Rates up, prices up?

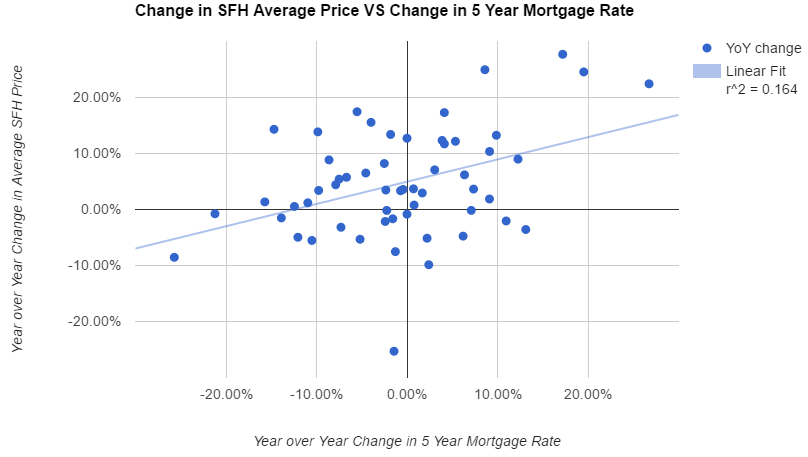

Remember when the VREB tried to tell us that the government might raise rates to stimulate the economy? Well it’s time to examine another interest rate theory that seems to come up often. Courtesy of Michael, this has been posted several times with the hypothesis that prices go up when interest rates go up, which is somewhat counter to the intuitive notion that higher interest rates will dampen prices because they reduce affordability.

Fundamentally I do agree with the idea that hard assets do well in times of inflation, but looking at the chart above there are also many times when interest rates and prices are dropping together. If we look at how mortgage rates changed compared to how prices changed across the whole period, we can get a better idea if rising rates are correlated with rising prices.

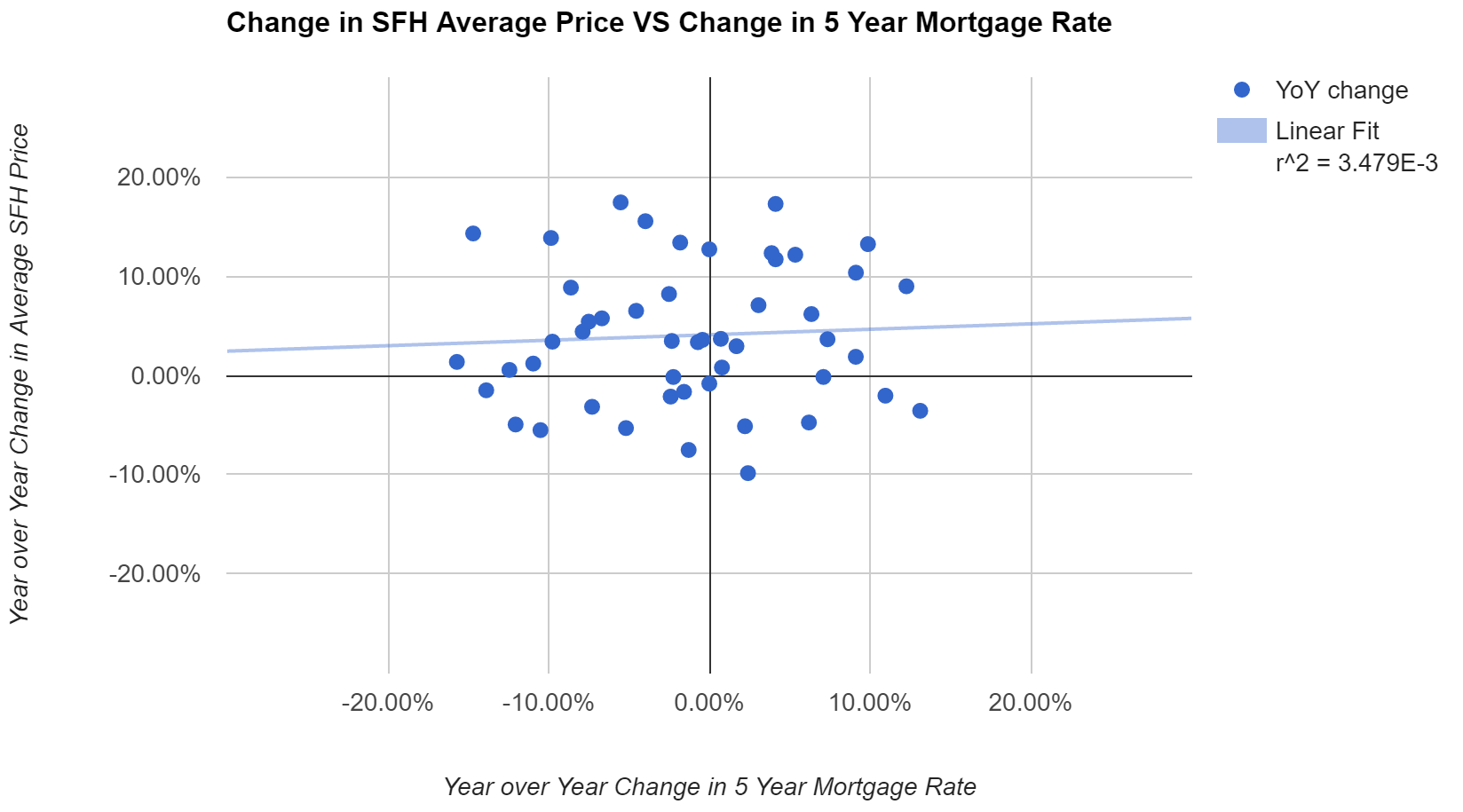

Now here we do see a (very weak fit) positive correlation that indicates that rising rates may happen at the same time as more quickly rising prices. However this doesn’t mean that rising rates somehow cause rising prices. It’s much more likely that a strengthening economy, better employment, and higher wages lead to both price gains and increases in interest rates.

The low R^2 value means the data is about useless for any predictions (see our jump in prices this year while interest rates declined). I also think that fundamentals like affordability have a much greater effect than movement in rates, and affordability is looking increasingly strained in Victoria. Continuous regulatory tightening in the mortgage market will also push up lending costs without any improvement in the economy which will throw a wrench into this already weak theory.

Anyway, back to the data courtesy of the VREB via Marko Juras.

| September 2016 |

Sept

2015

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 104 | 241 |

704

|

||

| New Listings | 108 | 363 |

962

|

||

| Active Listings | 2011 | 2061 |

3478

|

||

| Sales to New Listings | 96% | 66% |

73%

|

||

| Sales Projection | — | 732 | |||

| Months of Inventory |

4.94 |

||||

Still 40% less inventory than last year but the sales rate is now virtually identical, just 4% ahead of what we saw last September.

The Vancouver data is pretty grim though. The board is going to have a very tough time spinning this at the end of the month. Even the brokers are getting very nervous and advising their Vancouver clients to extract their equity while they still can.

There is a new listing on Midlands in the Uplands for 2.4 million. This is a tear down (built 1953, 1700 sq feet). When I was looking to buy a house, I considered getting a teardown in the Uplands. They were selling for somewhere around 700 to 800k.

I almost regret not doing that now. What bothers me is that we have city councils that seem determined to increase density everywhere. Between basement suites and the new concepts of mni houses in backyards, they seem determined to turn Victoria into just one more overcrowded American city.

That does create some comic moments when one second the politicians tell us that we have a water shortage in Victoria and then the next moment they say they want to plan to have an extra 30,000 people move into the city. I am waiting for the summer showering restrictions to come into effect any day now.

Thank you Michael for the update on Terrace.

Well I guess it’s not so bad if you made all your money in USD.

https://househuntvictoria.ca/2016/09/15/hac/

Terrace Ave. sold for 2.41M

King George is definitely a teardown… if only you could get rid of the power lines.

https://www.google.ca/maps/place/46+king+george+terrace/@48.4107108,-123.3220099,3a,90y,28.5h,92.19t/data=!3m6!1e1!3m4!1sinAPAp-lXYbLL8FVOnlDUw!2e0!7i13312!8i6656!4m2!3m1!1s0x0:0x32567a2711acb6fd!6m1!1e1

The only other drawback is the steady flow of traffic zooming up the hill in front of your living room.

There was a house on Terrace Ave. listed for around two million seven; does anyone know if it sold?

It was adjacent to the high rise apartment.

Thanks

If that house was in Mt. Doug/GH neighbourhood (similar age/era house) would it sell for much less than a million? I doubt it. Agree it’s not practical for a family so it may be falling between market segments.

46 King George Terrace – old home with a steep, rocky lot. And it would be awkward getting out of that driveway too. Probably OK for a retired couple but most families wouldn’t go for it.

46 King George terrace sold for $1M even.”

With a 1.198K asking price, that’s quite the haircut. Looks like a lot of power lines blocking the great view.

46 King George terrace sold for $1M even. Is that not a sweet deal given how little a million gets you now in the core? Awesome views perched on Gonzalez hill.

This could be another iceberg lawsuit if proven guilty.

Couple claim they were told to fake assets to buy Richmond home

“The prospective buyers of a $2.46 million Richmond home put down a $120,000 deposit. When they were turned down at three major national banks for financing to complete the deal, an employee at RBC Royal Bank of Canada and a real estate agent at Richmond-based Metro Edge Realty advised them to exaggerate and/or fake assets in China in order to qualify for a mortgage here, according to a notice of civil claim filed in B.C. Supreme Court. None of the allegations in the claim have been proven in court.”

http://www.theprovince.com/business/mortgages/couple+claim+they+were+told+fake+assets+richmond+home/12196782/story.html

It is rather crazy the gave 57 million to the kids….

Wow. Remember when we all laughed at how the US banks could be so unbelievably stupid as to give out NINJA loans?

I think a lot of people are going to wonder at how it possibly could have gone on this long.

http://www.theglobeandmail.com/news/british-columbia/incomeless-students-spent-57-million-on-vancouver-homes-in-past-two-years/article31892652/?cmpid=PM17

Plenty of people that rely on financing make unconditional offers. Just have to be confident that the financing is sorted out ahead of time.

What advantage do they have now? None as far as I can tell. If the 5% down guy is pre-approved for the amount and there’s no issue with the appraisal they can buy it just as quickly as the cash buyer.

Currently the cash buyer can make an unconditional offer. That is the advantage. Sellers regularly take upwards of $50,000 less for unconditional offers, I’ve seen it many many times this year.

If buyers making conditional offers always acted in good faith sellers wouldn’t be taking less for unconditional offers.

In reality what happens is you take a conditional offer for 7 business days. A bunch of other buyers are disappointed and continue looking at other properties. After 7 business days buyer gets cold feet and says they are collapsing the deal on financing.

Now you call back all the other interested parties and they think you are lying to them and the buyer collapsed the deal on something else, not financing. Really tough to get moment going again.

***When sellers take $50,000 lower for an unconditional offer we are taking all the offers are above asking price by a mile.

For example, if asking price is $995,000 seller will not take $950,000 unconditional over $995,000 conditional.

Agreed. We have consumer protection laws for so many in comparison trivial purchases. I can sign a contract for Telus internet and change my mind at any time before the install. I can return most items if they are defective within a certain period regardless of the vendor’s return policy. There are lemon laws for vehicles, etc.

Why not for houses? A 5 day mandatory conditional period makes sense.

Could always have a small non-refundable deposit. I doubt many buyers are going to waste their time making offers on houses they have no intention of buying.

What advantage do they have now? None as far as I can tell. If the 5% down guy is pre-approved for the amount and there’s no issue with the appraisal they can buy it just as quickly as the cash buyer.

A couple years ago, at our first renewal, Vancity’s rate was even lower than Coast Capital’s, so we asked Coast Capital (our mortgagee) to match it and they did — no questions asked.

We were prepared to switch to Vancity if CC didn’t match, but it turned out well.

Interesting. I always heard the opposite that banks will first offer a high rate and hope the client doesn’t know what the market rates are. Never had a renewal so will be interesting what CIBC does when the time comes.

What have others experienced?

The wild wild west days of residential real estate have to end. At one time it was consumer beware. Today the marketing is slick and fast putting prospective purchasers at a disadvantage to schemes that are too difficult for the typical person to comprehend.

We need consumer protection to protect buyers just as we have rules to protect sellers such as the recent residential flipping regulation. Why is it alright to protect sellers rights but not purchasers?

I like the idea of a mandatory condition that a buyer has 5 days to conduct an inspection. In a balanced market, buyers already do this anyway, and use it as an escape clause.

A chance for sober second thought is never a bad thing when throwing down hundreds of thousands in cash in a blind bidding war for some old lady’s rancher.

Better yet, and has been suggested here, requiring disclosure of all offers on a property would be a thing of beauty for everyone other than realtors and a few lucky homeowners.

Is that what is happening with condos? Are people making ridiculous offers and walking?

And just because there is a 7 day cooling off period that doesn’t mean you can not accept back up offers that run concurrently in time with the original offer.

I believe it is seven days. You can change your mind for any reason or no reason at all in those seven days.

I think if that were to be expanded to all residential sales it would go a long way in buyers and sellers acting in good faith and not one try to pull the wool over the others eyes.

A lot of buyers would just throw in dumb offers and walk away on the 7th day.

Also, would only encourage leverage to a further extent. A financial savvy and diligent cash buyer would have zero advantage in the offer process over someone with 5% down with a 7 day cool off period. Cash buyer offer would be made on equal terms even though they have cash. Importance of cash is even further dimished. Screw saving as the cash buyers all of a sudden are no competition.

“Case in point I did not renew my 10 year term life insurance and informed the company by email. They said email was not sufficient so the charged me a three month penalty. ”

Had the same happen. Tried to cancel via email, no go. Wanted it written and hand delivered to their office so the insurance guy can try and talk you out of cancelling. Insurance companies are the worst scum in the world.

We already have a precedent for a mandatory cooling off period when you buy a pre-construction condominium from the developer. I believe it is seven days. You can change your mind for any reason or no reason at all in those seven days.

I think if that were to be expanded to all residential sales it would go a long way in buyers and sellers acting in good faith and not one try to pull the wool over the others eyes. It would also give lenders time to complete their checks and perform due diligence.

I think in the past we were a lot more honest with each other. A deal was done in a handshake and backed by your word. Now it seems that everyone is out to rip you off.

Case in point I did not renew my 10 year term life insurance and informed the company by email. They said email was not sufficient so the charged me a three month penalty. Yet they have still continued to debit my account. So I went to put a stop order on RBC INS -life. I was told that after a year the stop order is lifted so they could debit my account again.

Fine, I closed my account and opened a new one. There was no stop order charge and I get a hundred free checks. What a BS world we live in when you can’t even trust a big company like RBC to do the right thing and have to resort to closing accounts.

As to mortgage renewals. approximately 75% of mortgages are for a five year term. On average one quarter of all mortgages come up for renewal every four years. In law a renewal is actual a new mortgage, the old has expired. Under Canadian banking laws, banks are prohibited from granting a mortgage to a property when there is no equity in the property (there are limited exceptions when other security is deposited with the bank). A “renewal” is always treated like a new mortgage.

In the event of major price drops in the housing market this would definitely cause a crisis for a certain spectrum of renewals. Would the government change the rules to deal with such a crisis is a good question.

You paid for CMHC insurance and that stays with your mortgage even if you change lenders and the amount of the insurance will not change. This is insurance not a loan and not dependent on the loan to value ratio. CMHC doesn’t tell the bank if it can or can not renew a mortgage.

CMHC is likely one of the biggest rip offs of consumers. Unlike in the states if you refinance and the loan to value ratio is less than 80 percent, CMHC does not refund you the unused portion of the insurance that you took out for 25 years. In the states, if you pay down the mortgage you get the unused portion of your prepaid insurance returned to you.

RE: Mortgages Underwater:

At the time of renewal if the mortgage is CHMC insured will CHMC even allow the mortgage to be renewed if there is not the required amount of equity in the house?

Does anyone actual know as opposed to a guess?

I have not given it a lot of thought but my initial feeling is to simply change the legislation to include a clause in every agreement of purchase and sale to include a condition that the purchaser has five days

to do all desired home inspections at his expense.

I am aware that this might be used as an escape clause for buyers remorse but I dont thing that is necessarily a bad thing.Nobody should feel compelled to buy a house, in a hot market, without a proper home inspection. Nor should one be expected to spend a lot of money on a home inspection prior to having an agreed purchase agreement.

This does not solve all the problems with over bids but it is a small step in the right direction.

But this was a fast thought and I would love to hear input.

Banks will offer you a good renewal rate because if you have enough equity you can easily walk out the door to a new lender.

It’s when you are upside down in your mortgage that’s when you can get squeezed a little bit more. The banks are here to make money for their shareholders not to be your buddy.

When you dance with the Devil he calls the tune and tells you how long to dance.

I can understand why OSFI would like the banks to recalculate the loan to value ratio at the time of renewal. And no one knows how they get the information. The loans officer may just ask you what you think your house is worth today.

This would have been good information for the Americans to know when MBS and credit swaps were defaulting. Because then Fannie Mae could evaluate what they were worth and determine a discount rate to sell them at. As it happened no one had a friggin idea of what they were worth.

So it is a good idea but I don’t think it is necessary to call in a performing loan. However you might not want to increase any more loans to these people.

I’d have to read the legislation.

The lender may have to calculate the new loan to value ratio at renewal time but that doesn’t mean they have to act on the information. The could just simply roll the mortgage over as they have done before as long as there are no changes to the terms. But anyone wanting to extend their mortgage or chang any other term might be affected.

3555 Beach Drive. I could live in that.

I don’t think so LeoM because they will never get an offer until they reduce the asking price to within a few percentages of market value.

We can’t make people who list their own home for sale follow a fair listing regulation but we can make real estate agents do so. That means agents will not be able to conduct deferred offers or blind auctions to elicit multiple bids by under exposing and/or under pricing the property to the market. Agents have to market the property under the definition of fair market value which includes a reasonable asking price and reasonable market exposure unless they disclose to the public that the asking price is not a fair market listing but meant to elicit multiple offers over an arbitrary short time period.

That’s a fair disclaimer that a prospective purchaser should be made aware of before they bid.

Purchasing a home will probably be the largest purchase in most of our lives. Why can’t the process be conducted in a fair manner to all participants. That’s not being dictatorial, that’s just being fair to all parties. Because if you don’t then you end up with is a lot of law suits where the purchaser feels they were manipulated into paying too much for the property. They would not have paid so much if they had known that there were no other or less bidders or had more time.

And these delayed offers or blind auctions are not monitored for fairness. There are no rules on how the delayed offer is to be conducted. How can you have the listing agent also act as the auctioneer because that sounds like a conflict of interest. Especially when all the parties are not in the same room to listen to the bids at the same time.

According to Garth that’s not totally correct. Bring out the knives for ole Garth but this is what he had to say a few years back.

“Ottawa has a new regulation which will force the banks to re-calculate the loan-to-value (LTV) ratio every time a home loan comes up for renewal.

What does that mean? Simply, if there’s a widespread housing correction and values fall by (for example) 20%, hundreds of thousands of people who bought recently with small downpayments could be in negative equity, owing more than they own. So in order for the LTV to be restored to the ratio agreed to in the original mortgage, owners would have to cough up money to pay the bank.

For example, a $400,000 condo bought with 5% down would have a 95% LTV. If, upon renewal, three years later the unit was worth $320,000, then the maximum mortgage amount offered would be 95% of the new value, or $304,000, instead of the original $380,000. In order to renew, the owner would have to hand over $76,000, less the small amount of principal paid.

And how many first-time homeowners have seventy grand in cash to give the bank? Right. None.

The consequence: A wave of listings as jilted, disillusioned, shocked and scared owners try to get the hell out. And this surge in supply will have exactly the same effect here as it did when this happened in the US – all prices will be brought down, creating lower valuations, more negative equity and more demands for cash payments upon renewing.”

@ Leo,

Most renewals are offered at extremely competitive rates, and are difficult to compete with as a broker. Banks can offer better rates on renewals for the simple reason that they don’t have to pay broker commissions, never mind clogging up their underwriting centres.

A hint to the HHV crowd. Negotiate with your bank at renewal. They can, and nearly always will drop the rate to keep you.

@ Just Jack –

Yes you are correct on that. Only at renewal could a lender request/demand full re-payment. However, why would they refuse to renew the mortgage, demand full repayment if the borrower is in good standing and making regular payments? This doesn’t make sense. Any foreclosure based on this scenario would have to be agreed to by both the bank and the insurer – which I think would be highly, HIGHLY unlikely given the guaranteed losses that foreclosure in a negative equity situation would generate.

Also, a negative equity event doesn’t automatically mean people aren’t going to be able to pay their property taxes. In fact all borrowers with high ratio mortgages (and most susceptible to an decrease in equity) already have the banks collecting and paying their taxes for them.

I think the overall debate here is what will happen if/when the market tanks. This debate has been raging for some years on HHV and I don’t expect/want it to stop anytime soon. However, on this particular point, I think Hawk’s doom and gloom was reaching a bit far past common sense.

“Just noticed that 2405 Musgrave sold for $809k while 2571 Musgrave sold for $952k (both were asking $799k)”

A lower price might be justified because 2405 is right across the street from willows school but the house isn’t really configured very well for small kids. Only two beds on each floor and having to reconfigure the entire back yard are two pretty big compromises for a young family with more than one kid, zero extra money and zero time to do it themselves (which is more or less every young family these days. For older buyers, the house is laid out ok but has all the issues with being in a family area (school drop off/ pickup, etc), so maybe is less appealing for them as well.

Either way, I think that is a pretty good deal for that street. The 950 sale was more what i would have expected.

It is not illegal for the bank not to renew your mortgage. Just as it is not illegal for you to get financing from another lender.

Part of your mortgage terms state that you can not jeopardize the security of the loan with outstanding debts. So if you haven’t paid your property taxes for a couple of years the bank does not have to renew your mortgage. And if you don’t pay off the loan by the renewal date they will foreclose. Even though you have never been late on one payment.

JustJack said: “What BC needs is a fair listing policy. If you offer your property for X amount and a buyer comes in with a full price offer without conditions that should constitute acceptance.”

Jack, you have lots of good information, but some of your ideas are bizarre. If you become Chief Dictator of BC and implement this new law, then people will just do the opposite of what they do now. Instead of listing their property at a low price to encourage a bidding war, people will just list their property for double their expectations. The psychology of this is better too, every purchaser will feel like they got a great deal at 80% less than asking price!!!

Just noticed that 2405 Musgrave sold for $809k while 2571 Musgrave sold for $952k (both were asking $799k), which I think is one example of where you can get 2 houses in similar location, similar year built (+/-5 years), maybe similar street appeal, but what really makes the price jump up is liveability or quality – more square footage (renos don’t seem to matter in those houses).

To be honest, I think if you took the delayed offers away, you’d only get more crazy competitive bids without conditions, because people would be racing against the clock to find a house & submit a bid within 1 minute of it going on sale – no time to think at all. At least delayed offers have given people a chance to do an inspection ahead of time.

I noticed those types of houses were subject to bidding wars within 1 day of listing even 3, 4, 5 years ago.

That’s interesting. Never heard about that.

Do you think a lender would offer competitive rates at renewal time if a borrower is in a negative or near-zero equity position or would that borrower be stuck paying a higher than market rate?

@ Hawk

“Oh yeah, the owner is $100K in the hole and the bank will renew no prob with no additional cash paydown. Dream on.”

Moving to foreclose on a property that may be in a negative equity situation, but where the owners are still making payments would be illegal in Canada. At renewal it may make sense to requalify – but normal course of action is to auto renew at standard rates with borrowers that are in good standing. To undermine their own security, and force foreclosure makes no economic sense for the lending financial institution, or the approving mortgage insurer.

The banks don’t have to renew your mortgage. They retain the right not to renew. That did happen in the last credit crunch. Because the banks have to maintain a reserve. To maintain that reserve they may choose not to renew and be paid out on the mortgage or they can borrow from the Bank of Canada.

Most if not all lenders would prefer to fix the reserve problem internally rather that signal to the rest of the world they are having problems.

If I were performing mortgage appraisals in Vancouver I would only present sales in the report that occurred in under 30 days to demonstrate that a market exists for properties like the subject and this is the range that they been selling for in the last 30 days. I wouldn’t use any sale, no matter how perfect, that is over 30 days. What also would change is my reconciliation that would expand to show a market analysis of how prices are changing and how I interpreted the data.

Mortgage appraisals would not be the problem because they a current market valuation. The big problem are relocations where companies are paying out their employees on their homes and foreclosures where you have to account for a changing market in the upcoming 90 days. These are tough reports because your client wants you to forecast the anticipated selling price in the next 90 days. They are tough because the data is not there or so fragmented that it doesn’t make sense.

The silver lining is that the falling prices in Vancouver will eliminate the “bad” appraisers. They will spend more time in court defending and losing. Ever so often all industries have to have a cleansing and Vancouver is way over due.

The Vancouver appraiser is only insured up to one million dollars per occurrence with a maximum of two million in any one year. Any settlement over that amount comes out of the appraisers’ pocket.

And one more big no no that a lot of appraisers were doing with condominiums was using contract purchases of new condominiums that were never listed for sale as representing market value without testing them against sales in other complexes that were exposed to the market. Might as well not go to court on those ones – just write the cheque.

Thanks Jack. I wasn’t meaning they would have to come up with the whole $100K, but a portion of it like $25K. I recall reading several stories in the last correction when that happened or they were forced to pay higher rates and payments in lieu of the cash down as long as they had a job.

I also recall this is why some were being forced into these private lenders in Canada, (more like loan sharks), at much higher rates because the banks didn’t have the faith in their employment longevity at renewal time.

Appraising in a declining market is really tough.

In a rising market any mistakes made in the analysis are quickly covered up by rising prices.

In a declining market those errors in judgement are magnified. Lenders lose money and they trot out the appraisal report and read it forwards and backwards to find errors and then they sue the appraiser for damages. The biggest fault is usually the most elementary. Because of time constraints the appraiser doesn’t measure the house and relies on incorrect information or they don’t conduct an adequate inspection that leads to losses by the purchaser.

When the market declines, the number of sales drops off and the idea of finding three similar sales is gone. Since most lenders have gone to AMCs for speed, the appraiser that has survived has only learned the skill of filling out a form to meet basic minimum requirements. They haven’t developed the critical thinking required to value properties when similar sales just do not exist.

@Dasmo

Did anyone say he would?

The things is, Hillary is, so some contend, by far the most corrupt candidate to ever be in the running probably in the history of US politics…

That’s one reason it’s a horse race. With Trump up today in most if not all polls.

So folks should be careful when making RE investment decisions on how much confidence they place in the notion that Trump’s ridiculousness will keep him out of the White House and his plans for stimulating the domestic economy at the price of inflation and increased interest rates off the table.

If you have negative equity the bank is not going to make you pay down the mortgage unless you change some of the terms. That means you’ll pretty much have to accept what the bank is offering you on renewal.

But where it will have a substantial effect is on your ability to get financing to buy another property or other goods. It’s unlikely that you will get financing to buy another property if you are over exposed in the housing market. That’s where the Teranet numbers become a useful tool for the banks to quickly estimate if you are in negative equity. Especially if you are in a trade that is dependent on real estate.

When things are going well, bankers throw buckets of cash at contractors. That does reverse and the lines of credit are eliminated for those same contractors in a credit crunch. This is what most of the government’s policies have been trying to defer. The last time we had a credit crunch, our government goosed the housing market by insuring 1.2 trillion dollars in Canadian mortgages which led to higher prices and now higher rents. Higher rents are inflationary creating immediate demands for higher wages and goods. That will make the government act with higher interest rates. I think the BofC is waiting on the Americans to act first which probably will not happen until after the election. That’s a reason why OSFI and the banks have been doing stress tests on the market. Trying to determine how much home owners can accept before they walk away from their mortgages. Personally, I think most Canadians would continue to pay their mortgage even if the principle on the mortgage was 20% more that what they could sell the home. Given that most Canadians have considerable equity in their homes that would likely mean the public in general could sustain an interest rate hike and a substantial loss in equity and the banks would still be safe.

What BC needs is a fair listing policy. If you offer your property for X amount and a buyer comes in with a full price offer without conditions that should constitute acceptance.

Too many problems with this. The seller isn’t as sophisticated as Walmart and the value of a home is much more subjective than a gallon of milk.

Why penalize the seller if he or she and their realtor misprice the home?

That being said the current market state of people blatantly underpricing has been super annoying and a waste of a lot of time. Buyers consistently ask me to show them properties assuming they can get the property at asking price when I know it is going 100 to 200k above ask.

Jack,

Garth posted this on his site yesterday. Would the appraisers job now be much tougher on the way down then the way up ? It seems like it would.

“So if you were an appraiser working in Vancouver, what would you do? How do you put a value on an asset that’s shedding almost $10,000 a day?

The answer: Like horny porcupines. Carefully. The experience in August shocked many, even though sales volumes for detached houses had been cascading lower for a couple of months right across the region. As you might expect, mortgage brokers are now seeing appraisals turn up on their desks a lot lower than a month ago, less than sellers expected, and even below what recent buyers agreed to pay. Whoops.”

Oh yeah, the owner is $100K in the hole and the bank will renew no prob with no additional cash paydown. Dream on.

So someone makes payments for 5 years straight and on renewal the bank decides to foreclose and take a 100k loss plus administration costs associated with the foreclosure? Common sense tells me the bank rather foreclose on someone when they stop making payments; the bank hasn’t lost anything before this point.

It is far more likely that the owner simply walks away as they are under water.

Maybe Mike Grace can comment?

“Ohh yea, this makes perfect common sense. The bank will force someone that is making payments into foreclosure.”

Oh yeah, the owner is $100K in the hole and the bank will renew no prob with no additional cash paydown. Dream on.

Year to year comparisons are pretty much meaningless. The residential market a year ago has little in common with what is happening today. It’s how quickly the market is expanding or contracting that is important.

Yes there are seasonal variations that occur in most balanced markets but markets that are “hot” rarely slow down. Neither does the months of inventory increase as dramatically from one month to the next, or a significant rise in the new listings to sales ratio. Only now has the higher MOI and New listings/Sales ratio had an effect on days-on- market which are just beginning to rise.

And that is the key to ending these delayed offers and blind auctions that has led several buyers to pay over market value. Which in my opinion has been one of the major causes of the rapid escalation in prices in specific areas of the city. An increase in the DOM will make the delayed offer/blind auction ineffective.

What BC needs is a fair listing policy. If you offer your property for X amount and a buyer comes in with a full price offer without conditions that should constitute acceptance.

“Sales are lower than the spring but by no means low. We are on pace for the 3rd best September in the last 26 years.”

The point should be is we’re not on pace to be the best September with near record prices. Markets are cooling across Canada, we’re no different. Foreigners are leaving and mortgage lending is tightening with government policy changing.

Glad to know you’re a banker now too. If you’re negative equity you will have to pony up hard cash.

Ohh yea, this makes perfect common sense. The bank will force someone that is making payments into foreclosure.

Aren’t most people doing 5 year mortgages too? It wouldn’t be enough for the market to correct 10-15%. It would have to be corrected by that amount in 5 years. At that point with these interest rates there will have been decent principal repayment.

“and no, as long as you are making payments they will renew.”

Glad to know you’re a banker now too. If you’re negative equity you will have to pony up hard cash.

The low sales numbers for September might partially be explained by a reduced number of buyers from Vancouver who are retiring here.

What’s happened that in the last month we’ve thrown out 30 years of concrete stats that clearly show the concept of seasonality?

Sales are lower than the spring but by no means low. We are on pace for the 3rd best September in the last 26 years.

Has anyone given any thought to what happens to the housing situation if mortgage rates go up one or two points? Also if prices drop by 10or 15% will the banks expect people to come up with more capital when it is time to renew?

When will rates go up one or two points?

and no, as long as you are making payments they will renew.

Noticing a few apartment buildings along Fort St advertising for suites for the first time in a long time. Considering this is prime month of the year for students it could suggest the rental market is possibly in the early stages of turning. Even in the slow years you would never see that in September.

Gluttons for punishment. Oh right, but it’s “good” debt until the market tanks, then it’s negative equity and you’re hooped.

Household debt levels hit record as borrowing for mortgages mounts

http://www.bnn.ca/canadian-household-debt-levels-set-new-record-in-second-quarter-1.567342

New listing at 617 St Charles at 949,000. Seems like a fairly decent home on a very large lot. Has a basement suite. Has been a rental in the last few years. Wonder if it will go over asking. Two others in Rockland at 1.2 million seem to just be sitting on the market for a few months.

I still have a problem with getting my head around the fact that an older very modest home is a million dollars these days. Your average family income in Victoria would be hard pressed to pay for this even with the low mortgage rates.

Has anyone given any thought to what happens to the housing situation if mortgage rates go up one or two points? Also if prices drop by 10or 15% will the banks expect people to come up with more capital when it is time to renew?

I have no stats to support this but I am under the strong impression that a large portion of the people moving from Vancouver to Victoria are early retirees. Basically people between 55 and 65 who have sold their homes for 3 to 4 mil and are buying for half that amount in Victoria. They are able to bank a million or two after paying off a house here, Who would not be tempted to leave Vancouver and retire in Victoria at age 55?

I am not a real estate agent and since there are no stats on who is buying here I would ask any of you who are agents to comment on your impressions of the buyers, particularly in the core.

If a significant number of buyers are early retirees from Vancouver then slowing sales in Vancouver will have a real impact on sales here in Victoria. The low sales numbers for September might partially be explained by a reduced number of buyers from Vancouver who are retiring here.

But I would love to hear from some agents that are selling in the core. Who is purchasing in your experience.

The 12 month or less re-sales continue with some insane numbers.

319/321 Windermere purchased September 2015 for $1,320,500 and sold today for $1,780,000.

Outliers or not, I rather have 700k budget 2 years ago than today with 1M if I am shopping for a new home in the core. Unconditional offer for a life changing purchase, no thanks.

I think on average in the core maybe $1 mill today buys you a tad more than 700k two years ago; however, I would take the 700k 2014 budget any day over this unconditional offer market.

I guess I am wrong, here is still good buy in the core under $700k. 2060 Carrick St sold at asking $680k. OB w/ a suit, 7000 sq ft land, new drain, 200 amp. Dated but move-in ready(?). Surprisingly it took 14 days to sell.

True.

That kind of neighbourhood sounds fantastic!

Not a fan of the mean or median, Just Jack prefers the mode.

Even if the market crashes, today’s desirable neighbourhoods will still be tomorrow’s desirable neighbourhoods. Those living in these neighbourhoods would just need to ride out the crash and not make a hasty decision.

Also, if I sold today and locked in the gain, where the fuck would I move to? Langhole? There’s a reason I’m not there right now.

I don’t think the tax would have caused sales to increase here in July/August.

Just my opinion, but there were many factors: the biggest was probably the annual cycle of spring market vs summer/fall. Also Chinese buyers weren’t as big in Victoria as in Vancouver, but they caused Vancouverites to move to job centres like Victoria with lower cost of living, who then increased competition in the spring – the busiest time of year – even if they didn’t submit the winning bids.

Then the tax probably slowed sales everywhere because suddenly buyers & sellers are wondering what their next “move” should be (eg., BC gov’t told everybody that if prices were affected in other cities, they’d apply the same tax – so nobody wants to take chances on that).

If all the things you said were true Vicbot, then our sales would have substantially increased from July to August when the Vancouver tax was applied. But they did not. In July there were 206 house sales in the core and in August there was 206 house sales in the core and as at September 14 there have been 70 house sales this month in the core.

Where are all these out of town buyers that you speak of? I hear from the bulls of the millions of baby boomers and a billion Chinese millionaires that all want to live here. ….. 70 sales…..so far this month.

Maybe they are just driving through to Duncan.

Foreigners flooding to Seattle. Turn out the lights pumpers.

http://vancouversun.com/business/real-estate/seattle-gaining-on-vancouver-with-chinese-buyers

Without the bears on this blog there would be no reason to visit or comment or read… It’s the countering of opinions and spread of ideas that adds tension and suspense. It’s the fight and the debate that makes it interesting. So I welcome all trolls, bulls bears, sock puppets, realtors, and info to this blog….

Definitely true. That said tech salaries are still pretty decent here. Not like Seattle though.

My bet is Victoria will be the fastest rising city in country 2017 & 2018.

Seems like just yesterday we were in last place.

http://i.imgur.com/6wffcg8.png

“None of the graph/stat will show 300% gain in the past 10 years, but I bet you she isn’t lying. ”

Agree this is true because I’m still tracking things – out of curiosity. Prices jumped by $200k-$300k during 2015-2016 on my spreadsheet. 2014 prices were still $600k, now close to $1M or over. 1950s houses on Eastdowne, Wootton, Larkdowne, etc.

“You’ll notice they say prices in Canada excluding Vancouver & Toronto are cheap. Victoria has been driven up by Vancouver. ”

Agree. I think the sudden increase in prices in Victoria was due several factors: Vancouverites leaving for cheaper places to live + increased speculation by foreign & domestic buyers + retiring boomers + developers/city officials approving too many condos & luxury homes & not enough homes big enough and affordable for families.

The 15% tax and hopefully CRA crackdowns have definitely changed the game for speculators.

@plumwine – “Sweethome said she missed a house in Henderson iirc. Tripled the value in a few years. None of the graph/stat will show 300% gain in the past 10 years, but I bet you she isn’t lying. It is very possible a solid house in Henderson will sell @ 1.2M today, was asking under 500k few years ago.”

I want to make sure we are not confusing time periods. From my recollection, some time around 10 years ago, before the peak in 2008, nice houses could be had in Henderson in the $400K range. It may have been as far back as 2004. After that run-up, they settled in the $700K range. Recently they have gone for around $1M.

An example is 3371 Gibbs which was listed in 2014 for around $775K, appears not to have sold, then re-listed this spring for $998K (I don’t know how much it sold for, but it went fast). Also, 3340 Woodburn sold for $800K in 2013 (which I thought was a lot) and listed earlier this year for $1.188M (I also don’t have selling price).

So, the tripling is over at least 10 years, but some houses in that area (and Gordon Head) have increased 50% in the last few years (mainly since early 2015). It certainly mattered where you owned in this recent run-up.

Commissions are a percentage of the sale price. And this is how total dollar volumes have been been changing over the year.

Month Sales, $ Volume

Jan $265,465,939

Feb $420,325,058

Mar $633,920,415

Apr $741,212,143

May $761,303,504

Jun $676,370,926

Jul $547,718,214

Aug $490,885,789

Fewer commission checks are being cut these days. A 10 percent drop in dollar volumes. This may be the reason for an increase in new trollers in the last month.

If you’re bullish on real estate you want to stick with the year over year comparison. But that’s been falling like a stone lately.

The July to July increase for house prices in the core showed a 23.7% increase in median price.

$610,000 in 2015 and $754,500 in July 2016

But

The August to August increase for houses fell to a 10% difference in median prices

$659,500 in August 2015 and $726,500 in August 2016

And that’s why you never use year over year comparisons by month because they have wide swings

Instead you look at the flow of median prices by consecutive months to see the trend such as house price in the core.

Month Sale Price, Median

Jan $655,500

Feb $681,500

Mar $740,000

Apr $759,500

May $760,000

Jun $743,000

Jul $754,500

Aug $726,500

A 3.7 percent drop in the median price in the last month doesn’t show a trend to lower prices. It more likely just represents stable prices as the number of sales from the previous month has dropped like a stone too. And that is also mirrored in dollar volumes. To me this suggests that for the last two months prices have been stable. The same with average prices for houses in the core which actually rose by 4.3%

What happened in Vancouver has had little to no effect on Victoria because Vancouver and Victoria are not substitute cities for each other. You don’t sell your house in Marpole and move to Maplewood and then continue to drop the kids off at the same school and commute to the same job as you had before. Substitute cities have to be in the same CMA like Surrey and Vancouver or Langford and Victoria.

That doesn’t mean that Vancouver does not have an effect in a complimentary way on Victoria as both Vancouver and Victoria are in BC and subject to similar political, social and economic forces.

Comparing one city in BC to another province is dubious. Comparing on city in BC to that of another country is ludicrous.

Thank you for suggesting Friendly Giant for gutter cleaning. I have phoned them and will let you know how they work out.

By the way, I am one of those boring old people referenced to by an earlier post. I am also one of those old boring people that allow a lot of restaurants to keep going during the winter months.The young people are indeed vibrant but a large number of them are also broke .

Everyone seems to talk about the technology companies here in Victoria but does anyone actually know how many of them pay large salaries? I understand that a number of the tech jobs pay only a fraction of what they get in Seattle; is that true.

JD: “I don’t know that you can make that broad statement and assume it’s the only reason. Vancouver proximity is but one; I think Victoria also has its own drivers.”

Yeah, speculation that the Chinese etc. are going to ride in on horseback to snap up everything in town. Not much evidence that there’s an uptick in Chinese buyers. The same with Vancouver buyers. This price increase is driven by pure speculation.

If I was an owner now, who has owned their place for an extended period and has made some serious money (on paper), I would be listing my place now to lock in those gains before this market crashes. You’ve not made money until you have cash in hand. 😉

“Homes are cheaper on both a U.S. dollar adjusted and Chinese renminbi basis than in 2010-2014.”

Problem is the 15% tax nullifies a big chunk of that so called savings. With the yuan on a downhill slide since the New Year versus the loonie and more yuan devaluation coming it’s not surprising the foreigners are going to the US or elsewhere.

Government policy is changing and foreigners don’t like surprises, especially having to reveal true identities and shell company directors etc. Them’s the facts.

“There is a lot of noise on this forum.”

Sounds like a lot of starving agents on this board trying to rile up the troops. They need to get out off the blogs and start banging those doors and dropping off shiny leaflets.

I had a great afternoon at the beach thanks, what about you ? 😉

Not a new house, but a solid new home.

For 1M today, you get a 1940s with only hours to make up your mind after the open house. (ie. Musgrave)

$700k would not have gotten you a new home in the core 2 years ago.

Yet another house shipped out from Oak Bay this afternoon. I bet it isn’t “high quality” enough for most of you to live in…

Sweethome said she missed a house in Henderson iirc. Tripled the value in a few years. None of the graph/stat will show 300% gain in the past 10 years, but I bet you she isn’t lying. It is very possible a solid house in Henderson will sell @ 1.2M today, was asking under 500k few years ago.

Outliers or not, I rather have 700k budget 2 years ago than today with 1M if I am shopping for a new home in the core. Unconditional offer for a life changing purchase, no thanks.

“Victoria has been driven up by Vancouver.”

I don’t know that you can make that broad statement and assume it’s the only reason. Vancouver proximity is but one; I think Victoria also has its own drivers.

You’ll notice they say prices in Canada excluding Vancouver & Toronto are cheap. Victoria has been driven up by Vancouver. They’re saying the rest of the country that hasn’t seen massive gains is cheap.

There is a lot of noise on this forum.

When people link to zerohedge, brietbart, Garth, etc, or post multiple crash posts per day for years and years and years, it makes this forum into something of a conspiracy theory nut job place.

There are a few level headed voices in the mix however.

http://www.vancouversun.com/canadian+homes+still+cheap+least+foreign+currency+bank+america/12193230/story.html

The economy is finally after 10 years starting to get going, great rates, lots of housing being built which will help with affordability and rental %. The new additions will bring more money into CRD, which will enable improvements to roads and public spaces.

This is an amazing place to live, there really is no better. Get off this forum all day wishing for a crash and go improve your life.

Edit:

[political insults removed, let's stay on topic please - admin]Canadian homes are still cheap: Bank of America

Financial Post, Sept 14th

http://business.financialpost.com/personal-finance/mortgages-real-estate/canadian-homes-are-still-cheap-at-least-in-foreign-currency-bank-of-america

http://www.bnn.ca/vancouver-proposes-to-tax-empty-homes-by-as-much-as-2-by-2017-1.566765

Revenue 2m/ they claim expenses 2m. Voluntary disclosure . LOL

So they think this will get the rick people to rent their places. Glad the liberals did not wait for this stupidity.

“I was jumping ahead to when Mayor Lisa and most of the alfalfa grass council get buried in the next election.”

Helps could face some strong challengers in 2018. Council is likely to include a lot of the same faces though. Incumbents are heavily favoured. Unless Victoria moved to a party or “slate” system in municipal politics you can safely assume that one council will look a lot like the next.

@Vivbot those are huge declines in SFH sales in Van!

Trump won’t get in. There are a lot of stupid people for sure as evidenced online but their aren’t enough of them. He is by far the most ridiculous candidate to ever be in the running probably in the history of US politics….

“Re: Hawk. The Bear trap and Bull trap can look like the same if you scale the graph differently. People just love to see “supporting” evidence for their viewpoints. I see Jesus every morning on my toasts.”

You should put your Jesus toast up on Ebay. 😉 The chart looks identical to the GVREB parabolic chart which is the prime definition.

Flip it whatever way you want but the foreigners are leaving and the politicians are out for blood preserve their power with policy changes that were never there before in history. It’s a perfect market top downturn even the blind can see.

“This little area is going to be full of beards and thousand dollar strollers in no time.”

It already has. Downside it’s a trendy little grocery store not a “supermarket” that has it’s limitations on what to buy. Basics like bread is very limited and prices ain’t cheap plus it’s hard to find parking and get in and out of. But love that smoked bacon !

The bike shop has been there for like 50 years so nothing new there. Coffee shops with limited parking makes me pass right on by to easier access places.

That is true.

But when you have a US presidential candidate saying interest rates “must go up” and advocating policies that would make that claim come true, one has to acknowledge a measurable risk.

And with Hillary Clinton not campaigning while she recovers from, allegedly, pneumonia, Trump is running unopposed, which makes the risk of higher interest rates look quite significant.

The election will be determined by the vote in a handful of swing states, and in those states Trump is doing quite well: for example, up 5% in Ohio, according to Bloomberg today.

If you’re looking at Whole Foods etc to predict prices, take a look at the area around Red Barn on Oak Bay Ave. You have a couple of trendy coffee shops, a trendy supermarket, a trendy juice bar and a bicycle store all within 2 short blocks. This little area is going to be full of beards and thousand dollar strollers in no time.

Too bad REBGV does produce a composite median any more but at least, by region, there seems to be a pretty broad-based decline for detached in August.

http://www.rebgv.org/sites/default/files/8.%20REBGV%20Stats%20Pkg%20August%202016_0.pdf (page 6)

“The Mean/Median may not show 50% jump. However, in 2013/14 if you have 500-600k, you could nit pick a humble house in the core, or even in OB, or with a suit. This year under 1M is dog eat dog. “Good value” houses are over 1.5M now, back then you can buy into Upland or waterfront with that amount of $$$.”

If, in a correction, you “nit picked” some houses that lost 50% of their value, while the rest of the market corrected approximately 20%, you wouldn’t claim the market was down 50% now would you?

The purpose of using median is to limit the effect of outliers.

Re: Hawk. The Bear trap and Bull trap can look like the same if you scale the graph differently. People just love to see “supporting” evidence for their viewpoints. I see Jesus every morning on my toasts.

The Mean/Median may not show 50% jump. However, in 2013/14 if you have 500-600k, you could nit pick a humble house in the core, or even in OB, or with a suit. This year under 1M is dog eat dog. “Good value” houses are over 1.5M now, back then you can buy into Upland or waterfront with that amount of $$$.

@cs actually I read the news, and I’d rather trust somebody that trips on stairs – which is all that was – than the village idiot. (Pics like that are no better than the aliens in News of the World – bullying & rumour tactics designed to distract from his incompetence)

Strange how that National Post Teranet story is right beside this opposing story:

http://business.financialpost.com/personal-finance/mortgages-real-estate/vancouver-is-dragging-down-all-of-b-c-housing-market-numbers-new-data-says

“Vancouver is dragging down all of B.C. housing market numbers, new data says … and consensus from the industry is the pullback in Canada’s most expensive city is far from over.”

“Big Box store executives follow these trends for thousands of towns and cities across North America. It’s not a coincidence that the Big Box stores all arrived in Langford just as the housing supply of Greater Victoria started becoming unaffordable to the average young family and just before Langford’s population and building explosions; the executives knew what was happening long before anyone else.

This is not a chicken and egg scenario, this is astute planning by Big Box store executives.”

So I wonder what the decision for Whole Foods to open at Uptown says about Victoria these days. Maybe that we’ve arrived at an ideal level of wealthy foodies?

That’s not how the Teranet works. It considers all repeat sales and then calculates the change in value since the last sale date.

Haha good point. What I meant was high price to income doesn’t mean it must come down again.

“The big correction has yet to happen in Vancouver.”

Agreed, things are just getting started. Just like in the US crash it all started with mass denial (like Mike), scams exposed, mortgage lenders tighten, media exposes corruption in the real estate industry, etc etc.

REBGV only 60 sales yesterday, lowest in the month. Doesn’t look good at all for the big sista.

http://www.robchipman.net/

I think they may show a strong potential for price compression in the market. As the high end homes are re-listed at lower prices and compete with the less than high end homes. And that starts a domino effect down the property ladder.

The big correction has yet to happen in Vancouver.

Draw one of your little green arrows on the “Denial” stage Mike. You are there. 😉

http://2.bp.blogspot.com/-ZWsQNhB12M4/Tf161ZP8iFI/AAAAAAAAAu4/iEFXxNao1KU/s1600/800px-Stages_of_a_bubble.png

How many repeat sales are there in one month? How many people buy a house in August and sell it again in September.

Best guess is that there are close to none. That means they are using at least a three month rolling average. Fine if the last three months are the same as now but if the market changed Teranet won’t see the new data for another 3 or 6 months.

That’s using the rear view mirror to drive with.

Teranet are the most accurate, as they’re based on repeat sales. What it shows is the typical Joe’s house in Vancouver went up in August (1.75%), opposite again to what the bears thought.

We have thousands of comments over the years to display that 🙂

“Teranet are the most accurate, as they’re based on repeat sales. What it shows is the typical Joe’s house in Vancouver went up in August, opposite to what the bears thought.”

Typical Joe is the last to wake up, just like Mike.

“Unfortunately, the graph is using averages. Personally I don’t bother with averages or any study that uses them.”

Jack,

I think they are a great tool when determining a major top or bottom has been reached, especially with such an extreme parabolic chart.

If the higher end of the market is supposedly causing the big moves in average prices then this can be seen as a sign of big money coming into the market as well as leaving the market.

Since Vancouver’s market has been driven by billions monthly in the high end for over 5 years this is very telling to the future direction. I’d rather pay attention to the speed boats than the freighters and find out 6 months later the market tanked.

It may not be perfect science but it’s a great momentum and sentiment indicator. In light of the all the recent exposure of mass money laundering/tax evasion and now mortgage lending scams/ tightening by banks etc, it says more than any Teranet or HPI would ever tell you.

Unfortunately, the graph is using averages. Personally I don’t bother with averages or any study that uses them.

Teranet numbers are like driving a car by looking in the rear view mirror.

They’re fine as long as there isn’t a bend in the road up ahead.

“Best for a bear to wait for it to pop and then call it a bubble.”

The GVREB chart shows the “bubble” has popped….but the bulls are in denial. All part of the beginning of the downhill slide. The ripples across the water from big sista always takes a few months to hit the masses.

Victoria is typically late to the game culturally and financial, its a decades old tradition for all you newbies from Van and other locales. 😉

“Teranet numbers are out.

Vancouver real estate shrugs off tax…”

Mike likes to read 6 month old news. The Van market is tanking and Vic sales are down for last 5 months. The rose colored glasses on too tight.

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2016/08/27/vancouver%20prices.jpg

It’s just that this natural urban evolution is not strictly linear. Even the largest and most popular cities have had several price correction events.

But like a Goldfish in a jar, a city can only grow as big as its environment. That leads to new city centers such as Surrey and Langford developing. Or in the case of Nanaimo the abandoning of the old town center for a new one. There are also countless ancient cities that no longer exist in the world or towns were the population has not significantly increased in 200 years.

Vancouver in the 1980’s drove out a lot of its pensioners from the City to Aldergrove and Abbotsford by raising property taxes. And Victoria just like Rome will likely decline due to mismanagement and higher taxes too. Because that seems to be the natural evolution for governments.

How many of us want to pay $10,000 a year in property taxes for a typical home? Because that’s what someone was paying for a 1 million dollar home in taxes in 1996 in Victoria.

That would make a lot of people want to leave today.

Well I like that. A nice example of having things both ways. A high price to income ratio can (does) indicate an interest rate risk, but it is not in and of itself a risk because. well, um, because it is not a risk unless events prove it to be. Or something.

The fact is, a risk is a risk.

@ Leo M

That’s true. However, any effort to combat that tendency will help maintain and expand a city’s economy and accumulated wealth. Thus, cities such as New York and London have huge quantities of publicly subsidized housing, thus providing for a large population of young ordinary working folk in close proximity to the business core. Moreover, such cities follow planning guidelines that increase population density. Unfortunately, some of our municipalities seem to prefer monster homes and mansions to smaller lots and higher densities.

This, however, will be to the advantage of the periphery where people and useful economic activity will increasingly concentrate. Municipalities such as Oak Bay, meantime, will stagnate and ossify, becoming ultimately, no more than mausoleums for boring, rich, old people.

I’m not claiming to show anything. I wanted to examine Michael’s claim and there is at best a very weak relationship that disappears when you remove the outlier years.

Sure. And? Price to income isn’t really important until interest rates change. So yes, a very high price to income can indicate interest rate risk, but isn’t a danger by itself.

I doubt that you could state if it was or was not a bubble just by reviewing year over year data.

Most of that increase in the core housing market occurred over the first two months in 2016 and only in specific locations which sounds more like speculation than gradual price increases due to rising incomes or declining interest rates.

Using a term such as bubble is just inflammatory. It suggests that there will be an immediate drop in prices. And if the market doesn’t drop within X amount of time then that is used to show how wrong those bearish on real estate have been. There is no time limit on how long a market can stay in a bubble that I know of.

We have a reasonable expectation that another large meteorite or comet will hit the Earth. If it doesn’t hit by Thursday does that prove that the Earth will never be hit again? Or how about an earthquake. We haven’t had a big one in a long time does that make the chances of a major earthquake happening tomorrow more likely than a year from now?

It is best to keep away from inflammatory words such as bubble that are meant more to illicit an emotion in order to sell more magazines and newspapers or a way for a bull to discredit a bear because it has not popped. What I find ironic is that most bulls bring up the subject of a bubble more often than bears. Best for a bear to wait for it to pop and then call it a bubble. Because in hindsight you are always 100 percent right.

Finally found some historical house price data for Vancouver. 1960 on.

@ Plumwine

Most people seem to be predicting Hillary will win. However, I made no prediction. I merely pointed out that it was a two person race and that the other contender had an economic policy that would swamp the RE market.

But Everyone here seems confident of a win for Hillary, even if she does have to be propped up while taking the oath of office.

http://www.wnd.com/files/2016/08/hillary-clinton-staircase-600.jpg

So let’s not worry about what would happen to price/incomes ratios were interest rates to rise.

Affordable family housing in the core?

Forget it; not happening.

Urban planners know it, professional developers know it, Big Box store executives know it. There comes a time in the evolution and growth of a sought-after popular city when the demand and house prices exceed the financial ability of most young families to compete for the limited stock of houses in older established neighbourhoods. Increased population means more people with higher incomes and these people are willing to pay higher prices for their choice neighbourhoods. Even the smallest house on a small lot in a choice neighbourhood in the core is beyond the financial reach of most young families.

Big Box store executives follow these trends for thousands of towns and cities across North America. It’s not a coincidence that the Big Box stores all arrived in Langford just as the housing supply of Greater Victoria started becoming unaffordable to the average young family and just before Langford’s population and building explosions; the executives knew what was happening long before anyone else.

This is not a chicken and egg scenario, this is astute planning by Big Box store executives.

It’s certainly not unique to Victoria that the core neighbourhoods are becoming exclusively dominated by high earning professionals, older folks who have downsized, foreigners, and those with family wealth. It happens to every popular city, it’s a natural part of urban evolution, and no politician can stop this natural evolution. When I was a kid, six decades ago, most young families with an employed father, could afford a decent house in Vancouver proper or Victoria. But not now.

San Francisco, Seattle, Vancouver, Boston, London England, Paris… these are all cities that have gone through this natural urban evolution during the past hundred years; now it’s happening to Victoria.

Affordable family housing in the core of Victoria is following what happened in Vancouver in about 1980, it is disappearing fast and affordable housing is not coming back.

@ Vicbot

Not so. I have no television.

You write as though you consider me a Trump supporter, but as I have stated, I consider both Trump and Clinton appalling.

Given your antagonism to only one of the US Presidential contenders, is it possible that you are watching too much CNN or CBC?

Or 23% in 6 years. It’s a real stretch to call this a bubble..

Teranet numbers are out.

Vancouver real estate shrugs off tax…

http://business.financialpost.com/personal-finance/mortgages-real-estate/what-correction-vancouver-and-toronto-lead-gains-as-canadian-home-prices-rise-in-august

Vancouver up 1.75% in August.

(Vic up 2.25%)

Market prices have not increased 50% in two years. If you own a condominium or live outside the core the price increases will be less than 27 percent in two years.

Primary Year Sale Price, Median Core for houses

2006 $479,000

2007 $535,000

2008 $560,000

2009 $555,000

2010 $601,000

2011 $595,000

2012 $578,000

2013 $572,500

2014 $582,000 *

2015 $630,000

2016 $740,000 27% increase since 2014

Interesting the whistleblower is a Chinese immigrant himself. Maybe it’s time to think about shorting the banks as the OSFI clamps down on foreign mortgages and forces them to be called in if suspect.

“The bank employee – himself an immigrant from China – fears he will be fired if he is named. He said lenders require all domestic mortgage applicants to produce one to two year’s worth of Canadian income tax records and pay stubs. Because that is impossible for foreigners and newcomers, he said, his bank made the changes to attract those clients.

In Vancouver, speculators exploited that, he said, to buy properties they had no intention of living in, hold on to them as demand increased and prices rose and then flip them for a profit.

“I have seen many people doing this, many times. I have customers brag about it in my office – about how small money they put in and how much profit they got,” he said. “I can say it is a very big share of the mortgage market … it’s out of control.”

Nice to know the big 5 banks have the foreigners best interests at heart instead of hard working Canadians who can show their income and credit history. What a totally corrupt system this is.

Canadian banks’ mortgage guidelines favour foreign home buyers

“Canadian banks allow foreign clients with no credit history, including students, to qualify for uninsured mortgages without proving the sources of their income – a practice that exempts non-Canadians who have money in the bank from the scrutiny domestic borrowers face when buying a home or an investment property.”

http://www.theglobeandmail.com/real-estate/vancouver/canadian-banks-mortgage-guidelines-favour-foreign-home-buyers/article31869946/

Joe Biden for 2016!!

Most of us are living here in Victoria, finding our daily fix on this blog, enlighten by JJ’s #, craving for Marko’s input, and of course reading graphs, lots of graphs by Leo. However, none of us was able to predict this +50% price jump in core for the past 2 years. Now we are predicting the US election outcome?? Guys, where can I find that crystal ball?

“how someone displaying serious neurological or cardiac problems and who is currently trailing in the polls, will nevertheless convince Americans during the next couple of months that she is qualified to be Commander in Chief of the United States Military.”

CS, you’ve been watching WAY too much Fox news. Trump displays serious signs of mental instability, pathological lying, & extreme ignorance of the way trade or military (or national security) operates.

http://www.independent.co.uk/news/world/americas/us-elections/petition-trump-narcissist-medical-mental-state-psychology-a7177681.html

“His impulsiveness and lack of control over his own emotions are of concern.”

http://www.nytimes.com/2016/07/19/us/politics/trump-book-tony-schwartz.html

“Lying is second nature to him,” Mr. Schwartz told The New Yorker (ghostwriter for Art of the Deal) … He described Mr. Trump as a painful interview subject who could not handle questions that required any depth to answer and who had little recollection of his youth … If he could do it over again, however, Mr. Schwartz said the book would be titled “The Sociopath.”

Dunno about racists, but there are lots of blacks and Hispanics in Florida and Trump apparently has more of them backing him than either Bush or Romney. Moreover, according to the latest Florida Atlantic University poll, Trump is leading Clinton in this important swing state by 4%.

@ Leo S

And the differences can easily confound the effects you are claiming to show.

I said nothing about affordability being higher in the early 80’s.

What I pointed out was that people borrowed a lot less in the 70’s and 80’s because prices were lower and interest rates were higher. Thus, I suggested that if you plotted price to income ratio against interest rate you would find an inverse relationship.

If so, then a rise in rates implies a significant fall in price to income ratio. If incomes rise, then prices could remain high. But if interest rates escalate without substantial increases in incomes houses prices will have to fall, since it is evident that buyers, at least first-time buyers, are currently stretched.

The President won’t force anyone to relocate anything, but if he has Congressional backing he can do a lot to revise the tax code, revise trade agreements (remember globalization began for the US with Bill Clinton’s signature on the 1994 GATT agreement that opened US workers to competition with billions of Third Worlders earning less than 5% of American wages) and enforce immigration laws that affect wages and hence prices.

“The UPI/CVoter daily presidential tracking poll released Monday (September 12) shows Donald Trump leading Hillary Clinton by about 3 percentage points.” Yeah it’s a self-selected online poll where ‘the margin of error cannot be calculated’. Science!

Vegas doesn’t agree with you: http://www.oddsshark.com/entertainment/us-presidential-odds-2016-futures

I think Nate Silver was saying 80-20 Clinton (edit: Leo S beat me to it). More to the point, though, is that he basically needs all the swing states. That’s a really tough ask. Not enough white racists left unfortunately.

That’s why you never pay any attention to one poll and instead let the experts combine them.

http://fivethirtyeight.com/

http://fivethirtyeight.com/features/election-update-leave-the-la-times-poll-alone/

@JD

That’s a very suave remark. But what’s it mean? Nothing, perhaps.

There are lots of polls. They show what you like. Here’s today’s UPI poll which shows Hillary trailing Trump:

The UPI/CVoter daily presidential tracking poll released Monday (September 12) shows Donald Trump leading Hillary Clinton by about 3 percentage points.

“The economic consequences of a Trump presidency, which on the whole would seem desirable, cannot therefore be lightly dismissed by anyone with a grasp of the political realities.”

I’m drawing a mental Venn diagram and you’re not doing very well in it.

Wut?

http://i.imgur.com/fwFo02p.png

Things are always different from how they were in the past.

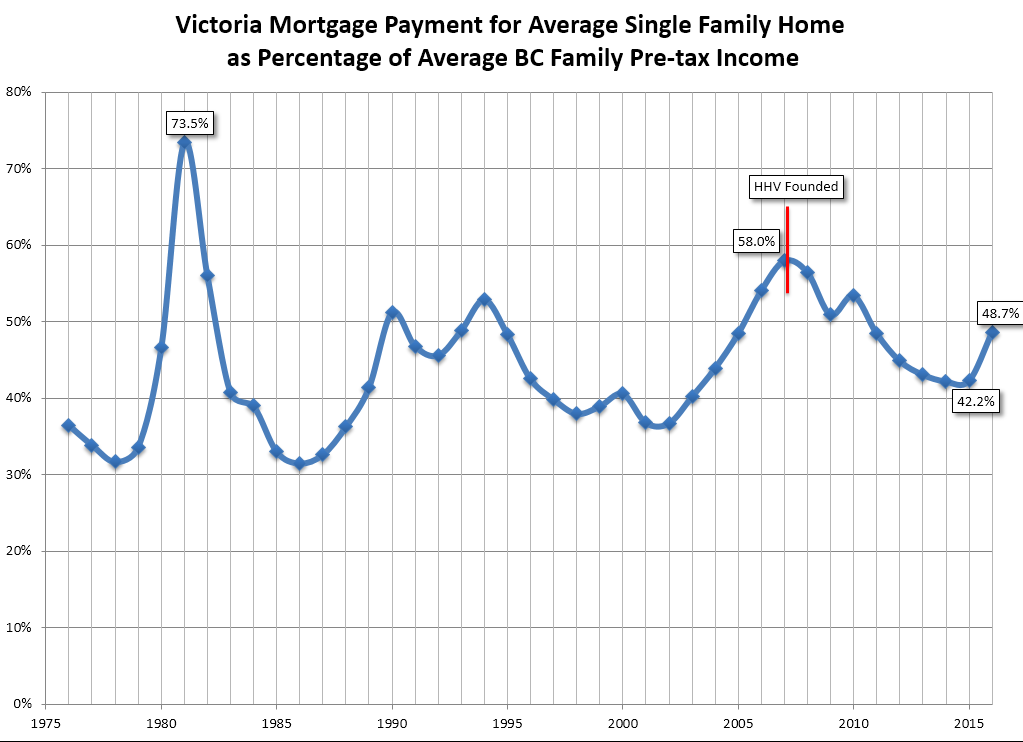

Actually it did. Affordability was incredibly stretched in the early 80s and in fact was worse than it ever was even at the last peak in 2008.

That very well might be. However how many of those couples are there out there, and what is the chance of rates rising significantly? The economy is going nowhere, and if a small bump in rates causes significant economic pain it will immediately put a halt to rates increasing further. We’ve been talking about how rates are about to go up on this blog at least since 2009. It hasn’t happened, and I’ll bet it won’t happen for quite a bit longer.

Never going to happen even if he does win. The president has very limited powers and forcing companies to relocate production is not one of them.

Probably not that unusual for him.

@JD

Really? It wasn’t intended to be funny. Perhaps you would explain how someone displaying serious neurological or cardiac problems and who is currently trailing in the polls, will nevertheless convince Americans during the next couple of months that she is qualified to be Commander in Chief of the United States Military.

Obviously the outcome of the election is uncertain, if only because the Democrats, having apparently fixed the primary to exclude Bernie Sanders from the nomination, may be able to fix the general too.

There is also the possibility, now under urgent discussion by the Democratic National Committee, of replacing Hillary Clinton with another candidate, possibly Chelsea, although that can only occur with the present Democratic nominee’s agreement, which might not be forthcoming, however sick she may be.

My own view is that both candidates are appalling, but to dismiss the considerable likelihood of a Trump victory seems unrealistic at this point. The economic consequences of a Trump presidency, which on the whole would seem desirable, cannot therefore be lightly dismissed by anyone with a grasp of the political realities.

“In that connection, Donald Trump is now running essentially unopposed for the US Presidency”

Ah thanks, that was funny. Dude, if Hillary died she’d still win by 5-10 points.

With all due respect, plotting change in interest rate versus change in house price based on data for the last forty or fifty years is essentially meaningless. Things are very different now from what they were in the past.

Three and four decades ago, when interest rates were high, houses were cheap relative to incomes, and mortgage lending was much more restrictive than now (see: https://vreaa.wordpress.com/2013/01/). Moreover, many properties had long-term low interest mortgages that were assignable to the purchaser.

Thus, in Vancouver, for example, a pair of junior academics could buy a Point Grey home for less than one year’s joint income and still have ten or fifteen thousand left over to pay their taxes and buy some groceries. Under those circumstances, a several percent rise in interest rate had little impact on housing affordability, or therefore, price.

Things are quite different today when a couple who have paid essentially nothing down and are paying something like half of their after tax income in mortgage payments and taxes will likely be killed by a several percent rise in rates. In that connection, a historical chart showing price to income ratio versus interest rate would surely be instructive.

What I fear is that those who have recently bought into this market could be badly hurt. Losing a couple of hundred thousand on a property deal can play hell with marital relationships. In that connection, I suggest that if you have just bought, you’d do well to agree now not to blame your partner, or to forgive them in advance, because there is little prospect of interest rates going anywhere but up.

In that connection, Donald Trump is now running essentially unopposed for the US Presidency and he has stated that “interest rates have to go up.” And interest rates will go up if the US adopts Trump’s Americanism-over-globalism agenda. Prices will go up too, as cheap imports are increasingly replaced by domestic products manufactured with domestic labor at domestic wage rates, so inflation will add to the difficulty of servicing a mortgage in a rising interest rate environment.

Other assets, besides houses, will likely fall also. Only yesterday, Warren Buffet is reported to have lost $1.2 billion on just one stock holding.