Dec 12 Market Update

Weekly stats update courtesy of the VREB via Marko Juras.

| December 2016 |

Dec

2015

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 222 |

465

|

|||

| New Listings | 218 |

451

|

|||

| Active Listings | 1702 |

2517

|

|||

| Sales to New Listings | 102% |

103%

|

|||

| Sales Projection | 502 | ||||

| Months of Inventory |

5.41 |

||||

Amazingly enough we are still running about 8% ahead of last year’s sales rate despite having nearly 40% less inventory. I thought December would be the end of the trend of improving year over year sales but it isn’t the case yet.

December is a month where we usually see about as many listings as new sales, so don’t expect any reprieve to the inventory situation until February at the earliest.

Coming up next: The ruling concerning whether the Toronto Real Estate Board can block the release of sales data is due to come out any day now. If you recall, the Competition Tribunal ruled that the TREB cannot block this data from being made widely available to the public, which the TREB promptly appealed citing privacy concerns to releasing the data. My prediction is that their appeal will fail and the data will be released. This precedent will likely spread to the rest of the country within about a year so look forward to Zillow in Canada and many other similar sites that will pop up.

It will be interesting to see the effect on the real estate industry once this happens. Currently they are wailing and gnashing their teeth, but has it really hurt the industry in the US? Their home sales data has been available for years and yet typical commissions in the US are 5-6% of the sales price, which is even more than here (typical is ~3.5% on the average Victoria home). While those sites are allowing people to be more informed (or is it just more info-garbage?), they’re apparently not doing a thing to impact the value proposition of agents. The high transaction costs seem to be much more resilient to a better informed consumer than anyone would have anticipated.

Thing is, you had to get in before mortgage rates started rising. If you jumped in at 18% rates, you were about to take the roller coaster down.

http://i.imgur.com/EUjnkbv.png

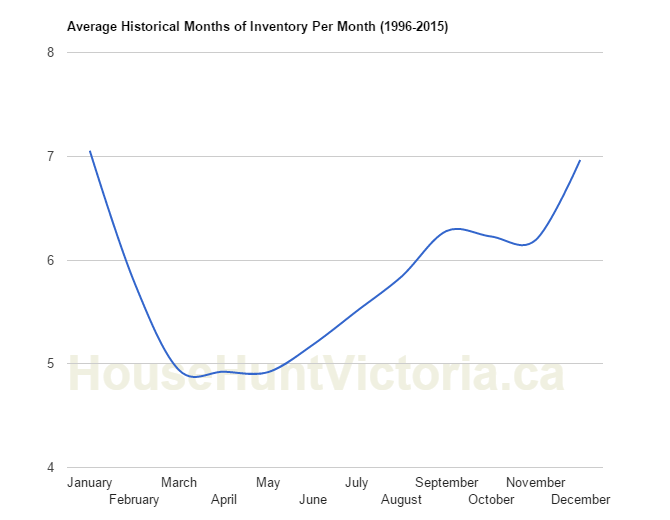

New listings for house in the core are down about the same as sale volumes. But Active listings are only down by 21%. That put November as the third highest months of inventory at 2.21 behind January (2.84) and October at 2.38 We were scraping bottom in April with half the inventory we have today when it was only 1.06 months of inventory.

We have to look back to 2006 and 2007 when the MOI was this low. Oddly, although our median prices were rising they rose over a much longer period of time in 2006 and 2007 and not as much in percentage or lump sum as what happened this spring over a couple of months.

Or to think of it another way. We had 5 or 6 years of a flat market where people paid down their mortgage and gained equity. Equity that they used to buy homes this year. However that equity advantage quickly disappeared with rising prices and now sale volumes have fallen dramatically.

“Christy is just starting a subprime lending election ponzi scheme”

The world of zero interest is truly awesome. If five years of free money doesn’t keep the bubble growing, then extend it to ten, twenty, for ever.

It’ll keep construction booming, and anyway what else can she do?

The forests are so poorly managed that the industry has now to make do gluing shavings together, the gas bonanza has yet to be realized and may never be, and there must be a limit to how many British Columbians can find employment making video games.

New post on our ridiculous new program https://househuntvictoria.ca/2016/12/15/what-one-hand-taketh/

So, do we surpass Dow20k before New year’s, or after?

Although, everyone caught on to that a year ago, before JJ did.

http://www.theprovince.com/Realtors+predict+2016+year+condo/11654752/story.html

When interest rates go down, “affordability” is said to go up, which means that prices rise. When interest rates go up, “affordability” is said to go down, which means prices fall.

Therefore, if “affordability” declines sufficiently, many folks can afford a house without entering into expensive long-term debt. That was the situation in the early 70’s when a house in P0int Grey cost only a couple of years of household income. So for first-time buyers, it seems that an 18% mortgage rate would be a God-send.

Christy is just starting a subprime lending election ponzi scheme just as rates are about take off. That’s the worst thing you could do to a young person.

Meanwhile she makes the couples with no kids and seniors pay more MSP then give it to the families who just got an extra $400 a month from Justin. Christy is toast in the spring.

@ jj

Yet, despite the sales slump, listings and inventory are way down, most likely because those thinking of selling are waiting for prices to peak. Once they realize prices have peaked, then the deluge.

Totoro, forget talking about HELOC’s its a non starter in this discussion.

You can refinance your home with a private equity lender that doesn’t have to stick to loan to value bank guidelines. Most homes under foreclosure have mortgages in excess of their market value. Some how they got mortgages for more than the property was worth? Because desperate people find desperate means to get money.

It’s highly doubtful that you’ll find a major lending institution financing these loans. But there are a plethora of lenders you never have heard of that will. Just google the law courts and you’ll see how many equity lenders, that few people have ever heard of, that are foreclosing on home owners. The lending world is bigger than just a couple of Canadian banks.

http://www.theglobeandmail.com/news/british-columbia/bc-offers-interest-free-down-payment-loans-to-first-time-buyers/article33335499/

This is pure electioneering. It doesn’t make any economic sense whatsoever when they’re trying to cool down the housing market.

However, it will allow extra first time buyers to enter the market and so should be positive for prices.

Mike , you must have a shallow life as a rich dude to look back at quotes from a year ago. No worries tho. The commodities boom you screamed about has a pulse but still well below where you made the infamous blown call well over a year ago.

http://stockcharts.com/h-sc/ui?s=%24CRB

Christy wants to give out free tax payers money to keep the bubble from popping after Justin tries to prevent one. Talk about political pressure from developers greasing the palms. The real economists (not Mike) say this is a joke. NDP will rip her a new one. Disaster in the making.

Joshua Gottlieb @GottliebEcon 9 minutes ago

4: Subsidies like this one actually worsen the affordability problem and reward speculation.

UPDATE: BC to offer interest-free loans for first-time home buyers

The provincial government says it will match contributions from first-time home buyers on their down payments, providing up to $37,500 or up to five per cent of the purchase price. The 25-year loan is both interest-free and payment-free for the first five years only

Your stats are really helpful JJ. And I’d agree that you did point out that condos were a deal when they still were.

Of course I was talking about dropping sales volume at this time last year as it was the start of the winter market.

And I was also describing the market anomalies that illustrated that something strange was happening in the market as prices were heavily skewed with large fat tails . That eventually proved out to be the harbinger of the rapid rise in prices in February, 2016. I also suggested that people look at buying condominiums for quick price appreciation.

For a “bear”, I think I’m pretty bullish on real estate. As I search out where the market is under performing for the best deals for buyers.

You have to qualify for refinancing based on your debt service ratio. You can’t just pull “almost all of your equity out”.

If you are in trouble financially and trying to consolidate debt and can’t get a HELOC because you don’t have 35% equity, the maximum you can refinance for is 80% of the home value or the an amount between 20-35% of the equity in your home. You will not be a high ratio borrower.

And the new mortgage rules apply which reduces borrowing capacity by 25% further narrowing the amount you can borrow.

12% of Canadians are “highly leveraged” – they carry 40% of the debt in Canada.

However, steady increases in asset values have generally kept debt-to-asset and debt-to net worth ratios stable. I’m not sure what percentage have very nice homes. What we do know is that, on average, Canadians have 70% equity in their homes.

Here is a report on indebtedness with lots of stats:

https://www.cmhc-schl.gc.ca/en/hoficlincl/observer/upload/housing-observer-examination-household-indebtedness.pdf

As for Hampshire you would have to believe that BC Assessment is totally incompetent in how they do their job to believe such rubbish.

Or that the home was substantially renovated. Renovations that BC Assessment was not informed about by a building permit. Or that the renovations were performed after October 31, 2015 and would not be included in this years assessment.

Anyway the property taxes based on the old assessed value of $676,00 were $4,356. This new home owner is going to get quite the surprise in the future come property tax time.

While there are limitations of how large your global limit may be on your home equity loan. You can re-finance your home to pull out almost all of the equity in it. That would make these home owners new high ratio borrowers too. And over half of the re-finance appraisals are for debt consolidation purposes.

And that was a conversation I had this week with a person that had a $950,000 home and needed to consolidate another $40,000 of debt into the mortgage. She couldn’t do it with a HELOC so she needed to re-finance the mortgage. That adds mortgage, legal, appraisal and other fees to the cost of the loan.

A lot of people with very nice homes are up to their eyeballs in debt. It isn’t just first time owners or people that just bought their homes in the last five years. Most of the foreclosures that I do are on homes that were bought 20 years ago in Saanich, Victoria and Oak Bay. Because prices have gone up this year, the owner can re-finance with another lender to get out from pre-foreclosure but that only puts off the inevitable. So don’t assume that it is the first time buyer as I’ve had to appraise $10,000,000 homes that were in the pre-foreclosure stage. Crap happens to everyone.

Sells for 100% over assessed! 1367 Hampshire with an assessment of $676,000 sells for 1.3 million. The market must be heading up up up. Just wait for this new loan for first time buyers to be announced. Yep, all these doomers with their hidden agenda of wanting prices to drop so much that is all they can talk about: you snooze you lose.

PS. If you disagree you are just a doomer. Other facts and market information are irrelevant.

I don’t know why you guys don’t just cut-n-paste from last year’s date to save time.

Jack was going on about dropping sales same time last year, and here’s a snippet of hawk’s comments from Dec 15, 2015.

On the other hand we have another Oak Bay home with a price reduction, and a massive one at that, of $600,000 from $2.1 to $1.54 million and under assessment.

Looks like Vancouver is leading the way down and all the sheep are left overpaying here.

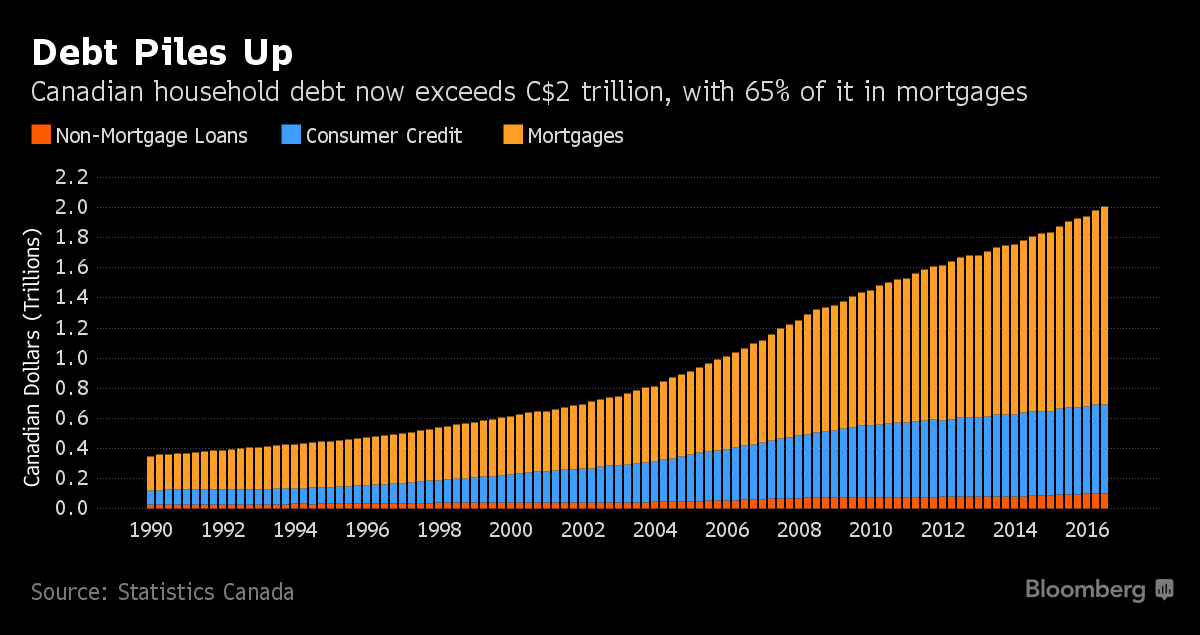

Surprise, surprise. Canadians borrowing their ass off to infinity and beyond.

Federal Reserve raising rates for the first time in nine years…risks for a credit crunch in the region as China’s economy slows

If you don’t like my posts on new information potentially effecting house prices then skip them and go back to your rocking chair.

I saw a Fairfield house in nice shape drop their price from $720,000 to $660,000 in order to get the sale. That’s a 60K hit on high expectations. Ouch. As my friends agent said to them there is a shift in the winds in the Victoria market.

That drop in sale volumes is more evident in the more costly areas.

For Saanich East, Victoria and Oak Bay the drop in single family home sales was 64%

In the rest of the core it was 51%

Langford and Colwood it was 55%

Oak Bay had a drop of 67% in sales from April to November.

These are not typical seasonal declines.

As Barrister mentioned the high cash buys via the agents he talked to, you have to remember it only took 11% of the US market to go into dire straits before it crashed. The cash purchasers aren’t part of the selling process in a crash, it’s those who borrowed too much as LeoS’s article stated.

That one third will be enough to send it over the cliff with a rapidly declining purchasing power to keep the market moving.

“The bank calculates that almost half of new high-ratio borrowers in Toronto are above that threshold, and 39 per cent are in Vancouver. In Toronto’s case, such monster mortgages are spreading to nearby cities like Oshawa and Hamilton too.

“In these cities,” the bank said, “the proportion of high-ratio mortgages with … ratios exceeding 450 per cent has more than doubled over the past three years, from around 10 per cent to roughly 25 per cent.”

But we have seen a drop in sales. A 54% drop in sales from May to November. It’s just that most on this blog think of it as being seasonal.

Yes there is a seasonal variation in sales but not 54%. Last year it was 35% The year before it was 37%. In 2013 it was 38%.

LeoS,

I think it’s the typical delayed reaction based on the amount of FOMO who were lining up just a few months ago who don’t pay attention or went and borrowed more money from ma and pa. The deniers also play into it and thus takes awhile to drain the swamp, so to speak. 😉

I think many people have priced too high the last 6 months gwac, and they luckily got their price and more. Now they’re not.

‘It really does look like Vancouver’s housing bubble has burst’

http://www.businessinsider.com/vancouver-housing-bubble-burst-2016-12

Nearly a third of recent Canadian homebuyers with so-called high-ratio mortgages wouldn’t qualify for their loans under new rules recently implemented by the federal government.

Makes it surprising why we haven’t seen a drop in sales here after the new rules. Who is taking up the slack from the sidelined first timers?

http://www.cbc.ca/news/business/bank-of-canada-financial-system-review-poloz-housing-1.3897875

Hawk

408 and 581 are the assessed prices on those 2 price reductions. People are pricing too high at the beginning.

Barrister,

What happens if 10% of the seniors die off ? I think it’s a saw off at best. Victoria is not the place it was 20 years ago for many who think they want to retire here and might have not been here for ages. I would imagine Parksville/Qualicum is the future growth area, less big city BS and few mental health problem cases on every corner. Been downtown for a walk lately ?

From this morning’s Globe on the plans of millennialis, boomers, and gen-Xers to leave Vancouver:

A poll of more than 1,700 B.C. residents, done by Insights West for Resonance Consultancy, indicates that 68 per cent of the millennials surveyed would like to live in the Lower Mainland if money were no object.

Only 16 per cent who live here now think they will move away within five years.

But other data in the poll also show that the region is on the verge of a tectonic demographic shift.

That’s because a third of boomer homeowners, many retired or on the verge of it, say they’re ready to cash out and move to another part of the province in the next five years. That’s significantly higher than in any other part of the province, where typically only about 20 per cent of that group say they think they’ll move within five years.

Even more striking, half of Gen-Xers who are homeowners say they’re ready to move to be able to afford a larger house.

http://www.bankofcanada.ca/2016/12/fsr-december-2016/

scroll down to middle of page:

Mortgage Loan-to-Income Ratios

Would be great to see a version for Victoria.

Couple of nice townhouses in same complex on Mallek Crescent had to slash their prices $14K and $10K. I thought townhouses were on fire and selling in a day. Guess not.

Hawk:

You are right about there being an impact when the boomers finally move on. But I think you are looking at a fifteen year horizon. In the meantime the demographics nationally would suggest that we are looking at just the beginning of the wave of retirees potentially moving here. To avoid opening up a flood of “not everyone wants to move to Victoria comments” try calculating the numbers if only one per cent of Toronto boomers decide to retire in Victoria over the next few years.

Decent size place in Lake Hill cul de sac slashed $30K, now $749K. 4046 Century Rd.

The city of Victoria should seriously consider passing a bylaw requiring all of us to stop aging and start becoming younger. I think I will work on that today.

“At a quick eyeball there seems to be more people who are 50 and older than there are between 25 and fifty.”

Less young people to buy the old folks homes when they want to downsize or die off. Kills off the food chain with tougher rules for first time buyers makes it seem like it’s inevitable inventories will increase in due time.

Chris:

I tend to agree that house prices might be plateauing out at this point. The joker in the pack is if there is an increase of retirees coming to Victoria over the next few years. I spoke to two real estate agents who sell high volumes in what I call south Victoria (south of Bay Street basically, Rockland, Fairfield, James Bay and Oak Bay) both of whom said that their experience is that well over half of the single familly houses were being bought for all cash and no mortgage. One said that in Oak Bay that number is more than three quarters. I have no idea of the truth of that but I am passing it along for what it is worth.

If that is true, I am not sure what to make of those numbers. Does anyone have any thoughts?

Secondly, thank you for providing the borrowing numbers. It would support the prices of homes in the West Shore for most income earners in Victoria but I agree that other factors seem to suggest that we have reached a plateau. It could be argued that if interest rates continue upwards that price declines might be seen on the west shore. Unless mortgage rates seriously increase then I suspect that price declines would be pretty minor.

At a quick eyeball there seems to be more people who are 50 and older than there are between 25 and fifty.

I saw that! Looks like a significant increase in the age bracket.

Langford price slashes continue. 872 Arncote Place whacked $34K , now $535K. Guess it’s not as hot as it was out on the Westshore, things change.

LEO:

Thank you for the demographic numbers. At a quick eyeball there seems to be more people who are 50 and older than there are between 25 and fifty. (I am discounting the big spike in 20to 25 because they probably represent the large number of students here).

The other relevant fact seems to be that the number of people over fifty has grown substantially over the last decade. I will keep looking for a breakdown by age. Obviously the government must have the raw data to figure out medien income but they might not have parsed it out by age.

The age groups are here https://househuntvictoria.ca/2016/03/07/demographics-part-one/

I don’t know of a source for income by age though

Barrister – I didn’t give it a lot of thought and the only issue I had was the idea that there were so many rich business owners (and rich retires) that average/medium income had no relevance. This was stated like it was fact with no supporting info.

The points you made are sensible and I agree – the average wage earner is not buying housing in the core unless they have a huge down payment. However the ratio between house prices and incomes, at all levels, has never been so high. Using the Royal Bank qualification tool with a $200k income and $350k down payment, the maximum qualification is just over $1M. That’s with no other debt – no car payment, loans, etc. What you get at that level is the very low end of Oak Bay and is usually a house that requires extensive renovations. So I suppose this income level could support current prices but it’s hard to fathom prices going up significantly from here with all the other headwinds pointed out (interest rates, debt levels, etc.).

Chris:

First, I agree with you that private business owners probably have a minor impact on house prices. So lets put that aside. Were we probably disagree is on the impact on house prices of retires on the one hand but also how retires may alter the medium income of Victorians. The newest census I was able to find was 2011 which shows the city of Victoria having about 19% of the population over 65 and with Oak Bay having almost 25% of the population over 65. The median age in Oak Bay 54. The national average is about 14 percent. It is not untypical for many seniors to have a fairly substantial asset base while also have a low income. The fairly large student population would also impact the medium or average income.

What would provide a much better picture of affordability is the median or average incomes of those between age 25 to 55. This would tend to exclude students and most retirees. It would include most first and second time homebuyers.

The other factor when dealings with averages is that they can be deceptive if there is not a breakdown by tranche. I vaguely remember one of my profs illustrating it by looking at the average age in the City of Guelph. At the time it was something like 42. In point of fact, people aged between 35 and 50 were only a small percentage of the population. Because of the University there was a vast number of young people in Guelph while there was also a large population of people over fifty. The thirty to fifty year old had migrated to jobs in the big cities. My point is that the average, while accurate, did not reflect the reality.

I suspect that a similar effect might be occurring in Victoria. A lot of the jobs in Victoria are in either retail or tourism both areas that are known for low pay. On the other end of the spectrum a lot of the public sector jobs are reasonably well paid. There is a large gap between the two. The example pointed out to me is that a 35 year old police officer married to a 30 year old teacher have a family income around 150k. If there are two segmented groups of wage earners then these has some real implications for housing prices in Victoria.

I have looked but I have not been able to find any really good stats on income in Victoria as to wage breakdowns by segment and by age. If anyone can find these please post them.

If you point is that it is harder for people in low paying careers to get housing in the core i totally agree with you. Most people, particularly developers who are getting rich, propose increasing density. I am probably the single voice on here suggesting that we follow the more recent, and in my view very successful Swiss model of moving jobs into clusters of smaller cities and communities. On that point perhaps we can agree to disagree.

To be clear, I am not disparaging your point about the average income but rather I would like to see more thorogh statistics to see if we are dealing with statistical reality or deception.

Big news from provincial govt dropping tomorrow regarding a 5 year interest-free loan matching program for couples under combined income threshold. This is bound to add further confusion to the markets. You heard it here first, folks!

For all of you that are about to receive your assessment. The assessed value is an estimate of your property as at July 1, 2016 assuming the condition as at October 31, 2016.

So in Sidekick’s example his 25% increase is from July 1, 2015 to July 1, 2016. If you disagree with your assessment that is the date of the value you are appealing. Not what you think your property is worth today.

Sale Price, Median Single Family Core Districts

Month 2015 2016

Jan $542,500 $655,500

Feb $597,500 $681,500

Mar $625,000 $740,000

Apr $631,200 $759,500

May $620,250 $760,000

Jun $629,450 $743,000

Jul $610,000 $754,500 23.5% year over year increase

Aug $659,500 $728,000

Sep $640,000 $781,550

Oct $677,250 $826,500

Nov $620,550 $809,000

Dec $672,500

I think one thing that may change the market is simply perception – we’ve have had years of lower and lower interest rates, ever rising prices and short lived corrections. If Vancouver continues to lose ground it will become clear this is not a buying opportunity, as has happened in the past, but the actual correction everyone kept predicting but never seemed to come. There will be an urgency to crystalize the massive tax free gains and I think we’ll see some momentum on the downside with cash flow negative “investments” unloaded. To me the stars seem to be aligning for this outcome and with the recent quick rise in Victoria prices we’ll see some of the same, though less pronounced. Seems posters here believe the perception of buyers will remain the same regardless of the changing economic environment.

Of coarse not everyone in Victoria is rich. That would be a ridiculous statement. But, I dont know why you are arguing about it since absolutely no has even suggested that everyone in Victoria is rich.

I bring it up because in the past when I’ve mentioned average/medium incomes it was quickly dismissed with several comments indicating the reason it’s so low is because the many Victoria business owners who draw a minimal salary while reaping huge profits within their corporations, as well as a prevalence of rich retires with small incomes vs. their assets (more likely to have some significance). I’ve just been making light of those weak arguments because the comments irked me! I’ll refrain from doing so going forward…

I think Warren Buffett was referring to personal debt, and he wasn’t saying you shouldn’t use leverage – he was just saying that it’s the only way a smart person might go broke. (Thanks for posting his quote)

Speaking of stereotypes, Warren Buffett said, “If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.”

Imagine that – a rich dude with a heart – not as uncommon as you might think.

Side

You are one of 4000 in greater vic that got a letter. Lucky you 🙂

Ouch. Pre-assessment came in the mail today. 25% jump over last year (not in OB, all land value). I actually think they got the market value about right this time, although I could probably argue 10K off.

That’s pretty funny because Warren Buffet actually depends on the judicious use of leverage to augment his returns.

Read this:

http://www.forbes.com/sites/timworstall/2013/02/08/explaining-the-secret-of-warren-buffetts-success-double-leverage/#3ccba5197ba9

Warren Buffet has a wonderful way of inserting common sense into a matter. Thank you for that wonderful quote.

On HELOCs and leverage;

“The only way a smart person can go broke is by using leverage. So if you’re really smart, you won’t use it and if you’re not so smart, you have no business using it in the first place!” Warren Buffett.

There’s two ways of looking at it, right now it doesn’t take the season into account, so the absolute assessment is correct as it is less hot than it was in the summer. It is “ludicrously hot for November” but just “hot” from an absolute perspective.

Just Jack:

You might have a point about the lower inventory being the new norm. The number of new listings seem to be matching the monthly sales. In some areas the amount of inventory seems to have crept up a bit from three months ago.

I am not sure how much the drop in house prices in Vancouver will impact here in Victoria. While prices have dropped the gap between similar houses still is extremely large. Now some people on this blog do not believe that transplants have much influence on our market in the first place so, if they are correct, it should not matter much.

TD just raised rates again. 5 year fixed up to 2.94.

“James, I guess my point is that it would be great to stop generalizing about well-off people as if they’re all braggarts trying to avoid taxes.” Stereotypes are stereotypes for a reason.

“Well they have a point, since they are required to pay more than half their income in taxes (if you include capital gains tax, excise taxes, sales taxes, property tax, etc.).” They aren’t, and they don’t since most don’t make their money from a paycheck.

Month to month sale volumes drop off dramatically in the winter.

However, looking back over the last 252 house sales in the core since October 24, the median price was $792,500. The year before there was 241 house sales in the core for the same time period and the median price was $654,000. A whopping increase of $138,500 or 21 percent.

But for most of the year the median price for a house in the core has not changed significantly since April and May when it was $760,000.

Despite the low inventory, the low number of new listings to sales and the low days on market – prices have not changed much since the spring.

If this is a hot market and prices are flat. What happens when the market eventually cools?

While we or at least some of us, religiously monitor the months of inventory, sales to listings ratios and days on market. That measure of illustrating if we are in a buyers, sellers or balance market is just a guide and is always shifting. If we only have 2 months of inventory and prices are flat, then 2 months is the new balance instead of the usual 5 or 6 months.

Vancouver is down right depressing compared to Victoria. Even the valley is a complete wack job of a place to be. There’s no way I’d live there in a million years even if I had all the money in the world. Just terrible, completely terrible.

I always feel like December stats are useless, especially after the 15th or so. No one wants to be worrying about staging open houses around the holidays or trying to make dead flowers and yard plants seem vibrant in the dark days around the solstice. January is almost as useless, except the latter half of the month can start to have enough volume to be interesting sometimes.

So don’t sweat the details. We wont know anything new until the the first weeks of February – and then we’ll be roaring (or limping?) into the spring market, and trying to figure out how the CIA’s assassination of Pres. Trump will affect things in 2017. Ha!

Re: rich people and charity

“Most bleat on about how much taxes they’re paying.”

Well they have a point, since they are required to pay more than half their income in taxes (if you include capital gains tax, excise taxes, sales taxes, property tax, etc.).

With that, you’d think that governments could do a decent job of caring for those who cannot care for themselves.

True, many, it seems fall between the cracks or, perhaps, deliberately evade the system, which is why we still have a need for charities, some of which no doubt do a good job.

Unfortunately, Canadian governments provides little or no supervision of charities, so one is usually uncertain which charities are honest and which are a scam. It would be good, in my view, if all charities were required by law to provide on request to those they solicit for contributions a one-page audited statement of accounts clearly revealing all overhead costs and the manner of cash disbursement on behalf of beneficiaries. A charitable group of accountants might be organized to prepare the audited statements without a fee.

“I’d take that bet in a heart beat. Most bleat on about how much taxes they’re paying.”

James, I guess my point is that it would be great to stop generalizing about well-off people as if they’re all braggarts trying to avoid taxes. There are some very generous people and very selfish people out there – but it’s not determined by where they live or how much money they have.

Introvert, funny enough, one of the first things that a transplanted Vancouverite (who just moved to Victoria) said to me last night, “the traffic has gotten so bad there!”

I know of two fifty-something couples from the Lower Mainland who are planning on retiring in Victoria. Both regard Victoria as a slower, quieter, simpler — yet equally gorgeous — location in which to live.

So take a hike!

The only redeeming thing about Calgary is its proximity to beautiful mountains.

The riskiest thing I’m comfortable with is buying a house in Gordon Head (in 2009).

Just picture those rents, pimpin’ in a blacked out Escalade!

So the Fed rate increase coincides with 2 cents off the Canadian dollar, two bucks off the price of oil and 100 plus points off the Dow. Under those circumstances, I’d hesitate to pay a premium of 30 to 70% over assessment for a house in Oak Bay. Moreover, were it not for a combination of family ties and inertia, I’d be inclined to plunk my old OB heap on the market at a fat premium, while looking for an ocean-view spread in, say, Costa Rica.

” I bet you anything that most well-off people recognize their good fortune, and contribute to society or charities to help other people in need.” I’d take that bet in a heart beat. Most bleat on about how much taxes they’re paying.

“I certainly agree with you that the views on this blog have been very polarizing”

Agree, Barrister, it’s unfortunate that sometimes there’s too much focus on black or white instead of shades of gray.

There are a lot of smart cookies on this blog so I get huge value in reading the data and anecdotes from all sides, because that’s what worked for me – tracking BOTH data & word on the street. (eg., company stock was always “up on rumour & down on fact”)

It’s understandable why Oak Bay was a popular topic – because it shot up quicker than anyone expected, so there was useful discussion as to why – and what the alternative hoods were.

There’s name calling on all sides, eg., saying that anyone that lives in OB or Rockland wants to brag about it or wants it as a status symbol. Gimme a break. Sounds like sour grapes. I bet you anything that most well-off people recognize their good fortune, and contribute to society or charities to help other people in need.

So it would be good if we could all agree to disagree. eg., I understand where JJ is coming from – even though we don’t always agree – because his job is trying to protect people from over-leveraging, so he’s very conservative when it comes to RE. If one of Hawk’s comments came out harsher than intended, I think he got exasperated because of other posters that, as he said, pounce on a small thing & take a condescending tone – not you Barrister 🙂

Yes, the fact-checking curse. You have figured me out.

totoro

“Good advice.”

…but I bet you can’t help it 🙂

Thanks Leo. I didn’t realize that.

I don’t believe credentials are needed to post and I’ve never claimed to be an expert. I generally post based on a review of data, and I’m definitely more interested in figuring things out than promoting a viewpoint.

It is probably better not to have credentials posted. If your information and analysis cannot withstand third party review it doesn’t matter what your education and background is. The emperor really has to wear clothes this way.

Good advice.

The change in assessment is more a function of the way the algorithm assigns “hot” vs “ludicrously hot” and not a reflection on the market actually cooling off. The algorithm says anything under 2 months of inventory is ludicrously hot, so at the current 2.2 it is above that. However there is natural seasonal variability where in the winter the months of inventory tends to be higher. So 2.2 is a record low for November, even though it is above 2.

What I should do is assign the market evaluation based on comparison to same-month historical ranges, not an absolute number.

@Hawk. No need to stoop. I guess I see it more from you simply because I agree with your position, but you’re the only one who espouses that position who posts frequently. So I see the “pumper” name calling too much. It’s certainly much better than the dude who’d come by just to correct evrey one’s (that’ s for you ;)) spelling.

James,

Don’t read them then, no problem. What you call personal attacks are normal responses to the blatant pumpers posting imaginary charts/info in the face of conflicting information. There are a couple whose who choose to repeatedly talk down to people with their “higher than thou” attitude because they’re over leveraged/overtalk their wealth, and any bear statement with some fact behind it is shot down continuously with spin talk and taunting. Shit happens.

James

I gave up a long time trying predict interest rates/ housing prices/ stock prices. I just go with the trend until a moving average breaks or some other trend determination happens. :).

Trump is a huge wildcard. If he cuts taxes and increases spending like he says. We could have an inflation issue quickly. 100 oil, 3% increase in interest rates within 2 years.

It is no time to load on debt that you cannot afford to pay much higher rates on. These low rates should have been a time when people cleared up debt. Unfortunately the opposite happened. Jobs and debt repayment ability are the factors to watch.

@gwac. this year they had 4 anticipated rate increases, only ended up doing 1. The reason was Brexit though. They were anticipating two next year until today’s meeting. You never know though, depends on world affairs, could have a Frexit, which would delay them, or Trump could start a trade war with China, and they’re probably increase the number.

james

1 to 5 year mortgage rates are base on Canadian bond rates. No central bank direct influence.

Variable is a based on prime which is based on Bank of Canada overnight rate. Set by the Bank of Canada. So what the Fed does has no direct impact on Canada. Bond rates may go up if the 3 suggested rates was not anticipated. Got to remember Canada`s economy is not as strong as the US. BTW anticipated increase have not materialized in the past. with the US.

Oops

As I stated below Canadian 5 year Bond rates are up 60 BP since Trump was elected in anticipation of his spending and the impact on Canadian inflation and growth. No idea if it continues. No idea when Canadian short term rates may go up. My guess is a year. My point was Canadians need to get their balance sheet in order and be ready to pay higher interest rates in the future.

Gwac:

Hawk

We do not live in the US. Our economy is way behind that of the US.

We will have to see what happens to Canadian bond rates.

Unfortunately, we don’t have to wait too long, Gwac. The 5yr bond rate has gone up significantly from it’s 52 wk. low of .40. The bond market is going to do what the B.O.C. doesn’t want to do …. raise mortgage rates. The rates have gone from .70 a few months ago to a high (so far) of 1.17 today.

In the world of bonds that is a big move. We will be watching the banks now.

http://www.marketwatch.com/investing/bond/tmbmkca-05y?countryCode=bx

Canada 5 Year Government Bond

TPI: BX:TMBMKCA-05Y

Enter Symbols or Keywords

GO

Market Index

OVERVIEW HISTORICAL QUOTES

1.16

Change

+0.04 +3.11%

Volume

0

Dec 14, 2016 3:34 p.m.

Quotes are delayed by 20 min

Previous close

1.12

Day low Day high

1.07 1.17

Open

Open: 1.12

52 week low 52 week high

0.40 1.17

Marko:

I really appreciate more information as to what is going on in the West Shore. Oak Bay is mostly interesting because there are more stats available for it as an individual city. My impression is that

prices in Oak Bay, to some degree, mirror the increases we are seeing in Fairfield, James Bay and Rockland. Stats for those areas are harder to get since they are rolled into Victoria as a whole.

By the way the Dalmatian coast must be one of the most beautiful places I have ever been (let me point out that this is a very personal opinion so i will save some people the bother of saying that not everyone wants to go there and that there are people who dont like it). it is absolutely gorgeous and also filled with wonderful history and very warm friendly people. If i had any chance of getting immigration papers that would have been right at the top of places to live.

Also Canadian bond rates are heavily influenced by international bond rates. Why would people buy Canadian bonds over US bonds if the US bonds paid more. They wouldn’t. So bond rates go up even if the central bank doesn’t raise rates (since less people are buying them and more are selling them). When the US interest rates increase and the Canadian ones don’t, the Canadian dollar goes down, which further incentivizes people to sell Canadian bonds.

So the fed increasing the rate will increase the bank rates here, regardless of whether the Canadian rate is adjusted.

@gwac, the lending rate isn’t based solely on the bank of canada prime rate. Also the main news in the states this morning isn’t just the interest rate hike, but the fact that they’re planning 3 more next year.

@Hawk, I think the housing market is about to correct personally (too many conflating factors, and when the government is introducing policy to deflate a market, i don’t know why anyone would want to enter that market.) but I don’t like reading your posts. When you stop personally attacking the people on this board, people will have more time for you. Attacking ideas & data is actually great, telling people that they’re just another pumper or whatever else is just a waste of time (yours included).

Chris:

I certainly agree with you that the views on this blog have been very polarizing. Since I am neither a bear or a bull on real estate I have had the privilege of being attacked by both sides. It is when the attacks become either personnel or when they intentional distort what I have said that I find it annoying. The extreme comments do less than nothing to help anyone understand the Victoria Market.

Just for absolute clarity, I find your comments are reasoned, insightful and I agree withe majority of them. Nor have I ever seen you do personal attacks. This might be a bit of a long winded post since I am going to try to put some of my views out in detail.

First, I tend to agree with you that there are some serious storm clouds in the Canadian real estate market. Foremost is the unrealistically low interest rates. When i was a young man and interest rates moved up 2 points it was unpleasant but not disastrous. A two point increase these days would have major effects on the markets in my view. Would it be cataclysmic; probably not but certainly very painful. A quick escalation (by quick I mean over two years) to historic averages of 6% might well produce a cataclysmic impact on Canadian real estate markets. I also whole agree that our market is much more vulnerable than the US ever was simply because the vast majority of Americans have 30 year fixed terms on their mortgages. (By the way, I have yet to have anyone explain why Canada does not have thirty year fixed terms when our neighbours to the south do; if anyone actual knows I would like an explanation). Would Victoria be impacted by an interest rate crisis; of coarse it would. the real question is how vulnerable are we compared to other Canadian cities? Do i have a simple answer to that; absolutely not.

I will turn briefly, I hope, to a couple of recent posts. They are the ones that are screaming that not everyone in Victoria is rich. Of coarse not everyone in Victoria is rich. That would be a ridiculous statement. But, I dont know why you are arguing about it since absolutely no has even suggested that everyone in Victoria is rich. I am offended by this type of comment because setting up a fake straw man in order to knock him down is the lowest form of argument. it is both deceptive and dishonest.

The original issue is how does one account for the dramatic increase in house prices over the last three years. I would hope that at least everyone agrees that there has been a dramatic rise in prices especially for SFH. The second related question is whether this rise is likely to continue. Understanding some of the factors that have lead this rise in prices is important but there very well might be new influences that will counteract future prices (less foreign money, higher interest rates,

etc). My point is it is not a simplistic dynamic at work here.

One of the big difficulties is that we dont have accurate or even necessarily meaningful statistics in many cases. What the statistics actually mean and what they are counting in the first place is very important. We have some raw numbers given for the number of people moving to Victorian from elsewhere every year. Those numbers indicate only a very slight increase in numbers. But it is important to know what this statistics is measuring (and I actually dont have any idea as to the details at this point). Does this statistic include students that move to Victoria; if so the increase numbers of people moving to Victoria might largely be accounted for by the expansion of the university and colleges. I am not saying that it is but rather that i dont know.

In terms of the real estate market, we actually have no idea how many retiree’s are moving to Victoria. Twenty years ago most retirees were 65 and over. I think it is safe to say that is no longer the case. There are a number of unanswered questions about retirees moving to Victoria that directly bear on the real estate market. Foremost in my mind, is how much money do these people have and has that increased significantly over the past few years. Secondly, has there been a significant increase in retirees under 65. (That is important because if they are buying a house at age 50 or 55 that house might not be on the market for another thirty years; it relates to volume of future inventory).

It is here that a blog such as this can be useful, since there are not detailed statistics. it allows input in what one sees and knows of one own neighbourhoods.

Speaking of the value of this blog, one of the best posts (at least for me) was a younger person that stated that I am likely not in touch with the younger generation. They commented that there were a fair number of young families with children moving into Oak Bay. I found this information extremely useful as well as the very true reminder of how limiting my own experiences might be. The next day i went to Oak bay and paid particular attention to whether there were a number of younger families about. My initial impression was that the blogger that corrected me was making a very valid point. I also asked the librarian whether she had noticed any increase in young er families in the last few years and she said that she definitely did and the circulation numbers for children books seemed to back that up as well. How significant that is for the real estate market remains to be seen. My point is that I learnt something from this blog of real value(principally that I need to observe better )

I have similiar problems with the medium family income number. Do they include full time students in these statistics. Do they also include retired couples? The implications for the real estate market is dramatically different depending on what those numbers actually reflect. My suspicion is that incomes in Victoria are very stratified. (I dont have statistical evidence for this). The public sector pays a lot more than the tourist industry here in Victoria. A 35 year old policeman married to a 30 year old high school teacher have more than double the medium income for the city. (This does not make them rich but it does allow them to buy a house in the core).

Chris, I again would like to support your comment that the polarization on this blog is rather unfortunate. But perhaps a greater degree of civility might really be in order.

When house prices are rising, people thinking of a discretionary move, either up or down, will surely be inclined to buy first (before prices rise further) and sell later (when prices may have risen further), which means inventory will tend to fall, causing prices to trend further upward. But when a top is evident, the rational approach to moving up or down market would be to sell first (before prices fall further) and buy later (when prices may have fallen further), which means inventory will tend to rise, causing prices to trend further downward.

Is this an important factor in housing price dynamics and, if so, will the announced FED rate raising trend, set off a comparable trend in Canada and if it does, does that mean we are we now at the tippy top for RE in Canada.

http://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/

5 year is up 60 basis points with the anticipation of the coming inflation and growth in Canada. ??? no idea if this is true this time or false like the previous jumps in 5 year over the past 3 years. I have no idea. In the end people need to smart about debt and make sure they can handle 1 to 2% increases.

gwac, the 5 year rate here tracks the US FYI. I believe the US long term rate jumped half a point in the last week.

You need to get over the fact totoro that people are entitled to their opinions when they see changes in the market that weren’t there a month or two ago. You can spin it all you want but it is what it is. The market is hot due to a low inventory which is a temporary condition which is showing cracks which I am pointing out.

Since you’re the “expert” on here maybe you could disclose your credentials ? I’m just a regular joe who sees what is happening and makes note of it to the other house hunters on here.

Like Barrister your thin skin becomes more evident while you have no problem dishing it out that you always know more. There is a name for it. Is retirement that boring ? Seems like it.

This blog measures the market using stats. If you look at the upper right-hand corner the market is currently “hot”.

This does not mean that the market will always be hot. Indeed, it used to be “ludicrously hot” so there is a change. This change does not mean prices are declining, but it may mean that they are no longer rising like a meteor.

I have no plans to sell Hawk. I would prefer the market to drop myself as we would buy a nicer house.

The personal attacks on anyone who has facts to present that don’t align with your imminent doom theories that have gone on for years now and accusing anyone who points out information that contradicts your wishes or interpretation of stats is not very credible.

If you want to take part in predictions then there is an annual post for this, which I don’t think anyone has ever gotten right.

Yes, you’ve figured it out JJ. The appreciation gamble is not something for the faint of heart. Lots of risk in doing this in a market that has already risen at above inflation rates. Less risk if it is your primary residence and you will have the exemption, you would pay rent anyway, maybe you have rental income if you need it, and your income will likely rise.

Hawk

We do not live in the US. Our economy is way behind that of the US.

We will have to see what happens to Canadian bond rates. Short term rate increase in Canada is 12 months away at least.

All that said it is time for Canadians to clean up their balance sheet and pay down debt.

Rate hike of quarter point, 3 more to come next year. Batten down the hatches, credit noose will be tightening.

“Our debt is a pyramid scheme held up by low interest rates”

Not by the looks of the news gwac but it is a pyramid scheme about to unravel. Many people will get crushed with a one point rise on their rate and likewise on a 5.6% stress test to qualify.

Hawk

Our debt is a pyramid scheme held up by low interest rates and good employment. The problem is no one ever knows when the pyramid will fall. Could last a month or years and years. So far years. It is vey concerning to say the least.

“You really need to do more analysis on these “slashes” if you want to understand what is rather than what you wish to be. ”

It is what it is totoro, they were priced to sell otherwise any agent worth his salt wouldn’t waste his time and it looks like a lot of agents have been with the amount of price slashes the last month.

Funny how the multiple property owners try to diss the facts and can’t take it that they are losing paper profits so they make up excuses. The market was hot, now it’s not. That’s what you need to understand, totoro. Deals are collapsing and major price slashes have been happening.

Can’t be that debt thing can it ?

Canada’s Gravity-Defying Household Debt Swells to C$2 Trillion

https://www.bloomberg.com/news/articles/2016-12-14/canada-household-debt-ratio-hits-record-with-c-2-trillion-tab

If I understand you Marko. I would agree that too much attention on this blog is wasted on Oak Bay. Oak Bay is not symbolic of the market place. It is an anomaly.

Adanac was, and maybe is, priced too high Hawk. Look at recent sales in the area. It is assessed at 370k and is a 1 bed 1 bath.

Service has a direct sales comparison available. Same type of house sold in June 2016 for $691,000 at 3240 Service, but the garage had been converted for a suite with separate entrance and fully finished basement.

In addition, the sale on Service collapsed. This can mean the financing did not come through, or it could mean that there is a deficiency with the property like perimeter drains or foundation.

You really need to do more analysis on these “slashes” if you want to understand what is rather than what you wish to be. Looking at recent comparable sales is probably the best way, including the relative condition of the properties you are comparing.

I’d say that Service is a better gauge of what that sub-area is at. It will be interesting to see what this property sells for.

http://www.century21.ca/Property/BC/V8X4H7/Victoria/4461_Cottontree_Lane_11417562878

706k assessment. more than double. I am interested to see how this goes.

I ccould pay it off tomorrow by selling my investment portfolio, but I’d be stupid to do so

Often the thought of simplifying my life and selling my investment properties, paying off my personal house and jetting off to my native Dalmatia to do nothing but sit on the pier drinking beer watching yachts pull in and out has crossed my mind, but yea it would be stupid. Maybe if interest rates go up and the market doesn’t completely tank I would consider doing such. Right now, when my mortgages are hovering around 2% and rents are escalading doesn’t make sense.

Demand – Everyone wants to move to Victoria and we don’t have enough homes to accommodate

There will be more than enough homes to accommodate, just not in Oak Bay. Westhills has hit its stride and when Royal Bay is in full swing there will be all the inventory you want. I had a young couple that purchased a brand new three level home on an 8,000 sq/ft lot in Royal Bay for $599,900 (GST included, no PTT) a couple of month ago, basement is unfinished for that price, but nice detached garage and large lot (they have a few bigger ones available).

You move the same house over to Oak Bay (add $100,000 in finishing upgrades) and it’s over $1.5 million+ on a 8,000 sq/ft lot.

Problem with this blog is we aren’t discussing floorplans at Westhills and Royal Bay. We are discussing Oak Bay where apparently, everyone and their mom wants to be. Unfortunately, the orthopedic surgeon and her nurse husband trump the family with two upper middle class jobs making 75k/each. The $150k/year income family is being squeezed out of Oak Bay, not the housing market. I do think prices in the Westhore will moderate once supply catches up. My feeling is developers were caught off guard by the last 12 months and only building at a pace we saw for the last 5 years. They will adjust and market will slow down a bit and then there will be a bit of oversupply while they slow down.

Hawk there was an offer that collapsed. Wonder what the price was since the

BC assessment is 491k in 2015 and 464k in 2014. Interesting to see what it does go for.

According to JJ`s post 650k or 32% above assessment is the median.

Let’s take a look at the stats for the first week in December for houses in the core.

34 house sales ranging from a low of $420,000 for a small home on a 5,550 square foot lot along Shelbourne near McRae to a high of $2.28 million (original ask was 2.6 million) for a McMansion in Ten Mile Point on a two-third’s of acre of waterfront.

One year ago there were 26 house sales in the first week. Ranging from a low of $420,000 for a starter home on 5,000 square foot lot near Tolmie and Alder street in Mayfair to a high of $2.4 million for a 4,000 square foot home on a half acre of waterfront near Portage Park in View Royal.

New listings for the first week this year stood at 36. A year ago it was 24.

New listing were being added at the rate of 34:36 or 1:1 compared to a year ago at 24:26 or 1:1

Median Sales to Assessment Ratio in the first week was 132% up from 124% the year before.

A very small sample size of just the first week of December and therefore subject to large swings.

As for listings, for those that want to get into the Oak Bay market there is an updated starter home on a 5,500 square foot lot in Oak Bay just a block from the Golf Course and the Ocean that has been listed now for 21 days at $749,000.

Another choice is a small home on a 5,000 square foot lot along Westall near Gosworth and the Hillside shopping Mall now listed for 22 days at $575,000.

For those that want to trim the budget a little bit more there is a renovated starter home on a 5,000 square foot lot near Cadillac and Seaton that has been listed now for 28 days now at $499,888.

As rental properties by themselves it really doesn’t make sense to purchase any of these properties because of the size of the down payment that is necessary to give you a neutral income stream. If you have saved enough for a large down payment there are better places to invest a couple hundred grand and earn income.

However, if you are just using equity in your house and gambling on appreciation then you may find these properties worth taking a look at when you BC Assessment arrives this January and find that you’re richer than you think. Dust that HELOC off and get rich!

3224 Service Street slashed $20.9K to $698K and it’s just a mere handful of houses away from St Mike’s and easy walk to Camosun,Landsdowne school, the mall etc. I thought these hoods were all going over ask. Guess the tide is changing.

The collapse of 249 King George Terrace is an interesting one. Was it part of the Nov stats? If so it would count as a collapse in Dec and drop the average. Could be a huge swing in averages from Nov to Dec.

I too wonder how they will account for it…..as I said at the start of the month December will be the biggest average drop in the history of the VREB.

I was also thinking that 4 years of month over month of previous year increases would come to an end in December but it is going to be real close……I don’t think we will see a streak like this again in our lifetime, it is unprecedented statistically speaking.

“The collapse of 249 King George Terrace is an interesting one. Was it part of the Nov stats?”

Was wondering that too LeoS.

Looks like Bob the builder wants the hell out of the 1753 Adanac shack ASAP. Just slashed it $50K. to $599K. Lot prices taking a hit in the core.

Maybe – or just use index funds and learn to invest yourself through TD e-series or Questrade or just invest through Tangerine. I don’t know enough about stock picking to feel comfortable doing that myself and the stats show the vast majority of people don’t either.

@ Totoro

“The risk you run is that rates rise and the stock market drops and you can’t sell to cover the amount borrowed.”

That’s why you need the large stock portfolio 🙂

The collapse of 249 King George Terrace is an interesting one. Was it part of the Nov stats? If so it would count as a collapse in Dec and drop the average. Could be a huge swing in averages from Nov to Dec.

Yes, the interest on a HELOC on funds used to invest is tax deductible. There is no minimum stock portfolio required.

The risk you run is that rates rise and the stock market drops and you can’t sell to cover the amount borrowed.

We have quite a large HELOC on our primary residence. You can make the interest payments tax deductible if you have a large enough stock portfolio. So not only is the interest rate very low, but you also get to deduct the payments from your taxable income. As JD said, it makes perfect sense in this environment.

Yes it does. We have an unused HELOC. I admit it would be better to use it to invest than have it sit.

I also agree there is an issue with HELOCs being used for consumer items, but consolidating consumer debt through a HELOC makes good sense.

If interest rates rise those borrowing to the maximum of affordability on a mortgage will be impacted. Those borrowing through a HELOC may have an affordability issue, but the equity will create an asset buffer that may result in a lower net worth but not catastrophe.

In the low interest rate environment the HELOC makes sense even if you have money. I have one, and it’s sizeable, but it’s very serviceable given the low interest rate. I’ve seen a significant increase in my house’s value and can take advantage of it – and why wouldn’t I? I ccould pay it off tomorrow by selling my investment portfolio, but I’d be stupid to do so given that I can make more in equities than I can save by paying the HELOC off. It’s just sound financial logic to leverage yourself when it makes sense. There are many stocks that pay more in dividends alone than I pay in interest.

I suspect many people are in that position.

You can only borrow up to 65% of the home’s value so those without substantial equity won’t have access to a HELOC at all. For a house in Victoria this means you will need to have almost 300k equity in your 850k home before being able to borrow anything.

I’d agree that there are a lot that will qualify for a HELOC. There are also stats that show that older Canadians are accessing a HELOC in increasing numbers and this amount makes up 22% of the debt carried by those over 65 in Canada. The median amount is about 18k.

12% of households in Canada held 40% of total debt in 2014 and the proportion of highly leveraged Canadians remains concentrated in a small cohort. My guess is that this would be newer buyers in high cost areas and those who have refinanced for business reasons or poor financial management or other reasons such as illness or divorce.

Newer buyers here will have greater debt here on average than those in lower cost markets, but not sure how it compares to the average. Buyers who have owned for 10 years or more will likely have less than $217,000 even in Victoria simply because prices were significantly lower 10 years ago.

What about the huge increase in HELOCs in Canada? When Victoria prices jumped earlier in 2016 I spoke with more than a few parents at my child’s school about renovations that could now be done with the new equity. I doubt all the renos in Victoria are being done with income/cash and a lot are probably done with debt. I have no figures to confirm but it would be an interesting number to see.

Hard to tell really as the BC figure also includes all of Vancouver.

Newer buyers here will have greater debt here on average than those in lower cost markets, but not sure how it compares to the average. Buyers who have owned for 10 years or more will likely have less than $217,000 even in Victoria simply because prices were significantly lower 10 years ago.

Hows the syndicated mortgage bizz doing these days ? Since they finance a lot of these big condo projects it’s important to see what’s cooking. More law suits by the looks of it.

Fourth syndicated mortgage claim filed

http://www.mortgagebrokernews.ca/news/fourth-syndicated-mortgage-claim-filed-218228.aspx

totoro – thanks for the reasoned response, (though I already do understand how medium income is derived…). The medium income in Victoria comes in at number 8 in the country despite our high real estate prices (yes Vancouver and Toronto are low too but they have much bigger populations).

The mortgage figures are very interesting and sound like they could support the resiliency of our market, though I would like to have more specific details – the 70% home ownership rate is for Canada as a whole I believe. And “40% of BC homeowners without a mortgage” and “BC residents have an average of $217,000 in mortgage debt” includes a lot of areas outside of Victoria! I imagine people in low value areas would likely have higher rates of mortgage free properties. Not sure if you can just apply the BC figure to Victoria and get a reliable outcome when our prices are so much higher in relation to incomes.

Appreciate the comment David. I try to base my posts on facts or indicators of changing markets that many bulls like to call “weak links” when it’s the new reality.

As far as the inventory goes, anyone with a brain knows it will change at some point and the longer it goes, the larger the increase as the fence sitter hoarders/flippers, and those hoping for more easy money start to see it slip through their fingers in $10K to $100K increments like we are seeing in Vancouver.

Trying to say inventory increase won’t happen here because everyone is so rich and doesn’t need the cash is just asinine and very narrow minded to how markets function. It’s a boom at it’s peak, with Peak Cranes never seen before in this city. It’s always the tell tale sign.

Canada’s cooling housing market will soon start dragging the economy down, watchdog warns

http://business.financialpost.com/news/economy/canadas-cooling-housing-market-will-soon-drag-the-economy-down-watchdog-warns

The median family income is about 80k in Victoria. This is not all due to “rich company owners and retirees” whose buying power is not reflected in their income: it is a median that reflects the median salaries of employed folks. It correlates well with wages here earned from an employer.

Median income is the amount that divides the income distribution into two equal groups, half having income above that amount, and half having income below that amount.

As for mortgage debt, BC residents have an average of $217,000 in mortgage debt. About 40% of BC residents own a home without a mortgage so the average will be skewed a bit lower by that. Oak Bay’s rate of mortgage-free owners might be slightly higher if the age of homeowners is slightly higher – I don’t know but my guess is the difference would be small.

Will older people downsize? Seems unlikely for the majority. 80% of boomers want to stay in the homes they currently occupy according to a survey of homeowners carried out this October by Manulife.

If the home ownership rate is 70% and 40% have no mortgage that sure creates a lot of equity in BC.

I see the polarization of views is alive and well on this blog! Not sure when it started happening but I see the same thing in Canadian politics – anything and everything proposed by one party is shot down and discredited by the other. Doesn’t matter which side you’re on, the strategy and myopic views are the same. It’s a shame more people seem less and less inclined to step back from their point of view to utilize some rational and critical thinking.

As I’ve tried to point out there are so many negative influences building in the real estate market which are hard to dispute though it seems the weakest of arguments are put forth:

Low average/medium incomes – all due to rich company owners who only draw small salaries and rich retires with small incomes but huge assets. Average incomes have been flat for 10+ years, debt levels have exploded to record levels and we’ve had year after year of weak employment with most new jobs being part time or related to real estate. Despite the numbers apparently in Victoria everyone’s rich and has lots of available assets so all is good.

Demand – Everyone wants to move to Victoria and we don’t have enough homes to accommodate, even though migration levels are just above norms, housing starts are near 10 year highs, and of course it has absolutely nothing to do with year after year of quick easy tax free profits that have been way beyond the majority of income levels. Did the honor system arrangement with the principal residence exemption have anything to do with speculation/demand?

I admit I’ve had a negative view of Canadian real estate for a while and have been wrong but the mounting evidence of negative factors is hard to argue against. From my perspective the only driving factor is income/assets produced outside of Canada and being funnelled into residential real estate. As mentioned this makes Canadian home owners “rich” and stokes the economy but I question how long we can keep it up against growing backlash. Trudeau is targeting immigration levels of 400k and the Quebec Immigrant Investor Program is still in place so maybe it will continue. If this is the case I would suggest Canadians get on board and buy real estate and/or start earning income from global sources which are much more lucrative than Canadian incomes. Seems like a short sighted, unequal and unsustainable way to build a country’s prosperity though…

ASH:

To add one more thing, I agree that higher prices motivate a lot of people to put their houses on the market. But I wonder if the last three years of major price increases has already pulled out a large percentage of people of might be motivated to more. The example that comes to mind is one of the neighbours who sold all five of their rental houses recently. I regularly do garage sales on weekends, if nothing else it gets an old man out of the house and reminds me which day is Saturday). It struck me that there seemed to be a lot tenants holding garage sales because the house had been sold. Once again totally unscientific and perhaps completely wrong.

My point is that the market may have already sucked out a disproportionate number of people that might have been motivated to move by price increases. Further price increases might have a much smaller effect on increased inventory. Of coarse there are the usual death, divorce and nursing home

allotment of new inventory. I cannot speak for Victoria but I know that in Toronto there were whole neighbourhoods that were extremely stable with houses rarely coming on the market. In many cases houses were passed from one generation to the next without ever coming on the market. I have no idea if this happens a lot in Victoria; perhaps someone else does.

Bman: You seem good at digging up statistics. Have the number of new listings for the past five years remained stable or was there a large increase during this hot market?

Ash:

Thank you for having the courtesy of actually reflecting on what I wrote. But let me say that i might be wrong since there is no real statistical basis to actual pin point the situation. Obviously it is far from all buyers in this market but many buyers are paying all cash with a more long term view of settling in.

For many of these buyers increased house prices are not a big incentive to sell since they really dont want to move again and dont have any real need for extra cash.

What might provide some insight is if anyone has the statistics for what percentage of buyers are purchasing without a mortgage. A breakdown by area would also give a clearer picture.

You made an interesting point that I have not even thought of; that younger recent buyers in areas like Fernwood are carrying such a large mortgage that their ability to move up will not occur for many years. it is a excellant and very insightful thought.

At first glance I thought Rabidoux’s violin pic might have been in reference to the Globe story citing the Vancouver RE industry’s private complaints to gov’t about the foreign buyers tax.

Barrister, you might be on to something re: that lots of recent purchases could be for the long term. When I first read your post I thought “BS”. But with core detached prices being so high now, the first time ‘starter home’ buyers may be being filtered out. And those first timers that are buying are coming in with a ton of debt, so likely not positioned to flip the place in two years and move up to something bigger/ better. Even on a Fernwood/Oaklands starter at ~700k, will as many be looking to ‘move up’ in a few years?

The flip side of course is when owners start to see what they can get they may be tempted to list. Lots of variables to consider.

David:

Arrogant and selfish; interesting viewpoint. Name calling is often a substitute for rational argument.

I have no idea what your comment about the numbers “telling a different story” actuals means of even what you are referencing. Maybe you can clarify your point. I assume that the last point is some sort of generalization and not specific to me.

You are welcome to find whatever value in Hawks posts that you want. Accord me the same right to ignore them. I am always open to listening to reasoned opinions, and value them whether they concur with mine or not, but comments like yours sadden me to no end. It seems to be increasing what increasing substitutes for intelligent discourse these days.

Haha

http://i.imgur.com/S6VkOkE.jpg

Thanks for the Over 65 incoming, Bman. I think I’m going to call you Statsman 🙂

Agreed, it may take another Toronto ’89 meltdown to surpass the ON to BC ~25,000 number from the 90s.

Barrister,

Who are you to say Hawk’s posts have no value! Yes they do, actually, the fact that it bothers a lot of people in this blog means a lot. You all want to pretend like you have tons of money, nothing to worry about etc. when the numbers say a different story. You are so arrogant and selfish that I assure you that you bring nothing interesting in this blog, I am your neighbor by the way.

Barrister,

Not sure why you’re offended, sorry if I did. You stated you believe the inventory numbers won’t rise anytime soon because you talked to a number of those families in the hood and your perception is most people in the core have houses paid off in cash. I think that’s just a crap shoot guess as you have no hard numbers to back it up. From my buddy talking to a credit counselor it’s evident that it’s the opposite. That’s just his opinion but he’s in the debt business. Sorry again, but I thought lawyers had thicker skin.

On a side note I just learned of another young couple with a couple of kids divorcing and having to sell the house they’ve been in for just over a year. The pressures of life with the big mortgage etc got to be too much.

Hawk:

I never ask people how much money they have nor do I stop people on the street. But you know this already. Sadly, this just underlines your ability to totally fabricate things. Your credibility has just reached a new low for me. Your posts have no value and your thoughts even less.

I had to google Holt Renfrew….lol, never been to one. Who has time to go to stores? Just ordered my glasses on clearlycontacts and my awesome pair of shoes arrived from Aldo.

@Hawk

Agreed. The numbers are way down from where they were in the 70s and 90s. The one area where Mike might be onto something is the number of over 65 migrants. Perhaps not too surprising given the aging population, but the last 3 years shows a significant spike in the number of inter-provincial migrants in this category moving to BC. Hardly a wave, but something to think about:

2015/2016 Over 65 5524

2014/2015 Over 65 5375

2013/2014 Over 65 4659

2012/2013 Over 65 3519

2011/2012 Over 65 3545

2010/2011 Over 65 3267

2009/2010 Over 65 3407

2008/2009 Over 65 3123

2007/2008 Over 65 3434

2006/2007 Over 65 3549

“1992 25762 5094”

Interesting numbers Bman. Looks a long ways off 1992 peak when the housing boom was peaking then too but similar trend. History soon repeats itself.

Barrister, so you stop families on the street everyday and ask them where their from and how much money they have ? Judging people’s financial situation is the biggest false assumption you could make. As a lawyer you should know better than judge folks by the looks of their appearance.

Michael,

Gonna need a pretty big boost from these two guys for that to come true. Here are the number of people who migrated from Quebec and Ontario to BC since ’72.

Year Ontario Quebec

2015 19133 3687

2014 18005 3710

2013 14311 2964

2012 14294 2785

2011 14316 2601

2010 14721 2727

2009 14678 2562

2008 16154 3111

2007 16131 3101

2006 18579 3866

2005 17234 3076

2004 15977 2769

2003 15058 2267

2002 15354 2561

2001 13944 2638

2000 14131 2726

1999 13790 2925

1998 15830 3357

1997 18289 4672

1996 22121 5353

1995 22663 4988

1994 24424 5388

1993 25630 5253

1992 25762 5094

1991 22807 4666

1990 24679 4064

1989 22308 3801

1988 18830 3064

1987 14264 2453

1986 11385 2017

1985 9949 2053

1984 9502 2143

1983 10702 2858

1982 12581 3483

1981 19703 3945

1980 23347 4734

1979 21641 5240

1978 19620 5823

1977 19396 6026

1976 18250 5009

1975 18201 4077

1974 24169 5484