Paying the Vig

Thanks to Bman for posting the link to the mortgage arrears stats compiled by the Canadian Bankers Association.

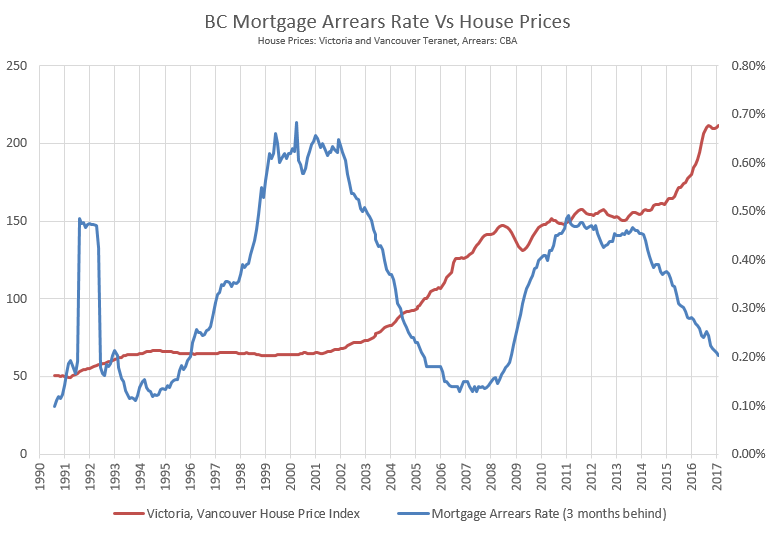

The big factor that influences mortgage arrears is the unemployment rate. You can’t very well pay your mortgage without a job. But the other factor is house prices. Even if you don’t have a job, if the market is going up you can take equity out of the house or you can sell for a profit with no problems. So looking at the BC stats, is there any relationship between house prices and arrears rates?

Pretty interesting how arrears tend to increase and stay high when house prices are flat or declining, and drop when they go up.

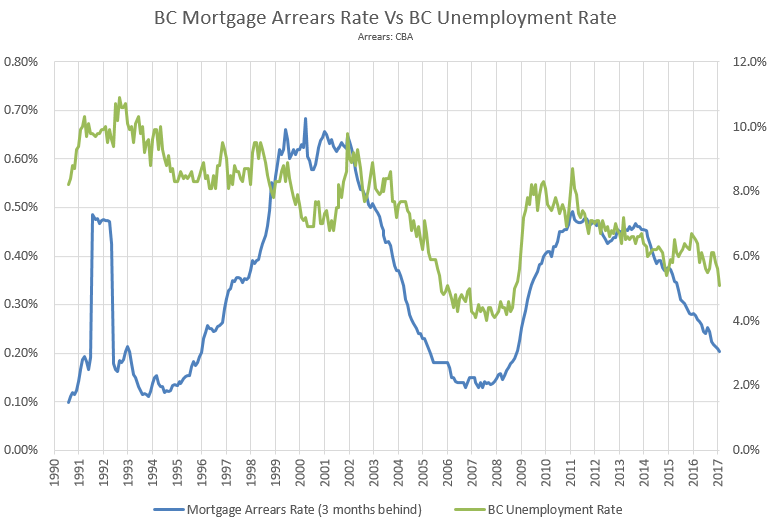

If we look at unemployment rate, we definitely see a strong correlation during the 2000s, but interestingly enough a stubbornly high unemployment rate did not seem to cause high arrears before 1995 (when the real estate market topped out and started stagnating).

Perhaps we need both? High unemployment is not enough to cause high arrears rates, but if house prices are flat or declining at the same time, it will cause arrears to spike.

“Certainly an NDP government would earn little love from home owners if they crash the market by imposing multiple new taxes on RE”

Most homeowners could care less if the value of their home falls. Unless you move to a different city or downsize you’ll never see any extra cash. It’s mainly the speculators and over-leveraged who are in panic mode if this happens. Christy Clark was booted out because of the disaster she created in the BC real estate market. More people would be happier if prices fall because their kids might actually have a chance of buying a place here. Look at vancouver where almost 90% support the foreign buyers tax. They know it decreases the value of their home but for most a home is just a place to live

As someone who grew up in Victoria, it was sad for us as a family to have to pack up and move away from the market because it was just not affordable for a young family when we bought around 2010. We decided to make a move up Island where prices were still reasonable, albeit work was more scarce. The Island is certainly a beautiful place to live, though.

Nice weekend! Sorry I missed the open house, out enjoying the sunshine in other places…

New post: https://househuntvictoria.ca/2017/05/29/march-29-market-update/

“Vancouver Supreme Court is swamped with foreclosures applications today.”

How many is “swamped”?

Vancouver Supreme Court is swamped with foreclosures applications today.

If you mean in terms of bears missing out yet again I’d say yes.

Wonder if the summer is going to be a scorcher….

Hawk posted the deeply-researched and thought-provoking graph today. So did Garth.

For the emoticon generation this is what passes for discourse.

You’re as greedy as I am, Hawk. Except I’m smart and didn’t sell just before prices skyrocketed (again).

https://www.theglobeandmail.com/real-estate/vancouver/what-vancouver-can-learn-from-the-vienna-model-for-affordablehousing/article35128683/

What can Vancouver (and Victoria) learn from Vienna about working towards resolving our housing crisis? Interesting article, and there is a lot of Federally owned land in the CRD that could be put to more use of housing. Where there’s a will there’s a way. I’m really glad the Liberals didn’t end up with another majority, and now the Greens hold the cards who will they team up with? We should see soon… and will they do anything about the housing affordability problem in both Van and Vic?

Well since all the price reductions have been mentioned, we may as well mention some of the homes that all sold over asking recently…

2804 Cook St. Listed at $998,800 Sold for $1,100k

3552 Kelsey Pl. Listed at $995k Sold for $1,250k

1265 St. Denis St. Listed at $1,095k Sold for $1,245k

1712 Monteith Listed at $1,295k Sold for $1,428,500

1772 Kings Rd Listed at $699k Sold for $703k (right next to Spirit Garden, and with a large lot).

Many more homes are going for very near asking. Some people overprice their homes and they either don’t sell or sell under asking. Some people price homes low to incite bidding wars. Some don’t even know what their home is really worth and are totally clueless… like 3553 Redwood – now re-listed for $1,795k in my opinion still at least a few hundred grand too high (will I be proven wrong?), esp. when you compare it to what nearby Kelsey Pl. sold for, it’s probably only worth maybe up to $200k more than that.

There’s a target market for every home – some homes have a very narrow target market, like the place at 222 Dallas Rd by the cruise ships that finally sold for $1,925k after originally being listed for $2,225k.

The market is constantly changing and as we saw in late 2015/early 2016 when the market started to take off – some people were caught ‘off guard’. Others didn’t see the writing on the wall before this and now probably regret selling if they did then.

We also went to the open at Kinross after the Spirit Garden, and were impressed but thought perhaps the price was slightly too high for what it is. We will see what it goes for.

Morneau is going after the money launders and tax evaders as well as those with their private corporations trying to dodge tax. This will have a huge impact on foreign money and the small time property pimps like Bearkilla. Escalator up, elevator down. 😉

Morneau is going to do what Harper didn’t have the balls to do that would expose his buddies.

Finance Minister Bill Morneau vows to close ‘unfair’ tax loopholes

Commitment follows a Star investigation that detailed a culture of corporate secrecy that remains entrenched across the country.

https://www.thestar.com/news/world/2017/05/26/finance-minister-bill-morneau-vows-to-close-unfair-tax-loopholes.html

Cherry picking Bearkilla ? Price reductions are listed daily and increasing at a higher rate than I’ve ever seen in prime hoods and mostly all very nice places. That’s a sign of a weakening market regardless of a few bidding wars. I see more overall listings in MLS in a long time as well, more price slashes are inevitable.

Of course you don’t want to admit that nor hear that the bottom is going to fall out of the bubble. The more you post the more it’s obvious your being kept awake at night.

Another thing about prices in this market – sellers don’t seem to know exactly what to list houses for. One seller might list it based on the recent upward trend of prices and another seller might stick with recent sold prices in their hood. Then I’ve seen the first realtor being blamed for over-pricing and the second one being accused of under-pricing to get a bidding war started. It’s hard to know where the price point really is.

To me, the over-priced ones are the ones that are missing something for their target market, eg, no ensuite or family room or dining room in a hood where other houses have those (so you can’t expect the same price).

2617 Cadboro Bay Rd is a funny one.

Listed @ $899k, DOM ~2 weeks, cancelled

Listed @ $849k, DOM 2 days, SOLD @ $865k

Original / Asking / Listed / Sold prices and DOM aren’t a good tell tale signs for the market.

Well cherry picking price reductions is apparently a solid methodology for judging market sentiment for some people. The conclusion is always the same… The market is tanking. For more than a decade.

How long does Vancouver bounce back when they are in the throws of the classic bull trap and Toronto is showing signs it’s about to blow up ?

The market is based on greed and emotion and the sentiment in Toronto has been like a kick in the guts with inventory tripling in short order.

The longer those headlines play out, the more it creeps into the buyers minds to back off and see what happens. No one wants to be the last fool in the pool.

http://2.bp.blogspot.com/-ZWsQNhB12M4/Tf161ZP8iFI/AAAAAAAAAu4/iEFXxNao1KU/s1600/800px-Stages_of_a_bubble.png

Asking prices individually do not mean anything. But in aggregate they do. Average sale price / ask ratios are a good reflection of the market, and if the proposition of price reductions increases then the market is weakening.

Not the best measure though, DOM probably more direct.

Bah, asking price has never revealed much. Overpricing and underpricing have both been plenty common the past couple of years. The only things that matter are sale price (& history), volume and inventory. The resale metrics (Teranet e.g.) would be ideal if it weren’t for their failure to track improvements.

A listing that requires a price reduction in order to sell is by definition overpriced. If it wasn’t it would have sold (assuming adequate market exposure)

@Leo “So in your mind, there is no such thing as a price reduction,”

You missed my point Leo, I was talking about overpriced listings and I gave an example.

Contrary to public opinion, it is often not the realtor that sets some of these ridiculous high prices but the sellers themselves. Realtors will recommend a price range and the sellers insist on a higher valuation. After a few weeks pass sellers then relent and lower their price closer to what the realtor recommended but now they have lost those key first two weeks and promoting the property becomes a lot more challenging. Are there any sellers out there that will admit to this? I am sure other realtors will back me up on this.

Yes great to meet you all at the spirit garden! Beautiful day for it, and huge variety of plants and flowers – fantastic work by the whole neighbourhood. We also stopped by the open house on Kinross – it was busy but we were a bit surprised by the price – interesting to see what it goes for.

So in your mind, there is no such thing as a price reduction, since every single price reduction in history only happened because the original price was too high. If it wasn’t, it would have sold at the original price.

Investopedia did not conduct this survey and this is not a technical term that has a single accepted definition. Unless the survey company posts their definition, they are losing the term more loosely. I actually don’t see any evidence that the question in the survey even used that term, so it is not a good summary of the results. It was created to get headlines.

Hawk, stop making quick conclusions from media hype. Vancouver did the same thing, but listen to the Vancouver Housing Podcast and you’ll see how strongly the market has rebounded. Even Tom Davidoff concedes that his bearish predictions for Vancouver didn’t bear out.

https://itunes.apple.com/ca/podcast/vancouver-real-estate-podcast/id1078731249?mt=2&i=1000385312866

You know it’s a beautiful sunny day right?

To all who attended the spirit garden open house – great to meet you! What an inspiring place and great way to build community. I was impressed!

Holy shit, things are getting ugly ! Funny how fast things can change when the greater fool pool runs dry.

GTA home sales plunge as much as 61 per cent

“A nervousness has crept in and seems to be taking hold quite quickly,” said Andrew Harrild, vice-president of Condos.ca.

https://www.thestar.com/business/2017/05/26/gta-home-sales-plunge-as-much-as-61-per-cent.html

All the high end digs in James Bay have taken some slashings too. 118-21 Erie St slashed 60K, Shoal Point has a couple in the $200K plus slash range. Big money trying to get out while they can.

Bearkilla and gwac can’t handle the increase in price slashes and have to resort to attacking the messenger. Too bad you’re losing money by the day by playing the property pimp, soon to be property chump.

Never seen so many price slashes in such a short period of time. With Toronto down 10% in a month, and buyers walking away from deposits this is setting up for one mofo of a cleansing.

BEARKILLA:

I dont think that the end of the world is here yet but in fairness there are some signs that the market may plateau out. I would certainly think twice before buying an investment house although if you are looking for a principle residence then the equation is a bit different.

http://www.timescolonist.com/news/local/passerby-finds-woman-s-body-in-bowker-creek-oak-bay-police-1.20247475

Oak Bay is losing its charm…

408 Goward is looking like a wonderful place for a commune sanctuary.

Still a completely terrible market for bears. Every single year you fools are getting further and further away from ever owning anything. Must be completely depressing to be so wrong for so long. I hope no one listens to the doom and gloom because they’ll regret it.

Totoro:

Thank you, your numbers were very informative. They at least provide a clearer picture of the overall situation.

Got my tax bill. Assessment up over 20 % bill up 5%. I was expecting worse.

I see price slash Hawk is at work keeping us all informed of the dooming crisis.

Lovely villa townhouse at 11-1880 Chandler Ave slashed $40K, now under $1 million mark. Fairfield must be tiring out as of late with the new build having to slash too.

Even Dallas Rd new builds can’t find the love. 226 Dallas slashed $202K.

I’m very curious to see the average sales price for the month of May. If I recall correctly, it peaked in January and dropped every month since then. I’m thinking May might be flat or slightly up, then I am looking to see it drop into the summer quiet season.

Overbidding on tactically low priced homes and price slashes on overpriced homes…it all comes down to the wash on monthly average sales price…in my opinion.

Correction….. Agents who “don’t” want to starve don’t overprice by $150K

Agents who want to make money price them accordingly to what the neighborhood has been getting for their recent sales. Slashing $150K in just over a month in prime Oak Bay and Golden Head is a sign that the big money is slowing down.

Agents who want to starve don’t overprice by $150K in prime territory nor $450K in the Uplands.

The increase in price slashes in a low inventory market also shows that. It’s not rocket science, it’s a bubble showing it’s warning signs. Why do you think Marko sold out one of his hot properties ? I bet Mike has dumped all of his.

What constitutes a price reduction? An over priced property that then reduces to a realistic value is not a price reduction in my opinion. It would be an over priced property. Some sellers over price and wait till the market catches up to them. 332 Irving Rd is just such a listing. It has been overpriced for a long time but slowly the market is edging towards its value. It will be interesting to see if the seller finally caves or waits it out.

Totoro: “I view borrowing for home ownership as a lower risk overall than most other types of borrowing.”

I believe that you believe that Totoro but let’s take a look at how the Mortgage Brokers look at things. Apparently, OSFI has really put a dent in mortgage lending now that they’re actually requiring decent FICO scores. Hmmm kinda makes you wonder how many slipped through prior to the new rules.

https://www.canadianmortgagetrends.com/2017/03/more-rates-now-hinge-on-credit-scores/

Ever since the banking regulator (OSFI) jacked up capital requirements on default insurers, and linked its capital formula to credit scores, more and more securitizing lenders have:

a) set different rates for different credit score ranges; and/or

b) raised their minimum credit scores for given mortgage products.

At some lenders, borrowers with, say, a 640 credit score are offered rates that are 1/4 point worse than someone with a 750 score. Many retail channel lenders set their internal discounts based on credit scores as well.

http://www.experian.com/blogs/ask-experian/credit-education/score-basics/640-credit-score/

A 640 credit score on the FICO score scale of 300-850 is considered fair. People with this credit score may be considered subprime borrowers and may be offered higher interest rates or less ideal terms for credit cards and loans.

The Asian contagion will sink Intorovert’s greed in a hearbeat as the money is choked off.

Chinese investors pull out of Melbourne apartment market

“In the past, they helped drive the inner-city apartment market to new heights. Around 5,000 new apartments are expected to be completed and up for sale this year.

However, around 80 per cent of Chinese buyers will not be able to settle because of trouble getting finance, according to Ming Li, a real estate agent in Melbourne’s eastern suburbs who specialises in selling Australian property to Chinese investors.

He said many of his clients had either forfeited their deposits or sold their apartments at a loss.

“The Melbourne apartment market is cooling down,” he said.

“It is kind of the oversupplied market, and the Chinese investors are losing their interest in buying an apartment in Melbourne. The capital gains return is so low.”

Another reason for the downturn relates to the Chinese government’s restrictions on its citizens’ ability to move money offshore.”

http://www.abc.net.au/news/2017-05-25/chinese-investors-pull-out-of-melbourne-apartment-market/8557182

“@SteveSaretsky

Steve Saretsky Retweeted

RE/MAX Condos Plus

So about a 10% price drop in Toronto real estate virtually overnight…”

Yikes, 10% price drop in a month via Remax agent …. coming soon to Victoria where no one is immune.

See many condos reduced already the last few weeks, just haven’t bothered to post them all.

Great idea!

4086 Tyndall Ave—$112k over asking. On a very busy road.

I doubt it. And your writing is atrocious.

Barrister, since you’re new in town I’ll fill you in. Victoria has always been late to the game for decades to react to global changes wether it’s music, culture, or financial. It’s the “won’t effect us” mantra, and then it does.

Watch for more holes in the ground in the coming year as the pre-sales can’t flip them higher as the greater fools pool is depleted.

Why can’t Bear Mountain get their own money to complete all their big deals they promised just a year or so ago, and are looking to sell out ? Canary in the coal mine.

“My take is that qualifying to buy a house screens out many people with poor credit and lower income/net worth – unless they have a cosigner.”

It’s not the poor credit, it’s those who get mortgages through liar loans based on their incomes being falsified in order for the mortgage broker to get the sale.

With shadow lending at 50% of the banks lending you have to be totally naive to not see what is happening. Everyone is a genius in a bull market that is over extended by cheap credit and shady lenders.

As Warren Buffet says: : “There’s never just one cockroach in the kitchen”.

Yes it would, much better than a survey based on feelings.

About 40% of the net worth of Canadians was in RE in 2012.

3.5% of working Canadian households have no wealth and limited incomes – these folks are in trouble with one missed pay cheque and would quickly need social assistance – most of these people are single parents, young people and new immigrants – and they rent.

The bottom 20% by combined net worth and income have a median net worth of $8700. These folks will likely have less than 5k in liquid assets. They mostly rent.

The median net worth of the other quintiles is below and most of these folks will have 5k in liquid assets based on the stats, but there will be some who will not for various reasons, including illness, divorce, addictions, and overspending. I haven’t found specific stats on this.

Second quintile 113,500

Middle quintile 236,900

Fourth quintile 388,200

Top quintile 879,109

My take is that qualifying to buy a house screens out many people with poor credit and lower income/net worth – unless they have a cosigner. Among homeowners, there is a relatively small proportion of borrowers holding a large proportion of total debt, including those who are new purchasers.

If the economy declines and jobs are lost this would likely lead to home value declines imo and newer home buyers could quickly become insolvent and, at the same time, could experience job loss. If interest rates rise but jobs are not lost many new homeowners could hit the pay cheque to pay cheque criteria, particularly those who used a cosigner to borrow.

I view borrowing for home ownership as a lower risk overall than most other types of borrowing. However, those that become highly indebted for home ownership are at an increased risk of financial insecurity and insolvency for a number of years should they become disabled, lose their job, or get divorced. Those borrowing with a cosigner, which is likely on the increase, are at particular risk given that they may be taking on more debt than they can handle if conditions change.

We’ll know more about mortgage debt and financial security when the new survey data comes out.

Kersac:

That is a relief to know; I was actually worried that it was the poor working class that was buying in the Uplands.

Here is another one for Hawk. 1265 St Denis; asking 1,095 and sold for 1,245. 150k over asking. On the market for eight days.

Personally, I am completely unsure were this market is headed at this point.

It the middle class people piling into overpriced real estate you have to watch our for not the poor working class priced out of the market. It will be interesting to see where these graphs head in a years time.

Plumwine:

In fairness lots of working class people manage to successfully budget within their means.

Your buddies just don’t want to hangout with you! 🙂

Even governments rule by the “smartest” people on Earth running a deficit, how can small potatoes working class balance household budget while they have no control on policy making?

Vicinvestor , there wIill always be someone paying too much with no conditions if more than one person wants their house even in a down market. Those bidding wars are on the decline.

It’s apparent the price slashes have increased of late in prime hoods and I understand there are more places getting conditional inspections.

Interesting discussion geared towards RE.

https://www.alumni.ubc.ca/podcasts/can-victoria-saved-popularity/

I suspect that a fair percentage of Canadians would have trouble making ends meet after a few missed paychecks but not anywhere near 50%. Rather than dealing with averages, median or otherwise, it would be more illustrative to know what percentage of Canadians actually have a net worth of less than 5,000 in liquid assets. Also of those that have less than 5,000 how many have no or very little home equity.

What to me is a red flag is the number of pay day loan offices I have seen in Victoria. Having said that, I would also point out that Victoria may be statistically atypical of many other Canadian communities. What I am suggesting is that it might be more informative to look at tranches of income rather than at a medium average.

Hope I have not just added fuel to the fire. In terms of the real estate market one might also consider that job losses dramatically increase the rate of eventual divorces which increases the number of houses on the market. Unemployed husbands in particular have a relatively short shelve life.

Hawk, we should all post a strong sale for every ‘price slash’ you post. We just to balance out your apocalyptic and negative world view. Here is one: 1717 Gonzales for 1.33 mil. $130 overasking & unconditional.

Totoro: “Given the qualification criteria for mortgages, the villain will not generally be mortgage debt imo, but other debt incurred besides a mortgage, combined with job loss, disability, divorce and addictions.”

I’m not sure that we are going to see eye to eye on the whole issue of debt, Totoro. You are seemingly focused on Statscan average and median numbers whereas the bigger problems are provincial. Apparently, the Bank of Canada agrees with me.

http://globalnews.ca/news/3128802/rising-household-debt-menaces-the-national-economy-bank-of-canada-warns/

In its latest financial system review, the bank says at a national level the proportion of highly indebted borrowers with mortgage-to-income ratios above 450 per cent reached 18 per cent in the third quarter of 2016, up from 13 per cent two years earlier.

The report says high home prices have helped fuel growth in the proportion of these highly indebted borrowers in cities like Toronto, where in the last two years the proportion of highly indebted borrowers increased to 49 per cent from 32 per cent, and in Vancouver, where it rose to 39 per cent from 31 per cent.

I personally have friends and family that have told me they are living paycheque to paycheque. Some are homeowners and some not. The non-homeowners have university debt. They can’t land the jobs they want and fear they will never afford a home. The homeowners don’t have any savings and worry about job loss and losing their homes. They also complain about school cuts and buying school supplies that are no longer provided when they went to school, price of food, bills, daycare costs, bills, gas, et cetera. I really do think there are a lot of people living with heavy debt loads. My brother worked for a collection agency years ago and it was a full time job. he was shocked at the number of people who were in debt. He said it was depressing to hear people say they couldn’t pay their bills or loans. He said he came across people from all walks of life, even a lawyer whose BMW car payments were in arrears.

The BoC report says highly indebted households are at greater risk in the case of job loss. It doesn’t say anything about missing a single pay cheque.

Highly indebted households are a growing minority of home owners and 8% of all Canadian households, including renters. New homeowners are at higher risk. Most who have just purchased for the first time also probably have very limited liquid assets, or other assets for that matter. Dropping house values and job loss could disproportionately impact the solvency of new owners pretty quickly.

I agree with the report cited below and the one here:

http://www.bankofcanada.ca/wp-content/uploads/2015/12/fsr-december2015-cateau.pdf

Even people who aren’t literally living paycheque to paycheque often cannot meet debt obligations if they lose a job and cannot replace it quickly. This becomes more of an issue when they can’t sell their house for the same or higher than they bought it. See the Bank of Canada report linked below.

Maybe Leo. I used the defined term. And think carefully about the fact that the median household has 100k – likely at least 150k now – in liquid assets. How can 50% of Canadians be unable to meet monthly obligations upon a missed pay cheque while at the same time saving amassing this amount of savings, never mind the greater amount of home equity the median household has.

http://www.investopedia.com/terms/p/paycheck-to-paycheck.asp

I’ve worked with many buddies over the years in good paying jobs with kids who were cash poor and couldn’t even go out for beers etc once in awhile . Real life with kids cramps your finances bigtime even when you own a house. They are both money pits wether you want to admit it or not.

Totoro who was a lawyer making big bucks can say they don’t know anyone due to her high end circle. McLeans article states even those types are now increasingly finding their way to the insolvency trustees office for financial debt problems with many more to come.

Should be, ” you are in danger of being hard-pressed to meet your monthly obligations and living pay cheque to pay cheque”.

The issue here is that for a survey like this the interpretation is up to the person answering it, and you are choosing to interpret it a different way. Unlike what you are saying, the term “paycheque to paycheque” is not strictly defined.

“Many working Canadians are barely making ends meet. About half (48% nationally and 53% in B.C.) report it would be difficult to meet their financial obligations if their pay cheque was delayed

by even a single week.”

What does it mean to be difficult to meet financial obligations? To me that means I don’t have enough money in the account. If I had to liquidate some TFSA investments that makes it difficult. You are assuming that it doesn’t get difficult until you’ve exhausted all liquid investments. I don’t think this is a sound assumption and doesn’t match how most people would answer this question.

I do agree that the result doesn’t mean that 50% would be in real trouble with a delayed paycheque, they would just have to dip into other accounts.

It’s not my definition JD. Go look it up. Little or no savings and can’t meet your monthly obligations with your income or liquid assets and you are living pay cheque to pay cheque.

Liquid assets generally include:

Cash

Deposit account funds (checking and savings)

Certificates of Deposit (CDs)

Stocks

Mutual funds

Bonds

The median Canadian household has more than a years’ worth of liquid assets and the savings rate plus the accrued investments means, imo, that people are not spending every last cent of their pay cheque each month nor are they generally accessing their liquid assets.

If you want to debate whether the definition should be expanded to include home equity I’d say we would reduce the number of pay cheque to pay cheque qualifying folks and expand the buffer for homeowners from falling into this category at the same time.

Year nine (?) and the sky still is not falling. One day.

So how much of your pay cheque is left over after paying the bills?

Not including cashing in your RRSP or TFSA or line of credit or dipping into your savings.

Can your monthly income pay your monthly debts?

My guess is that a significant number of Canadians refinance their homes on regular basis in order to consolidate debts so that they can make those payments. Converting high interest credit card debt into long term low interest rate debt in order to get those monthly payments down. But would that be considered living from pay cheque to pay cheque?

According to some on this blog – it wouldn’t.

Of course, but the posted stat was that 50% of Canadians are living paycheque to paycheque.

I posted the median household stats can information for all savings and investment types. I also pointed the wealthsimple stats for average liquid assets (agree average is not the best and the number is over 200k).

The median Canadian household has a significant amount of liquid assets, mostly in TFSA, RSP and other savings, more than enough to cover a missed paycheque. Enough to cover a years’ worth of missed paycheques for the median household. Here are the median numbers from 2012 and the numbers have gone up since then:

Deposits in financial institutions

4,000

Mutual funds / investment funds / income trusts

50,000

Stocks

30,000

Bonds (saving and other)

3,000

Tax-free savings accounts

10,000

Half the people have this much or more. The survey information makes no sense. It seems to me that most people are not reading the data, they are reading poorly written articles based on other poorly written articles.

My best guess is that about 20% of Canadians, made up of mostly those that do not own homes and those that do own homes but are retired on a fixed income, live paycheque to paycheque. The number of homeowners living like this could increase with a rate increase, but would increase with a spike in unemployment imo.

John Dollar said: “vacancy rates did play an important role in the crash of the 1980’s real estate market. ”

I was there, John is right. The other big factor in the crash was that banks insisted people maintain at least 20% equity at mortgage renewal time, but as the market value of houses decreased many people had less than 20% equity at mortgage renewal time. The bank gave mortgage renewal applicants two options; 1. Pay down the mortgage with a cash amount that would make the renewed mortgage equal to 80% of the banks assessed value, or 2. Sell your house and pay off the mortgage.

I personally knew several people caught in this situation, most people sold their houses because they could not get the cash to pay down their mortgage. A few lucky people got enough cash from friends and relatives or from savings to reduce their renewed mortgage to 80% of the banks assessed value. CMHC insurance will not prevent this scenario from happening again, the insurance will just prevent bank losses from mortgage defaults.

Luke – “Rare quality house not priced absolutely ridiculous just came up in North OB: 2200 Kinross Ave at $1,149,888 (what’s with all the 888’s?). Not often something like this comes up, this is what I mean by ‘quality’ and I’ve often admired this house while walking past. This one will sell fast.”

The 8’s often tend to be directed to Chinese buyers. Happens in Van frequently.

“Numerology – This may raise some brows, but Chinese buyers have a propensity for the numbers 6, 8, and 9. Considered lucky numbers in Chinese culture, 6 (六; liù) in Mandarin sounds similar to the Chinese word for ‘flow’, thus 6 indicates ‘everything will run smoothly’. 8 – the luckiest number for Chinese – signifies prosperity and wealth, while 9 in Chinese is similar to the Chinese word for ‘longlasting’ and ‘permanence’. In short, the more 6, 8 or 9 is included in a house number, floor level or price, the better. And before you scoff, a savvy agent in Australia scored an A$8.5 million sale to a Chinese buyer – just by changing the number of a luxury home from an inauspicious 64 to lucky 66!”

https://list.juwai.com/news/2015/10/9-things-chinese-look-at-when-property-hunting

Neither an increasing net worth nor the savings rates precludes the possibility that a large percentage are living paycheque to paycheque.

To me that term means having no easily accessible cash. Net worth is often in real estate or in retirement accounts and pensions that can’t be easily accessed.

Also citing average savings rates is meaningless when it very well could be that the ones living paycheque to paycheque aren’t saving and the average is from a higher rate in the other group

Well Bman, vacancy rates did play an important role in the crash of the 1980’s real estate market. As BC was in a recession and jobs were scarce, many people left the province for better opportunities in Alberta and Ontario. The shrunken economy also gave rise to the boomerang generation that moved back in with mom and dad.

Vacancy rates increased and that left a lot of landlords short on their mortgage payments. From speaking with landlords that went through that 1980’s market they explained that they were caught between a rock and a hard place. And one by one their vacant rentals went into foreclosure. The residential investor became a unicorn with no equity to buy up rentals the market fell to the level were only those that had not bought a home and still had a job could buy. And that was a long, long way down from the peak.

No, they are not. Reliable stats do not support this conclusion. The Manulife survey was of a non-representative sample and there is no claim to validity made.

Reliable stats show mortgage debt is rising, as is net worth and savings. As the median net worth includes significant liquid assets, 50% of people are not living paycheque to paycheque. I’m not sure how many are, but it is not that many.

The median net worth of Canadians was $243,800 in 2012. It has risen since then. The important number for paycheque to paycheque is liquid assets – those that can be accessed in the case of job loss or illness or disability.

You are, imo, confusing rising debt levels with rising rates of living paycheque to paycheque. It does not always work that way. When interest rates are declining your payments may actually go down. Plus the proportion of consumer debt is declining while the lower interest mortgage debt is rising. The average amount paid towards interest has actually been declining over the last five years.

If interest rates rise there will be, imo, a decline in the savings rate and more people with debt will live paycheque to paycheque. Given the qualification criteria for mortgages, the villain will not generally be mortgage debt imo, but other debt incurred besides a mortgage, combined with job loss, disability, divorce and addictions.

The highest insolvency and arrears rates are in Altlantic Canada. Atlantic Canada is .63 while Vancouver is .28. My view is that living paycheque to paycheque is correlated with unemployment rates more than housing prices or interest rates at the moment and higher insolvency and arrears rates would point to more people living paycheque to paycheque.

There are more gov’t reports about debt levels, eg., a very detailed 2016 report from Bank of Canada that shows:

Percentage of high-ratio mortgage originations with loan-to-income ratios over 450%:

49% in Toronto, 39% in Vancouver, 18% nationally (see page 5)

http://www.bankofcanada.ca/wp-content/uploads/2016/12/fsr-december2016.pdf

(or acceleration in prices see page 15 for Victoria)

“Households carrying high levels of debt could find it more difficult to adjust to a loss in income or other financial shock. They may be forced to sharply cut back on their spending and, in severe cases, may default on loans. The consequences for the economy and the financial system could be significant.”

Bman, related to 1981 mortgage rates, some of them were even higher at 21%. Also to your question “Can you pay your mortgage if you can’t find tenants?” That’s exactly what happened in Victoria in the 80s – people left because the economy was bad so it was hard for some landlords to find renters.

“Leo, it might be worth it to correlate arrears to interest rates.”

I was thinking that too. I calculated an annual average using the posted 5 year fixed rate. Data is from the BoC.

Year Avg. 5Y-Fixed-Posted

2016 4.66

2015 4.67

2014 4.89

2013 5.23

2012 5.27

2011 5.39

2010 5.59

2009 5.69

2008 7.09

2007 7.02

2006 6.65

2005 5.98

2004 6.25

2003 6.44

2002 7.02

2001 7.40

2000 8.35

1999 7.56

1998 6.93

1997 7.07

1996 7.93

1995 9.16

1994 9.53

1993 8.78

1992 9.51

1991 11.13

1990 13.35

1989 12.06

1988 11.65

1987 11.17

1986 11.21

1985 12.13

1984 13.58

1983 13.23

1982 18.04

1981 18.38

1980 14.52

1979 12.19

1978 10.54

I also wonder if there is strong correlation between the arrears rate and vacancy rate. Can you pay your mortgage if you can’t find tenants?

Totoro: As per your first link.

“In 2012, total debts in lines of credit amounted to $144.9 billion, up from $33.2 billion in 1999 and $77.5 billion in 2005. One-quarter of family units had lines of credit in 2012, the same as in 2005, but up from 15.4% in 1999. The median line of credit debt was $15,000 in 2012, up from $6,600 in 1999 and $10,200 in 2005.”

Okay, let’s get serious! Canada’s population is 36 million. Ontario, Quebec, Alberta and B.C. account for 31 million of those people.

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/demo02a-eng.htm

So, you have (had) 3 of the real estate bubbliest provinces comprising those 4 provinces that speak to Canada.

Now, let’s take a look at those line of credit numbers. Where do you really believe those numbers are proliferating? How about those mortgages? And this was 2012. Today debt is in excess of 2 trillion.

Yes, half of Canadians are living paycheque to paycheque but those Canadians are all probably living in Ontario, B.C. and Alberta. Hmmm .. that’s close to 22 million people .. over half.

So, as long as Toronto, Calgary, Vancouver, Victoria and suburbs continue to see home values rise they should be able to cover their debts.

http://www.cbc.ca/news/canada/calgary/conference-board-alberta-insolvency-rates-bankruptcies-calgary-edmonton-consumer-business-1.4049820

Alberta insolvency rate jumps 34% as upward trend continues

http://www.financialpost.com/m/wp/personal-finance/mortgages-real-estate/blog.html?b=business.financialpost.com/personal-finance/mortgages-real-estate/toronto-bidding-wars-turn-to-homebuyers-remorse-as-market-gets-nervous

Oops, we did it again.

Bingo, throw in a couple of kids with all the surprises and things can go south real fast. You might exist but you’re not getting ahead at those incomes. I know a few with less than $500K mortgage and they have to cut things tight all the time.

Wouldn’t you rather know the median income of mortgage applicants? Most loans representatives could tell you that.

TD Canada Trust did an interesting study showing income volatility is at high levels as job quality deteriorates. Again, stick you head in the sand but it’s dog eat dog out there in the job market. More part time, less benefits etc.

CIBC found similar results in an earlier survey.

10 Million Adult Canadians Can’t Count On A Steady Paycheque: Survey

The CEO of TD Canada Trust is warning that the country faces a “pervasive and profound” problem with income volatility.

Some 37 per cent of adult Canadians — or about 10 million people — experienced moderate to high levels of income volatility over the past year, according to a new Ipsos poll carried out for TD.

Of those, some 3.3 million people saw their pay go up or down by as much as 25 per cent from month to month.

A CIBC study last November found “a slow but steady deterioration” in job quality in Canada over the past two decades.

CIBC economist Benjamin Tal found that an ever-larger share of Canadians are finding work in low-paid areas, while a smaller share is seeing work in above-average jobs.

“That trend is consistent with a widening wage gap symptomatic of deteriorating labour market quality,” Tal wrote.

http://www.huffingtonpost.ca/2017/05/18/income-volatility-canada-td-bank-survey_n_16687080.html

hawk

Median. Average/mean is higher. Adjusting for inflation median family income would be closer to 90K. Enough to support a 500K property at today’s interest rates (give or take) but 700K+? Not if something slips.

Time will tell. Anyone I know that could possibly run into trouble would have help from their parents if stuff went sideways.

totoro

And income stats are due in Sept. I am really curious if median family income in Victoria has increased significantly since 2014. My guess is it hasn’t even kept up with inflation. Then again, who knows.. maybe all those tech jobs and dual income families (necessary to buy a house it seems) have bumped it up. My money is on no significant change.

If you are going to ignore the explosion of debt to income charts then live in the dark. With an average household income of $85K for Victoria, high rents and expensive housing and other costs, it’s not a stretch that half of debt/mortgage holders can be a pay cheque away from tough times.

You can use old Stats Can numbers and stay in denial or you can use common sense. This survey was done last summer by a different group and came up with similar numbers as the Manualife survey. It may not be precise to a tee but it’s an indicator of stress on the average joe. You only need 10% or less to tank the market.

“The 40-question survey was conducted online by Framework Partners between June 27 and Aug. 5. There was a total of 5,629 employees who responded from a number of sectors including forestry, manufacturing, government, oil and retail.

https://www.theglobeandmail.com/globe-investor/personal-finance/household-finances/half-of-working-canadians-living-paycheque-to-paycheque-survey/article31741113/

Leo, it might be worth it to correlate arrears to interest rates.

I just finished reading the Vancouver Real Estate Board’s description whether an agent is a fiduciary. The answer is – it depends.

I think that’s a blurry line. That you might have an agent representing you but they can slip in an out of the fiduciary responsibility. Not knowing the boundaries it would be easy for a person to give the agent confidential information that may hurt them financially and enrich the agent.

Imagine if a lawyer or accountant could do this. The article also goes on to explain that if you are in doubt you should contact the real estate board. That’s the fox guarding the chicken house because they don’t have a fiduciary responsibility to you either.

StatsCan is an excellent resource and has released newer data (2012) that states the same thing except the net worth and savings of Canadians increased substantially:

http://www.statcan.gc.ca/daily-quotidien/140225/dq140225b-eng.htm

http://www5.statcan.gc.ca/cansim/a26?

lang=eng&retrLang=eng&id=2050002&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

The newest financial security survey closed December 2016 and data will be released shortly: http://www.statcan.gc.ca/eng/survey/household/2620

There is also a 2016 wealthscapes survey that has been released as well that shows an increase in net worth, savings and debt. The increase in debt and net worth are both related to housing. http://www.environicsanalytics.ca/footer/news/2016/09/07/wealthscapes-2016-reveals-continuing-improvement-in-canadians-finances

Also, this slideshow has a lot of detailed data set out in an easy to read format:

http://www.environicsanalytics.ca/docs/default-source/webcasts/20160915-wealthscapes-webinar-final.pdf?sfvrsn=2

I see no evidence that 50% of Canadians are living paycheque to paycheque.

Then the term Fiduciary has been watered down and has little to no legal soundness. It has now just become a punchline in someone’s resume.

Because in the past if someone held themselves out as being a Fiduciary and they screwed the public over that would have been the end of their career not a piddling fine.

Professions that I considered Fiduciary were the clergy, accountants, lawyers, architects, notaries, doctors. They took an oath or had a written code of ethics to protect the public and not just their commissions. Breaking that public trust meant harsh consequences to their careers.

Something that should be considered by the Real Estate Council of BC.

There is a long list of things the REC(BC) should review. Residential real estate should be dragged out from behind closed doors as it is in the interest of the public to have transparency and fair pricing in what may be the largest purchase in their life.

If you’re the kind of person that wants to screw someone over then feel free to dive into commercial or industrial properties. But when it comes to human shelter there should be stronger regulations and penalties.

They are.

totoro

Like I said, not a representative sample. It was a survey of 5800 “working canadians”. The media loves to sensationalise and tends to be bad at stats (I don’t think I’ve ever read an article that had a confidence interval).

Just like Hawk’s article he recently posted. That was an internet survey and the better media outlets put disclaimers about the quality of the data.

Even if it were true that half of Canadians are living paycheque to paycheque that doesn’t mean it’s true for Victoria. We have a large % of people that own homes outright.

John:

When I have some free time I will research the status of real estate agents as being in a fiduciary relationship but my initial view is that they are exactly in that position. The question arises as to their status when it is an issue of their compensation. This obviously a contractual employment relationship. The grey area arises when a listing agreement is presented to a homeowner as a “standard” agreement without advising them of the terms of the agreement in detail and also whether such an agreement is clearly one sided to the benefit of the agent.

What we might certainly agree on is that many real estate agents clearly only care about what is in their benefit. This is a situation where legislative imposition of terms of the contract would be most helpful.What strikes me as fair is that the agent has a right to take only his rate of commission out of the deposit and not his whole commission. If the deposit was a hundred thousand and he was charging 6% then he should be limited to 6%. He should be able to go after the defaulting buyer for the rest. I know that I have had listing agreements amended to reflect that division in the past. If your agent wont agree to that then it is always easy to find an agent who will.

A line of credit is a poor emergency fund. Emergencies are stressful. When one takes care of an emergency by borrowing money, one is eliminating one stress and replacing it with another. Far better to have a cash emergency fund—the bigger, the better.

I guess I’m just a millennial with an old school mindset.

Totoro: “Not to say that there are not those that are living paycheque to paycheque, but the stats do not support 50% doing this.”

StatsCan used to be an excellent resource but as you can see by your links they are extremely dated in some circumstances. Each of your links referred to 1999 – 2005.

Unfortunately, the bubble really didn’t take shape until after 2009 when interest rates dropped considerably and everyone got to play with monopoly money. I’m leaning towards that 50% figure in light of the amount of mortgage debt that has been snorfled over the last several years.

https://betterdwelling.com/canadians-consumers-set-a-new-debt-record-over-2-trillion/

“The number is actually so large, most people I speak to don’t quite understand how big it is. It’s 9% higher than the total debt of all businesses in Canada. It’s also 18% higher than the GDP of Canada, and 30% higher per capita than our neighbours in the US. Actually, that number is so magnificently large, that the debt held is greater than the total wealth of the 9 richest people in history. All of history, not just recent. So if someone says it’s not all that bad, make sure you don’t let them give you any investment advice.”

A Greens/Liberals alliance would be quite something, considering the two parties agree on almost nothing. Also, Clark would need to achieve a unified Liberal caucus, where every member agrees to swallow and vote for Green policy that is detestable to most Liberals.

Not to say that there are not those that are living paycheque to paycheque, but the stats do not support 50% doing this. The average household savings rate is 5.8% and the median household net worth is quite high.

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/famil111a-eng.htm

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/famil110-eng.htm

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/ind01/l3_3868-eng.htm?hili_none

I don’t believe half of Canadians can be living paycheque to paycheque unless the definition of this includes 5.8% savings and no ability to ever call on the savings if need be. The definition of living paycheque to paycheque is:

Kalvin: “He’s frustrated that homes are not selling at the same price just a few months ago.”

While I’m sympathetic to his personal situation, I have difficulty feeling similar with regards to this frustration. House prices in Toronto sky-rocketed the last couple of years. Perhaps he’ll have to settle for only 30% appreciation instead of 40%. I bet he’s still better off financially (even after the lawsuit) than he was several years ago.

I’m saving my sympathy for children, students, new graduates, etc. People who had no part in how things got to where they are but will feel the consequence.

Thought this (older) article was interesting. http://fortune.com/2015/06/17/subprime-mortgage-recession/

“while foreclosure activity started first in the subprime market, the foreclosure activity in the prime market quickly outnumbered the number of subprime foreclosures.”

” The vast majority of mortgages in the U.S. were still given to prime borrowers, which means that the real estate bubble was a phenomenon fueled mostly by creditworthy borrowers buying and selling homes they simply thought wouldn’t ever decrease in value.”

“Ferreira’s data show that even with strict limits on borrowing—say, requiring every borrower to put 20% down in all circumstances—wouldn’t have prevented the worst of the foreclosure crisis. “It’s really hard for certain regulations to stop the process [of a bubble forming],” Ferreira says”

My sister is in the GTA. A potential buyer walked away from their deposit on a house just a few doors down from her. The seller bought another home and needs to sell fast or he will be stuck with two mortgages. The poor chap selling the home has had some bad luck. He is selling the home because his fiancé died in a car crash last year, so it’s just too many memories in the home for him to keep it. Now, his late fiance’s parents are taking him to court for half of the proceeds from the sale of the home. He’s frustrated that homes are not selling at the same price just a few months ago. The realtors used him to reduce the price by 40k. Still no one is interested. My sister said that suddenly, homes are not selling as fast. Not sure if Vancouver or Victoria are experiencing the same issues.

The NDP/Green 44 to 43 liberals is just too tenuous, I don’t think they could accomplish anything significant.

JD/JJ:

Excellent point. We bought a place we could afford on one income (it’d be tight but doable). Seems like that’s not really doable anymore what with 700K fixer uppers.

Shoot, I forget the poster’s handle, but the couple that just bought in Colwood for around 500K. I think we would have done the exact same thing in this market. Buy what you can afford to avoid financial stress. You can’t predict what life is going to throw at you. In our case it was injuries that put us both out of work for 6+ weeks. Apparently that would put a lot of Canadians in financial ruin.

Heck, it seems like a water tank needing replacement would put a lot of Canadians in financial ruin, let alone a roof or transmission in the car or emergency dental work… etc etc.

Even the Golden Head waterfront mansions are having to slash. Tennis anyone ? 1708 Barrie Rd slashed $200K.

Looks like the new builds in Fairfield have lost their sheen too. One of the “relist and slash the price”deals on 1044 Harling Lane. Just took a $75K whacking.

“He must have fallen for one of those Nigerian scams “Dearly Beloved” !!”

I think it’s called the Asian contagion of money launderers who want everything with no tax. I’m sure many more lawyers and agents will be uncovered in the coming months when as the wheels fall off.

‘Corrupt Elite’ Laundering Money In Canadian Housing: Report

http://www.huffingtonpost.ca/2017/03/31/money-laundering-real-estate-transparency-international_n_15725728.html

http://i.huffpost.com/gen/4928610/original.jpg

Recent polls show a lot of BC voters want an Green-NDP coalition …

http://vancouversun.com/news/politics/clark-should-step-down-as-leader-if-liberals-cant-form-government-poll

Most respondents, 51 per cent, want the Greens to support the NDP … among those who voted Green, 62 per cent said they are in favour of the party supporting the NDP

(I just want corruption/cronyism – caused by huge corporate donations – removed from the BC economy)

Either way, I don’t think it’s going to affect RE prices as much as other factors. First there’s Home Capital & Toronto. But Canada is still seen as a safe haven, even for people from the US. Articles like this are appearing more often, now in financial news:

It’s time to plan an escape route, for you and your money

http://www.marketwatch.com/story/its-time-to-plan-an-escape-route-for-you-and-your-money-from-trumpland-2017-05-26

“it is becoming increasingly clear that Americans should be taking reasonable steps to diversify their investments outside the U.S., including holding assets in currencies other than dollars, and where possible to acquire a second passport.”

I would have assumed that most would be newer home owners as their living expenses just shot up with the purchase of a home. The first 5 years is challenging for most new home owners as they learn to adjust to their new lifestyle.

Introvert:

What was it, nearly half of Canadians are living paycheque to paycheque?

It was covered by basically every news outlet about 8-9 months ago and Garth repeated the stats ad nauseam.

“48 per cent say it would be hard to make ends meet if their paycheque were delayed even a single week”

“Almost one in four (24%) don’t think they could come up with $2,000 if an emergency arose in the next month.”

Bit of bias in the survey, since it was “working Canadians” (so biased towards those who have to work for a living, which isn’t representative of the whole population). Still.. scary numbers.

Can’t come up with $2000 in an emergency? Super scary. 2K is a pretty cheap home emergency. I wonder how many of these people own homes.

I’d assume a lot are renters, but I know some home owners that are pretty bad with money.

Edit:

If 70% of Canadians own homes and around 50% are living paycheque to paycheque, then by the pigeonhole principle at least 20% are home owners. Of course it’s 50% of working Canadians living paycheque to paycheque, so presumably lower as a percentage of the whole.

Will soon be a non-issue. University enrollment is about to take a ~10yr dive.

http://i.imgur.com/lI3JTxY.png

The only people that have been successful in creating affordable housing in Victoria are the First Nations. That’s because they retain the land and lease it back to the developer/investor/non profit society/ home owner.

Instead of a strata titled condominium people would be buying a leasehold condominium. The condo looks exactly the same but at a lower cost.

I’m hoping for all those things too – but will it take the Greens teaming up w/ Liberals? In the debate they called them worse than the NDP. Personally, I’d like to see the Greens team up w/ NDP and deflate that Chrusty’s ego.

The university not having enough housing is a huge issue. And, Camosun has none. They have so much undeveloped land so it’s not like they don’t have the space. Uni students looking for housing takes away from the general rental stock so it would benefit everyone if they had more housing and take unnecessary stress away from students.

There needs to be way more funding for subsidized rental housing, available on a ‘means testing’ access basis. This could help the homeless problem.

“The panel found he ignored “a sea of red flags” and allowed $25,845,489.87 of offshore cash to float through his trust account between May and November 2013.”

He must have fallen for one of those Nigerian scams “Dearly Beloved” !!

Rare quality house not priced absolutely ridiculous just came up in North OB: 2200 Kinross Ave at $1,149,888 (what’s with all the 888’s?). Not often something like this comes up, this is what I mean by ‘quality’ and I’ve often admired this house while walking past. This one will sell fast.

A few months back I brought up the discussion of purchasers breaking the contract to purchase. I remember all the hate that spued out from the bulls/steers at that time.

What I had noticed back then was the closing dates seemed to be long and the size of the deposits were small in comparison to the price of the home. That makes it easier for purchasers to walk from the deal.

The scum keeps floating to the surface as all bubbles expose the corrupt that the government turned a blind eye too in order to keep the books looking good, and they are now neutered.

B.C. Law Society panel finds West Van lawyer guilty of washing $26m through trust account

“In the face of an overheated real estate market and public concerns about foreign capital last year, the society cited Donald Gurney over his involvement in four questionable, three-year-old transactions.

The panel found he ignored “a sea of red flags” and allowed $25,845,489.87 of offshore cash to float through his trust account between May and November 2013.

He charged a tenth of one per cent of the amount given “the risk involved.”

http://vancouversun.com/news/local-news/ian-mulgrew-b-c-law-society-panel-finds-west-van-lawyer-guilty-of-washing-26m-through-trust-account

2192 Cranmore Rd just took it’s third slashing of 90K to a grand total slashing of $150K in the last month or so. Looks like the Oak Bay fixer uppers have shown their major cracks.

Thanks LeoM, saw that one. Imagine this happening here ? This blog would(will) have a cardiac. 😉

“We are seeing people who paid those crazy prices over the last few months walking away from their deposits,” said Carissa Turnbull, a Royal LePage broker in the Toronto suburb of Oakville, who didn’t get a single visitor to an open house on the weekend. “They don’t want to close anymore.”

Barrister do you really consider a real estate a fiduciary?

In my opinion, a fiduciary will put your interest ahead of theirs in a transaction. I don’t think a sales person that derives their income from a commission could ever meet that test.

Barrister, the numbers has changed a bit but so far this May there has been 304 new house listings in the core and 167 sales. That’s 1.82 new house listings for every sale in the core. 1.82:1

Active listings which include new listings, sales, expired, etc. is at 447 houses for the month so far. With 80% of the month completed the projected months of inventory for houses in the core would be 2.15. That’s double last years MOI for May.

Historically what has happened after May has ended is that the MOI continues to increase for most of the rest of the year. The exception in some years has been around September and October when kids return to school. It wouldn’t be historically out of character to see the current MOI increase by another 50% or double some time during this year.

Styles of a house are very much an individual taste. My house is about a hundred years old and it is certainly not everyone’s cup of tea.

That’s what I’m hoping for. Then:

1. Get money out of politics.

2. Proportional representation referendum with 50%+ to pass.

3. Way more funding to incentivize building rental housing

4. Cracking down on housing speculation and money laundering.

5. Require and enable universities to house more of their students.

Along with some more environmental policies that are offtopic here but pushing more energy efficient buildings is one of those.

408 Goward road is the best thing to hit the market since 2008.

I wondered about those cases myself. Frankly, I would have thought that the real estate agents comission should have been limited to a percentage of the deposit and since the real estate agent is in a fiduciary position to the seller that any contract provided by the agent to the seller that did not reflect this should have been read as negligence upon the part of the agent.

Introvert I think the greens gave a hint that they will side with the liberals. They want a long term stable government. With 2 more seats than the NDP that is more stable. NDP and Green would have 44 to 43. They would have to give up a member for speaker who could also casts votes in a tie. So 43 to 43 but still pass votes. Issue is if one member does not show up than the government could be defeated. The other way would be 46 to 41 so a few liberal or green could not show up and the government would hold up.

You can, for a period of time, if one has an emergency fund. But that would be too sensible.

Barrister interesting. There has been recent cases in BC where the real estate agent went after the deposit for their commission and won.

On the topic of provincial politics, this morning’s Lindsay Kines article helpfully outlines the possibilities:

http://www.timescolonist.com/news/local/shape-of-government-still-unclear-throne-speech-key-1.20212067

Also, the deposit is held in trust and it is not automatically transferred to the seller. You need either the consent of the defaulting buyer or, once again, a court order. In many cases the sellers will agree to limit damages to the amount of the deposit simply to get their hands on the cash fast.

Barrister good point. Just leads to problems if the seller has bought themselves.

GWAC:

Often people wont try to sue you for additional damages if the difference is reasonably small. Even with a large shortfall the amount is often negotiated down rather than the long delay and expense of going to court.

As every lawyer will explain, winning a judgment is one thing collecting it is another. If it is a foreign buyer lots of luck on collecting.

Not sure I understand the rational of walking away from the deposit. That person would lose any lawsuit and could ended up paying 100

s and 100s of thousands of dollars plus legal.John Dollar:

Can you repost the numbers for single home sales in the core in this blog. This may be one of the most important stats on here in a long while and I dont want it to be missed because we have changed topics. Up to now some people have been arguing that sales are down primarily because of low inventory yet your numbers might suggest that this may not be the case. One month of numbers does not prove anything but just perhaps it is a red flag that one should take note of going forward.

Here’s one for you Hawk!!

The last thread started a foreclosure discussion, so this article might be interesting to some posters:

http://www.financialpost.com/m/wp/personal-finance/mortgages-real-estate/blog.html?b=business.financialpost.com/personal-finance/mortgages-real-estate/toronto-bidding-wars-turn-to-homebuyers-remorse-as-market-gets-nervous

How to make an impression: bring her home to 408 Goward. Some styles age well. Others…

While prices are going up the likes of Home Capital can refinance subprime lenders. When the start to fall those lenders are on their own if they get into difficulty.