:

Generally I agree that I am not seeing major signs of weakness in the Victoria market yet. Having said that I dont really trust the VREB numbers. They are not based on any objective standards and are produced by a group that has a strong vested interested in pumping up the market. i am not saying that they are necessarily wrong just that one cannot rely on them.

Instead of or in addition to a foreign buyer transfer tax, I do not understand why the city does not a much higher property tax for foreign buyers. For clarity, one level of tax for Canadian citizens and landed immigrants (these should be treated equally) a much higher level of tax of everybody else including students or people on temporary work permits. I would suggest a property tax that is at least quadruple the regular tax. This would have the advantage of both discouraging foreign buyers but also encouraging the present foreign owners to sell. At present city council just sits around and says that we are waiting for the province to fix the problem.

I confess I do not see any sign of the declines in Victoria some are talking about. Prices at record levels; inventory still very tight; sales very strong; benchmarks (vreb) showing steady gains MoM, 3-month, 6-month, etc. DOM still very low. Where are signs of weakness? Townhouses (a bit soft MoM)? Uplands mansions 2.5 million plus? Who gives a shit.

Bring on the foreign buyers tax, fraud crackdowns, interest rate increases (modest please!) – all these will be good for Canada. For the present, like the past 3 years, i see nothing suggesting Victoria RE is declining at all.

Article on Chinese foreign funds into real estate — “Local critics and some in the real estate industry say keeping track of the number of foreign buyers like this doesn’t allow for understanding the amount of overseas money flowing into Canadian markets because purchases are being made with offshore trusts, shell companies and the use of land titles of proxy names to obscure the identity of beneficiary owners. ”

http://vancouversun.com/business/local-business/canada-a-top-destination-for-property-investments-by-mainland-chinese-buyers-report

“The more prudent & thoughtful you are, the more you miss out on big gains.”

Only those who cash out and rent are the ones making big gains. The rest have a nice story to tell the grand kids how they could have sold at the top and made a bundle, but didn’t.

Wolf talking about secondary homes not people immigrating and being an asset to the country.

The word vacation should have been enough. I guess for you I needed to explain it more.

29 price slashes in the VREB district since this morning. Most I have seen in ages. Bearkilla is going to need one bigly crying towel as his hood gets hacked the largest ones.

Looks like Victoria is not slowing. But, man, Vancouver appears to be back with a vengeance! Van condos are on a tear & I know family members who claim $100-200k price appreciation in the last few months. My own parents bought a 2-bed DT condo in 2005 for $280k. This week, the same units are selling for $850k (~ $1000/sqft)! New presales are easily fetching $1500/sqft. Although I do own my own SFH in the core here, I have FOMO for not investing more in RE. Nothing appears rational any more. The more prudent & thoughtful you are, the more you miss out on big gains.

https://beta.theglobeandmail.com/real-estate/vancouver/greater-vancouver-condo-prices-surge-market-for-detached-properties-bounces-back-after-foreign-buyers-tax/article35554917/?ref=https://www.theglobeandmail.com&service=mobile

“Come for a vacation but please go home and do not buy anything.”

If that’s not drawbridge mentality I don’t know what is. It was okay for you or your ancestors to move here though I’m sure! I don’t like foreign ownership (/more competition) either but if immigrants come through proper channels they deserve every opportunity that you and your ancestors had. Foreign investors that don’t live here? I agree with you completely.

On another note, if houses were my stocks I’d be selling the whole portfolio right now. In my opinion people should look more at market sentiment. It’s already significantly changed, and I think will change even more when June sales data comes out in Toronto. I wouldn’t touch real estate at the moment and I know many others who feel the same.

http://vancouverisland.ctvnews.ca/mobile/video?clipId=1161325&playlistId=1.3490491&binId=1.1180928&playlistPageNum=1#_gus&_gucid=&_gup=twitter&_gsc=8qgCXZO&_giguuid=eced25a79a0040f996aee6fff9fb15d9

Stuff like this does not help with our housing issue with foreigners. BC is a paradise. It needs to be protected and kept in the hands of Canadians.

Come for a vacation but please go home and do not buy anything.

Grace that sucks. Hopefully you didn’t take some bear advice and sell early because the market was about to crash.

BTW bears I guess you lose again.

My sisters former home in West Van…once a warm and well cared for family home now sits empty. The grass is turning to weeds. The whole place just looks so neglected and well…. empty! It is happening to the entire neighbourhood. Her best friends just sold across the street and have made a deal that they can remove the beautiful plants and shrubs because they will just to be left to die.

On the other hand we sold our Victoria home in December and I can’t shake the feeling we could have got far more now. Yeah greed is a many splendid thing!

http://www.bnn.ca/boc-has-to-put-the-housing-genie-back-in-the-bottle-fraser-institute-1.796338

so it seems the BofC created this mess and now they will try to fix it. Gee what could go wrong.

Hey Leo, I like to check out Zolo for trends. That and myrealtycheck.

https://www.zolo.ca/vancouver-real-estate/victoria-ve/trends

Condos seem to be driving both Vancouver and Victoria markets.

Vancouver mayor plans to license and tax Airbnb rentals

As part of a new regulatory framework for short-term rentals, a city staff report suggests requiring owners or renters who list their principal residences with short-term rental agencies to purchase an annual business license for $49.

Meanwhile, the short-term rental platforms, like Airbnb, would be hit with a transaction fee up to three per cent that would be remitted to the city to help fund the administration and enforcement of licensing short-term rentals.

The city won’t allow secondary residences to be rented out for short-term stays.

http://vancouversun.com/news/local-news/vancouver-mayor-plans-to-license-and-tax-airbnb-rentals

“splateau”…good one!

That’s great! Houses should not sit empty, esp. in places with a housing crisis for locals who are priced out like in Van. Any word on Victoria bringing in a similar tax (or the Province?). The taxes should all be so onerous so that housing here is no longer viewed by wealthy foreigners as a commodity. Bring that on – along w/ huge foreign taxes – unless you are going to move to and participate fully in Canadian society – you should pay through the nose to ‘hold’ an empty house here.

I wasn’t at all surprised…. thought it was higher than 10%, but Saanich is quite large. That’s just like Airbnb – not much noise from municipalities outside Victoria. I bet if you break down foreign buyers in Saanich – the vast majority of them are as close as possible to UVic. The one hood in OB popular w/ them (probably not enough to make the numbers) is the OB Henderson ‘hood w/ the large lots – near UVic. Of course that’s speculation, but drive around town for a while and you’ll start to see what I’m talking about. Lots more very high end sports cars bought by money earned out of country than there used to be… starting to look a bit more like Vancouver.

@ LF:

“It’s amazing to read that – I have read several publications over the last year or so that argue Vancouver today has reached a “permanently high plateau”, or will “stabilize at very high levels”.”

Once the market plateaus, everyone has to believe it’s plateaud permanently, or it ceases to plateau.

We are presently at the moment of universal belief. Let no one accept no stinking low-ball offer or the plateau will go splateau.

“And then there’s the core. If I look around Gordon Head I see more and more listings sitting on the market and not selling. Same goes for Oak Bay. There is no denying that the hottest markets are slowing down. ”

Hottest time of the year and no one wants to lay out the bucks for over priced hoods. Once listings ramp up like Toronto’s tripling in a few weeks then many will have their ass handed to them. The denial stage can be a painful lesson.

This sounds like Victoria, take away real estate and the unemployment rate would head to 8%.

Ontario economy too dependent on housing ‘bubble,’ study says

The Fraser Institute report warns that with interest rates expected to increase, Toronto’s housing sector could collapse, leading to serious economic disruption

http://business.financialpost.com/news/ontario-economy-too-dependent-on-housing-bubble-new-study-warns/wcm/7baf7302-0236-4f53-a002-bc6b4be7169d

It’s amazing to read that – I have read several publications over the last year or so that argue Vancouver today has reached a “permanently high plateau”, or will “stabilize at very high levels”.

We never change, do we. Ha!

Some panic around empty homes tax in Vancouver http://www.cbc.ca/beta/news/canada/british-columbia/property-owners-panic-as-vacancy-tax-takes-effect-1.4190576

@ Lore:

Absolutely, or to paraphrase Irving Fisher of Yale University, one of America’s greatest mathematical economists, when writing in the New York Times of the 1929 stock market:

Real estate prices “have reached what looks like a permanently high plateau.”

Leo:

That is an excellent question. Instead of waiting for the province to act could the city simply not quadruple property taxes for foreign buyers? That would have the two fold benefit of both encouraging them to sell and get out of town and also providing at least some benefit to the local communities that have built Victoria. Every level of government seems to point the finger at some other level of government.

Of course, the NDP/Greens won’t influence access to credit (unless they kill the BC Home partnership program) But they can do a better job stamping out money laundering and speculation in real estate. That could have a large impact on the market.

I was surprised at the large percentage of foreign buyers in Saanich. Wonder why the Victoria council considered the tax for their 5% but we never heard a peep from Saanich at 10%?