Oct 17 Market Update

Weekly stats update courtesy of the VREB via Marko Juras.

| October 2016 |

Oct

2015

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 244 | 398 |

734

|

||

| New Listings | 301 | 500 |

925

|

||

| Active Listings | 1995 | 1990 |

3170

|

||

| Sales to New Listings | 81% | 80% |

79%

|

||

| Sales Projection | 800 | 800 | |||

| Months of Inventory |

4.32 |

||||

No noticeable impact from the mortgage rule changes yet, but they just went into effect today. We are still tracking 9% ahead of last year’s sales rate and that combined with 40% less inventory that still makes the market ridiculously tight. I would expect moderation in the coming weeks at least in the lower end of the market as some of those buyers that were stretching for a sale adjust their expectations.

@JJ

Thanks for the numbers. Interesting to see the big drop in Vancouver buyers from summer until now.

So prices are holding despite a lack of Vancouver buyers (I assume that was your point).

I’m going to give Hawk a bit of credit here: hype helped drive prices. Doesn’t matter what reality is as long as the local buyers (actually driving the market) bought into it. The anecdotes about luxury cars and “asian” buyers.. when how much of our market was foreign? 2% including Americans? Something low enough to be forgettable.

If we didn’t have all the media attention I don’t think we would have seen prices accelerate as quickly. Of course, now the hype is gone and we’re still seeing bidding wars.

I’d blame that on inventory. Yes, months inventory has increased slightly, but the quality isn’t there. Anything decent is snatched up quickly. Anything sitting is sitting for a reason. We need a lot more inventory to cool things down.

The anecdotes I’ve heard from my realtor friends matches what you are saying regarding the mix of properties Vancouver buyers are buying. I was surprised to hear about some wanting cheap fixer-uppers etc. It doesn’t match the cliche of the equity rich Vancouverite or my own experience.

The two couples I know that came over moved up the property ladder significantly. But that’s anecdotes for you. 2 isn’t a very good sample size.

New post: https://househuntvictoria.ca/2016/10/19/delayed-taxification/

When was the last foreign tax in BC your referring to Mike ? Your posts are getting desperate. The foreigners are leaving, the billionaire Chinese guys just told you.

No they’re not Michael.

September numbers show Van is already rising again (all property types).

August’s ‘average’ plunge was simply due to sales mix (ie. a temporary halt to the sales of the extreme high-end). Besides, history shows foreign buying always resumes shortly after the initial shock of a new tax.

http://www.yattermatters.com/wp/wp-content/images/2016/10/2016-10-01-Average-Price.jpg

This year has been anything but normal. There was an increase in the number of Vancouver buyers temporarily in the spring. Now we have returned to historical norms where 70 to 75 percent of all purchases are made by locals. And I suspect that is normal for most cities as people move from one city to another. I’m sure people in Duncan are blaming their higher house prices on rich Victorians moving there too.

Vancouver buyers driving up prices is a red herring. Our detached housing market is primarily driven by locals purchasing property. Once you say Vancouver, people assume that all Vancouverites are rich and therefore pushing up prices. Vancouver buyers are no richer than Victorians. They are buying in all price levels and all types of properties just like Victorians are doing.

Booyeh! That’s Canadian for booyah, eh.

New records are on the way.

http://stockcharts.com/h-sc/ui?s=%24tsx

“We had nearly no international buyers here on the way up (same as usual). Sure some vicarious money via Vancouver locals cashing out and moving here. Was that the sole driver of Victoria price gains? I don’t know. ”

Jack settled that number question Bingo. Was it the sole reason ? It fueled the whole media/industry push, as was evident on here daily by stories by posters and Marko of open houses lined up around the block, large groups of high end cars circling the blocks, mailbox stuffings and door bangings begging you to sell your home. Where are they now ?

Not to mention agents gloatingly promoting filthy rich Chinese pouring in on planes daily on the news (and being evident at every open house). You tell me with these facts pumped all over the news nightly from February til about a month ago if it would not have an effect ?

Don’t have to wait to see what’s happening in Vancouver, look at the chart. Show me when it’s dropped more. The money is leaving Vancouver by the same planes it came in on.

http://www.canadianmortgagetrends.com/wp-content/uploads/2016/09/Vancouver-Average-Price.png

Just Jack:

The Vancouver buyer numbers seem like a pretty normal seasonal spread. I think that we will have to let the numbers run into the spring before a clear picture shows up. How do your numbers compare with the year before?

Maybe. The program is growing in popularity with 38,000 current users – most over 55:

At a rate of 1% simple interest this is a much better deal than a mortgage or HELOC.

http://www.vancitybuzz.com/2016/01/rich-bc-homeowners-property-tax-deferral-program/

If you can’t afford to live in your place with property tax deferral you may be better off selling and downsizing. Seniors with mortgages that could pose an issue for renewal with a deferment might be in this category.

Well Bingo, Vancouver buyers for houses in the core has been drying up ever since our market peaked in sales back in April/May.

Month Sales, Number of Vancouver buyers of houses in the core by month

Jan 11

Feb 16

Mar 36

Apr 43

May 41

Jun 38

Jul 28

Aug 22

Sep 14

Oct 2 so far this month

And yes our months of inventory for houses in the core is increasing too. It has nearly doubled since April/May

Month Months of Inventory

Jan 2.84

Feb 1.66

Mar 1.31

Apr 1.06

May 1.09

Jun 1.26

Jul 1.86

Aug 1.81

Sep 2.04

Yes Totoro, some will elect to defer the taxes as long as the property is clear of all mortgages that is a possibility. But by doing so that means the person can not have a home equity line of credit or a mortgage. The bank will not renew the mortgage if you have a charge against the property. And that can become a problem if they need a new roof or windows.

It has also been my experience that most pensioners will not defer their taxes. They want to pay their taxes and not encumber the children with a debt that has to be paid off when they die.

And I agree with them. It isn’t that they are bankrupt and need assistance, they have lots of wealth, just no money. Not everyone is out to get something for nothing.

So while your guess is logical it isn’t reality.

We had nearly no international buyers here on the way up (same as usual). Sure some vicarious money via Vancouver locals cashing out and moving here. Was that the sole driver of Victoria price gains? I don’t know. It was definitely due to too many buyers and not enough inventory. Locals were still the main buyers, but 15% being Vancouver is nothing to sneeze at. The question is what happens if the Vancouver demand dries up. Months inventory should increase, but we have a long way to a fair market.

In the short term I don’t think we’ll see a drop in Vancouver buyers. It’ll be interesting to see numbers if VREB releases them. I think a lot of people are going to cash out on the way down and they’ll “have” to buy somewhere. Obviously they don’t have to buy after cashing out, but the rental market is tight in Vancouver. Especially if you need to accommodate big pets, an RV, kids.. whatever. There are lifestyle things someone who previously owned a SFH won’t want to give up. Especially if they now have enough equity to be mortgage free in another market (like Victoria). Then there’s the ego thing. Some people can’t stand the thought of “paying someone else’s mortgage”. The same people are often bad at math.

Time will tell if and how we are affected by Vancouver. Heck, we still have to wait and see what is going to happen to Vancouver. I think prices have peaked and are now on the way down, but it’s not going to happen over night. Slow decline is my bet.

Barrister

Meh. Maybe? I don’t know if Rate hub’s calculator is up to date as far as qualification rules (as changing the rate affected affordability quite a bit). Roughly it shows people can stretch themselves if they choose (and can scrape together a down payment).

The interesting thing with the new rules: it may take out the bottom end for a while, but those who are able to qualify should be able to weather rate increases no problem (since they were qualified at a higher rate). Doesn’t help anyone that bought at peak before the new rules of course.

It’s interesting how few high ratio mortgages there are in Victoria. Where is everyone getting their down payment from? Are young buyers relying on Bank of Mom?

AG: No there is no way to bet $50.00 on the average house price. The people on this site, with all respect, would spend the next year arguing what is average and what is included in the definition of a house and, possibly, in which currency should those calculation shouldbe made.

Lets pick something easy instead like figuring out what colour the center of a black hole is?

But it was a fun thought.

That seems an incredibly illogical decision given that they can just apply to defer the property tax until the property is sold. Problem solved.

Here is the qualification criteria for those who are disabled, over 55 or there is a program for those with kids under 18:

Let’s make this interesting.

Is there a way for us all to put in say $50, and make a prediction for the average Victoria house price in 12 months? Winner takes all.

For those on a fixed income, higher property taxes are a factor in selling. In 1994 a million dollar home owner paid $10,000 a year in property taxes. This year a million dollar home owner will pay around $6,000 a year in property taxes.

A million dollar home today isn’t very much of a house and a lot of not so rich people on fixed incomes still live in them. What if the property taxes for a million dollar home did go to $10,000 today?

In my opinion that would make a lot of not so well off pensioners sell. And judging by the cheap happy hour beer night at the Penny Farthing there are a lot of them.

MIchael

Fuzzylogic is paper profit vs real money paying increase taxes.

Those who sell or will sell no issue. Those that are on fixed income and or retired and like where they live have a potential cashflow issue if they cannot defer under the government program. Anyways lets see how it plays out in June when the actually bills arrive and lets see how happy people are that are impacted.

Fuzzylogic – I don’t want to make a million this year in property since my taxes (& rents) will go up a few thousand.

And why do the bears keep saying Sept data isn’t out for Vancouver? It was out right after Victoria’s and shows prices increased month-over-month.

Introvert/tot

So yes will some will have seen their house assessment go up by 30% their taxes may only go up 10 to15%. Boy somehow that is not a win for those who do not plan on moving and may be a tad upset and may not be able to afford it with their 2% government raise. All I saying next years tax bills in July may be shocking for some.

I honestly have no idea. All I know is I never claim CCA (because it would void the PRE), and my maintenance expenses are fairly minimal. (Two largest maintenance expenses in approx. seven years of landlording: replaced the elements on our home’s electric furnace [few hundred dollars], and replaced the 1970s-era dryer that finally conked out in the suite [$600].)

Almost no one understands this concept.

JJ

The justification is Brand. Same reason people buy a 80k BMW vs a 30k accord. Both do the same thing and are the same size and will last the same amount of time. The BMW represents something to the buyer and what he or she is trying to tell everyone. That is why less sales in the “in” hoods still do not mean lower prices.

@JJ no need to bring logical economic theory to this market. People are paying iPhone 7 plus prices for 90’s Motorola flip phones….

Totoro

Those people with more expensive houses in nicer hoods will pay a lot more and those areas that see less increases. A house going from 750 to 1m vs a condo going from 250 to 300k. Victoria will experience this. Those with lower price housing will see a nice cut in taxes. Victoria/ Sannich and even oak bay will see some very surprised owners with their tax bills. While the overall money collected will only go up 3%. A larger burden will be paid by those that have seen huge increases on their street or areas. IE GordonHead vs the area near Mann street.

A $100,000 increase in value translated into approx $700 in additional property taxes last year in Victoria. As properties rise in value, the mil rate is decreased as tax budgets are budget based, not tax assessment value based. This means that the amount paid per $100,000 should also decrease next year if assessments rise so the impact on the taxpayer’s bottom line would be a fraction of the % of the gain.

I won’t be complaining about a few hundred extra in taxes on a $100,000 or more gain, albeit on paper. If long-term the less popular streets have lower gains the property tax differential is a minor consideration imo.

The tax notices will be fun. As an appraiser you are suppose to comment on the tax assessment and property taxes for the property you’re appraising. And I do find myself commenting that some of the current assessments are neither reliable or reasonable relative to other similar properties currently selling in the marketplace and that may effect future property taxes (up or down) if the property is re-assessed. Or sometimes I will advise the client to appeal the assessments to have them reduced. Not so much in the core housing market but some high end condos or properties further out from the core.

As you look at the modes for houses in the core, core condos or houses in Langford and Colwood. Only the core housing market has had a significant shift to higher prices. And most of this increase is attributable to Oak Bay, Victoria and Saanich East. It is very localized.

As house prices rise fewer people can buy. That’s the same for steak and BMW’s as it is for houses. Any store keeper will tell you that to sell more you have to lower prices. If you keep raising prices people will choose to shop elsewhere. And in my opinion, that is what is happening to house sales in the core as prospective buyers are choosing to purchase alternative types of properties or elsewhere.

The difference between identical starter homes in the Gorge and Oak Bay it is about 350,000. In contrast the difference between near identical homes in Victoria and the Gorge is about $100,000. You really have to stretch your imagination to come up with some outrageous justifications for the price differences between Oak Bay and the rest of the marketplace.

“Yet Animal Spirit sales are down from the month before for houses in the core and have been trending lower since May.”

Jack,

Thus the noticeable decline in the local nightly news leading off with the “red hot” real estate market. I haven’t seen a “we can’t find a house in Fairfield” sob story for a while now. Haven’t seen any live auctions in Rockland for like 5 months now either. 😉

Tax assessments are going to be fun next year in those popular expensive hoods. It may do wonders for your ego to say you live there but your taxes are going up vs the less popular streets and hoods.

Yet Animal Spirit sales are down from the month before for houses in the core and have been trending lower since May.

Some say this is seasonal but if more out of town buyers were purchasing then we would not be seeing declining house sales in the core. And that is what is happening in condo sales. They are increasing as out of town buyers buy mostly condominiums in the core and not houses.

And that seems reasonable. If you are retiring to another city, why buy a house with all the associated expenses. Buy a newer condo and you can lock the door and go off to Mexico for four months with few worries. Better yet, if you’re from Ontario then downsize to a condo in Ontario and go to Europe or Florida during the bad weather months and not have to leave your friends. At least then your children will have access to the best post secondary education and best paying jobs in Canada.

“JJ – my suspicion is that the hot money from overseas that is no longer going to Vancouver is getting distributed to other locations such as Victoria. I have no data to back that up though.”

If it’s going anywhere it’s Toronto but the Chinese billionaires touring Canada say investors aren’t buying Canada anymore. I think if it was happening here Marko would be pumping it ad nausuem.

Ok…nan knows one. Another future ghost house. 😉

@ Animal Spirit: On hot money, I heard from one of the neighbors that the Dunlevy house that sold last week for 1.2MM or so was bought by Chinese folks who didn’t even want to look inside the house. This is very Vancouver like so maybe you are right.

Introvert – thanks – at what point do maintenance expenses become a trigger for CCA?

I think those are the main ones. If you do hire an accountant to do your taxes, you can also claim a portion of that expense.

JJ – my suspicion is that the hot money from overseas that is no longer going to Vancouver is getting distributed to other locations such as Victoria, driving up high end demand. I have no data to back that up though.

Low unemployment rates and the vast amount of construction happening to me mean that the current supply/demand factors won’t change to being a buyer’s market – maybe flatter though. Interest rates would need to change to change the underlying nature of the market.

With the CCA / PRE questions going around, it looks like my family is on the safe side – we rent out a room in the house (with use of the house and property) to a great boarder. One question, while we’ll obviously declare income, which expenses to claim? We have mortgage interest, utilities, property tax, maintenance, yard upkeep, some expenses to make the room livable, etc.

Your thoughts? Haven’t talked to an accountant yet…

JJ – my suspicion is that the hot money from overseas that is no longer going to Vancouver is getting distributed to other locations such as Victoria. I have no data to back that up though.

With the CCA / PRE questions going around, it looks like my family is on the safe side – we rent out a room in the house (with use of the house and property) to a great boarder. One question, while we’ll obviously declare income, which expenses to claim? We have mortgage interest, utilities, property tax, maintenance, yard upkeep, some expenses to make the room livable, etc.

Your thoughts? Haven’t talked to an accountant yet…

JJ,

I believe the Trumpf-style place was built by Fred the Caspian Carpet guy.

It’s a good month so far for Oak Bay house sales. 15 have sold ranging from a low of $828,000 for a house suitable for a Great Dane to a high of $3,298,000 for a gaudy Trump like mansion that was listed off and on since the day it was completed in 2015.

With only 79 house sales so far this month in the core, that is having an effect on both the median and the average. In the case of Victoria it has pushed both the median and the average substantially higher than the previous month.

A similar skewing phenomenon to either the high or low end may be happening in Vancouver and that may be a reason why their board is reluctant to release September data.

From my experience we need to have at least 250 house sales in the core during the month to make the data meaningful. And that doesn’t happen as we enter into and during the winter market. There is historically some seasonal variation in prices but when the market was stable for five years that variation was minor of under 5%. Our strongest market with rising sale volumes has been the Spring-Summer and the weakest is the one we are now entering into as the volume of sales decline.

But that doesn’t mean prices follow that same path. Many factors can influence prices and raise prices in markets with low sale volumes such as a drop in interest rates or easing of lending policies.

As we are enter our weakest market for housing the government is tightening up on lending. That should bring prices down. However, preliminary medians and averages for the first half of the month seem to show projected sale volumes are down from the month before but prices have risen substantially for houses in the core.

Is our core housing market over valued then?

Is it the rush by prospective purchasers to buy before the lending rule changes?

FrancVictorian

I think the first question to ask is whether your variables are normally distributed. I suspect they are bimodal so percentiles will not capture what is really going on. My guess is that a few people have a lot of money and buy a lot of real estate, so they skew the numbers while the rest of us have an average income and buy one house.

I thought Canada was going to boom next quarter, now it won’t be til mid 2018. Stick a fork in the housing market.

The Bank of Canada slashes its growth forecast

“The bank said the government’s recent move to tighten mortgage and tax rules around housing was likely to restrain residential investment, dampen household vulnerabilities and leave the level of real GDP 0.3 percent lower at the end of 2018.

Canada’s long housing boom has helped offset the oil price decline and a commodity slump, but economists believe slowing in most major markets – with the notable exception of Toronto – will hamper growth next year.”

http://www.businessinsider.com/bank-of-canada-interest-rate-decision-october-2016-10

I think the 25% cash sales is a very important number. It only makes sense that retirees would be paying cash since they have little or no ability to carry a mortgage.

The other group who would be paying cash are those that might be downsizing often to a condo.

The kids are grown, you sell your Fairfield house for 1.3 million. Get rid of your half million dollar mortgage and get a condo for $600,000. I have no idea how common that is. Marko what is your feel for that? Guessing it is a smaller group than retirees. But I have run into a number of people doing that.

As to income figures, does anyone know what the threshold income of the top 20% of income earners actually is. To be clearer what is the minimum income you need to have to get into the top 20%.

Income is not really an accurate gauge of wealth and buying power.

Those at the top are often incorporated and retain earnings in corporations at a 15% tax rate. And assets and inheritances are not counted. The wealthiest people I know in Oak Bay don’t have the highest incomes – that would also mean paying the highest amount of income tax which is not part of a smart wealth management strategy.

Two million invested and a paid off house will get you a comfortable lifestyle with a family income of $80,000 a year at a relatively low tax rate for a couple.

After tax income is a good measure of affordability when there are no other savings or assets.

“Average, not median. That can easily be explained away by the high end market dropping.”

East Van sales plummeting and price slashings of hundreds of thousands where joe average lives.

”@SteveSaretsky 12 hours ago

Van East detached on pace for 62 sales this month. Will be fewer than September. #VanRE”

“What’s with your obsession with Vancouver? Victoria didn’t go hand in hand on the ride up, but they’re tied at the hip on the way down? Different markets not directly tied. There has been some influence for sure, but Victoria isn’t going to mimic Vancouver.”

Ummm, maybe because it’s part of BC ? Victoria has generally followed Vancouver through out history but on a lower price scale because we are an island etc.

Victoria didn’t have billions of foreign money pouring in the last 5 years but the parabolic blow off top this year of Vancouver’s chart and Victoria’s rise was tied together with Vancouverites selling and moving here back in the spring and the FOMO being sucked in by the media and industry pump. What else could explain at $100K rise in a few months ? The pump was on and now it’s take cover with new mortgage rules etc.

Average price in an overbought market will show the early money direction indicators and the median benchmark trails by 6 months or more. Since most of the bulls on this board say over and over how Vancouver houses average $2 to 3 million a pop and they get slashed 700K and now it’s not a big deal ? As Steve Sartetsky says he listens to the large investors and they are selling Vancouver.

If you want to think you’re isolated in a cocoon Bingo, keep on dreaming, Victoria is not immune from international money flow when it influenced the price spike on the way up and it won’t on the way down either, history has shown that.

BC income Richest 20% $212,944/year income

This seems ridiculously high; 20% is like 1 in 5. If these numbers are true Oak Bay prices make more sense.

@Franc, don’t know if it is avg or median/quintile. I agree entirely with your observations of how the outliers could easily affect the income numbers.

My only conclusion after seeing the info and researching articles regarding net worth, is that the wealth gap between the poor and the rich is widening. The rich tend to be older, more educated, and have tripled their net worth over the last 15-20 year mostly via real estate and investments; and to a certain extent – income.

Victoria as a retiree hub, older people represents a large demographic. And if they follow the trends in terms of wealth, then there is a lot of it in Victoria. Hence, a partial explanation/understanding of the potential “wealth” driving the market.

numbers hack,

Are those stats reporting the average family income (presumably, but never stated) within each quintile? The 99th percentile would skew that number substantially — it wouldn’t surprise me if the 99th were close to 10x the 80th.

Not sure how much faith I’d put in their numbers given how imprecisely they’ve presented them.

Anybody have a chart of house sales percentiles over income percentiles?

Here is income stats for BC by Family in 2015 before the RE increases this year.

http://www.moneysense.ca/save/financial-planning/the-all-canadian-wealth-test-2015-charts/

BC income Poorest 20% $16,679/year income

BC income Richest 20% $212,944/year income

Toronto Income Richest 20% $298,000/year income

Calgary Income Richest 20% $363,000/year income

Vancouver Income Richest 20% $239,000/year income

BC Net Worth Poorest 20% $158K Assets

BC Net Worth Richest 20% $1.4MM Assets

It doesn’t break into Victoria BC separately. Also another anecdote, I have a few broker friends in the City who provide wealth management services. An account with $500,000 in investible assets elsewhere in Canada is considered large, and in Victoria, anything less than $1MM a year, you get the secretary/assistant. That tells me there is a lot of 1%ers in the city and not to mention someone previously poseted 1/4 of RE sales in Victoria are ALL CASH.

Leo: Thank you for the clarification on the article. It was very helpful.

Introvert:

Not so that you can sue him. but rather that should an issue arise then you can convince the tax department that you were acting in all good faith and with no intent to avoid. Honest mistake goes a long way to smoothing a settlement. I am not saying your accountant is wrong but I am suggesting that it does not hurt to be a little prudent when it seems to be a gray area. But please yourself.

Bingo:

Thank you, that was very helpful. Your numbers would seem to suggest that the Victoria market is to some extent supported by local incomes. That seems to support your position that the Vancouver drop will not be mirrored here.

Hawk:

Average, not median. That can easily be explained away by the high end market dropping.

I do think Vancouver prices can and will drop a lot. But Vancouver has a lot farther to fall than Victoria.

What’s with your obsession with Vancouver? Victoria didn’t go hand in hand on the ride up, but they’re tied at the hip on the way down? Different markets not directly tied. There has been some influence for sure, but Victoria isn’t going to mimic Vancouver.

How about this for a theory: as people start to bail from Vancouver as prices drop some of that money will come here. People are going to bail for sure. Whether they come to the island after cashing out.. who knows. But it could bolster prices here for a while.

Regardless we need more inventory for prices to drop here. We’re scraping the bottom of the barrel (Neil for 1 mil?!).

barrister

I’m curious about this too. Too bad people don’t have to report income when buying so we’d have stats on that. I’m assuming people buying SFH are making over median, but I could be wrong. Median family income in Victoria was 88K circa 2014. So let’s assume 90K currently.

According to Ratehub that means you can afford 840K if you have 20% down (30 year amort). That drops to 760K on 25 year.. at their rock bottom 2.14% fixed mind you.

Both scenarios are $2500/month. That seems like a lot on 90K (especially if it’s single income). That’s around 70K take-home. Add in property tax, insurance etc and it’s easily 35K/year to keep your home without counting any maintenance. Half your take-home just to “own”. No thanks.

Assuming you have 200K down you need an income of 109K for a 1mil mortgage. For 25 year amort you’ll need around 125K income. $3550/month on 109K income seems absolutely nuts. You have 10K/year more take-home than a family making 90K but 12.6K more in mortgage fees per year. How does that math work?

Anyhow.. it looks like you don’t need to make much more than the median family to get a million dollar mortgage (assuming you have 200K). You just have to be willing to stretch yourself to the limit. So maybe lots of families can stretch to 1 million.

So I can sue him if he’s proven to be wrong? No thanks.

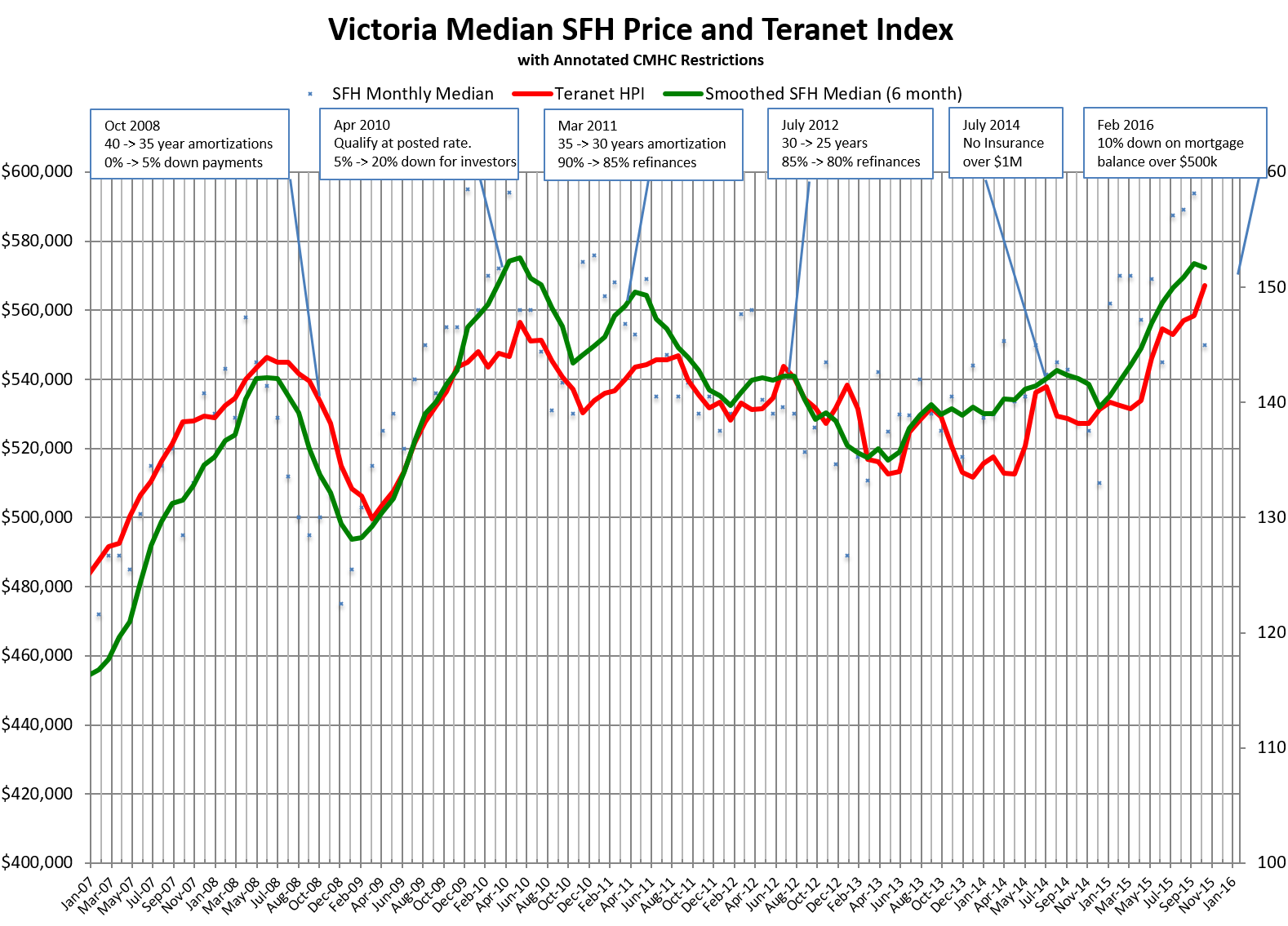

They have been making changes since 2008. In 2012 they reduced the maximum amortization from 30 to 25 years and reduced refinances from 85% to 80%

Amendment made by the real estate council of BC. They are increasing the required grade to pass the Realtor exam from 65% to 70% as of January 1, 2017. The first of many screws to be tightened on the industry I’m sure.

Please do not limit postings here. I am learning so very much from the discussions.

Besides, Jerry, I just bristle at the mere hint of anyone trying to limit anyone else’s speech. Read the posts, skim them or move along but continue to let people speak.

Would the mods consider limiting individuals to a certain number of posts per day? The rolling interchange here used to be reasonably trenchant but now it seems people can’t walk past their computer without feeling compelled to type and post any half-considered notion which pops into their head.

[Nope, sorry - admin]AG:

I noticed the date on the heading of the article but when you actually read the article it clearly refers to the recent changes as near as I can tell. But perhaps I am wrong. I think we can safely assume the author did not have a crystal ball.

Dasmo:

In ten years Imperial Tobacco will dominate the marijuana business.

I am not thinking of any subdivision of the land rather selling it to a developer for a luxury estate.

@ Barrister, Do you really think that suddenly they will let you subdivide your ALR land in ten years? It’s only going to get harder to do that…. It would be a good investment if you had a good farming business plan. Maybe an underground organic cannabis farm?

There’s nothing like an article from 2012 to convey the immediacy of the threat to the housing market 🙂

Marko:

I am thinking that the best investment property for me at this age might be ten orfifteen acres of vacant farmland in the Peninsula within the agricultural land reserve. No tenants just a professional farmer. What are your thoughts? I am thinking of a ten year investment window by the way.

@Hawk that article is over four years old.

Looks like lots of alligators to dodge when renewing now. If you’re deep into your leverage/HELOC and other debt, things could get very expensive.

New mortgage rules could make switching or refinancing tougher

http://www.theglobeandmail.com/real-estate/mortgages-and-rates/new-mortgage-rules-could-make-switching-or-refinancing-tougher/article4389044/

Marko:

Sounds like you are working far too many hours. As for your kitchen it may be time to giving some thought to hosting a dinner or two a month. In my experience the personal connections that you foster that way pay off many times over. People often overlook the personal connections that bring value to life.

But different strokes for different folks.

I agree with Barrister about the idea of stuffing young people into shoebox sized apartments and how there is no sustainability in that. People need space to raise children and have a family and a future. I believe that cities will start to shrink. I know this goes against what the current thinking is. Cities have been growing. But I believe a big change is on the near horizon and city governments haven’t a clue what is about to happen. My prediction is that the young people will move to the outlying areas of the city and telecommute. (Those who have to be physically at the office will commute by autonomous cars…. and not so far off ….drones. ) The commute will no longer be an issue because time will not be simply wasted. Who would live in an expensive, tiny box stacked one on top of another if another alternative is possible? The taxes in the city are also outrageously high compared to outlying areas where the cost of housing is hundreds of thousands of dollars less and taxes are low. Look at Sooke and the surrounding areas. It’s filled with young people and baby strollers everywhere.

So we lived in a one bedroom 530 sq/ft condo for a year and then we lived in a one-bedroom condo 780 sq/ft condo for almost three years. Last 18 months on a 1/2 acre, huge house, three car garage. Our master+ensuite+walk-in is bigger than our first condo.

I am not any healthier (physically or mentally).

I am not any happier.

I don’t feel like I wouldn’t be able to go back to the 530 sq/ft condo for any particular reason.

The only thing that would make my life a tad more inconvenient is charging my car but that will be resolved in strata complexes in the next 10 years.

I grew up in a communist style block in Croatia and I don’t think my upbringing was affected by lack of space. The condo was small but I would meet the other kids outside and we would go play in the park?

My ideally situation would be a 1 bedroom + den condo (for home office) plus a bedroom for each potential kid. So if two hypothetical kids a 3 bed condo plus den in Vic West/Songhees would be my 100% ideal living arrangement, finances aside. Problem is when you factor in finances the house in Saanichton is cheaper on a monthly cash flow basis and a much better investment over 20-25 years than a three bedroom condo at Bayview, for example. One of the few buildings that has a good selection of three bedroom units.

Having a yard is very over-rated. Absolutely love pulling weeds in my 2 spare hours per week. We don’t have much stuff so huge amounts of storage are a little useless too. Massive kitchen with huge island great for two times a year we host family/party, otherwise useless as well, etc., etc.

There is a lag between completed construction and demand that can take a couple of years to quench. Once construction catches up to demand, new builds easily over produce and we find ourselves in a glut with level or declining prices.

That’s what happen in 2006, 2007 and 2008 and 2009. New construction caught up to demand and housing in the core went from under 3 months of inventory to over 3 months and then prices leveled off for six years.

But that was not a bust that was just a correction as neighborhood prices readjusted to historical norms relative to each other. The market for most of the time in those five years was still in favor of sellers with less than 5 months of inventory or balanced with 5 to 7 months of inventory. Only for 2 or 3 months in 2012 of those five years did the months of inventory slip into a buyers market with over 8 months of inventory. Some buyers that over bought in the irrational markets, with under 2 months of inventory, lost large amounts of equity in excess of what the general market slow down exhibited as the market moved back into balance between buyer and seller.

We have been very, very lucky as we dodged some big economic bullets through political maneuvering of CMHC. As we have yet to experience a prolonged buyers market. Even this year’s impact on oil, benefited our economy as itinerant workers from the oil patch returned home to Victoria and bought rental housing temporarily pushing up sale volumes until volumes peaked in May.

There has been this constant re-vamping of the natural real estate cycle by political and positive external causes that haven’t allowed the market forces to cleanse its excesses. And that has resulted in some of today’s irrational sale prices. And that in itself is symbolic of a market in turmoil and heading for a correction. Much like a serial killer in their last days becomes erratic in their spree believing that they are immune to capture. Some buyers believe that the market is immune to a correction.

And of course this is all- In my opinion

Let’s not get this topic started again.”

Hah – that didn’t last long:

“If I understand it correctly this issue first came up because one will now have to file a new form for all sales of a principal residence in the coming tax year.”

…including deemed dispositions:

http://www.cra-arc.gc.ca/gncy/bdgt/2016/qa11-eng.html

“Does the new rule apply for deemed dispositions of property?

Yes. The new rules apply for deemed dispositions. A deemed disposition occurs when you are considered to have disposed of property, even though you did not actually sell it. For example, a deemed disposition will occur if there is a change in use of the property:

•You change all or part of your principal residence to a rental or business operation.

•You change your rental or business operation to a principal residence.”

I agree with Barrister about the idea of stuffing young people into shoebox sized apartments and how there is no sustainability in that. People need space to raise children and have a family and a future. I believe that cities will start to shrink. I know this goes against what the current thinking is. Cities have been growing. But I believe a big change is on the near horizon and city governments haven’t a clue what is about to happen. My prediction is that the young people will move to the outlying areas of the city and telecommute. (Those who have to be physically at the office will commute by autonomous cars…. and not so far off ….drones. ) The commute will no longer be an issue because time will not be simply wasted. Who would live in an expensive, tiny box stacked one on top of another if another alternative is possible? The taxes in the city are also outrageously high compared to outlying areas where the cost of housing is hundreds of thousands of dollars less and taxes are low. Look at Sooke and the surrounding areas. It’s filled with young people and baby strollers everywhere.

Bman/numbers hack,

News like this seems to get missed but has far reaching implications moving forward.

Canada’s $440-billion mortgage-backed securities market may cool on new rules

“Efforts to cool Canadian home prices could trickle down to the $440 billion market for debt backed by insured residential mortgages.

Stricter rules for banks lending to home buyers and higher requirements for mortgage insurance could reduce mortgage origination in Canada and in turn lower sales of mortgage-backed securities, according to investors and analysts.

“If it slows down the housing market, it’s going to slow down the quantity of mortgages that will end up being on banks’ books, which means there’s a smaller pool that’s available to be securitized,” Jean-Francois Pepin, co-chief investment officer at Addenda Capital Inc., which manages $28 billion, said by phone. His Montreal-based firm invests in mortgage-backed securities.

http://business.financialpost.com/personal-finance/mortgages-real-estate/canadas-440-billion-mortgage-backed-securities-market-may-cool-on-new-rules

Barrister,

Don’t mind Introvert, he only wants to read Marko’s over priced sales , not the real news that will effect the Victoria market in the coming months.

Numbers Hack:

I am reading the report for a second time and it is causing me some real concern. What are your thoughts?

Taxpayers on the hook… Very very scary. Bank of Canada Report last Year

http://www.bankofcanada.ca/wp-content/uploads/2015/12/fsr-december2015-mordel.pdf

Seems like nearly everything is backed by the government. If I didn’t read this incorrectly. Ouch!

Did some reading and as I understand it, about 35% of mortgage debt is sold off via CMHC mortgage backed securities or covered bonds. Does anybody know the percentage of low-ratio loans that are bundled up and sold off? Seems like not too many laymen (including me) were aware of bulk insurance.

Marko:

What are your thoughts on buying a couple of smaller parcels in the Peninsula that are agricultural

land bank protected? I guess I am wondering if ten years down the line there might be a demand for ten acre parcels for estate homes.

Marko:

The experience of most cities is that while high density reduces some infra structure costs that other municipal costs are substantially increased after a certain point of growth. There are also so real issues as to quality of life that are associated with high density cities.

I am saddened at the thought that we want to condemn the younger generation to being squeezed into little high rise boxes. I really think that we can plan a better future for our country.

As to basement suites I think we will have to wait to see if there is a policy change by CRS. If I understand it correctly this issue first came up because one will now have to file a new form for all sales of a principal residence in the coming tax year. I suspect that the contents of the new form will give a pretty strong hint as to whether self contained apartments will be excluded from the principal residence.

I spoke today with an old classmate of mine who is one of the top tax lawyers in Toronto. I dont want to open up the debate again but if your accountant is advising you that your basement apartment forms part of the exclusion under the principal residence exemption than you most certainly should get his opinion in written form.

Introvert:

Well. I hope that my posts have not offended you in some way, if so I apologize. Mind you since you skip over my posts this might be an exercise in futility. I am somewhat surprised in that I am neither a bear nor a bull in terms of the market.

I didn’t notice that because I skip over Barrister’s posts most of the time. (Same with Hawk’s.)

“Siddall said the new mortgage rules will both reduce the ability of home buyers to borrow and will increase lenders’ funding costs. He added that mortgage rates are expected to rise “modestly in response.”

Higher mortgage rates, stress tests, CRA snooping in everyone’s basement, everyone needing an accountant to be a landlord, costs passed on to borrowers, doesn’t look good for bulls. I see sellers stepping up here soon once the reality kicks in.

1524 Davie St got severely hosed. They won’t be able to afford Red Barn.

“Oddly enough only 19 new listings today. Lowest Monday new listings I’ve seen in a long time.”

Deer in the headlights. Kinda like Bearkilla when CRA comes knocking.

“Since you asked, the debt (orange) in the last rate trough (WWII) was much higher than today.”

Didn’t know they had HELOC’s and credit cards back in 1940’s and 50’s. I’d say that chart is BS.

“1524 Davie St listed in 2013 for $569,000 with no sale. Listed last week for $699,900 and sold for $850,000 today. That is a 49.3% increase, wow.”

Two words: Red Barn. 😉

I think we need more chicken Little topics surrounding home ownership and cra crackdowns.

Also, introvert, I was waiting for you to comment on the advise/advice great grammar issue of the past few days.

I know! It was a comprehensive and focused discussion, though — unlike any we’ve had on this blog in memory.

Since you asked, the debt (orange) in the last rate trough (WWII) was much higher than today.

http://i.imgur.com/QVwzbzY.png

Yep.

Probably wise.

Oddly enough only 19 new listings today. Lowest Monday new listings I’ve seen in a long time.

We spoke with our accountant recently. He told us that because our suite is 50% of total home square footage (or under), and because we haven’t ever claimed cost capital allowance, we qualify for the Principal Residence Exemption in the eyes of CRA, and have all along. This also means that when we choose to stop renting out our suite, there is no deemed disposition because the PRE always was, and continues to be, in effect.

I believe totoro’s accountant told her the same thing.

Let’s not get this topic started again 🙂

CMHC to issue 1st ‘red’ warning on Canadian housing market

http://www.cbc.ca/news/business/cmhc-red-warning-housing-1.3808364

One of the comments….

The #1 reason for ridiculous housing prices in Vancouver and Toronto, is lack of real estate. Even in other cities, detached homes are inflating because of rules set by municipalities on housing density. They’re purposely under supplying the market with detached homes. Do to the lack of supply. The increased cost of these homes has meant that people who don’t have exceptional jobs, or money from family, will not own detached homes in major Canadian cities.

The reality is that baby boomers never had to deal with urban sprawl. The cost of roads and public transportation is massive when you have sprawling suburbs with low density. People should accept that living in an apartment will eventually be a reality for a large portion of the country.

Good point. Didn’t really think about the infrastructure required per household in the Westhills/Royal Bay type development versus a condo tower downtown.

We spoke with our accountant recently. He told us that because our suite is 50% of total home square footage (or under), and because we haven’t ever claimed Cost Capital Allowance, we qualify for the Principal Residence Exemption in the eyes of CRA, and have all along. This also means that when we choose to stop renting out our suite, there is no deemed disposition because the PRE always was, and continues to be, in effect.

I believe totoro’s accountant told her the same thing.

1524 Davie St listed in 2013 for $569,000 with no sale. Listed last week for $699,900 and sold for $850,000 today. That is a 49.3% increase, wow.

CMHC to issue 1st ‘red’ warning on Canadian housing market

http://www.cbc.ca/news/business/cmhc-red-warning-housing-1.3808364

@Marko: It’s possible that the $1.2 million friends had 20% down or could have gotten it from parents. I was under the impression that they didn’t, though.

Possible, but they wouldn’t fall into the 1 in 5 buyers affects that I was referencing.

What were the household debt levels back then Mike ?

Rate cycle bottoms can easily span 20 to 30 years. We’re likely in the bottom of the ‘bowl’ for at least another decade.

http://ochousingnews.com/blog/wp-content/uploads/2015/12/ust-via-cs-600×284.png

VicRenter:

I am old enough to remember when 10% was considered a low rate. I am not suggesting that any increase like that will happen in the near future but a two point rate increase over the next few years is far from impossible. Two points would almost double a lot of peoples mortgage payments. Is it likely to happen over the next five years is perhaps a better question.

Many people have never known interest rates to be all that high, especially if they’re first-time buyers. It’s unfathomable to most that their payments could increase by a huge amount.

@Marko: It’s possible that the $1.2 million friends had 20% down or could have gotten it from parents. I was under the impression that they didn’t, though.

Correct. Not only that, but even with 20% down rates will be going up on those properties because you can’t bulk insure them anymore.

Smart people, yes. But what fool would not consider that mortgage rates could easily double in five years. I am not saying that they would but one has to recognize that interest rates are uncommonly low. Still many people are less than prudent when it comes to their finances.

Sounds like smart people who are aware of the changes and probably be cautious in their purchases.

And another pair of friends was approved for $1,200,000 but set their own budget at $900,000.

I don’t think you can buy over $1 million with less than 20% down…Mike clarification?

Hawk and Bingo:- let it go and stop taking at each other. You are beginning to sound like a routine from “Grumpy Old Men”. Let me ask a different question, what percentage of couples under fifty have enough income in Victoria to afford to carry a million dollar mortgage? Does anyone know?

“Approx. 20% of individuals are buying with less than 20% down; affected by the new mortgage rules.

Out of the 1/5 you have probably 20 to 40% that were not shopping at the top end of their budget.”

This has certainly been true of my friends who’ve been looking recently and have had less than 20% down. One couple was approved for $1,000,000 but refused to spend over $800,000 out of concern for what would happen if rates went up, etc. And another pair of friends was approved for $1,200,000 but set their own budget at $900,000. There will be some people whose budgets are affected by the new regulations but many weren’t already planning to take every dime that the bank would give them.

“Doubtful. That would take some major pressure on affordability. ”

So Vancouver sales down 47% and average prices 20% (300K), in last two months is doubtful too ? Interesting.

“Repeating an unanswered question is hardly whining. ”

I already gave a timeline in my guesstimate on the last thread but you were too busy slagging as I said before. Best go reread it.

If you got lots of equity and say I’m wrong then why do you care so much about my opinion ? Sounds like you’re scared of losing all that paper profit and not treating your place as a home long term.

Never asked for an exact date. Just an amount and a range of time. 6 months, 12 months a year?

Refusing is absolutely valid (and I’ll honor that) but until now you just spoke around it and avoided my question. Repeating an unanswered question is hardly whining. Persistent, annoying, but definitely not whining.

Asking you to quantify “big” and “soon” is a fair question since you keep using those terms and they are ambiguous. Intentionally ambiguous maybe?

At what point do you jump in? What’s a big enough drop from current prices for you to jump in?

As I said, market can tank and I’m fine. Plenty of equity. I’d have to sell to lock in any recent “gains”, but I didn’t buy a house as an investment. Thanks for your concern though.

Doubtful. That would take some major pressure on affordability. Financial crisis or sudden ramp up in interest rates. It’s not impossible, but not likely. Definitely would benefit those with cash in hand. I’m assuming in such a scenario borrowing fees would be outrageous.

I threw my prediction out there. 2 years until we tip in favour of buyers again. What’s yours?

Last time I ask, I promise.

“That seems like a big change. Does this effectively kill off the 30 year mortgage? Did it just get more expensive to buy an investment property?”

I believe it does Bman unless you want to go to an alternative lender which some are dropping out of the bizz so you will pay a higher interest rate to get a 30 year as it won’t be insured. Could be some real gouging going on there.

“In fact, lenders have already begun announcing surcharges on new mortgage applications for refinances and for rental-property loans that will close after November 30. Several have suspended lending on rental properties altogether, and these announcements are expected to continue over the coming weeks.”

http://www.movesmartly.com/2016/10/what-canadas-latest-mortgage-rule-changes-mean-for-you-part-two-october-11-2016.html

RE: Low LTV portfolio insurance.

That seems like a big change. Does this effectively kill off the 30 year mortgage? Did it just get more expensive to buy an investment property?

Bingo, can you quit whining about a number and exact date ? Only a dolt would keep bringing this up. If you got in over your head that’s not my fault.

Maybe it will be 50% like the early 80’s when all the house obsessers got their ass handed to them for being too greedy. Guess you’ll find out in due time.

Meanwhile the foreigners are whining too about paying tax to buy here and they will now go elsewhere, but it’s OK when it’s us trying to buy there. Hypocrites.

Chinese real estate billionaire says customers troubled by Vancouver tax

http://www.theprovince.com/business/chinese+real+estate+billionaire+says+customers+troubled+vancouver/12290193/story.html

I moved here about 7 years ago from Vancouver and it’s only been in the last year that I’ve started seeing my age group (mid to late 30’s) start to come over here. Many were hoping for prices to drop in Vancouver but it’s just gone out of control there. They also have kids starting elementary school and they want to choose a permanent location. Getting a good job here can be difficult, but some are actually keeping their Vancouver job and telecommuting, which is more and more common these days. So maybe were seeing a bit of a tipping point.

$981k might sound crazy (house on Neil) but these people are accustomed to dilapidated Vancouver specials and can’t believe you can get into a nice neighborhood for that price.

So is that you’re number your going with? 30% drop? I won’t debate 30% being “big”.

Over what period will this 30% drop occur?

You said the big correction is coming soon, but your soon might be different than mine. Less than a year?

“The parents will front the dough and sell grandma’s home at a later date.”

Sounds all great in a perfect world, but then the parents and grandma’s houses tank 30% and they all live happily ever after together as granny lives 10 years longer than planned and needs expensive home care and health costs.

Never has a generation of parents fronted so much cash to kids to buy over priced assets borrowed against their own homes. This will not end well at all.

Agreed. Those houses look exactly the same as Taylor st between Shelbourne and Richmond. To me Neil isn’t any more desirable. Good area, but no way I’d pay an OB premium.

“Anyone catch the sale price on 2117 Neil?

$981,000”

Now that’s what you call dumb money. Seller made off like a thief in the night.

Also wondering if everyone realizes that a “deemed disposition” resulting from a change of use (e.g. rental to non-rental etc. and vice versa) needs to be reported now (on your tax return) as with a sale of the principal res.

Has this been posted? – details of the recent cooling measures by the feds including how low-ratio mortgages are impacted (where the banks buy insurance) starting Nov .30:

http://www.fin.gc.ca/n16/data/16-117_2-eng.asp

How much of a premium does everyone think those Neil Street buyers paid for the place simply because it’s in Oak Bay?

I figure an identical place might sell for 100-200k less on the other side of Richmond. Maybe even less than that.

If that house is a million then I am being to suspect that I might get two million for mine. Rather ridiculous. Be interesting to see if it ends up being torn down after all.

“So Oak bay is now 1mil fixer-uppers? Seems too pricey to be a tear down.”

Paid exactly list at more than $300k over assessed. That thing is coming down.

Hahahahahahaha.

My expectations at that price are at least a semi-recent roof (last decade). Those t-lock shingles were discontinued quite a while ago.

So Oak bay is now 1mil fixer-uppers? Seems too pricey to be a tear down.

And that seems like the right price (to me) for something like that. The mind boggles. 1mil?!

Do you believe that whatever the impact will be that it will be felt more in the West Shore than the core?

Yes, West Shore will probably feel a bigger impact for sure in my opinion.

I do think the market needs to be cooled off but I just don’t think these regulations will be enough. Makes it tougher in terms of paperwork to get a mortgage but once you get it everything is still the same as it was yesterday.

The most obvious factor dictating the market continues to remain unchanged; interest rates.

This probably applies to Victoria -> https://ca.finance.yahoo.com/news/cmhc-issue-1st-red-warning-171031802.html

Marko:

Thats very interesting as to the number of buyers under the 20% rule; the impact sounds like it might be a lot less than suggested by some people. Do you believe that whatever the impact will be that it will be felt more in the West Shore than the core?

LOL yeah…bought into that ‘hood last year. Identical floor plan and paid >$300K less. Unbelievable.

wowza @Neil sale price

Not your dream million dollar listing?

Thank you for putting the figures together once again. I was expecting a bit of a bump up in the numbers as people tried to get in under the wire before the new mortgage rules.

Approx. 20% of individuals are buying with less than 20% down; affected by the new mortgage rules.

Out of the 1/5 you have probably 20 to 40% that were not shopping at the top end of their budget. I often will have clients that are looking in the 600-650k range when they’ve been pre-approved for 800k+ simply as they don’t want a massive mortgage and prefer to keep their Mountain Co-op lifestyle going. Let’s say their borrowing power dropped from 800k to 650k they are still buying in the 600-650k range because the actual mortgage rate/mortgage payments didn’t change.

Out of the 1/5 you have another percentage that will look at creative ways to get around this. For example, I have one set of clients right now that will collect on their grandma’s house early to get up to 20%. The parents will front the dough and sell grandma’s home at a later date.

Whatever is left over will move down the product chain in a very low inventory environment. It’s not like there is a glut of supply at 500k that is now in big trouble as all those individuals now only qualify for 400k. There is low inventory across the board.

The market isn’t going to turn overnight. I can’t see inventory approaching a 10-year average until March setting up the an interesting spring.

wowza @Neil sale price

Anyone catch the sale price on 2117 Neil?

$981,000

Thank you for putting the figures together once again. I was expecting a bit of a bump up in the numbers as people tried to get in under the wire before the new mortgage rules.