Delayed Taxification

Isn’t it nice when you can get one government to pay the other government’s taxes?

Most people know about the option to defer your property taxes if you are over 55 in BC. That program is more or less a no brainer (shockingly, only 2.5% of BC’s seniors take advantage of this). Why pay several thousand dollars a year in taxes when you can borrow the money essentially for free and then stick your heirs with the bill? It works like this:

- Apply for the deferral before your taxes are due (one time $60 fee).

- When approved, the province will pay your municipal taxes on your behalf, charging you 0.7% simple interest on the loan.

- They put a restrictive lien on your house which means you have to pay the balance of the loan when you sell.

- Every year you apply to renew the deferral.

Easy peasy. Apply here.

But what if you’re one of those rare people in Victoria not over 55 years old? Well turns out you can also avoid those pesky taxes as long as you have kids.

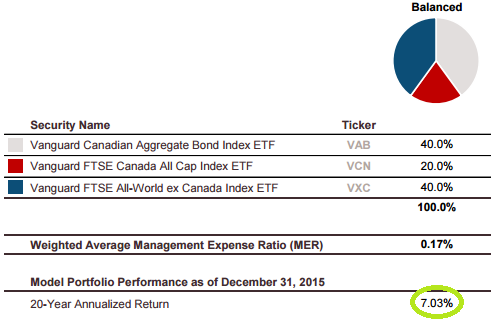

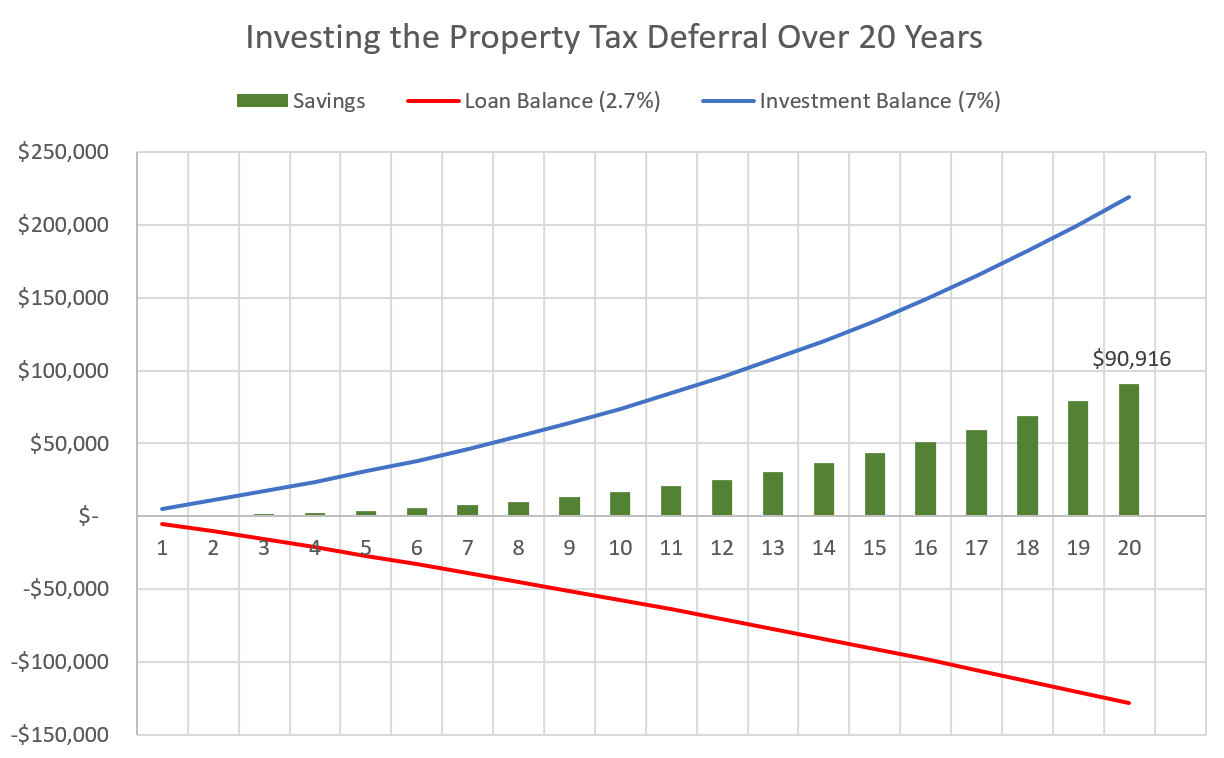

In that case the interest rate isn’t quite as generous at 2.7%, but still low. Meanwhile a simple set of balanced low cost index funds have returned around 7% in the last 20 years. If you’re the type to invest your money rather than pay down the mortgage, why not also defer those taxes and invest the difference?

Let’s take an example family that has bought a house in the core for $800,000. Property taxes are about $5000 annually. Let’s say they have a couple kids, a couple years apart and thus they qualify for 20 years of tax deferral which they immediately invest.

So this hypothetical couple might end with an extra $90,000* to send their rugrats to college.

*blah blah it’s a lower yield world, blah blah past performance not indicative of future performance YMMV

What do you think? Am I missing something? Is the family program worth taking advantage of?

Do you defer your municipal property taxes?

- No, but I qualify under the family program (41%, 33 Votes)

- No, don't qualify (34%, 27 Votes)

- No, but I qualify under the regular (over 55) program (16%, 13 Votes)

- Yes, under the family program (5%, 4 Votes)

- Yes, under the regular program (over 55 years old) (4%, 3 Votes)

Total Voters: 80

The core has always been Oak Bay, Victoria, Vic West, View Royal, Esquimalt, Saanich East and Saanich West.

Sometimes, some of us narrow the core down to Saanich East, Victoria and Oak Bay since this is where most of the sales are happening as well as the crazy over asking prices.

Once you leave the core, the market is a lot more predictable. For example here are the median prices for houses in Langford and Colwood. Not much of a change over the year.

Month Sale Price, Median

Jan $522,000

Feb $489,600

Mar $531,000

Apr $518,000

May $542,500

Jun $559,500

Jul $567,000

Aug $570,000

Sep $552,000

Oct $534,000 so far

Compared to Saanich East, Victoria and Oak Bay where there is some serious property speculation going on.

Month Sale Price, Median

Jan $692,072

Feb $771,500

Mar $800,000

Apr $849,950

May $832,000

Jun $850,000

Jul $817,500

Aug $805,000

Sep $840,000

Oct $882,500 so far

There was a time when prices in the core and the Western Communities were rising at the same rate when the market was dominated by people wanting a home to live in. Now housing has become a commodity in the core to be played like the stock market.

Michael if you re-read what I wrote you notice that this was a comparison from two sets of data covering the first three weeks in October of 2015 and 2016.

After a very robust year of sales, it appears that sale volumes may be falling to the fifth lowest level for an October in the last decade. The market peaked in house sales in the core in May when they hit 376. We may only be at 40% of peak volume by the end of the month. Last year at this time we were at 72% of peak volume.

We are only three weeks into the month and things could change. The reason why I’m looking at these numbers, at this time, is an attempt to determine if the new lending guidelines are having an effect on sales of houses in the core.

Re: Definition of the “core”.

I was under the impression that the term, “the Core” , meant the City of Victoria, the Township of Esquimalt, all of Oak Bay and Saanich East (anything in the Municipality of Saanich east of Blanchard St./Hwy 17 up to and including the northernmost core neighbourhood, Cordova Bay).

Clarification please?

Marko you are just looking at what is currently listed. Active listings also include the properties that were listed this month and sold. Actually, active listings are everything that was available during that month

I did notice that. The question is, who is buying a house to get a free TV? I hope it’s at least 90″.

Interesting stats on debt load in Victoria

@Hawk “As per my buddy’s credit counselor friend telling him 70% of Victoria is living on the edge of going under. I take those words very seriously.”

Do they mean 70% of their clientele? I’d hope they’re not extrapolating from people seeking credit help to the general population!?

@Marko “the top of hill on Roseberry Ave is prime compared to the 3000 block of Scott Street, for example.”

Agreed. Yet it’s interesting to see that place on 2600 block of Scott go for even more than 2665 Roseberry a few weeks ago, and Roseberry was arguably in better condition.

Sales decline from roughly the mid-point of every year clear across the continent. It’s in part due to weather, schoolyear, & holidays, and yet every year the bears try to scare people the market is crashing. This sales chart is the average from 1995-2015.

http://www.housingwire.com/blogs/1-rewired/post/36855-heres-why-seasonality-matters-in-the-housing-market

http://www.housingwire.com/ext/resources/images/editorial/BS_ticker/PDF/A-April-2016/charts/chart2.png

However, as Marko mentioned, Victoria is still on pace for its strongest October sales since 1992.

Jack’s declining sales numbers are coinciding with Marko now giving away free TV’s with every sale. Is there a free set of steak knIves too for after the crash ? Desperate times indeed. 😉

Thanks huevos. Surprised that old listing is up.

Definitely a flip. Was a deal @ 665 even even in the condition it was in.

I am not sure that one should lump Fernwood and Oaklands together any more. The prices seem to have separated. Marko what do you think. Is fernwood following the path of James Bay?

Between Haultain and Bay Street is officially Fernwood (I didn’t know this until last year) and that section of Fernwood is pretty much identical to Oaklands.

I think for Fernwood and Oaklands it is more important to look at the individual blocks. At the top of hill on Roseberry Ave is prime compared to the 3000 block of Scott Street, for example.

Marko:

Just so we all are on the same page what are you including in the core ( is Oak Bay and Esquimalt part of the core or just the city of Victoria?).

Thanks

I am not sure that one should lump Fernwood and Oaklands together any more. The prices seem to have separated. Marko what do you think. Is fernwood following the path of James Bay?

quailwood 11 months ago?

http://www.victoriahomesforsale.com/property-details/357258

Marko:”Bought 11 months ago for $665,000.”

I assume a reno was involved. No way it looked that good inside for 665 11 months ago.

Oct 372 so far

Just wondering what numbers you are using, I only see 250 active SFH listings in the core.

1074 quailwood. Price please.

$956,000.

Bought 11 months ago for $665,000.

@gwac

956,000

So, below list. Nice looking place.

1074 quailwood. Price please.

Okay Barrister, let’s look at Fairfield, Rockland, James Bay, Oak Bay and Fernwood/Oaklands

In the first 3 weeks of October there have been 38 sales down from the year before when there was 52 for the same first 3 weeks.

Are higher prices weakening demand? Is weakening demand a precursor to declining prices?

So maybe sales are lower because there is less available? Nope. Active listings for houses in the core haven’t dipped.

Month Active Listings, Number of

Jan 347

Feb 378

Mar 418

Apr 398

May 368

Jun 366

Jul 383

Aug 375

Sep 379

Oct 372 so far

neither has months of inventory dipped

Month Months of Inventory

Jan 2.84

Feb 1.66

Mar 1.31

Apr 1.06

May 1.09

Jun 1.26

Jul 1.86

Aug 1.81

Sep 2.04

Oct 3.38 so far this month

But sales have dipped.

Month Sales, Number of

Jan 122

Feb 228

Mar 318

Apr 376

May 337

Jun 291

Jul 206

Aug 207

Sep 186

Oct 110 so far this month

Just Jack:

In about half the core there are very few houses even listed under 800,000. ( I am referring to Fairfield, Rockland, James Bay and Oak Bay and even Fernwood these days). I did a fast look at the map and I would say about only 10% of houses in these areas are under 800K.

But the total drop off of sales of SFH is a more interesting number.

“No, they’re based on recently published data.”

Where does it say they are all moving to Victoria and/or spending it on real estate ? Nowhere.

Desperate times for over leveraged Mike. Canada’s financial stability is at severe risk, and you keep pumping. Pretty sad for someone who calls himself an ex-economist who can’t do the math.

Canada’s record household debt is threatening its financial stability, global bankers fear

“The combined debt of Canadian governments, companies and households reached US$4.4 trillion in the first quarter, or 288 per cent of gross domestic product, exceeding the same gauge for the U.S., the U.K. and Italy, according to the Bank for International Settlements.”

http://business.financialpost.com/news/economy/canadas-record-household-debt-is-threatening-its-financial-stability-global-bankers-fear

The higher prices are driving buyers out of the market. Similar to what an interest rate increase would do to the market.

If sale volumes had risen or stayed the same then it would be a good indicator for the market in that demand was rising or at least constant. But this is weakening demand.

Sale volumes typically decline before prices start to decline.

“Not sure what your point is…..a 700k house has gone to 875ish in the last 12 months so there are more homes selling over $800k.”

Meanwhile the Vancouver $1.25 homes are getting slashed by $250K and all those profits went “poof” in a couple of months.

Assuming that these prices are here to stay is foolhardy with the under $800K’s in major decline, it won’t be long now. Typical delayed response as the under $800K’s tanking is the first sign of a turning point.

“Don’t forget that most boomers are in relationships. So even for the average BC boomer couple, that equates to nearly a half million inheritance on the way. ”

Not every spouse has parents who even own, or have sold already and blown the money on themselves. Many parents live in smaller towns with lower priced real estate. Many parents also say screw the kids, we’re having fun, you’re on your own. Your assumptions are based on total fabricated BS.

House purchases under $800,000 have fallen by half to three quarters relative to last year while sales in the over $800,000 have increased.

Not sure what your point is…..a 700k house has gone to 875ish in the last 12 months so there are more homes selling over $800k.

If the market was flat your comment would require some analysis as to why but the why in this case is fairly obvious.

“And frankly, $200k+ isn’t meaningful to anyone anymore anyways”

“BTW, $230K is not much”

Don’t forget that most boomers are in relationships. So even for the average BC boomer couple, that equates to nearly a half million inheritance on the way. Certainly adds extra buying power for retiring to Victoria this coming decade, especially once piled onto their current net worth.

nan,

The inheritors will be paying off their HELOC’s and credit cards, and putting what’s left in an RRSP, not buying Victoria real estate. As per my buddy’s credit counselor friend telling him 70% of Victoria is living on the edge of going under. I take those words very seriously.

Victoria is past peak house when the fools shun the common sense warnings from the government, CMHC, bankers, economists and all the international financiers who look at us like we’re a bunch of idiots who didn’t learn a thing from the US crash.

This is going to be so fricking ugly. No fear though, granny will save you. 😉

Canada’s record household debt is threatening its financial stability, global bankers fear

“When you get to levels on total debt that makes even the Italians blush, you know you’re in a straitjacket”

http://business.financialpost.com/news/economy/canadas-record-household-debt-is-threatening-its-financial-stability-global-bankers-fear

House sales are down in the core for the first 21 days of this month at 105 compared to 147 house sales last year at this same time.

This is mostly offset by an increase in condo sales from 90 to 127 in the first 3 weeks.

What’s interesting is in what income groups the house sales have been collapsing. House purchases under $800,000 have fallen by half to three quarters relative to last year while sales in the over $800,000 have increased.

If sales continue to fall off at this rate we might hit a five year low for the decade in house sales in the core for October.

Wave bye bye to the middle class house buyer.

I don’t doubt that some folks will get lots of money from their dead parents, but it will be primarily in real estate, meaning that the Canadian market already has those dollars in it. Being transferred as inheritance will have it taxed and charged upon but unless Victoria is an unusually skewed beneficiary of those inheritances, it isn’t a home run for real estate in Victoria to me. Anything beyond that is pure speculation because no one can tell the future.

And frankly, $200k+ isn’t meaningful to anyone anymore anyways as an amount of money to have in your hands. What can you get with that? 50% of a condo? gamble on monetary 5 condos? 3 new cars? 5 years of living expenses for a couple with no kids? The correct place for that money for today’s heavily leveraged boomers will be either to pay off their own mortgages or better yet investments in low cost diversified index funds so they can retire one day.

“There was a place on Scott Street (Oaklands area) that sold a few days ago and rumour is it had 26 offers. That is 25 buyers left. There are currently two listings in Oakland’s; one has an accepted offer and the other one is $1.2 million.”

AKA “The Greater Fools”, at least 25 of them left, shouldn’t take long to soak them up. Anyone buying Oaklands for a million needs some serious psych help.

“These are the ones most likely to relocate to Victoria upon retirement.”

This is the type of idiotic statement where your credibility goes out the window Mike. The city lacks retirement homes that aren’t mainly aging dumps and no family doctors. Supposing they will all come here in the first place to an overpriced city for a senior trying to conserve money is pretty brain dead.

Seniors can move to Parksville for half the price and a quieter retirement without a downtown full of drug addicted mental health cases on every corner.

BTW, $230K is not much if that is your retirement or you are one of the massive growing seniors retiring in debt.

http://wpmedia.business.financialpost.com/2015/09/fp0908_debt_by_ages_gs_b.jpg?quality=60&strip=all&w=231&h=544

Thank you for the numbers once again. It looks like it will be pretty similar to last year with the exception that there are a lot less active listings. Wonder if the next week will start showing the impact of the new mortgage rules (if any real impact occurs)

We will clear last year due to the Monday the 31st (good for 40-45 sales). It looks like we are still on pace for the strongest October since 1992.

I was at a lot of open house this weekend and nothing seems to have changed. Wrote a few offers over the weekend. One house had 11 offers, one 12.

There was a place on Scott Street (Oaklands area) that sold a few days ago and rumour is it had 26 offers. That is 25 buyers left. There are currently two listings in Oakland’s; one has an accepted offer and the other one is $1.2 million.

The number of overall listings and sales has slowed but the insanity on each specific property has not.

“Their family sizes are relatively large (at least 2+). lots of kids mean less meaningful inheritance.”

“Since they had 3 to 5 kids plus grandkids, it doesn’t leave much”

Better to look up what the boomers are already starting to receive than assuming. $230K average inheritance per BC boomer adding to their net worth. Furthermore, look at how uneven the distribution is – the highest-income boomers will get the lions share. These are the ones most likely to relocate to Victoria upon retirement.

http://i.imgur.com/3NKnGAV.png

“war turned them into savers”

Yes – savers of cash. Which has lost 95% of it’s value since they started saving. I don’t have the facts on this but anecdotally, the folks I know in their 80’s and 90’s have a few things in common:

They own their houses/ condo and are mortgage free

They might have pensions from their past employer/husbands employer that are not keeping up with inflation

They receive CPP/ OAS because they need it

They have a modest amount of cash that is not wisely invested – as you say they are savers, not investors. This money has rotted for the last 15 years.

If they do live in old age homes, unless government subsidized, those homes are expensive. ($4500/month+ and +$1000 for a couple)

Their family sizes are relatively large (at least 2+). lots of kids mean less meaningful inheritance.

So at the end of the day, my feeling (no data, remember) is that most boomers won’t get much of value from their parents that isn’t real estate. Great for boomers, not great for real estate markets since the transfer of real estate will just create sellers in some markets and buyers in others, not net new money available to sellers (like loosening the CMHC and opening the borders did)

Marko:

Thank you for the numbers once again. It looks like it will be pretty similar to last year with the exception that there are a lot less active listings. Wonder if the next week will start showing the impact of the new mortgage rules (if any real impact occurs)

Exactly 154 sales each of last 2 weeks. Amazing how that happens. 😉 Will need 254 sales to make Marko’s prediction of blowing through 800.

Michael:

The oldest boomers are only 70. The boomer generation started after World War II in 1946.

What you are thinking of is the silent generation

“Not much boomer parent wealth is tied up in real estate at this stage, as they are typically widowed, in their 80s & 90s and in old age homes. One of the reasons they’re so wealthy is growing up during the depression & war turned them into savers.”

Which means they sold their homes 10 plus years ago when real estate was half the price or less, to move into the old folks homes who are soaking up the extra care costs.

Since they had 3 to 5 kids plus grandkids, it doesn’t leave much once it’s split up after retirement home and nursing costs. When they had cash to save it was from working 25 years plus ago when average wage was a third of today. Not much cash there to save.

Mike’s imagination of every retiree as some filthy rich heiress living in the Uplands comes from watching too many old TV shows.

@nan – “what do the Boomers parents own again? Oh right – inflated real estate.”

Not much boomer parent wealth is tied up in real estate at this stage, as they are typically widowed, in their 80s & 90s and in old age homes. One of the reasons they’re so wealthy is growing up during the depression & war turned them into savers.

Mon Oct 24, 2016:

Oct Oct

2016 2015

Net Unconditional Sales: 552 734

New Listings: 673 925

Active Listings: 1,948 3,170

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

@ Michael – “Buying power for Victoria is mathematically-certain to skyrocket”

Maybe – what do the Boomers parents own again? Oh right – inflated real estate. What other assets do they have? Where do they own it? Disproportionately in retirement towns like Victoria (because you know, they’re retired). Seems to me the best Victoria pumpers can hope for is that money received from liquidated housing will be disproportionately reinvested in Victoria, net of transaction fees. Also, Boomers are more frivolous & entitled than their parents, so don’t forget leakage from parents real estate to new cars and fancy trips.

With financing drying up one day at a time, it doesn’t seem so mathematically certain to me.

Add to that the fact that a disproportionately large number of current retirees benefit from defined benefit pensions from gov’t industry and military, not only will the transferred money not create any net new demand in the economy, but the removal of pensioner demand could contribute to slowing things down as old folks die out and the consumption driven by their pensions die with them.

@Totoro:

Your links are to the “Federal Program”, lots of hassles and hurdles.

It is much different.

The Shenzhen program is at the “City Level”, here’s the Forbes article on it:

http://www.forbes.com/sites/caseyhall/2016/03/31/chinas-silicon-valley-wants-you-offers-million-dollar-payments-to-move-there/#28bf26265a27

https://medium.com/@johnwong93/the-coming-of-shenzhen-china-s-silicon-valley-1c3d9baf0a01#.sdymsh3jp

FYI: one Irishman (half drunk) that runs in circles just go approved…haha

The program defines it as:

http://www.1000plan.org/en/

And it comes with some less than glowing reviews:

http://www.scmp.com/news/china/article/1631317/chinas-programme-recruiting-foreign-scientists-comes-under-scrutiny

There are other far more modest programs for those who don’t fall in this category and by modest you get 3k if you have a bachelors degree and 6k if you have a masters and get a job in Shenzhen in tech.

Frustrated and not getting ahead, want for a little “adventure”?

Real Estate growing faster than your paycheque, check out what this amazing city is doing.

NOTE: the term “leading research” can be applied quite generously

Shenzhen, the Silicon Valley of Asia/China has an offer for you:

1/ 1.18$MM Canadian upfront

2/ free accommodations for 10 years in 2200 sqft apartment, which is yours for free if you stay ten years

3/ medical/schooling for your kids…

http://english.caixin.com/2016-03-25/100924850.html

Now that is an incubator! BTW, if you do make it and want to establish a company:

A corporate income tax rate of just 15% (lower than Hong Kong’s 16.5%)

• The Shenzhen-Hong Kong Youth Innovation and Entrepreneur Hub (a large startup incubator)

• Free housing and office space for 1 year for entrepreneurs (dependent on age and industry) who open companies there

• A fund to offer low-cost loans to startups

• Easy access to VC firms due to them being given preferential policies

• Individual tax for foreign experts lowered to 15% in comparison to China’s usual 25% rate

• High tech and animation industries are exempt from business tax for 2 years from when they become profitable, and then it is charged at 50% for the following 3 years

• Development of certain green technologies, such as water-saving, is tax deductible

• Loans in foreign currency

800 Gorge – yikes! Total nonsense price for cash flow or appreciation. I can accept Oakland’s spiral up, but this is madness. Realtor gone wild and homeowner strapped in for the ride.

There’s a Warren Buffett quote that deals with appreciating stock markets and the potential fallout on margin.

“When the tide goes out, we’ll find out who’s swimming naked”

Perhaps you could swap in tsunami for tide, all things considered.

Regarding earthquake damage, no one really has any idea how bad things will get. Only in the last 15 years or so was anyone able to peg Japanese records of a tsunami in January 1700 to the last big one here. I think most SFH will be fine but I have concerns regarding towers, and apartment complexes with underground garages. Simulations only go so far. In Chile they went from 6″ to 8″ thick concrete flooring and those fared much better. Our code was never designed for such concerns.

Agreed, so they can buy undervalued assets not overvalued real estate. Basic investor advisor logic right AG ? Think they’re all reading the news of red warnings saying lets go buy a house ? Odds are slim and none.

Investors hoarding cash is a bullish signal, 90% of the time.

VicRenter,

I heard Ozzie Jurrock talking yesterday about those numbers. Michael Campbell was talking about them on GlobalBC this morning.

Sure Mike, the parents are going to dole out the big money when the market is tanking so the kids can piss away their hard earned inheritance. Nice thought if you live in a bubble where everyone is filthy rich, but reality is not everyone is stupid like you to keep buying at the top. That’s why Vancouver is tanking and will soon spread here.

People are hoarding cash more than ever including all those rich boomers. Might want to make up another fantasy chart with little green arrows.

Canadians hoarding a record $75 billion in extra cash

http://www.torontosun.com/2016/01/26/canadians-hoarding-a-record-75-billion-in-extra-cash-report

“Preliminary numbers for October so far reported on Global News this morning. Vancouver single detached sales down 77%, condo sales down 53%.”

I can’t seem to find evidence of this anywhere online… Anyone seen/heard these numbers somewhere?

@Leo

I’m pretty sure the new CMHC rules would only apply to new mortgages. Banks just have to price accordingly. Even with a deductible, the insurance on offer is still a straight-up gift from the taxpayers to the banks.

??

Buying power for Victoria is mathematically-certain to skyrocket. One reason is the already rich & retiring boomers are about to inherit a fortune – much of which they’ll give to their kids to buy homes.

Canadians between 50 and 75 years old are set to inherit $750 billion over the next decade, the largest intergenerational wealth transfer in Canadian history

http://www.cbc.ca/news/business/baby-boomer-inheritance-1.3617891

Ouch !! Good thing they’re building lots of rentals in this town, as this tsunami of lost buying power will take years to recover.

Home Capital says new mortgage rules could take 60% bite out of its insured mortgage business

http://business.financialpost.com/investing/home-capital-says-new-mortgage-rules-could-lead-to-60-decline-in-new-insured-mortages

Preliminary numbers for October so far reported on Global News this morning. Vancouver single detached sales down 77%, condo sales down 53%.

Canada’s growth projection downgraded again in part due to new mortgage rules according to their expert.

The CMHC proposal to have the lenders share some risk is quite diabolical. Insure 100% of the value when the market is going up and foreclosures rates are rock bottom and then shift risk to the lenders when the market is turning down.

Curious Cat you have to be more specific. A brief description of house and lot size and location. Then I can calculate the sales to assessment ratio for similar properties that you may be interested in. Otherwise the ratio can be very wide and not meaningful.

So outside of the photos you have to realize there in 129 days they never fixed the following errors in the 1 “sentence” description:

JJ – any idea of how much houses are going for above BC assessment now?

Last one, I promise! lol

800 Gorge Rd West – a triplex for $1,429,000. I understand these might be a little harder to price, but this seems outrageous! The property is assessed at $653k, so asking price is 219% over BC assessment.

Love the last sentence in the description. “Chinese version of remarks available. ”

https://www.realtor.ca/Residential/Single-Family/16859985/800-Gorge-Rd-W-Victoria-British-Columbia-V9A1N9

Speaking of main roads, 3156 Quadra Street. Does the owner even want to sell?? Do they really think these things just sell themselves? These are terrible photos! They couldn’t even be bothered to close the dishwasher or put the peanut butter back in the cupboard. You can even see the realtor?/owner?/photographer in the bathroom photo. Niccccce.

DOM 129 days, asking price 675k.

https://www.realtor.ca/Residential/Single-Family/17069470/3156-QUadra-St-Victoria-British-Columbia-V8X1G1

How desperate would you need to be to buy directly on Bay St? I would buy a house on a fairly busy roadway if it was setback really far. This one is so close to the road, you could probably open the window and spit on passing cars.

1340 Bay St listed at $428,888 – DOM at 32 – no pictures of inside so assume it’s a real dump. The lot is actually on the smallish-side at 3400 sq ft.

Sidney has its own areas of concern as well:

http://www.sidney.ca/Assets/Fire+Department/Saanich+Peninsula+Tsunami+Planning+Map.pdf

The CRD redid their Tsunami Hazard Map in 2013. “The new hazard line does not differ largely from the hazard lines created in 2004, but confirms the tsunami planning zones already in place. The best available data suggests that in most areas of the Capital Region, 4m or 13 feet above high tide is a safe elevation. ”

At the entrance of the Esquimalt Harbour, the tsunami will arrive in 77mins, max water level is 2.7m.

Victoria Harbour and Gorge Waterway entrance will arrive at the same time, max water level is 2.5m.

Cadboro Bay tsunami will arrive in 90 mins, max water level is 2.0m.

Sidney tsunami will arrive in 110 mins, max water level is 2.0m.

“Higher ground” in CRD is generally 4m or 13 feet above the high tide level.

Here is a link to the Saanich properties that will be potentially affected by a tsunami. (Most of the Gorge is fine, unless you have a house on the Portage Inlet.) http://www.saanich.ca/assets/Community/Documents/tsunami-brochure-saanich%202013.pdf

And here is the Greater Victoria map: https://www.esquimalt.ca/sites/default/files/greater_victoria_tsunami_map.pdf

Ogden point will be under water it seems.

Spoke to an acquaintance recently who owns a small place in Sidney, who wants to move into the core. Prefers Oak Bay; and asks me what is there for around 700K. He has seen some scientific(?) simulations which show the other BIG ONE-Tsunami-due in the next 50 years, taking out Ogden Point and sweeping over the Songhees–so much for BOSA’s lowest garage level and then penthouses as basement suites–and flattening the Gorge. Maybe discounts are appropriate there. Capital gains will not be an issue and basement suites can be advertised as covered swimming pools.

Hawk give the link to your blog already where we can subscribe for your weekly hand-picked stock tips for a low low fee. Don’t hog all the 400% profits! Sharing is caring… don’t you want to share your knowledge?

The nuttiness in the marketplace continues.

6472 Willowpark Way (Sun Rivers in Sooke) sold yesterday for $499,900. Purchased in 2013 for $347,500. Purchased again in 2015 for $415,226.

220 – 1375 Bear Mountain sold yesterday for $312,000. Purchased in 2014 for $225,000.

Didn’t think I would see the day were we would be seeing this type of price appreciation in Sun Rivers and Bear Mountain condos.

Still crazy busy at SFHs in the core the last few days I’ve been showing properties.

Reading through one of those articles I totally forgot about the 10% required above $500,000 regulation that came into play in February.

The Gorge was a deal two years ago. It has gone up a lot in the last 24 months.

AG,

My stock portfolio is inching in on 400% but don’t get all nasty at your 2% hedge fund guy. He’s just doing his job, which is nothing. 😉

Vancouver still in free fall. Victoria a ticking time bomb. We are not immune to major market financing changes no matter how you spin it.

Buyer Demand Continues to Slow in October

Sales to Active Ratios Continue Free Fall

“Three weeks into October and it’s much of the same. Sales continue to fall and listings are piling up. It appears clear as day the market is correcting even the CEO of Royal Lepage was quoted as saying “Vancouver prices have seen their last hurrah.” That’s a pretty bold statement from someone in the real estate industry.”

http://vancitycondoguide.com/buyer-demand-continues-slow-october/

We know all about Hawk’s portfolio. It was up 300% earlier this this year and is probably up 1000% by now. Just a couple of years until he’s at Berkshire Hathaway levels I guess.

Of course if all that were true he’d be able to afford a nice house in Oak Bay too……… 😀

“1990 original cond, assess 479k, ask 624k, sold 733k”

Another sucker got hosed on a 1990 leaker special. Hope they have an extra $100K or more put aside when the mold pops up anytime soon. Must be new to Victoria and didn’t do their DD. Don’t tell me it was you who bought it Mike. 😉

“GE hit 33 this summer and pays a 3.2% dividend. What are you complaining about.”

But you never sell Mike, just like your real estate hoarding. Tell us about your losers someday, I’m sure you have lots. 😉

I think Marko pointed out that it’s not much of a deal anymore. Big jump in prices there too.

The Oak Bay vs. the Gorge comments are interesting.

Coincidentally enough, just before I read them, I was thinking that the Gorge might be the one place in Victoria that could go up more than the average. Why? It’s not considered a “core” area and yet it shares many or most of the attributes of a typical “core” neighbourhood. I would say it is more similar to a “core” neighbourhood than a Westshore neighbourhood.

Let’s look at the similarities to many other core areas:

Waterside location that is rather scenic (not every core area is a waterfront location including even some higher end core neighbourhoods like Henderson not to mention more modest areas like Maplewood or Fernwood).

Older established well kept streets near well kept parks and gardens. Some streets are waterfront streets.

Some character homes (prettier than many expensive Gordon Head generic boxes er Victoria Specials?).

Not that far from Downtown and places of employment. Indeed, some “core” areas like Cordova Bay/Broadmead are further out. It’s certainly much closer in than Langford.

The Gorge, except for some exceptions, is not a high income area but then neither is most of Victoria proper (excl. Rockland and parts of Fairfield) and even parts of Oak Bay like Poets Corner are not high income either.

Am I only the one who thinks that the Gorge is an undervalued gem waiting to be discovered?

Thoughts?

Cuz the fiddlers @ Irish Times don’t start til around 9pm laddie!

How can you be bored on a Friday night in Victoria?

Crazy what condos are going for. This one just came through tonight:

318-10 Paul Kane Pl, 1990 original cond, assess 479k, ask 624k, sold 733k

Especially as Hawk mentions on the float plane strip, and not much of a view for 3/4M.

http://images.realtyserver.com/photo_server.php?btnSubmit=GetPhoto&board=victoria&name=2FB4B161.L17

GE hit 33 this summer and pays a 3.2% dividend. What are you complaining about 🙂

BTW Mike you told everyone to load up on GE back in February at 30 and that it was a guaranteed slam dunk. Don’t look too good today. Bad DD I guess.

Sorry Deb, I meant to post the one from summer where there is one yellow.

Anyway, I think it’s unlikely Vic will jump from all green to red in 6 months. Especially since most of our price gains this year were from Jan to April, after which we were still all green.

As far as “desperate”, you’d be surprised how little I care where prices go. I simply get bored some Friday nights and like to guess where the green & red lights are in our future 🙂

Is it my imagination or does it seem everytime the market rules change effecting it to the downside Mike’s posts and lame charts increase five fold ?

He and his group must be chomping at the bit right now as Vancouver tanks and banks tighten lending. Worst possible situation for a maxed out investor and it’s only just starting.

@ Michael

The state of housing you posted was from April 2016 and has been posted before. You really are desperate to pump thing up aren’t you. I think perhaps your shirt tail is hanging out on this one.

Canada is top diggity dog…

top performing developed equity market in the world

http://www.theglobeandmail.com/globe-investor/inside-the-market/market-updates/the-close-tsx-continues-rise-as-energy-rally-persists/article32476090/

I think it was Hawk who predicted in January that Canada would be top market this year? 🙂 snicker, snicker

There will be no red warning for Victoria.

http://wpmedia.business.financialpost.com/2016/04/fp0427_cmhc_housing-gs-copy.png?w=620&h=526

Highly unlikely LeoS. Vancouver boomed from foreign money laundering and is now paying the price. That period was an aberration from historical norms. Victoria incomes could not support higher prices thus the government stepping in which is unprecedented. Did you miss the red warning from CMHC like Mike ?

From January 2008 to now, Vancouver is up some 60%. Victoria up 20%. Vancouver rose a lot while Victoria did squat so the reverse can also happen.

Michael doesn’t look at what’s happening in Vancouver which leads Victoria historically. He even posted so many times on the way up. Just can’t see past his nose when the chart goes down with hundreds of price slayings at all price levels and types. I think it’s called a hypocrite.

Mike DeJong lies there is no foreign buyer problem and 10 days later the tax pops up. There’s your government truth.

“Is it just me or are the bears, bmen and jacks getting grouchier as they try to grasp what’s going on?”

In the mind of some Victoria has been a rainy, crime-ridden, gridlocked hell hole since at least 2007.

If what you say reflects reality, then the bank should have set lending value at $1,6750,000 and not 2.4M as per purchase price. So, did they?

Similar if not better houses than Neil but on the Victoria side of Foul Bay were selling in the spring for $750,000-ish. In fact, I looked at a house on the Victoria side of Neil St. itself that was newly fully renovated with 3 beds up and a 2-bed suite downstairs. It sold for $780,000 or so, if I remember correctly. The premium to be on the Oak Bay side is insane.

And here is the actual Canadian definition that is accepted by the courts. Notice that no where does it state that what a property sells for is its market value.

“The most probable price which a property should bring in a competitive and open market as of the specified date under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus.

Implicit in this definition are the consummation of a sale as of the specified date and the passing of title from seller to buyer under conditions whereby:

buyer and seller are typically motivated;

both parties are well informed or well advised, and acting in what they consider their best interests;

a reasonable time is allowed for exposure in the open market;

payment is made in terms of cash in Canadian dollars or in terms of financial arrangements comparable thereto;

And the definition by the International Valuations Standards Council.

Market Value

The estimated amount for which an asset or liability should exchange on the valuation date between a willing buyer and a willing seller in an arm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently and without compulsion.

It’s just you Michael.

Mike de Jong is not an attorney, agent or appraiser. This is his personal thoughts and were not meant to circumvent a hundred years of court cases that have defined market value. You’re giving a politician too much credit in understanding the complexities of real estate. And frankly just because it came out of his mouth doesn’t make it true.

Market Value has been defined by the courts, the Canadian Universal Standards of Appraisal Practice and the International Valuation Standards (IVSC) not Mike de Jong or Wikipedia.

If he said what a property sells for is its Market Value then he has been wrongly informed. And government ministers have been known to be wrong.

What a property sells for is its selling/contract price not its Market Value. Quite simply one sale is not a market. A market is made up of all sales and in order to test if the property sold at market value it has to be compared with similar properties (not including the property) to determine if the price paid is reasonable, fair and equitable. If the property fails these tests then it did not sell at market value.

Understanding market value is simple it’s just that those who have a stake in a particular outcome or price suffer from temporary cognitive dissonance. They can’t accept the facts if it’s not in their favor. For example Donald Trump and the upcoming election results.

Is it just me or are the bears, bmen and jacks getting grouchier as they try to grasp what’s going on?

It’s the same for Hamiota. Saying that the land is $900,000 is being idiotic as that puts the price of 2,000 square foot home with a suite at that of a used Jeep.

In fact your entire argument that since it is mostly land value it must be worth it is bogus. Your only proof is by pulling a number out of your arse saying this is the land value when not one single vacant lot has sold in that neighborhood in three years. And the one that did sell – sold at $520,000. Which is far from $900,000.

This type of BS is common among agents selling properties in built up neighborhoods when buyers shake their heads in disbelief when they look at the house and then the price. Any buyer hearing this should immediately ask the agent for three recent vacant lot sales in the neighborhood to prove that it is truly the land value and not some made up number.

“What I hear from some estate agents is that if the property sold at X amount then that is its market value. That is a statement that illustrates the speaker’s lack of knowledge.”

For the purposes of the PTT BC’s Finance Ministry assumes selling price = fair market value as long as it was an open market transaction.

Open Market Transfers

A property transfer is considered to be in the open market when anyone likely to be interested in purchasing the property can make an offer. For example, the seller lists the property with a realtor or advertises it for sale.

The purchase price is considered the fair market value in most cases as long as you register the property within a few months of signing the sales contract. Otherwise, you will need to verify that the purchase price is fair market value if:

-there was a significant change in value

-the condition of the property changed

-you didn’t purchase the property in the open market

“You may want to ask yourself why West Van is worth $3,000,000 more for the same place as say New Westminster. The OB/Gorge spread will widen a lot further in the coming years.”

Ah, another number you pulled out of your ass.

JJ – I was talking about 2417 Hamiota.

Must be awesome to think that everything is always about you 🙂

Luckily, AG the banks don’t rely on you when lending their depositors money. Because you would spend most of your life in court being sued for negligence.

Because $900,000 + $750,000 = $1,675,000 not 2.4 million.

As I said, you can pay anything you want for a property but that doesn’t make the property worth it. What is or is not Market Value has been defined over a hundred years of court cases in Canada. What I hear from some estate agents is that if the property sold at X amount then that is its market value. That is a statement that illustrates the speaker’s lack of knowledge.

Hundreds of text books have been written on appraisal and market value and not one of them defines Market Value as what a property sells at.

Interesting that 2117 Neil sold so quickly and for $981. Hamiota is in similar condition (smaller lot though) but has been sitting on the market for a while. 2951 Eastdowne is arguably nicer, but has been on the market 36 days and had the price reduced from 1M to 950K. Would Eastdown not be a better buy at 950 than Neil at 981? Just wonder what makes some properties go ballistic and some go stagnant.

Lot value in most of Oak Bay is around 900k now. That 300k doesn’t seem unreasonable given the prices that we’ve seen this year

Just for those that are interested in construction costs. BC Assessment obtains the size of the home from the building plans along with an estimate by the owner/builder of construction costs. Which is cross checked against their data base of construction costs as being reasonable or not.

So when you are looking at a home that is just a few years old, the value of the improvements will be a reasonable estimate of construction costs.

The recent sale of a newer house in Oak Bay worked out to be about $190 a square foot or about $750,000 to build. The property sold for 2.4 million and that would make the 12,000 square foot lot have a residual value of $1,650,000.

In contrast another newer home on the same street shows a construction cost of $183 a square foot or $546,000. This home sold at $1,825,000 with a residual to the land of $1,280,000

When you pay more for a property than the cost to build the home new that signals an overheated market in that buyers are not willing to wait a year to build a home to save $350,000 to $400,000 dollars. And that’s their decision. No one says they have to pay fair market value. They can pay anything they want to. But it does have an effect of skewing the data, especially in Oak Bay where there are so few sales, which then shows the median and average unrealistically too high.

Because the buyer paid more than the cost to build, the property is not considered to have sold at fair market value as it goes against the economic theory of substitution which states that a buyer will not pay more than the cost to replace the property today. And that means this sale would be unsuitable for sales analysis and should be discarded.

Meanwhile in Vancouver foreclosures are heading up and nice parts of Coquitlam are getting slashed from $1.24 million to $990K, that’s $211K haircut.

@brettdrc

Great convo tonight with a paralegal for a company that focuses on foreclosing. She said they have never been so busy. #vanRe

@FIVRE604

“Price reduced from $1,249,000 to $1,149,000 to $1,099,000 to $990,000.00”

#VanRE

That $930k asking price is shocking and I can’t wait to see what they get. Another example of a place that, were it just on the other side of Foul Bay, would probably start with a 6 or a 7.

You may want to ask yourself why West Van is worth $3,000,000 more for the same place as say New Westminster. The OB/Gorge spread will widen a lot further in the coming years.

“Your graph is nice, and it looks meaningful, but it is actually unconnected with local demographics.”

Like all of Mike’s charts are. The immigrants with high skills are for major infrastructure projects spread across Canada. Referring every growth story to Victoria is getting lame.

Beside’s Helmut Pastrick let the cat out of the bag that the market is going to sell off and his 10% decline call is best case scenario for someone in the business. CMHC and Libs didn’t change the rules for 10%.

By the time the immigrants get here it will be 4 years from now before they are buyer ready with employment history as the banks will be clearly tightening up lending standards as per Reasonfirst’s post.

2417 Hamiota asking $930,000 – would this house in the Gorge area even go for more than $600k? Is Oak Bay REALLY worth an extra $300,000??? Unbelievable.

Description says: Southern exposure and almost 6500 sq feet make this lot and home perfect for an addition, holding property or tear down and build your dream home.

$930k for a teardown!

Look at the discount you get for East Sooke! http://www.luxurybchomes.com/properties/695-cains-way-363242

This house is listed at $1million below replacement cost, according to the listing. Pretty nice house for under $2 million.

http://www.theglobeandmail.com/real-estate/the-market/ottawa-proposes-sweeping-changes-to-spread-mortgage-risks/article32467860/

My first rental in Victoria was the basement of 4050 Braefoot Rd… ahh the memories!

Back then, this was a rural area with horses and sheep. I thought it was so cool being one block from McKenzie but having this laid-back area of farmers. Then one guy sells his acres and boom, bunch of big houses stuck together, ruining it all.

Mt Doug/Mt Dong… slip of the tongue? Maybe that’s what the realtors are calling that area now. They trying to tell us that this is an area of high Chinese population? Well duh.

Who writes these descriptions! It blows my mind the owners don’t seem to be vetting these things.

What is a “one of a kind potted landscaper”? There’s probably only one potted landscaper in the Mt Dong area, so that would make them one of a kind.

Also gotta love the area downstairs for the “reclusive teenager”

High demand on Mnt Dong indeed. That’s the kind of quality marketing that $40,000 buys you

Morning laugh…..check out MLS 371339….only a real man can afford this house!

Deferring taxes is great vehicle for seniors and families. IMO it is beneficial for society, it allows people to stay in their homes and might even be a net net, if they don’t have to move to social housing/ care homes etc…

Immigration policy; the right type of immigration of skilled workers/entrepreneurs + programs that facilitate value added manufacturing/internet/IT/services would be awesome for the country. Yes, RE might be impacted, but so be it, we got lots of land. This will lead to better employment for our future generations. Canada could add 10MM people over the next decade and we would be fine! BC’s top 15 richest people, Amar Doman, Hassan Khosrowshahi, Chan Family, Richard Li, Gaglardi, Louie, Lalji, Bosa, Aquilini, 9/15 are immigrants or 2nd generation Canadians. Left out the anglicised names. The aforementioned are all business owners and it is very likely they have created a lot of good jobs for the local economy. Might be off by 1 or 2 people, but the numbers speak for themselves.

Or course immigration (demand) affects RE prices (supply). But immigration also leads to GDP growth, job growth, etc… For a good policy on immigration, one might look to Singapore to see what they have done.

Victoria is #7. Oh well…secret is out. RE is going through the moon now, buy now or get left out forever. Seriously, Americans have been coming to Victoria in droves since when I was a busboy at a certain watering hole on the inner harbour many moons ago. They might love to visit, but only a miniscule % are going to move here or buy a dwelling here!

“Condé Nast Traveler readers cast more than 100,000 votes for their favorite cities in the world (outside the U.S.) in the 2016 Readers’ Choice Awards survey.”

So according to a survey of a bunch of Americans that bought little souvenir totems and some fudge after being shuffled off a cruise ship and bussed down to the strip for a couple hours, we are number 7 baby! Fuck it, I’m sold. Civic booster convert right here.

Victoria’s only the 7th best city in the world!

Come on, we know we’re #1 🙂 At least they have us 30 spots ahead of Toronto.

Newcomer, it should be common sense that rising demand from increased immigration will raise prices. There may be a slight lag as they rent before buying.

Some research on the topic.

http://www.theglobeandmail.com/news/british-columbia/research-ties-immigration-to-inflated-house-prices-in-bc/article30696275/

I’m quite certain a 50% increase of highly-skilled immigrants as proposed over the next 5 years will have an affect on our real estate markets.

Michael,

The immigration numbers for BC are readily available. For example, here: https://en.wikipedia.org/wiki/Demographics_of_British_Columbia

or with more detail, here:

http://www.bcstats.gov.bc.ca/StatisticsBySubject/Demography/PopulationProjections.aspx

If you graphed it, you would see the population growth sharply declining in the recent (2000 onward) price run up, and that growth was much higher when prices were flat in the 90s. Similar trends can be seen for Vancouver and, though there is no clear trend for Victoria, as the population is really too small to show strong trends, growth has been below average during the run-up.

Your graph is nice, and it looks meaningful, but it is actually unconnected with local demographics.

Finally something in the Times Colonist about the new mortgage rules. Oh wait, nope, just the TC Extra! Extra!

HOUSE PRICE DIP PREDICTED

For those that don’t receive it, here’s an online version:

https://www.pressreader.com/canada/times-colonist/20161020/282308204635236

Condé Nast ranks Victoria as 7th out of 25 for Best Cities in the World.

All Canadian cities:

6 – Vancouver

7 – Victoria

18 – Quebec City

37 – Toronto

39 – Montreal

http://www.cntraveler.com/galleries/2014-10-20/top-25-cities-in-the-world-readers-choice-awards-2014

http://www.cbc.ca/beta/news/business/monetary-policy-poloz-bank-canada-1.3811750

Donald Trump and new housing rules delay Canada’s growth takeoff

http://www.cbc.ca/beta/news/business/crea-house-prices-capital-gains-1.3801499

Capital gains tax break becomes part of a double whammy when home prices fall: Don Pittis

A slide in prices and its impact on the tax advantage could change the plan of some potential buyers

I love how houses used to be described by number of rooms total, rather than by number of bedrooms. Thanks for the throwback, Leo s!

Foreign buyers swarm victoria market…. in 1927

Uh oh…all major banks.

“Ross Kay @rosskay 6 hours ago

Warning Issued: Former 66% LTV ratios in latest lender mortgage portfolio disclosures for Q2 2016 are now at 83.5% in Vancouver.”

Increasing immigration 150K is not the big deal you make it to be Mike when you spread them all over Canada not Victoria or Vancouver as you suggest. The odds are no slam dunk it will be passed.

“The council and government officials are anticipating some resistance to the recommendations.

Immigration Minister John McCallum and Innovation Minister Navdeep Bains say they support more immigration, but acknowledge facing some opposition from within the government. Several recent polls – including one conducted for Mr. McCallum’s department – found little support for increased immigration.

Mr. McCallum said in an interview on Tuesday that he is not prepared to go as high as 450,000. But he suggested the number will rise from current levels of 300,000 when the government releases its 2017 immigration targets by Nov. 1. “This is a somewhat controversial issue, especially when you talk about numbers that high,” he said. The minister said no final decisions have been made.

Attracting investors to infrastructure will involve some degree of privatization – either for new projects or selling federally owned assets. A recent Public Policy Forum report said airports, water and waste-water infrastructure are the likeliest candidates.

However, public-private partnership projects have drawn criticism in Canada and abroad, while political meddling has created the kind of uncertainty international investors do not like to see, including efforts by the Ontario Liberals to change the terms of the privatization of Highway 407 set by the previous government.”

MD80, the intent of deferring the taxes is to help those that have fallen on hard times. Someone deferring taxes to buy another property is just gaming the system.

“And I don’t think we’re on the verge of World War 1 again. ”

Let’s hope not. One wrong decision and who knows.

Russian fleet spotted off Norway as it heads toward English Channel

https://www.theguardian.com/world/2016/oct/19/russian-fleet-spotted-off-norway-as-it-heads-toward-english-channel

I’ll admit, I do love the proposal. We could certainly use more skill in this country 🙂

increasing immigration by 50 per cent to 450,000 people annually over five years while easing the process for high-skilled and entrepreneurial foreigners

Vancouver sales and emigration by foreigners to the US will only increase as the CRA steps up the money launderers and tax evaders program. No wonder sales have tanked in Vancouver. The planes are heading south.

CRA recovers $240-million in real estate tax-fraud probe, but lags in B.C.

“The Canada Revenue Agency’s crackdown on tax fraud in the overheated real estate markets of Ontario and British Columbia is bearing fruit, with auditors recovering $240-million in unpaid taxes and $12.5-million in additional penalties over the past 18 months, new figures show.

The money is being recovered as auditors focus on several issues identified in a series of stories in The Globe and Mail, including property flipping, efforts to hide capital gains and avoid paying sales taxes, and false ownership statements.”

http://www.theglobeandmail.com/news/politics/cra-recovers-240-million-in-real-estate-tax-fraud-probe-but-lags-in-bc/article32447204/

You mean all the Syrian immigrants Mike who have zero dollars ? The Chinese billionaires just said they aren’t coming here anymore and Seattle is reaping the results. To draw an arrow exceeding 1912 is pretty pathetic but what’s new. Desperate measures for a maxed out investor.

Seattle becomes No. 1 U.S. market for Chinese homebuyers

“A growing wave of money from China and other foreign countries is pouring into the Seattle-area housing market, helping drive home prices even higher. And since July a new tax on international buyers in Vancouver, B.C., long a popular market for home seekers from China, has focused even more global interest here.

Seattle saw more inquiries from mainland-Chinese homebuyers than any other American city in four of the last seven months, according to Juwai.com, China’s biggest real-estate site for buyers looking in North America.”

http://www.seattletimes.com/business/real-estate/seattle-becomes-no-1-us-market-for-chinese-homebuyers/

Fascinating when you align immigration to see the dramatic effect it has on prices (1985-1995, 2000-2010).

As the Liberals now increase immigration to a new record over the coming 5+ years, in all likelihood we’ll see a similar price effect.

http://i.imgur.com/1lB30Pp.png

And I don’t think we’re on the verge of World War 1 again. Not much chance of reaching the Lib’s goal of 450k in 2021 and then seeing it fall back to 40k like in 1914.

@Cadborosaurus

“deferring them to invest is also unethical and does nothing for the city.”

How so? The program doesn’t prevent the city from getting your tax $ but rather the province is paying them on your behalf via the loan.

I understand GWAC, and I was suggesting that you can’t just look at property taxes. You also have to look at user fees such as the utilities the city charges. A user fee you can alter by changing the amount of say water you use. Of course not everything on your utility bill is a user fee some are taxes that should be on your property tax. But that’s just city politics.

1912 now Mike ? But that’s an excellent example of a bubble bursting and how history is repeating itself as we speak. Notice how the immigration fell off a cliff. Keep up the great DD there Max. 😉

“However, the prewar boom was not to last. Between 1913 and 1915, following the U.S. stock market collapse, and resultant worldwide depression, Vancouver’s real estate bubble burst for the first (and possibly only) time; suddenly, commercial rents declined by 50%, and ordinary working people, no longer able to meet their obligations, defaulted on their loans. The city of South Vancouver went into receivership. The market was decimated. In fact, there is one recorded instance of a corner lot on Cambie and Broadway being listed for $90,000, and eventually selling for less than $8,000.

Even though the Depression took longer to affect Vancouver’s real estate market than it did the rest of the province, construction slowed to a virtual standstill.”

What happened to those prices in the 20s and 30s. You know hawk will ask. :).

For instance, if you’ve ever wondered what drove Van prices to stratospheric levels in 1912…

…look no further than the immigration chart below.

JJ all I was doing was throwing it out there. :).

Society benefits from schools and alike whether u use them or not. I just think property tax should have a component of the number of people. To add the 75 year old has 18k in income while the 6 people in GH have 200k.

Someone mentioned Canada’s record immigration over the past 12 months at 320,000+ people. Looks like the Lib’s are about to set new records living up to their pro-immigration stance.

Advisory group’s economic blueprint calls for dramatic increase in immigration, foreign investment

The Globe and Mail

A group of external advisers to Finance Minister Bill Morneau will call on the government this week to dramatically increase the level of immigration and foreign investment coming in to Canada to stimulate a sluggish economy in future years.

Their recommendations include increasing immigration by 50 per cent to 450,000 people annually over five years while easing the process for high-skilled and entrepreneurial foreigners to come here; building a new department to entice foreign direct investment into Canada; and creating an arm’s length infrastructure bank. The recommendations were confirmed by several senior sources who spoke with The Globe and Mail.

To put in perspective, 450000 would be chart-busting immigration!

Cadborosaurus I agree with you. It is ethically slimy to defer your taxes so that you can buy more property. I think it is taught as a first year course at Trump University. I don’t think Women’s studies is an elective there either.

GWAC, that’s our progressive tax system. Is it fair that a 75 year old pay more taxes than 6 people in Gordon Head. Property taxes are not a user fee like water and sewer. If it makes you feel better, the people in Gordon Head will pay more for utilities than the 75 year old who uses less. I’ve had similar discussion with retirees who never had children and still have to pay the school tax. They don’t think they should pay for schools because they are not getting a direct benefit.

I guess you would have to look at combined property taxes and user fees to compare different areas.

Deferring your taxes appears on your Deed. At renewal time the banker will do a title search and discover the deferment.

Read your mortgage documentation about your responsibility to not jeopardize the security of the loan and that includes keeping adequate house insurance. Since deferring taxes reduces the equity in the home and may jeopardize the mortgage principle.

I will throw this out. How fair is it that an 75 year old person living in their house in oak bay who has lived there for 40 years never renovated pays more tax than 6 people living in a house in GordonHead.

This policy is really age discriminatory. If anyone’s going to get a break on property taxes via deferral it should be those who need to defer aka income/situationall based, not because of their age. 55+ year olds who likely have the net worth and ability to pay their property taxes deferring them to invest is also unethical and does nothing for the city.

LeoS said: “So this hypothetical couple might end with an extra $90,000* to send their rugrats to college.”

Leo, you’re a bright guy, you have exceptional skills, and you manage this blog with finesse, but you’re a tad naive if you think that people who take advantage of tax deferral will actually save and invest the money; maybe 5% will, but 95% will simply spend it. However, the 5% will prosper, not just from tax deferral, but from their logical, disciplined, long range planning and goals that will define their lifestyle.

Yes morally it is a little difficult to justify if you don’t need the money. Be like Trump and don’t pay your taxes!

It kind of is. I’m just not as comfortable with borrowing to invest in the stock market vs. RE. I’m not defending it as entirely logical, but it has been lower risk. We are sitting on cash alreadydue to concerns about success in the market and being unable to find a place to buy that fits our criteria so we don’t need to borrow more.

I’d be more comfortable investing borrowed funds at 1% than 2.7% and I’m not certain the interest can be deducted when you invest this way, although it probably can. So, I guess the bottom line is that it is probably a good financial move for a family with dedicated investment capabilities and discipline.

I also think there should be income testing for this. Not sure why the province would provide low cost loans to people no matter what their income is. Seems like a poor practice for a province with debt.

Interesting find Leo. Worth Looking into.

Why? I think it’s the same question as mortgage paydown vs invest. If you have decided not to pay down the mortgage aggressively in favour of investing in higher yield options, why not defer the property taxes at a similarly low rate as the mortgage? (and simple interest to boot!)

We deferred our taxes under the family program this year because we purchased a rental property and needed the immediate cashflow help. However, I probably wouldn’t do it again to re-invest just because I like to keep my finances fairly simple. I also don’t like the idea of having a large sum to pay off if we wanted to refinance our loan for some reason.

Yeah – we have a heloc which we’ve never used. Don’t think it would be impacted by deferral at all as it has been granted already. And my last rbc mortgage renewal asked no questions – just offered an auto renew. Seems pretty common. Still I would not do this unless over 55.

So the lady that came here asking if she should sell her house where the common advice was to defer taxes and investigate reverse mortgages can’t actually do both of those at once? What if you get the reverse mortgage first and then defer taxes?

What you’re missing is that the tax deferment appears on your Title of ownership. If you want to borrow against your home or have an equity line of credit you will have to pay up your taxes. If your roof needs to be replaced and you need to borrow then you will have to pay your back taxes.

Not much of a benefit. Easier just to use your line of credit at a low interest rate and pay the taxes. In that way a $5,000 property tax bill costs you $20 a month on your line of credit. At that rate you can collect pop bottles on the weekends.

OMG! – that’s why there are so many bottle collectors these days! They’re paying their property taxes!