Jan 23 Market Update and the Potential Impact of Low Inventory

Weekly stats update courtesy of the VREB.

| January 2017 |

Jan

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 65 | 160 | 275 |

539

|

|

| New Listings | 130 | 317 | 509 |

934

|

|

| Active Listings | 1424 | 1465 | 1502 |

2471

|

|

| Sales to New Listings | 50% | 50% | 54% |

58%

|

|

| Sales Projection | — | 436 | 447 | ||

| Months of Inventory |

4.58 |

||||

A reasonably strong week of sales but we are still about 17% below last year’s sales pace. Interestingly enough the sales/list ratio is more or less the same so while sales are down, new listings are down about the same amount.

Let’s dig a little deeper into the lack of inventory. With only 1500 properties for sale (many of which are the dregs which I will get into in a future date), it’s hard to believe we will be able to sustain anywhere near the record sales pace of last year. Sure enough so far we are trailing despite no indications that the actual market interest has subsided. But exactly how much fewer sales can we actually expect?

Well last year at the start of January 2016 we had 2517 properties on the market and proceeded to sell 10,622 of them in the year. Start of this January we had 1493 on the market. Setting aside those properties that expired or were pulled from the market (very few last year), about 1000 of last year’s sales came from existing inventory while 9622 of the sales came from new listings (of which there were 13,250 last year).

So the lack of inventory may not be a huge factor holding back sales. Yes we can expect maybe 10% fewer sales due to inventory constraints, but the much more important factor will be new listings. What’s happening there?

I’m quite surprised by this actually because all we’ve been hearing for months now is how people aren’t listing their houses because there is nothing to buy. Turns out this is more or less nonsense since there are just as many people listing their places now as there were when the market was completely dead in 2013. Then as now about 1100 new listings per month or 13,000/year. If they slow down that will put a serious crunch on sales, but if they keep pace we could be close to last year’s sales numbers.

Luke:

I am interested in what you are saying but can you be a bit more specific as to exactly what benefits

occur by increasing the population in Victoria. Specifically how does this benefit the people who already live here? Approximately how much more population and density does the city have to create to get these benefits. I really would like to get a clear picture of what you are suggesting.

New guest post by CuriousCat: https://househuntvictoria.ca/2017/01/26/the-basement-walls-are-crying/

Definitely agree the housing stock is not diverse enough. We need more row house / town houses and family friendly high density developments. Not only in the core.

http://www.focusonvictoria.ca/janfeb-2017/getting-victorias-growth-right-by-leslie-campbell-r5/

Interesting article that mentions how we should concentrate growth in the core areas of Victoria, rather than where it is currently going on (i.e. Westshore). Also mentions how many European cities have dealt with the same issues we now are confronting. We need a more diverse stock of housing to be more welcoming to families and those ‘without a lot of money already’. We need to move away from being fixated on detached SFH’s, which will become more and more unaffordable for most, and we need to offer people more diverse housing choices. Housing should be concentrated along existing transportations corridors, rather than what is currently happening in the Westshore, which is encouraging the use of the automobile. The article states: “We’re talking about a shortage of tens of thousands of housing units. If you already own a home, you are OK. It’s the young people who are just trying to get started—especially families with children that we do a terrible job of welcoming,”

I like Marko mentioning Croatia as it gives the example of other parts of the world with different income/house cost ratio dynamics that make the detached SFH unaffordable for most. (which is starting to happen in the core area here). It helps to show how they deal with housing differently and this is now where we are heading, given that North American planning norms have resulted in vast areas of the core to be developed with the detached SFH, and now people are chasing that in the Westshore as they can’t afford the core.

Victoria is laid out more like a European city than a typical North American city, so this should not be ignored. It is compact, without the typical ‘grid’ numbered streets, and limited for where it can grow (ex. hence, this is why we are one of the only cities in North America with UK built double decker buses in the transit system instead of typical North American longer articulated ones).

1790 Brymea Lane – Quality house built in 2002 – but nothing particularly special and backing onto a relatively busy road and bus route. It sold in July 2014 for $780k. So, it looks like they made a good profit – over $400k tax free in 2.5 years…? Nice work if you can get it.

Another home sold for over asking in Oak Bay today – this time in the Henderson neighbourhood – 3554 Kelsey Pl – listed at $979k sold for $1,017k. Not much over asking b/c it could probably use a bit of work.

I mean not a big on only technical comparisons….

1790 Brymea Lane (Gordon Head): $978,800 asking … $1.225M getting!

Andy7, interesting that you noticed that about Squamish.

I can see what you mean – although people have very different reasons for moving to Victoria, it’s interesting to see how Vancouver affects all the smaller markets, eg., Squamish and Kelowna too. Changes to the real estate market & the economy in the big city have a spillover effect into the smaller markets, because of the extreme price changes (allowing people to move, find other types of jobs, or retire).

Also, I think Squamish/Whistler & Victoria are very affected by changes in the US tourism market & the Canadian $, more than Kelowna, because of their closer proximity to Vancouver and the US – this affects both their economies.

Luke’s comparisons of Victoria’s neighbourhoods to Vancouver’s were very similar to my impressions as well.

A fun mix of personalities on here. Glad to see a few serious posters in between the daily regulars.

On our PCS, we watch things from a low of 850k to 2m, and we are seeing almost everything 850k selling for just over 1m on average. Seems a lot of people are easily able to move on up with equity now. As Totoro pointed out, there is around 70% of the population with a lot of equity that can be used to leverage up easily to the next level, or even move sideways at a much higher number then even a 2 years ago. 1.5m is easily reached for many home owners in BC that owned over the last few years.

With 70% of Canadians having easy access to a lot of liquidity, that will definitely buffer and delay/slow down any future slowdown/flattening of the market. Before the drastic price rise I would say we were at a slightly higher risk of a minor corrrction, but with everyone having a 200-450k backup fund, it will allow many people that would be forced to sell to ride out bumps in the road. This effect will smooth any downside to the market for at least 10+ years, there is a LOT of equity in the hands of home owners.

Oops –

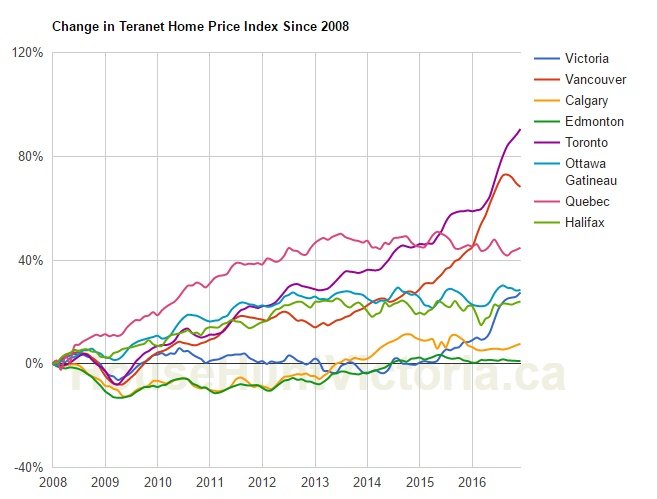

I agree until about 2015 then we look more like Hamilton. Both Victoria and Hamilton may have been subject to the ripple effect of their bigger neighbours…

Or could they be selling condos and townhouses instead?!!!

!!!

Or maybe no quality inventory…..to create sales.

Despite there being almost 300 activing house listings so far this month, there have only been 62 house sales in all of the core districts of Oak Bay, Saanich East, Saanich West, Vic West, View Royal and Esquimalt!!!!!!! House sales are down by 35% in the core from last January!!!!!

YIKES!!!!!

A lot of jobs rely on the real estate market and fewer sales means fewer and smaller pay cheques.

Could this be the start of an economic recession?

Reasonfirst:

Of course they are related – just look at the chart from Brookfield of Van vs Vic. The inflection points are all pretty aligned (except the latest in Vancouver which perhaps is foretelling)…just the magnitude of change is different.

There is going to be a certain relation between the two cities but I would suggest that we are looking at distant cousins as opposed to twins. lol.

The second closest correlation of your inflection points is actually Winnipeg. I’m not sure what that would represent but I don’t think it would be anything Victorians would be jumping on.

And a lot of Oak Bay will crumble when the big one comes.

http://www.empr.gov.bc.ca/Mining/Geoscience/SurficialGeology/VictoriaEarthquakeMaps/Documents/composite_map.pdf

gwac, most million dollar Oak Bay dumps can’t see the ocean , US coastline/mountains, cruise ships nor downtown vista either.

RE: Vancouver vs. Victoria

Of course they are related – just look at the chart from Brookfield of Van vs Vic. The inflection points are all pretty aligned (except the latest in Vancouver which perhaps is foretelling)…just the magnitude of change is different.

http://www.brookfieldrps.com/house-price-index/public-release/

Andy7, I’m not big on technical comparisons. Our market here has so many different elements. Like a diverse economy, land restrictions, retirement destination and a tourist destination. Most important is people working in Van aren’t buying here and commuting.

Except Jack…err Johnny, none of this discussion has even touched on the possibility that as prices for core SFHs rise, the motivation to cash-out also rises especially where you have an older demographic (e.g. Oak Bay). Right now we are in a bit of a stalemate but to not consider this is a one-sided argument.

Hawk

Million dollar view is looking at any dump pretty much in Oak bay. 🙂

“Hope Hawk doesn’t live in that building.”

No fear Intorovert, my building is all reno’d and up to par. Thanks for your concern. My million dollar view for $1300 is well intact. 😉

Hey Hawk, when I’m looking at the markets I’m looking at the numbers. Yes, Victoria has a ferry and is further away, hence it was affected later than Squamish. But Squamish has a highway and a big commute, and is closer to Van hence it was affected earlier but was still delayed due to distance. What I’m talking about is the buy/sell etc numbers, the patterns and the FOMO and language that was being expressed in Squamish that is now being expressed in Victoria and is so similar it’s like deja vu.

“As Langford/Colwood/Sooke continue to grow we will probably be a need for 6 cardiac surgeons over time. The surgeries will still take place at Royal Jubilee and those surgeons will likely want to live in the core. ”

Two more high paid surgeons can easily afford to buy one of those Uplands mansions that have been hacked $500K and languishing for many months. Grasping at straws. Eventually a severe shortage of inventory and high rents starts to decrease people’s desire to move here unless they are filthy rich just like past peaks back in 2012 where free rent was being given away.

It’s a cycle at it’s extreme and thinking it will last forever is just salesman bullshit. This Croatia talk is getting lame, it’s a commie country filled with graft.

There’s a thing called a ferry that makes Victoria different from Squamish, and a very expensive one that will only get more expensive. There’s also a thing called Trump that is going to cause major inflation with his whacko isolation economics. Take away the Asian cash inflows and Vancouver will influence Victoria the downside as it did to the upside.

Dasmo, if you look at the history of Squamish’s real estate prices, you’ll find Victoria is following it to a tee. Squamish was flat for years, when Vancouver took off it followed later. Squamish took off before Victoria did due to proximity to Van.

I know many here think Victoria is not tied to Vancouver’s market but it is. Vancouver is the heartbeat and the beginning of the wave. When Vancouver expands it spreads out over time, just like it did into the Fraser Valley and into Squamish and then affected the island. When Vancouver contracts, other places contract in time as well. Squamish is now contracting, the Fraser Valley is likely to follow suit (if it hasn’t already), and Victoria will in time as well.

Until, we get to the EU status where regular folk don’t even think about a SFH as an option.

True, SFH is not part of real estate discussions in many countries in Europe. In Croatia, for example, sign of wealth is moreso assessed by size of condo and the location. Everyone knows a SFH is only for the top 1% so not a big part of every day discussion. When you salary is 700 euro per month, mortgages are around 5%, and a decent house is 400,000 euros no point in even thinking about it.

I think it’s a weak assumption that wealth increases proportionally with population. I think recent news and statistics would confirm that fewer people have more wealth.

I think the raw number of people increases. I use to work for VIHA and at that time we had four cardiac surgeons and I think they made in the neighbourhood of $450,000 to $550,000. As Langford/Colwood/Sooke continue to grow we will probably be a need for 6 cardiac surgeons over time. The surgeries will still take place at Royal Jubilee and those surgeons will likely want to live in the core. So even if the percentage of the populations making half a million doesn’t increase, the actual number does.

As people, have pointed out no new inventory in Oak Bay as the amount on infills will be in the handfuls. Most of the new homes being built are simply only replacing a teardown and not increasing density.

All that matters is that there are more people trying to sell a million dollar plus home than there are trying to buy one.

It happen in Dubai and they have more millionaires than Victoria.

Barrister: Interesting point on the number of SFH not increasing, while population does. Therefore, there very likely is more people with more money competing for fewer quality homes than even a few years ago. I’d argue incomes are not as much of a factor for SFH prices in the core, especially when you compare it to the Westshore, where incomes are probably much more of a factor, and supply is continuing to increase there, but not so much (if at all) in the core.

When I cited that SFH prices in the core would have to decrease 50% to come in line w/ job related income, I meant that if people only had, say, 5% to put down, this is what would have to happen (so, it’s very unlikely). In that scenario, even if the household had two income earners in the household with higher than average paying jobs. Also, people’s liquid wealth (those not yet in the core market but looking) is not suddenly going to evaporate overnight completely.

I’d also note that comparing Victoria to Vancouver is valid on some points, like lack of land in both cities, and a high number of SFH’s, now unaffordable for many, left over from decades of poor planning practices that favoured low density and lack of variety in housing. However, despite geographical proximity, these are two completely different cities with completely different historical price fluctuations and different fundamentals at play, which will continue to be the case (ex. Vancouver was a target for Chinese buyers while Victoria wasn’t). If something happens to Vancouver, it doesn’t necessarily mean Victoria will just follow suit.

I do get why people often compare the two cities, as a former Vancouver resident, on moving here in late 2015 (after 8 years living ‘up island’), I often drew interesting comparisons between the two cities – for example, I thought of James Bay being like the West End; Fairfield a bit like Kitsilano, Rockland like Shaughnessy, Oak Bay a bit like the West side, Fernwood like Mount Pleasant, and so on…. while the area’s are all different, it did strike me that each neighbourhood/area appeared to compare to a ‘hood in Van in it’s own way.

Kelowna could be cited as more comparable than Van, but still different than Victoria in many ways. The CRD as a whole is larger than Kelowna, with a regional population of about 370,000; with the core at 245,000. Compared to Kelowna at 127,000. I don’t have much familiarity with Kelowna though.

If you are interested, the CRD released some fact sheets and projections to 2038:

https://www.crd.bc.ca/docs/default-source/regional-planning-pdf/Population/Population-PDFs/2014-population-employment-amp-dwelling-projections-to-2038.pdf?sfvrsn=2

As for who can afford the dwindling number of quality SFH’s in the core moving forward? I’d bet most people have a lot of equity from previous properties, help from their elders, (or inheritance) to put down on a house as a large down payment. Jobs factor in for some and are part of the story, but not for retirees. Also, no longer just ‘newly wed or nearly dead’, both Victoria and Kelowna are getting younger and more diverse demographically, so this will change the dynamics moving forward as well.

CuriousCat:

I think people are drunk off of land value and perceived future land value. They might be right though…

Agreed. Victoria is not the next vancouver. Kelowna is probably not a bad comparison with Victoria having more well diversified economy.

And they aren’t that far off from us.

Median condo $268k in Central Okanagan vs $319k for us

Median detached $595k vs $660k for us.

Curious Cat:

I have had a few people mention that the Gorge is an up and coming area. Not familiar myself, what do you think

This is incorrect. The average Canadian net worth was up 73% over the between 2000-2013 and even more now. Far exceeds inflation. Half due to house appreciation.

http://www.moneysense.ca/news/average-canadian-net-worth/

I’m surprised 3073 Donald St sold for $571,000 (list $539,900). There is zero potential for a suite in this house as it doesn’t even have a basement. Lots of cosmetic upgrades needed as well.

Hey guys, I am trying to get a little bit of an understanding on why all of the price comparisons keep coming back to Vancouver. Proximity doesn’t necessarily lend itself to comparison.

I can understand the spin off effects of rich Vancouverites running to Victoria….sort of, but certainly there can’t be a reasonable assumption that Victoria could follow Vancouver prices.

Population wise, Victoria isn’t even close. Victoria, on the face of it, appears to be more of a tourist/retiree destination. The population of Greater Victoria is approximately 84,000 and would probably be better compared with similar destination/population cities.

Kelowna would be more of a reasonable comparison. Kelowna has a population of approximately 120,000 and is also a destination city in terms of tourists and retirees. Alberta and Vancouver seem to be the drivers there for increased real estate prices.

Perhaps both of these cities will trend a little closer to each other as they seem to be in competition for those rich Vancouverites.

It hasn’t. The people who are independently wealthy or super high earners can afford a million off the bat – most can’t. But 70% of Canadians are homeowners. Homeowners in Vancouver and Victoria, for example, have experienced a lot of appreciation. If they could qualify for 500k ten years ago they now have their down payment plus principal paydown plus appreciation.

This means they have say 700k cash (tax exempt appreciation) plus their income has likely increased. They can sell their 1 million dollar home and buy one for 1.5 now. Many folks are in this situation largely as a result of the same appreciation that has brought average homes up to a million in some neighbourhoods. Income is not a good indicator of affordability when equity is doing the work it is in the market.

The first-time buyers are less than 30% of the market. They are not driving the prices up, they are trying to catch up. It is those with accumulated equity that can go higher and higher. The percentage of people who are in this boat increases with appreciation – it is not constant.

It’s also not that SFH numbers stay the same, they decrease. Either through condo conversions, or putting suites in them or being torn down to build town houses etc. This is why they will always have a strong tendency to appreciate in the core. There will be less and less of them and more and more people wanting them. Until, we get to the EU status where regular folk don’t even think about a SFH as an option.

I think it’s a weak assumption that wealth increases proportionally with population. I think recent news and statistics would confirm that fewer people have more wealth.

It’s a moot point anyways, as those people can afford more than one house and would account for the increased house buying if wealth did proportionally increase with population.

Cook Street apartment tenants face ‘renovictions’

http://www.timescolonist.com/news/local/cook-street-apartment-tenants-face-renovictions-1.8717852

Hope Hawk doesn’t live in that building.

Marko is always underscoring this point, and it’s an important one.

Dasmo:

I know a guy that married a girl from Squamish; does that count?

Luke:

I generally agree with a lot of the factors that you set out and they are definitely in play. But, at least in terms of the core, the other factor is the simple effect of population growth.

The percentage of people that can afford a million dollar home might have remained the same but the raw number of people with a million increases with population. Yet the number of homes remains about the same. ( I know that infilling does increase the numbers but we are reaching the limits of SFH that can be infilled). If there were a hundred people that could afford a million dollar home ten years ago and if the population doubles then you are now talking 200. Yet the number of single family homes remains about the same in the core. It would be interesting to know the actual number of SFH

in Victoria proper and what that number is ten years ago. Have not been able to find any statistics on it. Perhaps one of our stats wizards can help out here.

As many of you know, I live in Rockland and while Rockland is far from typical, there is far less SFH than one might think. Of the old manor houses well over half have been converted into apartment units or into boutique hotels (bed and breakfast at $300 a night). What infill occurred was done many years ago and very little recently. Again, I am focusing just on SFH here; density has definitely increased with basement suites over the last few years.

I agree with the other factors that you set out but I do question whether income levels in Victoria as a sole factor would actually result in a 50% drop in the cost of housing. This issue always seems to be put in terms of average family income. I suspect that the better question might be is what is average income of the top 20% of Victoria families. It strikes me that it is the top twenty percent that are able to buy SFH homes in the core. One of the math wizards might be able to figure out how many SFH there actually are in the core and what percentage of families would that number house. If there only enough SFH in the core to house 25% of families than the most relevant number might be what is the average income of the 25% in order to estimate the “domestic” level of demand.

Except Victoria’s market has very little to do with Squamish.

Hey Leo,

Mac Realty puts together a decent data overview on Vancouver through to the Fraser Valley and Whistler. West/North Vancouver stats are listed under “Greater Vancouver”. It can be found here:

http://macrealty.com/buying/market-insights/

When I look at what happened in Squamish’s market in the last few years, and what’s now happening in Victoria, Victoria reminds me of a delayed version of Squamish’s market.

I believe so yes. Good data is hard to find in Vancouver.

I think Vancouver market deteriorated due to insane prices and then the foreign buyers tax. We have high prices (not quite as insane) and no foreign buyers tax yet. I don’t expect us to follow suit, just as we didn’t follow suit while prices increased 70% in Vancouver since 2008 (we’re up about 30%)

Somewhat relevant distraction : Tommy Tiernan – Crooked Man – When Irish People Had Money

https://youtu.be/EUo93Hw7LSw

So if peak pricing in Vancouver was March 2016 – does anyone know how the inventory trends in that market, at that time compare to current island trends?

Was Van at all-time low inventory levels? Are any similarities a potential predictor for the island?

By the way the market summary price predictor was broken because the 12 month trailing months of residential inventory is now under 2.0 which has never happened in Victoria (since 1996). Uncharted territory!

Three Oak Bay SFH sales today, two over asking and one just under asking by just $900.

966 Transit Rd – Listed at $1,275 sold for $1,350 in six days

1866 St. Ann St – Listed at $955 sold for $1,150 in five days

2189 McNeil Ave – Listed at $1,099,9 sold for $1,099 (was re-listed after not selling for a $50k higher price)

The first two were quality homes, and I knew they’d go fast as there is such a chronic shortage of quality homes in Victoria’s desirable areas. McNeil, it could be argued, is not as much of a quality home, just ‘ok’, and on a somewhat busy street, but it still sold very near asking price, eventually. Again, probably because there really isn’t much to buy.

I don’t think quality SFH prices in the desirable core area’s are likely to return to ‘fundamentals’ tied to local income levels, ever again. It’s simply a fact that there aren’t enough quality homes, and no more land, and hardly anyone is leaving. Also, Baby Boomers are retiring across Canada in large numbers over the next decade, and they are set to inherit more than ever before…

http://www.cbc.ca/news/business/baby-boomer-inheritance-1.3617891

Only less than 1% of them coming here from across Canada over the next decade, and competing for a SFH home in our tiny market will be noticeable. And, many baby boomers will be helping younger people financially with that home purchase, even if they don’t live here. Jobs are part of the story, but for a quality house in the core to return to ‘fundamentals’ tied only to jobs it would mean a price drop of more than 50% from current levels!

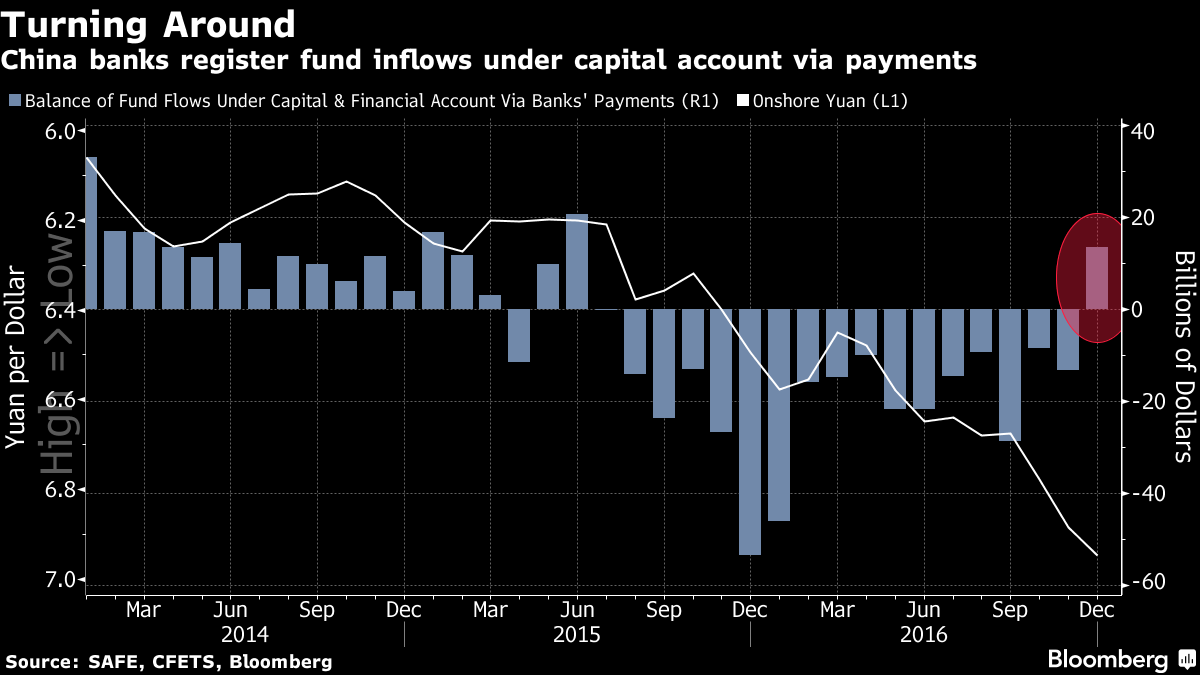

As for China clamping down on capital outflows. Chinese weren’t coming to Victoria in huge numbers anyway, outside of ‘ground zero’ in ‘Golden Head’ – and many of those are very likely Canadian citizens or PR’s. I don’t think they were or are a big part of what has been driving the local real estate market. It’s true Vancouver buyers were relocating here was part of the story last year, and they were awash in cash that Chinese buyers brought there, but even they weren’t here in huge numbers, but we can’t get accurate stat’s on that anyway. So, I don’t think implementing a foreign tax in Victoria, or not, will make much difference either way. As for Vancouver’s SFH home prices – they are going through a much needed correction as they had gone to ridiculous levels far beyond what Victoria is.

Lastly, if your bank is charging you those fees – city slicker – shop for a new bank! Or tell them another bank offered to waive the fee and you will leave them if they still insist on charging it. HSBC doesn’t charge the fee…

City you need to bitch complain and threaten. They will charge you whatever they can get away with.

Must be different at different banks. RBC paid our fees both times this year.

Curious as to when the banks started charging for appraisals.

Went to arrange a refinancing this morning and Scotia bank wanted $300 for a appraisal and $70 for a title search.

Previously they always absorbed these costs even for a refinancing.

Maybe if I was a new customer I would have negotiating room but I got nowhere.

Trump just put $1,512 into my pocket today…..long time TRP holder.

Agree, gwac, my comment was in response to John Dollar 🙂 related to the psychology at work with housing, ie., people’s lifestyles have changed so much over the last 30 years where their self-worth isn’t necessarily represented by their house anymore.

Vic I am telling you who can afford not who wants it. The people who want it and buy it are the ones who cannot afford it a lot of the times.

Reason

Inflation can get quickly out of hand. I do not see the 10 to 15% but the 4 to 8% could happen. In all this I would stay away from China stocks. I think Trump has in out for China and any other low cost producer. The dollar store may be the 5 and 10 dollar store soon.

“Are we about to go through the 70s and early 80s again.”

The fundamental forces behind inflation may be similar but the BoC only adopted inflation targeting in 1991 so you will see rates move up sooner perhaps mitigating the huge run up in both inflation and rates as we saw in the past.

There is a dentist in my family, as well as high paid tech execs, and nobody cares to live in the nicest house on the street or the city. (the areas of the city range from Oak Bay to Gordon Head and Mayfair)

Life choices come down to the individual and what you were raised to value in life. Some people spend all their money on possessions, but a lot of people spend it on travel, or art, or sunset views. Or they value walking to hobbies above everything else, and that’s where they live.

(if anyone cares that much about flaunting wealth, then agree, it’s a pretty shallow existence that leads to discontent or divorce)

Re: Hawk

No asset class moves up in a linear manner. In addition, prices can only stay detached from fundamentals for so long. I think Vancouver is now seeing that. I think Victoria will see it inevitably – Victoria isn’t full of high income earners able to afford high priced homes – it generally has a solid middle class population. Foreigners and debt have had a lot of influence on the recent run up in Victoria and of course panic buying. But eventually that will subside and prices will revert back to levels that are supported by fundamental (i.e., income levels). The hardest part is figuring out when – which no one will be able to accurately tell you.

“3174 Yew sold for $650,000.”

Interesting. A bit surprised that Yew didn’t go for more because of the apparent interest – also that it sold on a conditional offer. But then again, it isn’t exactly the type of house or neighbourhood that appeals to all-cash baby-boomers.

3162 Alder went for $580,000 in spite of (or because of?) its resemblance to a high school portable.

Not bad I guess for houses w/suites in the core.

@ Hawk:

It’s different this time!

Great article ISO 7. Good to see some reality on here. Many like Mike are caught up in the bull trap and don’t want to admit it.

“The Greater Vancouver area seems to be caught in the denial and bull trap phases. This also seems to be thinking throughout the region. Vested interests are reassuring everyone that this is a temporary setback and everything will return back to normal in the Spring. But Vancouver is already seeing properties list for well under July 2016 assessments and list for well under previous sales prices. I say “list” and not “sell” because nothing is selling. Sales have plummeted. The takers have disappeared – likely expecting prices to drop. If buyers don’t show up in the spring, you could see more sellers try to unload their homes. Just as panic buying happened on the way up, there will be panic selling on the way down. Sellers undercutting each other just to get out.”

Should be lots of locations to choose from when the foreigners and flipper/hoarders realize the Vancouver correction is for real and decide to take the money/losses and run ASAP. Major investors will back off bigtime. No yuan, no fun.

China’s Efforts to Stem Capital Outflows Are Starting to Pay Off

“This could be a turning point for China’s capital flows,” said Tommy Xie, an economist at OCBC in Singapore. “This year, the government will keep its capital controls tight, while long-term foreign investors will buy more onshore assets due to higher returns.”

JD tech people are the new doctors. Doctor are just middle class now unless you are operating out of health care system. Dentists and plastic surgeons still can afford the expensive areas.

I think inflation is going to make a roaring come back in the next 5 years. Protectionism and isolationism is going to make thinks more expensive. Interesting to see how higher inflation/ higher wages vs higher interest rates impact these high house prices and throw in Canada as a safe haven in this nutty world at least until O’Leary gets in. Are we about to go through the 70

s and early 80s again.Where Vancouver is at in the real estate bubble stage. Victoria should lag Vancouver by a bit, just like it did on the way up:

https://financialfreedom45.com/2017/01/23/stages-of-a-real-estate-bubble/

@ JD

The Vancouver experience shows that rich people will be willing to live in middle class (or worse) homes. Expectations adjust. It comes down to location, location, location…

Victoria may be severely unaffordable to most people but not to the rich.

But not all the rich. Those rich buyers that are willing to accept lower valued improvements. Such as an upper income family that is willing to live in a house that was built for a middle income family.

Many justify the purchase by saying that most of the value is in the land or they are buying location but that still doesn’t change that they are living in a house that is suitable for a lower income class.

Doctors used to live in the nicest house on the street befitting their status in the community now they have to buy a mediocre house that may have been previously owned by a dock worker.

That’s a social disconnect that I suspect many high income earners will not accept in the long term. It may be justifiable to live in a house below your social status in a market with rising prices as you are acquiring equity for a better home but in a flat or declining market I think the heightened level of discontent will prompt a lot more people to sell. Since the house you live in affects many people psychologically living below your status could also lead to an increase in divorces.

I thought the US was just getting going. Apparently not. Peak USA.

A $90 Billion Debt Wave Shows Cracks in U.S. Property Boom

“A $90 billion wave of maturing commercial mortgages, leftover debt from the 2007 lending boom, is laying bare the weak links in the U.S. real estate market.

It’s getting harder for landlords who rely on borrowed cash to find new loans to pay off the old ones, leading to forecasts for higher delinquencies. Lenders have gotten choosier about which buildings they’ll fund, concerned about overheated prices for properties from hotels to shopping malls, and record values for office buildings in cities such as New York. Rising interest rates and regulatory constraints for banks also are increasing the odds that borrowers will come up short when it’s time to refinance.”

https://www.bloomberg.com/news/articles/2017-01-24/a-90-billion-wave-of-debt-shows-cracks-in-u-s-real-estate-boom

“Victoria is deemed “severely unaffordable” in the 2017 Demographia International Housing Affordability Survey”

Just the type of article to scare away all those millions of wannabe-a-Victorian seniors who filled out Mike’s poll who thought Victoria was still a quaint village from their last trip here in 1969.

I understand Barrister’s point of view that we should be looking at the entire market and not just a small geographical area or type of property since the market is intertwined with each other. Prices in one area should have an influence on the adjoining areas.

Yet at a times it is interesting to drill down into one, two or a few market segments to determine if it is stronger or weaker relative to other neighborhoods, income groups or types of properties. So yeah I think we could compare Oak Bay to Ten Mile Point or Rockland as these areas would be considered alternatives to buyers in that price range. The same with the areas around Mayfair and Burnside with Esquimalt or Vic West. But I doubt we could meaningfully compare the inner core to the outlying areas of Sooke , North Saanich or Shawnigan Lake.

I also think new listings are more important than a low number of active listings. I would guess that some of those active listings are over priced properties that just sit on the market for months thereby overstating the importance of the months of inventory. Are people that put their homes on the market for extravagant prices really “active” sellers?

That’s why it is important to know if there is sufficient new listings relative to sales. Having one new listing to every home that sold might not be enough to keep prices flat as a percentage of those new listings will be cancelled or expired in the future.

And this is where the market might always be changing as the ratio of sales to listings may not always mean the same in different time periods to determine if the market is balanced between buyer and seller. I suspect then that if you say that the market is a sellers market based on historical ratios but prices are not changing then one should revisit those past ratios.

Those past ratios may have been foretelling when a larger amount of people could afford homes but as prices went higher and higher and fewer and fewer people could afford homes then those ratios indicating a buyers or sellers market may have changed also.

The market may be in balance as there are just enough rich buyers to buy expensive homes. Meaning that prices can remain flat at low sales and low inventory. Yet these low sale and listing numbers are not foretelling of higher prices to come.

Is there only 1 house for sale in Broadmead. Cannot be right.

http://www.rew.ca/properties/areas/broadmead-saanich-bc

3174 Yew sold for $650,000.

Chandler is sub 1M and has been on the market for ever. Smallish house, but large lot. I guess lot value has not quite reached that level yet.

“all over the place”

“Herding” behaviour going on?

Interesting how inventory has plunged all over the place in the last few years

http://vancitycondoguide.com/our-unsuspecting-neighbours/

Further re Demographia.

People also cite them as saying so and so is the most expensive place “in the world”. In fact the countries Demographia covers constitute less than 10% of global population.

@ Barrister,

Demographia is not a neutral study. Their reports are aimed to break down urban containment and “smart growth” in favour of urban sprawl so read with that in mind….

https://en.wikipedia.org/wiki/Wendell_Cox

A handful of SFHs have hit the market in Fairfield for 8 something. See what they go for I guess….

I reread the Times Colonist article on Victoria and what I find a bit disconcerting is that it appears that it focused on the actual city of Victoria in compiling its numbers. One is left with a very skewed view of reality if one simply uses municipal boundaries as opposed to the economic reality of the GVA (V being Victoria and not Vancouver).

I remember before amalgamation in Toronto explaining to some American businessmen that while the population of the city of Toronto was technically 650,000 the GTA was about 3.5 million. (This goes back a few years.).

I am amazed at how often people in Victoria want to pretend that the Saanich peninsula and the West Shore are not part of Victoria. The same holds true if you exclude Oak Bay from the stats.Statistics are supposed to strive to mirror reality not distort it.

Introvert:

The one thing that both Napa and Victoria share is that a lot of the housing market is driven by retirees.

I am familiar with it because it was on our list of ten possible places to retire. I dont know how they calculate medium income for Napa but I am suspicious of the 77,000 figure (is that family income).

There is a very limited job base of either tourist or agriculture income in Napa. Most jobs there are very low paying. The numbers are skewed by the fact that there are a fair number of reasonably affluent retirees whose income is either pension or investment driven. I suspect that, in Napa, the income curve looks more like an hour glass than a bell curve. We spent two weeks in Napa and what I was struck with is that you have the poor and the rich and very few in the middle.

Victoria airport, spurred by passenger surge, could speed expansion plan

http://www.timescolonist.com/business/victoria-airport-spurred-by-passenger-surge-could-speed-expansion-plan-1.8588385

Last year brought a high of 1,856,421 passengers through the airport. That’s up by 8.5 per cent from the previous record of 1,710,825 in 2015.

The airport had expected to hit the two million mark in 2020, but it appears that could happen sooner, said James Bogusz, airport authority vice-president of operations and development.

“We are quite well ahead of what we would have anticipated going into 2017. So if anything, we are looking to advance our capital program, even beyond what our master plan had shown. That’s very exciting.”

Victoria is least affordable smaller housing market in Canada: report

http://www.timescolonist.com/news/local/victoria-is-least-affordable-smaller-housing-market-in-canada-report-1.8588407

I like this comparison:

Napa, California, was the closest-ranked city to Victoria, with a median income of $77,100 and a median house price of $650,000.

More or less what I’m saying here. 90% of sales are driven from new listings. So the flow of new listings is much more important than the inventory.

No crystal ball here, but Steve always has some interesting things to say…

“Recently, there seems to be some sort of denial around the slumping sales numbers. Look I don’t know where the market is going, neither does the next guy. However, some are choosing to downplay sales even though we all emphasized sales only a short year ago. The latest excuse is that slumping sales are due to low inventory levels. This seems logical since little inventory means fewer homes for buyers to choose their “dream home.” But how quickly forget we set record sales last year despite record low inventory.

As an example, the peak of the market was in March 2016. Despite (at the time) record low inventories, we set a record number of sales. ”

source: http://vancitycondoguide.com/are-we-in-denial/

Same. Very helpful. Corrected the error in my assessment very promptly.

With absentee landlords this is a pretty low risk operation too. Unethical, but it works. It’s no holds barred in Vancouver real estate!