Foreign buyers part deux

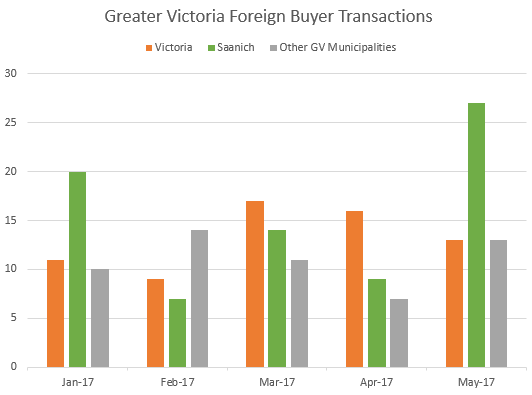

In the last article I posted the updated numbers for the capital region as a whole, where foreign buyers accounted for about 5% of transactions on average or about 45 sales/month. Problem is, the region is a large place and it’s quite likely that buyers are concentrated into certain municipalities like Victoria proper. Well I thought that that data doesn’t exist, but it does! Turns out that in the 2017 data they’ve added not only all the Greater Victoria municipalities but also the foreign buyer sales for each one.

One caveat is that in order to protect privacy of individual transactions, the province only releases the foreign buyer counts if they are either zero, or greater than 5 in a given month. You can imagine that when you split 45 sales amongst 13 municipalities many months end up with non-releasable data in most municipalities. For example, the data for Esquimalt is greater than zero but under 5 so mostly not releasable.

Esquimalt

| Total Transactions | Foreign Involved Transactions | Percentage Foreign Transactions |

|---|---|---|

| 78 | Not releasable | 1.3% - 6.4% |

| 87 | Not releasable | 1.1% - 5.7% |

| 173 | Not releasable | 0.6% - 2.9% |

| 100 | Not releasable | 1% - 5% |

| 163 | 6 | 3.68% |

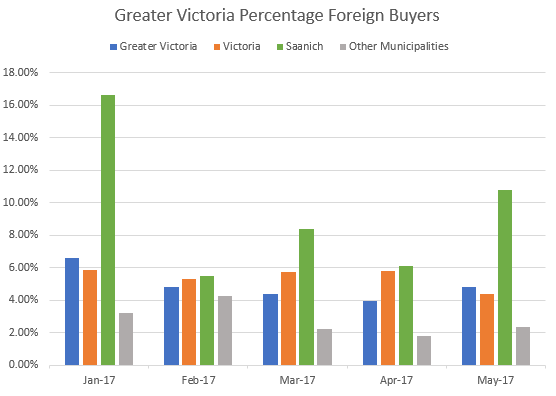

In fact the only two municipalities with enough sales to consistently be released are Victoria and Saanich. Here they are.

Anyone else surprised that the percentage in Saanich is generally much higher than in Victoria?

Of course all of this might be on it’s last legs if the NDP push through their housing policy. MLA David Eby has been active on the housing issue for years and provides some clues on how the NDP are thinking here in this video interview with Vancouver Realtor Steve Saretsky.

Well worth a watch, but in short, according to David Eby the NDP want to:

- Keep foreign buyer tax but revise it so no one working and paying taxes in BC pays it.

- Discuss with other communities about expanding it to those areas (like Victoria). No automatic expansion of the tax except perhaps to agricultural land.

- End flipping (assignments) of pre-sale condos in the vast majority of cases.

- Expand affordable housing supply.

- Stop selling off public land to the highest bidder without specifying what must be built on it.

- Set up a tax force to investigate tax evasion in BC.

Will be interesting. In any case Happy Canada Day!

Ramble on!

Never mind – rambling obviated by new post. 🙂

New post https://househuntvictoria.ca/2017/07/04/june-update-a-not-so-mixed-bag/

CS:

Facebook is another company that has never given a penny of profits to its common shareholder and probablely never will distribute a penny of profit. Yet people somehow believe the shares they own have value. It is sort of what George Carlen once said: By the time I was forty I finally realized how stupid the average person actually is but then I was really horrified when I thought about average actually means.

Gee whiz, who would’ve guessed that Vancouver SFH listings are jumping higher, while sales are sliding, and more people are listing their houses each month. This sudden change is happening fast as the Horgan contagion spreads to RE. But Horgan’s Hell on real estate will only compound the global RE decline that started a few months ago.

http://www.rebgv.org/listed-vs-sold

http://www.news1130.com/2017/07/04/vancouver-defies-expectations-overseas-housing-markets-cool/

@ Barrister

Yes, Canada’s only famous economist at his best. I think I’ve read his Great Crash more than once and, with luck, will live long enough to read it again.

And I agree, how things turn out is beyond accurate prediction or therefore consistently effective regulation, and we seem now to be in a period of particular instability and uncertainty.

Today’s tech stocks may not be as worthless as the Shenandoah and Blue Ridge Trusts of Great Crash fame, but Tesla, a company that makes 50,000 cars a year at a loss, valued by the market more highly than GM that makes ten million cars a year at a profit looks vulnerable to a stunning fall. Likewise, some other great names.

BC real estate may not match TSLA for unbelievable valuation, but that people are devoting such a large proportion of their lifetime earnings for the privilege of owning what in most cases is a very modest home seems bizarre. The box, after all, doesn’t cost that much to build, and the location folks are buying are in a remote provincial capital of the third most populous province in one of the world’s least populous countries.

What’s it feel like to lose well over $80K in a day Bearkilla? You and your neighbors must be be in some major pain. Keep drinking, you won’t notice a thing til the next big slash. 😉

CS:

I dont know if there will be a housing crash or whether it will be a soft landing for Victoria. I would point out that the Canadian housing market is much more vulnerable than the US market was during their crash. The big difference is that most US mortgage were for a thirty year term (yes I mean actual term not amortization period). Most americans were not directly affected by the crash unless they had lost jobs because of it which was the vast majority of Americans. In Canada, generally all mortgages are not for more than five years so if rates push up 2 or 3 percent a much greater percentage of people are in trouble. As more people get in trouble the greater the number of houses that are put on the market which in turn usually depresses the price of houses. but equally important is the fact that developers stop building houses and condos if the market starts to be flooded. In B.C. an inordinate number of people work in the construction industry. You can get a chain reaction which gets very ugly very quickly.

Again, I am not predicting it but it is far from impossible.

CS:

I was not making predictions as to what will happen but rather that the Bank of Canada does not have unlimited control over interest rates. Some people have argued that the B of C wont raise interest rates because that would cause a financial cris. My point is that the B of C might have no choice but to raise rates because the flight of capital would cause an even bigger crisis. If you are relying on politicians to do the smart thing then I suspect that you are living on a false hope. Almost always politicians are happy to let the problem grow if they dont have to deal with it in this term of office. It is far better to let the party go on and hope that you are not around for the hangover.

The fact that BC’s ecomony is extremely vulernable to a number of factors seems to completely escape people. I dont want to get into a debate with people about this since the very idea that BC’s economy sits on a bit of a knife edge is not what people want to hear.

If you only read one book on economics might I recommend John Kenneth Galbraith’s “The Great Crash”; the best part is that it is an easy read with only one chart in it (sorry Hawk, not your chart).

The rate hike like the housing crash is just around the corner says an increasingly nervous housing bear for the millionth time.

@ LF:

“We don’t have million dollar bungalows because we are wealthy enough to afford them; we have them because banks are willing to lend people that much to buy them. …[which has] created price inflation, but little real growth”

Well allowing the banks to go on lending money that they conjure out of thin air keeps people like Marko employed and supplied with a sharp set of wheels. And I suppose it fuels much of the new construction. But it seems a desperate measure to compensate for the fact that much of the rest of the economy is anaemic.

The question is what happens if and when the money stimulant is withdrawn.

We know what happened when Greenspan raised rates 17 times between 2004 and the crash of 2008, why would the same action under the same circumstances yield different results now? And if there is no reason for it to be different this time, why would it happen?

During the election campaign, Trump offered protection to American industry, lower taxes on American corporations, a wall to block the flow of illegal immigrants. Those measures would mean increased corporate investment but less available labor leading to increased wages and hence rising prices. Under those circumstances, interest rates would have to rise and the flood of new money curtailed. Trump thus offered an escape from the money printing addiction.

But Canada, under Trudeau, is committed to globalization. We have become a sanctuary country for immigrants formerly headed to the US. Ours is not a nation, it belongs, so Justin Trudeau asserts, to people from elsewhere more than to those born here. There can, therefore, be no Trump-like national economic policy because, so Justin Trudeau asserts, Canada is not a nation. It is the first post-national state. So how Canada’s cheap money addiction ends seems far from obvious.

Barrister says it has to end because there will be a flight from the dollar, specifically, Canadian government bonds. That may be so, but if so, then it seems that the lending spree will end not as a matter of policy but because of some kind of financial crisis.

John Dollar:

You are probablely right about the cannary in the condo. I guess that I can watch other people kiss their ass good bye since I dont have my money in Canada. No mortgage and the house only represents a small part of my net worth. On the other hand I have run into a number of people that own a couple of houses and are mortgaged to the yin-yang.

MoneySense declares Oak Bay best place to live in B.C.

http://www.moneysense.ca/save/best-place-to-live-in-bc-territories/

https://www.vreb.org/pdf/VREBNewsReleaseFull.pdf

core sfh benchmark up to 829k from 820.

The Westshore has been completely transformed from what it was in 1990. So I don’t know how fair of a comparison or if any comparison is relative to today.

The stock of houses in the core and most notably Saanich East, Victoria and Oak Bay has increased but not like that of the Westshore. The number of house sales in these three areas last month was 157. The average for the previous nine years was 148. Not much of a difference at all. Sale volumes are still way down from June of 2016 and 2015 at 189 and 195 respectively.

The big change is active listings. They are increasing as sales have slowed in these three areas over the past couple of years. Active listings are up from 250 in June 2016 to 340 today. Visually what you’re seeing are more “For Sale” signs staying on the lawns for a longer period of time. And that’s going to kill the deferred auctions in the future as the months of inventory stretch into 3 and 4 months.

Not until then will we see significant changes in house prices.

What I’m watching are condos in the core. The number of active listings can jump really high really quickly as shadow inventory comes on to the market. That’s one of the “canaries-in-the-coal-mine” I’m watching. Last month there were 258 active condo listings in the core but that could jump to 600, 700, 800 or a thousand.

If or when that happens you should bend over, put your head between your legs and kiss your ass good-bye.

2363 Bowker Ave on it’s second slashing for $50K from original. With million dollar condos just up the street how can you lose ?

Hawk: “Interesting to note that debt loads were under 100% back then with no HELOC’s, not 165% with HELOC’s out the whazoo.”

You’re dead on, Hawk. We’ve had the discussion on HELOCs earlier this year and it appeared that there was some division on the forum regarding the wide spread and wise use of HELOCs. As the tide goes out we shall see who was actually swimming in debt

http://www.msn.com/en-ca/money/topstories/bank-governor-may-be-about-to-break-our-credit-addiction-wells/ar-BBDLGYZ

“Among the more disturbing statistics was this one: 40 per cent of HELOC borrowers do not make regular payments toward their principal. The number of households that have a HELOC and a mortgage secured against their home has risen by nearly 40 per cent in six years.”

The term “silly” is a product of my personal bias against the broader concept of QE. Perhaps it isn’t justified, perhaps it is.

QE has created price inflation, but little real growth. It’s somewhat similar to what is now happening in the USA with their housing market – many places are experiencing housing price recovery, not housing market recovery. It’s illusory.

We don’t have million dollar bungalows because we are wealthy enough to afford them; we have them because banks are willing to lend people that much to buy them.

Re: 3190 Norfolk Rd

But hope springs eternal in the Uplands, it seems. This, at 4.3 millis, is offered at 42% above the 2016 assessment. But despite the drab exterior, it’s a nice house.

@LF:

Not sure that these interest rates are silly. With the price collapse, we lost more in oil revenue per capita than the Russians. And that was after we’d wiped out our manufacturing base through globalist trade deals. So what to do? Let the banks print money more or less ad lib to lend at “silly” low interest rates, so we could all live well selling houses, cars and everything else to one another on credit.

The resultant inflation that the BoC carefully conceals from public view drives down real wages and thus helps make Canada slightly more competitive internationally. When the 1994 GATT agreement was signed Chinese wages were about 3% of Canadian wages, now they are about 6% or maybe 12% if you take into account differences in cost of living, or 24% if you adjust wages for differences in productivity. So we need silly rates for at least a couple of decades more, if we’re ever to be truly competitive again.

“…the cost of buying a house in Victoria has almost doubled in the last four years. When you add that component into the inflation figures, particularly for first time buyers, then there really is a major inflation problem for a significant segment of the population”

Funny, that’s what happened leading up to 1981 crash. Home values and costs doubled in the preceding few years then rates moved up.

Interesting to note that debt loads were under 100% back then with no HELOC’s, not 165% with HELOC’s out the whazoo. History has a way of repeating itself but this time it will be far worse.

I wouldn’t know. I would think though, that a volatile economy would wreak havoc on a consumer and resource based economy, and provide a substantial disincentive for investment. Boring in this case, is good.

I think they’ve been running an experiment where no one knows the outcome. At this point, the economy has priced in these silly interest rates and the CB knows we must get out of the situation – but there there is no good and easy way to do it.

The other aside I’ll mention is to keep in mind – you don’t need most of the population suddenly unable to pay their mortgages to bring the whole fantasy down. You only need a small portion, and psychology will do the rest. Further, that doesn’t need a price drop to start it all off – it just needs the prices to stop rising for a period of time.

We’re not going to outsmart this RE cycle, or the next, or the next… although we’ll undoubtedly keep trying.

@LF:

Re Poloz “If we only watched inflation and reacted to inflation, we would never reach our inflation target, we’d always be two years behind in the reaction”

It would be funny if not serious that the BoC, while omitting house price inflation from its target inflation rate says it has to see years into the future to know what to do. Seems like they might do better just to maintain an honest measure of inflation as it occurs, and as it affects ordinary working people. But then the Bank would not be able to play the usual game of boosting the money supply before an election to create a boom that improves the electoral chances of the incumbent party, and then clamp down on the money supply after the election to create a mid-term recession.

It seems likely that central banks do more to destabilize than to stabilize the economy. A fixed rate of money creation, say 2% a year, would probably yield a smoother economic path than anything the likes of Mark Carney or Stephen Poloz will deliver on the basis of the crystal ball gazing.

However, a predictable and rational bank policy would not promote the “creative destruction” of the boom-bust cycle that can be so profitable to the speculative element of the financial community.

@ Barrister:

“…the cost of buying a house in Victoria has almost doubled in the last four years. When you add that component into the inflation figures, particularly for first time buyers, then there really is a major inflation problem for a significant segment of the population”

Agreed. The BoC’s consumer price index is carefully designed to massively underestimate inflation, as this G & M article explains.

One of the interesting developments regarding interest rate hikes is Steven Poloz’s most recent comments to the German press, indicating that inflation metrics are not the only ones that are being considered in determining whether interest rates should be changed:

Of course exactly what else is being considered is complete speculation, though I can’t help but wonder if the creation of asset bubbles has anything to do with it. Some, including myself, argue that inflation has been occurring, but has been focused in certain sectors of the economy rather than as a whole. They may be trying a “which course of action will do the least long term damage”. Who knows – and I’m not sure they’re certain either.

But if you’re a recent buyer, and more specifically a highly leveraged one, this does bear attention. Two or three more hikes, and “attention” may become an understatement.

How many sales were condos and SFH’s in Langford versus the core ? Many might have been trying to beat the rate hikes.

It’s not the amount of the rate hikes, it’s the psychology behind it that rates aren’t going anywhere but up from here on in. Bankers and shadow lenders tighten up lending criteria, and those phony income statements may become a thing of the past. Harsh reality indeed. 😉

Mortgage rate hike looms as Canadians continue to deal with near-record debt

TORONTO — Fears of rising mortgage rates are about to become reality, and some financial institutions have already quietly raised their discretionary rates in the past week, a potentially harsh reality for Canadian consumers grappling with near-record debt.

http://business.financialpost.com/personal-finance/mortgages-real-estate/mortgage-rate-hike-looms-as-canadians-continue-to-deal-with-near-record-debt-levels/wcm/e5818bca-ddbc-45cf-8e89-a89463ba7729

Leo:

What is the breakdown betwee SFH and condos?

Leo:

The new listing numbers seem to be more illusionary than real and seem to include an awful lot of houses that are actually just relistings in one form or another.

CS:

The problem the bank has to deal with is not inflation but the creation of assest bubbles particularly in real estate. The other issue is that if other safe heaven countries move interest rates up than Canada has to follow otherwise capital shifts out of the country particularly in the bond market. You have pointed out that the cost of buying a house in Victoria has almost doubled in the last four years. When you add that component into the inflation figures, particularly for first time buyers, then there really is a major inflation problem for a significant segment of the population.

1008 sales is the second highest June sales since 1990. Normal June numbers are in the 700s.

It is also higher than the 1006 we had in May which is unusual. Sales usually decline May to June.

I don’t see why rates should rise in the immediate future. Canada ran a large trade surplus with the US in April ($5 billion) and a near balance in trade with the world as a whole, while the C$ is up by 5 cents against the US$ over the last month, inflation has fallen from an annual rate of 2.1% in January to 1.3% in May, and the ten-year bond yield is about where it was 6 months ago.

But if the BoC sees something to justify a rate increase now, it would be interesting to know what that is.

Victoria Real Estate Board

Tue Jul 4, 2017:

Net Unconditional Sales: 1,008 1,174

New Listings: 1,358 1,319

Active Listings: 1,915 2,289

1008 sales is pretty respectable for June. Slightly more new listings than last year but close.

Thank you for the numbers John Dollar. Care to speculate (sorry, about that) as to what is going on with the top end of the market. Is it mostly less buyers or is it people pricing themselves out of any realistic market?

Oak Bay bucked the trend in June as new listings outpaced sales at the rate of 59:25 or 2.36:1

Victoria and Saanich East had the ratio decline to 183:131 or 1.4:1

Historically a ratio between 1.5:1 and 2.5:1 is a balanced market between buyers and sellers with stable prices. And that’s true of Victoria and Saanich East where the median has remained flat.

Month Sale Price, Median

Feb $888,000

Mar $889,000

Apr $898,500

May $950,000

Jun $910,000

A ratio of 2.5:1 and more would be a bearish or soft market with prices declining. Oak Bay prices are still flat but it is a much weaker market with rising months of inventory.

Month Sale Price, Median

Feb $1,288,750

Mar $1,149,000

Apr $1,263,500

May $1,285,000

Jun $1,256,500

Month Months of Inventory

Feb 1.95

Mar 1.96

Apr 2.75

May 2.44

Jun 2.92

But it isn’t because Oak Bay has become less desirable, it is a trend for housing in that price range anywhere in Greater Victoria as the volume of sales in the upper income bracket have declined more than the middle income market has fallen.

*McLister said banks were offering discretionary rates as low as 2.54 per cent to 2.59 per cent on a five-year fixed rate contract, but that range is now closer to 2.69 to 2.74 per cent. *

http://business.financialpost.com/personal-finance/mortgages-real-estate/mortgage-rate-hike-looms-as-canadians-continue-to-deal-with-near-record-debt-levels/wcm/e5818bca-ddbc-45cf-8e89-a89463ba7729

That puts us almost back to where we were in 2013. I think at 1.5% higher than now is where we start to get into problems for the market. The ones at the margins that are currently beg borrowing or stealing their 20% down payment to avoid the stress test will be in trouble.

On vacation at the moment, but will put up a post with month end numbers tonight.

Personally I am amazed that interest rates have stayed this low for this long. I also do not believe that it takes a degree in higher mathematics to figure out that there is a greater probability of interest rates going up three percentage points then down three points.

I am also surprised by the number of people with brand new cars who are carrying large mortgages.

On a positive note I was glad that the banks were calculating loans on the basis of a possible higher rate in the future.

Could be. Steadily increasing rates is going to make it harder for our magical “it’s different here/this time” housing market to continue on its unicorn stretch.

The amount of debt Canadians are taking on, and the cavalier attitude in which they are embracing it is an unfortunate and frightening reality. We’re not repeatedly making global headlines for nothing. It’s just a house, folks. It’s not worth mortgaging your entire future just to enrich some boomer or speculator who did nothing to amass these “gains”. The romantic notion of ownership at any cost invariably breaks down under the reality of actually owning under a lead umbrella of crushing debt.

We Canadians can be a tad smug when we compare ourselves to Americans or others – but the reality is we’re no different: we don’t learn from our past mistakes, we don’t learn from others’ mistakes, we think we’re special, we think we’ve learned from earlier fumblings, we think it can’t happen here, we think the CCB won’t raise rates because it “would kill the economy”. Oh, the innocence. If only we actually knew as well as we thought we did.

It almost reminds me of the fatalistic saying that goes something like, “By the time a woman realizes that her mother was right all along, she’s got her own daughter who’s convinced she’s wrong.” Rinse, wash, repeat. Sigh.

It’s very simple. In the long run, housing prices must be in line with the economy in which they reside. It can deviate, in some cases, for years. But not in perpetuity. None of your charts, assertions, rationalizations, appeals to authority, panels of experts or buckets of foreign buyers can change that. Sooner or later, gravity will always win. When it does, people will say the same thing they always say.

“No one saw it coming.”

Our almost cartoonish housing market and several others in Canada are flashing so much red I shudder to think people still think now is a great time to jump in. I’m not saying that there is no room in any market segments for more mania based gains, but I am saying this “growth” cycle is more stale than a stale cake on stale cake Wednesday.

Yea, no thanks.

Might want to read Garth tonite. As I posted here many times, the knives are out for Canadian real estate via international viewpoints like never before.

Via Dubai: “The coming interest rate rise will be property’s kiss of death. There are rumours of systemic fraud and more mortgage lender failures even as I write. Yes, this time the wolf is here.”

http://www.greaterfool.ca/2017/07/03/how-they-see-us/

“That selloff could trigger more selloffs as the “bond vigilantes” pull out of this “safe haven”. The result of that would be interest rate increases in the mortgage market that may be very surprising.”

Exactly oops. There have been many times in history where rates shot up much faster than expected once the risk money gets nervous and doesn’t like the looks of the bubble that is so far past the US housing crash.

More than half of Canadians say they aren’t financially prepared if interest rates jump, expenses rise: survey

The survey also found 70% of mortgage holders are not able to handle a 10% increase in payments, and the problem seems to extend across all generations

http://business.financialpost.com/personal-finance/debt/more-than-half-of-canadians-say-they-arent-financially-prepared-if-interest-rates-jump-expenses-rise-survey/wcm/291da6e4-d28b-4cbc-87ab-73a49345cdfc

Rising interest rates will be the GDP killer as the largest component of our GDP is consumer spending. There won’t be too much spending when so many FIRE industry jobs are lost and homes devalued. The degree of household spending that will be withdrawn from the market cannot be understated. This will start a cycle of unemployment that will be challenging.

Once the rest of the world becomes aware of our housing implosion you might also see an exacerbation of bond selloffs in Canada, in particular.

http://www.marketwatch.com/story/global-bond-yields-march-higher-as-easy-money-era-shows-age-2017-06-29

That selloff could trigger more selloffs as the “bond vigilantes” pull out of this “safe haven”. The result of that would be interest rate increases in the mortgage market that may be very surprising.

The phenomenal amount of Canadian bonds that were purchased by other countries during the GFC was unprecedented.

“If not a full-blown systemic risk, Canada’s leverage to foreign portfolio investors is a notable vulnerability for the country’s capital markets and debt issuers;”

“Nonresidents now hold just over 40% of the publicly available GoC bond stock—more than double their pre-crisis share”

“we estimate that the domestic value of FX reserves allocated to Canada has tripled to $300 billion since the crisis.

https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/government-credit-04feb2016.pdf

“Meanwhile, underlying demand risks faltering, partly in response to Canada specific concerns, but also courtesy of policies being pursued by foreign governments. More supply and less demand results in lower prices for affected assets, including the Canadian dollar, rates and credit.”

Rising interest rates are a godsend to pension plans and insurance companies because they lower their liabilities. Too many plans have their eyes on return and not enough on their liabilities. This will be some consolation, I guess.

Will they lower rates again, after? Bank of Canada probably will, but the bond market will determine mortgage rates.

I guess we can cross our fingers and hope none of this happens but we sure didn’t learn anything from our neighbours to the south.

100 bucks per 100,000 is substantial for a lot of people who are living month to month in order to pay a 500,000 mortgage. The impact is compounded on shadow loans at 12%. These are the people that will take the hit.

Even if the BoC raises overnight rates by 1% or 100 basis points in the next 18-24 months; it stands at 0.5% today. Here is the net effect on $100,000 mortgage, 25 Yrs Amort, Monthly Payments.

@ 2.5% Monthly $447.97

@ 3.5% Monthly $499.27

@ 4.5% Monthly $553.47

If rates go up 2% on a 5 yr, you are servicing $100 more per month for every $100K in debt.

Happy Canada Day! and From the guys with a broken Crystal Ball.

NBC July/Aug 2017 Good Summary

https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/monthly-economic-monitor.pdf

RBC July 2017 Interest/FX Forecast

http://www.rbc.com/economics/economic-reports/pdf/financial-markets/rates.pdf

Scotia

http://www.gbm.scotiabank.com/English/bns_econ/forecast.pdf

“Why would anyone predict that one segment of the market will drop while another won’t?”

Because they are a salesman with a financial interest who focuses on a certain low end sector and doesn’t want to cut his own head off. Market crashes take no prisoners. They all go down like dominoes.

When the NDP implements the Green’s 30% province wide foreign tax then we will see mayhem. Even if they compromise it will be 20% minimum.

Toss in exposing all private corporations/trusts etc true identities the for sales will pop up like rabbits breeding in Golden Head.

Ten years of emergency rates are over forever, batten down the hatches. The government has been warning for years to not take on excessive debt and no one listened. They won’t give two shits you can’t make your payments.

Why would anyone predict that one segment of the market will drop while another won’t? It makes more sense to me to anticipate a drop in the type of housing owned by the people who are most leveraged because those will be the people who will need to sell. People with 7 bedroom mansions in uplands can be just as leveraged as people with 400 sq foot condos in Langford.

Except that the C$ has been rising sharply without a rate increase (up four cents against the greenback in the last month), so an increase now will only add to the rising headwind for Canadian exporters.

Would analysis of the data not show that the top end has already declined sharply. That’s what one would expect given the huge increase in Uplands inventory since the start of the year. Moreover, it is consistent with the expectation that owners of high-end real estate are, in general, more attuned to financial trends than those buying 500 square foot condos.

A breakout of the price trend by quintiles or deciles would show if those assumptions are correct.

Plumwine asks a good question for which I have no idea.

Richard: “It seems to me nowadays capital is more interested in “safety” than it is in “return” hence all the foreign capital into Van. and To. into RE.”

The kind of capital being referred to is purchases of GOC bonds. Foreign purchasers of these bonds now account for about 40% of these bond sales. Barrister is correct and this is the kind of “capital” that affects the mortgage market.

When the market starts to fall, where do you think the initial impact starts? High-end condos ($500+ sqft) or starter SFH (500-750k) or OB “mansions” ($2M+)

I think custom new build SFH in Westshore will see the most weakness and micro skyboxes in DT are the least affected.

Not an economist, not even close, but here is a back of the napkin prediction:

people with high credit card debt will feel the most pain right away. Less available cash means less buying and slowing in retail. They will look for other sources of credit to pay off their cards so there will be increased applications for HELOCs or other LOCs. Banks will capitalize on this by raising rates on those instruments.

people with second and/or shadow mortgages will feel the heat, so they will start offloading secondary and investment properties. Foreign buyers will try to buy these up so the government will impose taxes to try to capitalize on this.

People with variable rate mortgages will rush to lock in as soon as they can. Banks, smelling opportunity, will raise rates on fixed mortgages first trying to make variable and short-term mortgages more attractive knowing full well than in a year to five years, these people will have to lock in at an even higher rate.

Local investors will see better opportunities elsewhere and off-load properties to free up some cash.

Foreign investors will continue to buy up CAN real estate as long as the currency makes it a good buy but when exchange rates, taxes and better opportunities elsewhere outweigh the relative stability of our market, they will jump ship.

I’m going to sit back and enjoy the ride. Real estate might get interesting again.

“we almost have to raise rates or capital starts to flow out of the country.”

It seems to me nowadays capital is more interested in “safety” than it is in “return” hence all the foreign capital into Van. and To. into RE.

Leo:

The other side of the interest equation is that if rates go up in other countries such as the U.S. or England than we almost have to raise rates or capital starts to flow out of the country. I totally agree with you that it is a delicate balancing act and that is far from controlled by the Bank of Canada.

Yep. The BOC will raise rates if the economy is strong enough and they don’t care about home owners debt loads. Higher rates means more money to debt service and less money to the productive economy which will put a drag on things.

Problem is this feedback loop is very slow. Some people will notice right away with increased variable rates but most have fixed mortgage terms and won’t see the higher rates until a year or two down the road.

Usually by the time the central banks notice they’ve raised too far it’s too late to avoid a recession

“The payments on a 25 yr. $200,000. mortgage with a 5yr. fixed rate at 10% are $1789. Oh and guess what, the same $70,000 income buys either mortgage. You’ll be fine Hawk. Lol.”

Those who saved and invested will be paying cash with zero mortgage and cash left over. 😉

I’ve always said…..”It’s not about how much you paid for a house, it’s about how much you pay every month”….. ie the mortgage interest, that’s where you save in RE.

Hope everyone had a wonderful weekend and enjoyed the perfect weather.

3Richard Haysom: “Hope you are all pre-approved and have a rate locked in so when you jump back in after the big crash you won’t be stuck with higher interest payments!”

Richard, I know that you are just poking one of the bears, but pay attention to those rising rates. They spell a world of hurt to Canada and they are coming.

I know that everyone and their dog that is invested in real estate (speculators, investment condos, second/third houses) have bought into the whole “govt. won’t allow rates to rise because it would be a disaster for home owners” but BE PREPARED.

Buyers should be much happier with a $200,000 mortgage rather than a $400,000 mortgage. Lower payments and less debt. On a 25 yr. $400.000. mortgage with a 5yr. fixed rate at 2.5% the payments are $1792. The payments on a 25 yr. $200,000. mortgage with a 5yr. fixed rate at 10% are $1789. Oh and guess what, the same $70,000 income buys either mortgage. You’ll be fine Hawk. Lol.

https://www.cibc.com/ca/mortgages/calculator/mortgage-affordability.html

Unfortunately, those homeowners that have monster mortgages now might not have the luxury of avoiding higher payments.

http://www.businessinsider.com/canada-financial-crisis-warning-signs-2017-6

Canada hit 2 critical warning signs for a financial crisis

“The credit-to-GDP gap has reached a critical level in Canada. The BIS defines this as the “difference of the credit-to-GDP ratio from its trend.” That’s bankster for “it compares credit consumption to the output of the economy.” If the level is too high, the amount of private credit is “unjustified.”

Hey Hawk!

“Looks like a trend developing with rates on the rise. ”

Hope you are all pre-approved and have a rate locked in so when you jump back in after the big crash you won’t be stuck with higher interest payments! Sucks that they only hold them for 90-120 days though!

Even Glanford area is taking big hits. 534 Tait St slashed $50K to $649K. In nice shape too but not even a low baller would step up to the plate. Looks like a trend developing with rates on the rise. 😉

Another one of those damn internet “articles” AKA real news, for those who live in a bubble. Hurry up kids, you can lose bigly like Hog Towners too. 😉

Realtors’ internal numbers show Toronto home prices fell more than 6% in two weeks

Internal mid-month statistics for June from the Toronto Real Estate Board show average prices in the Greater Toronto Area shed almost 6.4 per cent in just two weeks with sales down about 50 per cent from a year ago.

TREB reported Monday, in a note sent to members, that the average home sold for $808,847 from June 1 to 14 — a sharp drop from the average of $863,910 for May. The decline comes on top of a 6.2 per cent drop in prices from April to May. The board no longer makes public mid-month stats.

http://www.vancouversun.com/realtors+internal+numbers+show+toronto+home+prices+fell+more+than+weeks/13464141/story.html

Re: the Vid.

Eby is evidently a smart person and he gives a logical presentation of the socialist response to the failure of the free enterprise guys, Harper’s Tories and Trudeau’s Liberals in Ottawa and Christie and the BC Liberals in Victoria, to either protect high wage jobs in Canada from off-shoring and cheap immigrant labor, or ensure an adequate supply of low-cost housing via market mechanisms.

The NDP, if they can get their program through the leg. will evidently aim to bring on a massive supply of public housing, a la Hong Kong and Singapore. I think this is unfortunate. I believe a free market solution to cheap housing could have been achieved simply by sane rezoning.

With reference to Oak Bay, I have talked about reducing minimum lot sizes for SFH’s and rezoning along OB Avenue to allow much higher densities, up to ten or twenty stories, with lower but still increased densities along adjacent avenues. A coordinated program of rezoning along those lines throughout the Province would have insured an adequate supply of reasonably priced building land for decades to come, but the lure of profits from an RE boom evidently outweighed any consideration of good government.

Now there’s Hell to pay. Or at least it may seem like that to the rentiers, and the home owners dependent on a basement suit to cover their mortgage costs. However, that all depends on whether, and if so when, the NDP get their public housing projects off the ground.

In the long-run we can look forward to lots of probably soulless new tower blocks, with “public housing” written all over their design like London’s Grenfel Tower that when up in cyanide-laced flame and smoke the other day, consigning a large proportion of the population to life-long renter status.

Let’s hope that the NDP at least manage to hire some good architects and give residents the option to purchase the freehold, or at least the option to buy a 99-year lease, as with public housing in Singapore.

“We have had one of the longest continuous building sprees on record at some 16 years now and prices have not come down.”

Don’t know how it is in other municipalities, but in Oak Bay, despite many fine new homes, the population has shrunk during the last few years.

So how is that to be accounted for? More investor-owned empty homes? More empty nests, with just one or two oldsters hanging on? Or is it that most of the construction is merely replacing existing homes, e.g., on Lincoln Rd between Estevan and Dorset where the last seven sales have resulted in six tear downs and one house stripped to the studs inside and out and entirely rebuilt with a new roof line, and expanded upper floor.

Whatever the explanation of the seeming paradox of declining population and rising prices, I am confident that it does not refute the law of supply and demand.

But as for the rise in prices, that has clearly been mainly interest-rate driven, the decline in rates creating not only increased buying power but the expectation of price increases leading to increased demand.

I would suggest you watch the video above. David EBy has a good explanation of why endless building on its own doesn’t lead to affordable housing. Yes you need to build, but you have to build the right stuff.

Dundigging: Thank you for the Rockland price. Much appreciated.

We have had one of the longest continuous building sprees on record at some 16 years now and prices have not come down.

1575 Rockland sold for $2,050,000

Fairfield slasher at 542 Harbinger Ave whacked $100k to $989K.

Broadmead beatdown for $100K as well at 871 Royal Oak Ave for a similar $989K.

Both very nice places in nice hoods so very surprising they didn’t even get a low ball offer to whack that much.

Hurry up kids, you can be a bagholder too for the next decade or more of your life while rates take off. 😉

“All Hawk has are price slashes and Internet articles. Sad!

If it’s realistically within your reach, buy Victoria real estate, kids. Buy and hold. Don’t be like Hawk. Don’t screw yourself.”

Price slashes increasing in your hood by the day Intorovert, along with monumental/historical news about rates going up in a couple of weeks and credit tightening has you all depressed on such a joyous holiday ? Now that’s what you call sad.

Yes kids, keep on buying and be like Toronto bag holders who have lost bigtime in a mere month as it spreads west to Golden Head when all the foreigners have to dump ASAP as they are going to have to expose their true identities to Rev Canada.

Happy Canada Day!

CS, I just remember you are the guy who don’t know where Estevan is and keep saying who lives there, and how they should live. Now, you are suggesting to bulldozer Uplands park-like neighborhood, build skyboxes like HK, to help the local. I cannot wait what you are going to post next month. Gonzales into coral reefs? New Costco in North OB? Boat houses @ Willows?

Does anyone know what 1575 Rockland sold for?

“When you build more homes you stimulate the economy and house prices rise.”

In the short-run, maybe. In the long-run, not so.

But agree that in the short-run the price trend depends on sentiment.

@ Barrister:

<

blockquote>Perhaps a simpler solution would be to move the provincial capital to Ladysmith along with most of the government departments….

LOL. That would cause some squawking.

But given that the NDP government will probably embark on a hiring spree, it would save a further tightening of the local housing market, while giving a boost to the Up Island economy.

Might also change the way people here think about their city and how it should develop.

But that isn’t what happens. When you build more homes you stimulate the economy and house prices rise. Building more homes doesn’t make homes cheaper it makes them more expensive.

The way to bring home prices down is to increase the number of re-sales in the community. And that’s what will happen in Victoria. A lot of home owners have been holding back from listing their homes for sale. Or, they may have bought a new home but kept the old one as a rental.

Some time in the near future there will be an event or series of events that will change those home owners from wanting to hold real estate to selling. And most of them will want to do it at the same time. These past years of under supply will come back onto the market.

It is happening slowly now as sales slow and active listings increase. Eventually, new listings of re-sales will rapidly come onto the market and home prices will fall.

So it won’t be new homes that will bring down prices. It will be re-sales of previously owned homes that will bring down prices.

If the government wanted to bring down prices they would have to encourage re-sales of previously owned homes and not encourage new construction.

You can not build yourself out of this upward price spiral.

“Check out the new Bowker condos and tell me how they’re more “affordable” than westshore SFH….”

Plummy you really are a …..

Economics is mostly mathematical BS, but it has one basic and universally true principle, which is that supply and demand determine price. Increase the supply, e.g., by general rezoning of land to allow greater subdivision or taller buildings, or lower the demand, e.g., by placing a sewage farm in a residential area, and you reduce the price.

Conversely, …

Well I’ll leave it as a little exercise for you to figure it out for yourself.

But rezoning a few hundred square meters in a ten square kilometer municipality is unlikely to produce an obvious effect on condo prices, although if they’d allowed a 50-story high-rise, then it might have.

CS:

You have a good point and certainly just like Hong Kong Canda has absolutely no vacant land available anywhere. Perhaps a simplier solution would be to move the provincial capital to Ladysmith along with most of the government departments. That would free up a vast number of houses in Victoria and make it a lot more affordable. There are vast amounts of very cheap land for the government to build more affordable houses on and it would certainly benifit a depressed area.

Check out the new Bowker condos and tell me how they’re more “affordable” than westshore SFH….

June ended with the highest number of active house listings in the core since October 2015. A 20 month high.

House sales in the first six months in the core, at 756, are 35% down from last year’s total at 1,159. New listings for the first six months,(1,166) are down from last year’s 1,380 by 16%.

And the median price for houses in the core has remained flat averaging 938,750

Month Sale Price, Median

Jan $950,000

Feb $925,000

Mar $919,000

Apr $918,000

May $977,500

Jun $943,000

So here we are in what some have called our hottest real estate market with rising listings falling sales and flat prices. Obviously the aforementioned have little to do with the public’s perception of what a hot market means.

To most it is simply a matter of how long in takes to sell a property which is the average days-on-market or DOM. A poor indicator because it can be manipulated with deferred lisitngs/blind auctions and re-listing a property to re-start the DOM counter.

Well June was a bit of an upset as the average DOM increased from 16 to 20. That doesn’t seem like much of an increase but it is important as it relates to how successful agents are in trying to start a bidding war on properties. And in June we did see an increase in flops at the auction.

Plummy, are you a grammarian too?

Did you know that Hong Kong is the most densely populated jurisdiction in the world and that the Kwun Tsong district of Hong Kong has a population density of more than 57 thousand per square kilometer?

So if Oak Bay were to have the same population density as Kwun Tsong, then it would have 335 times its present population or a total of more than half a million people. Then, yes, RE prices would likely match those of Hong Kong. But it’d be a while before we reached that point during which sufficiently rapid adjustment of zoning bylaws to allow higher density development would reduce the cost of a home in Oak Bay.

The two of you could be very happy together. Picture it—long walks on Jacklin Road as you discuss such topics as the scourge of reverse racism and how lowering taxes improves public healthcare.

Well this is interesting – the Stat’s about foreign buyers in Saanich don’t surprise me all that much. Area’s near UVic are probably the most popular.

As for homelessness/addiction/social housing issues – we do have a big problem here in this city with the best climate in Canada acting as a magnet with that. Given the lack of investment in social or rental housing in recent decades the problem is exacerbated. I was thinking if the new Gov’t actually takes too many steps to address the problem we end up with the risk of being even more of a magnet for disenfranchised types from across the country.

Our ‘New Greenocrats’ are talking about bringing in a basic income (along with Ontario): http://www.huffingtonpost.ca/2017/05/31/basic-income-british-columbia_n_16898442.html

However, I think – don’t give basic income to able bodied individuals who can work but would rather just sit on their ass! Bumping min. wage up to $15/hour is also a good way to give incentive to work. (not much incentive at the current min. wage)

To avoid being a magnet they better make some sort of requirement for eligibility being long term residency in BC (say three years?) for this AND social housing projects. We’ve always had a problem on the west coast since we’re pretty much the only part of Canada where it’s possible to live outside during the winter. We can’t solve homelessness/addiction issues if we end up just encouraging more and more people to move here from across the country so they can access benefits that don’t exist elsewhere.

As for the former Liberal’s strategy of finally housing some of these people in old motels or care homes after public anger about tent city got to be too great. This is already shown to be an utter failure. Concentrating these people in buildings where their addictions can be fed and crime can flourish create’s sort of ‘Fentanyl hoods’. The ease of access to feed their addictions when housed like this is too great. Social housing needs to come in a different form than this, and creating this is complex but possible. Have a look at the Swiss success story: http://www.housinginternational.coop/co-ops/switzerland/

Portugal is an example of a jurisdiction that has virtually eliminated overdose deaths – lets look at what other places are doing…

https://www.washingtonpost.com/news/wonk/wp/2015/06/05/why-hardly-anyone-dies-from-a-drug-overdose-in-portugal/?utm_term=.3b3152b72b53

I don’t think anyone has all the answers. But, at least we finally have someone in office with a new perspective on how to deal with some of these issues. Hopefully they can do more than the uncaring Liberals ever did… an environment now ushered in where everyone, and not just the elites can benefit. I look forward to seeing what they do or try to do…

Happy Canada Day everyone! Let’s hope a better future is now in store for everybody in this province and country!

For Jerry:

https://twitter.com/SowaTheArrogant/status/880965638029807616

CS and Jerry make a cute redneck couple, don’t you think? Do y’all live in Langford?

HAhahaahahahah!!! 1st google search – “Hong Kong the world’s priciest home market for the seventh year”

http://www.scmp.com/business/article/2064554/hong-kong-named-most-expensive-housing-market-world-seventh-straight-year

And you think we should adopted HK model to help our youth….. hahaha. Thanks for the laugh.

Lands are cheap, they are 30-45 min drive from downtown. For some reasons, many ppl think they should able to afford to live in OB, yet, they hate OB, but they won’t stop talking about OB……

@ Intro:

There for all to see, the logical capabilities of a grammarian.

Actually, granting the franchise to children, or what amounts to virtually the same thing, teenagers and young adults chiefly concerned with getting a job, getting laid and getting a house of their own, is idiotic.

The only beneficiaries of such a so-called democracy are the governing parties that buy votes by handing out free lollipops and condoms, legalize pot and threaten professors with expulsion from the academy if they refuse to employ made up pronouns of their choice as demanded by more or less demented students.

All Hawk has are price slashes and Internet articles. Sad!

If it’s realistically within your reach, buy Victoria real estate, kids. Buy and hold. Don’t be like Hawk. Don’t screw yourself.

(From the previous thread:)

What a fucked up opinion!

I’m not a fan of nationalism in general. And I’m certainly not a fan of celebrating ongoing colonial occupation.

Housing is not expensive. A house is just a box of matchwood and OSB, with plumbing, wiring and some fancy finish inside and out.

What’s expensive is land. Specifically, the land required per residential unit, and that is dictated by zoning bylaws. Urban real estate values are thus almost entirely artificial, a consequence of government fiat.

If Oak Bay adopted Hong Kong’s zoning bylaws, we’d soon have a hundred and seventy thousand, not seventeen thousand Oak Bay residents, plus a bunch of high-rise factories.

But in its great wisdom, the Municipality of Oak Bay preserves those one acre-plus lots with moldering mansion in South Oak Bay and one to several acre Uplands lots with their new-build mansions for the nouveau-riche, so obviously house prices are sky high.

And frankly, why not? We all, surely, would rather have a bunch of rich, old foreigners living here than a mass of young Canadians breeding freely in cheap houses as they used to in the bad old days before Trudeau-I.

“All developers should be made to expose who their foreign investors are, not just purchasers/flippers. This is where money laundering begins.”

I have said it before. Do a title search in some recent developments in town and you can see who they are. 75% of the time the “investors” get their name on title.

Or get a corporate registry of the company that is doing the development. Most developers are doing it in a # company these days. Those numbered companies generally have the main investors as directors.

All developers should be made to expose who their foreign investors are, not just purchasers/flippers. This is where money laundering begins.

“That sound you hear is just crashing house prices. Carry on.

Moronic.”

Another Golden Head slasher at1800 Francisco Terrace for $25k now only $874K. One of many in the “moronic’s” hood the past week taking a beatdown.

These were going for $200K over ask the last few months with cars lined around the block. Nothing but crickets now. Price of land just keeps on tanking. 😉

Happy Canada Day !

Happy Canada Day! We are so very lucky to live in this great country. Just for today let’s focus on the positive!

You can do it!

It seems pointless to get into the discussion of the details of what a foreign buyer is….when it is not even a direct issue here in Victoria. (prices have risen here because Vancouver has exploded…as well as the fact that people are beginning to wake up and realize that Victoria is a paradise.)

The best way to help those who can’t afford housing is for the government to build a ton of affordable housing. (They have been doing that in indirect ways by funding groups such as the Baptist housing. Some great developments have been created by those types of groups) But it is not nearly enough. The government should build those types of units and fund them completely by government. The private sector won’t do it and can’t be expected to do it because the costs are just too high. This new government might do it. I hope so. But I don’t trust any of them quite honestly.

Happy Canada Day to all of you out there.

Foreign Entities and Taxable Trustees

For the additional property transfer tax, a foreign entity is a property purchaser or tranferee that is a foreign national or a foreign corporation.

A foreign national is a person who is not a Canadian citizen or permanent resident of Canada, including a stateless person.

A foreign corporation is a corporation that is one of the following:

A taxable trustee is a trustee that is a foreign national or foreign corporation holding title in trust for beneficiaries. The taxable trustee can also be a Canadian citizen holding

“Foreign” = Neither a citizen nor a resident of Canada. Correct?