The Signal and the Noise

Title shamelessly copied from the excellent book by Nate Silver.

Vancouver realtor Steve Saretsky has released his preliminary summary of the September market and while September isn’t looking great, it isn’t quite the collapse that one might have expected given his earlier updates that showed sales at 10 year lows.

It’s great to see insiders like Saretsky and the online brokerage YOLO Zolo adding new voices to the discussion with an analysis of up to date market data that cuts through the spin of the real estate boards. However the focus on day to day sales and prices can also lead to missing the forest for the trees. Rather than focusing on the larger picture, the discussion swings from excited speculation about how sales or average prices have collapsed, followed by muted backpedaling when it reverts to the mean. Humans are conditioned to see patterns in noise, and I am certainly guilty of doing the same at many points over the years.

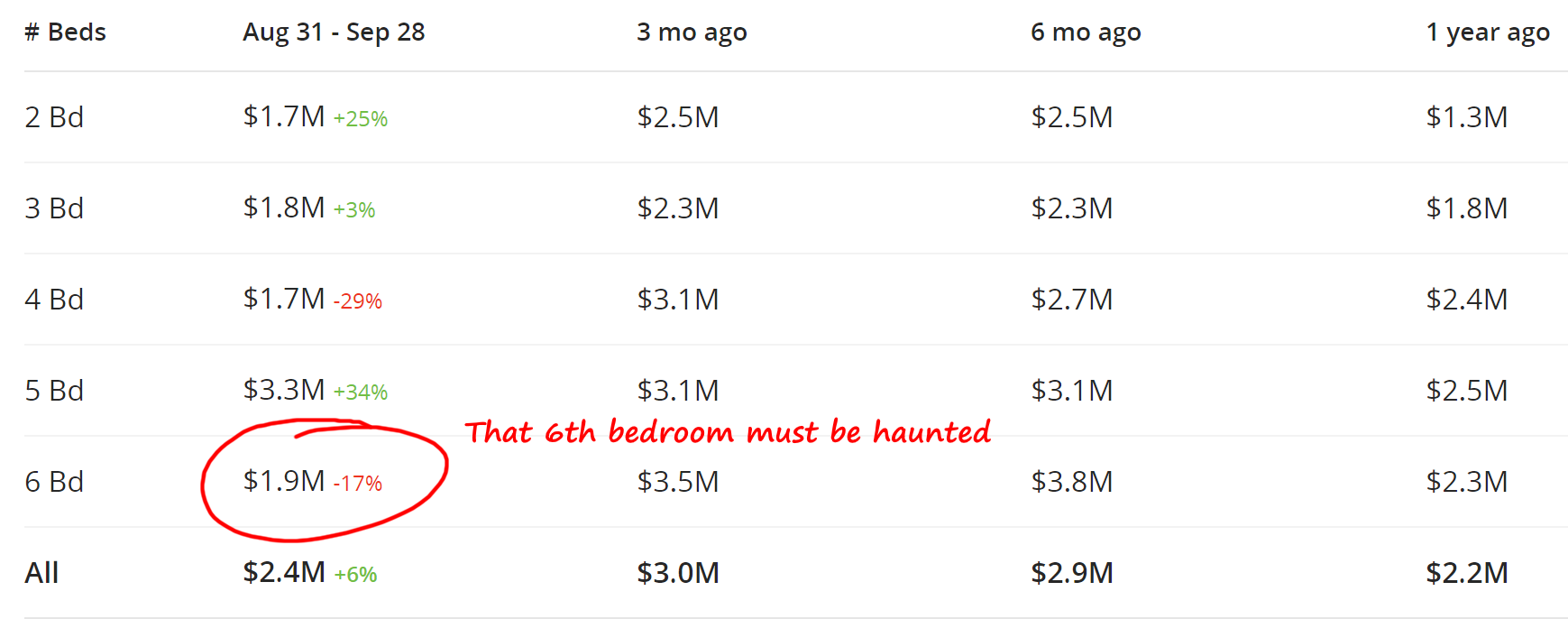

The Zolo trends I find particularly misguided since they emphasize data over insight. The headline numbers are all averages with no indication of distribution or what the outliers might be. Oh look! Days on market for the $0-$250k segment exploded from 37 to 59 days! The market for shoe boxes must be crashing! But above $2.5 million it went from 25 to 14! Luxury market must be hot. In reality this is almost certainly all noise and means exactly nothing except that different properties are selling at different times.

Yes data is fun, but is this helping anyone make a sensible decision? Or are we all just destined to drown in info garbage? Is Zolo even trying to give people insight with their tools or are they just trying to blast people with numbers until they go running to their agents for help? Despite it being essentially our provincial past time to talk about real estate, there is still a lack of quality information available on the market. The issue is that the real estate industry exploits the information imbalance to sell expensive services, so they have no incentive to improve the tools. Meanwhile no one else has found a great way to monetize that doesn’t involve feeding leads to realtors under the guise of education (which is essentially the same conflict).

The magnitude of the price jump in the spring took everyone by surprise. But the market had been signalling for 1.5 years that prices were going to stabilize then increase via the trend in the months of inventory. I have to believe there is more signal like that, as well as better ways to present it to even the normal people that don’t hang out here.

Great comments on the new regs. It’s gonna be interesting!

https://househuntvictoria.ca/2016/10/03/what-is-the-impact-of-the-new-mortgage-rules/

Billions were pouring in back in 2007 too. Then they weren’t. This is just another game changer with more to come from Christy. Fantasy Island just peaked, hope you all cashed out.

A very short flat line. Vic’s economy with billions pouring in will erect that line in no time! 🙂

https://twitter.com/fabulavancouver/status/783071636085813248

Just Janice,

You are making an assumption that someone buying with 5-10% down is financially disciplined and saving every single penny towards a down payment. Not what I see from my personal observations.

I think these rule changes are a positive. Buckle down and exercise financial discipline (don’t buy that $2,000/year dog, don’t go to Mount Washington 6 times a year, don’t buy the car that is $600/month, etc.) to buy your 1st home or delay the purchase two or three years. As Mike pointed out the delay is better than foreclosure in 2-3 years.

I think this is the one thing that could help flat line that market a bit and a breather is necessary at this point.

“but this should flatline the market for a while”

Chart that Michael…! 😉

Mike Grace said:

I wouldn’t be surprised if condos still have some lift while houses stagnate. Possibly there’s enough retiree, foreign & tech money on its way to keep pushing both higher, but this should flatline the market for a while. I like that it’s open season on the riskiest borrowers, and our banks should fare better. All in all good changes.

“Instead – you have people who even though they could “afford” the home at 2.25% fixed for 5 years, are forced to buy the home they can “afford” at 4.5%”

Who are the people who now have to qualify at 4.5% bidding against? It seems to me that everyone plays by the same rules and at higher qualifying standards, the same houses will go to the same strata on the wealth spectrum, only at lower prices.

For most segments, this move creates downward price pressure without a doubt. With increased pressure on the feds to lock the doors to foreign capital, all we’ll be left with over time are locals.

With incomes not going anywhere, there is no mystery foreign capital coming in from anywhere. Prices will go down or sales won’t close.

@ just janice

Believe it or not, these changes will also seriously affect the investor market. Most investors purchase with 5% down, ‘owner occupied’ then convert that property into a rental later on, when they move into their next high ratio owner occupied purchase.

The overbought investor segment of the market is really the bit that should have been tackled – not those looking to get a toehold in on their first home. Houses as homes – that is where the focus should be. Not houses as Air B’n’B’s – and I don’t see this policy tackling that issue. Rather I see it as throwing up a bunch of barriers that may not even improve affordability (ie. cause prices to come back down to earth). Instead – you have people who even though they could “afford” the home at 2.25% fixed for 5 years, are forced to buy the home they can “afford” at 4.5%. In places like Victoria, that makes a big difference – the difference between being in the market at all and sitting on the sidelines. Meanwhile – rents are still lofty, so that person is still going to paying a premium for housing, but rather than that money going towards their own equity they are forced to pay it towards the landlords’ equity. If anything this policy might encourage more hording as the return on investment for rental properties just went up.

“The biggest drop in purchases of houses in the core were by out town buyers with 25% fewer buyers than the month before. In contrast the drop in Victorian buyers was only 4%”

WOW – if there was any doubt that the spring surge was due to Vancouver buyers with locals being taken for a ride.

Further evidence is that Sunshine Coast just went through a similar bump in spring and then volume drops. I wonder what the Sunshine Coast has in common with us…hmmm.

http://www.garylittle.ca/stats.html#charttop

@James Soper

Thank you for your reply. It is a very interesting point that you are making. For some reason I also find it encouraging to hear that younger people are returning to Victoria. It makes for a much more healthy city (no pun intended).

I dont think the slow down in out of town buyers should come as a surprise considering that Vancouver has provided most of the out of towners recently and sales have been gutted across the pond.

I am still mulling over the new bank rules for mortgages. My initial impression is that this was a positive change overall. Certainly the banks have been playing Russian roulette and banking on the hope that interest rates will not go up. Itt will be interesting to see if there is a dip in house prices in places like the west shore.

@ entomologist

Agreed.

Yes Jack, I think we can stick a fork in it.

Ottawa has brought this country’s housing fantasy to an end

“The fantasy of endlessly rising house prices is over.

If the housing market doesn’t respond to measures announced by the federal government on Monday, then expect more action ahead. Argue all you like about how economic and real estate fundamentals affect prices. In the end, it’s government action that will bring housing to heel.”

“It’s the same as if rates went up to 4.64 per cent overnight,” Mr. Larock said. “There is a danger that government might have overtightened.”

http://www.theglobeandmail.com/globe-investor/personal-finance/household-finances/house-prices-will-not-rise-forever-base-your-financial-decisions-accordingly/article32219135/

@ Just Janice,

I understand your point, and I get that it may not seem ‘fair’ to this segment of the market. Interestingly, a major correction to the housing market may seem ‘fair’ to this same segment, but certainly not to the benefit of anyone else!

While this scenario may delay access to the market by 2-3 years, is this not a preferable situation when compared to one where these borrowers may be going through foreclosure in 2-3years?

[i]Shopping around at renewal time just got near to impossible for lower income high ratio borrowers – a good portion of the market will likely get gouged by there banks at renewal.[/i]

That seems shitty. Everything else seems reasonable, but for these folks to be exploited by banks (and therefore either have to pay exorbitant rates or lose their homes) seems like a real raw deal that benefits no one (deserving).

The number of buyers for all types of properties in all areas from Vancouver has been dropping since April we are now down to the level of last September.

Month Sales, Number of

Jan 28

Feb 31

Mar 76

Apr 89

May 79

Jun 83

Jul 86

Aug 53

Sep 33

And it’s the same for detached houses in the core too.

Month Sales, Number of

Jan 11

Feb 16

Mar 36

Apr 43

May 41

Jun 38

Jul 28

Aug 22

Sep 14

I think we can finally put a nail in the coffin of rich baby boomers retiring to Victoria. Unless you want to call 14 a wave of buyers.

Oh yeah, here’s the data for Oak Bay

Month Sales, Number of

Jan 2

Feb 5

Mar 6

Apr 8

May 9

Jun 10

Jul 3

Aug 0

Sep 2

If I understand what you’re saying Just Janice it is that fewer home first time buyers will just mean more investors buying these homes as rentals.

And that could happen. That’s why we need restrictions on the number of residential properties that someone may own. If you want to own a dozen rental units then go buy an apartment block but you should be economically discouraged to hoard a dozen properties that could be owner occupied.

Where we went wrong is that we began to treat homes as investments and not shelter. And that allowed a few to abuse the system.

Interesting Oak Bay benchmark is down to $1,087,400 from $1,109,000 last month. Same with Victoria $733,000 from $736,400. If the benchmark is cooling after such a “hot” month then we must be beginning the peaked market signs Vancouver did 6 months back. Victoria is always late to the game historically.

Throw in the “now forced out of the market marginal buyers” who don’t want a condo over a house(nor Langford) and will keep renting and we may be in for quite a “fall” market. 😉

They all bought SFHs. All came back because they were priced out of Vancouver and didn’t want to be priced out of Victoria too.

Marginal buyers being “squeaked out” of the market – is not necessarily good. In part the buyers you have deemed “marginal” are really the ones who benefit most from market access. Specifically these are the buyers who aren’t relying on the bank of mom and dad, and who in all likelihood will experience considerable income appreciation over the next decade as many are just starting out in their careers. Many will have considerable student loans that they are in the process of paying off. So now their entry has been delayed 3 to 5 years. 3 to 5 additional years of paying rent instead of a mortgage, and given Victoria rental rates, those are years where many will wind up actually paying more for their accommodations than they would have other wise. As this won’t impact the “monied” end of the market, there will simply me more housing for that end to buy – likely as rentals, meaning less owner occupied housing. If it does take the stuffing out of the low end of the market – then that same population (young home buyers) is likely harmed. Again – not sure if this is “good policy”, and there might be all kinds of unintended consequences.

Weighing in on the new mortgage rules today:

-The requirement to qualify all high ratio borrowers at the benchmark rate will have a considerable effect on the market. A borrower with an annual salary of $80K who can now qualify for a $465K mortgage, after October 17th, will only qualify for $369K.

A rental suite that produces $1000/month will only add $66K of qualifying room after October 17, compared with $86K now.

This is a BIG change, on par with the removal of the 35 year amortization 5 yrs or so ago.

Effect on the market?

1) First timers, and high ratio borrowers will be forced into cheaper alternatives for housing, get ready to see an increased demand for condos, and cheap cardboard cutout developments out in the Westhills.

2) Increased wealth transfer between parents and grown kids. This may cause parents to pull equity out of their family home to assist kids.

3) Price drops? It’s possible for sure, but in Victoria with inventory being so tight, this may not happen immediately following the changes. Nice that the changes are happening during a seasonal slowdown, and nice that the new rules aren’t being applied to renewals. Shopping around at renewal time just got near to impossible for lower income high ratio borrowers – a good portion of the market will likely get gouged by there banks at renewal.

My opinion?

This is a big change, the purpose of which is to lower the overall risk of a higher risk segment of the market. Policy wise, I think it’s a pretty fair change. Marginal borrowers that could squeak into the market before, will now be excluded, and perhaps that’s not such a bad thing.

The new rules would be felt most by those buying condos and starter homes as these people are most likely to have a lower down payment. However, many of those higher priced homes are conditional on selling a lower priced home. So the new rules would travel up the property ladder.

We may see more properties back on the market because of the inability to get financing. I think most of us realize by now that you should never put an offer on a property without a subject to financing clause unless you are prepared to lose the down payment.

What is really different about sales in September versus those in August is that the average price changed very little (859,981 to $863,401) but the median increased (from $728,000 to $785,250). The average and the median converged because there were fewer high priced sales in the core stand alone house market in September than in August.

And I can’t recall this ever being this dramatic of a convergence in the last five years.

The other interesting thing about September is the days on market. Both the median (11 to 12) and average (19 to 26) days on market are increasing for houses in the core. We are now at the second highest days on market for the year. Only in January, before the run up in prices, were the days on market higher at 17 and 39 respectively.

To me, this indicates a cooling market at the high end of the price range. And once more this is noticeable to many by fewer dramatic over asking prices. Hopefully if the days on market continue to rise we will see an end to the intentionally under priced properties marketed with limitations on market exposure. And that will be good for everybody.

Yes and partly. When I reference months of inventory on a monthly basis, that is the residential months of inventory (commercial inventory and sales stripped out). However, for the weekly data, we don’t have that kind of detail, so that is whole-market (residential/commercial) MOI. Usually I specify “residential months of inventory” but sometimes I get lazy and just say MOI. Residential MOI is generally lower than the whole market MOI. For example it is about 2.2 residential, but 2.6 for the entire market right now.

So the new rules discriminate against would-be higher ratio mortgage holders. And thus favour those with cash on hand. This seems a bit unfair, but also makes sense in terms of protecting the market from forced sales and thus the ‘burst bubble’ phenomenon.

To the extent that at least some of our market (retirees, those with $$ from Van/TO/overseas money) is less mortgage-dependent than some locations, this might affect Victoria less, but could have the effect of making the market for mid-range homes (450-800k) even more cutthroat than it already is.

Just Jack – that is really informative! I never realized the sales included commercial. Wouldn’t it be more relevant for this blog to strip those numbers out, or is that data not readily available?

Sorry I keep posting on this, but this is really blowing my mind!

If we were looking to upgrade today, regardless of our downpayment, we would have qualified for a mortgage of $670k (what!?) and with the old rules that meant we could have looked at houses from $705,000 (5% down) and up. Now with the new stress test, we would only qualify for $540k so that limits us to $568,000 (5%) and up.

There may have been 903 sales in September but only 737 were residential.

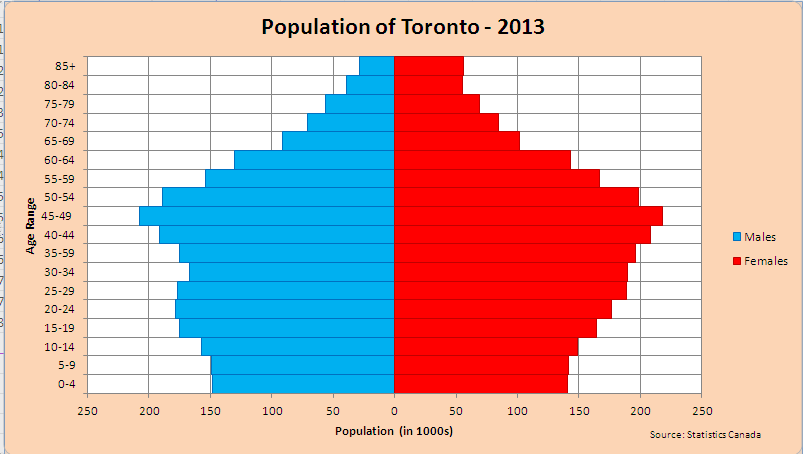

394 of which were in the core districts which is the second highest volume in the last decade since 2009 when it was 422. Last year the number of sales in the core was slightly less at 375. The ten year average is 314 September Sales.

The same for detached homes in the core. 183 sales being the second highest since 2009 when it was 218. The ten year average being 156.

Condos sales in the core are a bit different as the volume of sales are the highest in the last decade at 165. The ten year average being 114

And since so many of the recent posters are fixated on Oak Bay. Oak Bay had the third LOWEST number of sales in the last decade at 16. The ten year average being 20.

High prices are having the effect on the market of prospective purchasers substituting lower price neighbourhoods and lower price alternatives to stand alone homes. This is simply putting numbers to what anyone trying to buy a home knows already as prospective buyers find themselves priced out of neighborhoods.

The biggest drop in purchases of houses in the core were by out town buyers with 25% fewer buyers than the month before. In contrast the drop in Victorian buyers was only 4%

And that’s the same for condo sales in the core. 33% decline in out of town buyers compared to a 9 percent decline in Victorian buyers.

What seems to be happening is that we are just returning to “normal” when it comes to sale volumes and where the buyers are coming from after what seems to be a one time event at the beginning of the year. We expereinced a large gain in prices over this year due to the increase in sale volumes and to a lesser degree out of town buyers. Now without those factors – I wonder if prices will moderate lower?

When we were house-hunting our income was only $87,500 which may still be typical of early 30s homebuyers. We would have qualified for a $460,000 mortgage last week using the 5 year fixed rate so for a CMHC mtg the range would have been $484,000 – $582,000 using that income. The new stress test interest rate of 4.64% and the amortization of 25 years we would only have qualified for $370,000. The updated range of list prices would now only be $389,000-$463,000.

“@Hawk:

In your opinion who is buying the houses selling for 1.4 and up?”

You’re the Uplands/Rockland expert, not me. They are not the average buyer so who really cares. Higher end houses fluctuate wildly like Jack and yourself pointed out.

I suspect that the new mortgage rules could have a real impact on the West Shore in particular.

@Hawk:

In your opinion who is buying the houses selling for 1.4 and up?

“Every single person I’ve met so far that’s come from Vancouver this year has been in their 30s and 40s. Don’t know why you all assume it’s retirees.”

Do they all have $3 million in the bank now , a house in the Uplands, and retired too like the perma-bulls have pumped out continuously ?

James Soper:

That is interesting about the people from Vancouver. Out of curiosity did they buy condos or SFH or are they renters?

LeoS – crazy stuff! This could be bad news for a lot of new homebuyers. Back when I bought my house October 2008, the 5 year interest rate I got was 5.76%! We would have never been able to afford our house back then if it wasn’t for the 35 year amortization we started with. That made a huge difference in what we could afford, but in the long run, really has protected us. As our incomes have increased and interest rates decreased, we’ve been keeping our payments the same and just knocking extra years off the mortgage. From my bank:

Open Date: Oct 10, 2008

Renewal Date: Sep 1, 2018

Original Amortization Date: November 2043

Projected Amortization Date: June 2029

So now a new homebuyer has to qualify using a higher rate, AND with only 25 year amortization. That will probably price them out of almost anything in the core.

Every single person I’ve met so far that’s come from Vancouver this year has been in their 30s and 40s. Don’t know why you all assume it’s retirees.

Curious Cat: Thank you for looking that up, and making it clear. you saved me a lot of time.

Who cares about your Oak Bay obsession Mike, that’s another world that most aren’t buying in. Back in the real world, the rest of the market will be greatly effected by these stress tests rules. I know a couple who definitely won’t qualify now.

“That requirement was already in place for many borrowers, including so-called “high-ratio” mortgages for people with small down payments, and borrowers who borrowed money on terms of less than five years.

But from now on, any insured mortgages will be tested against that higher bar. Anyone who already has a mortgage, or who has already applied for mortgage insurance, is exempt from the new rules, which will formally kick in on Oct. 17.

That could have a big impact on buyers.

According to interest rate-comparing website RateHub, a hypothetical borrower with $100,000 in annual income and $40,000 to put down on a house today could qualify for a house worth $665,435 with a mortgage at 2.17 per cent, which three lenders are currently offering, according to the site.

But under the new rules, that same buyer could only qualify to buy a home for $505,762, or 24 per cent less than before the rules kick in. The lender is still willing to offer that lower rate, but the borrower would no longer be allowed to get it under the stricter rules, because his or her finances would be tested as though the mortgage rate is more than twice as high as it is in reality.

BMO economist Sal Guatieri thinks the new stress test is the more significant change of those announced Monday.

“This measure will make it harder for buyers to qualify for a loan, especially in high-priced regions,” he said.

“This means that many potential buyers won’t qualify for an insured mortgage, which requires the total carrying costs of a home … to consume no more than 39 per cent of gross family income,” Guatieri said.”

@Michael:

That seems like really high prices for older condos in Oak Bay. What are the new Abstract units selling for? On the other hand I have noticed a lot less for sale signs on condos this year than last.

Okay nevermind, I found the answer to my question on CMHC’s website. Previously to today the rule was:

“* Qualifying Interest Rate: For loan-to-value ratios greater than 80%, for fixed rate mortgages of less than 5 years and for all variable rate mortgages, the qualifying interest rate is the greater of the benchmark rate and the contract/capped interest rate. The benchmark rate is published weekly by the Bank of Canada in the series V80691335 and can be found at: http://www.bankofcanada.ca/rates/interest-rates/canadian-interest-rates/. For fixed rate mortgages of 5 years or more, the qualifying interest rate is the contract interest rate.”

So I guess ALL CMHC-insured mortgages beforehand would have been 5 year fixed mortgages because they could qualify using the posted bank rate of 2.54% for example. If you have only 10% down and wanted a 2 year mortgage at 2.09%, you would be out of luck because then you would need to qualify at 4.64%. After this announcement, every homebuyer has to qualify at the 4.64% benchmark rate, regardless of which mortgage term they choose.

Only for terms under 5 years. Now it’s for everyone. Given that 5 year fixed is the most popular term, this could be big.

Regarding the new stress test: Wasn’t this always the case that buyers had to qualify under the 5 year posted rate for CMHC-insured mortgages?

Re: Retiree movement

Seems like it’s really starting to affect our market by looking at 55+ sales this week…

401-1175 Newport, assess 370k, sold 606k

108-2119 Oak Bay Ave, assess 405k, sold 740k (41k over!)

These are old buildings too. The Newport one needs ~100k in renos just to the unit. Few years back most 55+ units were going for under assessed.

Dasmo:

Thank you for the info on lots in Fairfield. I am really beginning to feel that I got a real bargain in Rockland. For general info I have heard that the house on St. Charles has accepted a conditional offer for over 2 mil; and that it was only subject to a house inspection. This is reasonably solid rumour.

Ottawa steps up mortgage scrutiny, closes foreign buyers’ tax loophole

http://www.bnn.ca/ottawa-steps-up-mortgage-scrutiny-closes-foreign-buyers-tax-loophole-1.578314

“Kind of strange how Victoria RE has been following a similar pattern this year.”

Yes it’s funny how Victoria RE is connected so tight to the S&P 500. Looks like the S&P is about to go down. I guess Vancouver didn’t get the memo. 😉

http://www.mikestewart.ca/wp-content/uploads/2016/09/August-2016-REBGV-Statistics-Price-Chart-1977-to-August-2016-Vancouver-Real-Estate-Mike-Stewart-Realtor.jpg

Curious Cat:

You are welcome but different strokes for different folks as the old saying goes. But we did a lot of research into a number of places and Victoria was way above the other alternatives and that was even before we took into account affordability. What we found surprised us in that of the short list of five cities, Victoria ranked highest on desirability and by far the lowest for housing costs. Prices have certainly risen in the last three years ( I will not make the mistake of throwing out a number here and then having it nitpicked by everyone) but they are still substantially lower than the other alternatives out there.

But I also know that a lot of people and maybe most would prefer California.

What happens when the China real estate market blows up and all that margined cash on Vancouver mortgages stops being paid ?

Bubble Watch: Experts Sound Alarm on Chinese Real Estate

“When China’s richest man and its most successful real estate developer calls the country’s overheating property market “the biggest bubble in history,” it’s probably not a good sign.

But that’s exactly what Wang Jianlin, billionaire owner of Dalian Wanda Group and Communist Party insider, said in an interview with CNN last week. “The government has come up with all sorts of measures—limiting purchase or credit—but none have worked,” he told CNN.”

goo.gl/bom4Pe

On your mark, get set…

Kind of strange how Victoria RE has been following a similar pattern this year.

Rook,

Of course the Feds don’t want it to tank but it will. You are removing the majority of the hot money that has flooded this market for years and when you take it away then it’s a no brainer what is going to happen. The money launderers have left months ago or are trying to get out before CRA comes knocking.

Criminals and foreigners especially don’t want CRA digging into their personal business. These are game changers, that may take months to play out but they change the flow of the market cash. If the same was happening in the stock market or any other market where illegal funds were the driving force they will leave.

Look at the Chinese casinos when the corruption clampdown came, they all flooded their cash to their stock markets, then when they came after them there, they crashed their markets to get out. Criminals don’t hang around to get caught.

@ Barrister you would be hard pressed to find an 8000 sqft lot in Fairfield. That could cost you a million because the lot could be subdivided into two small lots or even three if it was a corner. One can only know when one sells but I would guess 750k +- 100k

Second strongest September ever, only second to 1992 when there was 903 sales.

We’ve crossed $5 billion in Total Sales $ YTD. The strongest year ever was last year at $4.3 billion for the entire year.

Half way through this month we’ll also set a new record for most sales in a year.

Lowest active inventory on record. For example, in 2012 we had 5,025 listings at end of September.

Hawk

“Feds going to stick the knife in the foreign buyers. Better late than ever, but this will tank Vancouver even more.”

I think I disagree with your predicted outcome of the government changes. I don’t think anyone in government wants Vancouver to tank, federally or the BC libs. The changes being made are long over due and only being done because reporters like Kathy Tomlinson, Ian Young, and Sam Cooper are exposing huge flaws with our system:

1)CRA has been exposed for its incompetence, taking the easy Canadian small business money rather than fighting foreign tax evaders and fraudsters (criminals ignored) .

2)The loopholes in the capital gains tax exemption

3)The HUGE impact that foreign money has had on the Vancouver housing market, houses being traded like stocks creating FOMO in the local population and in turn skyrocketing prices to unattainable levels

4) Investor Visa program through Quebec into Vancouver (aka immigration by bribe)

5) The unworthy, distrustful self regulated real estate board

6)Criminal activity in property development in Vancouver

7)Homes sitting vacant in Vancouver while there is a housing crisis for the poor and middleclass.

8)And don’t forget, Landlords soliciting sex from young women for a roof over their heads (http://bc.ctvnews.ca/ctv-investigation-i-posed-as-a-woman-willing-to-exchange-sex-for-rent-1.3091162)

All this and more exposed to the public by investigative reporting (and maybe Dave Eby as well).

I think the changes made by the government have been mainly for PR. Just enough for the public to think they are really tackling the issue.

I think if the Government was willing to part with the vast amount of money coming from housing speculation they would initiate the tax that has been suggested for years, pushed now from Dave Eby which limits loopholes used by non tax paying individuals.

Mon Oct 3, 2016:

Sep Sep

2016 2015

Net Unconditional Sales: 781 704

New Listings: 1,050 962

Active Listings: 2,061 3,478

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

New mortgage stress tests to be more robust than previous tests. How many can make it 2 full points higher ? I would say that cuts out a lot of buyers.

“@gbonnell

@BNN example given for stress test rate in release today is BOC’s 5yr fixed of 4.64%.”

Barrister,

Agreed, I rented a condo once for a short term and the committee was a nightmare, even though I wasn’t involved. The constant fighting turned me off the whole idea. Look what happened in the Sun story and I’m sure it’s happened around here.

I believe Mike stated the Stadacona leaker was for similar committee bitching reasons and they had to rip that one down to the studs inside the suites to get rid of the mold. 2 years of work to fix that one and I see they just recently have one side of the building dug up with mounds of dirt so must have done a shitty job as it appeared to be finished a year ago.

Barrister, thank you for the background. It gives us all a peek into the mind of a buyer. My husband and I share your opinion of Vancouver. I find it ugly, and the mountains in the distance do nothing to distract me from that. Toll bridges, lots of ugly strip malls with no English anywhere, narrow lanes, not enough left turn lanes, and no one seems to observe a red light. (I’ve seen 2-3 cars turn left after the light has turned red, and it’s so common, you just need to know it’s gonna happen.) The Vancouver specials with their white railings mixed with the Largest House That We Can Possibly Fit on a Postage Sized Lot and lets not forget the lions guarding the walkway! There is no thought, no planning at all, to aesthetics or cohesion. I actually like the row townhouses because at least they look nice. They should build more of those! Victoria in comparison to Vancouver, no contest. We are very lucky indeed.

@Hawk:

I sometimes get the feeling that people who buy condos really are not informed about what is involved.

I rented a condo for almost a year at Songhees and I was amazed at how much bickering was going on between groups pf people. The condo next door was a bit older and they had major remedial work that had to be done. I talked to a couple of people that had to sell out because they could not pay the special levy.

That does not mean that condos are bad but rather it seems that a lot of people dont really fully understand the legal situation with condos before they buy them.

The joys of condo ownership continue. Don’t you just love condo committees ?

Judge orders Vancouver strata to impose $16 million levy to repair leaky condo problems

http://vancouversun.com/news/local-news/judge-orders-vancouver-strata-to-impose-16-million-levy-to-repair-leaky-condo-problems

does anyone know what 3000 lansdowne sold for

listed at 2.29 million– a tear down

the two houses beside it went in the 900 range three years ago with much larger and nicer lots

uplands prices on a roll

Feds going to stick the knife in the foreign buyers. Better late than ever, but this will tank Vancouver even more.

Bill Morneau reportedly to close tax loophole for foreign homebuyers

http://www.bnn.ca/bill-morneau-reportedly-to-close-tax-loophole-for-foreign-homebuyers-1.578314

@Dasmo:

Actually, on a serious note, what is the cost of a building lot (knockdown) in Fairfield today. Lets say a nice street fairly close to the ocean or Cook street village. Preferably on a lot of at least 8,000 sq ft. Give me a price range.

To Curious cat:

You make a good point about why most people do not move out of Toronto; it is family and friends. Of the people I know who are looking to move to Victoria I have noticed that some if not all of their kids have left Toronto for Calgary, New york, California and texas. A lot of people I knew were not originally from Toronto with families in places like Montreal and winnipeg or from out east. I cannot speak as an expert on this but when I look around the circle of people I know there seems to be a large dispersions of people elsewhere, many due to divorce or moving to retire elsewhere along with more funerals. Frankly, for many of the Bay Street guys you dont have friends as much as you have business associates. It would be interesting to note why people do decide to move thousands of miles away.

To Curious Cat:

First I am retired, my practise was in Toronto and yes I was a Bay St. Bandit.Moved to LA for family reasons and spent four years there. met my wife in LA> She is obviously a California girl originally from Berkeley but had been living for many years in Beverly Hills.

Basically we had to decide where in Canada or the United States we wanted to live. Europe was eliminated because of the difficulty of getting permanent residence status. Neither one of us particularly liked LA. There were a number of things we did not like about LA. including the air quality in the city, the endless heat in the summer and high up on the list the impossible traffic. While there was a lot going on in the city it was often extremely difficult to get to it. If you had theater tickets in Passedena you almost had to leave at three in the afternoon for a seven oclock show. Might take and hour to get there or it might take four or even five hours. Malibou beach is nice but the traffic up the PCH was a walking speed in the summer and lots of luck getting parking. Frankly endless summer is less pleasant than one might think. What I associate with LA most is endless brown parched hills everywhere. Honestly I missed green and rainy days.

We started with a couple of very personal criteria which probably does not apply to the majority of people:

1) I did not want to “snowbird” between two residences so it had to be a single location.

2) The climate had to be moderate year round; I do not like really warm temperatures nor did I want to have to deal with snow.

Those first two criteria narrowed the search down more than one would think. Looking for a year round moderate climate knocked out virtually the whole east coast and almost all of Canada.

Fargo got dumped from the list as well.

Our list got narrowed down to San diego, San Francisco. Santa Barbara, Seattle, Vancouver and Victoria. California cities we deemed to expensive for the areas that you wanted to live in. Crime rates were also uncomfortable high. Seattle prices were very high and the city was not particularly pretty and the cost of living was very high as well.

After living in Toronto most of my life, I have developed a strong dislike of of endlessly sprawling high rises. Basically, I watched Toronto become Americanized to one more city of condos and traffic jams.

We spent a number of weeks in vancouver touring various parts of the city because we had read how it is a great city to live in. Frankly, we were both really disappointed with Vancouver. Leaving prices totally aside neither of us liked the city at all; endless highrises, really bad traffic and not particularly picturesque. Some of it was little things like 3,50 an hour parking at Stanley park if you could find a parking spot. It felt like just one more American city and actually had less charm than Toronto. I am sure that many would disagree but I am just expressing the feelings of both my wife and myself.

Both of us were instantly taken with Victoria. The old city downtown had been preserved; there was a human dimension to the city. Neighbourhoods of houses that were not totally dominated by high rises. The city had a slower more gentle rhythm to it. This goes back four years so house prices were extremely reasonable and cheap compared to the other alternatives. The weather was far better than either Vancouver or Seattle. I suspect that eventually the developers and the politicians that they have bought will turn Victoria into just another American city but probably not in most of my lifetime. The city is set in a natural beauty that I sometime suspect the residents take for granted.

It is an extremely active city with virtually everything you could wish for at your very doorstep.

The decision was totally obvious to us, nothing else even came close. Still one mans paradise is another mans hell.

@ Barrister, I’ll sell you a knock down in Fairfield for a million.

@Hawk:

I assume you are joking when you assume I know most of the Ontario people who moved here. Or should I assume you know every person in BC and Alberta.

As to the Uplands. I seriously looked at four knockdowns and considered building my own house here.

This was about 3 1/2 years ago. My recollection was that they were asking from 700 to 850 k at that time. What is a knockdown selling for in Uplands proper in the last six months? Let me know when you find one on a half acre lot for a million four.

Barrister, I would be interested in your personal reasons for moving to Victoria from LA. Los Angeles is arguably much nicer than Victoria, better weather, nice beaches, more things to do, and Disneyland! 😉

Are you retired, and if so, why did you choose Victoria to retire over Vancouver?

Of your 4 friends that are retiring here from Toronto, why Victoria? My entire extended family lives back east, and the number 1 reason they say they stay where they are is because of family and friends. My father has 6 siblings and a mother that is still living, and 3 kids himself that live within a 15-90 min drive from where he lives. (I’m the oddball that moved “away”, but I did it when I was 24, before I had kids or a partner.) AND he has like a million friends! lol I would imagine it would be really hard to uproot at that stage of their lives.

I guess it’s relative. Fairfield has always been pricy. I went shopping there in 2011. Even then it was $750k for a fixer upper. Now that places are selling in the hillside area for 900k, that seems cheap… Fairfield has simply gotten further out of reach.

Not making anything up Barrister. You made up things like the Uplands has doubled when it hasn’t and every one in ten guys you know in Toronto that have ten million and are planning on moving here. Sounds a bit stretched to me.

As a lawyer I would assume you know alot of people which would mean you know most of the Ontarioans that have moved here this year. I have a large extended family in Van and Alberta and not one ever retired here or desired to.

Victoria isn’t Mecca when you can’t find a doctor,traffic is getting worse and there’s a mental health and drug crisis going on. As a senior those things are a priority consideration over a nice beach and no snow . Just sayin.

Dear Hawk:

No idea if I am related to Mike although I have long suspected that my dad got around a bit in his youth.

Yes, Victoria was always a retiree haven. The difference lies in the demographic impact of the baby boomers retiring. From a totally personal point of view, I think Victoria has more to offer many retirees than Vancouver (not even taking pricing into account).

Hawk, I never said that they are all coming with ten million dollars so why make something up to argue against? I am a little surprised since you often have some good points to make.

Barrister,are you related to Mike ? He beats the retiree thing to death too. ICYMI Victoria has been a retiree haven for decades. Once Victoria gets over valued like it is now they will slow down moving here like past peaks.

Not every retiree has ten million like you portray.

This catch up theory because it was slow here a couple of years ago is lame too. We rose because of foreign money FOMO the past year, nothing else. They are leaving BC by the thousands, the peak has passed. Check the Vancouver chart.

Leo S:

Actually, in terms of the bigger picture, the higher end buyers have a real impact on the lower end buyers. I am not an expert on Victoria (Marko feel free to jump in here). My understanding is that ten years ago Fairfield was a modestly priced neighbourhood. Today it is beyond the reach of most young families. Again, I am not an expert but James Bay and Fernwood also seemed to have SFH that used to be modestly priced. A lot of the homes in those two areas are starting to creep up towards a million.

If you start having 500 out of town buyers a year that can write a check for a million or more cash than this going to impact through the whole market if they are predominately buying SFH. The impact will be further magnified if these are younger retirees that will hold onto their houses for a decade or more. One of the reasons that the inventory if low is that people are moving in faster than they are dying off here.

Surprisingly when using Teranets, much of western Canada was fairly stagnant from Spring ’08 to Spring’13.

http://i.imgur.com/l4TuKG5.png

Marko:

I suspect that the major driver for retirees is the age demographics, the investors follow the retiree demand increase much like sharks follow blood in the water. The smart ones show up before the retirees get there.

For some reason that reminds me of the Toronto lawyer who, when accused of being an ambulance chaser said, with a very solemn face ” Oh, no that is not true; I always get there before the ambulance “

Why? Both are exactly one unit off the market. The hypothetical toronto buyer may have more of an impact on the upper end, but the hypothetical Nanaimo buyer would have more of an impact on the lower end. Arguably the lower end is more relevant to ordinary local buyers so the impact of reduced availability in the entry level is greater.

Thank you Leo:

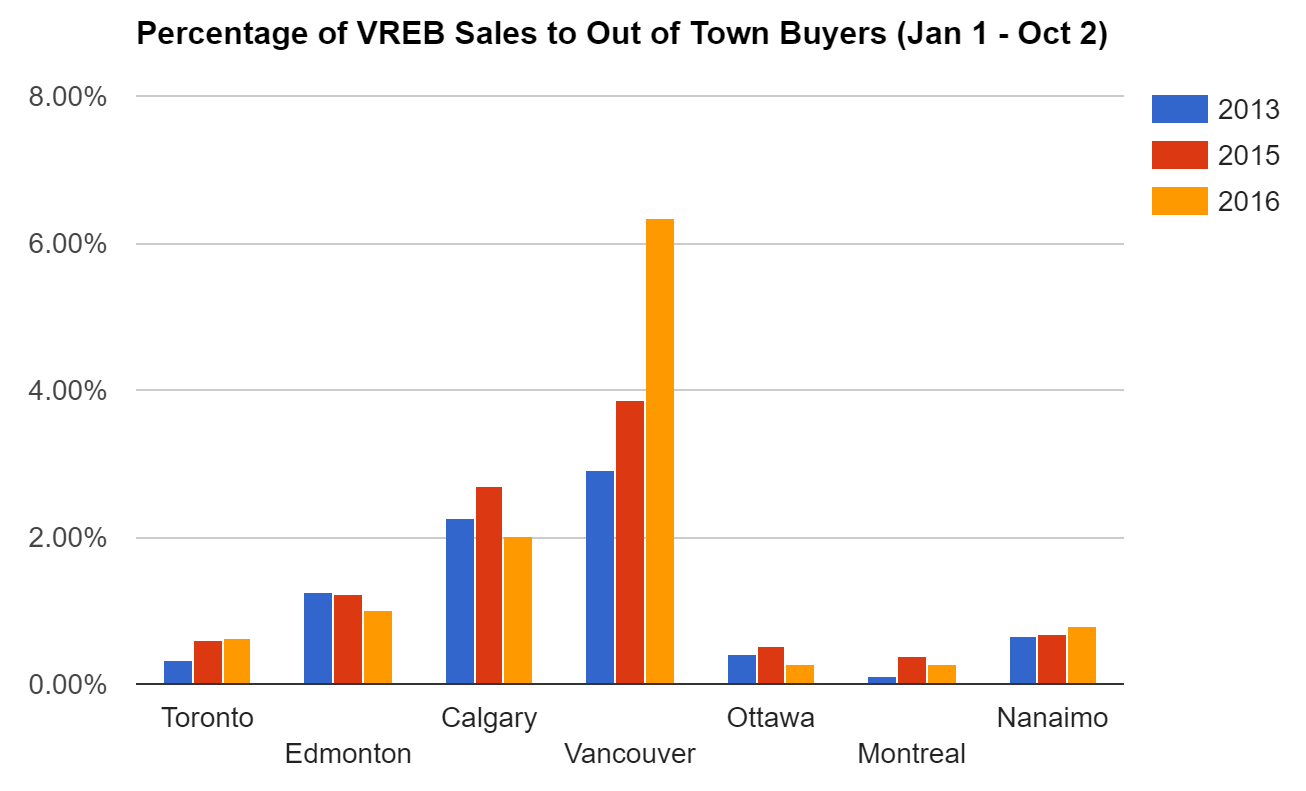

The charts and numbers are very informative. There are two other numbers that would help to assess the impact of out of town buyers. The simple one is to break out the raw numbers between SFH and condos. The stats show that Vancouver buyers account for 6% of all sales. But if the bulk of those sales are for SFH then their impact on that segment is much more significant. (I am not saying such is the case but it would be good to look at the numbers.)

The second number that really needs to be looked at is the total dollar value of each group. Just by way of hypothetical, the chart indicates a greater number of people buying from Nanaimo than Toronto but if the average sale price to Nanaimo is 350,000 and the average for Toronto is 1.5 million than there is a very different picture of impact on the market.

Now a question for the real estate pros out there. I am getting an impression (quite possibly wrong)

that in the core a lot of locals are selling to out of towners and then downsizing to a smaller, cheaper place in or close to the city. Marko what is your feel for this?

In the case of Vancouver buyers it’s probably more to do with their market being hot and being able to cash out. Same from Toronto although in much smaller numbers. The Victoria market spent half a decade stagnating while the rest of Canada appreciated by some 50%. So makes some sense that it became steadily more attractive.

I wonder what Bill Morneau has up his sleeve tomorrow morning ? Maybe ban the auction sales ? Maybe hike fees for flippers ?

Maybe Christy follows through this week with her recent comments that she isn’t finished with more new real estate laws to pop the bubble. Maybe she’ll throw a 15% tax on the out of province retirees since we got too many already. 😉

http://www.bloomberg.com/news/articles/2016-10-02/canada-s-morneau-to-make-announcement-in-toronto-monday

I guess the question I have is are retirees moving here in bigger numbers due to age demographics across Canada or are more out-of-towners buying because the market in Victoria has been “hot?” Does the performance of the local market psychologically influence out of towner purchases and the quanity?

Marko,

Thanks for the numbers. Another depressing reminder that I should have bought in 2013 when I was thinking about it.

So retirees are moving here it looks like to me. Is that the consensus?

Would you also be interested in posting the number of houses bought by Chinese foreigners? I would be interested in seeing the change.

Thanks again

Not sure, but I think you have to take into account how busy the market was. You could graph the absolute number of Victoria buyers in the last 3 years and come to the conclusion that there was a big increase, but really just the whole market got busier.

That said I do see that in the case of out of town buyers that represent pure demand, it might make more sense to compare them to the absolute number of units available or something…

Anyway here raw.

Fixed chart.

Vancouver has seen a big jump and is clearly significant. Alberta flat. Nanaimo and Toronto possibly up a bit but insignificant.

Actually I did mean 2013; wanted to compare to a really slow market.

Wouldn’t absolute numbers make more sense in this case? By doing a % it makes it seem as if the number of buyers from Calgary is falling when it is actually increasing.

Thanks Marko very interesting. Did you mean 2014 or 2013 for the last column?

Just Jack:

Stats are dangerous when looking at a small area like uplands. One of the waterfront homes selling for 12 million can really screw up the average monthly sales figure especially if it is the only sale. Just as important one really has to separate the knockdowns from the other sales. They really are two different categories.

Dear Marko:

First, the Alberta numbers make total sense when one takes into account the major job losses in the oil patch. A lot of people make a lot money out there over the last ten years. For a number of the professionals such as engineers there is no reason to stay in Calgary now that the jobs are done.

For many of these people the value of their house is only a part of their total assets. I have meet a number of engineers and oil industry professionals here who all say the same thing. Jobs gone, worked hard , made a lot of money; time to retire and enjoy life. They all think it could be years until oil prices recover. For now the boom is over. Freezing your ass off in Calgary waiting for the market to recover is not smart.

Thanks for providing the price increases for the various areas. I looked in the uplands about 4 years ago and there were a half dozen knockdowns selling at between 700K and 900K. I notice that they are asking over two mil for knockdowns today.

I am finding that figuring out the housing market here in Victoria is perhaps more art than statistics. Blanket stats are often a bit deceptive. The average price increase varies a lot simply on whether one separates single family homes from condos

By way of example, two house across the street just sold in the last two weeks, side by side,on similar sized lots, one for a million and one for two million. the average would be 1.5 million but that does not reflect the reality of the market. Knockdowns and new builds are two different markets here. And this is where having an honest and very knowledgeable real estate agent is important.

Surprising that the increase in Toronto buyers past 3 years (+267%) is almost as high as the 304% increase in Van buyers.

Toronto buyers… 55 (YTD) vs 15 (2013)

Vancouv buyers… 557 (YTD) vs 138 (2013)

But I suppose we haven’t seen anything yet…

Let’s put a little common sense behind those Upland sales.

Here are the number of sales each month in Uplands.

Month Sales, Number of

Jan 3

Feb 3

Mar 3

Apr 5

May 4

Jun 1

Jul 3

Aug 1

Sep 2

With only 1 to 5 sales a month, there is not enough data to determine a reasonable and reliable estimate of how that neighborhood is performing relative to any other sub markets.

But if you want to try then here are the median prices this year for Uplands

Month Sale Price, Median

Jan $2,005,000

Feb $1,877,500

Mar $2,300,000

Apr $2,360,000

May $2,723,500

Jun $2,500,000

Jul $1,675,000

Aug $1,950,000

Sep $2,520,000

And the averages

Month Sale Price, Average

Jan $1,801,667

Feb $1,960,833

Mar $2,199,333

Apr $2,297,000

May $3,217,500

Jun $2,500,000

Jul $2,038,333

Aug $1,950,000

Sep $2,520,000

September continues with another steep 16% decline in sale volumes from August. This is the second largest decline in a decade when 2007 had a 22% decline. In 2010 and 2014 sale volumes actually increased but for most of the decade the decline in volume from August to September have averaged a 10% decrease. This months volume of sales stands at 731 which is the highest in the last decade with the decade average at 562. The lowest volume was in 2012 when sales declined to 397. Sale volumes are down by 44 percent from the peak this year at 1,297 sales in May.

And prices? Well despite the dramatic drop in volume, the median price for all properties in all areas increased from the month before by 5 per cent to $507,000 but still below the years high in April at $520,000. The median price for the year so far stands at $499,000. Up from 2015’s median at $465,000.

October historically brings an increase in sale volumes as the kids are back to school and parents resume house hunting. So it will be interesting to see if October’s volume continues to decline or has a rebound.

Dear marko:

You are right they have not doubled overall but some areas like tthe Uplands have almost doubled and parts of Oak Bay are up by at least a third. Do you actually know what the average price increase has been over the last three years in the core?

My stats show Uplands having gone up the most in value at 52% over the last 24 months. Nothing else is close. Oak Bay as a whole is up about 35% which is no where near a “doubling.”

Buyer City YTD vs 2015 Jan 1st-Oct 2nd vs 2013 Jan 1st – Oct 2nd

Toronto 55 vs 39 vs 15

Edmonton 89 vs 80 vs 59

Calgary 177 vs 175 vs 107

Vancouver 557 vs 252 vs 138

Ottawa 25 vs 34 vs 19

Montreal 25 vs 24 vs 5

Nanaimo 70 vs 44 vs 31

How does one break these numbers down? Is there a trend in terms of retiring to Victoria or is everyone piling in because the Victoria market is “hot.” For example, if prices had stayed flat since 2013 would these numbers look the same or different?

I can’t get my head around Calgary being up YOY. Sell in a horrible market and buy in a market that’s gone up 20% plus in the last year?

It doesn’t matter where they bought. There are more of them so they have a bigger impact on the region.

@leo S

To have a meaningful insight into those numbers you would have to know where people were buying and for how much. I dont think you are suggesting that all your Naimo buyers bought in Uplands.

“September started out as a very ugly month and slowly rebounded, somewhat. We still set record low sales in some areas. Price reductions are piling up, and the market showed no real signs of a turnaround.”

Bottom line is the Vancouver market has turned from a sellers market for a very very long time to a buyers market. That is a major trend shift no matter how you look at the numbers which are clearly down and price reductions are now the norm.

Sooner or later the psychological effect will hit here, we are not immune to hundreds of thousands being lost daily a very short distance away.

“Again a buyers market in all areas for detached.”

@Barrister

Back to reality. In 2015 there were 259 buyers from Ontario and Quebec. Meanwhile 315 people bought coming from the north/central island. So those rich people from Nanaimo are having a bigger effect on our market than Toronto is.