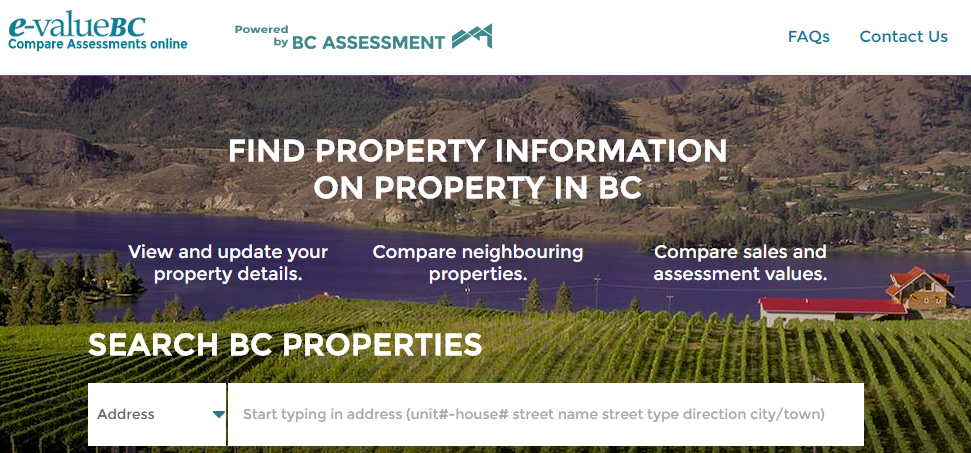

2016 Assessments Now Available

Unless you were one of the lucky few thousand that got an early warning about your assessments, you should be getting some mail next week with the updated assessed value of your house. Luckily it’s the Age of Computer and while that might mean that nobody knows exactly what’s going on, it does mean we all get to look at assessment values of friends and strangers online.

Given the market insanity in the past year, you can expect some big increases, but remember, that doesn’t mean you will necessarily be paying more property tax. Yes, your property tax is set as a percentage of your assessed value but those percentages are re-calculated every year. If your assessed value has gone up by a percentage that is similar to the rest of the properties in your municipality you can expect your taxes to only increase to cover the growth in the city’s budget. So the property tax rates will actually go down in a year where assessed values jump. If the assessed value seems out of whack, make sure that the property information is correct and take a look at the sample sold properties that BC Assessment thinks are comparable to yours. Remember that the assessors are not actually visiting your house in most cases so if you know something they don’t you can always appeal your assessment and try to have it lowered. The deadline for appeals is January 31st and as it seems our property information has an error I will try the appeal and document the process here.

What are you seeing in your area?

Up 24% in Camosun/Hillside area. I appealed last year’s assessment based on the fact that the building portion of my assessment was assessed about 15% higher than comparable houses in the area. I used recent sales with photos and descriptions of the qualities of the homes vs my own in my presentation. Although the appeal panel agreed that it was out of line with the comparables I wasn’t successful in reducing the assessed value of my home because, according to them, my building was assessed correctly and the others were low. The appeal panel recommended that the assessor review houses in the neighbourhood to correct this imbalance.

This year? No adjustments had been made to correct the imbalance in the area. It did take quite a bit of time to prepare for the appeal and I’m not sure I want to do it again this year so will just live with it for now.

+29.5% in Fairfield. Can’t argue about the land value but our building value jumped and seems high relative to neighbours with newer, bigger, better houses.

New post: https://househuntvictoria.ca/2017/01/03/2016-year-in-review/

Interesting sales were running 10% ahead of last year all month but in the last week they dropped off to just match it.

Thank you Marko:

You posted last months results just as I asked the question and hit send. The mark of a great real estate agent, anticipating a question before it is asked.

Marko:

Are December’s number out yet? Hate to bring up a real estate question here. I am sure that you have posted them but I must have missed them.

By the way, happy new year and all the best to you and your family.

Dec Dec

2016 2015

Net Unconditional Sales: 471 465

New Listings: 392 451

Active Listings: 1,493 2,517

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

Interesting the new China rules are targeting money laundering AND channeling of money into overseas property. That could be a bigly. 😉

China Gets Strict on Forex Transactions to Stop Money Exiting Abroad

-Regulator targets outflows for property, money laundering

-Bank customers must pledge to stick to currency rules

“The State Administration of Foreign Exchange, the currency regulator, said in a statement Dec. 31 that it wanted to close loopholes exploited for purposes such as money laundering and illegally channeling money into overseas property.”

https://www.bloomberg.com/news/articles/2017-01-03/china-drills-down-into-forex-transactions-as-money-exits-abroad

How does BC Assesment factor in renovations? If done with permits do they just find out the costs and add it to the value of the house or do they have a formula for figuring out how much value something like a new kitchen would typically add to the value of a house? And would the renovation just need to be completed by July 1 to be included in the next assessment?

My friends bought a place with approximately $100,000 in brand new renovations completed just before the closing date in May, but their assessment shows the value of their property having increased about the same amount as the other houses on the street. So it doesn’t look like the reno was included in the assessment. They’re not worried about appealing – they just want to know if/how BC Assesment deals with renos.

1.2M, you lose your homeowner grant, and a lot of people haven’t budgeted for such sudden sharp increases.

$570 a year or $845 for seniors.

A bit rich for South to make an issue of Hawk supposedly posting under another name, when she has done so repeatedly. I don’t consider myself a bull or a bear, but I do appreciate Hawk’s posts. Doesn’t mean I agree with everything Hawk says.

Anyway, thanks Leo for the info on property taxes. I was wondering how that worked…

Thanks Vicbot and Leo 🙂

@Local Fool

I’m surprised by the number of negative comments on other forums about big jumps in assessed value. Most people do think it means they will pay much higher taxes.

The jump over 1.2M will be hitting just about every oak bay owner very soon.

Yes, more or less.

Say the municipality needs to raise $100 million via residential property taxes and the total assessed value of properties is $15 billion. So they divide $100,000,000 / $15,000,000,000 and get 0.67% or a mill rate of 6.67. Mill rate is how many dollars of tax you pay per $1000 of assessed value.

So it doesn’t matter if the average property is $100,000 or $1,000,000. The mill rate will just adjust in order to generate the total revenue they need.

So as long as your assessment is the same relative to others in the municipality, your taxes will only increase by the percentage increase in the municipal budget.

However if you can appeal to get your assessment lowered that will always decrease your taxes because now you’re lowering it relative to others.

Jim Dandy, I think part of the reason why assessments are becoming such an issue in Vancouver (and some in Victoria) is because with anything over $1.2M, you lose your homeowner grant, and a lot of people haven’t budgeted for such sudden sharp increases.

Is it correct that your property taxes only increase if the percent of your assessment is larger than other homes in your area? If this is true then the only factor that matters is the percent that you increased/decreased when compared to others in your area.

I’m curious as to whether the 2016 assessments might serve as additional political fodder for those on the mainland protesting high housing costs. With the massive 2016 run up, renters were ticked off, but homeowners may have felt wealthier. Now it will come to actually hit the latter in the pocketbook. The timing almost couldn’t be worse in that sense, as the values now are of course different than when the updated assessment was made. Really don’t know about Victoria. Prices aren’t dropping very much so perhaps the optics don’t sting to the same degree? I’m quite interested in how this will all play out in this year’s provincial election.

AG, you are usually the first to reply with within mere minutes to any of my posts with taunting comments. I suspect you are maxed out on leverage much more than you let on as no one should give a shit what I post the way you do.

I like to see Hawks articles as the wider geopolitical situation can definitely be a factor. Impossible to predict what effect if any it might have but worth considering.

Back on topic: Who’s appealing and what is your strategy? I’m going to call them tomorrow and ask if I can correct the square footage and get a lower assessment without the appeal. Seems like a simple error to me they should want to avoid wasting time on an appeal.

Then again the presumption that a government organization will act logically might be overly optimistic

Hawk you’re the worst culprit for the name calling….

Jim Dandy,

If the many juveniles on the board allowed a two sided discussion instead of making up fantasy and not have a hissy fit attack when they don’t like seeing the latest news then maybe you’ll get your answers. Until then you may want to go to Vibrant Victoria or Reddit.

Is anyone interested in real estate? Or would we rather engage in anonymous drama?

It’s great to see a really positive, conflict-free start to the new year 🙂

A few of the regular posters are really taking the value out of this blog in my opinion. It’s become about 80% name-calling/bickering/insults vs. 20% mature discussion. I have tried to engage in conversation a few times now but my comments get overwhelmed quickly by the negativity every time. Too bad that the few have to ruin it for everyone else. You’d swear it was a high school gossip blog after reading some of the comments below.

Oh come on, South – it was totoro that threw the first volley at Denise.

All Denise was saying was: let an opposing opinion be heard.

When you’re comfortable with where you’re at, you can handle everyone’s different opinions – agree, disagree, take everything with a grain of salt.

I understand why Denise said “smug” because you just have to read the remarks below – the comments about Denise being Hawk. Even then, Hawk is just posting an article about what OECD said about Canada & the US, and the last time I checked, Victoria was in Canada. Meanwhile, Hawk is being honest about not being a homeowner, which takes a lot of guts here.

Denise1, good for you, you must be at least 50-60 year old with that attitude and why you on a house finding website insulting other women that own their houses outright. You sound like Hawk on another IP.

[Future posts on this nonsense will be deleted - admin]South ,

You are as delusional as totoro.You both can’t handle an opposite opinion after lucking out for a few bucks which will be temporary until you cash in.

Might want to post articles that aren’t over a year old and have zero relevance.

http://www.chinalawblog.com

Yawn…drop off South. I am not Hawk, I don’t know what his RE history is.

As for myself, I couldn’t care less about the assessments. We own our home, mortgage free, have for years; and have no intention of selling any time soon, if ever. You’ll note I said “home”, not house, because that’s what it is, our home. It’s not an investment, not a piggy bank to borrow from to satisfy our avarice; it is our home.

Grow up South, your greed and insecurity is showing more with each word you post.

Different people.

Clearly Denise1 is Hawks alter ego. She showed up just as everyone was celebrating hundreds of thousands of free money, it was too much for Hawk to handle, having timed the market and sold his house in 2012, expecting the mega crash to happen because Garth.

50k fine is pretty small if you are exporting 5-10 million. And that’s if you get caught, pretty slim chance if you do it via international business.

https://www.bloomberg.com/news/features/2015-11-02/china-s-money-exodus

“QED”?! Lol. You’ve proven nothing Totoro, except that you are one of the “smug, sanctimonious ” people on this blog. One that thinks the blog belongs to them & if another’s opinion does not agree with theirs, that person is either faking their identity or someone to be criticized/bullied.

I feel sorry for you. It must get so very lonely believing you must reign supreme at all times.

South,

You mean the couple of rules like $50K fines and more as well as losing your right to transfer money out for two years ? The family mules will be thinking twice before sending the cash to help out the scammer relative.

LeoS ,

The local online news feeds have many a Horgan article or video, more so the past month. I think you just aren’t following the mainstream sites. Saw quite a few over the holiday.

Chinese will always get around these barriers, always have and always will. The harder the gov tries to control the more money wants to leave.

I’m expecting a massive flood of money now that a couple rules are being forced on citizens.

Happy New Year bloggers.

http://www.globaltimes.cn/content/1026830.shtml

Getting money out of China just got a whole lot harder starting yesterday.

Still lots of noise around the foreign buyer, but since being back for a month and attending many a function, surprising how many folks are from the Prairies and…Europe. There seems to be a long of new people in our neighbourhood, but not from where most people would like to tend to believe they are coming from.

That explains it. I don’t own a TV. When I see stories online it’s almost always David Eby not Horgan.

QED

Sorry Totoro, I am not Hawk; I just don’t care for smug ,sanctimonious people feeling a blog is theirs and theirs alone.

totoro,

You are one paranoid poster. Did you sell and are a renter now and is why you post all strange now ?

Dasmo, the government top up still goes against your ability to pay as per the banks, it’s not a freebie.

Anticipating advanced inheritances is a mugs game. Most folks I know (and their elderly parents) are hoarding theirs til the bitter end to protect themselves. They think they will either all live to 100, or as Vicbot pointed out want to stay and have live in nurses etc if they have to.

Just for AG who thinks Victoria is only “remotely” 20 miles away from the big town which is looking ugly. At this rate the deals will be over there, not here. Looks like the perfect bull trap set up.

“As noted in the table above, detached sales fell year over year by 47% in Vancouver East, 52% in Vancouver West, 66% in Richmond, 59% in Burnaby, 52% in REBGV, 54% in FVREB (Fraser Valley). REBGV detached sales were 24% below the 10 year average, Fraser Valley fell 22% below the 10 year average.”

Months of Inventory

Vancouver East- 9.3

Vancouver West- 6.6

Richmond- 8.9

Burnaby- 7.6

REBGV- 6.8

FVREB- 6

http://vancitycondoguide.com/december-detached-market-report/

But the government just printed it Hawk. They didn’t have to but they did. Without a doubt this will further boost the market. Inheritance when dead is over. The trend is to give now. Every home owner just got a top up. Sure it’s f’s up but it is what it is. The debt binge isn’t over yet.

Denise#1 seems to post solely to support Hawk. Very similar language and also doesn’t use the quote function just like Hawk. Probably just a coincidence.

When global events like mass Chinese currency inflow make their real estate go up it’s all cool for the bulls. But when the same global conditions change opposite there’s no way bulls will allow the thought of prices to severely correct because “we’re different” and “will never happen”. I think it’s called “having the blinders on too tight” or in Introvert’s case “having his head too far up his ass”.

It’s good to hear both sides because it helps you be realistic about your budget & prepare for a rainy day, as they say. Hawk was quoting the OECD & they have a good chart in that article.

Another thing that struck me this Christmas is at $1.2M you lose your homeowner grant. Sure you can defer, but people are living healthy longer. Our parents & friends’ parents are now living in their own homes into their 80s/90s because they’re healthy enough to stay, and believe me, when you get to that age, you don’t want to move.

It’s so easy for someone in their 30s to say “Just move to a condo or a senior’s home!” and it’s important to understand why it’s not happening. When you get to be 70 or 80, you’ll be fighting a move too, because your home is much more than a physical piece of property.

In any case, this is probably contributing to low inventories around here. That’s also why I think the “wealth effect” related to inheritances isn’t going to be as high as some people predict – the elderly who own homes are deferring taxes & spending lots of money on home care & live-in assistants.

“the BRIC countries will form a new currency this year”

Just as the eurozone looks like falling apart?! Your friend is crazy. Monetary union without fiscal transfers (as per the eurozone) is pretty much 100% discredited now. And can anyone imagine Putin allowing Russia’s interest rates to be set in Sao Paulo???

It is dangerous to get sucked into a single track. Doom is easy to preach but difficult to predict. Met up with a friend on my Alberta road trip who is predicting doom and buying physical gold and silver. He is predicting that the BRIC countries will form a new currency this year which will cause the US dollar and its economy to collapse. Of course when you start to explore this further it falls flat. If the end comes propane will be worth more than some gold coins. Plus, betting against the US is a fools move. Last I checked they had the largest military and a crap load of people willing to go loco in other countries. They also have the final solution. They simply would not let this happen sitting down. So the debate gets to WW3 in which case gold will probably be useless since it is still a faith based currency. They would be better off building a bunker and stock piling fuel, food and weapons.

Introvert has a point, Denise. Hawk has a tendency to post ‘doomer’ articles that are only tangentially relevant to Victoria real estate, then prophesy impending catastrophe based on them. In Hawk’s world any news is bad news, usually.

Introvert

January 2, 2017 at 11:54 am

Hawk’s nuanced outlook:

“When the bulls are overly bullish – – > housing crash

When the bulls are minimally bullish – – > housing crash

[Anything at all] – – > housing crash”

Quit being a troll Introvert.

Hawk’s nuanced outlook:

When the bulls are overly bullish – – > housing crash

When the bulls are minimally bullish – – > housing crash

[Anything at all] – – > housing crash

When the bulls are overly bullish you know what that means. 😉

Fears of a ‘massive’ global property price fall amid ‘dangerous’ conditions and market slow-down

“Ms Mann said a “number of countries”, including Canada and Sweden, had “very high” commercial and residential property prices that were “not consistent with a stable real estate market”.”

http://www.telegraph.co.uk/business/2017/01/02/fears-massive-global-property-price-crash-amid-dangerous-conditions/?WT.mc_id=tmg_share_tw

They must read your posts. Agreed your mahogany panels are treasure compared to fibreboard.

/s

“Ask 100 people on the street I bet no one could name a policy that John Horgan stands for.”

Ummm, this is NDP country LeoS, and Horgan has been on TV and the media lots lately promoting his $10 a day daycare, minimum wage hike, anti- pipeline, as well as stopping raw logs to China and getting mills going again. Only the Libber’s don’t seem to read the news. Christy has so many scandals and failures I lost track, that will come back to haunt her in the coming months.

On top of Eby in the media relentlessly smoking the Libs on their housing flip flop debt for kids program with no economic sense and shady connections to developers and others. Clark has the lowest rating in Canada next to Notely, not sure where you’ve been.

Stop complaining; my assessment went up 48.5%; the building is assessed at 3.5 times my next door neighbours which is a much fancier house; same vintage but in a much better state of repair.

Time to appeal.

Appeal process for this year now live: http://www.bcassessment.ca/Services-products/appeals

Yeah I think CAD will drop to .50

It’s not fantasy money Leo, you always say this. You can use it to buy a home for your kids, you can sell and cash it out “hard” and rebuy smaller or move or rent etc.

I think what you mean is that it’s just a big credit card, and it’s a loan without real cash banking so it’s so risky that you wouldn’t ever use it.

But historically housing has gone up numerically. As long as you can afford the mortgage and the payments on the heloc you should be ok. And as long as you use the heloc for solid careful investments then why not?

It is good for local economy too. Old timers finally willing to cut the cheque for much needed reno.

It is easier to convince yourself to spend $10k for the roof, $20k for the drain, $30k for the new kitchen, $100K for the new basement…. when you “know” your place is worth $1 million.

Yes could be. All that fantasy money is going to make people itch to spend it.

I don’t think anything can lose Christy Clark the election. It’s not that there aren’t things to complain about, it’s that there’s no competition. Ask 100 people on the street I bet no one could name a policy that John Horgan stands for. They should put David Eby in charge, at least he has profile.

Up 26% in Tolmie/quadra. Time to sell and buy a place in Cowichan with a burnin’ barrel.

Interesting post Introvert – also Ian Young’s tweet “Did BC Assessment just lose Christy Clark the election?” because of how people are saying that Vancouver assessments are 20% above current market value – ouch. (assessments always lag, but the optics on it aren’t good – most people there are fed up with the increases)

https://twitter.com/ianjamesyoung70/status/815636938984079362

Here in Swan Lake, the part north of Saanich Road, our property and our neighbours have all gone up by about 20 percent.

We purchased eleven months ago for less than 2015 assessment value, which makes the current assessment seem even wilder to us.

However, we don’t plan to move for many years, so the assessment is mostly useful for justifying our recent purchase to relatives.

My friends’ place in Hillside/Quadra went up 24%. Would the new assessment take renovations that were completed in April into consideration? They bought in May.

@Leo, I think it will affect the market because of the activity timed with the gift of hundreds of thousands of dollars. That’s a lot of down payments… Mom and dad now have more room to take out equity on their homes to give to the kids to buy a house… They won’t do that for the kids to go on vacation.

50% lower than now?

2017 is going to be the beginning of the largest growth in wealth for homeowners in the history of home owning. Mark my words, you can feel it in the air and also in the stats.

CAD will be 50% lower and once word gets out prices here will pop like never seen before.

Inflation will (and has been) growing at unbelievable rates (just look at all your bills and all the new taxes coming online) and that means numerically prices will go up, so make sure you own assets that hedge inflation like land, etc.

Happy New Year!

What a coincidence — the incorrect word sounds almost the same as the correct word, and they both mean the same thing!

This is a good point to make. Correcting their info is not the same as appealing your assessment. They will happily leave your incorrect assessment in place even if you correct them. You need to appeal to change it for the current year.

Would that cause real estate prices to rise though? I believe the wealth effect is more commonly felt in consumer spending. Your house just rose $100,000 so why not go on that $10,000 vacation?

Happy New Year blog family!

Up 6.8% here on the Saanich side of Gorge. Looks like the area ranges from 11%-19% increases.

I think the reason mine didn’t go up as much is because last year I noticed that BC Assessment had arbitrarily changed the finished square footage of my basement to 2/3 of the main floor, which they had also changed from 1006 to 979. Bizarre!! It had been the same for years, 1006 sq ft up & zero for the basement then suddenly they decided everyone on the street with a garage door has a 2/3 finished bsmt and if you have no garage door, full finished basement. I didn’t appeal the assessment, but I did click on “Are the property details correct?” on the main page, right below the assessment roll #, and I filled out the form and corrected all the square footage information. (I bumped the upper sq ft to 1067 and the lower to 390.) I never heard back from them, but this year the information on the assessment is as I had stated on the form!

Looking at my neighbour’s house, I see that his is TOTALLY wrong! His used to be 1066 sq ft on the main and 391 for his second story and this year, it shows 1060 for the main, ZERO for the second story, and 697 sq ft for the basement. I may be wrong, but I’m pretty sure the second story of his house is still there! They still list it as 1 1/2 story house too, so I’m not sure what’s going on at the assessment office…

As for friends and family:

Colwood – up 12.5%to 16%

Swan Lake – up 16%

Reynolds – up 18%

Behind Hillside Mall – up 14%

Glanford – up 24.7%

Christmas Hill – up 22.5% (bff’s house, PY 907, sold for $1.015 in Feb, now $1.111!)

Cordova Bay – up 21% (bff’s sister’s house, PY 842, sold for $1.030 in Apr, now $1.020)

Biggest jump was a relative in West Van: went from $1,922,200 to $2,678,000!

“It’s jibe. Jive is swing music.”

You’re wrong. Jive can be used as slang for matching up or agreeing with something.

If you are going to hand out free money you will give most to the rich….

Darn!

It’s jibe. Jive is swing music.

@Leo, they might affect the market due to the wealth effect.

Thanks Leo I am no expert so that is why I am asking

No. Assessments have no impact on sale prices. A high assessment might mislead someone into trying to list their house high, but it doesn’t change market value for that house.

I have looked at some of the currently listed homes and notice that some are listed now quite close to assessed value. Do most of you think that the new assessments will have an immediate upward effect on prices? Further will people with currently listed homes now close to assessed value raise their current asking prices? As an example 3528 Plymouth is listed at 1,390,000 with an assessed value last year of 908,000. Assessed value as of today 1,229,000 with of course the same list so it suddenly appears a much better value if that’s a word to apply to a close to a 1.4 million dollar home. I mean I get that assessments are from 1 July but before the new assessments came out it seemed ok to ask 482,000 above assessed value but now it’s only 161,000 above assessed why would not an agent be calling his/her client to ask to adjust the price up?

House we sold in January up 22% but still 25% less then what we sold it for…

Up 12-18% in the Gorge area of Saanich.

Up 23% in Cedar Hill (Saanich east). This is notably less than the +32% change calculated based on the ‘comparable sales’ method, so I don’t think hat method was correct in retrospect.

So odd that Cadboro Bay, Ten Mile Point, Queenswood and Arbutus didn’t go up that much. I would consider those places pretty much at the top other then Oak Bay/Uplands.

You have houses along Yates St and Mayfair Mall much higher then these areas, confusing.

Maybe there just isn’t that many houses that come on the market there?

Our principal residence in Esquimalt only up 6% (?)

Our rental property in Esquimalt up 30%

And our rental property in Fernwood up 30%

Assessed values are as of July 1 2016 so they will already be behind the market again

Have assessed values caught up with market values, in general? Or are they still below market value?

We’re in Cowichan Station. Our assessment went up 40% from last year, but it’s previous assessment was really low for the area. We bought for $540k in the spring and now it’s assessed at $447k, with most of the value being in the land. The house is a 1972 Panabode in very good shape. Interesting how they don’t put much value in it, but I’m not complaining.

Jubilee we are up 24% but house went down. It’s interesting because 2 years ago I appealed the value and got the house portion down. Last year it bounced back up and I thought it was too high (the house portion). This year the house portion is down. I can’t figure out this logic other than some people in our area are doing major renos or tear downs and maybe somehow that devalues my older house or the reno on my house is now 20 years old and it has reached some special depreciating milestone in their algorithm.

Marco – you mentioned in one of your posts ‘transient zoning’. What is that? Thanks.

Our place in Gordon Head is up 29%.

What makes no sense is that the building went up almost 23% (land, 31.5%). Other than regular maintenance, we’ve made no changes to our place.

Curious, I looked back at all the percent changes on our building value going back seven years:

2009-2010: +18%

2010-2011: -9.5%

2011-2012: +2.5%

2012-2013: +3.8%

2013-2014: +5.3%

2014-2015: +12.5%

2015-2016: +22.8%

Total change in assessed building value from 2009-2016: +31.8%. So… building value seems awfully elastic given our building hasn’t changed. (Not going to appeal or anything; I don’t really care.)

Since we bought our first (and only) place in Gordon Head seven years ago: +46.4%. Canada’s inflation rate over that time: 11.63%.

I don’t want to say told you so, but 40.4% is quite a jump 🙂

Current house in Victoria (‘the red barn zone’) went up 40.4%, as previously mentioned. I did receive a pre-assessment letter. 21% increase in S.OB waterfront. Victoria assessment seems right at market value and OB seems under. I could probably shave 40K off both, but most likely not worth it.

Barrister, yes the map seems to be temporarily unavailable. I clicked around neighbours last night one by one via the map. I’m sure they will fix it soon.

Barrister, I don’t remember that function from previous years (maybe my memory is going) but there is map-based assessment & sales data on “VicMap”

http://www.victoria.ca/EN/main/community/maps.html

Those appealing. I won last year. Have lots ot photos and comparisons. Make sure you have lots of data to support your view. Last year the assessment people where speachless when the panel ask them to justify the increase vs my neighbors. The assessment people asked me what I would be happy with. They and and the panel accepted it. Show photos of the worst areas of your your house that really helps. Make sure you have copies for all the panel and the assessment people. Make is as easy as possible for the panel to support you. Be polite.

“Interestingly enough my unit at 834 Johnson $282k (market value $260ish).”

With the new homeless shelter next door and the cops there 24/7 I don’t think you need to worry about assessment going up, more about the price going down. Location, location.

Cottage only up 5% thank god and that is the building. All my neighbors are up 20% so very happy. This could have been an ugly day for me. Very happy.

Up 24% but my neighbors got hit harder so happier. My successful appeal from last year has had a lasting impact. :).

My strategy of buying extremely small condos for rental purposes continues to work well….unit at Promontory assessment up to $248k (market value $330ish) and Era $245k (market value $360ish).

Interestingly enough my unit at 834 Johnson $282k (market value $260ish).

Reason 834 Johnson is so far off is square footage is the largest (but least functional) and no parking spot. BC assessments doesn’t seem to be collecting data on whether a unit comes, or not, with parking. It also doesn’t adjust for a bunch of other extremely important factors such as whether the building has transient zoning, or not, which greatly influences market value.

Our assessment increased 27%. We’re in the Glanford area of Saanich West. All increase was in the land value.

Up about 15% here. Most homes are still way below market value.

No worries bulls, they will all be down next year bigtime when the market blows into “smithereens”. Happy New Year ! 😉

‘All hell is going to break loose in Vancouver’

“It’s going to blow to complete and utter smithereens,” Cohodes predicts.

“I think the market probably topped in the spring of ’16 and I think all hell is going to break loose in Vancouver in 2017.”

http://bc.ctvnews.ca/all-hell-is-going-to-break-loose-in-vancouver-ex-trader-s-real-estate-forecast-1.3222636

When I looked at the assessment site a few hours ago it showed the individual lots and you could scroll to see what the neighbour was assested at. That function seems to have disappeared? Is anyone else finding that their map is not broken into individual lots?

Some of the differences between assessed and sale prices are pretty surprising. I’ve seen some where assessed value vs sale price are around 40% difference.

My assessment is only up 8% which jives with people around me so I’m good I think tax wise.

As an aside, I bought my place privately and the sales data doesn’t show on the assessment system. I did receive some kind of questionnaire about the sale that I threw out maybe that’s why.

We’re in Rockland. Lot up by 20%, which, interestingly, seems to be on the lower end of increases mentioned here. Why would Oak Bay & Uplands appreciate so much more than Rockland?

Still counting my blessings that we have a house in such a nice part of Canada. Life is good.

Ours is up 32% in Estevan and 38% for the house itself (probably due to renos). A relative’s place in Hillside is up 25% but the house itself decreased 12%. Another relative in Quadra/Mayfair is up 45%.

“people in Victoria want to make moves, lateral in my case just want a different area, but won’t list homes as there’s nothing on the market.” Yes there seem to be a lot of younger people wanting to move up from a starter home but can’t because the cost differential is so high now.

My home in Broadmead is up 26.5% and it seems everyone on the small street I am on increased about the same. Now only if I could find a decent home to buy on the peninsula I would be be out of here. I think that’s the problem right now, people in Victoria want to make moves, lateral in my case just want a different area, but won’t list homes as there’s nothing on the market. Bit of a catch 22 or am I way off the mark?

30% increase in OB and 19% in Saanich. We had both properties appraised recently – October and December – and the assessed value is currently well below market.

We’re up 24% in Jubilee, exactly the same as JD.

Whew. Up a tiny amount on the lot and 20% up on the house (all land). This instant paper money given out will help fuel the market… More debt please!

Here are some changes and comments:

Parent’s Home – South Oak Bay near Windsor Rd.:

30% increase to $1,200,000+ – 4 bedroom, older character home, no surprises here – this area is always expensive for the lot sizes.

Relative’s Home – Ten Mile Point

30% increase to $1,500,000+ – older home on big almost one acre lot, non waterfront, non view. Same increase for neighboring properties including waterfront. Curious about the 12% increases as reported below. Maybe it’s because the street is one of the posher ones in the area – but not this house which is in poor condition.

Relative’s Home – Cordova Ridge

15% increase to $1,100,000 – large home in great condition, great views

Friend’s Home – Cordova Ridge

12% increase to $900,000 – older home for area, great views

Family’s Investment Rental Townhouse – Gordon Head

15% increase to $400,000+ – not bad of an increase for dated 1980’s style multifamily rental

Friend’s Home – Uplands

Big winner here blowing away everything – a STAGGERING 50% increase to $1,900,000+. The 50’s bungalow “tear down” home is in poor condition but on a large 0.7 acre lot. Most properties on entire posh but non view street are also all up 50% or so.

Conclusion

Uplands was the place to buy even as late as last year. It’s behaving more like a Vancouver neighbourhood than anything else. The spread between Uplands and everything else including the rest of Oak Bay is widening.

I agree with South that there is tremendous value in those nicer Saanich East areas.

I wonder if Hawk is checking the assessment on the house that he sold….

Seems logical. 🙂

I’ll add your prediction. Lots this year!

BC Assessment thinks we have 2539 finished square feet when we actually have only 2116. Should be an easy appeal. Not sure why I didn’t notice this in previous years.

15% increase here in the the Northridge neighborhood of West Saanich.

Last round up 20%, this time up 40%!! ouch

(all land value btw)

I predict this time next year my place will be up 80%….

Annual Sales 12000

SFH Average $925,000

BoC Rate 0.75%

Check the increases in the sample sold properties. What’s the average increase? Keep in mind it’s valuation as of July 1, 2016. If the increase (and final value) in comparable properties was much less that can be grounds for appeal.

Up almost 40% here too. Ouch.

I thought larger increases were going to get a letter in advance?

I just got a 40% increase in assessment but my neighbour’s hertage house is set at 60% of mine.

Time to appeal.

Just checked ours. It’s up a grand total of 9%.

Also checked my friends and it’s around that or less.

I’m still shocked prices are up maybe 9-12% in 10 years here. Prices look very affordable still to me. A lot of 500-650k appraisals in amazing areas like Oak Bay – Cadboro – Arbutus – Cordova etc.

We are near 10 Mile.

My house is in South Jubilee and we have a 24% increase, right about where we expected. My folks’ place on Ten Mile was a much more moderate increase of 12% on a house a little over a million last year, which surprises me. I’d have thought the rate of change would have been about the same in those neighbourhoods.