November 7 Market Update

Weekly stats update courtesy of the VREB via Marko Juras.

| November 2016 |

Nov

2015

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 123 |

573

|

|||

| New Listings | 158 |

747

|

|||

| Active Listings | 1849 |

2952

|

|||

| Sales to New Listings | 78% |

77%

|

|||

| Sales Projection | |||||

| Months of Inventory |

5.15 |

||||

Sales of approximately 20 per day which is about 13% ahead of the pace we saw this time last year. Thing is we have 40% less inventory this time around so the market is far tighter than it was last year.

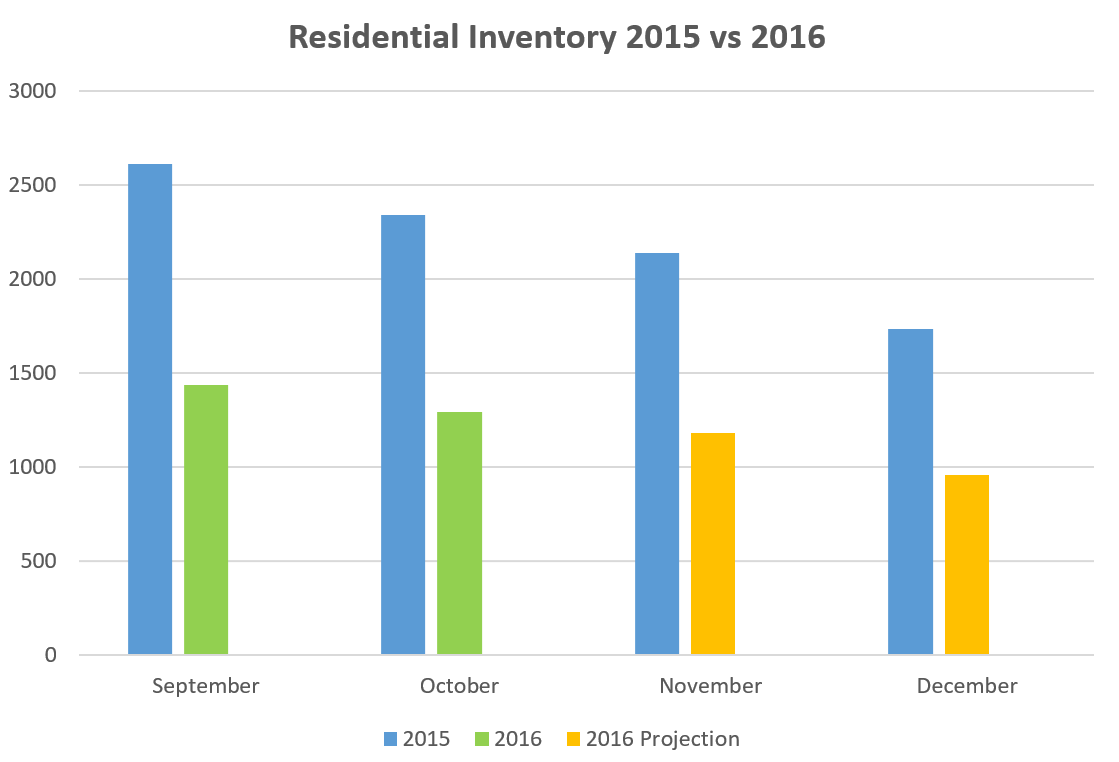

In addition to that, the headline inventory number includes commercial property as well which tends to swing a little less wildly than the residential inventory, and if we factor commercial out it looks even worse. There were only 1292 residential properties for sale at the end of October, which is down 45% over last year. If the trend continues, we could be at under 1000 residential properties available for sale by end of the year.

Dasmo:

You are correct about that but that was caused by the fact that 37 of the States were walk away states. The bank could only take the house and was able to go against any other assests you might have.

More affordability numbers for Victoria https://househuntvictoria.ca/2016/11/13/affordability-recap/

Most Americans were affected because there house value was cut in half. Hard to pay the mortgage for 500k when the neighbors house just sold for 250. Many simply stopped paying….

Totoro:

The article, while interesting, is really not focused on typical homeowners that are carrying a mortgage.

If you are carrying a 300 or 400k mortgage a two point increase a couple of years from now is a lot more than 50 dollars.

Actually I wonder what percentage of homes in Victoria are mortgage free? I suspect that this really varies by area.

I guess one of the things that concerns me is that during the American housing crash most American homeowners were not effected since they had thirty year terms (yex, I mean term ). In Canada I believe the average term is a little over three years. So the question in my mind is if rates went up two points how many homeowners would not be able to handle the extra mortgage load. A friend of mine with one of the major banks says their projects indicate 15 to 20% of mortgage holders would not be able to afford that sort of cost a renewal.

By the way, looking at historical charts of what occurs when the mortgage rate goes up two points is not an accurate way of judging the statistics. Rather look at what happens when mortgage rates increase by 40%. For example, a young family in a starter home might be paying a third of their after tax income in mortgage payments. Could they still manage if that went up to 50% of after tax?

The article is here: http://www.cbc.ca/news/business/transunion-debt-interest-rates-1.3759844

And the findings of the report are:

If an increase of $50/month is not something a homeowner can handle they probably should not be a homeowner. $50/month is less than the call out charge for a plumber. I find it hard to believe that a homeowner could not handle this unless they have accumulated other high interest debt or have had other life circumstances change in a way that makes making ends meet difficult.

http://www.transunioninsights.ca/PaymentShockStudy/

Almost a million Canadians couldn’t handle a 1-point interest rate rise, TransUnion says

1 in 6 Canadians would owe an extra $50 a month if rates rose by just a quarter percentage point

By Pete Evans, CBC News Posted: Sep 13, 2016 11:44 AM ET Last Updated: Sep 13, 2016 4:38 PM ET

Michael, the biggest difference in those time periods is in the size of the mortgages that were taken out compared to the size of mortgages taken out over the last 5 years, in particular.

Barrister, a 2% rise in interest rates will make the U.S. housing meltdown look like a slight correction.

Good luck to all.

Normally we do that at the end of the year but I can put it up early.

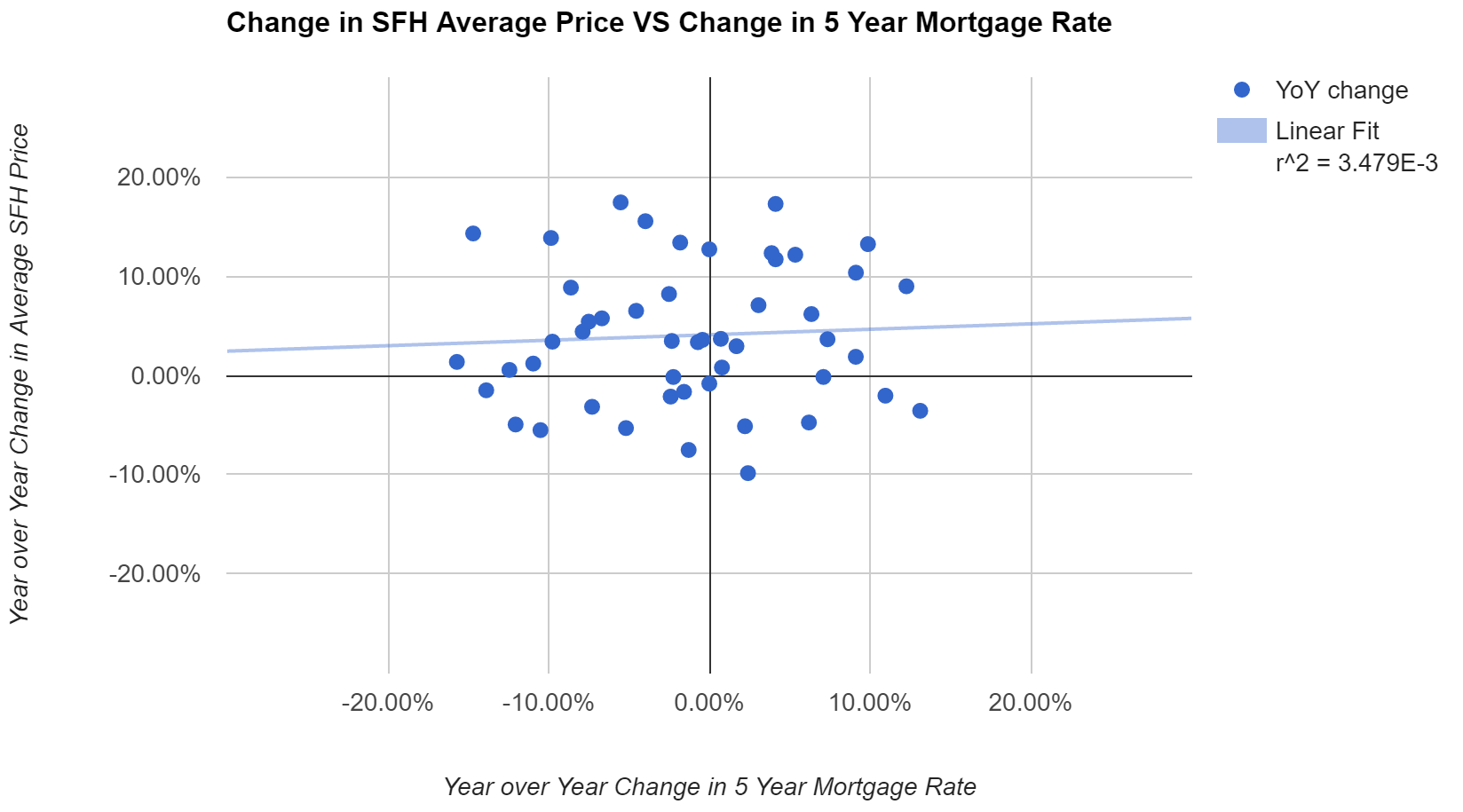

And from July 2001 to July 2003 rates dropped about 2% and Victoria prices increased 25%. In other words there is no or very little correlation and you cherry picking 2 dates doesn’t mean anything. There is no correlation once you take out the couple outliers during the wild swing of 1981

Quite right Michael. The first 2 years of rising rates are typically associated with rising real estate values. There’s really no reason to think it will be different this time, in Victoria at least. In Vancouver the regulatory changes are a wildcard that could lead prices lower.

An inflationary environment, rental vacancy of basically zero, a weak currency => It all points to higher real estate prices here. Doesn’t matter how “overvalued” you think they are already.

The last 2-year period where 5-yr mortgage rates increased ~2% was from July’05 to late’07. Victoria prices went up approximately 25% during that period. However, I don’t think we’ll see quite enough inflation in the next few years for a 2% rise in mtg rates.

I am curious, just for the sake of argument, what does everyone think would happen if interests rates went up from the 2.5 they are today to lets say 4.5% (call it a 2% increase across the board) over the next two years. I am not asking if you think that rates will be that high. The question is what do you think the effect on the real estate market here in Victoria would be if rates did go up by a full 2 points over the next two years?

“Michael is correct. Real assets should outperform in an inflationary environment, largely because short term interest rates are usually well behind the curve.”

Mike is basing all his predictions on 1912, 1941 etc etc,. This is 2016 where Canadian real estate HELOC’s make up 12% of Canadian GDP, triple the United States back in 2007.

Real estate will tank, not rise, as even more people are denied mortgages with minor moves of a quarter point. Canadian housing starts are already cooling and half the new buyers just got shut out. Throw in NAFTA destruction and we’re in for a roller coaster ride downward.

“As you are aware, the Bank of Canada does not set the interest rates for mortgages, other than the variable. If “bond vigilantes” determine that Canada isn’t such a safe place or money continues to pour into stocks and out of bonds, there will be a lot of shocked Canadians.”

Good point. It’s interesting back in January that Justin was actively shopping for nulti billions in bond money in the US for his big infrastructure plan. The Financial Post stated that high level bond fund lenders didn’t want anything to do with Canada and would have to shop from second tier US lenders.

Nothing happens for many months, until he recently announces he’s now shopping for foreign money to help create the infrastructure program. Says it all that the big US money sees Canada’s economy as high risk and could easily jack the mortgage rates much faster than we could imagine in what now looks like a US inflationary atmosphere.

Wasn’t there going to be a poll where we could make our predictions for the next 12 months?

AG, you are somewhat correct in your assumptions on real asset appreciation except you have conveniently overlooked the massive debt loads of Canadians and their INABILITY to withstand even minor increases in monthly costs.

Michael correctly pointed out the increase in stocks but the rise in bond yields came as a result of a trillion dollar sell off. That bond sell off occurred in Canada, as well and it will herald higher interest rates for mortgages.

As you are aware, the Bank of Canada does not set the interest rates for mortgages, other than the variable. If “bond vigilantes” determine that Canada isn’t such a safe place or money continues to pour into stocks and out of bonds, there will be a lot of shocked Canadians.

Good luck to all.

Michael is correct. Real assets should outperform in an inflationary environment, largely because short term interest rates are usually well behind the curve.

In the case of Trump, he doesn’t even need to do anything to create inflation. Expectations have already changed, thanks to the campaign rhetoric before his victory.

Prices go up when rates are low, prices go up when rates are high. Sorry but it doesn’t work both ways. Higher rates are going to be a lot more negative for prices than lower rates. Right now we have a strong economy in Victoria and low rates. Higher rates and higher inflation is not going to make the economy any better but it’s going to massively increase the carrying cost of those mortgages. Overall will be negative.

Michael: Only goes up up up in your delusional world. I guess all these maxed out people can handle these increasingly higher mortgage rates, along with everything else that’s going up.

For all those who think asset prices must fall as interest rates rise, they may want to mull over this week’s 5.4% rise in the Dow, alongside a 20% rise in US bond rates! They may also want to mull over what started happening to our home prices a year ago, after the Fed raised for the first time in 9 years.

A clue is that RE loves inflation.

James Soper: He doesn’t say. Watch them edge up now. Going to suck for lots of people who thought that rates would stay low forever. I’m sure that gang also figures that we’re “running out land”, and that “everyone wants to move here”.

Rates are creeping up a bit http://www.financialpost.com/m/wp/news/blog.html?b=business.financialpost.com/personal-finance/mortgages-real-estate/big-banks-mortgage-rates-edge-higher-in-response-to-ottawas-efforts-to-cool-housing&pubdate=2016-11-12

@Bizznitch what’s he basing it on though?

One thing is that treasury bonds have jumped almost .25 on 5 year bonds last week, and with the fed almost definitely going to increase the rate next month, there’s no way they can sustain the rate that they currently have.

A good read: http://www.theprovince.com/opinion/columnists/douglas+todd+canada+public+guardians+have+failed/12377432/story.html

I suspect that the high prices over the last couple of years has sucked a lot of the sellers out of the market. In addition I have a suspicion that a lot of what were rental houses were sold and converted into SFH. Does anyone know if this is true?

1849 active listings. How low can it go?

The irony is that Americans en mass voted to reject people who continually call them names like racist, sexist bigot homophobe for disagreeing with leftists. The reaction by the leftists? Double down. Which in a way is good.

Mortgage rates going up next week?

https://mobile.twitter.com/SteveSaretsky/status/796812110579658752

Trump has been fun for all. Back to the real estate market. Does anyone else feel that prices seem to be leveling out?

The recent posts speak for themselves…Trump brings out the best in people, including HHV posters.

CS said: “LOL. When did Canadian industry last depend on slavery?”

Everyday of every year CS!!!

Slavery has been renamed to a nice politically correct term; it’s now called minimum wage earners. And if Canadians refuse to work for slave-wages, then the government will happily import Temporary Foreign Workers to artificially keep the slave-wage at a sub-poverty level.

Minimum wage and the threat of temporary foreign workers taking those jobs, allows employers to pay slave-wages and effectively create a class of slaves within Canadian society.

No I’m definitely not an NDP Socialist, but government enforced minimum wages are slave wages that create a class of people who are nothing more than indentured slaves. Slave owners provided their slaves with food and housing and clothing for their families. Minimum wages do not provide that!!

@ Vicbot

“By that time, my response was already done.”

What’s the fuss anyhow. The word means “Something said quickly and suddenly” according to the Oxford Dictionary, still the Canadian standard I believe.

But since some may be obsessed with bodily functions, another word seemed preferable.

I didn’t know that during the four minute editing period a post was visible. I wonder if the blog code might be changed to prevent that. It would better, I think, if only the final edited comment were visible.

Anyway, time, perhaps to return to the subject of RE.

Good night.

Gimme a break, CS, tell the truth. We all know you used your 5 minutes of editing time to change it to a different word. By that time, my response was already done.

@Vicbot

You mean you twist your case.

I did not use the word “ejaculation.”

I said:

” but since you direct this little eruption in my direction …”

Don’t believe me, check below.

Hey, com’n. I don’t like Trump either. Although, who knows, he may not blow up the world.

Yes.

I do. But, being an introvert, I don’t want to meet you to buy you one.

“Don’t know, Vicbot, why you address this little ejaculuation at me.”

I rest my case.

As for my opinion, it comes from a place of civil discourse, which seems to be going the way of the polar bear.

“I could provide a list of nasty names, fair or not, applicable to Mrs. Clinton”

Again, she has not made racist or misogynistic statements, so playing that card doesn’t work either.

You’re entitled to your opinion, but since you direct this little eruption in my direction, may I say that it seems to have come prepacked from the Clinton propaganda machine. But the election is now over, so why bother.

Certainly, what you say tells us nothing that seems either interesting or true about economics and, in particular, the implications of globalization for wages and employment, or the options available to an administration that wishes to adopt a national, rather than a globalist, economic policy.

And, contrary to your sweeping denial, Trump does have options, and has, in effect, already nixed the Trans Pacific Partnership, which may not force anyone to manufacture anything in the US, but it gives them greater incentive to do so.

Incidentally, I could provide a list of nasty names, fair or not, applicable to Mrs. Clinton, but it would’t add much to the conversation would it.

CS, Trump has sold snake oil to all those that feel disenfranchised. (Similar to his “Trump University”)

All that “local manufacturing” talk is bafflegab to convince an uneducated population that he can tell businesses what to do, what to make, and where to make it. So much for a free market.

Plain & simple: there’s nothing any president can do to force businesses to hire Americans to manufacture fridges/stoves/TVs – that train left the station back in the 70s.

Economies like Germany are driven by innovation and value-added technology, not naval gazing back to the 50s. If innovation requires hiring a brilliant mind from another country, more power to them.

The only thing he has succeeded in doing is legitimize lying, racism, and misogyny.

Most of the rest of the world recognizes this, and most Americans do as well, as he didn’t win the popular vote.

TD STILL is the outlier on prime mortgage rate a 2.85. How can they continue this stance? ZERO banks have matched this.

The benefit? Or do you mean the cost? Trump’s economic policy will, as I’ve mentioned, lead to inflation, i.e., higher prices.

The restoration of full employment in America at good wages would lead to very substantial price increases, especially for those goods currently manufactured by relatively unskilled labor offshore, e.g., textiles and shoes.

Nevertheless, most working people would be better off, especially those among the 94 million of working age who are not working though they would like to, and those who have to compete with illegal immigrants in the untaxed, below-minimum-wage underground economy.

For most of those, like me, who live off investments, it would mean a reduction in income, as the result of a squeeze on the profits of global corporations.

CS,

I repeat – one sided – You haven’t mentioned the benefit to the consumer, which is everyone, once. the benefits are dispersed (which is a good thing) but large in total.

LOL. When did Canadian industry last depend on slavery?

In fact, for most of the 20th century, Canadian industry, like most industry in Europe and much industry in the US depended on unionized labor, which received substantial legislative protection from exploitation, including exposure to unsafe and unhealthy work conditions, and which was represented in national legislatures by what often became ruling parties, such as the British Labour Party, the US Democratic Party (before it sold out to the globalist interest — quite literally where the Clintons were concerned), and in Canada the NDP.

But if you want to debate globalization why not watch Jimmy Goldsmith make the case against it before offering further remarks.

Except big business has always relied on low cost unregulated labour. Up until recently it was slavery…

It’s a rarely acknowledged fact that David Ricardo, who demonstrated the benefits of free trade, even between economies differing in labor productivity, believed that free trade with the free movement of capital to enable investors to benefit from cheap labor abroad, would not be desirable. At the time that Ricardo wrote, all business was, by today’s standards, small business. Thus, Ricardo believed that free trade with the free flow of capital was not likely to occur, because owners of capital would be too far removed from the place of investment to have adequate control.

In the age of the jet plane, the internet and the mega corporation, things are totally different, and moving both capital and technology (which was beyond Ricardo’s purview) to low labor cost jurisdictions and jurisdictions with little or no regulation of workplace safety, or protection of the environment has meant the hollowing out of most Western economies. Germany’s success proves the rule, since Germany has become Europe’s leader in snapping together components made with cheap E. European labor. That, however, is a game not everyone can play.

This was all anticipated by, among other, Sir James Goldsmith, a billionaire founder of an anti-EU poltical party in the UK. In this discussion with Charlie rose, he trashes Bill Clinton’s Chair of the Council of Economic Advisers. Bill Clinton, nevertheless signed the 1994 GATT agreement, the forerunner to the World Trade Organization, which led to the rise of China and economic stagnation throughout the West.

RickyBobby,

CS is only extolling the negatives of free trade. One sided.

But I agree this argument is why Trump won.

@cs

I usually don’t agree with anything you say but your points on trump and globalism are really interesting and spot on. It explains how he won.

“Dow closes at new record high”

http://www.cbc.ca/news/business/asian-europe-na-markets-thurs-1.3844857

The globalist rich are already getting richer!

Re: Trump the globalist not.

Trump visits Obama, after which Democrat Senator Charles E. Schumer tells labor leaders that the Obama-backed Trans-Pacific Partnership is dead.

No, Trump is not behaving like a globalist, which is as you’d expect of the sole proprietor of 500 small American businesses.

That letter exactly encapsulates the globalist imperative versus the nationalist ideology: i.e., We celebrate the cheapest brains and labor, wherever it they can be found. And the Hell with the American worker, who we celebrate only if we have to and who we will replace with an H-1b visa immigrant whenever we can.

Apple has stood it’s ground a few times for the common good. Not handing over the keys to the kingdom was one. This is Tim cooks letter after the election. The last paragraph in particular is pertinent to the feeling of sadness people have with this result….

“Our company is open to all, and we celebrate the diversity of our team here in the United States and around the world — regardless of what they look like, where they come from, how they worship or who they love.”

http://www.forbes.com/sites/briansolomon/2016/11/10/apple-ceo-tim-cook-on-trump-lets-move-forward/#4454ff52331e

Or you mean that Trump, as a leader of a global corporation, will not damage the interests of the likes of Apple, Walmart or Ford.

If so, I think you misunderstand the nature of the Trump Organization. Basically, it’s a collection of mainly US-based small, or smallish, businesses.

Trump International is a franchise operation. In other words, Trump sells consulting services to people in 81 countries that want to run a hotel under the Trump International brand name.

So Trump International is a US-based service exporter. So I think you are wrong if you equate Trump’s interests with those of vastly bigger global corporations, that rely on offshore labor and brains to export goods and services to the US.

Trump’s personal interest is much more closely aligned with US small business.

Y0u’re saying global corporations rule? Not elected governments? I’m no disputing the claim, just seeking to clarify.

What’s hilarious is that people think the leader of a global corporation is going to do anything that’s going to hurt those corporations in favour of the common person.

Good old Rolo!

Bill Clinton used it too. American non-greatness has evidently been ongoing for a while.

Generally, people are better off with a job than without a job, whatever the price level.

Whether Trump does anything he has promised remains to be seen. If he did, it would be unusual. I mean, what other US President in recent history did what he promised while on the campaign trail? Obama, the Peace Prize winner, is now at war in about a dozen countries. And George W. Bush, who promised “a humble foreign policy,” began most of the multi-trillion wars on Muslim countries that continue today.

But if Trump were to bring about policies that resulted in Americans (and perhaps Canadians too — Trudeau has indicated readiness to renegotiate NAFTA) making stuff for one another, as they used to do, it would bring about a reversal of the income distribution trend since Bill Clinton signed the GATT mega-free trade deal in 1994.

Profits of global corporations (and dividend payments to investors) would shrink, while labor demand at home would increase along with wages, which in America are, for most people, remarkably low.

RE prices would probably fall, however, as inflation would lead to significant interest rate increases. But whatever of significant happens in the economy, it will not likely happen overnight.

Trump “Make America great again” isn’t this Roland Regans slogan? His platform is pretty identical to Regans just that it’s on steroids. Cold War, tariffs, at least we get a wall,m. wonder how the housing market will play out now?

On the flip side to how the rust belt will/will not benefit with a Trump presidency. When he starts slapping tariffs on stuff, watch the low Walmart prices go up up up. I wonder where rust belt people buy a lot of their crap? Their few dollars will not go as far.

Ticking time bomb.

Via Steve Saretsky:

Home equity lines of credit now make up 12% of Canadian GDP. Triple the United States back in 2007. #VanRE https://t.co/yVafCUJUVi

http://vancitycondoguide.com/canadian-economy-unhealthy-addiction-to-real-estate/

Americans hoping to move here will be out of luck. Not as easy to do as you think. The Province explained it yesterday but dont have the link. More realtor and Mike hype.

So ironic given they do their manufacturing in the US. Trump should be 100% behind them.

Tesla is not popular with many groups.

OK, but a significant amount spent on materials should leave a decent amount for wages.

Did you know that the average wage of the lowest paid half of the American workforce is less than $13,000 a year, and that the median income from employment is less than $29 thousand?

As for the source of materials, the Trump administration will surely mandate American sources of steel, cement and other materials for all Federally funded infrastructure projects. That would not be that big a deal. The US is the world’s third largest producer of iron and steel, for example, with annual production of around 120 million tons, which accounts for about 80% of domestic consumption. Producing another few million tons won’t be a big deal. Production is currently way below capacity.

Canada needs to build a wall.

Sorry missed read the stats. listings outpacing sales today by 17:7 or 2.4:1

I suppose a lot of jobs depend on free trade with the USA. Time to sell the rental property before Armageddon hits.

Some humor for the day.

Canadian realtors already fielding calls from anxious Americans — but sorry, Toronto isn’t on the ocean

http://business.financialpost.com/personal-finance/mortgages-real-estate/canadian-realtors-already-fielding-calls-from-anxious-americans-but-sorry-toronto-isnt-on-the-ocean

I also heard our Immigration website and Maple Match dating site crashed from so many Americans looking to flee.

Spike in new listings today. As they currently outpace sales 23 to 13.

It could be worse.

You could be Paul Ryan

Financials came out the strongest as rumor of tearing up Dodd-Frank. Banks can run wild again. I came out flat on the day. Much more volatility ahead as the market will move by whatever shoots out of The Mouth.

As suspected Trump has a hit list of all his enemies so he’ll waste more of his thin skin trying to get even than running the country.

Yep, batting two for two. Thought Clinton would get elected and thought the markets would keep with the overnight dip. Buy nothing day today. Only silver lining is that I can wait for a Trump disaster – hope there isn’t one but odds seem good.

Canspecccy,

Don’t get me wrong – I think infrastructure spending is generally a good thing but few core trump supporters will benefit.

10 million 100K/yr jobs – hate to tell you but a significant amount will be spent on materials not jobs and I bet my bottom dollar that a lot of that will be imported esp. raw materials.

So ironic given they do their manufacturing in the US. Trump should be 100% behind them.

Yep hardest hit for me are my solar plays. I guess the market wanted certainty most of all. To bad I sold LMT a while back. Just nagged my morals having it even if it was more a robotics play for me….

Agreed Reasonfirst, the US is near full employment. Not like he can bring in immigrants to work for peanuts. He’ll be too busy rounding them up for the bus ride home. Old coal miners won’t cut it. Again , Trump is a fraud who won’t expose his taxes.

Totoro said it would be time to go bargain-shopping for American equities so I steeled myself and opened my TD Direct page. No bargains to be had.

Uncle Donald did however pass me $31,500 I didn’t have last night.

It is a strange and magical world.

If Trump tries to tax Mexico 35% then under NAFTA he has to tax us too. He can’t cherry pick.

I have friends from Mexico that are scared and won’t pit stop in the US on trips back home. With anti Trump protests ramping up in Times Square and even a high school walked out of class where teachers joined in, this is not going to be some easy ride for Trump. He’s about to screw the world and put the US in debt another $5 trillion.

Good luck with his non existent BS economic plan. He’s a fraud.

Look, if you spend a $trillion on work that cannot be offshored, there’s going to be some jobs created — ten million year’s worth at $100,000 per job. Plus, since the money is to be printed, not raised through taxation, there will be a big multiplier effect, meaning many more jobs beside the direct jobs in construction, steel mills, cement plants, at Caterpillar factories (Caterpillar up 7% this AM), etc.

Canadian lumber prices and stocks getting smoked along with auto parts stocks.

Yea but TRP is up 2.5% today and is pulling my portfolio up 1% for the day.

Anything to do with clean energy is down including Tesla.

Canspeccy, that ain’t gonna help undereducated ex-factory workers unless all the infrastructure work is in the rust belt.

And I can’t see all these old guys lifting a shovel as they won’t be getting the skilled jobs required.

Once rates start rising, asset prices typically rise for at least another ~3 years. (excluding bonds of course)

Victoria prices have always surged ahead for at least a couple years into a new rate cycle (based on the available ~50 yrs data).

You maybe right, but in that case Canadians are likely to be disappointed in what the Trudeau government can do for them, because the Trudeau government has already adopted a massive deficit-funded infrastructure program, such as is the centerpiece of Trump’s economic policy.

About Canadians coming home due to TN visas being stopped via NAFTA reneg:

~This will take a long time if it happens at all – I think Congress will make it difficult for Trump.

~These “Canadians” are likely career-minded, in well-paid positions and will not be coming to a backwater like Victoria for career advancement.

“It’s going to be the people and attitudes he has enabled” – but they will be quickly disappointed with what a Trump presidency can actually do for them.

Trump’s not worried about Canadian sweatshops taking American jobs. It’s the Mexican sweatshops he’s concerned with, plus the collapsible garment factories in Bangladesh, where Loblaws get their Joe Fresh shirts, and the cellphone assembly plants with suicide nets in China.

Logically, a Trump administration should favor free trade with Canada and other high-wage jurisdictions. However, such free trade will surely depend on coordinating policy with the US on trade with the low-wage Third World jurisdictions. Overall, Trump’s impact on the Canadian economy will likely be similar to its effect on the US economy: inflation, higher interest rates, lower asset prices, more manufacturing jobs, higher wages, and wage gains by the rest versus the 1%.

The slump in lumber prices is probably in anticipation 0f a decline in asset prices, including RE and hence a slowdown in home construction. However, steel and cement, essential to both Trump’s and Trudeau’s infrastructure projects should do OK.

Autoparts should benefit eventually, as auto production comes back to Detroit.

Introvert’s “There will be no President Trump. I guarantee it.” Was in response to my suggestion, last August, that there might be.

It seems to me, therefore, that Introvert owes me at least a coffee.

What will be interesting to see now, is whether my projection of a Trump-led interest rate rise and asset price collapse is also fulfilled.

Canadian lumber prices and stocks getting smoked along with auto parts stocks. Mike missed the memo, it’s Make America Great Again and Fuck Canada. Our economy is already sucking wind, killing NAFTA is the final nail.

If Trump does break NAFTA as he said, Canadians working in US under TN visa could be forced out.

Voters in Florida, North Dakota and Arkansas approved medical marijuana measures.

-they’ll need it!

Best tweet.

Don’t forget to set your clocks back 60 years tonight. #ElectionNight

Mike, you just said he will be one of the greatest presidents. Sounds like full endorsement to me. The fact you support rounding up 11 million families is disgusting but why am I surprised.

Markets are waiting for him to open his yap. Plunge protection team saved the market last night and this morning. They shut down the futures market ICYMI. This is just getting started.

Markets will likely be volatile until everyone gets a better sense of what he will and what his party will allow him to do (or will he even care what they say?). The only themes I can find are protectionism and unapologetic selfism.

He used his base shamelessly to secure power and now will abandon them. The rhetoric has already shifted from build a wall, wear a ball cap and make America great to partnerships, trade and cooperation, probably a shift to try to quell the nerves of nations and markets. Once settled, it will be all about making Trump great rather than helping the rust belt.

My son found this on twitter: To all the American girls who wish they had grown up in the fifties, wish granted.

Not likely. As long as there are tax cuts for the rich, a “pro-life” SCOTUS justice, and a repeal of the ACA, the Republican Congress will be his lap dog.

Never said I back him. I didn’t support the actor Reagan either, but he turned out to be a great president.

Say, what happened to all the bear talk of the markets getting smoked? 🙂

Well, the markets are back up… so much for timing.

I don’t know what kind of policy changes Trump will implement. No-one does yet because he has said so many crazy things. I didn’t expect him to win. That he has, despite well-documented and widely publicized bad conduct which included sexism, racism and out and out lies, plus the over the top narcissism, is disheartening.

Haha! I just finally had the courage to look. I knew my Twitter stock would be up…. market thinks it might become state owned I guess….

He is not going to be the problem. It’s going to be the people and attitudes he has enabled. This is the spark of an ideological battle. globalism vs isolationism, progressive vs regressive, good vs evil. Gotta rewrite the Harry Potter novels with Draco Malfoy as the lead….

So when do we hear about the special prosecutor who he will appoint to put his political rival in jail? This what democracy looks like?

this man is a narcissist and every decision he will make will be for the good of himself alone because that is all he can do. His aides and other Republicans will need to not only step in and run the country but keep him on a very short thick leash. I’m willing to bet there are already Republicans in a room somewhere talking about impeachment.

Let’s not forget his tax returns which he will never release. I’m hoping some hackers with some real guts solve that issue and more. Not one single Trump email leaked out, not one. Putin’s puppet will open his fat yap in a few days then the bloom will be off the rose with the rotten roots.

Mike, you are messed in head bigtime. He’ll be impeached in his first 6 months to a year for corruption and Russians connections, not to mention sexual assault civil claims plus Fraud University. America is about to go down its darkest road yet.

Good to know you back someone approved by the KKK and elected by Putin. The real Mike has emerged.

Believing his acceptance speech as truth is deplorable.

Don’t look now Leo, your investments might even be up!

So you’re saying he’s going to sell out the people who voted him in? Shocking.

Get a grip people. He’s going to be one of the greatest presidents! The Trump you thought you knew this past couple years was just playing politics. Listen to his acceptance speech if you haven’t already – puts Trudeau to shame.

Ash, we sold for a number of reasons:

Old house with several big ticket renos required (despite 80k of improvements since purchase)

Desire to be mortgage free in a reasonable amount of time (see above)

Big, quick and unexplained increase in value of Victoria housing at the start of the year

Too much uncertainty with many potential impacts to those recently increased prices –

– A crack down on the real estate industry, tax evasion and money laundering.

– Pending US election (wow what a result!) and the upcoming BC election.

– Changes to mortgage qualifications and shifting of risk from CMHC to lenders.

– Bottoming of interest rates.

– Extreme debt levels combined with highest homeownership rates.

My work is not location specific

We moved to the Comox Valley and now have a house that is bigger, fully renovated, close to kid’s school and at a price almost half of what we sold for. My wife doesn’t have to work and can focus on our kids. All round a great move so far!

Far east update. The entire expatriate community is in shock and disbelief that this could happen. They don’t know what is scarier the person or the people who voted for him.

Reporting from overseas (southern hemisphere) at the moment. Everyone here is in shock and is sickened as well, even the most conservative cannot fathom how hate, bigotry, and misogyny won.

Time for most of us to go out and get a new crystal ball.

Didn’t think I’d be watching Trump give an acceptance speech. Black is white, cats are dogs. I’m not going to look at my investments for a while.

It looks like Trump took it.

Global markets down, currencies down, oil down. How low will they go?

I dont see a flood of Canadians coming back, but I might be wrong.

@caveat might as well have one more debate about house prices before the blinding flash and then nothing….

It has nothing to do with moving here as an American. It’s the Canadians coming back.

Moving here for an American is not that easy; noy going to happen. Just media spin.

Given the calamity south of the border it seems almost lame to speculate on the impact on Victoria real estate. If Trump puts all his unhinged policies into place I’d agree with Hawk that a global recession is not out of the question. Depends how much a Repub congress wants to control Trump.

Sure a few more Americans are going to want to move here, but is that going to compensate for Canada’s economy taking a hit.

Props to CS (and Michael Moore who has been calling this for some time).

This is the US electorate flipping the bird to their political institutions by voting this goon in.

But remember it’s not like a parliamentary system down there where a majority leader can run roughshod over pre-existing policy. He can cause some problems and slow things down no doubt but he needs some support across his party to actually get anything done.

Yes I feel genuinely ill. All the social and environmental progress that the US has made in the last decade…just poof, up in smoke. There will be a hard lesson for that country, and the pendulum will swing the other way. I just fear that it will legitimize hate and bigotry, and that it will rise out of the shadows and make worse an already terrible divide. I worry that economically, we will get dragged down by a flailing, drowning neighbour.

Anyone worried about that rising rate anymore? I’m searching for positives.

Everyone will want to head for the Shire….

It’s like wave two out of Alberta but bigger. Microsoft has a lot of Muslim staff in Seattle. Best move them up north now.

America is one fucked up country. A bigotted sexual predator with thin skin has control of the nukes.

For once we agree 🙂

America is one fucked up country. A bigotted sexual predator with thin skin has control of the nukes. Real estate will not save your ass Dasmo. A global recession is about to hit bigtime.

Very

Harsh… the world is broken. At least I have real estate here. Expect upward pressure big time….

Politics and real estate state aside how can 66% of white women vote for Trump? I don’t get it.

Everyday I log into my computer and read stories about the gender wage gap, objectification of women, etc., etc…..and then they vote in an old rich white guy that has had kids with three different women and objectifies women versus a career woman that is a mother and grandmother. What da?

Congrats to CS on correctly predicting the election.

CND down a full cent….Victoria is become cheaper and cheaper. Time for the foreign tax here too?

Anyone besides me feel actually sick?

I’d say brexit given that there is far more power behind the scenes than the presidency, but bets are off as to what will happen next. I’m buying tomorrow, but not all in. I’ve been waiting for a downturn but would be happy not to have this opportunity as I’m pretty sad about the results.

Hard to tell. Will the stock market dip be like brexit, or is this something more serious? So hard to know if Trump was actually serious about all the policies that would be disastrous for the market or not.

Get ready to buy stocks!

I just turned on the TV and it looks that there is possibility that Trump might win.

Futures are down hard, but I’d wager a post brexit like scenario where the losses are largely recouped in the days/ weeks that follow …obviously I’m an optimist 🙂

Can you guys imagine Trump delivering a State of the Union address?

Bye bye investments.

Chris, I’m curious, why did you sell? Did you manage to find a suitable rental or did you downsize?

http://i.imgur.com/muN2Hkd.png

Getting nervous Introvert?

Imagine 1000 places hitting the market tomorrow, and Trump winning on top of that. The market would get smoked even without Trump.

Some times too little isn’t better

See Oak Bay watering restrictions.

Might have something to do with sunshine (less rain).

Annual Rainfall:

Port Renfrew – 138 inches

North Van – 99 inches

Coal Harbour – 59 inches

Sooke – 55 inches

Nanaimo – 46 inches

Sidney – 35 inches

Victoria – 24 inches

Oak Bay – 21 inches

http://www.olympicrainshadow.com/images/satellite.jpg

This Coal Harbour condo can be yours for a meager $59 million.

bought the property in 2014 for the bargain-basement price of $16.6 million, which was actually $6 million below the asking price.

http://www.timescolonist.com/news/b-c/vancouver-penthouse-comes-with-a-59-million-pricetag-1.2529799

We got money or a least we got equity.

We got precious equity thanks to years of non-local incomes,layering on debt and various measures to stoke the obsession with real estate. As mentioned the belief in ever more equity is what encourages people to be all in. If things change preservation of that equity will be paramount as we have little in the way of savings. (Generalizations of course – there are people in Victoria who have become rich locally and others with big incomes but they are in the minority.)

I think a lot of Victorians think Victoria will be the next Vancouver.

Just as those from Surrey think that Surrey will be and is the next biggest city center. And there are a heck of a lot more of them than there are of us.

Victorians are not equity poor. I forget now who the poster was that was bragging that they were sitting on $700,000 of equity. You hear it all the time in the city people brag about their wealth or at least their equity.

The joke is that people from other cities have pictures of their children in their wallets. Victorian’s have pictures of their house.

I think Victorian’s are wealthy or at least as wealthy as out of town buyers. The home owners that haven’t spent their equity on living expenses have accumulated equity in their homes with the rise in prices. That makes it easier to put down a large down payment.

Most home sales in Greater Victoria are in the $500,000 to $800,000 range with 21 percent of the sales over a million. And 57% of those million plus dollar sales were bought by Victorians. We got money or a least we got equity.

What would it take to get 1 or 2 percent of that 97 percent to list their homes?

Price declines! If the perception of ever increasing prices diminishes home owners will make the jump. I think a lot of people believe Victoria will be the next Vancouver and our prices can disconnect even further from local incomes. That may be true if foreign funds (income earned outside of Canada – citizen or not) continue to find out markets attractive. But to think that current prices can be sustained by local incomes is wrong. As you mention it’s only a few transactions out of a huge inventory of (potentially available) product that can sway the perception.

Only 3 or so percent of the total stock of housing is ever up for sale. That is the size of our real estate market.

That leaves 97 percent of housing out of the market place. What would it take to get 1 or 2 percent of that 97 percent to list their homes?

One of the biggest incentives for home owners to sell is cost. Not the cost of buying – the cost of maintenance and taxes. Back in 1994 a million dollar house in the city paid close to $10,000 a year in property taxes. Today those taxes on a million dollar home are about $6,000 and rising. Imagine what that would do to the finances of most pensioners today since pension increases have not kept up with housing costs.

I see this with many fixed income pensioners today. Living in a million dollar home but surviving on scraps. And you’ve seen it too. A drive through Fairfield and you’ll see the houses with the paint peeling and roof patched. There is no money for repairs. They are house rich and income poor.

So I would say part of the solution isn’t to cull those over 65 but to educate and counsel them that there are alternatives to freezing in the winter because they can’t buy oil. Estate planning so that they can live out the remainder of their lives in comfort.

Victoria might be a paradise but that doesn’t make it better for those elderly people who will miss diner tonight so they can buy their medication tomorrow.

And it is far less expensive for taxpayers to educate rather than spend millions in subsidies for condos that few people want to live in.

To clear 100k you require 165ish in pretax earnings at the top tax rate – it was early and unfortunately I’m not in the top tax bracket which I thought was just under 50%. I fully agree that the price increases are due primarily to external incomes / wealth entering the Victoria market even if it is not identified as such. I don’t agree the inventory is being restrained by rich retires waiting to die before they sell. Once the perception of a continually rising market is broken inventory will rise significantly.

Just Jack – thanks for the enlightenment… I was referring to the view of the regular posters here.

Chris:

I am going to assume that your “extra 200K of pre tax income” is a typo. But perhaps you are referring to the total cost of paying off the mortgage (it is early and my wife just brought me in my first cup of coffee. Unfortunately, my wife is using my crystal ball for a paperweight so I dont make predictions.

I have only been in Victoria for four years (bought my house three years ago after a whole year of looking) so i really don’t claim to be any sort of expert. But three seems to be two separate segments of home owners here. There is the usual group of locals employed in Victoria but then there is also a very different group of retirees. Victoria, according to the census has a higher proportion of seniors over 65 than the rest of the country. But what is telling is that it also has a much higher proportion of people over 55.

I suspect that the dynamics of both retirees buying and also selling in Victoria may make the market a bit different, disproportionately in the primum core areas such as Fairfield, Oak Bay and James Bay. than areas such as the west shore. What would interesting to know is what percentage of homeowners in Oak Bay have no mortgage. For this group of retirees I suspect the principle reason for putting their house on the market is death, downsizing and divorce.

We have had two years of very high house prices and I suspect that a lot of people who were motivated to sell by these higher prices have already sold. I suspect that at this point even if house prices increase another ten percentage that this not motivate a lot of people to put their houses on the market in these premium core areas. What we lack is a reliable set of statistics to base any real conclusions on. It would be interesting to know whether the number of SFH in this core area that are available for rental have gone up or down and by how much. What I noticed was that a lot of the rental homes where on the market. What i dont know is whether these homes were bought by other investors or whether the percentage of rental SFH went up or down. The reason this is important is that a major price increase would have an impact on having these homes come onto the market. The same increase is a lot less motivation for retirees that are living mortgage free.

I have heard a rumour (probalely not true) that the real estate agents have suggested that there should be a cull of people over 65 in order to increase the inventory of homes.

Does anyone know what 2052 Kings Rd in North Oak Bay sold for? Looks like it finally sold, listed the third time in the last few months. Was listed at $860k after being reduced from $879k.

Had a look at the open house and didn’t think much of it – tiny pokey rooms and needing lots of updates.

Maybe but most communities carry out this type of survey and 99% is the highest result I’ve seen. Ex. Nelson is 90%, core as a whole is 81%, and Penticton is 78%.

I’d say there are more objective measures of quality of life than community perception, but I’d be inclined to put weight on the resident’s reviews myself – haven’t noticed that living in a community stops people from noticing or complaining about what is not working for them.

The way I understand things Chris is that of the 152 people that bought homes last month in the Victoria Core they considered prices affordable. That doesn’t mean everyone in the city thought prices were affordable. If they had not thought prices were affordable then they would not have bought.

Last October there were 204 house sales in the core. The year before there were 175. The worst year was during the 2008 recession when only 97 people thought houses were affordable that month. The average for the last decade was 148. Relative to the last decade affordability is not better or worse – just average.

However if monthly sales for November fall under 134, then affordability would be less than average.

Here’s another OB repeat listing. Originally offered at a cool $10 million, the asking dropped to around $6 million. Now its re-offered at $6.8 million. Is this a resale or a second shot at the $6 million mark by the original vendor, or what?

Here’s one North OB property offered at a deep discount. Listed earlier this year for, I believe, around $3.3 million, now newly listed (for resale?) for a $2.598 million.

Without similar discounts, I should think some other offerings in the neighborhood may be listed for a long time.

And if North OB is setting a trend, the outlook is for a sharp decline in sales throughout the region.

Another factor to look at is the days-on-market. The average DOM has increased significantly yet the median DOM hasn’t moved much. Last month the median was 12 days. Back in January before the increase in prices, and agents began to purposely under expose properties and market in blind auctions, the median DOM was 17. It was as low as 9 days near the peak of house sales in the core during the spring.

Hopefully the median DOM will continue to rise as I expect that will put a dagger through the heart of these delayed offer schemes. And that will be good for buyers.

Really Totoro, isn’t that like asking parents to rate how intelligent and attractive their children are?

Last month house prices in the core rose once more as did the Sale to Assessment Ratio.

Houses sold as low as 99 percent of their current government assessed value for a home along a busy street in one of the less desirable areas of the city to a high of 173 percent for recently renovated home near Lambrick Park.

Most home sales fell around the median sales to assessment ratio of 137 percent. That’s up 3.8% from 132% the month before. However because of the lower sales volume in October the error could be a couple of percent. But still values would be marginally up from the month before.

When sale volumes decrease but prices increase that seems irrational and to be going against basic economic theory and in most cases the following month proves that as prices decline to offset most of the previous months increase. So I’m not expecting any great price changes for this November for houses in the core. I do expect sale volumes to continue declining. I don’t expect November house sale volumes to be the worst in the last decade in the core, but I expect us to be closer to the bottom than the top for core house sales in the last 10 years.

House sales in the core for November of each year

2007 – 173

2008-83

2009-155

2010-122

2011 -166

2012-121

2013-119

2014-113

2015-151

2016- ??

Real Estate isn’t homogeneous cans of tomato soup. Houses are not physically all the same to one another even if they have the same asking price. So, while listings may decrease it doesn’t mean that the quality of properties coming to the market will also decrease.

I think you should still be looking in the winter because along with fewer listings there are also fewer buyers too. The only time you’re going to get a good price on a house is when there are fewer buyers competing against you driving up that price.

The greater the months of inventory the more likely you will get a good price on a house. And for houses in the core that has been increasing and last month was the second highest of the year so far. The MOI is still low so the odds of getting a deal on the purchase is low but the odds of paying over market value is lower too. The only strength a buyer has in a market like this is to play hard ball. Make your best offer and never counter. There will always be another home coming to the market and it might even be a better home than you just bid on.

Month Months of Inventory for stand alone houses in the core districts.

Jan 2.84

Feb 1.66

Mar 1.31

Apr 1.06

May 1.09

Jun 1.26

Jul 1.86

Aug 1.81

Sep 2.04

Oct 2.38

“In my view demand and lack of inventory is fueled by year after year of easy profits and real estate as an investment obsession. I’ll be interested to see how all the changes made will influence this behaviour.”

Well said Chris and smart move to sell at the top. Government has never stepped into the market like this before and the results sometimes take a couple of months of deer in the headlights by the buyers and sellers.

The latest numbers were from a couple weeks back so moving forward they could drop lower or flatline at best based on Vancouver tanking. The ripples will eventually reach our shore just as they did when it was going up.

Canadian housing starts, permits slip in latest signs of cooling

“The slowdown in new construction was sharpest in British Columbia, where starts dropped 44.9 per cent. Vancouver, Canada’s most expensive housing market, has come off the boil since the August introduction of a tax on foreign buyers in that city.”

http://www.theglobeandmail.com/real-estate/the-market/housing-starts-slow-in-october-cmhc/article32718422/

OB residents rate the community except for the pesky deer:

https://www.oakbay.ca/municipal-hall/mayor-council/news/oak-bay-community-satisfaction-survey-gives-district-thumbs-and

If I understand correctly the consensus here is that SFH prices in Victoria are reasonably priced historically (based on monthly payments). The jump in prices since the beginning of the year is primarily due to locals (95%) who have now recognized the value in Victoria and have also been influenced by the extremely low inventory numbers. Another assumption is few people will be motivated to sell because demand is so high and prices keep rising, leading to even lower inventories and higher prices – this should continue for the foreseeable future until we build more units.

If we generalize and say most SFH’s rose at least $100k + that means the average local buyer had to come up with an additional $200k in pretax income – which they suddenly decided was worthwhile (and accessible) at the start of the year. Interesting…

In my view demand and lack of inventory is fueled by year after year of easy profits and real estate as an investment obsession. I’ll be interested to see how all the changes made will influence this behaviour. I think we are seeing the initial stages in Vancouver but there is still the confidence (low inventory) this is just a blip. If the declines take hold watch for the same downside performance as we had on the way up. Once the idea of subsidizing renters for future capital gains is seen as no longer effective we’ll see lots of inventory and fewer sales. With extreme debt levels and an economy so dependent on real estate watch for momentum on the downside to accelerate. This of course presumes foreign investment (declared as such or not) doesn’t jump in and prop up prices again and that’s the real question on where we go from here. Canadians have been neutered.

FYI – we sold our Fairfield house in the summer.