2016 Year in Review

How to sum up 2016 for Victoria real estate? Well it’s been an eventful one. After several years of languishing and complete boredom in the market, things got exciting both in the local, provincial, and national spheres. I think I’ve written enough superlatives about the months of the year and I don’t need to rehash the various regulatory and policy changes we’ve experienced.

Looking back it’s not like we didn’t have warning. Since mid 2013 the market has been improving at a remarkably steady pace. Just like water boiling the proverbial frog, market conditions were improving so slowly and steadily that no one really thought that much of it. However in the spring a small swell of out of town buyers combined with improved local affordability to put the market into overdrive. Once that hit the news it sparked full scale panic and fear of missing out amongst those watching the market and the rest is history.

The sales to list ratio climbed steeply until July when it seemed to top out at 80%. While the plateau might seem like good news, this is a level higher than has ever been seen in the Victoria market so it would need to fall quite a bit to return some sanity to the market. Also December was an unreal reading of 120% sales to new listings which brought the annual average up another couple points. For every 5 homes that came on the market in December, 6 sold and 3 were taken off the market.

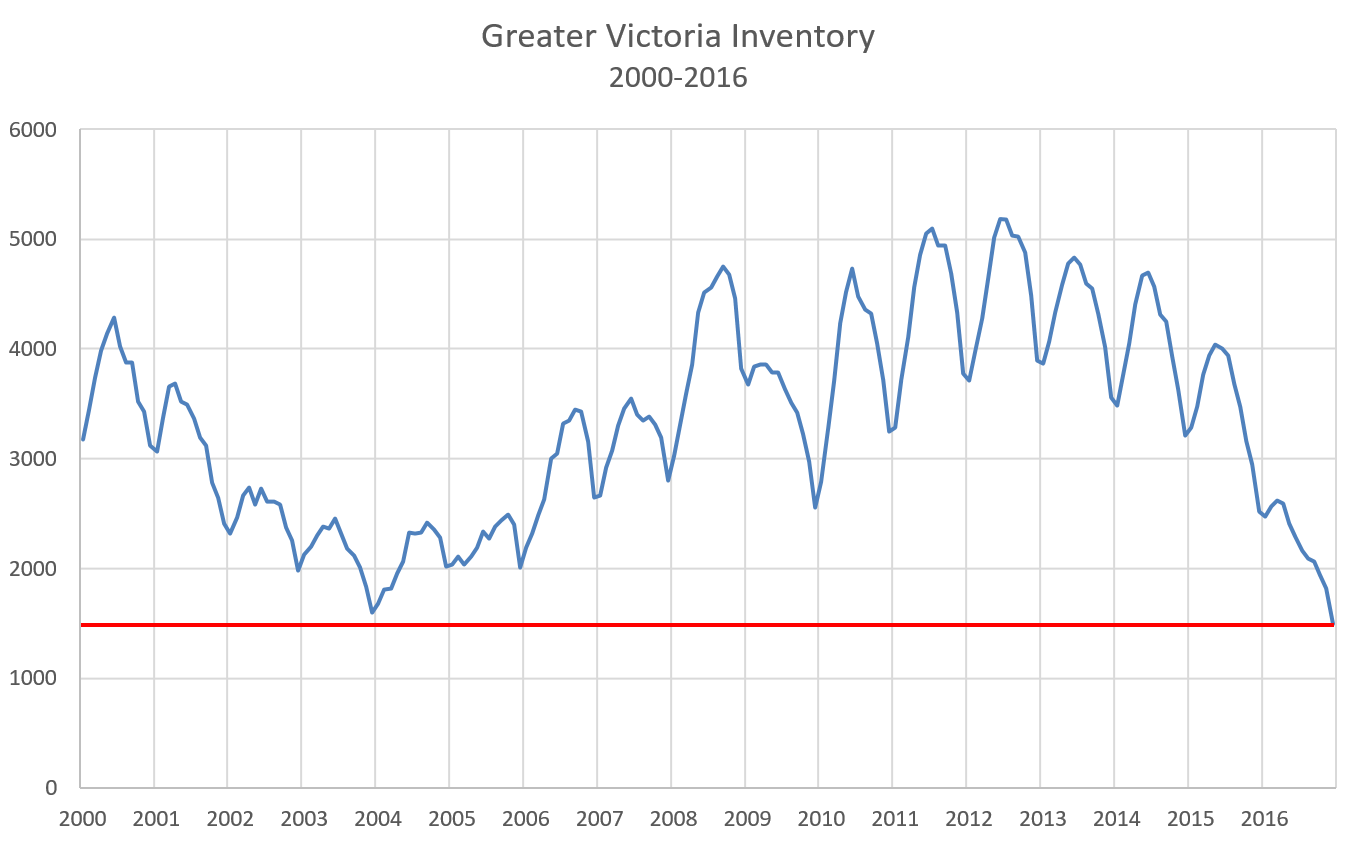

The sales panic this year led to a rapid consumption of inventory. Where previously inventory was falling by a leisurely 10% per year, by the second quarter we were down 40% over 2015 and kept up that pace even into December. Obviously this will have to moderate this year just because it’s hardly possible to reduce inventory further than it already is. We have only 921 residential properties for sale!

Lowest inventory ever. Notice the lack of a seasonal build up in 2016 as properties sold faster than they were being listed.

What will 2017 bring? Well you can refer to the predictions thread to get the shotgun approach to what might happen. Taking the average of all the projections, the average single family home will increase by 5%, while the average condo will increase by 10% as sales drop by some 14%.

Also a pretty active year for HouseHuntVictoria. According to the stats, the 90 some articles published were viewed by 51,000 users that created 528,000 page views. However most impressively and the reason this site is fun were the 13,356 comments left on the site in 2016. Thanks to everyone for contributing and here’s to another interesting year in Victoria!

Sweethome- they’re probably burning wet wood, and/or using an older inefficient wood stove. New ones with dry wood produce next to no smoke and very little, if any, smell. Might be worth talking to your neighbour- burning wet wood and/or with an older stove is costly- so much of the energy from the wood is being used to dry the moisture before it burns. Could be a win/win if they are approachable and ignorant- they are probably wasting hundreds of dollars to heat their home poorly.

It’s a also a fire hazard, as burning wet wood leads to creosote.

(I do realize most/many annoying neighbours aren’t very approachable, but it’s always worth a try.)

Why would anyone want or expect shopping and culture at a beautiful natural beach?

New post: Is it low inventory or high prices that are hurting sales in the core neighbourhoods? https://househuntvictoria.ca/2017/01/05/low-inventory-high-prices/

Makes some sense. So they’re behind the curve for pricing in both scenarios. In 2014 they were pricing at peak prices despite a declining market. In 2016 they were pricing at previous year prices despite the jump. So lesson is: you better educate yourself if you’re going to sell privately.

SweetHome, sorry to hear about the constant wood burning – it’s definitely a health issue, eg., particulate matter. It would be worth talking to a fireplace or stove expert, the city, or even a lawyer (it could be considered a public nuisance).

It could be a problem with what or how they’re burning. According to BC Ministry of Environment “inefficient wood stoves and fireplaces, and improper burning, can result in a lot of smoke pouring out the chimney and into your neighbourhood.” http://www.bcairquality.ca/topics/wood-burning-appliances.html

You may have thought about all this, but if you haven’t found a solution or think the neighbour might stay for a long time, it might be worth moving, even if it’s a location further from town.

I’ve had my assistant search private sales once a week for a number of years and she sends me the spreadsheet with all the usedVictoria/craigslist/etc., links that I go through each Friday. This is what I’ve noticed.

In years like 2014 it was difficult to find great deals privately. Sellers would typically price their property at market value, or higher. Not too many people out there that would take a $600,000 home and price it at $590,000 figuring for a $20,000+ savings in commission. They would price it at $600,000 or higher. There is always a deal out there but ratio is like 95% overpriced, 4% market value, 1% deal.

I saw the most “deals” in January-June last year (2016) and I think the reason was you had a few sellers out there that weren’t aware of the 20% jump that occurred in the spring. For example, a private seller would list a 2014 $600,000 home for $650,000 thinking they are pricing up but the market had actually taken that home to over $700,000.

Vetting the neighbours when buying is tough….not to mention in Canada people move a lot. The nice family next door is not going to be there forever like they might in some European countries. When they go sell they will want to sell for top dollar including which might be an investor that plans to use the property a poorly managed rental.

Haha. The blog in live action with canned goods ” For every 5 homes that came on the market in December, 6 sold and 3 were taken off the market.”

Sorry man, but just a brilliant analysis of the marketplace I had to use.

Haha. The blog in live action with canned goods ” For every 5 homes that came on the market in December, 6 sold and 3 were taken off the market.”

http://vancouverisland.ctvnews.ca/mobile/video?clipId=1029638

Dec low inventory. Marko is in it.

Thanks, all — good advice. I’m definitely ready to broaden my horizons. For years I thought I’d live in Fairfield or OB just because those are the neighbourhoods I know, but 2016 taught me to let that idea go. I’ll give Esquimalt and the Gorge a better look than I have in the past. And I’ll check out some private listings.

@SweetHome: I have no idea how you’d predict something like the neighbour heating with wood when you’re buying in the spring/summer (as I think you did). That’s a tough one. I guess all you can do to ensure house satisfaction is spend as much time in the neighbourhood as possible before you make an offer and then hope for the best.

“I see a little house on Sims that has been for sale for some time now and yet I know that in about another month or two people will be jumping over each other trying to outbid one another.”

On the topic of air quality from my last post, Sims is right next to the highway. That area will have pollution, and I would avoid. Personally, I also avoided all the areas in West Saanich near the high-voltage power lines.

@vicrenter

We have lived in Esquimalt for over 10 years and love it – you may want to consider it – especially the neighbourhoods closer to the water. Can’t beat a 7 minute bike ride downtown. Still some reasonably priced houses here too. And lots of development happening – Red Barn Market opening up in March, new kids splash park, etc.

@VicRenter – “I’m sorry to hear that you’re still having some regrets about your house. Is there any chance you’d be willing to share what those are?”

Here’s one: the neighbour heats with wood, and the smoke bothers me. I never considered that: 1) someone would use wood as a significant source of heat in this day and age, 2) the smoke emitted would permeate into my house to a noticeable extent, 3) the allergy I had to smoke as a child is still alive and well (I have not been around smoke in years, so it was not something I considered).

So, check out your house, but also try to see if there are any red flags from the neighbours regarding your particular concerns. It’s really hard to foresee everything, so, in general, I wish it weren’t so prohibitive to change houses. If the market stays strong for sellers, there are not only the transaction costs but the fact that it would likely be unwise to sell one’s home without having another one lined up.

@ vicrenter

I live in the Gorge and really like it. Our neighbourhood is changing rapidly too, with quite a few custom builds popping up – including mine.

We’re super close to downtown, vic west, up-island and the gorge waterway is a great place to walk – which we do quite frequently. I’m also noticing that the previous sketchier pocket from Vincent to Ker is starting to clean up it’s act as well – starting from the Vincent side.

Unintended benefit of the area? The Fairway market, while a bit dodgy has the cheapest groceries in town – and the parking lot is reasonably laid out so there’s hardly ever any frowning competitions like there is by the minute at the Fairfield Thrifties!

We have purchased two homes privately.

First was word of mouth at a party – left party slightly tipsy and toured home at about 9pm. Went back to party and wrote up offer. Offer accepted at 1am subject to inspection.

Next was a house advertised on usedvictoria. I just filled in the standard buy sell agreement form to make the offer. Went fine.

I would be worried about inspecting for a buried oil tank and make this a condition in Victoria.

I think now that sellers can use a mere listing service like Marko’s it makes less sense not to go for MLS exposure so there might be fewer FSBO deals but worth keeping an eye out for them.

Caught Nils Jensen, mayor of Oak Bay, on CFAX 1070 this morning discussing property assessment increases. He mentioned that he moved to South Oak Bay 20 years ago and paid just under $300,000 for the privilege. He explained that, at the time, he said to his wife, “This is where we’re gonna live forever, because we’ll never get our money out of this house — we’ll never make it back!” He continued, “We thought we were paying way more than the actual value.”

Sometimes you have to think outside the box.

I listed a house $50000 below assessment last year… didn’t sell.

The current land value assessment alone is equal to last years total assessment. A buyer would have built land value equity alone in a year with a 1950’s house as a bonus.

Go figure.

@ DH: “Garth has a pretty good take on declining inventories today.”

I suspect the explanation is simpler than Garth supposes; namely, that those who may be considering a move are deterred by the fact that, when inventory is small, not only is there little choice, but there are no deals, and, if you aren’t prepared to make a snap decision, any property you are considering will be sold to some one crazier than you.

As I may have mentioned on this blog 50 or 60 times before, I was in Toronto in 1987 trying to buy a house. At the time, there was essentially no inventory at all. To have a hope of buying you needed to have financing in place ahead of time and be prepared to engage in an auction, with the winning bid often way above the asking. Under those circumstances, how many people are going to move if they don’t have to, especially when the craziness will likely end with a crash as it did in Toronto, with prices plunging by about half beginning in ’89, as mortgage rates rose from 9.5% to 14%.

https://vreaa.wordpress.com/2012/12/29/canadian-cities-inflation-adjusted-house-prices-1980-2011-annotated-chart/

As for the picture, a typical Westie: mucky thing.

When I am looking for a private sale on real estate, I simply google “houses for sale” by owner…. in the city I am interested in. If you are buying new then talk directly with the builder before he lists it with an agent.

I also check the usual places like “Used Victoria” or “Craigslist” or the local newspaper.

Buying from a private seller is not complicated. I use a lawyer or a notary so that the legalities are looked after. He or she will guide you through the process and look after the exchange of the money.

I’ve also had good relations with realtors for buying a listed house on MLS.

My point though is that buying a house privately is a good way to get a house….especially when the market is hot. Make sure you have done your homework on what houses are worth. Go to a number of open houses and be familiar with the neighbourhood and city.

Hope that helps

Good luck

Deryk Houston,

Wondering where the best place to look at private listings are?

Thanks Vicbot. He’ll come out of his shell one of these days. I’ve read Introvert post many times he always skips my posts. Apparently not. 😉

Comment for VicRenter: One thing you might wish to consider is to look for private sellers.

People generally are nervous about doing a real estate deal privately and so those houses are overlooked.

Our family bought a house this past summer when the market was totally crazy and yet when we bought from the owner…..no one else was interested. We got a terrific deal on the house.

We also listed our own house for sale as a private owner…..and we got zero calls. This seemed odd to us considering the very hot market. What really surprised us was that we only got “ONE” real estate agent who called us to see if he could get the listing. This was in a very hot market and realtors were begging for listings. We were asking about one hundred and fifty thousand dollars more than what it is valued by the city. No one called except the one agent! Have to laugh.

Anyway. Checking out private sales might be good advice.

We decided at that time that unless we could get one million dollars ….we were not going to sell.

We now have no plans to move in the immediate future.

Introvert Bot:

[ run all posts through spellcheck ]

[ complain about hawk ]

[ feel smug about living in victoria on blog where everyone lives in victoria ]

Garth has a pretty good take on declining inventories today.

If that doesn’t tickle your fancy, it’s at least a nice photo…..

Hawk – congratulations – all this attention proves you’re highly skilled, competent, and intelligent (but Introvert is too introverted to show his true feelings of awe & adulation 🙂 )

Thanks DB 🙂

Victoria is definitely something very special.

There are so many opportunities for businesses to expand here. The tech industry is clearly one of them. People don’t need to live in the major centres any more in order to hook into what’s going on in the world. For several years I have listened to some people complain that Victoria is boring.

In reality …it those negative people that are boring because opportunity has been in their faces for years and they were so busy being “bored” that opportunity simply walked past them:)

I’m an artist and I don’t sell any paintings here in Victoria. All my work goes to Vancouver and beyond. And…..I love living in Victoria because there are more exciting things going on than I have the time to go to.

Thanks, totoro! And thanks to everyone for the advice! No doubt I’ll check about various things as I continue searching… I know from experience last year that it’s tough out there.

Dasmo, thanks for the info. Definitely it’s increased in the last year and I don’t know which drywall contractors you’ve tried, but you may want to check with PR Wilson Interiors for a quote because they’ve been reasonable.

Also have to agree on Hillside, Quadra, Mayfair areas – I have relatives there, and they appreciate the views and walking distance to town, especially for summer events at Inner Harbour. We are lucky to live anywhere in Victoria to tell you the truth. If you try walking around a neighbourhood for at least an hour, you get a good sense of noise levels, neighbours, types of traffic, etc.

derykhouston

You made one of the most “SENSIBLE” commentary I have seen on this board altogether…

It just happens to agree with my opinion since I moved here 45 years ago from South of the U.S.A.

“Most of the value is in the lot”; “Victoria is amazing value compared to other cities in the world.”

Deryk Houston

January 5, 2017 at 7:41 am

@Vicbot, that was my floor space sqft. Anyway, I am looking at earthen plaster again. If it’s going to cost a fortune I’d rather they be organic and bespoke…. Drywall was invented to be a lower cost wall finish than lath and plaster… Not sure it is anymore.

@Rook, Not bummed at all. Just thought I’d toss out the experience. I wasn’t investment shopping at that time. I was looking for a solid but undervalued house I could fix up and that is exactly what I found. Loved the house. Hated the neighbours though. Plus I already sold it to buy my lot. The neighbour issues is why we sold this house and not our rental.

Hawk could easily be replaced by a bot:

[Cite any news story involving China]

[Predict real estate catastrophe in Victoria]

[Sometimes insert winking face emoji]

Dasmo:

If you are bummed about your VicWest house I would gladly buy it off you! ; )

My prediction (out of my winter hat) say there will be increased listing in FF / OB at under 1M this summer.

Even everyone and everyday news media keep telling us the prices of SFH are soaring. Many seniors are living under the rock. They just tune out from the BS news… Now, they got the assessment letters, from the government, telling them their little houses are worth 1m. (to be fair, I am too surprise by the huge jump on land value this year, even I log in here daily…. yes, I have a boring life…)

This magical ONE MILLION DOLLAR mark may finally have enough push for them to cash out the house, buy a new place in westshore with zero maintenance. Many of them are really living poor for decades. The new wealth (cash!!) will let them enjoy life finally.

Why this summer, but not now? In summer, their moldy basement can air out. The yards will clear cut to make it presentable.

Yep, Fernwood was a miss for me. In 2003 I was considering there and VicWest. My budget was 180k so Fairfield was out! I chose VicWest because I liked the proximity to water and that it was easy to get out of. It also had huge gentrification possibilities and was even less crackshacky than Fernwood. My mistake. Fernwood appreciated way more especially after it became the mayors hood….

No True Barrister. Here are a few in the core and only a few….

https://www.realtor.ca/Residential/Single-Family/17685116/354-Foul-Bay-Rd-Victoria-British-Columbia-V8S4G8

https://www.realtor.ca/Residential/Single-Family/17678679/1423-Fairfield-Rd-Victoria-British-Columbia-V8S1E6

https://www.realtor.ca/Residential/Single-Family/17654847/526-Quadra-St-Victoria-British-Columbia-V8V3S3

https://www.realtor.ca/Residential/Single-Family/17572920/1753-Adanac-St-Victoria-British-Columbia-V8R2C4

https://www.realtor.ca/Residential/Single-Family/17670455/2421-Trent-St-Victoria-British-Columbia-V8R4Z4

etc etc…. just get ready to compromise are work on it….

I like that Hillside area and hope you find something good Vicrenter.

The Gorge is a great place. If you like a nice place to eat …try The Crow. It’s very nice food. We tried the option where you let the chef choice for you. (You get to pick vegetarian or meat but generally leave it open to the chef. I think they call it “The Truman” on the menu.)

Another undervalued place is the area up behind Uptown Mall. (My daughter bought a little place on Sims avenue.) It is an area that will clearly change in the next ten years as you can walk to uptown in twenty minutes.

Anything within walking distance of downtown has to be a winner. It wasn’t that long ago that people turned their noses up at the Fernwood area. Now the New York Times is writing about it! Look at Vancouver. Anything east of Main street was considered sketchy. Now those same houses sell for around $1.8 million even for an old rubbish house.

People are only starting to wake up and realize how good Victoria is. I see a little house on Sims that has been for sale for some time now and yet I know that in about another month or two people will be jumping over each other trying to outbid one another. This idea seems odd to me:)

@ Barrister: “The other thing to keep in mind is that building materials have really gone up in price even if you are doing the work yourself. Labour has jumped through the ceiling assuming you can get someone good in the first place.”

Yes, that’s a good thing to consider. I’d be happy buying a place that’s livable for now but that I could work on down the road when building prices return to something like “normal.” I take your point that anything that needs immediate work could really get costly.

I haven’t looked at much in the Gorge but your comment has me considering it more carefully. I’ve tended to think of it as a bit sketchy, but it is closely to downtown. I don’t work downtown but I really value being able to walk to shops and restaurants, whether they’re downtown or in one of Victoria’s many villages. I commute to work by bike or bus.

VicRenter:

As you already know, Oak Bay, Fairfield, James Bay and Rockland are out of reach for you. The one area that still has pretty fair prices and that I suspect will appreciate is around the Gorge. Close enough to downtown without the super premium prices. The neighbourhoods vary a bit around there so it is important to really get to know the area.

Unless you actually work downtown you might want to at least consider a bit further up the Peninsula. We find that we actually rarely go downtown and in the last few years with the druggies

flooding the downtown even less so. Three years ago you could have gotten something nice in Fairfield for around 750 but those days seem to be long gone.

But I am sure that you have looked at everything. The other thing to keep in mind is that building materials have really gone up in price even if you are doing the work yourself. Labour has jumped through the ceiling assuming you can get someone good in the first place.

Still waiting for Intorovert to offer up a relevant post beyond slagging. He must be losing sleep wondering if the exodus of Asian students in the coming China crisis will wipe out his fleeting paper profits.

Looks like for many it’s a waste of time sending them here when they don’t want to learn according to a recent study.

International Students Stumble During Study Aboard

“A teacher surnamed Wang at Huijia International School said her students were not very respectful. “Many students at international schools come from wealthy families, and they don’t come to learn. Teachers are expected to please them,” she said.”

“According to “2015 Study Abroad Trend” study, China sent about 4 million people abroad from 1978-2015. Of them, 1.3 million people failed to finish their degrees, and over 2 million returned to China.”

https://beijingtoday.com.cn/2016/12/13010/

Lots of local spam, too: Hawk’s comments.

http://www.timescolonist.com/news/local/hundreds-of-thousands-at-stake-in-saanich-soil-contamination-nightmare-1.6288778

Scary story. Even after remediation. Hard to sell it in the future. Feel bad for this family.

Buying acreage best to get the soil tested.

Interesting to see if the estate/heirs ends up paying and whether it could be more than the estate was worth. Not sure how the law works for this type of thing.

“I guess he will have to revise his dates again now with solar getting so efficient….”

Agree Dasmo, solar is the future. Some climate change news for the doubters.

Global warming data that riled doubters turns out to be true

http://www.cbsnews.com/news/global-warming-data-that-riled-doubters-turns-out-to-be-true/?ftag=CNM-00-10aab7e&linkId=33042552

Thanks for the advice, Barrister. I’m unlikely to buy anything built pre-1950, but you never know. But even if the house is “only” 67 years old I’ll definitely try to do as much due diligence as possible. We didn’t put in any offers without subjects in the spring. If we ever did do that, it would only be after having all necessary inspections done first.

As for location… As I mentioned, I’m interested in Hillside since $850,000 can still get you a nice house with a bit of a view there. Otherwise, I’m open to anything in the core and am willing to buy a place that needs some work.

I know that my thoughts on buying a house will be different from most everyone else but I will say it anyway:)

When I buy a house, Five things get my attention. Location. Wiring. Roof. Drains. Signs of sagging.

I’ve been involved in buying two houses sight unseen. Why? Because the price was right. I knew I was buying location. Most of the value is in the lot and by making an offer with no subjects I was able to jump ahead of the cue and get the property cheaper than anything else.

I also think that we have too high expectations. We want everything to be perfect, when in fact you can find fault with most every house you look at. I’ve seen many houses that have been all dressed up with new gyproc and carpets in the basement, but when you give everything a simple look over….it is clear that there are issues. But it looks good and I see everyone rushing in to make an offer. I’d rather get the one that has not been all dressed up because people turn their noses up at those ones. People prefer the thin, shiny veneer. I’ve followed house inspectors around and I continually laugh my head off at the comments they make. “Oh…..that water tank “might” need to be replaced”. Can you imagine the “burden” of having to replace a water tank on a house that you are paying eight hundred thousand dollars for? Are you really that docile that you can’t see that it is an older tank and might need replacing? The first thing inspectors do before they even start to look at the house is they have you sign a form that absolves them of any responsibility for getting the inspection wrong. Yet banks put great value on their reports.

The bottom line is that houses always need work and continual repairs. So do condos. You have to factor in these kinds of things. My advice…..stop conjuring up all the hypothetical things that “could” go wrong or you will never be able to make a decision. Victoria is amazing value compared to other cities in the world. That is what you are buying. The value is in the location. Victoria is an incredible place to live. That’s why no one is selling their house and you see practically no listings.

VicRenter:

In my limited experience, this is the time of year that you can often get the best deals on a house.

Some of the houses on the market have been sitting there for a few months. The owners are often a bit edgy since there usually are few showings in December. While you are worried that prices will go up in the spring, the owners are equally worried (after a few months on the market) that they missed the peak and that prices are on the way down.

I dont know what type of house you are looking for but if it is anything older like a heritage house it is vital in my experience to get it fully inspected. I dont mean just one of those home inspection outfits. At the very least get a structural professional engineer to check out the foundation. The first two accepted offers that I had on houses here in Victoria I had to walk away from because of the engineering report (one house was very unique but his estimate to repair the foundation was over a million dollars). The other vital inspections on a older house is to have the perimeter drains scoped and have a roofer examine the roof. Getting a reputable electrician in to make sure that there is no knob and tub in the house is also a good idea.

That is a serious problem when it comes to blind bidding where they are demanding unconditional offers. If you are looking at a heritage house I would simply not do it without a full set of professional inspectors. Trying to get inspections done by professionals within five days is next to impossible. It is like asking someone to buy an old used car without having a mechanic look at it.

You will have a greater selection in the spring but also more buyers. It comes to the old supply and demand. The simple truth is that absolutely no one has any real idea what will happen this spring. Starting the year with such a low inventory is not a good sign. But there are factors on the other side of the equation. Personally I have preferred looking in October and November since these are often the left overs from the last of the summer market.

With a budget of 850 you are priced out of many of the areas in the inner core. Where are you looking? Westshore?

@SweetHome: Thank you for the advice based on you own experience. I’m sorry to hear that you’re still having some regrets about your house. Is there any chance you’d be willing to share what those are?

I agree about the dangers of having to make quick decisions. One thing I actually like about the auction-style sales is having 4-5 days to consider a house and see it 2-3 times before putting in an offer. That’s preferable to me than viewing a house and having to put in an offer that day, which I know has been the case in other “hot” years around here. But of course I don’t love bidding wars or no subject offers. This is a frustratingly competitive market.

@VicRenter – “My spouse and I have decided that we’ve been on the house-buying fence for too long (ever since we sold our condo in 2010) and that we’re going to buy this spring.”

I wish you good luck in your hunting, but I would give yourself a little flexibility if the selection does not improve and bidding wars abound. I think it would have helped us to set a hard deadline several years ago rather than passing on certain houses because something better might have come along. However, last year we did have a deadline, and I do have some regrets about our purchase.

I don’t know that we could have done better for the price at the time that we bought, but some compromises are harder to live with than I thought. It was hard to get a feel for that because it was my first house, and I grew up on the prairies where houses and lots were much more uniform. It was hard to keep all the factors in my head with such a tight time deadline.

Perhaps it would be good to consider whether or not you could afford to sell the house if you really don’t like it. Otherwise, I say buying in a market like last year’s with very little time to consider your decision is to be avoided if at all possible. At the very least, make sure you have a clear make-or-break list (write it down).

That being said, I do not how long you will have to wait before the market turns more buyer-friendly. I am not going to make any numerical predications, but I can’t see the number of listings suddenly jumping back to where they were a few years ago. So, I think it will still be a strong seller’s market, at least until May.

Dasmo & Marko, when you say 2500 sq ft or 5000 sq ft, do you mean the house square footage, or the square footage of drywall that counts ceilings & walls? Thanks.

We actually only have data for October still. They are way behind on publishing their data. https://catalogue.data.gov.bc.ca/dataset/9c9b8d35-d59b-436a-a350-f581ea71a798

Just about as bad as slowpoke CMHC with their rearward facing forecasts

More like February. But yes March, April, May, are generally the most active months

https://househuntvictoria.ca/2016/02/04/what-happens-in-the-spring/

That’s not how loss aversion works. When you are down you don’t want to lock in the loss. You hang on hoping for a recovery even if it doesn’t come. We’ve seen this in our market. Why weren’t there very high sales when prices were declining here? Based on Deryk’s theory people should have been itching to sell before prices declined further.

Well its settled, Richmond mayor states that it is hard to enforce illegal house hotels and “birth hotels” because many of the offenders speak a different language. Instead, he decides its best to make them all legal.

http://www.richmond-news.com/news/city-of-richmond-staff-urge-legalizing-illegal-hotels-1.6154283

730 Kelly Road and 482 Dressler.

$415,000 and $430,000

Once again if anyone would like a PCS account, no obligations, please email me at markojuras@shaw.ca and I’ll set you up.

And the industry is using this as an excuse to double their rates. My 2500 sqft drywall quote was 36k…. That’s brutal, I paid $27.5k in 2014 for double the size.

That’s a solid resume! I’ve been reading financial news long enough to take predictions for what they are no matter the resume behind them. His peak energy theory has bubbled up before and while I like it because I’m an apocalyptic end of the world fan I’m not so sure we are heading back to the stone age this century. I guess he will have to revise his dates again now with solar getting so efficient….

Dasmo, I don’t follow the guy religiously but his resume shows he’s got some experience and knowledge about how world financial events evolve from boom to bust,especially from the Asian perspective.

http://www.richardduncaneconomics.com

Since beginning his career as an equities analyst in Hong Kong in 1986, Richard has served as global head of investment strategy at ABN AMRO Asset Management in London, worked as a financial sector specialist for the World Bank in Washington D.C., and headed equity research departments for James Capel Securities and Salomon Brothers in Bangkok. He also worked as a consultant for the IMF in Thailand during the Asia Crisis. He is now chief economist at Blackhorse Asset Management in Singapore.

Richard has appeared frequently on CNBC, CNN, BBC and Bloomberg Television, as well as on BBC World Service Radio. He has published articles in The Financial Times, The Far East Economic Review, FinanceAsia and CFO Asia. He is also a well-known speaker whose audiences have included The World Economic Forum’s East Asia Economic Summit in Singapore, The EuroFinance Conference in Copenhagen, The Chief Financial Officers’ Roundtable in Shanghai, and The World Knowledge Forum in Seoul.

@Hawk, no. I appreciate what you post and like to read all perspectives. I’m just a skeptic and find I t’s useful to frame the source for perspective. Same with industry insider pumpers….

“@Hawk, Isn’t Richard Duncan a doomer pundit?”

Isn’t everyone a doomer pundit to you Dasmo if they say the markets have a lot of risk right now ?

@Vicbot, And the industry is using this as an excuse to double their rates. My 2500 sqft drywall quote was 36k….

@Hawk, Isn’t Richard Duncan a doomer pundit?

Interesting that the Canadian Trade Tribunal just approved the new tariffs on drywall, which doubled the price of drywall – this means cost of renos & home building is going up.

The construction/home-building industry had been fighting this since September (it was originally the Canadian manufacturer CertainTeed that requested the tariffs, arguing they needed them to keep 200 jobs in Canada).

http://www.cbc.ca/news/business/drywall-tariff-us-imports-1.3920515

While the Chinese capital controls can probably be circumvented, the increased difficulty and risk in doing so will probably relegate the activity to the very well connected and wealthy Chinese. The legions of middle class folks buying western RE with mortgaged funds may not be so lucky.

Given the burgeoning size of China’s middle class and their current propensity to see RE as the ideal investment, I think it would be a mistake to underestimate the impact of them being mitigated globally as a force in our RE markets.

Local Fool,

Not to forget Trump’s effects of his intent to eliminate the trade deficit. It would destroy China and the global fallout would be fricking ugly.

“2. If the US eliminates its $1 billion a day trade deficit with China, China’s economy could collapse into a depression that would severely impact all of China’s trading partners, and potentially lead to social instability within China and to military conflict between China, its neighbors and the US.”

https://www.richardduncaneconomics.com/trumps-trade-policies-good-intentions-devastating-consequences/

Rook,

Juwai is in the business so not surprised they would disagree. The flows will never stop but will be slowed down as China deteriorates further as per the research company you quoted. There can be only so many financial channels and can’t be many holes left to plug.

“We see the summer fall in China’s stock market and subsequent efforts to revive assets values by pumping in cash as a tipping point. Now China’s economy is visibly deteriorating. Consumer spending lags already weak GDP growth. Only heavy spending on infrastructure kept the economy from tumbling into recession late 2015, and negative growth seems likely to come.”

http://www.jcapitalresearch.com

Fool, I was also reading the similar article on China’s line in the sand is $3 trillion in the kitty and if it dips under they will implement severe restrictions on travel and education abroad.

The Liberals will be looking for more votes and I expect the 15% tax here in the next 2 months or else the NDP will run with it.

VicRenter, from what I remember, March had an uptick in homes for sale but it was still early enough before the market got too competitively “hot.” But who knows this year!

@CS, many consider Freeman Dyson a denier because of quotes like, “I’m saying that the problems are being grossly exaggerated.” Another quote: “The warming, he says, is not global but local, ‘making cold places warmer rather than making hot places hotter.'” He’s obfuscating the issue with irrelevant data.

I’ve worked with people who are feeling the effects now, & with people trying to find solutions, so it’s not my assessment, it’s their real life experience. Also look up Bangladesh or North Africa climate refugees, or birds being displaced or going extinct due to warmer seasons affecting their migration/food sources/breeding/predators.

@ Rook,

Regarding the capital controls in China, I think it may be getting a bit more desperate from the PRC’s perspective. From another site, one person wrote:

…………………………………………………………………..

“China is trying to defend the “$3T Line” of its Foreign Exchange Reserve (FXR), if the line is broken and drops below $2.6T, then all hell will break loose because the amount will be lower than what is needed to maintain China`s daily economic operations withe the outside world (importing oil, raw materials, BMW, Lambo, paying wages to foreign workers…etc.).At $2.6T or below, anyone can go to China and say:

“… Hey, I have $1M USD, but I want 50-to-1 exchange rate instead of the 7-to-1 that was last week… What? You don’t like it? I will come back next week and it will be 200-to-1…”

In other words, it is the destruction of China’s economic power.

Time will tell if this measure is effective, and there is not much time left. Rest assured, it will likely be THE most interesting 6 months in modern economics moving ahead.

There are only 2 ways this can go:

1.) A “slow bleed into a stampede”, in which the downward pressure of RMB:USD exchange rate (breaking 7:1 anytime now) increases the anxiety of people to move money out, further depletes CFXR and trigger the $2.6T line, exchange rate crash into oblivion.

2.) An artificial “slam shut” one-off exchange rate drop by China’s central bank BEFORE the stampede: a one-off, massive devaluation of the RMB:USD exchange rate from the current 7:1 level to…. 8-to-1? 15-to-1? Something that is far beyond what normal folks can be incentivized to do the FX. This way it will safe keep the CFXR….

How will this impact the RE industry? Well, previous report suggest that 70%+ of the GVRD RE bought by foreign purchasers is with debt, meaning that the foreign buyer will have to make monthly FX exchange to fulfill the mortgage payments. When the exchange rate crash… well…..

Hey, I can be wrong = all of the Chinese people who desperately wanted to move money out of China are actually law-abiding citizens and will obey the central government’s order to stop buying RE in Vancouver, GTA, Seattle, Sydney… starting January 1st, 2017″

………………………………………………………….

Food for thought.

” Vicbot:

If you know that humans are “changing the chemical composition in the atmosphere,” then it would be helpful to avoid quoting climate change deniers & making statements that can be read in 2 ways.`

I quoted no climate change denier. If you think Freeman Dyson is a climate change denier, you are mistaken. But he does understand the models. He has worked on many things, including reconciling Richard Feynman

s diagrams with Tomonagas mathematical treatment of QED; nuclear rockets; the Strategic Arms Limitation Treaty; and, at Oak Ridge National Laboratory, climate modeling.On the whole, I find Dyson`s assessment of the anthropogenic climate change issue more realistic than yours. But that’s merely an opinion — not worth debating, I think.

After Novembers spike in foreign buyers we had some discussion on here about the 15% tax being extended to the island.

I don’t expect the percentage has spiked much in December do to seasonality, but does anyone have the number?

Hawk posted an article from the globe and mail today regarding China trying to stop the outflow of capital from the country. There were some quotes he forgot to mention regarding this,

“I haven’t seen any anecdotal reasons to believe that there will be a drop in inquiry levels from a year earlier,” Charles Pittar, chief executive officer of Juwai.com, the top international property website for Chinese buyers

“There is no doubt that Chinese buyers will set new records for international property purchase in the years to come,” Mr. Pittar said.

‘The new currency rules could even motivate more Chinese buying by making “people more worried about the security of their assets and more eager to move them overseas,” said Anne Stevenson-Yang, co-founder of investment advisory J Capital Research.’

‘Chinese investors tend to be nimble in finding ways around new rules, too. “It takes about a month before people find the next channel,” Ms. Stevenson-Yang said.’

https://beta.theglobeandmail.com/news/world/chinese-scrutiny-of-money-movers-could-slow-canadian-property-sales/article33485996/?ref=http://www.theglobeandmail.com&service=mobile

Christine Duhaime, a prominent global lawyer that works in anti-money laundering recently tweeted :

“Over $2,000,000,000,000 in proceeds of corruption moved from China to US, Canada, AUS, Netherlands. My Q&A. http://www.antimoneylaunderinglaw.com/2017/01/qa-on-the-2-trillion-in-proceeds-of-corruption-removed-from-china-and-taken-to-us-australia-canada-and-netherlands.html”

A huge animal driving real estate prices. I predict we will see an influx this spring. I know the ‘numbers’ don’t show it, but I don’t believe these numbers are reliable as there are many ways around stating where you are from. I can imagine some real estate agents and lawyers may even encourage not specifying in the documents.

I really am not trying to create an anti-immigration statement on here as that is not what I believe, but I do think we should not ignore the facts, even here in sleepy Victoria.

Another interesting article regarding this if you feel like a read:

http://vancouversun.com/opinion/columnists/douglas-todd-vancouvers-escalating-housing-crisis-erupted-in-2016

@ce: In other words the rough magnitude of climate change was predicted a century ago?

The fact is there is a lot of uncertainty and their always will be as the models are not perfect and never will be as climate is an incredibly difficult system to model.“

I thought that`s what I said!

Can anyone tell me what two properties in Colwood sold for recently? 730 Kelly Road and 482 Dressler.

Thanks

“The rough magnitude of climate change was predicted more than a century ago just by knowing the infrared absorption of CO2.”

CS

In other words the rough magnitude of climate change was predicted a century ago?

The fact is there is a lot of uncertainty and their always will be as the models are not perfect and never will be as climate is an incredibly difficult system to model. However imperfect is not the same as useless.

I don’t advocate a catastrophic approach to climate change but where there is high uncertainty and potentially bad outcomes, caution is warranted….

No back to regular housing discussion…….

@ Local Fool: “if you’re stretched to buy a place at $850,000”

We won’t actually be financially stretched with an $850,000 house – I just meant that we’ve increased our budget significantly over the years with rising house prices. Buying a house for $650,000 would have been nice because we would have been being very financially conservative, but we’re still being quite conservative at $850,000. (I’m paranoid about rising interest rates and have done my own “disaster” stress tests.)

@ Vicrenter,

If you made up your mind, you made up your mind. But, and at the risk of sounding like a troll, if you’re stretched to buy a place at $850,000, you’re going to be seriously hurting when interest rates rise. For many today, artificial interest rates are the only thing separating them from financial oblivion.

Unless of course you have a horrendous down payment, and also presuming that values don’t fall significantly – then have fun and enjoy your new place.

My spouse and I have decided that we’ve been on the house-buying fence for too long (ever since we sold our condo in 2010) and that we’re going to buy this spring. As I’ve been writing here, we’ve been looking actively but I think we both still believed that there might be a dip in the market after the rush of last spring and so didn’t actually commit to buying. (We did put in a few auction-style bids with subjects but didn’t win.) We’ve watched the market go WAY up over the last few years – initially we thought we’d buy a place for under $650,000 and now we’ve had to stretch our budget to under $850,000. At the moment we can comfortably afford $850,000 but neither of us would be happy spending more than that. Because we can afford to buy now we’re going to buy now — we’re done trying to time the market. And I just don’t see prices dropping at all significantly with inventory this low.

When does the spring market usually start around here? March?

I still think that Hillside (or the residential area bordered by Hillside/Quadra/Finlayson/Cook, at least) is a reasonable deal for what it is compared to Fernwood or Oaklands . You can get a place with a nice view in there and the streets are pretty. It’s also a 25-30 min walk to downtown. Here’s hoping something good comes up!

Nice to see our tax dollars via CMHC creating housing….in Beijing that is. What a joke.

CMHC Helps Build Another Vancouver…In Beijing. Ironically, It’s Also Half Empty

https://betterdwelling.com/cmhc-helps-build-another-vancouver-in-beijing/#_

In terms of waiting for the market to change in the long run there is an old saying “That in the long run we are all dead”. That is not always actually accurate since I will be dead long before we hit the long run; more like in the short run. Had a point but forgot what it was at the moment.

“I was arguing that human caused climate change is currently impossible to predict with any accuracy.”

CS, I guess you realize you’re sending mixed messages. If you know that humans are “changing the chemical composition in the atmosphere,” then it would be helpful to avoid quoting climate change deniers & making statements that can be read in 2 ways.

For example, “impossible to predict with any accuracy” is understood by a climate change denier to mean “impossible to predict.” In fact, what you’re saying is “with any accuracy” but that nuanced meaning is totally lost by the time your sentence is finished.

The deniers have created huge amounts of misinformation based on bafflegab & twisted reporting of the science, and unfortunately that lack of clarity is feeding their game plan.

Another example: you said the people of Kiribati “wouldn’t have much to say.” Not only is this completely untrue – they have constant meetings about “Kiribati Adaptation Programs Phase 1/2/3” – it’s a total misrepresentation of a National Geographic article.

Oh I see. Then yes, we agree, and you’re just saying that it’s hard to predict where we’re headed. Interesting that you bring up schools – there have been a bunch of studies done showing the CO2 level in classrooms over the course of the day. They show that at the start of the day the levels are low, and then they steadily climb way above acceptable levels until recess, at which time there is a small downward trend. As expected, levels pick up again until lunch, and then again after lunch.

I don’t think classroom ventilation is on the funding radar though…

There have been some similar studies done in houses too underscoring the importance of proper ventilation.

SS: ” I was assuming that you were arguing that human-induced climate change is insignificant, to which I’m disagreeing”

No, I was arguing that human caused climate change is currently impossible to predict with any accuracy.

But we know we are changing the chemical composition of the atmosphere, which seems a dumb thing to do, and something that I’m against that for several reasons.

@ Caveat emptor:

“The rough magnitude of climate change was predicted more than a century ago just by knowing the infrared absorption of CO2.”

You’re probably referring to the work of Svante August Arrhenius (1859 – 1927) who estimated that a doubling in atmospheric CO2 would cause global temperature to rise 5C. Current estimates are rather different (1.5 to 4.5Cand take into consideration many other factors, e.g., feedbacks via evaporation, cloud cover, and much else beside). So no, the effects of CO2 on climate are not that clear cut.

However, we do know that rising CO2 will have many disruptive effects on ecosystems, and can have negative effects on human cognition at surprisingly low concentrations, i.e., lower than those that prevail in many schools and offices, which is why I have been a long-time advocate of carbon taxes, with countervailing duties on imports from countries without carbon taxes.

I guess I just don’t know what you’re trying to say.

“Climate changed before humans…” – yes it did…so what?

“Predicting the extent and direction of future climate change is really hard”…true…so what?

In another post you suggest that because it’s cold right now….?…or maybe that was a joke?

From these I was assuming that you were arguing that human-induced climate change is insignificant, to which I’m disagreeing, by referencing historical climate data.

If I’ve misinterpreted your intent, my bad.

@ SS: you quote me:

“Climate changed before humans appeared on the scene and continues to change independently of human activity.Therefore, a prediction of the extent and direction of future climate change must take account not only of effects of human action, which are numerous and difficult to model, but other factors that vary independently of human activity.”

Then you say,

“So you’re in the ‘climate change doesn’t exist’ camp then.”

Is that a crazy conclusion or what?

@ Leo S:

“People will switch en masse to electric cars when they’re better than gas cars. …”

Absolutely.

But waiting to see whether technological advancement will outrun environmental disaster need not be such a nail-biting experience. We just need to keep raising the taxes on things we don’t want, including rising atmospheric CO2. Unfortunately, introduction of Canada’s carbon tax is somewhat botched since it is mixed and matched with other incentive schemes. In the long-run, though, it should be possible to straighten it out.

At Marko J.: “electricity is super cheap in B.C. and comes from non-fossil fuel sources.”

It’s cheap in part because, aside from the GST, it bears no taxes. And as pointed out below, using hydro here means using more thermal power elsewhere. So given the fungibility of energy sources, hydro probably should be taxed like any carbon based fuel.

“at near 5,000 lb curb weight and extremely low center of gravity you don’t feel the wind storms on the highway. ”

But lugging all that weight you consume a lot more energy per mile (about 50%) than a Hyundai Ioniq.

But talking of performance, the Volt outruns a Tesla S85 from zero to 50 kph!

http://insideevs.com/2016-chevrolet-volt-accelerates-tesla-model-s-85/

@ Leo S: “But we don’t live in one of those places.. ”

Makes no difference. BC Hydro sells surplus power to California and other jurisdictions that rely on thermal power. So my using hydro here, increases thermal use there.

“By the way I just tested the Leaf and it only uses half that energy when idling with everything cranked. About 4.5kW.”

Yeah, but when its below zero outside, are you as cozy in a Leaf as you’d be in a Volt? Presumably not. At least, the Leaf cannot warm up as quickly. But after the first ten minutes, power demand for the heater in the Volt does drop sharply.

Leo S.

“This is not likely to happen both from psychological factors (google Loss Aversion) and from evidence in our market. When prices are declining sales go way down.”

Actually Leo, I think that you have made Deryk Houston’s case for him. Loss Aversion in the case of a good percentage of Vancouver home owners means just that. Sell now or risk losing more equity. They weren’t going to sell when more money was to be made but if they see the trend reversing they just might see their retirement shrinking and bail out.

Unfortunately, contrary to Deryk’s presumptions on boomer movement, I really believe that most of these boomers are going to get trapped into the “market coming back” meme and end up following this market down when they do list.

The flippers and speculators will be the sellers that can’t afford “loss aversion” because they, more likely than not, have put down minimal down payments and will be underwater really quick.

The market, again, is driven by the populace that has to sell, not those that can wait it out. You can sit on your million dollar house while comparable must sells are slowly degrading your equity. Well, hopefully slowly.

A good New Year to all.

Lamest climate denier line ever. The climate phenomenon that we are currently experiencing has a fancy scientific name – it’s called “winter”. Sorry – global warming is not going to cancel winter. A cold spell in winter no more “refutes” climate change than a hot spell in summer “proves” it.

He’s wrong, but it doesn’t matter. The rough magnitude of climate change was predicted more than a century ago just by knowing the infrared absorption of CO2. If someone could prove that you can keep adding CO2 to the atmosphere without causing warming that would actually overthrow a large well accepted chunk of modern physics.

@CS – “I’n not in the ‘climate change doesn’t exist’ camp, I just don’t believe predicting climate change over a period of decades is possible.

Climate changed before humans appeared on the scene and continues to change independently of human activity. Therefore, a prediction of the extent and direction of future climate change must take account not only of effects of human action, which are numerous and difficult to model, but other factors that vary independently of human activity.”

So you’re in the ‘climate change doesn’t exist’ camp then. We don’t need to predict the future to confirm or deny climate change, we look at the past. Is climate modelling hard? Yup. Do we have a historical record of our climate? Yup. Are humans having a significant impact? Yes we are.

This is not likely to happen both from psychological factors (google Loss Aversion) and from evidence in our market. When prices are declining sales go way down.

Looks like the cat’s outta the bag.

Chinese scrutiny of money movers could slow Canadian property sales

“Strict new government scrutiny on Chinese people who want to convert their money into other currencies threatens to slow the rush of foreign property buying that has stoked sky-high home prices around the world.”

“Under the new regime, the number of buyers will “drop sharply,” said Andy Xie, a China economist formerly with Morgan Stanley. Those selling homes to Chinese buyers should brace for their “business to shrink dramatically,” he warned.”

http://www.theglobeandmail.com/news/world/chinese-scrutiny-of-money-movers-could-slow-canadian-property-sales/article33485996/

Millennials just passed the boomers population and half of them just got chopped out of the market. Less buyers for the old folks and flippers homes makes for a declining market to kick in with rising interest rates coming faster than you think with Trump’s trade deficit disaster plan.

Assuming people will sell Vancouver because it’s falling there and buy here is wishful thinking as the numbers have shown they are on the decline. Moving to the island is a complete life change and you need a job etc. Not everyone is automatically going to retire because they cashed out. They will bank the cash and rent in Vancouver or downsize to a condo there versus establishing a whole new family/social existence.

BREAKING: Vancouver home sales plunge again

Metro Vancouver home sales fell 39.4 per cent from a year earlier to 1,714. They were down 22.6 per cent from November, according to the Real Estate Board of Greater Vancouver, and 5.6 per cent for the year. The benchmark price for all types of homes was down 1.2 per cent from the previous month to $897,600

Does anyone know anything about the Elkington Forest development? They are building houses with solar hot water and heat and rainwater catchment systems. Anyone been up there?

This one is in response to “Rook”. I believe that as prices in Vancouver start to drop, the people there will make the decision to sell. (Why would they sell when their house was going up every year by tens of thousands?) People are more likely to jump ship when they know that their property value is dropping. Especially if it is dropping by the tens of thousands as Vancouver is likely to do.

Those people selling will have to buy a house somewhere and Victoria is still seen as a total bargain when compared to vancouver. (Vancouver houses are at least $2.5 million dollars and that is likely for a lot half the size of one in Victoria. The same house in Victoria, would sell for $850,000.00)

I predict that Victoria prices will make another big jump this coming spring. I believe that a house in Victoria worth $850,000.00 today…. could easily see One million dollars by next summer.

Even if the Vancouver house drops in value by five hundred thousand dollars…..The person selling that house could still buy the Victoria house for One million dollars and still put one million dollars in the bank.

It seems like a no brainer…… but of course….only time will tell.

Michael:

Generally you are right but you also have to adjust for mortality. 50% of men are dead by age 74 but they dont all die at 73. But I think we have a few good years ahead for Victoria.

Besides I expect that ten years from now a lot of people will want to move since is that also not the year that the blue bridge will be put in place. Naturally it will only lift once and then lock into place in order to be a tourist attraction. Lisa Helps will claim it was designed to reduce traffic downtown.

If we throw in a green arrow at your 62.5 Barrister, it looks like we still have about 10 years of increasing retirees.

http://i.imgur.com/FRZHPWX.png

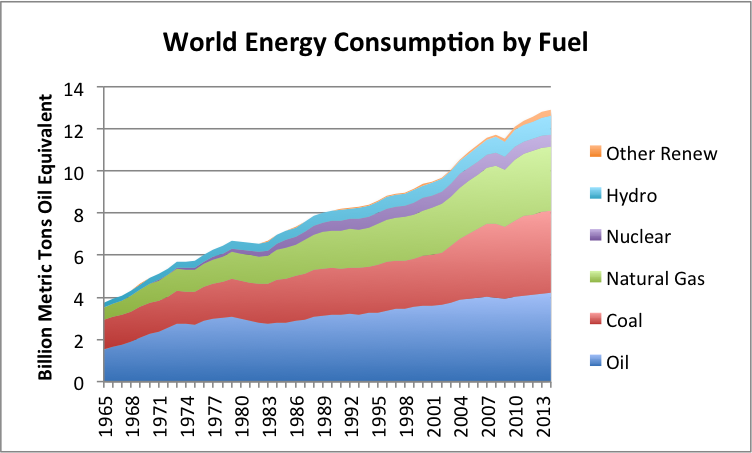

Someday renewables will become an important part of the mix.

Leo S

Thanks for the chart and it is probably more accurate than what I was reading. I believe that the average age of retirement is now about 62.5 so you are right that we have another five years before hitting peak. I stand corrected. I learn interesting things on this blog.

Do you think that this will keep driving prices in Victoria?

This is the key. Climate change here or there, you have about as much chance of convincing someone it exists as arguing them out of their religion. People will switch en masse to electric cars when they’re better than gas cars. People will switch to passive houses when they’re better than the alternative. The world will switch to renewable power when it’s cheaper than oil and coal.

Good news: all that stuff is happening right now or within the next few years. Fast enough to prevent disastrous climate change? Maybe, maybe not. No point worrying about it in any case.

I’m all in favour of bringing back more higher paying manufacturing jobs here but Trump doesn’t understand the main point – we need to stop our reliance on oil, and manufacture more electric vehicles & alternatives to petroleum-based products,

It’s coming irrelevant of what Trump does it just needs 10-15 years. Electric cars are just a much better platform in terms of safety, performance, practicality.

Electric cars really aren’t much more efficient than ice-cars in this weather.

Who cares about efficiency anyway…electricity is super cheap in B.C. and comes from non-fossil fuel sources. I’ve been super impressed with the Tesla in the winter weather. I have a long and steep driveway and the AWD is insane. Handles snow much better job than an Audi with Quattro. Also at near 5,000 lb curb weight and extremely low center of gravity you don’t feel the wind storms on the highway. Best part is being able to pre-heat the car from my cellphone when walking back to it.

Turned 30,000 km today. Not one problem, not one trip to gas station, not one service, and the car has improved since I bought it (screen is easier to use and regen brakes work much better thanks to software updates). I think the first thing I will need is new tires at 50,000 km this summer. Battery at 99% compared to new.

Model 3 will be a game changer. I work with a few builders and have them all installing Nema 14-50 plugs in garages as standard spec now.

But we don’t live in one of those places.. And even if we did, if you’re going to consider the energy it takes to deliver the electricity then you have to also consider the energy cost of delivering your litre of gasoline. By the way I just tested the Leaf and it only uses half that energy when idling with everything cranked. About 4.5kW.

@ BitterBear: Your joke made me laugh, so CS is probably not DT.

@Sidekick Spliff: I’n not in the ‘climate change doesn’t exist’ camp, I just don’t believe predicting climate change over a period of decades is possible.

Climate changed before humans appeared on the scene and continues to change independently of human activity. Therefore, a prediction of the extent and direction of future climate change must take account not only of effects of human action, which are numerous and difficult to model, but other factors that vary independently of human activity.

I drive a Volt mainly because I hate pressing those sticky buttons at the gas pump and standing in the breeze on a winters day pumping gas. Also, electric drive is pretty cool — instant torque.

As for interest rates in Canada, you are probably right if you assume we will be somewhat insulated from whatever the Trump administration does, although I think not altogether.

In fact, I think Trudeau would be smart to get on board the Trump train. Trudeau’s infrastructure program, for example, seems to be going nowhere fast. But working with the US we might get some interesting cross-border projects going soon and providing real economic stimulus, e.g., the Mexico City to Winnipeg highway, maybe, or a hyperloop link from Ottawa to Montreal, Toronto and places South.

@ Leo S: “Your gasoline car when cold will idle at about 2L/hour or about double that usage.”

Yes, but my 9 kwatts would, in most places, be generated with a gas turbine (60% efficient), and there would be line losses and losses in energy storage and release. So it would be about even.

@ Vicbot: It’s to protect their own assets when the big claims start coming in from extreme weather events”

But climate warming is predicted to be greater at the poles than the equator, thus reducing the energy differential that drives hurricanes and other extreme weather events. And it is claimed that US hurricane frequency has indeed decreased over the last 150 years:

https://www.google.ca/search?q=hurricane+frequency+by+year&espv=2&biw=1280&bih=890&tbm=isch&imgil=p8SpLY8wwjNC6M%253A%253Bcmcn-KyDeJ6AgM%253Bhttp%25253A%25252F%25252Fwww.climate-debate.com%25252Fforum%25252Fhurricanes-worldwide-1970-2012-d6-e86.php&source=iu&pf=m&fir=p8SpLY8wwjNC6M%253A%252Ccmcn-KyDeJ6AgM%252C_&usg=__pu5OArzdNg7jX3vkJjcOw7i1xdk%3D&ved=0ahUKEwjQ1ZrJ6KfRAhUEKWMKHb3lBOIQyjcINw&ei=DpBsWNCWNITSjAO9y5OQDg#imgrc=KTOvyj-eTOj0jM%3A

As for predictions, I see Vancouver prices taking a nose dive this spring and a lot of people panicking. Anyone else seeing this in their crystal balls?

What would this mean for prices in Victoria?

by the way, there are thousands of stories on what the insurance companies are doing but here’s one: http://www.cbc.ca/news/business/fort-mac-climate-insurance-1.3576918

“Twenty years before the Rio Earth Summit, where the world’s countries first focused on a global strategy to fight climate change, the insurance industry had recognized that claims were rising more quickly than their risk tables had told them they should. Their research pointed straight at climate change … homeowners …will be encouraged to do things like direct runoff away from their houses, install devices to prevent sewer backup, cover window wells, or make their homes more fireproof.”

“Being a cynic, I suspect they’re building in a bit of extra profit based on public anxiety about climate change”

Nope, the insurance companies don’t talk about this publicly much at all. It’s to protect their own assets when the big claims start coming in from extreme weather events – all the big insurers are, but it’s not worth getting into detail on a housing blog. You can try to pick the wings off flies, bury your head in the sand & quote crusty old climate change deniers (a mathematician isn’t the same as a climatologist), but that’s not what’s happening in the real world today.

How do you figure? This chart is from 2011 so add 5 years to the ages and the boomers are currently between 51 and 71 years old, with the largest number on the younger end. The older boomers have retired but the majority of boomers are still working.

Not true. Your gasoline car when cold will idle at about 2L/hour or about double that usage.

And I assume you aren’t just sitting in your car with the heat on. The driving is the important part.

Also the Leaf only uses about 4.5kW with heater and everything cranked.

@CS – you’re a hard person to interpret. On the one hand you sound like you’re in the ‘climate change doesn’t exist’ camp, and in almost the same sentence you’re driving a Volt. I don’t know whether to applaud or condemn!

Maybe we can all agree that it would be appropriate to leave our planet to the next generation in the same or better state as we inherited it. I would very much like to see leadership (government or otherwise) push us in this direction. So far, no dice.

As for interest rates, I just don’t see how the government can let them rise (possibly in step with the US) without precipitating a major recession here (barring major, across-the-board inflation). I don’t doubt that there are enough people living close to the line that a ~2% hike could crash the market. Let’s not forget how much of the economy is currently tied up in housing. It’s in (almost) no-one’s interest to cross that line. Politically it would be a death sentence.

So, I don’t think there is any other scenario but a slow and gradual climb of interest rates in step with inflation. My prediction is that our government will need to start QE again as the US rates go up, so personally I’d go with a variable.

As for housing, I think it all hinges on the external buyers, as I would agree that the majority of locals are not going to be able to afford increased prices without a flush buyer to kick-start the chain (Vancouver buyer pays the premium, seller can now afford more, and so on). Vancouver is still far more expensive, even with deflation there. You could sell your 33-foot wide property there and find waterfront or acreage here and still pocket a chunk of change. Same goes for Seattle.

If the dollar slides, which it most likely will, then Victoria will become more attractive to non-CADs. Then we’ll see if Christy extends the tax.

If there is, in fact, a significant number of buyers waiting in the wings, then I think we still have a ways to go (up) in 2017. I also think it makes sense that the condo market is heating up and SFH is cooling since many are priced out of the SFH market. Plus there is the allure of the ‘new’ in the many buildings currently under construction. Same goes for the western communities.

We’ll see…

If you add a letter to C, you get D.

If you add a letter to S, you get T.

Are we sure CS isn’t Donald Trump in disguise?

[joke]

Turn up the speakers and take note of the map time line at the end. Global warming indeed.

http://bloggersarena.com/science-and-nature/They-Took-A-Camera-To-A-Remote-Area-What-They-Caught-Terri/?l=2&utm_source=Fantastic&utm_medium=cpc&utm_campaign=They-Took-A-Camera-To-A-R-439

Vicbot,

“I’ve also worked with insurance companies that are already building in the costs of climate change into their risk calculations – businesses already know this”

Being a cynic, I suspect they’re building in a bit of extra profit based on public anxiety about climate change. In fact, climate always changes and no one knows for sure, the magnitude or direction of human caused effects.

According to legendary mathematician Freeman Dyson, the climate models do the fluid dynamics well but omit many significant variables thereby making them useless for predictive purposes. That seems to be the case. I don’t believe there are models that take account of everything: soot, methane, refrigerants, sulfates and other aerosols, surface albedo changes, changes in clouds at various altitudes, changes in solar output, changes in solar magnetic field and hence the flux of cosmic rays reaching the atmosphere where they create ionized particles that cause cloud droplet nucleation.

The world may have been warming, but solar magnetic changes suggest we are approaching another little ice age, like that at the end of the 16th century when the River Thames froze, so soon those Maldivians may find themselves high and dry, all around.

http://alexanderhiggins.com/top-scientist-on-nuclear-climate-change-science-controversies/

http://www.forbes.com/sites/peterferrara/2013/05/26/to-the-horror-of-global-warming-alarmists-global-cooling-is-here/#336911b269bb

By country:

Canada: 94%

US: 2.5%

Russia: 0.7%

China: 0.4%

Most of the out of country visitors are probably spam and bots.

Thanks, Leo.

I agree with Vic & Van that the Cadboro Bay, Queenswood, 10 Mile Point, Arbutus areas have good value. I purchased my property in Arbutus ( north of Arbutus Road adjacent to Queenswood ) this July, having moved from the South Surrey area where I had lived for 40 plus years. The purchase price was about 10% over 2015 assessment. The 2016 assessment has increased 23%.

This location is ideal: walking distance to U Vic, Cadboro Village and a short drive to downtown, relatively traffic free. Since I moved in, 4 other houses have new occupants: one from Saltspring, one from Calgary, one from Vernon and I haven’t met the other one yet. The houses were built in the 70’s and about half have been updated. The lots are 1/4 acre and larger ( mine 1 acre ) and well treed and private. South Surrey is getting completely overbuilt and busy: what used to be beautiful rural land is now becoming wall to wall townhouses and condos. Thus the move.

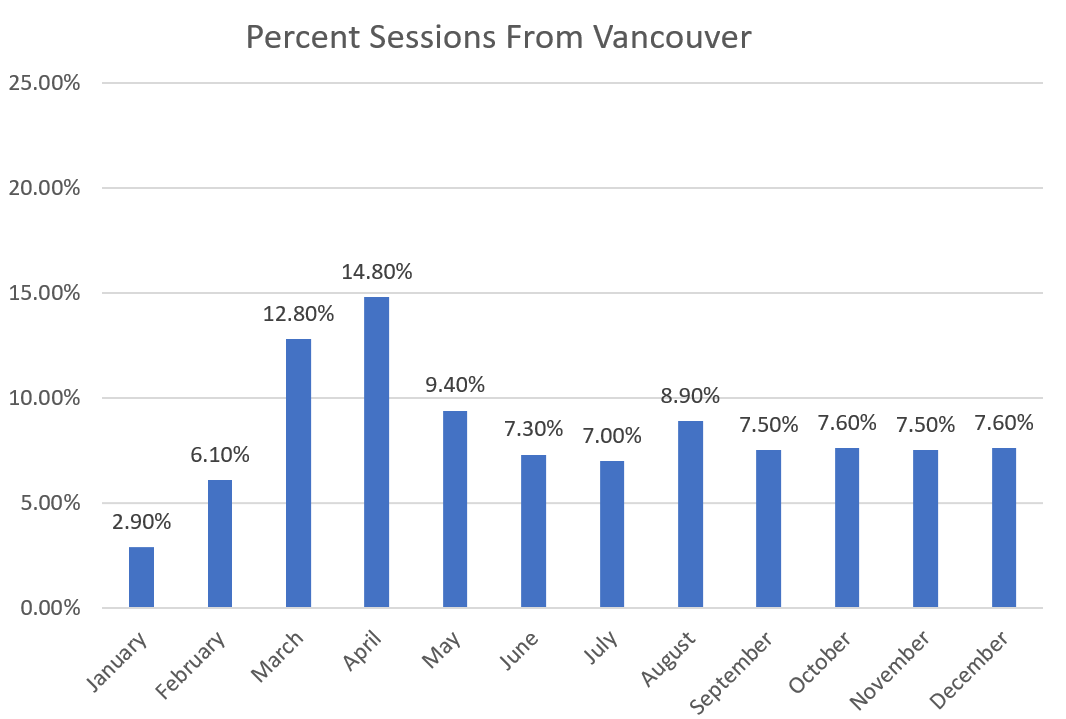

For the year:

11% Vancouver

1.7% Toronto

1.7% Calgary

Big jump in Vancouver views in the spring.

Most definitely. I dropped the ball on that one in 2016. Maybe in a couple months?

In the past, 80% of the time it’s been better to go variable than fixed. This makes sense because as rates decline it’s better to follow them down than to lock in at the higher rate for 5 years.

The unique situation we’re in is we’re at a rate bottom so it might not be as clear cut. That said I’d still go variable. The chance of a rapid increase in rates is very small as the economy couldn’t stomach it.

CS, actually those islanders have a lot to say about how climate change has affected them, and that National Geographic article discussed that. The land that you referred to as “building up” is actually the shifting islands (building on 1 side, losing on the other), and how they have to adapt their agriculture, infrastructure – which is next to impossible on the already-urbanized islands.

(I’ve also worked with insurance companies that are already building in the costs of climate change into their risk calculations – businesses already know this”

“The islands are going to fight back as the environment changes, and adjust themselves to new equilibriums. But there may come a point when they can no longer do that, and we don’t know when that point will be reached. The biggest fear island people have is not knowing what will happen beyond that point …

“Urban islands are in trouble because they’ve lost their capacity to adapt,” Kench says. “They’re environmentally degraded. Their reefs are damaged, the sedimentation processes are undermined, and the islands aren’t actively connected to their reefs. For densely urban centers, the only strategies to cope with rising sea levels will be engineered ones” Also: http://www.cbc.ca/news/canada/lennox-island-pei-water-ocean-sea-levels-1.3756916

“we need to stop our reliance on oil, and manufacture more electric vehicles & alternatives to petroleum-based products, if we want to stop these incessant oil-fueled wars.”

Electric cars really aren’t much more efficient than ice-cars in this weather. Today my Volt was pulling 9 kwatts when stationary: heater, demister, heated seat and steering wheel (the last two a minor drain compared with the heater and demister). All the “waste” heat from an internal combustion engine is actually used to heat the car.

Trump’s been quite explicit in condemnation of “oil-fueled wars” if you are referring to Bush/Obama ME wars. His plan is to seek continental self-sufficiency in energy, thereby making the US totally independent of the ME.

“All this talk about Trump and climate change is interesting for sure but I would like to hear more about Victoria real estate.”

My point about Trump was actually about Victoria RE, i.e., that Trump is one of the factors of which we can be most sure will affect real estate — via the economy and interest rates. But that is, certainly, quite speculative.

As for “Climate is different from weather. Talk to the people of… Maldives.”

They might not have that much to say. Their Islands are growing as fast as sea level is rising:

http://news.nationalgeographic.com/2015/02/150213-tuvalu-sopoaga-kench-kiribati-maldives-cyclone-marshall-islands/

All this talk about Trump and climate change is interesting for sure but I would like to hear more about Victoria real estate.

South had posted a comment before regarding Cadboro Bay/Ten Mile Point/Queenswood assessment increases lagging Oak Bay/Uplands. I am interested because I follow this area closely like South does.

One family member’s property in Ten Mile Point went up 30% – the same as the parents’ home in South Oak Bay.

I see waterfront in Ten Mile Point went up 20% which is roughly the same as the increase in waterfront in Oak Bay from what I can see. The overall increases seem to have tracked other Saanich East areas like Gordon Head and Broadmead generally. Perhaps South you can tell me where specifically assessment increases are less than average?

Of course, the increases are definitely less than Uplands which saw some streets going up 50% on average. That’s way above the average for appreciation and way above the average for the rest of Oak Bay.

I agree with you, South, that those Cadboro Bay neighbourhoods are excellent value relative to Oak Bay/Uplands and great places to buy even at these prices.

Some of the streets in Ten Mile Point/Queenswood are as posh and even prettier than some streets in the Uplands. The schools are good for those areas, you have the university, water and prestige.

I do think there is name recognition – most potential BC buyers in Toronto will know about Oak Bay or Uplands but won’t be familiar with Cadboro Bay or Ten Mile Point. Therefore, there is probably less pressure on prices from out of towners (esp non British Columbians ( than in Oak Bay or Uplands.

This might apply to Barrister’s neighbourhood of Rockland as well which as lovely and historical as it is, doesn’t quite have the Oak Bay name recognition outside of BC.

Just my thoughts but would be interested to hear from others. . . . .

@greysangel

The spread between fixed and variable rates is growing right now – with fixed rates heading higher, and variable rates remaining fairly static. A few months ago, when fixed rates were lower there was very little incentive to choose a variable rate mortgage over the security of a super low fixed rate.