Foreign Buyer’s Tax Has No Appreciable Effect on Victoria

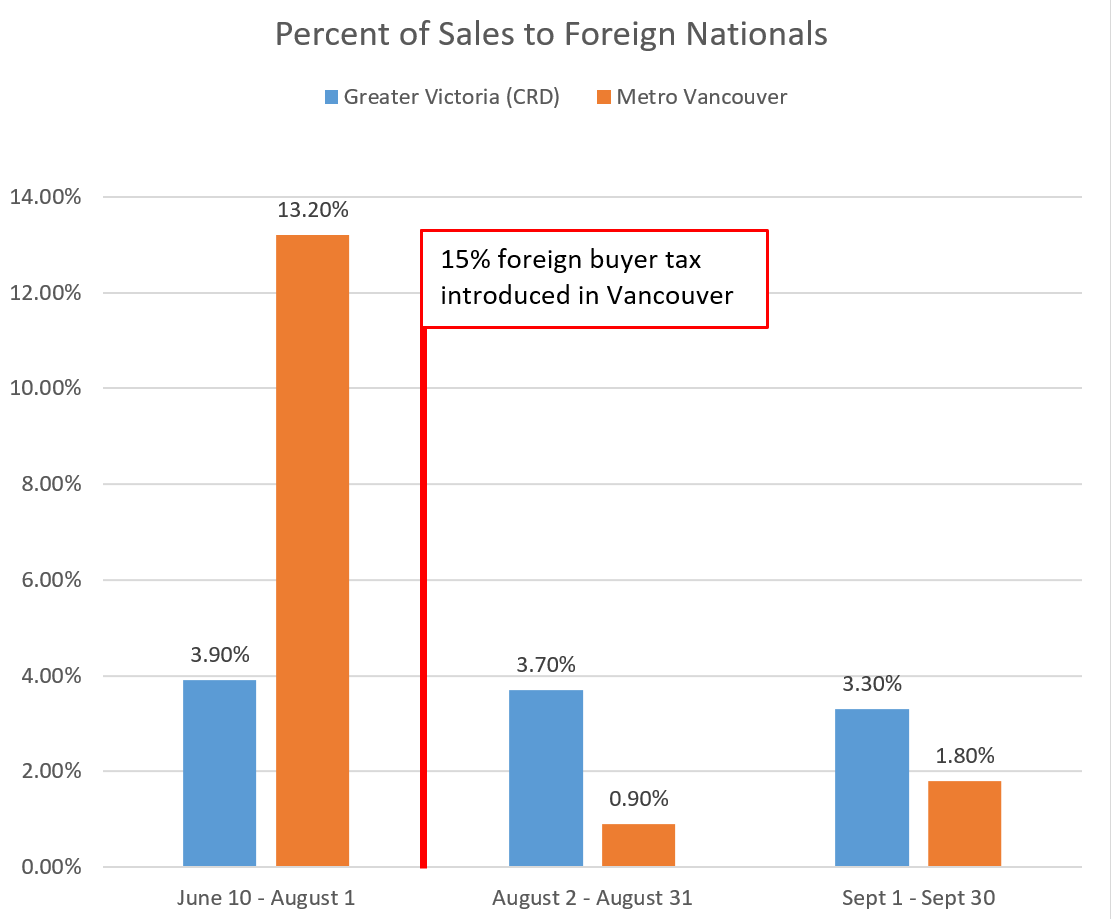

New stats are out from the Ministry of Finance and they reinforce what we have already noticed: the foreign buyer tax was blunt but incredibly effective. The percentage of foreign buyers in Vancouver is down some 90% from before the tax, and while there was a small bump in September, they are now down to at or below the average of the rest of the province.

There was some concern that a tax in only one region would push buyers to other regions, most notably Victoria. However that fear has turned out to be unfounded, as the sudden implementation of the tax and the warning it could be extended to other regions has put the fear of Clark into any buyer that may have still had their heart set on BC.

While there was a slight decline in Victoria as well, that is as likely to be noise as signal. Essentially there was no impact. Of bigger importance to our market is whether the small flood of Vancouver buyers we saw in the spring has abated. This may be the case, as VREB president, Mike Nugent, recently told the Times Colonist. “While evidence is anecdotal so far, it seems fewer Vancouver buyers with deep pockets are crossing the water to buy here.”

So good news all around. A return to more local fundamentals in Vancouver, and a possible stemming of the overflow into Victoria.

Update: Weekly numbers update while we wait for the VREB monthly report:

Definitely seems like the market is topping out at least in terms of activity. Not sure if it will make the full 180 into a decline but this is probably the last month for a long time where we will see year over year increases. New post: https://househuntvictoria.ca/2016/11/01/october-market-strong-but-early-signs-of-weakening/

Holy, another price slash on a nice place on Lochside with an ocean view. Looks like the walls are a tumblin’ down.

$778000 / 4br – 3013ft2 – PRICE DROP! Spacious Ocean view home on Lochside (North Saanich)

http://victoria.craigslist.ca/reb/5829979355.html

Price slashing in South Oak Bay ?? Say it ain’t so ! There should have been BMW’s and Jags lined up around the block for this one. Looks like the air is starting to leak from the bubble.

http://victoria.craigslist.ca/reb/5811409576.html

These charts look like a crash won’t be long now with Canada’s economy and debt worse than they thought.

So far past the US crash it’s insane to make calls of higher prices to come, especially if you are building over priced boxes.

Canada’s housing bubble makes US look tiny

http://www.macleans.ca/economy/economicanalysis/canadas-housing-market-looks-a-lot-like-the-u-s-did-in-2006/

Introvert,

Vancouver sales down 71%, average prices down $300K. Your Golden Head bubble world is about to get rocked.

Rents are plunging in the most expensive markets.

http://www.businessinsider.com/us-rental-market-analysis-2016-11

Some of them slip through.

We know you’re immune from reality.

I’d choose the fixed rate.

Bingo, that’s for Greater Victoria, not the core SFH.

SFH All Victoria only up $3400. Prices have peaked.

Median != benchmark Hawk.

Download the stats package. The numbers Michael quoted are correct.

SFH’s benchmark (that you love to quote) in the core up only 1.25% not 2.5% but whose counting right Mike ?

CuriousCat:

In this environment your calculations are probably right. I am far too conservative since I remember dealing with 14% and up rates. I have no idea if rates will push upwards in the next couple of years and i dont suspect that anyone actually does know.

But I am amazed at how much debt people are carrying these days in general. I do wonder how many people would be in trouble if the rates pushed up one or two percent?

VREB #s are out.

Median gain for October higher than I would’ve thought.

SFH 2.5%

Cndo 2.4%

THome 1.8%

I’m curious about Bay St as well! I originally posted on Oct 22 the following to refresh our memories:

October 22, 2016 at 6:37 pm

How desperate would you need to be to buy directly on Bay St? I would buy a house on a fairly busy roadway if it was setback really far. This one is so close to the road, you could probably open the window and spit on passing cars.

1340 Bay St listed at $428,888 – DOM at 32 – no pictures of inside so assume it’s a real dump. The lot is actually on the smallish-side at 3400 sq ft.

And look what a google search found! It was actually listed back in March for $372,888 – so in this case, the new realtor tried to relist it for MORE, not less. Or was it a flip?

http://www.usedvictoria.com/classified-ad/Introducing-1340-Bay-Street_27055717

Butter: I have never seen the 3 month interest be higher than IRD, unless you are less than 6 months away from renewal (something like that).

Yup just read the news about TD. http://www.cbc.ca/news/business/td-bank-mortgage-prime-rate-1.3830878

If other banks follow, which they always do, then your variable rate will now be 2.15%, which is the same as the fixed, so go with the fixed! lol

Barrister: I went with the 2 year because the 5 year offered to me was 2.54%. At the end of 2 years, the rate I renew at will have to be 2.9% or lower for the rest of the 3 years in order for me to come out ahead.

Sales down from last month by 46, continuing the major down trend since spring peak. So much or Marko’s call for blowing through 800 no problem.

Obviously the new rules and banks tightening the credit lending screws will tip this market over the next few months like Vancouver. Prices have peaked and nowhere to go but down as per Couvellier and Associates.

Depends on how your lender calculates IRD. That 2.15% might be a discount off the posted rate (something like 4.75%) and they may use the posted rate in their calculation. You have to check your wording for how the particular lender calulates IRD. Even with no rate change or an increase the banker math may equate to a huge penalty.

Here’s some examples.

But what rate does the bank chose? The 5 year fixed? That might be quite a bit of money over the remaining term.

Thanks for the feed back Bingo, Barrister and CCat!

The fixed has a 3 months interest penalty or Interest Rate Differential penalty, whichever is greater. Looks like with rates so low. 3 months interest would always be greater. (unless I am missing something)

Hmm “Buyer’s agent to refer to supplements on Matrix.” (regarding Wyndeatt ). Some kind of deficiency? It’s a weird house, so it already has that going against it.

@butter

If you don’t plan on selling in the next 5 years, that’s a pretty sweet fixed rate and would give you piece of mind. First rate hike will be 0.25% and it’s a safe bet lenders will raise their prime rate by that much (whereas they only give you part of the drop when BoC drops the target). So one rate hike and you’re above the fixed rate and catching up on any interest you saved with the slightly lower rate.

Personally I tend to prefer variable due to the much lower cost of breaking a mortgage (3 months interest max). Breaking a fixed rate closed term mortgage can be costly (read your terms). I have no idea what the next 5 years brings. Locking myself into a term that long doesn’t seem pragmatic.

The spread is so low between variable and fixed right now though. When I went variable it would have taken at least 3 rate hikes for me to start losing ground on all the interest I saved by going variable.

You don’t have to even change estate agents. While it isn’t common practice, some agents will re-list the property immediately in order to reset the days on market. A practice that some real estate boards do not allow. It’s kinda like a car salesman rolling back the odometer on a car.

Incidentally, appraisers must disclose all listings and sales that occurred in the last three years. The lenders or anyone wanting an appraisal before putting in their offer would then have this information.

TD raised its variable mortgages. .15. First time ever without a bank of Canada change. Scum banks.

Others will follow.

Question:

If one changes real estate firms after the listing expires (lets say a five day gap) does the property get a new MLS number?

That’s really impossible to prove what is in the minds of others. I would argue that If you are speculating on house appreciation then most speculators would buy in Oak Bay.

If speculators only hold for a short term and home owners hold for long term then we could simply look at the turn over rate of property.

Anyone know how much the bay st bottom feeder went for? Busy street, tiny lot, really bad condition, bad placement,etc.

Thanks

CuriousCat:

I have noticed that there are a number of house that are taken off for a short while and then relisted. DOM is sometimes deceptive. For example, 610 St. Charles is listed as 90 days on market. It has been continuously on the market for at least 3yrs by the same owners. i suspect that there are a number of others out there as well.

Curious Cat:

I am wondering why you did not go with a five year?

Butter:

I would go for the five year fixed rate myself. I am sure that mathematically this might be the wrong choice and someone will point out that you can start with variable and then convert to a fixed rate later if rates start to move up ( one has to calculate the penalty cost and the ease of converting). It is a question of how many months of rates being under 2.14 to equal the savings for the cost of conversion.

Personally, I never liked the idea of having to keep an eagle eye on mortgage rates. Either choice is really cheap money. But be cautious with how much you borrow. It would not take much of an interest increase to raise your mortgage costs up by 50%.

I am sure a couple of people here will tell you why you are mathematically better off taking the variable and I suspect that they are theoretically right.

Butter – I would go with the variable rate. That’s a pretty sweet discount.

I renewed my mortgage in August and I was only offered a 0.35 discount for the variable. I went with a 2.09% 2 year fixed instead.

Here’s one that has dropped its price – 2864 Wyndeatt orig $629,900, dropped to $619,900, dropped to $599,900. Taken off and just relisted at $549,900 with a new MLS #, so showing DOM at 1.

Bingo:

I agree with you that i am glad that I am not house hunting at the moment. The selection is certainly less than four years ago. But in some ways it reminds me of some of the more established neighbours in Toronto. In those areas people tend to stay in their houses for a lot of years. The other thing I have noticed is that a fair number of those houses are passed down to one of their kids and never put on the market. Not sure if that is going to be a trend here in Victoria though.

Just Jack:

Thank you for the house core numbers. It is interesting that the median price seems to have had a major increase. A friend who lives in Oak bay was commenting that there seems to be a somewhat younger generation in their fifties moving into the neighbourhood. He was also saying that most of these new people seem to be settling in for the long run. His thought was that a lot of the houses that sold in the last three years might be off the market for a very long time. (There is always death and divorce). Not scientific but interesting.

I also had an interesting conversation with my neighbour who sold all five of her rental houses in fairfield in the last year. For some reason, perhaps because the houses had been bought by her father in the fifties, she seemed to have had a real personal interest in who the buyers were. She actually turned down a couple of offers from real estate agents. She believes that all five were sold to families with children. Does not mean that they wont be flipped in a year but I found it interesting that some of the house rental stock might be converting over to pure residential. She had an interesting analysis as to why it was time to get out of the rental business.

Mortgage renewal time…

2% variable rate (prime -0.7) 5 years

or

2.14% fixed rate 5 years

Which one would you choose?

Thanks

Thanks for the numbers JJ. Interesting stuff.

I’m not sure I’d categorise a difference of 37 houses listed as “slightly less” when it’s 10%. With such low inventory it hurts selection. If we had 1000 SFH to choose from in core, then a difference of 37 would be negligible (or so I’d expect).

Glad I’m not house hunting.

Thank you again for providing the numbers Marko. At a glance, the numbers seem to be similar to last year. Do you know if the ratio of condo to SFH has remained about the same?

Inventory is perhaps the most interesting number.

Detached houses sales in the core for October over the last decade have ranged from a low of 97 to a high of 204. The average number of sales being 148. This October house sales were near the 10 year average at 151.

Far different than April of this year when the 10 year average was 226 and there were 376 house sales in the core.

Some feel it’s due to fewer listings. Yet in October there were 361 active house listings in the core. Only slightly less than in April when there were 398. The months of inventory for October was the second highest of the year at 2.39. Which is slightly higher than the October before at 2.29.

The median price in April was $759,500 and in October reached $828,000.

Victoria Real Estate Board

Tue Nov 1, 2016:

Oct Oct

2016 2015

Net Unconditional Sales: 735 734

New Listings: 904 925

Active Listings: 1,938 3,170

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

The tendency of people to extrapolate that prices in the future could only soar up, up, up was key to inflating the U.S. housing bubble of the early 2000s, according to an IMF working paper released last year. It found that price expectation shocks accounted for 30 per cent of the increase in home values between 1996 and 2006, larger than all other factors driving price gains, such as housing supply, housing demand or mortgage rates.

Similar expectations of some of posters on this site!

https://www.imf.org/external/pubs/ft/wp/2015/wp15182.pdf

Happy Halloween everyone. Be safe.

Chris:

Not for the time being no. Calgary isn’t a very good example. When it was “tight” it had a vacancy rate of 1.4% which swelled to over 5% with the energy sector downturn. They haemorrhaged jobs, hence people were bailing on Calgary and vacancy surged.

Victoria is currently at 0.6% vacancy (according to the paper, at least). So we have a long way to go to tip things in favour of renters.

That being said, I wouldn’t put money on it. I think anyone that relies on rental income to pay a mortgage is nuts (whether that is an income helper suite or an “investment” property). I’m not a landlord and have no urge to be one.

I don’t see any relief on the horizon for renters short of a black swan event. I’d argue our local economy isn’t as precarious as one based on oil (i.e. Calgary). I think a bigger concern for Victorians is Canada’s economy in general, which is not recovering very well. If instead of a slow recovery we spiral down… let’s hope that’s not the case as cheaper housing and rent doesn’t help people without jobs.

I honestly do hope both the rental market and housing market ease up (it’s too crazy), but that doesn’t make it more likely to happen soon. Things happen in their own time and barring black swan events, that’s usually a gradual process.

The stats seem pretty similar to last year. A few less sales but also a few less listings.

Alex

Bingo: You can’t see rents decreasing? That’s what they said in Calgary just two years ago:

It’s a massive swing for a rental market that was the tightest in Canada just two years ago, when Mayor Naheed Nenshi made a public plea urging landlords to stop “gouging” tenants.

http://calgaryherald.com/news/local-news/a-perfect-tenants-market-calgary-landlords-scramble-to-reduce-rents

But yeah, no cycles in Victoria real estate – there will always be excessive demand because our economy will always be strong (cause we facilitate money laundering, tax cheating and foreign investment in residential real estate.) and the Liberals with their pro housing agenda will always be in power.

I’ve been looking for a new place to rent for about 2 years. My comment is based on no data but my observations of browsing rentals for the last 2.5 years in spurts but often daily. I have been renting here for 10 years and have lived in many different places. It has always been tough competition but I think now with house prices the way they are a lot of young families and couples are looking for a non basement suite and it’s stiff competition and increasing prices. I haven’t been looking the last few months because I have decided to stay where I am for another year or two to save money because my place is so cheap for what it is.

My comment about house prices and rent decreasing was like I said what I THINK. I didn’t say it’s going to happen. Just my unprofessional opinion… sure call it intuition 🙂

Based off what? Just intuition and schadenfreude?

Victoria has low rental vacancy. Until we see a significant increase in the rental supply I can’t see rents decreasing. We have an increasing population (increasing demand) and supply doesn’t appear to be keeping up, let alone growing beyond demand.

The rental building at Uptown is something long due. But only 134 units of which 104 will be 1 bedroom.

I wonder why they are biasing the build so much to 1 bedroom. I’m also curious if there will be any 3-bed apartments. I’d assume not. The remainder 30 units are probably split between bach and 2 bed.

This part is disturbing: “Hamill said she does not believe workers at Uptown will be able to afford rent for the apartments.”

Awesome. So people that work there will won’t be able to afford the convenience of living by work. They’ll have to commute from elsewhere. It’ll strictly be for people that want to walk to Whole Foods for their produce so they can feel smug about their low footprint lifestyle.

I am a renter and am so surprised there are so many people who want to buy a house with a suite. When/if I buy a house I want the whole property to myself. I think currently a suite is required for most first time buyers to meet their payments on their house. I live in an upstairs of a house now with someone below me and it’s kind of annoying to be honest.

I’ve viewed carriage houses and I’m not sure I would want to live in one long term. To whoever said renters only want a roof over their head and would live in a box…that is total BS. Maybe for students that’s true but not the average professional in victoria. I would also pay a premium to rent a whole house or upper over a garden suite or basement suite…just saying I don’t think you will get 2k a month for one.

It all sounds fine and dandy spending 100-200k on a garden suite when you think you are going to get renters who will pay what they pay now. What if rent goes down? It has increased a lot over the last couple of years with house prices but I don’t personally think it’s going to stay like that. Some people are milking it and I don’t feel sorry for them when they have to drop rent. That with the capital gains of that the property, declaring the income on your taxes and the lost interest on your building costs how can it be worth the risk to build a garden suite? And sharing your property with some lowly renter scumbag… who wants that? I think most landlords think they are getting rich off of their renters who are foolishly “paying someone else’s mortgage”. Kind of funny really.

Nice shed! Wanna build me one? 😉

Great, stylish shed, freedom_2008. I love it when people put so much care into such things – they add to the neighbourhood.

freedom_2008, very nice looking shed. Thanks for sharing.

I have been planing to build one myself for awhile…

ps We are architecture buffs and MCM admirers, thus the desire to build a structure to reflect what we like with our own hands, be it a shed or a coop. Actually we even added metal braces in all shed’s frame joints so it would stand well in a earthquake. With a generator, water, dry and canned food stored there, our friends and neighbors have already booked it for emergency 🙂

But understand your concern of the real garden suite.

Mon Oct 31, 2016:

Oct Oct

2016 2015

Net Unconditional Sales: 708 734

New Listings: 876 925

Active Listings: 1,933 3,170

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Haha, no need to worry about our shed, as it is just winter home for our bikes and garden gears and tools, and we went through the city with the plan before we built, so everything is by the book:

– less than 10 square metres (sqm) in area

– 3m (10 ft) from a street

– 1.5m (5 ft) from a lane

– 1.2m (4 ft) from a side property line

– 1.5m (5 ft) from any structure

– 3.6 (12.5 ft) maximum height

We are surprised and very proud of our own work wrt the shed (this is our first real project), but my point was that it shouldn’t cost $200k to build a 500 sq ft garden suite.

Exactly JJ. Just rezone for real. Duplex and row house in all Vic. Let it happen properly.

Freedom_2008 last post is what I hope the city will avoid. There has to be design controls on these buildings.

Parking is a problem in most of our City. These properties have to have enough off street parking for the principle home and the secondary house. In some areas it has gotten to the point that I think residents that chose to park their cars on the street should pay an annual parking fee and one side of the road should not permit street parking at all.

Why not just strata title these minnie mees. Then people could buy them. Why increase the price of housing in the city to the disadvantage of the first time home owner.

Introvert, thought you never read my posts ? Actually I want space when I buy again in order to avoid potential anal neighbors like you who think they’re special.

Funny how the bulls get more defiant when they hear of 71% sales drops in Vancouver and think it won’t ever happen here. Nowhere is immune from the coming correction.

Shhh freedom! That’s a 200k garden suite you are talking about! Chaching!

$200K for a garden suite? We designed and built this nice little shed ourselves with total material cost under 3K.

So, if one is R2 zoned, can you have a suite in the house (we do not right now) and a carriage home? Not that it would work easily where we are due to the seasonal back yard pond, however if MIL ever needed to move in, it would be 200 percent easier for family harmony being in a separate building than converting the basement to a suite.

Costs would be high – building, building up the gravel, connection to city storm sewer… however the ability to do so opens up a lot of possibilities for those so inclined.

Thinking further, my father might even build it himself so he has a second home in Canada (the other is out of country. He was thinking of buying a condo here, however a garden house would be cheaper and all he needs.

In regards to garden suites in Victoria, this is great news for new development. Most of our clients are not up for the delay in the rezoning process (9-12 months before we have permit in hand), nor do they want to go through community meetings and have their neighbors voice feedback. However, I am very interested in seeing how planning will review these as they move forward with new applications. I will be in touch with the COV for some clarification of the matter this coming week as we have a few projects in the go where garden suites were originally on the table, but scrapped afterwards as it would hold up any new permit applications. Good on them for understanding this.

As for costs, people seem to always shoot for the max and want to build a architectural wonder. If you are in for the investment, build a modern box (rectangle), 2/12 shed roof, 1 bedroom, 1 bath, stacker w/d (in a closet), on demand h/w, electric baseboard heat (no mechanical venting required in suites under a certain size), vinyl windows, Ikea kitchen (no island, just a straight run) and keep it around 450-500 sq ft. Keep construction to slab on grade, framing is minimal but you’ll probably push the roof joists to I joists if you cantilever the front overhang, you could honestly frame this guy up in a weekend of two. People seem to think they need to build to the standard of what they would want, and frankly, renters just want a roof over their head and privacy. Anything new is going to be better than any basement suite out there on the market. Wanna make it look sexy on the outside? Use fibre cement panel with easy trim and paint it charcoal with cedar trim. Build it, and they will pay.

Who was it that paid capital gains tax just recently? LeoM? How did they figure out what you had to pay?

Yes, but we still have not answered the question as to what the rate applied to non-exempt space will be.

If you have a suite is part of a depreciating asset – the house – how much appreciation goes to the suite?

Say you’ve bought a house with a suite for $600,000 and the house value might be assigned as 200k and the land value might be $400k. When prices appreciate in five years the property might be worth 800k the land might be 620k and the house 180k. This means your 30% floor space with no external use of the property other than access might not be worth too much in the land of capital gains if properly assigned it’s share of depreciating building vs. appreciating land.

Not sure if it works this way but my point was that cra is pretty quick to limit the exemption for land re. principal residence when you have multiple acres to what you reasonably use – why wouldn’t this apply to a suite that uses very little of the land ie. 30% of the floor space of the house plus an access path. If the building depreciates perhaps there be there should be no capital gain after five years on the non-exempt suite?

It will have to be, because prices in the core keep rising, contrary to all your predictions/hopes.

“Actually, every major urban planning study indicates that cities reach their peak efficiency at around between 200,000 to 300,000 of population. More actually is not better. ”

“I moved to Victoria because I love what it presently has to offer. If you want all these changes move across the water; it is all there for you already.”

Agreed Barrister, this city has lost sight on it’s future and doesn’t get it that it’s road structure is not designed for another 100K people. They are so incompetent that they can’t even put in one mass transit system years ago on an existing rail line let alone build a 100 yard bridge at budget and 3 years over due. Can’t wait to see the McKenzie interchange nightmare. Thus why when I buy again it will be well outside the core.

Nope, but now they have a tracking system. Difference between actually outright lying on a form to the CRA and just not saying anything like has been the case.

btw, these suites can only be built where the existing home does not have a suite. Also, the permits department makes things so complicated for people that in reality we won’t see many garden suites actually being built.

We will go from 2 per year to 10 per year. I think it is a step in the right direction but by no means will you see garden suites popping up all over your street.

Strictly from an economic sense it doesn’t make sense to build them. I would wait and buy an existing one and let the original owner absorb the partial loss in construction costs.

It is going to be years before you can buy one. I’ve only ever seen one (legal) in my career.

It you are savvy it is going to be less than $250 per square foot to build one of these due to size/complexity. By savvy I mean you don’t need a master carpenter for one of these, you can hire an appreciate that works for a master carpenter and just help him or her by passing the sheeting, etc. How difficult is it to lay flooring for 600 sq/ft? You aren’t going to stuff Pella windows into it, more like PLYGEM windows.

There are certain inflection points in construction. For example, a 5,000 sq/ft home is going to be way cheaper per square foot than a 3,000 sq/ft home due to economies of scale.

400 to 600 sq/ft has the inflection point of being able to hire smaller contractors/do a lot of stuff yourself.

Yes, if you call in a big time builder to build your garden suite you’ll be screwed.

I think these suites make sense for some people just because money is dirt cheap and rents are through the roof. Financing a 100k against your home is only $400 per month. Not for everyone tough. If you lack all constructions skills and have zero savvy maybe best just to keep your yard.

There is no chance the CRA is going to consider a garden suite as part of your principal residence.

So, all the homes on the peninsula that have sold over the years with detached three car garages and a two-bedroom suite above have paid capital gains? My friends sold one of these a few years ago and definitively didn’t pay capital gains.

I am just noting what I’ve seen in real life. I do agree that even the current rules clearly would not consider a garden suite as part of your principal residence but it doesn’t appear, to me anyway, that this is being enforced on sale of home.

@Barrister, it’s common to want to raise the drawbridge once your on this side 😉

I can’t see the market paying $2,000 a month for a one-bedroom carriage house unless the rent was a gross rent including heat, electricity , water , etc. and in a good location. I would also expect a higher vacancy rate as anyone that can afford $2,000 a month can also afford to buy a condominium.

Right now, there are not a lot of carriage homes so they will get a premium. But at some point there will be enough competing against each other to lower the rent. And despite what you may dream they are not all going to be luxurious places.

$2,000 a month is the best case scenario and I don’t think that is sustainable given the alternative available for a renter to become a condo owner quickly. None of these carriage houses will be downtown where you get the high rents so an equivalent condo in square footage would be selling for $250,000. The mortgage payment, taxes and strata fees would be under $2,000 a month.

Strictly from an economic sense it doesn’t make sense to build them. I would wait and buy an existing one and let the original owner absorb the partial loss in construction costs.

Because even at the best case scenario of $2,000 a month, the contributory value of the building doesn’t come close to the cost to build a 600 square foot detached house. It may be a smaller house but the permits and costs charges by the city are not going to be much lower than a full size house. Kitchen and bathrooms cost the same to put in a full size house as a minnie-me so the price per square foot rate will be a lot higher than a full size home. My guess would be $250 a square foot to build a 600 square foot minnie house. That’s about $150,000. A custom garden house would be over $200,000. Or to put in another way you’re not likely to break even for a decade. And that’s longer than the average person owns a house.

Those are about the costs the person that sold their house near Oaklands school paid to build the granny suite. And he is a builder by trade.

Yeah, have to consider how much cooler a self contained little house is than a basement, even if the inside is built to the same specs.

There is no chance the CRA is going to consider a garden suite as part of your principal residence.

Maybe toss one of these on the site? http://containerwest.com/products/pre-modified-containers/40-container-heat-light-insulation/

As for what I want or don’t want, it is completely immaterial. The city is growing. End of story.

This. Anti-development is the wrong approach. Correct approach would be lobbying the government to elimiate child benefits and to cut immigration.

1+1 does not equal 1.

30 million + 300k immigrants per year does not equal 30 million people need a roof over their head.

There is no magic solution to population growth other than density or clear-cutting.

People are underestimating the rent. I am renting a 430 sq/ft condo at the Promontory for $1,295/month and I had a ton of applications. People will pay a premium for something nice.

My guess is a 1.5 story (loft) 600 sq/ft brand new with a bit of patio/yard would be around $1,500 to $2,000 fully furnished depending on location.

The garden suite is a non-brainer with a brand new single family home. You can T in the sewer, drain tiles, etc., into the main house.

For an old house one will need to research the infrastructure (drain tiles, hydro, sewer, water, gas). If everything is economically feasible building the actual garden suite will not be that expensive and with a project this small someone handy can do a lot of work themselves such as siding, drywall, flooring, etc.

If you can rent it for $1,500 per month (carries almost $400,000k mortgage) spending $100,000 to $120,000 makes sense in my opinion.

CRA regulations aside. Still need more accurate info/rules.

Agreed. A garden suite at the same size as an in-house suite will rent for significantly more.

Well a friend of mine recently converted his small garage into a 340 sq. ft. garden bachelor suite in Vic West and is renting it out for $1200 a month – so I think others’ estimates of rental potential are low. That little project cost him $40,000 but he did a lot of the work himself. I would say a 600 sq. ft one bedroom garden suite with a little private garden space would rent for up to $2000 a month right now in the core – people are willing to pay an insane amount for them!

Hey @Barrister – fantastic information you wrote (copied below) – especially the word ‘every’ in your first sentence. Put a link to several of these studies on the site so we all can learn. I’ve lived in several major European cities and large North American cities – all seemed pretty good to me. Each with weaknesses but also with many strengths.

“Actually, every major urban planning study indicates that cities reach their peak efficiency at around between 200,000 to 300,000 of population. More actually is not better. This may seem counter intuitive but the operational costs outweigh the additional tax base. Quality of life is also notably affected. The studies are not just theoretically but have been confirmed in analysis of countless cities.

More diverse employment opportunities.

Also more density is the only solution to increasing population (which is happening whether you like it or not). The only other solution is more sprawl, more congestion, more destruction of nature.

As for what I want or don’t want, it is completely immaterial. The city is growing. End of story.

Step by Step:

Actually, every major urban planning study indicates that cities reach their peak efficiency at around between 200,000 to 300,000 of population. More actually is not better. This may seem counter intuitive but the operational costs outweigh the additional tax base. Quality of life is also notably affected. The studies are not just theoretically but have been confirmed in analysis of countless cities.

Take a snapshot and compare Vancouver to Victoria. I am always amazed why all the advocates of ever increasing density dont simply move to Vancouver or Toronto. They can have their vision of a city of the future today.

I think for a typical city lot with carriage house they would use the logic that you are using your whole backyard and keep the lot as part of your PR. However for bigger lots with maybe a small fenced yard for the carriage house that might very well be considered part of the tenant’s private use.

Dear Leo:

You still have not answered my question as to how the city would be better for its current citizens by making it more dense. Personally I find it very vibrant as it is right now. I suspected that you have a bigoted and agist view of things that focuses on your needs and totally disregards other peoples culture and values.

But since you have a vision of a high density city as your goal I have a fast solution for you that does not involved booting older people out of Victoria. Move to Vancouver, you can immediately get what you are trying to turn Victoria into. You want overcrowded and overtaxed with endless social costs it is already there for you. Or Toronto, miles of high raises and all the vibrant life that you can handle.

I moved to Victoria because I love what it presently has to offer. If you want all these changes move across the water; it is all there for you already.

Strikes me as just a simplistic and easy way for politicians to supplement the rental housing stock by depending on dopey home owners who can’t calculate and don’t realize they are building a money loser.

I guess if you are going to go from 900 square feet to 600 the cost will decrease — the over 300k laneway house was actually 950 square feet.

I wonder how much you can rent a 600 square foot place for? Seems like it would end up being a small one bedroom? Maybe $1000/month? I wouldn’t go through the cost and process to permit and build for this return myself unless I knew family would be using it. Seems like an extraordinary hassle for a marginal return and lots of potential tax headaches.

Over 30k in site prep? Come on… most will require mowing the lawn first. At 600 sq ft there will be no requirement for large spans or engineered lumber. You’ll need a simple monolithic slab with a 2×8 stick frame on top. Only one bathroom and a small kitchen. Perhaps I’ll modify my spreadsheet and post an actual realistic cost…

Maybe, but the lady in the second link actually built a 900 square foot carriage house in Vancouver and it cost her over $300k. Maybe she overpaid. Not sure. Your link did not work for me btw.

And then there is this:

http://www.cbc.ca/news/canada/british-columbia/laneway-home-vancouver-expense-affordable-housing-delay-planning-1.3527971

I think he is very productive and has someone great assisting him with photos, but I don’t view his blog or books as admirable. Maybe his energy?

Respect is also not really the word I’d use for what seems to be a self-oriented approach to setting oneself up as a guru of some kind while being consistently wrong with predictions and information – and outright nasty to people who present alternative views.

Of course a builder will say it’s going to cost $270 to build one…. it will actually cost $180 more likely. http://Www.modernshed.com

Agree with him or not Garth deserves much respect for his determination and achievements. His self promotion is well within the bounds of class and he offers up much more for nothing. I’ll be happy for him when he finally is right and sells a bunch more books. Maybe a re-entry into politics? Maybe another five years from now? Ten? Eventually he’ll hit it.

Capital gains issues aside, which seem unclear to me, the math is pretty iffy for a carriage house for rental income, even though there is no extra land cost:

http://www.vancouversun.com/Laneway+houses+continue+soar+popularity+Vancouver/9331159/story.html

At $270,000 you’d have to be able to rent it for about $1800/month to have it make any sense for investment purposes. Seems unlikely given that it is going to be under 1000 square feet. If you are going to move into the smaller space and rent out your home for more maybe it makes sense:

http://www.homesanddesign.ca/communities/lessons-from-my-laneway-house/

I agree it makes sense for multi-generational living where adult children could not otherwise afford to buy and the family wants to live this close.

The garden suites will add value to the property.

But how much?

Since a garden suite will generate income like a basement suite. The value that it will add to the property would be similar to a basement suite.. I believe that there is a restriction on size, so these granny suites will be like building a single or double wide garage in your back yard. 400 to 600 square feet or what would be a one-bedroom suite in a basement.

A new one-bedroom suite, depending on quality and closeness to the university may fetch a 1,000 a month on average. Comparing houses with and without one bedroom suites might result in a difference of say $40,000 between the two which would calculate to a monthly rental factor of 40.

And that’s how you would estimate the value of the garden suite as the estimated market rent X the monthly rental factor of 40.

$1,000 X 40 = $40,000

If you rented the suite at $1,500 then the contributory value would be

$1,500 X 40 =$60,000

However the cost to build these detached buildings is going to be a lot more than the amount that they contribute to the value of the property. My guess would be the construction costs will be twice the contributory value.

I consider these garden suites will be a gimmick. If you want to make good coin on building and selling a home with a garden suite be the first to do so because you will receive a premium on the house sale. As more people follow and build garden suites that premium disappears as the market is saturated.

Well that is an interesting question.

How is the capital gain calculated on the rented out portion? The building is a depreciating asset and the gain will be in the land except for a new build and if you built the carriage house yourself then presumably you’ll have expenses to write off and the cost is often greater than the gain in market value.

And if you rent out a suite in your depreciating asset that covers 30% of the floor space and the tenants have no use of the large back yard – only the front walkway – how is the gain calculated? The land will have appreciated a lot and they did not have the use of 30% of the land.

Seems like there is all sorts of guidance when CRA wants to limit the capital gain on what part of the land is reasonably used for the home when there is a lot of land, but it would be interesting to see how it is applied in the suite or laneway house scenario, which is very common.

Barrister, I think you moved to the wrong place. Victoria’s goal is to become an ever more vibrant city that has a larger and more diverse economy. 15 years ago it was just government, university, and the base. Now it is very different and they are pushing more towards that. More economy means more people.

Also the reason why more retirees will be looking towards Sydney, Parksville, Qualicum Beach, and Courtney/Comox rather than Victoria in the future.

@Barrister – where is the 100,000 number from? I would think that more people add more consumers into the system, more business owners, more entrepreneurs, more tax dollars to support infrastructure, etc. It’s a positive thing overall.

The water restrictions are primarily due to climate change aren’t they? I’ve experienced far greater restrictions elsewhere in Canada. Also, people need to shift their behaviours such as gardens to less water-intensive plants and hopefully that will happen over time.

Schools are crowded but the last school my kids were in in Ontario had 16 portables, 2 principles, 2 vice principles, 2 shifts of recesses. That was overcrowding! I’m not sure it affected their education but I also don’t know how to measure this objectively. They didn’t have access to the great programs that are here in Victoria such as music.

Wait time for health procedures for many areas are certainly high which is more than hospitals. It’s so complex to assess where all the bottlenecks in the system are since the public has very little information available to them. I thought one of the issues was the lack of specialized health professionals.

The parking on streets is really quite incredible here. It’s my first location that doesn’t have snow clearing so that’s one contributor. I can’t get out my driveway very easily most days because of the SUVs and pickup trucks that block clear views, especially with many cyclists on the streets. And I live on a side street. There are so many rental units, and continually increasing, that this problem will get worse (except there is almost no room left on the street!).

My property is under built – I have a flat large piece of property with a small house. I live in one of the “old shacks” people refer to on this blog but in reality it’s updated and not a tear down. I have lots of room in my driveway for 3 more cars. I wonder if the change at city hall re: garden suites will increase the value of my property for someone who may wish to do this. We know we have an imminent move but thankfully a flexible employer.

Can someone explain to me why having another 100,000 people move into Victoria will make life better for the average citizen who lives here today? Is it the overcrowded hospitals or the overcrowded schools that will be an improvement? Or perhaps it is just the pleasure of even more cars parked on the streets?

The fact that we already have water restrictions surely must mean that we have a shortage of water. So I assume all those extra people will somehow bring more summer rain. I am not asking for a list of how to cope with all the problems; I am asking for the reason to get the problem in the first place.

I think it’s great that they’re encouraging garden suites. I just don’t see the appeal of putting one on my property, financially or otherwise. If you can afford to build one, do you really need the rental income, and is it the best use of your capital? Alternatively, if you’re a buyer, do you want to pay a premium to essentially give up your back yard/ privacy? Under what scenario are these things being constructed and/or bought? The one scenario I can understand is where a young family wants a place for the grandparents to live (or vice versa) so you have 2 generations sharing the cost of living.

Close followers of HHV might recall last spring when a bungalow on the 2700 block of Forbes (Oaklands) went for 960k. It had a small but very charming garden suite, so there must be demand for this sort of thing.

Another step forward in terms of density is if the City would remove the restriction prohibiting basement suite rentals on the same propert as a garden suite (I believe this is still in place but correct me if I’m wrong).

Just make it all duplex and row house zoning…

Most definitely. And there is no way you are talking the CRA into keeping the capital gains exemption on your entire property when you have a garden suite. And since it’s a self contained building, they may very well be inclined to add part of your land that would reasonably be expected to belong to the suite.

Marko:

Do you know if 1470 Rockland Ave. Victoria has sold and if so for what price.

Personally I think garden suites are a great way to destroy family neighbourhoods. Cramming more people into a neighbourhood rarely makes it better. You will see increased social service costs without any appreciable tax base to pay for them. Back to the capital gains issue as well.

BTW Entomlogist, he does shill for the condo developers and has links on his VV posts. Atrocious Vancouver sales numbers are not good for his business. That’s the bottom line.

Entomologist,

You missed the whole point. I simply posted brutal Vancouver numbers Ozzie Jurrock stated on Canada wide radio and Marko doesn’t like the numbers, and says they’re bullshit,then proceeds to diss the guy(as much as I don’t like him either). Sorry, but I find that juvenile and unprofessional.

I have a problem with an agent dissing numbers that he doesn’t like yet we’re supposed to believe everything he posts ? Like I said, like him or not, Ozzie has been around BC real estate bizz for 30 years in the media a lot and Marko for a cup of coffee whose never seen a real bear market.

Bull or bear, I don’t get his bizarre rant on real numbers that are 3 days away from being official. He’s one strange mofo.

Nice. Hope Saanich follows suit.

Policy is still unchanged which you can find here: http://tinyurl.com/h6dqed2

Finally! A step in the right direction.

http://www.timescolonist.com/news/local/victoria-removes-rezoning-requirement-for-garden-suites-1.2386664