Hottest Markets Slowing Down

It’s a bit of an odd market out there. On the one hand, there are more over ask sales than even last year and we have extremely low inventory. On the other the number of price cuts seem to be increasing. By the stats it’s still a very hot market but around here there are more listings coming on and they are selling quite slowly.

Last June Gordon Head was smoking hot, with only 30 detached homes for sale, and half of all sales happening in 6 days or less. Now there are 48 listings and climbing, and it takes twice as long for a sale. Similar situation in Oak Bay, with listings double that of last June, and time to sell climbing. So far the overall market stats have been masking these regional pullbacks. Places like Langford have fewer detached listings than this time last year and properties are selling twice as quickly (median 10 days to sell instead of 22 last June).

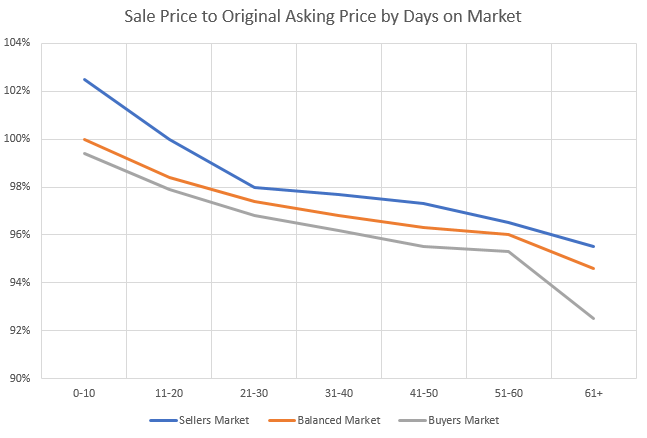

Now the average days on market are still low compared to any normal year, but as it increases we will start to see fewer above ask sales. Quite logically, the longer a property sits, the more of a discount off ask it is likely to sell for. More importantly for buyers, a somewhat cooling market gives some breathing room to do due diligence and add conditions to an offer.

The above chart was created from history in 2016/17 for the sellers’ market, 2014/15 for the balanced market, and 2013 for the buyers’ market.

Also weekly numbers courtesy of the VREB.

| June 2017 |

June

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 96 | 331 | 586 | 811 |

1174

|

| New Listings | 189 | 542 | 849 | 1146 |

1319

|

| Active Listings | 1939 | 2000 | 1992 | 2010 |

2289

|

| Sales to New Listings | 51% | 61% | 69% | 71% |

89%

|

| Sales Projection | — | 915 | 997 | 1009 | |

| Months of Inventory |

1.9 |

||||

We might actually crack 1000 sales in June which is impressive given there’s only twice that many properties on the market.

So it doesn’t get lost, reader freedom_2008 points out this recent FinancialPost article on capital gains liability from suites. Despite a history of a lack of enforcement, the evidence that things are changing continues to pile on. “With the recent requirement to report the sale of a principal residence on your tax return to be eligible for the PRE, it’s now much easier for the CRA to review the sale of your home and determine whether any potential gain on disposition qualifies for exemption. If you’ve historically been reporting rental income on your return from the same property, this could raise a red flag as to your eligibility to claim the full PRE.”

^ the above should in no way be interpreted as a recommendation not to report your rental income!

I cant believe that 1218 St David sold for 1.885 million; 300k over asking. Have people lost their minds?

New post: https://househuntvictoria.ca/2017/06/28/pure-demand/

James, there are a lot of reasons & articles written, but here are a few are: they’re still productive, contributing members of society, their home is “where their heart is,” and as they get slower they need a familiar routine to stay safe mentally & physically. It harmful to be pushed into a strange place or be around strangers before it’s necessary.

If you’ve ever been faced with frighteningly blood-curdling screams from dementia patients (before they’re transferred to another facility) you’ll understand that nursing homes have good and bad points.

James:

Get it five minutes thought as to why they dont want to move and it should probablely be obvious. if it isn’t then you really need to talk to a few seniors.

I wouldn’t actually want to live in anything over 1500 sq feet, but I really wonder why people who can barely get around want to live in a massive place by themselves that they can’t even take care of.

Vicbot:

You actually have a good point. There is often this indirectly expressed sentiment that seniors are taking up housing that should belong to me, me , me.

Marko, I honestly don’t want to re-hash an old argument, but I’m tired of people being called “dumb.” It verges on bullying. There were a lot of valid concerns that people have expressed to me outside of this blog, so I don’t know why there’s pushback here: Helps simply looks like she’s out of her league when it comes to homelessness & seniors issues by comparing it to WWII

Perhaps you just don’t have the experience but as you get to your 50s/60s and take care of parents & in-laws & friends and see their vulnerabilities, and see how people seem to gang up on seniors and tell them “they should move out of their homes” (not Helps) or (as Helps said) “they should take people into their large homes where they live alone” – it’s a mob mentality that is reckless and dangerous to people’s safety – and makes them fearful.

Sure – say that if you’re just JoeShmo – who cares. But not as mayor.

after the liberals changes. Federal only.

•15% on the first $45,916 of taxable income, +

•20.5% on the next $45,915 of taxable income (on the portion of taxable income over $45,916 up to $91,831), +

•26% on the next $50,522 of taxable income (on the portion of taxable income over $91,831 up to $142,353), +

•29% on the next $60,447 of taxable income (on the portion of taxable income over $142,353 up to $202,800), +

•33% of taxable income over $202,800.

You mean the one that’s already over capacity?

Gee, I sure hope our millionaire realtor friend is going to make it! (No offence, Marko.)

http://i.imgur.com/7O4LkJY.jpg

http://www.cbc.ca/news/business/taxes/tax-time-2016-1.2508364

Marko, that’s not the point about what people were concerned about.

I know what people were concerned about but it’s a really dumb concern. Literally every other house has an illegal suite or is running an AirBnB or some sort of infraction bylaw (illegal deck, etc.) in Greater Victoria….last time we got numbers from Saanich less than 100 suites out of some estimated 9,000 had a permit in place.

It’s like trying to throw a politician under the bus for driving 98 km/h in a 90 km/h zone where flow of traffic is 110 km/h. There are other more important things to worry about.

Cordova Bay slashes keep rolling in. Another nice place at 4960 Georgia Park Terr slashed $88K. The lucky 8’s didn’t work the first time.

Stodgy ole Rockland can’t catch a break either but it’s in very nice shape as well @1524 Bywood Pl slashed $100K.

Very surprising they needed to slash, but this is soon to be the norm with rates heading up and credit tightening.

“Here we make a big deal that her landlord has an AirBnB? Incredibly idiotic,”

Marko, that’s not the point about what people were concerned about. I really hope that conversations can more civilized and you can just accept people’s points of view instead of twisting their words into something they weren’t saying and then calling them “idiotic”. That’s just plain idiotic 🙂

It seems that you skim the comments sometimes, see the word “AirBnB” and defences get riled up for nothing.

Thanks Totoro, makes sense. I must have skipped that day in school (mentally at least). Luckily I have a good accountant and corp lawyer to lean on.

Holding companies are used to creditor proof the main corporation and in some cases to add shareholders.

“Who cares about me…my job doesn’t contribute anything to society”

You got that right.

Poloz has no choice as he’s a year late. Buckle up, the party is over.

Canada July Rate Hike Odds Jump After Poloz Restates Bias

Swaps trading suggests investors placing 69% odds of July rise

Poloz tells CNBC that 2015 rate cuts have done their job

https://www.bloomberg.com/news/articles/2017-06-28/canada-july-rate-hike-odds-jump-after-poloz-restates-bias

totoro

Why a separate holding company? Multiple shareholders in the corp and only you and family members in the holding company?

Leo S:

Ha. I’ll save the raisin in my trail mix for you. I’ve got dibs on the wasabi peas.

Interesting article on affordable housing. They interview Brent Toderian (chief planner in Vancouver from 2006-2012).

I’m incorporated with a holding company too. I’m not sure what kind of issues you’ve run into but I don’t find it too difficult to manage?

Leo is correct. Those working less are doing so for lifestyle reasons, not taxation. High earners like doctors can incorporate and pay 15% tax on retained earnings and withdraw only what they need to live on.

I am incorporated, plus a holding company, and it is a huge pain despite some tax advantages; there is a lot of crap no one told me about when I incorporated.

Sure a big part is lifestyle but for me a big part was taxation so I stopped taking on the worst business (i.e. a mere posting in Sooke or the Malahat). To drive to Sooke to do a mere posting for $899 is one thing but to go out there for $899 minus expenses and then the government takes 50% just not worth it so I don’t do it.

If you are a doctor you are getting taxed the most seeing the patient at 6 pm on a Friday. The 10 am Monday easy patient is in your lowest tax bracket.

CS:

I remeber the high taxes in the 70’s and I also remeber the brain drain of engineers and doctors heading south of the border.

Anna Edwards:

You are absolutely right about many people being reactive. But selling after the tax is implemented is like closing the barn door after the horses have bolted (why do they call it bolted anyway?).

I suspect the smart money is on the market now; time to grab the profits and run. All good things come to an end.

“Listings didn’t start piling up in the GTA until after the government implemented their new rules.

People are not proactive. They are reactive.”

And if prices have stopped rising, people will react to that.

“but I totally understand when you look at the tax structure. The incentive to work beyond a certain point becomes very low.”

Taxes must be too low, obviously!

When you get up around 75%, which is where the top personal tax rate was until well into the 70’s, high earners have to work long hours to earn enough to, well, be high earners.

Barrister

June 28, 2017 at 7:50 am

“I am a bit surprised that even more houses have not come on the market the last few weeks. I was expecting that anyone that bought a house to flip would be rushing to get it on the market before the new government started to impose large taxes on speculative housing flips. Perhaps there were simply less houses bought by speculators than people were estimating.”

Listings didn’t start piling up in the GTA until after the government implemented their new rules.

People are not proactive. They are reactive.

Leo is correct. Those working less are doing so for lifestyle reasons, not taxation. High earners like doctors can incorporate and pay 15% tax on retained earnings and withdraw only what they need to live on.

They are working 3 days because they can and they value their free/family time more than extra dollars, not because of taxes. Targeted tax breaks for high demand professionals would be interesting, but I doubt it’s going to entice too many people to give up their 4 day weekends.

One does have to be a bit concerned about the impact of high taxes on personal decisions like Markos.

Who cares about me…my job doesn’t contribute anything to society and 1,400 licenced professionals will gladly replace me in my absence.

Doctors and similar is where I worry. My doctor also only works three days a week, but I totally understand when you look at the tax structure. The incentive to work beyond a certain point becomes very low. You would be dumb to be seeing patients at past 4 pm where you get hit the hardest on taxes based on brackets. Might as well go home early and spend it with the family.

Sucks if you are waiting to see a specialist 3-4 months.

Was just a few months ago you fretted about an extra couple of weeks to move was major lost money but whatever. Have fun.

Rather be on a boat in the Adriatic for two weeks than moving.

Looks like fun Marko if you’re into driving for 5 hour shots in a line.

Drag racing P100Ds at an airport until the batteries start overheating is not for everyone, I understand.

“I know it is hard to believe but I have interests outside of real estate…..with the tax increases in the last few years I’ve been working less and spending more time in Europe sailing, driving electric cars, and other crap.”

Looks like fun Marko if you’re into driving for 5 hour shots in a line. Was just a few months ago you fretted about an extra couple of weeks to move was major lost money but whatever. Have fun.

“In the majority of countries, a mayor in a comparable city would go in a renter and come out a multi-millionaire (bribes for permits, licences, etc).”

Bribes? Sounds libelous.

One does have to be a bit concerned about the impact of high taxes on personal decisions like Markos.

Both my dentist and my wifes doctor only work three days a week; both are in their early fifties. That does not surprise me as much as my electrician who has decided to work only two days a week and his son, who took over the business, cutting back to three days a week. Probablely far from the norm but it does give one pause to reflect.

I am a bit surprised that even more houses have not come on the market the last few weeks. I was expecting that anyone that bought a house to flip would be rushing to get it on the market before the new government started to impose large taxes on speculative housing flips. Perhaps there were simply less houses bought by speculators than people were estimating.

In Oak Bay for SFH priced between 1 Million and 2 Million there have been 7 sales so far this month but there have been 24 new listings (some of these may have been relistings, hard to tell). One should not draw too many conclusion from one month of data but perhaps it is enough of a red flag to warrant keeping an eye out for what is happening.

Sounds like higher taxes are the best thing that ever happened to you. 🙂

I’ve seen some spectacular places this summer but looking over some of the comments over the last month regarding Lisa Helps really goes to show that we do live in one the best places on earth.

In the majority of countries, a mayor in a comparable city would go in a renter and come out a multi-millionaire (bribes for permits, licences, etc). Here we make a big deal that her landlord has an AirBnB? Incredibly idiotic, it’s like everyone has a government job and nothing better to do, but just goes to show what an amazing place this is when you factor in everything (weather, infrastructure, politics, health care etc.)

where is Marko ? He posts on VV still.

I know it is hard to believe but I have interests outside of real estate…..with the tax increases in the last few years I’ve been working less and spending more time in Europe sailing, driving electric cars, and other crap. Life goes by irrelevant of whether the Victoria market goes up or down 30%.

https://www.youtube.com/watch?v=DR5CtOEFnYE

https://youtu.be/8LK54cL-7ts

Leo:

If that Tech company cant afford to pay the going wage it sounds like it simply is not that successful or wants people to work for less the going wage in their industry. It is like having a construction company and complaining that I cant get good carpenters that will work for twelve dollars an hour.

Drop me a line next time you’re back in town. But careful, Stick around long enough you’ll sell the truck and start voting green…

Talked to a tech company this week, they are expanding extremely rapidly and are desperate for talent but they can’t find people fast enough. Or rather they can’t afford to compete with Vancouver salaries so that’s putting a damper on things.

Another one said they can still find people but getting a lot of requests for flexible work hours like 7 to 3 because people are commuting from out in Sooke or Duncan

Still my favourite member to member note on that listing: “Do NOT rub cat’s tummy, he bites.”

I’d be surprised if it went for $3M though, maybe if they exclude the cat..

Long vacation in Croatia. The VV posts seem to be just some pics probably his assistant took. Back in July I believe.

Smart! Didn’t think they did that actually.

Tuesday is pretty common, but people also putting in bully offers to bypass the auction.

Raisins are good! Stop all the hate!

Good analogy though, I agree.

Unfortunately I can no longer pull the foreign buyer stats from the system. However the VREB releases quarterly reports now so sometime in July (end of) we’ll get the report for Q2 2017 and we can compare it to last year.

Yes like that. A needed upgrade of facilities every 50 years isn’t so bad. How long does the average amateur landlord keep their rental? 5 years?

The deal being offered to the residents of Christie point seems pretty good (for the people that have been there for a while).

3Richard:

The problem with the jobs is that so many of them are dependent on the never ending boom of real estate. I am not sure about the lumber industry with the new tarrifs; will they have a major impact? Tourism is great and it creates a lot of jobs but how many of those jobs are high paying. A number of people are saying that we have a flourishing tech sector here in Victoria and I hope they are right. I keep seeing all those container ships of foreign goods coming in and I sometimes wonder what we are exporting to pay for all of it.

i really do hope that the people in charge have a better handle on this than what I suspect.

A history of economic cycles going back to the 1850s suggests a recession is near

A history of economic cycles going back to the 1850s signals a bull market in the final innings

At the end of this week, the current economic expansion will complete its eighth year and become 96 months old.

The typical completed economic cycle has averaged about 58 months since 1945.

Investors need to be prepared for a very rocky period for equity markets over the coming three to five years.

http://www.cnbc.com/2017/06/27/op-ed-a-history-of-economic-cycles-suggests-a-recession-is-near.html

Richard, employers cant find workers, they stopped moving here due to high costs as per CTV. Timmys can’t find workers and changing hours. All just like 2008. The business cycle is ending and US recession in the wings.

Many catalysts about to hit the credit market. Home Capital was only sugar coated so they can raise rates which is the final sign of the cycle ending.

Bingo, you play the word Nazi like Intorovert plays the spelling Nazi. The only thin skin here is yours with your lengthy babbling.

Hawk

Ha. Seems pretty clear. You have thin skin and couldn’t deal with me commenting “shit assumption”. In all honesty it was a fair assumption (I just like digging at you because it’s guaranteed to get a response), but it was an assumption none the less and happened to be wrong.

Anyhow, I’ll go as far as apologising for the “shit assumption” comment. Not fair, not polite. I missed the “don’t poke the bear” sign ;). I should have stated: “Actually I was talking to him on Sunday” or whatever.

It’s not like I talk to realtors every day. Could you imagine?

Now price slashes in Broadmead I’d be interested in! Preferable south of Royal Oak dr and streets that have “wood” in the name.

Bonus points if it was designed by Michael Nixon.

I’ll take Broadmead stuffy over OB stuffy. Of course I can’t afford OB stuffy, so moot point. Heck, I’m not sure I can even afford Broadmead stuffy.

Folks you need something more than just house prices falling by themselves, you need a catalyst. Right now Victoria is enjoying a robust economy, low unemployment, low vacancy rate and low mortgage rates. Why on earth would house prices come down on that score? If house prices are to fall you need some major shake-up, ask us experts, Albertans!

Home Capital was a possibility, but the Oracle seems to have taken care of that…who would have thought?

The BC political impass has potential, but seems more likely just to be stalled in quagmire. Any outlandish proposal will just trigger another election. Now maybe the results of that might prove some worth.

Seems to me, the most likely will be some international incident, something that comes out of the blue and there, there is no shortage of possibilities. In the meantime oil slides so I guess just more of us Albertans will be heading your way as we start to feel the noose again. That just means a tightening on demand and borish neighbours. Ah well, whose problems would you rather have? Ours or yours? It’s a tough one, but my money is on the jobs, and there you guys are flush.

Bingo, you need a chill pill. You made a simple mistake so just own it and move on.

When is any price slash surprising ? How about in a hot market and when they are on the increase with declining sales which means the market is cooling. Even in your stuffy Broadmead.

Actually.. maybe that’s already happening in OB? I don’t follow OB at all (or Victoria proper for that matter).

JD and Barrister have been talking about the deluge of listings in OB. It’d be interesting if the mighty OB crumbled first.

We went to open house at 1528 Coldharbour Rd on Sunday. Very nice old house and has been meticulously restored and updated. If it is in fairfield or uplands, instead of fernwood-hood and surrounded by apartments buildings, it probably will go for over 3M with the house and 4 lots land.

https://www.remax.ca/bc/victoria-real-estate/na-1528-coldharbour-rd-na-wp_id174638252-lst/

Hawk

“Was talking” is past simple to the best of my knowledge (I know someone will correct me if I’m wrong). Adding just doesn’t change the tense. It’s still past tense. Debating the time range of “just talking to” is absurd. If your friend brings up your favourite band and you say, “Oh I just saw them!” Does that mean you saw them that day? No.

Another assumption. I’m no bull. I’m just not bearish enough for you. My prediction this past fall was flat this spring and drop in the upcoming fall. I’ve been amazingly wrong since spring took off to higher heights.

So far every drop you’ve posted has been unsurprising. If prices are starting to correct then at least a few of them should make you go, “Oh shit.. they had to drop the price on that?”

I’ll start worrying when houses priced close to comparables start slashing asking prices.

Spin it all you want Bingo, you said it in the present tense of that day so get over it.

“The sky isn’t falling, it was just a sky high asking price.”

But if it sells over asking then it was worth every penny as you bulls always tout. The slashes are increasing and the sales have been decreasing with mostly decent liveable homes.

Cherry picking your own perfection of what a house is to be is not reality of prices coming back to earth with some very painful thuds.

Hawk

Again, that’s an assumption. Was just talking to (the other day). I’ll make sure to be completely unambiguous for you in the future for your sake so you don’t have to assume.

Even if it was Monday isn’t the norm to hold offers until Tuesday? Maybe that tactic isn’t working anymore, so they are just reading offers as they get them, or people are putting in offers with that expire quickly. Dunno, but that could be a sign of things changing.

Yawn. Another overpriced rancher? 4239 Hayden Crt is a 3 bed rancher as well on what I’d claim is a nicer street (as far as Saanich West goes) plus it doesn’t have vinyl siding (yuck). Ask was 595K on Hayden (has accepted offer in place, but due to probate it isn’t posted as pending yet). We’ll see what that goes for, but it’s a safe bet it’s well under 680K. The ask on Ponderosa was way too high for a 3 bed rancher in that hood. The sky isn’t falling, it was just a sky high asking price.

I do appreciate you bringing pricing slashes to our attention. At some point I’ll be wowed, “How did they not get bids on that place?!” So far none have been a surprise. Keep ’em coming.

I assume royal bay is pushing hard with advertising as they need to sell a certain amount before they can start the next phase and the next phase etc.

I went to a viewing there last year and was impressed with everything but the price… SFH’s no suites start around 550k and push up well into the 600’s. I emailed to complain that with such a distance to Victoria they should be in the 450k range and was offered a 20k discount. I just got another email from them that their new townhouses start at 500k… I could see the whole development tanking at this rate. At least the high school was completed first.

In fact, the premium may increase because of it. #WestShoreFailOnce again another victoria resident that can’t even look at a map. I know you won’t but maybe look up parks in the westshore. Unsurprisingly to anyone with a brain there are lots of them! Oh wow! I’m always astonished by how dumb gordon head dwellers are.

I was surprised to see that the house, down by the Chinese cemetery at 48 Maquinna St. actually sold for 1,900,000. Small lot, mediocre construction and basically a 1990 type of cube architecture (to be clear it was a new build but looked dated from day one). I would have thought that the house at 1575 Rockland would have been a much better choice at almost double the floor space and triple the lot with actual clear ocean views. Goes to show different strokes for different folks as grandma used to say.

If Royal Bay is so great, why do they need to advertise?

In fact, the premium may increase because of it. #WestShoreFail

4252 Ponderosa Cres slashed $40K to $640K in the Glanford/Wilkie area. Falling like Home Capital stock price again.

How about those Golden Head places in nice shape and getting whacked ? Same in the Uplands ones. Cherry picking the bad ones as the norm is a shit assumption.

Bingo,

You said in the afternoon of Monday that you were “just talking” as if you just heard that day, you didn’t specify it was the weekend. Far from a “shit assumption”.

“Was just talking to a realtor that said he was taking a client to see some places, but of the 8 they wanted to view only 3 weren’t pending.”

“It’s not that there are just shitty homes that are on the market, it’s that in general the houses in Victoria are like this.”

A common complaint on here for a very long time, even Marko would harp about it endlessly. BTW where is Marko ? He posts on VV still. Did the VREB smack him around for trashing the 99% of stupid people he meets every year ? 😉

Leo S:

Tongue in cheek. Basically his opinion of what the current market is vs mine. Though JD is usually good for pulling out some numbers to support his position, sometimes quite good, sometimes cherry picked.

Any way you shake it a measure for shit properties would be subjective.

And JD was arguing it’s the same proportion as usual.

The way I see it the market is a bowl of trail mix. Right now we have a tiny bowl that’s mainly raisins and peanuts. If you see a few smarties someone else is going to reach in and grab them before you have a chance.

In a more balanced market the bowl is a lot bigger. Maybe JD is right and the % of smarties is the same, but there are more smarties in the bigger bowl and less people with hands in the bowl.

If you are in the market for overpriced raisins, come get your fill.

Hawk

Shit assumption. It was a Sunday they were viewing. Units to view were selected on Saturday.

Ha. That 2 bed was OK but waaaaaaay overprice. They needed to take at least 100K off.

The place in Dean Park was a nice lot, but the house needed everything. Roof, siding painted, wallpaper removed, kitchen, bathrooms etc etc etc. It was all original. It seems the type of buyer to buy in Dean park wants something a little more move-in ready.

Big DDOS attack on the hosting provider. Sorry about the site outage.

It’s not that there are just shitty homes that are on the market, it’s that in general the houses in Victoria are like this.

That is true Leo but 5 year fixed mortgage rates where running at about 6.75 back in 2008.But that does not account for the whole difference but it may be part of the puzzle. Like with many things in life there are usually multiply factors which also means that sorting them out is difficult.

Are you getting any impression that the number of Vancouver buyers is a little bit less this year?

Like professionally managed Christie Point, where the tenants will be homeless during construction and then offered the chance to re-rent at significantly higher prices?

The developers are selling Royal Bay really hard—have you seen the ad on the back of every bus in the city?

Has anyone visited the playground near the water at Royal Bay? It’s so sad compared to a place like Cadboro-Gyro Park! The premium to live in Saanich will never get wittled away by playgrounds and planning like that.

We will be shoving our parents into a nursing home paid for by their own pensions! Because we’re heartless.

2509 Cavendish sold on June 26 for 6% below assessment. It would be interesting to see the trend in sale price to assessment for the market as a whole.

Another Golden Head relist and slashed $100K at 4228 Oakview Pl. Looks like the price of land is taking some major hits. 😉

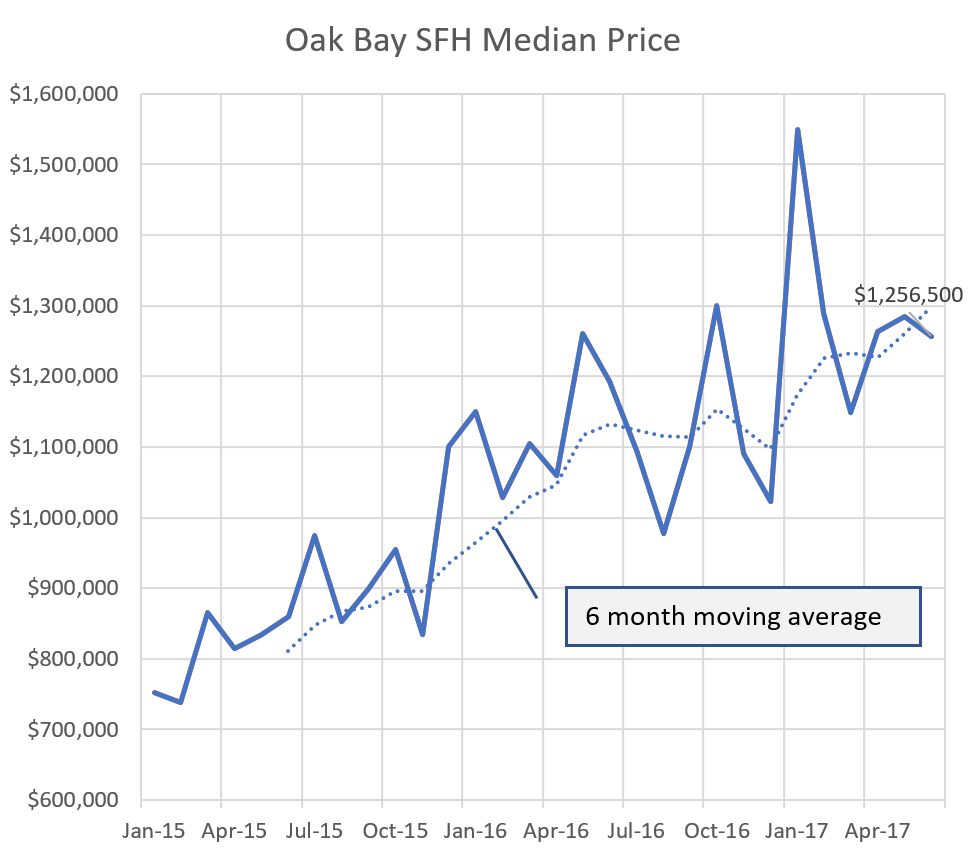

The level of January 2015 on that chart is what it hovered around since 2008. So the almost $500,000 increase in 2.5 years is astonishing, but spread over the 9 years it’s about $30,000/year.

Still, a rate of increase that exceeds the annual savings of most families in Victoria.

Thank you Leo; I really appreciate the amount of work that you put into this. You only have to glance at this chart to understand why so many people quite rightly feel that they have been priced out of this market over a very short period of time.

Here are just the SFH.

Leo:

Is your Oak Bay chart for just SFH or does it include condos?I wonder if there is a slow down in out of town buyers particularly from Vancouver?

But the chart certainly illustrates the massive price increases in just three years.

As to the definition of “the dregs”, I believe that I spoke about this a while back. For me that meant houses that were simply really overpriced comparable to any recent sales in their neighbourhood. It does not necessarily mean that there is anything wrong with the house itself other than a unrealistic pricing.

The amount of inventory on the market seems to really vary by neighbourhood as you have pointed out. By my fast count there are now 17 homes for sale in the Uplands where there were only four at the beginning of the year. Near as I can tell there are only one or two sales in the Uplands a month this year. It appears to me that there is about a years worth of inventory sitting there. Will prices come down? Hard to tell but it would not surprise me since a lot of the houses have been on the market for months now.

In the rest of Oak Bay I noticed nine new SFH listings come on in the last five days. I am only watching between a million and two million so there might have been more. I was wondering if the prospect of new speculator taxes by the province is convincing some people it is time to dump that investment house? Prices seem to have plateaued and if I owned an investment property I would certainly be thinking that just maybe it might be a good idea to get out while the getting is still good.I dont think there is any scientific way of measuring this type of “fear” factor so what are you hearing on the street?

CF Garth’s recent post titled “Mr. Math” and it’s graphs. They are quite striking and I think could easily be replicated here on our tiny turf over the next few years.

We’re gonna need some big sales to pull that median up in June in 4 days… I still don’t believe in flat prices with conditions as tight as they are, but I have to admit we’re gonna need to see another tick up pretty soon.

What would a metric even be? Number of properties that don’t sell? Number of properties that need a lot of work? I think the number is about the same now, but with so few listings the proportion of crap is higher than it would normally be.

Lurking,

The clock is ticking and it won’t be pretty.

Next financial crisis will hit with a ‘vengeance’ and Canada is especially vulnerable

The world’s top monetary watchdog says the next financial crisis will hit with a ‘vengeance’ and Canada is especially vulnerable

The global economy is caught in a permanent trap of boom-bust financial cycles, a deformed structure becoming ever more corrosive and dangerous as debt ratios rise to nosebleed levels, the world’s top monetary watchdog has warned.

The Bank for International Settlements said the rot in the global monetary system has not been cut out since the Lehman crisis in 2008. The current, now ageing cycle could finish in much the same explosive way, contrary to the widespread belief that the financial crisis of 2008 was a once-in-a-century event caused by speculators.

“The end may come to resemble more closely a financial boom gone wrong, just as the latest recession showed, with a vengeance,” said Claudio Borio, the BIS’s chief economist.

http://business.financialpost.com/news/economy/next-financial-crisis-will-hit-with-a-vengeance-and-canada-is-especially-vulnerable/wcm/a77a1946-91be-4984-80a3-991d531a7351

New builds in Happy Valley, container box styles must be slowing down. Several with minor slashes just to get attention. Another one in Bearkilla’s hood at 820 Brentwood Heights taking a $50K beating ,now $899K.

The fork is in this sucker

Funny, my neice and nephew are actively looking for a home and they both said there are lots of garbage homes out there and few descent homes. In their opinion, there are an inventory of homes to choose from, but they are garbage. And the descent homes are sitting on the market longer because they are overpriced by their observations. I guess you have to be a buyer at this time to appreciate a remark like that. They, unfortunately, have come across homes with mold issues, questionable plumbing, teeny tiny rooms, non-functional kitchens, and rooves that need to be replaced — all costly items that add to the price of a home.

“Yeah. Some. But not a good selection. Was just talking to a realtor that said he was taking a client to see some places, but of the 8 they wanted to view only 3 weren’t pending.”

Typical of looking on a Monday after most sales happen on a weekend. Like grocery shopping Monday morning. Shelves need restocked.

Majority of price slashes I posted have been nice places. Those selling fast were just priced lower for their area etc .

@ JD

“Oak Bay has moved rapidly from a sellers market to a balance market and at this pace will move through that balance market into a “soft” or bearish market.”

Consistent with that prediction, the last two sales in the Uplands were at 115% (Norfolk Rd) and 109% (Beach Dr. at Dorset) of the July 2016 assessment, and the latest listing (Nottingham Rd.) is within 1% of last year’s assessment.

JD

Have any metrics to back that up? Seems like the opportunists come out in droves during a seller’s market (ditch the poorly maintained rental property for some nice capital gains).

Good properties last days on the market, while crappy sit for weeks or months. So on any day on MLS you have the garbage that has been sitting and a few nice places that will be pending by tomorrow if they aren’t already.

In a buyer’s/slow market the good places will sit for a longer time.

So maybe it’s a complaint about exposure. Some interesting places show up on my pending list before I ever notice them for sale.

Yeah. Some. But not a good selection. Was just talking to a realtor that said he was taking a client to see some places, but of the 8 they wanted to view only 3 weren’t pending.

Nominally, good places are definitely down. That’s just a function of limited supply.

There is just as much garbage for sale as in any other good or bad market. I always question what the writer of this statement is saying. Because there are some very nice properties for sale. I suppose what the writer means is that these nice homes are not in his price range. But that would be a personal statement and not one about the general market.

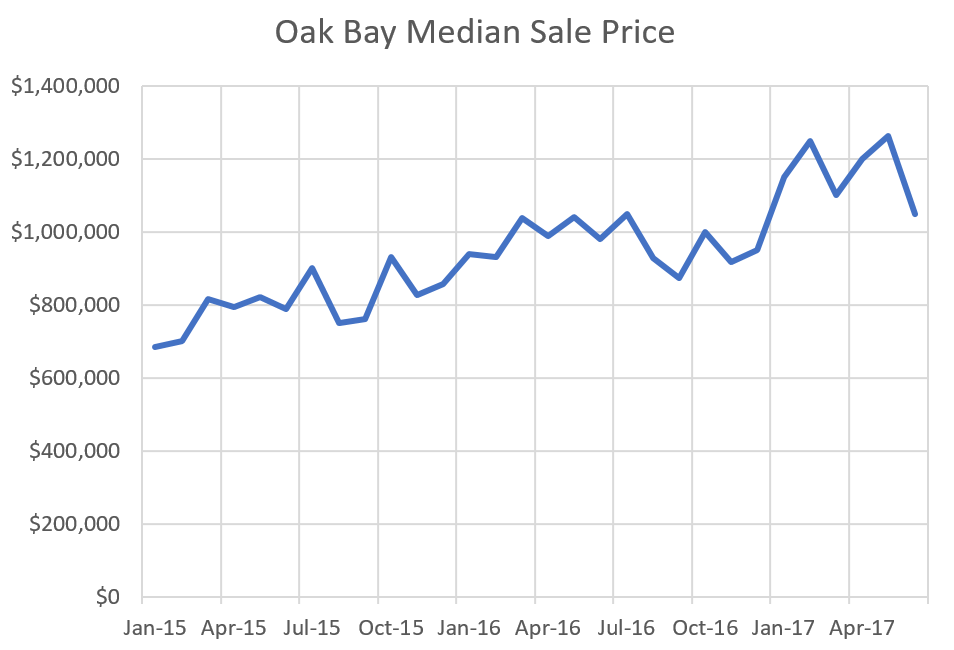

As for listings. Not every neighborhood is the same. Oaky Bay has had 75 active listings so far this month. The last time Oak Bay was this high was October 2015. And new listings are outpacing sales in Oak Bay at the rate of 50:18. That’s 2.8 new listings for every house that sold. Oak Bay has moved rapidly from a sellers market to a balance market and at this pace will move through that balance market into a “soft” or bearish market.

The result has been a flat market since February but now as inventory is rising we just may see some lower median and average prices this summer.

Your mileage may vary.

Neither my wife or I have parents anymore so we don’t have the pressure of considering an in law suite. We are only future proofing our garage with plumbing rough in though since we do have the sister in law with the large brood. This way a suite could be built in the future if needed/desired. Garage might become my office first. Otherwise the house is designed with smaller bedrooms surrounding a large open space. Big enough for large sleep overs and a ping pong table.

Speaking of the in laws… They bought an acreage with a 70s house in Bulgaria for $10,000 EU. Not missing any zeros…. It does have the climate of AB and there are no jobs but hey, you don’t need one to pay of your mortgage anymore!

I would agree that a suite over garage should not be calculated at a straight up cost per sq. It’s more the added bathroom and kitchen cost. Then add some extra framing (probably not a cost difference) extra siding and windows. Plumbing and electrical is also probably a wash since they will just charge x amount. They ain’t micro billing. So depends on your finishing level.

Also this time last year we were still drawing down inventory so some of those sales came from that. Now we’re building inventory (slowly) so although there is a lower sales/list ratio, the competition for realistically priced properties could still be just as strong as last year.

It’s interesting that Sales to List is down significantly from last year, but there isn’t any inventory growth. Yes over 60% S/L is still hot, but I think it speaks highly of the quality of stuff that’s being listed. Dredge market as Leo calls it.

There is some absolute garbage out there and some insane asks like the 2 bed rancher in BB Hawk posted (priced as high as 5 bed houses with suites in that hood). A hot market brings out the opportunists I guess. People with no real intention to sell, but would take the money if they could get it. Is that sellers predicting the peak or is it just more noticeable with such low inventory levels?

1607 San Juan Ave still hasn’t dropped their price. Wonder if they’ll drop the price or just take it off market.

I suspect Langford/Colwood are still hot as they hold homes more affordable for the incomes of the people living and working on the south island. I still firmly believe that this last year of craziness has pushed a lot of the cities FTHB into buying “FAST!” as FOMO has landed hard in this city.

When the reality of a high risk /reward ratio of buying multiple homes as investments, especially at peak prices hits, I think we may see listings flood the market with many of the FTHB already tapped out.

Another note: I drove through Royal Bay this weekend as the developers put on a family focused event to pump the development. I was surprised at the price of these new homes placed in the middle of a little desert between Colwood and Metchosin with two small roads in and out.

https://t.co/2bxN8IrkLb

https://t.co/7M2c9lHKSD

Some interesting reads from Financial Times

Agreed, Leo. This is also why I didn’t want to get into the weeds of every dollar on the suite vs. not on the suite. In our case, as in most new builds, eliminating the suite would suggest a significant change in design, necessitating either a complete redesign, or probably very little savings; I’m told that the most expensive part of most SFH builds are foundation and roof, and getting rid of the suite alone would not change the footprint of either, as our suite is over the garage.

For what it’s worth, I ran the numbers on an online quote for home insurance – rented suite vs. not – it was a $12 a month difference; ie, not worth worrying about.

Although in the present market its an academic point, that argument surely cuts both ways, meaning that a suite “exclusively put in for revenue” could generate a recognizable capital loss.

Probably the correct approach. Make it as close to integrated as possible and very small. Many suites in Victoria are half the house, and almost fully separate. That would be a tough argument to make those aren’t exclusively put in for revenue.

Except you have to calculate your marginal cost, which is way way lower. A 2000sqft house will cost almost as much as a 2500sqft house with a 500sqft suite. That’s why it makes sense to maximize house size on new builds.

I am still of the opinion that amateur landlords are a poor replacement for proper, professionally managed rental housing. Stories abound of people forced out because the landlord decided to cash in or got bored of running the rental, or whatever. As long as the government continues to invest in rental housing (and increases the rate), then I don’t think it’s terrible that a business in your house is treated like one.

It’s murky as usual but the CRA says “Because your home is considered personal-use property, if you have a loss at the time you sell or are considered to have sold your home, you are not allowed to claim the loss.”

By the definition of “personal use property” it seems even something like a cottage qualifies. http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/rprtng-ncm/lns101-170/127/glssry-eng.html#Personaluseproperty

So there is precedent for properties where you cannot claim a loss but gains are taxed. https://www.theglobeandmail.com/globe-investor/personal-finance/taxes/six-tax-mistakes-cottage-owners-must-avoid/article24677448/