Nov 21 Market Update

Weekly stats update courtesy of the VREB via Marko Juras.

| November 2016 |

Nov

2015

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 123 | 236 | 387 |

573

|

|

| New Listings | 158 | 299 | 499 |

747

|

|

| Active Listings | 1849 | 1834 | 1811 |

2952

|

|

| Sales to New Listings | 78% | 79% | 78% |

77%

|

|

| Sales Projection | 578 | 590 | |||

| Months of Inventory |

5.15 |

||||

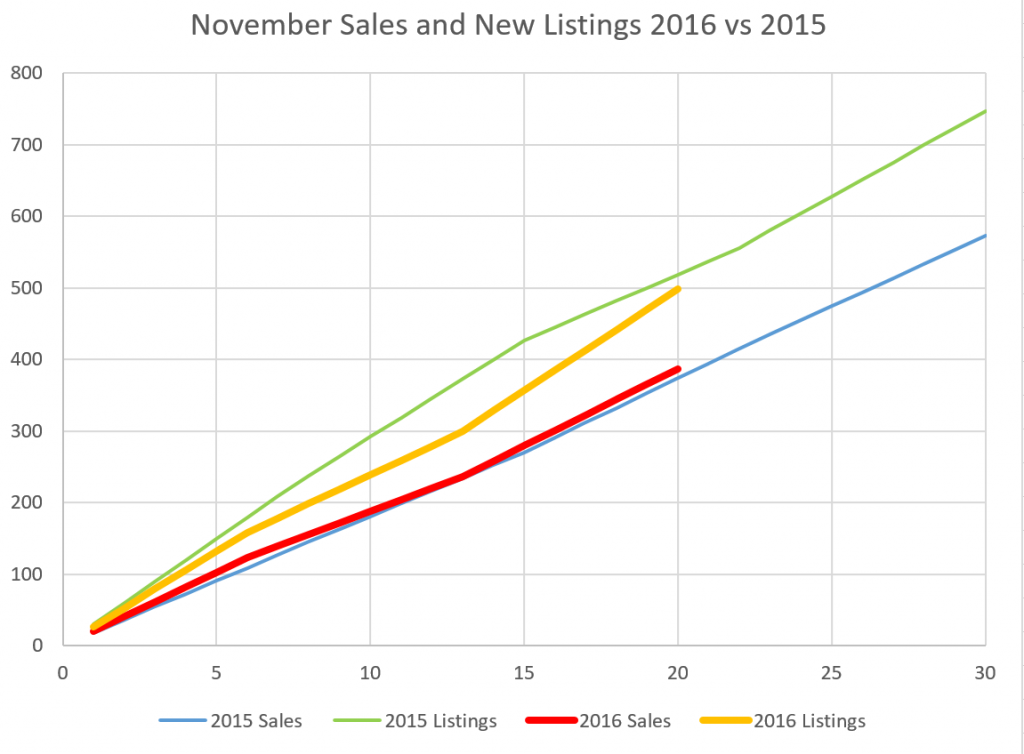

There really has been no divergence from last year at all and it doesn’t seem like the mortgage rules have had an appreciable impact on the market yet. Sales are almost dead on last year’s pace, and listings are just a smidge behind.

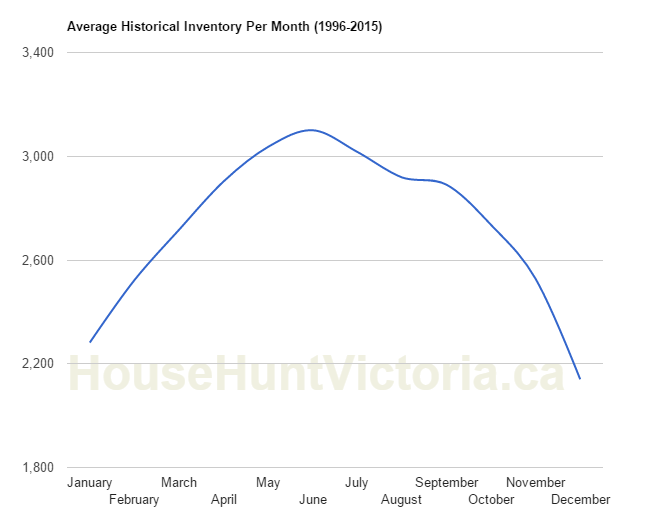

Looks like we are going to have to wait until the Spring to see much change from last year. At these low inventory levels it would be essentially impossible to match last year’s spring sales surge without a huge increase in new listings.

Gobsmacked at the price Amphion went for. A much nicer house up the street on Davie went for 789,000. Me thinks someone way overpaid for that lot. Cos basically that is what they got a small cramped lot.

Victoria has gone crazy.

Thanks for the comments on hydro costs. I am going to get a blanket for the water heater and see if I can get by with lower water temperature. I will also look at installing a HRV system so I can still have the fresh air I want without losing heat. My spouse has also been nagging me to get the chimney cleaned for the woodstove so we can try it out. We’ll see if the smoke it produces is tolerable for my allergies; there is already a smokey smell in the neighbourhood from at least one neighbour.

Hehe 🙂 Or the endless discussions about gold on Prairieboy’s blog?

All guest posts welcome! Just send me an email. leo.spalteholz(at)gmail.com

New post: https://househuntvictoria.ca/2016/11/28/nov-28-market-update/

“I’ll stop posting on this and let programming return to your regularly scheduled bear vs bull battle.”

I seldom post but have been following the blog since its inception (Anyone remember the good old days when Marko trolled here as a woman nurse?) and your recent posts on home energy efficiency are excellent. I think Leo should sign you up as a guest blogger.

1977 Gordon Head box. Brand new vinyl windows throughout (installed just before we purchased the home, in 2009). All original insulation.

AG. I agree I think with only 1840 listings and spring approaching quickly. All fundementals in this city are positive. Construction is booming. Government is hiring. Local businesses are hiring. I think 10% is realistic next year.

Oops,

My personal view is that Victoria real estate will start calming down late next year or in 2018. The fundamentals here are pretty good so I think it will probably flatten out for a few years, unless we see a big tick up in unemployment.

In the meantime though, everything points towards the market moving higher again in the spring.

It would be good if people here had some more nuanced views instead of either “it’s going to the moon” or “the zombie apocalypse is coming”

“This blog is House Hunt in Victoria, not an Armageddon Hunt in your fantasyland.”

Wow sums Hawk up perfectly plumwine.

http://vancouversun.com/business/local-business/metro-in-debt-newton-area-worst-in-the-region-for-debt-to-asset-ratio

The number of people seeking help through the Credit Counselling Society of B.C. has risen 14 per cent year-to-date to Oct. 25 over the same period last year and the society has hired more staff to deal with the increase, said counsellor Megan Faschoway.

As real estate prices rose over the years, so did debt tied to home ownership. The amount of mortgage debt in Metro Vancouver between 2012 and 2014 rose 24 per cent, to $110 billion from $89 billion, according to the SPARC B.C. report.

The number of consumer bankruptcies filed in B.C. in 2015, 5,683, was down 10 per cent from the year before. But consumer proposals to deal with debt were up for the same period 17 per cent, to 5,897, and outnumbered bankruptcies, according to the Office of the Superintendent of Bankruptcy in Canada.

“Bankruptcy rates are dropping everywhere, but without showing that consumer proposals are growing like crazy, an incorrect picture is drawn,” said Mantin.

http://vancitycondoguide.com/house-of-debt/

Evan Siddall the CEO of CMHC

“economic disasters are almost always preceded by a large increase in household debt. In fact, the correlation is so robust that it is close to an empirical law as it gets in macroeconomics.”

Hawk, I’m not entirely convinced that our resident bulls don’t see the obvious, but I’ll post this link because most bulls prefer the Real Estate Board stats and CMHC reports. Perhaps the fact that he used to be an Ex-Goldman Sachs Banker might provide some credibility to his opinion.

He seems to be a lot less interested in blowing this gasbag even further up than the previous Board. They can be forgiven the errors of their ways because clearly they had to look after their own interests.

Background of the previous CMHC Board:

Karen Kinsley, CEO

Former VP/Treasurer of two real estate development companies

She had this quote, as she was stepping down after 25 yrs.

“CMHC has been my home away from home for 25 years and I cannot adequately express how proud I am of our achievements,” Ms. Kinsley wrote.

Michael Gendron, CFO

Part-owner of VC firm that has a majority interest in a number of home-building and support companies in Edmonton

Michael Horgan

–

Brian Johnston

COO of Mattamy Homes

Sophie Joncas

Formerly employed by construction and real estate firms

E. Anne MacDonald

Real estate lawyer

James Millar

–

Rennie Pieterman

Partner at residential plumbing firm

Andre Plourde

President of industrial real estate firm in Montreal

Ian Shugart

–

Read my last post slowly plumwino. You drink too early too. $100K and $1 million loss and you compare to some condo with hypothetical gains from 2 years ago. Show us the old listing.

For those want to go greener and cut back on Hydro, get a Home Energy Monitor and connect to your smart meter. ~$50 iirc, It will give you real time ampere data.

I found the biggest daily draw for me is the hot water tank. The heat pump consumption is very reasonable. Thinking of getting a solar water heater, they are everywhere in Asia. (dirt cheap over there too)

AG, you two can’t let go. What’s random ? Price slashes of $100K in Oak Bay? Sounds like you drink early.

Rates have been low for years and made no diff. It was FOMO. $100K gift gain since beginning of year just got wiped out in short order. Over $1 million plus loss for starters if you bought Villa Madrona back in January. Real random alright. Good thing your an ex advisor, the public is safer.

Bwhahahahaahahah!

** can’t breath **

hahaahhaha

Whatever you are on, please hook me up!

Dude, YOU ARE WRONG in the past 24 months. THE MARKET WAS UP, UP and UP.

You maybe right in the next 24 months, who knows. But YOU ARE WRONG NOW and WRONG about the VicRE. Man up, grow some skin, admit it.

This blog is House Hunt in Victoria, not an Armageddon Hunt in your fantasyland.

I think wood is the most green energy source isn’t it? Carbon neutral and all that.

A condo in 2535 Cadboro Bay sold under 1 week, full asking $350k. Same unit, they cannot give it away for $200k just few years ago. Holy S!!! Just new paint and new kitchen. +75% gain. Wow, condo market really heated up.

Hawk all the random irrelevant stuff you post does not change the situation on the ground in Victoria. Low inventory, low vacancy, low rates, low unemployment, etc etc. Be prepared for prices to pop another 10% higher in the spring. Better get cozy in that basement suite 🙂

AG & gwac, do you 2 live together ? Sure seems like it. ICYMI a psycho named Trump just got elected. All your weak denials of a changing market show you are the last ones at the punch bowl.

Hawk, I don’t think you even understand most of what you post.

First, the bond bull market has been declared “over” countless times. We won’t know for sure until we see it in the rear view mirror. Just because yields have popped a little higher does not mean the end of a bull market.

Second, rising rates are usually correlated with rising real estate prices. The Feds are generally behind the curve and prices usually keep rising for the first couple of years of an upward rate cycle.

More links and more useless data comparing April to Nov. Hawk those not in the know will believe your crap. Those with half a brain understand you are just a basher that tried to play the housing market and lost big time. Now the sour grapes and all the rest wishing the Victoria market would crash so you could break even from a stupid play.

Might want to educate yourself gwac on what’s coming via the bond market which is massively larger than the stock market. The 35 year bond market bull started in 1981, it’s now over. Chew on that chart for abit, but I realize economics isn’t your forte.

2017 is when a decade of global monetary easing ends, says BAML

“Next year will be the first since 2006 that there will be no big monetary policy easing across the world’s leading industrialized nations, signifying the end of the 35-year bull market in bonds, Bank of America Merrill Lynch said on Monday.

Having driven interest rates to their lowest ever levels and lifted purchases of financial assets to over $25 trillion this year, central banks are finally maxed out, BAML said in its 2017 outlook.”

http://uk.reuters.com/article/uk-global-cenbank-idUKKBN13G1KO?il=0

gwac,

Sales down 60% in the core since April. Grow some skin. Guess a month was too long for you and you can’t leave with Oak Bay price slashes starting up. First sales, then prices. Economics 101.

Credibility omg Hawk. How does one have credibility when they have been wrong for years. I think the bulls have credibility since they have been right and continue to be right about the victoria market. Prices were stable at 5000 listing. We are At 1800 and a stable price. That is the real world not the so called experts link world you live in.

Btw it’s been going down hill big time for years. I guess you are right if your graph is upside down.

That’s the problem with you types AG/gwac, as well as the other handful of perma-bulls on here. You have so much invested that your hyper sensitive to the changing market. Calling me a troll for simply posting the latest news/data/stats/price slashes etc, effecting the housing market is pathetic.

Most people on here (bulls and bears) can carry a decent back and forth debate while the rest of you talk about your large land holdings and say every new set of data effecting BC/Canada is bullshit/won’t effect me/ go back to your basement renter, etc. It’s called credibility and I back up my posts with the numbers.

You bull-troll every reply to me because you seem to have thin skin on accepting a changing trend that is hitting Vancouver huge and now showing early signs of hitting here. I may have been wrong the past few years but I only have to be right once.

Maybe you perma-bulls should shut off BNN and stop reading the blog/papers etc if it’s going to upset you. It’s looking like it’s going to head downhill bigtime from here.

Thanks Bingo for the info.

I think its worth it getting a couple quotes. Love to get ride of the baseboards and use something else when I am not around.

The only time you should see it or smell it is at start-up. The new ones are really efficient if you use dry wood.

@gwac

Depends. Best to call someone for your particular layout. You don’t have to run ducts, but ductless gets pricey if you need to run a bunch of heads. We have 2 zone ducted on the main (vents in every room) and a single ductless unit downstairs. Outside unit is a 3 ton (36K BTU/hr). Was just under $14K before GST (and not including rebates).

The system replaced our old oil furnace (and its old ducts). So I’m no longer burning fossil fuels. Just renewable fuel sources ;).

Modern EPA rated wood stoves are quite clean burning (thanks to reburn). Once I have a fire going you don’t see (or smell) smoke from my chimney. Wish I could say the same of my wood loving neighbours.

EPA guide on wood stoves

The current spec is 4.5g / hour particulate emission (and it’s tightening). As a comparison, an open fireplace burning softwood (e.g. fir) is about 60g /hour.

Ya I agree reasonfirst. I don’t think Hawk is a troll either, although the two of them like to push each other’s buttons, don’t they. They made my morning entertaining; too bad I apparently lead such a dull life.

😛

Hawk

Anyways I have had my monthly fun with you. Be back in a month to read the same crap.

Like Victoria market going to crash because you have a link of a house in Bagotville that sold for below asking and was the market for a long time.

Enjoy that new stove. Maybe if you are lucky that 500 white fridge will break and you can get another from your condo owner. Oh to dream.

AG – this is trolling:

“Yep Hawk’s stocks are probably up 1000% or more by now. He obviously has excellent market timing and is a formidable investor.. oh wait, but he’s been calling for a real estate crash for how many years?”

Not that Hawk needs any help from me…

Hawk we may disagree on a lot of things, but I have to compliment your trolling.

Almost every post that you make has some kind of angle on it designed to provoke a response, either from an individual or from a group. Your last post aimed at gwac and me; your posts about your imaginary stock returns; your claims that Marko is just a shill for the real estate industry; your statements that all the bulls are levered up and a couple of rate increases away from bankruptcy, etc, etc, etc.

It all adds up to a brilliant and relentless trolling campaign. That is, of course, what the internet is all about. Without your inflammatory posts I think this blog would be a much quieter place 🙂

GWAC said:

“This island does not behave like Toronto or Van. Never has never will. While other markets were surging it did nothing for 6 years. ”

It looks to me that the patterns are very similar except for maybe between 2010-14. Never say never.

PS – I added the projections for Mike’s benefit.

http://imgur.com/a/Rj5NQ

Sounds like gwac and AG are twisting their shorts in a knot because they played it safe with the 2% hedge fund guy who takes 3% before profit. My 400% is doing just fine thanks but lots of others made it too, some I know twice that amount or more. About to add to my 400% soon tho. 😉

Thanks Denise, as you can tell as soon as the bad news of the first price slashes starts to hit our shores the denial is like a bunch of babies. As I said before it must be boring to be a rich dude to hang out here and make up juvenile stories to preserve your paper profits you say you’ll never see, as you’re leaving it for your kids.

What does the watchdog know ?

Canada’s banking watchdog warns lenders face big losses if housing markets turn

http://business.financialpost.com/news/fp-street/canadas-banking-watchdog-warns-lenders-face-big-losses-if-housing-markets-turn

Ok Duct. Funny though 🙂

Personally I like to run my ducks upstairs. They’re scared of the dark, the concrete is cold on their feet and I don’t like to risk the possibility of quacks in my foundation.

Question on Heat Pumps

How much are they aprox. Would it be worth while for the bottom floor 1500 sq. Ducks could be run in the crawl space. Heat rises??

Oh well still going to light up my wood insert tonight. I will live with the guilt. I do burn it hot to produce as little smoke as possible for my neighbours who also burn wood.

My last 12 months of hydro to Nov 21 was $1244.61 (including taxes). The year before was $1159.52. My projected 2 month estimate to Jan 18 is $240. I have a heatpump with an oil furnace backup which I have not filled since I bought the house in 2008 and used maybe 5 times over the years. We have no natural gas, so electric hot water tank and appliances. All light bulbs are either LED or CFL (about 75/25 right now).

I heat about 1650 sq ft and I keep the thermostat at 21.0 at night and 21.5 during the day (I’m home all day). This is pretty much bare minimum that I can tolerate. In the summer the A/C is set to 22.5. I’m in the basement right now, and I’m chilled (definitely cooler down here by a couple degrees) and will go upstairs and put a sweater back on before coming back downstairs. I wear slippers and keep blankets on the couch, etc. The house is 1940, one story with a basement, plaster and lath walls. I have no idea if there is insulation behind the walls (though the electrician said he did see some blown-in insulation so it may have been done at some point) and there is minimal insulation in the attic. I have a mixture of single pane windows and double windows (one sliding window, an air gap, and then another sliding window). We added batt insulation in the basement in the headers and things like that, did some caulking and added some weather-stripping and that seemed to help for our eco-audit in 2009 at least.

But it sounds like $1200/year is already pretty damn low compared to other folks on here, so not sure changing all the windows and doors would garner much savings. (Had Van Isle Windows give us a quote of $5000 to replace all the windows to double-pane). So when we do replace them, it will be more for the aesthetic rather than hoping to save $100-200/yr. Doesn’t sound like argon would be worth the extra cost for me.

I’m with you on that one Jack. I love wood heat myself (grew up in the boonies). But it does not belong in the densely populated urban core. Wood heat is the number 1 or # 2 source of pollution in most BC cities.

$869 K for a 6000 sq foot vacant building lot on Moss. Wow that brings home the increase in lot prices in Fairfield over the last 3 years. Wouldn’t that have been a 600 K lot in 2012-13?

Keep posting Hawk, this blog needs some balance what with all the smug pumpers/realtors out there. They remind me of Vancouver posters (everywhere) before Van started the correction it is now experiencing.

I can’t condone the use of wood burning fireplaces or stoves that are the source of winter smog. In a city of half million and more dollar homes why do you need to burn wood?

To save on heating costs or for the ambiance, wood burning is the second largest cause of air pollution and only slightly less than transportation during the winter.

All houses that sell in the city should have their oil tanks replaced, wood burning stoves and fireplaces disconnected or pay 1 percent of the sale price to the city as an environmental tax every time the property sells.

If you can afford a million bucks for a house you can afford to pay the tax.

Yep Hawk’s stocks are probably up 1000% or more by now. He obviously has excellent market timing and is a formidable investor.. oh wait, but he’s been calling for a real estate crash for how many years?

My kindling is reclaimed framing and shiplap from OB High. A little bit of history going up my chimney. Warms my heart and my house.

Oh that right your stocks are up 500% if I remember correctly. I guess that one share of a marijuana company did well. You like to buy the stock in a company that you use to get over the fact you missed the housing rise.

Enjoy that Stove. The owner made a few hundred grand on the unit so ya he can afford to give you a 400 dollar stove.

Jeez gwac, never heard of investing ? Made great coin this year on my savings.

How about the depreciation of 10’s of thousands of $$ on your two houses when prices start to really tank soon ? I’m paying several hundred less than the new suites plus hundreds if not more saved not having to throw down the bottomless shitter every time something breaks down. I just pick up the phone.

My stove broke down last year, I picked up the phone and a new one was delivered within an hour. All shiny and new with digital everything. Woulda cost me hundreds. Same with the fridge a year or so before that.

Better go for a ride or chop some wood dude, these price slashes are getting to you. I’m getting concerned. 😉

Hawk

What are you going to do with that appreciation from that unit you are renting. Oh that is right it is the owner that gets that. You just flush your rent money down the drain in a monthly swoosh.

What are you talking about gwac ? I get prime ocean views with the sea breeze streaming through my windows 24/7 whenever I want and all the free heat, all for over half the cost of a mortgage and hidden costs. No need to bust my ass chopping wood and polluting the environment.

Talking like an arrogant owner is the problem in this town. The coming disorderly correction will take care of that. As Steve Saretsky pointed out, it’s not going to end well.

Home equity lines of credit now make up 12% of Canadian GDP. Triple the United States back in 2007

http://vancitycondoguide.com/canadian-economy-unhealthy-addiction-to-real-estate/

Bingo

That is amazing. I love it too. I have an enviro Boston 1700 insert made on the island. Heats the whole house with the fan that came with it. I have a Kodiak 1200 at the lake with a fan. Heats the place nicely also.

Barrister the trees are from up island. No tree huggers there. You can cut at will.

Bingo:

You better hide right now. You are a murder of trees. If the politically correct find out they will burn your house down with you in it.That way they get to enjoy a fire while also feeling morally superior.

Yep Hawk. I own the 2 same homes. Both I love both I am keeping. When The summer roles around and I am in the lake I will be thinking of you in your hot sweaty apartment. Thank god I did not listen to the likes of you or I would not be able to afford that place today.

@gwac

I’ve got a wood insert too. Love it. They have some nice modern ones now (no dated brass or big blower box hanging off).

We have a ducted heat pump system on the main, so I turn the fans on and it draws the heat throughout that floor. It’s amazing how little wood can heat the place for a day. When I had a bunch of cherry, I could damp the fire down for the night then start a new one with the embers the next morning.

If I were doing a new build I’d get a standalone stove (some really cool modern ones available now). No need for a brick chimney with the 0 clearance pipes. I love a wood fire though, so even if it wouldn’t pay for itself I’d get one. Gas is nice for comfort, but it’s not the same.

Of course gwac, it’s always ” but it needs $150K renos” or “it was priced too high” bullshit excuse. Didn’t stop how many from paying $200K to $300K over asking in Oak Bay a mere few months ago that needed similar renos ?

You sound like a guy who just bought another place last week,overpaid and got the bad news the market is finally changing to the downside in a big way to come and can’t accept it.

Thanks for the numbers Marko. The November numbers seem to almost the same as last year. Ony the inventory is a lot less.

Hawk

That place needs 150k in renos. Check out the kitchen it looks like it is from the 1800`s. Like I said because someone lowers their price from an unrealistic level does not mean a crash. That was a 600k house 3 years ago. Keep on dreaming. Life in a apartment will continue for you….Keep on looking out your window and saying if only I was not so foolish I could live in one of those houses.

Bull and bear talk featuring Hawk vs Gwac.

I wish you guys did this more often!

😀

“Anyone feel like telling me what 2319 Central Ave sold for?

$809,000. ”

“There is nothing right now pointing to a crash or price correction in Victoria.”

Wow, gwac. That’s approx $100K plus price drop from the original asking price, which was then reduced and still went $60K under in prime Oak Bay. So much for your stable market theory. Don’t forget to click your heels together.

Hawk

and it continues. The market is crashing because a few people lowered their over priced homes. I assume we will see a lower median price by 10% this month. NOT.

This island does not behave like Toronto or Van. Never has never will. While other markets were surging it did nothing for 6 years. There is nothing right now pointing to a crash or price correction in Victoria.

“Your posts are wishful thinking and not reality in Victoria right now.”

OMG gwac, you can’t just skim by my posts and have to react to everyone now ? Is your name Donald ? Grow some skin.

Again, 2 substantial price cuts in Oak Bay in 2 weeks, and a well known high end property that’s been in the news for 10 years selling at near 20% off last buy price 11 months ago that was once listed for $19 million, now $6.8 million and that’s wishful thinking ?

As a multiple property owner you must be getting very nervous to keep attacking important trend changing news in Victoria.

I installed a wood insert 7 years ago. Bills with baseboards before in the oct to Feb were 500 dollars a months. 200 a month 3000 sq house now those months. Insert cost me 3k. So payback was aprox 2 years. I love having a fire going that is safe so that was an extra benefit. I go through 2 cords a year which is free for me and I clean my own chimney.

Alternate home energy saving strategy is slippers, jacket, and really warm blankets. Our house is 3,200 sq ft and >100 years old with all but two windows single pane. There have been some updates so the roof is insulated and I know at least some of the upstairs walls have cellulose insulation with fiberglass insulation downstairs. Everything runs off electricity (heating is cheap baseboards with the upstairs having horrible bimetallic strip thermostats buit in) and last year our total bill was $1,780. We are a family of four and we now have two students full time so with six of us we will be closer to $2,200 this year.

Hawk

OMG you cannot help yourself.

BTW I said we are in a price stable market in Victoria. How is that pumping. Fact is any nice house that is price right will go in days in Victoria. There is 1840 listings, 1000 to 1500 less than 2015 and 3200 less listings than 5 years ago. Median price is up substantially from a year ago. Those are facts. Your posts are wishful thinking and not reality in Victoria right now.

Anyone feel like telling me what 2319 Central Ave sold for?

$809,000. If you email me I can set you up on a PCS account so you don’t have to ask in the future 🙂

So is this another auction that went south: 3641 Savannah Ave, listed at $299,900 the listing said “OFFERS TO START AT 299,900! THIS IS AN AUCTION!” apparently the auction was to start at 8:00PM Sunday. Today the listing shows it is cancelled. Anyone know what happened?

Sure gwac, the last 9 months of posting every grossly over asking sale, but never under asking while he tries to flog his $1.39 million box on Bank St. No bias there at all. You need a bottle of chill pills for the coming “disorderly” down turn.

Last time I looked a $55K price slash in Oak Bay is big news on this blog with all these tweed curtain obsessors. Not to mention the high end price cuts that are now taking a major beatdown. Nope, that’s just blah blah blah…. get off the pumper wagon.

http://www.bnn.ca/oecd-warns-canada-at-risk-of-disorderly-housing-correction-1.618243

Bla Bla bla Hawk. Marko has never pumped, only provided what is really going on…..

gwac,

Have a problem with reality ? The same “crap” is what’s happening in the real world idiot. Marko and all the other pumpers can post every day but their happy news is just fine ?

Why should we listen to your same “crap” that houses will never go down with no facts to back it up ? I’m posting real info, so don’t read my posts, or better yet go for a bike ride and de-stress yourself.

Guess you just can’t handle the thought of a “disorderly” housing correction. Get used it, it’s coming, like it is starting to in Vancouver.

Hawk

OMG enough already. Day after day same crap. Victoria is not crashing anytime soon or surging. We have a very stable market price wise. Spring market may be different if no new inventory.

Marko Juras:

I am on board with this theory to an extent. It was difficult to find reliable trades people in 2013-2014 now it’s a total disaster. Not to mention cost, I paid $34,000 to frame my place in 2014 now I have clients paying $55,000-$60,000 for similar homes. It’s nuts.

A very good builder told me to never build a house in a hot market. Unreliable trades and shoddy work. The best home that I ever had built was after the 1994 crash. The builders and trades were crying for work and you could get the best at a real decent price.

Holy shit…batten down the hatches ! More BOC/government intervention possible. No wonder the rich are selling ASAP.

OECD warns Canada at risk of ‘disorderly’ housing correction

“Canada is at risk of a “disorderly” correction in the housing market that could threaten the country’s financial stability, the OECD warned on Monday in its latest global economic outlook.

The risk of a housing correction is most acute in the “over-valued” Vancouver and Toronto markets, the Organisation for Economic Cooperation and Development said, citing the potential difficulty for some debt-ridden households to make mortgage payments if interest rates or unemployment rise.

“Such a correction would reduce residential investment and, through wealth effects, private consumption, and in an extreme case could threaten financial stability,” the OECD said.

The group also said Canada’s federal budget this year gives the Bank of Canada leeway to raise rates to tame financial stability risks.”

http://www.bnn.ca/oecd-warns-canada-at-risk-of-disorderly-housing-correction-1.618243#_gus&_gucid=&_gup=twitter&_gsc=mTwFZbQ

“I am on board with this theory to an extent. It was difficult to find reliable trades people in 2013-2014 now it’s a total disaster.”

Typical market top like in 2007, nothing new there. Trades you do find do shitty work, and have to be fired, just like a couple I know who had to do it recently. Imagine right in the middle of having your place ripped apart and you realize the contractor is an idiot and you’ve been ripped off for thousands.

Anyone feel like telling me what 2319 Central Ave sold for?

Back In January Mike said:

“Vic’s really high end seems to be up up & away now as even Villa Madrona just resold for ~20% more than the buyer paid in 2013. There are some smart flippers out there.”

Looks like there are some real dumb rich people out there as Villa Madrona is up for sale at almost 20% under the price Mike claimed it sold for back in January. Talk about a huge OUCH loss of over $1.2 million before salesman fees.

I guess the rich in Victoria aren’t doing so well after all, and the credit crisis is hitting the deep pockets as I have been predicting. 😉

As the rich go, so does the market. Signs of Vancouver creeping into Victoria. Keep on the blinders Mikey, wouldn’t want to hurt those rose colored glasses.

https://www.realtor.ca/Residential/Single-Family/17043101/670-Lands-End-Rd-North-Saanich-British-Columbia-V8L5K9

Mon Nov 28, 2016:

Nov Nov

2016 2015

Net Unconditional Sales: 528 573

New Listings: 706 747

Active Listings: 1,832 2,952

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Don’t mind Hawk, he’s just upset he didn’t take advice to buy TCK & VicRE a year ago.

But the bears assured me wages aren’t going up 🙂

Yep feels gougy out there. What was your cost to drywall Marco? Got a quote for 36k for 2500 sq house two levels. Roughly $144 per panel. Or 100 man days labour….Not including paint.

“If you want to be an Alpha Bear, at least get the number right. It was org. listed @ $950k, -$55k.”

I stand corrected, couldn’t confirm the old price as the old listing was removed and I’m not glued to all the prices like you bulls are. $55K is even worse considering this is the second price slash in two week in prime entry level Oak Bay.

Funny how the bulls are all putting max selling prices on Oak Bay in a thin market, when a few months ago everyone here was fawning over every question about living close to the school, beach,and local tea shops to justify paying $200K plus over ask in the same area. What a joke.

Just another sign the cracks are showing in this bloated pig of a market.

Haha no problem. The being home lots is a good point. Downstairs resident is retired so home most of the time and that’s where the heat is most expensive (baseboards). And 2015 was partly my wife at home on mat leave too so that $2100/$850 heat is possibly even higher than usual.

Why the price gap?? My theory is Move-in-readiness.

It is a nightmare to find trades now. Buyers are willing to pay premium for not living in a dump after paying $1,000,000 for a house. Even if they have $$$ to do major reno, good luck finish it in a year.

I am on board with this theory to an extent. It was difficult to find reliable trades people in 2013-2014 now it’s a total disaster. Not to mention cost, I paid $34,000 to frame my place in 2014 now I have clients paying $55,000-$60,000 for similar homes. It’s nuts.

I would be totally blown away if this is the actual efficiency of your house (Dasmo is currently at 44 and appears to be trying pretty hard). Was your house built under the new code? If so, don’t you have to supply an energy audit on completion and show that you meet all the requirements

Makes complete common sense when I look at Leo’s $853/year. I have a brand new 2×6” house, he has a 2×4” 40 to 50 year old box. His heatpump is probably 10 years old and he has to heat the entire house versus my 4-zone Fujitsu inverter that allows me to choose what I heat. I have three point multi-lock extrerior doors, he has single point. Add the fact the he is probably home a bit more than I am, etc……Leo not trying to make fun of your home 🙂

My numbers, Leo’s numbers, and Introverts $1,950/year (all in) are all in-line with each other.

As Leo pointed out seems crazy low but it is reality. That is why I am harping on my viewpoint that I just don’t think there is a ton of money on the table to save when comparing new home vs new home passive. Where the difference is 1930s Oak Bay charmer vs new home passive.

I think my house was the code before this one…I had to have the three point doors but HRV wasn’t required at the time. HRV is now a code requirement (if you don’t have forced air).

As for the energy audit haven’t heard of muncipalities requesting this on residential homes. Building a home has already become extremely unaffordable last thing they need to do is add an audit to it all.

If you want to be an Alpha Bear, at least get the number right. It was org. listed @ $950k, -$55k.

This house won’t sell over $850k in 2016 (no idea what will happen in ’17, Trump won!? wut? lol)

Musgrave went for ~$810k, it is a better house/location.

Hawk (and bears), before you think the tide has turned, consider:

Another Mugrave sold for ~$950k over the weekend. Couple houses on Dunlevy sold ~$1.1M. 1710 Beach Dr (3bd, 2400 sq) sold $1.4m

Why the price gap?? My theory is Move-in-readiness.

It is a nightmare to find trades now. Buyers are willing to pay premium for not living in a dump after paying $1,000,000 for a house. Even if they have $$$ to do major reno, good luck finish it in a year.

Only if we have prefab homes here, rental problems will be gone in 6 month. (building a garden suite as easy as order on Amazon + pour a foundation)

Houses can be as energy efficient as we want when they are building in a control environment, with people know what they are doing in an assembly line. Most new builts are cookies cutters anyway, why not just get a prefab?

It’s crazy the support the USA gives EV.

Right now you can get a 2016 w 30kwh brand new well appointed Leaf for around 13.8k after fed state and Nissan discounts!

Now that makes sense. (Ignoring the rediculous exchange rate for a minute).

In so many ways Canada is behind on so many things, it’s really sad as we are supposed to be “better” and “smarter/superior” to everyone else.

Most definitely. I’m assuming 8%/year which I don’t know is accurate or not but gives it about $10k value in 5 years. Our gas car was also depreciating at about that rate so it’s about a wash. There’s two ways to argue depreciation on electric cars (past the initial years), either it will be worse than a gas car because of battery degradation, or it will be less bad, because the car always represents a potential cost savings even with somewhat reduced range. So far after 41,000km and 3 years the battery on this one reads at 95%. I don’t think it will need a replacement in 2021 but truth is no one knows.

~Barrister~”So why bother paying extra bucks for argon since it makes such a small difference. Which was my original point. The basic concept of an energy efficient house is a good idea but at some point it also has to make economic sense”

It makes a 7% difference, which is pretty big when the up-charge is so small (air vs argon there is a very small upcharge).

I will 100% concede that if you are not expecting to live in your (new) house for at least X years (where X can be calculated, but most likely is going to be >7), it does not make economic sense to try and achieve something like the PH standard. This is assuming that people will not pay more for an efficient house (which today is true). I do see that EnerGuide scores are posted on MLS now, if available.

I’ll stop posting on this and let programming return to your regularly scheduled bear vs bull battle.

2417 Hamiota St relisted with a price slash of $35,000 from $930K to $895K. Hmmm…. I thought Oak Bay was the cat’s meow with all their massive investment profits ? I think I hear a bubble popping. 😉

~Marko~“If I am spending less than <$1,000 per year on heating a 4,600 non-passive house I can’t see how I could save more than a $1,000 per year if I had built a passive home with high-spec windows.”

<1000$/yr x 1/.0829$kwh [https://www.bchydro.com/news/conservation/2012/kilowatt-hour-explained.html] = 12062 kwh/yr.

12062 kwh/yr x 1/427.3m^2 = <28kwh/yr m^2.

I would be totally blown away if this is the actual efficiency of your house (Dasmo is currently at 44 and appears to be trying pretty hard). Was your house built under the new code? If so, don’t you have to supply an energy audit on completion and show that you meet all the requirements [http://www.bccodes.ca/BCBC_9%2036%20EnergyEfficiency.pdf]?

~LeoS~”Doing that, I get $853 just for heating/cooling. Which seems crazy low, but them’s the facts.”

Don’t forget that there are many electrical items that are ‘leaking’ heat and helping to heat your home. Cooking, for example, is a big contributor. In PHPP, the modelling software used for passive house, you have to account for the heat output of your day-to-day usage of light bulbs, appliances, occupancy, etc. All of these items are helping to keep you warm (or overheat you in the summer) but wouldn’t typically be thought of as part of your heating bill.

Nice spreadsheet. The only reason it didn’t make sense for us compared to you, was that our second vehicle that we would have sold is a highly sought after expedition vehicle that is currently going up/sideways in value. We barely drive it and since it is “old” our insurance is very cheap on it.

Nice work though, made a lot of sense for you.

The only issue I see is that there will be quite a bit of depreciation on the 2013 model in just a few short years. The battery on those costs $7,000 and no one buying one in 2021 would want to pay near 16k plus an additional $7,000.00 bill on top of that for a well worn used vehicle.

$16k for a 2013 with 40,000km. We don’t drive much but even so it’s cheaper all in (even considering you’re eating the 12% tax on the purchase) than our old car (which we sold) if you keep it for about 3 years or longer. One thing that’s often overlooked is maintenance. The maintenance schedule consists of inspecting stuff and rotating tires.

Yes depreciation is brutal on the new ones, that’s why you don’t buy them new.

Here’s a spreadsheet I put together for analyzing buying a new electric vs gas (second sheet), or replacing your existing gas car with electric (first sheet): https://1drv.ms/x/s!AtGPo4j9IX0ui6RrTLyDSY9parKn9g

Leaf isn’t suitable to be your only car for most people, but perfect as as second car.

2100sqft Gordon Head box. 2015 Gas + Electricity costs of $2113. Heat pump, gas furnace secondary, gas fireplaces, gas hot water, baseboards downstairs. Whole place occupied.

As an estimate for just heating and cooling, I would subtract the base load when there is no heating and cooling.

Doing that, I get $853 just for heating/cooling. Which seems crazy low, but them’s the facts.

I’m building my house for my family so I hope it lasts generations.

Hi SweetHome. Our house is 2100 square feet and heated by a forced-air electric furnace only. All lights have CFL bulbs. We keep good records:

Over the last six years, our average annual BC Hydro cost was $1950, ranging from a low of $1670, in 2010, to a high of $2140, in 2014. Our biggest two-month bill over the last six years was $561 for Jan-Feb 2014.

What is the vintage of your home? You don’t even have the most efficient heating system and yet you are still under $2,000 per year all in.

The Etsy of house flipping?

This is interesting:

https://flipprr.com/

Hi SweetHome. Our house is 2100 square feet and heated by a forced-air electric furnace only. All lights have CFL bulbs. We keep good records:

Over the last six years, our average annual BC Hydro cost was $1950, ranging from a low of $1670, in 2010, to a high of $2140, in 2014. Our biggest two-month bill over the last six years was $561 for Jan-Feb 2014.

Keep in mind, BC Hydro rates have been steadily rising over the past few years and will continue to do so, as the Crown corporation is both deeply in debt (in large part because it buys power from private producers and resells it at a loss) and undertaking massive infrastructure projects, including Site C and the Northwest transmission line.

7 flat years while Vancouver soared meant no one thought it’s a great deal AG until they wanted to cash out for the next flip. Bias opinions from those up to their neck in leverage are getting better by the post. 😉

7 flat years is actually a significant bear market. Because obviously a “flat” real estate market is declining in real terms. Keep trying Hawk…

This is why the West Coast carries a price premium:

http://tinyurl.com/gscbeca

“Er, no. There is high demand for low inventory in this area and this has been fairly consistent over the years that I have followed the market closely and even in a down market this area has held its value better than other areas.”

Er, yes. This market hasn’t seen a real downdraft in the last 15 years because of Harper’s market intervention of 35 and 40 year mortgages combined with emergency interest rates. What you call the norm is a propped up market now being reigned in by Justin’s crew with more to come and a BC election coming with much more fuel to tank prices. With the Trump gong show out of control you will have volatile markets like you’ve never seen.

You’ve only been in the “one way up” market Totoro, and never experienced a real bear market. 7 flat years doesn’t justify anything, other than hot money from Vancouver found a new place to rape and pillage and pump the FOMO to pile in. Toss in the Don Campbell real estate HGTV pumpers etc, heavy on Victoria of late after he cost thousands of people big money buying Calgary at the top.

The astronomical debt levels and interest changes to the upside is about to rear it’s ugly result.

Er, no. There is high demand for low inventory in this area and this has been fairly consistent over the years that I have followed the market closely and even in a down market this area has held its value better than other areas.

I believe Hawk that you are consistently underestimating the asset base of those who buy higher end properties and equating the foreign investment phenomena/astronomical price increases in Vancouver with price gains in Victoria which were not based on this and which have gone up pretty much as expected after taking into account a seven-year flat period.

I would agree that the very top end of the market in Oak Bay, like 3million plus, is more prone to factors that affect investment speculation. People in really high asset brackets do often view these properties as investments – where else can you make 120k tax-free in a year on average on a 600k 20% down payment plus annual expenses investment? However, if they have to sell in a down market that can turn into big losses.

“Most Oak Bay folks would benefit from higher rates as their investments would see much higher returns. ”

Man that’s a lot of assumptions without any facts to back it up. Just because you live in Oak Bay has no bearing on if you’re invested in the stock market or have paid off most/or all of your mortgage.

Most seniors still there never invested in the markets and hoard cash to pay the taxes. They bought 50 to 60 years ago when it didn’t break the bank to buy in Oak Bay and joe average lived there. The new breed just bring larger debts just like West Van and any other high end area.

“Twenty-five out of 26 times when interest rates went up, home prices went up,” Schwarzman said.”

Guess that means 25 out of 27 as the US bubble has peaked again as well as Canada. Not many left in the pool left to buy who can afford to buy as CMHC just cut out half the new buyer pool.

:large

:large

Leo, how much was your leaf and what year?

They only seem to make real sense if they are near 15k for a 2 year old model.

The resale value is horrible with battery depletion.

We looked seriously into a Leaf, but just the initial tax and depreciation alone was around 6 years of gas bills on our older SUV.

We kept the SUV

Most Oak Bay folks would benefit from higher rates as their investments would see much higher returns. Besides, even if we assume interest rates are up from here, we should probably listen to smart people on what that would mean for home prices.

“Twenty-five out of 26 times when interest rates went up, home prices went up,” Schwarzman said.

VicRenter:

I bought in 2013 but it was not brilliant forecasting on my part. Just sheer luck and the right house dropped its asking by almost a million. I dont pretend to have a crystal ball but if I had to guess i suspect that prices are going to plateau over the next couple of years. There might be a small drop but I have been wrong more often than not.

I also suspect that a lot of the houses in Oak Bay have little or no mortgage. A disproportionate number of the buyers where coming from Vancouver in the last year and, at least for Oak Bay, these were often all cash sales. Would there be a few people in trouble if interest rates rose a couple of points. Probably, but a much smaller percentage than in other parts of the city.

Dear Sweethome:

You probably wont be able to get a real handle on your heating bill until the summer. I am assuming your washer dryer and hot water tank as well as your kitchen appliances are all electric as well. Need to compare a summer bill with a winter bill. It is a rough calculation and does not account for the extra lighting in the winter.

Personally, I tried to convince my wife to shave her head to save money on the hairdryer but that did not go over very well.

This seems very low.

With a ductless 4 zone system you just heat what you are using. At night instead of heating the whole house just the 1 zone is running. The main floor we pretty heat with the gas fireplace in the winter time given the price of gas.

Additionally there have been a lot of changes in recent years to minimum code even for your run of the mill spec home. These days front doors are three point multi-lock which isn’t just great for security but also increase weather-strip performance and efficiency. One of the many examples of increased code requirements.

“In Oak Bay I am guessing very few people have purchased within 20% of current prices. You have a lot of people that paid only 10 to 50% of what current prices are; therefore, they would be without a mortgage or an extremely small one at that.”

With such low sales in Oak Bay you won’t need many in trouble to cause a downdraft. $400K to $800K slashes in Vancouver in the average to high end hoods being the norm only fuel the reality of what’s to come. Keep spinning the narrative.

“Where do I charge a Benz in 30 minutes? It’s not a simple as saying here as an EV.”

I guess one has 3 years to worry about it….that took some thinking. Plus Benz is rolling out their new home solar systems next month with car charging systems to follow.

You think Benz future charging system isn’t going to be a universal system ? Might want to educate yourself versus staying in the Tesla cult bubble.

“Mercedes-Benz energy storage products will enter the North-American market early 2017, starting with the launch of a modular residential product. Each battery module has an energy content of 2.5 kWh that can be combined up to 20 kWh and used in various applications such as back-up power and solar self-consumption. These will be sold through various channel partners. The systems will be followed by larger energy storage systems for commercial and industrial customers. Mercedes-Benz Energy Americas will be working directly with a very diverse customer base to offer tailored solutions starting later in 2017. “ Mercedes Benz Energy is uniquely positioned to not only offer solutions to the energy and storage market that will help utilities, businesses and home-owners to save costs and solve needs, however also combine the advantages of electric vehicles and energy solutions into one holistic platform”, says Boris von Bormann, CEO Mercedes-Benz Energy Americas, LLC.”

http://media.daimler.com/marsMediaSite/en/instance/ko/Foundation-of-Mercedes-Benz-Energy-Americas-LLC-Mercedes-Ben.xhtml?oid=14420414

I think areas like Happy Valley would be at much greater risk for increased rates as everything has been built since 2008; therefore, everyone has purchased within 20% of current prices.

In Oak Bay I am guessing very few people have purchased within 20% of current prices. You have a lot of people that paid only 10 to 50% of what current prices are; therefore, they would be without a mortgage or an extremely small one at that.

but, now it has been 10 years of rates are going up any day. Not saying it isn’t going to happen but it will be getting to the point where anyone with any sort of financial discipline will have had enough time to pay off their mortgage all within an extremely low interest environment.

I guess as an “almost” Tesla sales rep you have inside info that the public doesn’t have? Most people who plunk down cash for a Tesla depended on what Tesla told the public, not hearsay.

I know, most people pay 6%100k+3%balance (commissions may vary) for their home to go in a bidding war over the course of a few days because they are told 6+3 will magically improve marketing and exposure 🙂

It’s not about “inside info,” it’s all quite simple common sense.

Model X was two years behind schedule to production. The Model 3 is not as complex but odds are it will be 6 months late. It’s not exactly the equivalent of assembling Yugos.

The Model S goes from $88,700 to over $200,000. Only difference being slightly larger battery, one (not both) of the electric motors is slightly larger, and the rest is software. If you spend an extra $100,000 on a Model S it costs Tesla <$10,000 more to produce that car. Same concept will apply to Model 3 and they will be short on cash. Obviously they will just pump the very highly optioned cars for the first 12 months.

Ramp in production doesn’t happen overnight.

Sure Benz will have an EV in 2020 but it’s not as simple as rolling one out. I went to Portland a few weeks ago and used the Tesla supercharger to go between Port Angeles and Portland. Where do I charge a Benz in 30 minutes? It’s not a simple as saying here as an EV.

I don’t think this can be true. In 2015 there were 325 sales of SFHs in OB total.

40% of homeowners have no mortgage at all. That leaves the remaining 60% of houses with some mortgage, but in a given year only 30% of all buyers, and only a very small percentage of the housing stock turns over in any year, are first-time buyers and this is probably lower in OB and for higher value homes in other areas of the core. My guess would be that there are 50-70 first time buyers of SFHs in OB in a year – maybe less as prices rise – and these would likely be high income professionals or those who have a guarantor and/or assistance with down payment.

I’d say most home owners in OB could afford an interest hike and there are not “hundreds of young families in OB” at risk if rates rise. Not to mention a rise only affects those buying with a variable mortgage or those renewing at end of term. Plus prices have risen in OB by 30% in a year so… so even those first-time buyers who bought last year have at least a $150k cushion now.

Yes, in the 80s prices dropped and rates rose astronomically. It could happen again, but among those I know in OB who owned during this period the only people that I knew that had to sell were a couple who were going through a divorce. I’m not saying that would be the case today if rates rose to double digits and prices fell, but that also seems unlikely to re-occur in the near future.

Yeah, as Dasmo points out, a 30% drop would put us back to last year. Shoulda bought in 2013. So depressing.

“I suspect that higher interest rates would have a major impact on the West shore; not so much in Oak Bay were a high portion of the sales were for cash.”

That’s highly debatable Barrister. Classifying Oak Bay as all of Victoria and Westshore as some other land of maxed out borrowers is not reality. The maxed out are in the core.

There are hundreds of young families in Oak Bay that just happen to have the income to pay the big mortgage or had a decent down payment to keep it within control in a low interest environment.

This is the first serious interest rate hikes to come in a decade with household debt out of control. This is a whole new ball game.

“How is this news? Anyone with any common sense knows they won’t be seen their Model 3 in Victoria until 2019 at the earliest.”

Let’s see now, it came out 4 days ago by a long time Tesla analyst, and the article quoted Tesla saying:

“Tesla says that the Model 3 will enter production in mid-2017 with volume production toward the end of the year.”

4 days ago Tesla sent out a note to buyers. Did you not get one or how is a note 4 days ago delaying delivery not news ?

“We continue to forecast a Model 3 launch at the very end of 2018 (more than 1 year later than company target) with 60k units in 2019 and 130k units in 2020.”

I guess it means US buyers will now see theirs a year late in 2019, and Victoria won’t see their’s til 2020 when Benz comes out with their first model. Common sense comes from reading the article and the facts stated, not making them up out of thin air.

I guess as an “almost” Tesla sales rep you have inside info that the public doesn’t have? Most people who plunk down cash for a Tesla depended on what Tesla told the public, not hearsay.

I have 3000 sqft and it cost 2000 last year. We don’t heat the basement though so we really only heat 1800sq ft. My estimate at the moment is about $450

“If I am spending less than <$1,000 per year on heating a 4,600 non-passive house I can’t see how I could save more than a $1,000 per year if I had built a passive home with high-spec windows.”

This seems very low. Does anyone with electric heat want to volunteer their Hydro costs? I must say I am getting an unpleasant surprise with the Hydro bill on my recently purchased house. I only had experience with an apartment before.

I thought I was being careful with turning thermostats down and wearing extra sweaters, but the estimate based on the past few days is $650 for two months, and we haven’t even hit the coldest time of year. Of course that includes all electricity, not just heating, and I do like to open some windows daily. I am wondering how that compares to other houses in the 2000-2500 sq.ft. range?

Who knows, they are getting better at the production game, but yes late 2018 is probably realistic.

In the meantime I bought a Leaf to tide me over. The used ones coming up from the US actually make economic sense.

Anyone know what 2319 Central Ave sold for?

@Hawk. That’s kind of funny considering they’re going to produce over 80 thousand model S’s and X’s this year. Basically they’re saying in 3 years they add no more capacity, when that’s all they’re currently trying to do.

The irony is 30% off of today’s prices will put them where they were last year…. Not that I would recommend buying now…. Passive house vs condos from an environmental perspective is not the point. Condos can also be built to a passive house standard. Needing to build a house to a high standard is needed anyway. If not for energy efficiency then to prevent moisture from forming inside your walls and creating a mould nest.

Buy going with the passive house builder you don’t have to write the HPO exam. Check and mate.

Hawk:

Perhaps a bit extreme. Not all of us will be either bankrupt or in dire straits if interest rates go up or house prices drop.Cant speak for others but it would not have a major impact on my lifestyle. On the other hand the bank is not my partner in life.

I suspect that higher interest rates would have a major impact on the West shore; not so much in Oak Bay were a high portion of the sales were for cash.

Hope none of you booked your Tesla for next year, it’s gonna be a bit late.

Tesla Model 3 will not arrive until very end of 2018

How is this news? Anyone with any common sense knows they won’t be seen their Model 3 in Victoria until 2019 at the earliest.

1/Tesla has an extensive history of being late with products. Whatever they are saying add 6 months minimum to production.

2/ The 1st year or more of production priority will be given to fully optioned Model 3s to drive corporate margins; therefore, if you order the stripped down “$35,000 US” version add another year or so worth of waiting.

3/ Tesla will focus on shipping out the US orders first.

4/ “$35,000 US” will likely turn into $39,900 US and apply our exchange rate = $54k. Add a few options and bigger battery and it will be 70k CND. BC Government will probably run out of rebate funding.

Hope none of you booked your Tesla for next year, it’s gonna be a bit late.

Tesla Model 3 will not arrive until very end of 2018

“He is not only forecasting the vehicle being late to market by over a year, but he is also predicting volumes to be significantly lower than what Tesla is forecasting. CEO Elon Musk has been talking about as many as 400,000 Model 3 sedans being produced in 2018 – compared to Jonas’ 60,000 in 2019.

It would be a major disappointment for the over 400,000 reservation holders.

Jonas has a good track record on Tesla and he was one of the rare analysts to have called the stock a ‘Buy’ before the massive stock price surge in 2013”

https://electrek.co/2016/11/23/tesla-model-3-late-adam-jonas-morgan-stanley/

Introvert: So you basically think there should be a law that ensures one’s hometown stays “affordable” in perpetuity?

Hey Introvert, I believe that law is “Economics”. The push to sell everyone a car and/or a home, based on monthly payments, is short term thinking but has ultimately been effective in selling a brand new generation into debt.

Sales people are predictable and I can’t blame them for pushing their products. The absolute lack of transparency and media balance, on the way up the ladder has been astounding.

The slide down that same ladder is going to be breathtaking and heartbreaking.

Best of luck to all.

“I think all Hawk was saying, is that just because you and a lot of people who live here think it’s great, doesn’t mean everyone else does. It all depends on what you like in a city or place.”

Thanks Bman for explaining to the cult what they can’t read. That is all I was saying. They’re too busy spinning the “narrative” as per the Steve Saretsky article.

Let’s face it, if the market crashes as rates rise they will all be bankrupt or in dire straits at best. I would be spinning it like a mad bastard too if I was them, so lets call it what it is.

BTW, Mike’s lame Haultain hard luck sale, which was the only one in town was not the norm. It’s been shown many times over but Mike’s narrative is to BS.

Crafting The Narrative

http://vancitycondoguide.com/crafting-the-narrative/

“Hawk: How far would you have to see the market fall before you’d buy? In other words, what would you consider a “deal”? I ask as someone who has also long been waiting for the perfect opportunity in the Victoria market but hasn’t yet seen it.”

VicRenter,

30% to 40%% off I would consider a deal, just like in past market crashes. The “cult” on here will always laugh (very nervously) while Vancouver sets the table because they have the most to lose, and most have never seen a real bear market.

Patience is the word that can’t be over stated at market tops as they play out over months. Victoria is behind Vancouver by 6 months and the 60% drop in sales is now beginning to show it.

The “cult” doesn’t want to admit Vancouver is in BC, let alone Canada. Booms always burn out no matter how many retirees, ex-Albertans with no money or jobs move here. Just look at the US crash, we’re not special.

Just look at these charts and ask yourself how long this can go on as Vancouver tanks ?

Canada’s housing bubble makes America’s look tiny

Comparing Canada’s infatuation with real estate against the peak of the U.S. housing bubble yields some disturbing insights

http://www.macleans.ca/economy/economicanalysis/canadas-housing-market-looks-a-lot-like-the-u-s-did-in-2006/

@AG

I complain about Victoria (poor public transit, slow drivers, it can be dull, snobbery, etc.) but overall, I like it, particularly in the summer when I can be outside. Should I pack my bags and leave the core because I don’t blindly love everything about it?

I think all Hawk was saying, is that just because you and a lot of people who live here think it’s great, doesn’t mean everyone else does. It all depends on what you like in a city or place.

So you basically think there should be a law that ensures one’s hometown stays “affordable” in perpetuity?

The lots sold for about $700,000 apiece…

At about 9,000 square feet each, the lots are larger than the Saanich average of 6,000 square feet.

Interestingly enough no suites allowed on these lots.

Tech changes and as anyone with a brain knows the EV/solar home charger industry is still in it’s infancy with lots of room for others to catch up to your man love Elon.

For sure in the next 10 years someone will come out with a better EV than Tesla and then Tesla will have to re-group and raise their game. That is almost a guarantee but with so many players out there saying it will be Benz specifically seems a little optimistic.

Forgot to post this when I read it a week ago:

Former Alberg farm lots [in Gordon Head] fetch $6M; nine of 16 sold

The lots sold for about $700,000 apiece…

At about 9,000 square feet each, the lots are larger than the Saanich average of 6,000 square feet.

http://www.timescolonist.com/news/local/former-alberg-farm-lots-fetch-6m-nine-of-16-sold-1.2942032

Mercedes-Benz achieves fifth record year in a row

Mercedes had a good year as the redesigned C-Class went up against the 8-year old design of the A4 and 3-year old design of the 3 series. Will see how they hold up next year now that Audi has rolled out a bunch of new models.

The long term trend has not been great for Benz with Audi pinching them in terms of market share.

http://www.goodcarbadcar.net/2015/12/bmw-vs-mercedes-vs-audi-usa-auto-sales-stats-2006-2015.html

“It’s funny how the nervous bulls watching Vancouver self destruct try to turn a bear discussion into a “you’re not happy, you better leave” BS. Typical market top comment.”

It’s not a ‘market top’ comment at all. If you genuinely don’t like core Victoria, as seems to be the case despite all your protestations, why don’t you just move away? If you want to buy a place well outside the core anyway, in the areas relatively unaffected by the ramp up in prices, then what are you waiting for? I guess the only downside is you wouldn’t have anything to complain about 🙂

Hawk will never buy. If he was going to, he would have 3 years ago at the bottom, when he could have got a house like the one on Haultain for 33% off what it sold for at the top. If he does buy something it will likely be near the next top in the 2020s, somewhere like Sooke.

I don’t think their stock price would be down ~35% past few years if they were “on a roll for quite a few years now.”

“I want out of the core and will be getting a major deal.”

Hawk: How far would you have to see the market fall before you’d buy? In other words, what would you consider a “deal”? I ask as someone who has also long been waiting for the perfect opportunity in the Victoria market but hasn’t yet seen it.

“More than 500,000 Canadians will become millionaires over the next five years, bank predicts

I think we should all send Trump a thank you card – he’s made us a pile of money lately.

I’m sticking with my Million $ core by 2020 forecast.”

Did the bank predict how many will go bankrupt when they can’t handle the coming higher rates ?

Was just listening to a Vancouver Sun Facebook video yesterday with two credit/bankruptcy guys. Said they are seeing a huge spike in young couples who bought too much house in the last 2 years and despite any gains in value they aren’t able to handle the payments and all the unexpected costs with being a homeowner and are in dire straits.

Sounds like what my buddy’s credit counselor friend said last month that 70% of Victoria borrowers are on the edge of going under. No one wants to talk about their debts to friends or family, we all know that disclosing financial troubles is the worst, next to divorce.

“If you’re not happy in Victoria, then maybe it’s you?”

I love this place AG, but glad I’m mobile for when the downturn comes, I want out of the core and will be getting a major deal.

It’s funny how the nervous bulls watching Vancouver self destruct try to turn a bear discussion into a “you’re not happy, you better leave” BS. Typical market top comment.

The market is over valued like other bubbles and with interest rates rising combined with more government intervention will soon show that in the coming months. Trump is the worst thing that could have ever happened to Vic real estate.

Meanwhile back in the real world, someone in Tsawwassen found out their “best awesome ocean views in the world” aren’t worth what they thought and took a fricking beatdown of $800K. Ouch !

What will happen when Uplands $800K slashes start happening? 😉

:large

:large

FIVRE604 @FIVRE604 Nov 24 Vancouver, British Columbia

1696 Beach Grove Road, Tsawwassen, Waterfront

List price – $2.9M

Sold – $2.1M

“Hawk you are showing your age. Benz doesn’t build the 1978 300c diesel you bought back in the day that ran forever.”

Sorry Marko, diesel sucks, never owned one and never will… and your ignorant age related comment shows your immaturity once again. More mid 50’s guys are more in tune with the new tech than you seem to constantly portray. You’re not an EV expert just because you bought a Tesla and met a couple of big wigs who you’re all enamored with every word they speak.

Tech changes and as anyone with a brain knows the EV/solar home charger industry is still in it’s infancy with lots of room for others to catch up to your man love Elon.

Last time I looked Benz sales have been on a roll for quite a few years now.

Mercedes-Benz achieves fifth record year in a row

https://www.daimler.com/documents/investors/nachrichten/kapitalmarktmeldungen/daimler-ir-release-en-20160108.pdf

I’ll finish this off with I have nothing against forward thinking. I have nothing against passive homes or Teslas/EVs, etc. However, I am not convinced the cost efficiency numbers work quite yet, not to say they won’t in 5 to 15 years. Didn’t buy the Tesla because the numbers make any sense or I think I am a god gift sent to the environment, I bought it for other reasons. If I was to build a passive home it wouldn’t be to save <$1,000/year on heating, it would be for other reasons once again (environment not being one of them, condo for that). Maybe comfort or cool factor or just to try something different.

This is 100% spot-on. No point in doing any of the things I’ve mentioned if you can’t find people to do it right (which is challenging). There are a few builders around town doing good work (Bernhardt, NZ) but most don’t bother because people don’t know better and/or care.

Essentially what you are saying is to build a passive home you need the expertise of a builder who has expertise with passive which right off the bat is a huge jump in cost versus doing an owner-builder (which I did for my non-passive home).

It also makes more sense if you are pretty confident that you will be living in the house for a lot of years. Predicting that is hard, even with a stable job situation people forget that there is a very high divorce rate.

You have to be super confident because there are some things such as high-spec windows where you do not get your money back on re-sale.

The point is, you can try and spin the argument any way you like, but the fact remains that within the scope of an efficient building, your windows and doors are important.

I am not spinning the argument, just giving you real life numbers. If I spending less than <$1,000 per year on heating a 4,600 non-passive house I can’t see how I could save more than a $1,000 per year if I had built a passive home with high-spec windows. You have to compare new to new and I am saying a new non-passive home is fairly efficienct under the new building code. It’s not fair to compare a new passive home to a 4,600 sq/ft 1912 Rockland character special going through $3,000-$4,000 in oil per year.

As far as the environment comments…….this is the Era building downtown. It has 157 units -> http://markojuras.com/2016/08/449900-1407-728-yates-downtown/

My personal house is on a bigger lot than the Era building. Just think of the enviromnetal impact if 157 passive homes/tree clearing/commutting/etc., compared to one building.

It’s like me saying I am environmentally friendly because I drive a Tesla. Compared to the woman driving the Porsche Panamera, yes. Am I really environmentally friendly? No. If I truly was I would have gone with a Nissan Leaf of BMW i3 which consume way less energy per kilometer driven.

Not sure what the problem with the Cordova Bay development is? It is almost all residential which doesn’t cause much in terms of traffic. Just look at Gordon Head, or Songhees where you can barely see a car moving. It’s the Uptown/Costco type stuff that are a traffic nightmare.

That’s not a good thing South, be very careful what you wish for. Victoria is a beautiful little city, rampant development will ruin it. It’s having detrimental effects as we speak.

Yes, I grew up here, so did my children and now my grandchildren. My father grew up here, as did his mother; my paternal grandmother. They’d be sad to see what is happening to our sweet, lovely Victoria. Like I said, be careful what you wish for…

You are ignoring many of the positives of growth such as your children have been able to find jobs here (I assume), during your lifetime two state of an art hospitals has been built (VGH and Jubilee rebuild), a half decent arena has been built so people can enjoy some Elton John coming to town, etc., etc.

Crofton is a sweet little town only 45 minutes away from Victoria where nothing has happened for a 100 years….not sure if I would want to live there.

But building for the rich as most developments like Abstract are doing, is going to come back to haunt them when the market eventually turns and they stop coming like they are in all the major centers of the world.

Have you driven out of the core? There is a ton of building for a middle class but it is in Happy Valley/Westhills/Royal Bay/Sooke/etc., where economics support it.

Technology will change 10 fold by 2020 and you will have an ancient version of a Tesla by then.

What? Benz by 2020 won’t have a car on the road with the range of the 2012 Tesla Model S 85. That is how big the gap is.

Don’t forget that Canada brings in 250,000-300,000 people per year. The population is growing and they need to live somewhere. So the ultimate blame lies with the feds.

If you have problem with development this is where the problem truly is.

Benz represents class and quality, Tesla still has many question marks as to it’s financial abilities to stay afloat.

Hawk you are showing your age. Benz doesn’t build the 1978 300c diesel you bought back in the day that ran forever.

The automotive landscape is completely different. Next time you are in a Tesla take a look at the window switchgear. Then hop into an E-Class Benz, IDENTICAL switchgear because it is sourced from same supplier. Probability of failure on the switchgear? Identical.

Problem with Benz is it can’t attract youthful buyers. BMW and Audi dominate there. BMW is already selling a half decent all electric car as well.

If reliability is super important you buy a Lexus, certainly none of the Germans.

Another Perspective, how is the rest of the World’s Real Estate performing?

Scotia provides some new insight November 2016:

http://www.gbm.scotiabank.com/English/bns_econ/retrends.pdf

Highlights from my perspective:

1/ affordability from 1990 to 2016 Mortgage Debt Ratio, debt servicing is so cheap!

2/ new home construction is @ lower levels than 2000

3/ SFH are lower levels than 2000

4/ immigration hovers around 225K to 270K

5/ Existing home inventory has not been balanced the last 16 years

6/ Less than 15% price increases in all major markets with the exception of TO and Vancouver, we can add Vic to that list

7/ best performing RE markets since 2006, National markets

Country 10 Years

Peru 111.3 %

Sweden 85.8 %

Columbia 80.5 %

India 72.2 %

Australia 50.2%

Canada 43.3 %

Switzerland 39.9 %

Brazil 30.2 %

Mexico 23.6 %

Thailand 23.3 %

I think we should all send Trump a thank you card – he’s made us a pile of money lately.

I’m sticking with my Million $ core by 2020 forecast.

@ Hawk

I’ve lived in quite a few places around the world. I can tell you that Victoria really is awesome. And I’m not alone in thinking that. Just look at the number of tourists that come here, the number of locals that say they are happy living here, and the number of tourists who visit and then staying.

If you’re not happy in Victoria, then maybe it’s you?

This sums up this town. If 11% tanked the US market, it’s just a matter of time til the debt bomb explodes.

Almost half of Canadian homeowners would run into trouble if they lost their jobs, Manulife survey finds

http://business.financialpost.com/personal-finance/debt/almost-half-of-canadian-homeowners-would-run-into-trouble-if-they-lost-their-jobs-manulife-survey-finds

Sweethome,

Almost every place. 😉 I have a friend in Saskatchewan and money he saves he can go to Arizona and other hot spots to get away at the peak cold times. Many folks/relatives from the prairies I’ve met over the years hate driving in this town, or through mountains etc, it freaks them out. They like flat and boring. Victoria/west coast isn’t everyone’s paradise is the point I was trying to make, though people like us find it hard to believe.

Anyone from the east who hasn’t been here for 20 years and thinks of it like the post card city of yesteryear would be blown away at the changes, with the mental health problems on every downtown corner, lack of medical doctors and a transportation system 20 years behind the times. Peak Victoria indeed.

@ Sidekick Spliff: Thanks for the recommendation. It’s a standard 6ft sliding glass door that’s developed a lot of condensation around the frame (not between the panes of glass). All other windows in the house are much newer and fine, so maybe the seal around the outside of the door is gone?

The current slider is aluminum. Is vinyl better in terms of energy efficiency? Approximately how much should a decent but not fancy new slider cost including installation?

Dear Sidekick: