November 14 Market Update and the MLS HPI

Weekly stats update courtesy of the VREB via Marko Juras.

| November 2016 |

Nov

2015

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 123 | 236 |

573

|

||

| New Listings | 158 | 299 |

747

|

||

| Active Listings | 1849 | 1834 |

2952

|

||

| Sales to New Listings | 78% | 79% |

77%

|

||

| Sales Projection | 578 | ||||

| Months of Inventory |

5.15 |

||||

Months of inventory trending upward but that is fairly normal this time of year.

Matching last year just about perfectly in terms of sales with 40% less inventory on the market. It is going to be a miserable time for buyers at least until the spring. There are many people waiting on the sidelines wanting to upgrade or downgrade but with nothing to buy there isn’t any point and putting the property on the market.

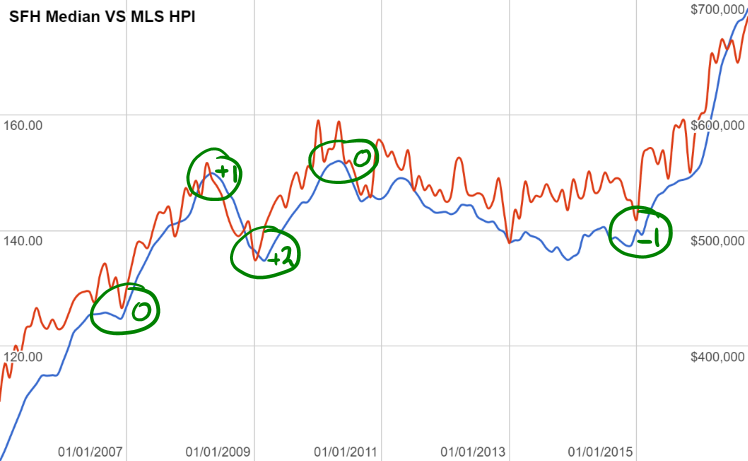

On to another topic. In Vancouver we have seen that the average and median prices took a tumble while the HPI continued to increase in the summer. Only in the past 3 months has the HPI turned around, and Vancouver agent Steve Saretsky contends that there is about a 3 to 4 month lag in the HPI compared to average and median prices. Is that true in general? Let’s take a look at the last few turning points in the Victoria market.

Overall I don’t see convincing evidence for systemic lag in the HPI compared to median prices. Often it turns at the same time as the medians, and sometimes it’s a month or two behind or ahead. The phenomena we see in Vancouver is likely more due to extreme changes in the sales mix. When the foreign buyers tax was introduced it decimated the high end sales and caused a plunge in the average sale prices without affecting the benchmark very much. Now a few months later those effects are trickling down to lower priced houses and the benchmark is trending downwards as well. We’ll see how long the downwards trend can last.

New post: The double edged sword of increased regulation in real estate https://househuntvictoria.ca/2016/11/20/the-double-edged-sword-of-increased-regulation/

BTW AG, how do you figure Trump is good for tech in BC when he rips up NAFTA? The tech industry doesn’t agree with you. It’s going to cause a shit storm.

http://www.itworldcanada.com/article/what-donald-trumps-surprise-election-win-means-for-canadas-tech-sector/388270

AG,

I’m getting concerned you’re spending too much time on here and responding within minutes to my posts. 😉

As I said, being a rich bastard must be boring as hell if you have to hang out here all day trying to debunk the beginning of a serious correction with the multiple red flags flapping under your nose.

How’s the crash going bears? Is it still just around the corner?

A sample Hawk post – “The retail price for watermelons has dropped 12% in Ecuador. Just another sign of impending doom in the Victoria real estate market. The financial stresses affecting all asset classes across the world are now undeniable, and central banks have little ammunition left to cope with it. Watermelons today – Oak Bay houses tomorrow. First sign of the correction.”

“As Trump kills the tech market”

That is highly unlikely

If it did happen, it would result in more tech jobs coming to BC.

Got any more random doom-and-gloom generalizations for us?

Time to scratch Cordova Bay off the buy list. The congestion will be brutal during building and after. Will turn into another Oak Bay Ave with all the old biddies in goggles backing up traffic for blocks.

As Trump kills the tech market I’m sure we’ll find out all those “secret” jobs as rentals increase like they are starting too now. First sign of the correction.

Yes, my one tip is that if you can afford to (including an interest rate increase and repairs) and want to, buy. There is no crystal ball and only the deal of the day. In an appreciation market like ours the buyers have who can hold have done way better than renters long-term. Life is too short to wait 10 years in hopes of a crash.

Looks like some big changes are afoot in quiet Cordova Bay. A nice little feature in today’s Times Colonist:

The changing face of Cordova Bay

http://www.timescolonist.com/news/local/the-changing-face-of-cordova-bay-1.2961956

B.C. tech sector growing so fast it’s hard to measure size of industry

http://www.theglobeandmail.com/news/british-columbia/bc-tech-sector-growing-so-fast-its-hard-to-measure-size-of-industry/article32953219/

The tech sector in Vancouver, Victoria and Kelowna is growing so fast that industry associations and leasing agencies are scrambling to define its size and component parts.

The newest effort comes from Colliers International in Vancouver, which has calculated that tech now accounts for 14 per cent of all office space in the Lower Mainland and 40 per cent of current demand for new office space.

With 75,000 employees, the sector is now bigger than oil and gas, forestry and mining-related activity in the region.

In Victoria, tech companies now occupy 17 per cent of all office space; in Kelowna, 10 per cent.

@ JimmyRickLang

That is why timing the market is so dangerous/difficult. No one knows what is going happen to real estate here, or to the financial markets, or to interest rates, or to the price of any other asset. We can all make predictions and the majority of us are certain to be wrong.

@ CS

It’s all very well making a bearish/bullish call and then saying “I would have been right, if it hadn’t been for X& Y.” You don’t get any prizes for that.

Basically, if you need a house, and you can afford it without stretching yourself, buy a house.

@JimmyRickLang

As one named among the guilty, or at least the incompetent forecasters, here’s my excuse.

First, we live in a world of endless monetary inflation. So any anticipated market downturn has to be viewed in the context of a generally rising trend in prices.

But that hardly explains this: 3705 Crestview, an 1833 square foot, 1950’s bungalow, assessed at $868,000 and offered at $2,380,000, or 274% of asssessed value.

https://www.realtor.ca/Residential/Single-Family/17595414/3705-Crestview-Rd-Victoria-British-Columbia-V8P5L5

True, it’s been nicely renovated, but renovations don’t cost millions, do they. So yes, unless the vendors of that particular house have gone nuts, there is something to explain.

My assumption had been that the market was being allowed to heat up to prop the economy going into the Federal election, but that the Feds would put the brakes on right after the election to prevent the market going ballistic. Instead, the liberals allowed things to drift until it was too late.

But, look on the bright side. If we have a crash now it could be a doozy.

@ Introvert

Re: Happy people live close to where they work.

That all depends. If your’re lucky and live in, say, Fairfield and work at the Parliament buildings, then you’re probably happy to have the option of walking to work across the park. Unfortunately, many work far from anywhere they’d like to live.

And the truth is, lots of people really like to drive. What they don’t like though is congestion. What they want is for the government to spend vast amounts on fine multi-lane highways by which they can commute at high speed, while playing their iPod or listening to the news.

What we need, therefore, if we want to make for a more energy efficient civilization, is to spend nothing on highways so that every commute is a hideous crawl, while spending the money saved on highways to improve the urban environment of those who live close to where they work.

“In fact, at this point it is simply a matter of preserving assets for the next generation.”

Where’s the fun in that? 🙂

Yeah I am retired also, was a government lawyer stock trader.

This whole house of cards is gonna BURN sell sell sell! Hide yo wife hide yo kids, this is going to burn tomorrow!

I am retired and should have grandkids and travel and a good life, but no, I post all day on a Doomer blog spouting literal bear keywords and link to shady websites.

[this is the last of your nonsense that I'm letting through. Contribute or leave. - admin]oopswediditagain,

I checked out the BIS report you’re quoting. And you fail to mention that Canada’s ‘credit to GDP gap’ actually improved from 15.6 last year. So you could say that Canada is now considerably less likely to experience a financial crisis that it was a year ago.

The credit to GDP gap is also a fairly suspect measure that involves generating trend lines and judging how far from them we have deviated. It looks like an interesting stat, but certainly not one that could predict an imminent housing bust. And the BIS, after all, has a long history of getting things absolutely wrong at virtually every turn.

We can only hope the government starts to raise the interests rates slowly so the pain is spread out.

I think minimum 10% down payment should also be instituted by the government across the board, not just 500k+ they introduced earlier this year which I completely keep forgetting about.

throw in a few dentists and the occasional lawyer

Haven’t had too many lawyers. Salary for lawyers, especially younger ones, seems to be really poor in Victoria.

I tried to time the market by listening to y’all these last 10 years, and watched as prices rose for no reason.

wow…..February 9th, 2017 will mark the 10 year anniversary.

That was very interesting about the doctors buying in the core (throw in a few dentists and the occasional lawyer). What you are pointing out makes total sense Marko. But it is good to get it first hand from your experience.

Dear Opps:

Have to agree with you that time is the most precious commodity I also agree that as you get older and comfortable making money becomes less of a concern, In fact, at this point it is simply a matter of preserving assets for the next generation.

We can only hope the government starts to raise the interests rates slowly so the pain is spread out. Hard to tell the voters that the stream of free cash is ending and now you have to pay. But I dont want to think about what occurs if rates ever approached the historical norm of six percent.I am not being a bear on the real estate market but I am looking at the math.

Read an interesting article that the vast majority, something like over 85% of the people in Victoria, in the Tech center are earning less than 70K and a lot of those are under 50k. Don’t know the accuracy of this figure but if true then the tech center is a lot less important than we are lead to believe.

Sounds legit. People keep referencing some sort of average and trying to correlate to SFHs in the core. The average family is not buying in the core. Looking at the last 10 sales I’ve personally represented the buyer(s) in either Fairfield or Oak Bay in 5 transactions at least one buyer, if couple, was a medical doctor.

It’s not the 70k person buying, it’s the person that has ten 70k people working for them that’s making 250k/year.

The bulls want to believe things can continue for obvious reasons and the bears want to believe things will crash for the sake of affordability… getting into the market.

It appears that Barrister and I are in somewhat similar positions albeit I’m not looking for an investment in real estate at this time.

Being comfortably retired takes away a lot of incentive to “make more money”. Time is the consequence of aging and money doesn’t buy that.

Pay attention to the sign posts. I don’t want to contemplate how many 50+ year old people are hoping real estate is their retirement.

Good luck to all.

http://wolfstreet.com/2016/09/23/bis-oecd-warn-on-canadian-housing-bubble-debt-see-no-exit/

The country with the highest credit-to-GDP gap is China (30.1), and the second highest is Canada (12.1). When it comes to debt creation, it’s not a good idea to be mentioned in the same breath with China. Turkey (9.6) is next in line. Then Mexico (8.8). And Brazil (4.6). Oh, and Australia (4.4)! So housing-bubble Canada is in excellent company!

The only saving grace is the permanently near-zero-interest-rate environment. Because that’s what it takes to keep this thing from deflating, according to the BIS, and even then there are “concerns.” But these countries, particularly Canada, are going to be in trouble when rates rise even a little.

So have central banks painted themselves and their entire bailiwicks into a corner with their ingenious emergency policies that have been dragging on for eight years? You bet. Is there a way out? Nope. Not a good one, at least. It’s just a question of when and how – and who gets to pay.

Dear AG:

You are right, I am neither a bull or a bear. Since my wife started using my crystal ball for a paperweight, I tend to avoid predictions. Like you I own my house mortgage free and I cant see selling it in my lifetime or for that matter my wife’s lifetime.

Like you, I have also diversified primarily with a view to the grandchilds. But, I would not mind picking up another investment on the island if the right property appears.

Investing wisely generally means being neither a bear or a bull. Of coarse, one cannot account for Black swain events. If Switzerland invades Lichtenstein that would be rather annoying.

AG, my peace of mind is just awesome thanks for asking. Your wealth can be devestated in a global recession no matter what currency.

Friend of mine knew a couple of multi millionaires a few years ago. One triple digit, the other double digit.Both went under within less than a year of each other. They thought they were all good too across various currencies/businesses/investments, until they weren’t. Could you imagine losing $100 million ? Yike.

Trump factor is massive in the coming months. If he can’t stomach an SNL skit, what’s he going to do to world markets. Escalator up, elevator down as they say.

We were at Goldstream Provincial Park yesterday where we met a newly retired couple who moved here from Ottawa. So probably “local buyers.”

http://i.imgur.com/48rWTap.jpg

The other Highway of Tears: the Colwood Crawl.

Got it. Thanks, Leo.

It’s tough to find any good news for prospective purchasers these days. Unless you have a substantial down payment of a couple hundred thousand dollars you are shut out of the detached housing market in the Victoria Core. That is a big chunk of the buying population.

For a young family where a condominium is a joke to suggest, that leaves the Westshore. But prices have been increasing in Langford and Colwood too. The typical home has increased from$489,500 last year to $542,750 this year. Of course you get a near home of some 2,000 finished square feet for that price. The equivalent home in Gordon head would be around $850,000.

$300,000 is a very big spread between the two neighborhoods for similar homes in age, floor area and lot size. Most of the spread happened this year when a typical house in Saanich and Victoria went from $640,000 to $780,000. Double the appreciation rate to that of Langford.

It’s even more dramatic when you look at how little land costs have changed in Langford and Colwood from the year before when the median price for a lot went from$291,000 to $314,000. In Victoria and Saanich East the median price for a lot went from$424,000 to $555,000.

The disparity between the two areas just ballooned this year. To anyone than owns a calculator, you can see that this disparity can not continue into the future. The neighborhoods have to re-balance to historical norms.

That isn’t going to help anyone looking to buy a house in the core since knowing when that correction occurs is outside of most of our expertise. One of the ways is to watch the velocity of sales. As prices rise fewer people can purchase and sales volumes decline. Which has been happening in house sales since April. House sales are down 60 percent in the core since April of this year. In comparison the year before sale volumes were seasonally off only 35%.

Hawk – I’ve outlined a number of times why I think house prices will see another leg higher. Low rates, low vacancy, low inventory, low unemployment, and a low loonie. Affordability isn’t really that bad here and I see no reason why prices can’t go higher again in the Spring.

As I also said, I don’t really care whether house prices go up or down. Our investments are long term and balanced. They are diversified across asset classes, durations, geographies, currencies and more. We’ll be fine whatever happens.

You say you’ve been through 3 crashes without losing money. But how much money did you miss out on during the boom times? Given the performance of the last 2 years, I’d say quite a lot. And more importantly, trying to ‘short’ the Victoria real estate market has left you renting and seemingly lacking in peace of mind.

AG,

I find it amusing those with the most to lose are more negatively concerned about my posts.

Been thru three crashes, none I lost on but have seen several friends and sssociates go bankrupt thru all 3 when the writing was on the wall as it is now.

Never have we seen what’s gone down in market intervention in the past few months. Government, financial sources everywhere are being ignored. Do you really think this won’t end well ?

Partially. The big jump was triggered by the overflow from vancouver but the upward trend (which started in mid 2013) was because affordability was getting pretty good and buyers were jumping back in. Even if there was no surge in Vancouver buyers prices would be up in 2015 and 2016

It has to have either a .png or .jpg extension. If you want to post something from imgur, then you need to go to the link, right click on the image and then go “Open image in new tab”, then copy that url (the image directly).

Hawk – thanks for your reply, which had the exact tone I was expecting 🙂

You asked why I visit the blog. It’s because we own real estate here in Victoria and we may potentially buy more (or maybe even sell) in the future. I also follow blogs in other locations where we own property. It’s a good way to keep your ear to the ground and follow market trends, as long as you can block out some of the noise and the more extreme views. It’s helpful to keep track of the market value of your investments (or “counting your cash” as you say).

I’m not disputing the factual basis of some of the articles that you post. I’m just disputing their relevancy. Real estate markets don’t tend to move as one. Even in the US real estate crash there were many areas that were hardly affected. By over-generalizing, you greatly limit your chances of making good investments.

Another question for you – how long have you been looking to buy real estate in Victoria?

AG,

Why are you here ? If you are as loaded as you claim you are then shouldn’t you be busy tending your crops and counting your cash ? Is life that boring as a rich dude ?

Which articles and generalizations are wrong ? Please show us bears where the facts and numbers in the articles that come from the financial industry are not real. You are the financial expert right ?

It’s called House Hunt and I’m a future buyer interested in tracking the market changes. Is there something wrong with that ?

Barrister,

I have read that before too, and pointed out many times that the tech bizz doesn’t offer the job security that one would want to take on a large debt load nor possibly qualify unless in a high management position.

Mike portraying the boomer parents of tech millennials moving here en masse is another one of his ridiculous fantasy jokes when the tech bizz is historically a highly mobile industry.

Hawk – I’m interested why you care so much? You seem to be on here all day long, replying within a few minutes in an attempt to rebut anyone who’s not completely bearish. You post doom-and-gloom articles from all over the world that have very little connection to our local market. You throw out lots of generalizations without really providing any relevant, local data to back them up. And your views seem every bit as uncompromising as the most bullish of bulls.

Some of the other posters might already know this, but I’m curious. Are you renting? Did you sell before the latest ramp up in prices? Are you an owner who wants to buy more at lower prices? I’m just wondering why you’re so emotionally invested in prices going down.

It’s called the bull trap Mike, just ICYMI. Typical when a bubble explodes.

http://www.futuresmag.com/sites/default/files/resourceinvestor/article/2012/01/29/1-30-12-pt-6-Bubble-Phases1.png

@ Michael

i.e., to where they were before the present run-up in Victoria RE prices.

So watch out if Michael yawns again. It could mean rates going back to where they were in, say, 2008.

Au contraire, mon petit faucon.

It was already back up $129K to $1,598,824 in October.

That’s a 9% rise in the two months following August’s tax introduction. Looks more like a repeat of 2014.

http://www.rebgv.org/sites/default/files/REBGV%20Stats%20Package%20October%202016.pdf

Read an interesting article that the vast majority, something like over 85% of the people in Victoria, in the Tech center are earning less than 70K and a lot of those are under 50k. Don’t know the accuracy of this figure but if true then the tech center is a lot less important than we are lead to believe.

You missed the boat there Mike. Debt levels have increased, stress tests of over 2 points higher have just been implemented. Get with the program, the times are a changing and credit is tightening.

Note the large down arrow equalling $300K. The foreigners money has left the station and ain’t coming back. They saw it coming 6 months ago, when will you ?

http://www.mikestewart.ca/wp-content/uploads/2016/09/August-2016-REBGV-Statistics-Price-Chart-1977-to-August-2016-Vancouver-Real-Estate-Mike-Stewart-Realtor.jpg

Yawn, 5-yr rates are back to where they were a year ago. Snoozefest! 🙂

http://i.imgur.com/4oQx4TZ.png

Did you miss this one too Marko ? Sounds pertinent to the Victoria market don’t you think or is it just too much doom and gloom to see the reality of a changing market. Sounds like you’re one of the drunks who thinks the party will never end.

‘Drunken Brew’ Of High House Prices, Debt Threatens Canada: CMHC

TORONTO — The head of Canada’s federal housing agency says regulators should explore the possibility of raising the minimum down payment required on a home as a way of easing affordability and reducing risk to the financial system.

“[Critics] don’t mention that the Canadian system has not been stressed since the Great Depression. Further, they choose to ignore the strong academic support that loudly warns against the drunken brew of elevated house prices and an advanced credit cycle.”

If you paid attention Marko you may notice that world markets drive investment and Trump just drove rates up more in 26 years within 2 weeks and wiped a trillion dollars out of the bond market. That is what will effect Victoria buyers who depend on scraping by to afford this market. Not your biased info that everyone is loaded and the buying pool will never end.

Why would I want to drive traffic to that lame Citified site you pump backed by developers to make the most obvious point that overbuilding is happening here, while volatile markets and rising interest rates reduce buyers and drive down prices ? It’s Economics 101.

Your “been wrong for 8 years” is even more lame as Vancouver begins to lead the province to the bubble bursting in the largest home made Canadian debt bomb in history.

I guess your doom and gloom denial to your buyers lines your pockets but will destroy many in the coming months. Is there a discussion on capital losses coming up soon ?

Global bonds are headed for their biggest two-week loss in 26 years

http://business.financialpost.com/investing/global-investor/global-bonds-are-headed-for-their-biggest-two-week-loss-in-26-years

For example, if I was a bear and I wanted people to read my comments and a comment was made by a bull about 0.6% vacancy in Victoria I would go on Citified and add up all the massive downtown rental projects which are bringing thousands of rentals units to the market in the next 24 months.

Then I would add a few supporting stories which should also add to rental inventory going forward such as this a few days ago -> http://www.cheknews.ca/victoria-councillor-jeremy-loveday-says-no-airbnb-new-condos-237959/

And I would draw a conclusion that there will be an upward trend in vacancy going forward.

People will read that and consider it carefully….not Trump said something at his Trump Tower penthouse today which will send us into a spiral. Or interest rates are going up….it’s been the same interest rates are going up comments for 8 years. They will go up, that’s for sure, but predicting it with such certainty after 8 years of completely being wrong weights on credibility.

The reason I think the capital gains suite discussion was so popular and engaging is it was something specific to our market.

Keep it up because there are a lot of readers and you need to offset the messaging from those that profit from the naive.

There are approx 5,000 monthly readers on the blog….Leo S can correct me, I might be wrong?

Over the last 6 years I’ve had a lot of HHV readers stop by my open houses and I’ll say, “ok wow, I am surprised you are buying given you are a reader,” and most of the time I’ll get a reply along the lines of…..”ohhh yea, lots of doom and gloom on there, we just read past those comments.”

The problem is people will comment with something like vacancy is at 0.6% in Victoria and the counter argument will be Trump will create volaitity, interest rates will jump overnight, the national debt bomb will blow up any day now, etc.

The bears would do much better if they focused in on counter arguments that weren’t based on everything blowing up. If you go back to to 2011-2013 comments on the blog by bears they are pretty much identical as they are to now.

Info at the bottom of the market in November 2012

Just Jack – your input to this blog is appreciated by many.

Victoria’s housing market has been in correction mode for some time, yet there are those who continue to deny this. It will only get more interesting as this correction/crash continues.

The OSFI regulations have now been implemented. This will only add weight to the already sinking market. No more cash-back mortgages. It has also mandated tighter lending regulations and requires stricter appraisals.

In terms of numbers, obviously average prices are not at all indicative of what is happening in the market when there are so few sales. The same can be said for the median price.

It is more helpful to look at the Teranet-National Bank index, although that can be easily misunderstood. An index drop of 1.5% does not mean that the average price dropped 1.5% in that month, which most people think. The index is compared to itself.

Hey Barrister,

I actually thought you were more bearlike, but a quick look on Realtor.ca shows us 16 homes in your areas under $1,000,000. There are 3 homes in James bay, 1 at $739,000 and 2 over $900,000 and in Oak bay you have 4 homes, 3 priced at $899,000 and 1 at $869,000. In Fairfield there are 9 homes, albeit the majority are over $900,000. There are 34 homes listed between $1,000,000 and $2,000,000 and 9 listings over $2,000,000

In terms of move up buyers I would suggest that a lot of Victorians, that built up equity elsewhere, probably took that equity to Oak bay and are carrying some substantial mortgages. Anything over $1,500,000 is a wealthier subset of buyer obviously.

Apparently, everyone wants to look wealthy. We’ll see what happens as the tide moves out.

Look guys, I’m just like you, renting and feel priced out, like my manhood was taken away. I tried to time the market by listening to y’all these last 10 years, and watched as prices rose for no reason. It’s a conspiracy!

Just Jack, Hawk, CS, Biznitch, etc, man did we get this wrong to date.

But this time it’s gonna crash right? I just hold on till spring when suddenly the supply is going to 10x and prices crash 70% back to when this blog started and y’all posting 20 times a day about the crash and burn and how you will be able to finally use that $12,000 inharitance your mom left you to buy a house in Oak Bay

@michael, I went to fantasyland once too. It was a theme park in West Edmonton Mall. Unfortunately Disney complained and so they had the rename it Galaxyland.

I would say the exact opposite. Victoria will be the least dependent on rates as the wealthy boomer bulge continues to flock here for at least another ~15 years, continuing to compete with their millenial kids for Techtoria’s vibrant core.

The only thing I could see stopping the flock is another US crash combined with above-par loonie such that boomers again substitute Vic for places like Palm Springs. One only needs recall what happened here several years ago before US prices finally launched off their bottom in 2012 (no surprise Vic’s bottom was shortly after). Now the boomers who’ve doubled their money on US property past 5 years are cashing in to buy here.

I put the chances of another US crash happening again in the next ~15 years at slim to none.

With Trump in the White House, you now have the biggest and scariest wild card in history. He could easily send financial markets into their most volatile periods ever.

How are international lenders going to respond ? They tighten lending to high risk housing projects in over valued cities like Van and Victoria.

As we see with Australia condos starting to tank, the lenders are now quickly tightening it up. All these condo panic buyers her may be in a tough spot in the next year as interest rates change the landscape for investors and create bargains for renters.

Sydney CBD apartment prices tumbled 9.1 per cent over the 12-month period while Melbourne CBD units dropped in price by 8.4 per cent.

“THREE STAGES OF RISK

There are three main risks facing the slumping CBD apartment market, Ms Conisbee told news.com.au.

The first one is settlement risk. This occurs when a buyer puts down a deposit for an off-the-plan apartment but when development is completed the bank won’t fund the loan because the value of the apartment has fallen, causing the buyer to default.

“Banks see it as risky or a bad investment [when prices drop],” Ms Conisbee said.

“Banks are now being restricted on the amount that they are lending, particularly to investors. They are being capped on the growth in their lending so they may see that particular apartment development as not being worthy of their lending. People have put down deposits two years ago … but the banks can change their approach to risk quite significantly.”

This will leave an abundance of CBD apartments just sitting empty.”

http://www.news.com.au/finance/real-estate/buying/apartment-prices-in-our-cbds-are-falling/news-story/059fba4b5d8bdd85b8a9dfc2c03f58b1

I have been accused of only looking at one portion of the Victoria housing market. That accusation is very true. I try to follow what is going on in the area that I live. it is an area that I have labelled south Victoria and basically covers everything south of Bay Street but also includes all of Oak Bay.

Basically that area is James Bay, Fernwood, Rockland, Fairfield and Oak Bay. I am afraid that i have to rely on the rest of you to give me snap shots of the rest of Victoria.

So what it is worth, at the moment there are only a couple of SFH even listed in South Victoria for under 895,000. Most are over a million and a number of those are over 2 million. I question how many of those homes are being bought by local people employed in the Victoria economy that are moving up from something like a condo. I have no doubt that some of them are, but I suspect that many are not. I did a quick and unscientific calculation, assuming that a couple has 300k cash down

and had to take out a 700k mortgage that they would need almost 5k after tax for housing costs (mortgage, taxes, sewer, water, insurance, heating, water and basic maintenance ). I just dont know how affordable that is even for young professional couples in their thirties or forties.

My point is that I suspect that a lot of the market for these homes is not based on local purchasers.

Prices are being driven by out of town buyers and the locals are hard pressed to compete.

http://www.vreb.org/media/attachments/view/doc/statsrelease2016_10/pdf/October

Through the analysis of over ten years of Victoria Real Estate Board MLS® sales data, the MLS®

HPI defi ned benchmark homes for Victoria in each category (single family homes, townhouses,

condos) and for each neighbourhood. The benchmark starting point was 2005, where each type of

property and neighbourhood was assigned an index value of 100.

I need some help here guys. I’m trying to get a sense of the Victoria HPI so I can understand the history of the market. On the VREB website they outline the benchmark in Oak Bay for 2005 Single Family Dwellings as $552,000 but their historical data only refers to an annual average summary in 2005 in Oak Bay of $698,291.

Perhaps, JJ, Leo S. or Marco can advise me how they come up with a benchmark that is just about $150,000 less then the annual average for Single Family Homes. Much appreciated.

http://www.vreb.org/media/attachments/view/doc/yesf2005/pdf/Sales%20of%20Single%20Family%20Dwellings%20By%20District

More info/views for the bears and bulls

2017 Outlook Canadian RE

http://www.pwc.com/ca/en/industries/emerging-trends-in-real-estate.html

@ oopswediditagain

We already own a couple of properties here in Victoria. We also own some other real estate in Canada and elsewhere. We have an investment portfolio too. I’m pretty indifferent as to whether real estate, stocks, or currencies go up or down in the short term – these are all long term investments and we are very well diversified.

I’m very familiar with the bull and bear arguments. I used to work in finance, and I’ve been through 2 different real estate crashes before moving to Canada, so I’ve seen first-hand what happens. From my perspective, the tailwinds behind the market here make it quite unlikely that we’ll see price declines next year. I think I’m in a pretty good position to judge that, but then I’ve been wrong about plenty of market calls before. My advice to anyone, regardless of what stage of the real estate cycle we are perceived to have reached, is to never overstretch your finances.

AG

“People are forgetting to look at the data. The fact is that we have low interest rates, almost zero vacancy, a thriving local economy, and unprecedentedly low inventory. With all those positive tailwinds, the base case has to be that house prices will go up in the Spring.”

I’m simply following your guidelines, AG. Both cities share very similar “data”. If you want to make the argument that the Chinese deserted the Vancouver market then you had better read Local Fool’s disclaimer. We’ve been reading on this blog for a couple of months now about the “Vancouver” invasion. You lose one, you lose the other.

Now, if you simply want to debate the possibilities, lots of people here will entertain you. If you are trying to decide whether you should buy, sell or invest in real estate in Victoria at this time, then I would spend a lot more time reviewing some of the bears arguments.

Confirmation bias is fine for debate, not so much for big financial decisions.

“On the contrary, there are several things that should continue to push local real estate values higher. Low interest rates, low vacancy, low unemployment, low inventory, and a low loonie. All of these are very supportive to real estate prices in Victoria.”

Low interest rates largely caused the price inflation, but after a certain point buyer and capital exhaustion will set in. Low interest rates and inventory will continue to feed high prices, but the rates aren’t going to be staying where they are forever.

IMO, the low inventory is a symptom of the mania in the market, not the cause. Ie it’s circular reasoning – sellers don’t sell because they want to sit on gains or can’t afford to move up, so they stay put and prices rise, so they don’t sell, so it rises more, etc ad infinitum. Our market has generally had enough supply, until this craze came into play – now suddenly we’re desperately short? Something besides normal growth is going on here.

Low unemployment is good for a stable RE market, which I think is why historically ours has been such. I don’t think that “stable” is how I would describe it now. Further the jobs in our economy are already stretched to pay these prices – look at the ratio of 450% mortgages. Is there room to stretch it even more? One thing I’m sure of is these prices are entirely dependent on emergency and unsustainable interest rates.

A low loonie is the wild card, as global capital movement is fickle. However it doesn’t look like that’s something that is pouring into the Victoria market at any levels beyond historical norms. Who knows, maybe next month this little town will become the next London…but I doubt it. Tea at the Empress is too overrated, anyways.

AG, you are also excluding the psychological impact of a falling Vancouver market. To say it can’t happen here is saying we are different and we’re not. If buyers get shut out of qualifying then the food chain implodes. Banks tighten credit in a falling market not loosen it. It’s already happening.

We had low unemployment in 2008 and it made no difference as the banks shut down the lending and global financiers shut down lending to Canada to dicey housing projects.

“Can Victoria continue to explode in value without large injections of outside capital, stagnant wages and climbing rates? Not for long, because the only thing left to drive it is simply the expectation that prices will rise.”

On the contrary, there are several things that should continue to push local real estate values higher. Low interest rates, low vacancy, low unemployment, low inventory, and a low loonie. All of these are very supportive to real estate prices in Victoria.

Just because prices are at record levels, or debt levels are high, or you think the market is getting unaffordable for locals – none of these things really matter in the short term. Prices may very well fall a year or two from now, but they are very likely to rise further before then. And if this low inventory persists until March, prices simply have to rise.

AG,

I think the point is capital in the Vancouver market is fleeing, not pouring in. There isn’t enough money in the BC economy to keep large price gains going. Victoria is not different in that respect. Can Victoria continue to explode in value without large injections of outside capital, stagnant wages and climbing rates? Not for long, because the only thing left to drive it is simply the expectation that prices will rise.

Also, what’s happening to Vancouver is not just at the top end of the market, it’s starting to work its way down. We’re still in early stages, compounded by a slower time of year. Most corrections work that way; you must know that. I don’t think panic mode in Vancouver has set in, and the collective psychology amongst sellers hasn’t fundamentally changed – ie sellers are still going “It’s down now, but I’ll wait till the spring time to sell because prices are going to climb again”. We’ll soon see. In March 2017, the RBGV YOY indicators will start looking very telling, unless there is a sudden turnaround in their market. Personally, I just don’t see that happening in that time frame.

It certainly hasn’t changed in Victoria – sellers are expecting their lottery winnings and in many cases are still getting them. It almost seems rude to offer a seller merely their asking price, regardless of how outrageous it may be. Unfortunately, that’s simply not a RE market in balance, and all things eventually come into balance one way or another.

Vancouver prices are certainly heading lower, because a massive chunk of demand was suddenly removed from the market. Hence the price drops at the top end of the market, vs the steady prices in condos etc.

Unless you can foresee something similar happening to Victoria, I fail to see your point.

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/lfss03l-eng.htm

AG …. seriously? Vancouvers unemployment rate in October of this year was 4.9% while Victoria’s was 5%.

http://vancouversun.com/news/local-news/were-in-a-crisis-vancouver-struggles-to-improve-rental-vacancy-rate

Vancouver’s rental vacancy rate is among the lowest in the world with just six of 1,000 units (0.6 per cent) available at any given time, Mayor Gregor Robertson said Wednesday, commenting on new data from the city.

The bulls on the mainland have been pushing the “low inventory” no price changes theory right up until the price drops were published.

Sooooo, these cities are so different??? AG, Victoria is certainly lagging Vancouver but I wouldn’t want to guess by how long.

Knowledge is power, prepare accordingly.

How much ‘syndicated mortgage’ business is there in Victoria? Does anyone know of any projects financed this way?

The “national debt bomb” is certainly a problem, but you could have said that 3 years ago. It’s unlikely to have an impact on the real estate market until rates move higher. Higher rates are indeed likely to cause some forced selling at some point, but that is extremely unlikely to be the case in the next 12-18 months.

The simple fact is that, in Victoria, almost all the usual determinants of real estate values are pointing towards higher prices. No matter how much hyperbole Hawk or anyone else can spout, that fact does not change.

How many condo buildings and other developments in Victoria are financed by syndicated mortgages? Many I would think. Another potential time bomb as the bubble gets ready to burst. Already the investors are about to get roasted like in 2008.

Regulators put syndicated mortgages in their crosshairs

Regulators appear to finally be cracking down on a popular real-estate investment called a syndicated mortgage that promises big returns and low risks

http://www.macleans.ca/economy/business/regulators-put-syndicated-mortgages-in-their-crosshairs/

Investors in Calgary’s Orchard project have been told of delays to interest payments.

http://www.mortgagebrokernews.ca/news/syndicated-mortgage-payments-delayed-217108.aspx

AG,

ICYMI, it’s the same province in the same country under the same lending rules that are changing by the week, if not by the day. Everyone is effected, and Victoria is not some island protected from the global financial events.

Because it didn’t get as stupid on the way up like Van doesn’t mean it won’t get hit on the way down like the 81 crash when all the rates went up and everyone was under the same credit lending rules.

Hate to break it to you but this is a national debt bomb about to blow in the near future where no one escapes. You might be all safe and cozy in your Uplands home but in the real world people are struggling bigtime. As an ex-financial advisor you should know that more than anyone.

In 2007 it was the biggest boom of all time and a year later no one could get financing. Rinse and repeat.

Since you didn’t live here in 2008 AG you might want to reacquaint yourself with what it was like. This will be a Canadian home made crisis this time around just as the US market has peaked.

Holes in the Ground

“There’s such an unprecedented level of construction activity in Greater Victoria that it’s easy to overlook one aspect of the long-running building boom: there is a growing number of holes in the ground and demolition sites where nothing at all is getting built.”

http://www.douglasmagazine.com/holes-in-the-ground/

The bears seem to talk a lot about Vancouver, as if Vic and Van are the same market. Well, they’re not. They behaved differently during the run up in prices, and they will likely behave differently during the coming few years.

People are forgetting to look at the data. The fact is that we have low interest rates, almost zero vacancy, a thriving local economy, and unprecedentedly low inventory. With all those positive tailwinds, the base case has to be that house prices will go up in the Spring.

Unless it’s “different this time,” of course…

Sadly, Leo, my image didn’t automatically expand. Can you assist, please? I want to be able to insert pics like Michael does!

http://imgur.com/a/Lh4L3

I think I would consider myself more bearish on the real estate market in Victoria and Canada, but a little less so than I was a year ago. A year ago I was contemplating buying a house but seeing the DOM of various houses in my price range, and the impending doom of Vancouvers real estate market I thought waiting would be more prudent. Boy was I wrong. The shock of what happened here in Victoria definitely was disappointing to me when a house we could afford last fall now became 100-150 g’s more expensive. I can’t bring myself to spend half a million dollars on a dump now. I do however wonder if I am making a mistake again and will be even further priced out come this spring.

What happened here in Victoria was an aftershock of the calamity in Vancouver. It all boils down to foreign money. An insane amount of new buyers with loads of money coming in, FOMO hitting hard and locals going nuts. Some of the locals and some of the foreign buyers move to the sleepy city next door and there you have what happened in the spring. It’s not a mystery.

If you follow Kathy Tomlinson, Ian Young, Douglas Todd, or Sean Cooper you would not be blind to the unbelievable going-ons in our Vancouver. The fraud, the government inaction, the gluttony, and the unfairness of it all has led to one of the biggest housing bubbles in history. Foreign transactions were not being tracked, and when they were it was done in the most unreliable, asinine way. Now we know that in some areas, 80% of houses were sold to someone from another country, one entire condo tower was being sold every 10 days to all Chinese buyers during the peak (pre-sales are still a hot commodity as they aren’t taxed), and now 10% of every house currently on market in Vancouver has never even been lived in. Canadian housing is a way to turn a volatile Yuan into CDN/USD. Simple. Illegal…but simple when not enforced.

Now in Victoria, foreign purchases are not being tracked. At least not in any reliable way. I personally think if you have not noticed more foreign buyers in the city you are in denial. I am all for immigration, all for multi-cultures. But when homes are being traded like stocks, government policy’s need to be put in place to deter this, despite the province procures from these transactions. I wonder if anyone is talking about it.

People on this blog tend not to talk about money flowing in from foreign buyers, I think for fear of being considered racist. It is not racist to talk about a problem in our country that stems from a vast amount of money flowing out of another particular country. It just isn’t.

I think any deflation in home prices will be further propped up by foreign money. I know it hasn’t happened historically, but what is happening in China certainly is.

Canadian housing crash = fire sale for foreign money, US an abroad.

The Federal and Provincial Government will be begging for them.

http://www.bloomberg.com/news/articles/2016-11-14/world-s-biggest-real-estate-binge-is-coming-to-a-city-near-you

http://vancouversun.com/opinion/columnists/douglas-todd-canadas-public-guardians-have-failed-vancouverites

http://www.theglobeandmail.com/news/british-columbia/farmland-and-real-estate-in-british-columbia/article32923810/?cmpid=rss1&click=sf_globe

http://vancouversun.com/opinion/columnists/douglas-todd-foreign-students-make-a-big-impact-on-vancouver

https://betterdwelling.com/city/vancouver/10-of-homes-being-resold-in-vancouver-have-never-been-lived-in/

http://www.robchipman.net/

Hey guys, here’s another mainland realtor. From what I can tell he doesn’t run a blog or express an opinion. He simply runs the stats for the REVGB and the FVREB every night.

I haven’t been able to find a day where the asking price matched the selling price for quite some time. Check it out.

Follow the trend, my friends.

Agreed Local Fool, Mike has an issue ignoring real numbers, especially being an ex-economist. Now we know why he’s an “ex”.

DEBT WOES: WHY CANADIANS OWE SO MUCH MONEY

One of the biggest problems in this whole debt-to-income equation is stagnant wages. We’re earning roughly the same amount, but we’re spending more because we have more access to credit. According to Statistics Canada, wages have increased 30 percent between 1981 and 2011. That sounds like a hefty amount, but it doesn’t exactly translate into higher savings because of the way our cost of living has gone up. Bank of Canada inflation data tells us that if you earned $50,000 annually in 1992, you should be earning about $75,000 in today’s dollars — in reality you’re probably only making an average of $65,000, or less.”

https://news.vice.com/story/debt-woes-why-canadians-owe-so-much-money

Oh Michael.

SS is a “bear monger”, but at least he uses actual data to support his concerns or view. You have one claim – up, up, and up, regardless of almost anything people or data say. You almost never substantiate your opinions, at best you offer vague proselytizations such as real estate will explode up because “It starts with confidence in what certain currencies are about to do”. Pray tell, Michael. Except you won’t, and more importantly, can’t – because there is nothing behind what your saying. Just pumping like some kind of short circuited automaton.

You just declare that boomers will create perpetual price gains, and that bears were wrong before, ergo they will continue to be. The problem is, you will be correct on that last point, until you are not.

I’m sure people here would appreciate a bull with good data and substantiated claims, even if they end up being wrong. This forum could sure use it. This has nothing to do with which side your on. A doomer that comes on here and just repeats “It will crash because it can’t go higher, burn burn burn etc” and never takes into account disconfirming evidence, while adding nothing else is little more than a troll. More or less, that is what you do for the other side. Most of the time, you’re just here to get a rise out of people, and little else.

I guess I took your bait…again. Okay, time for my lunch now. 🙂

Steve Saretsky lives in the real world Mike. How long can the Victoria greater fools keep up this charade ?

Developers keep pumping our local media too until the well runs dry like in Van. It’s 2007 all over again. 😉

Are you buying in Richmond Mike or do you just have a McLeans OCD mental issue ? They’ll be able to run that front page pic again very soon.

Condo/townhouse pre sale developments see 34% drop in sales year over year.

“Metro Vancouver’s new home market was negatively impacted by the recent government initiatives to slow down sales activity in the region,” according to the latest quarter Urban Development Institute State of the Market Q3 2016 report, compiled by real estate think tank Urban Analytics and released November 17.

Just over 3,000 new multi-family home sales were recorded in 2016’s third quarter, which is a decline of 34 per cent from the same quarter last year and a drop of 55 per cent from the six-year record set in 2016’s second quarter, said the report.

The figures run contrary to recent media reports suggesting that the new home market is bucking the downward trend seen in Metro Vancouver’s resale market. There have also been several press releases issued recently to media by developers citing recent presales successes.”

http://www.rew.ca/news/new-home-sales-in-metro-vancouver-see-similar-dip-to-resales-udi-report-1.2839717

Thanks for the analysis Leo.

Saretsky is just another bear monger 🙂

July 2012

http://www.cbc.ca/news/business/new-mortgage-rules-aimed-at-cooling-hot-housing-market-1.1151641

When the gov’t is meddling and the media is negative, it’s time to start buying. There are some great deals in Richmond right now.

“Hawk, you are actually preaching to the converted here on this blog, albeit those are just the commenters.”

I don’t post often but do read comments. I don’t usually have any useful information to share. I enjoy knowing that there are others out there who think like I do when I do read comments though.

I find it so interesting in the shift in media coverage lately. The CMHC/government is obviously promoting the fact that it thinks the housing market is now overvalued and risky. Why now is what I don’t get. It has been risky for quite some time for many people in many areas of the country. To me it is a strong signal of what’s to come when the government is trying very hard to stop people from overspending on houses. If the new rules don’t cool off the market in X amount of time and things continue I don’t think the government will stop there…

I wonder how many Victoria firms are on the list ? Too bad investigative journalism is dead as a fricking door nail in sleepy V-town.

Money-laundering watchdog cites ‘significant’ deficiencies at 100-plus B.C. real estate firms

“The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), the federal agency mandated to detect and combat money laundering, examined about 220 real estate companies in B.C. between 2012 and mid-2016, finding 112 companies with “significant” levels of non-compliance and five with “very significant” non-compliance, according to records obtained by Postmedia News through an access to information request.”

http://www.theprovince.com/Business/12400710/story.html

Hawk, you are actually preaching to the converted here on this blog, albeit those are just the commenters.

The bulls on this blog aren’t blind to what’s happening on the mainland. Some are benefitting from the bullish messaging on the island and some just like the debate.

Keep it up because there are a lot of readers and you need to offset the messaging from those that profit from the naive.

LeoS,

Further to the FP article, BNN expanded on the speech. Damn, that credit cycle thing again. 😉

“Siddall also called the proposal to reallocate mortgage risks “one of the most significant changes to the Canadian regime since securitization was introduced 30 years ago.”

The federal government recently launched a public consultation on proposed changes to Canada’s mortgage system, which would require lenders to take on a portion of losses on insured loans that default.

“Critics have called the proposal ‘a solution in search of a problem,’” Siddall said.

“They don’t mention that the Canadian system has not been stressed since the Great Depression. Further, they choose to ignore the strong academic support that loudly warns against the drunken brew of elevated house prices and an advanced credit cycle.”

http://www.bnn.ca/cmhc-ceo-warns-critics-ignoring-drunken-brew-of-hot-home-prices-high-debt-levels-1.611164

The horses have left the barn but the bulls got the blinders glued on tight. How many more warnings do the bulls need til they realize the game is over ? Government, CMHC, the banks who lend you the money, etc etc.

Total Capital Fleeing Vancouver Real Estate

Average & Median Prices Down Year over Year

“Lately the average sales price has been dismissed by the real estate industry. Which is funny considering it was frequently mentioned on the way up.

Of course now that the average sales price has collapsed we have decided to ignore it. The typical response in the industry is that it fluctuates too much and can vary depending on what type of inventory is sold that month. While this is 100% true, ignoring the average sales price altogether is completely irresponsible. Ultimately, the average sales price shows the amount of capital flowing into Vancouver real estate.

The capital flowing into Vancouver real estate has evaporated. Average sales price shows that 2015 price gains have been erased.”

http://vancitycondoguide.com/total-capital-fleeing-vancouver-real-estate/

Higher down payments could be on horizon as danger of Canadians’ debt grows, CMHC warns

http://business.financialpost.com/personal-finance/mortgages-real-estate/higher-down-payments-could-be-on-horizon-as-danger-of-canadians-debt-grows-cmhc-warns

Yes – read your listing contract – usually states the commission is due and payable upon delivery of any “valid offer” on the terms set out in the listing agreement, or any other terms acceptable to the seller.

True but every other single family home listing in Victoria has this in the REALTOR® notes….

“Clause 5Aiii, 5Bii partial and 10B deleted.”

5Aiii states

The Seller agrees:

A. To pay to the Listing Brokerage a gross commission of ________________________________________________________

of the sale price of the Property, plus applicable Goods and Services Tax and any other applicable tax in respect of the commission

(commission + tax = remuneration) if:

“(5Aiii) an offer to purchase is obtained from a prospective buyer during the term of this Contract who is ready, willing and able topay the Listing Price and agrees to the other terms of this Contract, even if the Seller refuses to sign the offer to purchase;”

Then that’s the easy way to fix it. Just make it so that a full price no conditions offer needs to be accepted if there is not multiple offers. This is the case in several jurisdictions (not here).

I agree in theory but too many real life problems. 92 year old hires Bob from XYZ Reality and Bob underprices the home by mistake. Someone comes in with a quick unconditional offer.

Yes you can have an accepted offer along with a deposit and the vendor can have the option in the contract that they can accept a better offer from another party in the next 10 days or whatever is stipulated. Then if you were the original bidder you would have to better that new offer. This is contract law.

In theory maybe but I’ve looked over a 1,000+ contracts (500+ would have been ones I did not write myself) and never seen such a clause in real life. It would be super difficult to get a buyer to agree to it as he or she has to invest money into inspections, appraisals, etc., with no guarantee of actually securing the property.

I’ve found seller conditions in general to be problematic with lenders and they’ll refuse to approve a mortgage application if there is a seller condition in play. For example a seller conditions could be, “subject to seller agreeing to a mutually end to tenancy with tenant by such and such date…..this condition is for the sole benefit of the seller”

Yes – read your listing contract – usually states the commission is due and payable upon delivery of any “valid offer” on the terms set out in the listing agreement, or any other terms acceptable to the seller.

Usually, but not always. If you are using the realtor standard contract which specifically sets out that it is signed under seal (binding expression of intention to complete/deed) and if there are no additional subjective conditions which require additional consideration. The courts, in several instances, have found that a very broadly stated subject to clause renders the contract void for uncertainty without additional supporting consideration.

https://professional.sauder.ubc.ca/re_creditprogram/course_resources/courses/content/112/notes_article.html

Some areas do this via the listing agreement. You don’t have to sell the place, but you may have to pay your realtor their comission. After all they have fulfilled their end of the deal by getting a buyer at the price you stated.

Deposit is not required. The consideration in a CPS is the mutual promises of the buyer and seller, not the deposit.

Then that’s the easy way to fix it. Just make it so that a full price no conditions offer needs to be accepted if there is not multiple offers. This is the case in several jurisdictions (not here).

Barrister said:

That’s what your anecdotal experience says, but your sample is definitely not a random selection representative of Victoria as a whole. Your particular examples are one age group and one area of town.

My anecdotal evidence would show it’s move up buyers. But the majority of people I know are young families or people wanting to start families etc. Selling condos and towns for houses or houses for bigger houses. Very few of the boomers I know are down-sizing. I do know two families that sold out of Van and bought >1 mil places here (both bought acreages in central saanich).

None. My point is you don’t know either so stop presenting your hypothesis as fact – it is not. And the question is not only whether people are answering it differently, but whether there are more people relocating here and renting prior to purchase than there used to be. My guess is that there are. Who really knows though except perhaps a group of buyers’ realtors.

In order to have a binding contract you need offer, acceptance and consideration plus an intention to be bound. This is why a deposit is required. If there are conditions this makes it a conditional contract, but still enforceable for a purchaser provided they remove the conditions. An unconditional contract is binding ie. no inspection etc. or the conditions have been met.

Quoting a price on a home on MLS is an invitation for prospective home buyers to submit an offer, but there is no requirement for the owner to accept if the offer is asking price or above with no conditions. The free market governs the transaction ie. willing seller, willing buyer. The seller can change their mind on price or on selling at all until there is a binding contract which must be in writing and signed by both parties in the case of land.

I don’t think you can have it just one way. Are Victorians moving up the property ladder or downsizing? I think they are doing both and I would suspect the larger portion of buyers from Victoria are moving up the property ladder and not retiring to a smaller home.

So when it comes to who is driving the market, I don’t think the percentage of out of town buyers in Victoria is much different than any of the major city centers across Canada that has a stable real estate market. There will always be people moving here and moving away from Victoria. And those that are from out of town are buying in all price ranges and not dominating any one price group.

And if you are selling your home in Colwood or Brentwood Bay and buying in Victoria, then you would be considered an out of town buyer since you’re answering the question as Brentwood Bay and not Victoria . It’s a case of six of these and a half dozen of those.

Yes you can have an accepted offer along with a deposit and the vendor can have the option in the contract that they can accept a better offer from another party in the next 10 days or whatever is stipulated. Then if you were the original bidder you would have to better that new offer. This is contract law.

This clause for the benefit of the vendor is not the same as flipping a property. Maybe the REC of BC should look at this too?

In the first place I am admitted to the bar of Ontario and, in the second place, I practised matrimonial law. Not an expert in real estate law in BC. But, just generally, any conditions whatsoever would require an acceptance.This would include the closing date and time. The issue of offers to treat is not an area within my expertise and I suspect that it is both complicated and turns on very specific details.

Practically speaking, I would not rely on anything without a fully executed acceptance.

By the way, because I was also renting a condo before buying I was listed as a local buyer. The fact that my wife was still in California and is American never even came up. My most unscientific impression is that a lot of house sales and, accordingly prices, are being driven by out of town buyers.

Native or long term Victorians are often purchasing but downsizing to either a condo or smaller house.The house across the street on St Charles is a perfect example. It sold for 2 million, the owners bought in Oak Bay a smaller house for 1.4 and, I am reliably informed that those people are moving into a condo. Hence in that small chain of transactions two thirds of the buyers were from Victoria but the price driver was from out of town.

Or you can turn your argument around Totoro.

What proof do you have that purchasers are answering the question “Buyers City” any differently today than they were 10 years ago? Has there been a change in how buyers are interpreting the question now than they did a decade ago?

JJ said:

This. Look up the term “invitation to treat” (or maybe Barrister could explain it, assuming he did any work in contract law).

From wikipedia:

Posting an asking price on a house is not an offer which becomes contract upon acceptance. I don’t see how that could work anyhow unless the list price also explicitly listed conditions and terms they were willing to accept.

Full ask with no inspection closing tomorrow is entirely different from full ask with condition to inspection, financing and closing in 2 months. One full asking price offer is not the same as another.

CS – We weren’t too concerned about the legality of it, more so the seemingly crazy counter with no other offers. It ended up working out for us in the long run as we likely wouldn’t have offered 15k under their list had they listed at the higher amount in the beginning.

JJ – I was just indicating that this is how my residency will be tracked which was part of the conversation on the blog a few posts back.

That can’t be right JJ. If the offer was accepted that means there is an enforceable contract. An offer that is full price, as you stated, is just an offer. It is not accepted until you have the acceptance in writing and a deposit – that means that the seller has to complete the deal or they can be sued for specific performance or damages.

Not sure who “we” is but you actually have zero way of knowing this as stats are not collected on this with any requirement to report if you have relocated recently to purchase. Someone with a local address is reported as a local buyer. The only people who might be able to gauge any change over time, or lack thereof, are buyers’ realtors. There probably should be criteria applied to this stat just like there is for the qualification period for residency in BC for other government purposes.

My best guess would be that it is easier to rent short-term since the internet became a viable source of rental information and more people would feel confident selling elsewhere and doing this while they look.

There have been numerous court cases that show that even though you offer full price that does not constitute an acceptance by the seller.

The asking price is simply a part of the advertisement to entice you to make an offer.

This is my understanding as well.

I do agree that huge under listing such as 200k below obvious market value does undermine the public perception of the system.

JJ – of course. Where do people get these ideas? When the offer is accepted in writing then it’s a deal, full ask or not.

There have been numerous court cases that show that even though you offer full price that does not constitute an acceptance by the seller.

The asking price is simply a part of the advertisement to entice you to make an offer.

In my opinion, if a home has been intentionally under listed in a delayed offer/blind auction, you should still make an offer.

But as RR illustrated make your offer the best offer and do not counter. And maybe you might want to add to the contract that the offer is only good for a set time period. No sense in the seller limiting your ability to bid on other properties. After all, a better home might be listed tomorrow to bid on and you don’t want to miss out on that one.

@RR

Is it even legal to do so?

Isn’t an offer to sell at an advertised price a commitment to sell at that price, i.e., a legal obligation to do so?

What if you’d flown from Shanghai or Timbuktu to view the property, only to find the advertised price was not acceptable? Would you not then have a legal claim for your time and expenses?

It would be interesting to know if a realtor was involved in this transaction and, if so, what the Canadian Association of Realtors has to say, if anything, about such tactics.

@ Oops,

“Gamble what you can afford to lose.”

Yeah, I have enough experience to understand that, if not to act on it: Canswest Global, some damn fool Chinese orange juice company, and others boondoggles too stupid to mention.

As a REALTOR® there are things I don’t like about delayed offers such as the mutiples but there are some things that are really beneficial. For example, as a buyer’s agent when a property gets listed instead of everyone scrambling to get into the home that night you know when the offers are being presented and you have some time to arrange a showing, etc.

As a seller’s agent it is almost impossible to price some properties accurately right now so the delay definitively helps correct pricing mistakes.

Do I think it is cool to price a $600k home at $399k and waste everyone’s time, no. A condo listed at $1,159,000 and selling for $1,177,000 seems acceptable to me.

RR no one is saying that you are or are not considered a resident when buying a home if you have rented for several months before buying.

What we are saying is that the percentage has not changed over the decades. There have always been buyers from out of town but the percentage has not changed relative to the number of locals purchasing homes too. For every house that has a buyer there is also a seller and that means there are those that are leaving Victoria for other cities too.

Victorians compete equally with out of town purchasers in all types of housing, in all areas and in all price ranges. Even in Oak Bay and downtown condominiums, half the purchasers are local.

Where the person in moving from has little importance to me. What is important is if aggregate demand is slowing or appreciating.

Marko, the condo is just an example. I could have chosen a Gordon Head home or an Esquimalt starter and the meaning of the post would be the same.

If the new watchdog for the Real Estate Council of BC wants the public to be confident that agents are operating fairly then the use of delayed offers/blind auctions must have strict guidelines and there shouldn’t even be a perceived conflict of interest with the agent acting as both selling agent and auctioneer. The delayed offer/blind auction has a least a potential of tarnishing the image of the real estate profession and that might be perceived as unprofessional conduct on the part of the agent and agency.

This is a no brainer as protecting the public also protects the real estate industry from law suits. If you are going to provide a delayed auction then hire an unbiased party, such as a lawyer, to conduct the auction. Agents already use building inspectors for a similar purpose. Why not eliminate that perceived conflict of interest?

CS

November 16, 2016 at 6:50 pm

Any practical suggestions, Oops, on the best way to short the bond market, e.g., via a short fund?

Sorry CS, there are ways to short the bond market but I don’t have any practical experience that I could share in this regard.

On the Pension Plan, we didn’t short the bond market, we simply lessened the duration on our bonds to mitigate against rising rates. eg: 25yr bonds become 18yr bonds etc.

Invest for your future. Gamble what you can afford to lose.

Just Jack, to piggy back on your comment –

Just closed on a property – we offered full list with limited conditions and it was the only one presented. Seller countered us with 15k over ask as they were expecting multiple bids to drive the low listing price up. We let our offer expire, and the seller re-listed next day for the same price they countered with. Week went by and no other offers, so we went back with offer at original list price and ended up closing 3 days later at that price.

Seller’s Realtor indicated that there were several people (who knows if that is true) on the sideline looking at making an offer but nobody wanted to get into a bidding war.

We were shocked that a seller would counter a full list price offer with no other bids, but we ended up closing on a price we were comfortable with and a property that met all of our “wish list”.

On another note, we recently moved back to Victoria from Calgary (lived here for 10 years previously), and have been renting since April. The contract says we are from Victoria, but I would consider us a migration from out of province for statistics purposes.

Just Jack,

We are talking about a penthouse condo in an extremely desirable area. This isn’t milk being advertised at $3.99 and a low-income family showing up at the store and it’s magically $4.99. That’s unfair.

No one needs a penthouse condo in Oak Bay to survive and I don’t think a buyer is being treated unfairly. Don’t like the delayed offer situation? Don’t get involved in it. No one forces you to make an offer.

I was looking at buying a pre-sale condo to flip this week at 595 Pandora. I didn’t like the chaos and sales process so I am just not going to buy anything. It is simple if you ask me.

I was disappointed at the sale price of the condo at Oak Bay. I thought it was under listed by a $100,000 to entice multiple bids. It appears that the delayed offer tactic didn’t work well as the property continued to be listed after an offer had been accepted. It appears the seller was fishing for a higher price.

Think of yourself as a prospective purchaser for a property like this. You put in an offer during the auction and you win. Now the listing agent says his client will continue to list the property for another ten days to find a higher offer.

The buyer bargained in good faith and their offer was accepted within the vendor’s time limit . Then for 10 days the offer was used to fish for other offers. I don’t think this is right – do you?

We need legislation to protect buyers from unfair listing practices. We protect sellers from “flips”, why is the government not protecting buyers from delayed offers/blind auctions?

As a prospective buyer you have to protect yourself from unfair listing practices. You need an agent working for you and a lawyer ready to protect your interest. Unfortunately for most of us, the legal advise comes after you signed the contract. That’s why legislation is necessary to protect buyers. The limited exposure time imposed by the buyer does not allow you to perform due diligence.

Thanks again for the great stats Leo. My wife is surprisingly tolerant for my real estate addiction. The fact that I spent all day putting up a rose arbour might be a hint that the idea of moving is a bit out of the question. Still I am considering at least one investment property if I can find real value.