Increasing prices on declining volume

Another month another stats update and it’s a mixed bag out there. Despite the persistent notion that prices have stalled, I still don’t see it even if you squint at the data many different ways.

Yes, months of inventory for detached houses in the core is up. The overall market months of inventory is no longer decreasing and on an annual basis it has flatlined since February. The VREB is calling it a “gradual return to a balanced market” but I think that’s getting a little ahead of the game. Months of inventory have flatlined at record low levels, and we haven’t seen any broad based cooling yet.

Meanwhile prices if anything have been picked up again similar to last year, and especially condos and townhouses are no longer lagging detached houses in price appreciation.

Looking at the annual averages, we can see that detached median prices are still increasing at about $7500/month while condos are on pace for about half that.

Of course prices are a lagging indicator. If we want to catch an earlier glimpse of whether the market is cooling, we can also look at how long it is taking for properties to sell, or the Days on Market (DOM). We can see that properties in general as well as various subcategories are selling faster now than this time last year. This should be the first measure the turn up in a cooling market.

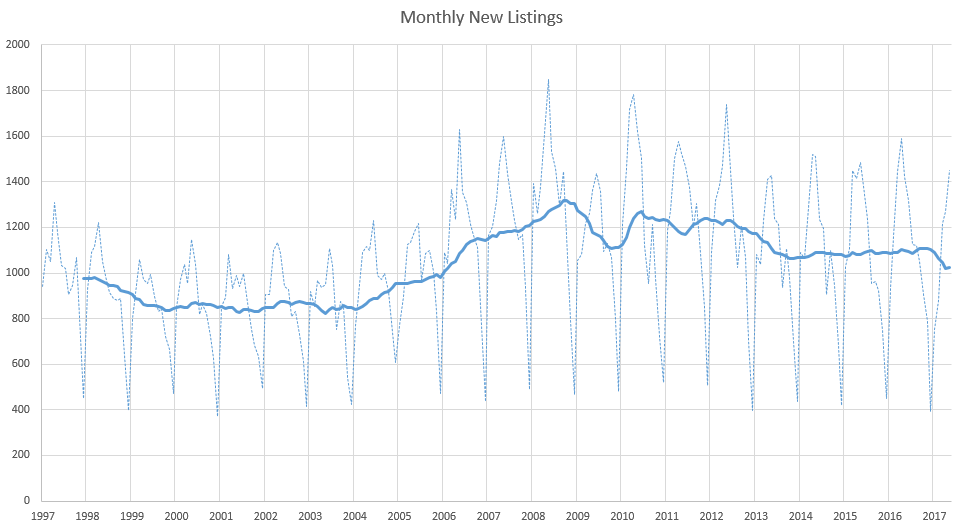

So what’s the good news? There might be some hope on the new listings front. First of all at 1451 new listings we are up (if only barely) over the 1423 from last May. That combined with lower sales than last year means we are building inventory instead of hemorrhaging it like last year.

If we look at the sale types, it’s clear how much fewer detached homes are selling this year than last and there aren’t enough condos or townhouses left to make up the difference.

I suspect the next segment to pull back a bit will be detached houses in the westshore. Remains to be seen whether it pulls back to any kind of level that would support stabilized prices. The good news at least is that we’re on the downswing again. It could take a while, but there’s only one way market conditions are going to go for the forseeable future.

Perhaps in part, because they had to strut around like something from the Ministry of Silly Walks. Just not the way to take over the world, especially in winter. You’d be liable to slip on the ice.

https://www.youtube.com/watch?v=9ZlBUglE6Hc

Irregardless:

Congratulations you have a sense of humour which seems rare in Victoria these days. I will have to take your suggestion under advisement but I am pretty sure that my dear old dad would not have approved since he found them ill mannered in Normandy and Holland.

Barrister, maybe you could restart this nationalist socialist party

– Amerikadeutscher Volksbund.

https://www.theatlantic.com/photo/2017/06/american-nazis-in-the-1930sthe-german-american-bund/529185/

Listening to the Warren Buffet biography. Really illustrates what kind of unique drive it takes to consistently outperform the markets

That’s when you may correctly use the misspelling “in suite” bathroom.

1800 Francisco Terr

Is this a bathroom vanity in the master bedroom? Classy!

http://i.imgur.com/CsmQNBC.jpg

I don’t think I’ve ever said that rates will go up imminently. In fact I’ve said the opposite a number of times. It is a relatively safe bet though that rates won’t continue their multi decade decline and that will have a large impact on real estate returns.

That said if rates stay low for a long time that means the economy is stagnant and overall not great news for housing.

More or less my thoughts as well. The economy is so dependent on real estate that any small increases will put such a drag on it that it will dampen the rate of possible increases significantly

Every bet and prediction on rising bond yields and the rising mortgage rates that should bring have been wrong for a solid decade and counting. (Yes you Garth Turner). People take the correct fact that rates can’t go much lower and make the incorrect prediction that rates must go higher soon. For the record I think that rates will go up, but only by a little bit and not in a great hurry.

Dovetailing with Entomologist’s point, all we hear from so many people (including Leo) is how rates can only go up. Well, today RateHub says I can get a 5-year fixed for 2.29%. 2.64% at Coast Capital. Both of these rates are subterranean compared to historical levels, and rates have been for, what, a decade now?

Geez, I’m starting to wonder whether, in two and a half years, I’ll be able to lock in my third straight 5-year fixed at sub-4% (and my second straight at sub-3%). There’s never been a time like this.

Very sensible, Entomologist. And because it is, you will be roasted.

Why? What do you care, Leo?

I’d say so. Part of what we’re experiencing is the more global phenomenon of QE. Problem is, it hasn’t really worked in spurring productivity, and it’s caused all this liquidity to go chasing yields anywhere it can. Some of it of course, has found a home in traditionally unproductive asset classes, namely RE.

Throw in domestically accommodative monetary policies, and presto. You have Canada, Australia, China, Sweden, and a few others. It’s a mess.

Local Fool, I agree with the sentiment behind what you say, but maybe it is different this time….maybe it’s much bigger, broader, manipulated, farther away from fundamentals, global, macroeconomic and overall much worse.

New listings down to levels of mid 2000s. Hope they start picking up again…

WTF?!

“Maybe you should go into politics and start a nationalist socialist party.”

Says the guy who’s currently using the Canadian medical system (which you and i and everyone here have paid taxes into)

I’ve talked to quite a few Americans recently who are appalled at what’s happening with US politics so that brand of name calling isn’t exactly going to win friends and influence people here.

Luke, I am impressed that you possess the truth. Still you do sound very pro Canadian so I guess that makes you a strong nationalist. At the same time I notice that you are also very socialist. Maybe you should go into politics and start a nationalist socialist party. .

Local Fool

I think this is a huge factor and the stats seem to support it (way more debt). Of course it’s generally chalked up to low rates (easier to leverage oneself to the hilt) but there may have also been a cultural shift putting owning a house as high importance and financial independence as low. Canada has always had a high home ownership rate, but it seems as though it’s now a cult.

There’s a lack of aversion to debt. Debt is acceptable, doubly so if it’s a house. There’s this whole idea of good debt vs bad and a mortgage is considered “good debt”.

Once something becomes cultural it’s extremely difficult to change. Policy won’t change something that has become ingrained.

Of course I’m young and I don’t know the past very well. For all I know my parents’ friends were all stretched to the limit on credit. The amount of debt they could take on (nominally) would have been less due to higher rates but maybe it’s just the same old same old but with more rope for making your own noose.

Grace

In my experience, most realtors won’t bother you. You just email and they’ll set one up. Worst case they’ll put you on their stupid paper mailer list (which you tell them not to, since it’s a waste of paper).

It’s sad people are so worried about realtors. A female friend of ours was interested in following the condo market but was deathly afraid of emailing a realtor (one I recommended). She wanted me to email the realtor and set up a list then pass her the link so she had no connection. The realtor is a trusted friend and good guy.

I had to explain he gets requests for PCS lists all the time and is glad to just hand them out. If you want him to actively work with you, he will. If you just are kind of interested in seeing what’s going on, he’s glad to oblige as well. No expectations. It takes a few minutes of his time and it’s a connection made (a potential customer). Not only a potential customer, but one that is willing to educate themselves. If you never get serious or go with someone else, it’s no big deal.

I’ve got multiple PCS lists from different realtors. Not one has bothered me about buying, even the out of town one I don’t know at all (which seems like the most likely.. but not even a, “Hey, you thinking of moving?”).

jeez that post didn’t look so big in the text box I was writing it in…:(

“Past performance is indicative of future performance.” Nope. Especially now. Even the BoC is pleading with us to stop this fallacious line of reasoning.

“It’s different here.” Nope.

I know, annoying. I just don’t listen. Brick wall. What is it with me? But I kind of picked my lane, so I travel in it. 😀

Most of the crowing, at least when I do it, refers to the largest urban centers and the markets that are affected by the spillover. Yes, no two moments in history will be alike, and from that perspective, yes. It’s different this time. In fact, the levels of consumer debt and the rock-vs-hard place that the BoC now finds itself in does indeed make it different this time.

I believe that what is occurring in our larger real estate markets and ours is not normal. The level of “craze” associated with home ownership is not rational, and it’s causing legions of people to take on levels of debt that sooner or later must be paid back. It’s not just that, either. It’s the laissez faire attitude to debt itself. I don’t think our local market has a lot of parallels with what has by-in-large been a fairly stable several decades.

A friendly bullish user on here frequently attempts to opine with, “indicators in Victoria are strong, therefore it is supportive of high and/or rising prices. Tourism, paradise, growing, discovered – it’s not like how it used to be, so it is different now!” He’s far from alone, and it completely misses a very simple point. When I imply “it’s not different this time” or “different here”, I mean something very specific.

Aggressive run-ups in household debt coupled with exploding house prices that leave the supporting economy far behind always have the same outcome. And in virtually all cases, that society writ large believes one of two things…”it’s different this time”, or “it’s different here”. Both our friend above and yourself are arguing the latter.

“It can’t happen here. That sort of thing happens in other markets, to other people, at other times. It’s different here – decades of history prove it. Our run ups will not result in the degree of trouble associated with other busts elsewhere, the condition will “moderate”, a “soft landing” can be engineered, we’ve learned from other peoples’ past mistakes, we’re better regulated, our public policy is sounder than theirs. And it’s not really a run up anyways – we’re so globally desirable now (New Paradigm™), we’re actually undervalued.”

You’re in good company, as were those in those other markets previously. Unfortunately it didn’t save them. On that cheery note, it’s coffee time!

#213- 2285 Bowker Ave jacked it’s price up $30K in 3 days from listing to $929K. Looks like a developer gouge at $726 sq ft to live on a very busy corner where cars gun it up the hill.

“Thanks for the compliment ol’ Barrister… all I do is speak the truth…”

LOL. Victoria Tourism is hiring Luke. You’d be a great spokesman.

1 bed 1 bath @ Bowker is listing for $625k…. at least is 750 sq ft.

https://www.realtor.ca/Residential/Single-Family/18239384/307-2285-Bowker-Ave-Victoria-British-Columbia-V8R5G9

Interesting insight from the US on the Canadian bubble.

Canada’s Housing Bubble Larger than that of the US Before 2008

https://jugglingdynamite.com/2017/06/05/canadas-housing-bubble-larger-than-that-of-the-us-before-2008/

Thanks LeoM, I missed that one. Correction on 250 Douglas, it’s listed at $398,888. You would think the sellers would know by now the triple 8 thing doesn’t work and the foreigners are probably laughing when they see one.

Smallest slash of the year goes to 333 Raynor Ave with a $100 slash.

Another multi slasher in Langford on #4 slash of $10K a shot at 820 Ashbury Ave. The local media has one thinking there aren’t any new builds left on the Westshore. Not.

One thing I’d like to call bs on right away: The whole ‘it’s different this time’ crowing. Hindsight is 20/20 and all, and if we look in the rear view mirror, do we really think various episodes of price drops were identical? Of course it’s different this time – it’s different every time . Victoria has had exactly one instance of YoY price drops over 5%, in 1981. All the other so called bubbles bursting, reversion to the mean, whatever, they caused minor corrections here, flat prices or minor drops for a couple years. The latest was from 2010-2013, a time, I should add, when most Canadian markets were booming.

I’m not saying affordability is unimportant or that rising prices are right and good. I’m saying we live in a place that has had no past trend of price collapse. If you believe that it isn’t different this time, then you should predict a minor correction or soft landing (and good luck timing that). That is what has happened in the past.

Thanks for the compliment ol’ Barrister… all I do is speak the truth…

Luke:

It is not a question of looking to the past or avoiding change but rather avoiding and not repeating all the mistakes that have been made elsewhere. If one starts to sound like the developers PR person maybe it really is time to stop and rethink ones vision of the city.

Nope Michael. We’re at the beginning of baby boomer bulge. With baby boomers aged between early 50s and late 60s currently… and people are often working longer. Many more boomers are set to retire. Some will leave big empty nests in Victoria perhaps downsizing to condos or elsewhere and some will stay, others will continue to move here from all over.

332 Irving has many things wrong and a future construction site right behind and is priced too high.

Leo … people keep moving to QB ( and living longer) and they’re nearing their cap if 10000 people very soon. Same thing here, for a while yet.

It does perplex me why so many on here dont seem to see what’s happening here or more accurately- you don’t want to see it or accept it. That’s probably because you liked the way it was before ( as an ex. I preferred the world the way it was maybe 10-20 years ago too ) Nothing wrong with that but the future looks friendly here so don’t fret. There is much change ahead here and it’s mostly / hopefully for good. You’re better off to embrace it rather than fight it or wish for the past that is forever gone.

Love the funnies local fool. Thanks for not taking opinions too seriously. It’s great someone’s on here who can lighten things up that way. Keep it up!

Hawk, you missed one failed attempt to get a bidding war going at 22 Cambridge, Fairfield, just steps to Dallas Road. After the date set to review all offers, they bumped up the price by $888, so I guess they got zero offers at $998,000, not surprising though… the house smells musty, like something is moldy. Must be trying to attract an Asian buyer with all those eights.

http://1.bp.blogspot.com/-mX9Q_FUhKxI/VAt7rRrnuAI/AAAAAAAAWg4/HM8uOLDWorg/s1600/bear%2Bnot.gif

Sorry, just wanted to use the board for my own petty amusement tonight…

http://www.chinadaily.com.cn/opinion/images/attachement/jpg/site1/20100121/00221917e13e0cc1dcdc01.jpg

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2017/06/01/20170603_bubble.jpg

Bman, it’s listed at $399K now, last slash $45K. Nicely updated but started at $525K.

Looks like another failed auction in Golden Head at 1800 Francisco Terr . Was $849K, now jacked up to $899K. That’s 2 failures in a day in the core. Market could be saying the suckers well has run empty.

Guess hiring Intorovert to walk up and down the street wearing the for sale sign in his pumps didn’t work either. 😉

Can we start saying ‘fewer listings’ please?

Or ‘less inventory.’

It’s up to you.

Hawk – what was 250 Douglas listed at? That building has very high strata fees, and pet and age restrictions. Probably full of meddling old fuddy duddies – too bad because it’s a pretty rad building complete with an all original Polynesian Room and tiki bar. Perfect for hipsters.

Is there anything worth buying these days?

Well if you’re a millennial or a speculator the answer is not really.

As for the armchair bulls ( I mean steers) you’re not buying anyway, you just want to grumble and pontificate about how smart you were 10 years ago.

But for some, there is an alternative and that’s houses on acreage.

In the core last month there were 157 active listings and 31 sales of homes on acreage. Now those are good odds for a buyer in that you may just be the only bidder for the property. New listings were added at the rate of 67:31 or 2.2 for every one that sold. And the average days-on-the-market was 29. And the sales to list ratio was 97.7%.

No low life agents under pricing properties and limiting exposure to a week so that you end up overpaying for the property. Bidding wars are rare.

And the median price for a 2,900 square foot home on 2 acres?

About the same price that you pay for a Gordon Head box with psychotic basement tenants or a Victoria house with Norwegian rats.

Thank you!

@Grace

Use the form at the top right of this site. I promise I won’t interact with you 🙂

How does one get onto a realtors PCS email list? Without having to actually interact with them personally!

https://youtu.be/ZoaRl0E2cKU

John Dollar:

Using your analogy, on rare occasions the ocean liner hits an iceberg and just sinks (Hawk, dont get excited).

In the long run John your cycle of life is absolutely accurate. Having said that, the cycle has not a yearly constant. I know in Toronto, there were whole parts of Etobicoke that people bought suburban homes. Most buyers were in their 30’s and a large proportion did stay in those homes for 30 years.

My impression (totally unscientific) based on talking with and meeting people is that at least in some areas like Rockland and Oak Bay that a lot of the buyers were in their mid fifties and retiring early particularly from Vancouver. Overall your cycle is correct but there are often plateau periods particularly in some neighbourhoods. Death and divorce is of coarse a fairly constant factor but divorce is lower as you approach 50. I suppose one could look to see if there has been an appreciative change in the demographics of owners of SFH in area like Fairfield.

The effect on market prices is the same. Or you could say the affect on the market. Or you could not use effect or affect at all and use impact. Or you could just say fuck it, this is just a blog.

Speculators or home owners the effect on the market is the same. The more listings that come onto the market the more selection there is and that causes more home owners to decide to sell.

For two years, we’ve been hearing home owners say that they would sell if there was something to buy.

It is extremely rare to find a person buy a home at 20 and live in that same house until they are 90. Most will buy several homes over their lifetime depending on where they are in their live.

At 20 something you buy a condo and get laid a lot. At 30 something you find your soul mate have a baby and get a house. At 40 something you divorce your soul mate and sell the house. At 50 something you find another soul mate and buy a home together. At 60 something one of you dies and you buy a condo.

Life’s a cycle.

3225 Exeter Rd slashed $200K. Looks like the Uplands is losing it’s appeal even for the flipper potential on this one.

The velocity of appreciation in the core condominium market.

Month Sale Price, Median

Jul 2016 $319,900

Aug 2016 $310,000 -3%

Sep 2016 $335,900 +8%

Oct 2016 $348,750 +4%

Nov 2016 $320,000 -8%

Dec 2016 $339,900 +6%

Jan 2017 $346,000 +2%

Feb 2017 $375,750 +9%

Mar 2017 $375,000 -0

Apr 2017 $365,000-3%

May 2017 $366,250 -0

Jun 2017 $?????

By convention appreciation has been stated on a month to month basis. Personally, I think we could do a lot better than picking an arbitrary time period. However that’s the way the world is. Most of you should conclude from the above that the velocity of appreciation has been slowing over the last six months.

In the way of an analogy. Real Estate is like an Ocean Liner plodding through the waters. Unless it hits an island the ship has to first slow before it can reverse itself.

John Dollar:

Are we actually getting any less listings or is it just that the last couple of years had an unusually high number of sales. In 2014 there were about 3000 SFH sales while last year there was over five thousand.

My impression is that the last couple of years saw a fair number of what had been rental houses previously being put on the market. Some where bought by speculators but many where bought by people looking for a long term home.

I am not surprising if we see more houses coming on the market for the next few months since I suspect that a lot of the short term speculators might decide to try to get out. Prices have gone flat, sales are slowing and the prospect of new capital gains taxation and other measures is clearly on the horizon. If they are not nervous than they should be.

Outside of speculators, I am not sure that there is this untapped inventory of people waiting to put their house on the market.

The condo slasher award of the year goes to 250 Douglas St. Even though it has prime Beacon Hill Park and mountain views etc, they are on their 8th price slash since April. Recently slashed $45K but the grand total is $127K of lost fantasy flipper profits.

Throw out the charts Mikey. The rich retirees aren’t downsizing to prime retiree area where walks in the park and the beach, with a pool as well , would be every seniors dream. Change is in the air.

I know that it is only 4 days into the month. But 45 new house listings in the core versus 10 sales!

I don’t expect this to continue but it does illustrate how fast volumes can increase.

For the last 14 days new house listings in the core have averaged 2.1 for every sale. That’s balanced between buyer and seller and one of the more important reasons why prices in the core have not escalated like last year. Only if new listings were being added at more than 2.5 for every one that sold would the market start to be characterized as being “soft” or favoring buyers.

But a rapid increase in listings did happen in Toronto.

We have been in a declining number of active listings for the last two years as home owners have chosen not to list. That may be coming to an end and we could have an increase in supply as those that held off from listing decide to list.

For the previous nine years we have averaged 770 active house listings in the core for June. Today we are well below that average at around 460. The highest number of active listings occurred in June 2012 when we hit 994 for the month. So there is a lot of pent up supply out there of home owners that have held off listing their homes for sale.

For instance, notice how our ‘geographic sister’ city to the south peaked once retirees merely ‘decelerated’ in mid-’05.

Almost makes me wonder how much the outright decrease in US retirees from ’06 -’08 may have helped amplify the correction in San Diego & other sunbelt cities.

(Note how Canada’s curve only had a slight pause ’07)

http://i.imgur.com/b7ZuQCR.png

Welcome, Leo. I don’t know how much a factor it is, but interesting nonetheless.

Interesting way to visualize that. Thanks.

We’re actually closer to the end. Hard to know the exact turning point, but the deceleration starting 2018 (flat section) could mark the end of the ~18yr trend.

http://i.imgur.com/GfRV4nf.png

What’s wrong with it?

Expired. Again

Did 332 Irving Road sell or did the listing expire?

@ Kalvin

No not the same buyers.

The problem with Citified is its advertising in the form of news. It’s a fantastic biz and great timing. But it’s advertising….

Re: 4071 Haro Rd priced at over 4 million sold before it even got to market; 4058 Monarch listed at $979 thousand has accepted unconditional sale one day after it was listed.

Wet these two properties bought by the same person?

7% during times of high inflation and dropping interest rates. Good luck with that in the next 40 years

What is your point here? Old people don’t in fact regularly die and their house hits the market?

2000 Runnymede Ave looks like a failed auction. Was $995K, now $1.249K. Hurry while you can. 😉

“Most Uni students and first time buyers aren’t buying SFH in the core, most of them can barely think of buying condo’s for now. ”

That’s not what the pumpers on here have had us convinced of. Everyone’s mommy was forking out $100K or more for junior’s nice digs so he doesn’t have to live in his VW. If you come from somewhere else then you can put down a load of imaginary steel as a downpayment.

http://images.huffingtonpost.com/2016-09-19-1474281563-8677988-CIBCBranchMortgagesForInternationalStudents.jpg

I would like to know how often is this happening in Victoria, focusing on Gordon head, which is where this student found a rental? Are there bylaw officers going around Gordon head looking for illegal suites?

https://www.reddit.com/r/VictoriaBC/comments/51nisq/just_moved_into_a_place_in_gordon_head_now/

Is 7 the new 4? I don’t think it’s normal when 1 year can sku a long term average return by almost double. Expect lower returns going forward.

Well, it looks like citified is wrong and you all can buy those rarer and rarer SFH in the core at much less than now soon, so there is good news ahead for affordability then… Continued population growth and an increasingly younger demographic on this small bit of land means affordability will only go up!

More people on the same bit of land with less SFH = increasing affordability for SFH! Love it! Good to know! This is great news! 🙂

Go talk to Qualicum Beach, Canada’s ‘oldest’ community, about how inventory and affordability keeps increasing there (it isn’t)…where they have ‘capped’ the population at 10,000. (and you could argue we are ‘capped’ here as well due to our lack of land). There’s a much older population there than here 😉 Median age in QB is 62. Here it is in the 40’s. We’re only at the beginning of the baby boomer retirement bulge, so yes – how many will choose to move here? Also, I was wondering how many existing boomers/ empty nesters here who now have houses too big want to ‘downsize’ and move elsewhere, often to places like QB? Many want to stay, but there will be those who will leave or perhaps buy a condo locally and house elsewhere. We just will never know how many are thinking of staying/leaving/ or coming here and will instead just see it play out over the years.

Most Uni students and first time buyers aren’t buying SFH in the core, most of them can barely think of buying condo’s for now. If they can even start a career or find a decent job, since now just about everyone has a degree it’s not as valuable as it used to be. The University simply needs to build more housing to take the pressure off the local renters and hopefully the new Gov’t will enable them to borrow money to do so.

Not everyone can live in paradise… Just ask anyone in any other nice place on the planet where many try to live but not everyone can… there’s always the west shore if you are a young gun that’s really wanting a SFH… The new Gov’t, or other changes ahead, may cause prices to fluctuate over the years, but I think Totoro is pretty well right on when she says the 7% average annual increase over time as we have seen in the past is the long term norm for Victoria.

Two quick sales in Arbutus: 4071 Haro Rd priced at over 4 million sold before it even got to market; 4058 Monarch listed at $979 thousand has accepted unconditional sale one day after it was listed. Open house cancelled.

As far as retirees coming here, that is reduced as prices increase. Realistically most retirees are not moving away from families anyway. Family is more important to most people than weather.

For those people who do want to move to Victoria, reality is only those in higher priced markets like Toronto and Vancouver or the very high earners in other markets could afford to do so.

So I think quite a bit of our future retiree immigrants depends on the performance of real estate in those markets. If they keep rising then more people especially from Vancouver will be tempted to cash out and move. If they correct significantly then that puts a damper on people wanting to sell.

With university students living in cars and leaving town as shown on the news the other night, the decline of first time buyers is happening now. Victoria has priced itself out for what it is.

Speaking of first-timers, the lack of will eventually become a problem. I’d say between 5-10 years from now.

We simply aren’t letting in enough young immigrants to fill the gap.

http://i.imgur.com/PNuQIIX.png

Working on an article on this. No idea how many people will come here but there is some research on when people become “net sellers” of real estate.

Good thing about having a very elderly population is there is constant supply of inventory

“Even condo sales in the core took a hit last month. Sales volumes were tracking those of 2016 but fell 28% last month. Unlike houses, condo sales are very tied to income because they are mostly first time buyers. Raise the prices slightly and you kill the market.”

JD,

Just going through the condo listings and the highest amount of price slashings are in the under $400K range. The first time buyer is clearly getting squeezed as the hype begins to die and reality of a mortgage on a 700 Sq Ft box sinks in.

“And in yet another scenario, agents say, deals are dying because lenders are not willing to cover the difference between the perceived value and the amount the buyer paid to beat out all of competitors vying for the house.”

LeoM,

Did we not see this point coming where the banks finally say sorry, you over paid…sucker.

“That citified article had all the tired arguments to stoke fear into potential buyers like saying if they don’t buy now they will get priced out forever.”

Like I said, it’s a promo rag funded by the industry to pump the over priced projects that desperately need buyers for, or the whole house of cards collapses. Which it will.

“Andrew Weaver’s riding of Oak Bay-Gordon Head is among the nicest places on the planet. If you are lucky and rich enough to have a house by the ocean, you can see the orcas frolic during whale season. This is paradise”

In AG’s case it’s a matter of being in hoc enough being highly leveraged to the bank,without the waterfront too.

At Barrister: “The question in my mind is whether we will see sudden panic in the speculators followed by a lot of new listings.”

An NDP administration intent on going through with the multiple taxes on flippers and foreigners enumerated by Garth will surely set off a severe panic.

Leo S

If first time buyers are priced out (and not replaced with out of towners) what happens is that prices go down. I wonder if there are any stats guys out there that know when we expect the baby boomers to be dying faster than they are retiring. My guess is in about ten years at least for men. I know that the average age of retirement is 63. But I am just guessing.

“Introvert, it will only take one disgruntled NDP MLA to defect when the liberals offer a plum position as Minister of Social Housing.”

If my understanding of the integrity of politician is corrects, by the time the Throne speech has been read it will be observed that half the NDP caucus has crossed the floor to take minor ministerial positions in a Liberal administration, while half of the slightly larger Liberal caucus has crossed the floor to take minor ministerial positions in an NDP administration. The Greens will then agree to form a coalition government with whichever side will accept Andrew Weaver as Premier.

Oak Bay got a mention in the Globe & Mail today 🙂

“Andrew Weaver’s riding of Oak Bay-Gordon Head is among the nicest places on the planet. If you are lucky and rich enough to have a house by the ocean, you can see the orcas frolic during whale season. This is paradise”

https://beta.theglobeandmail.com/opinion/bc-lobs-a-bombshell-at-mr-trudeau/article35187336/?ref=https://www.theglobeandmail.com&service=mobile

That citified article had all the tired arguments to stoke fear into potential buyers like saying if they don’t buy now they will get priced out forever.

First time buyers are the biggest source of demand in the market. If they are priced out the whole thing collapses unless they can all be replaced with out of town buyers.

Spent three days in Vancouver that’s enough for me. Too much traffic, too much noise. Nice to see the efforts to make the city more sustainable though. Decent EV charging efforts by City of Vancouver and improving bike infrastructure. They are at 50% mode share for trips not using cars which is the highest of any city in North America.

Once the internal combustion engine car disappears from cities it will make them much more pleasant places to be. I suspect an increased population in cities as they get cleaner

The CRA might know this (or they’re damn interested in finding out) but it’s not something that would be in VREB stats

Westerly:

In the upper end market there seems to be no lack of supply; Uplands alone has 17 properties for sale. They started the year with just four. Most of the properties have been on the market for well over thirty days.

The question in my mind is whether we will see sudden panic in the speculators followed by a lot of new listings. On the other hand no one seems to have any idea how many houses have been bought by speculators as opposed to long term owners. I am not convinced that there are less sales because of low inventory. I suspect that the answer might be the obvious simple one that there are less people looking to buy.

Looks like Hawk is finally right about Canadian housing if you believe all the news coming out of Toronto. Every couple days there is another news story from Toronto. Here are just a couple stories that show how fast the Toronto market went from a seller’s market to a buyer’s market. It changed from hot to cold in just a few weeks; in the short span of time between signing the purchase contract and closing date!!!

Also interesting that the international news is reporting the same flip from seller’s market to buyer’s market in major cities worldwide in just the last few weeks.

May 18th

https://beta.theglobeandmail.com/real-estate/toronto/toronto-market-turned-on-its-head-as-flood-of-listings-overwhelms-buyers/article35015919/

Today

https://beta.theglobeandmail.com/real-estate/toronto/torontos-unpredictable-housing-market-stokes-anxiety/article35164710/?ref=https://www.theglobeandmail.com&service=mobile

Oh, and BTW, JD, I have appreciated reading your discussions over the years.

I like that you’re segregating active inventory, I assume you mean current vs. aged? The current state of the market with the purposely under-valued asks and the pie in the sky dreamers (and Hawk’s subsequent “slashers”) makes evaluating actual value pretty difficult. In this hot market (with inventory selling in days), I have to assume that the 30% over 30 days are the later, are outliers, and are irrelevant to actual prices. They are either way outside market pricing, have something wrong with them, or both. Realistically, if we want to discuss current market it should be restricted to about 15 days.

I still think it is important when we say “raise the prices slightly and kill the market’ that we are clear about what we are stating: kill inventory?, sales?, demand? There are many people reading this blog and may have different interpretations.

In response to Westerly/JJ

That’s somewhat true but not entirely.

Active Inventory in May was 17% s higher than May 2016, but sales are 34% lower than the year before.

Inventory is tight in the lower end and that’s where the stories abound about over asking prices and multiple offers. You hear enough of those stories and you think its prevalent through out the entire marketplace.

Yet 30% of the houses for sale in the core have been listed for more than 30 days. You don’t hear too much about those, just the ones that have been intentionally under priced to entice multiple offers.

JJ: Are the reduced sales volumes not reflective of the lack of supply as opposed to lack of demand? If the market is such that people (like me) have stopped “moving up” (creating inventory) we get a market that sits stagnant while inflation catches up. In addition to my previous comment, my anecdotal observations are that everybody I hear talking about RE are trying to get into the market with no selection. No selection = no sales or over-paying for what little there is. Not a good market for buyers. When you say “raise the prices slightly and it kills the market” are you saying it flat-lines inventory or that prices drop? I agree that this is going to change but the market needs inventory – where is that coming from with what appears to be pent up demand?

Last year was a one-of-kind year. This is year is nothing like it at all. Dollar volumes are down in every price range for detached housing in the core as are the number of sales.

The housing market is collapsing under the weight of excessive prices. May was a mediocre month for house sales in the core and if history repeats itself June will be worse.

Even condo sales in the core took a hit last month. Sales volumes were tracking those of 2016 but fell 28% last month. Unlike houses, condo sales are very tied to income because they are mostly first time buyers. Raise the prices slightly and you kill the market.

You should watch this movie tonite Bearkilla to refresh your memory how painful this is going to be for you.

Home Capital the first to begin to crater the debt bomb of liar loans, Canadian style. Equitable next, then another, then another…. like a slow moving avalanche. Canadian salesmen are like every other country, full of greed and deceit.

“It’s a time bomb”. 😉

https://www.youtube.com/watch?v=vgqG3ITMv1Q

The bad news for bears just keeps piling up. How can they keep believing. The crash is never coming bears. Even if it did you’d still be priced out. Why do you bother? Move elsewhere and start again. Just wasting your life.

I agree Hawk, there are a lot of home owners refinancing these days. Half are refinancing to buy condos and the other half are refinancing to consolidate debts.

You’re welcome Westerly, wether you want to admit or not. 😉

“I work with a lot of “30 and under” young professionals in the accounting / finance field and am very surprised at how many are currently buying second homes and pre-build condos as rentals – literally anyone with equity is doubling down.”

Everyone wants to be a property king, then they aren’t. When the banks get downgraded after being touted as the safest in the world, you know it’s over.

http://globalnews.ca/news/3443462/moodys-downgrade-canada-housing-crisis/

Price slashings stacking up today. Condo listings increased to highest all year but more condo slashings, too many to list.

511 Caselton Pl right on the old Royal Oak Golf Course slashed $100K.

Another nice one in the Gorge area slashed for the third time for $50K at 2919 Wascana St.

New build at 3894 Wilkinson Rd slashed $82K.

After almost a decade of the mantras of the likes of Hawk, Info, Patriots, and others, we have finally succumbed to the teachings. We are no longer landlords (outside of our in-house suite) and have restructured our affairs to have no debt and a nice retirement nest. Wasn’t really what we planned short term but couldn’t resist given the current market. Thanks.

When signing our last sale the lawyer commented that the majority of his business recently is return clients (investors) that he helped get in a few years ago – they are getting out.

We’re not actually succumbing to the numbing effects of Hawk et al, and we are not predicting a significant bubble burst. But we do believe that on a balance of up or down this RE horse needs a rest.

When paying off our last debt yesterday, the young banker spoke of planning to put a 20% down-payment on her first rental condo (pre-build purchase) priced at $475,000, figures to get $2,000 / month. I asked a couple pointed questions about cash flow and mortgage payments but the answers were well rehearsed – they are going to “make bank”. I decided to leave it alone, but guaranteed the 20% is either coming from their principle residence (PR) equity or they at the very least still have a mortgage on their PR which could be paid down (which is the same thing IMO.)

I work with a lot of “30 and under” young professionals in the accounting / finance field and am very surprised at how many are currently buying second homes and pre-build condos as rentals – literally anyone with equity is doubling down. Given everything else going on in our macro world, if this is not the peak of the current cycle I will be very surprised (although I recall wondering who in this world would pay $250K for a Fairfield home not too many moons ago).

So we are out for the time being and wish everyone all the best of the end of the current cycle. Hopefully your “househunt” will come to fruition soon at a cost that makes sense.

“In fact, there are so many similarities with the 1980s”

Yep, looks like 1981. Everyone was getting priced out, sales stalled, prices began to get slashed, then the bottom fell out over the summer into fall as more and more couldn’t afford to buy.

Then the job losses kicked in like the poor 136 unionized folks just laid off at Viking Air. Whose next? Probably Intorovert.

Sales in Vancouver have gone for a shit the last 3 days. 56%,78 and 55%. Looks like the NDP effect is kicking in.

LeoM – I’m not. I just find it unlikely in the circumstances.

I think the more likely scenario, is that the NDP/Greens hold tight long enough to form a government, with the speaker playing partisan tie-breaker if need be.

The Liberals are an amorphous big-tent party, and are aware that Christy Clark has a problem with people liking/trusting her. The knives will be out, if they aren’t already, and I think she resigns as leader after the Liberals lose the confidence of the house (which seems inevitable right now), and resigns her seat thereafter. I wouldn’t be surprised if a couple old boys follow her out the door.

This should give the NDP/Greens a short window to govern, while the Liberals find a new leader, and by-elections are held to fill any vacancies on that side.

Don’t fool yourself that an NDP MLA won’t cross the floor. Politicians constantly remind us with their actions that many are a bit greedy. After years in NDP opposition all they need is four years in a ministerial position to bump their lifelong pension benefits from about $1500 per month to about $7000 per month for life.

Very true Gwac, but floor crossings are not taken lightly, and in the case of a dipper/Green MLA crossing to prop up the Libs, I imagine there would be a decent chance.

BTW, MLA Paul Reitsma resigned his seat in 1998 when it became apparent that the recall petition against him would be successful. His crime: using a pseudonym to write letters to the editor in support of himself and trashing his opponents. Seems quaint in the era of twitter and Donald Trump.

Bman

Collecting 40% of your riding official voters list in signatures is not something I would attempt to undertake. Sounds a tad challenging….I guess that is why all 25 or so attempts failed.

Gwac – Thanks – good info. That would be a very strong incentive to not cross the floor, no matter which side you are on.

In BC you can recall your MLA with 40% of riding and force a by-election. MLA need to be careful of doing anything stupid. Although it has never been successful.

Recall is a process through which a registered voter can petition to remove a Member of the Legislative Assembly from office. A voter can only petition to recall the Member for the electoral district in which they are registered to vote. The voter must collect signatures from more than 40% of voters eligible to sign the petition in that electoral district. Applications for recall petitions cannot be submitted to Elections BC during the 18 months after the Member was elected. In Canada, the recall process is unique to B.C. – no other province or territory has a system in place for removing elected representatives from office between elections.

LeoM – why would a dipper or Green MLA cross to the other side when they belong to a government in waiting? It doesn’t solve anything. Either way, the government has 44 seats, and is one bad tuna melt away from potentially losing the confidence of the house.

Crossing the floor would mean joining a government with 16 years of baggage, to support a premier who would be seen as desperately clinging to power, and who is already disliked by so many.

Would you really risk destroying your political career for that?

Yikes. I expect a response to that one. 🙂

You will get the graph for that comment..

In the history of Victoria real estate, there have been thousands upon thousands of fools who bought and ended up doing very well.

Of course, there have also been a few geniuses, like Hawk, who thought they could outsmart the market and all its participants by selling at “the top.” These brilliant people are the deserving roadkill dotting the highway of Victoria’s progress.

Into

One persons horror is another person`s dream. 🙂

I know. It’s fucking terrifying.

Prices could plummet 30% tomorrow, and Hawk would still be in a worse position than those who bought three or more years ago and held.

Let this be a lesson to all: underestimate Victoria real estate at your peril.

Introvert, it will only take one disgruntled NDP MLA to defect when the liberals offer a plum position as Minister of Social Housing. That one additional MLA will give Christy her majority.

She can scheme all she wants.

This is where we are…Legislation needs to be called by Sept. Than its a voting game.

http://news.nationalpost.com/news/canada/a-single-mla-with-diarrhea-could-topple-a-b-c-ndp-government-a-playlist-of-just-how-crazy-things-could-get-in-bc

Perfect storm of job and population growth pushing Victoria real-estate values higher

The Capital Region’s run-up in housing prices is far from over as a near perfect storm of demand pressures continue to push values higher and squeeze new supply.

“The housing boom we’re in is for the first time driven not only by a single major factor like retirees choosing Victoria as a retirement destination, but also young people flocking to the Island for jobs and downsizers turning to condos. On top of that, rising rental rates have also started to push people towards ownership.”

http://victoria.citified.ca/news/perfect-storm-of-jobs-and-population-growth-pushing-victoria-real-estate-values-higher/

Add this economy-boosting project to the dozens we already have going in our fair city (Greater Victoria, that is):

http://www.timescolonist.com/news/local/point-hope-shipyard-seeks-ok-to-build-50m-graving-dock-1.20321746

I have the unsettling feeling that Clark is scheming to somehow hold on to power.

By the way, did everyone see this?

https://twitter.com/PennyDaflos/status/869720729310420996

Barrister said: “It will be interesting to see if the speculators start dumping their houses over the summer.”

Good point Barrister. An interesting statistic to follow going forward is the ratio of SFH’s and condos that are listed for sale that have been used as rental properties vs those that were used as principle residences.

I wonder if Marko or LeoS have access to this data on the realtor computer system?

Thanks everyone for the history lesson. Interesting times ahead.

Gwac – The NDP certainly had its share of scandals. I was just a young buck when the NDP were in power, but I remember “Bingogate”, if only because Mr. Harcourt resigned in shame. The fast ferries project was an abject failure. One for the ages. The NDP also cooked the books to hide that they were running deficits. Those two scandals alone, probably sank them. Net interprovincial migration also turned negative in the late 90s.

The notion, however, that the NDP “ruined” the economy, or that the 90s were just a dismal decade is false. The statistics just don’t bear this out.

One more thing: The NDP implemented pretty harsh welfare reforms that cutback eligibility of single employable people (Harcourt called them “cheats, deadbeats, and varmints”) and reduced the maximum payable benefit.

http://www.bnn.ca/toronto-housing-market-at-turning-point-realtor-says-1.768854

Toronto market not looking so good. Those who bought in Feb/March. Ouch.

Vic

Thanks for the summary. Not a great record as a whole. Still the best place to live. 🙂

gwac, yes that was true – but every political party in BC has made a mess, including the Socreds & Liberals. It’s what BC has always been known for.

It doesn’t matter who’s in power – right now, it happens to be Clark & the Liberals. They needed to stop saying “Jobs for Your Families” – what’s the point of a job if you don’t have a home to live in for your family. Also the RE corporate donations are a disgrace.

Everyone remember the Van der Zalm years (Socreds)? I still have a red book called “Quotes from Chairman Zalm”

https://www.theglobeandmail.com/news/british-columbia/vander-zalm-describes-career-killing-envelope-of-cash-amid-lawsuit/article543238/

“Dressed in dark slacks, a neat plaid jacket set off with a gold tie, and flashing his trademark, high-wattage smile, former premier Bill Vander Zalm described in the Supreme Court of British Columbia how his career was brought to an end – and he tried to justify accepting an envelope stuffed with cash from a Taiwanese billionaire.”

BC Legislature Raids (Liberals):

https://en.wikipedia.org/wiki/BC_Legislature_Raids

Hearings began in BC Supreme Court in April 2007. The proceedings brought to light questions concerning the propriety of the sale of BC Rail to CN Rail and the conduct of various government officials and consultants as well as the role of various members of the government, including Premier Gordon Campbell and his advisers. In October 2010, ministerial aides Dave Basi and Bob Virk pleaded guilty to breach of trust and receiving a benefit for leaking information about the BC Rail bidding process.

BC Political Scandals:

https://en.wikipedia.org/wiki/Category:British_Columbia_political_scandals

“Is this stuff true?”

Yeah, though I seem to remember there was more:

remembering the RCMP raid on Glen Clark’s home

Former liberal voters voted for ndp/green for three main reason.

Christy has a very bad public image. She come across as not being caring.

Liberal way of raising money.

Their environment record. Example Shawinigan.

Liberal need to get their act together and tackle all three items quickly.

She actually did more than the ndp would have done to stop Vancouver house prices. Although she waited too long.

“The ndp and greens were voted in by homeowners because they also want to see sanity come back to this market. ”

Agree – that’s exactly why you saw the NDP winning across urban centres in BC especially in Vancouver.

A lot of boomers in Vancouver are fed up with the high prices because their kids are moving away. Some have cashed out, partly to retire earlier, and partly to get away from a city that’s not changing for the better.

We’ve heard from people from a wide range of ages – early 20s to 80s – from uni kids to businesspeople to retired folks – and all of them have complained that the Liberals have sold their future to speculators. The concerns with lack of affordable housing for the middle class have spread across all age groups, because it affects individuals and business owners alike.

Was not here. Is this stuff true?

https://www.facebook.com/BCProud/videos/1887138688230003/

In fact, there are so many similarities with the 1980s, it may be worth using today’s release and the ’80s fractal to venture a guess on the next top.

For the homegamers, on the left is today’s release and on the right is Vancouver attached cut’n’paste on top of 80’s prices (easier to line up). Would make for a great psychological set up, breaking to new highs first over the next few months.

http://i.imgur.com/i989JEc.png

David Eby, the most vocal NDPer on real estate controls in a district with high ownership levels and that probably saw some of the most out-sized gains over the years, received 55% of the vote (47% in 2013). What do you think that shows?

People will freak out if housing prices tank hard. OTOH I don’t think a gradual return to the prices of one year ago will hit that hard. Bottom line is 57% of British Columbians voted for parties that made a pretty big deal in their platforms about the need for housing affordability, cooling the market, clamping down on speculation. 40% of British Columbians voted for the party that is notorious for being in bed with developers and only acted at all on the housing market when doing nothing became politically untenable.

Cracks beginning to show ?

Viking Air to lay off 212 as slow sales hit production

“Layoffs will affect 136 unionized production workers in North Saanich and 76 in Calgary.”

http://www.timescolonist.com/business/viking-air-to-lay-off-212-as-slow-sales-hit-production-1.20294513

“Reaganomics then, Trumponomics now”

Trump and crew are neutered and he’s lawyered up for the upcoming criminal charges and impeachment. Trumponomics is a figment of your imagination.

< Toronto bubble peaked 1989

< BC NDP won 1990

2017 BC NDP won, bubble peaked this year. Look out below.

Really? Seems highly unlikely. My guess is that an opinion poll would show the vast majority of homeowners do care about this – a lot. I think the vast majority of homeowners would support market cooling measures though.

Doubt it. Most homeowners would, imo, prefer to have home equity and help their kids out. I personally wouldn’t mind seeing prices level out and drop a bit, but I doubt I’m in the majority for the drop although the majority may be for house price stabilization.

The liberals were voted in. The NDP and Greens were not – they are making a play at a minority government based on a coalition and platform that was not presented to voters. It could work well, but it could also go south pretty quickly too.

My guess is that a high proportion of the 30% that rent voted for the NDP, plus those hoping to buy who think prices might drop. There were many other reasons to vote Green or NDP and none to vote for them together. My biggest reason not to vote Liberal was concern about improper corporate influence.

Why Garth will prove wrong again

Property owners are about to be screwed by the NDP, according to Garth Turner.

But Christie Clark evidently has other ideas. Her bet, presumably, is that at least one and perhaps four, five or six NDPers can be persuaded to accept cabinet appointments in a government of Provincial Unity.

Then it will be onward and upward until every square foot of Oak Bay will be worth more than the $139,000 per foot at which the Imperial Palace grounds in Tokyo were valued before Japan fell into an economic black hole.

Let me see, then my tear-down on Oak Bay will be worth more than I will know what to do with, which will confirm Garth’s absolutely trustworthy reputation for wrongness.

I don’t think we should hold the NDP responsible for the mistakes of the 80’s since that was all Socred – Bill Bennett, the crazy Zalm and shopping bags full of cash.

The NDP’s mistake in the 80’s was in not moving to the centre and actually winning elections.

@ Luke:

“I have to agree Margaret Thatcher did shape up Britain for the better.”

I’m not so sure of that.

Visiting Britain once or twice a year, during those days, it seemed to me that the majority of people were distinctly less prosperous than they had been during the years of Wilson/Callaghan rule — they had a distinctly more unwashed odor about them, which is not surprising since the Thatcher era opened with a massive increase in the rate of inflation plus the introduction of VAT (GST equivalent) at a rate of 17%, or thereabouts.

Governments only run out of other people’s money, incidentally, when the tax rate reaches 100%, and capital is expropriated, which is more or less what happened in Britain during WW2. Even in the 50’s, the top tax rate both in Britain and in the US was 85% or thereabouts.

Far more similarities than you’d think…

< post-WWI baby boom retired late ’80s, post-WWII boomers retiring now

< Toronto bubble peaked 1989

< BC NDP won 1990

< Reaganomics then, Trumponomics now

< rates fell rouhgly in half ’81-’87 and ’10-’16 (prices fell ’81-84 and ’10-’13)

< oil crashed 70% in 1986, oil crashed 70% 3 years ago

Those are off top of head, but there are many others.

So disappointing to read the comments on a new post and find out 5 of 18 are from Hawk.

gwac, most of the detached central areas like Burnaby, North Van, Delta South and Van Westside are stuck in the bull trap still as the medians are still down from a year ago.

Hawk just posting this article. Not making any claims on it or future prices.

http://business.financialpost.com/personal-finance/mortgages-real-estate/vancouver-real-estate-market-heating-up-again-as-sales-and-prices-rise

Fantastic comment stranger times – I just can’t pry myself away from this this morning! Ha! As a home owner, I’m also happy to see the change from corrupt Liberals as it will benefit all of society if there is more affordability. I’m just mentioning the fundamentals at play in the core which we can’t ignore, are not all caused by or solved by who’s in gov’t.

The article is also stating many current facts Hawk. Even though we may not like it that costs are going up and I did say it is isn’t a good thing that un-affordability continues to climb. Hopefully the new Gov’t can curb just all the development catering to the free market and getting some more diversity of development happening, though we are at least seeing rentals built again we do need more affordable types of housing than we are getting, otherwise we risk becoming another Vancouver. The change in Gov’t could well be the catalyst we need!

Yes, finally – the rich who were milking it under Chrusty, and corrupt elites are the ones panicking!

“Good comment just not a fan of able body people expecting others to pay for their way. ”

This harping on the unemployed system milkers is getting pretty lame. With an unemployment rate of 4% there can’t be many left gwac. Maybe you should report them if you know so many.

I bet there are more rich people milking the system than poor people with all the insider deals Christy has handed out in the multi-billions the last 4 years or more.

“Certainly an NDP government would earn little love from home owners if they crash the market by imposing multiple new taxes on RE”

Most homeowners could care less if the value of their home falls. Unless you move to a different city or downsize you’ll never see any extra cash. It’s mainly the speculators and over-leveraged who are in panic mode if this happens. Christy Clark was booted out because of the disaster she created in the BC real estate market. The ndp and greens were voted in by homeowners because they also want to see sanity come back to this market. More people would be happier if prices fall because their kids might actually have a chance of buying a place here. Look at vancouver where almost 90% support the foreign buyers tax. They know it decreases the value of their home but for most a home is just a place to live.

So true, and esp. given they won’t have a majority – I say this time give the NDP a chance. I don’t think they’ll necessarily repeat the mistakes of the 80’s and 90’s. We need a change from all the money and benefits going to elites and corruption, developers and wealthy. The disadvantaged, after 16 years, could use a ‘leg up’. This is just about the best way to get this change as the NDP majority would’ve meant they could’ve gone too far the opposite way. Now they’ll be kept in check!

Anyway, I now have a busy day ahead so won’t be able to respond anymore today…

Luke, you are quoting a media source funded by the real estate industry. Keep drinking the kool aid.

Let’s see, it only took 16 years to get the McKenzie overpass only because of an election gift to try and steal seats on the island that backfired in spades. How much did Christy and the Libs put into the new bridge ? Zero.

Who put in the airport roundabout ? Gary Lund the MP. This is the best thing to happen to Victoria and your so blind from wasting your donation money to see it. We might finally get the E&N train to turn into rapid transit from the Westshore.

On the flip side this city needs a growth breather. Every business cycle peaks then busts and that time is here.

Well Local Fool – this is where I disagree with you. It IS different now than in the 1980’s, sorry. The world is vastly different now and so is Victoria. But don’t just listen to me… have a read of this article I found on Vibrant Victoria…

http://victoria.citified.ca/news/perfect-storm-of-jobs-and-population-growth-pushing-victoria-real-estate-values-higher/

I see this kind of stuff all the time from long time Victoria people, and different opinions from the many who have left and come back, or new people here. Long time people who have never left still often think it is just a backwater and they somehow think in this globalized world it will return to backwater status once again. This is where they’re wrong as the world is so much different now than in the 1980’s. Whereas, I often see that new people and people who returned after leaving for a while, realize what we have here that is so special.

It would appear I’m not the only one who thinks we are in for some continued big changes here, and the old Victoria that you all knew before is… gone… forever. Face it, it will never be the same again. More population and fewer SFH as density in the core takes over means… guess what… fewer people able to afford or just even think about being able to live in SFH – in the core. The Westshore may well be on it’s way to be the new ‘place to be’, so to speak, as the core becomes so unaffordable for those who don’t want to live in density – that’s why we could use better transportation links between the two.

Luke

Good comment just not a fan of able body people expecting others to pay for their way. Seems to be a lot of that these days. There is a lack of understanding on how and who pays for programs.. I lived through the mess in the 80

s and 90s with deficits that killed our economy and our dollar. People need to understand in their own lives and their government that there is not an endless supply of cash. It can run out and the consequence are swift and ugly.Well gwac I have to agree Margaret Thatcher did shape up Britain for the better. Back in the 1980’s 1/3 of the population there was ‘living off’ the other 2/3, this has changed much by now but they still have a much more generous benefit system than BC (which is woefully inadequate). This is part of the problem as to why they have had too much immigration over the last decade. I lived there during her reign and it transformed Britain from the ‘sick man of Europe’ to the much more progressive technologically advanced country we see today (albeit, now with the new unfortunate problem of occasional radicalized fanatic blowing themselves up). I remember many strikes and outages caused by all her union crushing. Reform of British railway so they actually ran on time, etc. That said, union’s aren’t necessarily a bad thing – it’s just that when you get virtual monopolies that will never fail (like Air Canada for ex.) we can see that competition goes out the window as there’s no need, and service can go downhill.

As for our new era we are about to embark on here in BC. It’s not an NDP majority – I wouldn’t have wanted that. It’s going to be very interesting times as everyone will be kept in check and on their toes – and actually have to attend the sessions in the Leg. There are so much needed changes coming down the pipeline – like a $15/min wage (still inadequate, but a good start – a better idea would be to have a lower wage for younger than 25 year olds) and reforms to curb speculation and house flipping (question is, will we see the 30% foreign tax and if we do I don’t think much difference will be noticed here in Victoria anyway). Most notably, a referendum on proportional representation. Along with many other changes that will hopefully benefit our woefully inadequately protected environment.

I welcome the change and Hawk is quite correct that Chrusty is the most corrupt politician ever (but do you remember Gordo Hawk? – he was really bad too).

Introvert

That is running out of other people money. Eventually over taxing leads to less revenue. Economy slows down. People move or the underground economy flourishes. Other way is to borrows, eventually that flow ends also,

Marginal rate in BC is closer to 50% 47.7% to be exact.. Which is crazy and going higher under those two idiots.

“Other people” have never come close to running out of money. Currently, all it takes for nonstop bitching and moaning is 40% taxation.

Great quote on socialism. Basic economics that even you Hawk can understand….

Margaret Thatcher

“The problem with socialism is that you eventually run out of other people’s money.”

It will be interesting to see if the speculators start dumping their houses over the summer. Actually is there are way of knowing how many houses were actually flipping after about a year here in Victoria?Any way of tracking this moving forward? I know everybody talks about all the number of short term speculators but are there any stats that might indicate how many houses are actually bought by speculators?

Christy will never be there, she hates Victoria and the rest of the corrupt gang will weaken as the books get opened up to reveal all sorts of illegal money shifting. Christy is about to be just a blip in BC history as the most corrupt politician ever.

She’s waiting til late June so she can ram through some final deals for her palm greaser insiders.

Development lots in False Creek Flats offered in untendered deal that needs provincial approval

“Postmedia News informed NDP MLA David Eby of the proposed deal and he said he would be concerned if the deal was rushed through for approval. He said an NDP-Green government might want to see Lots 6 and 7 used for ideas from their election platforms, such as promotion of affordable housing or technology development.

“I’m really unhappy that a major land deal might go forward untendered, when the province has a gap between two governments,” Eby said. “And if this deal allegedly involves big B.C. Liberal donors, I don’t think it is appropriate.”

http://vancouversun.com/news/local-news/development-lots-in-false-creek-flats-offered-in-untendered-deal

short article on where we are with a government

http://news.nationalpost.com/news/canada/a-single-mla-with-diarrhea-could-topple-a-b-c-ndp-government-a-playlist-of-just-how-crazy-things-could-get-in-bc

Another reason for a 30% province wide foreign buyer tax. This is even more scarier.

Why every housing bubble looks like the new normal

“This time is different,” buyers tell themselves. They’re right—until they’re terribly wrong.

Investment guru John Templeton is known to have remarked that “this time it’s different” are the four most dangerous words for investors. Economists Carmen Reinhart and Kenneth Rogoff published an entire book on the subject in 2010 and examined eight centuries of financial disasters. They found “this-time-is-different syndrome” pops up again and again. “It is rooted in the firmly held belief that financial crises are things that happen to other people in other countries at other times,” they write.

http://www.macleans.ca/economy/why-every-housing-bubble-looks-like-the-new-normal/

http://www.macleans.ca/economy/economicanalysis/chinese-real-estate-investors-are-reshaping-the-market/

WOW, THAT IS SOME ARTICLE.