May 15 Market Update

Weekly stats update courtesy of the VREB.

| May 2017 |

May

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 193 | 436 |

1289

|

||

| New Listings | 361 | 692 |

1423

|

||

| Active Listings | 1797 | 1854 |

2406

|

||

| Sales to New Listings | 53% | 63% |

91%

|

||

| Sales Projection | 889 | 812 | |||

| Months of Inventory |

1.9 |

||||

A quarter less sales than this time last year, and a quarter less inventory. Pretty interesting to see the months of inventory tracking last year’s performance so closely. We are scraping the bottom of the barrel here, and despite increasing reports of more new listings hitting the market, the market measures are not showing any cooling down in aggregate.

It is true that individual market segments are cooling. For example, there were 1.85 months of inventory for detached homes in the core in April compared to 1.06 a year ago. This will be something to watch going forward but so far these are being counteracted by other market segments that are more active this year than last (such as condos and townhouses). At this point the market cannot get more active, but we’ll need a bit more data to determine if it is going to back off across the board or just bounce around the bottom for a while..

On another topic, I’m still mulling over how to improve the site and make it more useful to house hunters out there. Part of the issue is that since I have a real job that I intend to keep for the time being, there is limited time to develop new features, but I may be bringing in some additional resources to jump start new developments.

This is where I need your help. I have a couple ideas for what I think would be useful, but what would you like to see added to this site first?

What would you like to see on HouseHuntVictoria?

- Better market summary by market segment (housing type, map area, price, etc). This would focus on summaries that are easier to understand rather than raw data (similar to current Market Summary) (39%, 42 Votes)

- More data tools to chart current market conditions by area and housing type. Similar to what you might find on Zolo trends* for Vancouver. (36%, 39 Votes)

- A private portal to manage and compare listings. Users would have to provide their detailed contact information to comply with VREB data access rules. (23%, 25 Votes)

- Other (please elaborate in comments) (1%, 1 Votes)

Total Voters: 107

@Luke

What did you ever find out about 1849 Gonzales Ave? Like you mentioned it was priced reduced and then disappeard off the “Realtor” site round about May 11th or so. I happened to drive by on Sat 13 and the realtor was holding an Open House. I checked the site again still nothing. Drove by early the 17th and there was a SOLD sign up. And now I understand it sold above the original listing price? All seems odd to me.

Off topic but Marko you said 300 deductible on insurance is crazy….my insurance on a 2005 Echo is coming due and I have 300.00 deductible for collison and comprehensive….would like to save money of course. What would you recommend? Car is worth about 3.000

It’s pretty common for Oak Bay / Victoria residents to stop visiting friends who move to the West Shore.

Pic related.

Now that your spirit has been crushed Dasmo I’ll take that lot off your hands. Say $50,000 and a cargo bike?

Although I should probably be protected from myself….

I agree LeoS. It was more a comment on the BS that they bring that out as the reason to have the regulation.

LeoM they we’re talking about the surveyor to come and pin locations for the excavation. So she would have had a survey of the lot. If she even knew what that drawing was for (by the sounds of it) its second hand so now I feel like it be of those changing stories is developing….

Thing is though it’s not the government’s job to protect silly builders from themselves. If they aren’t qualified that’s their problem, and maybe they end up digging a $100,000 hole and giving up to hire a builder. That’s totally fine.

You need a legal survey done by a BCLS before ANY construction/destruction work is started. One of the main reasons is the surveyor will take ground elevation readings at over 20 locations throughout the property and heights for various parts of the existing house, including the roof peak, and the elevations at each corner of the house. All future maximum building heights will be measure relative to these ground elevations, as surveyed before any excavations begin. If the final excavated elevation is less than the original ground elevation, then the final maximum building height will be measured from the lower final excavated elevation.

I’m not expecting a smooth ride but it’s back on track for now.

Although my surveyor kinda sucked in the job they did pinning the house location

Shoot, I just finished redoing all my plans because the house designer put all the outside dimensions to the concrete.

Welcome to building a house, just getting started with the problems.

How do you even get a building permit without a current survey certificate? Without a surveyor pinning the location of the house, good luck getting it in the right spot (if setbacks are an issue for you).

You typically need to get a survey out at least once during earth work phase….might need to how much further to dig or blast, etc.

Survey of the lot and house plans is all you need for the building permit. No one forcing you to have a surveyor come out to the site and pin the excavation. How much you wanna bet they don’t pin the house…. I’m also willing to bet they have maxed out the envelope so need precision here. Although my surveyor kinda sucked in the job they did pinning the house location…. They almost used old plans even though when I emailed them to come out I had attached the latest and referenced to use them. So still no guarantees. Shoot, I just finished redoing all my plans because the house designer put all the outside dimensions to the concrete. You don’t strip forms with ICF so they should have been to the outside of the foam. So thus the foundation/footing drawings were actually wrong. House is now 5.5 inches smaller….

How do you even get a building permit without a current survey certificate? Without a surveyor pinning the location of the house, good luck getting it in the right spot (if setbacks are an issue for you).

Wish someone would do an article exposing the owner-builder exam BS……introduction of an exam “to protect the public,” when the government has zero complaints on file.

and have to love this in the article

“The email was among 1,618 pages that The Tyee received in the second phase of a response to a request made in December for records under B.C.’s Freedom of Information and Protection of Privacy Act. The government did not release the records until May 11, two days after the provincial election.”

In my dealings with the HPO office same crap; they always release the information I am looking for on the last possible day.

This person is clearly in over their head but can obviously pass an exam. Which apparently should be on project management and not obscure code questions. An excavator on site for five weeks without direction and supervision!!!!

I been saying this for the last 10 months. Building a home is not about memorizing the building code.

Fyi, I ran into the same issue on my build. Excavated, hit rock, called a surveyor, he came out, I needed to blast or take a foot off the height. Instead of blasting and going 9′ – 9′ – 9′ I didn’t blasted (saved a ton) and went 8′ – 9′ – 9′ for ceiling heights and had 2 inches to spare on max height 🙂

Nothing to do with knowning building code or similar, just common sense stuff. Exams don’t teach common sense.

Quite the email. Wow. But not surprising.

I don’t believe the target of that particular FTHB program was ever about buyers.

How is this surprising one bit? EVERY single policy introduced last year was to benefit large builders/developers…..

$750k new construction PTT exemption….benefits condo developers and large subdivisions with stampage sized lots.

BC HOME Partnership…….benefits builders/developers.

Owner-builder exam….benefits builders/developers.

If I had to choose between the corrupt liberals winning the re-count and a NDP-Green collation I think I would to go with the later even though that would be a disaster in itself.

Etc., etc.

Sad. Just so sad. How many FTHB are going to be hurt by this “affordable” FTHB program. Crooks. Damn crooks.

“Oh my god this is pure gold…”

Yes: it makes a clear and pithy statement of the case that the Clarke government is either stupid or cynically willing to implement bad policy for electoral advantage, and quite probably both.

But let’s not jump to the entirely unreasonable conclusion that the other lot would necessarily be preferable. Today, all elections seem to offer a choice only among parties of frauds, cynics and dopes, representing disreputable entities hidden from view.

@ Leo

Quite the email. Wow. But not surprising.

I don’t believe the target of that particular FTHB program was ever about buyers.

Some interesting anecdotalness on HPO BS. My builder has a neighbour to the his house he is building. The owner did the HPO exam and passed. So they are doing an owner build with no GC. Sounds like they are bleeding money. An excavator has been on site for over 5 weeks. They were asking my builder what to do since they had little to no direction! The owner started bugging him about how deep to go etc. He told them to get a surveyor. She thought it would be too much. So after they blasted etc they were back again a week later (with the excavator still on site). When my builder asked what’s up the owner said they were out by ten feet so had to do more blasting. They are in it for mega bucks just for excavation and blasting so far. Yep, not worth a surveyor for $500. This exam does nothing to help the consumer…. This person is clearly in over their head but can obviously pass an exam. Which apparently should be on project management and not obscure code questions. An excavator on site for five weeks without direction and supervision!!!!

Oh my god this is pure gold from Andrew MacLeod’s twitter. An email from the president of CMHC to a BC government housing official on the BC HOME Partnership plan

More info: https://thetyee.ca/News/2017/05/18/BC-Liberals-Housing-Plan-Worsens-Crisis/

Marko

Totally. And all your points were on the dot. Seller hadn’t had any issues, hence unwillingness to budge. Buyers were wary.

That offer was in the high 500s iirc. Place sold for 550K (so seller should have budged.. it wasn’t hot enough to get another offer that good). The new buyer did some renos (maybe 50K worth). In 2016 it sold again for over 700K in a bidding war. Current value? Over 800K I’d assume judging by the recent sales in the area (crappy house just sold over 800K and it’s a much nicer house).

So yeah, 250K seems pretty close. If that buyer that backed out is still searching I’m sure they are kicking themselves.

Bingo, the house is in Gordon head. I am not allowed to disclose the address, nor is my friend. I believe there’s a clause in the contract with respect to that. The house has serious issues. That’s all I can tell you. Yes, definitely having a friend/family member view the home with you is a smart idea. Home inspectors only have so much time too.

I’m sorry, but having the experience of seeing my own family and friends suffer the consequences of buying in a rush and not having a home inspection is very sad for me. And seeing first hand how it can affect someone’s life is not something I wish on anyone. Like I said, cases in court involving house deficiencies do exist. And some couples go from civil court to divorce court because of the stress it’s caused. On top of that, a judge will tell you you had the option of a home inspection and you didn’t take it.

So I prefer not to follow the herd and be cautious. You can return a shirt that doesn’t fit easily and get your refund, not with a house that you decided to buy as is.

An anecdote:

House near me was for sale a couple years ago. Buyers had perimeter drains inspected, weren’t happy with the results (old cement or terracotta drains) . The seller and buyer couldn’t meet on terms so they backed out.

A future buyer didn’t do a drain inspection. November rolls around and guess who has a backhoe in their yard.

When possible always a smart idea to get the drain tiles inspected; however, problem is unless there is an active moisture/water issue it’s an extremely difficult negotiation point. Most drain tiles have issues and most sellers take the position of “that’s great that you found a problem, but we haven’t had problems with water/moistre inside the home in the 15 years we’ve been here so we are not going to knock off $5 to $15 k off the price.” I always tell my clients you inspect drain tiles to get an idea of what you are buying and whether your place might flood while you are on vacation in Mexico in the middle of January and your tenant is displaced. Don’t expect it to be a negotiating point.

Also, hope those buyers bought something else. I’ saw many people back out in 2014-2015 over vermiculite, drain tiles, etc., which made sense at the time. Two years later when they are still looking and the price of the home they backed out on is 250k up, kind of sucks.

Thanks for the info on the spirit garden, Janney Claire Alexi. We’ll try to make it to the open house, since we don’t live far and also email you.

We’re just starting to learn about drought-tolerant plants (so we use less water in summer) so would be interesting to compare notes with what you’re doing. Also Luke, you mentioned being a horticulturist? That’s great! Perhaps we can exchange contact info via Janney.

507 Whiteside St – ask 779K, Pending @ 871K

Nicely renovated place with 4 bed on main and a suite, and it IS a nice quiet street (I think.. not super familiar with the area) but that’s a lot of money for Saanich West, especially Tillicum.

That’ll buy you a pretty fancy new build out in the western communities with a suite.

“What do you call your magic triangle?”

Bermuda Triangle. Once you put your money in it’s gone forever. 🙂

Halibut

That’s the open house I went to.

I missed that. I don’t know what I would have said before seeing it in person. Seeing the traffic I would have said, “Yeah, maybe.” It was definitely a surprise @ 918K, I was thinking 800s (850-880).

Good location, 3 bed on main and nice yard. I guess that outweighed everything else (it’s a 50s house, and while well kept it was dated, I definitely saw a lot of future costs).

I didn’t think Camosun would be that attractive to people. You must get a decent amount of traffic shooting between Richmond and Foul Bay.

What do you call your magic triangle? Mortgage mountain?

Now it is seconds later and font is back to how it used to be so please ignore my last post.

Sorry to bug everyone about this but I find the new font extremely difficult to read. On computer browsers it is very difficult and on iPad it is impossible.

It is no longer possible to use two fingers to resize the text to something I can comfortably read without cutting off the edges. I use iPad the most.

Why did you change this? Wasn’t broken.

Kalvin:

Ah, but where in town was it?

Seems like most of core you’ll get outbid by someone with an unconditional offer.

My house is well taken care of (new roof, gutters, drains in good shape, 200amp recently installed, no oil tanks, etc etc). If I had an unconditional offer within a few thousand of one with an inspection, I’d go with the no conditions. I don’t think I’d even bother to counter to bring them up the few thousand.

Why? A buyer can use some trifling detail on an inspection to back out if they get cold feet. Can you fight that? Maybe, but good luck. Someone backing out of a no conditions offer is a solid case.

Leo S

THIS.

A lot of you are missing the point of a condition to inspection. The value isn’t getting an inspector in, as many of you pointed out they aren’t infallible (my experience is they don’t know much).

The value is twofold:

-It buys you time to properly look over the house without other buyers or the sellers being present (cool down from emotion and really evaluate the place)

-It gives you the ability to renegotiate price or back out

When I had my house inspection I spent at more than 4 hours at the house going over every nook and cranny. I found stuff the inspector didn’t. Why hire an inspector then? Because I had him take pictures and document those deficiencies. Having a “neutral” 3rd party that is a “professional” is a lot stronger than you as an individual saying, “Yeah, well I found this stuff I don’t like. I want money off.”

In my case the inspector found some stuff I missed and I found some he missed. It’s a different perspective. I also had an inlaw come who spent part of his career doing permit inspections. Completely different perspective.

In Victoria my top concern is water. It rains a lot here, so perimeter drains and any signs of water intrusion. Burried oil tanks is a concern as well (potentially $$$$ to deal with). I didn’t bother with an electrician, but my place definitely didn’t have knob and tube or aluminium wiring, plus I knew I’d be upgrading to 200amp immediately (which was going to be a bigger cost than any minor issues he’d find).

An anecdote:

House near me was for sale a couple years ago. Buyers had perimeter drains inspected, weren’t happy with the results (old cement or terracotta drains) . The seller and buyer couldn’t meet on terms so they backed out.

A future buyer didn’t do a drain inspection. November rolls around and guess who has a backhoe in their yard.

JD — all joking aside it’s hot in that it seems to be an area that gets talked about a lot here. I tend to follow it a bit closer that other areas because it’s where we bought.

Aside from the occasional price slash that Hawk is quick to point out (1772 Kings being one of them), I agree with GWAC that it seems anything of quality will sell quickly.

Me too, no joke! Sol is overpriced, if you ask me. 😀

Define what you mean by hot?

Number of sales, days to sell, highest prices, scantily clad women or men?

hahaha. I work right next to the ministry of environment. There are plenty of people there with phds who’ve worked there for ages that aren’t making 85k. Unless you’re management, you’re part of the Union.

BCGEU has all of the liquor distribution and liquor stores in it, both of which are not in Victoria.

Halibut

I think anything in the core that not a, complete dump and is between 800k and 1.2 is hot it seems. Over that price or in need of major renos sits it seems for longer.

Is this the hot zone right now? Close to downtown, Uvic, and Red Barn.

http://i.imgur.com/HyaFSUh.png

Yes true, but it’s a dump and backing onto a busy road. Fairburn had that in the sales description is all I was pointing out. Frederick Norris took a long time to sell last year, so will be interesting to see if it moves this time for much more $.

Entomologist

Wow sorry to hear. That is a crazy price looks like it still needs a reno in the kitchen. These prices are shocking that people have posted the past 24 hours….I hope something comes up for you.

Anything near the university is commanding a fortune…It seems

That’s because there’s not many properties like this currently coming OM in Victoria’s core (or maybe not all that many at all?). The fatigue people must have from looking at crapboxes when there’s still more realtors in town than listings must be mind boggling.

That Queensbury house was in a great location, near the walking trail and quiet. A nice letter about your beautiful family, or $130k more? On some levels it’s a bit sad, but what would most people take?

Cool new little graphic Wolf… that’s a mean looking print! When I lived upisland just north of Qualicum Beach there were actually wolves that came down and howled at night on the odd occasion – cool sound at night when one is on the safety of their deck. One time I saw their tracks…

@totoro

“Maybe there will be a better time to buy when inventory levels rise, not sure.”

Perhaps you can help out by selling your income property? 😉

@LeoS

In response to the original post, is there some way for people to see historical sale price/date for a particular home in the proposed private portal? Or is this still a can of worms? Public can only see the last 3 years on BC Assessment. I don’t want to buy a flipped house.

Frederick Norris is closer to Uvic than Fairburn.

2016 Frederick Norris sold for $920k for Sept. 2016. It was listed early that year and took a while to sell after numerous price reductions. It needs extensive reno’s and they have done nothing to it! They are trying to make over $200k in just nine months? After what happened on Beechwood though, I wouldn’t be surprised if they get it. The house backs onto Cedar Hill X Rd (so noisy back yard).

I looked at 1860 Fairburn online and I thought, yeah a million plus one is a lot, but – it has a suite, big lot and quiet street. Somewhat fixed up, and here’s the big carrot in the sales description… It’s near UVic! (not a big deal to you and me, but… that’s a big deal for some)

1283 Queensbury….listed for $949k. Very nicely maintained and updated 1965 house with some beautiful woodworking features, though no super-recent renos, and suite not obviously rentable. We live very close by and love our neighborhood but wanted a bigger/nicer place. OH was very busy and we knew there would be interest.

We put in an unconditional offer for $1,010,000. We also wrote a nice letter about our family…

Did we convince them? No we did not. Apparently all 8 offers were unconditional. Sale price – $1,141,000, 192K over asking. They were note swayed by our beautiful letter (filthy capitalists!).

Based on this anecdote, I’d say there’s still lots of interest out there for nicely kept properties.

re: Frederick Norris Rd. A guy in a car pulled up beside us last week after for directions to that house – he barely spoke English so it was hard to communicate – but we pointed & mimed our way through the directions & then he took off like a bat outta hell.

We looked online but it didn’t pop up into our PCS until yesterday – a full week later, and in the notes it says, “NO showing until further notice.”

Question: a different realtor told us she couldn’t show a home to anyone until it appeared in MLS.

Is that really the rule about showings? because the house seems to have been sold before it appeared in PCS. Makes us wonder if this is common here now.

@deryk – Inspection doesn’t mean by a building inspector. All the things you mentioned fall under inspection.

It’s not all price slashes out there; 1839 Townley ended up going for 918k.

I posed the question in the last thread if anyone thought they’d get 900k as I thought that was the perfect combo of location/bedroom/bathroom/suite.

@ Bingo

You need to be aware that inspectors sometimes miss things, sometimes major problems. Make sure you ask what the inspection will cover and tell them if there is a specific item you want them to pay attention to. The Building Inspector requirements have recently been updated which is a good thing. The last building inspector I used missed some knob and tube and vermiculite, but that was back in 2005. http://www.rebgv.org/new-requirements-bc-home-inspectors

I don’t place as much value on paying for a “house inspection” as most people do. I know this will sound crazy but I’m quite serious. Of course I would inspect the house myself looking for the obvious. I also get an electrician to check it over as well. (Hired “House inspectors” are more often than not….NOT even qualified to open the electrical panel up “fully” and have a good look inside.)

The first thing they have you do is sign a waiver that absolves them of any responsibility for the inspection…making it meaningless anyway!!! But everyone “loves” them including the banks.

When you are paying $800,000.00 for an old bungalow you can expect an “old” bungalow with the likely hood that it will need work. It’s not rocket science.

If you can afford $800,000.00 for an old, out of date, broken down old house, you should be able to afford replacing the hot water tank if it needs it. Same with a roof. Big deal.

You are not paying $800,000.00 for the house….you are paying for the fact that the house is in a good neighbourhood and in a very desirable city.

Check the bones of the house. Sags in the structure, water stains, damp odours, perimeter drains, check the electrical by an electrician, flush toilets, run taps fully, flush toilets, roof tiles in general, attic – check for water stains on ceilings upstairs, check to see if water is flowing fast in sewer pipe.

Look at how well things have been maintained. It is quite obvious. Watch for the obvious “clean up” signs such as new gyproc on the basement wall where there is obviously soil behind the concrete wall. Look for water damage on the floors or baseboards in the basement.

Oh… and asbestos…..there isn’t an old house in Victoria that likely doesn’t have it.

Have the yard scanned for an oil tank if possible. They are being removed every day and it is not a big deal 99% of the time. (But…..Everyone tears their hair out by the roots over that one too:)

Do you have stats on this? I’ve always heard the opposite but never seen actual data

People aren’t forgoing inspections because they don’t know the value of them. Of course they’re a good idea. Problem is if there are 10 offers then the one that’s conditional isn’t likely to win.

I wouldn’t buy without an inspection but it’s clear why they were less common at the moment. Could always pre-inspect.

Is 2016 Frederick Norris Rd really asking 1.15M? I get that the location is desirable but the house looks like it could use extensive updating…

“Bingo: We need enough inventory so that buyers can add conditions to their offer. Bidding wars are bad enough, but buying without a proper inspection is awful.”

Not necessarily. Recently, a friend of mine put an offer on a home with inspection – yes, even in this market. It was the best decision she ever made. The home ended up having a long list of costly deficiencies that needed to be rectified. Being at the top of her budget, she would have had to borrow money to fix the problems. A couple of issues were too serious to even consider that.

Homeowners should not be weary or afraid of home inspections if they took great care of their homes. It really does not take that much longer in the process. Buying a home in any type of market without inspection, hot or not, is ridiculous and not being smart with one’s money.

Even though contracts are signed, I have seen scenarios like this end up in the court system and it is extremely costly for both buyer and seller. It puts a drain in one’s wallet and sometimes relationships.

So yes, don’t be afraid to add an inspection to an offer. It is not an extra expense, it’s part of the biggest purchase you’ll probably ever make in your life and spend many years to pay off.

I have to wonder what sort of friends wont spend a half hour commute to visit with you?

@Newhomeowner

When we bought two years ago, we could have bought more, but didn’t. Both of us were making less money back then, so we bought half a duplex in the so-called core. Basically, a starter property. While it kind of sucks sharing a structure with someone else, there is something to be said for not being forced to eat lentils, ever (maybe we’d have to if one of us lost our job, but like you, we wouldn’t be homeless). For now, avocado toast is never in short supply in our half a house.

Since it isn’t our foreverhome™, we plan to sell this pile of glass, sticks, and plaster at some point, and buy a detached pile of glass, sticks, and plaster. Hopefully somewhere else.

So as LeoS said, good choice. It’s a compromise, you might have to commute, and those jerks that live in the city won’t visit, but at least you ain’t broke.

Also, are you really that much better off buying in the core in the long run? This blog is Oak Bay and Fairfield-centric. How do core areas like Esquimalt, View Royal, Burnside/Gorge, etc., compare to Colwood and Langford over time?

Which I don’t even buy. As Victoria expands Colwood will be considered part of the core. Then people will be stretching to buy there because the alternative is Spirit Bay or Shawnigan

Was just going to make the same point. If there were 7500 core public service jobs in 2014/15 making 75000+ that probably translates to no more than 5000 in Victoria. Some of these are BCGEU, many are management or other non-union employees, some belong to other unions.

You will find a lot of other high paid public sector employees from the broader MUSH sector (munis, unis, schools, hospitals). Federal civil service of which there are also quite a few in Vic also pays better than the province.

@john Dollar

Nah, that 200k is just money I would’ve spent in the core. And my 500k investment would now be worth 700k. The truth is that the previous owners bought my place for 400k a decade ago. Despite the crazy market the previous owners didn’t make a penny on the place. Motivated seller+no bidding wars+terrible staging means you can still get a passable value outside of the core. Comparable houses in the neighbourhood rent for 2k/mo. So even if things hit the fan I can almost break even by just renting the place out.

@leoS

-You just quoted our realtor. Her take was that it was a crapshoot in Colwood. That long term we should be fine, but short term there’s a solid chance that values could drop. She felt that buying in the core was a great plan and up the peninsula was a good plan as far as investments go. But she didn’t see how Colwood could appreciate much when so many places are being tossed up in Royal Bay and Happy Valley.

To be fair, she was also a Peninsula type person. And figured the overpass would change nothing.

@ash

The ftb loan? The lender used the repayment of the HOME loan plan (the down payment matching) when they were calculating my TDSP. So it didn’t really change the final loan approval amount. TO be honest, it was actually a crap benefit. All it meant was we could get 5% of the mortgage now and not start repaying for 5 years. If you use it to make a down payment of less then 5% then CMHC also charges you more for having an unconventional down payment.

@ash & @Wolf

a 30 in the BCGEU is as high as you can possibly go and is fairly rare union level. Though it doesn’t truly max out at 83k. Most jobs at that level are very hard to hire for because people with that experience and education make far more money in the private sector with a real job. So they are normally subject to a TMA(a market adjustment worth 7-10% more) and receive plenty of overtime. Of the few 30s I’ve heard of, all make over 100k.

As well, it’s primarily BCGEU that are based in Victoria. Other people covered under other agreements(PEA and Nurses) are spread throughout the province. That said, many of the best paid are non union. If you look at sunshine list in 2014/15 there were 7500 people on it. So at that time around 30% of the public service made over $75k.

One thing I have learned on here that you can take anywhere I think. Buying near a university is a good plan. Not sure about these levels but on a pull back.

Wow I looked at 1850 fairburn by mistake I thought that was crazy. 1860 is just a whole different crazy.

It seems there is a sale pending on 1850. What that price?

You mean the chambers applications?

https://justice.gov.bc.ca/cso/courtLists.do?listSelection=Vancouver_Law_Courts.pdf&courtType=SCCL

There are a number because they are only scheduled Mondays and Thursdays and have been since 2013. I don’t see an increase, nor would it make sense given the rates of appreciation in Vancouver?

Marko:

I just looked up the house on 1860 Fairburn. Has someone lost their mind. A million dollars for that crapbox and in that neighbourhood.

Good choice. Here’s the thing, maybe buying in the core is more lucrative in the long run. Maybe stretching to the max and getting a $700,000 mortgage would have led to greater appreciation. But what does it matter if it leads to 10 years of money stress? How much is your mental health worth?

In this market we would choose cheaper as well. The freedom associated with not being stretched is priceless.

Be interesting to see how this plays out in California:

https://www.bloomberg.com/view/articles/2017-05-17/taking-on-nimbys-in-the-quest-for-growth

Good on the state for taking on petty local politicians and bureaucrats. Here, the provincial government likes to shift blame on to local governments for constraining supply, but nothing is done about it.

Here’s a more recent quote from Andrew Bury dated November 2016

Wolf, a “high end” government salary with an advanced degree and 20 years experience is not 85k. 85k is more like a masters degree and 5-8 years in. Most professional-level staff are non-union meaning the grids that caveat referred to are not relevant.

Wow Hawk you and your buddies getting desperate. Lol.

Original article from 8 years ago.

http://www.notapennydown.com/blog/hello-world/

I just looked up tomorrow’s Supreme Court cases in Vancouver and it seems they are full of foreclosures.

Some ftbs are learning that they can’t borrow as much as they though they could, then falling back on the new ftb loan to secure financing. I’ve heard of this happening a couple times now. Gotta love those pre-election policies.

Why is everybody discussing only the inner core for first time buyers? There is nothing wrong with the Westshore, Brentwood Bay or Esquamalt or View Royal. It has been a long time since Victoria has expanded and oak bay was a suburb.

Marko looks outdated.

Hawk, that quote is from an article published eight years ago in 2009.

1860 Fairburn for $1,001,000…..wow!

Newhomeowner you should have been on this blog two years ago when some of the bloggers were trying to explain how it was a good time to buy in the Western Communities. You could have been 200K richer.

Yikes, bankruptcies heading up ? Is “The End” here ? Sure smells like it. 😉

@MortgageMark

This could be quite telling. I know Andrew, he’s probably the biggest foreclosure guy in town. If anyone sees the trenches, he does

https://twitter.com/MortgageMark/status/864854764428722176

Agree with you there John Dollar. You can time when you buy or sell when conditions favour you. No matter what happens in the future the simple fact is that buying now sucks….

By that extremely narrow definition of buying ONLY at the peak or the trough then you can’t time the market. The market is only at those points briefly. And I have NEVER said that I was trying to time a peak or a trough. But you can time things so that you can buy when the market is in your favor as my posts have repeatedly shown. That is timing the market, the other is just being lucky.

Yes. One way to get your time back is to outsource more. Another way is to work less. I lean towards the latter.

@cadborosaurus & @Bingo

on an insured mortgage the rules are 42% of gross income on debt on normal high ratio mortgages and 44% when your credit score is above 750. And that includes the approval at 4.7% rather then whatever it is you’re signing. Was quoted the same rules at both the broker and my bank.

I have a similar but different experience though. 125k/yr household income with perfect credit, I was approved at 750k. All told that meant over half our net income would go to a house($3700-3900/mo on housing costs, take home biweekly at $3300(both union so dues and pension are in there)). We thought that was crazy, but we felt we needed to buy(because of reasons) so we bought a 4br/3ba SFD in Colwood (on a bus route/near the goose) for 500k.

It means all of our city friends will never visit us again and it takes me 20 min to get to work/1 hr to get home. But it also means if someone goes on mat leave we aren’t reduced to bread and water, and if one person loses their job, we won’t be made homeless.

No regrets on buying now. About $200k regrets for not buying 18 months ago.

Sounds like AG is on Garth pumping the Uplands being cleaned up by the Chinese and millions being made by multiple friends.He forgot the guy on Exeter who had to slash $450K. LOL

totoro

Sounds like a reasonable explanation. We can’t blame it on 0 down 35/40 year mortgages.

We need enough inventory so that buyers can add conditions to their offer. Bidding wars are bad enough, but buying without a proper inspection is awful.

At some point months of inventory will increase, but the question is when and what will cause it. My money is on increased interest rates being the catalyst.

Well I should stop being shocked anymore…

241 Beechwood in Fairfield sold for $1,499,900 today…

Sales history: Sold for $763k in Sept. 2014. Sold for $1,195k in March 2016.

This ‘triplex’ left so much to be desired when I viewed it last year. And I can tell you nothing was recently done to it. I just can’t believe someone thought it was worth $1.5m ! Crazy!

Had a look at that ‘Spirit Garden’ on Kings Road today one block west of Richmond Rd – I’d encourage everyone to check that out, they’ve done an incredible job.

Yes. Without the 20% down or co-signer the new rules impact what you can borrow by quite a bit for ftbs, and the interest rate risk is significant without a suite. It is a bit crazy that prices haven’t been slowed down by this, but I guess it is move up equity, downsize equity from other places like Vancouver, and cosigners and parent help keeping things going with a bit of foreign buyer money. Maybe there will be a better time to buy when inventory levels rise, not sure.

So the $832K is not too different from the $800K I cited earlier; the 20% down payment is prohibitive. Also, if your down payment is less than 20% you can only ammoritize for a maximum 25 years and I think assuming 2.29% interest for 25-30 years is optimistic. And then, of course, the median family income is half of what we are discussing.

I certainly tried it once, in early 2016 when the US markets started their precipitous drop. Hung on for a few months, then thought it was going to keep going, and sold a bunch and went to cash. Then of course, it rocketed back up to new highs. Served me right, good lesson for me.

I agree, RE markets aren’t magic. But trying to determine where the peaks and troughs are is virtually impossible, as your own and others’ prior posts demonstrate. In my case, I choose not to participate, which will either be a great decision, or an awful one. 🙂

@Cadborosaurus

Thank you. Hard to beat a first hand example. I’d be pretty frustrated in your position. 100k is good. Sucks it’s a such a stretch to buy.

I went to an open house this weekend for shits and giggles. 799k ask. I was the youngest person there during my short visit (plenty of traffic though). Late 40s seemed the next youngest ( so a few GenXers) and lots of boomers (I think.. I’m a terrible judge of age.. they looked like my parents so I assume they were boomers).

In that age range I’d assume they were coming in with existing equity. Whoever bought it had some money. It got bid up to 918k. 50s house. Not updated recently and a weird 1 bed suite (have to walk through the bedroom to get to the bathroom).

Seemed like a good type of house for a young family to put some elbow grease into, but not at 900k+. Obviously 800k is a stretch for most families (even with a suite ) but 900k+ seems nuts to me. Someone saw value in it.

We bought our first house in the early 80’s for $92,000 which was a little more than two times our income. I vividly remember sleeplessly staring at the ceiling the first few nights staggered by the size of that amount and the upcoming 240 payments.

Unless your “starter home” customers have a household income of $300,000, they will (should?) be far more agitated than I was.

I can’t see how one could avoid personal and family anxiety while carrying that kind of commitment for decades.

More or less correct

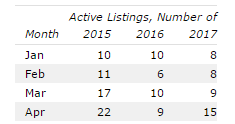

Listings:

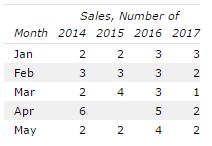

Sales:

MOI not really meaningful with such few sales.

Leo, not surprised. Watching the CTV news and now “affordable”housing downtown is $1500 for a one bedroom. Someone who is single making $20 to $25/hr will have to fork over a whole paycheck or more.

This city will soon implode when these landlords think they can all gouge like this. History will repeat like in 2012 where renters left town like the UVIC student is.

Don’t see why it would be. Where do you think the conflict is?

Martlet article on cost of rent. Not overly well written but this is going to happen more and more.

http://www.martlet.ca/a-letter-to-uvic-its-not-you-its-me-ortgage-rates/

I had a meeting this morning at a Starbucks. $2.75 for over roasted coffee. I prefer Timmys that serves a proper cup of Joe with a glazed doughnut. However, sometimes you have to sit beside one of the more verbose bloggers on this site.

https://youtu.be/Xt4ua_ZNoD0

On Vancouver news last night.

New house in Vancouver listed for sale in Vancouver and Hong Kong for 2099 bitcoin owned by a numbered company of which the agent is a director.

When asked by the reporter if it was ok for him to be a director of a numbered company owning a house he is selling, he replied “you ask a lot of questions” and hung up the phone.

Nothing to see here folks.

Watch the 2016 Grant’s lecture: Cohodes at his best/worst.

John Dollar:

You can get a Tim Horton’s medium sized coffee for a lot less than $2.75.

Thanks for the stats on Oak Bay House sales. Maybe sales in the Uplands will pick up in the next month or so but there seems to be at least six and maybe twelve months of inventory out there.

My head starts spinning when people start talking about first time buyers borrowing 7 or 8 hundred thousand.

On a positive note, I got my lawn moved and got the fountain started today. Hoping for some nice weather so that i can start some exterior painting.

Bingo- as a first time buyer I can speak from experience. Our family income is in the 100k range and we will have 5 – 10% down depending on the purchase price. We have good credit and no debt. We were approved for 620k from a local bank in Nov and up to 740k with a suite, both amounts absurd IMO. We likely would have been approved for higher from a 3rd party lender or if we took advantage of a Christy Clark loan of an additional 37k. We haven’t gone for a pre-approval since the new Fed rules took hold that require first time buyers to be able to withstand mortgage payments at current BoC rates of 4.7% so take 100k off our top end for a potential pre-qualify amount today.

We’re not going to buy at the high end of that range anytime soon, we are waiting for more inventory and eating popcorn on the sidelines waiting for the inevitable further government controls coming our way.

We have several friends our age and income bracket who will also be high-ratio mortgagers that are buying right now, 2 placed offers this week on places. They’re buying at the top of their approval range. Scary times

Hi,

I have a question.

Will it be conflict of interest? I bought a house with no agent. The seller’s agent helped writing offer, going through the process. now I am thinking of selling my current house, Will it be conflict of interest to use the agent who helped out buying new house?

“How did this bubble grow so gigantic?

“The Canadian housing market is a money laundering-induced market. They have sought Chinese money to keep the housing market propped up. But it won’t last. Especially Vancouver is a place for the criminal element to come into Canada and hide money”

Local,

Good post. Cohodes knows where there’s one Home Capital there are many more to come. There is never just one, only a total idiot would think that. The OSC just did their job and now they know the patterns of how these frauds lent out the money to those who shouldn’t have.

Just a matter of time til the books are scrutinized and more is uncovered. The Big Short Canadian Style coming up, just like the Trump and crew going down in a ball of flames.

I hear a few people talk about not being able to “time” the market. But what did they ever do to try and time the market in the past?

I don’t hear any pearls of wisdom being expressed on how they went about trying to time the market in the past and failed. Did they look at Tea leaves? Check out their Astrology chart? That kind of knowledge and $2.75 will buy you a cup of coffee.

For some, how real estate functions will always remain magic. I wonder why they even bother coming onto this site except to tell the world how wonderful they are. The people you don’t want to listen to are those who expect or ready to accept failure.

“Lead me, follow me, or get the hell out of my way.”

-George S. Patton Jr.

Totoro mentioned that ~$650k is about the price of a starter home in the core. Here are a couple recent sales that I think are decent deals (assuming there is nothing horribly wrong with either them) and fall into this category:

281 Rudyard in View Royal

2734 Roseberry in beloved Oaklands

If I just had to buy into this market, and wanted an SFD, this is what I would be going for. A non updated, but otherwise solid 50s shit-box with suite potential. Since most people are not handy (or think they aren’t), the competition isn’t so fierce. And if you are handy, you can build some equity.

Thoughts, would be first time buyers?

Wolf – try here: https://www.ratehub.ca/mortgage-affordability-calculator

Input salaries of 100k and 75k and assume no other debt. Use five year fixed for 30 years at 2.29 and monthly property tax of 300 (assuming HOG). You’ll get $1,370,218 in mortgage if you put 20% down – which you would not be able to save in two years but might have enough if use other investments so my numbers below based on two years’ savings don’t work with a 1.3 million dollar mortgage.

If you have less than 20% the mortgage amount declines to $902,257 using https://www.cibc.com/ca/mortgages/calculator/mortgage-affordability.html

but it is likely even less as the posted rate for qualification is higher at 4.64 – meaning you could only borrow $832,696.

So if you want a million dollar home as a first-time home I guess you are at putting 10% down plus transaction costs, or asking a parent to co-sign.

wolf

Lots of different Canadian calculators out there. Here’s one: https://www.ratehub.ca/mortgage-affordability-calculator

Looks like no matter how much down you have the most it’ll say you can afford is ~1.25 million + your DP.

Will a lender actually loan that much to a family making 175K? No clue. In my experience a bank will lend as much as it’s allowed regardless of whether it’s a good idea. When we bought our house the bank was willing to lend a lot more than we thought it prudent to spend. I don’t remember how much, but it was >100K more than we were willing to spend (so they thought we could handle at least $600/month more at those rates).

I wonder how much people make that are buying houses in the 750-850K range (seems to be the SFH sweetspot). Are families making 90K actually stretching themselves that far? Looks like if you have 20% down you can “afford” it. Yikes.

Anything less than 20% with 90K income and you can only borrow 460K + your DP (according to the calc). To afford a lot of these places on median or near median family income you need 20% down and a 30 year amortisation.

Ya, timing is a terrible idea. IMO anyone who does it successfully is little more than lucky.

LF

I stopped along time ago trying to figure out timing. Could happen tomorrow or in 10 years. Instead I just try to keep some cash for the down times. Things always go back up just need to be able to ride out the bad times. 🙂

Barrister, when it comes to the high priced homes there has been an increasing trend to the new listings to sales ratio since the beginning of the year.

In Oak Bay the ratio was 29:15 or 1.9:1 in January. That fell to 1.1:1 in February. 1.3:1 in March. 1.95:1 in April. And so far this month the ratio is 2.6 new listings for every house that has sold in Oak Bay.

That has led to a steadily increasing number of active listings and months of inventory. The market still favors sellers but less so than say in the last two years.

I think we are poised, much like we were in 2014, for substantial increases in the months of inventory in Oak Bay and in the high end market in general, perhaps doubling the current rate by summer. Yet that increase may not necessarily mean lower prices -or it might. It’s a coin toss at the moment.

I’d put it to you this way. If I were using Totoro’s or AG’s money for financing I would buy a house in Oak Bay but I wouldn’t use my own money.

If I’m seeing this trend then so are the banks and I would expect them to tighten up on credit for the upper market loans with larger down payment requirements.

Real Estate follows a cycle. It can’t be good times forever.

“We had other investments first that we cashed out to buy – I’m still repaying the HBP. We then invested again when we could afford it.”

I’d consider this all-in on a home. Sounds like you cashed out all your investments to buy.

Curious, who’s handing out 1.3 million mortgages to $175K incomes? How did you come up with 1.3 million?

Yes, and once you’ve reached that point the next point is where you’ve actually bought your time back.

Gwac,

Oh, I have a doomer article for that too. 😀

http://www.bnn.ca/wake-up-call-canadian-unemployment-conditions-worsening-per-survey-1.754290#_gus&_gucid=&_gup=Facebook&_gsc=SNkYNdc

Rate hikes or unemployment spikes are definitely catalysts to trigger defaults and a downward slide. You’ll notice that right now, arrears rates are very low. It suggests that Canadians are handling the debt well. Doesn’t it? Well…

Exorbitant house prices and excessive leverage go hand in hand – and in the hottest markets where you have both, you see few defaults. Does that mean we can afford the prices? Not necessarily. In a hot enough market, how would people writ large end up defaulting? If you can’t make the payment – so what? Put it in the market and it sells almost immediately, very possibly for more than you paid for it. Walk away feeling like you’re a financial genius.

The problem is when sentiment sours, and real estate goes back to being its traditionally illiquid self. Then it’s not so easy to get out from under the debt. Arrears start to rise, and the rest…well I’ll leave that up to imagination.

LF

He is right about the conditions but the difference with the US crisis is rates are not rising here. Teaser rates killed that market.

Either rates need to rise or unemployment needs to rise. Something has to happen to see people not paying their bills. Right now people are paying their bills.

He is just trying to shake confidence to go after the HC of the world…He succeeded with the help of the OSC.

Finally something I sort of disagree with you on. It is not an either or scenario. Everything counts imo and 400 dollars a month extra on food adds up if you are just starting out and trying to save a down payment.

You are not just starting though. You’ve been in for a while and maybe the who cares attitude on food is worth it for your quality of life vs long term return.

Taken a bit out of context; I did the small stuff too when I had time and it was relevant to my financial standing. I remember when I use to walk into Subway 10-15 years ago and people would order a Veggie ($3.49) when Subway has a special of the day 7 days a week for $2.99…..even in my teens I was like how stupid can you possibly be. Just order the special of the day and ask for the meatballs/tuna/etc., to be left off, and poooof you have a Veggie for $2.99. I must have seen at least 50 people order a Veggie at $3.49 over the years. My friends were always embarrassed for me when I employed the please leave the meat off trick 🙂 Not to mention it once made for an awkward date when she ordered a Veggie and I was like….”no no, she will have the meatball…..”

I don’t go to Subway anymore but I see this type of thing every day….like people getting ICBC deductibles for $300 or $500…..I am always shaking my head as it makes no sense.

My point is I am not going to line up at Costco for 10 minutes to save $3 on gas when I can do 10 minutes of research on selling a house, do a mere posting, and save $10,000.

At some point your time becomes more valuable than saving a few dollars here and there. When a crap house in the core is $1,000,000 saving on food is not going to get you there. You need to set it up a bit in terms of savviness and decision making…..actually I take that back. Just employ common sense, I don’t see a lot of it around.

Yes, that is a risk. We felt it when we first bought because we were close to our affordability line. We got a five year fixed term and rented a room out. Right now for 1.3 you’ll get a house with a suite which provides a buffer. If you don’t want a suite I’d go smaller and cheaper.

Not sure exactly if I agree. There is so much equity in the housing market that for move up buyers they aren’t relying only on income most of the time. Incomes can still buy houses, but they are getting smaller and further out for first time buyers. Equity can sustain greater appreciation because it grows with it.

No they don’t. We had other investments first that we cashed out to buy – I’m still repaying the HBP. We then invested again when we could afford it. A primary residence has been a very good first building block, better than stocks imo, due to leverage and tax exemptions. YMMV for the future.

Maybe, all I’ve got to go on is past performance. Anything else is a crystal ball. My best guess is that leverage and hold is your ally for a primary residence.

Sure. Up to you.

Marc Cohodes is one of the most feared short-sellers on Wall Street. Right now, he’s on the hunt in Canada where he spots a monster bubble in the housing market.

Excerpt from Interview:

What’s going wrong in Canada?

“The Canadian housing market is essentially the US housing market during the second half of the last decade but on steroids and LSD. People are leveraged to a scope I’ve never seen. In Toronto and Vancouver, which are the most moneymaking areas, the average income of a family is only about 80,000 to 100,000 Canadian dollars. But house prices are 8 to 10 times that. People live way beyond their means and in order to keep up they are borrowing more and more and more. The problem is that the people who are lending you money expect to be paid back. So when things change they are going to change drastically and people are not going to know what hit them. It’s going to be horrific.”

How did this bubble grow so gigantic?

“The Canadian housing market is a money laundering-induced market. They have sought Chinese money to keep the housing market propped up. But it won’t last. Especially Vancouver is a place for the criminal element to come into Canada and hide money. You walk around places at busy hours and there’s no one there. People own on multiple units and they’re just taking money from totalitarian areas and putting it into real estate, pushing up prices and crowding out people who really need to live there. The same is true for Toronto. It’s the financial capital of a banana republic. That’s what’s going on in Canada and they really need to start paying attention. They admit that they have a housing bubble and that they need to be doing something about it. But all they do is talk.”

How do you short the Canadian housing market?

“I think the five big Canadian banks are okay. But everything around the periphery is going to collapse. The regulators have been sleeping at the switch. To me, the struggling mortgage lender Home Capital Group is like the vulture in the Canadian housing coal mine. It’s Ground Zero for everything that’s wrong: you have mortgage origination fraud and you have laundered money. I have been talking about it in the media for two and a half years and I have exposed them for what they are. But regrettably, everybody is of the point of view to shoot the messenger and not listen to the message. What started off as a company which was telling stories and missing numbers in a booming housing market turned into mortgage origination fraud, then turned into disclosure fraud and will probably turn into insider trading. It will turn out that the numbers really aren’t the numbers.”

https://www.fuw.ch/article/i-focus-on-the-crappiest-companies-i-can-find/

What a bank (curious which bank) will give you and what you can afford are not the same thing. Your $175K, 1.3 million example family unit would likely be forced to sell if interest rates went up.

So it seems that you’re agreeing with me that house prices cannot be sustained by income levels.

Your comments always assume all-in on real estate, totoro. Not everyone works that way. Some of us take other routes that get to the same place. Perhaps it’s more risky, like you say, but it’s still math-based. Otherwise someone like me wouldn’t take that route. I would perhaps debate the opposite in that real estate can be more risky, especially if leveraged. What worked for one generation doesn’t necessarily work for the next.

Sure there is entitlement and laziness. But still it’s not enough to overcome that. Working 24/7 at your hotdog stand ain’t going to buy you even a microloft right now. I “hustled” my way here, I took risks and still do. Being self employed I am well aware of that angle. Still I can see that the same opportunity I had to get ahead in Victoria RE is gone for now….

“Depends on how good you are at hustling.”

For more than 20 years I would find myself in Singapore for a few days. I would always visit the same food court and the same vendor near the Carlton hotel. What with work and jet lag I could be in the court at any time of day from eight in the morning until two in the morning. No matter what time of day it was I was always served by the same two women and one man. Every day, every night, every morning without exception for two decades. These are people who will get ahead in Singapore and they will get ahead if they emigrate to Canada – much to the consternation of the native Canadians on their block who have a markedly different view of work.

Canada (to it’s great benefit) has immigrants like this (tip of the hat to the Juras family) but it produces almost no home-grown versions. It’s a big problem.

The Economist publishes a list of the world’s most competitive economies from time to time and one of the more recent ones rated Canada. In first place on the negative side of our nation’s balance sheet was the comment “over-expectant work force.”

Median income is 80k in Victoria for a family unit, not six figures per earner. With 175k a year income you can definitely buy a nice home here. You can run the numbers yourself. Should be able to save a down payment in two years and qualify for a 1.3 million dollar mortgage if you feel comfortable with that.

I did the math for the median family below. Still can buy here but buying options have changed to less for the $ as we know so I guess what “sufficient” means to you will be relevant, and each 5k saved is 100k borrowing room if you have the credit.

Also, if you have a public pension and plan to stay you need to save less outside of your house imo.

Yes, inventory is bad.

I’d be handing out flyers in the areas I want to live in and searching CL and usedvic. We handed out flyers to a few houses we liked in 2009 – didn’t pan out – but worth a try.

Finally something I sort of disagree with you on. It is not an either or scenario. Everything counts imo and 400 dollars a month extra on food adds up if you are just starting out and trying to save a down payment.

You are not just starting though. You’ve been in for a while and maybe the who cares attitude on food is worth it for your quality of life vs long term return.

Thanks for the link caveat. Very interesting.

“I am shocked how many millennials go for mutual funds if they have a bit of cash left over”

That’s because baby boomer and Gen X financial advisors at the banks (note spelling is not ‘advisers”) tell them that’s what they should do. It’s a bad choice IMO but that’s what they’re taught. Last time I checked Marko, you were in fact a millennial yourself. Don’t put yourself above your brethren, you’re not.

“Entry level homes are not one million in all of Greater Victoria. I’d say we are at 650k looking at the listings and much less in Langford/Colwood. Townhouses and duplexes are less still and seem like a reasonable first choice if you’ve decided you want to stay in Victoria and owning is worth it. Might not be for some.”

Not much available in the $650k range in the core. I agree that duplexes and townhouses are a reasonable choice for first timers looking to stay in the core…except there are about half a dozen duplexes for sale right now, and not many more townhouses. It’s just a lousy time to be looking.

I would wait for inventory to improve. This market sucks for first time buyers.

It’s not about the Avocado or filling up at Costco on gas to save $3.

It’s the big picture stuff where the millennials get screwed…..just ask a millennial to list three differences between TSFAs and RRSPs? I am shocked how many millennials go for mutual funds if they have a bit of cash left over. If you are paying 2% MERS your chances of getting into a house based on hustling and hard work are zero to none. Common sense is required too.

I blow a lot of cash on food. I honestly don’t pay attention and I just buy whatever I want. Who cares as I make up on a ton of other stuff by taking a few minutes to educate myself? On one really simple thing such as managing my own RRSPs and TSFAs in a TD Waterhouse account I save more than $4-$5k per year versus having someone “manage” it. And there is literally an extremely long list of where you can make up savings over the average person. For example, just do $1,000 deductibles with ICBC; one simple calculation and you save $200 or so per year.

Avocado toast, as stated in the article, runs about $22 although I have yet to see it on a menu. Let’s say I cut out a daily dose of Av-toast and I save an extra $8030 this year… while real estate jumps up another 20%. How is a millennial to keep up? Brunch is a luxury I enjoy a few times a year when I’m hosting family visitors and don’t want to make breakfast for them.

I will admit I do spend about 5k on vacay every year to get the heck away from my rental accommodation, I consider it mental health expense.

The fruit is way higher when you are talking about entering at close to a million. It has nothing to do with just working harder or hustling. It’s out of reach with only those two options. You need prior equity, rich parents, two very high paying jobs and little debt, lottery winnings or criminal income.

Depends on how good you are at hustling. You also have people out there that are mentally and physically capable of working 80 hours per week without vacations, I did it for prolonged stretches in 2009-2011(working+doing my masters) and 2013-2014 (just working) to get the ball rolling financially.

Also you can see what all the different levels of peons make with this salary lookup tool: http://www2.gov.bc.ca/gov/content/careers-myhr/all-employees/pay-benefits/salaries/salarylookuptool.

Echoing Wolf’s point – a 30 level employee makes roughly 83K. Large majority of non-management positions are below that classification level.

I agree that those who spend frivolously might want to reconsider complaining about house prices but the down payment isn’t the only thing to consider. Why save for a down payment if your income doesn’t qualify you for a sufficient mortgage? I’m not sure what percentage of Victoria works for the government (I’d think it’s a fair share, and those jobs appear to be sought after so there are likely many who make less) but upper level positions there with advanced degrees and 20+ years of experience aren’t 6 figures. A high end salary for government might be $85K – so maybe a household income of $170K for a couple. Depending on their down payment these folks can afford about a $800K mortgage, meaning they work for 20 years to afford a home far from the core. Sure, people in upper positions may have bought decades ago when it was more affordable, but when a city’s (relative) high income population can only afford the low/moderate priced homes, we have a problem IMO.

Public sector salaries can be looked up in the online database.

http://www.vancouversun.com/business/public-sector-salaries/INDEX.HTML

I’d agree it is objectively higher risk than it was a few years ago. I think it is fine not to buy too. Co-ops and moving start to look more attractive.

Maybe. I guess we will see the future when it passes us by. I really have no idea what will happen next. As a first time buyer my main concern would not be buying now and having prices drop, but buying now and having interest rates rise after five years and stay up.

@ CE

” Thinking back to my first house that seemed expensive at the time (and wasn’t really that long ago) the price paid was so cheap it seems like a joke by today’s standards.”

I think for most people, there is not much perceptual difference between “expensive” and “ridiculously expensive.” Above a threshold (for me about twenty bucks), everything seems ridiculously expensive. Thus, when we bought a house for less than 2 times annual income, it seemed like a Heck of lot, and it was painful to have to borrow ten thousand dollars from the bank that we paid off in six months. Today, faced with the prospect of buying a house for eight or ten times annual income, many may feel no more daunted than we did so long ago, even though mathematically, the situation they are dealing with is truly far more of a challenge.

“other ways of spending would arise”

So Mr. Money Mustache may say, but some deep thinkers in the world of economics have their doubts.

Much capital and technology and many jobs have moved to low-wage jurisdictions thereby greatly boosting profits of the global corporations. Those well invested in global capitalism or who have a job in one of the protected professions are doing well and are driving up RE prices in Canada.

But the success of the 1%, especially, and to a lesser extent the upper middle-class as a whole, has been largely at the expense of the rest of the population. The divergence in incomes driven by globalization is being accentuated by automation and the displacement of brains by AI systems, which means that even if “other ways of spending arise” there may be few able to spend on them and hence little reason for people to invest in them.

The assumption that savings necessarily = investment seems to be wrong. That is one reason why real interest rates are now below zero. Unless you pay someone to use your money, they may not be able to make it pay.

Until new ways of spending money that create a demand for the employment of large numbers of ordinary folk, we will likely continue to see a flat to declining economy, ever more negative real interest rates and higher RE prices.

Exactly. Its pretty simple yet a lot of people seem to resist the concept that it REALLY is harder now. Thinking back to my first house that seemed expensive at the time (and wasn’t really that long ago) the price paid was so cheap it seems like a joke by today’s standards. A cruel joke if you’re trying to get into the market for the first time.

Entry level homes are not one million in all of Greater Victoria. I’d say we are at 650k looking at the listings and much less in Langford/Colwood. Townhouses and duplexes are less still and seem like a reasonable first choice if you’ve decided you want to stay in Victoria and owning is worth it. Might not be for some.

Each 5k represents 100k of borrowing power for a FT buyer, excluding transaction costs. 200k makes a difference.

There are some low risk lower stress ways to do things and high risk higher stress ways to do things. If you don’t mind the gamble, higher risk can pay off. I’d find it too stressful. If you want to be lower risk your options are fairly limited and math-based.

Nope, never has been unless you’re rich. But it was a lot easier than now.

Boomers and Gen-X’ers (that’s me) should collectively be thankful for their luck instead of dissing the lazy wasteful avocado munching millennials.

Gen X and the boomers have had some amazing tailwinds on our investments. Continuously falling interest rates means bonds have done spectacularly. Ridiculously low starting valuations in the early 80’s means stocks have done spectacularly. The trend in interest rates also boosted house prices and stock prices and meant that every mortgage renewal has brought lower interest rates.

As you like saying there is only the “deal of the day”, but it is objectively a pretty crappy time to be entering the housing market in many major Canadian markets. As it becomes increasingly likely that we repeat the US housing experience avocado on toast may well look like a wise spending choice* compared to 5% down in one of the frothier markets of Canada.

*Not seriously. I’m actually in complete agreement with you that saving and living frugal when you are young is a great habit. Or if you are going to spend frivolously go travelling and enjoy bargain-priced avocado on toast in its native Guatemalan habitat.

Someone was inquiring about how many actual salaried tech jobs there are in Victoria (I’m assuming we’re concentrating on Victoria only). My brother is in IT in Ontario and I have a cousin who works in Silicon Valley. Both have informed me that a majority of tech jobs are not full-time, permanent jobs; most are on a contract basis. My cousin in the U.S. pursued his masters due to the fierce competition and foreign workers. Most foreign workers were from India, Russia, and Asia. He took on a job with NASA a year ago, but claims they paid him peanuts and it was a contract job. He decided to work for a private medical insurance firm in San Jose and it is a full-time job. It’s not his favorite job but it pays the bills.

My brother in Ontario worked for a company that deals with cash registers for fast food restaurants. Quite honestly, I don’t understand wth he does for a living . He recently was let go. Again. My brother cannot be approved for a mortgage because his jobs are all contract jobs.

They don’t believe Victoria will be the next Silicon Valley. People who work in Silicon Valley, live in Silicon Valley. Victoria has difficulty allowing guest houses to ease the rental market and it takes forever to approve new housing development. Tech companies need a lot of space, land which Victoria does not have And extremely expensive), nor I think the majority wants. Take a trip down to Silicon Valley if you can. It’s blocks and blocks of industrial looking buildings. If Victoria wants a Silicon Valley, it has to be outside of Victoria and it has to have amenities like stores, schools, hospitals, doctors, etc etc. don’t count on these startup tech companies to up real estate prices

Yes, although 67 years of data for Victoria and more for the stock market is enough for me to forgo some current spending for future return. YMMV.

http://www.mrmoneymustache.com/2011/05/18/how-to-make-money-in-the-stock-market/

If people who were not financially independent spent less on discretionary items our economy would change. All at once and it would cause a depression, but that is not a realistic scenario and other ways of spending would arise.

http://www.mrmoneymustache.com/2012/04/09/what-if-everyone-became-frugal/

And it is not poor people eating out usually. The low income cut-off is 18k for a single person and 23k for a couple assuming they don’t have free rent. People at these income levels have little to no discretionary income to spend in most cases.

It is most of people who have discretionary income doing this now – in the US people on average spend more on eating out than groceries now.

I have zero problem with people eating out if they want to.

I have a math issue with people claiming they can’t afford something they want while continuing to spend on things like this. It actually does add up and makes a difference over time and whether the current spending is worth it to remains a choice.

https://qz.com/706550/no-one-cooks-anymore/?utm_source=nextdraft&utm_medium=email

I was a saver back when. It’s funny because I had a friend that was a spender. He used to say I’m just going to be making more money later so I’ll pay it off them. Turns out he was right. There is no one way to do things. Damn, With prices the way they are I would say saving for a down payment is useless. Better just enjoy yourself and eat avocado toast because that 10k you saved by not going to make any difference in buying a place to live.

It’s totally different now. I thought it was tough for us Xers. I though I would never own a home. I mean a quarter million in debt is a lot! (turns out it’s nothing) Well, the opportunity came along when rates halved and banks got loose with the cash. Shoot, shopping in VicWest circa 2003 the flipping opportunities were abound. Much lower fruit when you could buy a detached house for 140k. Sure it was being eaten by bugs and the next door neighbours were bikers with pitbulls but sure enough I watched that house flip a few times in a few years. The first with nothing done to 180k, then a paint job for 240K. The equation is much much different now. The fruit is way higher when you are talking about entering at close to a million. It has nothing to do with just working harder or hustling. It’s out of reach with only those two options. You need prior equity, rich parents, two very high paying jobs and little debt, lottery winnings or criminal income.

“Lots of properties in the Uplands with not many sales.”

Absolutely — I was being tongue in cheek about the opportunity to turn an almost instant profit beyond the dreams of avarice, although in this crazy market one cannot tell what could happen next. Perhaps we’re at the beginning of the next leg up!

That’s like a climate model or a mutual fund promotion, it should come with the warning that past performance is no indicator of future results.

Furthermore, we should be grateful to those who are poor because they eat out, since if we all saved as much as we could, the economy would be in permanent depression.

CS:

You might be right about the resale price but personally I would be cautious. Lots of properties in the Uplands with not many sales.

A new listing on the Uplands waterfront, a 1950’s bung. modestly priced at under $4 mil. I should think a full reno would cost at least half a million, but then one could relist at maybe $6 to 8 mil. No wonder everyone’s borrowing their brains out to buy RE.

++ on what Totoro said. There is no doubt that real estate is less affordable now, but what to do? There are people that are exploiting opportunities in the real estate side and those opting out of real estate and being successful there too. Likely neither of them are spending frivolously to get there.

Profile pictures are set through https://en.gravatar.com/ You can go there and set a picture to the same email you use to post and it will show up here.

And the word for today is…

self-aggrandizement

The act or practice of enhancing or exaggerating one’s own importance, power, or reputation.

See also

Boastful, braggart, bragging, braggy, crowing

No, it should be about math because the math is not as open to misinterpretation.

In my view the math seems to say that buying a house in Victoria has gotten less affordable recently, but median income earners can still purchase a first house here. Just less house than median income earners could three years ago.

When we bought we had 50k which would be 63k today. Median income earners (a couple) should be able to save this in two years if they follow a strict budget and have no other debt imo. We could have borrowed an additional 650k based on our incomes and credit scores. Perhaps a bit more with the ftb program – not sure.

We would have been at a max price of 650/700k and this would likely have allowed us to buy a duplex like this: https://www.realtor.ca/Residential/Single-Family/18123724/B-1706-Kings-Rd-Victoria-British-Columbia-V8R2P1

Or perhaps a starter home, although I’m not sure if these will sell for far higher:

https://www.realtor.ca/Residential/Single-Family/18144582/3956-Cedar-Hill-Cross-Rd-Victoria-British-Columbia-V8P2N7

https://www.realtor.ca/Residential/Single-Family/18062799/1710-Albert-Ave-Victoria-British-Columbia-V8R1Z1

Once we had accumulated some equity in the home we would probably have sold and moved up, and based on our increased incomes and equity, we would likely have been able to afford a million dollar SFH house next but would likely have bought multi-family instead.

I’m gen x and it was not easy for us to buy a first home. We also don’t have pensions. I see little point in comparing our situation to boomers because reality is what it is. If boomers had it easier, good for them. As far as I can tell their lives had a lot less flexibility and choice compared to my generation.