Fiduciary..

This was a topic in the comments a little while ago so here’s a quick look at the different types of relationship you can have with a REALTOR® (this only applies to members of the CREA hence the registered term). Anyone who’s ever bought or sold something with an agent in the last few years likely had this explained to them to various levels of completeness, but I recall when we bought our house the differences between going with a buyer’s agent and dealing directly with the seller’s agent weren’t clear to me (too many forms to read).

Essentially whenever you work with a realtor you can either be their client or their customer and each of those governs what responsibilities the realtor has towards you.

As the client, the realtor is called your designated agent and has a fiduciary duty towards you. That means that he/she must act in your best interest at all times, protect your confidential information, obey your lawful instructions, act with reasonable competence, and disclose everything (including any compensation they may receive) that could be material to the deal.

If you are a customer, the realtor does not have a fiduciary duty towards you. In this case they can give general market information, help with standard forms and processes, and present offers and counter offers. They specifically can’t advise on price or negotiate on your behalf, or disclose any confidential information about the sellers. Basically they’re working for the other side so buyer beware.

Once the relationship is set (generally by you initialing the Working with a Realtor form), it can’t be downgraded. So you can later go from being a customer to a client, but if you are working with a realtor as a client, the relationship endures forever. So that Realtor you sold your house with 10 years ago? He still has a fiduciary relationship towards you and will forever even if you have no more business dealings.

In the vast majority of cases if you are buying with a buyer’s agent or selling with a agent you will be their client. If you are selling with a mere posting, read your listing contract as most agents will lay out some limitations to their duties.

If you are not working with a buyer’s agent (like we did when we bought our house) and go directly through the listing realtor, then you will be their customer (this is called double ending). This is fine, as long as you understand who they’re working for, the limitations of advice that they can give you and do your own due diligence.

Of course any ethical code is only as good as its adherents, and the fundamental misaligned incentives in the real estate business means that there are always bad apples that don’t adhere to the fiduciary duties laid out here and exploit the information asymmetry to their advantage. After all, self regulation was not taken away from the industry because everything was peachy. Under the new regime, maximum fines for breaches of fiduciary duty have been increased tenfold so hopefully we’ll see less of it going forward.

And it’s Monday, so a quick update of the numbers (only half a week so they are a bit distorted due to the start of month relisting surge).

| June 2017 |

June

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 96 |

1174

|

|||

| New Listings | 189 |

1319

|

|||

| Active Listings | 1939 |

2289

|

|||

| Sales to New Listings | 51% |

89%

|

|||

| Sales Projection | — | ||||

| Months of Inventory |

1.9 |

||||

New post: https://househuntvictoria.ca/2017/06/08/land-of-the-nearly-wed-and-nearly-divested/

Interesting my neighbor has been looking for a new job in Victoria. Four places that he applied 3 of the have emailed him back saying they are holding off on hiring or temporarily decided to put the position on hold. Hmmm

Is this due to the change in government? Financial? Or reading too much into this?

The sky is falling…. the sky is falling.

It’s all over.

People in Toronto are going to wish they paid a bit more attention to the fundamentals I suspect…

I think that Hawk is under the impression that people read his posts.

Bless.

The sky is falling…. the sky is falling.

Its all over.

I was perusing over Victoria condo listings and noticed there are many condos that have been sitting for days and even weeks. I also noticed that some were selling off one-fourth of the share and another one was selling off one-sixteenth of the share of the condo. I didn’t even think that was permissible.

Pretty crazy stuff on Garth how deals are collapsing en mass in Toronto.

“This scenario is playing out right across the region. Law offices are seeing deals break down by the hundreds in certain areas, somewhat reflected in the deluge of listings which continues. In the last seven days, another 10,000 properties hit the market in the Greater Golden Horsehoe region.”

CS,

Did you not read the article James posted? It says subprime, not BOC. Demand is high from shitty borrowers and the others are running out of money to lend due to Home Capital. I think that’s called the beginning of a credit crisis.

@ Hawk

“Laird says rates on subprime mortgages have inched up between 50 and 150 basis points in the last six weeks — a jump of as much as 1.5 percentage points in some cases, or the difference between a mortgage at three per cent and one at 4.5. Or a bump from five to 6.5 per cent.”

Bank of Canada shows no such increase. Only a continual decrease over the last five years:

http://www.bankofcanada.ca/rates/interest-rates/canadian-interest-rates/

Likewise, Ratehub:

https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

“Laird says rates on subprime mortgages have inched up between 50 and 150 basis points in the last six weeks — a jump of as much as 1.5 percentage points in some cases, or the difference between a mortgage at three per cent and one at 4.5. Or a bump from five to 6.5 per cent.”

That’s shocking James. 1.5% increase is huge and will cut out piles of first timers and strugglers. Looks like trouble in credit lending land to jack it up that high.

Gwhacked is having a hard time accepting Corrupt Christy’s loss. Haven’t been here 8 years bud but won’t be long til prices head back that direction by the looks of the daily slashings stacking up. Condos taking some beatings too.

I wonder how many layoffs of management at The Bay are coming ?

“Those numbers don’t pass the sniff test.”

But 3000 bank employees say they gave out HELOC’s and mortgages like candy to tens of thousands of people who shouldn’t have received it. Home Capital is based on the same thing. Denial ain’t a river in Egypt.

No, they don’t. 58% of Canadians pay their credit card balance in full each month. While 40 per cent carrying balances (down from 48 per cent in 2014) they pay much more than the minimum requirement; 16 per cent of Canadians who don’t pay off their balances every month pay it off most months (up from 15 per cent in 2014).

Also, 11% of adults do not have credit cards so reduce your 28 million to 25.

http://www.cba.ca/credit-cards

Leo S

How is that even possible? Out of the aprox 36 million Canadians about 28 million are adults (20 years old and older is all I could grab from statscan, but close enough). So > 70% of Canadians are carrying a credit card balance?! No way.

They failed to define ” carrying a credit card balance”, but I take that as past due and generating interest (an outstanding balance). Maybe that’s not what they mean or maybe it isn’t 20 million people but 20 million cards. I could believe that as I’m sure many people carrying credit card debt carry it across multiple cards.

Those numbers don’t pass the sniff test.

They clued in after 8 years….sure thing.

“What do you think Hawk? Are they all sharing their plans over martinis at the yacht club or the golf club?”

I think they all just started reading this blog and finally clued into the Hawk’s posts/charts. 😉

“Christ, that’s an average of 70 grand per heloc.”

Heloc, or helot?

Or as Winston Churchill put it:

Never before have so many owed so much to so few.

Running from the NDP Government LeoM. Too late. I think we see 3000 listings by the fall.

I’ve had the same PCS account for a few years and I’ve never seen such a high ratio of the city’s most expensive properties suddenly listed for sale as I’ve seen in the past few weeks. Do high end property owners all drink at the same club? Seems en masse they are trying to dump their properties for top dollar as fast as possible.

What do you think Hawk? Are they all sharing their plans over martinis at the yacht club or the golf club?

Lots of prime digs in the core being slashed. Some big, some just small to get attention. Seems these kinds of places were going over asking in a day a short time ago. Funny how fast things can change. This is just a handful, many others.

2497 Sinclair Road slashed $55K

1230 Victoria Ave slashed 430K

1277 Union Rd slashed $41,888

1690 Howroyd Ave slashed $30K

3553 Redwood Ave slashed $100K

when I said “fewer DOM” I meant “more DOM” – I need lunch 🙂

I was having a look at the Myrealtycheck.com website, and was struck by what I saw.

The narrative of a rebound, a hot rising market – seems to be almost directly contradicted by nearly any municipality that this site covers. Victoria looks to be no different, and this is during one of the busiest times of the year. Surrey is the one that seems closest to a mixed-bag of rises vs reductions.

I don’t know how meaningful it is, as I don’t think this data can capture trends. But it does give me pause.

Leo

A combination of both. A large % of homeowners have no mortgage, others up to their eye balls in debt and the rest somewhere in between.

“that’s an average of 70 grand per heloc.”

Funny that’s the number, because that’s how much a friend of ours got a HELOC for, for an SUV he didn’t really need.

I’ve also noticed a slower pace for the type of homes I’ve been watching (homes that are liveable, in good locations, possibly in need of a few renos) – fewer DOM (15 instead of 1) & even some under-asking, even though asking prices are comparable to what others have sold for recently. I haven’t seen conditions like that in at least a year.

Probably a lot of factors at play? eg., the subprime mortgage rate increases, the uncertainty with who’s running the BC gov’t, changes to Toronto, slowdowns in foreign investment everywhere. Maybe people are taking a step back to consider their options.

3Richard Haysom

“I’m sure a huge amount of Helocs are being used in this way and not for consumerism as these articles seem to suggest.”

Richard, similar to the U.S.A. during their unending rise in house prices, everyone seems to be driving high end vehicles and own a plethora of electronic toys and the latest phones. It is incredible the amount of bmw, mercedes and infinitis that are parked on a 3 block stretch …. anywhere in B.C.

Perhaps, if all of the Realtors in Canada purchased several properties and used helocs instead of mortgages we could isolate the consequences of the eventual crash in property values to one subset of the population.

I can never reconcile a 70% home ownership rate, rising house prices and net worth, with data like 20 million canadians carrying a credit card balance. http://www.cbc.ca/news/business/transunion-first-quarter-2017-1.4151237

Hard to tell what the real state of canadian consumers is. Wealthy or tapped out debt bingers?

James that was me. Stock is up they sold off some assests and now are trying to figure their next move to survive without going on the auction block. They have actually done a surprisingly good job to calm things down. Model is broken so not sure what happens long term.

James Soper said: “You realize that London isn’t Coastal right?”

I said, and you quoted me: “all desirable cities, especially coastal cities”

I didn’t say London was a coastal city!! You can cut and paste, but you can’t read very well.

All this attention on Heloc debt can be a little bit misleading. I replaced two mortgages with Helocs on revenue properties. In both cases the Helocs represent about 1/3 of the property value. The reason I converted to a Heloc is that I didn’t want to pay down any more of the principal so I didn’t have a diminishing write-off against the income which would increase taxes paid against the income. Additionally it gives better cash flow as the payments are lower. I’m sure many people are using this tax planning strategy causing rise in the popularity of Helocs. I’m sure a huge amount of Helocs are being used in this way and not for consumerism as these articles seem to suggest.

Speaking of which, Home Capital’s 2 billion line of credit should be nearly used up about now. Who was it that was saying back in April that it would get bought shortly?

http://www.cbc.ca/news/business/alternative-subprime-mortgages-1.4150023

that’s not good…

All those HELOC’s couldn’t have come via the 3000 employees and ex-employees ? Not 300, 3000. Now you know why so many get mortgages who shouldn’t have.

Ex-Employees Share Allegations Of Shady Practices At Canada’s Banks

OTTAWA — Parliamentarians listened Wednesday to allegations that workers at Canada’s big banks face pressure to hit unreachable sales goals, coax clients into raising their credit-card limits and offer mortgages beyond what customers can reasonably afford.

http://m.huffpost.com/ca/entry/16999126?

“Christ, that’s an average of 70 grand per heloc.”

The financial pros here will tell you it’s all under control. Except that money has monthly interest to be paid on top of all the other bills. HELOC’s will be one if the main catalysts of the bubble popping.

Thanks Charlie, been busy watching Trump the treasonor get exposed via Comey. I’m sure the price whackings will ramp up bigtime.

You realize that London isn’t Coastal right?

US fed is talking about starting to rein that back in by the end of the year.

Christ, that’s an average of 70 grand per heloc.

Threat from housing, high debts still growing, Poloz says

In its semi-annual Financial System Review, a key report outlining risks to the country’s financial stability, the central bank said that the booming housing markets in Toronto and Vancouver have added to already high debt burdens for Canadian consumers, as surging home prices, especially in Toronto and surrounding regions, have dramatically increased the size of new mortgages. It noted that Canada’s national ratio of household debt to disposable income, a key metric for consumers’ debt burdens, is approaching 170 per cent, a record high.

The bank argued that while strong fundamentals are partially responsible for the high prices in Toronto and Vancouver, it is concerned that those markets continue to see price increases that exceed fundamental drivers – evidence of speculation and unsustainably high expectations.

“Where house prices have grown at a faster pace than can be readily explained by fundamentals – such as in the Toronto and Vancouver areas – there is an increased likelihood of a price correction that could lead to financial stress,” the bank said.

Despite the concern about the dangers of a housing correction in those two overheated markets, the bank said that a sharp regional price decline likely wouldn’t have significant spillover effects on the broader national economy.

The bigger concern, it said, is the fallout from high debt levels and housing excesses in the event of a broader economic shock – “an externally generated severe recession, where a nationwide correction in house prices is only one of the channels through which the economy and the financial system are affected.” It said that in this case, rising unemployment and falling household income would put serious strain on households paying their debts, “potentially generating broad financial system and economic stress.”

https://www.theglobeandmail.com/report-on-business/rising-debt-sizzling-housing-markets-leave-canada-more-vulnerable-central-bank/article35247850/

Hey Hawk,

A smattering of Victoria listing price reductions hit the board for June 7 on myrealtycheck.ca

I live in the Layritz area and the traffic really isn’t too bad. The backed up traffic on Wilkinson is only bad if you’re trying to get to westshore weekday afternoons and even McKenzie is backed up at the same time. I figure if you’re trying to get to Westshore during rush hour it doesn’t really matter where you live as you eventually hit a bottleneck somewhere. Four years here and only a handful of times I’ve been stuck in traffic more than a few minutes. I do ride downtown for work and the Centenial trail connects up to the Goose via Interurban. I do wish we had better sidewalks around here though. Saanich really seems to hate sidewalks.

Nice thing about this area is how central it is to get places and it was cheaper for us getting into our first home. Every area has its pros and cons. I’m not a fan of Oak Bay for example. I like the sleepy nature but other than a few kayak launching spots, everywhere I go would require lots of driving through the city.

Hey Intro, I am still enjoying your guarantee that there would be no President Trump.

As for Abbotsford versus Vancouver, it’s not quite the same thing as comparing Oak Bay, with its shrinking population, and Langford, the fastest growing municipality in BC, as surely even you must agree.

@Leo, perhaps it’s just now that the effect of it is realized fully. Usually printing money causes hyper inflation. Maybe in this digital form under these conditions it just took a while….

For me it never had a small city vibe. I moved from the outskirts of a town of 20,000 people in the early 2000s so Victoria was already big.

Ask my parents or my wife’s parents and they’ll say that Victoria lost its charm 10 years ago.

It works for us because it’s big enough to have a diverse economy such that we’re not concerned about employment while being not too large that it gets stupid like Vancouver. But small town it is not

A simple sincere question. Is Victoria losing the charm and small city vibe that made it so special?

We do have something special, don’t we? And it should be “I.”

And maybe Abbotsford land will be worth more than land in Vancouver in the not-too-distant future. CS, do you enjoy living in fantasy land?

http://www.msn.com/en-ca/money/topstories/line-of-credit-use-soars-increasing-homeowners%E2%80%99-risk-report/ar-BBCfEmS

“Canadians owed $211 billion on 3 million home equity lines of credit (HELOCs) last year, but 40 per cent don’t make regular payments on those loans and 25 per cent make only minimum payments or pay the interest on the credit lines, says a report by the Financial Consumer Agency of Canada.”

I haven’t been posting all that regularly, lately. I’ve been out of town quite of bit and we are headed for Florida on Monday, however this headline caught my attention because I know that we had quite the interesting debate on household debt and responsible homeowners. Apparently, … not.

Not really a new factor in 2015 though.

Also don’t forget global QE resulting in money looking for return and looser lending of said free money by the banks.

Forgot one:

@ Bingo

“Not as long as there’s a stigma attached to living in Langford. People that were born here wrinkle their noses when you mention “Langhole”. It’s going to take a few generations for that to die off.”

Nah. Oak Bay’s dying. The population’s falling. Shabby but quite habitable family homes are being torn down to make way for pretentious six-thousand square foot mansions occupied as often as not by no one. Other core municipalities are stagnant. But Langhole has an astounding rate of economic growth. That means more doctors, dentists, plumbers, electricians, lawyers, and small business owners not just working on the West Shore, but living there, buying up the best property, driving up prices.

Soon we’ll see a four-lane highway all the way out to Sooke, not for people commuting to Victoria, but commuting to Langhole. Economics will win out over snobbery . And soon, for the sun shines and the gentle rain falls on both the just and the unjust, on the gentle folk of Oak Bay and and the Yahoos of Langhole.

wolf

Good poinor maybe they are from out of town and only saw the place during an open house on the weekend.

We checked out a place on Glyn back in 2009 iirc. House wouldn’t have worked for us period. Glad it didn’t work out. I’d be pretty irked by the traffic.

investors seem to be headed to Montreal now. Kinda funny how they seem to travel from city to city like the circus.

http://www.citynews.ca/video/2017/06/07/real-estate-reality-check-in-toronto-and-vancouver/

On another note, homes are definitely sitting longer in the greater Toronto area. There are more offers with conditions, and there’s not too many sold over asking signs. Looks like we’re returning to normal, more realistic conditions.

I’d like to see some numbers on that. One day we hear that there is more speculation in the market, the next day we hear people are unloading their rental properties at a record pace to cash in.

I think a good measure would be a “flipper index” which measures what percentage of homes are resold within 12-18 months of purchase.

” A good location is nestled in the countryside with rolling hills and apple orchards.”

And for all those so inclined, the RE bubble is not much of an issue as there are still plenty of rural lots for under $50K.

In fact, though, for many access to a particular school, a big hospital, an IT job, theatres, cinemas and concert halls, a university, or the best shops on the island, location is important and worth paying a million or more for. Hence the high price of homes in Victoria and Vancouver.

But folks daunted by the price should consider, do they really need what they are paying for in Point Grey or Oak Bay, or wherever. Why are they seeking to buy in those places, not Port Alberni, Courtenay or Ladysmith. Is it an investment, something to brag about, or what?

You forgot rising interest in speculation as prices accelerated

Few reasons I would bet on roughly in order of impact:

Basically all the reasons I outlined in why it was a pretty good time to buy in early 2016 contributed. https://househuntvictoria.ca/2016/02/22/why-it-might-not-be-the-worst-time-to-buy/

Wolf,

Domestic speculators are, IMHO, by far a more pervasive element driving this than the foreign ones.

@Bingo. Perhaps the Layritz buyer(s) don’t commute by automobile? Decent location to commute by bicycle depending on where you work.

Domestic speculators are a problem too LF. These self-centred folks only care about creating ROI and will blindly do so at the expense of the next generation(s). Hopefully regulations will be brought forward to inhibit this behavior.

https://betterdwelling.com/city/toronto/foreign-buyers-domestic-greed-121000-toronto-homeowners-multiple-homes-city/

China’s Massive International Real Estate Buying Spree Is Officially Dead

…China’s capital controls have led to substantially less money leaving the country, and the markets Mainland Chinese buyers flooded have no idea how much their homes are worth anymore.

China’s foreign exchange reserves rose for another straight month…This means a lot of things, but most important it means money isn’t leaving the country in the significant quantities it was last year.

Real estate markets that saw locals scramble to cash in on foreign buyers are now noticeably cooler. Toronto is seeing new listings hit an all-time high, coupled with a massive dip in sales…The one place that’s bucking the trend is Vancouver, where locals are still convinced that Mainland buyers are somehow buying – but not showing up in any significant statistics.

Mainland Chinese buyers were buying a lot of international real estate, but over excited locals bought into the narrative way too much. Countries that are nice, but not global leaders got way too excited that they were the next “New York.” Canadians after all, have been heavy real estate speculators without Chinese influence. Is a 30% rise in a single year a justifiable increase in property prices? We’ll find out.

https://betterdwelling.com/chinas-massive-international-real-estate-buying-spree-is-officially-dead/

To each their own. OB may be walkable, which I do value, but it’s too far away from other stuff for me. Same with JB.

To me, most of GH is better than south OB or JB due to proximity to other things (ferries/airport, highway up island etc). That’s why I like Broadmead. Enough amenities and a short drive pretty much anywhere.

CS

HA. Not as long as there’s a stigma attached to living in Langford. People that were born here wrinkle their noses when you mention “Langhole”. It’s going to take a few generations for that to die off.

It’s funny, the “Walkscore” grading is an important factor for so many people, with a higher score being “better” in terms of being able to walk easily to amenities and so forth. It usually commands a higher price.

For me, the closer to zero the walkscore is, the more likely I am to prefer it. Don’t know why. I guess I like the idea of being home and far away from the world – but to still have that world easily accessible. To each his own I guess.

Not for me. A good location is nestled in the countryside with rolling hills and apple orchards.

https://youtu.be/NwzaxUF0k18

or

https://youtu.be/umS3XM3xAPk

What makes a good location?

Access to jobs, hospitals, schools, universities, beaches and parks and recreational facilities, shops.

So which municipalities have the best location?

Oak Bay and Gordon Head, perhaps. But tomorrow?

Take a look at the West shore, good access to a hospital, a university, beaches, better access than the core to West coast recreational areas, big box stores, jobs in retail, services, as well as the hospital and university.

Maybe Langford land will be worth more than land in Gordon Head in the not too distant future.

@Hawk

Maybe we’ve reached peak GH. My pending shows a lot of GH boxes selling under ask (70s box style ones at least).

Of course over in Saanich West we have: 1284 Layritz pending at 765K (65K and change above ask).

That’s a lot for a 3 bed rancher (albeit a good sized one) in that area. I wonder if the buyer knows about the traffic on Wilkinson. It now gets backed up all the way to Carey. Probably not a big deal as long as you are heading away from the jail (take Vanalman to the highway to get downtown?). Still gonna be a PITA to turn off Glyn though.

I guess if you are downsizing from a bigger house you are still keeping some capital buying a rancher at that price.. but yikes. With no suite that’s definitely out of reach for the first time home buyer.

1194 Sunnygrove Terrace slashed $69K. That’s a fair chunk for an under a million house.

James Bay getting it too. #4- 508 Pendray St , slashed $63K.

10 Alma Pl slashed $50K.

More price slashes in one day than I’ve seen in a long time.

Another Golden Head special at 4367 Torquay Drive slashed $30K. Looks like another student rental flipper potential is not in demand. Price of land must be going down. 😉

Cordova Bay has a couple too. 5054 Catalina Terrace on #2 price slash of $85K.

Plumeine ssid: “Why did the price double in the past 3 years? Even I followed this blog closely, I still cannot pinpoint what exactly happened in Victoria. ”

It’s not just Victoria, it’s a global phenomenon in all desirable cities, especially coastal cities from China to England to Australia to USA to Canada to New Zealand and throughout the EU. The cause is most likely low interest rates and a tsunami of cash from Quantative Easing. QE flooded the world with Trillions of dollars in freshly printed cash. QE kept everyone employed and made factory owners wealthy, and people with cash want to buy real estate, lots of it, multiple properties equals long term security… until a correction…

Interesting article on foreign buyers.

https://www.ft.com/content/9de9bcd2-f9bb-11e6-bd4e-68d53499ed71

Here’s a listing description that had me laughing out loud. Who are they trying to cater to? Like, really, still this crap is going on?

“This address number & street name says it all!”

I see it as a sign of desperation.

http://www.sellvictoria.ca/property-details/379037

P.S. I’m still laughing

I think the market in Core is peaked for now. Given how tight the rental market is, I don’t see a huge price drop (20%+) in the future. Unless NK fired a missile to Seattle, then Hawk may finally move into an Uplands house for $650k……..

Anyway, what happened? Why did the price double in the past 3 years? Even I followed this blog closely, I still cannot pinpoint what exactly happened in Victoria. Yes, rate is low, so is the rest of Canada. Vancouver spillover? Kelowna, Nanaimo, etc aren’t as crazy as here. Chinese HAM? We don’t even have direct flights to China….

The wages and population stay the same, tent city is on-going problem, bikelane gridlocked, downtown shops moving to uptown. Old houses are more expensive to maintain. BC ferries just as expensive. Colwood crawl maybe solved in couple years…. The house prices in Core should went down instead. /Scratching my head

Goes to show how quick the market can turn around when it’s hit with external changes. Wonder what will come down here in BC if Vancouver doesn’t moderate on its own. Also with the greens and NDP from the island they may actually care what happens here for a change.

Wow Leo, free house!

Seems that there is more mortgage bridging in Toronto.

http://www.citynews.ca/video/2017/06/06/video-housing-market-fluctuations-causing-chaos/

Considering a brand new house of the same size on Majestic is listed at $1.15M….

$650 sounds better. Could tear down and build a cheap OSB box with a suite, six bathrooms plus splashy countertops and sell it for 1.4 million…

Long time lurker, first time commenter.

I was at a local coffee shop today. Within earshot was a group of

devilsdevelopers talking, via translator, with a pair of Asian investors. One of the builders mentioned that a show home, presumably the first part of a cookie-cutter sub-division, could be built (and sold) without any permits. Is this true? If so, yikes!Amazingly they could probably get 20% more than they paid for it. Nice return for 6 months, even after the costs of selling.

No way the place appreciated 67% or whatever gets them to their over 1 mil price.

699k might have got a bidding war. I’m with Hawk. 200k slash and it won’t even be enough. I don’t see how they could even get any viewings at that price. Over 1 million is going to limit the exposure in MLS and pcs. Heck, 900k is going to have limited eyes, under 800k has a whole lot more shoppers and under 700k would have even more.

I wonder if it was the realtor or client that wanted to list at that price. I asked a selling realtor I know about crazy ask they listed and it was the customer. List it at the crazy ask or don’t get the listing. Personally I’d forgo the listing, but there are a lot of hungry Realtors ™ out there so maybe that’s not realistic in this market.

Agreed.

Nothing can touch the relationship you and me have Introvert. That of stalker and stalkee.

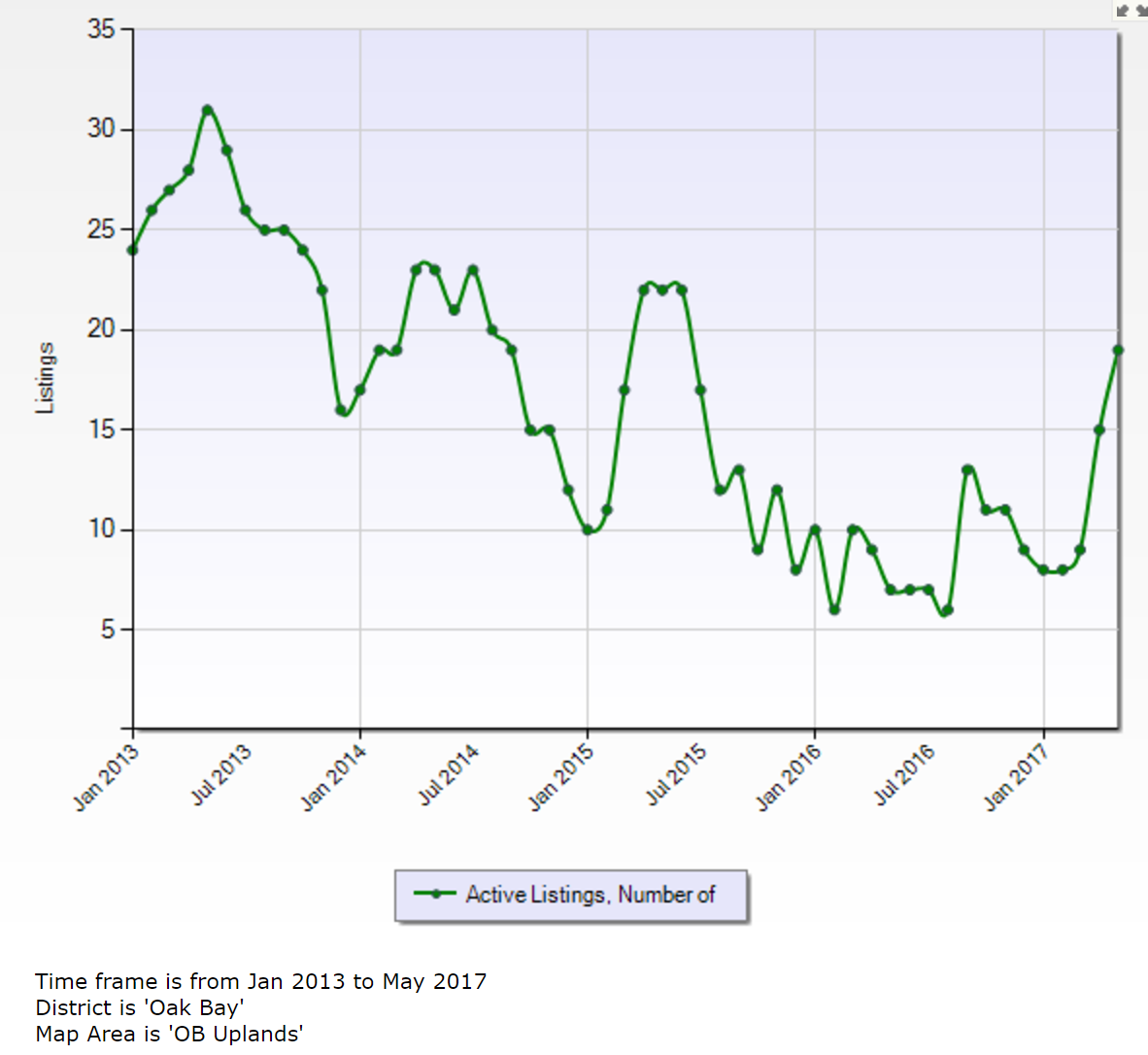

You are correct Uplands listings are up significantly.

More than what? How do you know what the land is worth when there hasn’t been any land sales since October 2016 when a lot along Thornhill sold for $595,000.

Now land is a million because …. you say so or are you just trying to justify the irrational by saying it’s high land values that make Gordon Head Houses sell for so much? Saying to a prospective buyer that paying high prices for a property is because they are mostly buying the land is a real estate agent’s tool to make a sale.

The value of a property is insitu and can not be separated from each other.

I know, it’s different in GH. 😛

That’s a bubble “value”, not a value pegged to any fundamental metric which is what Dasmo subsequently demonstrated. The pricing makes no rational sense at all.

BTW, I met the guy at our meetup a few months ago – he ain’t no goofball. 🙂

If an agent breaks that fiduciary trust with his client then is a fine sufficient?

$2,500 or $25,000 all this does is limit the agent’s exposure. It becomes just a cost of doing business when an agent can greatly enrich themselves at the expense of their client.

If you’re going to market yourself as a fiduciary then you should put your career on the line every time you do business. Depending on the severity of the breach of trust the agent should be facing possible expulsion from selling real estate.

1607 San Juan Ave easy $200K slash coming. Ex-student rental with a minor face lift.

Sorry but a 50X120 lot in GH is not worth 1.09 million.

That would mean one could buy said lot and build on it to make a profit.

Lot:1.09m

Demo and disposal: 50k

soft costs 50k

Build (cost at POS materials and build quality) 400k

so all in 1.6 milion cost. Need profit so sell at 3 million?

nope…..

From e-value BC –

1607 San Juan:

Sales History (in the last 3 years)

06/Jan/2017 $650,000

flip or flop? TBD…

Proofread, my friend.

You bet Gordon Head is dynamic—it’s home to Leo, who makes detailed spreadsheets and graphs when he’s not taking long naps on the couch.

It’s the land, goofball. Gordon Head is a very nice location, so land is worth more there.

By the way, looking through the photos of 1607, there is so much white inside they should provide sunglasses at the entrance on open-house day.

1607 San Juan Ave… Soon to be featured on lifestyles of the rich and famous…. Good god. Victoria is broken.

Bahahahaha. 1.09 million for that?! GH is hot and all, but that is absurd. I predict price slash. You heard it here first, though I’m sure Hawk will remind us once it happens.

1811 San Juan sold for 900K. Bigger lot, nicer house, carport and a big driveway with RV parking. Your tenant can actually park off the street (sufficient parking for the suite to be legal!).

1607 can barely fit a single truck in the driveway and it looks like one of the neighbours puts out cones to protect “their” parking spot on the boulevard. I’m assuming parking is an issue in that area.

Nope. Nope. Nope.

Not gonna happen. I’ll eat my hat if that sells for over a million.

1607 San Juan Ave

Quite the opening line from this recent PCS listing:

“Welcome to diverse and dynamic Gordon Head, one of the hottest real estate markets in Victoria”

diverse – sure, dynamic – not sure about that one.

“What happened with the Kinross Ave listing?”

Interesting – I suspect the layout & sq footage wasn’t worth the list price, eg., main was 1129 sq ft, the only back deck was off the master bedroom, 1 bathroom on main floor. Cramped lower floor. High quality materials though. If it had been listed for $900k it may have sold already.

Kalvin

Optical illusion. See the street view.

I can’t believe that’s the photo they chose. They had no other options?

Hawk

LMAO

What happened with the Kinross Ave listing? Don’t see it pending or listed anymore.

This new listing had me perplexed and wondering if anyone is familiar with this home. The garage looks like it’s sinking into the ground on the first picture of the home. Secondly, the listing agent added at the end of the description; “Call agent direct at 250-920-6850 direct offers given priority.”

Are agents allowed to do that? Is the agent encouraging buyers to only deal directly with him?

https://www.realtor.ca/Residential/Single-Family/18258490/2171-Wenman-Dr-Victoria-British-Columbia-V8N2S3

You forgot romantic.

By the way, love that screenshot from old PSAs on NBC. Nostalgia! Good job, Leo.

Bingo, didn’t you know ? Oak Bay has no legit borders. The tweed curtain now extends just past the Red Barn. Next week it will be past Richmond or wherever the last million dollar condo lies. 😉

Nan,

Maybe they’re all out getting loans against their cars. WTF ? What’s next ? Borrow against your RV or 5th wheel ? This is not going to end well at all.

Last acts of desperation for over-indebted Canadians: car title loans

https://jugglingdynamite.com/2017/06/06/last-acts-of-desperation-for-over-indebted-canadians-car-title-loans/

I gotta say I have never seen so many properties for sale in the Uplands. What is it now? 17? What percentage is that of total?

Hawk

Wooo. OB for cheap! Of course that’s not ‘real’ OB is it? The rich people are going to laugh at you when you say you live in OB then admit you live on Foul Bay on the wrong side of Fort.

The previous 899K ask seems nutty to me considering Townley (not OB, but only blocks away) went for 918K. Despite me shitting on Townly for being expensive, it was a much better house compared to this foul bay place.

-not on a major street

-bigger yard

-finished basement with ready to rent suite

-no carpet on the main (personal pref)

-better and bigger deck

-no wood panelling (fire issue, and damn ugly)

Be interesting to see what it goes for. Of course I won’t know since I don’t have OB pendings on my PCS list.

Which was the other Foul Bay house and what did it go for? If it went for around a mil I’d expect it to be a lot nicer than this place, or deeper into OB.

Another Peak Victoria special. A week ago someone was paying major bucks over asking to live on Foul Bay. Today 2465 Foul Bay slashed their price $100K to $799K. Needs a little fix up but the other place was in the million range if I remember correctly.