Victoria market problematic? CMHC says nay

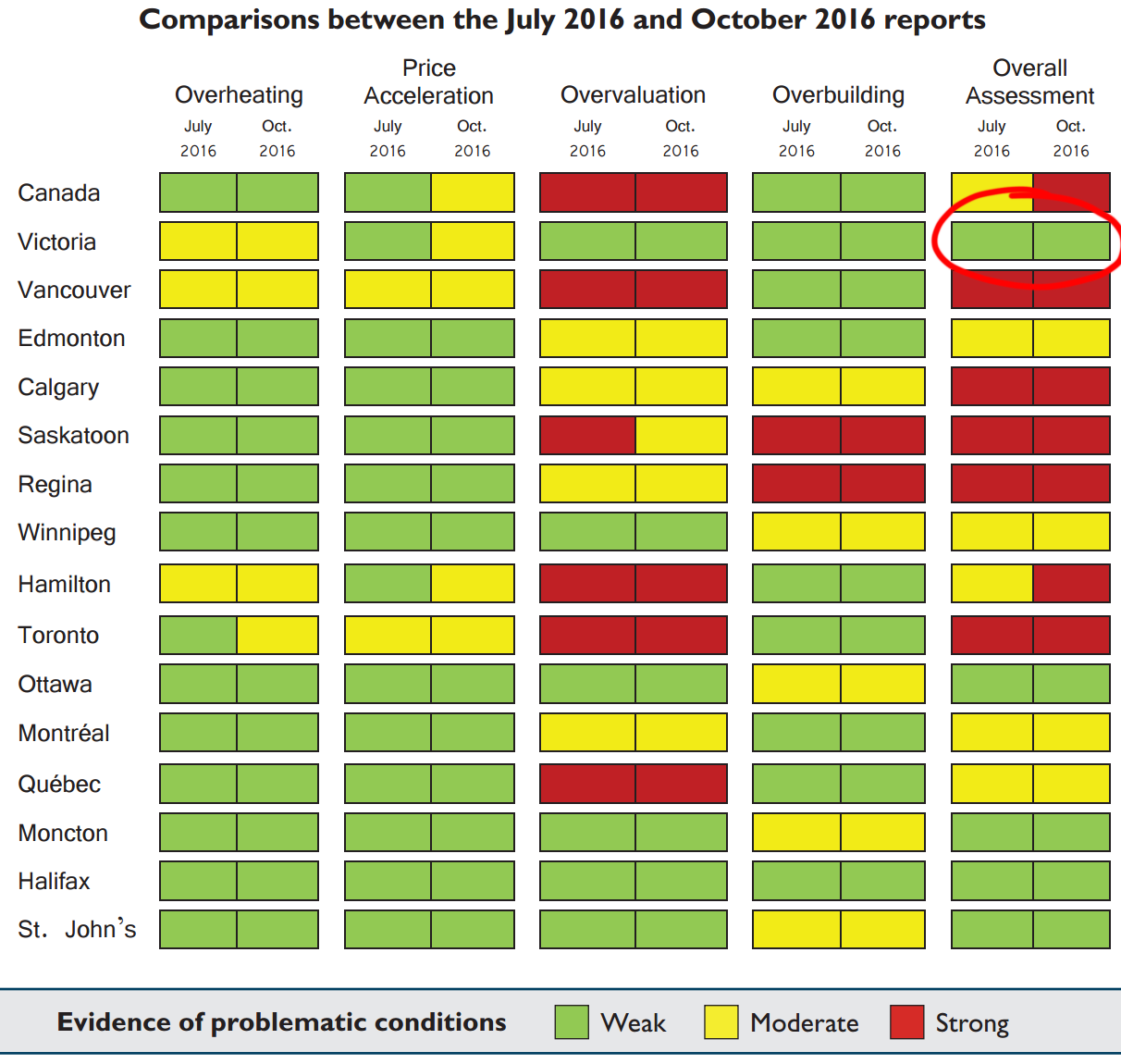

The first time the CMHC released their quarterly housing assessment I mocked them for using out of date information and thought that surely their all-green report for Victoria was because they hadn’t looked at the insanity we were experiencing in the early spring. The second time they again decided that there was nothing out of the ordinary in the Victoria market, and I puzzled at how they could possibly conclude that our market was about as unremarkable as Moncton’s.

Well another report is out, so let’s take a look. It’s the third analyst in as many reports, so let’s see if he’s come to a different conclusion than his predecessors. First of all, the CMHC has for the first time raised their Canada-wide alert level to high, so surely given we are amongst the most expensive markets in the country that should be reflected in our assessment.

Nope, they are sticking to their guns here. Victoria is green damnit!

Never mind that the average single family home costs $100,000 more than it did a year ago (more in the core). Never mind that the entire market had under two months of inventory for six months straight which has never happened before. Never mind we have record low inventory and record high sales. Never mind we have a frenzy of multiple unconditional offers on anything half decent. These all don’t qualify as problematic.

How is it possible to come to this conclusion? Let’s take a closer look at the actual assessment for Victoria. The first issue as I’ve pointed out before is that the data is ancient history. They are looking at second quarter data (to the end of June) and releasing it 4 months later. Wouldn’t it be useful for a framework that purports to identify problematic conditions in the housing market to actually be up to date? As an example, back in June the foreign buyer’s tax was just a glimmer in Christy Clark’s eye, our dear finance minister was months away from sideswiping first time buyers, and Vancouver prices were merrily spiraling into the sky. That was a world away but the CMHC lends their reports the appearance of recency by stamping Fourth Quarter on the front page.

But there has to be more to it than that. After all the CMHC isn’t run by dummies and they do say they are relying on “market intelligence” up to the end of September (they even read this blog). The real reason the CMHC thinks there isn’t yet too much to worry about is because our prices are still in line with fundamentals.

The framework indicates weak evidence of overvaluation as the level of observed prices was in line with fundamentals, despite the presence of overheating and price acceleration

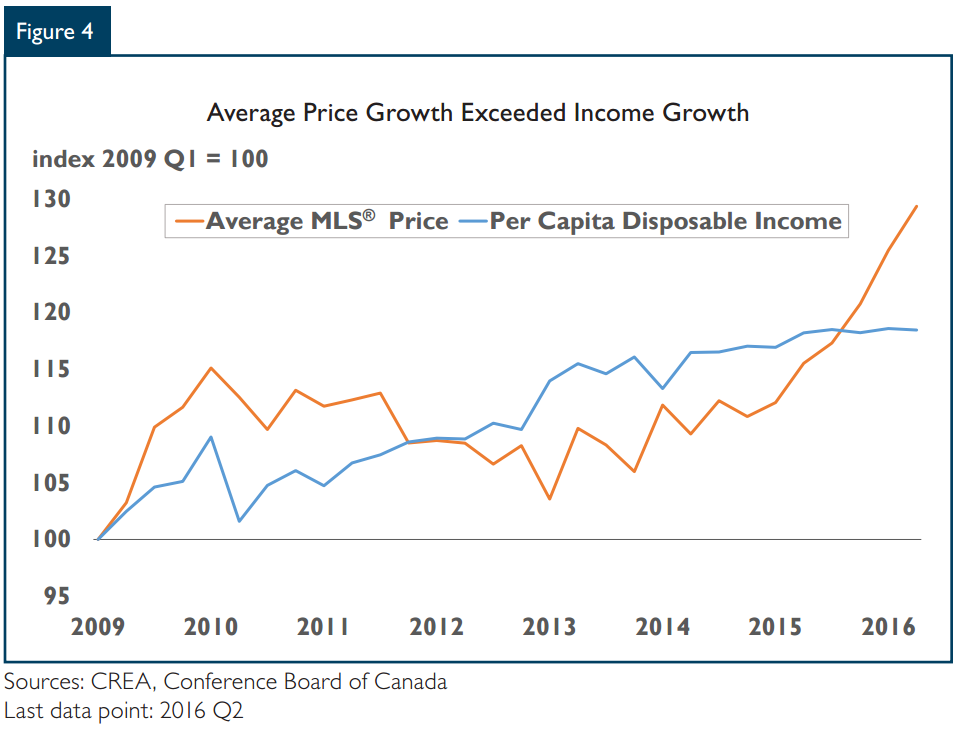

And unfortunately that is where the report is really lacking detail. They say the fundamentals are measured based on things like job creation, income growth, and low interest rates, and conclude that prices are OK based on those measures. Unfortunately they only provide one useless chart of a few years of disposable income vs prices.

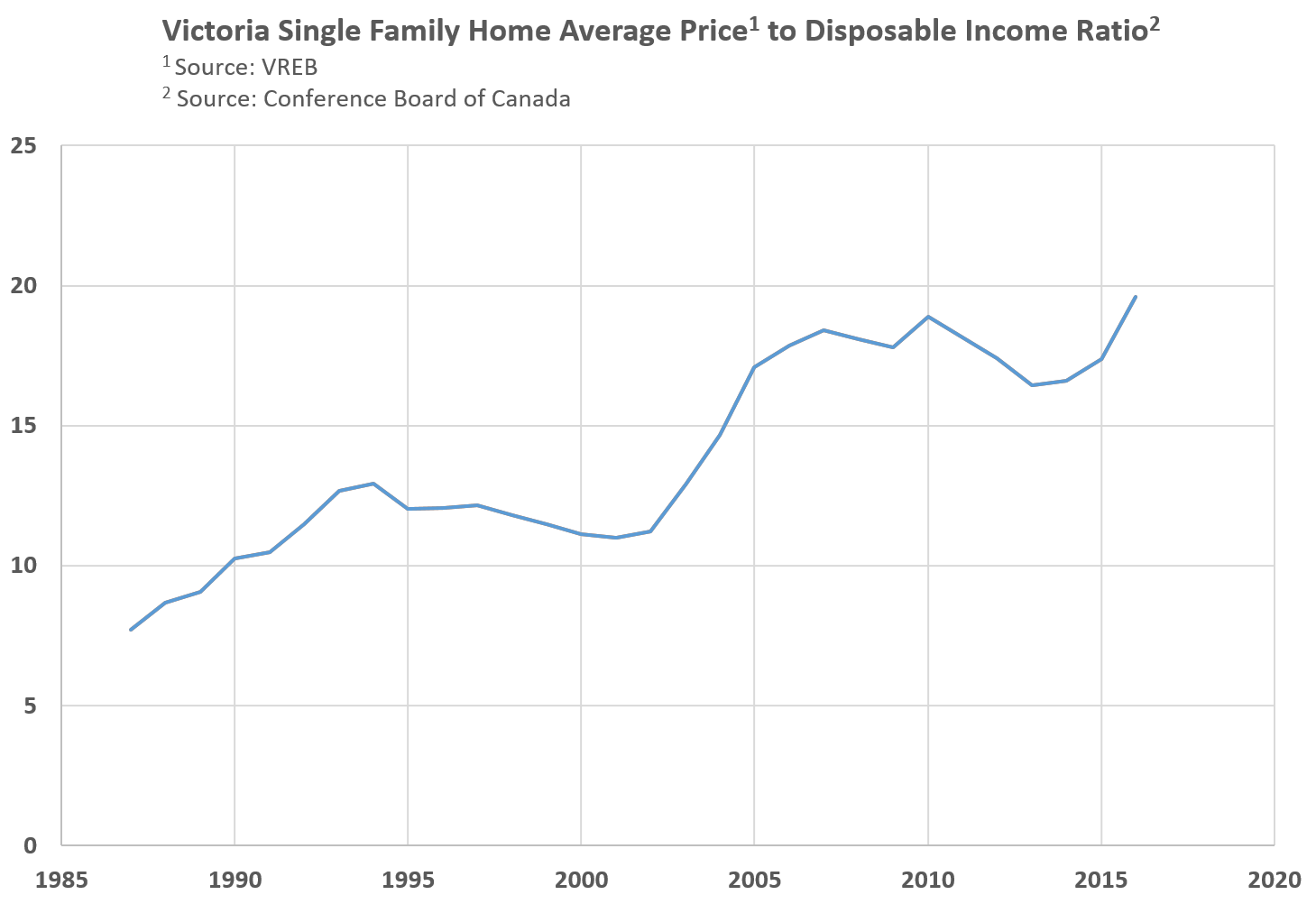

In order to investigate further, we need to look at the income data they are looking at, which is from the Conference Board of Canada. Disturbingly the data source has no information about how it was collected and goes from 1987 to 2020 without any indication of whether the data points are measurements, estimates, or projections. Ohwell, $116 later I have the data and here is how it compares to Victoria house prices.

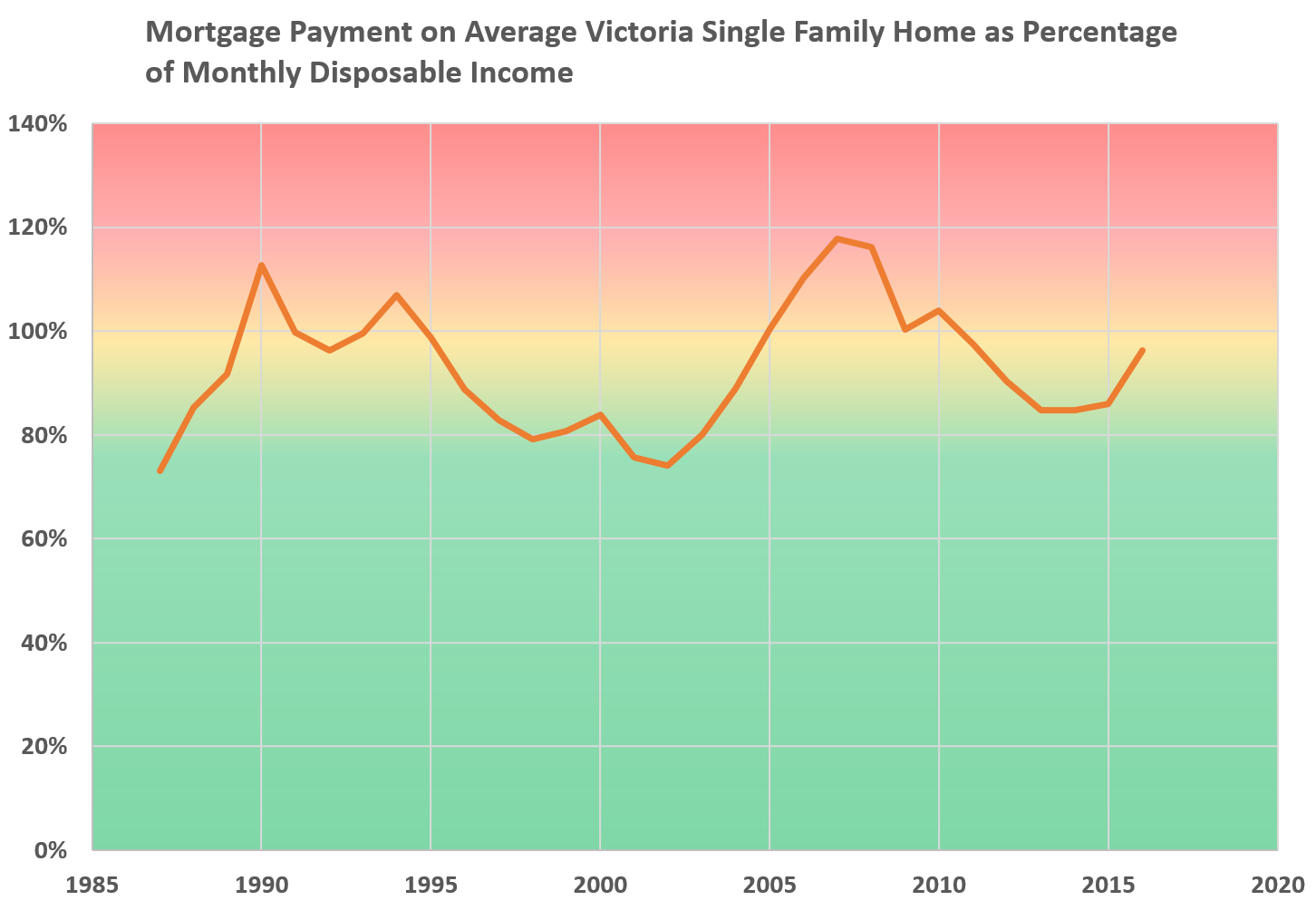

So price to income is at an all time high in Victoria and has tripled in 30 years. Clearly there is no indication from there that we are within any kind of historical norm. However, when we consider that interest rates have dropped in that time, the picture becomes a bit different.

Now we see where the CMHC might be coming from. Despite the runup in prices over the decades, the actual mortgage payment as a percentage of disposable income has been moving between 73% (1987) and 118% (2007). The current value of 96% is indeed not outside of historical norms. So as I have said many many times before, affordability is the only measure of the market that exhibits some kind of recognizable pattern in Victoria.

Don’t get me wrong. The market conditions are definitely problematic and if they don’t let up prices will quickly appreciate to beyond historical norms. Victoria should not be marked green, and I suspect once their data catches up with reality (in another 3 months) the CMHC will upgrade us to yellow as well. But because of our long stagnant period where prices went nowhere while the rest of Canada appreciated, we had some slack in the market to take up.

What do you think? Is the CMHC right to assess the Victoria market as not overly problematic based on affordability or is it now me that is out to lunch?

http://www.ctvnews.ca/business/td-bank-raises-prime-rate-for-variable-rate-mortgages-to-2-85-per-cent-1.3141307

up go the rates.

Marko is the bees knees. Everyone who’s ever done business with him knows that.

Hawk – I enjoy your crazy rants and low quality links, but not your bashing reputable local industry pro’s.

It’s funny because you are trying to troll everyone… you’re this blogs Donald Trump!

Here’s your campaign slogan: “Make Victoria Real Estate Market Great Again!” – Hawk 2016.

P.S. Still waiting for your eBook to go on sale on how to make 400% returns just like you!

Marko this is elementary stuff.

You lowered your commission in order to get an accepted offer to purchase. You did this to make a sale.

In the other example the offer had already been accepted. Then the contract was altered to evade taxes.

…Intent

Hawk, you’re way too harsh on Marko. He’s no shill – go back to 2012 and 2013, Marko was brutally honest (and totally correct) in stating that the market wasn’t going anywhere fast, predicting continued flat prices and slow sales. It’s only in the past 18 months that he’s noted, honestly it seems, that things picked way up. If you go to the annual HHV polls on annual sales numbers, Marko won more than anyone else.

You on the other hand, as well as GT, have one single party line to share, no matter the evidence: the market is a bloated bubble, and anyone who buys is an idiot. Mind the credibility gap; please.

Does anyone know if, and for how much 1470 Rockland Ave, Victoria, sold for? Abbey Moore manor is a B and B that has been on the market for three years now. It just disappeared from the listings. Felt almost like losing an old friend.

So much for foreign buyers coming to Victoria. New post: https://househuntvictoria.ca/2016/10/29/foreign-buyers-tax-has-no-appreciable-effect-on-victoria/

“Just went to Garth’s website….like his new post signature

“Doug Rowat,FCSI® is Portfolio Manager with Turner Investments and Senior Vice President, Private Client Group, Raymond James Ltd.””

That’s one of his two guest bloggers on the weekend. Again you shoot off your opinions without any proper DD. Must be a slow market out there to have the time to keep dissing Garth and Ozzie over a couple of really bad sales numbers. Saturdays usually are the busiest.

I guess Couvellier and Associates is right, the market is changing for those who want to admit it.

“So how come I have don’t access to these daily numbers with the VREB?”

Maybe you’re blocked there too ? Where do you get your weekly numbers from ? Out of a hat ?

Never heard of Ozzie ? As you say, give me a break. No problem spewing out the hate-on in a few minutes to determine someones business credibility. He’s been around BC for 30 years. I’ve posted his name on here many times.

This where your lack of professionalism shines. He stated the GVREB numbers he has access to wether he’s an agent or not and you call him a liar when many other agents like Steve Saretsky have been posting.

So how come I have don’t access to these daily numbers with the VREB?

You spin it into some bizarre Ozzie hate on out of the blue

Never heard of him before today. I just looked at his website and applied 2 cents of common sense.

Steve has a good post on the media and investor psychology http://vancitycondoguide.com/how-the-media-helped-create-perfect-storm/

“As for the numbers, let’s see what November 1st says.”

This where your lack of professionalism shines. He stated the GVREB numbers he has access to wether he’s an agent or not and you call him a liar when many other agents like Steve Saretsky have been posting.

You spin it into some bizarre Ozzie hate on out of the blue. Sounds like you got dissed by him and/or can’t handle the reality of a tanking market in Vancouver that should start hitting here.

I don’t even like the Ozzie, but I only posted where I got them from for validity and you go off like an idiot for several posts. Tough time selling that ugly box you’re building maybe ?

Works for Trump. Like you said, people aren’t interested in hearing nuanced opinions. They want certainty.

Real estate outlook 2017 CD Set – $87.77.

That’s it, next post I write costs $5 to read. It will be called “7 secrets to buying a house in Victoria – REALTOR’s hate him!”

Just went to Garth’s website….like his new post signature

“Doug Rowat,FCSI® is Portfolio Manager with Turner Investments and Senior Vice President, Private Client Group, Raymond James Ltd.”

Predictions accurate or not you have to admire the sheer amount of work that goes into writing a long and entertaining blog post every day (and then moderating all the comments).

He is a good entertainer. Wrong for two decades and the following grows stronger.

Garth gives away all his info for free (with the business model of acquiring business for his financial advice firm but that’s fine). He could easily make tons of money from his blog directly but he doesn’t so clearly he does it at least partially out of altruistic reasons.

Hardest working blogger around. Amazing he has gone on for so long. Predictions accurate or not you have to admire the sheer amount of work that goes into writing a long and entertaining blog post every day (and then moderating all the comments).

He isn’t an agent as far as I know.

Looking over his website what’s the difference between this guy and Garth?

Entertainer. Yes

Seminars. Yes

Book. Yes

Home completes at $475,000 and my buyer pays $0 PTT. Did we just fraud the government out of $1,212.80? Not to mention less GST was paid on commissions too. My income also shrank as well so less income tax. Government is out taxes on three different fronts.

Actually forgot the 4th one, yearly property tax could be less as result of assessment.

Thanks Just Jack and Marko

He isn’t an agent as far as I know.

On second thought did Ozzie ban you from his site too like Garth did ? Sounds like Trump, when the numbers are going up it’s fantastic, but when they go down he’s a liar like Garth.

Ozzie is a fan of Trump, fyi. People still read Garth?

Excuse me Marko. You shill for all the local developers on the VV site for years obsessing over every new build taking pics/flogging their properties. How is that any different from Ozzie ? Sounds like a total hypocrite to me.

Just look at his homepage -> http://ozziejurock.com/

“The only Canadian real estate advisor included, Ozzie Jurock is featured in Donald Trump’s new book.”

Ozzie Jurock creates the tools and environment to help people succeed in Real Estate investment, in sales, in personal growth,

It a comical read.

Over the years I’ve provided legit opinions on VV, I’ve bought 5 pre-sales myself so I put my money where my mouth is and I’ve written free articles for citified that don’t have an agenda of trying to sell my book full of “real estate secretes.” http://victoria.citified.ca/news/stay-small-a-guide-to-buying-an-investment-condo-in-victoria/

As for the numbers, let’s see what November 1st says.

On second thought did Ozzie ban you from his site too like Garth did ? Sounds like Trump, when the numbers are going up it’s fantastic, but when they go down he’s a liar like Garth.

Excuse me Marko. You shill for all the local developers on the VV site for years obsessing over every new build taking pics/flogging their properties. How is that any different from Ozzie ? Sounds like a total hypocrite to me.

So Ozzie states the latest disastrous numbers and he should be completely discounted as a liar ? Yeah give me a break alright.

I guess the atrocious numbers are bad for your bizz so let’s diss the GVREB messenger. Pretty sad for a so called pro IMHO.

Real life type example.

House with no appliances. Seller is firm on $479,000.

I am representing first time buyer, I’ve only shown her three houses, real estate cooperating commission offered is $8,685.

PPT (first time buyer) to be paid at $479,000 = $1212.80

I go to buyer and tell her since I’ve barely don’t anything so far I’ll offer to lower the cooperating commission to $4,685 (I am still making hunderds per hour) if seller is okay taking $475,000. She agrees with my idea, seller accepts idea.

Home completes at $475,000 and my buyer pays $0 PTT. Did we just fraud the government out of $1,212.80? Not to mention less GST was paid on commissions too. My income also shrank as well so less income tax. Government is out taxes on three different fronts.

I would say I represented the best interests of my client, but that is just my opinion.

Marko,

Ozzie Jurrock (the bigggest pumper)was just on the radio stating the brutal numbers every other agent has access to . You’re more arrogant and ignorant than I thought.

He is in the business of selling speeches and “consulting.” Just like Garth has a hidden agenda so does Ozzie.

To alter the original contract where compensation paid to the agent was based on the sale price of the property in an open and competitive market and then to rewrite it as a flat service fee for the purpose to evade taxes. That’s fraud.

It’s a matter of semantics. Let’s say you have a $800,000 home and the commission is $30,000 ($15,000 listing/$15,000 cooperative). Is it illegal to list it for $784,250 (discount equivalent of $15,000+GST) and offer $1 for the cooperation commission? No

Buyer’s REALTOR® brings you an offer with a fee agreement asking for $15,000. Is it illegal to counter with $800,000 because you as the seller now have to incur $15,000+GST additional cost. No.

It is alright if the buyer decides to pony up $15,000+GST out of pocket to pay their REALTOR® and the transaction completes at $784,250 saving cash on PTT, etc. Yes it is.

I’ve lowered my cooperative commission many times which is a change in the original contract between listing realtor and seller. It’s fraud to say I’ll lower my commission to make a more favorable deal for my buyer?

By your theory giving my buyers cash back is fraud because they are buying a property below market value with my kickback on completion. I am avoiding paying taxes by lowering my income and the banks are not aware of my cash kickback so that is mortgage fraud.

I know what you are saying but there is real life and there is theory. When I write up contracts excluding appliances do we call in an appliance appraiser to make sure we aren’t frauding the government? No, we pick a number that is realistic that ends with $,000. Who actually knows how much the appliances are worth.

Government gladly collects PTT on 99.9% of other contracts including appliances.

Marko,

Ozzie Jurrock (the bigggest pumper)was just on the radio stating the brutal numbers every other agent has access to . You’re more arrogant and ignorant than I thought.

Real estate is land and improvements and does not include movable property such as fridges and stoves unless they are affixed to the home. But by convention, lenders have agreed to include them in the mortgage. The same with the GST less any rebate assigned to the purchaser. Banks have agreed to lend on this tax. This is a business decision on their part. That doesn’t mean the land registry or BC assessment has to follow what the banks do.

Market Value would not include taxes such as PTT or the GST. However a mortgage appraisal would include the applicable GST and chattels but not PTT because the banks have agreed on what to and not to lend on.

However, chattels and GST are not the same as commissions. To alter the original contract where compensation paid to the agent was based on the sale price of the property in an open and competitive market and then to rewrite it as a flat service fee for the purpose to evade taxes. That’s fraud.

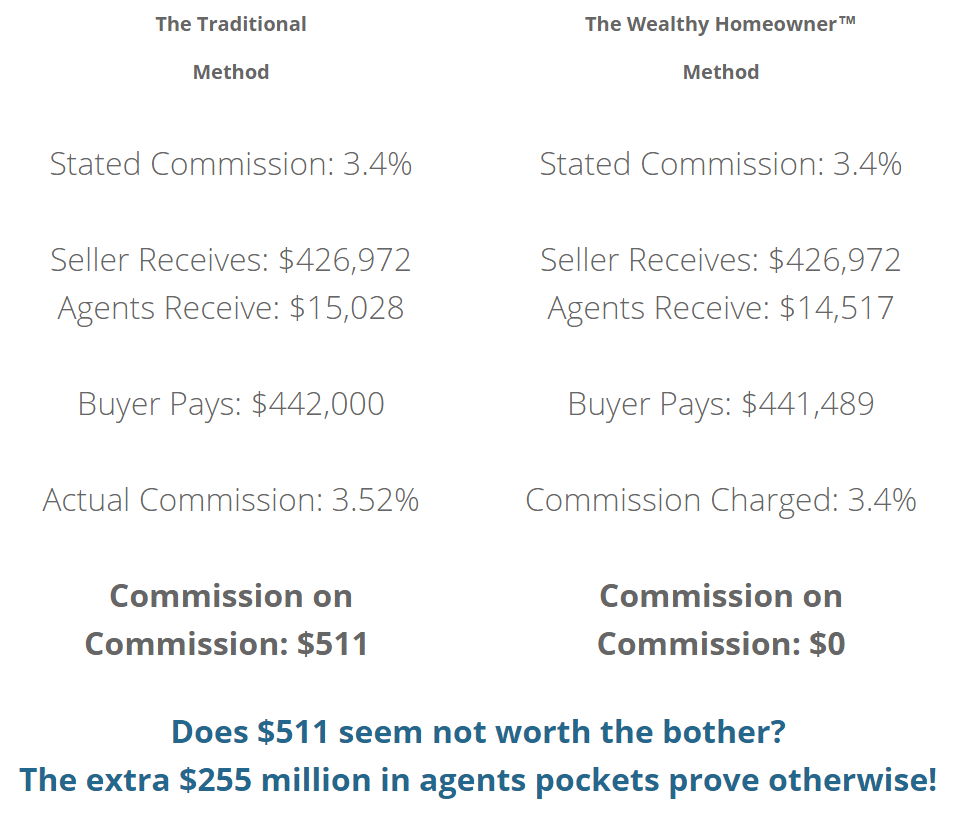

That is far different than what the advertisement is suggesting.

PTT is not paid on GST in BC, so one part of the advertisement is 100% irrelevant/useless advice as already standard practice. The other part of the advertisement is semantics. I know what he is saying and it could be structured, but just wouldn’t apply well to reality as provided by my appliance/reduced commission example.

99.9% of contracts in BC don’t have a clause purchasing appliances separately from purchase price. It doesn’t mean that doing so is illegal, because it isn’t. It’s just too much headache for everyone so no one does it and people get ripped off for $100 to $200 (or more if in first time buyer PTT exemption area) by the government on every sale in BC that includes appliances via the PTT.

That’s fine to do because appliances are chattels and not considered real estate. As long as the value of the chattels is reasonable. That is far different than what the advertisement is suggesting.

Most people want everything included so they can maximize the mortgage as the bank is going to lend on the lesser of the sale price or appraised value. If you are not maximizing the mortgage then this is an option to make a side deal on the appliances.

I’ve seen the opposite occur where the buyer wants to include a vintage automobile or a home based business in the sale price and I’m asked just to value the real estate portion.

As per Ozzie Jurrock

http://ozziejurock.com/speaker/

lol, give me a break.

If you want to save a ton of cash on selling your home the easiest method is a mere posting. When I started offering mere postings in 2010 I thought within 5 years that service would be at 10% market share. Currently it is at 1% (if you round up). Average seller has very poor financial savvy. Same with buyers.

When I was 18 yrs. old without $ I use to frequent Subway quite a bit. For a period of about 5 year Subway had a special of the day 6 inch (Meatball, Tuna, etc.) for $2.99. Their 6 inch veggie was $3.49. Initially whenever I encountered someone ordering a veggie I would be like, “you know you can just order the special of the day and ask for no meat on it.” Someone people appreciated the tip, most people were like is this kid trying to embarrass me? I gave up on the advice and continued to watch in amazement for years people ordering the Veggie for $3.49.

I continue to watch in amazement as people fork over 6%100k+3%bal for their place to sell in a bidding war over a weekend. (*commission may vary)

As per Ozzie Jurrock, Vancouver sales til October 28th in Van still tanking hard. SFH’s down 71%, condos down 46%. This is going to be one ugly winter for the bagholders.

Marko, what do you think about this? Valid strategy?

I’ve blogged about all of these things in the past, it’s nothing new -> https://www.youtube.com/watch?v=gm__nfCIihk

Valid strategies, huge pain in real life as you are not dealing with sophisticated individuals.

For example, when I use to have a first time buyer ($475,000 PPT exemption) and negotiations reached an impasse at $483,000 I would go back to the listing agent and say okay let’s structure it this way so my client doesn’t have to pay PTT.

$475,000 contract price

$5,000 for all the appliances paid on completion

I’ll take $3,000 discount on the cooperating commission (instead of giving buyer $3,000 cash back)

Too many logistical problems, most realtors never heard of excluding appliances from the contract and weren’t familiar with the structure of the deal. Others would come back with “what about the hit on my commission?” (listing realtor now being paid on $475,000 instead of $483,000 – out $120 on commission, yes I’ve heard it all), seller wouldn’t really understand the 3,000 discount on commission (they are just looking at the price on paper and would say but I still want $483,000). Mortgage brokers/lenders would get confused as to what amount they are lending on, etc., etc

After a while I said screw it all, including the cash back.

Leo S, I know that you asked Marko about the advertisement but in my business I have to deal with these contracts to purchase.

An appraiser is required to read the Contract to Purchase and comment on any discounts, rebates or gifts that may effect market value. For residential properties this typically does not happen because the client needs the report quickly so the client and appraiser agree to invoke a clause in the report that the appraiser did not review the contract to purchase and has assumed that there is no discounts, rebates or gifts. A statement to that appears in every appraisal report written to national standards. Otherwise the appraiser may face disciplinary charges by the Appraisal Institute.

Occasionally, I am sent the Contract of Purchase when the appraised value and the contract price are substantially different. The problem I have with this separation is that it may be an attempt to defraud the government of all taxes payable. And it may mean a lower mortgage as the sale price may be understated. That may be on little concern if the buyer is putting down a big down payment.

This is a well worded advertisement that is only asking you to talk to a lawyer about separating the commission from the sale price. Otherwise he would be counseling buyers to commit fraud. He is skirting the line here as he is not counselling people to do this he is just saying to ask a lawyer.

This is where the Real Estate Counsel should step in and order this advertisement pulled. And that means the Real Estate Council needs more powers given to them by the government to stop advertisement that is misleading and laudatory.

As I have written several times about Market Value and have drone on and on about it. I’ll make this brief.

I do get the question from people wanting to sell their home if the appraised value includes the real estate agent’s commission. It doesn’t matter if you use an agent or not, the Market Value is the same. An agent facilitates the trade between buyer and seller they do not make Market Value.

So while this may seem like a clever maneuver to defeat the tax man – it won’t.

However, there are some ways that are legitimate when it comes to new housing to level the playing field when it comes to the difference between someone buying a home to live in and someone buying as an investment. Since the home owner may get a rebate but an investor does not. But it is essential to understand that the taxes payable are exactly the same. And since this is disclosed in the Contract to Purchase their is no intent to defraud the bank. The only negative effect is the reported contract price may be over stated. And that just means as an appraiser I have to work harder to determine if the reported comparable sale prices are or are not at fair market value.

And that is simple for me as I never, never use contract prices in the same complex as primary evidence. If I am appraising a condominium in that complex, I will use the contract prices as a cross check but not as best evidence of market value.

Rolling eyes…. another make money on real estate scam…

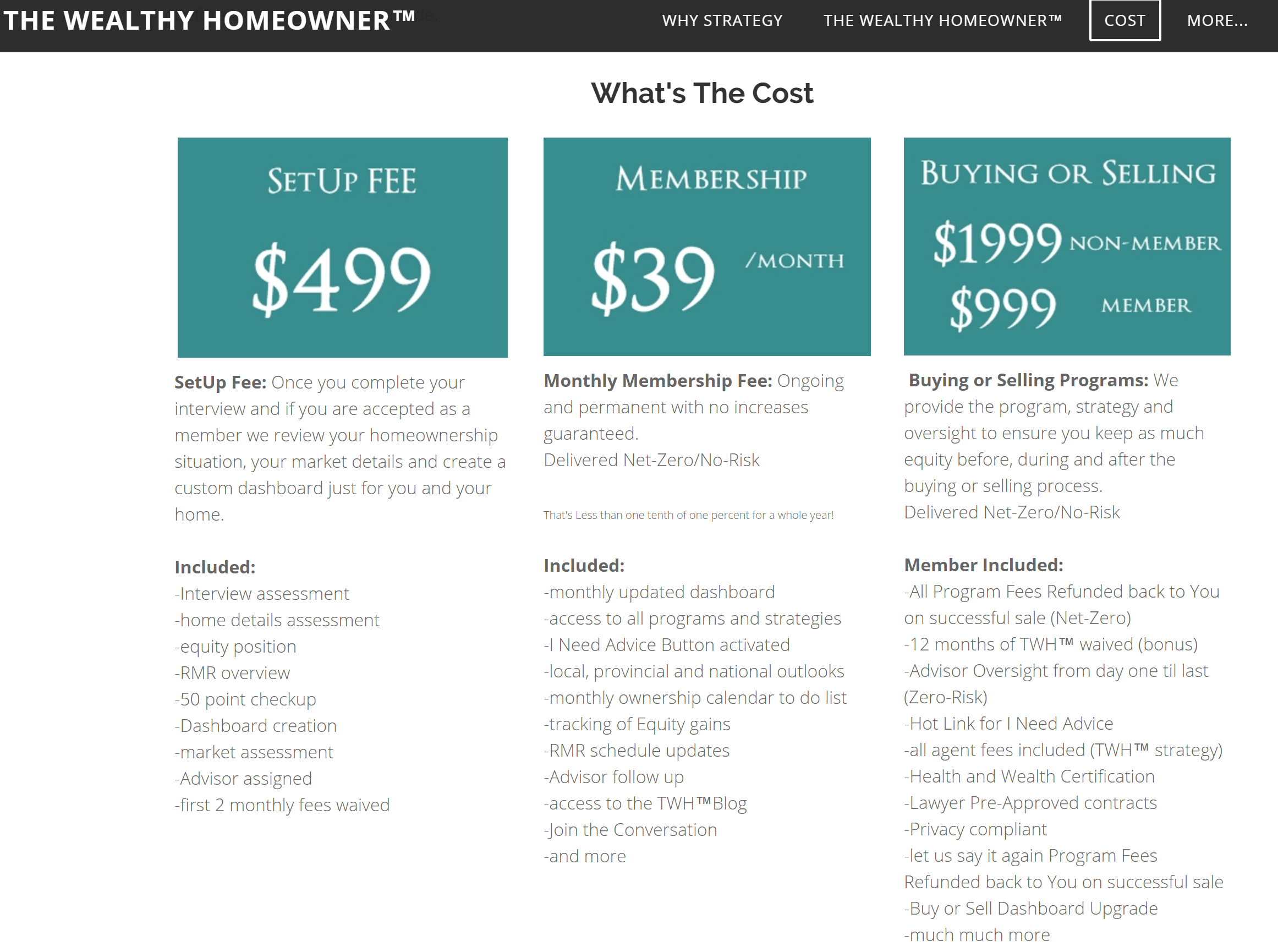

As for what Ross Kay’s info costs:

I’m curious to see what he has on the site, but I’m not about to pay $500 bucks for it. I don’t like you guys that much.. 🙂

Signed up to Ross Kay’s site…

Marko, what do you think about this? Valid strategy?

I didn’t see terms of use, so I assume OK to share here.

Ha ha ha. Someone really doesn’t know how to do math….

Canada & Europe to sign trade deal this weekend worth 18 Billion CAD per year.

CETA will also reduce the usual barriers that hamper the ability to engage in international services trade, such as citizenship and residency requirements, barriers to temporary entry, and ownership and investment restrictions.

http://uk.reuters.com/article/uk-eu-canada-trade-idUKKCN12S1RT

North Shore new builds taking big hits. Sooner or later the shift will hit here regardless of travel mags polls. Spec builders rolling the dice bigtime here.

“@vancouvermrkt

@Christina_Mae_1 MLS shows 50 of 334 active North Van SFH listings are new/spec built in 2016. 20 of them have reduced asking prices already”

Agreed Bman, if you actually asked some hard ball questions like when they asked a year or so back how did you like all the homeless addicts on every corner of downtown, many tourists said they won’t be coming back til it’s cleaned up.

The only thing the US GDP showed is rates will be going up several times over the next 8 months to a year which will make Canadian 5 year mortgage rates go up 3/4 of a point and make the stress test at 5.35% knocking another high percent of buyers out of an over valued market.

Canadian bankers are rumored to be doing their own stress tests on over 20% clients, as they will be soon having to soak up some of the CMHC risk.

Funny how an ex-economist translates higher rates into more airport visits but “you’re an ex for a reason” as they always say.

“Especially with Canada’s west coast voted #1 travel location in world for 2017 and YVR named best airport in world today.”

I get that you enjoy getting a rise out of those of us who are skeptics, and I know civic politicians and civic boosters enjoy this sort of BS, but does anyone else actually drink the kool-aid? For every survey which ranks Victoria or Vancouver as the #1 travel destination, there are countless other surveys that don’t.

On data, or lack thereof:

Why doesn’t VREB post median for each sub area anymore? They only do benchmark and HPI. I’d settle for median (and forget mean).

Only providing median and mean for GV and ‘other’ seems absurd.

Ha. I thought the exact same thing. There was a list of 10 best airports YVR made it onto and none of those airports making the list swayed me to go to the destination. Plus is YVR all that nice? I like SEA more than YVR. Easy to get around, plenty of amenities. The architecture isn’t as modern, but I don’t care as long as it’s clean.

I’d probably avoid the bottom 10. As it is, there are airports I avoid.

Agreed, but when you combine it with being voted #1 travel destination in the world for 2017, it’s nice to know YVR is also rated #1.

Re: recessions, I only brought it up since there are still people who think we’re entering one. Today’s GDP print puts that to rest. Considering the last recessions were around ’80, 90, 00, 10… the next might be around ’20, but probably later as our recovery from the last one is just now getting started.

I am sure that is a nice feel good for the airport authority, but seriously how many people travel somewhere because of a great airport?

“Let’s go to Moose Jaw honey, they were just voted best small airport in Canada.”

“With the US now accelerating, there’s certainly no risk of recession derailing our housing market.”

LOL…hilarious Mike. Guess you missed the Libs/BOC news and tanking Vancouver market ? Do you work for BC Tourism ?

Last time I looked we live in Canada not the US.

Bank of Canada downgrades economic outlook through 2018

Central bank maintained overnight lending rates, but cut its GDP outlook for 2016 to 1.1 per cent.

“The Bank of Canada held the interest rate at 0.5 per cent Wednesday but cut its economic forecasts through 2018, predicting a slower housing market and conceding the export sector is not rebounding the way it anticipated.”

https://www.thestar.com/business/2016/10/20/bank-of-canada-downgrades-economic-outlook-through-2018.html

As for absorption rates.

Sauder School of Business teaches real estate at UBC. According to their text book “The Appraisal of Real Estate” Second Canadian Edition revised 2005 11.11

An absorption rate is the supply of housing divided by the average sales per month. Which sounds pretty much the same as months of inventory.

However, it really isn’t that simple. Data from the real estate board is considered secondary evidence and should only be used as a cross check from your own calculations. The data is far too general and that could make it misleading. And besides you don’t know how the board calculated the data.

What Leo shows in his charts is excellent given the information he has to work with. There are little tweaks here and there that might produce a more informative answer. But Leo can’t do them because he can’t get the data and it would have to be done for every different type of housing and every area.

Most appraisers will do a Market Study which includes an absorption rate when they are asked to project a value within the next 90 days for a company that is relocating an employee and the relocation company is intending on listing the home in the next few months. The same for a property under foreclosure. The law firm may ask for a current market value under normal marketing conditions and an anticipated selling price in the upcoming 90 days with restrictions on marketing. In that case it isn’t simply the months of inventory.

You should also consider the median days on market. That too is part of an absorption rate for residential properties. It’s like the half life of plutonium. The median DOM of say 20 days is showing that half the properties will sell in 20 days and the MOI is saying that if no inventory is added then all properties would be sold 2 months. But new listings are always being added so you have to determine if the sold properties are being replenished at a high enough rate to keep the MOI stable. Then you have to look forward by reviewing historical data of what has usually happened to sales and new listings for the months of say November, December and January. Take that information and project what the effect it would have on the DOM, MOI, SNLR and then reconcile that new information in order to provide an estimate of what will happen to prices ceteris paribus (assuming no black swan events)

A lot of the interpretation of this data depends on the experience of the author. So it isn’t just a simple calculation there is also opinion involved as the author has to reconcile data that at times is conflicting.

And that’s what makes real estate fun.

With the US now accelerating, there’s certainly no risk of recession derailing our housing market.

http://www.theglobeandmail.com/report-on-business/international-business/us-business/us-economy-grows-at-fastest-pace-in-two-years/article32562495/

Especially with Canada’s west coast voted #1 travel location in world for 2017 and YVR named best airport in world today.

“Per 100$K worth of debt(mortgage) and what a change in interest rates will do to your mortgage payment”

So if you’re buying the average $800K house with 10% down you have to qualify for an extra $900 approx. on your stress test. How many on average incomes could have no problem coughing that up without feeling some pain? Not many.

As per Steve Saretsky, these landlord windfalls usually wind up being BS after they pay taxes, etc.

“@SteveSaretsky

@BenChimes @noshortre @ac_eco good stuff. I notice many who just take the rent and deduct mortgage and say “cash flow””

“rented outall home to 4 students, net 1300/month from 1st home and use it towards the mortgages payment towards 2nd home. again, rented out the 2nd home and still net 1800/month.”

Sounds great til the students leave in April and you get stuck paying the rent and the house prices have tanked back to his purchase price or below. This is how ponzi schemes unravel when you multiply it by thousands.

Not to mention whose house went up $270K in 6 months. Sounds like BS or the bank over valued the place who will be left holding the bag.

Numbers Hack:

Thank you for the mortgage payment chart. It is extremely useful in getting a feel for the situation.

Per 100$K worth of debt(mortgage) and what a change in interest rates will do to your mortgage payment:

Mortgage (Per Month) $452 Base Current Rate 2.50% 25 year amortization

Mortgage (Per Month) $457 1.1% increase in pmts 2.60% 25 year amortization

Mortgage (Per Month) $463 2.3% increase in pmts 2.70% 25 year amortization

Mortgage (Per Month) $468 3.5% increase in pmts 2.80% 25 year amortization

Mortgage (Per Month) $473 4.6% increase in pmts 2.90% 25 year amortization

Mortgage (Per Month) $479 5.8% increase in pmts 3.00% 25 year amortization

Mortgage (Per Month) $506 11.8% increase in pmts 3.50% 25 year amortization

Mortgage (Per Month) $533 17.9% increase in pmts 4.00% 25 year amortization

Mortgage (Per Month) $562 24.3% increase in pmts 4.50% 25 year amortization

Mortgage (Per Month) $591 30.7% increase in pmts 5.00% 25 year amortization

Financed to the Tilt

With so many people using RE to generate wealth or store wealth, let see how much people can borrow.

When considering purchasing a property, there are many different factors to take into consideration, including location, size, and affordability. The last of these, affordability, is also something that the lender will deliberate when you decide to take the last step in the purchase of your property and apply for a mortgage.

To a lender, affordability translates into two things, TDS and GDS. Gross Debt Service Ratio (GDS) and Total Debt Service Ratio (TDS) are two mortgage formula that lenders use to determine exactly how much money they are willing to lend you. Let’s explore what each of these ratios mean and how exactly what the mortgage calculation formula is.

GDS:

This is the percentage of your income needed to pay all monthly housing costs, which include your mortgage, property taxes, heat and 50 per cent of your condo fees, if applicable. The majority of lenders abide by a general standard of 32 per cent. This means your GDS should be lower than that to qualify for a mortgage.

Calculating your GDS (Gross Debt Service Ratio)

Add all of your monthly housing-related costs (principal, interest, property taxes and heating) calculated on an annual basis), then divide the total by your gross income. The sum is then multiplied by 100 to give your GDS ratio.

TDS – Total Debt Service Ratio

Your TDS is calculated next. The debt ratio formula calculation is very similar to that of the GDS, except all of your monthly debts are taken into consideration. This includes car payments, credit cards, alimony, and any loans. The industry standard for a TDS ratio (total debt service ratio) is 40 per cent.

Calculating your TDS (Total Debt Service Ratio)

In addition to the total monthly housing expenses, you now must add payments such as credit cards and car payments. Once you have added all of these expenses, divide the figure by your gross income, multiple by 100 and the result will be your TDS calculation.

964 carolwood did that really go for 1.6m? Nice big place but seems a lot. Oh well not my money.

Victoria market is definitely hot. real life experience:

1) one person landed 6 months ago, brought 1 home at 530k and now worth 800k. so he used cibc hloc and withdraw some equity out and put up another 50k and purchase 1m+ home( the second home)…. rented outall home to 4 students, net 1300/month from 1st home and use it towards the mortgages payment towards 2nd home. again, rented out the 2nd home and still net 1800/month.

2) this person’s brother just arrived 2 months ago, purchased an older home at 650k, rented out the whole place and he lives with his brother for free.

3) their friends now has lined up with cash waiting to get to Victoria…

“Anyway, the way to combat the secretive real estate industry is not by being even more secretive and obtuse”

Well he’s not going to give away all his insider secrets for free, you gotta sign up and pay him for that!

I am absolutely loving these exchanges with him – he’s a total badass. No pressure but can this be a semi-regular instalment on here?

Maybe there’s a case to be made that Realtor groups aren’t putting the public’s interest ahead of their own, but so far he’s not doing a great job of making that argument.

Except he didn’t give any reason why he thinks the MOI and S/L is designed to protect realtors. In fact the whole concept is ridiculous given they are just ratios. Maybe he thought I said MLS HPI.

Anyway, the way to combat the secretive real estate industry is not by being even more secretive and obtuse

”@rosskay 6 hours ago

@househuntv Sorry No. MOI was designed to present a false reading of the market to protect REALTORS as was S/NL ratio. 1/2″

That was very telling LeoS how the real estate cartel does it’s best to work against the public’s best interest. No wonder they are scared shitless of Zillow etc.

“Operative Listing Services Absorption Rate” means: to to through out a large complex sounding thingy to make you go away….

Marko or Just Jack, ever heard of a “Co-Operative Listing Services Absorption Rate”?

Never heard of it.

The only inevitable solution is a market crash that will flush out the greed and excess of easy credit. It’s 1981 all over again which will implode upon itself via a coming global recession. Irrational markets only last for so long with historical debt levels going off the charts. No rocket science involved here.

Bingo:

I found the RBC report interesting and it seems to reflect the reality of the market today in Victoria.

What might also be helpful is to have stats that give some insight into different market segments. Saying that 70% of sales are to local Victorians is interesting but it leaves me wondering as to how that market is segmented. How do sales break down in the various price ranges. 1 mil to 1.5 mil.; 1.5 to 2 mil; 2 mil to 3 mil and 3 mil up.

I guess what I am wondering is whether sales to Victorians are spread fairly equally across all price ranges or are they predominately concentrated in the lower price range.

More from Ross Kay

househuntv: Can you give a specific example of a type of data they don’t have that would be valuable?

rosskay: Co-Operative Listing Services Absorption Rates

househuntv: Thanks. Can you point me at a resource where you talk more about this?

rosskay: Victoria’s Absorption Rate for September was 23.8%. Last September it was 15%.

househuntv: How is that different from how it is usually defined (as inverse of MOI)? By the usual definition Victoria sept abs. rate is 38%

rosskay: Sorry No. MOI was designed to present a false reading of the market to protect REALTORS as was S/NL ratio. That’s why you cannot find any corroborating study supporting their use. Even CMHC has admitted none exists.

househuntv: interesting thanks. Where can I learn more about this? More info on your site?

Marko or Just Jack, ever heard of a “Co-Operative Listing Services Absorption Rate”?

The RBC Housing Affordability Report I was referring to. Looks like I was wrong on the “fairly narrow” band. Compared to Vancouver and Toronto, maybe.

They also have historic reports posted going back to 2010.

Thanks for the numbers caveat. That’s interesting. Not surprising per se, but interesting none the less.

City of newlywed and nearly dead and the newlyweds are too busy working to make children. 😉

Looks like single parent families isn’t really a contributing factor. Stats Canada states Victoria is 86.5% are intact families, which inline with the country as a whole (87.4% for Canada, 88.7% for BC).

Anecdotally it seems families are smaller. I know very few people under 40 with more than 2 children (especially if you limit it to Victoria). Kids are pricey, families are starting later (pursuing careers first).. lots of reasons.

I couldn’t find # of kids for Victoria. But household size is smaller than the Canadian average here. For Victoria Census Metropolitan Area the average household is 2.2 people. For both Canada and Bc the average is 2.5.

Smaller households here could relate to a higher proportion of retirees or to less kids per family.

JJ

3 or 4 children?! As of 2011 stats can was reporting 1.9 children per family average (down from 2.7 in 1961). I’d be curious about the stats for greater Victoria. I’d suspect they are lower than the national average (due to affordability mainly – single income family seems to be a thing of the past).

Leo S:

That’s not good enough? They’d love to hype foreign buyers.

If we want to target speculators, it’s the local speculators driving up the market, not foreigners. You’ve said it yourself, it’s locals to blame. #1 group of buyers in Victoria is Victorians followed by BC, then rest of Canada. Foreigners are bottom of the list and the majority of that small group of buyers are Americans. Anyone that looks “foreign” is probably Canadian (as supported by numbers hack’s numbers of visible minorities in Victoria). People love to externalise blame. “Oooh, it’s the foreigners making Victoria unaffordable”. No, it’s not. It’s idiots getting into blind bidding wars because of FOMO.

The CRA has partially tackled the speculation issue by tracking housing purchases closer. One house is your primary. If you switch which property is primary, you have to declare the change in use on both properties (and pay applicable capital gains, or at least declare and defer it).

I’d be fine with also excluding or scaling the primary residence exclusion based on how long the property was held. No exclusion if held for less than a year (or even two) then scale to full exclusion by 5 years. It would put a damper on the profitability of live-in flippers (people who buy a house, and live in it while doing a reno.. thereby claiming the exclusion).

The point of the exclusion is enable mobility (move within comparable markets) not enable tax free profit. If you treat a property like a source of income it should be taxed as such.

Know what happens if the CRA catches you day trading in your TFSA? You pay taxes on it as though it were unregistered investments (plus interest etc).

Which is exactly what RBC posted some time ago. We’re well within norms of affordability as far as a monthly basis go. Vancouver is not (it pushed the upper limit way higher). I don’t have the link to the PDF handy, but it was interesting. Victoria has been expensive as compared to most of Canada for a long time. It’s not new. When interest rates go up, prices will come down, but monthly payments as a % of income will stay roughly the same. We’ve stayed in a pretty narrow band.

great post Leo! I think a huge part of the problem with these stats is that averages don’t capture the variability in Victoria. I suspect that there are rich people getting richer and poor people getting poorer and all of us in the middle are getting pushed to one side or the other.

totally unrelated question. Can anyone recommend a source for reasonable and unbiased information about universal life vs term insurance?

A lot of excellent points from all corners here, especially the idea that ones home needs to match ones income (read: ego). I feel sorry for those people that won’t ever be happy.

On a note of sacrifice, decide if together you can do without one or two cars. A loan, maintenance and depreciation costs between $1200-$1500 of after Tax income straight out of your pocket every month.

Based on the last few real-life examples I’ve seen two bedroom suites in the Oaklands area are now renting close to $300 more than 24 months ago.

$300 services almost around $80k worth of a mortgage. Still not enough to offset the increase in purchase price but it does offset the affordability significantly from a monthly cashflow perspective.

When buying your first home you are usually quite pressed to come up with the down payment and meet the debt to service ratios.

Things are different when it comes to your second home as you usually have a larger down payment, from the sale of your first home and have established credit.

So I would say that average people are still buying homes in the core they just have a larger down payment from the sale of their first home. What is different for some new buyers is the source of the down payment. A lot more younger people are receiving gifts and loans from their parents who are using the equity in their homes. And they are not small gifts or loans.

Now can that go on indefinitely? I don’t think so. There is a finite amout of wealth that parents can tap into especially if they have 3 or 4 kids. And if prices started to fall a bit. I think the parents would be reluctant to come up with the cash if they perceive the value of the asset falling. And that would become a huge contraction in the size of the down payments which would make prices fall even further.

This is an inter-generational effect of putting all your eggs in one real estate basket which could have a domino effect if one of the parties loses their job or gets divorced. At a median price of $800,000 – the spouse that keeps the home (which is usulally the wife) would find it difficult to make the payments or qualify for a new mortgage. That means the parents would have to get deeper into debt so that that person can keep the home. That puts the parents retirement plans into jeopardy especially if they have co-signed the loan.

964 Carolwood Dr today for $1,605,000. Bought in 2011 for $694,000 and obviously renovated but no additions.

What’s needed is low-cost family housing, which could easily be provided with some rezoning. For example Oak Bay Avenue from Newport to Fort should be rezoned to allow much higher density, but with the requirement for a large proportion of family-sized units. If cars on the Avenue were replaced by autonomous electric buses shuttling back and forth every couple of minutes, it would make Victoria a much more environment friendly city.

Awesome idea, but good luck with getting anyone to agree with this. The average person just doesn’t understand supply and demand.

The same people that would complain about this are the ones the complain about how Bear Mountain was clear cut to make room of SFHs.

Absolutely not. Most home buyers are regular working people making an income.

That is per capita and I assume an average. So many people have dual incomes, and only the wealthier slice are buying SFHs. The important part is not he value, but rather the range that it has historically moved within.

@ Vicinvestor1983″

If Victoria is now unaffordable for an average family it seems that city planners have goofed badly, since it is clearly highly undesirable for the mass of ordinary working people to be compelled to commute from the Westshore, the Highlands etc., in order to perform their humble employment in town.

What’s needed is low-cost family housing, which could easily be provided with some rezoning. For example Oak Bay Avenue from Newport to Fort should be rezoned to allow much higher density, but with the requirement for a large proportion of family-sized units. If cars on the Avenue were replaced by autonomous electric buses shuttling back and forth every couple of minutes, it would make Victoria a much more environment friendly city.

VicInvestor1983 said: “The core is a desirable & popular area & there is no reason an ‘average’ family should be able to afford to live there.”

I know a lot of average families that own a house in the core. In fact I would say most families that live in the core are average. I don’t think there is anyone along my street that would be considered a high income earner. They are all average. That would be about 250,000 average people living in the core. So VicInvestor1983 how did all these average people get here?

@ Vicinverstor 1983

So the the entire analysis is irrelevant to anyone except “wealthy retirees and working rich”. And come to think of it, it’s clearly irrelevant to “wealthy retirees and working rich” too.

Does anyone have data for the 99%, or the 90%, showing mortgage payments as a percent of disposable income?

“But that last chart looks crazy. For thirty years mortgage payments are shown to have equaled close to 100% of “monthly disposable income.” How can that be? If disposable income is total income less taxes paid, how can people pay almost 100% of disposable income (monthly or otherwise) to service a mortgage? How do people eat?”

The average income is irrelevant because many buyers are wealthy retirees & working rich.

“The CMHC chart is frustrating to middle income families looking to buy a middle income house in a middle income neighborhood in the core. ”

The core is a desirable & popular area & there is no reason an ‘average’ family should be able to afford to live there. There are plenty of homes in Saanich, Westshore, Highlands, etc for the average family.

The CMHC report, however, is very misleading. I am seeing homes sold 12 months ago going from $700k to $1million. A 30% increase seem very problematic to me.

I look at the CMHC chart and I ask myself what’s its purpose?

It isn’t predictive as it completely missed the run up in prices this year. Nor has it shown that red cities decline in price either.

And some of the “fundamentals” are not fundamentals of real estate at all.

It sounds more like some pet project by someone on CMHC’s board who has little understanding of real estate instructing the local grunt worker to jump through a hoop. It’s fluff.

https://youtu.be/BKorP55Aqvg

“The CMHC chart is frustrating to middle income families looking to buy a middle income house in a middle income neighborhood in the core”

I agree with this completely. Affordability has nothing to do with a monthly payment – it has to do with how much of your life you have to commit to acquire suitable housing. At such low interest rates and high prices, the cost has never been higher.

Speaking of yellow warnings.

Recession Risk Is Rising, Deutsche’s Chief U.S. Economist Warns

The Fed’s labor market indicator is flashing yellow.

http://www.bloomberg.com/news/articles/2016-10-26/recession-risk-is-rising-deutsche-s-chief-u-s-economist-warns

@ JJ

Perhaps this is the New World Order reality: folks to pay most of their disposable income to the banks as interest.

The next logical step has already been pioneered in Australia: the no-repayment mortgage. That way, when ordinary folk buy a house they are, in effect, making their bank their landlord, accepting full responsibility for maintenance of the property, and committing themselves to life-long debt that can never be escaped except by selling their home.

And with no repayments of capital to be made, debt, and thus house prices, will still have room to soar. Bravo.

“I see people that have bought expensive homes and then three years later are selling again, because the homes are too expensive to maintain and that causes money and marital problems. That turn over rate is interesting to watch and seems to be higher.

I’ve seen well paid doctors purchase or build a home that they consider meets their professional status and then selling three years later because the cost of the home including maintenance has made them part of the working poor.”

Marko never tells us that. Appreciate your info Jack as always. The quality of house people are paying for even in Oak Bay is a joke and will have a ball and chain around them forever as interest rates rise and the chance of a global recession builds.

US Real Estate Stocks Plunge To 7 Month Lows As Rate Hike Odds Soar

http://www.zerohedge.com/news/2016-10-27/us-real-estate-stocks-plunge-7-month-lows-rate-hike-odds-soar

And excellent report and analysis.

But that last chart looks crazy. For thirty years mortgage payments are shown to have equaled close to 100% of “monthly disposable income.” How can that be? If disposable income is total income less taxes paid, how can people pay almost 100% of disposable income (monthly or otherwise) to service a mortgage? How do people eat?

And how do these data square with Numbers Hack’s numbers which show Victoria’s “Mortgage as Percentange of Income” at only 38.14%? Taxes cannot account for all or even most of the difference, whether Numbers Hack’s “Income” equals gross or disposable income.

Clarification would be appreciated.

Anyone one to send this to the CMHC analyst: bbatch@cmhc.ca

I already had him correct a mistake:-).

And how does this work? – Winnipeg, Montreal and Edmonton all have one yellow and yet they get yellow overall while Victoria has two yellows but is green overall.

The CMHC chart is frustrating to middle income families looking to buy a middle income house in a middle income neighborhood in the core. The monthly payment may be affordable but the life time commitment of $800,000 is ludicrous. And in my opinion, that’s where the CMHC study diverts from reality.

Most of us can buy a home in the core with 5% down. The home may not match our income group or our family situation, but if you have saved $15,000 then you can be a home owner today. That makes everything green in the chart but most buyers had to settle for a lot less than they wanted.

Today’s buyers have to settle for a lot less than the generation of buyers did before them, unless they pledge a large portion of their lifetime income to the bank. That’s what the CMHC study is missing, buyers’ dissatisfaction and unhappiness.

The generation of buyers before could pay off their mortgage in 15 years if they chose not to dip into the home’s equity. Today’s buyers are much more likely to always be refinancing and may never be mortgage free. 30, 40 or 50 years of payments.

I see people that have bought expensive homes and then three years later are selling again, because the homes are too expensive to maintain and that causes money and marital problems. That turn over rate is interesting to watch and seems to be higher.

I’ve seen well paid doctors purchase or build a home that they consider meets their professional status and then selling three years later because the cost of the home including maintenance has made them part of the working poor.

One interesting thing to note is that Victoria is at the same warning level as Toronto and Vancouver for Overheating and Price Acceleration.

“Consider that appreciation really took off in Late Feb of this year than CMHC is officially 9 months behind.”

Agreed TripleA, that’s what I believe Ross Kay is meaning. I know his stuff sounds meandering but in the end it’s old info CMHC is using and they don’t get the real situation on the ground.

How can CMHC say “it hit the line, but since it didn’t cross it, it therefore means nothing” ? That’s total bullshit. When a line is hit, it’s hit, triggering the whole point of having the fricking line in the first place. These analysts are getting worse by the quarter.

It may have pushed them into a yellow rating overall. They say the model takes into account the “persistence” of the signals, and the signals have been persistent from June until now. But I agree it probably isn’t the major factor.

Yes, thank you Leo! It’s really kind of you to buy and share the data. (I should have said that earlier.)

In the end Ross K is not a truth seeker but rather a self promoter. You Leo are providing the rare resource of the raw data presented clearly. Thank you for that…. it let’s us critical thinkers make up our own minds…

It’s a sentence fragment. It should read something like this: “This is the result of the design of home trading infrastructure.”

“The design of home trading infrastructure”: I think he’s trying to say that the real estate (home trading) system has been designed so that not everyone involved in it has all the data. But I agree that everything he says in that exchange is very unclear.

It’s annoying that their data only goes up until June but given that by June Victoria had already experienced its major leap in prices this year, I can’t really see how using data that’s 4 months out of date is too too bad here. It was bad when they were still using pre-March data (and thus pre-price run up data) but I’m guessing that, adjusted for seasonal differences, our housing market isn’t now all that different from how it was in June in terms of average prices, low inventory, etc.

My conversation with Ross Kay on twitter

rosskay: CMHC just said Quebec is overvalued but Victoria is not?

househuntv: Based on affordability they are correct Victoria is not out of historical norms. What do you think?

rosskay: They are wrong. They use Realtor measures not Realty measures. They use stale data to justify missing turns.

househuntv: the MLS price is not important to their conclusion. Can use median price as well. What’s a “realty measure”?

rosskay: the other 60% of the data CMHC is never provided.

househuntv: I’m sure they have that data. If not hist. affordability ranges, what measure do you propose that is more predictive of overval?

rosskay: They dont have it but then again CREA has been precluded from having it for 40 years. The design of home trading infrastructure

Maybe it’s just me but I can’t make any sense of what he’s saying. What data do they not have? “the design of home trading infrastructure” is a measure of overvaluation?

CMHC plays catch-up with vaguely alarming house price warning

http://www.cbc.ca/news/business/cmhc-canada-real-estate-1.3822489

Added a paragraph to clarify that I do believe Victoria should be marked as yellow, but I suspect that we will be by the time the next report rolls around.

The fact that they claim that the HMA is an “early warning system” is laughable.

Great post. I think CMHC should reimburse you 🙂

I wouldn’t have thought our market is still historically so affordable with the recent run up. Without doing a ton of work and spending more money, we can’t know whether this type of analysis would support the different CMHC assessments across the country. You’d think they would want to use a consistent methodology.

In other news, the underpricing/ delayed auction strategy still seems to be alive in different hoods. Wakefield in GH sold for 1M (ask 799k). The recent Oaklands listings are as well, especially 2626 Avebury asking only $589k after a teardown just sold nearby for 558k. Just going by the pictures I’d say this one needs to sell massively over asking to achieve consistent value with comparable sales.

Leo, super job. Create a fund me page and I’ll pay my fair share for the data!

Here are some things to consider from 16 other different sources @ NUMBEO. Again, this is just automated data trolling, but nevertheless provides another perspective:

https://www.numbeo.com/property-investment/in/Victoria

Victoria

Price to Income Ratio: 5.79

Mortgage as Percentange of Income: 38.14%

Loan Affordability Index: 2.62

Price to Rent Ratio – City Centre: 17.89

Price to Rent Ratio – Outside of Centre: 12.34

Gross Rental Yield (City Centre): 5.59%

Gross Rental Yield (Outside of Centre): 8.10%

Canada

Price to Income Ratio: 6.71

Mortgage as Percentange of Income: 44.21%

Loan Affordability Index: 2.26

Price to Rent Ratio – City Centre: 18.70

Price to Rent Ratio – Outside of Centre: 16.80

Gross Rental Yield (City Centre): 5.35%

Gross Rental Yield (Outside of Centre): 5.95%

Vancouver

Price to Income Ratio: 12.63

Mortgage as Percentange of Income: 82.86%

Loan Affordability Index: 1.21

Price to Rent Ratio – City Centre: 24.29

Price to Rent Ratio – Outside of Centre: 21.04

Gross Rental Yield (City Centre): 4.12%

Gross Rental Yield (Outside of Centre): 4.75%

Now, some very interesting data from CMHC, an counter view

http://www.canadianmortgagetrends.com/canadian_mortgage_trends/2016/10/21

Consider taxpayers’ risk:

•Ottawa guarantees roughly $774 billion of insured mortgages.

•Arrears have averaged less than 1 in 300 (five times less than south of the border).

•Average equity on CMHC’s insured mortgages is 46.8% (contrary to public perception, insured mortgages are not all high-ratio) and just 1 in 5 CMHC-insured borrowers currently have less than 20% equity.

Consider taxpayers’ reward:

•CMHC has returned $20 billion in profit to taxpayers since 2006.

•Insured lenders have saved consumers over $3 billion of interest in that time frame

The only change was price acceleration.

Consider that appreciation really took off in Late Feb of this year than CMHC is officially 9 months behind.

Sitting behind a comfortable desk and being on the front lines have never been further apart.