What one hand taketh…

the other hand giveth away.

Just when you thought the governments were all aligned to beat down our monster of a housing market, BC decides to give away free money to people without any. In an effort to buy some votes from those pesky left leaning millennials, the BC Liberals have offered them up to $37,500 to hand over to the condo developers.

It’s called the B.C. Home Owner Mortgage and Equity Partnership Program and here’s the details:

- Program starts taking applications January 16, 2017.

- Maximum loan is 5% of purchase price.

- Open to Canadian first time buyers earning less than $150,000 and purchasing a place under $750,000.

- Loan is interest and payment free for 5 years, and must be repaid over the following 20.

The kicker is that you can use the free money as part of your down payment as long as you had scraped together at least half. So on a $500,000 condo you now only need $12,500 down which combined with various mortgage cash back programs I’m sure you can whittle down to almost zero.

So while the feds have taken specific aim at first time buyers with the new mortgage stress tests, the province is actively undermining those policy moves before they even have a chance to take effect. Election years sure have a way of leading to schizophrenic policy decisions.

The issue here is threefold:

- The only thing this will do is drive up prices for first time buyers. Handing out free money sounds like a great idea but really it just means prices will jump up to match the extra cash people now have.

- Higher loan to value ratios are correlated with higher default rates. In other words, if you have less skin in the game you are more likely to default and that is especially true in a declining market (as the CREA just predicted 2017 would be). Again, just after the feds raise the down payment requirements on loans over $500,000, the province negates the change. Ridiculous.

- With an interest free loan for 5 years, you are setting people up for payment shocks when they have to start paying back those loans. Anyone remember the havoc that adjustable rate and interest only loans caused in the US? Now our loans won’t be huge so the shock will be less, but this is a bad direction to go in. Also given the abysmal repayment rate on the Home Buyers Plan (only half repay them properly), I suspect the province will spend a lot of money chasing those first timers down.

Certainly makes sense to take advantage of it if you are thinking of buying next year but I doubt this will do anything to make housing more affordable. Do you think this is good news for first timers or not?

Didn’t you hear? Arrogance and righteousness gets you elected president.

Also new post. The sales/list is going insane. https://househuntvictoria.ca/2016/12/19/dec-19-market-update/

“This has the effect of blocking text hogs like CS (sometimes it’s 15 iPhone screen flicks to get past his tin foil rants).”

By text hogs you mean posters who do not share your opinion. I’m sure you can find an echo chamber somewhere else if that’s what you want.

South: “I’m all for a correction if there was actually a bubble but we are up only 16% in 10 years in Victoria, that is NOT a bubble, that is below inflation.”

South, the boys at the N.A.R in the good old U.S.A. could have used you during their last couple years of run up prices. I’m sure they could have averaged out 10 yrs. to prove there wasn’t a bubble there as well.

However, VREB hasn’t quite caught on to your methodology. Lol.

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in November 2015 was $608,600. The benchmark value for the same home in November 2016 has increased by 23.9 per cent to $753,800.

http://www.vreb.org/media/attachments/view/doc/statsrelease2016_11/pdf/November

Damn Entomologist! You said what I meant but in such a smarter way….

Wade is super cheap, I mean under 700k and you get to live in prime Victoria. Lovely corner.

https://www.bloomberg.com/news/articles/2016-12-16/loans-for-vancouver-down-payments-risk-fueling-canada-debt-binge

off topic or on topic

Did anyone look @ the Wade on the corner Cook/Johnson.

Thinking of buying, 2 bedrooms/2 washrooms

650 to 670$/ ft2

Concrete low rise.

Local Fool: But my finger hurts from scrolling past Hawk, JJ, and especially CS’s long long ranting posts that do nothing but promote paranoia and false information.

Im all for a correction if there was actually a bubble but we are up only 16% in 10 years in Victoria, that is NOT a bubble, that is below inflation.

Hmm, what about a default word count per post that this blog would show, and only if you are interested could you click “see more” and expand. Just like CBC. This has the effect of blocking text hogs like CS (sometimes it’s 15 iPhone screen flicks to get past his tin foil rants).

South,

“Also would be great to limit people to say 10 posts a day to limit the amount of repeat posts (aka hawk).”

There’s an idea – better yet, how about doing it yourself and choosing not to read the posts you don’t want to see? No one on here is so prolific that you couldn’t easily skip it. I doubt you would have the complaint if the poster was more inclined to your views.

Leo S. try to approve new posters but adjust the date/time stamp so their comment shows up as new at the top. Just scrolled way back and saw a couple awesome new posts that definitely would have been lost. New poster and Jerry.

Also would be great to limit people to say 10 posts a day to limit the amount of repeat posts (aka hawk).

I called it before it happened. I would appreciate some respect/cudos.

Mon Dec 19, 2016:

Dec Dec

2016 2015

Net Unconditional Sales: 351 465

New Listings: 315 451

—–>>>>>> Active Listings: 1,618 2,517

Ok so my projections are literally right on track. I said in a post a couple days ago this exact thing was happening.

Record breaking Dec folks. And come Feb prices are going to get insanely hot.

Ps. No one from the west shore hangs out on blogs like this. Most people here are in the core.

Dasmo,

In 1981 the inventory was non-existent as well with only one or two rows of listings in the TC in January when it was usually a full page and a half. By March the both pages were full and the 40% downhill slide began.

Saying it can’t happen when every financial institution is warning it can is nothing but pure ignorance which is obviously Introvert’s forte.

Here’s an interesting graph: Canadian house prices in constant dollars, 1980 through 2011.

https://vreaa.wordpress.com/2012/12/29/canadian-cities-inflation-adjusted-house-prices-1980-2011-annotated-chart/

Prices were essentially flat over the 20 years to 2000 (well, except for a blip in Toronto in 1986, attributable no doubt, to the fact that I was trying to buy a house there at the time). Then, as real interest rates headed for negative territory, prices headed for the blue empyrean. But this cannot last for ever. The only question is whether this is a South-Seas-Company or John Law crack-up boom ending with wheelbarrow loads of loonies for a loaf of bread and hangings on Parliament Hill, or is sanity about to prevail.

Well said, Dasmo.

The point is that our individual moral imperatives – what we desperately want to happen, think could happen, should happen, is a near certainty to happen based on everything we know about the world – may not actually happen. Or not very quickly. Or not as severely as we expect. Or not in the same manner as that similar-looking community we studied so thoroughly in our Economics 323, ‘Real Estate and Development’ course. Or not like ‘last time’

I’m all for evidence, arguments, opinions, theories, random guesses. Tales of both markets soaring and crashing. But humility too. Arrogance and righteousness are obnoxious.

Fallibilism is the principle that one can hold certain beliefs, yet still accept that we might also be wrong. It’s the cornerstone of the scientific method (and the antithesis of religious doctrine). Some of us might consider embracing it.

One in the same, Introvert. I’d guess that those pumping RE the hardest and with the most exposure would be likely to drop it faster than anyone else when the market turns. Hence it would be more succinct to say, pimped pumpers are tomorrow’s dumpers.

I’ll pimp pumpers. Others can pimp dumpers.

You also have to look beyond what you want to happen and look at what’s happening. This blog is very useful in that Leo presents data and people from all walks of life present their views on the market. I see a lot of debt and danger signs too but at 1600 houses for sale, still record low interest rates, subprime lending alive and well, a growing in demand city in a country that is friendly to immigration there simply is a lot more to support the market than there is to take it down.

@ Introvert:

“just because someone posts a link doesn’t mean his/her assessment of anything is astute.”

No, so let’s have some rational arguments for why the sky’s the limit for RE, and less of such comments as “South is makin’ a lot of sense,” which amounts to no more than pimping a pumper.

@ Jim

“Forget about putting us further in debt Christy…”

Yes. What you should hope for is higher interest rates, which would mean lower “affordability”, which would mean that your hard-earned savings would go further, i.e., prices would fall.

And although most Canadians seem to think it improper even to think about the significance of Donald Trump, they may soon see the significance: namely, inflation and a cheaper dollar, to be achieved through a massive infra-structure spending and tax cuts. That’ll force up rates both in the US and here.

@ Denise:

Wow, the majority of you are coming across as this blog’s “Mean Girls/Boys Club”.

Well said.

The pumpers hate anyone to raise any question about their ridiculous forecasts based, usually, on nothing but hot air and the belief that real interest rates below zero are a natural, normal, and decent thing that can continue indefinitely — which of course they cannot, since otherwise everyone would borrow their brains out until the price of an Oak Bay bung reaches infinity.

Denise#1, why are you so insecure about our highlighting Hawk’s 0% prediction accuracy regarding local real estate trends?

Also, just because someone posts a link doesn’t mean his/her assessment of anything is astute.

Some engineering going on there. They want to go after investors without killer no first time buyers I guess. I’m fine with putting restrictions on foreign ownership. At the same time they should look at stimulating better inventory growth that is family friendly and supported by proper infrastructure. No more condos for AirBnB and black money investors. Look to the Netherlands for how to do it.

Ok hang on. My numbers are wrong. Here’s the new best case scenario for borrowers under the program:

Purchase Price: $750,000

Maximum Downpayment (9.99%): $74,250

Downpayment from own resources (50%): $37,125

Maximum help from the province (50%): $37,125

Insurance Premium @ 3.85%: $26,016

Total First Mortgage: $701,766.37

Total Second Mortgage: $37,125

Total Owed on Property: $738,891.37

Loan to Value: $98.51%

A little closer to the $37,500, but doesn’t actually get there under the current ruleset. Sorry abut the last numbers, was getting a little too excited on this one.

@ reason first

Ok, so I actually just got off the phone with the Genworth rep, to clarify this issue. I know this might be hard to believe, but the province acted unilaterally on this move, and didn’t really consult the insurers before making the announcement. Under current insurer guidelines, any down-payments that are either ‘non-traditional’ or ‘borrowed’ must be limited to 9.99%. The rep said that the insurers were currently reviewing the province’s program and haven’t decided if they were going to alter their programs to suit the province. As it stands right now with current programs, the maximum assistance under the program is $25,000. See below for a sample:

Here’s a quick rundown of the maximum benefit the provinces program can have:

Purchase Price: $750,000

Minimum Downpayment: $50,000

Downpayment from own resources (50%): $25,000

Maximum help from the province (50%): $25,000

Insurance Premium @ 3.85%: $26,950

Total First Mortgage: $726,950

Total Second Mortgage: $25,000

Total Owed on Property: $751,950

Loan to Value: $100.26%

Yikes.

Don’t forget about closing costs at approximately $15,000 and the buyers are in a serious negative equity position from day 1.

You tell me if you think this is a good program!

Thanks for the link oops. The amount of price reductions is very alarming.

Markets change for psychological reasons as well as financial and can go down faster than one could imagine looking at Vancouver. Is it a fast drop coming here or a slow melt ? Time will tell but we’ve never seen such a debt burdened society so saying it will take a 2008 event just to get back to balanced is wishful thinking.

When buyers wake up and stop laying down the cash cause they see their friends just got hosed for 10’s of thousands for buying at the top this past year, the downturn could accelerate much faster. No one wants to catch the knife and be the bagholder for the next 10 years.

oopswediditagain

December 19, 2016 at 10:12 am

I’m including another fun link to oversee the Mainland real estate market. If you’re a bear, it’s just more confirmation and if you’re a bull, well, it gives you some pause for reflection.

http://www.myrealtycheck.ca/

Thanks for the link Oops, very interesting, much appreciated!

I don’t see 2008 around the corner. Everyone just got an extra 200k in their HELOC for Xmas and Trump is going to give the mega corps a tax break to repatriate billions in cash to the US. This just might lead to wage increases which will lock this in as a step up in the real inflation ladder.

Off topic

A lot of bad shit going on around the world past few day. I assume it is not going to get any better when you piss off Putin.

Glad /lucky to live here.

Probably take a year of complete market reversal to get back to balanced market conditions.

Only a total panic event like 2008 would bring us a buyers or balanced market in 2017

We ended December 2012 with 3,896 active listings……..I think any downward pressure in the new year would need to come late spring/early summer. This inventory problem won’t correct overnight.

Inventory is crazy low. I can’t see a crash coming down the pipe this spring. Not with these letters telling people they are rich, the stock market climbing fast, the dollar sinking, rates so low. Van would have to keep crashing hard to have any negative effect here…. Trump ain’t doing it. Neither is Chinese money restrictions. Chinese with money have most of it out of the eyes of government anyway. I think this spring will see another bump in prices.

Leo

Must have been a couple weeks. Sorry.

1702 – 1618 = 84 not 200

Active Listings: 1,618

Wow I guess the season has caused this to plummet 200 from last week. Market need more inventory to operate efficiently. Hopefully January.

Denise#1

December 19, 2016 at 8:26 am

Wow, the majority of you are coming across as this blog’s “Mean Girls/Boys Club”. Some of you are posting for the sole purpose of attacking Hawk.

Good morning Denise. I don’t really believe that the bulls on this site disbelieve Hawk’s assertions of an impending/ongoing crash/correction on the Mainland. They are simply “debating” whether it will have any implications for the Island.

I’m including another fun link to oversee the Mainland real estate market. If you’re a bear, it’s just more confirmation and if you’re a bull, well, it gives you some pause for reflection.

http://www.myrealtycheck.ca/

So if someone goes for the max $750,000 home and get’s a $37,500 interest free loan, they would pay $26K in CMHC fees which then gets added to the mortgage. This leaves then with a $738,500 mortgage on a $750,000 home – 98.5% leverage.

Did I get that right? You would need to be insane to want to do this now.

@Leo,

“So confusing. Why does that rule exist?

So say someone has 10% down. Is it in their best interest to take the 5% from the government and invest their 5%, or is it better to just pay their 10% down?”

Way better to just put their own 10% down. Any advantages to interest free money would be outweighed by the higher cost of the higher insurance premium rate – 3.85% using the government’s cash, to 2.4% making your own 10% downpayment.

Yes, seriously confusing, but the final say ALWAYS rests with the insurers. CMHC, Genworth and Canada Guaranty. These guys make the rules – this is why this program is a bit of a joke in reality.

Mon Dec 19, 2016:

Dec Dec

2016 2015

Net Unconditional Sales: 351 465

New Listings: 315 451

Active Listings: 1,618 2,517

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Remember the article on Bloomberg about China capital controls effecting students living abroad ? Seems like the Chinese are taking it seriously and could have a huge effect on the school/housing system here. Don’t get out of joint guys, it’s just the news based on facts.

Chinese families with children studying abroad worry about impact of new curbs on yuan outflows

“I am still able to remit money abroad at present,” Zhang said. “But I am afraid that in future we may have difficulties in doing so.”

http://www.scmp.com/business/companies/article/2053213/chinese-families-children-studying-abroad-worry-about-impact-new

Relentless attacks AG ? Who was just posting pics referring to me ? I just reply to the relentless attacks I get posting the obvious price slashes and Vancouver bubble bursting and question those who say they are something they may not be. Seems like a lot of luck to survive 3 housing crashes in 15 years or so and live in the Uplands. Just sayin.

I just did my quickee Monday morning survey of South Victoria (Fairfield, Rockland James Bay and Oak Bay, Fernwood). Before someone points out that I am ignoring the West Shore and a lot of the rest of the Victoria market, let me totally agree to that. Actually, I am not ignoring it, I am just totally unfamiliar with those areas. Once a month I go to Cosco and that is about the extent of my trips to the West Shore. I would appreciate anyone living in the West Shore to give us updates on the market there.

WHat struck me is that the asking prices for homes in Fairfield have now almost equalled Oak Bay on average (I am excluding both Uplands and the crazy waterfront prices in both areas). In Fairfield there are only three SFH under 950. The average price seems to be running about 1,25 million. This was definitely not the case three years ago. My point is that the premium gap between Oak Bay and Fairfield seems to be narrowing. My impression is not so much that Oak Bay is going down as that Fairfield has gone up. There is still a gap between James Bay and especially Fernwood but both of those are also starting to narrow.

Love to know what is going on in the West Shore. For example is anything selling on Bear Mountain

or are prices still depressed there?

Hawk – I didn’t inherit anything, not that it’s any of your business. Some people are just more successful than others. I haven’t needed any help. I did make some paper losses in the other housing crashes I’ve experienced, but they were only temporary.

Anyway, why the relentless attacks? It’s almost like you’re trying to distract from something, like making the wrong call on the housing market for so long?

“And the various housing crashes I’ve been through have been in other countries.”

AG,

You sure have a bad track record of investing in multiple crashing markets in such a short time. I take it you inherited a lot of money.

Wow, the majority of you are coming across as this blog’s “Mean Girls/Boys Club”. Some of you are posting for the sole purpose of attacking Hawk. A good blog contains a variety of opinions and information. Many of you appear to be RE boosters/owners and want to keep this blog for your posts only. What are so afraid of? Why so insecure? You seem to feel threatened by Hawk’s posts because he’s not on the RE Booster Train. Keep posting your links and information Hawk, I appreciate it.

So confusing. Why does that rule exist?

So say someone has 10% down. Is it in their best interest to take the 5% from the government and invest their 5%, or is it better to just pay their 10% down?

Good idea. The government already does it for their own (federal and provincial student loan forgiveness). Much more fair would be to just put more needs-based funding into education so those without the ability to pay for it can get a very low cost education. No need to forgive student loans (and spend millions on managing the program) if there is nothing to forgive.

@marko

“In the scenario where first time buyers have 20% down and make <$150,000/year would they not be able to put down 15% and take 5% from the government? (and keep their 5% for improvements/investments)”

No this scenario wouldn’t be possible. Downpayment has to remain between 5%-9.99%.

https://www.cmhc-schl.gc.ca/en/hoficlincl/moloin/hopr/hopr_004.cfm – Specify non-traditional downpayment sources

or Genworth’s program here:

http://genworth.ca/en/products/borrowed-down-payment-program.aspx

South enjoying your posts. 🙂

Hawk, didn’t you know we already had our crash from 2008-2013. Prices adjusted for inflation dropped 23%.

You can see the crash, it’s just in the rear view mirror of your Pontiac.

Hawk I used to work in finance. Never said I was a financial advisor. And the various housing crashes I’ve been through have been in other countries.

Only early 40’s AG ? I thought you were a retired financial advisor who has been through 3 housing crashes ? You would have been like 8 in 1981, so there’s one. Next one in early 90’s when you were like 20. Any others I missed ?

Numerous pre-Christmas $20K price slashes to try and get the product moving. From shmancy Cordova Bay condo to a not so red hot Happy Valley new build at 3346 MYLES MANSELL Rd where you can put your low ball offer in on a triple stacker container house. All the joys of home ownership with a landslide behind you waiting to happen.

“Guess when your a rich old prick you get stale as an old loaf of bread.”

In my early 40s, but maybe I’m stale? Not sure who to ask..

Have all the tiresome, repetitive, preening gits been driven off other forums to this one? Is there any way of inviting them to leave? Surely Hawk’s impressive research and droll variations of expression could find a welcome home elsewhere?

RIP Just Jack.

First time poster, long time creeper…

As one of these “pesky” millenials (age 30) who currently owns a home I thought I might weigh in on this one. My wife and I are both hard working professionals (she’s a RN I am a project manager for a custom home builder), we both have university degrees (royal roads and UVIC) and saved for 6 years which allowed us to put 20% down on our first home.

I think this new program is very poorly thought out. As previously mentioned it will likely only further fuel these runway house prices and heavy debt loads.

If the liberals want to help first time homebuyers they should look at helping people further educate themselves (university, college, trades) and not come out of it with a mountain of debt. The burden this leaves on a new grad is huge, and makes a home purchase even more daunting. Why does the government collect interest on a student loan from a young person trying to better themselves and become a productive member of society?

Forget about putting us further in debt Christy, help us get rid of some of it.

I’m interested in opinions (except from Hawk and Barrister, who will probably just bicker like an old married couple like usual)

Boy, the bulls are becoming a defensive lot the more the prices get slashed and the mansions stack up with their fire sales. They can’t even come up with anything slightly humorous that only the rednecks find funny. Must have taken AG all afternoon to find that dumb pic. Guess when your a rich old prick you get stale as an old loaf of bread.

Coming soon to your hood. 😉

http://sandiegometrohomes.com/wp-content/uploads/2011/02/housing-crash.jpg

Here’s a market crash for Hawk.

http://i1.wp.com/jemblog.com/wp-content/uploads/2011/09/walmart-car-crash.jpg

Hahahahaha

Usually bears hibernate during the winter but not Hawk. The cold weather is a sure sign of impending doom for Hawk. In fact, from his basement suite vantage point Hawk has been able to observe first hand the collapse of the market in Victoria. Sales last week were off by at least 2, possibly as many as 4 in the bell weather area of Oak Bay. I also heard someone at the store complaining about money which is a sure sign of impending collapse. This is why I’ve been planting potatoes in the yard and hording liquor.

Hey, speaking of bears. You know what’s nice? How Just Jack has, for a long while now, been keeping his local real estate doomsaying to himself. He used to muse about a crash quite often. Not so much any more. Years and years of being proved wrong will have that effect.

You know what encourages Hawk? Any bad news economic story, anywhere! Because they all apply to Victoria, B.C.

AG:

I suspect that you are just encouraging Hawk. There is a possibility of house prices declining in Victoria but I really have trouble visualizing drops of more than 15% and only if interest rates get above 5%

I don’t know if Hawk aka Info will ever leave. This is his home, this is where he lives.

After a while, Hawk will slink away from the blog. All of this has happened before, and it will all happen again.

“100% of economists say Christy Clark is an idiot for using an old Socred vote buying gimmick”

Hawk – I think everyone agrees with this. It’s clearly an election bribe. You’re just mad because it’s another positive for prices.

South,

100% of economists say Christy Clark is an idiot for using an old Socred vote buying gimmick when the market has started to correct in Vancouver. Gullible suckers like you can’t see past your nose. You must a Liberal “hack” to believe that bullshit.

BTW Ozzie has been a bull for many years and is heavily involved in the industry. Its totally out of character for him to state that. Maybe call your banker on Monday and ask him to max out your HELOC but don’t think you enough equity yet to qualify after buying just last month.

CS,

Hillary involved in murder ?? LOL Don’t tell us you’re one of those conspiracy nuts who watches too many of those youtube videos made by the Alex Jones alt right white supremist crowd ? That’s too much CS ! LOL

@ hawk

“CS, if you think tweeting about individual companies by a president is OK then you got probs”

Hawk, there’s no difference between tweeting about cancelling the F35 contract and holding a press conference to issue threats against the only country in the world able to reduce the whole of North America to radioactive rubble — something Obarmy has done repeatedly (and he just sent 1600 tanks to Europe to confront Putin). But you think there’s no scope for insider dealing in advance of anything Obama says?

In fact, if you want to know something about Obama corruption, google “Elizabeth Fowler” “revolving door”.

But then Democrats never seem bothered by bribe taking, treason, trashing of national security or murder by the gangsters who lead the party they support.

But, wow, its strange what some people do on a Saturday night!

I’m quitting, good night.

@ South

“What part of what I wrote was false?”

It wasn’t false. It was merely fatuous.

No sign of any credit tightening, sure rates are slightly up, but the impact on monthly payments is maybe $25 a month on a 750k condo if that.

Don’t know if you saw that BC is giving away almost 40k interest free to buyers. That’s not credit tightening, that’s loosening.

Too bad you listen to all these talk show and twitter media spotlight hungry “hacks”. That’s probably why you dumped your home, because Garth told you the sky was falling.

Can’t you find another hobby? I mean or at least post real data here.

New readers, go back 10 years on this blog and you will see a few posters that post 10x a day still posting here about the crash.

South,

Ever heard of credit tightening? It’s when banks stop lending to shmoes like you with 5% down. ICYMI it’s happening right now.

Ozzie Juurock stated this morning no matter how good your credit is or how cozy you are with your banker that credit lending is tightening up bigtime. That doesn’t happen when a market you claim is going to rocket for years to come. It happens when markets are maxed out. May want to educate yourself.

South is makin’ a lot of sense.

Hawk you have been discredited hundreds of times over the last many many years.

What part of what I wrote was false? It’s all true data. I’m sorry if Oak Bay is too expensive for you after you market timed your house sale at the bottom, twice, then proceeded to gamble on the stock market, and lose it all.

CS, if you think tweeting about individual companies by a president is OK then you got probs. How do you know the insiders aren’t shorting before he tweets. It opens up massive conflict of interest potential as well. What happens when he rips up NAFTA and screws Canada ? This isn’t just about Mexico. This is a nutjob capable of blowing up the global economies that are already on the edge.

South you are on some serious drugs.

Looks like this month will be another record breaker. I don’t see the market slowing till at least August of 2022 based on historical 4/10 rules that seem to never waver.

I’m calling this Dec to be record breaking, with around 6.47% foreign buyers. Not enough to make any 15% tax apply, but juuust enough to jack up the competition and prices another 17% next spring. Then we will have caught up to 50% of the price rises in lower mainland and 80% of rest of Canada.

Remember, while literally everywhere else was rising for years we went down for 10 years. We still have well over 25% left to go to even be “even” with rest of country.

I don’t know why no one points out that we are still waaay behind other gains. We are up a tiny 16% in 10 years! That’s below inflation!

@ Hawk

“[Trumps] tweets about Lockheed Martin are just one in an increasingly large number of reactions that investors have come to expect after he attacked United Technologies, Ford, Boeing and drug companies.”

If Trump cancels the $1.5 trillion F35 project, it will surely be good news for investors whose taxes would otherwise pay for a piece of equipment of dubious merit and which could only be useful if the US intends kickstarting WWIII, as Hillary seemed keen to do.

As for United Technologies, they got a deal that made it worthwhile saving a few hundred US jobs. What’s to be upset about that. You think investors and business people care about the Mexicans who lost out, or what?

As for Boeing, what’s good about selling the US government a replacement for Airforce One at a cost of $4 billion?

As for Ford, obviously any concessions they’ve made on an agreement to restrict offshoring of manufacturing jobs has been made in the expectation of better prospects in the competition with Japanese, Korean, Chinese imports, based on Trump’s declared intention to force abandonment of non-tariff barriers to US automotive exports.

So as an investor, what would make you want to list your property?

I would probably sell half my stuff if it wasn’t for CGs and move it into something else. Problem with CGs is I have to sell a $350k condo and after transaction costs and CG I am at low 300k or so minus the mortgage payout. Now I have to re-invest the proceeds without leverage into something else. Or I can just keep the condo, cash flow positive, decreasing principal each month, tangible asset, rents going up faster than expenses, market value of the asset going up, leveraged.

One idea if CGs is carried over if you buy something new. For example, sell my 5-year-old condo at 834 Johnson and government lets me carry over the CGs to a new pre-sale purchase down the block at 989 Johnson. I eventually pay the CGs when I sell 989 Johnson. Would encourage people to unload and buy new stimulating supply? Just a thought.

There is literally ENDLESS amounts of land out towards Sooke and Duncan

Yea, but it isn’t walkable to Willows Beach. Not sure how a young family can survive without that.

This is not correct. Property taxes are set by the municipal budget and your house value relative to other properties in the municipality. They do not go up and down with your assessment in the way that you are describing.

+1, your assessment is important as in relation to others.

If the city budget is $100 million and assessments go from an average of $500k to $800k the city budget doesn’t magically jump 60% even though I am sure the staff wish it would.

Mortgage insurers will consider this downpayment to come from ‘non traditional sources’. The insurer’s ‘non traditional downpayment’ programs are only eligible between 90.1%-95% Loan to Values, and include (of course) a higher insurance premium of 3.85% (compared to the normal 3.6%).

In the scenario where first time buyers have 20% down and make <$150,000/year would they not be able to put down 15% and take 5% from the government? (and keep their 5% for improvements/investments)

fundamentally believe there is currently a demand problem, not a supply problem.

If there was simply a demand problem would vacancy in terms of rentals be higher?

“No need to even leave the site.. https://househuntvictoria.ca/2016/04/05/municipal-tax-rates/

Of course these will all be updated next year so don’t multiply them by your new assessment.”

Love this – thanks Leo!

AG, you’re obviously out of the loop. Chinese are selling out of BC real estate and China clamping down on cash leaving means they can’t get their money out easy anymore. But thanks for coming out.

Getting Money Out of China: It’s Complicated, Part 5

But as I noted in part 2 of this series, most of the requests deal with purchasing single family homes in the United States and “slapping together 3-5 single family homes and calling it a fund is not likely to make a difference with the Chinese government allowing money to leave!”

http://www.chinalawblog.com/2016/12/getting-money-out-of-china-its-complicated-part-5.html

“China Halts Trading In Bond Futures After Record Bond Market Crash”

Sounds like there’s a lot of money leaving the Chinese bond market. I wonder which asset class that money might move to. International real estate, perhaps?

Thanks for the link Hawk.

Those rosy colored glasses may be on too tight there South. The Trumponian disaster hasn’t taken the wheel yet and it looks like he’s going to dictate the world via Twitter, which is obviously an accident waiting to happen and the markets don’t like uncertainty.

Cramer fears the market is whistling past the graveyard, Trump could spook money managers

“Trump’s calls and tweets to business people could be too out of control and unpredictable for some money managers, Cramer said. His tweets about Lockheed Martin are just one in an increasingly large number of reactions that investors have come to expect after he attacked United Technologies, Ford, Boeing and drug companies.

Interest rates keep climbing, too, and the dollar continues to go higher. Historically, these are things that would usually gut the market and hit the stocks of international companies hard.”

http://www.cnbc.com/2016/12/12/cramer-fears-the-market-is-whistling-past-the-graveyard-trump-could-spook-money-managers.html

By the looks of the Chinese bond market and stock market, the VanCity hot money cash-out has just started as the yuan devalues faster than they can smuggle it out and capital controls kick in to prevent an outright crash. Christy is just sticking her finger in the dyke sucking in the youth and their parents money.

China Halts Trading In Bond Futures After Record Bond Market Crash

“The crash, however, was just the start of China’s woes, because what happened next could spell far more headaches for a market that is now in a “bursting bubble” mode. As the WSJ reported this morning, Chinese authorities halted trading in key bond futures for the first time on Thursday, “as panicky investors sold the securities on concern that a long, credit-fueled bull market was coming to an end amid slowing growth, capital outflows and heightened government concern about asset bubbles.”

http://www.zerohedge.com/news/2016-12-15/china-halts-trading-bond-futures-after-record-bond-market-crash

AG:

I went through the house about six months ago; it has been pretty well updated and in good shape. But it is a very unique type of arts and craft house; not most peoples cup of tea. The landscaping though is like a jungle and needs a lot of work but the gardens could be rather spectacular. The second floor has great views. Good kitchen and bathrooms. Basement needs a coat of paint but all in all in pretty good shape and reasonably updated.

South:

The free money program is probably going to bump up some condo prices in Oak Bay, Fairfield and James Bay. I agree that it wont have much effect on house prices in the Uplands.

If 610 St Charles has been on the market for that long, I’m guessing there’s a lot of deferred maintenance to be done by the new owners. They might need to spend some time stripping wallpaper too 🙂

AG:

Thanks for the update on it by the way. It is good to know.

AG:

610 St. Charles was on the market for over three years. They would change agents or briefly take the house off the market. I live in the neighbourhood and am familiar with the house. Also it was on the market when I was looking about 4 years ago. Same price, same owners. I could be wrong but I vaguely recall that about a year ago they had dropped the price to 2.2 but then raised it again. Does anyone know who bought it?

Not a lot for sale in Rockland these days. Waiting to see if the bank foreclosure on Pemberton (the house that was up for auction) drops its asking some time soon. I am thinking they will be lucky to get 1.4 for it.

Im telling (most) of the posters here who rant about prices being too high. It’s a supply issue that is not being fixed in anyway. The lefty/communist government nannys either try to control the demand by dampening it or juicing it. The main issue is the core and good areas are only a couple thousand homes so all these policies don’t affect prices along the water from Fairfield to Cordova Bay. Those markets (which people here seem to be obsessed about) are long gone for the “average” blue collar worker making $80k a year.

There is literally ENDLESS amounts of land out towards Sooke and Duncan for Hawk and JJ and CS to get a starter home/Armageddon Compound. I hear they are offering free tin hats with acerage purchase in the clear cuts north of Sooke.

This new policy will make prices in Saanich West, Esquimalt, Vic West, and Langford a little bit higher and more stable.

610 St Charles sold for asking price, $2.3m. On the market for 4.5 months, so I’m a bit surprised they didn’t get it for less.

Will $751,000 be the hot number around here? Lower end prices (which in the core already aren’t all that far off $750,000 for SFHs) will likely go up but what happens above $750,000? If you don’t need/want the government’s free money and can therefore pay $751,000, you’ll have the ability to outbid many, many folks competing for the low end of the market who won’t be able to cross that threshold.

Yes they sent those letters to properties that had increased a lot more than the average. Those people will see big property tax increases.

No need to even leave the site.. 🙂 https://househuntvictoria.ca/2016/04/05/municipal-tax-rates/

Of course these will all be updated next year so don’t multiply them by your new assessment.

In my defense, I did say it was a “rough” calculation 😉

Isn’t property taxes / assessment = mill rate? By multiplying that by the new assessment, hopefully that will be the worse case scenario. I wasn’t trying to be totally accurate because we won’t know the mill rate for months yet, but some people may need to plan(budget) ahead.

Determining the mill rate sounds pretty complicated!

“Oak Bay director of financial services, noting municipal taxes accounted for approximately 55 per cent of the taxes on the 2015 property tax bill.

The municipal portion of property taxes isn’t the only thing affected by assessments. Capital Regional Hospital District costs and many CRD costs are shared between the region’s municipalities using assessment figures… Oak Bay’s share of the total assessments in the region changes – up or down – its share of costs is also affected.

Similarly, Oak Bay’s share of library system costs is based 50 per cent on assessments and 50 per cent on population, so assessment changes also affect its library costs.

Other organizations providing tax rates, such as the province for school taxes and BC Assessment, also use assessment values to some extent to develop the rates used on property tax notices.”

The exact amount your taxes go up is hard to predict but they sent a “prepare yourself” letter for a reason. One other thing to be mindful of is that the homeowners grant has a threshold of $1.2 million (raised this year from $1.1 million), so if you were on the cusp, increased assessments may push some homeowners over the threshold. For properties assessed above the threshold, the grant is reduced by $5 for every $1,000 of assessed value in excess of the threshold.This could be an issue for a senior on a fixed income who has been in their home for decades. A lot of Vancouver residents were facing this reality last year. Maybe now it will shock more Oak Bay residents…

Mike the mill rate if I am not mistaken will not be available until all the appeals are done and the municipalities know what the total valuations are vs the approved budget. The only thing you can do is guesstimate on Jan 3rd when assessments are out. You are going to pay more if your property goes up more than the average % increase in your city as a rough estimate. Obviously the annual increase will make you pay 3 % or whatever more.

@ Curious Cat

Your property tax increase can be figured out by multiplying your new assessed value by your local municipal government’s mill rates (which are also always increasing). A quick google search for your local government’s mill rate should prove fairly easy.

Also-

Banks will debt service the interest free loan differently. Some will create an imaginary monthly payment based on a 25yr amortization serviced at the benchmark rate (4.64%). Others will simply use 1.5% of the balance added to monthly liabilities. Others may just use an interest only calculation.

In other news, what a clusterfuck today on the Trans Canada Highway. Poor West Shore residents! And things will only get worse as Westhills, Royal Bay and other communities continue to populate without a second thought.

http://www.timescolonist.com/news/local/broken-water-main-causes-massive-traffic-jams-in-west-shore-1.4730647

“This government loan has a cost (the interest you will pay) and there are payments, just not at the beginning.”

But you can pay it off at any time. So you could take this $37k to use for a downpayment, saving you having to use your own money, which could be invested instead. At 5 years you would pay the government loan in full and pocket the return.

In this case the only “cost” is to the taxpayer for the free loan.

This is not correct. Property taxes are set by the municipal budget and your house value relative to other properties in the municipality. They do not go up and down with your assessment in the way that you are describing.

The 20% average below is a guess. It could be higher in Oakbay so less increase for yourself. 20% is a pretty good guess everywhere else but JJ or Marko may want to chime in.

“”Our property assessment went from 580,000 to 800,000! We got one of those prepare yourself letters today.

Anyone have any idea as to how much our property taxes will go up?”

Rough calculation: Take your current annual property taxes, divide by 580 then multiply the answer by 800.””

No your tax will go up by approximately the difference between your increase and the average increase plus next years annual increase. This is a better rough calc.

So 38% – 20% plus 3% year increase. So 20% increase give or take.

“Our property assessment went from 580,000 to 800,000! We got one of those prepare yourself letters today.

Anyone have any idea as to how much our property taxes will go up?”

Rough calculation: Take your current annual property taxes, divide by 580 then multiply the answer by 800.

“But we don’t know what the interest rate will be after 5 years. I assume it will reflect the province’s borrowing rate so lower than a regular mortgage”

According to their website, the rate is going to be RBC’s prime rate +0.5%, then reset on the 10th, 15th and 20th anniversary.

@Mike – how will the bank lending the first mortgage take into consideration the second mortgage in calculating the TDS ratio? Seeing as it doesn’t apply until year 5, do they ignore it? I’m concerned that someone may be right on the line with the ratios, and they would have a real struggle in Year 5 when they have to repay. (I know when I refinanced, they didn’t check my ratios again, however I never had a second mortgage.)

Oh and I agree with mostly everyone. This is so ridiculous. I think Christy will lose as many votes as she gains. (I for one voted Liberal last election and this makes me want to puke in her soup.)

@ Dasmo

“the market is going up so fast that it very much reduces motivation to sell.”

Hence the low listings.

If the market tips, as CREA have predicted it will, we’ll see how well Michael’s theory about rising rates driving up prices works out.

@ Introvert

“Free means you don’t have to give it back. Ever.”

Free can mean without cost or payment.

Thus, in the case of an interest-free loan, what’s free is the use of the money, not the money itself.

I’m not so much of a property investor but no capital gains would make me strongly consider selling. But…it’s hard because the market is going up so fast that it very much reduces motivation to sell. We had to sell our primary to buy the land we wanted. That was punishing enough to watch the market jump right after. But… Too risky to try to over extend and juggle to time it otherwise.

Plus… A tax holiday isn’t fair nor is a tax punishment. This is just more meddling that might have unintended consequences.

The most fair thing is to go after non resident ownership. If you are not at least a permanent resident of Canada then you should pay an extra tax on any real estate purchase. If a non resident wants to invest in Canadian RE there are plenty of REIT to invest in…. If you are being imported for a job you will get PR pretty quick anyway….

Then look at the barriers to building like zoning. This is probably the biggest barrier to more inventory. Every project is a five year battle. Let’s just have that once every 20 years. I could easily draw up the zoning map for the region in an hour…. Plus, there should be some sort of influence to build family friendly high density. No more micro lofts are needed unless they are hotel conversions. More 2-3 bedroom duplex, condos and row houses….

I don’t see that it would help home buyers if landlords liquidated their inventory. It would create a shortage of rental property and thus drive up rents, which in turn, would intensify demand for houses for purchase, which would drive up home prices.

Barrister

The Capital Gains reduction was just a suggestion from one of the bloggers there could be other ways to increase listings.

The point being made is that there is an enormous stock of housing that isn’t on the market. Freeing up a fraction of those properties would reduce the imbalances in the market.

So as an investor, what would make you want to list your property?

How about we add supply by ending the spot zoning fiasco. Even the garden suite thing is BS. You still need to rezone…. and now with the HPO rules it will be very arduous to build a garden suite. Nothing accomplished here.

Giving a tax holiday for rental properties would be a drop in the bucket….

Let’s quibble about definitions; I think this debate is useful.

Free means you don’t have to give it back. Ever.

Free, to me, also implies no risk to the recipient, which also doesn’t apply in this case.

Just Jack:

I found stats for the percentage of people renting but no stats for how many whole houses are being rented. I believe that only if one put up whole houses on the market that this would affect supply.

I am assuming that we are not talking about converting rental buildings into condos?

Leo:

It is not a bad deal in that in five years, if market interest rates are less, then you can roll it over to a market mortgage without any penalty. (assuming you have built up some equity)

Barrister, you could always look that information up from Stats Canada. But I suspect if 30 percent of the market is renting it is going to be significant. If you only had one or two percent of home owners list that will change the market.

Leo:

Obviously you are correct, lend me 50,000 interest free and all the interest that I could earn at the bank during that five years would be free money. At some point, you might wonder why they are giving your money to someone else so that they can buy something instead of you buying something? Do we really need a charity for rich developers?

Thanks for the correction Introvert. So it is actually a bad deal after 5 years given market mortgages are below prime.

I maintain that an interest free loan for 5 years is free money (as in, you get the money and don’t have to pay for the privilege of using it) but now we’re quibbling about definitions.

This Vancouver Sun article specifies the interest rate:

The government would put a second mortgage on a property to reflect the amount it loaned, but not require any interest payments or payments on the principal for the first five years. After that, the 20-year repayment plan would be set at the prime lending rate plus 0.5 per cent…

http://vancouversun.com/news/local-news/b-c-government-offers-down-payment-loans-to-first-time-homebuyers

It’s not free money. It’s a loan that will have to be repaid eventually in full, plus interest. Free money is when your aunt dies and leaves you an inheritance.

Just Jack:

First of all, how many rental houses are there in Victoria? Serious question, does anyone know?

My unscientific impression was that the higher prices over the last few years have already put a fair number of the rental houses on the market.

Relocating most of the provincial government departs elsewhere, even if it is to to West Shore but preferably Nanaimo would go a long way to reducing demand and increasing supply.

Good idea Jack. All they need to do is to entice sellers of investment properties with a limited time capital gains tax break. We know enough of them on here who are obsessed with not paying taxes. But you wouldn’t be allowed to purchase another one for a 2 year window. Would be like dangling a steak over a salivating dog.

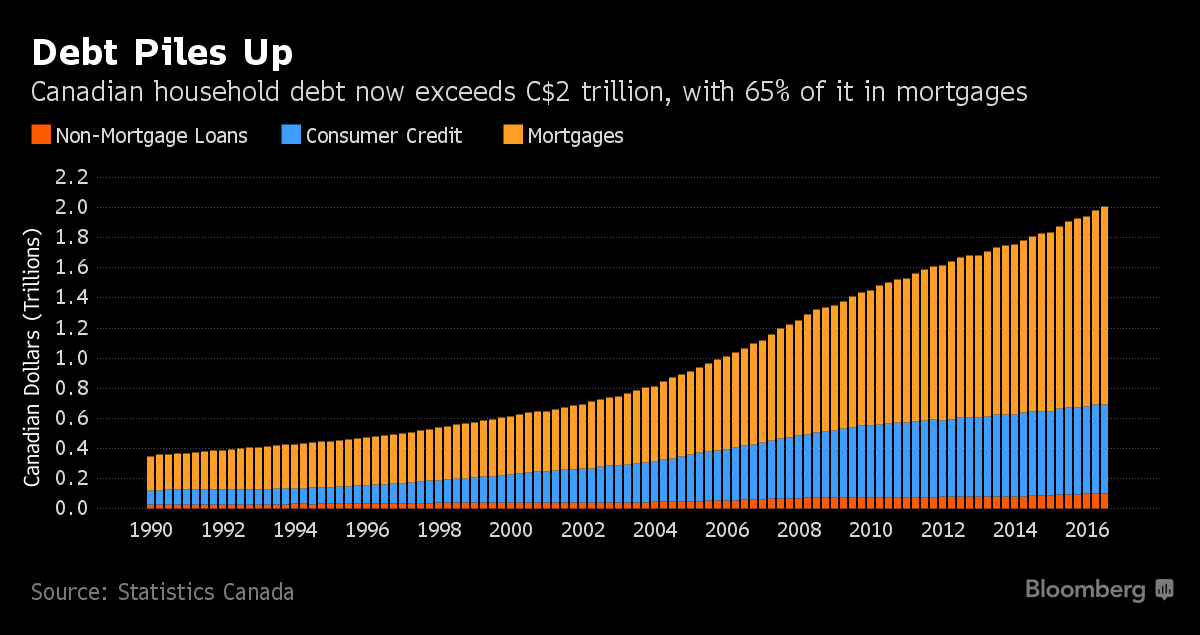

The 10 year cycle is over Mike. Mortgage debt doubles from $1 trillion to $2 in a mere 10 years. Yep, no business degree needed. Peak Cranes + Peak Debt = Peak House Victoria.

In my opinion, one way to ease the problem of run away inflation in house prices is to create more supply. Not by building which stimulates the economy and thereby creating more demand for housing but by bringing more existing homes to the marketplace.

97 percent of housing is not listed for sale. If the government could encourage 1 or 2 percent of home owners to list their properties that would be one solution to the imbalances in the current market.

For those that own rental properties. What could the government do to encourage you to sell one or more of your rental properties in the next 12 months?

3 of the funniest misconceptions on RE right now:

< That government policies have much effect, other than vote-buying.

< “Canada’s housing market” (it’s incredibly regional!)

< That rates up, mean prices down. People still can’t grasp how real rates often fall as nominal rates rise, and vice versa.

This program is in actuality a lot more limited than meets the eye.

Mortgage insurers will consider this downpayment to come from ‘non traditional sources’. The insurer’s ‘non traditional downpayment’ programs are only eligible between 90.1%-95% Loan to Values, and include (of course) a higher insurance premium of 3.85% (compared to the normal 3.6%).

This means borrowers that use this program are forced into the highest LTV bracket – they can’t use the program to get below a 90.1% Loan to Value, and significantly reduce both their insurance premium or monthly principle and interest expenses in the first 5 years.

This also means the program is likely to not affect pricing as much as some have predicted. With downpayments limited to 9.99%, and debt servicing of the interest free money also required, it’s not nearly as flammable as some suggest.

This program doesn’t offer smart assistance to help the the reasonably responsible and fiscally prudent first time homebuyers who have been working hard to break the 90% LTV threshold, gain higher initial equity in their purchases and pay more reasonable mortgage insurance premiums.

Also – I can’t wait to add government involvement into what is already an extremely rushed weeklong underwriting process that requires subject removal or else.

Just keep the real estate balls in the air and get past the election, Christy.

Would it have been a better suggestion if the government paid the CMHC premium and gave the option for the buyer to top up the amount to a maximum of say $37,500 to pay closing costs and immediate home improvements?

Michael, Numerology is an occult study on par with throwing the bones in a circle and reading them.

“I hate it. To be very clear, I think it’s really bad economics,” said Tom Davidoff of the University of B.C.’s Sauder School of Business. “Big picture, it’s a step in the wrong direction. We have too much demand chasing too little supply.”

Tsur Somerville, UBC’s director of the Centre for Urban Economics, agreed.

“They’re trying to cool down the housing markets, and now you have Christy Clark trying to give people extra gas (for the fire),” Somerville said.

http://vancouversun.com/news/local-news/b-c-government-offers-down-payment-loans-to-first-time-homebuyers

Further to Leo S’s example. At a 10% down on a 500,000 purchase you will pay $10,800 CMHC insurance.

This new policy is ludicrous.

https://www.cmhc-schl.gc.ca/en/co/buho/buho_023.cfm

And the great thing is you don’t need a business degree to crack the ’10-4′ code.

’71-81 up

’81-85 down

’85-95 up

’95-99 down

’99-late’09 up

’09-13 down

’13-23 up

Basically it is.

Let’s say you buy a place for $500,000 so your 5% is $25,000

How much will that $25,000 from the government cost you?

Well in the first 5 years, nothing. Then you have to pay it off over the remaining 20 at “current interest rates”. We don’t know what those are but I suspect they will be closer to the province’s cost of borrowing than market rates. Call it 1%.

So you’ll pay $2588 in interest on that loan (which you can pay 100% any time without penalty).

How much would it cost to borrow the money at market rates? Well at 2.5% it’s $8598 in interest.

So just considering interest payments you get some $6000 in free money over 25 years.

@ Local Fool

Quite right, although it should be remembered that the cycles can be of long duration. For example, it is said that real estate in Rome reached a peak around 400 AD and then declined for 16 centuries.

On further reflection, my interest rate formula looks even better than I thought when I first thought of it an hour or two ago, although it should, obviously, include a term for the velocity of circulation of money, which would likely negate, in part, the effect of money supply growth.

Personally, I think this is a shallow and hare-brained policy choice. If they absolutely must intervene, they should be making it harder to get into the market, not easier – or better yet, just get the dead hand out of the market so it can eventually curb the ridiculous excesses.

This initiative only encourages people onto what is already a completely unsustainable path of debt, aided only by unsustainable non-market interest rates. FTHBs then push demand up, and sellers in that segment of the market will simply adjust to absorb the new “money”.

I fundamentally believe there is currently a demand problem, not a supply problem. People in our region are either convinced that buying a home is a sure path to riches, or that if they don’t buy now they never will. Right now I’d personally rather invest in Enron than a house in southwestern BC, and FOMO folks are just ignorant of history.

These things move in cycles, and while you can kick the can down the road, the cycle will always prevail. There is no new paradigm here folks, no new fundamentals, no magical debt devaluation, and we’re not the next Manhattan – and we never will be.

It’s not free money.

Thinking further about interest rates, why not determine the base rate as follows:

Base Rate = Past 12 mo. money supply growth — past 12 mo. GDP growth + 3%.

That would be fair to lenders who would receive a 3% real return on their money, and it would set the current base rate at around 11%, enough to kill housing “affordability” and drive house prices so low that almost anyone who’d saved for a few years would be able to buy a house for cash.

I don’t understand your point, The advantage to paying it back is that you don’t lose the contribution room and you don’t pay tax on the money in the current year.

But we don’t know what the interest rate will be after 5 years. I assume it will reflect the province’s borrowing rate so lower than a regular mortgage

You got it wrong. It’s bad policy plain and simple. Why should provincial taxpayers fund house purchases for middle income folks that are going to be riskier than normal and then turn around and insure them through federal programs? No one needs to own a home. The money would be much better spent subsidizing rental projects so everyone has an affordable place to live.

The thing that would obviously help first time home buyers most would be a doubling, quadrupling or octupling of interest rates. With mortgage rates at 20%, what is laughably called “affordability” would drop to near zero and houses would become dirt cheap.

Even better than mucking about with interest rates would be for government to provide honest money. Instead, the amount of money sloshing around is just whatever Justin Trudeau or some other dimwit in government thinks it ought to be (almost 10% greater now than a year ago) to maintain the government’s popularity. The result is instability in prices that bedevils efforts at rational economic behavior.

This is such a dumb policy in my opinion. Want to save your pennies, work hard for a year building an owner-builder home for your family? Nope, sorry, BC Housing will make sure that doesn’t happen via some BS exam.

Want to buy a spec home to move into right away on massive credit….yes, no problem, we will even supply half of the down payment.

Don’t get me wrong. This is a no brainer to take advantage of if you are going to buy anyway. Free money! Definitely take it, I just don’t think it represents good policy, and I don’t think it is going to do anything for affordability for the market as a whole.

Rook

December 15, 2016 at 3:42 pm

I guess if you were planning on buying this year it is a small bonus. It also could be a bonus if it bumps your down payment to above 20% as you no longer have to pay the CMHC mob.

Unfortunately, Rook, the program is designed to stay under the 20% cap so that CMHC insurance covers the mortgage. In other words if the home is $200,000 and you wanted to put down $35,000. they would give you $4980. to stay under the cap.

https://homeownerservices.bchousing.org/housing-assistance/bc-home-partnership/bc-home-partnership-calculator.html

I’m honestly not convinced that this program is going to goose the market. They are catering to the lowest denominator in terms of credit worthiness and/or financial literacy. They still have to qualify for the mortgage.

The exceptions are fewer when the home ownership rates are at historic levels. If you couldn’t buy with the stimulus measures over the last 10 yrs. perhaps there’s a good reason why you are renting/living with mom and dad or ????

If I calculate correctly, this would be about a $1,600 savings in interest payments over 5 years on a $500,000.

Not all that much of a savings.

Considering it’s a gift from fellow taxpayers it’s more than enough, particularly as the intent is to dole it out to 40,000+

A bit off topic, but we were discussing electric vehicles earlier…

Lucid Motors unveils its 400-mile range luxury EV

http://www.autoblog.com/2016/12/14/lucid-motors-unveils-its-400-mile-range-luxury-ev/?ncid=edlinkusauto00000015

Today’s event not only showed what the luxury car looks like but it also showed off the largest battery pack in the automotive world. At 130 kWh (a 100 kWh battery is standard), the optional Lucid exceeds Tesla’s 100 kWh packs available in the latest Model S.

My initial reaction to this was joy, as it would allow me to augment my down payment to 20% towards a condo in Victoria. First time home buyer though, and I’ve only just started looking at how the real estate market works since a month ago.

Now, after reading this blog and the comments, I’m not so sure I should take advantage of this program now.

Looks like I have more thinking to do…

Clark’s been premier since 2011, so one more four-year term (for a total of 10 years in power) is probably all she needs. And it looks like she’ll do anything and everything to win it.

Our property assessment went from 580,000 to 800,000! We got one of those prepare yourself letters today.

Anyone have any idea as to how much our property taxes will go up?

Better move back to Van gwac, your Liberal vote is wasted here. Speaking out of both sides of your mouth has been on the increase these days. 😉

If I calculate correctly, this would be about a $1,600 savings in interest payments over 5 years on a $500,000.

Not all that much of a savings.

I guess if you were planning on buying this year it is a small bonus. It also could be a bonus if it bumps your down payment to above 20% as you no longer have to pay the CMHC mob. But if this incentive is allowing you to get into the market when you previously were not able to, all this is doing is tacking on $25,000 of debt to your life.

A little bit of forethought could have been made by self serving Christy to help first time home buyers.

Cynical pre-election ploy most likely prompted by her developer supporters. Any developer is going to love this subsidy to increase the demand for his product.

For the recipients – great free money if used wisely. Passport to trouble if used to get in over your head

I’d rather they use some taxpayer $ to create incentives for new non-RE-related businesses, which would make our economy a little more independent of RE – creating well-paying jobs for young people to afford to stay here and buy homes. But they’re all about instant gratification now to buy votes.

Absolutely agree but politicians can’t see further than the next election and the electorate is stupid.

So which do you prefer: rising housing “affordability” (LOL) and low unemployment, or cheap houses and 10% plus unemployment.

10% unemployment is exactly what this country needs to reinvigorate workers and businesses that have grown fat on easy real estate money. We have become so uncompetitive in the world we are compromising our future stability and the Canadian way of life. All good while the real estate market continues it’s assent but at some point it will falter and then the fun begins because we’ll have nothing to fall back on.

So if I got this right. People are pissed because it may put demand in the market and that big huge 10 year in the making crash will not happen in January as expected. Got it…..Poor Christy can not do anything right on the island. Thank god she does not need this island to get elected. 4 more years of Christy coming so get use to it. Than she can be PM. lol

Phew ! That was close Jack, just under the wire. lol

Yet another piece of advice: buy when you are ready. Don’t try to time the market. People have been giving the advice you’ve heard for as long as I can remember. It is a crapshoot and something you don’t really think too much about after you’ve bought.

As a first time home buyer who has been frustrated by housing prices, I believe this decision by the Liberals is completely foolish and another Christy Clark selve serving moves just in time for the election. This policy will satisfy the FTHB’s who are desperate to buy but can’t afford and will truly end up hurting them in the end. It is a step-stool for record debt. This policy will certainly buy the liberals votes but will make the frothy market across BC frothy for just a bit longer. It’s a move to delay the oncoming crash from happening before the next election.

This”free loan” that no one will pay off in 5 years will have to be renewed at interest rates millennials have never seen. It doesn’t take a crystal ball to see that in 5 years there will be a lot of hurting households and the market will look drastically different than it does now. I can’t see any good intentions other than for votes with this move. They can’t be that blind.

I would say there was a chance for prices to plateau, maybe even decrease slightly this spring in Victoria. Now the chances of that are zero (…well close to zero. The world is shaking up a bit these days). Vancouver and maybe Victoria will surely enter it’s bull trap this spring.

A foolish political decision that actually angers me quite a bit. The BC liberals hand blocks from concerned citizens to now shockingly unwise, untimely interventions have inflated this bubble exponentially.

Luckily, I got my comment in before yours Hawk.

Otherwise Michael would have accused me of just following what others had already said.

Bloomberg left out Victoria.

Vancouver Homes Are So Pricey the Government Will Pitch In

“All the benefit could end up going to sellers,” said Thomas Davidoff, head of the University of British Columbia’s Centre for Urban Economics and Real Estate. If a homebuyer is willing to pay C$500,000 and is presented with an extra C$30,000 of interest-free money, he’ll just end up bidding C$530,000, Davidoff said.

“Subsidies on the demand side are not the way to address affordability in a supply-compromised market,” he said.

https://www.bloomberg.com/news/articles/2016-12-15/vancouver-homes-so-pricey-that-government-to-loan-down-payments

Years ago the government came up with the plan to subsidize the purchase of a new gas furnace. At that time the typical furnace cost $2,500. The subsidy was $5,000. The next week gas furnaces went up in price at the store to $5,000.

That’s what will happen to housing when the government interferes in the free market. The government has all the good intentions but they lack foresight.

Totoro since you want to make this difficult. Let me bring it back to its simplicity.

Can someone refinance their home at 95% of its market value?

Can someone get a second, third or even a fourth mortgage on their property?

Yes they can.

Some people do this to consolidate debts from high interest rate credit cards, vacations, or roll their car and boat payments into their mortgage at a lower rate. Debt consolidation is one of the many reasons why people re-finance their homes. And some times that means they have to re-finance more than 80 percent.

This program does not apply to those couples (married or common-law) where one of them owns a condo/townhome/house already. This sounds like common sense but all it does is punish someone for their spouse making a decision in the past. I am a millennial that is currently trying to buy a semi-detached house in greater Victoria so I am fully aware how crazy and frustrating this market is.

The most frustrating part of the Victoria housing market is the variance in advice that you receive from people. Some people say to wait until the bubble bursts and not to take on so much debt. Other people say to get in now before you get priced out of the market. Others say to “look for deals in Esquimalt, I hear it’s up and coming”. News flash to those people is when you tell them that homes in Esquimalt right off the main drag are now selling for $600,000. Anything close to Saxe point is at least $800,000.

At this point I really hope the 15% foreign buyers tax is applied to greater Victoria. It has clearly made a least a small difference in Vancouver.

“This is not piling on more debt this is young people buying their first house at 750k or below. ”

712,500 more debt (or less) — side-splitting hilarious…

“I can’t believe that the government’s response to people not being able to get into the housing market is to facilitate and encourage them to take on more debt,” Eby told the Courier. “Young people and young families trying to get into the housing market have credit card debt, they have student loan debt — they have record levels of debt, according to the Conference Board of Canada.”

http://www.vancourier.com/news/b-c-government-offers-interest-free-loans-to-first-time-homebuyers-1.4670822#sthash.h1fMo2qK.dpuf

All it will it do is push up the prices in bidding wars and the only people making money is the agents and the developers. Who gives the most money to the Liberals ? Hmmm.

If you can’t afford to save it then tough shit, why should taxpayers pay for your lack of saving skills or “I want it now” attitude.

I don’t know if it is good to add this incentive in the market, but I do know that first-time homebuyers have an increasingly difficult time buying in as appreciation accrues. Those that own gain equity to balance this somewhat. I think it will lead to increasing competition for homes under $750,000.

Also, my math may be off but what is the advantage of paying an RSP homebuyer withdrawal off “properly”. Your top marginal tax rate window is not that small. If the RSP repayment pushes you over it you are paying slightly more tax than you would if you paid from earned income, but that can also be balanced out against the ROI on the initial withdrawal overall. I expect homeowners in Victoria have made more in most cases than they would have with the RSP even if they pay a slightly higher tax rate on the payment.

And regarding refinancing through private equity lenders, here is a list of private equity lenders which identifies max LTV offered from 2013: http://www.mbabc.ca/wp-content/uploads/2013/09/MBABC%20Alternative%20Lenders%20Directory%202013.pdf

Most cap at 75%. And the rates are between 7 and 10 per cent.

Here’s information from this year:

http://www.mortgagebrokernews.ca/contents/e-magazine.aspx?id=206730

Giving away free money will only make prices go up – I don’t see how this will help first-time buyers, and I’m tired of the gov’t using my taxpayer money to try to buy an election by further fueling an already over-priced market.

I’d rather they use some taxpayer $ to create incentives for new non-RE-related businesses, which would make our economy a little more independent of RE – creating well-paying jobs for young people to afford to stay here and buy homes. But they’re all about instant gratification now to buy votes.

There better be an exam (with no study guide) required to get this money. Good news for all the condo developers who are targeting this demographic, as well as the big developments in the outskirts. Those lobbyist dollars at work here methinks.

WTF.

Reason

No interest and debt payments for 5 years. Debt is fine if it is manageable with the expectation of 1 to 2% increase in interest rates. This is not piling on more debt this is young people buying their first house at 750k or below. It is not for a person who has a 300k mortgage adding a another 500k to buy their dream Oakbay 100 year old, 1500 sq ft home at 1.5m.

Reason, looks like some serious flip flopping. Politician maybe ? 😉

GWAC yesterday:

It is no time to load on debt that you cannot afford to pay much higher rates on. These low rates should have been a time when people cleared up debt. Unfortunately the opposite happened.

GWAC today:

I think young people should be given as much help as possible. Not easy out there for them at these prices.

You mean to start building debt Mike ? No problem if you have your head in the sand.

“Bank of Canada warns about huge mortgages, growing housing debt

Nearly half of new high ratio mortgagees in Toronto owe in excess of 450% of their incomes”

What about the rule that you can never have owned a place ever, anywhere in the whole world. How the hell can they prove that either way ? I guess that makes you a foreigner paying 15% also get the free money ? WTF ?

I don’t see it having much effect, except on the low end. At least it will allow a few more millenials onto the property ladder to start building wealth.

Michael Smyth interviewing Gasbag Coleman on CKNW, asked him why is the government turning into a bank and what if someone decides not to pay after 5 years or they get divorced before the 5 years is up and they are in negative equity, will they go after them to foreclose and he got all flustered calling him negative, then said they would go after them. More lawyers etc. What a shit show.

I think young people should be given as much help as possible. Not easy out there for them at these prices.

“The Angus Reid poll has Saskatchewan Premier Brad Wall at the top of the approval rating list at 58 per cent, followed by Manitoba’s Brain Pallister (50 per cent) and B.C.’s Christy Clark (35 per cent).”

Yes, but where would Christy Clark’s approval rating be if house prices slumped by 40%?

Having let loose the free money genie, governments cannot reign it in unless they’re prepared to see unemployment in double digits.

So which do you prefer: rising housing “affordability” (LOL) and low unemployment, or cheap houses and 10% plus unemployment.

Actually, I wouldn’t like to see my tax dollars spent that way. It isn’t difficult saving up the 5% down payment. A young couple just has to start an RRSP and fill their unused contribution limit.

Personally, I don’t think the government should be involved with real estate. Let the market take care of itself and keep the government’s grubby little paws out of it.

for what its worth – comments on CBC about 99% negative.

What’s another $700 million the tax payers will never see again, and once rising rates are tacked on it will be over $1 billion. A total disaster in the making. This woman has clearly lost her mind and desperate for love, only second to Notley.

“The Angus Reid poll has Saskatchewan Premier Brad Wall at the top of the approval rating list at 58 per cent, followed by Manitoba’s Brain Pallister (50 per cent) and B.C.’s Christy Clark (35 per cent).”