April 18 Market Update

Weekly stats update courtesy of the VREB.

| April 2017 |

Apr

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 255 | 464 |

1286

|

||

| New Listings | 419 | 681 |

1590

|

||

| Active Listings | 1661 | 1652 |

2594

|

||

| Sales to New Listings | 61% | 68% |

81%

|

||

| Sales Projection | 990 | 875 | |||

| Months of Inventory |

2.0 |

||||

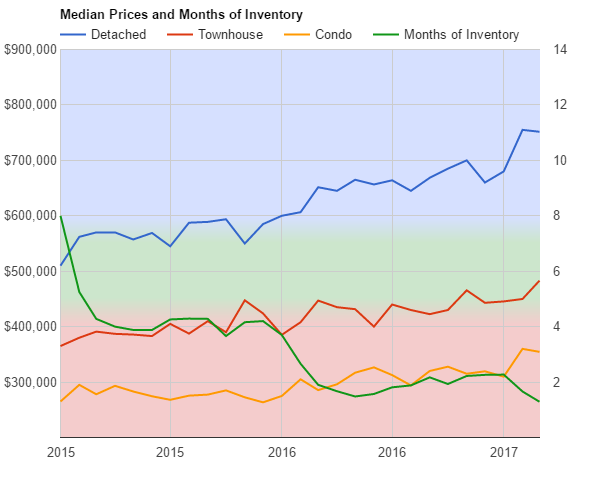

A significant dip in the sales rate last week, that’s probably due to the long weekend, which in a government town is 4 days long so we only really had 4 business days in there. I would expect quite a few sales to pile up today. We are approaching a third fewer sales than this time last year, which along with the approximately third less inventory makes conditions quite similar to last year.

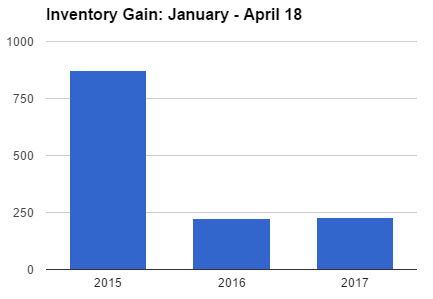

Inventory is down from last week again. Inventory gains were very low last year as well, but the difference was that sales were 32% higher and we had some more properties on the market to cushion the blow. This year we will be moving into the fall market with essentially nothing for sale. Compared to a more normal year like 2015, we have added only about a quarter as many properties to the market in the spring season as we usually do.

The Toronto situation is coming to a head with half of the stories on the Financial Post speculating on what will happen or marvelling at the price gains. The industry is getting antsy, so you know the government intervention should be good.

@totoro

“appreciating at 50k a year tax-free on your initial ex. 120k investment”

Some people beat that on the stock market, some even in their TFSA. Your argument also assumes that house prices and stock prices both go up. Either could go down. You seem to forget that stocks are liquid and you can cash out at highs and buy at lows much more frequently, amplifying gains.

From a net worth generation perspective yes. But that money isn’t necessarily useful. You get utility of a residence for it. After that you get only more equity that does nothing but provide some security and brings a glint to your heirs’ eyes at the thought of you keeling over.

So for a true apples to apples comparison of investments you need to consider the 3% interest you will pay to actually access that equity via a HELOC to make it comparable to a stock market investment you can liquidate and spend.

Also new post: https://househuntvictoria.ca/2017/04/24/taxation-without-representation/

Victoria’s debt bomb is like every other Canadian city. Those who make the most of their wealthy “appearances” are the most likely to be drowning debt while they fake all their friends and family out that they are living the good life.

Like my friend’s credit counselor buddy who said 70% of Victoria is in hock up to their eyeballs. AKA “The dirty little secret.”

Drowning in debt is the new normal in Canada

An expert in consumer insolvency describes what it’s like on the front lines of Canada’s worsening household debt crisis

“The bloated debt loads of Canadian households has become a pervasive topic in media. But for all the attention the subject has received, it’s a safe bet that most people still cling to very clichéd notions that only so-called “deadbeats” ever hit the debt wall. Nothing could be further from the truth. The reality is Canadians would be shocked if they could peer into the private financial lives of many of their closest neighbours and friends.

As a licensed insolvency trustee firm, our practice is on the front lines of Canada’s household debt binge and the bad personal finance habits that ensnare so many people. And what we see every day is that the majority of those grappling with serious debt trouble are the most typical individuals and families you could imagine.”

http://www.macleans.ca/news/canada/drowning-in-debt-is-the-new-normal-in-canada/

Local Fool wins the internets and redeems himself from earlier cyclist threatening jests 🙂

Totoro,

I’m actually kind of disappointed in looking at the construct of your rebuttal. You’re inserting quotes that don’t exist, or chopping off half of them and then using the neutered quote to argue accordingly. I think the tactic is discourteous and disingenuous.

The proper quote is,

And, this is correct. If the Crown requires the land, they can take it just as they can take your land. However, there are indeed checks and balances to this, which differ according to circumstance. That’s why it’s a constitutional monarchy, not an absolute one.

No. A court cannot grant any kind of title any more than you or I can. A court can make a determination as to whether a test proving Aboriginal Title has been met, within the bounds of the Constitution. The Crown then responds, whether that is the issuance of title, a change in legislation, an appeal, or a S33 override.

“The Crown ultimately remains unfettered”

Use my entire quote, Totoro. Don’t chop off half of it, altering its context so that you may issue a rebuttal. You could have saved yourself a lot of time.

That’s all beneficial interest. Basically, you’ve managed to essentially agree with me, but arbitrarily frame it as an argument for the sake of saying “you’re wrong”.

I love it when people poke holes in my stuff. I have a lot to learn. But I’d ask for the courtesy of having you do so legitimately. You’re more than capable of it.

Well it’s a lovely day here in Calgary…ah wait a minute..is it? no, it’s freaking snowing! For the love of no it can’t be! Oh God it’s almost May and it is xxxx snowing! Oh please Lord deliver us! Is it any wonder there is no housing crisis here, no foreign investors, no flippers, no aweful investors.. starting to sound like paradise! What you need Vic and Van to get rid of all your problems is SNOW SNOW SNOW! Cone and get it! It’s yours for the taking….love you guys!

My point is that your ROI with the capital gains tax exemption has made the a primary residence a better investment in Victoria than the stock market – they are not equal in the end. People forget about the leverage and the exemption when comparing.

The tax difference is also not insignificant on its own either if you are investing in taxable accounts or tax deferred accounts like RRSPs when you do start to withdraw. And RRSPs will get converted to a RRIF at 71.

For someone who retires early, like you may do, you can lower your tax rate but probably not eliminate it. If you are taking 25k a year each you’ll each pay about $2500 in tax assuming no other income. Someone withdrawing 50k a year would pay $8200 a year.

I agree the TFSA withdrawals are equal tax wise – better because you don’t have to sell your house – just that the lack of leverage makes them an inferior investment to a home (at least to date) such as yours which has been appreciating at 50k a year tax-free on your initial ex. 120k investment.

I know you don’t look at your house as an investment so maybe it is moot for you anyway if you stay there forever.

What does that have to do with capital gains taxes?

Until you add in the leverage provided by a mortgage. Very significant difference, especially in the first ten years. After the leverage kick-start the magic of compound interest is also exponentially greater as a result. If you are buying for cash your returns will be lower.

While you made me laugh Local Fool your analysis is not quite correct here. Title is not at the pleasure of the crown, it can be granted by a court. There is a legal test and it is not discretionary. The issue is proof of title and BC has been loathe to grant title unless sued even where there is legal proof.

Not unless they want to be sued.

While Aboriginal title is held communally, the rights are not just governance rights. The rights include the right to decide how the land will be used; to enjoy, occupy and possess the land; and to proactively use and manage the land, including its natural resources. Rights somewhat greater than fee simple and more like BC’s rights over Crown lands.

The Crown can only override Aboriginal title in the public interest where:

1.the Crown has carried out consultation and accommodation;

2.the Crown’s actions are supported by a compelling and substantial objective; and

3.the Crown’s action are consistent with its fiduciary obligation to the Aboriginal body in question.

I would not call that “unfettered” in any way. I would call the process for overriding very similar to what is required to expropriate land (consultation (more than for expropriation), accommodation (permanent alienation usually requires fair market value), and public purpose objective).

Ratio decidendi is correct. The “reasons” underpinning a legal decision.

Aboriginal Title was the “very limited circumstance” I was referring to earlier. On Tsilhqot’in Lands, the community (not an individual) may be granted a beneficial interest in those lands (most notably, an element of governance – something that fee simple title cannot do). However, that granting of beneficial interest still occurs at Her Majesty’s pleasure. The Crown ultimately remains unfettered, although it introduces some new checks and balances. 😛

By the way, Introvert, are you slipping? Shouldn’t it be “ratio decidendi” in LF’s post?

(which I discovered through my Googling prowess)

Good point.. I guess the tricky part is calculating how much difference it actually makes. You can stash 18% of salary + $5500/year into tax deferred / tax free savings accounts. For someone making $100k/year that is a savings rate of 37% of take home so many people won’t even need to hit taxable accounts.

Then of the taxable returns, you don’t trigger capital gains unless you sell so again most people won’t see any most of the time. Most income over their investment lifetime will come from dividends until they start drawing down.

I doubt it has a huge effect in the end.

Ya too funny, Local Fool!

Another thing I stupidly ignored for too long is that the primary residence capital gains exemption swings the scale towards putting your spare “investment” capital into a residence as opposed to the stock market.

This is way too often ignored in rent (and invest) vs buy analysis.

Nice, Local Fool. Nice.

Haha 🙂

Bearkilla’s response:

In light of the particulars of the Tsilhqot’in case and the concluding ratio decendi, I have come to understand that my comments were not only ill informed, but needlessly incendiary.

To wit, my comments writ large have demonstrated an earnestness toward my need to learn about the world around me, and perhaps there is value in considering the scope and depth of my thoughts before speaking as a blackguard or from juvenile impulse. To date, I have not had the introspection to even realize this elementary principle.

Learning from this experience, I will take it upon myself to explore and appreciate the complex social and economic history that forms the tapestry of our national identity, and appreciate how my own life and identity can better fit in with the community and national fabric in which we all live.

Thank you Totoro, for enabling this important first step in my growth.

We found the “cost” of rent to be much higher than what it appeared to be on paper:

-had to live with numerous deficits to the property that we would have fixed if we owned it

-couldn’t customize the living space long-term.

-had to live with “neighbours” who lived in the downstairs units of the house we were renting in (we rented the top floor). You could hear them arguing, and when they were cooking the smell of spices permeated our home.

-we had to endure a weird slave-master relationship with our landlords, which I feel is probably unavoidable unless you’re renting from a corporation or an unusually selfless and benevolent landlord. I’m an adult, I don’t want to be scrutinized, I don’t want somebody holding a deposit over my head, I don’t want someone scheduling showings of the unit on major holidays because the contract says they have that right, etc.

The feeling of control and autonomy I have owning my own house is worth a low four-digit sum to me every month.

We had enough money to buy our own place (actually multiple places), but we were renting because we weren’t sure what our plans were going to be the next few years. Once that solidified, we bought; actually, we bought slightly before things solidified, but that was because the market had began running away, we reasoned that we could rent the house out if we had to, and renting really really sucked.

Another thing I stupidly ignored for too long is that the primary residence capital gains exemption swings the scale towards putting your spare “investment” capital into a residence as opposed to the stock market. And I say this as someone who had all his dough in the stock market and was renting. A second property is a different story because of the capital gains treatment. If I had to bet on it I’d bet you’d come out ahead by owning your home in Victoria for 30 years versus renting and investing your savings in the stock market for the same length of time.

I recommend you read this Supreme Court of Canada case: https://scc-csc.lexum.com/scc-csc/scc-csc/en/item/14246/index.do

They should be thankful that they got to live in that rental property at an obviously under-market rent. Sounds like the landlord mispriced it.

The rental market is so tight because of Airbnb. If people want to stop reading stories like this, just bring in restrictions on Airbnb like Vancouver is doing.

Thanks for sharing, Janney, interesting how many changes you experienced. Yes after Expo 86, the different areas of Metro Van started planning neighbourhoods based more on community centres (often involving Skytrain routes). Kits & Kerrisdale always had more of a mix of building types, but they started doing the same things in the North Van, North Burnaby, New West, etc.

Funny, the only issue was that they thought everyone would both “live & work” around these community centres, but most people had to go wherever their jobs were, which meant anywhere in Metro Van, which meant more traffic jams on roads & bridges everywhere.

So they’re still trying to solve the traffic problems & pollution (maybe with better rapid transit or self-driving electric vehicles!) Crazy RE prices have driven some people out. Hope Victoria learns from all that.

@Jamiekat “Does anyone know what 34 Armine Place sold for?”

Listed and sold for $850K (under assessed value).

Need more rental units

http://www.cheknews.ca/nearly-50-rent-hike-forces-victoria-family-home-306723/

@Luke “wants to give Hawk a 133rd try to post that same old graph yet again (Hawk’s dream graph that will never come true for SFH in the core).”

Personally the only time I’d use the word ‘never’ would be to say that I’d never use the word never. The same was said about housing in the U.S. in the years leading up to their crash. What’s that quote by Mark Twain in the introduction of the Big Short: “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

The next CMHC quarterly should be out soon. I don’t expect its sentiment will have changed much from the last one; in fact it may be louder. I’ll be curious to read it.

Leo

My screwup. Seems that popped up in my search for this site and I assumed it was new. Sorry to Hawk also.

Nevermind that story is from January

Nope the conqueror owns the land that’s how it always works. We are not on anyone else’s land other than Canada’s.

Hmm. Did the TC get the report early or did they discover the one from last quarter?

@ Vicbot – your question “Where did you live for 45 years in Vancouver” really got me pondering how everything changes.

Grew up in the 50′ & 60’s in Southeast Vancouver (Victoria & 49th.). Very quiet in those days.

Kitsilano in the 70’s – I loved the old architecture & mature trees & of course the beach. I was young, on my own for the first time & the demographic was a real good fit.

Did a stint renting in the outskirsts of Shaughessy – not too shabby.

West End in the early 80’s – Bute & Davie – ugly-era skyscrapers – soul-less to me.

Off to the Commercial Drive Neighbourhood in the late 80’s, early 90’s – it was such a strong multicultural community, truly a peak time in my life & it remains a model that inspires my current efforts in community-building here in Victoria.

Then back to the family home in Southeast Vancouver. What was a clean, working class neighbourhood while growing up had become a dangerous & very dirty area by the 1990’s. (We would find so many needles when mowing the lawn – junkies just tossing them onto our front lawn as they went by.) Traffic everywhere had become hellish.

It became a dream to move to Victoria & find some peace – realized in 1995 when I bought my house here in the North Jubilee neighbourhood (the little neighbourhood no one EVER mentions on HHV).

A decade later, in 2005 I began 5 years of a commuting lifestyle – weekends here & working in Vancouver M-F. This time was perfection, I felt – living high in the sky in Yaletown. Yaletown hadn’t been developed when I had lived in Vancouver before so it was like a completely new city in so many ways. I maintain that the reason for such a positive experience in the city I had once loathed & had to escape from was because of the smart design of Yaletown. So central & Pacific Blvd. made it easy to get around a certain core from Commercial Drive & Main Street to Point Grey & everything in-between over the Bridges.

Finally, In 2010 I had to move back to Victoria full time to care for my aging father. I was very unhappy to have to give up my big city lifestyle then but time does change everything – I call it my “Dorothy Experience”. My opinion these days is that Victoria is quite simply a paradise & I am very, very lucky to call it home !!!

Sorry for the long personal story but it is interesting how things change & how the qualities of a neighbourhood can affect one’s whole being & whole experience really. How will Victoria change? The energy of change here is so strong these days – an intensity is building. I’m good with it (so far.) I love that Victoria is becoming more multi-cultural.

“Under new immigration criteria they wouldn’t qualify to come to Canada anymore.”

Good point Marko. Times have changed. People nowadays need more qualifications for the same opportunities that were available to previous generations (this applies to immigrants and young Canadians in my opinion). Thus, the need to keep housing affordable or opportunities will further diminish for future generations.

This should make Hawks week

http://www.timescolonist.com/business/greater-victoria-housing-market-overvalued-cmhc-says-1.9036616

The other elephant in the SFH is our immigration policy, highest in the world per capita I believe.

I keep bringing up immigration to the NIMBY crowd but no one ever replies…..have a problem with the huge tower going up downtown? Write to Trudeau.

It is not just the number of immigrants but the type of immigrants too. I spend a lot of my time on Croatian emigration forums and I’ll give you a here is an example of a family moving from Croatia to Victoria approx. two months ago.

Early 30s, 4 year old kid, moved here from Croatia to work at an IT company as a computer programmer specializing in apps. Both wife and husband speak perfect English. Renting a condo at Dockside Green. This is the type of immigrant that within 3-4 years is already in a position to buy a condo and within 7-10 years looking at a SFH.

Compare that with my parents who moved here in the mid 1990s and my father was working as a stone mason and my mom as a housekeeper. My dad spoke some English on arrival and my mom spoke no English. Under new immigration criteria they wouldn’t qualify to come to Canada anymore.

As a universal statement, that is debatable. For you, however, it could be true. We were a bit house poor in the beginning, I’ll admit. But our incomes grew, and the 40%+ gain in our house value means it turned out to have been a great decision (to buy and be a little house poor at first, that is).

The latter can increase the former, if, say, one makes a boatload of money on the latter, which has happened to people a time or two in this town.

Deep breaths, Introvert. Deep breaths.

The Indigenous people own much of the land, and we squat on it. We’re now celebrating 150 years of our boot on their throat.

I see this point of confusion in my line of work absolutely all the time. Folks buying or otherwise acquiring property in Canada are granted fee simple title to land, at the pleasure of Her Majesty. This is distinct from allodial title, which except in very limited circumstances, rests entirely with the Crown.

If you compare our property interest regime with a place like China – in some sense they’re similar in that the head of state holds allodial title, but in practical application, it’s of little significance here. You’re not going to see, as a general principle, heads of state in a western nation usurp private property unless doing so is part of a compelling national interest.

A communist nation on the other hand…are you into Falun Gong? No property for you…

Leo, that still doesn’t change the fact that under Chinese property law, you can only “lease” the land. In Canada you can “own” or “lease” it.

That’s a distinct difference that explains why RE in places like Canada, US, Australia, NZ, UK, is so attractive.

You don’t own land in Canada either, you only own an interest in the land.

Numbers hack, remember there’s a complication with Chinese property that people cannot “own” the land – they only “lease” it for periods like 70 years.

But the gov’t is currently drafting a law that would extend the leases (for a fee) unconditionally (people thought the fees might be 1/3 the value of the property, but new laws might make them lower)

https://www.loc.gov/law/help/real-property-law/china.php

“Individuals cannot privately own land in China but may obtain transferrable land-use rights for a number of years for a fee. Currently, the maximum term for urban land-use rights granted for residential purposes is seventy years. In addition, individuals can privately own residential houses and apartments on the land (“home ownership”), although not the land on which the buildings are situated.”

https://www.forbes.com/sites/sarahsu/2017/03/21/good-news-for-chinese-homeowners-premier-li-offers-some-clarity-on-land-leases/#57909d727b4a

Agree that there’s much more to life than property though 🙂

If a person measures their success by how much money they are worth (e.g. how much there house is worth) – which they shouldn’t…

Then LUKE, methinks your worth is what they call a “rounding error” when compared to others in the neighbourhood.

Oh that is a little pretentious…I am starting to sound like…

Must be time for a new topic?

“Did you know that earth’s shape is not technically a sphere? It’s an oblate spheroid, due to earth’s rotation flattening the poles. But don’t call the phenomenon “oblation”, since that word means something else.”

And that is why Mt Chimborazo measured from the centre of the Earth is actually the tallest mountain on Earth.

VICBOT; Your description is the Canada I want to live in.

Clarification

1/ can’t assist a “know it all” who can’t simply cannot google foreigner buying home in China

2/ amazed to hear and discover about how wonderful his “new” neighbourhood is from a family that has lived there for many generations.

3/ even more amazed how this new crop of occupants in the hood views “others” who don’t live there.

Now I understand why we let our hedges grow taller and taller in front of our house… 🙂

Sorry, that was not directed at the well traveled, well educated, and definitely well informed…Luke

No, I tried to – I see the full link did not post. Foreigners can buy and the rules are being relaxed.

http://www.ibtimes.com/china-relaxes-rules-let-foreigners-purchase-more-real-estate-attempt-boost-slowing-2072571

The other elephant in the SFH is our immigration policy, highest in the world per capita I believe.

Australia, with a similar RE problem, is tightening things.

If the foreigner tax doesn’t achieve its objectives, does this become a target?

They are called aIglets.

Faux literacy would be a good topic.

Correction on previous post: Numbers hack didn’t provide proof we can buy property in China (but oversea’s property is so popular with Chinese because they can’t really own property in their own country).

Jerry wants a new topic so we can have more of the same… wants to give Hawk a 133rd try to post that same old graph yet again (Hawk’s dream graph that will never come true for SFH in the core).

And – I had not heard of Pokemon before 😉 If you don’t like long posts – skip ahead to the next one…

I found the last two days had refreshing conversation about foreign buyers and opening up food for thought with some really good links, etc. Previously, I hadn’t thought that Americans were as big a factor as buyers here as people say they may be… it goes back to it doesn’t matter what the origin of buyers is, we just need to make sure most properties here are being bought for people who are staying here and living/working/contributing. Of the Americans… my guess is they’re buying condo’s for vacations instead of SFH.

Numbers hack doesn’t provide any proof that we can’t buy property in China (but no one really ever owns property there anyway).

I’m starting to agree w/ John Dollar – list price may be ‘meaningless’ after all… this brings any price reductions into a new light. Of course, sale price is all that matters at the end of the day. Here’s two sales I see today with divergent list/sale prices:

1562 Despard Ave, Rockland – Listed for $1.5m sold for $1.350k Big house in need of extensive updates – straight out of the 1970’s.

223 Government St, James Bay – Listed for $950k sold for $1,101k – Even though it was dated I bet this was about location and lot size. This was a bidding war for sure, unlike many homes in that hood it has a generous 9,240 sq ft. lot.

Janni, it was in North Burnaby, but there were other neighbourhoods like that in North & West Van, West Side, etc.

(of course in the last 5 years when prices went ballistic, some ghost towns were created. A friend was telling me that she’s having trouble retaining employees with families – there’s high turnover – because they’re moving to lower cost cities or suburbs.)

Where did you live for 45 years?

Did you know that earth’s shape is not technically a sphere? It’s an oblate spheroid, due to earth’s rotation flattening the poles. But don’t call the phenomenon “oblation”, since that word means something else.

Did you know that if you yelled for 8 years, 7 months and 6 days, you would have produced enough sound energy to heat up one cup of coffee?

Did you know the reason firehouses have spiral staircases is a relic from when fire trucks were pulled by horses? The horses on the ground floor figured out how to walk up straight staircases.

Did you know donkeys kill more people annually than plane crashes?

Did you know the plastic things on the end of shoelaces are called aglets?

I hope this helps to spark a new topic for you, Jerry. Going to check out the Butchart Gardens today. Don’t want to miss any stages of the spring bloom. Might even get a sundae there. Their ice cream is delicious. 😛

Hawk got to post his graph.

Barrister got to remind us that he is mortgage-free in Rockland and quite well off.

The Pokemon got to post 9 (!) tedious.prolix.point.by.point.rebuttals.

Must be time for a new topic?

@ Vicbot – curious – I lived for 45 years in Vancouver and I’m totally drawing a blank on the walkable neighbourhood you are referring to. Do tell.

Sometimes I miss The cultural diversity of Vancouver but less and less as Victoria is changing (for the better IMO.)

“Since when is being inclusive a Canadian virtue or necessarily a virtue at all.”

I’ve noticed a difference between Canada & the US, but this is only my experience?

I could be wrong, but in the US, I haven’t seen the same extent of mixed socio-economic communities as in Canada, eg., …

We used to live in a walkable neighbourhood in Van with a huge range of housing – large high-end houses in one pocket, high-rise condos in another, rental buildings on one corner, subsidized housing in the middle, and middle-class townhouses on another side. (tall trees separated different areas to allow both privacy & views)

In the middle was a mall with fresh-food grocery store, a playground, and a golf course. Several different schools were nearby.

The rich kids would play with the poor kids, the rich golfers would have beers with everyone at the golf club, the Porsches would park beside the jalopies. The tech workers would eat lunch at the pub. Rich kids would work at the grocery store with poor kids.

Money didn’t determine your access to services, or education, or health care, and it seemed to help, so people didn’t divide themselves into “castes” for life.

I like your reasoning Local Fool. I think rent and invest, if your rent is significantly lower than the costs of ownership, has way more upside than it used to in Victoria and other high appreciation markets.

Freedom is a motivator, certainly. I don’t know if I’d call it a primary motivator, though. I would say it’s a planned dynamic emergent from the choices I have made, but if I perceived more value in this market, I would happily give a portion of that up to own. Not all of it, mind you.

As it stands, I don’t perceive that value in this market, conversely, I don’t wish to move elsewhere. So I act accordingly – perhaps to my financial benefit, perhaps to my detriment.

Right now, people are panicking to get in, and participating in panic as a FTB as an investment strategy or any kind of strategy is just foolish IMO. Even if I was bullish, what inventory would I have to choose from in the neighbourhood I want? See, another part of my issue is the place I want has to meet certain criteria. I won’t buy a run down home on the premise of “it always goes up”. Not unreasonable, but my choosiness objectively weighs unfavourably in a market like this. So be it.

There’s no question, at least in my mind, that home ownership can be a great way to build wealth and hedge inflation, and so people accept the purchasing/owning liability at the front end for that reason. To me, there is now too much liability at the front end – so I accept that my skittishness has the potential to affect my net wealth. I’m sure it already has. If I was born 10-15 years earlier, I would probably have chosen to own a home a long time ago, and this recent run up would mean my net worth would be much higher now. Alas, I rent, with no home equity at all, haha. But I do have a PS4 with a couple of awesome games. That’s worth something, isn’t it? 😀

I’ve looked at it before and there is a lot of data collected on renter vs. home owner age, marital status and income and net worth. Here is my two minute search result that shows that there is enough data to at least CMHC make the following conclusions and I expect that we could segregate by those factors quite easily with a bit more research:

Homeowners are, on average older than renters but age is not the only factor underlying differences in wealth.

As you would expect lifetime income differences were the primary cause of the differential in net worth between renters and owners.

However, since the 1990s the growth in home equity has exploded, widening the gap significantly.

I thought this was an interesting article about real estate agents and the industry.

http://www.macleans.ca/economy/the-crazy-world-of-realtors-in-a-red-hot-market/

Some advice I was given early on:

Timing – when to buy? It always surprises me how many people jump in at the top of a market when everyone else is jumping on board. Buy when you can afford to buy. Always plan for the worst case scenario. Make sure you have the ability to hang on. (Could you live in the tiny suite downstairs for example….. if one of you loses your job? )

Don’t risk your principle residence to buy another property. Buy another property…. if you can do it without risking your principle residence.

Rent only if you have no other choice. You can get evicted for many reasons. For example: Landlord can’t afford to live in the main house anymore because of changing financial circumstances etc. Landlord needs to sell the place. Landlord may chose to get market value for the space and can apply to the governments to jack up your rent to market value. (Don’t believe me…check the rules. Most renters and even many landlords are unaware of this clause in the rental rules.)

Increased house taxes, increased costs of maintenance, increased financing all put pressure on landlords to increase rents.

By the way, our real estate agent who is a super nice fellow, actually talked us out of selling our home and we are most grateful for his advice. We decided to simply fix up our own house and make improvements instead. He saved us a bundle in moving costs. Thank you Rick H. !!

Well no it just means that younger people who are more likely to rent have lower net worth than older people more likely to own which isn’t surprising.

I’ve never seen a stat of net worth of home owners vs renters controlled for age, marital status, and income.

“Innovation and creativity aren’t in the top 50 of what I’m looking for in a city, so I don’t feel as though we need to be changing a bunch of things in order to foster them.”

Florida’s point, though, is that without innovation and creativity, cities will cease to be particularly nice places to live with especially happy people walking down the streets. He argues that everyone’s quality of life drops once cities become too unwelcoming to the “creative class.” Cities that can’t foster artists, the arts, etc. will, in theory, no longer be interesting places to live with varied, high-quality cultural activities. This is a very simplified version of what he’s saying, but it’s basically an argument for boutiques rather than big box stores. Without a healthy creative class to make it in some way distinct, each city becomes a cookie-cutter version of the next. Will urban densification alone ensure that the creative classes do well? No. But Florida seems to believe that that’s part of the answer because people need to be in the city rather than the suburbs in order to make that city thrive.

Yes, but it does point to the fact that very few of the 30% who rent are investing the difference and landing up as well off as homeowners. Maybe more will be doing this now that prices have gone up like they have. In the past, home ownership was part of the mindset of a saver/investor. Now the sacrifices in time freedom might not be worth it so people are researching alternatives like global arbitrage. Some bright folks will make different choices.

That is a good position to be in.

It was for us, but we were at the start of our careers and thought out incomes would rise. I think with a 900k house price we might well have chosen the Okanagan over Victoria, or bought a townhouse instead of a SFH. Most likely we would have looked for a like-minded couple and bought a house that could be divided if we couldn’t have done it otherwise. We have co-owned other property and it worked out well. Also not for everyone.

We would always have bought though. Being a homebody who also worked from home, I would not enjoy having to move or not being able to do what I wanted with a house and garden or feeling like it was a waste to put money and effort into it. I understand not everyone is like this, but I get a lot of satisfaction from improving my living environment and knowing it is ours.

If freedom is your primary motivator then maybe buying is not a good choice overall given the alternative of investing the difference between renting and owning? You would not be alone. I’ve posted this link before but maybe it matches up with you? Seems like a great way to go for some: http://www.millennial-revolution.com/start-here/

Where are you getting this from? All six of our millennial friends/family who bought in the last couple of years (two Gorge, one Esquimalt lagoon, one Langford, one Oaklands and one Songhees) are very happy they did and have no plans to move or become renters again.

The move from homeowner back to renter at that age and stage would signal a significant change in home ownership mentality in this generation. None of the data supports this that I’ve seen.

Does anyone know what 34 Armine Place sold for?

I’ve said it before but the thing that separates bears from bulls is income. When a bear finally manages to earn a proper income they buy. Instead of wasting all this time trying to justify your bear position you could be studying so you could find a decent job.

Local Fool:

You are absolutely right that home ownership is not for everyone and that being house poor can be a bad decision for many.

Personally, I really enjoy working around the house and in my shop and my wife is an avid gardener so owning this house is a real joy for us. On the other hand we dont have a mortgage and the house represented only a small fraction of our net worth.

Since when is being inclusive a Canadian virtue or necessarily a virtue at all. I love the way that people wrap their own ideas into the Canadian flag. Trust me, anyone that things that being inclusive is part of the Canadian identity has never been schooled at UCC.

People insist on throwing out their social engineering assumption as if they are somehow scientific fact.

“So drawing a straight line to gauge inflation will make every market seem overvalued.”

Leo is absolutely right in making that observation. The almost 10 years of extremely low interest rates was predicted to eventually create inflation and it seems those days are finally here and has impacted the market in a big way.

Yep. What’s more important, freedom or a house? If the latter will impede the former, I’d choose freedom every time.

Correct. But that statistic has almost nothing to do with the relative return of home ownership to other investments.

The time to buy is when your personal finances, job security and you are ready to buy. It should have nothing to do with trying to time the market.

In the 70′ and 80’s Alberta had an excellent housing program during the boom years and housing shortages which should be revisited. The provincial program offered discounted interest rates for the construction of rental apartment buildings. The concession was that 15% of the units had to be for low income earners and their rents couldn’t be above their affordability levels. These units had to remain subsidized for 15 years before they could revert to market conditions. It was an excellent program and tens of thousands of units were built. From a social perspective there were definite benefits as different socio-economic groups were mixed which is a healthy societal objective and inclusive very much in the Canadian way.

You are absolutely correct. As a general principle, market timing is a terrible idea. I did that with an investment actually at the start of the last year, when the market went straight to the gutter. Not a good idea. With real estate, I wouldn’t say I’m timing it. Put it this way – a market timer will say,

“I am waiting to buy a house when the prices reach (strike price).”

Whereas I say,

“I will not buy a house unless the prices are within (strike price).”

Do you see the subtlety there? In the latter case, the buyer isn’t interested unless a set of circumstances occur. It’s just not a priority otherwise – I’m not necessarily waiting for anything. So I doubt I will ever “kick myself”. Don’t get me wrong – I’d like some of the benefits, and even the trials – of owning a home. I would just love to have my own workshop and build cool stuff. 🙂

For me though, I am too value oriented to jump in right now. If my car breaks – I suppose I could get a new one. But I go buy the part and fix it myself. My jacket pocket got a hole in the interior lining this winter – I sewed it up rather than buying a new one. My partner is the same way. $3500 a month mortgage in 2017 dollars is silly. I’d rather pay the guy upstairs less than a third of that, and pocket the rest. Granted, I don’t make 20% returns like homeowners recently (although in some ways that’s a tad meaningless), or 500% returns like my friend Hawk. But I try. And I do okay. Sometimes.

For others thinking of jumping in and are reading this – do what you want, but understand, that the mere idea of owning a house can be far sexier than actually hunkering down and owning one. It brings its own joys and benefits for sure, but there’s another side to it. It’s not worth being house poor, and if you are, you will come to hate your four walls faster than a new Fiat owner learns to hate his car and subsequently question his life choices. That’s why nearly all millennials that have purchased in the last few years plan to sell their home in the near future. Once they’ve tasted the reality – the hype suddenly is seen for what it really is.

Sorry, had a bit to drink tonight…

totoro has previously cited evidence that, in general, homeowners’ net worth is vastly higher than renters’. So you are perhaps an outlier.

Many people have tried to time the market and failed (miserably), so it is possible that prices could flatline only to spike again, perhaps leaving you kicking yourself for not having bought today. But, as crappy newscasts like to end their stories, only time will tell.

I should! You see, we’re all helping one another be better writers—and people. 🙂

While I fully support mixed density neighbourhoods with many different housing types together, the argument that these kinds of neighbourhoods somehow lead to innovation is laughable.

Dammit. I thought avoiding getting into this market and instead diverting my monies to savings and investments – and buying a home only if it felt right for me and my partner – was a viable path.

But now…I have seen the light. I am an abject failure, a burned out shell of a man bereft of potential with no meaningful wealth or hope of succeeding. If only I just bought a house. It would change everything. I am going to call Marko on Monday and get the ball rolling. I better buy that 900k bungalow, because 67 years of history demonstrates that next year – it’s just going to be worth more!

Wait a sec…my common s…errr sense of failure… is kicking in. Darn it…still ain’t going to buy a house. And if that’s failure, haha, failure is awesome 🙂

“And the corollary: renters are too small to succeed”.

Introvert,

You, of all people, should know that a colon should never be used after a sentence fragment.

Also, it seems like Richard Florida is arguing that all cities ought to be striving to be like “the world’s most innovative and creative places”: “San Francisco, New York, and London.”

Really? Why don’t we just let those three cities handle innovation and creativity? I could care less whether Saanich or Greater Victoria is innovative or creative. I care that we have a mild climate, lots of trees and parks, places to recreate, beautiful scenery, amenities and services, happy people walking the sidewalks and biking the streets, lots of libraries, etc. Innovation and creativity aren’t in the top 50 of what I’m looking for in a city, so I don’t feel as though we need to be changing a bunch of things in order to foster them.

I guess I’m just a New Urban Luddite.

Very interesting article, Irregardless.

I think what it actually comes down to is that upper class and upper middle class people generally want to congregate and live mostly amongst themselves. We obviously eschew density, as that might create “affordable” dwellings that would attract people of lesser means who would bring a host of problems we’d rather not have to witness or deal with.

It is accurate at what it proclaims to measure: buyer address.

It is not accurate at measuring buyer citizenship, which it never proclaimed to measure.

I wonder how accurate the origin breakdown you posted is then? If the total sales add up to 5% of all sales or roundabout that should be fairly accurate. Have you compared? If not, there is another unknown, although maybe extrapolation is realistic. I’m not sure.

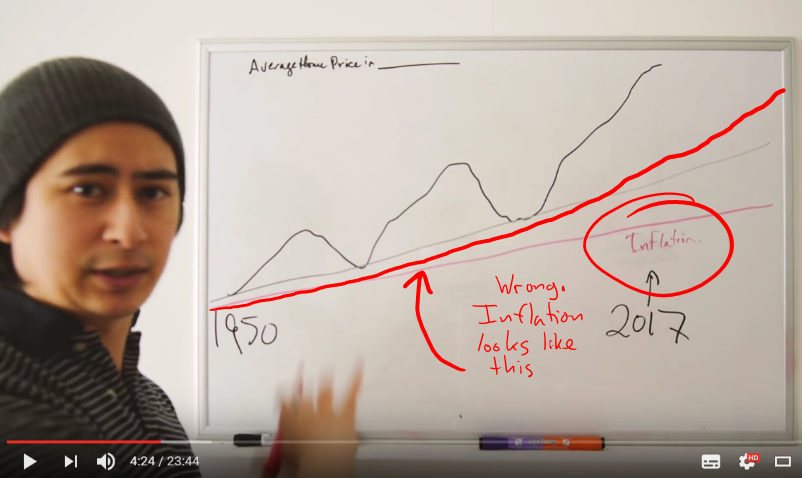

Good video but he makes the same mistake I made about 5 years ago. Drawing a straight line across a graph to indicate the increase from inflation. Problem is inflation is exponential and not linear. So drawing a straight line to gauge inflation will make every market seem overvalued.

@totoro The 48 is buyers where the buyer city was indicated as somewhere in Asia. So of course there were many more buyers that aren’t caught in this methodology that have a local address here first before buying. However the same would be true for American buyers so I think it’s reasonable to conclude that american buyers here are just as much of an influence as Asian buyers and no one notices them. The provincial PTT stats are much more accurate and show about 5% of all sales are to non-citizens.

When was the last time we heard an anecdote about an open house swarming with white people driving Buicks? Just not that different from the typical Victoria resident to be noticeable. 🙂

Never use a semicolon like this. It is wrong.

Old numbers, but probably still true:

http://i.imgur.com/bBmXhuv.jpg

Source: http://credbc.ca/role-energy-sector-bcs-economy/

Sweet! And the corollary: renters are too small to succeed.

Maybe, but they sure don’t talk about the others on this board. It is all about the shady Chinese money but, after thinking on it a bit I think the reason people here are posting against Chinese buyers and not Americans is because of all the coverage on Chinese buyers in Vancouver when they made up 70% of the foreign buyer market. People probably did not know that our market has such a high % of Americans in the foreign buyer category rather than Chinese.

I can tell you our former tenants were one of the 48 Asian buyers last year. The daughter went to school here and her parents sold their car and house in China to move here to be with her and they bought a modest house in Oaklands. They will immigrate and settle with her after the grandparents pass – meanwhile they go back and forth. All above board. So that leaves 47, not all of which will be buyers from China. And don’t forget buying through a company means you won’t get your primary residence tax exemption so that is an odd move for Victoria real estate. My guess is that most Chinese buyers in Victoria likely have family here and are above board. Tracking down the paper trail for the remaining 47 sales would be easy for the RCMP to do if there was a reason for it imo.

I don’t believe the illegal cash is the impetus for the hue and cry because the real issue is price escalation and there is little or no evidence that “money laundering” is behind what is occurring in Victoria given the limited number of sales. If you are arguing foreign buyers are having a big impact focus on the weak Canadian vs. American dollar and you’ll have a better argument given the stats. My guess is that it is the Americans that are buying luxury properties as an investment for appreciation and hoping to cash in when the Canadian dollar rises in future.

I was not. I was talking about what has been posted on this board about the Victoria market over and over again. And the difference between prejudice and error is difficult to evaluate when people feel free to put down a group with zero fact checking.

Can’t pull data from the buyer origin field..only the VREB can do that? Quelle suprise….

Numbers hack – so the better dwelling article was wrong ? Or out of date? We can buy property in China? Yay! I’m on the next flight. But wait – just breathing the air there is worse than being a heavy smoker? Oh wait again – you never really own property in a totalitarian communist state? Now I know why they’re coming here and everywhere else in the west that’s somewhat desirable. I think I’m staying home.

I wanted to post an article this week on the new Vancouver numbers and if this year has just as many buyers from Vancouver as last year.

Unfortunately this is no longer possible. There used to be a field called Buyer City that was filled in by the listing agent with the city the buyer had as their address. That field has been replaced by a field called Buyer Origin that is no longer free form entry but gives a list of regions to enter that the buyer is from. This is good in that it improves data quality by forcing a predefined choice rather than being prone to spelling errors and the like.

However the buyer origin field is not available as an option to search on, so there is no way to pull any data based on it. Only the VREB can do that internally now.

“why there is so much hue and cry over Asian buyers and so little over American buyers when Americans buy almost triple the number of houses here? … Hard to believe that that is not prejudice at work.”

People are concerned about ALL foreign $ affecting RE – who cares if they’re from US, Asia, Russia, Germany, etc. (but before I trust the stats, the gov’t needs to track who the beneficial owners of corporations buying RE are)

The differences in how we discuss the buyers are directly related to the movement of $$ around the world – not racism.

First & foremost, the US$ is the world’s main reserve currency. The US is a stable economy, with banking processes & private property laws & civil laws that are transparent & parallel to Canada’s. There isn’t a flood of illegal cash coming out of the US for all those reasons.

It’s totally different for a country like China. There are several reasons why the Asian $$ come up a lot in the news:

1) China’s foreign currency restrictions, its growing pains as an emerging economy, & the flood of capital that is/was leaving the country to be held in worldwide RE & other currencies, and then all the associated corruption, money laundering, shadow banking, etc. It’s been in the news because of the insanity. Of course not 100% of buyers, but these are real issues

2) Tony Joe and his self-serving, hypocritical arguments

3) Russian money laundering is typically done through Europe. Latin American is done through Miami & other US cities)

So we’re talking about the insanity of how the money is flowing from places like China – it’s not racism.

Justin Fung said it well:

http://www.straight.com/news/734326/justin-fung-open-letter-those-who-play-race-card-vancouver-housing-affordability-debate

“Folks who have gotten rich in China over the past couple decades see that their money isn’t going to be worth as much in the future and are getting it out as quickly as possible into assets in held in other currencies …

This has nothing to do with Chinese people as a race and everything to do with China as a rising economic superpower with its own set of growing pains …

It has everything to do with the corrupt and complicit politicians who serve the corrupt needs of a B.C. real estate industry whose continued success depends entirely on us turning a blind eye to the obvious problem …

Let’s stop talking about racism in Vancouver real estate. It’s distracting us from getting to solutions to making housing affordable for those of us who call this city home. It’s time we cut through the bullshit and hold our elected political leaders accountable for the mess they refuse to clean up.”

Believe it or not, it’s far worse in Vancouver.

“Worst side-effect of the housing boom? All anybody talks about is housing. Canadians have actually made ourselves even more boring.”

https://twitter.com/coopertrustee/status/855519424367001601

I’ve been too afraid to leave my house, James. I know you’re out there…waiting for me. 🙁

http://www.iheartradio.ca/cfax-1070/news/eyewitness-says-grey-dodge-dakota-sped-off-after-hitting-young-cyclist-1.2555897

Is that you local fool?

The problem is, it’s impossible. It doesn’t matter how much they can or can’t afford to let it pop, because that isn’t the question to begin with. The only thing government can really do is attempt to clean up afterwards. If a government could avoid a bubble popping, they would.

PS not arguing with you, I get the context of your post. More or less adding to it. I don’t doubt there are people out there that think the “too big to fail” argument holds water (suspect the most common variant is “they won’t raise rates because it would crash the economy”).

RE in BC as % of GDP is foolishly over-represented, IMO. Look at the rest of the Province – LNG is not going to be built any time soon, no matter what the current government tells you. Fishing sucks, and the tech sector is struggling to be competitive as prospective employees can’t afford to live. Lumber isn’t horrid but it isn’t great, and Mr. Trump isn’t expected to be conciliatory with respect to softwood lumber.

Only the surface has changed on account of this RE madness – the underlying real economy isn’t very much different than it always has been, but it can be less apparent to those living in the few bubbly zones. It isn’t hard to see though, if you’re willing to look.

Take RE back to nominal levels – and what do you have? Well, you have what BC generally always has been – a Province that teeters on “have” vs. “have not” – sometimes we contribute to transfer payments, sometimes we need them. Is an economy based on FIRE sustainable? Personally, I’d rather see money get invested into productive sectors of the economy – and that’s not houses.

20% of the BC economy depends on this beast. At the very least it needs to be propped up past the election.

I’ve said it before. Real estate is now too big to fail. Governments at all levels can’t afford to let the bubble pop. I think we will see a string of toothless “interventions” to convince renters and hopeless millenials that their government really does care, followed by mystified government officials claiming they did their best but it didn’t work, so it must be that foreign buyers, speculators, Air BnB, flippers and hoarders aren’t the problem afterall therefore fundamentals must be sound, we must be able to afford these prices, it really is different this time and this is the new normal.

Underlying all this rubbish, of course, are macroeconomic factors that keep Poloz awake at night. All he can do is spout mixed messages that bears take one way and bulls take another but either way he will be able to claim he warned us.

I have no faith in any data coming out of the industry or the government. Ten years in the spin cycle and no one can see straight anymore.

Doubt it.

Stats were collected before the tax was brought in and the numbers were significant, particularly in Richmond. And post tax the numbers have dropped a lot. Given that we have data on this it is hard to argue otherwise.

I think what this means is that the tax was effective for the purposes of discouraging foreign buyers, but there are other factors at play right now even in a market that had a greater proportion of foreign buyers than Victoria – like population growth.

All of 2016

Even a 15% tax is not much of a deterrent. For US buyers houses, even after a foreign buyers tax, Canadian real estate still comes at a discount because of the value of the American dollar. For money launderers it’s still cheaper than paying income tax or doing time.

So when Vancouver introduced the 15% tax and a slight cooling occurred in the market, some would like to interpret this as proof that there are not many foreign buyers. I think it means that tax isn’t high enough to be effective. It should be raised to 50% or institute measures like the Swiss, then you’ll see how much foreign buyers really influence the market. Better still do both.

While some measures need to occur, sadly, it is a decade too late. And now the government is between a rock and a hard place trying to grease their palms while avoiding a conflict between Homeowners versus House Hunters. Homeowners like he escalated values of their properties and will not be pleased to watch this plummet. It always comes down to who has the deepest pockets as well as the largest voting population.

LEO;

Were the following numbers for sales since Jan 1st 2017?

“Who would a foreign buyers tax hit in Victoria?*

USA 106

Europe 25

Asia 44

Other 23

Total Outside Canada 198”

Did no-one pay attention to the post by Leo on the country of origin of foreign buyers in Victoria? I have no idea why there is so much hue and cry over Asian buyers and so little over American buyers when Americans buy almost triple the number of houses here? And why so little news coverage of American buyers?

Hard to believe that that is not prejudice at work. And the numbers are not very large overall. I’m not saying don’t bring in the tax but this cannot be the main reason the market is the way it is.

And China has experienced exactly the same thing as we have with foreign investors which is why they brought in those restrictions – which they are now lifting as the market is no longer so hot and they are again looking for outside investment – a position Canada may well be in again one day:

http://www.ibtimes.com/

And here is the Tony Joe flyer: ?quality=70&strip=all&w=720&h=480&crop=1

?quality=70&strip=all&w=720&h=480&crop=1

Don’t see why his is more outrageous that the marketing strategies used by Sotheby’s, Colliers and the like to appeal to the international market – mostly Americans. Heck, Sotheby’s is called “Sotheby’s International Real Estate”. Want to run them out of town?

Tony Joe is small potatoes next to that.

Luke – false

Foreigners can easily buy properties in China.

Most just can’t afford it or want to do it.

Here’s another $100k price reduction in OB – See… I have no problem posting these… 2777 Dewdney Ave in Estevan. Down to $1,299k.

Looks like yet another home that needs an extensive reno. in this 1939 build. Kitchen prob. from the 1980’s. Dated bathrooms. Despite it’s location close to Uplands… after 44 days, not yet selling.

Nan: I agree – never mind just taxes we need full restrictions on foreign buyers (from anywhere) who won’t live, work or contribute to our society. If Tony Joe doesn’t think it’s a problem, then – no problem, right? His flyers say otherwise though (had these delivered to your door yet?). On the front of the flyer it says ‘Foreign buyers want your property!’ and then the back of the flyer is all in mandarin. (I searched online for the flyer image but couldn’t find it).

Here’s how China (the main source of foreign buyers in Van and probably TO) deals with foreign buyers… turns out if we wanted to we can’t buy more than one property there, this is AFTER spending a year living there. Yet for some reason they should be able to squash home ownership dreams for Canadians by buying multiple properties here? And, unlike what Chinese could now be doing to skirt around the new tax in Van and TO (creating companies to buy property, buying as a ‘student’), they wouldn’t allow any loopholes.

From: https://betterdwelling.com/city/toronto/7-places-tax-foreign-property-investors/#_

China:

Having a population of over a billion people would put any country in a housing crisis, so it’s no surprise there’s a lot of property rules in China – including ones that target domestic owners. Foreigners are allowed to purchase only one property for their own personal use, after having spent one year in the country. After that, if you become a permanent resident, you’re allowed to purchase one additional property for personal use.

Thinking of skirting the restriction using a shell company? Not so fast, the Chinese government conducts regular audits and foreign companies must use the property they reside in, or risk having it taken away.

Imagine if Switzerland didn’t have any restrictions on foreign ownership… the Chinese would’ve been there in droves by now… Like Denmark, Switzerland has always restricted foreign buyers, long before it ever became a problem for their citizens…

Switzerland:

The Swiss have always had strict rules regarding housing, especially foreign ownership, with each canton (that’s a township if you’re not French-Canadian) assigning annual quotas and requiring approval before being sold to foreign owners. If approved, you can use it as a personal residence only, so forget your dreams of being a landlord in Switzerland.

Fun fact, not even the Swiss are allowed to build homes over 1,000 sq. m. without a special permit – so there aren’t a lot of Bridle Path style houses to choose from. Sad, I know.

Thanks, Vicbot.

Hands up if you’re a New Urban Luddite….

https://www.citylab.com/housing/2017/04/meet-the-new-urban-luddites/521040/?utm_source=atldaily041817-2&utm_source=nl-atlantic-daily-041817

Glad to see the city is moving one step closer to the foreign buyer’s tax. I’ll be interested to see if there’s eventually calls for the tax to be applied outside urban areas so that it hits the recreational property market in rural areas like the Gulf Islands and the Okanagon/ Shuswap. I had always assumed there was an element of foreign (mainly US) ownership in those areas. Obviously different situation than the urban areas but I think there’s an argument to be made that the tax should go province-wide. Heck, I’ve even heard rumours of foreign buyers moving into places like Kamloops.

Interesting to see the odd bully bid happening in the condo market. Here’s one from today:

208 – 1371 Hillside Ave

Ask: 349k

Sold: 402k

Assessed: 305k

DOM: 0

Can’t blame the seller for not waiting to see if they could get more. Haven’t seen many units like this break through the 400 mark.

In case you can’t see the video from Introvert’s link, here’s another one:

https://www.youtube.com/watch?v=mrGFEW2Hb2g

Happens between :10 & :20 🙂

I just wanted to post this little YouTube video.

It features a very clear, easy to understand depiction of housing markets in general, their corrections, and how both up and downturns are a necessary component of what is ultimately an inalienable housing market cycle. No jargon, no stats, no selling – just a very simple lecture with some light humor here and there.

Hope you enjoy it.

https://www.youtube.com/watch?v=c-ktIPtE4E4

Who would a foreign buyers tax hit in Victoria?*

USA 106

Europe 25

Asia 44

Other 23

Total Outside Canada 198

*blah blah buyer origin not a measure of citizenship, etc.

@Animal Spirit and 3Richard: thanks for the advice!

Bill Maher’s closing editorial monologue included a little joke about how the Chinese are all moving to Vancouver. It’s in the first 20 seconds:

https://twitter.com/billmaher/status/855650228220731393

Wayne Newton is now banned. By the way he was previously known as “Jim Dandy”.

Leo:

Thanks for providing the accurate numbers and the annual comparison. It will be interesting to see where we end up by the end of the summer. But there are more sales than I believed might be occurring.

Does make one wonder were all these people who can write a cheque for 2 mil are coming from.

Good article on housing speculation in Canada:

http://www.huffingtonpost.ca/wolf-richter/housing-speculation-canadian-economy_b_16053078.html?utm_hp_ref=canada-british-columbia&ir=Canada%20British%20Columbia

“stats on the number of foreign buyers are not accurate and cannot be relied upon until a more accurate form of measuring is introduced.”

Smoke and mirrors. Not much can be proved conclusively. We can debate specifics ad nauseam but Vancouver appears to have at least some sort of foreign influence. Many Vancouverites cashed out and came to the island in 2016. Look up ‘out of towner’ not ‘foreign buyer’ stats in Victoria.

Assuming even a 5% (very) long-term foreign buyer presence, that’s 1 in every 20 homes outside Canadian hands. That seems like a large number to me when I look around the neighborhood.

Again, stats on the number of foreign buyers are not accurate and cannot be relied upon until a more accurate form of measuring is introduced.

I don’t really understand how ‘foreign buyers tax’ got interchanged with ‘Chinese foreign buyers tax’. It’s a tax on all foreign buyers and it doesn’t matter where you come from. If you don’t have citizenship or a work permit, etc then you shouldn’t be able to buy property. It’s really that simple. I don’t care if you’re Chinese, American, European, Indian, etc.

The argument that Victoria is not affected by foreign buyers seems like a short-sighted view that only focuses on direct buyers. Sure, maybe foreign buyers are only 5% in Victoria, but we all know that 2016 saw increased numbers of Vancouver buyers here (Leo posted the stats). Perhaps these buyers are cashing out of a foreign buyer (1 in 6) inflated Vancouver market, outbidding islanders and driving up prices here? There’s a ripple effect that some people appear content to be ignorant about.

Vic renter – talk to Rob Reynolds at HMR in Oak Bay. He was on this board a while back and got me much better and better priced insurance than my employer was offering

Feel free to request a Matrix account on the right side you can check yourself ———>

Luke:

Thank you for the OB sales over 2 mil. A few more than I thought.It will be interesting to see what the inventory in this tranche looks like at the end of the summer.

Nice to finally have a sunny day and try to catch up on the yard work.

“Does anyone have advice on the best place to buy life insurance?”

To get the best rate for Life Insurance you need to have a complete physical. Certain providers will do this i.e. Sun Life and my premium dropped by 50%.

What a BS straw man argument. With the exception of “Golden Head” the majority of foreign buyers in Victoria are Americans with their 35% discount thanks to the exchange rate.

The foreign buyer’s tax is not illegal discrimination.

What is protected is Tony Joe’s freedom of speech within reasonable limits so even if you disagree with his opinion he has a right to state it.

What is questionable in terms of legality in Canada are comments on a blog that offend, threaten, or insult groups, based on race. There is a way to report these comments should you run across them:

http://www.stopracism.ca/content/report-hate-social-networking-sites and http://hatecrimebc.ca/internet-hate-crime/

I’d suggest both of Mr. Newton’s comments should be removed.

Does anyone have advice on the best place to buy life insurance?

Nice try Tony … I mean Wayne

[Removed - uncalled for - admin]“The reality is that the people that were doing the speculation or land banking in Vancouver were only looking in Vancouver,” Joe said, adding that Vancouver and Toronto are global cities while Victoria is not. The vast majority of people buying properties in Victoria are not holding them vacant but are moving here, he said. He said the tax is not unlike the head tax. “Why call it a foreign tax. Why don’t we just call it a Chinese tax?” he said.

“Reality” “The People” “Global Cities” “Vast majority” “Racial Epithet”

Lots of subjective terms, no data and then call city council racist. I know you read this blog Tony – care to back any of your BS up with a fact or two?

If there is no speculation or foreign ownership in Victoria, a tax on will have no effect…so what are you worried about? That tax should be 100%. 1000%. Whatever is necessary to keep people who don’t live here out of local real estate.

Sounds like you were worried enough to go and lobby for your own self interests which based on some of your previous public communications are at least partially based on selling Victoria’s valuable and rare housing to foreigners and/or speculators.

Our society really needs better control for these rich self interested mouthpieces. I’m really tired of hearing rich realtors spout off completely unsubstantiated bullshit for their own gain, and then getting the gain and then doing it again and again and again.

Maybe we should work towards getting the BCSC involved in the real estate market – at the end of the day, there are more disclosure requirements for marketing a $10 share in a company than there are for a $1,000,000 house and that is at the very least, not in the public interest but in the interest of RE industry beneficiaries in my opinion.

Yes I was curious about that, totoro. OB & Saanich would probably be in favour, but I’m surprised there wasn’t a mention of that. Maybe they agreed on something behind the scenes? (eg., Nils Jensen & staff had been looking at a vacant home tax so there were discussions about possible taxes)

I wonder how the Council of the other municipalities feel about Victoria making this request without their concurrence or consent. I wonder if they even consulted with the other municipalities? I’d be concerned if it did not reflect the will of the majority of the constituency in other areas, but maybe the majority are in favour everywhere.

It might be a good move to impose the tax, but unilateral action might have some blowback – they should have stuck to their municipality.

Victoria council asks B.C. for foreign speculators tax

http://www.timescolonist.com/news/local/victoria-council-asks-b-c-for-foreign-speculators-tax-1.16307896

“Victoria council is calling on the province to immediately impose a 15 per cent non-resident buyers tax here to cool what has become one of the three hottest real estate markets in the country …

Victoria’s resolution, passed Thursday, asks the province to immediately impose the 15 per cent tax to curb speculative property purchases by non-residents in either the entire capital region or in just the city of Victoria, whichever is more expedient.”

Of course Tony Joe tried to play the race card but council quashed that.

I’d agree that maybe Canadian banks should do the same. I’m particularly annoyed at the workaround situations where the wife and child or just child are in Canada buying fancy houses with zero income getting access to free education and child tax benefits while the non-resident spouse lives in China (usually), paying no Canadian taxes on the money the family is actually using and living on. That is an egregious misuse of the Canadian system that needs to be stopped.

I just don’t see this myself having gone through a qualification process with RBC last November. They were very diligent in applying strict policies and review of documentation. I also had a mortgage with a smaller bank that agreed to waive the penalty to transfer to RBC (at a lower interest rate) because they were not making enough on their mortgage portfolio overall – interest rates have stayed too low too long for them.

So basically you are just repeating a rumour and have no evidence of this in Victoria. It is fine to have an opinion, but when you present it as fact it becomes confusing.

So true, if you find a quality home here – hang on to it! That’s what people do here, that’s why they don’t move much. Most times, people aren’t left with much choice but to renovate when entering the SFH market in the core.

I guess Hawk’s penthouse must be just like his 500% stock option returns… 😉 🙂

Ah so someone who missed the biggest $ real-estate move in Victoria due to speculation is someone with “open mind of how markets function” Got it… I have another name but whatever makes you sleep Hawk.

Jerry,

It’s a commonly used chart used by professionals to show how bubbles blow up no matter what the market. Calling it from Mad Magazine only goes to show how deep the kool-aid flows by those with a vested interest to see this continue forever and not with an open mind of how markets function.

not too many in Victoria. I heard Marko’s Dad used to build them before he realized that most people here don’t care.

Some of this later commentary is getting quite strident. I think this is because Hawk has let more than 24 hours go by without posting that market graph from Mad Magazine.

Maybe some clarity would appear if you just did that for the 35th time?

BTW Luke, you bullshitters always say I live in a “crappy basement suite” when confronted with signs of a shifting market. Once again, I have a very nice large penthouse suite with beautiful ocean and downtown views you could only dream about. Your insults about where I live as many renters do, shows your pathetic ignorance and arrogance.

Easy to tell people what to do, harder to do it yourself.

As I’ve said before, I’ve posted many nice places Luke but your pompous pumper attitude won’t allow those many slashes to be talked about as it blows up your fantasy story. Thems the facts.

Barrister – this morning’s OB news home sales over $2m: 237 King George Terrace – $5.650k. 599 Island Rd – $2.500k. 2475 Landsdowne Rd – $2.850k. 3225 Rippon Rd – $3.400k. 3185 Rippon Rd – $3.135k.

Just a sampling perhaps Leo could tell us more – I don’t get PCS over $2m (had to bump it up from $1.5m recently though).

I agree this needs to be brought in asap. However, nothing will happen until after the soon upcoming election. If Chrusty gets back in, she will be all relaxed and then I’d expect nothing to happen on that front.

Really Hawk, you can do better than throw insults at practically everyone on this blog while hiding in your crappy basement suite. You just don’t like it when people post facts. I’ll be waiting forever for you to actually post a quality home that was price ‘slashed’. I will continue to dissect the crap boxes you post that were ‘slashed’. Quality homes sell, crap boxes over-priced often don’t.

Educate yourself totoro.

Canada’s doors are ‘wide open’ for criminals to launder money in real estate: report

“Give us your criminal, your corrupt, your anonymous masses.

It’s a message that Canada is sending to the world with its “doors wide open” approach to money laundering in real estate, says a new report by Transparency International (TI), a Berlin-based organization that works to stop corruption around the world.

One of the biggest reasons why it’s easy for illicit money to enter Canadian real estate is that it’s not difficult to hide the identities of people who buy homes in the first place.

Canadian law does not require non-financial professionals doing real estate deals to “identify beneficial owners when conducting due diligence on customers.”

Say a real estate agent is closing a deal on a property. The agent may be working with a customer on behalf of what’s known as a “beneficial owner.”

http://globalnews.ca/news/3350193/canada-launder-money-real-estate-report/

Luke, you are a househunt pussy. Clearly you can’t handle the signs of a market rolling over. Maybe you should go through all those similar Oak Bay houses in your hood that went $200K over, same stuff, small rooms,etc. Get over it.

Go to Stats Can totoro, I’m sure it’s there to pacify your court case proof. I hear they advertise in the papers too so everyone knows. Foreigners want everyone to know as they harbor no secrets….ever.

Wow – generous sized lot too at 2280 sq ft. 40ft x 57ft. Funny how you didn’t mention that. Built in 1911 and sinking. ( when house hunting last year I noted many parts of James Bay and Fairfield former marshlands are like this – it felt like I was drunk while sober walking through these old homes swaying from side to side where nothing was level). Awesome basement height of 6’1″ – I’d be bumping my head. That all said the kitchen doesn’t look too bad but the bathrooms… ugh! And, we are still talking well over $1m here.

You still haven’t found a quality home to post that was ‘price slashed’ have you Hawk? I’m still waiting…

“until the federal government imposes lending or foreign buyer restrictions or they will operate within their own risk assessment framework.”

Yes, that’s one of the issues. I don’t want to make this only about foreign speculators, because as I’ve said, there are both domestic & international speculators.

And I’ve been one of the main people on this blog discussing the many factors that contribute to high prices in Victoria. What I was focused on, in that one post, was speculation – one of the factors – due to the rate of escalation over a short period of time.

Stephen Poloz himself said, “There’s no fundamental story that we could tell to justify that kind of inflation rate in housing prices … Demand is being driven more by speculative demand”

Then there are also plenty of other reporters (G&M, Province), analysts (Teranet), & economists (Porter) that have compared Ontario’s % YOY price escalation & Victoria’s (specifically: Toronto, Hamilton, Victoria).

Look at the charts:

http://www.theglobeandmail.com/real-estate/house-price-data-centre-canadian-house-prices-see-record-breaking-month/article29697029/

In terms of the mortgages, banks in Aus & NZ like Westpac and ANZ already stopped lending to foreign buyers before their gov’ts asked them to, to reduce risk.

Canadian banks (& gov’t) need to start taking the risks seriously, because the system is being abused to buy multiple homes and it’s contributing to low inventories.

Here are just 2 of many news articles:

http://www.vancouversun.com/news/alleges+Metro+Vancouver+homes+were+part+scheme+launder+money+embezzled+China/10926774/story.html