Double Whammy

One of the common pieces of advice you hear about buying a home is to “buy the biggest house you can afford” (yes it’s usually real estate agents that will tell you this). Now this may be good advice insofar it will lead you into a house that you can stay in for a longer period of time but other than the obvious downsides of having to pay off a larger mortgage, a bigger or more expensive house compounds expenses on top of the price itself.

Taxes are clearly proportional to the house price, and while they are higher or lower depending on what municipality you live in, they definitely go up with increasing home value. And with local mega-projects like the sewage treatment plant on the horizon, you know the rates are only going in one direction.

A bigger house also means more maintenance expenses. More bathrooms to get outdated, more square feet of floor to replace, more systems to maintain, more roof to leak, more windows to blow seals, and more granite to stain. Again, all elementary stuff that I imagine most buyers do at least give some cursory consideration.

But what about those more insidious costs? You stretched your budget and bought on a nicer street. Here the lawns are nicely kept, and the Toyotas are Lexuses (Lexii?). You might not notice until you move in, but is that old Civic going to cut it here? Nah better trade it in for a newer model. As some commenters here would say, in the nicer areas the people take care of their lawns and don’t let them die. And who’s got time to landscape when you’re working two jobs to pay for the house? Luckily your friendly neighbour has offered to send his lawn service over every second week for a quick run around for only a couple hundred a month.

Surely only peasants live without ice makers so you’ll have to replace that.

When you were looking to buy, that stainless fridge and inductive cooktop sure seemed fancy in those digitally enhanced listing photos. Maybe you wouldn’t normally splash out on that kind of thing but hey if it’s part of the house anyway you won’t say no. Thing is that when those things break down, are you really going to go back to some simple white goods that you would have normally bought? Not a chance.

I’ve seen a similar effect happen during renovations. People start out with a house that more or less is finished to the same quality, and then they decide to redo the bathroom. And if you’re going to rip the thing out why not go up a couple steps in quality? So you put in tiles instead of that prefab shower pan. A jetted tub instead of the basic one, and a fancy vanity. Looks great!

But wait, now you notice that the rest of the house looks a little shabby in comparison. What used to be just fine seems unreasonably dated, and you start spending all your free time on Houzz thinking about open concepts and bay windows. And so starts the cascade of renovations until your $20,000 bathroom turns into $150,000 for the rest of the house.

So before you stretch to get that quartz countertop or into that posh neighbourhood, consider what level of consumption you’re buying yourself into and what it will cost you to maintain it. Once you’re hedonically adapted to the fancy, it’s difficult to go back.

Amusing read Leo S. ! Very true, like the “Lexii”!

Hmm, guess that one week of sales where we were lagging last year was just a fluke. Back to outperform. https://househuntvictoria.ca/2016/12/12/dec-12-market-update/

Yes, just like I overstated your overstatement. Appreciate the admission.

South – do these reporters ever look up numbers or do they simply receive their info from realtors?

25,760 starts in 2016 up from 18,806 with absorptions down from 13,873 to 13,302 – sorry to contradict a good story with facts…

https://www.bloomberg.com/news/articles/2016-12-13/home-prices-jump-a-quick-40-in-vancouver-but-no-one-is-building

Canadian cities are becoming boutique gated communities with almost impossible building codes and burocratic red tape.

With no end in sight to the nimbys and commities and triple ended runarounds, if you own a house here, until the supply issue is fixed, your house will go up.

Lol…kind of like you over-stated “over 5”.

I was merely suggesting that you over-stated the amount that mortgage rates have fallen between 2010 and 2014. Do you have any evidence of people locking in “near 5%” that is not in the form of anecdotes?

Bman, I said “near 5%”, not “over 5”. I was merely pointing out that rates have fallen alot since 2010 as the 5-year chart below shows. It would be strange if the bears didn’t try to argue 🙂

Going to some Vancouver agents unloading some BMW and Mercedes soon. Maybe a house or 2. Hope they prepared for the slower times.

Michael,

The discounted 5 year rate in 2010 was somewhere between a high of about 4.3 and a low of 3.4:

https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

I doubt there were lots of people locking in over 5.

“No surprise, the gov’t is already OTL on their population projections.”

So you’re now in charge of BC’s real population growth numbers because you make them up out of thin air, but never hesitate to post the other government info that fits the pumper narrative. You’re getting real sad Mike.

Richmond is still taking a shit kicking.

Mortimer @mortimer_1 36 minutes ago

Bought Apr 2016 $1.380MM. Now trying to entice bidding war? Asking $999K #vanre dude, that ship has sailed

https://twitter.com/mortimer_1/status/808436396792782848

2010 had lots of people locking in near 5%. I haven’t come across anyone in the past couple years who locked in for higher than 2 something.

http://advisoranalyst.com/glablog/wp-content/uploads/2015/11/goc-5-year.png

No surprise, the gov’t is already OTL on their population projections. Investors are always better at projecting than govt.

Interesting youtube video on the market in Vancouver and now prices are moving lower in parts of the Fraser Valley. Vancouver and the Fraser Valley may be starting to de-leverage. Falling equity in their homes means buyers have less down payment on the next home and that makes prices fall further and then the market goes into a downward spiral. The more homes you own the more equity you’re losing and the less likely a banker is going to approve another mortgage for you.

Given the choice between Oak Bay and South Delta, South Surrey or White Rock it’s a slam dunk for buyers to choose the Fraser Valley. Housing is built better over there, location is far superior, better employment opportunities, weather is great and they’re on the mainland.

If the trend for lower prices continues in the Fraser Valley, it may have an effect on Victoria in the months to come. It would be ironic if people in Victoria sold their homes to retire to the Fraser Valley?

“Hawk, you are really selective with your picks here”

Funny how the bulls are so sensitive to price slashes. I’m not selective at all, just calling it as I find them since no one else here ever posts prices slashes, only the over asks which Jack has shown are on the decline. Then we get the “gentrification” pumps which seem to be fizzling as well.

Seeing many price slashes right before Xmas says to me there’s some that want out bad and aren’t here to try and time the spring pump, which most likely be a dump with interest rates heading up and more competition.

“More proof Mike has a hard time with the truth.”

that’s a nice way to out it…:-)

“773k assessment. That area is sure not seeing much increase.”

Assessments are meaningless, as per Marko. It’s what’s in your wallet.

Reasonfirst,

More proof Mike has a hard time with the truth.

https://www.realtor.ca/Residential/Single-Family/17593671/3158-Wessex-Close-Victoria-British-Columbia-V8P5N2

This house sold for 660 1.5 years ago. 1.2MM! My wife and I wanted to see this one but it was sold before we could get to it.

Totoro

I also cringed at that 5300 tax bill. They should have fought that assessment years ago based on your comments.

“-the 1960-born boomer bulge were in their mid-20s, just as their kids are now”

“One dramatic difference is the boomer bulge that is now retiring here. There wasn’t nearly as many people retiring here in the late 80s (born ~1920).”

Population growth in Victoria in late 80s and early 90s was about 2%/year. Projected growth for next 10 years about 1%/year.

http://www.bcstats.gov.bc.ca/StatisticsBySubject/Demography/PopulationProjections.aspx

I’m not sure how repatriated cash of US mega corps would affect us but that’s the point. I predict if Trump gives the tax holiday then the Apples, Microsofts, and Amazons will bring billions back and will be looking to spend it. Special dividends and infrastructure will trickle money into people’s hands pretty quick. In general though it’s an injection of billions in cash to our economic brother’s system. A percentage will trickle here. This cash injection would be accomplished without manipulation from the Feds. Wage increases down south will apply pressure here. We are already experiencing huge inflation here. Forget the CPI. Try building a house. Then you will feel the pain of inflation. Builders are certainly experiencing huge wage growth right now. General wages will have to follow. The setup for a crash is specific to inflation and rates rising rapidly with wages doing nothing and consumer confidence tanking.

Seems like the BC Assessment valuation is really high here relative to similar properties around the golf course like the ones on the other side on Diana Road that are assessed at 200k less for a more updated houses with the same amount of floor space and land – or the houses one street down on Doncaster for that matter that are assessed at 540k and selling for 750k. I’d say this is a good example of why BC Assessment doesn’t reflect market a lot of the time.

And, again, pricing a house over market at $895,000 in this area is not the same as a house priced under market in Oaklands or Fairfield going for 200k over.

Hawk, you are really selective with your picks here. I can point out numerous over ask sales in December ask well. Look at 443 Kipling St – 150k over ask and $477,500 over BC Assessment valuation. List means little and BC Assessment is, at best, an outdated ballpark when it can be off market by 60%. All a price drop means in this market, imo, is that list has caught up with the market and instead of being “ludicrously hot”, the market is simply “hot”.

Maybe we’ll see the Vancouver effect here soon but I don’t see it yet.

“mortgage rates fell nearly in half ’81-85 and ’10-14”

BOC Prime Jan. 2010 2.25%, posted 5 yr 5.39%

BOC Prime Jan. 2014 3.00%, posted 5 yr 5.24%

https://www.ratehub.ca/prime-mortgage-rate-history

https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

Just when I thought you were learning to research.

If you believe that there is an unlimited amount of out-of-town buyers with unlimited amounts of cash then you would also have to believe that prices in Victoria would be limitless.

Yet we are having seasonal slowing sale volumes at historical norms along with stabilized prices.

In Saanich East, Victoria and Oak Bay we have 133 houses listed for sale with 35 houses listed since the beginning of the month and 31 houses have sold so far this month. Considering the millions and millions of people in the world with trucks loads of cash, this doesn’t sound like the world is at our door step.

This sounds like a locally driven real estate market with buyers having normal financial constraints when buying a home as to the size of the down payment and mortgage payments. This spring we did have more than average number of buyers that chose to move up the property ladder as they had built up enough equity in their homes as well as an increase in the number of out-of-town purchasers. And that was evidenced in the stats. Now we are back to historical norms in both monthly sales and the proportion of out-of-town buyers for houses in the core.

“-Vic prices went up 170% from late ’84 to ’94, the highest % gains were AS mortgage rates climbed 4%!”

…and subsequently fell another 8% by ’94

Meanwhile in Vancouver, prices are dropping on many properties – expect Victoria to follow if Van goes down, just like it followed Van after the way up… https://www.youtube.com/watch?v=ViQM9CUiNsE

1483 Tolmie Place

773k assessment. That area is sure not seeing much increase.

Another price slash in the core. 1483 Tolmie Place, large lot, nice view of front nine valley of Cedar Hill Golf Course. In need of a bit of love but same as all the other places that sold for $200K over a few months ago. Was $895K, slashed $45K.

“Just buy the best house you can afford”

At what interest rate? That is the problem – there has never been lower interest rates and thus higher risk of borrowing “as much as you can afford”. “The best house you can afford at today’s interest rates” has never had a better chance of causing an unpredictable default down the road when those 5 years renew. There are no 25 year mortgages like in the US.

Since no one knows what they can actually afford in an unstable, non-market interest rate environment, solvency at the margins is directly linked to the whims of a volatile bond market and governments in Canada and the US. That is not something you should rely on.

My advice would be to carry 2/3% of the mortgage you feel comfortable paying forever. If rates triple from 2.5% to 6%, in the next 10 years (which I feel is a reasonable worst case scenario) at least you’ll have 10 years of the mortgage paid off and your payment will be roughly 25% more for the remaining 15 years but on an inflation adjusted basis more or less the same.

The problem? No one does this. That last 33% in mortgage payment is the difference between living in a place in langford for $500k or something reasonably nice in the core for $750.

Looking back over 2016, I would say the primary driver towards higher prices was falling days-on-market. As that seems to be how most prospective buyers defined how “hot” the market was. Fueled by marketing schemes to entice multiple bids and add to the panic felt by buyers of never being able to own a house ever. And you can see this in how the median DOM declined and prices increased. Then the DOM stabilized and started to increase and prices stabilized for houses in Saanich East, Victoria and Oak Bay.

Month Days to Sell, Median

Jan 15

Feb 9

Mar 7

Apr 8

May 9

Jun 9

Jul 9

Aug 8

Sep 11

Oct 10

Nov 14

Dec 15

Month Sale Price, Median

Jan $692,072

Feb $771,500

Mar $800,000

Apr $849,950

May $832,000

Jun $850,000

Jul $817,500

Aug $805,000

Sep $840,000

Oct $885,000

Nov $875,000

Dec $875,000

2016 was not the year to be a prospective buyer for a house in the core. Most paid more and got less. Others acted irrationally getting caught up in bidding wars and over paying enormously for housing.

The way I see it now, the one thing that could cause a crash, now and always (but maybe more now), is a global destabilizing event. Something like 9-11, a big earthquake, hot war over Taiwan, tsunami on the west coast – a major shock to people’s trust and confidence in the future (I won’t quite go as tinfoil-hat as to say ‘WWIII’). I will grant that in the era of Trump and ilk, the chance of this seems rather higher than it did 6 months ago.

Otherwise, I think this market has too much momentum. I think we’ve shown on this blog that

– a market of ‘mostly local’ buyers is anything but (ie, the data sucks; if you’re here for 6 months, you become a local buyer)

– the market is only weakly influenced by incomes, due to unclear factors (retirees, foreigners, cash purchases from investments, parents’ helping kids, mobile workforce, etc.)

– there is still loads of demand for good properties, as always; Canada and Victoria in particular looks great to Americans ($, Trump) right now, as it has in the past; yes, there is a bubble of boomers exiting the workplace over the next decade, some of whom have no kids or don’t care about being with them – they are much more likely to pick Victoria over many other places in Canada, and a small number of them could influence things significantly

– in the absence of a major shock, the change in demand here moves slowly; because of this, even if there is a significant recession, it will likely be 2019 or so before prices drop more than 5% from the annual median. Predicting the timing of this is a fool’s game if you are buying for yourself or your family, as shown in the history of this blog (for investors/speculators it may matter more)

– interest rates are going up; the question is how much and how fast. Anyone buying with a mortgage should surely be thinking that in 5 years or so (when they refinance) they will have to be able to afford at least a couple of % higher, say rates up to 4.5 or so. Anything higher than that would be sign of a much stronger global economy, which would have as much chance of helping Victoria prices as anything.

1700 active listing in December is not the lowest we’ve ever had. Active listings for all types and all areas has range from a low of 1,348 in 2006 to a high of 3,788 in 2012. The average for the last 10 years has been 2,773.

But I guess most of you don’t really care about houses on Salt Spring Island or condos in Sooke and would like to know more about your neighborhoods such as houses in Saanich East, Victoria and Oak Bay. Active listings in December ranged from a low of 158 in 2007 to a high of 468 in 2012. The 10 year average being 281. This December there are 218 active listings.

But active listing only tell part of the story. One has to look at months of inventory. And that can change very dramatically for houses in the core. The MOI was as low as 2.14 in 2007 and as high as 10.7 one year later in 2008. The 10 year average being 5.1 MOI. Last month we were at 2.33 and my guess is that by the end of the month there will be a smidge over 3 months of inventory. Which seems to be more than enough to keep median prices stable as prospective purchasers shift further afield to find affordable houses.

Just buy the best house you can afford, saves moving in the future, saves costly maintenance and nightmare living/work conditions (ala curiouscat living in a reno for months while working), also appreciates more, and so on and so on.

Get that nice stuff, life’s short, and most likely you will break even on those cosmetic updates if you are in the core in a good area.

Don’t buy on a busy street, wait and save to get a proper place, the cost of moving in the future is much more then that money saved.

Looks like this will be a record Dec from the sales I’m seeing on PCS.

I can’t believe only 1700 places for sale and remember, that stat includes commercial!

Give the largest company in the world a tax holiday to bring its cash back to the US. Instant billions into the system… AND rates can go up! So it’s still not a shoe in for collapse

Dasamo does this plan somehow include Canada? Did I miss something? Last I looked the US interest rates have influence on Canadian rates (or the dollar) but we’re in a much weaker economic environment (according to the Bank of Canada).

“A home in Happy Valley sold yesterday for $510,000 and it was purchased LAST YEAR for $395,000. That’s insane appreciation. Either developers can’t keep up (my guess) or construction costs have gone up, but if the developer was making $ at $395,000 can’t see construction costs having gone up to the point where they can’t make a profit at $510,000 sale price.”

3619 Vitality Road just took a price slash so I guess Peak Langford has been hit.

Dasmo, you actually have to be sucked in that Trump will actually get the tax cuts he says he would.

As well you have to hope he actually makes it to inauguration day, and then have to totally believe those companies will bring the money back with the all the so called “manufacturing assembly line jobs of the 80’s”. This is 2017, it’s a farce that is going to happen on any grand scale as those jobs are all gone high tech. The rust belt is dead forever unless they retrain themselves and move.

Most of the corporations don’t trust Trump and did everything to get him dumped, ie: the Koch Brothers. Thinking Apple is going to ditch China and move everything back to the US is ludicrous.

http://www.bcstats.gov.bc.ca/StatisticsBySubject/Demography/PopulationProjections.aspx

Hawk:

Most retirees will not move to Victoria but for many places like Toronto, Victoria looks cheap and affordable. But i agree that having actual numbers would be nice.

Thing is Hawk, the debt bomb is shared by world governments. So it’s in their best interests to use inflationy tools to reduce their burden. Trumps strategy is simple. Give the largest company in the world a tax holiday to bring its cash back to the US. Instant billions into the system… AND rates can go up! So it’s still not a shoe in for collapse. You are playing hard but the board is so big it’s easy to miss the bishop in the corner….

“Vic prices went up 170% from late ’84 to ’94, the highest % gains were AS mortgage rates climbed 4%!”

No one had HELOC’s back in the 80’s, as well as access to multiple credit cards with $30K limits on all of them. You couldn’t use a credit card to use as a down payment either. This is a whole new ball game as the post below stated. Any minor interest increase cuts people out of their borrowing power or in dire straits with their ability to pay.

The business cycle is over, it’s been on an 8 year run and the stock market is now doing it’s final melt up like the past booms.

Please show us the actual numbers of retirees moving here as well not some lame birth chart. It’s all pump talk, retirees don’t move here in droves to expensive cities when they are trying to conserve cash for retirement.

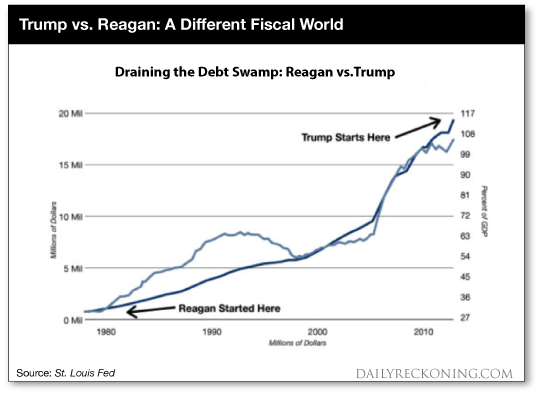

“Reagan cut taxes in ’86 & stock markets soared, Trump is about to”

Sure Mike. Might want to actually state what is the truth, you seem to always miss that important part of your pump to infinity fairy tale. Reagan didn’t have the debt bomb to deal with. Every ex-economist should know that.

“The Reagan recovery occurred on the back of a relatively clean national balance sheet. At the time of his inauguration the public debt stood at $980 billion or just 31% of GDP. By the end of the Reagan-Bush era it was nearly $4 trillion, representing an outbreak of peacetime public borrowing that had never before been witnessed in American history.”

“But as Herb Stein famously observed, every unsustainable trend sooner or later tends to stop. In that respect, the public debt will surely cross the $20 trillion mark before Donald Trump takes the oath (it’s already above $19.8 trillion). That means it will hit 105% of GDP, crystallizing the fact that we are in a totally different ball game in 2017 compared to 1981.”

“In this context, I must remind about the elephant in the room: The Fed is out of dry powder. During three decades of egregiously expanding its balance sheet and monetizing the public debt, its footings expanded from $200 billion in 1981 to $4.4 trillion today. That’s a 22X increase in the monetary fuel during a span in which the nominal GDP grew by only 5X.”

http://wallstreetexaminer.com/2016/11/draining-swamp-2-0-trump-versus-reagan-2/

Housing demand is a strange concept in some ways. people forget that to some degree demand is linked to cost. The demand for Uplands manson’s at a price point of 200k is rather huge.

I have a rather old fashioned view of my house in that I dont see it as an investment but rather as a consumable. It is sort of in the same category as my books.

A number of people have mentioned medium income figures. I am wondering how those are derived.

Medium income figures for somewhere like Oak Bay would be rather deceptive considering the portion of the population that is retired. Medium income for all the college students here in Victoria is also not meaningful.

What might be useful is medium income for the 30 to 50 bracket of couples. This would be the group that would be driving new house sales.

What might be more useful is medium income

Just a quick reminder of some similarities I pointed out almost 2 years ago:

-mortgage rates fell nearly in half ’81-85 and ’10-14

-oil crashed 70% in mid-80s & mid-10s, prairie folk headed west

-loonie crashed to 70 cents both periods

-similar RBC affordability index ’84 vs ’14 for Victoria

-the 1960-born boomer bulge were in their mid-20s, just as their kids are now

-Reagan cut taxes in ’86 & stock markets soared, Trump is about to

-Vic prices went up 170% from late ’84 to ’94, the highest % gains were AS mortgage rates climbed 4%!

One dramatic difference is the boomer bulge that is now retiring here. There wasn’t nearly as many people retiring here in the late 80s (born ~1920).

Birth numbers:

http://www.statcan.gc.ca/pub/84f0210x/2005001/ct004_en.gif

Mon Dec 12, 2016:

Dec Dec

2016 2015

Net Unconditional Sales: 222 465

New Listings: 218 451

Active Listings: 1,702 2,517

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Introvert thanks for the great example of “crafting the narrative” …. let’s take a look at what’s being said:

Casey Edge, executive director of the Victoria Residential Builders Association:

“We have passed our peak year in over a decade and we will be going to be seeing stronger starts than we’ve had in several decades,”

The numbers: Up 48 units or 1.75% from 2015

“Next year, he said, Victoria won’t hit the 3,000-mark, but it will likely see as many as 2,400 new homes started.”

So he’s estimating 387 less units or 14% less – I thought we were making up ground or was he just talking about the massive 1.5% increase?

“The strength of homebuilding and real estate in Victoria and the Lower Mainland in particular has pushed B.C.’s economy to a forecast 3.4 per cent growth this year according to the Conference Board of Canada”

Again an economy based on housing…

The board believes starts will decline by 13.3 per cent provincewide next year.

Edge doesn’t necessarily buy that. “Over the last several years, quite frankly, a lot of people have predicted downturns in the housing market and a lot of people have been wrong,” he said.

Why doesn’t Edge buy that? It’s the almost the exact same number he predicted!

Capital homebuilders busiest in a decade

http://www.timescolonist.com/business/capital-homebuilders-busiest-in-a-decade-1.4199336

Canadians “can’t see the forest for the trees”…

Affordability: Yes it’s “affordable” but only because unusually low interest rates (which appear to be headed higher). Price to income levels are at a historical extreme and Canadians can only get a maximum 10 year fixed rate (as far as I know). If you could lock in today’s rate for a 25 year term then prices could make a bit more sense.

Cost to build: As pointed out here often the cost to build has been hugely inflated due to long term excessive demand so I think the figures people are using to justify the prices are not representative of normal conditions, unless of course this is the new normal and demand will always outstrip supply.

Demand: As pointed out the cost of housing is apparently going up on a daily basis and far, far faster than the average income, with few other investments appreciating anywhere near as rapidly. With the ease of borrowing, huge leverage and year after year of seemingly unstoppable gains all baked into a physical structure, Canadians feel comfortable going “all in” and ignoring other investments. Demand causes higher prices attracting more demand – we’ve had almost optimal conditions to keep this cycle going but the support is slowly being eroded (higher interest rates, debt levels, foreign buyer tax, mortgage requirements, etc.).

Net worth: The argument being Canadians have a solid net worth and will withstand any downward pressure and this will support demand despite reduced prices. Canadians net worth has surged 40% in the past few years and it’s primarily based on housing. With this sudden increase is it really the assumption the majority will just sit back and watch it melt away if prices start to decline in a sustained and meaningful way? Is the net worth argument not exactly the same as right before the US housing crash?

Housing dependent economy: Thanks to our politicians (every one of them) we’ve ignored the real economy and put ever increasing faith in housing to support our economy. This is where foreign investment (direct or indirect) and debt is critical to the ongoing prosperity of Canadians. In my view it’s an idiotic way to try to build real long term prosperity. Trading houses at ever increasing prices depends on foreign investment and debt as incomes have long ago become irrelevant. The politicians are making every effort to keep this going (Crusty’s choice to only impose the FBT in Vancouver, immigrant investor programs, foreign student recruitment, immigration targets, etc.) while facing backlash from the populace.

I suppose all of this could continue but I’m getting increasingly sceptical…

Marko:

What part of town was the condo in? Interesting that the condo market seems to have really revived.

Does anyone actually have a real idea of the profit margin on the typical Westshore house?

Difficult to say in this market as the market has been going up during construction of the homes currently being sold so I would guess it is north of 30%. In a flat market probably 12 to 15%.

I can understand Uplands/Oak Bay going nuts due to restricted supply but Happy Valley is insane too.

A home in Happy Valley sold yesterday for $510,000 and it was purchased LAST YEAR for $395,000. That’s insane appreciation. Either developers can’t keep up (my guess) or construction costs have gone up, but if the developer was making $ at $395,000 can’t see construction costs having gone up to the point where they can’t make a profit at $510,000 sale price.

Wrote an offer on a condo this morning for a client and it ended up with 6 offers. Two years ago couldn’t give condos away in the same building.

To be in the world’s top 1% you need a net worth of $795,000.

Income-based the top 1% earns above $191,100 per year in Canada. Marko’s family may hit this. You might not given you are retired.

The asset base of the top 1% in Canada seems to be north of $3,000,000, which you likely hit – the primary residence counts.

The top 1% asset base would generally be considered rich within Canada.

Dear Sidekick:

Actually, the material costs might be running a bit higher than that. A lot of things come up from the US and our dollar is really weak.I know that concrete has risen like crazy over the past few years.

Does anyone actually have a real idea of the profit margin on the typical Westshore house?

Agree generally that $550k is a reasonable entry point if we’re talking brand new. But are you even getting a yard for that price? Some of the places listed out there don’t seem to have much for yard space, which may be just a footnote to those all excited about the stainless and the new floorplan

Marko:

Not a personal attack since neither of us is rich or even close to it. Houses in the core of any successful city are always priced to the top 5% of the population. On the other hand you can pick up a house in downtown Detroit today for next to nothing.

Chris:

Langford is no longer in the sticks as you put it. The fact of the matter is that Victoria has grown and grown a lot. Langford is a pretty short hop to the downtown core. Don’t forget that it was not so long ago that Oak Bay was in the sticks. A few generations ago Rockland was well outside the city as well.

I am a bit puzzled about exactly what people mean by affordable. Considering how fast houses are selling they are obviously affordable to a lot of people. i suspect that the top 25% of income earners in Victoria have no problem buying in the core.

By the way, I was never trying to compare Forest Hills with Fernwood; Uplands is a better comparision and it is a still a lot less.

@Chris – The building materials and labour for one of those ‘fine’ homes is probably 200K. Cost of land, land and services prep, and red tape probably eat another 100k. Is there room for those places to come down? Sure…but it won’t be much unless the development is forced to sell after a crash.

You’re not going to get/build a new home for much less than that. For a custom home you could easily triple those build costs. Is it reasonable? Not really…just saying that materials alone cost a lot.

BRAND NEW houses in Happy Valley for $550k, 4BD, 3 Bath. How it is not reasonable?

I guess…. 7.5x 2011 Medium household income: ($72,728) for a new house in the sticks – sounds totally reasonable… I guess everyone wants to live in Langford and they’re probably running out of buildable areas too.

When interest rates start climbing next year you’ll find out what reasonable is. The 35 year bond bubble is starting to blow up. Who cares what Europe is priced as it’s been overpriced for decades. That will end soon as Euro Union breaks up country by country.

BRAND NEW houses in Happy Valley for $550k, 4BD, 3 Bath. How it is not reasonable?

Everyone want in the core, want 3 bed upstairs, stainless kitchen, big lawns, keep up with the jones, $$$uite, lots of parking, energy efficient home, but they won’t pay the price for it. How it is reasonable?

If that’s the case, with the info below, how can you believe Victoria is reasonably priced?

My comments are more anecdotal than anything…it is so difficult to compare all the numbers published online for a variety of reasons.

When I go travelling I’ll walk through neighbourhoods and I’ll be like……..”wow this is really nice and walkable to city center,” and then I’ll go online and my jaw will drop.

I was in Zagreb for a week this summer and I stayed with a friend in this neighbourhood -> https://www.google.ca/maps/@45.8223209,15.9889748,3a,75y,209.59h,91.74t/data=!3m6!1e1!3m4!1sS8EIdzLmXQebRGxK1diJaQ!2e0!7i13312!8i6656!6m1!1e1

1,000 sq/ft condo in one of these buildings will set you back 300,000+ Euros. A decent house will be pushing close to a million Euros. Average paycheck is less than 745 Euros per month in Croatia.

It seems like whether it be superpower like Germany or board line third world like Croatia nice neighbourhood close to city center of a desirable city is unaffordable in a lot of places.

All places have areas like Langford and Sooke where affordability dramatically improves. A 500k Sun Rivers box would be a million in the Oaklands area.

Okay, no bubble, but when I’ve travelled in Germany and Austria the places I would actually want to live are unaffordable.

If that’s the case, with the info below, how can you believe Victoria is reasonably priced?

Face it, you are not rich or even close to it.

Is this a personal attack? lol

“Try comparing it to house prices in Forest Hill in Toronto.”

I agree, but Fernwood is a ghetto compared to Forest Hill. The quality and condition of houses in the two neighbourhoods are wildly different.

Marko:

The list of places that you would find unaffordable is rather long. You can add Greenich, Malibu, Beverly Hills, Cape de Ferrat and the list goes on. Face it, you are not rich or even close to it. According to stats Canada there are over 100,000 people in Toronto alone that have assets worth over 1 million NOT including their principle residence.Germany has a booming economy; did it expect people to have less money than even Toronto. On top of that you keep looking at the most desirable parts of these cities.

Like I said before, when I bought three years ago I thought prices in Victoria were super cheap. They have gone up but they are still reasonable. I expect that prices in both James Bay and fernwood to really start to escalate. Being able to live right downtown is a luxury. Try comparing it to house prices in Forrest Hill in Toronto.

Does it make sense to appeal your assessments?

In my reports I comment on the BC assessement as to whether it is fair and equitable relative to other similar properties that have sold. If it is too high, then you’re paying too much in property taxes. If it is too low then a buyer for the property may have a significant increase in their taxes the following year. It is also information that the lender should know when considering your debt service ratio.

The leading most asked questions when it comes to value by home owners and buyers is how the assessment relates to current market value. Are the assessment 10, 20 or 30 percent below market? That tells me that both buyers and sellers place weight on the government assessment in their decision making process. Another reason to make sure that your assessment is reasonable.

Most of you will see a big increase in your assessed value in January. That doesn’t necessarily mean that you will have a big increase in your property tax. However, it is more palatable to the public for the districts to increase taxes when property values have gone up. You should appeal if you disagree with the value. And I say this with a bias, as I charge $300 for a report you can use to appeal your assessment. The more of you appeal, the more I earn.

A million dollar home in the city paid about $10,000 a year in property taxes in the mid 1990’s. Today a million dollar home in the city pays nearly $6,000 in property taxes. So there is definitely room for the districts to raise property taxes because paying 10 grand in property taxes for a million dollar home sounds pretty cheap today. If you don’t appeal then you’re leaving yourself open to a bigger tax bill come July.

Munich density per sq km: 4355

Vancouver density per sq km: 802

Why Munich is the most expensive place in Germany to buy a home – https://www.ft.com/content/9b5df910-baba-11e5-b151-8e15c9a029fb

So equivalent to Vancouver but the prices? From the article:

According to the German Real Estate Association, apartments located in average residential areas in Munich (including units sold with long-term tenants) typically cost €3,600 per sq metre, up 10.5 per cent over the course of 2014. The same type of apartment would cost €2,100 per sq metre in Hamburg (also up 10.5 per cent in 2014) compared with €1,750 per sq metre in Berlin, up almost 13 per cent.

So about 334 euros per square foot or $462 CAD – seems cheap even compared to Victoria! And you can get a fixed 15 year rate of 1.58%.

https://www.numbeo.com/property-investment/in/Munich

Apartment (3 bedrooms) in City Centre Average ren: 1,840.77 € ($2547.18 CAD)

In other words is there an incentive to knowingly provide info that will likely result in higher property taxes?

Not that I am aware of. I’ve heard of REALTORS ® asking their clients to re-assess before listing a property to pull up the assessment but I haven’t seen any proof that this helps to increase the sale price.

Germany has taken a different path than basing their economy on housing and it seems to work ok:

Okay, no bubble, but when I’ve travelled in Germany and Austria the places I would actually want to live are unaffordable.

It’s like the massive price difference between Victoria and Crofton (less than a 60-minute drive). Or Vancouver and Surrey.

Sure if you want to live in Innsbruck real estate might be affordable but I would want to live in Munich or Vienna, both ridiculously unaffordable. I spent a week in Munich and 2014 and checked out some real estate and condos walking distance to the core were insane.

No. The market sets the price and BC Assessment valuation may bear little relation to it, plus the number they set happens in July and conditions change throughout the year. This is why, for example, a bank will order an appraisal for a mortgage and accept a number that is 200k higher than BC Assessment value. You are better off paying less tax.

I don’t have one or a water dispenser as a choice just like I wouldn’t install a jetted tub.

http://www.dailymail.co.uk/femail/article-2320397/The-germ-ridden-spot-kitchen-Refrigerator-WATER-DISPENSERS-harbor-concerning-levels-bacteria.html

Housing can be one of two things in my opinion: the resale house and the forever house.

Given that the average homeowner moves every five years there is no sense in renovating or buying without roi and resale value in mind unless you are lucky enough to have reached the stage in life where you have a dream house come true or you know for sure you will stay long enough to get full quality of life value.

Most of the value for the resale house is in location. I’d definitely buy the two bedroom up in the right location if that allows you to get in the market. There will be a buyer in future for it and you can install a wireless doorbell outside the downstairs bedroom that links to your bedroom if your kids are worried later about being on a different floor.

In dollar terms, west-side detached houses still far exceed the east side. In terms of equity, owning a single-family house in Hastings Sunrise generates an average of $692 a day. In Kerrisdale, it’s $1,400 a day.

Couldn’t have a more perfect example of the insanity our housing market is displaying. Prices have absolutely nothing to do with incomes anymore. As I’ve said before why would Canadians even think about jobs, productivity. profitability, etc. etc. when all our dreams can be met by simply buying real estate. A big down payment (from parents, equity, drug dealing, money laundering, etc.) makes a tiny income irrelevant so why bother pursuing a career? What a wacky environment our politicians have fostered.

Germany has taken a different path than basing their economy on housing and it seems to work ok:

http://dir.richardsongmp.com/web/MacBeth.Team/buy-german-housing-instead

I guess they have to create wealth the old fashioned way unlike us Canadians who have figured out the road to riches doesn’t take any effort! And you guys wonder why there’s such demand for housing?

caveat, well said.

Sidekick Spliff – it’s encouraging to know that other people see how risky & costly to the BC coast it is to transport a bitumen substance, whose composition is a trade secret & whose spill clean-up is totally different than crude oil. (see Kalamazoo River pipeline spill – almost $1B cleanup)

Ash, agree, I don’t understand the need to have the whole family on 1 floor – especially when my relatives sometimes had 4 generations under 1 roof. Or even the need to have all 3 beds on another floor – if you’re planning to live there long, stairs for everybody aren’t good when you get older or have health issues.

Question: does it ever make sense to update BC Assessment in the case where your property is under assessed based on incorrect or out-of-date information?

In other words is there an incentive to knowingly provide info that will likely result in higher property taxes?

If you ever find yourself stuck on the hedonic treadmill racing to keep up with the neighbours, a good cure is to travel rough in the Third World for a few months. Will give you a new appreciation for what you already have.

@ Barrister: “…it is nice to have that extra bedroom for a den or spare bedroom for friends).”

Barrister, when I have visitors, can you put them up in your carriage house? 🙂

A lot of the two bed up + 1 or more down houses actually have fully finished basements with suites. So when the time is right for the owner they have the option to take back the suite for just that sort of flexible space.

“Dunno, but that kind of thinking is everywhere.”

Agreed, but again I think people should challenge their priorities. Is having all the beds on one floor really worth the added cost and/or commute?

The über competition is for two story houses with at least 3 beds up. I’ve come across a few people that absolutely insist on this layout…and they’re still house hunting.

General question. So who are the good builders in Victoria? If you were putting up a home who would you use.

@Introvert – 8.8 billion (if it’s actually on budget) could probably solve a few problems we actually have. Oh wait, I forgot that we need it for all the power hungry fracking we’re doing. We’re getting hosed by all levels of government these days 🙁

It’s like the feds announcing their big coastal protection policy so we can all feel better about pipelines and tankers. I wonder who is paying for that? Oh right, we are. So let’s all pay to protect our coast so that big business doesn’t have to.

East-side Vancouver homes surging in value

http://www.theglobeandmail.com/real-estate/vancouver/east-side-vancouver-homes-surging-in-value/article33287877/

In dollar terms, west-side detached houses still far exceed the east side. In terms of equity, owning a single-family house in Hastings Sunrise generates an average of $692 a day. In Kerrisdale, it’s $1,400 a day.

Don’t work for your house. Make your house work for you!

Dear Curious Cat:

Unlike you. I went to a lot of expense and effort to redecorate the exterior of my house. I found a Welsh flag at a garage sale for a dollar ( I am Scottish but I really like the red dragon on it) and fashioned a great flag pole from a very fancy black curtain rod ( $2,00 at a different garage sale). I am firmly convinced that my old house looks like it was built in 1924 instead of 1923. It looks a lot like one of the Abstract boxes except that it has character, style and above all else warmth.

My big exterior splurge was a wonderful brass doorbell cover at general salvage for $6.00. It was actual solid brass with an intricate pattern.

As to the post about wood panelled rooms I dont see the problem? I have beautiful solid mahogany panelling in a couple of the rooms and I think it adds character and warmth. The carved griffins are a work of art in my view. But each to his own.

“Personally I was thankful for all the 2 bed + basement houses in Victoria…it was the reason we could buy here and not have to move further out! We specifically sought out these places because location was really important to us.”

Yep — that’s the situation I’m in now. Despite my realtor’s warnings, I think we’ll end with someplace with 2 beds up and one down. Everything else is just too expensive. I have friends whose kids share rooms and they appear to be doing just fine…

“I’m not sure where the thinking of people these days is coming from regarding not wanting to be separated from your kids for 2 seconds.”

Dunno, but that kind of thinking is everywhere.

The New York Times has taken an interest in our Site C project:

http://www.nytimes.com/2016/12/10/world/canada/canadas-7-billion-dam-tests-the-limits-of-state-power.html

No one disputes that electric bills will go up to pay for the project, which would not be paid off by provincial residents until 2094, at the earliest.

Seems reasonable.

The epicentre of interior wood paneling is Gordon Head. That is all.

Ash – we too ended up with a 2 bed+basement home. Funny, because we insisted to our realtor that we would only look at 3beds+2bath! We were coming from a 3 bed+3bath townhouse in Langford and based only on the house, it would appear we went down a rung on the housing ladder, but location won. We told ourselves that if we were to have a second child, they could share a room. I have 3 siblings and had to share a room for years before my father finished the basement and my two sisters got their own bedrooms in the basement. Yup, imagine that, two children sleeping on a separate floor than their parents! Oh the horror! 😉 Given the quantity of 2 bed 1 bath homes in Victoria, there had to be MANY families that were making it work, or were all Victorians only having one child?? I doubt it. I’m not sure where the thinking of people these days is coming from regarding not wanting to be separated from your kids for 2 seconds. Isn’t it the job of a parent to teach your child to be an independent, functioning human being? Isn’t the goal for them to be contributing members of society that help make the planet a better place, rather than teaching them to be leaches? I can’t tell my friends that I allow my 10 year old son to walk 500m home from the bus stop alone, for fear I will be labelled a bad parent. Even though at the same age, I was captain of my school’s crossing guard! But that’s a topic for a whole other blog 😉

Great post Leo. It’s easy for people to fall into that trap of HGTV and Houzz! I used to love “Income Property” and “Love it or List it”, but I cancelled the channel as it just made me unhappy with my current house because it didn’t meet some sort of imagined standard. I’ve spent hours on Houzz as well, but I find that website to be much more informative and useful as it depicts real world examples, problems, and homes that haven’t been professionally staged. The trick is to stay away from the published articles with the designer photos, and instead, hang out in the forums where people post their Design Dilemmas.

A personal example, when I bought my house, one close friend told me I should remove my window awnings immediately because they make my house look old and out-of-date. Certainly I didn’t like the awnings because they were blue and white striped and looked pretty nautical. But this is one of those slippery slopes that a homeowner can find themselves on very quickly! You remove the awnings, and then all of a sudden your house looks naked without them. You start to notice, even without the awnings, the house STILL looks old. So then you decide you need to get new siding, or a new garage door, or a new front door. The possibilities are endless. You end up spending tens of thousands of dollars on cosmetic surgery to try and fool NO ONE that your house isn’t a senior. Well newsflash, my house is old! Thanks to Houzz, I had strangers rave about how cute my house was and explain to me all the benefits of awnings, especially on south-facing windows. They help to reduce cooling costs in the summer and protect your furniture and hardwood floors from the harsh UV rays of the sun. You can still watch TV in the daytime without glare. I can keep my drapes open all year round and have no need for blinds, as I’m blocking the sun before it even enters the house. I was convinced to replace them with a more pleasing colour scheme instead of trashing them. I have learned to embrace the age of my home and nurture its character instead of trying to make it something it’s not.

Like Barrister mentioned before, I too have discovered General Salvage on Jacklin Rd. I’ve found glass doorknobs to replace missing and chipped ones and a good quality, original heat register that matched my hallway register, to replace the cheap, generic one that was shoe-horned in the bathroom. It’s so funny the joy that such a find can have on a person! I guarantee you, I am more proud of my $40 heat register than I am about my $900 new couch.

Keeping up with the Joneses is real. I try and convince myself that I am not affected by it, but I get so much pleasure when I receive compliments about my house, that I know that it must. The difference is, that I’m no longer trying to wow by making drastic changes, but by trying to incorporate, enhance and improve the character of the house, working with it instead of against it, and prove how I can have a nicely designed house, even if I don’t have an ice maker. 😉

The other advantage of a three bedroom home is that the resale is a lot easier. Besides when the kids are finally moving out (or sold for body parts in an attempt to pay off the mortgage) it is nice to have that extra bedroom for a den or spare bedroom for friends).

We all seem to have survived the great blizzard of 2016.

The comment about neighbourhood is an interesting one but “keeping up with the Joneses” or maintaining an impeccable lawn is not necessarily directly proportional to the affluence or expense of the street. There is a lot of variation between neighbourhoods in terms of tolerance or having neighbours that “fit in”. In some places, it’s perfectly normal for one neighbour to drive a brand new Bentley and the neighbour driving a beat up Toyota. Or having an overgrown lawn next to an impeccably kept opulent mansion. but it varies.

For instance, the owner of a secluded waterfront acreage in Deep Cove can get away with a lot more overgrown bushes/grass than the owner of an Uplands home with a big front lawn.

Broadmead, while by no means the most expensive hood in Victoria, is probably the worst as maintenance, yard regulation, no secondary suites etc. are enforced by covenants that are attached to land title. Plus people I know there complain incessantly about the nosy, priggish residents association police poking their noses into everything and everyone’s business!

Excellent post Leo – consumption creep. I’d say it’s especially true of the highly visible – landscaping, the car in the driveway, etc.

“My realtor recently told me that the #1 reason why he sees people sell their houses is that they don’t have at least 3 bedrooms on the same floor. People who have 2 kids don’t like the idea of one of those kids sleeping on a different floor.”

Ahh the all important third bedroom. I think people should challenge their thinking on this. Is it really so bad? Maybe it’s the mark of a lost middle class when Victorians have to put their kids in bunk beds, but I don’t see it. Personally I was thankful for all the 2 bed + basement houses in Victoria…it was the reason we could buy here and not have to move further out! We specifically sought out these places because location was really important to us. This basically meant looking in Oaklands and a couple of other pockets that we were interested in. For a tad more you could get 3 on the main in Maplewood/ Cedar Hill, but to us it wasn’t worth it.

I am feeling this as I struggle building an expensive house that is absolutely not for profit. I accept it is desire. It’s Expensive because I want it to last so I’m prioritizing durability, comfort health and an inspirating environment over financial conservatism. I’m not stuffing bathrooms everywhere. I am making it sleepover friendly but no suite. I am trading off a bathroom and bedroom for an open space that can house a ping pong table. I am no mustachian (already because of my cowboy stock picking) Then again I don’t belong to any religion….

Good post LeoS, so true. Worst part is most will never recover any cash they put into the reno unless they flip it immediately into a hot market. Better like what you put in, and plan to live there for 10 years to get full enjoyment out of it because by then you will see zero payback from it. Been there, done that.

What is stopping an owner builder from purchasing this warranty now?

Will they sell it to you?

I’m pretty determined to buy a house that I can see myself staying in for 10+ years and hopefully longer. I don’t want a huge house that I can’t take care of or that weighs me down with maintenance fees, but I don’t want to buy feeling as though I’ll need to move up to something bigger and better later. I’m therefore avoiding 2 bedroom houses or any place that doesn’t have adequate storage. I don’t need bells and whistles, but I would like to feel as though I’m not going to outgrow the place since I’m skeptical about my ability to buy more house down the road. A 3 or 4 bed bungalow + basement or garage would be just fine.

My realtor recently told me that the #1 reason why he sees people sell their houses is that they don’t have at least 3 bedrooms on the same floor. People who have 2 kids don’t like the idea of one of those kids sleeping on a different floor. There are TONS of houses in this city with 2 beds on the main floor and one down.

I’ve watched friends go nutty over granite, stainless steel appliances, etc. I’ve also watched friends start to feel serious pressure to do their own renos after the neighbours have and when they really can’t afford to. Keeping up with the Jones will kill you.

Simple solution, just buy a hundred year old house and you will find yourself at general salvage looking for old replacement parts and being able to furnish it cheap from used Victoria. Replacing the vanity in the master bathroom involved buying a old mahogany sideboard and repurposing it. Beautiful carvings and drawers of solid old mahogany at less than $200. The rooms are large and so you dont have to do open concept in order to feel like you have space around you.

On a serious note, you make a very good point that one has to really give some thought to cash flow and additional maintenance. On the other hand, five years down the road the cost of moving up in the market can end up being next to impossible if prices continue to escalate.