10 years of HHV: Time for a meetup?

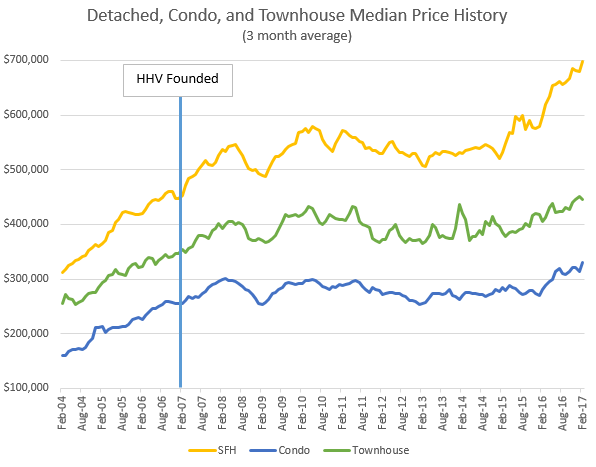

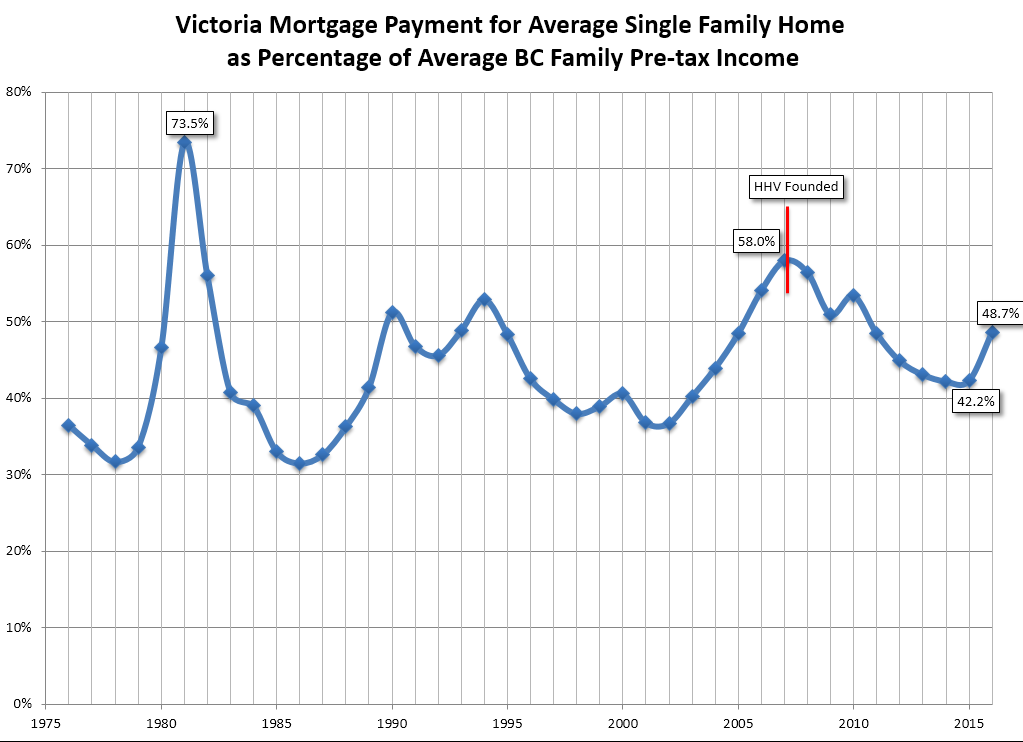

It’s been just over 10 years since the first post appeared on the original House Hunt Victoria blog. Back then the blog was an expression of the frustration of the original author in trying to understand the insanity of the local housing market in early 2007. It’s interesting to go back and read some of those early posts and see the similarity to the market today. Many of the same factors were present, with an ultra-low rental vacancy rate of 0.5% and a condo building boom. To HHV’s original author John, something about the current prices didn’t quite add up. And indeed after many years of rapid price appreciation, 2008 marked the end of the bull run.

However the big crash that some predicted did not arrive, and in retrospect it was clear why that was the case. Interest rates at very low levels combined with price stagnation and income growth combined to return affordability to more reasonable levels.

What’s in store for the next 10 years? Sounds like something to discuss over a couple beers so I’m proposing the much delayed HHV meetup. Given everyone is obsessed with Oak Bay, I suggest the patio (enclosed, heated) of the Penny Farthing on either the evening (6ish) of Thursday March 30th or Friday April 7th.

Let me know if interested by putting your name on either or both dates at this doodle.

Weekly stats update courtesy of the VREB.

| March 2017 |

Mar

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 107 |

1121

|

|||

| New Listings | 209 |

1445

|

|||

| Active Listings | 1581 |

2618

|

|||

| Sales to New Listings | 51% |

78%

|

|||

| Sales Projection | — | ||||

| Months of Inventory |

3.3 |

||||

Big drop in sales/list ratio and sales are 33% below levels of last year at this point, but don’t get too excited, that often happens at the beginning of the month and last week was only 3 business days.

I’m seriously going to come on April 7th I’ll be the guy with the Metallica shirt

@john Dollar

my real estate friend doesn’t know prices but she took home $220K last year. I’m sure you took home much more given that you obviously know much more.

New post: https://househuntvictoria.ca/2017/03/09/hot-vancouver-money/

Hmm… $20 for various shysters to try to sell you something? No thanks. I’ll let some other brave soul report back.

Thanks, Dasmo. I’m sure I would.

Who’s going to the Victoria Real Estate Investment Expo this Saturday?

http://victoriarealestateexpo.com

That’s ok introvert. We will post a transcript for you to find fault in our grammar 😉

I’m a pay-off-the-mortgage-ASAP guy; I don’t care whether interest rates are high or low. Couple that with the fact that I’ve never felt comfortable with the idea of investing my money in evil entities like big banks or especially oil companies.

You won’t find me at this get-together; it would be an introvert’s nightmare! But I hope everyone who does attend has fun.

Look for the table with Hawk and Introvert trying to give each other noogies?

From my inbox:

The Canada Revenue Agency (CRA) will soon be conducting its eighth annual Office Audit Letter Campaign.

The letter campaign is designed to encourage behavioural changes among a selected taxpayer population by providing relevant information about their current or past reporting requirements and guidance on how to correct any common errors.

In February and March 2017, the CRA will send approximately 30,000 “intent-to-audit” letters to selected groups of individual taxpayers and business owners claiming consecutive business or rental losses, and selected taxpayers who may have sold rental property. The objective of the campaign is to encourage letter recipients to review and correct their tax affairs where applicable. This can be done on-line through My Account or in paper format by submitting required changes using Form T1-ADJ – T1 Adjustment Request, or through the Voluntary Disclosures Program.

The CRA’s emphasis is on helping individuals and small businesses better understand their tax obligations, which in turn increases future voluntary compliance, protects the government’s tax base and uses resources within the CRA more effectively.

If you or your clients have questions about the CRA’s Office Audit Letter Campaign or need help making changes to previously filed returns, go to cra.gc.ca/lettercampaign. You can also call the individual income tax enquiries line at 1-800-959-8281 or the business enquiries line at 1-800-959-5525.

Seems like April 7th is the clear choice. Reserved for 20 people at 6PM on the patio.

Still, that’s a great price for a house just a few blocks from the ocean. I would have thought it would sell for over a million.

Someone got a good deal despite what AG says.

Regarding Lulie: it has a low basement and not exactly appealing reno of their dining room/kitchen – let’s face it, the house still needs work.

But also, one of my suspicions is that the low inventory is breaking down the old “psychological barriers” between neighbourhoods, and people are finally discovering how small Victoria really is. So they’re willing to pay similar amounts if a house is 5 minutes drive away, no matter what the neighbourhood is called.

Victoria’s municipalities are so misleading in how tiny they are. People now have better ways to compare Victoria to other cities, especially if they’ve lived other places, but also through social media.

In the 80s it was hard for anyone to understand what it was like to live in Vancouver or Sydney or Toronto – all we had was postcards & short visits – now we experience it all in real time. Just the other day my out-of-town friend said “OMG you live this close to Gyro Park?” and I used to think it was far because it was Saanich – funny what growing up in a small town can do.

Luke, I think that Straight article was missing some points – for some reason they intentionally left out the negative “intraprovincial” net migration out of Vancouver, and also the fact that some places like Surrey are growing while City of Van itself is declining. Goes to show you how you can never get a complete story out of anyone these days.

Gwac: As a general rule I find Emily Carr to be one of the quietest main thoroughfares in Victoria, I suppose because it connects nothing to nothing and unless your destination is in South Broadmead there are multiple other roads that are much better for getting across that general area.

Coming soon to Victoria as well I would bet with insane fools paying $200K over assessment and no inspections. Gotta keep those Golden Heads in check. 😉

Ontario reconsidering a foreign buyers’ tax to cool housing market

TORONTO — A foreign buyers’ tax is back on the table in Ontario, with the finance minister saying Thursday it’s one possible option he’s looking at to cool the housing market.

http://www.cp24.com/news/ontario-reconsidering-a-foreign-buyers-tax-to-cool-housing-market-1.3318454

About 2 months ago, I was telling you (or your alter-ego Just Jack) that standard lot values in South Oak Bay were around $800,000. You argued vehemently against this, saying that they were lower.

Today, a virtual teardown on a small lot sells for over 900k, and you thought it should have sold for more?!

At least be consistent with your misreadings of the market, Jack. I thought you claimed to be an appraiser??

Mukluk

Is the noise from Emily carr bad around that area?

I though the 1.450k was good value for the size and photos. Never visited the house.

Luke: I saw 909 Boulderwood for sale last June post-renovation for 1,199,000 and thought it seemed like very good value at the time. The only drawback was it was on a somewhat-weird corner lot looming over Emily Carr. Unfortunately we had purchased in April so there was nothing we could do about it. Either the original owners didn’t get a bite last year, relisted it for 250k more 8 months later and got it, or someone bought and flipped it.

Am I high end enough? I’d love those returns. Heck, I’d settle for a lousy 250%.

“Of course a far better option would be to give your money to Hawk and have him invest it at 500% annual returns.”

You couldn’t afford me. High end clients only. 😉

Paying off the mortgage at 2 or 2.5% equates to making 2.8 or 3.5% on a GST in a taxable account. Not great, but the highest fully guaranteed return you’ll make. Once you have used up RRSP and TFSA space I don’t think mortgage pay down is that bad an idea for conservative investors. I think mortgage pay down without using up tax-sheltered saving space first is a bad idea for most people.

Of course a far better option would be to give your money to Hawk and have him invest it at 500% annual returns.

You are correct, I started pouring a lot of money into the mortgage at the beginning. I’ve since come partially to my senses and dialed it back a lot, but still not the minimum. I understand it is a suboptimal allocation of money, but my conservative nature still likes the safe return of it… I’m working on it.

Isn’t that your strategy Leo?

I don’t think you’d be alone. A lot of people pay down the mortgage faster and 40% of Canadian home owners have no mortgage.

” Surely this location is worth a heck of a lot more than Oaklands? It just goes to show you how dysfunctional a market can become when sales are too low.”

John, it’s just another one of many examples of late that can create a whole new blog called: Shit That Happens at Market Tops

@Introvert. That was good advice from your 2012 comment. Except the paying off the mortgage rapidly, that would have been suboptimal use of funds.

idk direction seems kind of important.

909 boulderwood sold for $750k in Aug 2014. Even if they did an extensive reno. – that’s a huge profit to get $1,450k for it.

Here is a property that I thought would sell for a lot higher.

1855 Lulie in Oak Bay. Just three blocks from the water. A remodeled character home on a 5,800 square foot lot. Just the house alone is assessed at over a hundred grand. It only sold for $903,000. A week before a similar home on Falkland sold for $1,149,000

I though lot values were suppose to be over a million in Oak Bay? Didn’t a rancher just sell in Oaklands for $750,000. Surely this location is worth a heck of a lot more than Oaklands? It just goes to show you how dysfunctional a market can become when sales are too low.

Mukluk thanks

80% ? Holy cow. Can’t happen here right ? Wonder how many Vancouver/Victoria deals are hanging by a thread ?

There are reports a lot of Chinese buyers are struggling to settle on their Aussie apartment

According to a report in The Australian, citing an industry expert, almost 80% of Chinese buyers can’t settle on the Australian apartments they have bought off the plan and wish they could walk away from the contracts.

“The off-the-plan apartments market is now the worst I have seen in the last 10 years,” sai Li Ming, the co-director of Melbourne-based real estate company Aussiehome.

https://www.businessinsider.com.au/suddenly-almost-80-of-chinese-buyers-are-struggling-to-settle-on-their-aussie-apartment-2017-3

Some agents are really bad at knowing what a property is worth these days. If an agent is more than 10 percent off on the list price maybe they should be parking cars for a living.

515 Falkland Rd in South OB finally sold for $1,149k after (months?) on market. Can’t tell as it was refreshed so much. Did I mention it’s ugly? Must have been the location that finally closed the sale.

As for the rail – I bet it’s another election tactic – ‘vote for us and we’ll build the commuter rail line’. Only to Langford though? If you ask me it’s needed all the way to Nanaimo, and this time, going in the direction needed for commuters. Imagine what that would do to property values in Cowichan Valley/beyond. If it was an actual proper commuter train.

Yep – Maple Bay is cheaper than Golden Head – wonder why? Didn’t the Malahat (basically the only single lane route in/out of there to Vic) shut down yet again the other day?

Of course, Leo S is so right on this one – We suck at building infrastructure. I’ve traveled all around the world to other developed countries, and always come home disappointed at our lack of know how in this regard – though appreciative of all the other high quality aspects of living here, so in the end it balances out. Not to forget, the slow travel speeds here – Canadians drive so slow in comparison to most of the world… but maybe we have to b/c of all the potholes. (our asphalt thickness levels being much thinner than most of Europe, for ex. so potholes develop much faster and more frequently here)

Yes it’s quite true lots of Vancouverite’s don’t see the appeal of Victoria, but conversely – many do. And – many Victorian’s don’t see the appeal of Vancouver. How many from here moved away, only to come back humbled w/ tail btwn. legs? (sorry it’s better here, they say, I just had to learn the hard way).

And here’s another article on those Chinese capital controls… http://www.straight.com/news/864656/chinas-new-capital-controls-are-just-one-factor-influencing-vancouver-housing-prices

“Hawk, how many curbing of Chinese capital outflow articles are you going to post? Aren’t they all the same one?”

Intorovert says he never reads my posts so thought he might want a second chance to clue in before the walls come down.

I thought everyone is saying $1.8 million is cheap ? 😉

chevalier, was it a Chinese buyer ?

Chevalier your real estate friend doesn’t know house prices. That home was easily a million bucks. The same kind of house sold on Merida back in January at $950K

909 Boulderwood went for 1450, same as asking.

Condo sales in the core have been rocking good this year and it has been showing up in both higher median and average prices.

Really low months of inventory of under a month have shot prices up substantially from this time last year. I would guestimate that condo prices in the core have increased by at least 25% in one year. And, unlike houses in the core, the number of sales has not been declining.

Higher prices and higher sale volumes an agent’s wet dream come true. If only you would have known then what you know now!

But can condo prices go higher? Historically, condos have been a first time buyers choice. Those that have scraped together a minimum down payment and don’t have that high of an income as they have not worked for very long. That has always led to a cap of how high condo prices can go. But with prospective house purchasers being priced out of houses, the condo may be their only hope of buying into the core market.

But at this point sales don’t appear to be slowing down and we may break last March’s sale volume.

Hmmm.. There just isn’t enough political will to get rail back. And we suck at building infrastructure around here.

Golden Head: realtor friend listed it at $749K. Sold yesterday $911K.

The sky is still falling.

909 Boulderwood Place

Anyone know the sale price? thanks

Don’t Swear.

@introvert, at least hawk and JJ were right about the magnitude, they just got the direction wrong. You couldn’t even see a change coming. I don’t know why anyone would take advice from a moron like you.

How is the Langford luxury commuter bus doing?

Just intentions? FFS.

http://i.imgur.com/ujEI7MM.jpg

Funny:

https://www.thebeaverton.com/2017/03/lotto-649-commercial-features-dream-owning-1-bedroom-condo-toronto/

If I had $1.8 million burning a hole in my pocket…

Hawk, how many curbing of Chinese capital outflow articles are you going to post? Aren’t they all the same one?

That’s $180K price slash from the original price on Quimper, two slashes ago. Looks like the Chinese cash is drying up bigtime, so much for Golden Head. 😉

China’s Capital Outflows Just Reversed, Bad News For Global Real Estate

The world’s greatest overseas real estate binge might finally be over. According to the People’s Bank of China (PBoC), China saw its foreign exchange reserves rise to over US$3 trillion. The unexpected rise is the first in 8 months, and may indicate that the new regulatory crackdown on capital outflows is actually working. This is bad for real estate markets that have seen a sudden surge of buying activity from Mainland Chinese buyers.

https://betterdwelling.com/chinas-capital-outflows-just-reversed-bad-news-for-global-real-estate/

I notice that the house on Quimper has lowered its price again. Don’t see a lot selling but I am not seeing very much coming on the market in South Victoria either.

Such good news. Hard to believe, actually. I hope it’s true!

Ha! Speaking of the Colwood Crawl, this announcement was made tonight: http://victoriabuzz.com/2017/03/commuter-rail-connecting-west-shore-downtown-victoria-expected/

Dasmo

Sorry it sucks. Building is stressful enough.

You still have the blog?

We will see, but man, that drywall quote…. Crazy…. I admit, I am terrified sailing into this storm….

Dasmo

Curious about your build and how bad costs have gone up.

Andy7, sounds like a great place!

Rook, “Let other people have different opinions” – yes.

People seeing their home values go up 20-30% have been lucky. People who predicted differently or are trying to buy in this difficult market have been unlucky (so far).

Why anyone feels the need to point out the misfortunes of others, I don’t get it. If we were arguing over a hockey game bet, fine. But when you’re talking about >$200k, not so much.

“People are already saying a million is cheap.”

Just like I posted, very Trump like – “I’m hearing….”. The people who are saying are trying to justify a market about to blow. ICYMI, rising long term mortgage rates = bank credit tightening.

China yuan outflow shutting down kills off any imaginary ripple effect.

Canada, China Flashing Warning Signs Of Financial Crisis:

A new report from one of the world’s top banking authorities is warning that Canada and China are the two countries which face the highest risk of a financial crisis, thanks to elevated debt levels.

Many observers have pointed out that Canada’s economic recovery from the last financial crisis has been heavily consumption-driven, and that household debt has soared in recent years, to the highest levels of any G7 country.

http://www.huffingtonpost.ca/2017/03/06/canada-financial-crisis-bis_n_15189530.html

CC, that sounds insane and a recipe for disaster. Looks like the credit unions will go under before the banks.

Strangertimes, agreed, if the financial industry pumped out the BS the real estate industry does the former would all be in jail. Kinda like Trump saying “I’m hearing …..”.

John, if the real estate board was forced to post them monthly from the last year then the hype tool would blow up in their face. Better to keep the fake news rolling.

Sales are not tanking but they are quite a bit off from this time last year.

Sales, Number of single family sales in the core districts

Month 2014 2015 2016 2017

Jan 90 90 122 82

Feb 125 164 228 138

Mar 150 231 318 41 (to date)

New listings seem to be accelerating and we will likely be over 300 this month but not likely over the ten year high of 421. If we were ever to hit more than 500 new listings in any month that would likely become a rout.

Hope that i did not sound cynical but I have known too many people like your friend. If you really want to help her look around for a rich husband for her. Have you noticed that so many people never learn from their mistakes.

Barrister, that is good advice. 😉

Curious Cat:

I have some friends much like yours. No point in giving them advice since they dont want to hear it and besides they know better. They will only resent you. I usually revert to the “That was bad luck” as opposed to “you are an idiot”. At least you have the good sense to never lend them money. The other thing I would suspect is that she spent a bit more than she has told you. Then again I buy my coffee at Tim’s instead of Starbucks.

Unless you want to lose a friend don’t give her advise.

Deryk – no need for insults, keep it clean please. Vicbot — West Van, 1.5 Million family home within a kilometer of HorseshoeBay, a few houses away from a beautiful beach on a dead end, quiet street. Not near the highway. One of the most beautiful areas in Vancouver. These deals are out there. That’s why when I see something like that, I can’t justify some of the prices in Victoria.

I agree with Dasmo. The ripple effect is very much what this is about.

As I said before, I expect prices to make one more “substantial” push upwards this year.

But after that, all bets are off and I would personally be careful.

People are already saying a million is cheap. I find myself thinking it when I look at the PCS feed for SFHs in OB and Fairfield.

My recollection is he’s not been wrong, except about Trump.

And now the industry try’s to push the language even higher. Maybe they can get it to the point where people are saying a million dollars is cheap…. http://victoria.citified.ca/news/hold-on-to-your-hats-victorias-luxury-real-estate-values-to-skyrocket/

As for her new build, how quickly costs creep up! Last summer she said she hoped to spend “no more than 700k incl. lot”. She hoped to sell for 830 and pocket 100 (after realtor fees). In the fall, she then said she will be at 800k and list for 840 so profit of 40. (what happened to the realtor fees? lol) In January the build was now at $830k, and she could breakeven IF she sold for $860k. I assume she has another 20k on top of that now (it’s been 6 weeks and they are still doing landscaping, stairs and driveway), but assuming she does, she now needs to get $880k. Bottom line, this foray into the Highlands in search of big profit, did not materialize.

If she would have asked me, I would have told her that she should stick with the core at least. But lots in the core are tough to find and tear-downs are $600k+, while lots in BM are only mid-200’s. At least this duplex idea of hers is back in the core so maybe she’ll make out like a bandit. Time will tell.

@Dasmo

I mostly agree – except I think Langford has done a decent job with density in and around the gold stream area. There is a mix of condos, townhouses, SFDs, which makes it unlike many older suburbs.

Langford is awful because it is new – transit service isn’t very good and traffic is funneled onto a few arterial roads. Everything has a cookie cutter feel to it. The land of chains and big box stores. I think this will change as it matures.

Gordon Head was probably awful in the 1970s.

@stranger times

But this place is paradise, who wouldn’t wanna live here!?

Couldn’t agree with you more. Just because you live in Victoria, think it’s awesome, and think Vancouver sucks, doesn’t mean Vancouverites feel the same.

2033 San Rafael Crescent: $167k over asking.

List price: $788,000

Sale price: $955,000

DOM: 5

A nice location: close to the beach, Sierra Park, and Township Coffee—amirite, Leo?

@Hawk

I just had lunch yesterday with my girlfriend who moved to Bear Mountain last week from Christmas Hill area. She leaves at 8am to get the kids to school for 8:40am (they are still going to the same school close to where they used to live), but she says for her the commute is “not as bad as she thought” because she has discovered it’s a great time to catchup with the kids. They use the time to talk about what’s coming up that day, and on the way home to ask about homework, how their day went, etc.

On the other hand, her husband has to leave the house at 7am to get to work at 8am. He hates it. I told her it’s probably because unlike her, he has no one to talk to and only the radio to break the monotony of traffic. Also, she has a couple different options for route (Helmcken, Burnside, McKenzie, etc) so if she’s bored, she can entertain herself by trying a different route, whereas her husband has no choice but to go TCH pretty much all the way downtown.

But even though she’s trying to see the “bright side”, she is still making immediate plans to relocate back to town. She was at the bank two days ago trying to gauge how much the bank will lend her so she can buy a duplex she has her eye on, tear it down and build a new duplex on the lot. Interestingly, Island Savings said she would only need 20% down, while all the other banks said she would need 30%. (Actually no other bank would lend to her because she has an existing builders mortgage.) Made me wonder, how the heck can she get any more money?? Her family income doesn’t even break six figures! Well she found a friend whom I’ve never heard her mention before, who will partner with her. And, her MIL has said she would lend them the downpayment and even co-sign for them if they need to. (Before she approached her MIL, she had already asked her uncle and another friend to loan them the downpayment and they had agreed, like $60k-$100k was no big deal.)

Everything my friend does, she is motivated by money, as she freely admits. She told me, “OMG I need to get this duplex so badly!” The number one reason I follow this blog, is because I’m looking out for her, trying to make myself not worry about her, to convince myself that she will be ok. Being bearish myself, everything she does with real estate gives me anxiety, but a Bull’s gonna do what a Bull’s gonna do! All I can do without hurting our friendship is to feed her information I’m gleaning from this blog. Things like, “you know I heard dealing with Saanich for permits is a real pain in the ass now, not like Langford”, and “did you know there is a new test for owner-builders?” and “so what happens if you put in the unconditional offer and the financing falls through? Do you think you can lose your deposit?” And then she either responds that she’s either heard that as well, or researched it, or good question, let me check with my realtor. End of the day, she’s a grown woman, and I’m going to support her, be her friend, and give my opinion if asked. I just won’t lend her any money or go in any “deals” with her. 😉

I am irritated by the market too but sheesh. There is a problem and it’s not that sales are tanking!

@ Strangertimes,

Completely agree.

This whole Vancouver coming here talk is hilarious. All my friends who live in van say the same thing about vic. Nice for just the day but would never move here. I love when the vreb says people from van are flocking here yet offer no proof of a change from any other time. The only people driving up prices are locals who listen to these silly scare tactics. The vreb is nervous that home sales are tanking in vic and are desperate to try and change the story.

Wow, Hawk has new competition for bitterest, most delusional renter on here.

This market is getting to the renters! They are upset!

You go downtown because it’s a people place. Langford is a car place. You drive to COSTCO, then drive to Home Depot, Then drive to Tim’s, then drive across the street to the Market, then drive across the parking lot to check out Scann designs, then drive the the LogHouse for a pint before driving home. It’s why that particular zone is ridiculous… They almost have something around the Goldstream roundabout area but in general there is no evidence Langford is going to change their style so that is not the solution. They had their chance when they were a blank slate. They blew it. Now it’s just like every other suburb….

Where’s all the evidence Introvert? When you’ve got a spare moment from jerking off to all of Just Jack’s old posts can you do us the favour of finding all your old posts that proclaim your genius?

http://i.imgur.com/107HU5p.jpg

Did they have to wait a long time?

no.

Wrong wrong wrong Introvert.

edit – why’d you delete your post?

Or just put a toll on roads into downtown.

The solution to the crawl is not to work downtown. That’s a more viable alternative than it was a dozen years ago because of the growth of commercial and retail in the Westshore.

Who needs to go downtown anymore on the weekends.

I think it’s paramount that people believe that Vancouver is driving our prices higher. Otherwise the public can not justify today’s house prices. The real estate board has that information. They just have chosen lately not to publish it.

If the NDP had a brain they would announce they are 6 laning the TCH and eliminating all the lights. As this article shows the congestion is just getting worse even in town so not sure how all the new Vancouverites like being backed up from Blanshard to Hillside Mall on a regular basis or McKenzie to Gordon Head etc etc.

Congestion is congestion and our streets are getting limited, even Oak Bay Ave has become a joke most days. The only way out of Victoria shut down all afternoon again the other day for another ugly accident.

GRIDLOCK 2020: Killer commute, costly delays of Victoria traffic crunch

“The Colwood crawl is getting worse by the day and there’s not really anywhere in town not affected by traffic congestion anymore,” says Hill.

http://www.cheknews.ca/gridlock-2020-killer-commute-victoria-traffic-crunch-lead-to-costly-delays-285614/

I think the Vancouver effect is a big driver. Sure people moved years past but our tech scene is bigger now, working abroad is more doable, but most affecting is the price differential! Never before has someone been able to sell their house in Van and buy three better ones here… We are simply experiencing the ripple effect of international money via Vancouver. If we have a other 30% gain this year I will be afraid. It’s not sustainable….

The city should lift the building height cap around the Hudson and provide incentives to build larger family friendly rental complexes. That area is the best for mega density, there is nothing to protect, it’s on the right side of the pinch point and we need to flood the market fast and enable more competition….

Vic&Van, I said I was limiting it to the West Side for geographic/commuting reasons – eliminating price altogether. Your post just added more detail on East Van – which is great.

There’s a lot of streets off Cambie that aren’t like Henderson, eg., I have friends that bought there around 2008 and it was very very middle class, older houses, some maintained, some not, power lines on streets (which Henderson doesn’t have) – so I guess I saw a different thing than you did. Maybe the area around Queen Elizabeth Park or right on Cambie the street was always more tony?

For Marpole, have you ever driven along Marine Way and seen the houses on the hills? That’s why Mayfair reminds me of, with some views, but some houses on the shabbier side that are changing.

Probably 6 of one, half a dozen of the other.

“It’s now happening…. and some people on this forum are still saying it’s not going to happen. I find that funny:)”

People have been moving from Vancouver for ever, this media pump is getting to be fake news as Ross Kay has stated. They need another story to spin to fill air time and print space.

John’s stats showed the amount of Vancouverites was decreasing since last spring. If they are renting first then buying and saying they are from here, then that only shows less Victorians can afford the market.

As an agent I would want to know where they come from which would have to come up in conversation with any client, which they would then use as a public marketing tool, not some top secret info only the bloggers can speculate on.

Most competent agents get to know their clients good enough to find that out and is probably one of the first questions they ask.

Most Vancouverites would be gloating about cashing out big, not pretending they came from some secret city.

“Ross Kay @rosskay 6 hours ago

Ross Kay Retweeted Brent Jang

Another example of Regurgitation replacing Reporting. Fake News from the Globe using Alternative Facts.”

Vicbot – no offence intended but your comparisons are way off.

Those are not equivalent areas even adjusting for the city differences.

There is no way any of those hoods are remotely comparable to a Vancouver West Side area.

Cambie before the Canada Line came through had similar incomes and houses to Henderson.

The Canada Line has changed all that now with

those former largish upper middle class 50s bungalows being sold for $4,000,000 and then being bulldozed for luxury condos.

Mayfair’s homes are way too small to be compared to Marpole. Gordon Head is the best comparison to Marpole. More similar homes, incomes and large Chinese population even decades ago. Marpole is entry level SFH Westside.

You are a bit closer on the mark with your Hillside/Mt Pleasant comparison but Mt Pleasant is now a super hip, ultra hipster, expensive area despite or because of its industrial blue collar past. I would say there is nothing in Victoria like that – maybe Fernwood. I think Shoreditch London is the best comparable to Mt. Pleasant.

It would be silly to compare Victoria to Vancouver and expect them to be the same price. I don;t see anyone doing that in this forum.

What I do see is people saying is the following: What would be a fair price for a house in Victoria compared to the prices in Vancouver….considering the fact that Victoria is not Vancouver.

Vancouver has a ton more opportunities than Victoria. It has more of everything so no one would compare Victoria to Vancouver.

But….. the question arises. Would you expect to sell your home for only $800.00 in Victoria because Victoria is not an international city like Vancouver is? Would you expect to sell your home for $800,000.00 because Victoria is not an international city like Vancouver? I have been saying for several years now that people will cash in their homes in Vancouver on a big scale and come to places like Victoria with all their cash. It’s now happening…. and some people on this forum are still saying it’s not going to happen. I find that funny:)

“What are the Vancouver equivalents of Oaklands, Mayfair, and Hillside?”

Off the cuff impressions are Oaklands ~ Cambie, Mayfair ~ Marpole, Hillside ~ Mt Pleasant (?) I’m not including anything outside of West Side because there would be too many 100’s of other neighbourhoods. You could probably find similar comparisons in Burnaby and East Van, but longer commute times. As John pointed out, crime is also a factor, and it also varies – some areas are more prone to break-ins, whereas others are more drug related, and neighbourhoods are changing.

East Van for sure – former blue collar, fairly centrally located, gentrifying and now expensive.

However, not the most hipster, the most central areas around Main so I would say Renfrew, Hasting Sunrise, Trout Lake, Grandvuew

Sounds like a real tourism Victoria pump. Except where Mark says that it’s so great the cops come to your house like they don’t in Vancouver. I guess Mark moved into a bad hood but doesn’t want to admit it, but they do have “coffee shops”. Amazing.

No follow up on all those ancient houses being filled with asbestos, but who wants to bum out the convo. 😉

Interesting they had someone who gets claustrophobia here and needs the big city action like all the people I know over there who will never move here.

What are the Vancouver equivalents of Oaklands, Mayfair, and Hillside?

Great link Leo of that radio show! Very relevant to our discussion here about Vancouverites cashing in and moving to Victoria. Here is a link to a transcript for those that don’t want to listen to the audio.

https://househuntvictoria.ca/wp-content/uploads/2017/03/Transcript-of-Steele-and-Drex-March-7-2017-show-1.docx

A preview:

Linda: So when did you get the idea, ‘Hmmm, maybe Victoria might be a good option?’

Mark: As a Vancouverite I visited Vancouver Island frequently, and to me Victoria is probably THE most beautiful city in this country. You know when you put everything together in terms of amenities, attractions, weather, climate, the whole works. Vancouver is definitely a beautiful city but I think Victoria has a slight edge on it. It’s also a lot smaller, more comfortable, and it’s kinda like the city I grew up in, ‘cause I’m from Ottawa originally.

Days with over .2 mm of rainfall:

Victoria Int’l (yes, a little outside the golden circle): 149

Duncan: 165

Perhaps, when it rains in Duncan it just rains a little harder. Don’t think that would bother too many people.

Here’s how the neighborhood prices increased between 2015 to 2016

Map Area Sale Price, Median 2015 Sale Price, Median 2016 Percentage Change

Vi Rockland $847,500 $1,130,000 33.3 %

Vi Fairfield West $791,500 $965,000 21.9 %

Vi Fairfield East $725,000 $919,000 26.8 %

Vi James Bay $652,500 $860,000 31.8 %

Vi Downtown $757,350 $786,500 3.8 %

Vi Fernwood $525,000 $675,000 28.6 %

Vi Jubilee $550,000 $659,500 19.9 %

Vi Oaklands $490,000 $611,000 24.7 %

Vi Central Park $505,000 $600,000 18.8 %

Vi Mayfair $480,000 $600,000 25.0 %

Vi Hillside $518,500 $573,000 10.5 %

Vi Burnside $476,000 $565,000 18.7 %

You might find that crime statistics are a better indicator than rain fall.

People already complain about the rain in Victoria. A 40% increase in the number of rainy days and over a 100% increase in the amount of rainfall each year is pretty dramatic. Lots more flooded basements. I don’t mind rain that much, but I’m willing to pay for a location with less of it.

To be fair, commuting is a big factor for where people buy homes. Any highway commuting makes a difference.

So Langford would be a fair comparison to Coquitlam because you have to get onto a highway to get anywhere else.

East/West Saanich, OB, and Victoria would be more similar to West Side Vancouver – in terms of commute or hassle times.

But that would probably only explain price differences between the regions in Victoria. Don’t know what the right price differential is with Vancouver, but it explains why all these neighbourhoods like Hillside, Mayfair, Oaklands, GH, and Maplewood are going up in value similarly – they’re no longer seen as being out in the boonies.

“Comparing langley, coquitlam, Port Coquitlam Port Moody etc…”

Is it any sillier than comparing Victoria to Vancouver?

Ignoring the fact that Victoria is about 1/7th the size of Vancouver isn’t doing your argument any favours. Yes Victoria prices are cheaper than Vancouver. So are Squamish prices, or Nanaimo prices. Clearly it makes zero sense for Victoria prices to equal Vancouver, so what is the “correct” level?

@Totoro

Significant, but not dramatically different. Victoria is a bit milder and drier, and the summers are cooler. I doubt most people would notice much of a difference.

You can bike or walk to the town centre in Maple Ridge too.

“where did someone find a house in West Van for $1.5m ? Right next to Upper Levels Hwy ??

Good point Luke – I think people sometimes mistake “West Van” for “West Side”

West Side is around UBC, Kits, Kerrisdale, etc. West Van is on the north shore. West End is downtown.

My friends moved from West Side to West Van due to lower prices in West Van ($2M instead of $4M) for their growing family. Bridges affect prices. The house they have now is bigger as well.

This is for “Andy”. Comparing langley, coquitlam, Port Coquitlam Port Moody etc. with Victoria prices is a silly idea. We are trying to have an intelligent conversation here.

My position still stands. Victoria houses within a short bike ride or walk to the downtown core are two thirds less than a comparable house in Vancouver within the same general distance to the downtown core. That to me is a massive price difference.

Differences are signficant:

Days of Rain Inches Millimeters

193 Campbell River 58.6 1489

173 Courtenay – Comox 45.4 1154

202 Duncan 59.4 1509

208 Gold River 112.2 2851

176 Nanaimo 45.9 1165

178 Port Alberni 75.1 1907

217 Port Hardy 75.1 1908

207 Port Renfrew 138.0 3505

155 Sidney 34.8 883

208 Tofino 128.8 3271

148 Victoria 27.8 705

Victoria has 54 fewer days and 32 fewer inches of rain than Duncan.

Victoria has 28 fewer days and 28 fewer inches of rain than Nanaimo.

Victoria has 25 fewer days and 28 fewer inches of rain than Courtenay.

@Michael

Much of the east coast of Vancouver island is in a rain shadow. The difference between Victoria, Cowichan, Nanaimo, Courtenay, etc., isn’t that dramatic.

“The developer controls the supply therefore if you want a suite in the complex you have to pay the developer’s price.”

Yes – we saw this a lot around Vancouver. That’s why (it became clear after observing it for 25 years) that it was location & new-ness that are biggest determining factors in price.

There are a few articles that estimate 5-10-25% premium on new condos vs resale:

http://sf.curbed.com/2014/6/11/10088904/new-condo-construction-grabbing-big-price-premiums

https://www.brickunderground.com/blog/2013/01/ask_an_expert_how_much_more_do_new_condos_cost

In some cases, developers would invite special clients (friends, family, associates) to insider pre-sales, then they’d flip at higher prices

http://www.theglobeandmail.com/news/british-columbia/vancouver-developers-shutting-out-regular-buyers-with-insider-condo-sales/article30498453/

Of course all the new condos were being built around the most trendy locations, so location & age often went hand in hand. Then as more condos were built – more competition – lower prices for older ones.

New condos also don’t have many strata bylaws/rules – but stratas always introduce rules over time, as buildings age, and the need for maintenance becomes higher – age & maintenance affect prices & special assessments.

No one wants to replace carpets or tile every 2 years, so they eliminate what causes the carpets or tile (or elevator walls, doors, pool, sports eqt, etc) to get wrecked.

Condos can be a great place to live – buyers just need to be prepared to get involved in strata, and be prepared for special assessments & competing new builds as their investment gets older.

“Also, prices in Vic compare w/ Tri-Cities, Maple Ridge, and Langley – oh joy – I lived in both Maple Ridge and Tri-Cities in the past and I can tell you they come no where near to comparing w/ Vic. In comparison, living in those places is quite miserable.”

For the price of a Gordon Head shit box, I could buy waterfront property in Maple Bay. Gordon Head seems miserable in comparison.

Due to the rain shadow effect, there truly are different weather worlds on the south island. Oak Bay for instance averages even a few inches less than downtown’s 24 inches. Port Renfrew averages 138 inches, with Sooke nearly as bad. North Van averages 100 inches.

http://www.olympicrainshadow.com/images/satellite.jpg

https://list.juwai.com/news/2017/03/vancouver-is-set-for-a-return-in-chinese-buyer-demand-here-s-why

According to Juwai -Vancouver could see a return of Chinese buyers. It comes down to Chrusty’s announcement that those w/ a work permit would be exempt. However, I have to wonder how the new ‘Chinese Capital controls’ will impact this?

Interesting anecdote on foreign buyers in Victoria that I thought of after reading some comments on greater fool blog. The Americans are getting a ‘bolt hole’ foothold here? It leads me to wonder how many of our ‘foreign’ buyers are Americans? I know there are those that will say it doesn’t matter where the foreign buyers are coming from, just that they’re foreign. To that I say, it does if China’s capital controls curb the Chinese exit, but the high (and likely increasing) purchasing power of the yankee dollar and the fear generated in leftist American circles by Trump could lead to increased American interest here (and there is also no foreign tax here yet). I think the BC Gov’t is now collecting Stat’s on where foreign buyers are actually coming from – so it would be interesting to know what percentage of our foreign buyers are American? Also, maybe there’s even European’s coming here – there is a big exit of rich French travelling around the world as well, so who knows?

As for Deryk Houston – not only positive but modest – how refreshing. Yes, unfortunately I’ve noticed much negative tone on this blog – most of it coming from one source, which then unfortunately perpetuates even more negativity – I find myself fighting that even spreading to me and seeing it spread to others on the blog. How sad that some people just exist that way. I will try to not get drawn into that from now on…

I guess I was counted as a local before buying here as we rented for seven months before buying. I think its more difficult to buy when you are not already here.

Also, I’m wondering where did someone find a house in West Van for $1.5m ? Right next to Upper Levels Hwy ?? Also, prices in Vic compare w/ Tri-Cities, Maple Ridge, and Langley – oh joy – I lived in both Maple Ridge and Tri-Cities in the past and I can tell you they come no where near to comparing w/ Vic. In comparison, living in those places is quite miserable.

As for Sooke – it’s a beautiful spot, I love going on hikes out there, and its much wetter than Vic, but if it didn’t have that long twisty highway that is the only route in/out it would probably be priced much higher. Also, it has a very ‘granola’ feel to it. People there seem very ‘down to earth’ to me. Great place to retire, but to commute from – not so great.

Using solar potential as a proxy for sunshine (not 100% accurate), Oak bay only has 4% more solar potential than Sooke. http://hespv.ca/pv_potential_datasets/municip_potentiel-potential-BC.xls

That’s a laugh.

Where’s all the evidence Introvert? When you’ve got a spare moment from jerking off to all of Just Jack’s old posts can you do us the favour of finding all your old posts that proclaim your genius?

Keep hoping for the Chinese to prop up your temporary house value Introvert, the yuan outflow is stifling business bigtime. The tap has been shut off and the foreign influence will be muted moving forward.

China’s Capital Controls Trigger Backlash as Deals Thwarted

Bloomberg News

March 8, 2017, 2:29 AM PST

‘Door is almost shut for funds going out’: Creat Group chair

Zheng Yuewen, chairman of Chinese drugmaker Creat Group Corp., said separately that “the foreign-exchange management is so strict now that it’s almost impossible to move funds out.”

Zhang Li, co-chairman of Guangzhou R&F Properties Co., said that “we see a lot of good projects overseas.” But at the same time “the capital controls are very strict now” and it’s difficult to transmit funds abroad, he said.

https://www.bloomberg.com/news/articles/2017-03-08/china-s-capital-controls-trigger-backlash-as-deals-thwarted

CS is correct that the Sooke number must be wrong. Looking at the climate normals if found nearly 2200 hours of bright sunshine for Gonzales. I did not find sunshine data for Sooke. However Tofino with double the rain of Sooke still had nearly 1700 hours of sunshine

“The only place you can get Victoria weather is within a 10 km radius of Gonzales. Everything else is a different planet.”

Bullshit overstatement. Try leaving the 10 km bubble occasionally.

Intorovert, you may want to pay attention to the central bank to all the central banks. I think they know more than the Chinese who borrow their brains out.

Bank for International Settlements says Canada is showing early warning signs of financial crisis

Canada has been flagged by a global banking body for “vulnerabilities” tied to credit, property prices, and the prospect of rising interest rates.

In a quarterly review published Monday, the Bank for International Settlements, or BIS, said Canada is among the jurisdictions showing early warning indicators for financial crises and domestic banking risks.

The report measures credit and housing prices relative to gross domestic product, and the ability to service debt in the event of rising interest rates.

http://business.financialpost.com/news/economy/bank-for-international-settlements-says-canada-is-showing-early-warning-signs-of-financial-crisis

Looks like the over bidders in Gordon Head got sucked in bigtime. For $10K you can make your own 3-D house.

http://mashable.com/2017/03/03/3d-house-24-hours/#amJ8Zsa1OOqN

Chinese buyers want Canadian real estate for educational reasons: study

http://www.timescolonist.com/chinese-buyers-want-canadian-real-estate-for-educational-reasons-study-1.11118318

Proposed class action against B.C. argues foreign-buyers’ tax unconstitutional

http://www.timescolonist.com/proposed-class-action-against-b-c-argues-foreign-buyers-tax-unconstitutional-1.11073634

The representative plaintiff in the proposed class action is Jing Li, a Chinese national who learned she would have to pay an additional $83,850 on a $587,895 home in Langley that she agreed to purchase days before the government announced the new tax.

…

The court document describes the disadvantage the tax places on non-Canadians and non-permanent residents as arbitrary because it assumes foreign nationals are richer and better able to outbid domestic homebuyers

CloseCommute program could ease traffic woes, developer says

http://www.timescolonist.com/business/closecommute-program-could-ease-traffic-woes-developer-says-1.11118282

Since, at the time, I wasn’t arguing that prices would spike tomorrow, I was right. And I was sure as hell more right than those who said prices would decline precipitously.

Because their track record to date has been so piss poor. That we do know.

@ Jerry

“It would be well to remember that Victoria gets 2100 hours of sun and Sooke gets 800 …”

Rubbish. Nowhere in BC get less than about 1500 hours of sunshine.

Agreed John, seen it many times before. The developers get greedy then get caught on the wrong side of the deal. Vancouver house hoarders who bought at the top last year can’t be too happy if they have to renew their short term mortgages and they’re underwater.

Imagine the tone of this blog if prices looked like Vancouver right now. They’d be jumping off the Blue Bridge.

Via Steve Saretsky:

Vancouver East Detached Prices off 12% from the peak

Vancouver West Detached Prices off 13% from the peak

Richmond detached prices off 7% from the peak

Burnaby detached prices off 12% from the peak

“Let other people have different opinions than you without being so uncivil.”

Well said Rook. Introvert is right for one year out of the last 7 and he thinks he’s a genius. No one predicted this kind of panic buying move, but many can see the light that the odds of a repeat are slim in a rising long term mortgage rate environment and government intervention which has never been seen before. Eventually the two will win out and stifle the rise. Just my opinion of course. 😉

Hawk, buying up properties and hoarding them to increase the values in an area is not new to Victoria.

Years ago it happened in Shawnigan Lake when someone began buying up lake frontage and artificially inflating the prices. It worked for awhile but eventually the price discrepancy between lake front and alternative properties became so large that it caused people to not buy lake front and the scheme collapsed.

The same with a new condo complex. The developer controls the supply therefore if you want a suite in the complex you have to pay the developer’s price. The same happened with some new residential developments in Langford. Eventually re-sales begin to occur in the complex and the developer no longer had control over the supply.

The lots were pretty uniform at about half an acre. Prices ranged from 600k to 800k asking. sale prices came in a bit under. Obviously, I am not including waterfront but lots that were in the actual Uplands only.

Thanks Jerry, I myself use the annual flower count. In that way I can multiply the number of flowers by an amount and determine how much to pay for the property. It’s a lot easier than looking at sales in the neighborhood.

I think most are not going to care one way or the other as the application fee is a very small amount relative to the entire cost. But some will cheat.

And it is true that BC Assessment gets that information. But they also calculate the building cost using their computerized costing system and cross checks their calculated cost with the building permit. The BC Assessment cost of improvements shown will be based on the percentage of completion as at October 31 of the prior year.

The worst way is to get the cost to build a home is by asking anonymous bloggers.

The best way is to get quotes from several builders that have reviewed the plans and building specifications and have had building experience in the neighborhood.

You can also purchase software provided by companies such as Marshal-Swift. This is the software that your insurance company uses. But to really understand this software you need to complete a course in costing.

Occasionally we see Sooke presented as an alternative to Victoria. It would be well to remember that Victoria gets 2100 hours of sun and Sooke gets 800 whilst luxuriating in 1230 mm of rain. Victoria gets 700 mm.

The only place you can get Victoria weather is within a 10 km radius of Gonzales. Everything else is a different planet.

Introvert – ‘I’ve been bullish on the Victoria market since I started posting to this blog many years ago. When prices were essentially flat for a long while, I was predicting they would go up. They did.’

So it sounds like you were wrong to be bullish as prices stayed flat for such a long while. Why do you criticize people like Hawk and John Dollar for their views that may not come to be proven for another year,two, or three. Your predictions didn’t happen the next day.

Let other people have different opinions than you without being so uncivil.

Interesting tweets from Ross Kay on Victoria and the Globe pumper/tourist brochure article.

Who says a techie with deep pockets makes him a real estate whiz ? Could be a lot of pain ahead when the Uplands goes for a dump with the rest of BC.

Ross Kay

@rosskay

Ross Kay Retweeted Brent Jang

Another example of Regurgitation replacing Reporting. Fake News from the Globe using Alternative Facts.

Ross Kay

@rosskay

@brentcjang @globeandmail Really Brent.. 10 months of falling sales in Victoria and you report this nonsense.

Ross Kay Retweeted Eric Duficy

A 20% correction takes Victoria back to its Sustainable Price but you should prepare for the province wide fall out.

Barrister

How much was a tear down? What size lot?

I was talking last summer with a tradesman that i use regularly and he was hired to work on eleven of the Uplands houses owned by Mattrick. I suspect that Mattrick noticed that Uplands was really underpriced three years ago and further that it is just about the only really premium area in Victoria.

Rockland might have been a premium area a long time ago but not any more. Most of the large lots were sub=divided a long time ago. Most of the large elegant houses have been converted into apartments (condo or otherwise). The increased density caused by the ever growing number of basement suites have also decreased the premium nature of the neighbourhood.

To be clear, I do not want to start an argument of whether this is a good thing or a bad thing. I am merely pointing out what is a fact that Uplands, today, really is the only premium area in Victoria.

There are days when I regret not buying a Uplands knockdown and building there instead of what I bought. It would have definitely been a better investment.

Andy – Langley and some of the other Van suburbs you describe are analogous to Sooke: a recently rural suburb that has its own small commercial area and is an hour or more in commuting distance from the core. A quick glance at Realtor shows prices in Langley for sfh ‘s starting around mid-600s and rising quickly from there. Sooke starts in the 300s. We all know that asking prices aren’t the same as sold, but still- mainland prices are in their own league. Kits should probably be compared to Fairfield or James Bay – equally select areas, that remain about 1/3 to 1/2 the price of the Van counterparts.

Vancouver radio segment on vnacouverites moving to Victoria https://omny.fm/shows/steele-drex/metro-vancouverites-are-fleeing-the-lower-mainland

Deryk – “The price difference between Vancouver and Victoria is still massive. $3million for a simple tear down bungalow in Vancouver…. versus an $800,00 simple bungalow in Victoria. ( Not to mention that the $3million dollar house in Vancouver sits on a property half the size of the Victoria lot.)

So many Victoria people seem to have no idea of this price difference and why Victoria is still considered very cheap in price by anyone from the mainland. I believe that one of the reasons for this misunderstanding is the way newspaper article almost always compare the “Metro Vancouver regional district” average price….. instead of simply “Vancouver” prices. Metro Vancouver (formally GVRD, includes houses out to the Valley and even includes Bowen island.)”

I noticed you’re comparing Victoria to West Van/Kits prices which is not really an accurate comparable. $3M for a teardown in Van? Ah no, that’s incorrect and would only apply to a very small, select area. A nice family house in a great neighborhood in West Van located a few houses from the beach, sold for $1.5 M a few months ago. As well, check out prices in Coquitlam, Port Coquitlam, Maple Ridge, Langley. Single Family Homes there are about equivalent to Victoria prices (excluding high end areas like Uplands) currently. I don’t know if that’s historically been the case or if this is a new development in the last year.

We’ll have to hold differing opinions/theories on relocation rent/buy then Leo. I don’t see any stats one way or the other.

There are good stats on migration. Each census surveys it for one and five years prior to the census year. The majority come from other provinces in Canada.

http://www.bcstats.gov.bc.ca/StatisticsBySubject/Demography/Mobility.aspx

In the core there are approximately 960 new households formed each year and this is projected to the same until 202o. If 70% are own homes, which might be high, this means there will be demand for an additional 600 or so owner-occupied homes in the core each year.

A household, as defined by Statistics Canada, is a person or group of persons who occupy the same dwelling and do not have a usual place of residence elsewhere in Canada or abroad. The dwelling may be either a collective dwelling or a private dwelling. The household may consist of a family group such as a census family, of two or more families sharing a dwelling, of a group of unrelated persons or of a person living alone.

Actually there is a rental shortage even if you have money. At least there was two weeks ago.

As for Don Mattrick (ex MS CEO) – that family has so much money I bet he could buy most of Uplands. I seriously doubt he’s in it for $.

Interesting link to the census data, Totoro. In case anyone missed it,

2014-2015 Net Migration, Interprovincial / IntraProvincial / International

Victoria 2487 / 12o7 / 146

Vancouver 2596 / -4395 / 20282

Kelowna 1864 / 1456 / 105

(just a WAG based on anecdotes, but I’d bet international migration increased to Victoria 2015-16 because of the lower Canadian $ and higher cost of living in Van. Also it makes sense that low inventory has maybe increased number of people who rent here first – because most desirable places are now sold in 1 day – no time to hop on a ferry and check it out)

Hawk, agree with you: “I just tell them be prepared to love that place for 10 years for when the market goes south.” Everybody needs to be prepared for worst-case scenarios – it’s the way businesses operate, so it makes sense for individuals as well.

Yeah I don’t buy it. 20 years ago if someone wanted to live in Victoria before buying they would have done that and rented first (there have always been furnished rentals). The idea that AirBnB is some kind of factor in changing buying habits is a huge stretch with no evidence.

There is no rental shortage if money is no object, which if you are suggesting airbnb as an alternative is clearly the case. Also if you are moving here first and buying later then you are going to rent for about 6 months or longer. Many airbnbs are not available continuously that long and you’d pay a fortune.

Not since Airbnb maybe. With a vacancy rate of .6% there is a problem obtaining rentals otherwise though and this has been an issue for years. And right now your chances of finding a home immediately if you’ve sold your home in Vancouver or TO seem not great given the low inventory and bidding wars. Pretty sure a reasonable move for many who have sold would be to rent a furnished place while looking to buy right now – especially if not familiar with the market.

I think Barrister rented first while looking to buy.

If you want to get an idea of building costs, I’ve been told that you can go down to city hall and ask to see the building application for a new house. That building application will have the cost estimate to build. Then you just divide it by the square footage.

This is the worst possible way to get an idea for building costs. Your permit fee is calculated based on cost, BC Assessments collects the data (property taxes), etc…..what do you think people are going to quote?

Your first sentence doesn’t make sense to me. Please rephrase.

Every 145th post should be a link to what a multi-million dollar property looks like in the real world.

http://news.nationalpost.com/homes/renovated-1909-mansion-with-a-glassed-in-lap-pool-close-to-seattle

It is a far more reasonable assumption that people’s habits pre-move haven’t changed much than that they are suddenly much more prone to rent first. There has never been a problem finding rentals if someone wanted to check out a city in detail first.

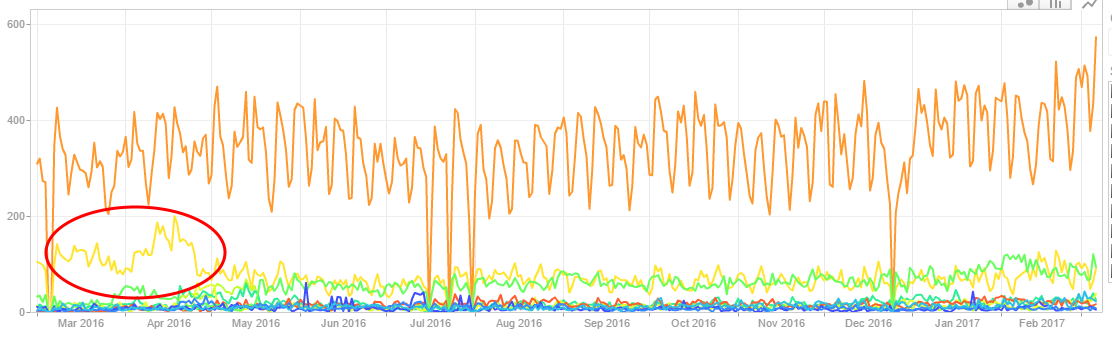

I don’t doubt the Vancouver surge though. Just look at traffic on this site last spring. Big surge of visits from vancouver in March/April over the usual level.

The VREB data that we had from early 2016 also indicated the same.

A video of downtown Victoria taken in May 1907. I don’t recognize much until about 1:40, and then it’s just amazing. An Empress Hotel under construction, a comparatively dead inner harbour – and the Parliament Buildings!

The fellow who filmed it, William H. Harbeck, also filmed the aftermath of the San Francisco earthquake in 1906. Harbeck was a passenger on the Titanic but did not survive.

https://www.youtube.com/watch?v=Jp1qWV5OZec

Easy enough to check. The records are public.

I’d say someone has a big man crush on me.

https://youtu.be/AuzPN_8GwYA

http://i.imgur.com/faR6yBN.jpg

Numbers hack

Interesting….I too have heard this ‘gossip’….apparently he is buying for ‘the inlaws’ – referenced on at least three occasions when I asked if a certain house was available to buy…it wasn’t available because he had just bought it ‘for the Inlaws’. He must have a lot of wives ; )

I was told in passing by a friend at a coffee shop that he has bought 25 properties in the Uplands…

By paying substantially over the assessed value for these high ticket properties these purchases are manipulating the market upwards….which benefits him, the realtor and the developers of properties in those areas who buy and flip, sometimes several times in a short period.

By purchasing and holding these properties without renting them out, these properties are removed from the market for potential family/community purchasers by reducing the number available to purchase…without contributing to the rental pool either as most of these are held vacant.

The minimum they will accept is around $180/sq.ft. Doesn’t matter if it actually costs you less.

Also a forty-something man who says ‘LOL’ in blog comments, apparently.

So you did not bother to review it the link with the data. Unsurprising.

I love Estevan village. I wish I owned the cupcake shop. That building was for sale not too long ago.

LOL

It seems you don’t like being schooled.

You mean my brain?

You’re a forties-something man who still has to look up the difference between it’s and its.

So you’re saying censuses are not every five years?

Foreign money in Victoria and a little bit of gossip…

Spent a few weeks at home and if Marko or one of realtors can verify this, a certain Senior ex-Microsoft executive has purchased most of Estevan Village in addition to 10+ homes Uplands and Estevan. They run an office out of a Upland’s home and are in the process of constructing a few new homes in OB for sale. Spoke to a few business owners in the village that we’ve known for years and they have verified that as true.

With that type of firepower(money), one individual can really skew the market. Guess they cracked the numbers and the investment thesis for higher end RE in Victoria looks quite attractive.

Depends on your definition of local. I think the most common interpretation is living here for more than a certain time period , but I could be wrong. People relocating or retiring from TO or Vancouver may have more equity to invest.

The data measures the change from 2014 to 2015. You didn’t actually look at it did you?

@AG, that is for Custom home finishes. So Mid-High to High Range.

Spec home prices for homes you see in the Western Communities would be much less.

Hence new home prices in the WC are $550 to $750K for a SFH.

“The historical discount for Vic compared to Van has been closer to ~25%.

So if WestVan is ~3.5M, could the best areas of Vic get to an average of 2.5M? Possibly.”

Vancouver’s westside is a massive area that extends west from Ontario Street and was a mixed bag in the not so distant past. The upper crust lived in Point Grey and Shaughnessy while Marpole and Dunbar were working class or middle class hoods. I’m not sure what the comparable would be in Victoria. The best areas, according to this blog, are Oak Bay.

The run up in prices on Vancouver’s west side happened because lots of Chinese people and money started moving there. In Victoria, Chinese people and money trickle in.

The main factor that pushed prices up there, does not exist here. Yet.

If you want to get an idea of building costs, I’ve been told that you can go down to city hall and ask to see the building application for a new house. That building application will have the cost estimate to build. Then you just divide it by the square footage.

I’ve done this with condo buildings but never houses.

If you are having a house built you should have the contractor take a look at the plans and complete a written construction cost estimate along with a building specification sheet indicating the quality of cabinets, type of floors, plumbing, garage door openers, landscaping, decks, etc.

A contractor that just says $250 or $320 a square foot might not be your best choice.

Thanks makes sense Caveat since babies don’t buy houses. But 20 year olds do become 30 year olds and they do buy houses.

Not everyone that moves here buys a house. And house purchases are made up of families of 3 or 4 people not one. And censuses are every five years.

So how is that more accurate than the real estate board that tracks housing purchases specifically.

100% of Greater Victoria’s population growth coming from net in-migration is not inconsistent with most of the home sales being to locals. Locals moving around doesn’t change the population

totoro

the Statscan report you posted contained a fact I find sad. Victoria has the lowest proportion of kids (0-14) of any CMA in Canada. 12.6%

Abbotsford was the highest at 18.1

I wonder what level of finishes that is for?

Sorry – I just took that from the column marked “population growth rate”.

Or I’d have to believe the census. Did you click on the link?

The VREB data is not, imo, as good as the census data which actually asks the question specifically. People moving here and renting first are marked as local on the VREB data forms even if they are bringing cash from TO or Vancouver and moved three months ago. I suspect a high number of out of town buyers do this, especially now that furnished rentals are easy to find online.

New house replacement costs for the core. For those interested the building costs being quoted by reputable builders in the core, GT Mann, Zebra, etc… is between $250 to $320 per sq ft now. Really expensive.

Framers that use to charge $7 sq ft to frame 2 years ago are charging $12 to $15 /sq ft. Based on a 3000 sqft house, no wonder houses in the core are going in the $1.5MM+ range for new builds.

Unbelievable as it may sound. I agree with you Michael, condos are doing very well. There are more out of town buyers in the luxury condo market than the detached housing market.

And that makes sense. Sell your house and buy a luxury condo or townhouse. Who wants to spend their retirement gardening or cutting lawns. Or paying crazy property taxes, utility fees and house maintenance costs.

Sell the house, buy a condo and bank the rest.

Totoro –

I agree with most of what you wrote, but 11 per thousand is a growth rate of about 1.1%, not 10%.

No, you wasted everyone’s time running posts through a grammar checker.

“Hawk:

How many people buying a house for 2 mil use U-Haul. Stop throwing out meaningless “facts”.

Barrister,

Young families are fleeing Vancouver because they’re priced out, and young tech workers and construction workers make up the bulk of all those new jobs. I hate to break it to you but those people use U-Haul, along with many cheap ass rich dudes like yourself.

I think you need to wake up and quit believing the media promotion bullshit that everyone moving here has just sold a $3 million Vancouver house. Your perceptions are getting warped hanging up in the Rock too long.

Not really, you have to make some monumental assumptions to believe that to be true.

It’s better to use the Victoria Real Estate Board’s data on where the home buyers were from and in what price ranges they were buying. Unfortunately that contradicts you.

But hell, that’s never gotten in your way before.

I can understand why people need to have a bogey man to blame for this run up in prices. They look at their salaries and say “I can’t afford that and I have good salary” therefore no one else can and it must be people from out of town. Yet the stats from the real estate board don’t show that at all. The main driving force for house prices being so high is coming from Victorians themselves.

Anyone know what the cost per square foot of condos in Japan was before deflation hit?

“So if WestVan is ~3.5M, could the best areas of Vic get to an average of 2.5M? Possibly.”

More pipe dreams. So I guess your a buyer of $2 million plus places Mike ? You never do answer.

“We bought our first house in Kerrisdale for $50,000.00 and our friends laughed at us for paying too much.”

I had friends laugh at me for selling at the top in 81, “where ya going to live ? ” they cried. “Rents are so high, you’re crazy”. When I rebought two years later at 40% off they all laughed ” are you crazy ? Real estate’s going to keep going down after I told them the crash was over”. The friends bought at 50% higher a couple years later.

“I pass on my thoughts because I want young people to understand that they should buy a house if they can possibly manage it.”

That’s OK too. I just tell them be prepared to love that place for 10 years for when the market goes south. Problem is they all think it’s going up $100K a year like all the pumpers on here preach. That’s a recipe for major disappointment and financial disaster.

The historical discount for Vic compared to Van has been closer to ~25%.

So if WestVan is ~3.5M, could the best areas of Vic get to an average of 2.5M? Possibly.

Congrat’s Newnormal.

The condo-craze lately has me almost wondering if skyboxes could outperform this cycle. I doubt it, but it is possible with the boomer factor. Last cycle was neck & neck.

http://i.imgur.com/xLYkxYG.png

Regardless of which of you has or has not been accurate, your measure above in my view, isn’t very good. You were guessing then, and any prognostication about the future is also a guess. You just happened to, more or less, be correct. Good for you. I hope you made a killing on the gains.

But like I said a while back, if you are a bull you’ll always be right, until you aren’t. It makes the bear look foolish until what they say then becomes perfectly obvious. I guess I would say both sides eventually end up looking foolish.

Your crystal ball doesn’t work any better than anyone else’s. If it did, you’d be wealthy beyond imagination and probably wouldn’t take time out of your day attempting to discredit someone you’ve already deemed non-credible.

This post is for “Reason First” and other that doubt what I have posted.

I’ve listened to and read for five years now people on this forum constantly say that prices in Victoria are too high. I’ve posted on many occasions that Victoria is cheap compared to Vancouver. I always got push back on my ideas. My family invested in real estate based on what we believed would happen.

I’m the first to admit that I am not that bright. But …..this idea seemed a no brainer to us. History proved us right. I happen to still believe that Victoria prices still have a lot further to go. History will prove me right or wrong. Victoria is “Not” Vancouver. But it seems like a no brainer to me that Victoria should be at least worth half the price of a Vancouver house. The prices for Victoria houses are at least two thirds less than Vancouver and that is why I believe that they will easily climb substantially this coming year. I’m 63 years old. I have listened to people all my life tell me that houses are not worth what people are getting. We bought our first house in Kerrisdale for $50,000.00 and our friends laughed at us for paying too much. I pass on my thoughts because I want young people to understand that they should buy a house if they can possibly manage it. Over the long haul, they will be miles ahead of the game and be in a much more secure situation overall.

The negativity on this forum is tiring.

Keep an eye on the big picture. Take a world view. Positive people attract positive thinking people. Taking this kind of approach will open more doors for you. That’s what I have learned.

Er, it is very one-sided in terms of net numbers. And there are definitely not as many people leaving as moving here.

We don’t actually need to guess at where the growth in Victoria is coming from – there is 2016 data.

There is a negative natural increase (people are dying faster and reproducing slower than replacement). Almost all of the growth is from people moving from other areas of BC and Canada to Victoria and not from outside Canada. Most of them come from other provinces.

Out of a 10% growth rate there was -1.2% natural growth, 6.8% came from other provinces and 3.3% from other places in BC. Only .4% from international migration.

So I guess we really can point to TO and Vancouver as probable contributors to the recent run up.

http://www.statcan.gc.ca/pub/91-214-x/2016000/section01-eng.htm

We sure don’t. But we do know that certain people’s sense of the market has turned out to be more inaccurate than others’, and that ought to affect the weight we give to what they’re saying today.

I’ve been bullish on the Victoria market since I started posting to this blog many years ago. When prices were essentially flat for a long while, I was predicting they would go up. They did.

Just Jack, I will wait for someone cleverer than you to explain to me how I’m wrong about this:

You are grasping at straws.

Introvert, what have you ever been right about? Did you call the market increasing significantly from 2007?

Really? So Marko forced himself to build a mansion in Central Saanich?

I know it is impossible to believe, but yes, I would prefer to live in a condo.

My mansion doesn’t have strata fees, has huge potential for monthly revenue from secondary accommodation, and it is on 1/2 acres so when the big one hits and everything is levelled at least I will have somewhere to park a trailer. i.e. land doesn’t depreciate.

When I bought my lot in 2013 it was literally a 50/50 coin flip between the 1/2 acre lot and a 19th floor pre-sale unit at the Promontory that was 1,160 sq/ft. In addition to the factors listed above I created $100,000-$150,000 in “sweat equity” via the house. I can’t build my own 19th floor condo.

Money is a factor and the house wins hands down in terms of a longer-term investment. Not only is it cheaper on a cash flow basis when renting the suite but appreciation is also better. It is a win-win financially. (I am comparing my house to a substitute condo which would be 1,200 to 1,500 sq/ft condo at Bayview Promontory).

That’s right Barrister.

There are many things that could have been. If we could only have foreseen the future at that time. And we still don’t know how things will turn out ten years from now.

People made a lot of money with Bernie Madoff through out the years. It was the people that held out to the end that lost money.

Hawk:

How many people buying a house for 2 mil use U-Haul. Stop throwing out meaningless “facts”.

John Dollar:

Or they could have invested the money with Bernie Madoff.