Who’s buying in Victoria?

Last week we looked at the explosion of Vancouver buyers that happened in 2016 and despite having looked at these numbers before, I was surprised at the magnitude when compared to previous years. Now the VREB have released their updated stats on buyer origin for all of 2016, so let’s take a look at who is buying in Victoria and how that has changed from last year.

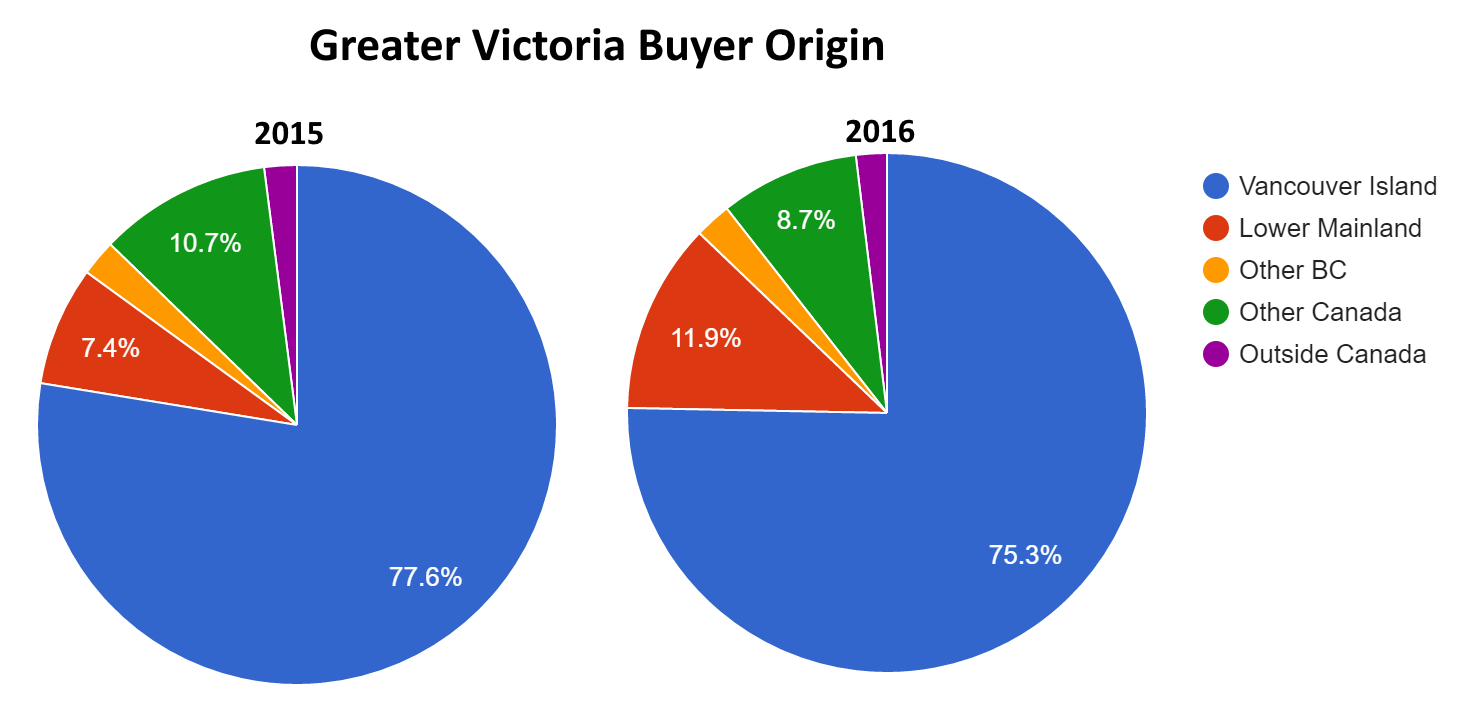

While locals still accounted for three quarters of the over 10,000 buyers last year, they dropped a bit from 2015 (which was down a smidge from 2014). Based on this data, we can see that:

- Vancouver buyers increased massively in 2016. In fact they doubled, from 600 in 2015 to 1221 in 2016.

- Buyers from the rest of Canada did not arrive in Victoria in any greater numbers than they usually do. Percentage wise they are down, and in absolute numbers there were only 24 more buyers from the rest of Canada in 2016 than the year before. If the boomer wave is coming, they definitely did not arrive yet.

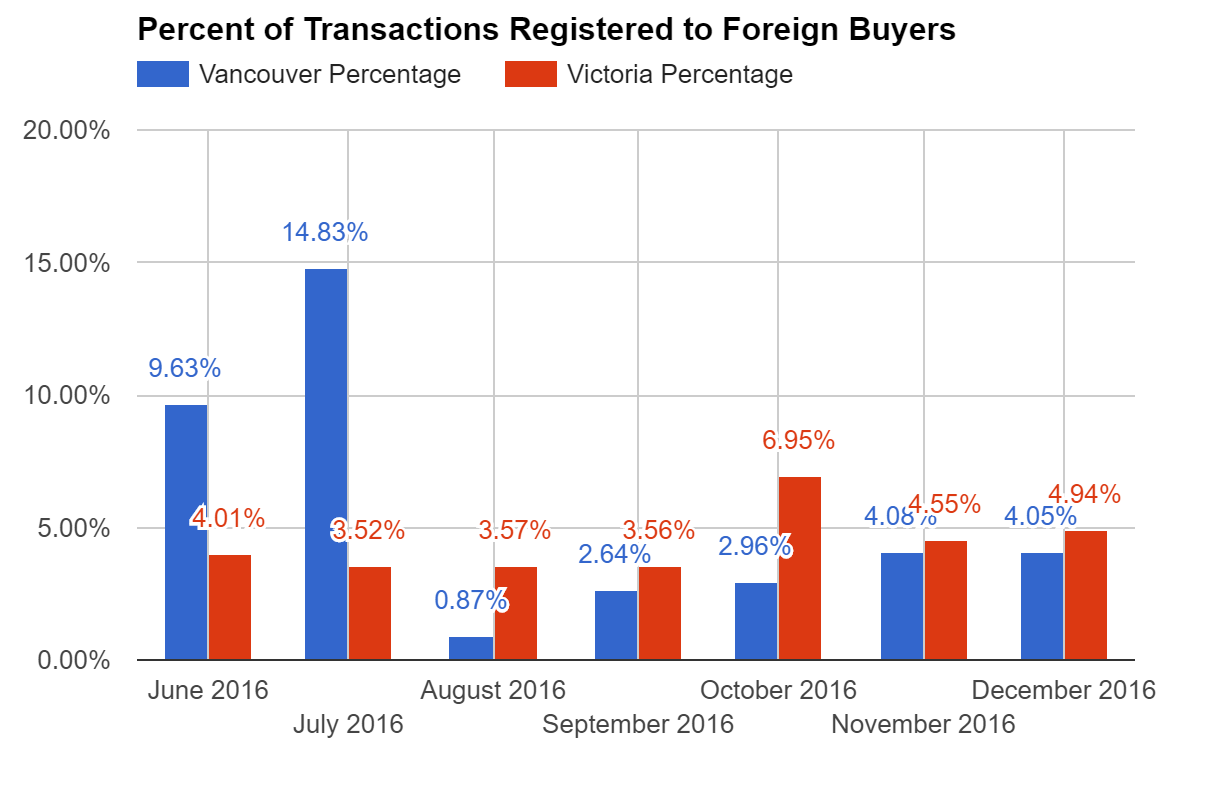

- Buyers from outside of Canada are not a large factor based on these stats (less than 2% of buyers). Note that this is not measuring nationality and is different than what the province collects (which indicates about 4-5% foreign buyers)

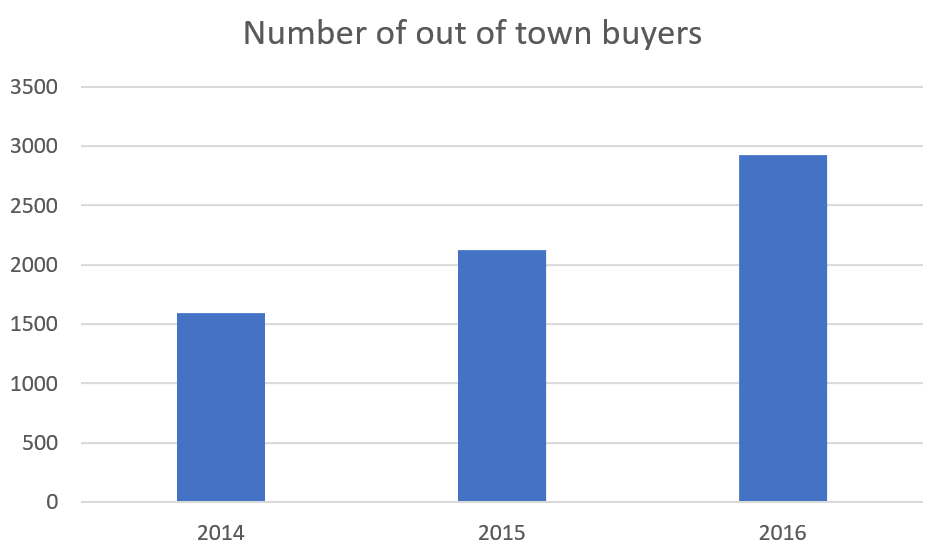

- There were a total of 2927 out of town buyers, which accounts for 28% of the market. However the percentage is less important than the number of buyers, because out of town buyers represent pure demand. And that pure demand has been growing.

It will be interesting to see if the Vancouver wave continues this year (so far it doesn’t seem to be).

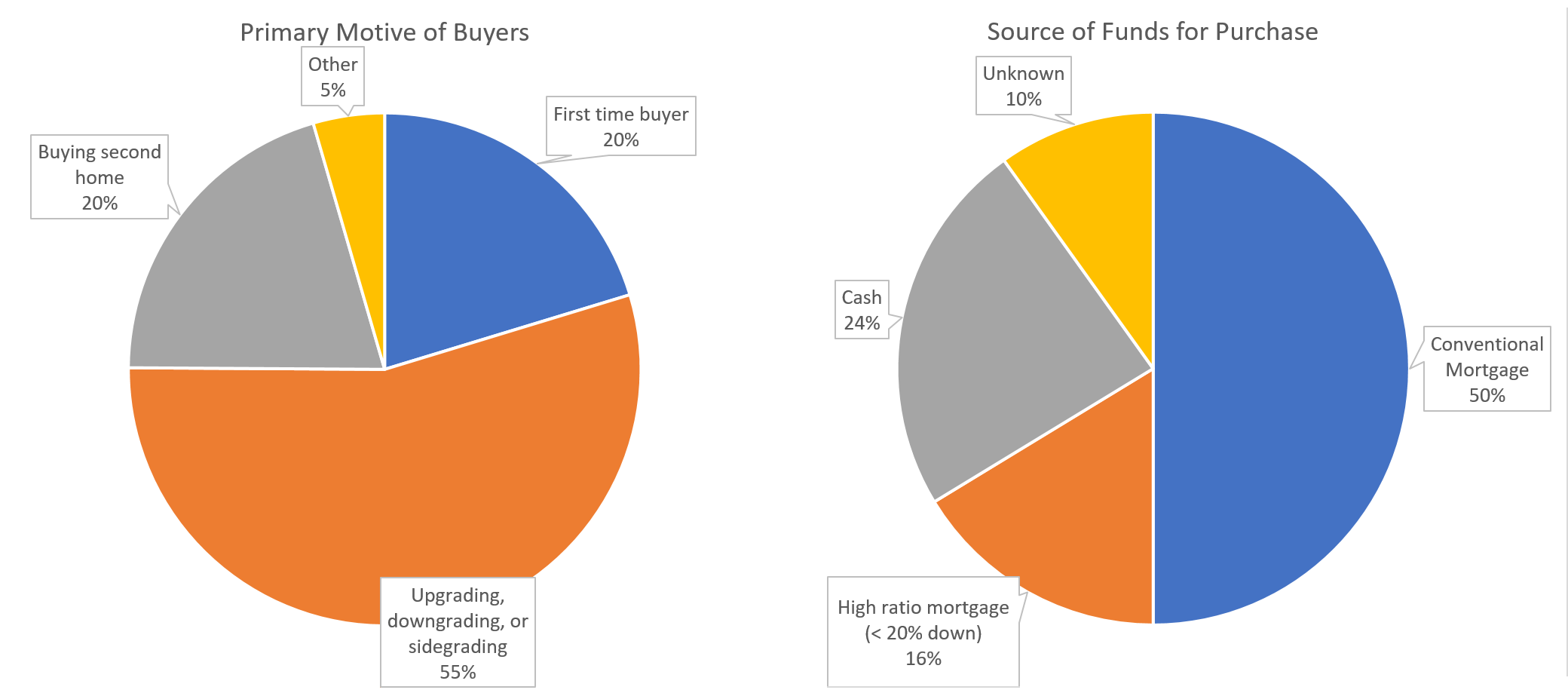

The VREB also surveys their members on some other buyer characteristics of interest.

These percentages are fairly stable across years with 20% of buyers being first timers, and 15-20% requiring high ratio mortgages to buy. Suprisingly enough the percentage of buyers using high ratio financing actually seems to be declining (2013 was 21.8%, 2011 was 23.6%) but the low response rate on this survey in earlier years makes year over year comparisons questionable.

From a demand perspective, the first timers, the out of towners, and the second home buyers are the most important players in the market. However many locals want to up or downsize is essentially irrelevant in comparison.

“The only problem with his “facts” are that they are alternative. Lol.”

oops,

Funny how those facts get in the way of a good yarn when you’re in the business. The “New Paradigm” is alive and well in a world where free markets never go down.

new post: https://househuntvictoria.ca/2017/03/20/march-20-market-update/

http://www.cbc.ca/history/EPISCONTENTSE1EP17CH3PA1LE.html

“In 1982, Dome Petroleum, the country’s largest oil company, avoided collapse with a last-minute bailout package with Ottawa and the banks.

Within two years, mirroring trends elsewhere in the country, unemployment in the province rose from 4 to 10 per cent. For the first time in more than a decade, Alberta had more people leaving the province than coming in. The province led the nation in housing foreclosures, bankruptcies and suicides.”

Apparently the banks weren’t too sympathetic. Then again, who could envision oil companies having problems again, nowadays.

Irregardless

March 19, 2017 at 7:49 pm

Yeah Hawk,

Calgary average house prices only fell 38% in the 80’s, just an incy wincy real estate collapse..

Hmmm, apparently, Irregardless, as Richard has pointed out:

In Calgary’s 1982 real estate meltdown (thanks to the NEP) CMHC ended up with 15,000 foreclosures. We didn’t see any on the market for almost three years and when we did, they released blocks of about 500 a time so as not to flood the market. The last 3-4,000 were sold when the market had rebounded and they actually made big gains on them.

So, hoping for a real estate collapse in order to get into it, is not going to turn out the way that many may think.

The only problem with his “facts” are that they are alternative. Lol.

http://www.cbc.ca/news/canada/calgary/jingle-mail-alberta-housing-1.3430867

Alberta is the only Canadian province to broadly offer non-recourse residential mortgages. Those are loans with at least a 20 per cent down payment and thus are not insured by the Canada Mortgage and Housing Corporation (CMHC).

Agreed, and that’s what the 1990 crash showed. As Toronto crashed for ~5 years, Victoria did the opposite and gained (after a brief pause in ’90).

I was reading somewhere that many areas were hitting the 50%+ y/o/y last time, so perhaps it’s getting closer. I bet areas closer to downtown will near ~50% annually before it pops (markham, vaughan).

Personally, I think that’s very sad for the young people of Ontario…and the older people banking on that as their retirement fund.

Look at this….

http://torontorealtyblog.com/wp-content/uploads/2017/03/AverageDetached2017.png

I’m not convinced that Victoria and Toronto are connected other than in the most macro sense…

I think those dynamics will help bring it down, but my question was more, “Could this go higher, and if not, why not”

Personally, I think it can in the short term. Vancouver went to 1800k/SFH with a median income lower than Toronto’s. If most of the drivers are move-up buyers taking advantage of low interest rates with speccers also in there – perhaps it could go to 1.8 or 2 million. I’m not convinced of the foreign buyer meme, at least not directly.

Going to 2000k would be extremely alarming – I already think this is going to unwind as it is absurdly delinked with fundamentals. However the limits of mania are less defined and could set this whole thing up to be worse. And given the size of the Van and Toronto markets collectively, I think our country, Victoria included, is on some dangerous footing.

This is not a collective mania; it’s bordering on psychotic.

Agreed LF, and once Toronto does finally correct in the next couple years, Vic should stumble for a short while like last time.

http://i.imgur.com/xMSMaxm.png

Those thinking they can go higher with rising rates, massive debt bomb(that wasn’t there in 89) and a fucked up neutered US government is in for a rude awakening. Not to mention credit margin borrowing at all time maxed out levels.

1082 Price Changes for March, 2017

http://www.myrealtycheck.ca/

http://realinvestmentadvice.com/wp-content/uploads/2017/03/Margin-Net-Credit-Debt-031717.png

LF I thought you were smoking something but homes in Toronto are still more affordable than 89. OMG it could go higher. Crazy

http://www.rbc.com/newsroom/_assets-custom/pdf/20161221-ha.pdf

Thanks for the post, Hawk. I was reading elsewhere a little while ago that while Toronto’s prices are high, they are not at the 1989 levels yet and in fact, may have some distance to go before that is the case.

I shudder to think there’s that much room left in that market…what do you think?

Partly owned by the league guys. Great 5 parcel development. This parcel is the last one has been increased a couple times with the inventory dryup. Still no buyer. Going to take a lot of blasting. Has great potential if you have the $ to build and blast.

Interesting insights at the Toronto real estate expo.

“This Is Going To Blow Sky High” – Observations On Canada’s Housing Market

I attended the top of the Canadian Housing Market, so you didn’t have to

https://onbeyondinvesting.com/blogs/blog/i-attended-the-top-of-the-canadian-housing-market-so-you-didnt-have-to

GWAC:

Who owns part of the property, you could have given us the answer to start.

Sorry Marko. On the plus side I’d say that your willingness to put yourself out there on an issue you feel passionate about without a motive for financial gain shows your character and many people would like to hire a realtor who acts as you do.

179 Meadowbrook. On the market for ever just raised the price 50k. Guess who owns part of this property. 🙂

Interesting article Vicbot. I wouldn’t have been so kind to them. Dumb people don’t get as far as they did. I can’t explain it away with “inexperience”. They were simply too clever for that to fly.

Sorry to ask, but is VV “Vibrant Victoria”?

Sorry to hear that Marko. So you’re breaking the rules by helping owner-builders write an exam that’s required under the rules? It probably has more to do with your opinion.

Every profession has issues, but that’s why I think RE in BC can be such a tangled web – it’s very hard to protect home buyers’ interests & RE industry interests at the same time, especially when you have the banks & gov’t depending on people racking up debt (and as numbers hack pointed out with the Tyee article, the global financial industry).

Dasmo, great that you tried to point out problems with League – too bad there’s not more freedom to actively question businesses like that! Good G&M story on that whole debacle.

http://www.theglobeandmail.com/report-on-business/rob-magazine/league-of-their-own/article16583968/?page=all

“REITs are supposed to be safe”

Marko, you belong to a cult/syndicate that has no others interest but theirs and their developer buddies. Just look at Vancouver agencies fraud cases, they are in major damage control and will do anything to stifle free thought unless it’s to their benefit.

What set my alarm bells off at the time was the ridiculous financing structure and the promise of obscene returns in their REIT.

Neither Adam or Manuel had any relevant experience whatsoever, especially in development.

There were so many massive red flags it wasn’t even funny….like who invests that much capital into an underground parkade in Colwood? Even at Uptown they built the parkade in stages.

When I saw the parkade going in and the footprint I had a feeling everything was going to blow up. An experienced developer would have just built a parkade size for the first portion of the development and then added more parkade in the following phases.

Then they came out with pricing for the condo towers that at the time was equivalent to the Bayview Promontory….like what? I can live downtown overlooking the inner harbour or in Colwood? for the same price per foot.

@Marko, I stopped my posts on VV and don’t really blame them for shutting me down. They are what they are and that is exactly why they shut it down. Still, this is why they got away with it. Strong arming and threatening anyone who spoke against them. What set my alarm bells off at the time was the ridiculous financing structure and the promise of obscene returns in their REIT. I am involved in the world of marketing so I am also extremely skeptical and cynical when I see some major BS being pulled off for evil. The crest was perfect….. Not as good as the Nazi symbol but excellent branding for evil….

Marko:

There is an old lawyers saying (being an old lawyer I guess i get to use it).

It is fine to speak the truth but be prepared to leave the country.

@Marko – I have no problem posting it. Send me your latest and I’ll throw it online anonymously.

I think it is outrageous that you were shut down for providing information.

Well…..I am also extremely negative on the exam and the FOIs I’ve submitted in the last few weeks probably don’t help the situation. I don’t think if I was only providing information and saying how great this exam is that there would be a problem.

Dasmo:

Can I use your dad’s quote; there is real truth in it. particularly in B.C.

My dad had a saying. If you are going to play the role of Jesus Christ, prepare to be crucified…..

Marko:

I think it is outrageous that you were shut down for providing information. it is a scandal. When I was practicing in Toronto I would have lunch occasionally with the corporate guys and the generally consensus was that doing business in B.C. was like entering a snake pit.

I am sorry that you had such a horrible experience trying to do what is right.

Marko

They win if the exam material goes away. The exam is staying. You have to ask yourself it you want to help. Charge $20 and donate it to the food bank.

I would get rid of all negative stuff and just make it a business with small revenue. I am sure their concern is really not the exam help but your opinion of it.

So I am not allowed to have an opinion because I belong to a professional organizing? 🙂 It is a legit opinion, BC Housing has literally not provided one piece of legit reasoning as to why this exam was introduced. They introduced it July 4th, 2016 and haven’t issued a single statement since then even thought their phone lines are jammed with people complaining every day….I’ve now submitted more FOI requests, etc.

But anyway…I literally have nothing to gain as I built my home before the exam was introduced. I few people have suggested I make the study guide available for download for $50 or $100 and at about a 1,000 requests per year there would be some revenue there but was never my intention to make money off it and not interested in going that route at this point. About 50 people have helped me with putting it together and making money off other peoples good will seems a little odd.

My point is VV deleting comments on the Leauge thread was likely due to fear of lawsuit of some sort.

Marko

Some times you have to hold your breath from all the bullshit to continue to help.

That’s too bad Marko. I guess you have to make a choice when you get a horse head in the bed….

http://www.billdamon.com/wp-content/uploads/2013/03/Horsehead.png

MJ

Charge for it. You are providing a service. They have no claim Many study guides and practice exams on line for different professional or license exams.

I would get rid of all negative stuff and just make it a business with small revenue. I am sure their concern is really not the exam help but your opinion of it. 🙂

House Hunting:

How did you come up with a formula for separating the land value from the building value?

I bought three years ago in core and that made it simpler since I paid $206 a square foot for the house

but that was without giving any value to the lot. ( ie: square footage divided into the purchase price)

The lot was 26,000 square feet (,6 acre). My question is how should I have apportioned the purchase price between land and house? The purchase price was 1.6 and the house was 7, 885 square feet (I am not counting the carriage house on the property which also had an addition 770 square feet on the second floor).

Do you figure out the value of the land first or what is the method that you use?

I’m surprised that article didn’t reference League financial partners. Our own local real estate scam that remains unpunished. I called that one out early and got shut down on VV.

At the time League was suing people including a blogger and it went to court, etc. VV isn’t a massive operation that can go out and hire lawyers…..my guess is they were trying to protect themselves.

I recently took down the HPO owner-builder exam materials from my website as the HPO filed a complaint with the BC Real Estate Council and now I am “under investigation” for “conduct unbecoming of a realtor,” for putting together and providing a study guide for the exam, for free, which is being interpreted as I am encouraging people to break the law. My opinion on the exam has not changed but I don’t have the re-sources to hire lawyers to get into a scrap with BC Housing and government corruption (my opinion as to what is behind the exam), easier just to take down the materials and shut things down.

Dasmo, I would also be keeping an eye on these guys who I believe are behind a development here. Looks like red flags to me.

Additional syndicated mortgage claim filed

A total of five claims have been filed against Fortress Real Capital, bringing the total to $137.5 million.

http://www.mortgagebrokernews.ca/news/alternative-lending/additional-syndicated-mortgage-claim-filed-221859.aspx

I am neither an expert on real estate nor am I in the real estate game. In other words take this advice with your own good judgement. I think that a number of people on this blog have very accurately pointed out the problems with blind auctions. In reality you can end up paying tens or even hundreds of thousand over the next highest value. In point of fact yours might be the only offer.

There really is only one solution to the problem. Simply dont even bother with houses that have just come on the market. But I might miss out on the perfect house. That is certainly possible but the more likely outcome is that you have seriously over paid for the house. What I suggest is that you look at houses that have been on the market for months or at least for several weeks. Some of them are just really overpriced while others actually have some serious issues. Especially after three or four months you will find some of the owners much more motivated to strike a deal. Be aware that some owners will simply not budge off their price since they are only willing to sell at a ridiculously high price but others really either need or want to sell. It is the latter you are looking for.

In south Victoria (Fairfield, Rockland, James Bay and Oak Bay) about half the listings have been on the market for months. By the way because of the way listings are recorded you cannot trust the posted days on market at all. Houses are taken off for a week and then come on as a new listing. If you change real estate agents they come on as a new listing as well. This is where it is important to get both an honest and a knowledgeable real estate agent. Since I had been looking for a year before I finally bought I had a pretty good idea how long some of the houses had actually been on the market. I actually used this as a test question in picking an agent. If they just gave me the official days on market I simply concluded they were either not knowledgeable or that they were dishonest. In many cases I suspect it was both.

While I am stating the obvious, the other problem with the auctions is that it does not provide enough time to do a proper set of inspections. This is completely critical if you are looking at a older home and should be absolutely mandatory with anything approaching a heritage house. Personally I am not a great believer in the “Home Inspection Industry”. But the contracts that I have seen exclude most of the basics in their fine print such as plumbing, wiring, roof and particularly foundations and perimeter drains. But on the other hand, they will tell you if the doorbell works. I am not saying that they dont look at any of those areas but rather that they dont guarantee their inspection to be accurate. I strongly suggest that you get at least a civil engineer to inspect the foundation (at least he is covered by professional insurance and held to professional standards). The perimeter drains should also be scoped . If the house is old get an election to examine the house particularly with an eye to examining for old knob and tube that might connect some of the fixtures.

I also had a heating company examine the furnace as well as a plumber.

The point I am making is that these sort of inspections take time to line up and will cost you a couple of thousand dollars to do. Money really well spent by the way. But they really are not possible or practical if you are doing a blind auction. Not enough time to line up the guys in a week or less nor do you want to spend $3,000 when you dont even know that you are getting the house. That brings us back to my original point. Look at houses that have been on the market for a longer period of time where the owners are willing to accept reasonable conditions.

My dad taught me a simple rule: “You will never get a good deal if you are not prepared to walk away from a bad one”. By the way, he was a lot smarter than I am.

Bearkilla tells his 10 year old every day they are getting the boot at 18, no matter what. He would be the last to be listened to and should be voted off of here along with Introvert for the two most useless posters who offer nothing.

” I called that one out early and got shut down on VV. Posts deleted and reprimanded. Anyway, I hope someone makes a movie about that one. ”

So typical of VV and some of the industry related cheer leader posters on here who try to discredit the obvious elephant in the room debt bomb that’s only being reported on a daily basis. The local media never steps in until it’s so fricking obvious they have no choice in order to not upset the advertisers and site sponsors.

Househunting;

You’re on the right track. I did the same thing.

I also worked out what the $/finished sq ft and $/sq ft Lot for all sold properties by area.

Then I applied going forward to guess what I felt houses should sell for.

In the end? We stayed out of the core.

Couldn’t justify paying 10-15years Fwd prices.

Maybe if subjects were able to be placed but not both.

Go where the value is.

You’ll be rewarded as other buyers won’t put the time into that. Particularly the $/Lot sq.

Just my 5c

@VicBot, I’m surprised that article didn’t reference League financial partners. Our own local real estate scam that remains unpunished. I called that one out early and got shut down on VV. Posts deleted and reprimanded. Anyway, I hope someone makes a movie about that one. Some genius moves. The crest, the heavy handed lawyers, the showmanship, over a hundred companies (mostly numbered) owned and intertwined in the mess, targeting the old. Sorry but I would rather invest in the stock market. It at least has a modicum more scrutiny than the Wild West of BC real estate.

Thanks househunting that map is cool.

With delayed offers being so common, we really do need a better way for buyers to guess at what to offer. However it is so property dependent I can’t really think of a way this could be done.

@db

“Can you clarify one thing? when you say overpaid or done well. Is it in relation to the Assessments? and are the Assessments the 2016 BC Assess? or was this 2015?”

The assessed value is taken from the listing, and Foul Bay has been corrected – it should have been the 2016 value the 2015 value must have been on the listing. Keen eye, thanks for catching that.

@Leo S

“What was your metric for this again?”

The metric is % of Sold Price vs. Assessed value. ( Sold – Assessed ) / Assessed * 100.

The primary intent here is to trend how much over assessed values houses are going for, to help determine what a reasonable Offer price would be going into a sale situation.

There’s likely flaws in my logic here, it’s preferable though to just blindly following the “Offer what you can and then some” kind of mentality. And, sure there’s more to it than just a single metric and this should be considered just be another additional finger in the wind.

Yeah hawk is a pretty crappy market timer lol. Great job hawk I’ll be sure to continue to completely ignore everything you say and I strongly advise everyone else to as well.

Yeah Hawk,

Calgary average house prices only fell 38% in the 80’s, just an incy wincy real estate collapse..

(I think Marko’s book reccs wins for under-the-radar subtlety..)

Common law relationships on the rise, no wonder divorce is down.

http://www.cbc.ca/amp/1.3312500

Interesting article in Canadian Business:

A Forensic Accountant on How Canadian Investors Get Duped

http://www.canadianbusiness.com/investing/al-rosen-mark-rosen-easy-prey-investors/

“So, hoping for a real estate collapse in order to get into it, is not going to turn out the way that many may think.”

Well Richard that’s exactly what you said. I guess to protect your clients I assume that just bought in.

Impeccable credit was not required, another false statement. I had average credit and a job with history. People with shit credit have no business being in the market but I guess those are your clients.

AG ,

You need to get over the fact one can make just as much in other markets or businesses. Your small mind is getting painful to read.

Correcting myself: “If I had chosen a field that didn’t lead to a well-paying job …” 🙂

Non-prolix response to arts degrees and their real-world value

-the child is doing her MPhil in Early Modern History at Oxbridge

-it is recruiting season at UK universities

-investment banks have been trawling all the Oxbridge colleges

-they say most of their recruits will be postgrad History students

-they say it has been an “off” year but first year bonuses should be 75,000 pounds rising tenfold over the next decade

“Arts” does not appear to be always linked with penury

Leo,

would you have those US mortgage stats say 2007 or 2008 just before the crash?

People are only getting married in their 30’s nowadays, give them a chance!

Not even true anymore. Divorce rate is pretty low these days.

Now that I think about it, maybe a factor in our lack of inventory. Fewer divorces, fewer forced sales?

And another benefit of an education:

Hey Hawk,

Why do you read something into my comments that clearly I did not say? Nowhere do I deny the possibility of a real estate collapse. From my previous comments it is clear that I counter my clients only to buy “when they are ready, irregardless of the market”. This is in big contrast to “used car salesmen” tactics! (Isn’t “salesmen” politically incorrect?)

“Maybe if we had more people that had studied and learned some critical thinking skills we wouldn’t have trump right now…”

Agree, I’ve seen too many people in my life that have lost money because they don’t have good critical thinking, communications, and math skills, all of which they could have improved with post-secondary education. (They have fallen victim to sales tactics at banks, insurers, company stock schemes, and even conspiracy theorists). Without those skills, we wouldn’t have engineers/scientists inventing the Internet or iPhones, or carpenters building stairs.

Probably the most valuable gift my parents gave me was a sense of practicality and responsibility. If I hadn’t chosen a field that didn’t lead to a well-paying job, then my parents wouldn’t have forked over any extra money to me – even though they could have bought me multiple properties, they didn’t.

People need to have realistic expectations – they need the freedom to decide what makes them feel like they’re contributing to society, while at the same time, what earns them enough to afford they type of house or car they want. The ability to invest money needs to be a reward for their own efforts, not an entitlement (otherwise they won’t be productive or satisfied in the long run).

Seems like ~35% of American homeowners have no mortgage. Really not that different.

This time around, you sold near the bottom and it’s since gone up around 40%. So I guess that’s a wash?

Richard, in early 80’s Victoria prices went down 40% or more depending on the area. Personal household debt was a mere 66% versus todays 167%. I sold at the peak and bought back 2 years later at 40% off. Thats all that matters when the bottom falls out.Not what CMHC does.

As an agent trying to deny it won’t happen is irresponsible of you but typical of used car salesmen.

Hawk,

for all those waiting on the sidelines for the great big real estate collapse there are some “truisms” to consider.

In such a catastrophic environment it will be almost impossible to obtain credit except for those with impeccable credit.

As frequently pointed out 40% of Canadians own their properties outright and a real estate value plunge will have minimal impact on them, contrary to the US real estate bubble crash where Americans were (and still are) encouraged to carry mortgage debt on their principal residence so they can right off the interest against their income.

CMHC, who would be the carriers of a huge portion of high ratio mortgage forfeitures, will hold them off the market to minimize the impact on real estate values and eroding their own portfolio wealth. In Calgary’s 1982 real estate meltdown (thanks to the NEP) CMHC ended up with 15,000 foreclosures. We didn’t see any on the market for almost three years and when we did, they released blocks of about 500 a time so as not to flood the market. The last 3-4,000 were sold when the market had rebounded and they actually made big gains on them.

So, hoping for a real estate collapse in order to get into it, is not going to turn out the way that many may think.

Dasmo:

This blog does not always lead itself to subtlety. What a gorgeous day we are having. Some new inventory has come on line this past week in south Victoria but not a dramatic number of houses. A few have sold but nothing seems to be flying off the shelf.It is still mostly the same houses that we started the year with on the market.

One more point on the ma and pa DP gifts. The convo seems to be built around one child, when most have 2 , 3 or more. That makes it a $200K to $400K layout in a bloated market built on bully bids and FOMO. When most parents homes are worth $800K then they are borrowing up to half their paper profits.

Some kids need to learn that daddy isn’t as smart as he thinks he is when he says real estate is a lock.

Canada, China Flashing Warning Signs Of Financial Crisis: Report

A new report from one of the world’s top banking authorities is warning that Canada and China are the two countries which face the highest risk of a financial crisis, thanks to elevated debt levels.

“Early warning indicators for financial crises continue to signal vulnerabilities in several jurisdictions,” stated the report from the Bank for International Settlements (BIS).

http://www.huffingtonpost.ca/2017/03/06/canada-financial-crisis-bis_n_15189530.html

I still think it’s a bad idea not to get any education. A diploma in something practical doesn’t take long and doesn’t cost much. If they want to get into investing (including real estate), then a commerce/business/accounting diploma may be well worthwhile. A house is not a substitute for skills.

I guess that’s the difference. I did my undergrad (engineering) not to earn a lot of money but because I like software development and solving problems that way. The people that take engineering only to make money are generally not the good engineers in my experience. Then I did my masters knowing full well they don’t pay off but just because I found an interesting topic I wanted to pursue and an $18,000/year stipend was good enough to live on.

I’m sure I’d be much further ahead if I dropped out of high school, got into construction, and invested every spare cent into real estate. Still wouldn’t do it in a million years though.

@LeoS: “Maybe if we had more people that had studied and learned some critical thinking skills we wouldn’t have trump right now…”

Agreed!

The liberal arts (Latin: artes liberales) are those subjects or skills that in classical antiquity were considered essential for a free person (Latin: liberalis, “worthy of a free person”)[1] to know in order to take an active part in civic life

Maybe if we had more people that had studied and learned some critical thinking skills we wouldn’t have trump right now…

As someone has already mentioned, degrees in fine arts and the humanities are not the same thing. One is a BFA and the other a BA. BA recipients have all kinds of transferable skills (logic/reasoning, the ability to construct a persuasive argument, writing/communication). BFA holders (such as the actors who totoro mentions) are generally not seen to be as employable outside their fields of study.

Good humanities students are actually often as competitive for all kinds of finance and tech jobs as business students might be.

https://www.forbes.com/sites/georgeanders/2015/07/29/liberal-arts-degree-tech/#3f2094cf745d

https://www.washingtonpost.com/national/on-innovations/why-you-should-quit-your-tech-job-and-study-the-humanities/2012/05/16/gIQAvibbUU_story.html?utm_term=.4025c4995221

Funny how some think all parents flipping out $100K plus for their kids is some easy task. Most will pull it out of a HELOC and still have to pay it back. Many will see a bloated market built on debt and say you’re on your own like they had to.

It only took 11% of bad mortgages to tank the US market so seeing the big 5 banks were handing out mortgages like candy to “make the sale” it shouldn’t be long til the new credit tightening shows up with increased sales falling through.

Haha! Was I the only one that got that?

Dasmo:

Precisely. Considering the rate of divorce, marriage seems to be an act of irrational optimism these days.

Ash, I like what you say, but I do not believe it to be true based on my experience.

Surprising and sad:

Obituary: Saanich Coun. Vic Derman, 72, hailed for his work on environment

http://www.timescolonist.com/news/local/obituary-saanich-coun-vic-derman-72-hailed-for-his-work-on-environment-1.12211353

I very much liked and respected Vic Derman. I saw him at Planet Organic on more than one occasion, bike helmet always in hand.

But what I will most remember him for was his dogged determination to thwart the cabin resort proposal that threatened the Juan de Fuca Marine Trail a few years ago.

He will be missed.

But you are who you are today because of the path you’ve taken. And your kids will need to go through some learning of their own to get to where they need to be. I agree some parental advice/support is needed but there’s no easy shortcuts with this stuff.

Where is your data on this? A full 40% of Canadians have a paid-off house and many parents will inherit. And there is a difference between helping with a down payment and co-signing on a mortgage the child will pay vs. taking on mortgage debt you will pay. There are risks, but for many parents they see it as an opportunity to help their children that will increase their opportunities at not a huge cost.

That wasn’t the topic for me and I think I raised it. It was whether in some cases (emphasis) it is better to stay at home, work, save, invest and have the parents invest the same amount they would have paid for an education on behalf of the child.

My premise was never that a liberal arts degree was worthless or should not be supported by parents. There are many government jobs that require a BA and education has value, just not sure it will have value for everyone who goes. I do have friends who paid for an education they never needed in their profession and have been paying off student loans for years as a result and I believe some would have been better off without the degree financially.

As an example, my friend got a degree in acting and never made it big. She works as an accounts manager now, but is still very involved in the community. I’d say she is quite happy overall, but there is no doubt she could have done what she has without the degree. My best friend also started in acting at university and never finished the degree and now works in something completely unrelated. Neither can afford to buy a house still in the HCOL areas they live in.

Who said they would be doing “nothing”.

This issue arose for me because I have a child oriented towards fine arts who doesn’t love school. A fine arts degree doesn’t generally pay off financially and in fine arts you get ROI, including increased skill, from creating. Works slightly differently for different arts. That is what I’d expect my kid would be doing if not in post-sec: work, stay at home, save and do art for a few years and maybe travel a bit.

We’d look at investing the money we’d pay for university into something that would bridge the likely earnings gap later on vs. my math whiz kid who is in sciences and for whom education is a slam dunk. This would likely be real estate in our case because I know it well and believe I can provide some value. At the same time, we’d see how best to stabilize our fine arts kid’s earning potential through certification or entrepreneurship or, if the they change their mind after giving it a go, through post-secondary later.

As far as, say, a sociology or psychology degree goes, I also have friends with these who are not using them and never needed a degree for their job, but I agree they can lead to greater earnings that a high school diploma.

Then perhaps consider investing on their behalf in something more passive if they are pursuing a passion that doesn’t have high ROI likely. I don’t view home ownership as a burden myself, but rather as a privilege with payoff for effort. Heck, going to school involves work too and many aren’t doing it because it is fun, but rather because they expect it to pay off. And many aren’t working after their degree for fun or pleasure, but largely because they need to pay for the cost of living.

Agreed. I have loads of education and I see a need for perspective. Some of my education was very valuable, and some was a waste of my money and time. If I’d known then what I know now I would have taken a shorter route through, pursued my other interests independently, and invested the savings early.

Or on a single salary of almost any sort, including the educated sort, unless you have moved up the property ladder or had other windfalls or parental help.

“But as VanCity says in their ads targeting despairing millenials- don’t give up!”

Yep, don’t give up kids, the crash is coming and those who got shut out get a second chance, happens every generation.

Ratings agency sounds strong warning on Canadian housing market

In its report released last week, Fitch Ratings downgraded its outlook of the Canadian housing market to “unsustainable”.

The credit rating agency’s latest survey of 22 countries placed Canada among the ranks of Greece and Singapore as the real estate markets facing the greatest risk of major downturns in the near future, BNN reported.

“Canadian home prices are not supported by underlying fundamentals and the risk of a price fall in over-valued markets has risen,” Fitch stated.

http://www.mortgagebrokernews.ca/news/ratings-agency-sounds-strong-warning-on-canadian-housing-market-221560.aspx

Because you are a divorce lawyer?

Luke:

I agree that Quimper Street sold for a more reasonable price than the original 2 mil that they were asking. But that is still a lot of money for a small lot. Not even any views of the ocean. While it is a matter of taste both my wife and I found that the inside of the house felt like a condo.

As for divorce being the great destroyer of real estate wealth that is probably generally true but my own personal experience is that it generated an great amount of wealth.

2079 Quimper St. in OB Gonzales went for $1.7m + GST

Great ‘hood and house design-wise, and they did have to reduce the price from even higher in the stratosphere, I’d also say it was a much better house than the Fair St. house that went for $1.6m. But, it is on a small lot – and… 2 sump pumps…

To add to all the talk about the bank of ‘mom and dad’ in many cases this can also be expanded to include other relatives. That rich aunt you barely knew who had no kids that passed away and left you a fortune. It happens… Or, in some cases they help you out while they’re still alive.

As for education – it can often lead to where you want to be in life, but increasingly these days for the young – it doesn’t. Often, they don’t even use their degree! That said, education always looks good on a resume. However, now that a much higher percentage of people are getting degrees – it no longer looks as impressive. Def. a more challenging time to be young than in the past. But as VanCity says in their ads targeting despairing millenials- don’t give up!

https://www.youtube.com/watch?v=wQ0h3u2TZwY

Thanks John Dollar – and I never did mention I often enjoy your youtube videos.

I’d bet in this market some people can get away with this – but in a more ‘normal’ market that wouldn’t be the case? Can they make the time period longer than 48 hours? I guess so. I’ve never seen this type of thing in my experience buying/selling. It would appear to add more stress than necc. to the process.

As far as education goes I would agree that direction is needed. Ideally passion. Otherwise it’s potentially a waste of time and money. If someone is passionate about flipping houses at the age of 20 then trying to force them to go to uni and become a doctor is also flawed. If my child was pursuing their dreams I’m not going to saddle them with the burden of home ownership. Leave youth for being young…

http://i.imgur.com/CPyV3cV.png

@db, you don’t lend books, you give them….

Totoro,

You have switched the argument from “liberal arts” to “fine arts” to better suit your conclusion. In that regard, I would suggest that the fine arts data may not be as robust in terms of “reported” income, ala Evan Solomon.

Also, the future may not be comparable to the past, thanks to “Watson”:

“The institute put a 70 per cent or higher probability that “high risk” jobs will be affected by automation over the next 10 to 20 years, and it said workers in the most susceptible jobs typically earn less and have lower education levels than the rest of the Canadian labour force.”

http://www.cbc.ca/news/business/automation-job-brookfield-1.3636253

And while a third of Ontario engineers may have jobs not requiring a degree, I know what my guess would be as to who gets hired when a engineer goes head-to-head with a highschool grad.

@Marko Juras

Suites in Duplexes: Thanks. I’ll give you a bit more detail. The duplex was built in 2009 with suites on each side. The original owner is selling both sides of the duplex. A neighbour complained in 2014 about the suites to the municipality. At that time the owner took out the stoves in both sides of the duplex suites. My realtor is telling me this shouldn’t be a red flag because it’s much different for a landlord to be renting out a fourplex where they aren’t living than two landlords renting out there suites. My concern is that the duplex is now going to be on the radar of the municipality, but our realtor went to the municipality and doesn’t think this is the case. What would be your advice to a client?

I am not a believer in education (unless specific); I literally learned nothing doing my masters but it is required to nudge doors open in certain fields. Seems like a bachelor’s degree is the new high school and a masters is like what a bachelors use to be.

People forget schools are businesses too….the cohort of about 30 people doing the M.H.A program had everything from incredibly intelligent physicians to complete morons who could barely hold a pencil. We all got a M.H.A. at the end of the day.

“The Millionaire Next Door” and “The Millionaire Mind” are 2 books that delve into these ideas of Univ vs Home Ownership and more.

Written by Thomas J Stanley, Ph D

Since we are on the topic of books I would like to add a few more

“How to invest like Warren Buffet”

“Tennis strategies – play like Roger Federer”

“Michael Jordan – the art of the crossover”

You know Leo.. you create what you believe…

By the way db. Your cousin would not be successful in today’s housing market anymore unless they got parental help. No matter how much you hustle you ain’t buying a detached house in Victoria at today’s prices on a janitor’s salary.

“The Millionaire Next Door” and “The Millionaire Mind” are 2 books that delve into these ideas of Univ vs Home Ownership and more.

Written by Thomas J Stanley, Ph D

The first is available at the Library – (I lent mine out and never got it back)

The second covers Schooling choices and Housing Choices (as well as spouses 😉 )

db, the topic was specifically a child wanting to get a liberal arts education and what the parental response should be. Unlikely that this person’s dream is to be a janitor. That is a different case than someone who doesn’t want an education and wants to get straight to work.

As dasmo said, the question is about who you are, what you want to do with your life, and not about what is the quickest way to get into any given investment. Those two things are orthogonal.

Leo

Why did you add on the” staying home” and “doing nothing”? I don’t see where saving and investing translates into doing nothing…

It’s that kind of embellishment that makes having a conversation and sharing ideas on your blog antagonistic. I didn’t read that into totoro’s comment at all.

I had a cousin (same age), that didn’t go to university, who bought a house, sub-divided the property and built 2 more houses as well as maintained a janitorial type job and was married with 2 children.

@Deb,

At the the risk of incurring the wrath of yet more posters..

The Hyphen

Without a hyphen, “local” and “buyer” are separate modifiers of “statistics”, so, of all the buyer statistics in the world, you are describing the local statistics (ALL the buyers in Victoria).

With a hyphen however, they become a compound modifier of “statistics”, describing a subset of all Victoria buyers, the local buyers, which is what you meant to describe.

Buyer vs. Buyers

By way of analogy, we speak of used-car dealers, not used-cars dealers, and when speaking of used-car dealers, we are not suggesting that all the dealers are selling only one car.

Damn, when you are 19 and at uni you should be thinking about who you are, what you wanna be, getting drunk, learning things, getting laid, expanding your horizons… Not worrying about replacing the perimeter drains or dealing with a leaking hot water tank.

I don’t understand how you are comparing education and investing in housing as an either or choice. So you stay home, invest in housing, and do what? I’m fully in support of trades instead of academic education, but doing nothing and banking on investing in real estate instead is a bad idea and a half.

Irregardless, you realize you are looking at US studies right? And in the US the cost of post-secondary is substantially higher than here so the math might be more favourable for working vs. post-sec. It is not just about lifetime earnings, it is about net worth which needs to account for debt and investments.

If you spend 200k on a degree in the US and have 4 years of lost earnings, let’s say 120k net, that needs to be factored into the analysis. You can earn more, but if you are paying back loans and more taxes are you netting that much more?

In Canada where education costs are lower I still think you can still come out ahead by not paying for school, living at home the years you would have gone to school, and saving and investing as much as you can as early as you can – particularly if you are getting a fine arts degree which generally does not pay off at all – lifetime earnings are below those with a high school diploma.

http://www.statcan.gc.ca/pub/11-626-x/11-626-x2014040-eng.htm

I’d support and invest in this plan for a kid who is not super keen to go to university and I’d put in the same amount I’d pay for post-sec. I think their lifetime earnings will likely be lower, but their net worth may be higher with parental help, depending on the field.

The real reason you cannot afford a home…from the The Tyee, pretty leftist publication, all which it makes it more compelling, Kudos to the writer.

https://thetyee.ca/Opinion/2017/02/20/Real-Reason-Cannot-Afford-Home/

As as the final sentence was in the past tense that was also grammatically correct. It was happening but is no longer happening in Richmond but it is now happening here.

I acknowledge I could be wrong about the facts and also I don’t check as thoroughly as I should. Do I get detention?

The typical bachelor’s degree recipient can expect to earn about 66% more during a 40-year working life than the typical high school graduate earns over the same period.

https://trends.collegeboard.org/education-pays/figures-tables/lifetime-earnings-education-level

So it might come as a surprise that a new study shows the value of a college degree is greater than it has been in nearly half a century, at least when compared to the prospect of not getting a degree. The Pew Research Center has found that the earnings gap between millennials with bachelor’s degrees and those with just a high school diploma is wider than it was for prior generations.

https://www.google.ca/amp/s/www.usnews.com/news/articles/2014/02/11/study-income-gap-between-young-college-and-high-school-grads-widens%3Fcontext%3Damp

Love it, thanks

The first comer after so is fine, the rest is a run-on sentence. I disagree with the use of a hyphen completely.

The sentence “I am assuming that the local buyers statistics would include foreign students purchasing a property on behalf of their family/investors” is grammatically fine.

The sentence you are suggesting “I am assuming that the local-buyer statistics would include foreign students purchasing a property on behalf of their family/investors” would indicate there is only one local buyer with many statistics associated with him/her/them.

So that was fun.

Sometimes. I have friends with liberal arts degrees who graduated with large students loans and, in the end, the job they got didn’t need that degree and lost those years of income as well.

I have one kid who is arts oriented so it has been on my mind quite a bit. Early home ownership with rental potential and/or index investing might be a better move than a BA. I don’t see why we wouldn’t help with this instead of a BA.

Marc Cohodes on CBC, the house of cards is about to collapse. I expect the NDP to run on some very strong anti-foreign money laundering laws and new affordable rental housing projects.

https://twitter.com/OnTheMoneyCBC/status/842543716891992064

Hi Deb,

I’m Irregardless. Pretty sure db was addressing me, not double-negging Hawk.

I could leave it there, but I have taken on the unenviable task of slapping down the HHV grammar trolls whose sh*t don’ stank, so…

Deb on March 17 at 9:54 am

I am assuming that the local(-)buyers(buyer) statistics would include foreign students purchasing a property on behalf of their family/investors. If so(,) this would not be very accurate as there have been many cases sighted(cited) of students with no income purchasing expensive homes in desirable areas(,) so it doesn’t really show us where the money is coming from. (Man, that’s a run-on sentence..)

I personally know of one family with three adult children who’s(whose) names are on the properties for three different homes in Richmond,(.) t(T)he purchase of the homes was funded entirely by overseas investors. If it was(is) happening there(,) I am sure it is happening here.

I don’t put any stock in price to income. However at these rates of price increases we are quickly approaching levels of unaffordability similar to the 80s as well.

In 1981 houses peaked at roughly 5 times average household income before tanking 40%. Current house prices are roughly 8 times average household income. “Unsustainable” can’t be over used.

@deb

I believe he was actually referring to the poster named, “Irregardless”.

Regarding education, in Ontario a full third of engineering graduates end up working a job that doesn’t require any degree at all. One third work in engineering or engineering management, and another third work in a non engineering job that requires a degree of some sort.

So even a very practical degree has a lot of graduates working in jobs they could have done out of high school.

Haha brutal. No education better than a liberal arts education 🙂

@db

Just one little pet peeve, times change, so does English but a double negative is still a double negative.

The prefix ir- (i-r) is a negative prefix, so if you add the prefix ir to a word that’s already negative like regardless, you’re making a double-negative word that literally means “without without regard.”

Irregardless, Hawk

You are putting up good counter-points.

Best time in 30 years ? Who woulda thought with the fool pool at Peak Dumb as ever.

2 big banks raise alarm over Toronto housing ‘bubble’

Housing price surge of 23% in a year can’t continue, BMO and TD warn

“It’s pretty much the best time to be selling a Toronto home in at least 30 years,” BMO economist Robert Kavcic said, noting that feverish activity is spilling over into neighbouring regions

http://www.cbc.ca/beta/news/business/toronto-housing-bmo-td-1.4028032

“The average house in Victoria in 1977 was $50,000 which means it should double in 10 years or 1987 = $100,000

Similarly in 1997 = $200,000

in 2007 = $400,000 (interestingly enough it was ahead of itself)

in 2017 = $800,000”

In 77 interest rates were about 13%, popped to 20% in 1981 then the market blew up but most people were getting 5% wage increases over those few years. Interest rates have gone down for 35 years, now they go the other way for several percent which will be the equivalent effect of the 13% to 20%.

In 1980 debt levels were 66% , now 167%, doesn’t take a brain surgeon to figure out why Canada has the largest debt bubble in the world with a shaky economy built on greater fools buying more houses because of FOMO.

The US housing crash was so far below where Canada is now but every sucker in a generation has to learn a hard lesson on economics.

Big 5 banks handing out mortgages and loans like candy to make sales or be fired is the biggest red flag ever. Wait til the investigations start and the public trust in the so called conservative banks is toast.

Everyone is a fricking financial genius in a bull market, then they aren’t.

Housing market will burst like all bubbles do

https://www.thestar.com/business/wealth/2017/03/04/housing-market-will-burst-like-all-bubbles-do-pape.html

I would definitely look at the market and run the numbers for expected roi if my child was living away from home and, If it made sense, I would help them buy.

Housing might be a better investment in your child’s future than an education in some cases, and especially if they are liberal arts inclined or not inclined towards post secondary at all. If you are spending 60k it is good to weigh the options.

A case study would be interesting. My education paid off, but I’d probably have a higher net worth if I’d worked a lower paying job without the credentials and bought re early.

And yes, education is valuable for other reasons, but had I known at 19 what I know now I’d have made some different decisions and I tell my children this.

db,

The Money Supply was growing just as quickly for Montreal, with a slightly different outcome.

http://www.chpc.biz/6-canadian-metros.html

The bullish Greater Fool poster who suggested taking a look at the Japanese market apparently failed to take his own advice. The Japanese residential real estate bubble remains one of the biggest bubbles of all time.

http://www.doctorhousingbubble.com/japan-real-estate-bubble-home-prices-back-30-years-zero-percent-mortgage-rates/

Re suites in duplexes I don’t have any negative experiences (i.e. city shutting down); however, when I have clients looking at duplexes with suites the first thing I check is whether the other side has a suite. I would think in such a scenario the risk would be lower. If your neighbour doesn’t have a suite could be problematic. For one the building insurance is one policy, etc.

I project that my kids are going to be terribly disappointed when they come to me in 10 years and ask me to fund their future realty deals, “but Mum it will be a great investment”. I will be investing in my retirement so they don’t have to deal with me living in their spare bedroom.

local fool

I don’t have to defend anything. I was just laying out some comparisons…

some facts…

I said… your guess is as good as mine…

A projection is just that…a guess…

Indeed. The concept that link speaks to is meant to apply to one’s life writ large. I agree with it.

However, I don’t think it means to forgo the element of common sense in specific circumstances.

Does anybody have, or no somebody that has had experience with a suite in a duplex? I know suites in duplexes are considered “illegal” like most suites, but are they generally targeted more by the municipality?

You are absolutely correct.. local fool… and yet, the money supply keeps rising…

shame, shame on me…

https://www.farnamstreetblog.com/2017/03/rich-thinking-versus-poor-thinking/

And that folks, is precisely the danger of the extrapolation db is employing in his/her post below. Let’s follow this through:

2027: 1,600,000

2037: 3,200,000

2047: 6,400,000

2057: 12,800,000

2067: 25,600,000

2077: 51,200,000

2087: 102,400,000

2097: 204,800,000

2107: 409,600,000

2117: 819,200,000

So home prices in just over a century should be over 1.6 billion dollars each.

The inflation rate in Canada averaged 3.16% percent from 1915 until 2017, so if we presume that a current average wage of $80,000 increases at an annual rate of 3.16% for the next 100 years, the anticipated wage of that same person in 2117 is $1,795,656.80.

So that person earning $1,795,656.80 buys a house for just over $819,000,000, and 10 years later that house is 1.6 billion dollars.

Don’t think so.

http://www.tradingeconomics.com/canada/money-supply-m3

http://www.vreb.org/media/attachments/view/doc/graa2016/pdf/Annual%20Average%20Selling%20Price%20Graphs

Always a good exercise…compare the 2 graphs above and consider when real estate should drop in dollar terms.

Using a 7% rate of return on R.E. (regardless of presumed inflation or interest rates) consider the following (play along if you will)

The average house in Victoria in 1977 was $50,000 which means it should double in 10 years or 1987 = $100,000

Similarly in 1997 = $200,000

in 2007 = $400,000 (interestingly enough it was ahead of itself)

in 2017 = $800,000

Now the above is simplistic and takes no supply demand into account…AND YET…it would have served you well to consider the possibilities since MONEY SUPPLY was growing steadily during this timeframe…

So what do you suppose MIGHT BE the average value in 2027… your guess is as good as mine..but I know where I am leaning to…

Hustling?

Nm, I see the answer is “have rich parents” again.

John / Deb

I used to have to arrange just such a situation annually to the tune of $5000 per on Mother’s day (with taxes out of the way in April) . Kind of gives a whole new meaning to inter-generational planning 😉

The bank of mom and dad could also be expanded to include Grandparents. I’ve seen this happen where the grandparents bought a home for their darling granddaughter and then went on to remodel the home without ever asking the husband for his input. The husband just automatically got up from the table and walked away from the discussions.

You could hear his balls hit the floor and roll out the door.

Based on Crisis investing…

UVic should start closing down starting this year thanks to the effects of Y2K 😉

@db

It may sound unlikely to you but most Mom+Dad banks here have so much debt that they would balk at taking out mortgages for their little darlings. Also the last couple of generations have been starting families later so by the time their offspring want a house their parents are in retirement. Should said parents want a fun time themselves the kids are out of luck.

The difference between someone buying a second home or buying a home in their child’s name is that a first time buyer has some tax exemptions. The effect on the market is the same – an increase in “pure” demand as a new household was created when one did not exist before. That puts demand on new housing to be built.

As you can see from the above graphs, half of the sales are creating new demand. If the economy were to take a gunshot to the belly this would be the soft belly of the real estate market. This “pure” demand could go from half the volume of sales to almost zero in a short time period. If there is a “bubble” this is where it resides. The bigger the percentage of “pure” demand the bigger the potential bubble.

Hawk Hawk Hawk…

The biggest destroyer of real estate wealth is D.I.V.O.R.C.E. ;0

When a business owner wants to transition their business, they often arrange loan terms to their successor.

What is to prevent a vendor financing?

Luke, this isn’t like buying a car.

The seller and purchaser can write most anything they want into the contract – yes there are exceptions. The vendor can therefore continue to market the home and if a higher price comes in, the original buyer would just have to meet or beat that new price within a certain time period. The clause is usually called a 24-hour or 48-hour clause.

Now if you are the original buyer and a new offer comes in at a higher price that could end the original contract. This could be your “Get out of Jail for Free” card if you did not want to proceed with the sale.

Dasmo

Is there any reason a parent can’t give a mortgage to a child? Probably for a better return than leaving the money in a 0% bank account and with collateral to boot.

So, why all this anti student buying angst?

Dasmo – the bank of ‘mom and dad’. As is the case in many of the Asian students that we were seeing buying houses near universities in Metro Van and now apparently, here in Vic. This is probably happening for many domestic students as well, though I think for them likely on a lesser scale than the notable purchases like Fleet St.

The house sale on Ash that has an accepted offer perplexes me – it sounds like the Scottish system.

I thought in Canada – once an offer on a house was accepted that was that – the house is yours! I didn’t know they could market if for another week to ‘fish’ for better offers?! Can someone enlighten me as I never knew or thought this was allowed here.

Also, that house isn’t in that great of a location, it’s on a busy corner that is also a busy bus route.

Thanks John Dollar. It answers my question.

I find Sooke to be an interesting and quite a beautiful place.

I certainly was focused on the newer houses in Sooke. Small lots compared to the surrounding properties for sure. But then….. A newer house is up to current building codes. Well insulated in 2X6 walls, more modern layout and kitchens and bathrooms etc.

It costs a lot of time and money to upgrade older homes with 2X4 walls, old foundations, old drainage and sewer pipes etc. It’s why the younger generation go for the newer homes. It is much more practical and cheaper in the long run.

Local Fool – that is irrational. However, Japan is a very crowded country that is also mountainous so unlike most crowded Euro countries it lacks ‘liveable’ land. So, it goes back to what I was saying about people in other countries having different expectations than Canadians, and young Canadians will have to learn to adjust their expectations moving forward. While house prices here are not likely to go that high – they could very well stay at these levels as we are no longer adding supply in the core of what was built in the past (SFH on large-ish lots).

Things will likely never again be like they were in the past, esp. considering the current globalized state of the world which wasn’t the case in the 1980’s. Question is: will the populism we are seeing in the US/UK with Trump/Brexit change that, and will borders once again close more in terms of trade, immigration, and movement of capital? In Canada, on the horizon is even a possibility of our own populist potential PM in the form of O’Leary? That’s a scary thought indeed.

What we’re now seeing in Victoria, Toronto (and before the tax, Vancouver), is people coming flooding in from elsewhere, increasing ‘pure demand’ while supply remains stagnant- In Van and TO many were buying to speculate. Weather the new demand be from mostly other parts of Canada as Leo’s graphs indicate is the case in Vic, or other parts of the world as was/is the case in Van/Toronto. As long as this trend continues, prices of the dwindling supply of SFH’s will continue on their current trajectory.

The thing I still wonder is, do people become locals (the big section of the pie graph that is blue) after renting here for just one month? How many of those are not really locals??

@db do you have any tips on how a student borrows half a million dollars these days?

Thanks John, that explains things well. The agents in this town are more concerned with greed and can’t accept they blew it. If I was the buyer I would be pissed they would be trying to screw me out of my new home. No wonder they get no respect and are in the same vein as used car salesmen.

“Just when do anyone think real estate is going to get any cheaper?

It’s priced in printed currency controlled by socialist governments that know no other solution but to increase the debt limits.”

Hmmm, lets see now….. I wonder how financial crisis’s are created ? Maybe from too much easy credit lending for the last 17 years ?

Ignore economics, charts and common sense. Real estate never goes down right ? Ask the multi-millions of Americans who suffered foreclosure or worse.

Not to forget a psychotic man child is the leader of the free world who is already showing his ability to bankrupt a nation like himself multiple times over is about to reek havoc for the global economies.

Bank for International Settlements says Canada is showing early warning signs of financial crisis

http://business.financialpost.com/news/economy/bank-for-international-settlements-says-canada-is-showing-early-warning-signs-of-financial-crisis

Canada’s housing bubble makes America’s look tiny

http://www.macleans.ca/economy/economicanalysis/canadas-housing-market-looks-a-lot-like-the-u-s-did-in-2006/

Great comment. It reminds me of that famous episode of the Twilight Zone.

Alien beings come to Earth under the auspices of helping the human race, and they bring a book titled “To Serve Man”. Based on that title, everyone is convinced of their benevolence, and many eagerly board their spaceships to visit the alien world.

At the last minute one of the humans figure out that the book is actually a cookbook, with its title being a double entendre. Lambs to the slaughterhouse…

Hawk, the property on Ash has an accepted offer. The agents are continuing to list the property to fish for another offer.

I would agree with you that the auction probably flopped on the agents and that’s why they are still marketing the property.

These auctions are so rigged against the buyer that even if you win the auction at a reasonable price the vendor can still fish for a higher price. Meanwhile the buyer is locked into a contract for another week so they can’t bid on another home.

When can we get some decent legislation to protect buyers from unfair marketing practices.

This is the statement put out be RECBC

Notice that they are here to ensure the public is well served. In this case I’m sure when they say well served they mean the public is well cooked.

househunting

I asked because I noticed that 354 Foul Bay came up as 67% way over assessment and when I looked at BC Assessments I see it was based on 2015 ($467,000) while 2016 is a more like ($626,000) making it only 25%

househunting

Thanks for that insightful map…

Can you clarify one thing? when you say overpaid or done well. Is it in relation to the Assessments? and are the Assessments the 2016 BC Assess? or was this 2015?

It may seem like a silly question, but I didn’t notice any references.

Well Deryk, I assume you are only interested in houses on city lots in Sooke. Because if you were interested in condominiums, townhouses, acreage or waterfront then the results would not be the same.

Non waterfront detached houses on 15,000 square feet or less of land. Those are properties that are within a small area or 2.5 kilometer radius of Sooke Village center.

This small area of suburban housing comprises 22 listings and 24 sold in the mid February to mid March period. Sale prices ranging from $335,000 to $571,000.

This pocket of houses had 1.5 months of inventory in February and that is likely what March will have as well. At this time listings are being added at the rate of 20:12 or 1.7:1. And the average days on market is 22.

That puts the market for this type of property in this pocket of housing in favor of sellers. This is a very small sample of 12 sales so far this month with only 2 selling over asking price. I believe I know the property that you referred to as selling in under 4 hours and that sale is not representative of the general marketplace. Marketing can be as low as a week for well priced properties. But with listings so low, some agents can create an auction by underpricing properties and restricting market exposure that may lead to irrational bids in excess of market value.

There you go Deryk, I think that is pretty much what you wanted to hear.

Leo … Have you looked at the Craigslist adds from students?

Most want to rent for about $600..

Other seem to be willing to pay $900…(not necessarily students)

and you don’t have to limit yourself to Downtown ownership nor near the Univ…

Camosun is out near View Royal/Colwood.

Then there is Royal Roads..

People seem to think with blinders on…

Leo

Congrats…At least you tried to look at it constructively.

As I mentioned, one of my friends did the house purchase and rental to other students thing and did very well.

I approached it differently because I had been hustling since I was 15. Hustled so hard I was driving out to the foot of Bear Mountain on a M/C to work til midnight back in the early 70’s while in High School, and back then View Royal was considered cottage country.

My offspring lives in the UK. And I visit it quite regularly. It isn’t getting any easier there for anyone either, yet they hustle. (I doubt Hawaii gets any cheaper, nor will vacations to Mexico or Costa Rica)

Just when do anyone think real estate is going to get any cheaper?

It’s priced in printed currency controlled by socialist governments that know no other solution but to increase the debt limits.

You can wait til you save enough…or you can get into the system and take advantage of the constant currency debasement.

When I was in Argentina learning to dance the Tango (which I failed at miserably) I asked the female teacher over a glass of wine at a tango bar ” how did she survive the Devaluation?”. Her answer was owning real estate and hustling…

I don’t pretend to have the answer, but I do believe owning things of value is the answer.

One way to own more of something is to take risks when you are young and hustle.

Because sure as night follows day, you won’t want to take risks when you are older.

(oh, and before I forget… once you have children…you aren’t likely to take as many risks…)

Re: buying while in university

Skip university and learn how to make money. The world is full of clueless academic slaves 🙂

I should clarify that when Toronto corrects it will be a nasty recession for much of Eastern Canada, possibly as bad as the early 90s.

@Local Fool

One answer is to look at what our market has done since the US started raising rates in late ’15.

The previous ’04-’07 cycle (10+ rate rises) saw a ~50% price jump. However, I don’t think we’ll see quite as many rate rises this time before a mild recession hits in a few years (likely triggered by Toronto bursting).

I was scrolling through the comments on the latest Greater Fool blog entry, and I came across one regarding the Greater Toronto area, and I just had to share it here.

There are few words – for me at least. I wonder how many more minds are out there like this. I knew bubbles made people irrational, but this?

What’s the deal with 1605 Ash Rd ? Looks like they tried a blind auction and it blew up in their face so now they jacked the price up $80K to $930K from $850K. More signs the market is topping out as they wake up to the scam auctions.

I was wondering if anyone has a handle on what is happening in Sooke these days. I see prices for a house with a legal one bedroom suite in Sooke….. have jumped from $380,000.00 for a new house a couple of years ago to anywhere from $490,000.00 to $550,000.00 today.

(I know for a fact that one three year old house sold in four hours after being listed).

Are there any bidding wars going on in Sooke? Seems like there could be if a house sold in four hours. When I look at the listings in Sooke, I see “Pending” on so many of the listings.

Anyone have the inside scoop on what is happening to Sooke?

I apologize if someone already posted this:

Toronto’s Housing Boom Refills Empty Nests, Driving Prices Even Higher

An unusually high 56.5 percent of people in their 20s in the Toronto area still live with their parents, compared with 42 percent nationwide.

Basic economics says that high prices ought to entice more owners to sell, with the added supply helping to relieve some of the upward pressure. But that is not happening in Toronto, where, despite intense demand, the rate of new listings has been stagnant for several years, and even fell 12 percent last month.

https://www.nytimes.com/2017/03/12/world/canada/torontos-housing-boom-refills-empty-nests-driving-prices-even-higher.html

What was your metric for this again?

Owning real estate in university… Despite claims that the HHV clique is out to get db, let’s see if we can look at this rationally.

Assuming minimal parental help, detached housing is right out.

So condos. Well you better buy something that allows rentals to cover roommates and when you aren’t in town on a co-op. What kind of 2br units are around? Well the lower end is something like 205-827 North Park St for $270k.

5% down you will need about $16,000 to start. Doable, maybe the folks will pony that up.

Then you end up paying about $1800/month for mortgage, taxes, and condo fees. With a roommate that would be $900/month.

That’s about two to three times what I paid in rent during university. Given the listing says it is rented at $1500/month it is 20% more expensive to own than rent the place (+opportunity cost).

So will you make it up in appreciation? Not a gamble I’d be willing to take.

Wow..

Was going to say something different, but will repost the link to the map I’ve been updating instead:

https://fusiontables.google.com/embedviz?q=select+col5+from+1SvVWy6ekdz6uuiaoiq29LlzPkNRE5aMDlkaJmsUM&viz=MAP&h=false&lat=48.472532161462794&lng=-123.30270760860594&t=1&z=12&l=col5&y=3&tmplt=4&hml=TWO_COL_LAT_LNG

The full document is available here with some additional details:

https://www.google.com/fusiontables/DataSource?docid=1SvVWy6ekdz6uuiaoiq29LlzPkNRE5aMDlkaJmsUM

The map is a snapshot of what comes through on my PCS feed of pending sales. If a marker is in the Yellow then they’ve done well, if in the Red then they’ve massively overpaid, simple as that.

… or more concisely: brainpumped?

Marko, my hiring experience is in eng. positions in the private sector. I was about to start defending civil servants, but the last thing we need is a new distraction!

LeoM said:

“Tell your friend that if they withdrew equity from their existing house (a mortgage) then used that equity as a downpayment on their new home in Oak Bay, then they can not claim the mortgage interest as an expense on their rental property.”

Good point LeoM, thanks. I think he did well on his new OB place, incidentally… but perhaps I’ve been brainwashed by the pump-fest?

Don’t take it personal db. Think of it like walking into the middle of a heated debate and throwing out your opinion into the mix. Of course you will get a chorus of “BAH” and “PHOOEY! Instead of bowing out, engage and prove your detractors the fools…. That said, I think the concept you propose is ridiculous. Fantastic in hindsight, but it’s terrible advice at present. Stay free in your youth….

Vicbot – thanks for the warm welcome to the blog.

Introvert – it took me a second before I realized your “employer” quote was actually a grammar quiz! Thank you!

1) ..zero(-)tolerance..(what’s with the hyphen haters?)

2)..gramma(tical) errors..

..(n)or creativity, (n)or intelligence..

..”it’s”(,).. (comma should be after the closing quotation mark)

If it takes someone more than 20 years… (that’s not even a logical sentence. Kyle’s not comfortable with a 20-year learning curve, period. It’s not conditional (If..) on something else happening.

Local Fool,

..person(-)hood.. (no hyphen. Are you sure you’re not Introvert?)

..comprises.. (you got a couple of these right, a couple wrong – it’s helpful to think of it meaning “contains”, so “comprises you” is incorrect)

nan – so nan, out of interest, would you toss an application that contained the phrase “..regularly get dozens even over a hundred..”?

Is no one worried about the budget?

While I agree that jumping into real-estate during/right after University could problematic – I sure wish I had done it. Probably four or five times I thought about picking up a place way back when…and then it sure sounded expensive.

I remember shaking my head at the Rogers suger house in McNeil bay (on King George) which went on the market for 400K. After shipping off the house that lot was split into 3 and now each one has a 2M house on it. Right next to that was a lot that sold for 500K which was split into 4 lots (now a cul-de-sac).

20/20 hindsight.

DB,