October Market Strong but Early Signs of Weakening

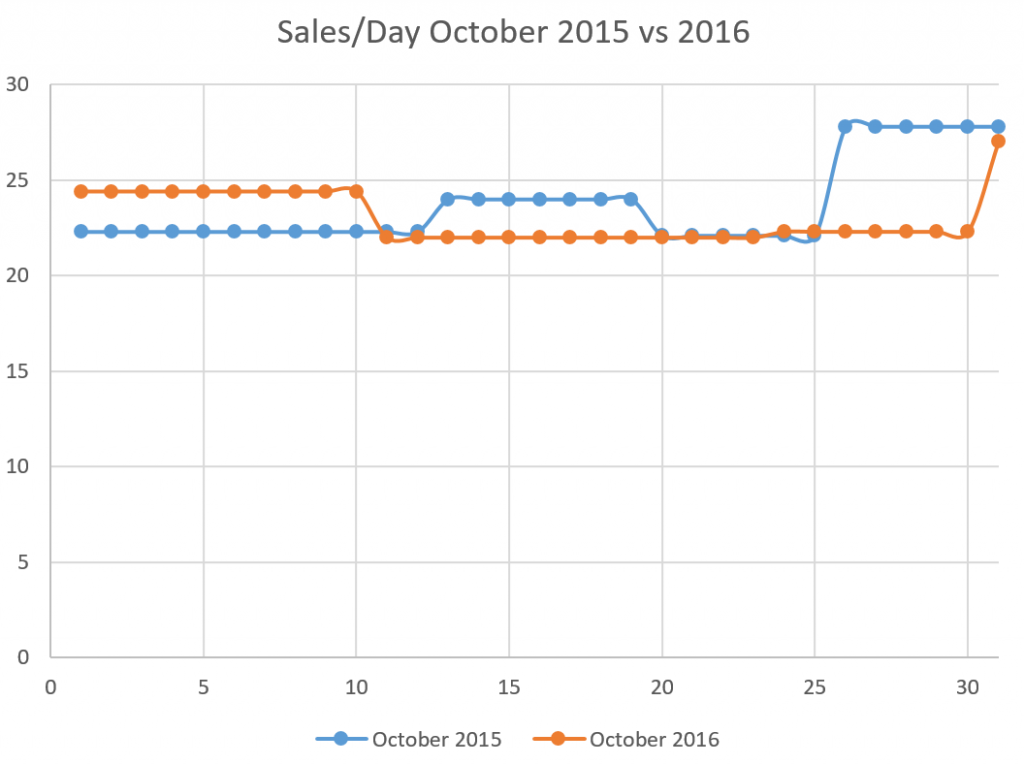

October numbers are out and the market is undeniably still very strong. Record low inventory and months of inventory for October lowest in 20 years. But the list of records isn’t quite as long as we’ve seen in the past few months. Sales are strong but at 735 they are the same as last year, and lower than 2009, 1992, and 1991.

So why did the weekly numbers predict 800 sales and we only hit 735? Because the last week of October 2015 had a strong sales surge that we didn’t see this year. I predict that from November to well into next year, every month will have fewer sales than a year ago. That’s not to say we won’t have an active market, but it’s quite unlikely we’ll be able to match this year’s outperformance with the headwinds of the mortgage and other regulatory changes.

Prices are still rising, albeit more gradually. With such low inventory, it will take a big reversal and a doubling of inventory before prices have a chance of coming down.

Unfortunately new listings are not picking up at all. The opposite in fact, they have been trending downward for 9 years! When are people going to start listing their places again?

The sales/list ratio has also flatlined for the last few months which breaks a 3.5 year rising trend. That said it is flatlining at the incredibly high level of 80% so we have likely just reached the maximum that can be sustained.

Barrister asks “Do you know if the ratio of condo to SFH has remained about the same?” and the answer is yes. While the percentage of single family sales are a down a couple percent from this time last year, there is no big shift to condos despite how expensive anything detached has become.

The other thing to consider is that the sales we are seeing are sales that happened in some cases a couple weeks ago as they are registered as sales with the real estate board. As we get into November, we will start to see the sales that actually took place after the mortgage changes take effect.

As Chris points out, market sentiment is also a huge driver of continued buying behaviour and thus price appreciation. One study calculated that about 30% of the price appreciation during the USA’s housing bubble could be attributed to the positive feedback loop of increasing prices. If Vancouver continues to deteriorate like it is (detached months of inventory in strong buyers market territory) and starts hitting the news with big price declines, that could dampen the mood of Victoria buyers and sellers as well. Countering that is the assessment notices that will be arriving in people’s mailboxes in a couple months and showing massive gains. It’s going to be interesting.

Victoria will follow Vancouver’s market, but expect it to lag 6-12 months behind.

http://www.nsnews.com/news/north-shore-home-sales-dip-towards-a-buyer-s-market-1.2546222

Last month house prices in the core rose once more as did the Sale to Assessment Ratio.

Houses sold as low as 99 percent of their current government assessed value for a home along a busy street in one of the less desirable areas of the city to a high of 173 percent for recently renovated home near Lambrick Park.

Most home sales fell around the median sales to assessment ratio of 137 percent. That’s up 3.8% from 132% the month before. However because of the lower sales volume in October the error could be a couple of percent. But still values would be marginally up from the month before.

When sale volumes decrease but prices increase that seems irrational and to be going against basic economic theory and in most cases the following month proves that as prices decline to offset most of the previous months increase. So I’m not expecting any great price changes for this November for houses in the core. I do expect sale volumes to continue declining. I don’t expect November house sale volumes to be the worst in the last decade in the core, but I expect us to be closer to the bottom than the top for core house sales in the last 10 years.

House sales in the core for November of each year

2007 – 173

2008-83

2009-155

2010-122

2011 -166

2012-121

2013-119

2014-113

2015-151

2016- ??

Real Estate isn’t homogeneous cans of tomato soup. Houses are not physically all the same to one another even if they have the same asking price. So, while listings may decrease it doesn’t mean that the quality of properties coming to the market will also decrease.

I think you should still be looking in the winter because along with fewer listings there are also fewer buyers too. The only time you’re going to get a good price on a house is when there are fewer buyers competing against you driving up that price.

The greater the months of inventory the more likely you will get a good price on a house. And for houses in the core that has been increasing and last month was the second highest of the year so far. The MOI is still low so the odds of getting a deal on the purchase is low but the odds of paying over market value is lower too. The only strength a buyer has in a market like this is to play hard ball. Make your best offer and never counter. There will always be another home coming to the market and it might even be a better home than you just bid on.

Month Months of Inventory for stand alone houses in the core districts.

Jan 2.84

Feb 1.66

Mar 1.31

Apr 1.06

May 1.09

Jun 1.26

Jul 1.86

Aug 1.81

Sep 2.04

Oct 2.38

We could be down below 1000 listings by the end of the year. Bad time to be looking https://househuntvictoria.ca/2016/11/07/november-7-market-update/

There are a lot of good people renting, ot owning, sub standard space for their requirements in victoria. Families generally need 2-3 bedrooms, yard space and others in the building who don’t mind noise.

This group will continue to buy SF in the CRD, and townhouses too. With population increases, a building boom and low interest rates, there is far more upwards market pressure on decent houses in most places than downwards pressure. Although basic prices are ridiculous right now, until something underlying consumer behavior or interest rates change, I don’t see more than nominal price drops here. The wildcard is consumer behaviour, the animal spirits.

Probably correct. We had a poll here and quite a few people said they are looking at condos now given how expensive the detached market is.

Nan:

Sounds more like false-consensus effect than Occam’s razor.

With less than 20% down and 90K in income (assuming that’s median for Vic in 2016), you can qualify 550K total (according to ratehub). If you don’t want to live in the western communities or the peninsula that gives you about 11 SFH to choose from (assuming they don’t sell over ask and you can afford closing costs).

With 5% down that gives you about 460K total. That’ll get you a 1 bed 1 bath on Shelbourne or 3049 Donald St. I don’t know about you, but I’d rather live in a condo than either of those.

People are buying condos because that’s what they can afford. While I’m sure there are some insane people leveraging their paper gains to buy a condo that won’t pay for itself.. that’s not the simpler theory.

People want to “own” a place. They can only afford a condo, so they buy a condo. Hard to reduce it further than that.

I think we’re stuck with the current market until spring.

The next three months combined will only bring about 2,000 listings. Even if we had zero sales for next three months and none of the existing 1,800 listings came off the market inventory would only creep to approx. the 10 year average.

We are pretty much stuck till spring.

I’m an Occam’s razor kinda guy when it comes to the surging condo market. In 2011 there were 66,000 single family households in census Victoria. With an average gain of say 30%, every single house has given its owners a $200k paper gain. A very small number of people need to tap that equity to tighten the market.

Why are they buying condos? because they want more exposure to rising prices and free money but don’t have enough to buy a second house.

I can’t lie- I’ve thought about it.

Bubble in Victoria? On a basis of mortgage payments to income we’re pretty much at the norm for Victoria. Victoria has been a lot less affordable than it is now.

Vancouver on the other hand, is the least affordable it has ever been this past year.

Ha. So we’ve improved from horrible selection to poor selection?

In North OB it’s seems to have gone from no inventory, or at any rate most new listings selling within 24 hours, to quite a few seemingly ridiculously priced listings of which a number have now been on the market for weeks. Seems like prices have nowhere to go but down.

@Bizznitch – Couldn’t agree more. I am happy we didn’t buy that place.

Funny.. RBC says $280,000

Bman: They should have been stress testing at the posted rate since 2008, not suddenly starting now. Part of the reason this bubble has inflated so much.

to Reasonfirst: renting first when moving to a new place is my take for sure, but it is also others’ suggestion if you read through comments on that story (the one has 20+ thumbs up) 😉

JimBob

No doubt current conditions are crazy but if you think things don’t change then your were born yesterday.

“Economy better then it has ever been in history”

Unemployment in Vic was 3.3% in 2008…5% now. And fewer employed.

“Have you seen the US economy? Credit is just “loosening” there after a period of ultra tight requirements.”

Say what? – you got it backwards. Quantitative easing ended a few years ago, FED rate is currently lowest in history and the consensus is that it about to rise. Just look at any fed rate chart

“I can guarantee you haven’t actually applied for a home, because if you had, you would see how “insanely hard” it is to actually be approved for a mortgage since 2008.”

I have, I’m middle class (HH income ~ 115K) and I got $400K and could have asked for more.

Get educated (or stop trolling) – We can help you understand some of those big words and how to do research 🙂

“The best is to rent here first before buying, but then they would be inaccurately counted as local buyers by VREB stats again.”

That’s your take. The article didn’t mention renting at all. nice try.

“Go ahead, go to a broker and see what they would approve you for, I’m betting not more the $128,000-186,000 if your single income is 70k ish and your credit score is average.”

Looked at a house down the road from ours. Top floor rented at $1500, basement at $980. Asking $519k. We thought the numbers made some sense, and worked with our income, which (unlike some on here) I won’t lie about. Our combined income is around $90,000, so pretty much the median for Victoria. We don’t have stupid debts (own a single 14 year old vehicle), and our credit scores are good. We’ve owned our current place for a little over a year.

So we went to see our friends at BMO, which I understand to be one of the more conservative lenders. Anyway, this is basically what we were advised to do if we wanted that place:

-Leverage current property for a 5% down payment. Blend and extend for a lower rate!

-Evict the upstairs tenant and take possession.

-Rent out current house (seems the bank was happy to use potential rental income to help with qualifying)

-Keep renting out the basement.

~$1500-1800 plus $980 *.5 plus our income and qualifying rate of 2.6% = Maximum of about $750,000 in mortgage debt.

Fast forward two weeks, and the feds announce that 5 year fixed terms need to be stress tested at the posted rate. The above scenario is no longer possible. Not a small policy change in my view, but one designed to have a measured impact on risky lending.

That is not what I would call strict lending. But it just got a lot more strict. Don’t discount the impact that will have on demand and on prices.

JJ:

Ha. So we’ve improved from horrible selection to poor selection?

It’s relieving to see less bidding wars. Definitely a move in the right direction.

I think we’re stuck with the current market until spring. Spring will hopefully bring a bunch more listings, then we’ll see if there is demand to support the increased supply. Bulls think there is pent-up demand (of a massive scale in some cases), bears think demand will continue to decrease (regardless of what inventory does). Time will tell.

My bet is on a flat market come spring (for Victoria) and a drop in other markets, such as interior BC (due to tighter lending rules). I’m thinking Vancouver is now in blow off mode, but this fall might turn out to be a bull trap with spring being a “return to normal” (slight uptick, before any real correction). Of course I could be (and am most likely) wrong on all accounts.

Why do you think the market summary says it is ludicrously hot? Based on historical performance we are looking at 16% annual price increases with these market conditions. No argument from me although that isn’t taking account regulatory changes and their impact.

https://househuntvictoria.ca/market-summary/

Don’t worry. The entire real estate industry and 1300 agents in Victoria are here to tell everyone to buy buy buy. A little bit of balance is probably not going to hurt.

I don’t have a stake in the market one way or the other (we own but I have zero interest in investing in real estate or selling our principal residence). I’m just here to add data and try to minimize the bias with which it is delivered. The perma negative viewpoint isn’t accurate, but the perma positive isn’t either. Vancouver is learning that as we speak.

As Greenspan says, rates are going up to 3 to 5% and the current lending cannot go on much longer. Mortgage rates will double and JimBobRay’s $700K is cut in half or more. It’s Economics 101, not his manic pumper speech.

Perhaps JimBob doesn’t read the news.

Vancouver Average Detached Home Prices See Worst Slide In 39 Years

http://i.huffpost.com/gen/4657294/thumbs/o-HOUSING-CRASH-570.jpg

Leo S

I’m just coming here to point at your graphs and point at reality. Can’t anyone see the lowest inventory and the highest sales???

It’s insanity in here. If I listened to the perma negative here over the last 8 years I wouldn’t be sitting on 700,000 equity.

I worry about a few uneducated timid new buyers listening to a couple renter/basement dwellers and making the wrong choice.

If you can get approved for a mortgage it’s so strict here you are not “out on a limb” financially. Especially with these new rule changes.

If you can buy, then buy. These other guys just don’t make enough money to be approved. Why would a renter hang out on a house finding website if they don’t want and can’t afford to buy??

Bizznitch,

We won’t say someone named “JimBobRay” isn’t uneducated either but sure sounds like he just bought too much house. 😉

“Here is the deal. Economy is best it’s been”

Why is Vancouver tanking as they have a stronger economy than Victoria ? It’s called a credit cycle for a reason. If you’re uneducated then you wouldn’t understand.

Or none at all. But when you’re here to pick a fight you gotta take what you get.

The market is selective so when JimBobRay states these overall stats they do not apply to the sub markets.

If we are just looking at housing in the core, then this isn’t the highest sales in history or the tightest market for inventory. In fact this is one of the better times this year for hunting for a house. It isn’t great but it isn’t the worst time to be a prospective purchasers. Our current months of inventory is the second highest this year at 2.38. We were down to 1.06 months of inventory in April.

The number of active listing has stayed relatively constant between 347 to 418 listings per month and sales are way way down from the peak in April. Our average days on market is slightly better too. House sales in the core in October were the sixth lowest in the last decade. So the stress level of today’s buyer is slightly lower than back in April when there were a lot more multiple bidding wars.

Being the optimists that I am, my guess is that things will continue to improve for prospective buyers with more homes to chose from and more time to make an informed decision. There may be some slight relief on prices but if you’re chasing the same places as others are today then don’t expect much relief. Make your best bid and don’t counter. Then wait for the next home to come up for sale. Because we aren’t running out of houses.

“Super tight inventory lowest in history”

Vancouver condos only 3 month supply and prices down 5%. Panic buyers always lose at market tops.

US interest rates going up bigtime forever now, so ignore the debt charts that are in the stratosphere, free money for everyone !!

Obama’s Successor Inherits Bond Market at Epic Turning Point

“We’ve really got ourselves into a pickle here,” said Edward Yardeni, president of Yardeni Research Inc. in New York, who’s been following the bond market since the 1970s. “All these years we’ve been kicking the can down the road, and suddenly we’re seeing a brick wall.”

The scenario of quicker growth and inflation may push Wall Street to ramp up expectations for Fed hikes and anticipate higher yields for years to come.”

http://www.bloomberg.com/news/articles/2016-11-06/obama-s-successor-inherits-a-bond-market-at-epic-turning-point

A couple angry responses as expected.

You can talk all you want about so called “credit cycles” (what exactly is that?, no one has a clue about these things), or bla bla “tightening cycles”, or any other buzzword you find in Econ 101. But at the end of the day look at the actual reality on the ground.

Super tight inventory lowest in history

Highest sales in history

Economy better then it has ever been in history

In-migration to a landlocked area

I could keep going, but name one single thing that points to prices dropping? And no, don’t use beginner abstract buzzwords that have literally no meaning.

Have you seen the US economy? Credit is just “loosening” there after a period of ultra tight requirements.

I can guarantee you haven’t actually applied for a home, because if you had, you would see how “insanely hard” it is to actually be approved for a mortgage since 2008.

Go ahead, go to a broker and see what they would approve you for, I’m betting not more the $128,000-186,000 if your single income is 70k ish and your credit score is average.

A story in G&M financial facelift that a retired couple want to move to Victoria. They have enough means to do it, but wanting to pay about $600k (double what they current house value) is not realistic at all. The best is to rent here first before buying, but then they would be inaccurately counted as local buyers by VREB stats again.

http://www.theglobeandmail.com/globe-investor/retirement/retire-housing/a-cross-country-retirement-move-is-within-this-couples-grasp/article32682373/

JJ:

189K? Is it even a 1 bed? Decent used 1 beds back then were into the 200s from what I remember.

Hmm.. was that right at condo peak? We sold a condo back then around peak (late 2009). We’ve been watching that building since and prices are still down from back then. One unit finally sold for more than ours this summer (nearly 7 years later), but only by a few thousand and it was a better renovated unit (same size, # beds, similar layout, also top floor etc, but newer kitchen and bath). There was a serious shortage in the condo market back then. Glad we got out when we did. The person that bought our condo would be lucky to sell it today for what they paid in 09. If they drop 20K into a reno they could get a few thousand more than they paid (before realtor fees).

One of our friends sold a townhouse back then too. A comparable unit (both end units, same size, same # beds etc) sold this year for less than they sold for in 2010. In this case their unit was better renovated than the recent sale, but the difference was more than enough to make up for that.

Just because prices are up, doesn’t mean everything is up. The market for condos and towns is a fickle one. One moment at type or area is in favour, the next it isn’t.

JimBobRay: Don’t assume that someone who has a bearish view of the house market is uneducated or poor etc. I know I’m quite well educated, have travelled all over the world, and make a quite respectable income. You sound like you’ve been living in a fishbowl for too long.

As far as I’m concerned, these market increases are the result of cheap and easy credit, combined with low interest rates. I think that JustJack’s comments about the oil industry layoffs are also part of this increase. What do you think is going to happen as credit tightens and interest rates go up?

@ JimBobRay

I think your assertions regarding those who “talk down” the market are generally unfounded and presumptuous. Not everyone crying foul fits your uneducated or forlorn profile you have laid out.

A comparison to US housing prices to a singular tiny market in Canada in the way that you have done is a bit apples to oranges, regardless of whether your numbers are accurate. Manhattan, NY is far more expensive, does that mean we should cost more? Broken Arrow Oklahoma is far cheaper than here, ergo we’re being ripped off in Victoria?

The fact that Victoria is on an island is undoubtedly appealing to some, and a complete deal breaker for others. The flipside to your argument is that Victoria is very isolated from the major metro regions in the area, and to boot, the major metro areas aren’t that accessible or broadly desirable. Seattle and Vancouver are hardly world class destinations. No Hollywood or Broadway shows within a thousand miles. If you want or need to go anywhere, it is accessible only by boat or plane involving considerable expense and logistics.

Neither of us have any idea what will happen in the Spring. You might be absolutely right. However, there are at least two metrics that challenge the “upa upa upa” argument – that is SFH’s are rapidly moving out of reach for most families – the median income in Victoria will not support huge gains on top of what’s already occurred, unless there is a huge influx of an outside money source. That is currently not happening to any degree, as far as I know, outside historical norms.

The other issue is the level of indebtedness of the population writ large, with a substantial and growing percentage of folks in the Victoria area taking mortgages with ratios exceeding 450%. That is not sustainable, no matter how much someone may argue.

There is an inevitable end game to this, and while you say “all signs point to an incredible spring of price gains”. – I’d argue though, that all signs point to the maturity of the current credit cycle, and an upcoming pullback and deleveraging.

From the perspective of someone who travels extensively for work, Victoria is a haven from crime and is an amazing deal compared to so many places around the world.

I think a lot of the permanent negative vocal minority posters here are either renters, have a low education level, have not travelled extensively, have a low income, can’t afford a baseline house in the area they want, and so are vocally talking down the market regardless of all the signs of a very strong market.

Try to go on Zillow and look at any suburb anywhere in America and you will find baseline houses are around 400-500k USD. And this is in a country with higher monthly overhead with healthcare costs of $400-800 USD per month.

Victoria is a literal paradise, it’s a gated community that is filtered from the horrors of the world. This is no “nice neighbourhood” 5 min off of a USA Interstate, it’s in Canada, it’s on an island, and it’s at the tip of an island with no land, in the sunniest and safest and nicest place on earth.

Here is the deal. Economy is best it’s been, boomers moving here with inherited money, no land, it’s still very affordable compared to many places, prices here were down for 10 years while Canada went way up, lowest inventory in history with some of the highest sales.

All signs point to an incredible spring of price gains. Prices will rise till they reach a financial point where people are willing to sell and move to the west shore or some other location up island.

What single indicator shows a weak and weakening market?, other then the voices of regret and failure.

The small policy changes won’t do anything for the core, this is not a low income market that gets affected by these small changes, maybe Royal Bay will slow down a tiny bit in a few years.

And on the other hand. I was in court last week on a foreclosure of a condominium in the core that was listed for six weeks with only one offer at $159,000. Previous owner purchased the property in 2010 at $189,000.

It isn’t all condos that are hot. The “hot” condo market is very selective. You have to have the right product in the right location.

“I don’t really understand how 24 months ago you couldn’t give a condo away and now people are buying them like TVs.”

When we were looking in 2011, we looked at a variety of places – townhouses, condos, SFH. A 3br townhouse in the railyards backing onto the Galloping Goose was listed at $525k. The mostly renovated 4br house we bought in Jubilee was listed at $575k. There was no question as to what was the better value. Two years ago friends of ours bought an original condition bungalow on the Oak Bay side of Carnarvon for $500k even. Why would you have bought a new build condo instead of that?

Fast forward to now, where SFH has outpaced other housing forms. Condos are simply in the range of affordability for most people and they’re the only option left for people who have a budget in the $500-600k range and want to remain in the core.

“Or is the last minute stock surge a Wall St. effort to save Hillary’s failing campaign?”

Wall St. is rallying because the FBI have again dropped the Clinton harassment and it looks like she’ll win.

(She’ll win by more than polling indicates).

“I don’t really understand how 24 months ago you couldn’t give a condo away and now people are buying them like TVs.”

I think it’s called a “fad”. Kind of like owning purse size dogs. Cute when you first get them, then the reality kicks in that constant small poops on the floor are like jail cell sized claustrophobic living spaces.

Marko: It’s just the herd mentality. I bet a good chunk of the condo buyers figure buying a 400 sqft cat box in the sky is a surefire investment. Once it becomes more apparent that there’s a full-blown crash happening in Vancouver, it wouldn’t surprise me if some of these local and wise RE investors start unloading these units again.

“Net Unconditional Sales: 123 ”

Can’t wait for the “at this rate we’ll blow through 800 sales no problem” claim.

Mike, I assume you’re loading up for the easy 30% gain ? Or are you just spreading another load ? 😉

:large

:large

According to the Mcleans article linked to by Hawk, Canadian RE prices are now ahead of Japan in 1991 and the US in 2008, suggesting that it won’t take a Trump victory (now off the cards according to all media reports), to cause a slump, with positive feedback driving prices down, not up.

Or is the last minute stock surge a Wall St. effort to save Hillary’s failing campaign?

Condos are not my speciality but my last 5 listings have been condos, 6th one in a row being listed tomorrow.

The amount of showings/offers on condos specifically seems crazier than it was in the spring. I had 40 people through an open house yesterday on a condo in Saanichton. I only brought 15 feature sheets.

You couldn’t give condos away 2-3 years ago.

Also pre-sales are nuts right now. The Wade launched this weekend and they sold 400 sq/ft studios (without parking) at $265,000+GST. Like what the!!!

I don’t really understand how 24 months ago you couldn’t give a condo away and now people are buying them like TVs.

Prices will continue to rise as long as foreign funds have unfettered access to our housing market. Canadians will continue to be marginalized as prices move further and further out of reach of Canadian based incomes.

Ottawa needs to make housing its top priority

http://www.theglobeandmail.com/report-on-business/rob-commentary/ottawa-needs-to-make-housing-its-top-priority/article32692885/

“Someone asked why more people are not putting their houses up for sale considering the high prices in the last couple of years.”

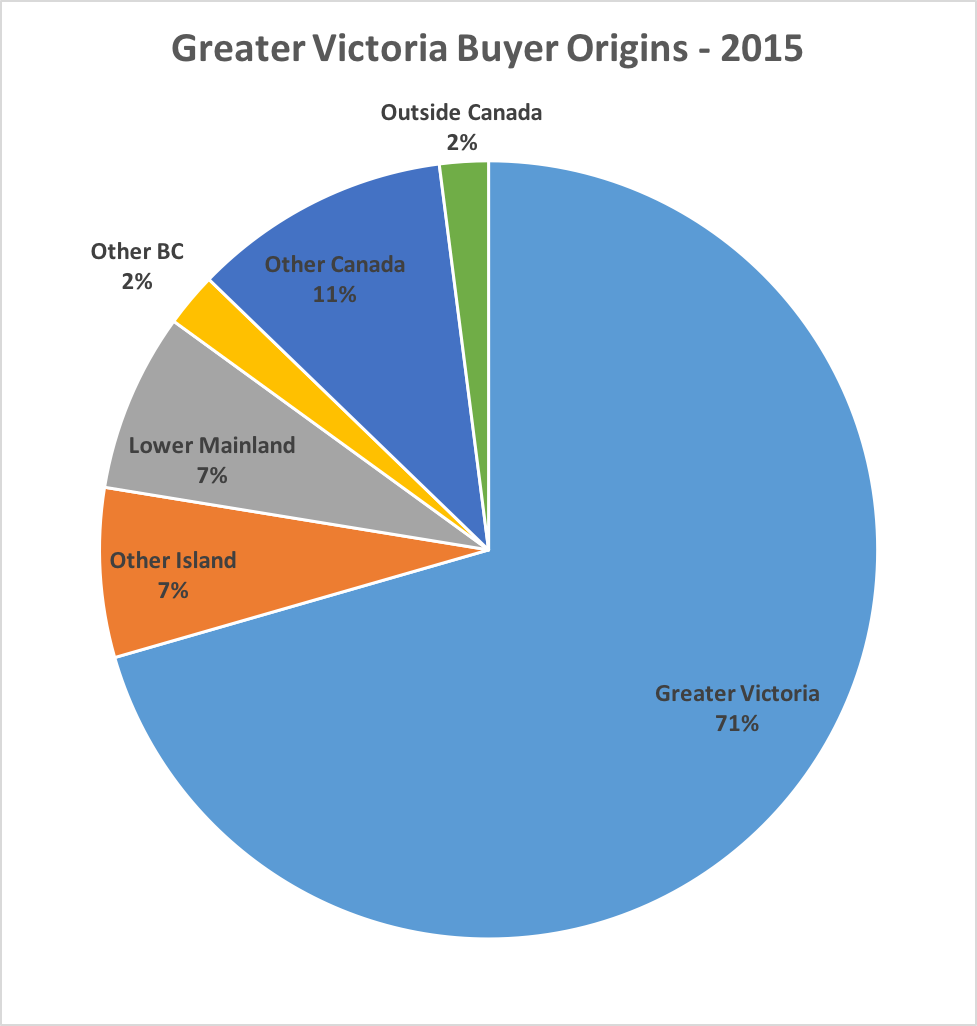

The stats seem to indicate that it’s largely Victorians that are buying Victoria houses. People aren’t selling because those that want to move up or down look at the market conditions and don’t see that there are a lot of affordable alternatives out there. You sell into a thin, rising market and you’re stuck with less purchasing power and poor choice months later. It’s not rocket science.

Surprisingly 13% ahead of last year’s sales pace with 40% less inventory.

So no other bank has matched TD’s mortgage prime rate increase. Note also that the increase is only their so called “mortgage prime” and no their prime rate for LOC and HELOC products. Surely they can’t keep this up.

Marko:

Thank you (once again) for providing us with the numbers.I really appreciate that you make the effort.

Sales seem to be about the same as last year. We seem to be adding to inventory at a slower pace. Someone asked why more people are not putting their houses up for sale considering the high prices in the last couple of years. I think this is a very key question and I would love to hear everyones thoughts on it.

I’m astonished that sales can more or less keep pace with last year, even though there’s only 60% of the inventory.

Million$ core 2020.

Slam dunk.

Mon Nov 07, 2016:

Nov Nov

2016 2015

Net Unconditional Sales: 123 573

New Listings: 158 747

Active Listings: 1,849 2,952

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

The rise in prices in the early spring coincided with the layoffs in the Oil Industry. Itinerant oil workers returning home with fat severance and pay checks wanting rental properties. And now that that event has run its course, Greater Victoria is back to 10 year averages.

This was a black swan event,that impacted Greater Victoria, which could not be predicted.

“They’re probably just throwing these units up as fast as they can. I’m sure these will be going much cheaper down the road. Just like everything else..”

Agreed Bizznitch, they are slapping these up in a gravel pit wasteland. They will be the first to fall and the first developer to go under like Bear Mountain did. History repeats itself.

As Steve Saretsky mentioned this morning, the Titanic has hit the iceberg and taking on water but they don’t want to alert the passengers to the serious danger starting to unfold.

Sure, last year we had the prediction thread here: https://househuntvictoria.ca/2016/01/13/2015-predictions-roundup/

And we were all spectacularly wrong (on the plus side, I haven’t yet seen a single person that predicted this upswing correctly).

No poll on that one, but we can add that as a quick way to vote for the next prediction run for those that don’t want to comment. Also I think we need a cash prize for the winners.

With a number of posters certain that we are at a peak in Vic toria (at least for SFH prices in the core), this might be a good time for a poll.

YOY prices, Sept. 2017 (3-month median):

10+% higher than 2016

5-10% higher

2-5% higher

2% lower to 2% higher (no change)

2-5% lower

5-10% lower

10+% lower

Leo – can you set this up? I don’t know how many are interested, but I think it’s nice to have people’s opinions committed in writing. Or maybe it’s not easy to set up polls like this in WordPress.

FWIW, my vote is no change.

1/ Royal Bay by Gablecraft is a beautiful product…and now you can get into RE with only 5% down or 29$K. What a bargain.

They’re probably just throwing these units up as fast as they can. I’m sure these will be going much cheaper down the road. Just like everything else..

“5/ RE is the rage; it seems like everyone is talking about it”

You mean the Oak Bay gloaters that don’t see the coming correction ? When something is “the rage” you know the end is nigh. Are they talking about the recent price slashes in the hood ?

Wow, new 30% foreign tax in Hong Kong as they try to rope in their market. That’s a double, plus locals now paying 15% new tax unless first time local buyer. Looks like the world’s multi-bubbles about to unleash some major pain.

Hong Kong Home Prices Set to Plunge on Policy Change

Hong Kong leaders’ surprise move to cool the world’s least affordable home market is set to spur an immediate plunge in prices and transactions as buyers and sellers hit the pause button. Shares of developers slumped.

In a televised conference including the city’s top-ranking officials, the government announced plans Friday to raise the stamp duty to 15 percent for all residential purchases — except for first-time buyers who are permanent residents. Until now, the highest levy for residents was 8.5 percent, while foreigners already paid a 15 percent stamp duty.

The changes mean foreign buyers will now pay an effective 30 percent stamp duty.

http://www.bloomberg.com/news/articles/2016-11-06/hong-kong-s-shock-home-curbs-seen-slashing-volumes-by-up-to-70

Random Musings:

Had the wonderful opportunity to spend sometime at home before heading back to work. Can’t say we didn’t miss the rain. Here are some casual observations from lifelong residents and accidental global workers:

1/ Royal Bay by Gablecraft is a beautiful product…and now you can get into RE with only 5% down or 29$K. What a bargain.

2/ Roads and infrastructure are very lacking. Around 3:30PM on Wednesday, it took us 1 hour and 30 mins to get from Admirals/Gorge to the View Royal Casino to meet with friends. There have been no lanes added for the last 60 years, and you wonder why they call it the Colwood Crawl.

3/ The bike path infront of Lansdowne School and the associated paving, OMG, it is like watching the paint dry to see the progress there!

4/ In our neighbourhood in OB, lots of new residents; many with young families and interesting enough, lots of Vancouverites who still work in Vancouver whilst their families are here. Visible minorities/foreigners were far and few in between.

5/ RE is the rage; it seems like everyone is talking about it

6/ Other than Walmart + Costco + big box retailers, local business seem to be on the wane. Hard to imagine so many vacancies in Hillside, Mayfair, Uptown and downtown.

7/ and finally my wife noticed this…so many people wearing yoga pants! and crazy people running around at 6:30AM in the morning 🙂

Sounds like heaven to me.

Wow, only 64 Vancouver house sales on a Friday down 50% from the usual double or more. Lowest I have seen yet. This is going to be a long term melt down even if Hillary gets in.

Canada’s housing bubble makes America’s look tiny

Comparing Canada’s infatuation with real estate against the peak of the U.S. housing bubble yields some disturbing insights

http://www.macleans.ca/economy/economicanalysis/canadas-housing-market-looks-a-lot-like-the-u-s-did-in-2006/

Interesting article https://www.google.ca/amp/www.cbc.ca/amp/1.3826727

Interesting article on Greece’s housing market & change to their tax laws. What jumped out at me are these two figures – Greece home ownership at 74% of households – European Union at 70% of households. That’s far higher than I had expected and the EU matches Canada: http://www.nytimes.com/2016/11/02/opinion/in-greece-property-is-debt.html?_r=0

Trump has promised trillions for infrastructure renewal and job creation, together with cuts to both corporate and and personal taxes.

The deficit would be largely covered not by borrowing but by money printing.

Money printing creates inflation.

Inflation would cause interest rates to rise. The Fed cannot hold rates down when market forces dictate otherwise.

Rising rates would drive down asset prices — stocks, bonds and RE.

Effects of inflation and rate increases on the dollar might largely balance, although Trump’s anti-globalist agenda would affect many things including trade agreements, tariffs, and capital flows, making the future of the dollar difficult to predict.

Canada would have little choice but to follow US policies or lose out in the N. American marketplace. So a Trump victory would likely be negative for Victoria RE, driving mortgage rates to perhaps two or three times current rates.

Yes, although the US dollar may no longer be deemed as safe as it used to be.

Overvalued real estate is not a flight to safety. Cash is.

Buy at the top like Mike and his GE guaranteed winner from 9 months ago. Bulls in panic mode as Oak Bay price slashes reverberate from West Van tanking. Big sista is in crash mode as the big money train for last 10 years has left town for good

What would a Trump presidency mean to Victoria housing?

The stock markets are extremely jumpy. There will be a medium sized crash if Trump wins, but who knows how long it could last. One could imagine a flight to safety as the stock market loses certainty.

2424 Beach Dr drops to $1.25M. That’s a surprise. Asking only ~150k more than Lincoln and Dunlevy, which both need updates, but sold within a week.

Fat lady singing???

Laneway house story:

https://ca.yahoo.com/news/vancouvers-laneway-love-little-homes-130009145.html

Always do the opposite of what Madani & company are preaching:

Time to Panic about the Housing Market

Maclean’s magazine

Feb 28, 2012

The biggest elephant of all is how much the boom has been fuelled by cheap and abundant credit thanks to a low interest rate policy pursued by the Bank of Canada, along with government-insured mortgages. “All the warning signs are there,” Madani says. “We just have to connect the dots.”

There is evidence the tide may already be turning in Canada’s housing market. The Canadian Real Estate Association reported home sales had fallen 4.5 per cent in January compared to December, the steepest decline since July 2010. Prices still rose, but by just two per cent, the slowest in the past year. Kelowna, B.C., a popular spot for retirees and vacation homes, reported a tenfold increase in foreclosures compared to three years ago. The hard landing might already be upon us.

The debt bomb is only going to drag out Vancouver for years to come. Victoria will not be able to escape that massive pressure.

Like I’ve been saying all along, it’s all about the credit cycle which the pros and bulls are in full denial.

“I do think the Vancouver market is going to have a very, very hard landing that will probably drag out for a few years potentially,” Madani said.

‘All about the credit cycle’

For Madani, the cooling market in Vancouver has little to do with the foreign-buyers tax. Real estate market fluctuations are “all about the credit cycle,” he said.

“Anything that reduces the amount of credit available to purchase a home,” he said, “will slow the market down.”

And the credit cycle hinges on two things: interest rates and leverage.

Interest rates have been at historic lows for years, so more people are borrowing to buy. What fewer people understand is that many buyers are more heavily leveraged. In the 1980s, homebuyers typically made down payments of 25 per cent. Today, down payments can be in the single digits.

“So the housing mess that’s been created over the past decades or so, it’s not just about low interest rates, it’s about the increased leverage in the system,” Madani said.”

http://www.cbc.ca/news/canada/toronto/vancouver-toronto-housing-markets-1.3835744

freedom

I think you forgot what point you were making.

Of course, lots is a relative word, like anything else. But 30% of them are in BC.

Remember those kids’ parents who chose to stay with their children here can/do rent and buy houses here.

Gotta imagine that limited dual agency is next on the chopping block in BC. Can’t imagine it will last much longer under Mr. Noseworthy. Seems like such an obvious conflict of interest I’m surprised it still exists.

It’s not like there’s a shortage of realtors out there. If your client wants to buy your listing you send him over to a colleague.

Dual agency will most likely be cut but double-ending will continue for sure. The listing agent will just not be able to offer an agency to buyer, only a customer relationship. I’ve done this for the last 5 years.

Gotta imagine that limited dual agency is next on the chopping block in BC. Can’t imagine it will last much longer under Mr. Noseworthy. Seems like such an obvious conflict of interest I’m surprised it still exists.

It’s not like there’s a shortage of realtors out there. If your client wants to buy your listing you send him over to a colleague.

Finally some media news is getting out about double ending commissions in blind auctions or delayed offers.

I understand the frustration selling agents have when their client wants to bid on an intentionally under priced property in a delayed offer scheme. In my opinion there is a conflict of interest to have the listing agent act as the auctioneer because at the least there exists the perception of wrong doing.

I applaud Marko for being so up front with his clients when it comes to bidding on these delayed offer schemes. And I would hope that the new real estate counsel of BC drafts guidelines for agents conducting these schemes including employing an unbiased auctioneer ,with errors and omission insurance, to conduct the delayed offer or blind auction.

Maybe the condo owners are finding some ill effects of living in Mike’s fantasy land.

How the Street You Live On May Harm Your Health

http://www.everydayhealth.com/news/how-street-you-live-on-may-harm-your-health/

“That one should easily sell for 1.15. It is the village location that boomers will ‘dying for’ over the next 20 years.”

Easily ? Well if you open your window long enough at that place you’ll be easily dead of carbon monoxide poisoning in less than 20 years. More like 20 mins. No wonder they’re trying to dump it ASAP. The lower level suite that was for sale either took 8 months to sell or they pulled it off the market.

Shouldn’t have to wait long to find out if the condo sells for more than asking since the blind auction is on November 7.

The last re-sale in the complex was at $827 a square foot.

Both 1765 and 1969 Oak Bay locations have similar walk scores laying in the very walkable 70 to 89 band range. Being closer to the elevator or at the back or front of the building or floor would have more of an effect on location than the algorithmic estimated 85 and 89 scores.

New units in buildings receive a one time premium over re-sale units in older buildings unless the older unit has provenance by being designed or owned by someone famous. Much like a new car loses value once it is driven off the lot.

Freedom:

“There were 336,497 international students in Canada in 2014, representing an 83% increase since 2008, and an increase of 10% over the previous year. International students made up 11% of the postsecondary student population in Canada in the 2012-2013 academic year.”

That’s Canada not Victoria. I’m not saying that there hasn’t been an increase, I just find the term “lots” as pretty inarticulate.

“You can also check out from local high/elementary school boards, e.g. SD61, to see the increase of international students enrollment.”

This was a discussion about student renting not kids.

“the collection requirement didn’t start until June 10th 2016.”

So? it’s current and you said it was probably lots more than 2% – it’s only 3-4%

That one should easily sell for 1.15. It is the village location that boomers will ‘dying for’ 🙂 over the next 20 years.

The new building on OB and Richmond has a worse location and they are asking the same price for one of the penthouses when you add the GST: https://www.realtor.ca/Residential/Single-Family/17460163/404-1765-Oak-Bay-Ave-Victoria-British-Columbia-V8S3Z5

Pure insanity. That location is terrible.

I think so. There were only 1292 residential properties on the market end of month that is insane. Plus mortgage changes, I think people will be sitting out a few months to assess. I think we’ll be down some 10% from last year.

Looks like living in a so called million dollar Abstract penthouse at the busy corner of Foul Bay and Oak Bay isn’t what it’s cracked up to be. I thought gentrification was taking over the area when it looks like they are cashing out while they can. 1500 sq ft for $1.15 ? Really ? Some serious gouging going on.

https://www.realtor.ca/Residential/Single-Family/17548370/402-1969-Oak-Bay-Ave-Victoria-British-Columbia-V8R1E3

Ash.

You nailed it. Gold star post.

Whats most intriguing is those that were born here (albeit in a hospital that no longer exists) to fourth generation Islanders (principally Victoria), move away to get there start, struggle year over year to make it work in another city (ie. Vancouver), and then get labelled by neighbors as Vancouver buyers.

True you can’t judge a book…. but you also can’t tell how deep or how large an Old Growth tree’s roots are.

We’ve had 44 consecutive months of YOY increases in sales. Is November 2016 the end?

There seems to be a tad of inventory coming to market to start the month so I am going to make a prediction that November makes it 45 consecutive months and the streak finally ends in December. It is going to be difficult to top 465 sales in December of 2015. With the inventory and the new mortgage regulations I think most buyers will hang it up until the spring.

the collection requirement didn’t start until June 10th 2016.

From CBIE (http://cbie.ca/media/facts-and-figures/):

“There were 336,497 international students in Canada in 2014, representing an 83% increase since 2008, and an increase of 10% over the previous year. International students made up 11% of the postsecondary student population in Canada in the 2012-2013 academic year.”

You can also check out from local high/elementary school boards, e.g. SD61, to see the increase of international students enrollment.

The odd thing about Coon’s story isn’t just that he has 27 out of town buyers, but that he has zero in town clients. How could someone be so unpopular with locals yet be killin it with out of towners?

There seems to be an assumption that anyone coming from Van is cashing out on a lottery ticket SFH over there. When in reality there’s gotta be a mix of income levels, many no doubt priced out of Van and looking for something more affordable.

But how do they collect it?

Are lawyers required to collect when paying out the PTT?

But how do they collect it?

Freedom

The government now collects residency stats in all of BC unrelated to the PTT. See the previous post. It’s 3-4%

Oh Oh… I know a little bit about selling in Vancouver and buying on the island.

I sold my place in Vancouver (South Granville) and came to the Island with no intention of buying… staying in a B&B. My understanding was that when you sell or move your residence you must change your address on your Driver’s Licence within 10 days or your insurance is not valid… so that is what I did… I used the B&B address.

I had only been at the B&B for a few weeks when a lovely house above the beach came on the market… the property to me was an unbelievable bargain compared to Vancouver. When I entered into the contract I was asked for ID… showed my DL with the B&B address. Local buyer!

“We have lots more students and visitors now and lots of them buy houses after renting here.”

Lots?

Y% might have changed more than you thought. We have lots more students and visitors now and lots of them buy houses after renting here (and in Vancouver and Toronto). Let’s say if we also had 15% PTT here, the impact would be much more than 2% (outside Canada buyers by VREB stats), as some of these buyers are probably counted as local in current VREB stats, like they did in Vancouver before the extra PTT.

That is the good part about owning your time – you get to choose what you spend it on – so thanks for the suggestion but I’m happy with the feedback here if someone feels like giving it.

There’s only two realtors on here. Maybe pick up the phone and call a dozen and report back. You are retired afterall so time isn’t an issue.

Maybe Y is changing over time. With the advent of short-term rentals online it is much easier to find a place to stay in while you look. The increase in prices in TO and even places like Saskatoon has created a windfall situation for some. I don’t think it takes much of a shift in Y to potentially increase the competition at the top end of the market.

But that is all a guess on my part and I’d like to hear from realtors if there is a noticeable difference or greater % than reported officially.

Yes, coon can be seen as a slur: http://www.urbandictionary.com/define.php?term=coon. It also is a shortened form of raccoon. Given the racial undertone to the word, I wouldn’t be using it as my username, particularly if I were a real estate professional.

9I thought agents had a “know your client” clause and they know full well where their clients recently moved from. Applying this knowledge would only help their bizz and VREB from a marketing perspective that they would heavily encourage.

In other words Jack is correct, and the nonchalance/secrecy about ones hometown is BS. Unless you are a criminal on the run or money launderer, most people love to boast about their roots.

Fundamentally it doesn’t even matter. It’s more about whether it is changing. There definitely seems to have been a surge in the spring that may have been a large reason for the jump in prices. Most buyers from Vancouver would not be renting here first I suspect. Some up to date stats may provide early hint of price movements in both directions. As mentioned before, an out of town buyer is much more significant than a local buyer.

You’re missing Just Jack’s point.

X% of the market is out of town buyers

Y% of out of town buyers will rent here for a while before buying.

100%-Y% of out of town buyers will not rent and just move directly.

Z% of buyers is what is recorded as out of town by the VREB via “Buyer city”

We know Z. We don’t know X. However it is very reasonable to assume that Y does not change over time. There will always be some percentage of out of town buyers that rent here first and are recorded as locals, and the rest come here directly. In other words Z (what we know) is a good proxy for X (the actual percent of out of town buyers).

Example:

Assume 30% of out of town buyers rent here before moving here and thus are not captured by VREB stats. 70% move here directly and are captured by the VREB stats.

So when the VREB says that there were 1741 buyers from out of town in 2015, there were actually 1741/70% or 2487. But the absolute number doesn’t matter. It’s really how that ratio is changing over time. An increase in foreign buyers being a strong sign that prices may be driven higher.

I’m leaving Victoria when I retire and heading for a small mountain town – nice place to raise a kid which is the only reason I am putting up with ridiculous real estate prices.

Via what Marko posted below (did you read his explanation as to how the stat is recorded?) and the fact that someone moving here and staying in an Airbnb looking for a house would then be classified as a local buyer if they use their Airbnb address on the contract – or a local PO Box – which they likely would if they’ve sold their house in TO for ex. An increase of these types of buyers over time would not be reflected in the stats.

How do you know that?

And the point really is that the percentages have not changed significantly over the years. Unless you think people are interpreting the question “Buyers City” differently than they did 10 years ago.

And I doubt that is the case.

It is all about best evidence. And you have none.

Sorry Jack, but you’ve been OTL on your ‘deathbed boomers’ for years now. Clearly the boomers are already having an effect on Sidney, as prices have risen almost as much as Oak Bay.

http://i.imgur.com/A7qxRvh.png

The point is that the stats you get do not accurately identify who is local and who is not so neither you nor I nor anyone who is not a buyer’s realtor will have any way of gauging this now or over time. I guess it doesn’t given the relatively limited market if it leads to more deep pocket boomer or Vancouver buyers who can pay more.

Simple Totoro, I get the stats and the percentages just have not changed very much over the years.

Even if the stats did show out of town buyers are purchasing more homes in the city that would not mean they were buying only expensive properties. Out of town buyers are buying in all prices ranges , all areas and all property types – just like we are.

Three out of the five most expensive properties that were bought last month were people from Victoria. That’s still about half of all high end purchases. Now unless you’re looking to buy in the plus 2.5 million dollar range – I wouldn’t sweat it.

Sidney is mostly a retirement community. And the stats on it are the opposite of what is happening in the core.

The median days on market have doubled from the month before, The months of inventory have been over 3 for the last three consecutive months. Active listings are also up. And the median price fell from $450,000 in September to $325,000 last month. That’s your boomer market.

And I can understand why boomers are looking elsewhere these days. Because in Victoria you get half the house you’re leaving at twice the cost. Victoria isn’t good value for your money. The only thing retirees can do in Victoria’s winter is leave for Arizona.

How would you know? We don’t have stats to be able to tell.

My appraiser never asks me whether I’m local and I’ve had houses appraised in more than one location. Same when the bank orders them for properties in my experience. Only the buyer’s realtors have this relationship with clients and now the PTT notes non-resident buyers.

Coon has a lot of boomer out of town buyers – has the % increased over the time you’ve been a realtor? What about you Marko?

Haven’t seen any evidence of boomers arriving in Victoria in any greater numbers than in the past. Developers pay a lot of money to advertise to a specific target market. And I don’t see the boomer heavily portrayed in sales brochures. Instead developers are designing smaller down town condos targeting young professionals.

Victoria isn’t a retirement town anymore as it has grown too large and too expensive. Think Qualicum and you have a retirement town.

Yes Totoro, but would this year be anymore skewed than any other year?

I doubt it.

Then it is completely fine to compare one year against another to see if there is any change.

Anecdotally speaking. I lived here for ten years before I stopped saying I was from another city. When asked by someone I met, I always said my home town. I think that is more true of people that have moved here and have been renters as they haven’t set roots down in the community yet.

Coon said

“As for the out of town buyers, one word: boomers.”

People still underestimate the boomer effect that’s brewing for Victoria.

As seen from our 2016 age structure, Canada will see a very steep gain in retiring boomers for another 15 to 20 years.

http://www.livepopulation.com/images/chart_age_canada.png

Add to that, their parents bequesting $750 billion to them over the next decade.

http://www.ctvnews.ca/business/canada-in-line-for-a-750-billion-bequest-boom-cp-1.2932779

If this is where the stat is derived from then the % of local buyers will definitely be skewed by those renting or living with relatives while they look to buy.

I agree. It is not great or accurate data but it is what we have. VREB to the best my knowledge hasn’t given us any special instructions on reporting “buyer city.”

I’ve represented buyers where the city reported has been Victoria and 100% of the funds came from overseas, for example.

If this is where the stat is derived from then the % of local buyers will definitely be skewed by those renting or living with relatives while they look to buy. I’ve had two tenants from out of town renting while they looked to buy in the last two years. I guess a more accurate stat might be derived from the population growth rate x rate of ownership?

I don’t even know what the criteria should be to qualify as a local buyer – lived in Victoria for more than 6 months – 12 months?

I suspect ‘Victoria’ is often recorded due to their local rental address, when in fact they’re really newcomers to our city. Thus, the 71% local buyers is misleading. As Marko mentioned, no listing agent is going to call up the buyers’ agent to verify how long they’ve been here.

It’s very common for a newcomer to first rent for a few months, even it’s an airbnb for a month.

Agreed Ryan, chances of Vancouverites renting first are low.

Be wary of your agent.

http://www.cbc.ca/beta/news/business/real-estate-agents-caught-breaking-the-rules-on-marketplace-s-hidden-camera-1.3825841

How would you answer buyer origin if someone is from elsewhere but rents for a month, three months, six months? When do they become a local?

Listing REALTOR® reports the sale so I just enter in whatever city is on the contract of purchase and sale for the buyer. I don’t call up the buyers’ REALTOR® to see how long they’ve been in Victoria. No one does.

So the buyer origin stats that the VREB published are not from the emailed questionnaire that goes out with every deal?

Not sure how they could be. I fill out the questionnaire 40 times a year….5 questions

If this was a residential property, was it a new and never before

occupied home or was it a previously occupied home at some

time?

What was the primary motive of the buyer(s)?

How did the buyer finance the purchase?

Please describe the buyer (Single male, single female, etc….)

How did your buyer first learn about this property?

The stats must be from when we report the sale in the system and enter in “buyer city.”

It seems likely that most immigrants from Vancouver, perhaps the entire lower mainland. would not need to “test the waters” in Victoria before making the commitment to buy, since they are not moving far from friends and relatives and, by living relatively nearby, they have had the opportunity over time to properly assess most facets of Victoria important to them and its real estate markets. This would likely not be the case for many immigrants from outside BC who might be more inclined to want a test period before committing–given, for many, this will likely be their last move.

The bottom like is that we dont have very good statistics on where the buyers are coming from for Victoria. I talked to one agent who is extremely active in Oak Bay and he claims that will over half the buyers have been from out of town for SFH. He also said that most of the deals are for cash. The local buyers are often downsizing into a condo in Oak Bay to stay near their friends.

I also suspect that the market in the prime areas of Victoria might function a bit differently than the West Shore.. But we are all speculating since there really are no good numbers to base any of this on.

Dont know about houses but I picked up some great furniture mostly solid mahogany for next to nothing. Have noticed over the last year that there seems to be less good stuff. Seems a lot of professional buyers are going through the stuff these days.

It is more important to see how the percentage of Victoria buyers is changing. How the question was answered wouldn’t change if someone says that they are from Victoria or they are from another city from one year to another. But if more out of town buyers were purchasing relative to all sales then the percentage would change.

That did happen in the spring. The percentage of Victorians buying fell a few points, but today we are back again to historical norms.

We have always attracted seniors to our city, that hasn’t changed. But are we attracting more, less or the same as in the past?

We also may now be losing seniors at a higher rate to death and home care facilities as the first of the boomers are now into their 70’s as well as the parents of the youngest boomers.

Can you buy stock in funeral homes?

That is indeed a local agent based on the email.

Email questionnaire could mean online questionnaire.

So the buyer origin stats that the VREB published are not from the emailed questionnaire that goes out with every deal?

How would you answer buyer origin if someone is from elsewhere but rents for a month, three months, six months? When do they become a local?

BTW, Speaking of slurs, isn’t “coon” a racist term ?

Marko,

More reality is Vancouver detached house sales are down 55%. Van East (working joe hood)at 2008 sales low. Average prices down over $200K. Those numbers are a fricking disaster.

Economics 101 says sales down first then prices. Prime Oak Bay price slash is very telling of what’s to come no matter how you spin it for your clients.

Marko, reality is sales on SFH’s were down 71% as of Friday. HPI is a lagging number and that agent sounds a bit like a phony.

It’s a great point. The 71% local statistic could be very inaccurate as I’m sure there are many who arrive from afar and rent in order to take a good look around before purchasing a home (as we did).

Nice! It so happens that a wanted ad on UsedVictoria is how we found and purchased our last two vehicles.

For what it is worth, I rented for a year before finding just the right house. Am I local, am I from Toronto or do we count my three years in LA?

The house across the street is a good example of what may be a more accurate picture of what is partially happening. The buyers are from vancouver; the sellers are down sizing to a smaller house in Oak Bay and the people they bought from are downsizing to a condo. No idea about the condo owners. Two out of three sales in this chain are to local Victoria people but the “new” money (a little over two million) came from Vancouver.

What I suspect is that there are not a lot of locals that are moving up from a 1.2 million house to a 2 million dollar one.

I think there are about 1200 fairly active agents the Greater Vic area right now.

There are 1302 active agents right now…just takes two clicks in our system to get the live number; not sure why you would need to “think?”

Right now I have 27 active (or will be active within the next 4-6 months) buyers and they are all from off-island.

follow by

Someone made a good point re: what determines “Victoria residency”. Whenever a Realtor does a transaction, the local Board has us fill in an online questionnaire. I cant remember the exact wording but I don’t think there is any wriggle room on the residency question.

If you are in fact working with 27 buyers than you would be closing a buyer deal per week at minimum. As you know the questionaire is automatically emailed to us with each deal. Not sure how you wouldn’t be familiar with it?

Further more there is no question in the questionaire about residency. The data posted in the pie graph below is from a different source.

Hawk

Vancouver sales down 71%, average prices down $300K. Your Golden Head bubble world is about to get rocked.

Reality

The Real Estate Board of Greater Vancouver says home sales plunged 38.8 per cent last month compared with October 2015.

Last month, the composite benchmark price for all residential properties in Metro Vancouver was $919,300 — a 24.8 per cent increase compared to October 2015, but a 0.8 per drop from September of this year.

This isn’t the end of the world and it is being reflected in the small drop in the HPI. Sales numbers are bad compared to last year but not the end of the world.

October 2013 – 2,661 Sales.

October 2012 – 1,931

October 2011 – 2,317

Of all the warmer places, Victoria is one of the most expensive especially in the last year. I’m not trying to cast aspersions on your claim of all your buyers being from off island, but given the stats the VREB released, you have to admit that is a highly unusual situation

Who knows, maybe I am a quirky anomaly – I have no explanation. All of my business is from referrals. When I help someone from elsewhere they in turn refer me to their friends who are also trying to move here and so it goes. Someone made a good point re: what determines “Victoria residency”. Whenever a Realtor does a transaction, the local Board has us fill in an online questionnaire. I cant remember the exact wording but I don’t think there is any wriggle room on the residency question. If my client was from elsewhere and had been renting for 4 months, my answer would be their original home, but as I said its not specific.

We were renters for seven months then we bought. When quoted in a news article as from Victoria I had to laugh. Not from here! Happily settled in our new home in oak bay that we found on used victoria! No realtor! No competitive offers. After loosing three homes working w a realtor we almost gave up, but found our home through a house wanted ad I placed online. In tough times for buyers it was time to get creative. We still have an awesome relationship w the people we bought from.

On CTV news tonight, Steve Saretsky commented on the 40% drop. Reportedly, when asked if he would encourage people to list their homes, he answered “yes”. When asked if he would buy a house right now, he said “Not a chance. “

I have a friend from Cranbrook who is retiring soon and got a short-term job in Victoria and will rent until they find something to buy. One of our tenants is from overseas and looking to buy. I wonder how many move here and rent first before buying and are therefore are counted as from Victoria?

Of all the warmer places, Victoria is one of the most expensive especially in the last year. I’m not trying to cast aspersions on your claim of all your buyers being from off island, but given the stats the VREB released, you have to admit that is a highly unusual situation

I, for one, am looking forward to contributions from someone else with everyday experience with the market. Please ignore the unwarranted slurs Coon – I agree that this can be very off-putting and it is very unfortunate but by no means representative.

Hi Leo

I got my license in 2006/7 and I think I was told that there were 1400 agents at that time? I think there is a natural ebb and flow to the number of agents. I expect there will be fewer over time if the # of transactions drop off.

As for the out of town buyers, one word: boomers. They were my predominate class of buyers before the Vancouver refugees started coming over here and still remain so. Mostly 50+ looking to retire somewhere warmer that didn’t empty their life savings. Most of my clients are from up north or elsewhere in BC, Ontario.

And Mr Hawk I am being genuine in this forum. This is why I have been loath to step in and say anything. Anonymous slurs don’t get this discussion anywhere. I have absolutely no reason to hype whatever is going on in the market. I am happy to share my thoughts and personal experiences but not if you are going to be a jerk about it. If you knew me, you would know I am being forthright.

That’s funny. Stats don’t show any bus loads. More like canoe loads the last few months. Realtor hype in the face of a serious correction.

Vancouver sales down 40% year over year. And that’s with a condo market that hasn’t weakened that much. Detached sales have fallen off a cliff.

Was there a big dropoff in the stagnant years in Victoria or is it fairly constant?

That was certainly the case in 2009. The market went from dead to frenzy within about 3 months. Interesting that you still have so many out of town potential buyers when the VREB said that anecdotally it seems fewer Vancouverites are coming over now. Are you specifically recruiting those buyers?

I am a local Realtor and my client put me on to your site. I can get the graphs myself of course but the commentary is great.

I think there are about 1200 fairly active agents the Greater Vic area right now. My business is probably weighted 70/30 in favour of buyers. I always like to compare my personal experiences with the news feeds and commentary out there. Right now I have 27 active (or will be active within the next 4-6 months) buyers and they are all from off-island. People are still moving here by (or probably more correctly, wanting to move here) by the bus loads. I know I am not alone in having so many out-of-town buyers so there is still a pronounced imbalance. I get the feeling we are in the middle of a malaise right now as people (my clients included) are trying to assess if they should wait to buy – with the assumption that prices will come down. They may drop, but as soon as they do all it will take is for a few antsy buyers to start buying and everyone will jump back in.

At least that’s how I see it.

It’s the western communites that are keeping our sale volume up over last year. If you just look at the core market for all types of properties we are down from last month and down from last year.

Sales, Number of

Month 2015 2016

Jan 196 288

Feb 329 458

Mar 453 654

Apr 488 704

May 502 736

Jun 494 613

Jul 446 500

Aug 376 475

Sep 375 399

Oct 383 376

October house sales in the core are the twelfth highest since 2001. But we owe most of overall sales of all property types to condos, as they are at their highest in that same time period for the month of October.

More choice in luxury condos are making the difference in today’s market as prospective purchasers shun high priced houses for newer quality condos.

http://www.theglobeandmail.com/report-on-business/economy/conference-board-says-consumer-confidence-posts-big-drop-in-october/article32641233/

Anecdotal I know but my realtor said he has a few retiree type clients that want to sell but won’t because they are afraid of what they will be able to buy (to downsize) with low inventory. So they are staying put for now.

Condominiums are predominately situated in the core district of Victoria. If you are using gross sales from all areas then you won’t be seeing a shift as condo sales get swallowed up in the overall percentages from all types and all areas.

If you are going to measuring houses versus condominiums it only makes sense if the data appeals to the same market. And location is one of the most important criteria to determine that target market. Otherwise you are comparing house sales in Sooke and Shawnigan Lake with condo sales in the core. They are not the same target market.

Surges in the market in the number of sales are common at the end of each month as buyers don’t want to pay for two properties. Much like in the days when you were trying to move from one apartment to the next – moving days were at the end of the month. It is immaterial if there is a surge in the last week or not – the data is the data.

Nice graphs as usual Thanks.

Sales momentum slowing but would take a lot of new listings to affect prices. At least hunting conditions might be better this spring. Unless there is a flood of people coming north…

Thank you an excellent chart that answers my question of whether there has been a shift in the ratio of condo to SFH.

As to when people will be listing their homes again, I suspect that there are two factors year. The high prices may have sucked a lot of the rental houses into the market over the last few years and they were bought as residences. I also suspect that a large number of homes were bought as long term residences and might not be on the market again for years if not decades.

So we seem to be waiting for death and divorces; maybe the TC can start run a series of articles on the joy of adultery which might get the divorce rate a bit more perky.