So much for that plateau

I’ve said it before and I’ll say it again. There’s no such thing as a price plateau in a hot market. Monthly medians (let alone averages) are notoriously variable and will go up and down depending on the sales mix. Due to that randomness sometimes you can get an extended period where prices look flat in a hot market or other periods where the overall trend seems to be contrary to market conditions.

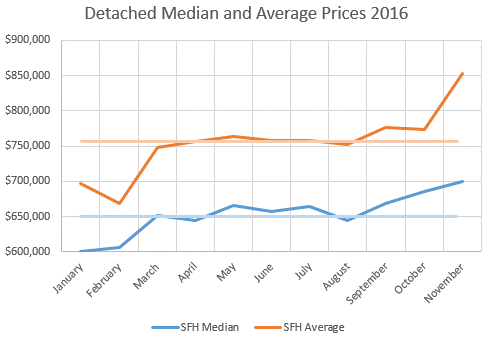

This months stats have shown that to be true, with bigly jumps in both the single family median (up $15,000) and the average (up almost $80,000 to a record $852,590).

What matters is the trend, and calculating that over 12 months is a great way to take out any influences of seasonality which could confuse. Months of inventory for the trailing year is still going down, continuing a record 3.5 year run of steady declines. So far it has dropped by 78% from the high in May 2013.

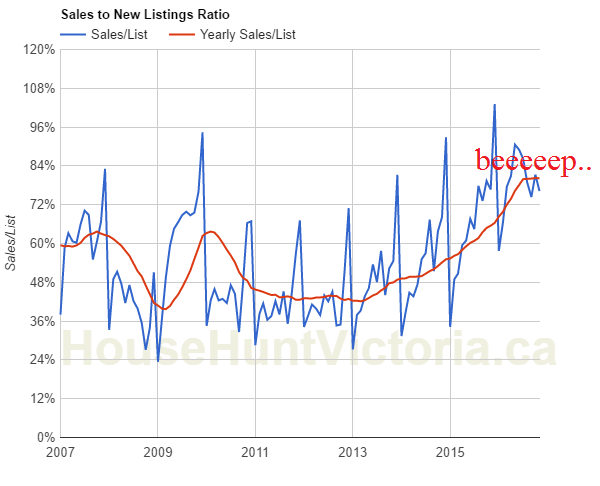

At least the sales to new listings ratio has finally flatlined at 80% which seems to be the maximum that can be sustained for the year. Sales to new list is a good early indicator of where the market is going by measuring how many properties are selling relative to how many are listed. Again it is highly seasonal with only the yearly average telling the story on whether the market is heating up or cooling down.

Market conditions are now very similar to what they were in November 2003, with almost identical inventory and sales.

Why the continued insanity? The VREB figures it is due to “our current positive economic conditions, baby boomers retiring here, millennial buying cycles, a low Canadian dollar” which is likely not a bad guess. Although I would say the explanation is simpler than that: When affordability improves people buy until affordability deteriorates again. And although prices are rising quickly, affordability is still considerably better than it was in 2007 (when this blog was founded by the way).

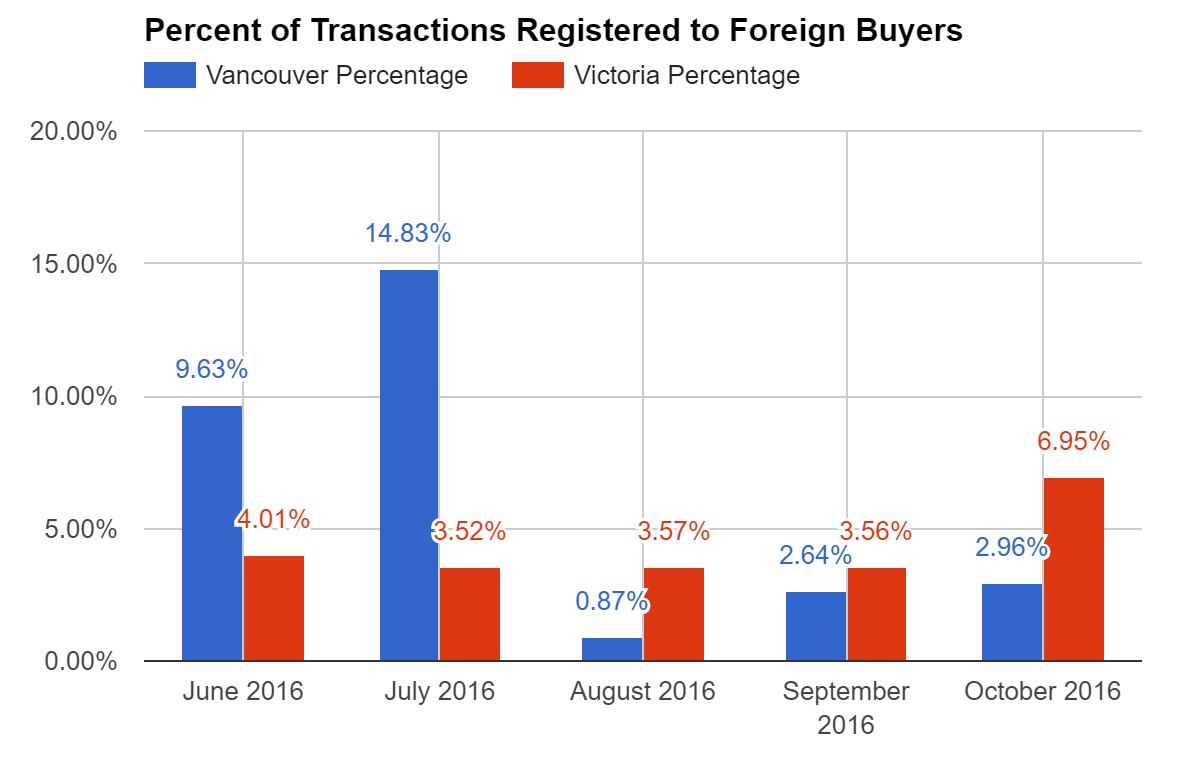

Of course the jump in foreign buyers has also been a factor although that data is a month behind. The jump in October to 63 from 39 the month before was significant to pushing that month into record territory.

Compared to the VREB’s data that indicated only 2% of Victoria buyers were from outside Canada in 2015, that’s quite the big jump. Either VREB’s data was incorrect or we are seeing a big increase this year. If we see 2 or 3 more months of these elevated levels of foreign investment I’m certain that the province will extend the tax to Victoria as well in time for the election. Let’s not make the same mistake that Vancouver did and wait until the horse has left the barn. With 75.6 million dollars in foreign involved transactions in October, that is a big chunk of change to be taxed.

Update: Want to help bring the tax here? Email Christy Clark at premier@gov.bc.ca or your local MLA which are:

Oak Bay – Andrew Weaver – andrew.weaver.mla@leg.bc.ca

Victoria Beacon Hill – Carole James – Carole.James.mla@leg.bc.ca

Esquimalt Royal Roads – Maurine Karagianis – maurine.karagianis.mla@leg.bc.ca

Victoria Swan Lake – Rob Fleming – rob.fleming.mla@leg.bc.ca

Saanich South – Lana Popham – lana.popham.MLA@leg.bc.ca

Saanich North and the Islands – Gary Holman – gary.holman.mla@leg.bc.ca

Juan de Fuca – John Horgan – oppositionleader@leg.bc.ca

Feel free to use any of the data or graphs from this site to support your point.

Also good news: I’ve received a guest post from CuriousCat and another reader is preparing one as well. Will be published shortly as a break from the endless stats. Thanks! The community is what makes this site fun.

New guest post: https://househuntvictoria.ca/2016/12/04/challenging-times/

On price cuts, they are probably used more as a gauge by looking at the percentage. In other words, how many properties required a price cut before they sold? How is that number changing over time? There will always be some price cuts just like how there will always be bidding wars even in dead markets. The proportion is more important

I don’t mind Hawk posting about price reductions – it’s a gauge of what’s happening out there. Also good to be aware of the limitations of just looking at asking price cuts. He was also pointing these out a year ago, amidst the price run up:

Hawk, December 14, 2015: “On the other hand we have another Oak Bay home with a price reduction, and a massive one at that, of $600,000 from $2.1 to $1.54 million and under assessment.”

https://www.realtor.ca/Residential/Single-Family/16180478/3615-Cadboro-Bay-Rd-Victoria-British-Columbia-V8R5K9

—–> The mighty Hawk has made his prediction, within the next 180 days, the price will drop 40%. <—–

Hawk, get a new pair of shoes this holiday season, and start dancing for apocalypse in MJ style.

Introvert’s head has already exploded with his neighbor slashing his joint $500K. He’s probably scheming about stuffing his neighbors mailboxes with phony buyer glossies to make himself feel better.

With all due respect Barrister, in a year where prices and sales went nowhere but up and up and bulls selling their souls for their daily multiple over asking sales by $150K to $300K, it is very worth noting. It’s a sign of a hot market cooling off fast.

If this was a year ago I would totally agree, but this year was an unheard of rapid price gain by hot money and FOMO money. Major price slashes show the agents aren’t getting their clients the money a few months ago, their neighbors got for similar properties.

Vancouver is a prime example of hot money entering and leaving in short order, and Victoria is now starting to see the cracks. If you’re going to ignore the economics explained to all by the banks, CMHC, housing analysts, BCREA, then you’re on you’re own.

Three price slashes in South Oak Bay within blocks of each other is a prime example. Oak Bay benchmark is a tad lower than 3 months ago as well. The top has been hit and the fools pool is getting drier by the day.

Add in condition and location of property, which are not always reflected in the asking price as far as I can tell. You likely need a visit to the site to accurately gauge what this should be and experience with the sub market. Probably why the VREB moved to the HPI.

I would strongly agree that pointing out individual “slashes” or over list sales prices does not give an accurate measure. A bit of a fools game really given the total lack of objective criteria applied to list prices.

“With all respect, asking prices are not much of a metric.”

Agreed. While far from perfect, sell price relative to tax assessment seems like a better measure. Perhaps we could also examine reduced asking prices from this perspective?

Hawk:

With all respect, asking prices are not much of a metric. The question is were actual sales price ends up.

I think one might make the argument that prices are up this fall or that prices seem to be reaching a plateau. I really dont see any evidence of an overall price drop at this point.

In spite of a seriously lower inventory the number of sales seem to be keeping up with last

When March rolls around and we see the market get hot — again — I wonder if Hawk’s head will explode.

I guess it was Alberta

http://globalnews.ca/news/3101696/alberta-man-has-brand-new-house-demolished-after-court-finds-he-built-it-without-proper-permits/

Starting to build without permission from the masters is crazy! I don’t think builders need to write the HPO exam. They just need to apply with evidence of experience and then be interviewed. It took my builder eight months to be approved…. I also would not have noticed the HPO barrier until after I would have applied for my building permit. The only reason I noticed the requirement in the BP forms was because I had been talking about it for a while with my builder. I also find it a requirement that only restricts freedom and opportunity. The biggest problem isn’t the owner builder though, it’s no new builders. Less competition will lead to even more gouging.

gwac and Mike keep the comedy show going while the ship starts to sink. You think the multi-millionaire who is in the process of taking a $2 million bath on Villa Madrona since just January thinks it’s BS ? How about the guy in Golden Head who recently slashed his $500K ?

The money train has come to a grinding halt in Vancouver and is showing it’s ugly head here with dozens of price slashes not reported on here, that no one on here want to talk about because they are just about all scared shitless homeowners.

As per Vancouver Mikey, it’s called the “bull trap”, you might have heard before in your “group”.

http://2.bp.blogspot.com/-ZWsQNhB12M4/Tf161ZP8iFI/AAAAAAAAAu4/iEFXxNao1KU/s1600/800px-Stages_of_a_bubble.png

Michael, different realtors different messages.

http://vancitycondoguide.com/november-detached-market-report/

“Sales continued to collapse, falling well below the 10 year average for the month of November. Buyers appear hesitant to pull the trigger, the homes that are selling are the nice homes in good locations that are competitively priced or willing to take a significant reduction.

Prices

Prices continue a downwards trend. As the detached market hits it’s fourth consecutive month in a buyers market this keeps a downwards pressure on prices. Again, average and median will fluctuate month to month. Prices whether going up or down do not follow a simple vertical line. As per the average price REBGV detached prices are down 11% since January, median sales price shows a 12% decline.”

I tend to look at Realtor’s agendas. Larry Yatkowsky has gone on record condemning the latest foreign buyer tax.

Steve Saretsky seems to be building a solid case for a market melt down. I think his readers are either going to love him or hate him in the coming year. Either way, the readers that believe his message won’t be buying soon and that affects his pocket book. That shows a little more credibility to me.

No problem I wouldn’t do it if I didn’t enjoy it.

Coming up later today, a much less political guest post from CuriousCat to distract us all 🙂

My mother in law manages all the gardens and plants here and she just put in a drip system from Canadian tire with Gardena attachments so it’s easy to attach/detach when necessary. Not high tech, but only takes a couple minutes every few days in the summer to attach/detach the hose.

Back to boring. Does anyone on this sire know of a good garden irrigation system? Any experience with an above ground system.

Please, please do not start the debate as to whether or not to water a lawn. I have large flower and vegetable gardens that need watering. I do appreciate anything useful in the way of practical information.

Unfortunately a foreigner tax won’t make any difference for Victoria.

Vancouver’s average is now up 3 months in a row.

http://www.yattermatters.com/wp/wp-content/images/2016/12/2016-12-01-Average-Price.jpg

Here’s what Yatter has to say:

“Our Cherub Premiere is ramping up her need for votes and in a Super Natural moment will empty her foreign tax bucket at currently tax free communities still not understanding that her action will not stop the rain of ever increasing home prices.”

Leo that is only one person I do it to and that Is because a month of reading the negative BS builds up and I have set him straight. I think he really start to believe his posts….:).

Leo 7 years of this site has lead to an incredible education about real estate. A big thank you for keeping it going. I know it is very time consuming.

“I think you would find it helpful if I wasn’t honest with myself. If I came out and said, “no one worry, we will lobby this 15% tax, the market will tank 40% and once again families will be able to to buy in the core.””

No need to lobby, it will happen by May as Christy has no choice but to implement it or face the NDP who will.

Add on the market forces after Trump’s big mouth promises fall flat on his fat face (unless he does hack up NAFTA which will make it worse for Canada), and you have a struggling economy with massive historical household debt that isn’t going away anytime soon.

2017 will be the year of Peak Credit as banks cut back heavy on lending to conserve all those profits.

“The blog has taken on a strange vibe of late.”

It is strange, as soon as I start posting the multiple/major price slashes in all the hot areas, the bulls have come out of the woodwork and get all out of joint trying to disrupt this shocking news that any bear is some loser renter in a basement BS again.

Though they all say they have no interest in selling for the rest of their lives, it seems they have some serious worry as every financial institution in Canada, and even the BCREA is calling for prices to fall next year. Peak house is here, it’s evident in never seen before government intervention, higher interest rates and tighter lending standards = basic market top signs.

Says the guy who’s spent the last week bickering and riling people up.

It’s December, there isn’t much change in the market, gotta talk about something. I think it’s awesome Marko was actually considering buying a lot just to take the exam and help other people. 🙂

This slogan alone can make you become the next mayor of Victoria!

Marko or totoro, could an owner builder create a corporation to build their home, thereby circumventing the HPO exam?

Introvert

Yep more anger and frustration than usual. Been following for 7 years never seen it this bad.

The blog has taken on a strange vibe of late.

Yep I bet we will see more backlash against government overreach in the next few years. It just can’t continue the way it is. And I say that while we derive the vast majority of our income from the public teat.

Also that 70 year old is in for a world of hurt. they just tore down a place on the mainland for lack of permits.

There is some hope at streamlining bureaucracy to fix the housing issue. The liberals already suggested it for rental approvals and they have a history of being anti red tape. A well executed campaign against the HPO phrased as part of the fight for housing affordability might work.

2 more emails today plus a comment on my video -> https://www.youtube.com/watch?v=duGyq4TtYvg&feature=gp-n-y&google_comment_id=z13beznhtsrbc1vqs04cgxqiynqrixaxk40

“thanks for the info i will be writing the exam in January so this is very helpful. the property that is next to mine has a foundation in the ground and power on the property and not a single permit pulled all because of this exam, the guy that is building the house is in his 70 and had built 7 houses before this one, he did not know about the exam he told them down at the hop office to F-off and he left and just started building.”

This HPO policy has opened my eyes as to why such an idiot like Trump could get elected. At some point people just get tired and have had enough BS.

I kind of took you as as a kind of “realtor for the people”. Doesn’t really sound like it.

I am all for helping people when I can actually help such as this HPO thing. I am answering 30 to 40 emails per week without any monterey benefit and rarely is anyone from Victoria (not like I can pick up any business answering these emails).

In Victoria properties sell at market value and I offer discounted commission services to help people put more in their pocket versus the real estate industry. Unfortunately, I can’t influence the marketplace. If you have a budget for a condo in James Bay (doesn’t have a yard) or a home in Sooke (too far of a drive) I can’t produce a house in Oak Bay within the same budget constraints.

I think you would find it helpful if I wasn’t honest with myself. If I came out and said, “no one worry, we will lobby this 15% tax, the market will tank 40% and once again families will be able to to buy in the core.”

Then I would be the ““realtor for the people.”

Now that is just heartless and void of any form of community discussion. I can’t imagine you would have liked someone saying that to you when you were getting started and looking to find a home. Or maybe it was always really easy for you? I kind of took you as as a kind of “realtor for the people”. Doesn’t really sound like it.

It’s not heartless, it is reality people don’t want to hear. The community discussion consists of Just Jack and Barrister with their opinion of “downtown highrises are ruining our quaint little Victoria and we don’t want to be another Vacnouver.” Then you have Hawk’s opinion of character homes are being demolished to make way for new boxes without character…..outside of Oak Bay the majority of these new boxes would have brand new safe secondary suites that would provide housing to at least one individual…..then we have the comments of the basement suites are cloging my street, etc.

In conclusion the community discussion is very much anti-development of any sort but affordable housing. If you have a town of 100 houses and family 101 moves into town you either have to tear down one house and make it a duplex or you have to go further out. There is no magic solution, well there is, stop all immigration and take away all child care benefits to discourage people from having families.

I didn’t have anyone tell me anything re housing, it was really easy to figure out. I remember in 2007 working a nightshift only two months in my job at the Jubilee Hospital and punching in $75k/year into an online mortgage calculator. After surfing realtor.ca (mls.ca at the time) it was very evident that things looked very grim. A few of my friends moved to Edmonton as at the time Respiratory Therapist made $6.50 per hour more plus better shift differentials plus housing was cheaper. There was no way I was moving to Edmonton so I went back to UVIC to take some courses. I got my bachelors degree, got me no where. Then I went to UBC and got my Masters Degree in Health Admin, still got me no where, but I kept trying until something worked (real estate). I worked hard and failed before I was finally able to increase my income so I could be in a position to afford real estate.

My first place was also a $198,900 condo downtown with no parking, just made it work. Would totally live in it again if I had too.

“I kind of took you as as a kind of “realtor for the people”. Doesn’t really sound like it.”

Rook, I’ve been trying to get that across on here for a long while now to deaf ears. He’s a salesman here to line his pockets and promote his strange world ideology ,not to be your friend.

650 Victoria – how much would it cost to build a new smallish house like that, with the subzero, home automation etc? Anyone care to guess?

You sound like most of the Vancouver realtors for the past 4 years.

I spend quite a bit of my time trying to help people with the HPO exam. I also spend even more time on Croatian (I am Croatian) forums and blogs trying to help people with questions about immigration to Canada -> https://www.youtube.com/watch?v=w4goOcRPj8I&t=4s

This morning a young woman emailed me about immigrating. Turns out she is under 35 so I told her in my opinion her best option to get over here and move towards PR was to apply for a Working Holiday VISA as there are only 337 people applied for a pool of 275 and her chances were pretty good. But besides the point, where does she want to move to? Vancouver.

I’ve answered probably 500+ immigration emails in the last year and people just aren’t emailing with Winnipeg as their desired city of settlement. For various reasons, many will end up in Winnipeg but ideally people want to be in Toronto or Vancouver. Very few have even heard of Victoria.

I don’t think immigrants wanting to ideally move to Vancouver or Toronto is a REALTOR® myth.

What makes you fully convinced something similar isn’t happening now?

It’s happening but it isn’t exactly my point. My point is that in hot markets you get the over market value outliers (even within the context of the that market at time of purchase) to a much greater frequency versus slow market.

I guess what I am trying to say if the market hypothetically dropped another 10% in 2014, from 2013, most people would be out 10%.

If the market hypothetically dropped 10% next year, from this year, some people would be out 10% but you would also have people out 15 to 25% that got caught up in insane bidding wars in 2016 due to the hot market.

When you see bad purchases in hindsight they typically occurred during hot markets.

There is some hope at streamlining bureaucracy to fix the housing issue. The liberals already suggested it for rental approvals and they have a history of being anti red tape. A well executed campaign against the HPO phrased as part of the fight for housing affordability might work.

Marko Juras-

‘Reminds of 2007 when you had buyers plunking down $550k+GST on one bedroom “investment” condos at The Falls that would rent for $1,350 on completion in 2009 and be worth $370ish in 2013.’

What makes you fully convinced something similar isn’t happening now?

‘It’s so easy and convenient to blame the housing issue in Victoria on foreign buyers.

I think a big part of the problem in Canada is a lot of people want to live in Victoria, Vancouver, and Toronto with the two bigger cities being super popular with new immigrants.’

You sound like most of the Vancouver realtors for the past 4 years.

‘all people want is to be able to live affordably in the communities they work, call home and contribute to.

Move to Sooke or Duncan? Problem solved.’

Now that is just heartless and void of any form of community discussion. I can’t imagine you would have liked someone saying that to you when you were getting started and looking to find a home. Or maybe it was always really easy for you? I kind of took you as as a kind of “realtor for the people”. Doesn’t really sound like it.

650 Victoria, in Oak Bay, just sole for $1,650,000. New house, with that condo feel, 5,400 square foot lot, about 2,100 square feet. Sloped ceilings on second floor. I know that it is the market price but I am having a hard time getting my head around the price.

Yes agree, Marko, in a lot of countries you can create a corporation, but Australia does enforce the foreign ownership rules even if it’s a foreign national buying through an Australia corporation, eg., “if an individual not ordinarily resident in Australia, a foreign corporation or a foreign government holds a substantial interest in the corporation”

Also yes there are some crazy transactions – I don’t know how exactly how some people get around the additional downpayment requirements, except in some cases, they do get family loans, and in other cases, maybe they work something out with the mortgage brokers? In the US, with investor groups popping up like Home Union, they offer to find financing solutions for your average person who wants to become a SFH investor.

Has the blog ever before implicitly encouraged its readers to write to politicians (with contact info provided!) in an effort to produce a specific legislative outcome?

#3 Marko, some other countries (and PEI) do impose strict rules and hefty penalties for foreign buyers flouting the rules, eg., Australia has forced the sale of foreign-bought properties:

In a lot of countries registering a limited company as a foreigner and buying property is totally legal. It’s a way around a symbolic “no foreign ownership,” but a legal one. Country probably collect some fees from having the limited company registered.

Kind of like I can incorporate and reduce my tax bill by 50%. Tax avoidance is legal, tax evasion is not.

I personally have talked to people here & in Van who are middle-class homeowners, including tradespeople, NOT doing the math themselves listening to HGTV stars (eg., Scott McGillivray) or their realtors tell them that investing in other houses is good

Reminds of 2007 when you had buyers plunking down $550k+GST on one bedroom “investment” condos at The Falls that would rent for $1,350 on completion in 2009 and be worth $370ish in 2013.

Seems like when the market is super-hot you get some crazy transactions taking place. In 2007 could have bought a solid house in the Oaklands area with a suite for $550k.

It appears that we don’t have enough information to determine whether real estate hoarding (foreigners excluded) is a “problem,” or not, but even if it is I don’t really understand why it’s such a bad thing.

Let’s say I buy a piece of land, I spend a year slaving over owner-building a home. I throw in an awesome 2-bed suite with 9′ ceilings. All-in I end up spending $850k.

Suzy buys the house next door off a builder for $1 million and goes with a media/rec room so her kids have a room to play.

Market goes nuts and both homes increase to $1.4 million. Suzy pulls out the equity out of her home to buy a cabin on Cowichan along with $80,000 ski boat so her family her spend quality time together up at the lake.

I pull out the equity, buy I dump in the Tilicum area, fix it up and throw in a suite into the basement with the plan of passing it on to my kids in 30 years.

Now all of a sudden I am a bad guy for hoarding?

I don’t really get a lot of what’s going on right now. Every night I hear on the news about how low vacancy is and what a huge problem it is, people can’t find places to rent and it is a crisis. However, everyone complains about suites….not in my backyard type attitude. Here is a perfect example, 9,000 sq/ft lots in Saanich that could EASILY accomodate suites and additional parking…….well no suites because neighbours didn’t like the idea. How difficult is it to understand supply and demand?

http://vibrantvictoria.ca/forum/index.php?/topic/5730-saanich-mount-douglas-estates/

Happens in Vancouver, but we don’t have Vancouver equity. It cannot be that widespread here based on the math of Victoria’s median incomes, the 20% required down on rentals, new qualification criteria, and an approx. 20% rise in prices over 7 years. Not to mention that the net rental income from the Sooke house will be negative so you need to have extra for that. Most owners who bought in the last seven years still won’t even qualify for a HELOC.

Math is fun.

“I’ve yet to see any convincing argument that property “hoarding” is bad. Last time I checked our vacancy rate is 0.5% so if someone wants to buy up some properties and rent them out that’s a good thing. ”

#1, I didn’t say RE investing was a bad thing (I’ve profited from RE myself!) What I was trying to say was that the US, Australia, and the UK have recognized that there is a growing problem with investors pushing out SFH homebuyers – Victoria isn’t immune to the effects of the global phenomenon – we need to learn from that. The scale of what’s happening with SFH is unprecedented :

The UK has imposed “buy-to-let” taxes, & Australia has had HUGE “negative gearing” debates.

In the US: “Investors With Cash Edging Out First-Time Home Buyers ”

http://www.wsj.com/articles/investors-with-cash-edging-out-first-time-home-buyers-1455656617

(also see SFH investor startup “Home Union”, or web sites like Lifestyles Unlimited article “How Owning 22 Rental Properties Can Retire You Faster Than $1M in a 401K”)

#2 Also, thanks Totoro for the link to the Wealth of Canadians survey, but as with every survery, there are some weaknesses: it doesn’t differentiate major urban centres where housing prices are highest (eg., survey’s mean principal residence was $300k & other RE $180k – if you were to crudely extrapolate to Vancouver/Victoria averages, this would be north of $700k & $420k).

I personally have talked to people here & in Van who are middle-class homeowners, including tradespeople, NOT doing the math themselves listening to HGTV stars (eg., Scott McGillivray) or their realtors tell them that investing in other houses is good (or CuriousCat had a good anecdote of how an irresponsible realtor can convince people to build a home – easypeasy) – and if you use the extrapolated #s, it’s a very real thing that people buying a $700k house in the core are buying a $450k SFH in suburbs like Abbotsford in hopes of renting it out.

(In fact, a family of 5 I know got booted out of their suburban house rental because another investor bought the property & wanted to hike the rent).

As other countries have found though – this pushes out first-time home buyers who need a place close to work for their families.

Besides that, when prices started going exponential in Vancouver – everybody and his dog got into the game – including realtors, international investors, entire families locally, etc – it was literally the Wild West. So Victoria has to remember & study what happened there – don’t repeat history.

#3 Marko, some other countries (and PEI) do impose strict rules and hefty penalties for foreign buyers flouting the rules, eg., Australia has forced the sale of foreign-bought properties:

http://www.news.com.au/national/breaking-news/govt-forces-sale-of-illegally-held-homes/news-story/f421ff310d223cb92487b860ee155d4c

“Since taking office in 2013, the coalition government has forced foreign nationals to divest a total of 46 properties worth almost $93 million.”

When the China real estate bubble pops soon we won’t have to worry about them coming here as they’ll all be broke. 😉

Billionaire: Chinese real estate is ‘biggest bubble in history’

“Chinese billionaire Wang Jianlin made his fortune in the country’s real estate market — and now he’s warning that it’s spiraling out of control.

It’s the “biggest bubble in history,” he told CNNMoney in an exclusive interview Wednesday.

Bubble is a sensitive word in China after the dramatic rise and spectacular crash in the country’s stock market last year, which wiped out the savings of millions of small investors who thought Beijing wouldn’t allow the market to drop.

After struggling to contain the fallout from the stock market debacle, China’s leaders could face a similar headache in the real estate sector.”

http://money.cnn.com/2016/09/28/investing/china-wang-jianlin-real-estate-bubble/index.html

How are you planning to publish the question database? Let me know maybe I can help you out.

Not enough people are emailing me questions. The obvious solution would be for me pay $450 and write the exam and memorize the questiosn but that is where I’ve hit the roadblock. The HPO won’t let me write the exam without being in ownership of a building lot…………..just another of many examples of how stupid this policy is.

You have to buy a building lot FIRST, only then do you find out an exam is required which you may not be able to pass. This is why so people across BC are fuming. There is no required disclosure in terms of the exam. You find out after you buy and the HPO refuses to help you study for it.

It’s not just this exam though….you should see some of the policies at Saanich and Victoria, even worse than this exam.

But than again if you are working at Saanich or Victoria in the building permits and inspections department why would you care? Salary has been increasing at a higher clip than any other level of government. If you make it a nightmare to build a home you have better job security. If someone is 12 months behind in starting construction who cares you’ve had 12 months of flex Fridays, a couple of vacations, and another pay increase.

However, you will email your MLA about the foreign tax because that is the cause problem….

HPO is insane, but I don’t see a clear path to addressing it.

How are you planning to publish the question database? Let me know maybe I can help you out. Also I still think a petition is worthwhile. With the current housing crisis it might get some traction.

The worst part is the exam was put into place without a problem in the first place. One of those government employee ideas that has zero relation to real life.

“We are going to protect the consumer who might be buying a owner-builder home by introducing this exam.”

There is no path to addressing the HPO exam in my opinion as the average citizen just doesn’t get it. The average person just buys re-sale or brand new builder built spec homes and complains about how foreigners have driven up prices and their child in Vancouver can’t find a rental because of Airbnb.

Let’s say you have a young late 20s couple consisting of a framer working for Campbell Construction and a nurse. They don’t make a huge killing but one of them is in the construction industry. One of their options, for example, if they want to get ahead is to buy a building lot in the Latoria area of Colwood for $250,000 – $300,000 and owner-build a nice home with a suite for $400,000. This exam is a massive attack on this option. Instead of working hard after hours to build a house the government is encouraging this of individual to just buy a home for a builder from $750,000-$850,000 and take on a bigger mortgage? In my professional opinion I HIGHLY DOUBT the builder home is better in terms of quality of construction, or less problematic versus a home they would have owner-built.

People with 40 years of experience in construction have been failing the exam. One guy emailed me to say his exam had four questions on chimney code…….who on earth builds a home in 2016 with a chimney these days? It’s called direct went fireplaces. Just goes to show that the government workers at the HPO office haven’t even bothered to visit a construction site in recent years.

“The pigs at the trough are the ones frowning upon the investors that are providing them housing and paying millions in taxes for their health & social programs.”

That’s hilarious Mikey, I thought all you big real estate tycoons incorporate so you don’t have to pay a nickel of tax to help the system….just like Trump. The pigs will be eating themselves in short order, Peak House has hit.

Warning signs grow that 2016 may be the year of ‘peak housing’ for Canada

http://business.financialpost.com/news/economy/why-2016-may-be-the-year-of-peak-housing-for-canada

http://wpmedia.business.financialpost.com/2016/12/peak.jpg?w=620&quality=60&strip=all&h=487

“While I understand why you think OB land worth 800k, this land is on market for awhile.”

I’m sure AG will find something wrong with it. Just like his neighbors slashing their Uplands digs by $265K.

I don’t see how this issue is political.

HPO is insane, but I don’t see a clear path to addressing it.

How are you planning to publish the question database? Let me know maybe I can help you out. Also I still think a petition is worthwhile. With the current housing crisis it might get some traction.

Tracking the data has zero effect. What is your suggestion for preventing the Vancouver problem if not a tax?

I don’t. I’ve yet to see any convincing argument that property “hoarding” is bad. Last time I checked our vacancy rate is 0.5% so if someone wants to buy up some properties and rent them out that’s a good thing. Affordable rentals are more important than affordable housing to purchase.

Unless he was leaving those empty I don’t see the problem.

Well we don’t have great data but we do have 4 months where it stayed very steady. 4%, 3.5%, 3.6%, 3.6%, 7%. Not sure where you get 2 months of data from.

It is very notable. Foreign buyers represent pure demand so those 63 buyers have a much bigger effect on the market than 63 locals who are selling their place to buy another (net zero demand).

This is such a bizarre argument I can’t even wrap my head around it. The media covered Chinese foreign buyers because that’s who was buying. It would have been crazy to write stories about Austrian and Russian buyers when they weren’t buying any significant amount.

I disagree. We know out of town buyers (from Vancouver) had a huge impact on the market this year. We saw it in the stats, and foreign buyers are similarly powerful in that they add pure demand. There is actually no evidence that I know of that local speculators are to blame.

Nonsense. We have Exhibit A across the water from us. Pretty clear from the percentage of foreign buyers we saw there and the subsequent collapse in sales volumes that they were a massive factor. We also saw the detrimental effect of housing prices completely detaching from local fundamentals.

So, should we wait until Victoria is driven up to similar insane heights or should we actually think about being proactive this time. Of course another few months can’t hurt but you definitely don’t need years of data.

What unintended side effects have we seen in Vancouver? The tech industry will hurt a lot more from unaffordable housing than they will from a foreign buyer tax. When your workers can’t live in the city you won’t be able to find them.

Not to mention all the other supply delay and increased cost restrictions being put on by the government that the average Joe is completely oblivious too….I received 6 more HPO related emails today alone. Average Joe is focused on the foreign tax while there are unfounded policies much closer to home driving up prices of homes.

“Hi Marko, just writing to say thanks for your owner-builder videos. As a person who falls neatly in the category of ready to build and THEN only just found out about the owner-builder requirement, I was very happy to hear your perspectives on it. One would think that being reasonably educated and most importantly, surrounding oneself with experts in the field of construction – all of which I have – would be enough. It’s not like anything will be done in contravention of the code – in fact, far from it.

Anyway, I’m hungry for more questions, as only studying the the building code tome is daunting at best and pointless at worst……….xxxxxx, Gabriola”

“Hey found your videos on the new HPO requirements and just wanted to say i agree with you 100% that this is such a joke! I bought a property 3 months ago and just now find out about this test. We are a young family and just want to build our own home and have the freedom to hire our own qualified trades people! How frustrating, when i called the HPO office for a study guide the guy said there isn’t one for a reason and that they dont want people cramming for it and passing it haha, i almost lost it. Keep your videos coming something has to be done!” xxxxx, Penticton

This one below is my favorite….can’t even do an addition to your home anymore…..lol. Makes me think the garden suites in Victoria won’t take off either as people will be forced to hire a large licenced builder which will make them cost prohibitive.

Hi Marko, my husband and I have owned our home in Abbotsford for 28 years and recently decided to build an addition to accommodate our adult daughter and her son. Upon submitted our plans to the municipality we were informed of the HPO requirement. I wrote the exam a few weeks ago and failed at 59%. Even thought my husband and I will be doing the contracting together they are only letting one person sit for the exam. Do you have an email list or anything like that, or will the next batch of questions (assuming there are more) be again posted via youtube? Please help……xxxxxx, Abbotsford”

It’s so easy and convenient to blame the housing issue in Victoria on foreign buyers.

I think a big part of the problem in Canada is a lot of people want to live in Victoria, Vancouver, and Toronto with the two bigger cities being super popular with new immigrants.

Then in Vancouver and Victoria you have a supply issue in my opinion. It’s funny the municipalities are complaining to the province and to the feds but they don’t do their part in the crisis. Just try to build a house in the City of Victoria or subdivide a lot. If you have a large lot with a crappy unsafe house on it that you want to attempt to subdivide into two lots that will accommodate two brand new homes with suites it will literally take years.

This is the stance the city councillors take -> http://www.timescolonist.com/news/local/in-fairfield-plans-for-small-lot-face-political-scrutiny-1.2361236

Even if you purposes homes with two bedroom suites it would be the exact same response, “million dollar homes.” So you have these councillors one night they are on TV talking about how we have the lowest rental vacancy in the country and it’s a problem and the next day they are quashing development that would bring supply to the market place. Its basic economics they don’t seem to grasp.

It’s generally not so much about supply and demand.

Let’s ignore whether people rent or own. Where do you physically accomodate thousands of people moving to Greater Victoria every year? (and 300,000 across Canada)?

The demand will be constant unless you write to Trudeau and ask him to close the boarders.

Now let’s turn to supply. Supply in the core isn’t changing because the city has a massive aversion to replacing single-family homes with higher-density structures.

A lot of other countries don’t allow foreign ownership because they are intent on protecting their land for their citizens.

In countries that “don’t allow foreign ownership,” it is typically symbolic. For example, in many countries this problem is dealt with by opening up a limited company and then buying the property.

all people want is to be able to live affordably in the communities they work, call home and contribute to.

Move to Sooke or Duncan? Problem solved.

Marko Juras

Her words not mine. I guess she meant assistant.

Why do realtors need to chase out of town buyers when our inventory is so low?

(That site hurt my eyes)

I overhead a realtor during a meeting today that she is looking to hire a unlicensed Chinese realtor for this spring. I wonder what her intent behind that is?

No such thing as an unlicensed REALTOR®. In terms of Chinese REALTORS® there is no shortage -> http://www.victoriabbs.com/

While I understand why you think OB land worth 800k, this land is on market for awhile.

https://www.realtor.ca/Residential/Vacant-Land/17629463/3096-CADBORO-BAY-Rd-Victoria-British-Columbia-V8R5J9

I overhead a realtor during a meeting today that she is looking to hire a unlicensed Chinese realtor for this spring. I wonder what her intent behind that is?

Don’t get me wrong, I’d happily live in Hamiota. Just not for that price. Put that house in fernwood/Oaklands and there’s no way it’s getting torn down.

Don’t tell JJ about that Hamiota sale. He still thinks Oak Bay lots are worth 600k.

Maybe they find Oak Bay over priced and over rated. $90K slash is major. Funny how anything in need of some imagination is a knock down for an ugly box with zero character. Peak house will solve that problem.

Hamiota finally sold: $860K.

A far cry from the 950K the sellers originally wanted, but still a pretty penny for what’s essentially a knock-down.

Like someone on here said the other day, young families aren’t interested in paying nearly a million for a place that needs endless renos – I think that rings true with this one. And for those whose kids have grown up/moved out, they probably don’t want an elementary school in their backyard.

Why not pass a law that states houses can’t be sold for more than $700,000? That would also do the trick, and there’s no way it could be perceived as xenophobic or racist.

Bingo, please don’t use the race card. It’s been used for years in Vancouver, while we stood by and watched the destruction of our housing market .

If Victoria was smart, they would call for the implementation of the foreign tax immediately, before they end up in a situation like Vancouver. In fact, it should be implemented throughout BC in my opinion. Victoria doesn’t “need more data” — there likely is a problem with foreign money, best to just nix it before it gets out of control.

It’s generally not so much about supply and demand, that argument was used and still is attempted to be used endlessly in Vancouver by developers/realtors while endless amounts of units are built and then sit vacant, and at the same time, politicians and developers/realtors called everyone racist if they dared bring up the foreign money element.

Eventually people got tired of the race card being used, and started to fight back, because using the race card is an attempt to shut a conversation down; all people want is to be able to live affordably in the communities they work, call home and contribute to. And if that means taxing or banning foreign monies/ownership to make that happen, so be it. A lot of other countries don’t allow foreign ownership because they are intent on protecting their land for their citizens.

That the HHV blog is now engaging in political advocacy is a little off-putting.

Also, you misspelled our premier’s surname.

Everyone knows mixing metal with the housing market is bad.

Barrister, that’s quite funny coming from the guy who seemed to relish quoting the Reagan line, “The nine most terrifying words in the English language are ‘I’m from the government, and I’m here to help.’ “

Here’s a nice set of graphs of the stats from 2012:

http://nhrc-cnrl.ca/sites/default/files/Wealth%20of%20Canadians%20Results%20of%20the%20Survey%20of%20Financial%20Security%20%202012-John%20Nicoletta.pdf

Sorry! I meant if you did the math. I’m pretty sure you can do it. Too late to correct..

Yes, but don’t lose sight of the previous seven flat years and the costs of ownership. Break out the rent v. buy calcs :). Makes the ROI much less, especially for people with a lot of equity.

There are some secondary property ownership stats JJ – Stats Can does a survey of Financial Security regularly that collects this data – last done in 2014 and updated this December.

Twenty-five percent of Canadian family units own other RE besides the family home, although the value of these assets is much less than primary residences or pensions at 9.9% vs. 30% for the family home. This includes cottages and vacation homes that are not rented out, the vast majority are owned by those in the 45-65 age bracket, and about 1/4 of the second homes are located outside Canada. The median value of non-primary residential real estate is $180,000. That is a lot of ski cabins and not a lot of SFHs in Victoria.

Let’s not forget that you now need to put at least 20% down on an investment property and qualify on your debt service ratio. How many homeowners in Victoria who are not in the 1% and who have purchased in the last ten years can do that? Look at the median SFH price here and do the math.

And I don’t know how to be any clearer than this:

in Victoria it likely pays to buy an expensive primary residence long-term imo if you can afford it;

in Victoria it does not pay to buy for rental income and a rental is a poor choice as compared with putting your eggs in the primary residence basket;

SFH rental properties in Victoria will lose money each month short-term unless you buy with cash, in which case you are better off investing your money elsewhere for less effort imo;

if prices appreciate all leveraged RE benefits. At historic 4% appreciation rates you may do okay with a rental here over the long term, but you might do better in the market and you will have to be able to carry it in the meantime. If you are investing straight cash and not using leverage this is not going to be your best investment.

So maybe there are people out there buying SFH rentals here, but I’m not one of them. I would not invest in a rental home in Victoria now as there are better uses for our capital. I would buy a more expensive primary residence. I would only do this if I was sure I could afford it, I had other motives (ie. helping family), and could hold onto it for at least seven years.

So, if you are able to do the math, which I suspect you have not JJ, you will see that “hoarding SFHs ” is really not the biggest issue with use of home equity. The biggest issue is likely the ability of the 70% of homeowners who move up the property ladder at prices that increase beyond the rate of inflation which supports a system that increases beyond the rate of inflation.

“If the market had been allowed to correct, many of these hoarders would have gone bankrupt by now and we would have a lot more listings and lower prices. That’s the natural order of real estate. The excesses are cleansed by market corrections.”

Bang on Jack, exactly what I’ve said too all along. Which is why this will be one nasty mofo when the unwinding starts as the buyers continue to pull back.

Warning signs grow that 2016 may be the year of ‘peak housing’ for Canada

There’s one particularly troubling tidbit to be found amid Canada’s surprisingly strong third-quarter growth: residential investment hit the skids.

The annualized 5.5 per cent decline in this category was its worst quarterly showing since 2010, notes Macquarie Capital Markets Analyst David Doyle, who views the details of the report as “growing evidence that 2016 will be the year of ‘peak housing’ for Canada.”

http://business.financialpost.com/news/economy/why-2016-may-be-the-year-of-peak-housing-for-canada

Nan, remember when you admitted you were tempted to buy a condo using equity from your place?

If you follow through and purchase a second place, you’ve just reduced supply, hence putting pressure on prices. No foreigners involved. No need to overpay.

The pigs at the trough are the ones frowning upon the investors that are providing them housing and paying millions in taxes for their health & social programs.

Yup, nobody knows what the % is, that’s a huge issue. I also agree it isn’t about being rich or middle class, because I know both types of buyers having investment properties – but about how much the banks and investor web sites encourage people to pour money into real estate as an alternative to other investments.

Again no evidence because no one has looked for it.

It isn’t that you can call up CRA and ask them for that information since your tax forms are protected private information.

If you went down to a bar right now, the chances are that some one at one of the tables around you would be talking about real estate and their investment properties. It’s everywhere. On the buses, in the restaurants, in the bars. As the old adage goes “where there’s smoke there’s fire”

nan:

Inherently undesirable? Rent or stay in a hotel? So I guess the US should do the same. Block all Canadians from owning vacation properties. Block all Canadians working under a TN from buying a house while they live there.

Better protect yourself from cancer by getting chemo right now nan! A foreign tax is heavy handed and it was used as a late treatment to an issue in Vancouver. The preventative measure is closely tracking foreign ownership. That’s the insurance.

nan:

And local idiots bidding against each other doesn’t do the same thing?

Take all the foreigners out of the picture right now. We’re still in the 70% range for sales to new list ratio. A seller’s market.

It’s demand exceeding supply driving up prices. Make up imaginary scenarios where all foreigners pay more than market value or whatever you want, the facts are Canadians made up 94% of our market last month. Your imaginary overpayin boogieman isn’t the problem.

Totoro at least I was honest to say that no one knows how many people own more that one property or how many are necessary to make an impact on prices. Somehow you know it’s a small percentage. Last month a total of 23 houses sold in Victoria City – how many do you need to impact prices?

Don’t worry Totoro you’re safe.

After all Cabinet Minister Mike de Jong owns 7 properties in Abbotsford.

There are a lot of pigs at the trough who don’t want to see changes either.

“Are there hard numbers about property hoarding?

Nope. No one or public body accumulates that kind of data.

So according to AG it must not exist. And therefore we shouldn’t look into hoarding.”

JJ – you’re being deliberately obtuse, again.

Of course there are people that own multiple properties. I’m one of them. You say you met a guy who owns 95 condos – well, there have always been guys that own 95 condos. What you really should be determining is: “Is this an increasing trend?”

It might be, or it might not be. I’m guessing it wouldn’t be too hard to gather that data from tax returns etc. If it was actually an increasing phenomenon, I suspect that we would have heard about it.

I find it interesting that you are opposed to a foreign buyers tax (when the evidence very strongly suggests that it is or will become a problem), yet you’re in favour of some kind of penalty on real estate investors (when there is no evidence at all to suggest that it’s a problem).

The money doesn’t have to come from outside of the community. Equity is created as a new source of funds. In one year the equity in people’s homes grew by 20 percent. That’s a lot of new “money”.

“we don’t yet have proof that rich foreign investors are affecting our market.”

I have said this before – this simply does not matter. Any foreign ownership of residential real estate is inherently undesirable and should be prevented before it happens. If it never happens, well at least we were protected. You want to come here for vacation or whatever? Rent or stay in a hotel.

People understand buying insurance before a fire or a car accident, I find it really funny that so many people want to “make sure” a ownership disaster can actually happen or is happening in real estate before they begin to prepare for it. “Lets make sure the horse has fully left the barn before we think about closing those doors!”

The difference? An earthquake doesn’t line your pockets with tax free capital gains without lifting a finger.

Most speculation is local because when capital comes from abroad and buys a relatively small number of houses at inflated prices, those transactions raise the prices of all houses. Who owns all the houses? Locals. I demonstrated a few months ago how $1MM price increase (created with foreign money) on one house in a neighborhood could create $200MM in additional equity in the surrounding houses to borrow against. If only 5% of that $200MM in additional equity is extracted, the $1MM in foreign speculation on one house will have created and additional $10MM (or 10x) in additional demand from locals (aka local speculation). When you looked at the data, you would see 9% foreign speculation and 91% local speculation. Then you would read: “91% speculation is local! Lets keep letting foreign folks in because they are a minor part of the market here! Don’t be racist! Bollocks.

There will never be a case where the majority of speculation driven by foreign investors isn’t carried out by locals because for every foreign buyer paying an inflated price, there are 100 locals who will feel rich and motivated to increase their investment speculating in the rising market.

Are there hard numbers about property hoarding?

Nope. No one or public body accumulates that kind of data.

So according to AG it must not exist. And therefore we shouldn’t look into hoarding.

https://youtu.be/C7xHN3TJiFs

Yet I know many people that have more than two properties and one person that owns 15.

At a convention I spoke with one person from Vancouver that said he owned 95 condominiums.

Low interest rates over such a long time coupled with price high appreciation has made many people into multiple property owners. Now if you’re buying apartment blocks or office towers that’s a good thing. But owning many single residential homes that’s drives the price of housing up and up and up.

This year prices went up by 20 percent. If you owned 3 residential properties that meant you could pay a lot more than someone who saved for five years for a down payment. In a bidding war you would beat a saver every time by tens if not hundreds of thousands.

As a society do we want housing to be a commodity traded like stocks and bonds or a place to live and raise a family. This is a social issue that costs taxpayers millions and millions of dollars that the government spends to build more “affordable” housing which is ironically bought by more hoarders.

It’s because the market has lasted so long due to government interventions that we find ourselves where we are today. If the market had been allowed to correct, many of these hoarders would have gone bankrupt by now and we would have a lot more listings and lower prices. That’s the natural order of real estate. The excesses are cleansed by market corrections.

A very small percentage of Canadians own rental property. On this blog there is Marko and I and I’m not sure who else but I’d say the majority of people here don’t own more than one and many are renters saving to buy a place.

In the real world none of my friends own rentals, even if they can afford to, due to the perceived hassle and real risk. I know of two other families in my wider social circle that own a rental property: both of them live in Uplands.

Rental properties are clearly not for everyone. Think about your social circle and how many of those with median family incomes could do this here even with equity from the recent run up in prices. Generally in Victoria a second SFH rental will either increase your taxable income without much supporting cash flow, or be cash flow negative. That is a higher risk proposition unless you are quite well established with equity or have a very high income or bought ten years ago.

Victoria is just not a good rental income market and this contributes to the shortage of SFH rentals – rents don’t pay the bills. You would be investing for appreciation here and if you do this you will pay capital gains tax. You might also already have a lot of money and be investing for lifestyle reasons ie. a condo to use part of the year. For the last eight years, barring the most recent run up this past year, you would have lost money if you’d bought a rental investment property and resold before the run up.

The equity that was made in the last year in Victoria will not likely stimulate rental property ownership imo.

Many people do not want to be a landlord and the ROI is marginal unless you can hold for the long term and you need a higher than average income to do this in Victoria. What I believe is that those with equity in their primary residence are now in a position to move up in a rising market. They may sell the condo and buy a SFH, or buy a different house, and the investment potential makes this an attractive move, along with quality of life factors. And it does become harder to buy the first house as this occurs because of the increase in prices.

If I had a do-over I would likely purchase the biggest SFH in the best area I could afford and work harder to pay the mortgage if need be. The capital gains tax exemption is worth far more than appreciation on a rental without the exemption in a market like ours. You can see the pay-off in Barrister’s example.

And as far as that foreign investment numbers from last month go, the overall value rather than number has me concerned that this will affect the top end of the market and have a trickle-down effect beyond the annual historic 4% per year appreciation.

And finally, the rich have always gotten richer. Money makes money if you invest wisely. Of course, unless you inherit, you need to work hard to accumulate enough to start the cycle and wait for the compounding to work its magic. Start as young as you can so that you have enough time to enjoy the magic. RE is not the only way.

Unintended side effects. It’s a heavy handed treatment. I’ll save you the copypasta of my previous response to that argument.

Basically, it sends a message to foreign investors, and it’s not friendly message.

Hawk:

A much too likely event for people over leveraging themselves in RE. If you’re leveraged to the hilt and the market turns.. watch out. Hawk and I may disagree on the inevitability of a severe down turn, but I definitely agree it’s real possibility. You can be prepared for the possible without treating it as inevitable.

AG:

With a boom and a crash like the US if we just let it happen. Then it ripples out through the economy.

Agree JJ on how this market may well implode on itself after half the first time buyers are now cut out. Read an article today on millennials that may just shut the door on housing and say screw it, not worth the risk and the cost.

Sounds about right when I base it on my sons many millenial friends who most seem to have zero interest in a massive ball and chain for the next 30 years just to scrape by to get in and pray you don’t lose your job. It was different the past 20 to 30 years where you could secure a decent job with little threat of layoff if you did you job well and advanced up the ladder abit. Nothing is secure for them now.

As well many of the millenials aren’t getting into serious relationships leading to marriage or shacking up like the previous generations. I think that’s why apps like Tinder etc are making their hay. The millenials wanna have fun much longer than we did with no heavy debts dragging them down, plus stay mobile. They’re here for a good time, not a long time as Trooper once sang.

Overextended AG? Now there’s a concept. Record historical debt loads might explain it.

Condos on mid-Johnson losing value with new homeless shelter not going over well with the neighbors. Lawyer lady was on news last night saying how crime and vandalism has increased and sketchy walking in the area now. Feels she would take a loss if she sold and doesn’t want to do that.

“Nic Cage went bankrupt.”

Because he overextended and had to sell his properties. Rockefeller died and his estate was split up so that there are hardly any wealthy Rockefellers around today.

So this ‘property hoarding’ problem tends to sort itself out, over time. In other words, it’s not really a problem.

Nic Cage went bankrupt.

Famous property hoarders in history:

JD Rockefeller

Crassus

The Duke of Westminster

The Queen

Nic Cage

I’m sure the ancient Romans were moaning about how many properties Crassus owned too.

Is there any actual evidence to suggest that an increasing number of people are owning multiple properties?

These ‘property hoarders’ that you speak of… they have always existed. Investing in real estate has historically given a good return and it’s a healthy diversification away from stocks and bonds.

If anyone has any evidence that this is a trend, I’d be interested to see it. It would be a useful metric to judge how over/under-valued a market is, and how much potential extra demand there might be from existing owners.

“I don’t know if a foreign tax would do much in Victoria”

So what’s the harm in implementing now, and getting ahead of the curve?

If only there was a nearby city that waited too long to implement a foreign buyers tax. Then we could look at that city and guess what might happen in Victoria if we don’t do anything. Oh, wait…

Agree that an extra tax on investment property (especially SFHs) would also be useful. (I still think the 15% foreign tax is useful if the data holds up over the next few months before spring). The UK has made similar tax changes.

Years ago, when interest rates were higher and people made more money from other types of investments (including purpose-built apartment rental buildings), there wasn’t so much competition to buy SFHs.

Now, banks/gov’t have made it too easy for everyone to chase real estate as a way to invest money (causing even more people to panic & buy RE for their kids so they don’t “miss out”), and if that continues, there’ll never be enough units or houses built – unless prices decrease or the rental vacancies go up due to another recession.

I don’t know if a foreign tax would do much in Victoria. Maybe the condo market where foreign investors leave the suites empty?

I think, what we need is a cap on the number of single family properties you can own. Buy as many apartment buildings or office towers that you want but housing should not be a commodity.

If you own more than 3 residences then every residence after that you purchase will not receive any capital gains exemptions. After 3 residences, when you sell that is fully taxable at your personal income tax level.

I don’t think it is necessarily foreigners driving up prices but hoarding real estate and that can be by Canadians or foreigners. I would also like to put restrictions on foreign students buying property and re-selling it back in their home country for a commission. That means no capital gains exemptions for non-Canadians and that all transfers of properties must be conducted in person within the province of BC at a Notary or Law Office and the parties are fingerprinted.

Thanks Vicbot. I’ve read that before. And yes, the actual issue was rich foreigners (nationality wasn’t the issue).

My point is in Victoria is that we don’t yet have proof that rich foreign investors are affecting our market. By the numbers, local speculators are to blame.

The side point, is people pushing for a foreign tax without evidence is driving policy by fear. Fear of ‘outsiders’ taking ‘our’ homes. An irrational fear of people from other countries is literally the definition of xenophobia. Without evidence foreigners are driving our market the fear is irational. So I’m quite just in using the term xenophobic to describe people who want to limit foreigners without evidence. Again, 2 months or data does not make a trend.

If speculation is the issue, we can deal with that and it needs to be dealt with across the board (whether the buyers are Canadian or not). The CRA measures will partially put a damper on this (better enforcing capital gains), but we could go further. Why not a 15% tax on purchasing property beyond your primary? If you want a cottage to vacation at, consider it a luxury tax. If you want an investment property, it’s a speculation tax.

As JJ has pointed out, we have a problem with equity rich people buying more property. Most of those are local to the market they are buying in. No one needs more than one home. Make it more expensive for people to flip their equity into more homes and you make it easier for people looking to get into the market.

JJ

Sorry to trouble you but do you have access to same median number for Toronto and Vancouver?

This guy does a nice vlog about China. I know that most bulls want to show that foreigners want to leave their country because of pollution and move to Victoria. But that is an over generalization. I think this is a balanced view on the topic of Chinese pollution in the cities.

https://youtu.be/L_DNf40z3m0

Bingo, best to read Justin Fung’s words (Chinese Canadian that started HALT Vancouver) about playing the race card … Also, I agree there’s too much red tape with the simplest renos & builds, but the talk of a supply problem is driven by the real estate industry to justify all the unnecessary Vancouver condo projects that get repeatedly sold to investors instead of homebuyers:

“An open letter to those who play the race card in the Vancouver housing affordability debate”

http://www.straight.com/news/734326/justin-fung-open-letter-those-who-play-race-card-vancouver-housing-affordability-debate

Justin Fung said: “As one of the resident Chinese-Canadians on the HALT team, I was particularly frustrated to see this misleading headline on the front page of the Vancouver Sun “Is Racism Part of the Issue? … If anything, it’s the Pete McMartins and Bob Rennies of the world who would take advantage of our Canadian politeness and welcoming nature toward people of all races to suggest that racism is what fuels the Vancouver housing affordability discussion.”

It [unaffordability] has everything to do with the corrupt and complicit politicians who serve the corrupt needs of a B.C. real estate industry whose continued success depends entirely on us turning a blind eye to the obvious problem.”

Median prices certainly look bleak for new detached house buyers in the core. Here’s how median prices for the year have changed for houses in the core.

Primary Year Sale Price, Median

2006 $479,000

2007 $535,000

2008 $560,000

2009 $555,000

2010 $601,000

2011 $595,000

2012 $578,000

2013 $572,500

2014 $582,000

2015 $630,000

2016 $750,381

So how did we come into more money to buy houses this year? Well it wasn’t from a surge in wages but by using the equity in our homes. We were able to pay down the mortgage and free up equity over the last half dozen years so that we could put down a bigger down payment to buy another rental property, a house for our kids or move up the property ladder. If you had property then you could buy more property.

The people that were left behind were those who didn’t have a property to pull out equity or parents that were not willing to give/lend them the bigger down payment for a house.

I suppose the ardent bulls would say this is the new paradigm. A world where the rich get richer and those unable to reach out and grab the first rung of the property ladder get left behind.

Normally a real estate market could be described as pyramid shaped with a lot of new buyers at the bottom and fewer and fewer buyers as we reach the apex of higher prices. But we don’t have the pyramid shape as the pool of new buyers shrinks. Instead we have this circular shape like a Chinese dragon devouring its tail where only home owners can buy houses from other home owners.

I don’t know if that new paradigm of home ownership can continue if we no longer have a strong foundation of new buyers purchasing. But it seems to be working right now. The test will be if we can survive a minor recession when all of this equity floating around evaporates and home owners can’t buy more houses. Because it’s a long ways to the bottom where those buyers left behind can buy a house with 5 or 10 percent down again.

But until then those left behind will have to suffer the bulls who lack humility and flout their wealth. I hope that if a correction does happen the bears will show empathy for the bulls that some bulls currently don’t show for the bears. Because it could be really bad for the economy. When one bull goes down to bankruptcy that means 3, 4 or more houses come up for sale.

Do we need to count how many headlines said stuff like “How Chinese Buyers Are Driving Up Home Prices” or “The Canadian Housing Boom Fueled by China’s Billionaires” or “Chinese real estate investors are reshaping the market “?

While I wasn’t in the lower mainland during the run up, I have lived there and have plenty of friends still there. Our anecdotes differ. From my perspective locals were blaming the Chinese and the media echoed that.

Try to find a single article blaming any other nationality. Yes there were other factors, and they were covered in the news (well.. cheap money was hardly blamed, but the other factors you mentioned were). The concern wasn’t all foreigners, it was Chinese. The tax affects all foreigners, but the goal was to eliminate (or reduce) one particular nationality.

It’s a heavy handed remedy. Due to the timing of the gov’t, I don’t disagree with its use in Vancouver (they delayed doing anything and it was the quickest solution). Applying it to Victoria without further evidence would be political theatre to appease the paranoid and xenophobic.

It may end up being necessary to implement here. If evidence supports it being necessary I’d support it, however it is premature without enough data to support a trend. 6% of buyers what’s driving our market higher.

Why aren’t people screaming at the gov’t to make it easier to build? 12 months to get building approval in Saanich on an empty lot? HPO exam which knocks out smaller builders and owner builders?

The issue in Victoria is simply supply vs demand. The problem is on the supply side. Reducing demand up to 6% isn’t going to fix our problem.

Michael, if the extra tankers were carrying something other than bitumen, it would be different.

There’s a peer-reviewed study coming out that describes the risks:

“There are large, unexamined risks to the marine environment from oil sands products and that means that the approval of new projects is problematic, maybe even bordering on irresponsible.”

http://www.theglobeandmail.com/news/british-columbia/bitumens-impact-on-ocean-life-is-uncharted-water-study-finds/article33117945/

“… nor was there any work on the effects of bitumen spill cleanup. Basic information on toxicity is missing – partly because the exact composition of what goes through the pipe is considered a trade secret.”

I think the Liberal gov’t thought the only hurdle they had was paying off landowners for the pipeline.

Bman

Issue is Greater Vancouver at the time. No other area has proven to have the same issue. Get it over 10% for 3 months and sure go for it. One month in a low sales month does not make a trend.

Michael people do not understand how our social programs and government jobs are paid for.

Gwac,

The Liberals had to hit the Vancouver market with a sledge hammer because they procrastinated so long. Why not apply the tax province-wide in the first place? It would be prudent and responsible.

As for Trump, haven’t you been around long enough to know that all politicians over promise and under deliver? We’ll see what Trump actually does.

Vicbot, we’re already at 5 per month to Westridge near Burnaby and you may want to keep in mind…

“But despite the tanker increase, the number of ships in these waters overall is down significantly to around 10,0000 from a high of 14,500 just a few years ago. Add the additional ship a day (to Kinder Morgan) and it still doesn’t get us back to historical highs of the early 2000’s,” Obermeyer of the PPA says.”

I look forward to watching every tanker pass to pay for our health, education, & social services.

Bingo, I’ve worked all my life in the tech sector, so I agree it’s a challenge to attract talent and drive growth, but we have plenty of co-op programs across Canada too – we don’t just rely on the US for that.

I was in Vancouver when this started and people weren’t shouting “it’s the Chinese”. Houses were being traded like an international stock market – it resulted in ghost-town neighbourhoods where you didn’t even see cars parking on the street at night. It drew in a number of complex problems like money laundering, shadow flipping, tax evasion, etc

I would have supported better checks by CCRA and CBSA, removal of QIIP in the first place, but if the gov’t is only willing to apply the tax, that’s the remedy we’re stuck with, until the gov’t can get its act together (if ever).

See HALT Vancouver for more: https://haltvancouver.org/

Vicbot

Agree we need more refineries and stop using the US ones. We have way more oil than we possible can use though for gas. Better to get it out now and sell before the demand is gone in 50 to 75 years. The American do not need ours as much any more. They have found the wonders of fracking (god know the lasting environmental impact of that) Our oil needs to go to Asia, our need is so tiny compared to the 4 billion barrels of reserves.

I understand the point of exporting refined gas instead of oil. The problem no one wants the refineries or pipelines to supply the refineries in their backyard.

Conventional Oil Reserves

(Barrels) 3.9B 4.1B

Conventional Oil Production

(Barrels per day) 1.3MM 1.4MM

Prices – WTI @ Cushing on Nymex

(US$/bbl) $48.80 $92.99

Exports – Crude Oil, Condensates, Pentanes, etc.*

(Barrels per day) 3.0MM 2.9MM

Imports – Crude Oil

(Barrels per day) 745,000 636,000

Canadian Consumption of Refined Products

(Barrels per day) 1.8MM 1.9MM

The people in Vancouver were quite loudly shouting “It’s the Chinese! The Chinese!”. They wanted action that would take care of that concern regardless of how it was done. Spray the field with roundup, nuke it from space, whatever analogy you like. We’ll see if it affects business investment in Vancouver’s tech sector. Vancouver, Victoria and Kelowna have growing tech sectors.

Canada is a great place for US companies to set up branches. We have talent and it’s (relatively) cheap. Vancouver isn’t even paying Seattle wages and Victoria is cheaper yet. Paying an engineer 100K CAD is only 75K USD (which barely gets you a new grad in SF).

6% of our currently low sales figures (need Hawk to remind us how long sales have been dropping?) is hardly notable nor the driving factor in affordability. Locals make up the majority of the market by a long shot. I know we love to point the fingers at others and externalise blame, but we’re the ones driving prices up.

We need to keep the oil here and refine it here instead of shipping it off to other countries, while importing too much ourselves. We need to support businesses like this one building the Sturgeon refinery in Alberta: http://www.theprovince.com/business/energy-resources/sturgeon+refinery+could+start+something+even/12467941/story.html

Agree that China is smog-filled (which drives some people to leave) – but they are showing leadership with their manufacturing initiatives in new technologies.

Vicbot

A bit dramatic I think. We are a resource based economy, if we like our nice standard of living the product needs to get to its destination. One of those destinations is your gas tank of your car.

Been to China lately. Smog in major cities is unbearable.

“What if it was 90% Americans? Still want the tax immediately?”

Of course. People in Vancouver didn’t care if the foreign buyers were from Mars as long as their communities could be liveable again. Home values are meaningless without liveability.