Market Timing

Some discussion here about market timing in real estate this week and whether it can be done. Thought I’d add my 5 cents to that discussion.

Market timing in the real estate sense would be to either buy or sell based on expectations of where the market is going. There are several kinds of market timing in real estate:

- For non-owners, choosing to delay buying based on an expectation that prices will decline.

- For owners, choosing to sell real estate on the expectation that prices will decline and perhaps that it can be bought back at a cheaper price later.

- Buying or acquiring additional real estate much earlier than originally planned based on an expectation that prices will increase quickly.

Mostly we hear about the first on that list, and then occasionally we see people attempting the second.

In the stock market, there is pretty good evidence that market timing doesn’t work, but what about in real estate? Having read many thousands of very intelligent and convincing arguments about why the market was either under or overvalued in the last 10 years, I’m inclined to think that although the local fundamentals like incomes and market conditions can be used to make reasonable predictions, the macro-level factors (credit availibility, housing policy, market sentiment, immigration, etc) are so influential that you can’t have much confidence in those predictions.

On top of that unpredictability the transaction costs are murder. If you want to sell your average house ($830,000 as of April) at what you believe is the top of the market and buy back in later, first you might pay a Realtor the typical commission of about $28,000 to get rid of it. That puts you down 3% right off the bat. When you buy back in (maybe the same house is $700,000 now), you get hit with the property transfer tax of $12,000 and another $2000 in legal and other closing costs. So the little maneuver cost you a BMW 3 series in fees before accounting for any time. Even if you smartened up and reduced your real estate commissions the PTT cannot be avoided.

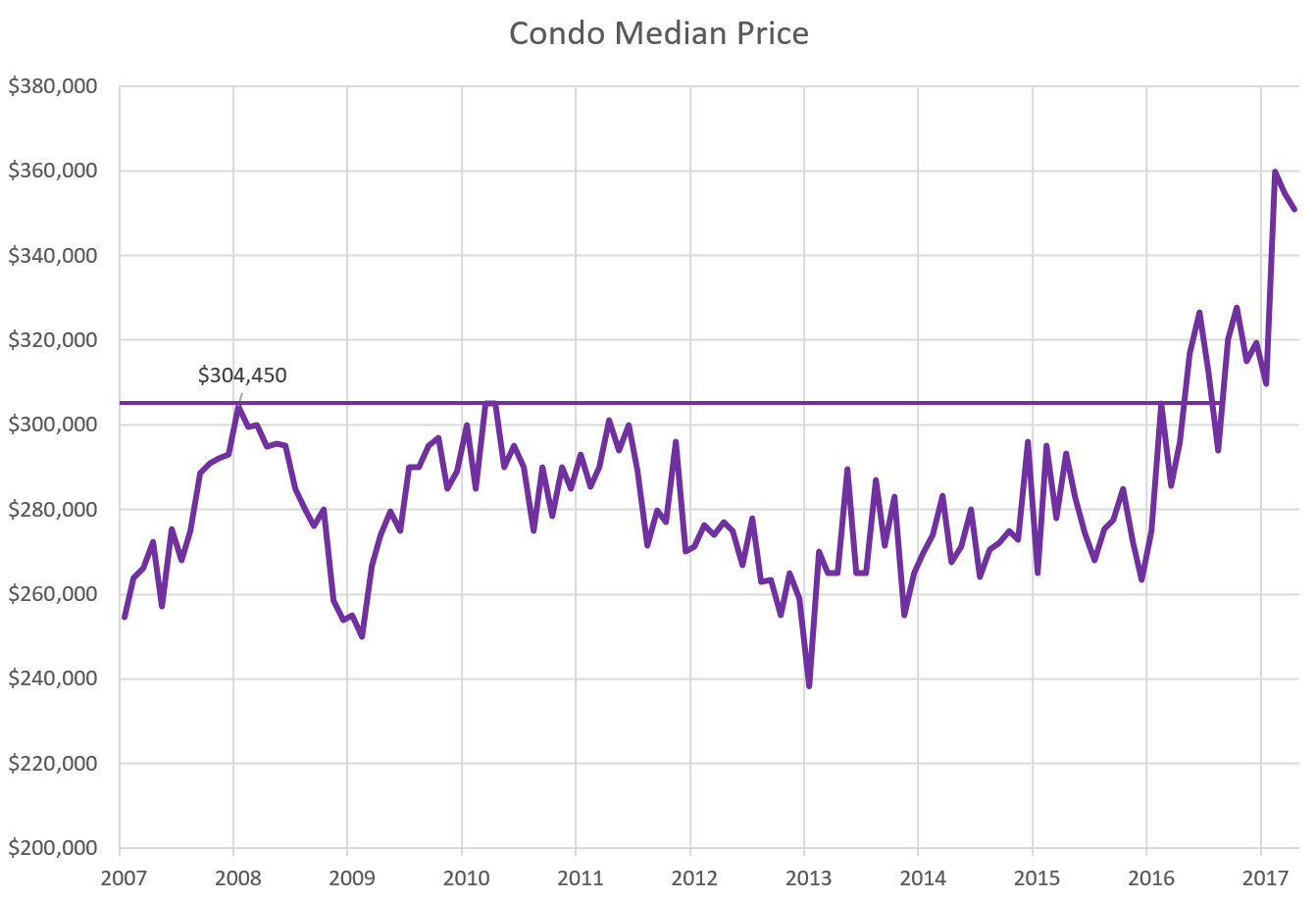

On the selling side then the picture looks pretty grim. You would need a pretty big drop (at least 10 or 15%) to make it worthwhile, and you’d have to be pretty close to timing the top and the bottom to make it work. What’s working in your favour at least is that the market is typically pretty slow. Our market bottomed out in 2013 and started slowly improving after that. It improved steadily for a year (green line) without prices moving much, and it took almost 3 years before prices started taking off. That’s a lot of time to recognize a buying opportunity.

Same at the top in 2008, the market had been slowing for years.

The great financial crisis was about as close as the market gets to a flash crash and that still played out over about 6 months. This is not the stock market where if you miss a few trading days you can leave a large proportion of your return on the table.

On the buying side it’s a bit more of a grey area. The market remains very difficult to predict, and as we’ve seen in Vancouver, it can remain irrational far longer than most people can afford to wait. That said I do believe that you can look at some fundamental metrics like months of inventory to make pretty decent price predictions in the short term, and other metrics like affordability to gauge the level of risk in the market.

In 2008 we looked at $300,000 condos selling on 6% mortgages and it did not compute. How could it make sense to pay some $1600/month when our apartment cost less than half that to rent? I didn’t understand affordability measures back then but it seemed out of whack and it was. Condos languished at or below those prices for over 8 years (more if you take into account inflation).

Instead of getting on a property ladder with all the bottom rungs broken, we saved, interest rates dropped to rock bottom levels, our incomes increased, and I started to feel that the risk I had seen in the market in 2008 had faded. We bought in mid 2013 but I didn’t have the feeling of that it was the bottom. At the time I was expecting another 5-10% decline that ended up not happening. Worked out well, but since the decline in detached housing was not as large as in condos, we could have also bought in 2009 and gotten the same deal 4 years earlier if we could have stomached the risk and a larger mortgage. The other thing to consider is that the same strategy would have backfired miserably in Vancouver.

All that said, should you time the market? In general I’d say no. The chance of the best market conditions coinciding with the time you want to buy are pretty slim. Better to buy when you are ready, or conversely, not buy if it seems too risky or if renting is cheaper. You can use the Wait or Buy Tool to run some scenarios and in which cases waiting would make sense (I’ll update this tool sometime soon). There is only one foolproof way to time the market and that is to jump out of a high priced market and move to a lower priced one, just like the Vancouver buyers were doing to us last year.

Looking forward though I remain hopeful (perhaps foolishly) of the potential in market timing. The last two corrections we had were very mild in the mid 90s and the 2008 – 2013 period, with most of the correction coming in the form of lower interest rates, increased incomes, and declines in prices when taking into account inflation. Those kind of corrections are difficult to take advantage of because the nominal decline is barely enough to cover transaction fees. I’m fairly certain that the next correction in Victoria will look quite different from those two. There is no room to move on interest rates, and when the market runs out of steam we will see a significant pull back in prices and overshoot when it declines. I’ll be keeping my eye out for that opportunity when it comes.

New post: https://househuntvictoria.ca/2017/05/23/may-22-market-update/

John:

You are right that properties on the margin may well give an insight into where speculation is going.

Personally I would be reluctant to bet that the market is going to continue to rise. But I am wrong as often as I am right so you might want to just throw darts at a board.

Since you have been watching this more closely than me what are your thoughts on the probalities involved.

Barrister if you wanted to find a barometer of the market then watch the properties on the margin. The ugly orphans of real estate such as housing along busy streets.

For example 1250 Bay Street. It’s been up for auction for the last five days with the offers to be presented this Thursday. Asking $535,000. The sale of this property would be evidence of how nutty our market remains. This is the type of property speculators bid on. They are not buying on what is physically there, location or income but on the speculation that anything they paid for a property can be sold for more in the near future.

Luke:

You are absolutely right, the tourists are back and James Bay does become a madhouse for the rest of the summer. But a lot of the people like all the activity. Personally, my wife and I pretty well avoid downtown all year round. But I am aware that a lot of people bask in the idea of spending most of their time downtown. Each to his own.

As to Uplands, I am following the real estate market there on the theory that it is a good barometer of what is happening with out of town buyers. Totally unscientific but my reasoning is that a lot of the demand must be from out of towners since the price point seems to be almost beyond the reach of even most professionals in the city. I agree with you that the house on Exeter is overpriced still but I am biased in that I find it particularly unattractive. But that is simply a matter of personal taste.

I think that Exeter Rd house that is priced at $4m is probably still overpriced. Even after the reduction. They will need a lot of loonies if they are planning on heading back home to Dubai.

Well it was a beautiful sunny and hotter than I expected day today full of fun activities all around town. For the first time it felt like summer! Looks like many others were too judging by the sparseness of comments on here Victoria Day.

The forecast: Nothing but sunshine and temp’s in the 20’s. for the next fortnight… Looks like that cooler/wetter than usual early part of spring is over!

I discovered a really interesting gem yesterday up near UVic- the Children’s centre for health, run by VIHA and open to the public. Beautiful beach and trails there, and uh oh I probably shouldn’t mention it b/c now everyone will go there. Ha! 😉 From UVic just turn left off Arbutus Rd onto Haro Rd and head up Haro Rd to the end and take the trail in. There’s also a cool water garden there with a man made waterfall. Trails are paved so wheelchair friendly.

Seems the tourists are back in town in big numbers now too I’m noticing, w/ the cruise ships now here, long weekend, etc. I ran into some Russians who said they were from the States so that was odd. While I like James Bay, I’m not sure I could live in James Bay for this reason. They must feel invaded every summer.

I wonder if the Uplands market is simply adjusting to its true value looking at supply and demand.

I know one big buyer had bought up a bunch of properties in the area about a year ago which probably distorted the market considerably.

Thanks for the numbers John. It looks like we have about six months of inventory i the Uplands, give or take.

This weeks numbers should be interesting.

There is a reporting lag time – says it on the site and it happened on April 27.

I found that odd too Vicbot. Bad for business or they just don’t have a symbol for home invasion/ attempted murder.

Just curious – does anyone know why Oak Bay didn’t include the incident on Esplanade in their crime report for April?

https://www.oakbay.ca/public-safety/police-department/community/crime-maps

“3175 Exeter is probably the most typical of the properties in Uplands and it sold for 2M recently.”

Which was price slashed twice to the tune of $450K to get the sale. The Uplands has shown it’s colors, the rich have to slash to get out.

You property pimps need to get with the program, the market has peaked. Negativity is only your perception because you’re losing money by the day. I’m the most positive guy you’ll ever meet. 😉

Perhaps this online tool will help with the Victoria crime stats debate going on here. Many buyers are using this to narrow down on the neighborhoods they want to settle in or see what kind of criminal activity is happening in various neighborhoods.

I do agree that Hawk is a bit of a downer, but I do agree that with population growth comes more crime. It can really change the look and feel of a neighborhood in a matter of years. It happened in the area where my parents resided many years in Toronto. It never was the same again and property values did shrink. I went back once just to have one last look at the family home only to leave sad and disappointed. No place is immune to crime, of course.

But Hawk, negative energy only attracts negative energy. Try to be positive and focus on the good things around you.

So here’s the online tool I previously mentioned. It’s already set in the area of the kings road incident.

https://www.crimereports.com/home/#!/dashboard?lat=48.438256&lng=-123.333324&zoom=15&incident_types=Assault%252CAssault%2520with%2520Deadly%2520Weapon%252CBreaking%2520%2526%2520Entering%252CDisorder%252CDrugs%252CHomicide%252CKidnapping%252CLiquor%252COther%2520Sexual%2520Offense%252CProperty%2520Crime%252CProperty%2520Crime%2520Commercial%252CProperty%2520Crime%2520Residential%252CQuality%2520of%2520Life%252CRobbery%252CSexual%2520Assault%252CSexual%2520Offense%252CTheft%252CTheft%2520from%2520Vehicle%252CTheft%2520of%2520Vehicle&start_date=2017-04-21&end_date=2017-05-05&days=sunday%252Cmonday%252Ctuesday%252Cwednesday%252Cthursday%252Cfriday%252Csaturday&start_time=0&end_time=23&include_sex_offenders=false¤t_tab=list&shapeIds=&shape_id=false

Hawk ever though of working for Victoris tourism board and or DVBA. Your positiveness and excitement for the city would bring a breath of fresh air.

Hawk; which “hoods” would you be looking to buy back into when the opportunity arises? Where were you living when you sold your place?

Barrister, just 10 sales since January 1. Ranging from 1.7M for a 1950’s house along Lansdowne to a high of 4.4M for renovated 1950’s home on a half acre of water front.

3175 Exeter is probably the most typical of the properties in Uplands and it sold for 2M recently.

AG, one decade can be wiped out in short order as history has proved over and over.

Actually Warren said buying houses like an idiot at the top like you did is suicide.

“So this sound premise that it’s a good idea to buy a house this year because it’s probably going to cost more next year and you’re going to want a home, and the fact that you can finance it gets distorted over time if housing prices are going up 10 percent a year and inflation is a couple percent a year. Soon the price action – or at some point the price action takes over, and you want to buy three houses and five houses and you want to buy it with nothing down and you want to agree to payments that you can’t make and all of that sort of thing, because it doesn’t make any difference: It’ s going to be worth more next year.

And lender feels the same way. It really doesn’t make a difference if it’s a liar’s loan or you know what I mean? […] Because even if they have to take it over, it’s going to be worth more next year. And once that gathers momentum and it gets reinforced by price action and the original premise is forgotten, which it was in 1929.

The Internet was the same thing. The Internet was going to change our lives. But it didn’t mean that every company was worth $50 billion that could dream up a prospectus.

And the price action becomes so important to people that it takes over the — it takes over their minds, and because housing was the largest single asset, around $22 trillion or something like that, not above household wealth of $50 trillion or $60 trillion or something like that in the United States. Such a huge asset. So understandable to the public – they might not understand stocks, they might not understand tulip bulbs, but they understood houses and they wanted to buy one anyway and the financing, and you could leverage up to the sky, it created a bubble like we’ve never seen.”

http://www.businessinsider.com/warren-buffett-explains-how-market-bubbles-form-2017-5

“That said, crime levels in Greater Victoria are still at extraordinary low levels compared to elsewhere”

Luke, let’s not spin the BS too. You said Victoria crime rate, not Oak Bay. Victoria’s are 54% higher than the BC average. How is that a negative story when it’s reality ?

Instead of pumping out falsehoods look at the stats from Oak Bay. Theft from vehicles looks like they’ve exploded, plus a couple of B&E’s in AG’s hood all in a month.

https://www.oakbay.ca/sites/default/files/police/April%202017.pdf

As far as the “nearly deads” you say ended “years ago”, the over 65’s make up over one third of the Oak Bay population.

http://www12.statcan.gc.ca/census-recensement/2011/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CSD&Code1=5917030&Geo2=CD&Code2=5917&Data=Count&SearchText=Oak%20Bay&SearchType=Begins&SearchPR=59&B1=All&Custom=&TABID=1

I still say you and AG are both missing your calling as the new Oak Bay Welcome Wagon laddies.

Warren Buffett taught me to “Be Fearful When Hawk Is Greedy and Greedy When Hawk Is Fearful.”

It’s worked pretty well for the past decade 🙂

AG, you are such a bullshit spinner. I guess that comes with being a salesman. I don’t like downtown, it’s a congested mess like many others see it as well.

I like Oak Bay but the way you and your OB cheerleaders can’t stop pumping it daily as the best place on earth makes it pathetically nauseating. Lived there, done that, and there’s many great areas of Victoria besides there and that’s a fact.

Golden Head is boring and overvalued, so what’s new there as increased price slashes to get sales are showing it.

That leaves 75% of the city I totally enjoy, so what’s your problem ? Afraid of a major crash it seems since you bought a second place at the top of the market on max leverage. Warren Buffet teach you that ?

AG

How sure are we that Hawk actually lives in Victoria? I am a bit suspicious since he picked the Oak Bay Hotel as his supposed rental apartment? Maybe he is actually hiding out in Chilliwack or even Horsefly BC.

Hawk – you hate Oak Bay, you hate Downtown, you hate Gordon Head, etc, etc.

Here’s a serious question for you. Why do you still live in Victoria? There are plenty of other towns that would welcome your brand of sunny optimism 🙂

Well I get the OB crime reports every week and virtually nothing other than the odd car break in occurs here. (this is usually stupid people who leave the door unlocked and something in view to grab). Other than the Esplanade incident which I heard from local chit chat was drug related (young rich girls non payment of drug debt).

Hawk – you spew negativity wherever you can find it because you want house prices to go down for your benefit. I get it. I think we all realize you will never give up – so I give you an ‘A’ for effort.

I don’t think high house prices are a good thing. I don’t want to see people struggle with taking on too much debt, etc. The greed that took hold in Vancouver and hollowed the community out there, and now may be happening here, is not a good thing. Personally, high house prices didn’t help me either as I had to pay more for my house than I would’ve otherwise. If I was to move I’d still have to buy again at high prices so it’s no benefit to me unless I left town – which now I’ve found my paradise I won’t. If prices go down I’d actually be ok with that. It really makes no difference to me as I’m here for the long haul. If prices go down here, they go down in outlying area’s as well. If they go up, they tend to go up more in OB. It’s all relative.

Now, out to enjoy Victoria Day…

Queensbury Avenue –

Someone had posted that they had missed out on the sale of a home here. I walked by the house this morning and the “For Sale” sign is still up at the house with an addtional sign down at the intersection with Blenkinsop.

Just in case you are still interested. It’s a great area to live.

Let’s do some fact checking Luke, your stats as a safe city compared to other large places looks weak. We’re getting worse.

You all want everyone to come here and prop up your house price but this is what comes along with the short term prize. Increased crime rate and the associated riff raff.

Rising crime rate strains Victoria police force

Offences increase nearly 20 per cent over 2 years

“The city’s crime rate tracked sharply upwards by 10.5 per cent in 2014 and 8.8 per cent in 2015 after more than a dozen years of steady decline, according to Statistics Canada.

The same trend occurred across Canada as well, but Victoria’s increase was among the highest.

The number of crimes per population was 54 per cent higher in the city than the average for B.C, police departments.”

http://www.cbc.ca/news/canada/british-columbia/victoria-police-crime-rate-increase-1.4012616

I changed ‘decades’ to ‘years’ Hawk…

I guess you must just focus on your kindred spirits around town (i.e. old and grumpy people who are unhappy with what happened in their lives).

I’m well aware it’s much younger here than Qualicum Beach so maybe that’s where I’m coming from on that one. The median age in QB, Canada’s ‘oldest’ community, is 62 – here it’s more like in the 40’s.

The ‘shit show’ you mentioned is so tame compared to Vancouver or other larger cities as well. There’s always exceptions, but most of those types here are quite mellow as the 420 is so good it tones them down.

“Victoria is certainly no longer home to the old adage ‘newly wed or nearly dead’ – that changed decades ago.”

Decades ago ? Man are you out to lunch Luke. Guess you never walk down Oak Bay Ave on a regular basis. Life still slows down to 10 Kmh with more Q tips than you can imagine. The malls are filled with old people.

Downtown is not the be all end all to this city, just a congested shit show of homeless addicts and some techies on skateboards and bikes.

Another Golden Head home under $1 million slashed $50K at 3974 S Livingstone Ave. Losing track of all the price slashes out there. I guess sales aren’t that brisk.

Did the home at 1772 Kings Road in North Jubilee sell? If so for how much. It was listed at $699k after being reduced from $750k.

I noticed that it sold in May 2016 for $555k. Interesting that it’s another flip.

Victoria is certainly no longer home to the old adage ‘newly wed or nearly dead’ – that changed years ago. It’s much more vibrant, youthful and diverse now than it ever was. It’s constantly improving in diversity with every passing year. The old Victoria is gone now we are entering an exciting new era.

“Last post. Reading the letters in the newspaper, I have to say I’m tired of old people complaining about their property taxes and about how much money they perceive city hall is wasting.

If you can’t afford your small absolute-dollars tax increase, then you should have saved more money during your working life. These people are holding cities hostage because of their piss-poor prior financial planning.”

Guess you didn’t read the fine print when you moved here Intorovert. Victoria is home of the nearly dead and has been for decades. Once again you prove your an effing idiot. Most of the old folks didn’t have the incomes to save up for, nor anticipated thousands of weak brained FOMO running up the price of houses so far beyond it’s means like a casino and so far past the US crash point.

Maybe you should start a petition to get rid of all the old people who built this place….. and consider moving somewhere more progressive like Langford. What a tool.

John:

Any way of finding out how many sales there have been in the Uplands since the beginning of January?

http://www.timescolonist.com/news/local/man-arrested-after-apparent-standoff-on-ryan-street-1.20115496

Re. the Kings Road incident btwn. Richmond Rd and Shelbourne early Sunday morning, and the related incident at Ryan Rd and Shelbourne. The man involved has been arrested (later found in James Bay). Kudo’s to Victoria police and the fine work they do! I see them in action all around town many nights dealing with various incidents.

I think back to the recent incident/ home invasion on the ritzy street Esplanade at Willows Beach in OB and I think this reminds us all that crime can occur in any neighbourhood, anywhere, and you should never think to yourself smugly it isn’t happening in my ‘hood. That said, crime levels in Greater Victoria are still at extraordinary low levels compared to elsewhere, esp. the Lower Mainland, TO, or major US cities (which some, like Chicago, are more like low intensity war zones more dangerous than much of Mexico).

You’ll probably find that many of these types of incidents are connected to the drug trade as well, even the Esplanade incident, and the greater public is never at much risk if not involved.

FACT: Introvert insults anyone who does not agree with him and he is starting to sound like Donald Trump. I hear a lot more complaints from younger people than older ones.

Here’s the recent data for house sales in Gordon Head

Sold Price Sales, Number of

$0 – 200

$200 – 300

$300 – 400

$400 – 500

$500 – 600

$600 – 700 2

$700 – 800

$800 – 900 3

$900 – 1,000 3

$1,000 – 1,250 2

$1,250 – 1,500 2

$1,500+ 1

Too little data to make a call on distribution bases solely on recent sales. But if you look back over the last five months then almost 60% of the sales ranged between $800,000 to $1,000,000. Only 11 percent ranged between$500,000 to $800,000. So depending on many factors a small starter house on a standard lot along a less traveled residential road in Gordon Head could now be $700,000.

But if you’re not looking to buy an existing home and instead are a builder wanting a vacant ready to build on lot, you will have to pay more for that vacant lot.

Last post. Reading the letters in the newspaper, I have to say I’m tired of old people complaining about their property taxes and about how much money they perceive city hall is wasting.

If you can’t afford your small absolute-dollars tax increase, then you should have saved more money during your working life. These people are holding cities hostage because of their piss-poor prior financial planning.

Fact: the City of Victoria needs a new fire hall. Fact: bike lanes are necessary long-term. Fact: old sewer lines need replacement. Fact: sewage treatment is necessary. Fact: Lisa Helps is not responsible for the Blue Bridge debacle; it happened under Dean Fortin and then-councillor Helps voted against it.

Define brisker? The ratio may increase or decrease but I don’t know what you mean by brisker.

Scanning recent sales in Gordon Head, I see that sales in the $700s are now outliers, while sales in the $800s, $900s, and millions are happening in roughly equal proportion.

In other GH news, the Sierra Park playground replacement project is underway. Looking forward to its completion!

I wonder whether sales/listings will be brisker now that we finally have some decent warm and sunny weather.

Too early in the morning….. seize the property.

I wanted to correct this before the blog dogs went ape-shit.

We should report all non-Canadian purchases to the buyers home country. Let their country investigate for corruption. And in the case of the Chinese, they will all be found guilty because that’s what their courts do. Then our government can cease the property, have it sold and split the proceeds with the other country’s government.

We could potentially make a serious reduction in our National debt. It’s not like we haven’t done something similar back in the 1940’s.

We might consider quadrupling property taxes for non Canadians. That would be an incentive for them to put the properties back on the market, You could increase the tax over a period of years so the market does not crash all at once.

“John Dollar: Maybe we aren’t so special after all.”

Oh, this is a world issue. We have family in Europe and they are facing the same housing woes as we are in canada. My family in Portugal say the prices are definitely inflated by the realtors and are taking advantage of investors, and at the same time, hurting their children’s chance of buying a home.

https://www.bloomberg.com/news/articles/2015-03-03/chinese-rushing-to-buy-property-for-portugal-visas-get-burned

FYI

It’s not just Victoria

https://youtu.be/9fYiF7i28bo

Maybe we aren’t so special after all.

Thank God I didn’t catch oakbayitist when I we t to dinner at a friend’s place there the other night. I did get a sense that the market is about to crash though. No champagne.

That’s how we found/bought our last two vehicles: through a wanted ad on UsedVictoria.

Good thing the Kings Rd seller got the sale cause the new owner’s neighbor sounds like he has some issues. Same goes for the spirit garden open house being next week and not this. Having a SWAT team hang out all day is not the signs of a safe family hood. Second time in a few months for that block.

http://vancouverisland.ctvnews.ca/mobile/heavy-police-presence-in-victoria-neighbourhood-for-ongoing-investigation-1.3423417

@step-by-step, “A subtopic – landscaping & decks – do these make a material difference to house prices? They do to my enjoyment of my home.”

Yes I believe so but it probably depends on the house. I’ve seen new builds and view homes with minimal landscaping and they still get high prices. But there are some older houses that probably wouldn’t be worth as much without their beautiful landscaping.

We found our house by putting up a craigslist ad. Very specific about price and requirements. Up Island where listings are also scare and even more so in January. I didn’t expect it to work but three replies and one was perfect. Buying privately was wonderful. We were all reasonable people and honest and it went smoothly.

Surprised me but I am so glad I posted. It can’t hurt that’s for sure!

Marko – the craigslist ad that was posted was too funny, so I sent it to a friend who’s been watching listings in that area. She told me it’s been on the market forever/the past year at least. The satanic part is a bit strange and so is listing with an agent from TO. I’m aware that other homes in that area have had bidding wars and so this one seems like a weird steal, but I’m not gonna check it out, haha. A bit too creepy sounding for me.

Luke, I think putting an ad in the paper was a smart idea. My cousin in San Francisco did that and found someone who was going to sell their home. Although he had to update and repair a few things, it was a great home in comparison to what was available at the time.

Another indication that deals can be had in real estate where they can’t be had in the stock market. The stock market is full of professionals scouting the market for any inneficiency all day every day. The real estate market is full of amateurs being advised it’s always a good time to buy.

For example: great investment opportunity: http://victoria.citified.ca/news/first-time-buyers-take-note-aggressively-priced-concrete-condos-nearly-sold-out-at-the-wade/

@Richard. Didn’t Marko already explain the deal? Mere posting.

3Richard Haysom, hawk’s posting about the Craigslist ad of the Glyn Oak home is what prompted me to contact the broker of record. Needless to say, his response left me feeling very uneasy.

That Glen Oak listing looks like a scam to me. Has anyone driven by to see if there is actually a for sale sign up with a realtors name on it? I wouldn’t be surprised if this so called lister is pocketing as many deposits as they can before the ruse is up never for anyone to see their money again.

Not only can you buy couches, tools, equipment, etc on Used Victoria – you can also buy your house on Used Victoria!

In the panicked frenzied chaos that was the RE market for SFH in the core in early 2016 – we kept getting outbid by multiple offers – so, I decided to place a ‘house wanted’ ad on ‘Used Victoria’ while we kept looking. Almost a state of desperation? Maybe, but it paid off – big time – I put our price range in the ad, and also where we wanted to be (OB or Fairfield) and waited…in the months that we were looking I had to repost the ad several times. I almost didn’t bother the last time but thank goodness I did because in the end we found an awesome custom re-build house by a live-in builder who it seemed, didn’t want to deal with the RE market, showings, frenzy, tons of people coming through the house, etc. It turns out that sometimes it’s about the connection you can spark with people, and after meeting him we hit it off right away, and are still good friends. We knew a good thing when we saw it – esp. when it became so clear that the Victoria core SFH market is full of homes that need extensive reno’s.

After a few responses from people with homes that were too large, or needing too much reno’s, or with swimming pools or strange multi-septic pumping systems (in Colwood – it had incredible views, and at first my ad had said ‘anywhere!’) or… my most hated thing – sump pumps, the right home finally came along.

So, it proves that sometimes in life it takes perseverance to get what you want. Would it work in this market? Probably, you never know, but it was by far the best way to buy a house that I can think of. Looking at homes through the ad’s, we met a great deal of people who are disenchanted with the way the ‘system’ is set up in Canada and feel it is ‘rigged’ by shifty full commission realtors who make a yearly salary in just a few days work. I would try it again in a heartbeat (maybe avoid the Satanic house though).

Is there something I am missing with this Glyn Oak home? Listed as a mere posting which means the seller has no agency relationship with the brokerage. The seller can advertise it privately for sale.

Haha, anyone care to check out the Glyn Oak Place home and let us know what to deal is??

Solid post Mukluk,

Isn’t one of the big problems here that all that free money that was supposed to kick start the economy by encouraging small businesses, job creation etc basically went out in the form of mortgages which then turned into illiquid assets that generate no growth. When governments interfere in markets, they create bubbles. And presto! A real estate bubble.

Great post Marko, thanks for the insight.

Hawk, you posted a Craigslist ad of a home that’s for sale by owner. I actually recognized the home. It’s on the MLS. I contacted the broker of record (that is the contact person and from Toronto) and wanted to make him aware of the Craigslist ad. The response I received was that it’s probably a selling feature of the home. Well, my hair is standing on end and my arm is with goosebumps. I think that’s one house I’m steering clear of, maybe even the whole street. Here is the MLS listing.

https://www.realtor.ca/Residential/Single-Family/16849273/1256-GLYN-OAK-Place-Saanich-British-Columbia-V8Z5J4

Canadian Speculators, Not Foreign Money, Are Driving up Home Prices

Pretty much what I am seeing in Victoria. I decided to take some market exposure off the table and I sold one of my units at the ERA earlier this month. Had 7 offers on it and all greater Victoria. Most had their addresses listed as homes in the 700-$1.2 million range; I am guessing people are tapping into equity to buy investments.

I bought the unit two years ago for $215,900 – $2,500 presale promotion (yes, they were moving so slowly the developer had to do a promotion). Sold for $361,700, was cash flow positive every month and the mortgage dropped 5k or so.

Two years ago I remember I had a good friend pass on buying a unit besides mine….”I don’t know, it’s facing north, the view isn’t great, etc.” Even thought the numbers worked really well; buy for $215ish and rent out for $1,200 to $1,300.

Now that the numbers make no sense at all at $361,700 people are piling in. The unit still faces north, the view still isn’t great. Obviously speculation is at play and market sentiment seems to be a big driver of market speculation.

Some of the calls I’ve been receiving this year about investment condos people are actually assuming prices will only continue to go up……and I am just scratching my head at the lack of common sense.

Canadian Speculators, Not Foreign Money, Are Driving up Home Prices

https://thetyee.ca/News/2017/05/20/Canadian-Speculators-Not-Foreign-Money/

John:

I assume you have read Galbraith’s “The Great Crash” and if not can I recommend it to you. In addition to being extremely insightful it is beautifully written with a sparkling dry wit.

Leo:

I dont bother with any collision on my older 2002 car and have a large deductible on the newer one.

It seems to be a great day out and I hope everyone gets a chance to get out and enjoy the sunshine since it seems to have been a long time in coming.

Leveraging wealth has been a fantastic if not magical ride for so many. It has been possible to get out of debt by taking on more debt.

A friend of ours completed his degree in Economics and had acquired a mountain of student debt. The solution was to go into more debt by purchasing a home and then selling it a few years later to pay off the debt. You won’t find that written in any economics text book.

And this is why most of an entire generation have been novacained into believing that house debt is good debt. And the more of that debt you have – the richer you are. And it helps that their parents are just as convinced as they are and willing to assist their children to acquire a mountain full of long term debt.

And this strategy has worked. But like the effects of Viagra eventually the market has to go flaccid and we will have millions of mortgage holders feel the effect of how extremely difficult it is to de-leverage from real estate.

But for now…

https://youtu.be/JfTyu4W_ryo

Insurance is there to prevent catastrophic losses. So the question to ask yourself, if your car was totaled and it was your fault, would the $3000 represent a catastrophic loss? If not, don’t bother with collision/comprehensive at all.

Sold $951,000

@Luke

What did you ever find out about 1849 Gonzales Ave? Like you mentioned it was priced reduced and then disappeard off the “Realtor” site round about May 11th or so. I happened to drive by on Sat 13 and the realtor was holding an Open House. I checked the site again still nothing. Drove by early the 17th and there was a SOLD sign up. And now I understand it sold above the original listing price? All seems odd to me.

No, the friendly advisor/adviser at the bank said this is how much we can borrow.

Guilty admission: Once I pulled a ($10 Superstore) White Serving Plate out of my mother’s garage sale (she had it listed for $2 but no takers). Our good friends were getting married & we gave them a $100 cheque & put it on the Serving Plate to wrap up.

Afterward our friends were really adamant about how we got them too much. I later realized that they thought it was an expensive fancy plate! Wasn’t really my intention..

Barrister “less great items listed” online -not sure about that. Difference is that online the good deals go quick (so they are harder to see).

When I moved here a few years ago, I bought a usedvic couch for $850 (they bought 1 year before for $1700 but they couldn’t fit it into their new Bear Mountain house) + they threw in 2 free dressers.

Got a home-made Lori wall-bed on usedvic (traded them a real bed worth $350 for it – so nothing but a handshake involved). I spent some cash painting it, used it for a few years & then recently sold for $600 so that I could buy a better wall bed on used vic for $1800 (worth $4000.) If I can’t flip a house, this at least felt good.

Got a previously a sewing machine & expandable sewing/craft table for 1/4 it’s cost (they nicely delivered it too!) The wall bed with shelving units & expandable craft table was one of the reasons I bought our condo (if I can make 2 rooms like having 3, I don’t need the 3rd room.)

Bought my ironing board ($10) & desk chair ($30) from an older lady down the street (walked them home). Ironing board lady had a for-sale-by-owner sign on her house that I ponder asking about (dear 2011 self, you should have asked!)

Got an awesome desk for $250 (they got so many responses on they said they would have raised the price if I hadn’t come right away). Also a great bike for $300 (that I only got because I was the only one who came right away in the rain.) All of our phones are used as well.

Bought two $10 lamps off someone’s front porch – left the cash in their mailbox.

When I was a student, I bought seven $11 medicine balls at Walmart in the USA & then sold them in Canada out my front door for $30 each.

My cat was supposed to be $25 on kijiji, but when I got there they said I could have him for free (best deal ever.)

A nice older couple (where I realized homes near the water in esquilmalt are beautiful) sold us another beautiful desk for $80. Couldn’t even find a desk in a store anywhere near as nice. Shopping online is great because people can send you the measurements & then you can think about while you are still at your space in your home.

Bought our 4 dining chairs from someone who stages houses (like new, very stylish, great deal)

I bet buying/selling used is probably more popular than ever!

*Chuckle & agreement on totoro’s comment on low market for mink coats 🙂

“I have seen as many economic forecasts be wrong as they are right.” I agree Barrister, this sentiment is usually my starting assumption and I do think western economies are in largely uncharted territory, meaning using the past to predict the future is harder than ever. Interest rates have basically been nil for the past 9 years and no one really saw that coming, even in the wake of the global financial crisis and the massive money printing that has ensued. The reason is because the economy isn’t generating the growth needed to raise core inflation and thus bring up interest rates. The question becomes whether that dynamic will change; if it doesn’t then interest rates will remain low for the foreseeable future.

Mukluk, you are probably right but I have seen as many economic forecasts be wrong as they are right.

Many relevant prognosticators believe interest rates will be between 2 and 4% for the next decade. Warren Buffett thinks there’s a good chance they’ll be around 3% (in the US of course, but our rates are closely related to theirs). There’s economic reasons interest rates rise, and those reasons just aren’t in place right now.

Kalvin:

it is a ridiculous amount of mortgage for a median income family to take on. If five years from now rates were pushed up to 7 or 8 per cent this would sink a lot of people.But i am a old guy and dont understand the logic of modern financing. Does anyone ever do after tax calculations on what they can really afford?

People are very comfortable with debt it seems. And you can’t argue that it’s been the more lucrative approach to leverage to the hilt, but it’s not for me. Would rather have less total net worth and a smaller debt load.

A colleague of mine helped her eldest son buy his first home. Her son was able to put down what I would consider a hefty and healthy down payment curtesy the bank of mom and dad. The house is an outdated two storey in a prime location in Toronto. His mortgage will be $275k. The mortgage broker made a comment that that amount is not even considered a mortgage nowadays; $500k and up is the norm. How do people sleep at night with such a heavy mortgage? Is it just me that thinks that is a ridiculous amount of mortgage?

It is hard to get information about pre-internet stats unless you find a university study. You probably have the best information here Barrister. Might not match actual stats, but closer than what I might guess because I don’t understand how the lending rules, exchange rates, norms, appreciation rates, and investment climate interacted back then. I would guess that during the crash period there probably was not a lot of second home investment.

I knew a few people in the 2000s that bought US vacation rentals – they were middle-aged, using savings, with rental income to help with bills. Sometimes it was bonus or stock option money. In all cases, they saw it as a way of investing some extra money that they had. (Also knew people that bought in Whistler/Mt Washington – some without financing, some with. Those are in a different category because you can easily drive there, control costs – no $ exchange – & not deal with borders.)

It’s a little disturbing to see all sorts of Vacation Property shows on HGTV with young 20- & 30-somethings buying foreign vacation properties – it’s like watching non-stop real estate ads. There needs to be more hard math going into the shows – but that would take away from the hard sell.

By the way, speaking of all the hoods here, maybe Victoria could produce this kind of video (for girls & guys) about the different neighbourhoods, eg., Kits is expensive but people focus on the nuts-and-berries lifestyle. No vitriol, all humour

https://www.youtube.com/watch?v=mXQCABue8y8

That would be throughout the 80’s and even early nineties. But the stats might show a very different reality. But back in the late eighties you could still buy a modest cottage north of Toronto for less than a years salary.

Bitterbear:

People in Oak Bay understand other peoples perspective they simple either dont agree with it or really dont care what your perspective is. One might as well get used to it since the fact of the matter is that virtually no one else cares what your or anyone else’s perspective is and if they tell you they do they are usually lying.

Do you mean in the early 1980s Barrister?

Most of the people I knew that where buying second homes in the states where using savings rather than mortgages. The percentage of income taken by taxes was a lot lower and you got paid a much higher rate of interest on your savings. Mortgage rates were so high that most people did not want to pin on a new mortgage.But that was just the people I knew and it does not mean that it is statistically true.

When we are talking about danger I interpret that as risk to an individual’s credit-worthiness. Thirty-five percent equity is a significant amount. Prices would have to fall a lot to come close to impacting equity in a negative manner. 65% is lower risk than 80% by far.

From where? Are you saying this was based on savings alone for most owners of US property? Seems very unlikely, but I’m not aware of aware of exactly how this worked the 1980s-1990s. My understanding is that refinancing would have been a common way to obtain funds for a US purchase prior to HELOCs, but perhaps that is incorrect. I do know HELOCs have been marketed since the mid-1990s.

I also came across this study that shows tax incentives for owning rental property where significant in the early 1980s and there was a second complete capital gains tax exemption for a couple (qualified for two). People were definitely using financing to buy second homes with a view to profit and for the rental income. It is pretty interesting – traces investment in Whistler.

summit.sfu.ca/system/files/iritems1/3703/b14238238.pdf

I’m also not aware of how the rate of US home ownership has changed over time except that it has dropped from 70,000 homes purchased in 2010 to 26,000 homes purchased in 2016. Twenty-six thousand does not seem so big for a population of 35.85 million?

Oakbayitis is also known as the “Let them eat cake” Personality Disorder. People with this disorder are pathologically unable to understand the perspectives of anyone outside of Oak Bay. Diagnostic criteria include 1) restricted interest in real estate 2) compulsive 4 dollar Americanos 3) hoarding re-usable Red Barn bags and 4) a smug and vacant smile.

Totoro, sometimes I find your comments interesting and other times just naive. The Heloc rules were changed back in 2013. What would you consider to be a better exchange; 65% of $908,300 or 80% of $596,000?

http://www.rebgv.org/monthly-reports?month=November&year=2016

(2012)Since reaching a peak in May of $625,100, the MLS® Home Price Index composite benchmark price for all residential properties in Greater Vancouver has declined 4.5 per cent to $596,900. This represents a 1.7 per cent decline when we compared to this time last year.

(2016)The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $908,300. This represents a 1.2 per cent decrease compared to last month and a 20.5 per cent increase compared to November 2015.

Totoro: “The new HELOC rules don’t seem to be creating much danger. Do the math and you’ll see what I mean.”

https://canadianmortgagesinc.ca/2016/03/snapshot-canadas-residential-mortgage-market.html

It’s no wonder that HELOCs are now the biggest source of personal loans in Canada, accounting for roughly 59% of non-mortgage personal debt.[12]

HELOCs became extremely popular in the United States between 2005 and 2008, right around the time the housing market was going belly up and paving the way for the biggest financial collapse since the Great Depression. According to experts, HELOCs that originated during this period are likely still underwater today, despite a strong recovery in US home prices over the past several years. “Underwater” means that the LTV ratio on the outstanding loan secured by the property is 125% or higher.[13]

In Canada, the maximum HELOC rate varies based on institution. Banks typically cap HELOCs at 65% LTV, although some institutions allow this to be combined with a 15% fixed or variable portion to receive up to 80%. HELOCs up to 80% LTV can be arranged through credit unions. Borrowing limits rise automatically with each mortgage payment, creating a constantly rising source of potential credit. With house prices rising dramatically, this has many people in the mortgage industry concerned about runaway debt, especially since HELOCs typically provide people with far more money than they could otherwise get with an unsecured credit card.[14]

….. and Totoro, this was an article from March of 2016. Yes, it’s a danger.

My parents and friends of my parents were actually using real money back in the day, to purchase vacation homes in the States. Today, it is speculative “equity”. Like I said, this bubble had better not crash.

Hawk, I haven’t heard of OakBayitis before. Is that the feeling of peace and deep satisfaction that comes with living in one of Canada’s best neighbourhoods? Please enlighten me!

“The new HELOC rules don’t seem to be creating much danger. Do the math and you’ll see what I mean.”

Look at the real world and what it’s causing in Vancouver as well as here. OakBayitis has permanently melted some minds that record debt has no consequences.

“This could be quite telling. I know Andrew, he’s probably the biggest foreclosure guy in town. If anyone sees the trenches, he does”

https://twitter.com/MortgageMark/status/864854764428722176

Hot tub conversation was a dreadfully boring discussion of tax districts in the US. You’d think the rich would have the decency to discuss something more interesting like Bugattis or which congressman they are considering buying.

Bullshit. It hasn’t stopped what is happening in Toronto as speculators begin to unload their properties.

A subtopic – landscaping & decks – do these make a material difference to house prices? They do to my enjoyment of my home. My experience in the past hour at Canadian Tire Hillside. They have an outdoor garden centre area. I’m driving between ‘kid-things’ and stopped in to purchase some wood chips and saw some nice flowers on sale. No outdoor cash register so now I’m pushing a somewhat heavy and certainly bulky load across the parking lot, into the store, to line up to buy garden stuff inside. One of their employees told me the boss said out door cash registers are too expensive. Anyway, the cash register beside me had dirt spilled around it from another transaction. One of my purchases had the wrong price come up and so out I trotted with the manager on duty (I think) to look at the price card and sure enough it was the price I thought – not the price from the cash register. So he said “I will give it to you at this price”. I said “No, you are not giving it to me – you are honouring the price clearly posted”. No he insisted he is giving it to me. What an attitude. So as we continued to “build our relationship” walking back into the store I asked about a garden centre with no outdoor cash register. His excuse – we are just a new store. My suggestion – May long weekend comes every year – plan for it. Note – cashiers (and this transaction involved a few) were each very apologetic and polite. When I finally left the store with my purchases the line up for the cash registers was very long. Sorry to anyone who was behind me.

The new HELOC rules don’t seem to be creating much danger. Do the math and you’ll see what I mean.

We live next door. They have better weather. They have been marketing to Canadians for years. Bet your parents or grandparents had friends with a place in Hawaii, Palm Springs or Florida for Ontarians.

Canadians are not the new Chinese. If you look at the chart the numbers of Canadian buyers have been dropping drastically since 2010 even while home equity has been rising. In 2010 Canadians bought 70,000 houses vs. 26,000 in 2016 – Canadian dollar has a greater correlation than equity. The Chinese still bought more in 2016.

For all you witches out there looking to buy it doesn’t get any better. 😉

Satanic house for sale by owner

https://victoria.craigslist.ca/reo/6138773954.html

Meanwhile, poor ole Rockland just can’t catch a break. What’s the deal, too many ghosts in those ole mansions ? 😉

1513 Laurel Lane just had to slash $100K in order to attract some love.

Leo, maybe you and Hawk can catch up and talk about real estate in that hot tub some time?

LeoS, welcome neighbor ! The food is exquisite. 😉

One of the dangerous side effects of this bubble is the homeowner’s extraction of equity (heloc) to purchase more property. Interestingly enough, again, Canadians are the new Chinese in the U.S.A, dominating foreign purchases of real estate in 5 cities.

Notably, 3 of those cities could be called B.C. purchases and the other 2 Ontario?

I know, I know, just because Vancouver and Toronto have the highest house prices doesn’t discount the possibility of other speculators from other regions.

It’s interesting the things we buy when we think we’re rich. The bears had better be wrong about this crash.

http://www.businessinsider.com/canada-is-dominating-us-home-sales-to-foreign-buyers-2017-5

@plumwine

there were more than a few good deals 36 months ago 🙂

I’d just like to say we’ve sold and are renting in Hawk’s building. Drop down and visit sometime.

AG, hows that silver spoon going ? Your neighbor on Exeter had to slash $450K. Ouch ! Looks like you’re taking a major hit. Best to keep that prescription up to date. 😉

2378 Cranmore Rd can’t catch a bid, had to slash it a mere $25K praying for a bidder. I thought Oak Bay was the be all, end all place to be?

231 Montreal St in prime James Bay slashed $60K in hopes of a bid somewhere.

The longer this goes, the deeper the cuts. Imagine when inventory pops at the rate of the GTA tripling? Bearkilla will hand in the keys and load up the old van to live down by the river.

Bearkilla – you have to admire Hawk’s indefatigability, at least. He’s made the wrong call for ten years, and lost his primary residence in the process, but he keeps on coming. Who knows, maybe this year is the year that he’s correct. You know what they say about broken clocks being right twice a day 🙂

Funny how the bull(shitters) are so defiant of the bubble popping in the face of multiple daily price slashes in prime areas of Golden Head as well as Gangford slumlord shacks.

Markets blow up when the sheep stop paying and the pool of fools is emptying by the day with Vancouver buyer exhaustion and mortgage quality in the tank.

981 Perez Dr in Broadmead just whacked $100K. Many more to come.

How can a bear be wrong for a decade and still arrogantly pronounce the top is in? It’s really something to behold.

“I’m curious to know what “timing the market” even looks like for first-time homebuyers in this market. My partner and I, both in our early 30s, little debt and good income (about 220k), are also low net-worth due to being early in our careers (about 80k saved over 18 months). Are we “timing the market” by continuing to save for another year or two so as not to put all of our net-worth in a house? This certainly has backfired for us over the past year given the rise in housing prices. On the flip side, wouldn’t we also be “timing the market” to put all our money in a place now for fear of continued rising home prices? It feels like we may as well spend our down payment on lottery tickets .”

Invega: one strategy you could use is a form of dollar-cost averaging. What you would do is buy a less-expensive place now. It could be a condo or a townhouse. Then, if the market were to fall substantially, you’d move up to a bigger house or buy a second property and rent out the first one. You would be hedged; the “loss” you’d incur on your small property in the case of a market decline would be offset by the the savings you’d get on buying the additional real estate at a discount. And if the market doesn’t decline, by owning something you wouldn’t be left completely out in the cold.

This is the approach I took with the place we bought. The market crashing would probably be the best thing possible, because we would be able to get into a high-end property for cheap–high-end properties will go down more on an absolute basis than our house will. If the market continues to increase, as it has since we bought, then we share in that benefit. If we ever have to leave Victoria we would rent out the property to avoid transactions costs.

We dont actually resell stuff although two of our neighbors have given us short lists of things to keep an eye out for. We have had a surprising amount of luck in finding what they were looking for. Everything from an apple peeler to a really nice dart board with high quality darts. I was actually tempted to keep the dart board for myself but my wife pointed out that I was likely to knock someones eye out.

By sheer coincidence we usually start up around Sydney but that really has nothing to do with the fact that I love the Sydney bakery or that there are no calories in anything that they sell on Saturday.

I am pleased that the weather seems to be great for everybody’s long weekend plans. So have fun and enjoy.

Those do sound like good deals, although I think the market for late night walks in full length mink coats with matching hats might be a bit smaller than you’d expect. Also good for the environment and minks to buy used. Oak Bay gargellium is June 10 this year.

I absolutely agree that used Victoria is a great place to look for deals but I have noticed that there is a lot less great items listed and there seem to be a lot more dealers out there. For busy millennials garage sales might be too time consuming but the best bargains are still to be found there.

For my wife and I it is also a great way to get out of the house and away from the gardening. We actually dont really need anything but the treasure hunt is fun. Last weekend we picked up a Bose Ipod sound system, still new in its box, for $10.00. A few months back my wife got a full length mink coat in immaculate condition from the Eaton Furrier in Toronto for $15.00 and it came with a matching hat. Perfect for the late evening winter walks. For me, I found a three volume set of Napoleons military Campaigns in perfect condition for $5.00. Looked up the volumes on both Ebay

and Amazon later and the best prices I could find was $480.00. None of these are things that we actually need; the fun is in the treasure hunt. But there are lots of practical items like fertilizer; garden fencing, brass and metal screws for next to nothing.

Is it time well spent, maybe not, but we have too much fun to really notice.

Hope all of you have a wonderful weekend and if you are house hunting try to remain cheery in spite of feeling like your wallet is being ripped out of your nose.

Cruel would be what you could have bought in 2013. A perfectly livable rancher in the Uplands for about 750k.

You are one cruel man. 🙂

Thanks Lurkess! 🙂

Local Fool: 815,000k

Barrister – most millennials probably use UsedVictoria & VarageSale so we can find exactly what we’re looking as it’s probably not an effective use of our time rummaging through random garage sales.

Ash – I would take the TH over the house. Just a personal preference.

Now what would Warren Buffet say about timing?

“Be fearful when others are greedy and greedy only when others are fearful”

Market timing – buy low-ish and sell high-ish, don’t try to get the exact low or high or you will be left out in the cold. Now is high-ish if you are looking short or mid term. Long term, just hold and think about other things.

Airbnb’s- earlier comment right on track. If tourism doesn’t pick up next year probably you will see a lot of short term rental properties swinging towards long term rental, just when more condos are coming on board. Could add quite a bit to available rental pool.

Does anyone know what 1155 Royal Oak Drive sold for? (MLS 377740)

2014 Sales Data Dump…what you could have bought in 2014…

Property Address Sale Date Sale Price

2391 BEACH DR VICTORIA V8R 6K2 13-Jun-14 $2,000,000

2001 BEACH DR VICTORIA V8R 6J7 30-Sep-14 $1,950,000

2580 LANSDOWNE RD VICTORIA V8R 3P3 31-Jul-14 $1,365,000

2560 NOTTINGHAM RD VICTORIA V8R 6C5 27-Aug-14 $1,275,000

3025 CADBORO BAY RD VICTORIA V8R 5K2 30-Sep-14 $1,200,000

1709 HAMPSHIRE RD VICTORIA V8R 5T7 30-Jun-14 $1,015,000

1624 MONTEREY AVE VICTORIA V8R 5V4 15-Jan-14 $975,000

1764 HAMPSHIRE RD VICTORIA V8R 5T6 05-Jun-14 $961,500

1666 HAMPSHIRE RD VICTORIA V8R 5T6 07-Oct-14 $952,000

1710 BEACH DR VICTORIA V8R 6J1 26-May-14 $945,000

3015 UPLANDS RD VICTORIA V8R 6B2 21-Jul-14 $920,000

1814 MONTEITH ST VICTORIA V8R 5X5 11-Sep-14 $889,900

2592 BOWKER AVE VICTORIA V8R 2G1 01-May-14 $889,900

2527 NOTTINGHAM RD VICTORIA V8R 6C6 25-Apr-14 $885,000

2861 CADBORO BAY RD VICTORIA V8R 5K1 24-Jul-14 $875,000

2642 DEWDNEY AVE VICTORIA V8R 3M4 27-Oct-14 $870,000

2820 HERON ST VICTORIA V8R 6A2 01-May-14 $862,000

2584 THOMPSON AVE VICTORIA V8R 3L3 26-Feb-14 $855,000

2634 CRANMORE RD VICTORIA V8R 2A2 25-Jul-14 $850,000

1536 YORK PL VICTORIA V8R 5X2 25-Apr-14 $846,000

2986 WESTDOWNE RD VICTORIA V8R 5E9 14-Jul-14 $839,900

515 FALKLAND RD VICTORIA V8S 4L4 27-Jun-14 $795,000

2698 TOPP AVE VICTORIA V8R 5W5 30-Jun-14 $792,000

2741 BURDICK AVE VICTORIA V8R 3L8 01-May-14 $791,250

1882 HAMPSHIRE RD VICTORIA V8R 5T8 31-Jan-14 $780,000

1866 ST. ANN ST VICTORIA V8R 5W1 27-Mar-14 $780,000

2627 HERON ST VICTORIA V8R 5Z9 30-Oct-14 $780,000

2645 BOWKER AVE VICTORIA V8R 2G2 14-Jul-14 $780,000

2193 CADBORO BAY RD VICTORIA V8R 5G8 22-Oct-14 $760,000

3664 CRESTVIEW RD VICTORIA 15-Oct-14 $750,000

1573 WILMOT PL VICTORIA V8R 5S3 21-May-14 $750,000

2385 LYN CRES VICTORIA V8S 4Y6 30-Oct-14 $747,225

2358 BEACH DR VICTORIA V8R 6K1 15-Jul-14 $745,000

1752 ARMSTRONG AVE VICTORIA V8R 5S6 30-Jul-14 $735,000

1869 LULIE ST VICTORIA V8R 5W9 15-Sep-14 $732,500

577 OLIVER ST VICTORIA V8S 4W2 24-Jul-14 $730,000

1718 ST. ANN ST VICTORIA V8R 5V8 21-Oct-14 $729,900

3420 WOODBURN AVE VICTORIA V8P 5C1 07-Aug-14 $727,000

878 NEWPORT AVE VICTORIA V8S 5C9 14-Feb-14 $722,500

3171 HENDERSON RD VICTORIA V8P 5A3 25-Jul-14 $720,000

2537 WOOTTON CRES VICTORIA V8R 5M7 17-Jul-14 $715,000

1755 LULIE ST VICTORIA V8R 5W7 26-Jun-14 $715,000

2675 TOPP AVE VICTORIA V8R 5W5 30-Apr-14 $710,000

1885 ST. ANN ST VICTORIA V8R 5V9 25-Jun-14 $707,500

2423 CENTRAL AVE VICTORIA V8S 2S7 16-Sep-14 $707,000

1199 HAMPSHIRE RD VICTORIA V8S 4T1 22-Oct-14 $695,000

2255 HARLOW DR VICTORIA V8R 3H9 31-Oct-14 $692,500

2195 CUBBON DR VICTORIA V8R 1R4 03-Jul-14 $690,000

3035 EASTDOWNE RD VICTORIA V8R 5S1 29-Aug-14 $687,000

1778 ST. ANN ST VICTORIA V8R 5V8 17-Jun-14 $683,000

2943 HENDERSON RD VICTORIA V8R 5M4 15-Apr-14 $675,000

951 FOUL BAY RD VICTORIA V8S 4H9 13-Feb-14 $670,000

1564 MONTEREY AVE VICTORIA 28-Aug-14 $670,000

2666 DORSET RD VICTORIA V8R 3N1 20-Jan-14 $665,000

2438 LINCOLN RD VICTORIA V8R 6A4 24-Jan-14 $662,500

1255 ST. DENIS ST VICTORIA V8S 5A6 15-Jul-14 $660,000

946 BYNG ST VICTORIA V8S 5B4 28-Aug-14 $660,000

3025 EASTDOWNE RD VICTORIA V8R 5S1 01-Aug-14 $650,000

2564 DUNLEVY ST VICTORIA V8R 5Z2 14-Feb-14 $650,000

2353 DALHOUSIE ST VICTORIA V8R 2H5 28-Jul-14 $646,000

2071 TOWNLEY ST VICTORIA V8R 3B3 31-Mar-14 $644,000

2594 HERON ST VICTORIA V8R 5Z8 09-Oct-14 $640,000

958 OLIVER ST VICTORIA 30-Jun-14 $640,000

2465 FLORENCE ST VICTORIA V8R 5E7 13-Jun-14 $640,000

2129 SANDOWNE RD VICTORIA V8R 3J2 27-Jun-14 $637,500

1753 ARMSTRONG AVE VICTORIA V8R 5S5 27-Feb-14 $637,000

2363 PACIFIC AVE VICTORIA V8R 2V6 02-May-14 $636,000

2739 CADBORO BAY RD VICTORIA V8R 5J6 27-Jun-14 $630,000

2182 BEAVERBROOKE ST VICTORIA V8S 2W2 31-Jan-14 $629,000

2041 CHAUCER ST VICTORIA V8R 1H6 07-May-14 $625,000

2656 EASTDOWNE RD VICTORIA V8R 5R3 27-Feb-14 $615,000

2737 DUNLEVY ST VICTORIA V8R 5Z4 25-Feb-14 $615,000

985 OLIVER ST VICTORIA V8S 4W5 29-Apr-14 $610,000

2085 LORNE TERR VICTORIA V8S 2H9 05-Sep-14 $600,000

2701 BURDICK AVE VICTORIA V8R 3L8 01-Aug-14 $600,000

2770 DUFFERIN AVE VICTORIA V8R 3L4 29-Sep-14 $595,000

2080 MCNEILL AVE VICTORIA V8S 2X8 30-Jun-14 $590,000

2240 KINROSS AVE VICTORIA V8R 2N5 15-Jul-14 $585,000

2139 FOUL BAY RD VICTORIA 06-Jan-14 $583,800

978 HAMPSHIRE RD VICTORIA V8S 4S7 17-Oct-14 $583,000

2467 MCNEILL AVE VICTORIA 15-Oct-14 $582,000

2508 FLORENCE ST VICTORIA V8R 5E8 14-Jul-14 $580,000

770 LINKLEAS AVE VICTORIA V8S 5C3 30-Sep-14 $575,000

1842 LULIE ST VICTORIA V8R 5W8 24-Apr-14 $574,000

2531 WOOTTON CRES VICTORIA V8R 5M7 23-Jul-14 $570,000

2373 COOKMAN ST VICTORIA V8S 2X3 29-Jan-14 $569,000

2548 DUNLEVY ST VICTORIA V8R 5Z2 30-May-14 $557,000

1550 YALE ST VICTORIA V8R 5N4 15-Sep-14 $550,000

2358 CADBORO BAY RD VICTORIA V8R 5H5 28-Mar-14 $547,000

1883 LULIE ST VICTORIA V8R 5W9 17-Oct-14 $540,000

2675 CADBORO BAY RD VICTORIA V8R 5J6 31-Oct-14 $531,250

2768 CADBORO BAY RD VICTORIA 13-Jun-14 $525,000

2170 FAIR ST VICTORIA V8R 2H1 12-Aug-14 $519,000

2660 CADBORO BAY RD VICTORIA V8R 5J5 30-Apr-14 $510,000

2072 NEIL ST VICTORIA 25-Jul-14 $504,000

2030 CARNARVON ST VICTORIA V8R 2V3 24-Jun-14 $495,000

2173 FAIR ST VICTORIA 30-Jun-14 $492,058

2218 BOWKER AVE VICTORIA V8R 2E4 25-Jun-14 $478,000

2574 EPWORTH ST VICTORIA V8R 5L1 30-May-14 $475,000

What we are talking about did happen in Mississauga years ago as developers were buying up farmland at the outskirts of the residential development lands. Farmland went from a couple hundred grand an acre to millions. And since Ontario assesses farmland according to what other similar farms have been selling for – the assessments went up as well. They weren’t assessing the development potential they were using actual farm land sales that happened to be selling in the millions now. If farmland at the outskirts of a residential area is selling for two million an acre then that’s what other similar farmland will be assessed at.

Curious Cat and others, if you were renting out a suite in your house would you claim CCA, given CRA is likely going to tax you on the suite upon resale? We have a suite for now, will likely take it over in a couple years, then we don’t plan to sell for 20+ years.

@Janney & Luke, sounds great! I’ll email tonight with a similar subject line as Luke’s. We’ve been out in the garden all day digging until sunset 🙂 Agree Barrister & Dasmo on the garage sales & UsedVictoria.

I bought in 2009! I got the same deal as you! I must be on the right track.

Feels like the party is just about over. It’s not so much about timing but whether you can live with a fall in prices or any hike in interest rates. If you have cash to spare in the end you are ok, but if not you might want to bide your time.

Yeah the 30% jump on an older townhouse stood out to me. And the fact that it sold for more than 2734 Roseberry Ave (670k), a detached house in one of the best locations in Oaklands with 3 beds on the main. But there you go, this market’s been full of surprises.

@ Vicbot – I’m assuming you read Luke’s post from 11:17 am today, suggesting the sharing of e-mails between the two of you. If you send me your e-mail I will forward it to Luke.

I’m at janisv@shaw.ca

Actually, it really would be a nice little event for any interested HHV people to meet up in a super relaxed way –

May 27th. – 2-4pm – 1782 Kings Road “The North Jubilee Neighbourhood Association Spirit Garden.”

We are a very humble neighbourhood looking to build community & we believe that FREE ICE-CREAM just might do the trick to get the ball rolling.

Also handy to take a gander at 1772 Kings – on sale for $700 K – it’s a very tiny place right next door to the garden – is it worth it?

Cheers to all !!!

I see 1606 Yale sold for 1,8 mil; 180 under asking. Still a fair bit of money for 2600 sq foot on a 6, 350 lot.

I’m curious to know what “timing the market” even looks like for first-time homebuyers in this market. My partner and I, both in our early 30s, little debt and good income (about 220k), are also low net-worth due to being early in our careers (about 80k saved over 18 months). Are we “timing the market” by continuing to save for another year or two so as not to put all of our net-worth in a house? This certainly has backfired for us over the past year given the rise in housing prices. On the flip side, wouldn’t we also be “timing the market” to put all our money in a place now for fear of continued rising home prices? It feels like we may as well spend our down payment on lottery tickets.

@ Barrister, joking aside I do Usedvictoria and Vragesale. Both for selling and buying.

Actually I did not mean Friday but Sat. or Sunday is when the bulk of the sales are taking place.

You can do this with regular property under certain conditions (you’re direct family).

Barrister writes: “Got the furniture moved so we are off to lunch and a garage sale. We do regular garage sales and I often wonder why there are so few young people at them. With a littl patience you can furnish a whole house and get a very complete kitchen for a fraction of the price.”

There was also this thing that bubble up in the 90’s called the internet. I think that’s where all the kids do there shopping nowadays…..

“and the CRA’s administrative policy described above would likely not apply.”

Yup. All those accountants and landlords who are relying on the 50% rule to insulate them from CG always overlook the structural change part. In tax court, it’s gonna be the “self-contained unit” part that’s going to get you. I could argue that I’m renting 4 out of 5 bedrooms in my house AND using my basement to run a daycare but that the main purpose of the house is my principal residence, (because I’m living there and nowhere else) but it’s kinda hard to argue strangers living in a separate apartment within your home that you can go weeks without interacting with.

Barrister writes: “Got the furniture moved so we are off to lunch and a garage sale. We do regular garage sales and I often wonder why there are so few young people at them. With a littl patience you can furnish a whole house and get a very complete kitchen for a fraction of the price.”

As a young person, I couldn’t help but chime in. I’m not at a garage sale at noon on a work day because… it’s a work day. Enjoy that lunch in Brentwood bay.

John it’s a pointless argument. His dad sold it many moons ago and any farmer with half a brain would have sold farm land that close to Toronto many moons ago thinking of their present needs not what their kids needed 40 years later.

The point is farm land is not assessed anywhere near its development land regardless of where it is in Ontario.

Pretty clear:

The CRA will also look at whether there have been any structural changes to make the property more suitable for rental purposes. Generally speaking, such changes must be of a more permanent nature, such as installing a separate entry for tenants, adding a second kitchen or reconfiguring the space by adding, moving or removing walls. While the ultimate determination, again, will be made by “a review of all the particular facts and circumstances in each case,” the CRA did state that the conversion of a portion of a taxpayer’s principal residence into a separate, self-contained housing unit, such as a basement apartment, used for earning rental income will generally result in the application of the change-in-use rules and the CRA’s administrative policy described above would likely not apply.

That may be the case in ON but in BC the assessment of farmland bears little or no relation to the value the land would sell at. That’s easy to verify just go to e-value BC and click on some farmland parcels. The assessments are ludicrously low. ANY parcel of land in BC can be assessed as farmland provided you produce agricultural products of sufficient value. The land does not have to be ALR. The farm income thresholds are very low so not that hard to meet for many rural farms. One of the reasons there are so many hobby farms in BC.

There are significant advantages to achieving farm status in BC for a property

1) much lower taxes every year

2) you can transfer the land within the family and not have to pay PTT

3) No capital gains tax when the land is transferred to your heirs

Being in ALR obviously crimps the value of a property. But merely having farm status does not, as you can get out of farm status any time merely by stopping farming.

GWAC, I am happy to see that you can google.

But there are no farms in downtown Mississauga. What you have clipped out of the act refers to rural properties. But even if it weren’t. The assessment is based on what other farms are selling for in the same location. A five acre farm surrounded by high rise towers would still sell in the millions and that’s what the adjoining five acre would be assessed at. Or what other five acre farms are selling for in that neighborhood – millions.

Were you thinking that it was only houses that were increasing in price? Because it sounds like this is news to you.

But if you really want to be shocked by the percentage increase in prices look at manufactured homes in the Songhees in View Royal. On a percentage basis they have out performed almost everything. Increasing in some cases by 50% in just 12 months.

I remember last year a well informed blogger was talking about leasehold town houses in the Songhees along Admirals Road and how good of a deal they were when they were selling a year ago at $100,000. One year later they are now at $200,000.

JD

From the Ontario website

Assessing Farmland Properties

Accurate farmland values in Ontario are determined by extensive analysis, using only farmer-to-farmer sales as legislated by section 19(5) of the Assessment Act. Farm values are based on the land’s productive capability and other factors such as climate and location. It’s important to note that the assessment of a farm is not based on the land’s potential use (e.g., development).

We may be arguing the same thing but Mill rate is really low also compared to residential. So even though value may go up on Farm land. The mill rate will keep the taxes low.

No one is arguing that point GWAC.

You can tear down your house and put a pig on the lot but you are still going to pay taxes on its residential value not a farm value.

Ash they are nice, great location but wow on that price.

Looks like some townhouse complexes are trying to keep pace with the detached market:

9 – 2828 Shelbourne St

Sold 705k on day 1, asking 650.

Two similar units in that complex sold for 540k-ish just last spring.

Wolf, I think you could also follow the downward trend and buy when the market begins its next up cycle. In that way you don’t have to wait 20 years from the day you buy to the day you sell. You can stay liquid in other investments and making a reasonable rate of return while the real estate market is in its down cycle, which could last years. How long you hold real estate is important. Ideally you want to make money without having to go through a long down turn.

It isn’t just the Return on Investment, it’s the Internal Rate of Return relative to you.

An investor is looking at the long term holding of a property. That rents will increase more than expenses and improve the net income over time.

That’s not what a speculator is doing. They are holding for short term appreciation. Our modern day Carpetbaggers.

https://youtu.be/atBdy_7hoWo

Got the furniture moved so we are off to lunch and a garage sale. We do regular garage sales and I often wonder why there are so few young people at them. With a littl patience you can furnish a whole house and get a very complete kitchen for a fraction of the price.

JD farm land is taxed very low in Ontario to get people to farm it. Unlike here,in Ontario it can be converted to residential pretty easily as long as there are no glaring problems with the land or so forth. Developers buy up the farm land rent it out to farmers and wait. Pay very little in taxes because the assessment is not what it could be but what it is used for.

I could be mistaken but I believe that until the land was rezoned for subdivision it remanded as agriculture only zoning. technically because of the zoning it could only be assessed as agriculture.

It probably would be today but back then there was an agricultural exemption to benefit farmers who were a large voting block after WW2 . The world changes and these days the tax code is critical in deciding a lot of economic decisions.

GWAC,

Well if its just farmland then he wouldn’t be one of the 50 richest men in Canada either.

400 acres of pasture land isn’t worth the same as 400 acres of prime residential real estate.

But I’m guessing that’s not what you meant. You think the Ontario government would only tax on it being farmland although the highest and best use would be residential.

I suspect that Ontario, like BC, their assessments are based on the Highest and Best Use of the property. One acre of farmland might be worth a couple of hundred grand but one acre of prime residential vacant land (even with a pig and a cow on it) would be assessed in the millions.