February 20 Market Update

Weekly stats update courtesy of the VREB.

| February 2017 |

Feb

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 119 | 285 | 439 |

772

|

|

| New Listings | 152 | 344 | 572 |

1160

|

|

| Active Listings | 1502 | 1498 | 1537 |

2562

|

|

| Sales to New Listings | 78% | 83% | 77% |

67%

|

|

| Sales Projection | — | 748 | 718 | ||

| Months of Inventory |

3.3 |

||||

Finally a bit of relief from the punishing trend of decreasing inventory at the start of spring market when it should be piling on. Sales haven’t slowed down but an increase in listings has stopped the bleeding of the inventory. Let’s hope it continues because we have a deep hole to dig out of.

In other news, Harcourts is trying to bring the real estate auction to Canada with a test run in Vancouver. Personally I love the transparency this approach can bring to the market. You can access all of the listing information (see link in description) required to make a sensible decision and no one will be paying $50k over the next highest bid because they didn’t know. Doesn’t mean the final price will be any lower, but transparency in the process is always good. It will be interesting to see if this one is more successful than our Rockland auction that failed.

How does BC assessment know if you have a suite?

LUKE, I spoke with someone from CRA last night about obtaining clarification about a basement suite. And he explained that it is complicated because of many of the things that have been discussed on the blog.

But they know if you have a suite. It appears in the data the BC assessment collects and on your taxes. Now with the new changes on the tax form they will be able to track what you own at any time. From his desk he can get all he needs in a few minutes to assess your situation. His basic answer is that people should disclose the information because you are not going to be able to hide anything anymore.

GWAC said:

“so they are going to commute from Nanaimo to Victoria to solve their sooke to Victoria commute?”

No GWAC they are moving to Nanaimo and are going to work in Nanaimo.

New post: https://househuntvictoria.ca/2017/02/23/the-owner-builder-exam/

Caveat:

Judging by the other developments in that area, I’m wagering $750,000+ for a 3 bedroom unit.

I agree, more townhomes, or better, row homes. There are a few on and just off Oak Bay Ave, probably townhomes, but have the same look as the rowhomes you see in English media. Unfortunately, even those ones are in the $600k+ range, despite being older.

Fed will raise and Canada will kick in too and catch many off guard. JT’s next move to cool the psychotic housing market.

Fed minutes: Trump policies could lead to rate hike ‘fairly soon’

“Several” committee members said the probability of the Fed overshooting its dual targets for employment and inflation was “high,” which could cause the committee to have to move more quickly than the market expects.

“Interest rates are screwing everything up….you move them up 2% and borrowing power drops $150k….up 4% and down 250k”

Won’t be long to see how this market will begin to meltdown when the inventory finally kicks in.

How many cops and teachers can be left to buy ? That line is getting worn out. Westshore is where I hear the cops own because they’re priced out in the core. Most people like some cash left after all the bills.

How’s the 2% club working out for ya AG ? The 500% club is still working out great here, about to make the next move up. 😉

This http://cookstvillage.com/ project is going to have a few 3 BR units. I am sure they won’t be cheap though! Several councillors cited the 3 BR units as part of their rationale for approving the project. Not sure how much Victoria (or any of the other) councils are doing to really support or require this though.

I really agree that as SFH prices move out of reach we need to get more 3BR condos and/or affordable townhouses in the core.

The people actively looking to buy and the people actually offering their houses for sale determine the market at this instant in time.

But all the non sellers and non buyers do have an influence on the market as well. Broadly speaking they determine the shape of the supply and demand curves. Most owners could be induced to sell at some price. How high that price is determines the shape of the supply curve which in turn determines how the market would respond to an change in demand. Similarly many people could be induced to buy a (or another) house) if prices dropped low enough.

http://www.bnn.ca/personal-finance/video/moneytalk-the-cra-and-your-principle-residence~1063408

Video on how the CRA is increasing scrutiny of people who previously to 2016 were avoiding paying Capital Gains on secondary properties… by using trusts or their kids names on second properties, for instance. Now, the CRA’s microscope has been adjusted… to also capture non residents who previously avoided Capital Gains (this probably would be supported by most Canadians).

We still have yet to get any clarification on what constitutes a suite, and weather or not they will pursue Capital Gains on the percentage of the home that is a suite (and how) when people go to sell their Principle Residences.

priceless

When do we start getting 3 bedroom condos? I think I’ve seen one available on MLS since I moved here, if you don’t count those Craigflower ones with assessments waiting in the wings.

Council is being really slow on this. I believe it’s a mandatory percentage of all new condos in Vancouver, but I haven’t heard a peep about it here.

934 Green St went for $1,002,200 – asking price was $950k.

Another house for ‘a million dollars’ (but plus PTT you’ll need to cough up quite a bit extra – I notice Chrusty Clark didn’t think about touching that in the latest budget)

Only several blocks away from the 24 hour Mcdonalds on Pandora St. Convenience! Steps to aging Crystal Pool. Lovely parking lot across the street. Great ‘hood (not)

It’s indicative of what people want desperately in this city – new-ish housing (this was built in 2005). So rare in the core, people are willing to fork out large amounts for this… thereby avoiding all those issues that come with the more common older housing stock so prevalent here.

Re. Kings is ‘lipstick on a pig’ Go have a look at the next open house and see if you can spot the ten things I did… Go to ‘street view’ and you can see it was a ‘dearly departed’ house that someone bought for $800k last year and they’re trying to ‘flip’ it. There’s also no gas up there and there’s a propane tank instead…

so they are going to commute from Nanaimo to Victoria to solve their sooke to Victoria commute?

Last month I was talking to family from Sooke who have very well paid jobs but work in Victoria. They can’t stand the drive into the city and have decided to relocate.

Not to Victoria but to Nanaimo. Moving to the city core is not an option for most people anymore.

Thanks.

Reminds me of the conversation I overheard in front of Buddies toys the other day. Mom said to her three or four year old daughter (who looked quite resolute) “Hailey, after we apologize we don’t say blah, blah, blah”.

What kind of work still needed on Kings? Just curious, it looks pretty “done” in the pictures. Is it a lipstick only reno?

Here’s a rare SFH price cut in this market (I won’t use the word ‘slash’ that’s reserved for you know who): 2111 Kings Rd in North Oak Bay – still won’t sell, now reduced by $30k to $1,035k.

Might have to go under $1 million I think for this one. It’s really on the small side and needs more work. The people selling it are trying to do a quick ‘flip’. So far, it’s not working out for them…

Nearby on 2586 Eastdowne is a better/bigger house that recently went in just 6 days for $974,9k, which was asking price. For this one, the Bare Naked Ladies song still applied… even after PTT! (barely)

@ Luke,

Too funny. The other day I was thinking of that song too in the current context.

“♫ If I had a million dollars, ♫ I’d have…not enough.”

I remember people saying ‘it can’t go on like this for much longer’ in Vancouver back in 2007… I know (I said) Victoria is not Vancouver, but…

Then look what happened there. Prices became totally detached from income fundamentals. Just saying – in a city like Victoria where there isn’t enough SFH houses or land to meet the demand, who knows where the top limit lies?

I have to laugh now when I heard the song by the Bare Naked Ladies yesterday… ‘if I had a million dollars, I’d buy you a house’… well – maybe they should change the lyrics for Victoria to: ‘if I had two million dollars, I’d buy you a (decent) house!’

Still, all the extreme activity at levels under a million shows you where people are at (with what most people can actually afford, or… barely afford).

I was driving up by that big piece of empty land by the Victoria Gen. Hospital yesterday… perfect location for more housing, but I guess it’s in the Ag reserve? Anyone know what the story is with that (just off Watkiss Way)

Wow, 934 Green St is what a million dollars looks like now. I don’t mind the house itself (other than it’s across the street from a parking lot) but, like Scott and Pear streets, it does tick all the boxes for what most buyers are looking for.

My apologies to you then Totoro.

I get the two of you confused as you both back up each other in personal attacks on some of the posters.

934 Green for > $1M?!

I think there is something to what you are saying Marko. Demand for houses in the core is shrinking to high income earners. Traditional first time buyers and middle income households with 20% down can no longer buy. That puts a finite number of prospective purchasers for houses in the core.

When supply increases again (because it always has) that’s when this market is going to get very interesting. You’ll have sellers that refuse to lower their price and you’ll have those that have to sell in the immediate future because of relocation, divorce, foreclosure etc. This happened in the USA and they banks are still working through the effects of a two tiered market.

If this were to happen. There would be fantastic opportunities for those who have piles of cash. Cash once more will be King.

No. JJ you are not even able to double-check by scrolling down?

Argh, now I can’t help but notice that your imaginary rebuttal argument is completely illogical.

When market conditions discourage listings this can impact inventory. If there is a reasonable basis to be worried about being able to buy back in this factor could impact the interest a homeowner might have in listing. Longer healthier lifespans can keep people in their homes longer. Sharply rising markets can discourage listings on the hope of future gains. Lower inventory can impact prices if demand is constant or rising. That is law of supply and demand.

We might be experiencing some of these factors currently.

I have no idea what you not wanting to buy my house has to do with anything. Weren’t you off to subdivide Oaklands and become a greedy house hoarder anyway?

Totoro said in a February 22, 2017 4:21 PM post the following:

“You’re wrong. Not-sellers are part of the market, because by choosing not to sell they are determining inventory.”

http://www.vicrealestate.ca/broadmead-saanich-east-homes-for-sale.php

Our Broadmead experts how can there be such a difference between Maltwood and Deventer. I know Deventer is smaller but 650k smaller???

I think it can’t keep going like this for much longer

No way it can. Add another $250,000 to the house that just sold on Scott Street and it is over a million bucks for a bungalow with 2 bedrooms upstairs.

But then I am just playing around with this calculator……https://www.cibc.com/ca/mortgages/calculator/mortgage-affordability.html

A family making $150,000 per year on a 5 year variable with heating costs of $200 per month and taxes of $400 per month can service a mortgage of $742,379??? It’s been a while since I’ve played with the calculators but that seems super high.

Teachers x 2, Peace Offices x 2, etc., with $100,000 downpayment can still afford in the core.

Interest rates are screwing everything up….you move them up 2% and borrowing power drops $150k….up 4% and down 250k

Thursday seems to be list day. Interesting to see how much the weekend sales eats that up.

True, Thursday is a huge list day for those taking offers Sunday/Monday/Tuesday. That being said 58 listings in last 24 hours is very high.

I am hoping that an influx of listings will spread the offers around. Because the majority of offers are unconditional in the core on SFHs people can’t go around making offers on 2-3 houses at once. If inventory can help reduce offers on any semi-attractive property from 5 to 8 to 1-3 buyers will have a chance again.

I never made any such argument, although it may well be true. Not smart to post alternative facts when people, including you, can just scroll down to check. I recommend you do.

What kind of jibber jabber is this JJ? Now you know what I’m thinking and you are formulating responses to this imaginary conversation? Toxoplasmosis can have some weird effects, I’d get checked.

Reason

Thursday seems to be list day. Interesting to see how much the weekend sales eats that up.

Reasonfirst, historically around this time of year people begin to list their homes for sale.

And historically more people like to purchase in the spring as well.

So now we are going to see if the high prices in Victoria keep people from buying while listings begin to grow.

Local Fool, there is something known as Shadow Inventory but that isn’t what Totoro is alluding to. Shadow inventory would be condos and houses under construction that have not been listed for sale but most probably will be in the near future.

Totoro’s argument that people that are not willing to sell their home have an influence on prices is false. Just as it is equally false to say that people that are not actively looking for a home to buy have an influence on prices.

Totoro is not willing to sell her property and I am equally not willing to buy her home either.

I don’t think there is a psychological price barrier. A million is not what it was. I’ve already moved past it in my head because the market in my area has.

It took a few months for me to adjust to the new reality, and realize that we can’t afford to buy the house I thought we would next year without very unattractive lifestyle impacts as the market has risen faster than our assets have.

I think it can’t keep going like this for much longer, but I doubt the market will slide backwards to 2015. This means that a million is going to be the low end at best should we decide to move.

Probably just a blip but my PCS had more new listings today than I have seen in months. Anyone else?

Bear if they get ride of the hydro poll it will be worth another 100k.

Its in the Roots Cellar area, that alone is worth 250k.

“will $1,000,000 eventually be a psychological threshold outside of Fairfield/Oak Bay for a bungalow in Oaklands/Cedar Hill/etc., or a 70s box in Gordon Head (that isn’t on a large lot or something).”

Good question. Two years ago I would have thought that $750,000 was the threshold but apparently not. It looks like Victoria wants to catch up with Vancouver.

A couple of weeks ago it seemed like things were going to be a little calmer this year. Now, at least from the postings on here, it’s evident that the hysteria is starting to build again.

Looks like we’re at the start of a major jump higher in the market.

It might well be the ‘blow off top’ that Hawk keeps talking about. But that could easily mean another 20% higher before it starts sliding.

@Bearkilla: Agreed — Nicholson is also totally insane.

Outside of Oak Bay will $1,000,000 eventually be a psychological threshold outside of Fairfield/Oak Bay for a bungalow in Oaklands/Cedar Hill/etc., or a 70s box in Gordon Head (that isn’t on a large lot or something).

Is it time for a 2017 update on Hawk’s portfolio? Must be up 100% or more by now 🙂

1055 NICHOLSON ST 815,000 in one day. Madness. Look up the location on google maps.

Madness.

My current WTF sale is 1613 Pear St for $891,000. I know it’s been renovated, but still.

Thanks Leo!

2820 Scott is a nice turn around. $547,000 in 2015 and 20 months later $792,000 or more than $10,000/month appreciation. The open house was insane.

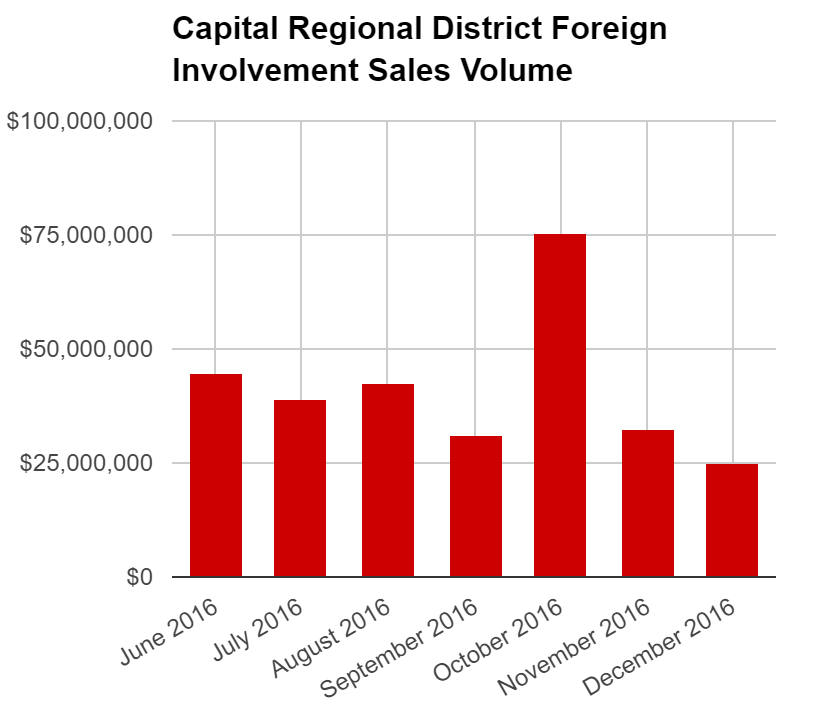

Here are the numbers of transactions

Jun: 64

Jul: 46

Aug: 47

Sep: 39

Oct: 63

Nov: 40

Dec: 39

1631 Hampshire just sole for 1.25 million; had been asking 1.3 mil. When you think about it, if one does, that is an insane amount of money for a small house on a small lot.

The data is on databc

https://catalogue.data.gov.bc.ca/dataset/9c9b8d35-d59b-436a-a350-f581ea71a798

According to the RBC Housing Trends and Affordability Report Dec 2016….

‘Recent property transfer stats show foreign buyers represented more than 10% of the VALUE of transactions in the CRD in October, up from less than 5% in June.’

Page 3, British Columbia, Victoria – attracting more attention

http://www.rbc.com/newsroom/_assets-custom/pdf/20161221-ha.pdf

Yep, would need to look at housing type and area to get a real sense of influence IMO.

Thanks for posting Leo, btw.

Do you have the total sales volumes for those periods? That may give a clearer picture of foreign influence on the market.

What are foreign buyers purchasing is the real question. If they are mostly buying/speculating houses (ie one segment of a the market) that would make a difference as their total market share of that segment would be much greater than 5%.

The foreign buyer’s stats are the worst they can possibly be for the market. Not quite high enough for the government to pull the trigger on the tax but high enough that they do have some impact at 4.94%.

Oh, I really wouldn’t rule out toxoplasmosis on this board:

But I suppose they could be trying to hide stats. And house hoarders are buying up the places. And the old people need to get the hell out. And the predatory speculation…

https://www.theatlantic.com/magazine/archive/2012/03/how-your-cat-is-making-you-crazy/308873/

Where did you obtain that data?

Haha, well I thought I’d actually go check on the data and it was just released 10 hours ago.

Here is is. Nothing of note in Victoria, volume and number of foreign involved sales down from November.

“YES! Extremely suspicious. What the heck are they doing here? Are they trying to avoid showing an uptick after they relaxed the rules? Or did they just get lazy?”

Did BCGOV make a commitment at any point with respect to how often they would release the data? I haven’t been able to find it anywhere. I agree it’s odd that they’ve clammed up.

2820 Scott St

Sold for $548,000 in Aug 2015 – just sold for $792,000 with 5 DOM – 45% increase and it doesn’t look like the most recent owners have done any work to it. Just crazy how much the market has changed…

YES! Extremely suspicious. What the heck are they doing here? Are they trying to avoid showing an uptick after they relaxed the rules? Or did they just get lazy?

Leo, don’t you start it too. I’m not going to be able to sleep tonight. All I’ll be thinking of is, “crunch, crunch crunch” and wondering if that mangy little heathen has come back from the grave to dine under my bed once more. I don’t need some kind of PTSD over here; I have to go to work tomorrow.

It is a bit odd. John Dollar’s point showing how much SFH sales have declined in the core does make me pause somewhat. Is it all just inventory constrained or is there something else going on?

They haven’t been infected by toxoplasmosis.

I find it suspicious that the foreign buyer numbers haven’t been released for the last 2-3 months.

It may have something to do with the upcoming election.

@ JD,

The difference between your argument and AG is essentially potential vs actual market activity. AG is saying that a homeowner making a choice not to sell is a choice that would effect the market – the market is viewed as activity potential within the entire housing stock.

Your argument is never mind the entire housing stock, what is relevant is what portion of the stock is subject to having a willing buyer and a willing seller.

I’m more inclined to agree with the latter interpretation, as I could easily invert the former argument by saying a person who is willing to buy a home, but chooses not to, is effecting the market by not buying. Another angle is to say a potential major earthquake is effecting the market by not striking and levelling all the homes. One is theoretical, one is not.

I thought of getting a cat to control both deer and real estate agents from wandering around the yard.

If God wanted men to like cats he wouldn’t have made them the size and shape of a football.

Totoro, here is the definition of Market Value. Note that no where is a market defined as those that are not selling just as the market is not defined as those that are not buying. Markets are made up of willing buyers and willing sellers. If you do not offer your home for sale then it is not on the “market” because you are NOT a willing seller.

https://youtu.be/ieR5FVz-kR0

Because it’s preferable to discussing feline predators. This is degenerating.

Your judgment is suspect.

Stock predators? How come we are talking about stock predators now? Are you saying the market is full of… house predators? Chewing rats under your bed?

@ totoro,

Speculation inherently involves confidence, but it is otherwise distinct. Speculation in this context manifests as predatory demand on a stock in order to make a fast, or relatively fast, profit.

Ugh. Cats. I will never forget the time my neighbour’s cat quietly brought a rat into my house, put it under my bed – and stayed there chewing on it until I went to bed and the sound of the crunching startled me. Cats are the devil’s handiwork…incorrigible, quadrupedal monsters.

Yep, and Victoria is not Vancouver either.

I don’t know. Vancouver clearly had a foreign investor component like TO has. I think we need to define speculation a little more clearly. If speculation is equated with consumer confidence only TO, Victoria and Hamilton still have that… for now. I don’t think Vancouver is operating in the same way anymore.

The real question is what is wrong with people who don’t like cats.

“We do not have the same set of factors.”

Yes we have similar factors related to speculation. Even CMHC finally reported it:

http://business.financialpost.com/personal-finance/mortgages-real-estate/cmhc-keeps-red-flag-on-canadas-housing-market-with-several-cities-still-too-hot

“Price acceleration in Vancouver, Victoria, Toronto and Hamilton indicates that home price growth may be driven by speculation as it is outpacing what economic fundamentals like migration, employment and income can support,” said Bob Dugan, chief economist with CMHC.”

Toronto, Victoria, Hamilton, Vancouver – look at YOY price charts – everyone is seeing that those cities are leading the country – they are asking WHY – what do they have in common.

http://www.theglobeandmail.com/real-estate/house-price-data-centre-update-canada-toronto-hamilton-records/article29697029/

In response to “Something being discussed here does not make it true.”

Of course not. What I said was that the same topics we discuss here are exactly the things that those analysts researched: builders & red tape, inventory, unabated demand, listings ratio, first time buyers. Then those analysts came to the conclusion that it’s speculation.

CMHC has concluded that it’s speculation, and I see valid arguments there (Speculators make money in Victoria because its climate makes it a retirement & vacation destination & it’s close to Vancouver, & then millennials starting families are fighting to stay in the game).

@ totoro

“Something being discussed here does not make it true. We do not have the same set of factors.”

I’m not sure I agree on the latter. Both the 2 largest metro regions operate under the same federal monetary policy and I suspect both have been, and are, being driven by a speculative investor mania. Toronto’s and Vancouver’s secondary markets are being affected by spillover from both cities in terms of investor mania and city dwellers fleeing to less expensive nearby regions. I suspect that the dynamics are very similar across both markets, if not identical.

You’d have to know the motivation to understand this. It can make sense when you build but are not yet ready to move in. Could be that they were banking on appreciation. Seems extremely unlikely that they are long-term purpose-build rentals. Numbers do not work here and someone investing that amount of capital will know that.

Something being discussed here does not make it true. We do not have the same set of factors.

At least in South Victoria, I am not seeing a lot coming onto the market nor are there a lot of sales. Things seem frozen in time.

Dear Friends,

To avoid confusion, when addressing John Dollar write John Dollar as opposed to JD, as JD is a different contributor.

Better yet, call John Dollar Just Jack.

379 Tyee Rd , #901 slashed $25K. With a world class ocean/harbor view from the 9th floor even can’t sell. Is the condo market turning downward ? Smells like somethings up.

I thought condos were hot and going over ask ? Looks like the Songhees are not. 68 Songhees Rd , #617 slashed 30K.

You’re wrong. Not-sellers are part of the market, because by choosing not to sell they are determining inventory.

However, buyers and sellers are obviously more important determiners of the market.

To put more delicately what I’ve said before (so as not to get censored by Leo), just because one has access to and shares stats doesn’t mean one’s interpretations of them are any good.

You would miss it. I’m certain the squabbling is at least half the reason people keep coming back to the blog. The site would be stale without it.

Barrister – agreed. It’s not the best looking house inside, but with a bit of imagination it would be great. There are lots of expensive houses on that street too. I’d be surprised if it doesn’t sell at the new price.

Just noticed that 634 Island View dropped their price from 1.95 to 1.8. That is a pretty steep drop on a very nice street.

What’s wrong with cats, anyway?

I certainly couldn’t afford to build on my salary alone. Bank agreed and thus I had to borrow from a credit union. I am doing what I am doing mostly because of asset appreciation. Sure that is luck, but also not. I rented with room mates until I was 33 and invested what I saved. At that time I thought I would never afford a house so was applying the rent and save philosophy. I had worked with some engineers through the 90’s who were into the realestate debate and one guy had made a rent vs by excel spread sheet. Renting was better, until 2003 rolled along. It was just like this discussion group, but in meat space. Complete with the bears of the time….

Deleted. No need for this - adminThere’s something innately charming about the squabbling that goes on here. I don’t know what it is, but I would almost miss it if it were to go away.

Blah, blah, blah, blah

You sound like a bored cat lady AG.

Just Jack/John Dollar – you contribute some useful stats to the blog, and you seem to have some peripheral knowledge of the market. However, many of your posts betray a real lack of understanding of markets and market psychology.

Ag, you are just mad because I called you stupid.

There’s about 70,000 seniors Victoria wide based on 2011 census increase from 2005 of about 7000, could be a bit higher. How many still own ? How many have big pensions and can stay til they croak ? How many are scraping by ? How many will need to sell in the next year or will be advised to by their family before the bottom falls out and their inheritance is toast ?

If 10% hit the market in all categories I’d say we’d have one hell of a barn burner sales a happening.

The last RBC affordability chart out in December was within a few percentage points of the old highs in 2010 and surpassed 1994 levels.

We have to be in new territory now which is where all the bagholders will have a sea of regret as Vancouver buyers last year at this time. Victoria blow off top is right now.

http://www.rbc.com/newsroom/_assets-custom/pdf/20161221-ha.pdf

Not sure if you were referring to me, but I think income stats are important, absolutely – my comments were to address the assertion (which I think is correct) that income alone isn’t driving this market.

Great point, Leo…

Not sure why people think that income stats aren’t important. If the market wasn’t mostly determined by local affordability then we never would have had a flat period from 2008 – 2014. Prices would have just kept rising forever if it wasn’t about affordability being too stretched. Fact is every time affordability really deteriorated prices corrected until affordability was better again. Is it different this time? Maybe, but it’s too early to tell. The recent runup has not put us into new territory.

Just Jack/John Dollar, you really don’t understand.

One less seller has a similar effect on the market as one more buyer.

Let’s take two people. A wealthy senior and a poor senior, both with low income. The wealthy senior stays in her home because she can afford to. The poor senior can’t afford to maintain her home so she sells it, adding one more seller to the market.

As you can see, wealth clearly has an impact on the market. I’ll put it simply for you – wealthy people can carry houses for longer and at higher valuations. Econ 101. This is clearly a part of what has happened in Victoria.

As for your facile analogy of the car, there are clear differences. There is not a strictly limited number of cars in Victoria. By not selling my car, I am not preventing anyone else from buying the exact same model, and driving it on the exact same streets.

Next time, think before you type 🙂

Keep up the Trump cheer Mike, he’s going to single handedly take down the US housing market which will no doubt reverberate across the border when the credit market goes for a shit. That ole ripple effect you always refer too. 😉

Why Trump’s Immigration Crackdown Could Sink U.S. Home Prices

https://www.bloomberg.com/news/articles/2017-02-22/why-trump-s-immigration-crackdown-could-sink-u-s-home-prices

“It certainly helps to explain why Victoria has always been expensive, but, as you say, it doesn’t really explain the recent price jumps. Although all that extra wealth would certainly have helped with downpayments etc. Perhaps what we’re seeing is a cycling of money from other asset classes (stocks, real estate in other areas) into Victoria real estate.”

Prices are being driven by a convergence of several factors.

Stocks. I don’t know about you guys but my paper gains over the last few months have been very decent indeed. I have a heavy position in Shopify that I’ve held since the fall. I’m not the only one. There is a global asset bubble here; the world is awash in cheap money. I almost feel foolish for working the desk job, really, at this point. My significant gains over the last few years have been in asset inflation, not income.

Values and FOMO. Buying real estate has been more of a priority for most people. The increases have forced more people into the market out of fear, and there has been a bigger focus from extended families for children to hitch a ride here. I know people who wouldn’t have paid more than $500k for a place 5 years ago that are now looking at $800-900k houses. They haven’t suddenly come into tons of money – it’s that they have been pushed to really ask themselves what they’re willing to sacrifice now. This decision has been buoyed buoyed by the perception, right or wrong, that they’re purchasing an asset that will not depreciate and is , therefore, risk-free.

There’s so much discussion around property decreases as the inherent risk in real estate, but I think the biggest risk in taking on such a huge amount of debt is to relationships, lifestyle and health that comes with carrying that burden. There are a lot of people who have access to capital through wages, stocks and family help. I also know there are people out there that don’t.

AG, retirees staying in their home doesn’t have any effect on market prices.

The real estate market only consists of willing buyers and willing sellers. And only around 3 percent of the total housing stock is ever up for sale. That’s the size of the real estate market at around 3 percent.

The remaining 97 percent or so have zero effect on prices. The real estate market is made up of those actively buying and selling.

Just to dumb it down for you. I assume you own a car. How is owning your car having an affect on car sales today.

How about this for a bear theory to pick apart.

After the GFC (can you believe it was almost 10 years ago?) some bulls were arguing that people got scared of ethereal stocks and wanted bricks and mortar; and money, therefore, moved that way. Now that the markets are hot (my couch potato “assertive” portfolio has done better that houses over the past few months) and up for a long bull run (according to some), will sentiment change and money starts flowing in the opposite direction?

“As a matter of convention in debate, the claimant always bears the burden of proof, not on the listener to do the opposite.”

Blah, blah..

“Ultimately, it’s fed from the bottom up. Lots of wealth amongst retirees doesn’t really help move the market as a whole, IMO.”

It does, actually. Retiree wealth enables them to stay in their homes, even when their incomes suggest that they can’t afford to live there. Often, those homes are older and they are, in effect, competing directly with first time buyers. Wealth is a very important driver of real estate prices.

@ AG,

As a matter of convention in debate, the claimant always bears the burden of proof, not on the listener to do the opposite.

However, let’s go with the presumption that you are correct in as far as a lot of latent wealth – in that case, the money isn’t where it needs to be in terms of continuing to drive the broader market.

Ultimately, it’s fed from the bottom up. Lots of wealth amongst retirees doesn’t really help move the market as a whole, IMO.

Yes, intergenerational transfer of wealth will exert an impact, however there would be a few issues with relying on that. Firstly, we can see nationally that it doesn’t seem to be helping most of the other markets – and in the ones that are on fire, mortgage debt is exploding.

Additionally, that latent wealth is not productive inherently, especially if it just moves to the next generation to buy housing. That can’t go on forever – sooner or later new wealth will be required. I don’t think foreign buyers will pick up that slack, either…

“@ AG,

That’s just speculation on your part which begs the question. I doubt you have that data that can prove or disprove the degree of latent wealth here. While I don’t doubt that it exists to one degree or another, but I don’t think it explains the behavior of the market.

And most government pensions are not large by any means.”

I can’t prove anything, but it makes a lot of intuitive sense. Government pensions tend to be more generous (and probably safer) than private sector pensions. And there are certainly lots of retirees and business owners that have moved here (including me).

I’m not sure that I need to ‘prove’ something that seems so obvious. Rather, I think the onus is on you to disprove it 🙂

It certainly helps to explain why Victoria has always been expensive, but, as you say, it doesn’t really explain the recent price jumps. Although all that extra wealth would certainly have helped with downpayments etc. Perhaps what we’re seeing is a cycling of money from other asset classes (stocks, real estate in other areas) into Victoria real estate.

Jeez, I find myself using that word a lot lately. “Speculation”

@ AG,

That’s just speculation on your part which begs the question. I doubt you have that data that can prove or disprove the degree of latent wealth here. While I don’t doubt that it exists to one degree or another, I don’t think it explains the behavior of the market.

And most government pensions are not large by any means.

There is certainly plenty of wealth here. The income statistics don’t account for:

retired people with wealth but low income

business owners with retained earnings inside their companies (this includes many doctors and professionals too)

government employees with average incomes but large guaranteed pensions

Just Jack might describe Victoria as “income poor and house rich”, but the reality is that, for many locals, income doesn’t reflect their wealth at all.

I personally know of at least two builds in the last year that were rented out after completion. I agree with you I don’t think the economics make sense but the builders thought differently.

Luke, I’m tired of being played by agents that under price listings for properties that will likely sell in the 1.1 million plus dollar range.

It has become a waste of time to even look at these properties.

Luke

I think that one goes for higher.

Luke,

I have seen stats showing BC, in general, is having the highest debt load in Canada (I think) and it has been attributed to house prices (which is reasonable to include Victoria). If I find a link I will post.

2153 Sandowne Rd listed today at $949,9k. Looks to be priced appropriately on a generous lot on a quiet street in North Oak Bay. Tidy and fixed up, I think this one will go quick.

I have always heard Victoria being known as income poor and house rich.

The thing is ‘Local Fool’ we don’t have access to those statistics, so how do we know? There are more high paying Gov’t related jobs here than an average community. Also, more wealthy retirees here. There’s also a lot of people that have been here for a very long time and bought in when it was much cheaper. So I have to wonder what the stat’s for the local area really are, compared to the National Avg.

@ Luke,

“I’d bet that there is less debt loads here as I think, there are more affluent people here than the National average.”

Not so sure about that. The median income here is not terribly high relative to the national average, and Victoria has one of the highest rates of >450% mortgages in the country.

When it comes to condos in the city we are at the point where agents can start auctions/deferred offers on some of the better condos. We could see a real pop in condo prices this month and into the next few months.

Re. Canada’s household Debt loads at 168% now higher than ever before. And – that is the highest in the western world. Even higher than European countries that often have a higher cost of living than Canada. Is this a reflection of our lack of high paying (and secure) employment in anything outside Government-related jobs?

These are National statistics, and I have to wonder – what are the Stat’s for Victoria? I’d bet that there is less debt loads here as I think, there are more affluent people here than the National average. Also, almost all the high paying jobs here are Gov’t related.

Question is – how to we access statistics on peoples debt in just the CRD, for instance.? Or even – how about debt loads in the ‘core’. Would be interesting to know how it compares to the National average.

“Why are you quoting an article about Toronto as evidence of what is occurring in Victoria (if I understand you correctly)?”

Because all the same circumstances affecting Toronto are happening here – if you read the article, you’ll see references to everything we’ve discussed on the blog.

Also, Toronto and Victoria have seen similar spikes in prices since last summer.

Home Prices Sail in Toronto, Hamilton, and Victoria

http://www.theglobeandmail.com/report-on-business/top-business-stories/home-prices-soar-in-toronto-hamilton-victoria-as-even-vancouver-rises/article34015179/

If Fed gov’t increases Capital Gains back to 75% it will lead to even more people avoiding placing investment homes on the rental market, or renting out suites in their houses to permanent tenants. Better to go AirBnb/vacation rental or rent to students who don’t file taxes at your residence, or rent your suite to an in-law, or- just eliminate the suite altogether esp. if you’ve owned your home in Victoria or Vancouver or GTA since the 1980’s, or even in recent years during the recent large price increases (the Capital gains being huge on those kind of price gains).

Now, even if there isn’t any change in the Capital Gains rate, we still have to deal with the new ‘Principle Residence Designation’, effective Jan 1st, 2016, on the Income tax form placing people further under the CRA’s microscope than ever before. Welcome to Canada – what we do best here is tax tax and more tax (they don’t really want you to get ahead). When you sell your house, the CRA, weather or not they intend to pursue the Capital gains on the ‘portion’ of peoples homes that is a suite (this is still unknown), is now discouraging people from renting out suites to permanent tenants. This is because the benefits people derive from doing that are now eliminated, or even reversed (it could end up costing them more than they gain to have strangers in their homes). Once they go to sell their house they have to declare the part of the house that is the suite as ‘capital gains’, so why bother even having a suite? With permanent tenants, the CRA will know they are there b/c of ‘cross referencing’ income tax addresses. Way to go T2, you are making the housing crisis, and lack of rentals available, even worse.

As for why both the Prov and Fed Gov’t aren’t encouraging any more ‘3 storey walkup’ rental buildings that were built on masse with policies that encouraged this in the 1970’s. I’d have to wonder, with these new Capital Gains policies, why? A rental crisis is already here and looks to be shaping up to become even worse under these kind of Orwellian policies. The least they could do is offset it by encouraging developers to build rental buildings once again. They are also discouraging ‘co-op’s’ with their new policies as well. Where are people going to turn for housing?

I also wonder, now that the Capital Gains is under the microscope on the Income Tax form – will more people just stay where they are and not move at all in increasing numbers? After all, why bother moving at all when the cost is now even higher than ever before. You’ve got sky high Realtors commissions, PTT (and possibly GST) on buying the next house, lawyers fees, moving costs, aggravation of trying to find another place when listings are almost non-existent and now: Ta da! A potentially enormous Capital Gains tax bill when you sell your house that could be huge on the portion of your Principal Residence that was a suite! We are heading towards a communistic kind of approach to inhibiting people’s movement, doing it ‘Canadian style’ through mass taxation. Listings will drop even more as people stay put as the cost of moving becomes too high.

Why are you quoting an article about Toronto as evidence of what is occurring in Victoria (if I understand you correctly)?

RE markets are local with some national factors like interest rates and lending rules. Saskatchewan, Winnipeg, TO, Vancouver, Victoria…. local and really different in who is buying imo. I’m no expert on the TO market but I do know their rate of foreign ownership and investment does not compare to Victoria. Heck, Victoria and Vancouver are far apart on that too – and there are stats now to measure this.

” The only time a house or condo in Victoria might be preferable to stocks is if you are using financing and trying to leverage appreciation, a high risk endeavour given the low rental returns.”

Yes high risk – that’s a major problem today – a lot of people & institutions who don’t acknowledge the risk. Try telling that to all the condo investors Bob Rennie sells to.

“No, it is likely homeowner behaviour in an appreciating market. ”

Not according to some analysts.

From the Financial Post article:

http://business.financialpost.com/personal-finance/mortgages-real-estate/nobodys-cheering-expect-real-estate-agents-the-trapped-wealth-of-torontos-unrelenting-housing-boom

“Supply constraints don’t explain the price gains for condominiums, which have seen a flood of new completions …

“So, if home sellers are not driving demand, is it first-time home buyers? It’s tough to argue yes. The federal government has been tightening mortgage rules for a decade, and took some significant steps in October. ”

“If it’s not sellers, if it’s not first-time buyers, then who is buying?” said Robert Hogue, an economist at Royal Bank of Canada.

“We can’t say for sure, but by deduction it’s got to be probably investors are buying quite a bit.”

@ Totoro,

In my uneducated opinion, I think prices are more or less going up, because people think they ought to. I suppose that would inspire confidence, at least for a while.

Yes, but I don’t think it is what Vicbot was getting at. I think he was getting at people buying housing as an investment outside of their primary residence.

I just disagree that this is the main issue. This market incentivizes investment in a primary residence and shows people it can really pay off if you sell. LeoS doesn’t count his home equity but most do and this keeps consumer confidence up and people buying homes at higher and higher prices. Part of the market cycle in confidence. Things will change one day.

@ Totoro,

“No, it is likely homeowner behaviour in an appreciating market. Homeowners have increased confidence in the market and are willing to invest their retained equity and their credit limit in an asset they believe will be a good investment. ”

I think that’s speculation, is it not?

Localfool, If you don’t list your home then you are not a part of the market.

So instead of saying I wouldn’t sell because there is nothing to buy and that’s why listings will remain low. You should also see that there are many, many reasons why people choose to list their homes. And because high prices have reduced sales, we don’t need a lot of listings to tip the market.

Then with more listings you might find yourself saying that there are homes you would like to buy and you then would list your home and add to the inventory.

What will happen is what has happened in all markets before. We won’t be able to point to one single factor why people choose to sell but they will choose to do sell around the same time.

No, it is likely homeowner behaviour in an appreciating market. Homeowners have increased confidence in the market and are willing to invest their retained equity and their credit limit in an asset they believe will be a good investment. And to date they’ve been right. The numbers change when it is not a primary residence and it is no longer such an attractive proposition imo.

Where is your evidence? As far as I can tell we don’t have a high rate of foreign ownership, nor is Victoria a particularly good market for speculation unless you are willing to home long-term. If you have that kind of cash you’d be better off in the stock market. The only time a house or condo in Victoria might be preferable to stocks is if you are using financing and trying to leverage appreciation, a high risk endeavour given the low rental returns.

In Victoria in the last 10 years? Who the heck is doing that? What an odd way to try to make money given land prices and construction costs vs. rent. SFHs don’t make sense to build to rent out imo.

@Michael. Say it with me 3 times.

CORRELATION DOES NOT IMPLY CAUSATION.

CORRELATION DOES NOT IMPLY CAUSATION.

CORRELATION DOES NOT IMPLY CAUSATION.

“I know of three homes personally that were built because the investor wanted them built to rent out. The people who rented the homes were happy to get a house that they could not afford to buy themselves.”

This is the quagmire and endless loop we find ourselves in. Back in the 70s & 80s, purpose-built apartment buildings were constructed for those who needed rentals – with 1 bedr, 2 bedr, & bachelor suites. Because the majority of homes were being bought by owner-occupiers, people weren’t competing with investors to drive RE up. If the cap gains tax rate went up, it wasn’t the end of the world, because investors with apartment buildings held for the long term, 30+ years. It was rare to have a suite in your house.

Nowadays, too many local & international investors see RE as the way to make $$ – they’re driven by low interest rates & capital flight reasons & lax gov’t oversight to buy & flip houses or condos that aren’t owner-occupied (part-time homes, vacation rentals, monthly rentals) – which in turn, artificially drives up demand for housing, which drives up land costs, drives up material/labour costs, etc etc. (back in 2014, Brad Lamb of Toronto told CBC that 50% of the city’s condos are foreign owned)

Yes there’s an increase in population, but as that Financial Post article pointed out, it’s not population increases that are causing tight inventories – it’s runaway speculation – too many speculators chasing condos, townhouses, & houses that should have been built for middle- or even high-income single families, not $2.3M luxury homes, which benefits only the investor.

@ JD,

I guess that depends on how many sellers are willing to list. If I was selling and wanting to remain here, where would I live? There’s very little selection. It seems like a vicious circle. I know that circles break eventually, I just don’t know what the catalyst tends to be.

Are there more high end properties selling this year over that of last year?

It really depends on where you live.

If you look at all properties in all areas then the answer is no. Looking just at houses the answer is yes and that is even more pronounced when it comes to the core.

Concentrating on just the three areas that are experiencing the majority of gains in the market- Victoria, Saanich East and Oak Bay.

Most sales are centered around a million dollars today in these three areas. One year ago at this time house sales in these three areas centered around $700,000. But there have been 240 fewer house sales this year too and most of that loss has been in the middle income household market. The big gain so far is in the $900,000 to $1,250,000 with an increase of 8 year over year sales since the beginning of the year. All other price ranges have had a decline in sales.

There is no longer a market for the first time house buyers or middle income households unless the buyer (s) put down an uncharacteristic massive down payment of say 40% from the sale of another home or a “gift” from another source. The number of buyers that fit this uncharacteristic profile is much smaller. Luckily active listings are low enough to sustain current prices.

Historically active listing start to increase in March. It will be interesting to see what happens at these elevated prices when more inventory comes onto the market with fewer buyers to purchase them.

“I think what’s at play here in this weak December number is not just payback from the strength earlier, it’s also reflecting the fact that Canadian households have racked up a bit of debt ”

LocalFool,

Just “a bit” of debt. Like 168%, lol. Sales couldn’t be down from all those part time jobs could they ? 😉

The last 60 years of house price moves with rising interest rates never had this amount of debt like an anchor for many years to come. 1980 only had 66% household debt.

PTT exemption increased to $500,000 in the budget. I remember a few years ago there were still houses available under $500,000, but now that’s likely to just apply to condos.

1 in 4 Vancouver homes could be torn down in next 13 years: study

http://www.cbc.ca/news/canada/british-columbia/vancouver-teardowns-2030-ubc-study-1.3993312

This fascinating. Seems like Victoria’s ratios aren’t like Vancouver’s, meaning far fewer tear-downs here.

Blame record-high debt for retail sales slump in December: BMO

Canadian retail sales unexpectedly declined in December, marking the biggest drop in nine months as consumers bought fewer new cars and spent less during the holiday shopping season, data from Statistics Canada showed on Wednesday.

The 0.5 per cent decrease was worse than economists’ expectations for retail sales to be unchanged, while November data was revised slightly higher for a gain of 0.3 per cent from the originally reported 0.2 per cent.

December’s decline, the biggest since March, was widespread, with nine out of 11 sectors posting lower sales. Purchases at motor vehicle and parts dealers were down 0.9 per cent due to less spending at new car dealers, which offset increases elsewhere in the sector, including auto parts stores and used car dealers.

But BMO’s Director and senior economist thinks there’s more to the numbers than ‘payback’ for a few strong months.

“I think what’s at play here in this weak December number is not just payback from the strength earlier, it’s also reflecting the fact that Canadian households have racked up a bit of debt – especially in the Toronto and Vancouver regions where house prices have gone up a lot. Families have taken on more debts to get into the market. So I think that ultimately is restraining Canadian consumer spending,” Sal Guatieri told BNN Wednesday.

http://www.bnn.ca/blame-record-high-debt-for-retail-sales-slump-in-december-bmo-1.678090#_gus&_gucid=&_gup=Facebook&_gsc=GV78YOf

I doubt very much that any capital gains on houses would go up that much. If the federal government brought in anything too punishing then who is going to build any investment properties???? It just would not make any sense to do that and so I would think that any increase would be balanced and fairly modest. There is enough of a rental crisis already! The government can’t afford to punish those who are building rental housing stock by shooting them in the head.

Increasing the capital gains on houses might be a fair enough idea. But by how much? People who invest in homes are also providing a service to the renter and my question is…. should that important service be punished too much? I know of three homes personally that were built because the investor wanted them built to rent out. The people who rented the homes were happy to get a house that they could not afford to buy themselves. If the capital gains tax is raised too much then the investor will sell the houses to someone who will likely want to live in the house and the renters will have to find some other place to live. My point is that increased taxes are disruptive and cause harm. So it has to be balanced and reasonable.

I also heard that – rumours of cap gains tax going up to 75%. Investors will not be pleased.

I just heard that the federal government is proposing to increase capital gains in new budget. Guess the Feds want to get there share of the house hoarders sales. It will make it less attractive to sell a rental homes.

There appears to be quite a bit of demand for the upper end SFH rental house. I’m noticing demand from a number of people from the mainland and the US – most of them appear to be looking for a temporary place while they decide if/where to purchase. I’m also thinking that there is going to be a decent demand for upper end ranchers in about 5-10 years.

That would lead to my Halibut with horns hypothesis last year. I’m not there anymore. Now I’m just a halibut riding a bull. One that is charging the streets of Pamplona goring millennials looking for a life experience….

Maybe. The last two corrections were more or less plateaus because interest rates dropping brought affordability back in line with fundamentals. Once this run dies out, it is going to be interesting what the next correction looks like now that rates aren’t likely to be able to go much lower.

Trading only.

I’m licensed with Fair realty (see about page). Seem to be the most reasonable around as far as monthly fees. Still, likely about $4k/year to keep the license once you add up VREB, brokerage, CREA, BCREA.

BTW Mike since you tout the TSX run all the time, did you know if you take away the banks the TSX is down since your buddy Trump got in ?

I can see where you learnt your scumlord ways Mike. Trump’s swamp is getting murkier by the day. Jail won’t be far off as his clowns sink America for good.

“Mr. Schwarzman has flourished during the four decades that the people Mr. Trump purports to represent have languished. In the pursuit once known as leveraged buyouts — before some marketing genius fastened on “private equity” as a way to disguise the fact that the business still rests on a mountain of debt — Mr. Schwarzman and his brethren have become symbols for the economic inequality that Mr. Trump deplored during his campaign. They are able to borrow billions and deduct interest payments from their corporate tax bills while $75,000-a-year wage earners in Ohio, Michigan or Pennsylvania are unable to secure a mortgage and get no tax break on their monthly rent.

Just like Mr. Trump’s real-estate business, groups like Blackstone rely on enormous debt to prop up their business. The playbook for any of their acquisitions is to gain 100 percent control by financing the purchase of a company with a small down payment and a heap of debt secured not (heaven forbid) by their own savings or houses, but by the business they are looking to acquire. They then cut costs — which almost always means making sizable layoffs at the company they’re taking over — and figure out a way to reward themselves financially.”

You’re thinking a bit too linearly. Lots of our mortgage bonds are denominated in European currencies for instance.

Regardless, if you believe Canadian fixed mortgage rates continue to go up (~50 bps lately), at least be prepared for our prices to continue rising. Victoria has a near perfect 60-year track record of jumping for a few years as Cdn 5-yr mortgage rates start to rise.

Good point James, an increase in Canadian rates would be a defensive move to stop a flee of capital not a move to fight inflation from an over heated economy.

They’re not raising the rates in this country Michael.

They’re raising them in the US. Which will affect our bond market, and increase the rates that the banks charge.

“Twenty-five out of 26 times when interest rates went up, home prices went up,” Schwarzman said.

After all, interest rates only go up if inflation goes up. Btw, Schwarzman has been chosen as one of Trump’s top advisors.

“To see a serious drop interest rates would need to go up.”

They are going up. Probably again as soon as next month.

If the Fed starts to unwind QE, then look out.

@ JD,

Yikes…but Blanshard Courts/Travelers Inn are not condos. Nice try.

Marko, I highly doubt you will ever have a difficulty renting a downtown condo.

Problem is this makes downside in terms of market value sticky. If you can rent and not bleed in terms of cash flow per month psychologically people don’t want to sell at a loss so a large portion just continue to rent limiting inventory until the market improves.

If you couldn’t easily rent and mortgage rates went up then there would be a hole lot more downsize.

“Since 1988 there have been 8 years of YOY SFH gains in excess of 15%.”

Thanks…was 2016 an outlier?

Marko, I highly doubt you will ever have a difficulty renting a downtown condo.

Although you should have some vacancies as tenants move on and you need time to paint the suite, clean the carpets and get the blood splatter off the bathroom tub.

Just kidding – you don’t have to paint the suite.

Since 1988 there have been 8 years of YOY SFH gains in excess of 15%.

Bingo:

Rather than waiting for an inheritance, perhaps the better coarse is to marry rich. That does not guarentee a wonderful or happy marriage but after a few years it allows for a great and happy divorce.

Marko,

For a balanced view, what are the three biggest YOY increases over the last 32 years?

Thanks

R

I think 32 years is long enough to give people a lot of confidence that the market could never go down, or if it does – it will be like 2012. Probably has led to a lot of financially reckless decisions…

If there is a correction the way I see it is maybe 2-3 years of 2 to 2.5% drops/year and then 6-7 years of flat waiting for inflation to eat into it.

To see a serious drop interest rates would need to go up and the rental market would need cool off and it wasn’t even that cool 2011-2014….I had zero trouble renting my units downtown with multiple applications. By 2014 it was nuts receiving 10+ applications in 24 hours.

@ Marko,

I think 32 years is long enough to give people a lot of confidence that the market could never go down, or if it does – it will be like 2012. Probably has led to a lot of financially reckless decisions…

But the thing with Vancouver is that it’s only those who bought within the last year who are down anything. I gambled on a correction here last year but the market went up 25%. If I had bought pre- last year’s big run up I’d be way ahead right now and would have lots of cushion room for a correction. Another big leap in prices could happen this year in Victoria (as looks to be the case right now). It’s just as much of a gamble not to buy as it is to buy.

And that is the thing….in the last 32 years these are the biggest SFH drops YOY.

1995 – 5.47% drop

2011 – 2.55% drop

2012 – 1.72% drop

Once you go below 2% principal repayment becomes faster than the drop.

Not saying the market couldn’t tank 10-20% but we just haven’t seen it since the early 1980s.

I do not think that people really appreciate how political living in a condo can actually be. If there is an outdoor pool there is a constant battle over what hours it should be open and whether you can bring guests or the number of guests and what hours for adults and children. Arguments also break out over

what are acceptable pool chemicals to use and which are green enough.

The year i spent renting a condo gave me a new insight into the word petty. I clearly remember one of the first things I did when I moved into the house was to light a cigar on one of my balconies. People really need to do a lot more research before buying a condo.

The number 8 is considered good luck as it sounds like the word for luck in Chinese. But it doesn’t apply to the ask or sale price of a property. The number relates to the address.

I met an agent years ago that always put 8’s in the price because it was his signature. Much like Donald Trump’s hair. Chinese may be superstitious but they aren’t stupid.

@Barrister

The only draw for me on 469 Monterey would be the location. That’s really nice proximity to the beach. 150 amp service is strange. The difference in cost between 150 amp and 200 is negligible (at least when I priced it and went 200). Baseboard heat supplemented by 3 fireplaces? No thanks. I may be pro fireplace, but more isn’t better. It’s a tiny house. 1 is plenty. The others should be gas for ambience and supplemental heat.

I’d want to immediately upgrade to 200 amp service and add a heat pump system. Obviously I’m not Oak Bay material since I have issues with burning money on baseboard heat. Even oil or gas would be so much cheaper. Baseboard is cheap to install though.. makes you wonder what else they scrimped on.

Anyhow, out of my league, so my critique is moot. Ran the mortgage calc quick: at least an additional $800/month in mortgage (more to keep my current amortisation), $400/month extra in property tax, hundreds more per month in heating, more in maintenance as it’s an older home etc… I’d be looking at at least 15K/year extra to “move up” into that place. But dammit if I don’t want to live that close to beach drive.

Be interesting to see what it goes for. I’d need more equity or more income to make that feasible (or forget investing and bet it all on further property values gains).

I ran the numbers if my parents passed tomorrow and left me a “fair” % of their estate (they owe me nothing.. and I don’t expect anything). Definitely affordable in that scenario. My parents are still young, so not a realistic scenario. That said, they recently received an inheritance and could trade up. God knows they’ll do something silly like invest in GICs which won’t even keep up with inflation. Even at current prices I’d hazard there’s a better chance of an OB house keeping up with inflation than not.

Hey Leo, congratulations on the RE license. Did you just do the trading license or did you do rental or strata management as well?

I’m curious about which brokerage you went with any why, if there’s anything you can disclose there. I assume since you are mainly in this for the data, you went with the cheapest brokerage possible. Did you shop around? If you did, what was the range of costs?

2 interesting stories on houses & condos …

Nobody’s cheering, except real estate agents: The ‘trapped wealth’ of Toronto’s unrelenting housing boom

http://business.financialpost.com/personal-finance/mortgages-real-estate/nobodys-cheering-expect-real-estate-agents-the-trapped-wealth-of-torontos-unrelenting-housing-boom

“Pricier real estate also drives away less-affluent, younger people and boosts the cost of doing business, eroding competitiveness.”

(the analysis comes to the conclusion that investors are driving up prices, and one possible way to address it is clamping down on unregulated private mortgage industry)

Another article on rising strata council battles …

http://www.cbc.ca/news/gopublic/i-feel-bullied-says-condo-owner-taken-to-court-over-backyard-garden-items-not-allowed-in-bylaws-1.3985979

“It’s never been a bigger gamble to buy if you are in it to make money. The easy cash got made and you’ll never see another year like it to take the cash and run.”

I want a house to live in long term.

i see that 469 Monterey has lowered its price from 1.2 to 1.15. Interesting reduction in the heart of Oak Bay.

The lucky wining bid. Probably submitted in a red envelope. It’s a blind auction after all so you need to place your 8’s wisely.

List price with 888s makes sense, but sales price? I don’t get it.

Yes, Gordon Head is hot. I need to keep reminding myself that it’s February. Seemingly every house that comes to market in GH goes something like this:

List: $788,000

Sale price: $912,888

DOM: 4

Notice the eights?

Hillview is a nice, quiet street.

Mark Lane at Willis Pt. isn’t really all that great… good luck to them!

John Dollar -” It looks like the world has discovered Langford and Colwood.” many less homes in the core this year? Yes, of course, the Westshore will continue to be popular, where else is there to go? Saanich Pen. being all that’s left is Ag or FN reserve…

cavaet emptor – loved the cool publication on immigration to Canada up to 2014!

Owner occupied homes mean no GST or CGT. That explains about a couple hundred grand in taxes not having to be paid for Victoria Ave in South Oak Bay. Yes, indeed, it would appear Canada is shaping up to be the land of taxation…if T2 gets his way…? We will see in these weeks budgets… (Chrusty Clark is also releasing hers…). But guess what? If my experience living in the UK is anything to attest by.. people will always find ways around taxation… end of story!

1682 Hillview Ave for $912,888

@ Joker,

And 2.9 is reduced from their earlier ask of 3.7. They can ask whatever they want. Speechless is if someone comes along and pays it…

VicRenter , the odds of another 20 to 25% are highly stacked against you. It’s never been a bigger gamble to buy if you are in it to make money. The easy cash got made and you’ll never see another year like it to take the cash and run.

New listing today: 7442 mark lane sold for around 1.4 May/2016, now for sell for 2.9. Simply speechless.

@Marko re: Mars: that bit in the description about it being back on the market was just added in the last few days or week. I was wondering if an offer collapsed.

“How does it feel to be down 20% in 6 months ? Victoria will find out soon enough.”

But the thing with Vancouver is that it’s only those who bought within the last year who are down anything. I gambled on a correction here last year but the market went up 25%. If I had bought pre- last year’s big run up I’d be way ahead right now and would have lots of cushion room for a correction. Another big leap in prices could happen this year in Victoria (as looks to be the case right now). It’s just as much of a gamble not to buy as it is to buy.

The number of listings to agents is nuts. There should be a lot of agents leaving the industry.

1.15 listings per realtor 🙂

This market is like a hot stock with a high insider holding, a low float and buyers keep hitting the high ask because “it’s a sure thing”.

Those type of markets never end well with rapid downside like Vancouver has experienced. How does it feel to be down 20% in 6 months ? Victoria will find out soon enough.

Thanks for the numbers JD.

The number of listings to agents is nuts. There should be a lot of agents leaving the industry.

It does seem bizarre that prices are increasing and yet there is a drag on the economy.

If you asked yourself what would you experience before a market contraction, I would guess some of the answers would include a lot of what is happening now.

Remember the good old days when house prices were increasing along with sale volumes.

That’s right Hailbut if sales get much lower we should hit the million mark.

Unfortunately this causes another problem as the total value of gross sales is in decline. So while houses are more expensive, fewer people are making money. And that has an effect on our local economy as people become unemployed or underemployed.

Month Sales, $ Volume

Sep 2016 $160,352,165

Oct 2016 $147,276,429

Nov 2016 $144,388,126

Dec 2016 $83,101,136

Jan 2017 $85,806,249

Feb 2017 $82,382,574

$900,000 median?

We’re creeping closer to Mike’s prediction of a million dollar median by July 2020.

Marko:

That seems to be obvious speculation to me. People aren’t looking to live in the homes and are betting on the land value, not the home value, to provide a return on investment.

Just wait for the neighborhoods to start clearing out, maybe not at the same rate as Vancouver’s did though.

I wonder how many Canadian cities will experience this before meaningful legislation is put in place to counteract it. I’m guessing it won’t be until the BC and Canadian economies aren’t completely reliant upon real estate, construction, etc. for GDP growth.

John Dollar:

Thank you for the numbers. They are very interesting. I find it particularly interesting that in spite of a decline of sales in the core average prices have still risen.

@Marko: Any idea what’s going on with Mars St? I’m wondering why the listing says it’s back on the market.

It was on the market 4 years ago.

No offense John, but as you can see below you don’t seem to excel at estimating sales late in the month. Take last month for instance where core house sales ended up at 92.

January 25, 2017 at 3:48 pm

“there have only been 62 house sales in all of the core districts of Oak Bay, Saanich East, Saanich West, Vic West, View Royal and Esquimalt!!!!!!! ..YIKES!!!!! Could this be the start of an economic recession?”

Something that has been confusing me in the trenches the last few weeks is why some homes are heavily pre-inspected and others are not (condition of the home doesn’t seem to influence it one way or another).

I’ve stopped counting how many offers I’ve written since one was accepted but must be getting close to 30…..I’ve had two situations in the last two weeks with 5 offers and 4 pre-inspections each but I’ve also had two situations with 5 offers, only 1 pre-inspection each time (my clients), but still getting beat out by other unconditional offers.

Last year I went to the practice of asking the listing agent how many pre-inspections have taken place but the answer doesn’t seem to help whatsoever; seems like a lot of people are willing to unconditional without one. i.e., few pre-inspections doesn’t mean lack of unconditional offers anymore.

A couple of people emailed me last night looking for a buyers realtor to start the hunt and went sigh…..:)

Another crazy thing that an inspector pointed out to me today is there are almost as many realtors in Victoria as listings. 1331 vs 1537. That is nuts.

This month we will have more house sales in the core than in January at possibly 120 units in total. That’s way down from last year when there was 228. If we make 120 sales then this month we will be close to the 10 year low of 107 in 2013

Both the median and average are not significantly different from January around $900,000 and One million respectively. Last years median and average for the year was $751,000 and $863,000

Condo sales are doing well and we may end the month with 160 sales which is close to last years 176 and the ten year high of 180.

The median and the average for condos have increased slightly from last month and are $375,000 and $417,000 respectively. Last years median and average for the year was $317,000 and $363,500 respectively.

This does seem to be shaping up as the year of the condo for Condo’s in the Core

Of course there is a widening gap still between house and condo prices. And in my opinion buying a condo is not the best strategy, at this time, to build equity in order to move up the property ladder.

There are suppose to be a lot of new condominiums coming to the market this year, so we shall see how this shadow inventory will impact the condo market. In fact last year was suppose to be one of the best years for housing starts.

Langford and Colwood detached homes are doing better than the month before and may close at a ten year high as well. The median and average price have creeped up a bit to $640,000 and $693,000. An increase from last years $550,000 median and $593,000 average. It looks like the world has discovered Langford and Colwood.

Luke – This is a cool publication from Statscan “150 years of immigration in Canada” http://www.statcan.gc.ca/pub/11-630-x/11-630-x2016006-eng.htm

They have data up to 2014.

The big change in immigration is that in 1971 90% of immigrants came from US or Europe. In 2011 only 30% came from those countries.

I think Canada does a good job at welcoming immigrants compared to many countries. I also think 250,000 to 300,000 is a hell of a lot of people to integrate every year.

I have no idea what the right level of immigration is, but I would agree that there is some level that is “too high”. Difficult subject to have a rational discussion on though, as anyone arguing for lower immigration levels tends to be labelled a racist.

I don’t have direct stats but didn’t immigration levels to Canada go down in the Harper years? I thought T2 was also more about welcoming refugees, etc than Harper ever was. Can anyone dig up stats on immigration? Also, I wonder how many of these immigrants come directly to Victoria? A small percentage, no doubt. And, is Canada doing a better job at welcoming, housing and integrating immigrants than other western countries? Perhaps this is due to our lack of ‘core identity’ compared to other countries where immigrants likely feel much less welcome and often end up segregated from the mainstream populations.

That’s been the case since 1991 or so. The immigration rate averaged about 250K per year through Chretien, Martin, Harper. 300 K in 2016 is a relatively incremental increase compared to the increase from 100K to 250 K that happened under Mulroney

@Chapman Billy re 762 Victoria

Your information may well be better than mine. The house was definitely owner occupied. I had assumed owner occupied for just over a year to avoid CG , but I guess that doesn’t compute with September completion.

Regardless a remarkable profit. They must have done something right with design that really turned people’s cranks. That plus the walking distance to SMUS. Saves you having to fire up the Range Rover every morning to deliver the kids to school.

@Marko: Any idea what’s going on with Mars St? I’m wondering why the listing says it’s back on the market.

I should say that I actually love condo living in my current situation, which is as a renter rather than an owner. My building is nice and very well run. My unit is also spacious, so although I’d like to buy a house I’m not desperate to get out because I’m cramped. But the biggest reason why I enjoy my rental condo so much is that I don’t have to be involved with building decisions at all. I see the notices for meetings posted in the elevator, smile to myself about how relaxed I feel about not having to deal with other people making decisions that affect my investment, and then move on. I’m never buying again unless I buy a freehold property.

https://www.theguardian.com/world/2017/jan/04/the-canada-experiment-is-this-the-worlds-first-postnational-country