August 22 Market Update

Weekly stats update courtesy of the VREB via Marko Juras.

| August 2016 |

Aug

2015

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 188 | 396 | 599 |

741

|

|

| New Listings | 265 | 571 | 811 |

952

|

|

| Active Listings | 2133 | 2174 | 2139 |

3688

|

|

| Sales to New Listings | 71% | 69% | 74% |

78%

|

|

| Sales Projection | — | 896 | 889 | ||

| Months of Inventory |

4.98 |

||||

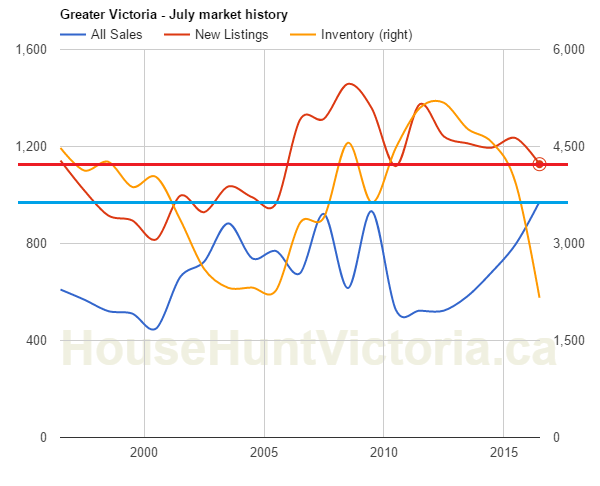

The bump in inventory last week seems to have been temporary.

Dasmo says “this market IS mostly about home owners not selling. It seems the crazy low inventory has less to do with insane sales numbers than low listings…. The recent price gains would feel more solid if the low inventory was because of huge sales numbers but it’s not.”

However can’t really say the data agrees. Sales are at record highs and that’s the main reason we’re in this market. New listings are middle of the road. Below recent years but above the levels of earlier in the 2000s and late 1990s.

Last time it took a good 5 years of hot market for the new listings really to pick up. Sooo… Maybe 2020?

Infill is always super tricky and fraught with issues, as inner city lots only have so much room to give and in many cases are already highly non-conforming in their present use. A standard 40×120 ft lot is already pretty tight, and to build something on that same lot at a significantly higher density is going to be problematic.

Easing the requirements for suites is an interesting one. On the one hand, my lot (in Victoria) has the potential for a plus-sized garden suite as I’m on the corner. Currently they require me to go through a rezoning for a garden suite (even as a public hearing could be waived as it conforms with the OCP) and provide building plans as part of that rezoning. Requiring building plans with a rezoning is conditional rezoning and is illegal. So they could fix that right now – as I understand they might be.

On the other hand – garden suites do little for real increases in density. They are a non-titled unit in your yard that costs ~$100k or whatever to build and only provides one additional unit on the lot. It effectively sterilizes the lot for redevelopment to a denser use such as row housing. So you have some sad lonely medical resident living in a mini shack in your (now smaller) backyard that you’re probably going to be cash neutral on for a while, and that you can’t sell separately. Hell, if I’m looking for a rental unit I would be better off to buy one in an apartment building and keep my backyard. Garden suites don’t make a ton of sense for anyone, and I think this is why you haven’t seen many of them built.

Yes I agree.

I just don’t see how the parking issue can be solved as I don’t foresee lifting this requirement for legal duplexing even though there are illegal suites causing parking problems already – as you stated illegal suites can be shut down but duplexes once legalized cannot.

Existing residents vote in the Council and they are not going to want to see parking problems legalized. I think most of the other issues are more easily addressed. So off to Langford you go for new build duplexes with appropriate parking.

FWIW there have been a number of duplex conversions in Victoria with the old homes but they

Whoa 300 comments.

Back from vacation —- > new post: https://househuntvictoria.ca/2016/08/31/august-29-market-update/

Sounds right ugly for Vancouver numbers.

Steve Saretsky @SteveSaretsky 4h 4 hours ago

Preliminary findings for August detached. It’s bad, like real bad.

..and in case I haven’t bored you enough, if it wasn’t clear: to get back to the original point, zoning is the hammer. Perhaps you can guess my profession. Once something is permitted by zoning, a property can legally have a suite as long as it meets that zoning and meets code. Meeting zoning and meeting code does not require a public process or public input of any sort, and nobody gets further comment. An illegal suite can be converted to a legal suite if the zoning permits it. This is what the CAs are concerned about.

@totoro – I’ll give you an example. I know a person with an illegal suite in a duplex in Fairfield (both sides have a suite). It’s code compliant but doesn’t meet zoning. It’s this way because she wants it to be safe, even as the suite is not currently permitted in the zone. Oak Bay is a good example of a place that has a lot of suites which are not permitted by zoning, and opposed by many.

@totoro – I was speaking in general terms and not necessarily referring to code-related issues. Suites can be illegal based on code or based on zoning, or both. I could get into specific conditional zoning issues around suites like parking, floor area regulations, garden suite regulations etc that would indeed be zoning related (but not necessarily Victoria related) but that’s splitting hairs. My point is that illegal situations exist and a municipality can choose to enforce selectively, or based on complaint. It works.

No. Illegal suites are still illegal even if the zoning permits them. The difference between legal and illegal relates to meeting building code standards as well. I’d agree that it does open up conversions and a lot of folks would be willing to upgrade an illegal suite to a duplex unit if they could then sell one half or both halves. It would be a gold mine for existing owners.

However, off-site parking requirements would not permit legal duplex homes on many lots in this area.

@Dasmo – I’d say if you’re talking about Cook St area west of the cemetery, yes there’s a lot of conversions. East of there and within Gonzales/Rockland, not as much.

Nevertheless, the name of the game in local politics is perception. Perception of change in demographics, lifestyle, property values, congestion, parking…the list goes on. If you legitimize the reality by rezoning, it removes the ability to enforce on illegal behaviour if necessary or after complaints. The Community Associations know this all too well.

@JD I know. No one will fight for that. It means a loss of control, loss of lift tax revenue, political turmoil etc. But Faifield in particular is the poster child for this behaviour. It is almost all duplexes and multi-family. Either by illegal and legal basement suites (which are up down duplexes except for ownership), and large house condo conversions. All those Abstract condo conversions are not even indicated as multi family in the zoning map for the city yet there they are… Heck, I lived in an illegal suite in Fairfiled for many years. It hasn’t been SFD for decades already. This is also evident by the shear number of cars on the street….

“Protectionist mafia” — that’s pretty funny.

“All of Fairfield should be zoned for duplex and triplex at least.”

Who’s going to fight this fight though? Much like many other community associations in established inner-city communities across Canada, the Fairfield Community Association is a protectionist mafia, and they have cheerleaders on Council. Pam Madoff and Ben Isitt want to go the other way – they want public hearings for demo permits. Victoria’s OCP basically blanket-protects these neighbourhoods as ‘traditional residential’. Any such blanket rezoning talk will get pummeled and the current Council is not ready or willing to take that on. Their current idea of progressive governance is painting bike lanes on roads.

As I have said many times, the zoning in this town is a sham. It’s all spot zoned. Unless they did a wholesale rezoning duplexes will do nothing for affordability. They will only affect profitability….

They need to have the one big fight and rezone the region. The area around the Hudson should have it’s height cap lifted. All of Fairfield should be zoned for duplex and triplex at least. (There is maybe 10% of the homes that are not multi suite anyway). Vic West should just all go multi family. It’s not like any of the small lot subdivisions in Fairfield were affordable unless you are part of the one million is cheap club….

Duplex lots?

Try Esquimalt, there are dozens of under-developed duplex lots.

https://www.esquimalt.ca/sites/default/files/docs/zoning_bylaw_map_july_2016.pdf

Great news Bizznitch and Bitterbear. If you own BC property and/or set your kid up in a BC school you are now given the boot. Long overdue.

Quebec Immigrant Investor Program news: http://www.ctvnews.ca/video?clipId=940972

If you look at Capital Heights, Mt Stephen, & Empire Sts there are a lot of duplex zoned properties, but definitely the City needs to get its act together if it’s not budging on the variances – too bad. There would probably be more support for it.

Hillside & Oaklands areas seem to have a lot of that type of zoning, Fairfield has some, and I can imagine Fernwood, North Park, Burnside, Vic West as well.

http://vicmap.victoria.ca, don’t see much in terms of R2. Then when you do see a R2 it still doesn’t mean you can build a duplex. If the lot is zoned R2 but smaller than 555 m2 you are still out of luck.

I looked at a teardown/lot on Cedar Hill Road a few years ago that was R2 and 551 m2 (only 4 m2 short) and city would not budge and I was told city would not support a variance either to build a duplex.

“Where are these lots in Victoria that are duplex and triplex zoned?”

Hillside & Oaklands areas seem to have a lot of that type of zoning, Fairfield has some, and I can imagine Fernwood, North Park, Burnside, Vic West as well.

I think it was CTV at 6.

I’m totally serious. Couldn’t believe my ears. I’ll try to find the clip. It was on the 6 pm news, maybe CBC Vancouver. they talked about needing to stop the trampoline effect.

So please don’t use an argument with me that Victoria is anti-density. It’s just that developers aren’t motivated to build affordable duplexes or triplexes because they can’t make the same money. It’s a vicious cycle – the more condos are built, the more pricey houses & land get (assessments are relative), the harder it is to justify a duplex or triplex, or even just a simpler home on Asquith.

Where are these lots in Victoria that are duplex and triplex zoned?

@Bitterbear – “Just announced on the news tonight. Quebec is tightening its Immigrant Investor program rules.”

I thought you were serious, but I can’t find such a story. What I found was just one of the parties would like to make changes. http://www.cbc.ca/news/canada/montreal/caq-francois-legault-immigrants-threshold-quebec-1.3741019

‘We have to open our eyes. We have a real problem,’ François Legault says.

Air bnb in Kitsilano, I think LeoS got a pretty good deal after all – this one rents for $70.

http://vancouversun.com/news/local-news/50-a-night-airbnb-camper-van-has-nice-price-double-bed-but-jar-ing-toilet

“There’s also a big jar in the van, in case of emergency — “It’s a good size, people use it.”

Careful LeoM. There are rational women on this blog and you might not know who they are.

Your assumptions could say more about you than you want them to.

“45 to 55 year old white women dragging their man around, talking furiously”

I don’t know what OH you’ve been to, but I’ve never seen anyone “talking furiously”. Sounds like a housewife stereotype from 1952. At all the OHs I went to, I saw a variety of people – a mix of locals & people from out of town – some from Vancouver, some families speaking Chinese with several generations represented (mom, dad, grandparents, young kids with sports cars – seemed like they were moving for university). In Vancouver I used to hear a wider variety of languages though.

Just announced on the news tonight. Quebec is tightening its Immigrant Investor program rules. If an immigrant investor has property in BC or a child studying in BC, they are no longer accepted for the program. Quick, the horse has bolted, close the barn door!

JustJack said:

“My guess is that the early spring market was more to do with Alberta workers that lived here and worked in Alberta…”

I don’t think so Jack. I attended dozens of open houses this spring and the dominant demographic I noticed at almost every open house was NOT Chinese folks or young Alberta dudes, but what I saw at every open house was many 45 to 55 year old white women dragging their man around, talking furiously trying to convince their man that they need to be quick if they want to add this house to their collection. House hoarders were evident at every open house, and many of them seemed to be from out-of-town, judging by the number of rental cars from National Car Rentals.

ICYMI Mike.

UBS: We are witnessing the end of the credit cycle, and a crash is coming

http://www.businessinsider.com/ubs-research-note-on-credit-cycle-and-stock-markets-2016-8

Good points Vicbot. Developers like Abstract won’t build anything unless it’s for a million. Affordable housing will only happen once the market tanks. UBS is calling today for the end of the credit cycle.

Well, a quick Ctrl-F on this post counts 16 uses of ‘correction’…1 by me & 6 by you Jack. Just imagine how many ‘crash’es you’ve racked up over the past 10 years 🙂

No worries Mike, your bank stocks are intact for now because they are cutting back mortgage lending even more than previous.

It’s Home Capital and CMHC you look for the first signs. Since Home has dropped 30% from $39 to $29 since May, I’d say the alarm bells are ringing in their back offices looking for the boxes of cash to cover upcoming losses.

Too funny how Scotia says they’re “not concerned” yet they are battening down the hatches.

“The Bank of Nova Scotia reported better than expected earnings Tuesday and said it is actively pulling back in domestic mortgage lending as worrying signs have emerged in the Vancouver and Toronto housing markets.”

“We have been taking progressive action across a number of (mortgage) portfolios,” said James O’Sullivan, executive vice president of Canadian banking. “We’re tightening exceptions, tightening organizations and reducing pre-approvals.”

http://business.financialpost.com/news/fp-street/bank-of-nova-scotia-hikes-dividend-as-third-quarter-profit-rises-to-1-9-billion-credit-losses-decline

Asquith is a strange one – priced on Aug 10 at $1,099,888 on YouTube (it’s obvious who they’re targeting with the 888) https://www.youtube.com/watch?v=-3gDCXA_Ixs

Then posted to MLS on Aug 24 at $828k, then Pend Date Aug 29 for for $1,168,000.

So did it sell for 6% over ask or 41% over ask?

Strange for the hood, but then again, people from out of town don’t always differentiate.

The New Yorker had a good article in 2014 about what drives Vancouver’s prices – it ain’t because it’s a business centre:

http://www.newyorker.com/magazine/2014/05/26/real-estate-goes-global

“Vancouver isn’t an obvious superstar. It’s not home to a major industry—as New York and London are to finance, or San Francisco to tech—and it doesn’t have the cultural cachet of Paris or Milan. Instead, Vancouver’s appeal consists of comfort and security, making it what Andy Yan calls a ‘hedge city.’ … ‘We’re one of the places where people seem to want to park their cash, and there aren’t that many of those places,’ Yan says. ‘So let’s raise the parking fees.’

I’m already a homeowner, but I’m concerned about runaway debt and local affordability – as mentioned in the RBC report that Hawk posted.

Asquith is another sign of developers & investors so motivated by making $$ from shoebox condos or “luxury houses” in unexpected hoods that your middle-income-earners are left behind – and those are the people that drive the local economy.

So please don’t use an argument with me that Victoria is anti-density. It’s just that developers aren’t motivated to build affordable duplexes or triplexes because they can’t make the same money. It’s a vicious cycle – the more condos are built, the more pricey houses & land get (assessments are relative), the harder it is to justify a duplex or triplex, or even just a simpler home on Asquith.

@Rook – I believe the provincial government now collects this data. If nothing has been released, you could try putting in an FOI request to the Ministry of Finance. Don’t hold your breath though if you do.

Again, it’s the bull Michael that brings up a market correction. I’m starting to think that Michael has mentioned a market correction more times than all the bears collectively.

I’m wondering if there is a reliable way to track how many homes are selling to foreign investors in Victoria. It would be prudent for our local government to help curb an influx that would further drive up our market into unsustainable territory.

Is there a way of obtaining these numbers?

Cdn financials surging again to new all-time highs… no sign here of any upcoming housing correction.

http://stockcharts.com/h-sc/ui?s=xfn.to

More outsiders seeing it for what it is.

Canada’s housing market nears ‘extreme bubble,’ warns ex-Lehman Brothers trader

“The Canadian real estate market is on the verge of a massive bubble, warns a former Lehman Brothers executive, citing a struggling Canadian economy and high debt to income ratios.”

http://globalnews.ca/news/2909453/canadas-housing-market-nears-extreme-bubble-warns-ex-lehman-brothers-trader/?utm_source=Article&utm_medium=MostPopular&utm_campaign=2014

I think that’s fair as long as he posts the link.

Obviously Hawk can’t reprint the entire report and most of us understand that he is stating his opinion. And to be fair that was the author of the report’s opinion as to what might be the future. Hawk just stayed with the data and omitted someone else’s opinion.

Anyone who is bullish on real estate should be ecstatic about August’s numbers. The positive news for both is the trend to more selection and stable prices. As a seller you are most likely to get the same price in the next few months as today which is pretty damn good. As a buyer you’re likely to pay the same prices as today but have more houses to select from in the near future.

So why are some of the bulls so angry still?

Nothing disingenuous about it, everyone will read the link, it’s no secret. It’s not relevant until proven to be a reality. So far the foreigner buying has never been a serious factor here through the hottest market in years despite some of the local agents selling themselves out and coming up dry for the most part.

What’s disingenuous is RBC and CMHC reporting for months now that everything is dirt cheap here while prices went through the roof. RBC is cheerleading the foreigner “hope” on a wing and a prayer, not stating proven numbers of foreigners actually coming here.

Hawk – my point is that you were cherry picking the parts of the article that suited your argument. Nothing unusual in that, but I wanted to point out to everyone else that you were being a little disingenuous in your reporting.

The number one reason I hear that foreign investors will not flock to Victoria is that there is no direct flight from Victoria to China. Ironic that it is easier to fly direct to Toronto than travel to Victoria.

Foreigner inflow is totally hypothetical AG, I only post the facts not the hype like the perma-bulls. Foreigners are a crap shoot not the current reality. House sales are in decline since March, get over it.

A few percentage points below historical highs is not “significantly better”. RBC says what’s “significantly”. Did you not read it ?

“This level exceeded the long-term average of 43.8% quite significantly, which suggests to us the presence of greater than usual affordability stress. This stress may have been a factor behind

a decline in home resales at the end of spring 2016—they fell by more than 10% between April and June—potentially a sign that this market has topped out. “

Hawk you’re funny. You intentionally left out the last sentence from that RBC report on Victoria –

“On the other hand, part or all of this decline could be reversed in the coming months if the new tax on foreign buyers in Metro Vancouver results in increased foreign investor interest in the Victoria market.”

You also forgot to mention their chart, which shows Victoria affordability as being significantly better than the previous peaks in 2007 and 2010.

At least try to cover your tracks a little better 🙂

$1.2 mm is a ridiculous amount of money. Even at a $200k per year salary, $200k less taxes = $135k. Less living expenses @ 5k per month for a family of 4 leaves $75k. Minimum recommended Investing at 10% = $20k, leaving $55k/year. 1.2mm /55k= 22 years. 22 years of diligence for one person in the top 2% of earners or two people in the top 14%. That price is hard to afford for high earners, and I doubt most of you earn that high.

I don’t know how big a problem it is when people stop golfing (two courses out of business this year) and tipping because the 15% is too high and then blow almost 400k over ask because 1.2mm “isn’t a lot of money” but we are there. Maybe it’s all the dispensaries fogging up the crowd.

monthly payments!!! wealth!!! Low interest rates!!! Prices only go up!!! Maybe, but that is a third rate Victoria neighbourhood and no matter how you slice it, very few people can afford that price and feel like they are getting their incomes worth. Vancouver is worse, doesn’t make it right.

http://www.financialpost.com/m/wp/personal-finance/managing-wealth/blog.html?b=business.financialpost.com/personal-finance/managing-wealth/how-does-your-salary-stack-up-to-the-rest-of-the-country-a-look-at-what-canadians-make

My guess is that the early spring market was more to do with Alberta workers that lived here and worked in Alberta being laid off and deciding to buy rental properties or rent and spend their EI cheque this summer in Victoria. That wave of itinerant workers has run its course and we are returning to the lower sales levels of years before. And i say this only because the events of lay offs in Alberta and vacancy and house sales in Victoria seemed to coincide.

I would expect sales activity to continue to slide lower and inventory to climb this September. We are still deeply into a market favoring sellers so I don’t expect a significant decline in the median price but I certainly would welcome the end of “delayed offers” that pump and distort the market. At this time my thought is the “delayed offer” may be the most likely source to a future destabilization in the marketplace.

I understand that if you’re a prospective purchaser you feel that you have to play the game of a shortened exposure time to entice multiple bids especially when the property is under priced. Because there is always the hope that you will be the winning bidder and maybe get a deal. But that’s what the other nine bidders are hoping to do also. Your best option is to go in with your best bid and never counter.

That’s what I do at the auctions. I leave an absentee bid and walk away. The next day I’ll know if I won or not. No grief, no worries, no anxiety.

It’s official as per RBC, Victoria has topped out. Not that we didn’t know. 😉

Victoria – Topping out?

Victoria is the other market in British Columbia outside Vancouver that experienced

a substantial housing rally and solid price gains in the past year. The

drawback of course has been that local housing affordability eroded after

reaching a nine-year best at the start of 2015. In the second quarter of 2016,

RBC’s aggregate measure for the area rose, by a sizable 1.6 percentage points

to 51.4%, for the fifth consecutive time. This level exceeded the long-term

average of 43.8% quite significantly, which suggests to us the presence of

greater than usual affordability stress. This stress may have been a factor behind

a decline in home resales at the end of spring 2016—they fell by more

than 10% between April and June—potentially a sign that this market has

topped out.

http://www.rbc.com/economics/economic-reports/pdf/canadian-housing/house-aug2016.pdf

I’m sorry but 1.2 million is a crap load of money…. Just wait until it costs 4.5% to carry it…. This is what I mean about psychology driving things.

“It is the condominium sales in August that made the difference.”

The greater fools have shifted to condos, interesting. Are the banks tightening up the lending forcing spec buyers to choose condos over houses, or are there less people moving here all of sudden with sales down big from several months ago ?

“Peaked early with record breaking sales and went downhill to record breaking sales due to seasonality.”

Record breaking for seasonality, but not for sales dollar totals. If it was truly “red hot” it would still be in the spring number ranges of 12oo and prices still rising substantially. Seasonality is just an excuse for a cooling market AKA distribution.

Rockland would not be going into default on the mortgage in a truly red hot market in a prime area of Victoria wether you want to cut down the property set up or not.

When Asquith sells for those idiotic numbers in an area with no storm sewers and Rockland doesn’t, the market is not red hot, it’s bi-polar where bad decisions are made and major money is lost.

Ash is right, the house sales in the core are not much different that many of the August months before. It is the condominium sales in August that made the difference.

Sales, Number of August Only

Month 2007 2008 2009 2010 2011

Aug 810 523 745 406 535

Sales, Number of

Month 2012 2013 2014 2015 2016

Aug 469 542 588 718 770

House sales only in the core for August

Sales, Number of

Month 2007 2008 2009 2010 2011

Aug 217 134 201 110 164

Sales, Number of

Month 2012 2013 2014 2015 2016

Aug 118 151 171 184 187

Sales, Number of Condos only in the core

Month 2007 2008 2009 2010 2011

Aug 193 137 176 91 98

Sales, Number of

Month 2012 2013 2014 2015 2016

Aug 110 92 129 140 188

A lot of things can happen in the economy when you plot data at 12 months intervals. If you want to see the market trends you have to watch the flow of sales month by month without 12 month gaps in between.

“Rockland house that failed at auctioned has been relisted for 1.87 by bmo. Mortgage in default.”

Will CHEK TV will be there live to cover the foreclosure hearing ? 😉

Rockland house that failed at auctioned has been relisted for 1.87 by bmo. Mortgage in default.

The pictures presented very well, it’s a newer home, and that area of town has become desireable over the last few years. That being said its a lot of money, more than I would have expected it to have sold for.

A similar home in a similar area in a comparible in Vancouver would have sold for $3M. A realize the theme in this thread is a down market there but $1.2M is not that much money anymore. There’s just an insane amount of money in the system now. Victoria is still undervalued overall but this house to some may challenge this notion.

Damn condo sales seem strong right now. I’m guessing this record-breaking August owes a lot to condos rather than houses.

Wasn’t Asquith listed a couple months ago and didn’t sell? Now it goes for way over ask? Weird.

Looks like an awesome house, but I also question the value of it in the long term – 1.2M is a bit ridiculous given it’s only 3 doors in from Bay street.

“2517 Asquith St listed for $828,000 and sold for $1,168,000. Purchased for $830,000 1.5 yrs ago.”

Several years ago, I would have told the person who built a high-end house on a 4200 sq.ft. lot in a low-end area they were crazy. “Who’s gonna pay $800K for a house there?”, I would have said. I would have said the purchaser was crazy, too. Times change. I do wonder what happens as the house ages, since I still don’t see that as a highly desirable lot.

Hawk: Without graphing the median numbers, it’s quite obvious that this year is much different than 2015. We peaked early and went downhill from there. Of course the RE agents (they know who they are) will use any excuse they can to pump the numbers.

Peaked early with record breaking sales and went downhill to record breaking sales due to seasonality.

2517 Asquith St listed for $828,000 and sold for $1,168,000. Purchased for $830,000 1.5 yrs ago.

I meant 2015.

Hawk: Without graphing the median numbers, it’s quite obvious that this year is much different than 2016. We peaked early and went downhill from there. Of course the RE agents (they know who they are) will use any excuse they can to pump the numbers.

If the median price flat lines or drops then Mike’s giddiness is all for naught. As per Jacks numbers it looks like there will be a lot of disappointment to set records and lose money or make nothing. Another sign of a market running out of steam.

Seasonality is never an excuse for a truly red hot market.

Leo has the stats, he can post them? Sales to list could also be the highest of all time as well.

2007 had the strongest sales August ever but had a decent new listing count. I don’t have time to examine all the other years.

Everyone is referencing what is happening currently to a record setting spring while we are having a record setting summer. It is not that long ago in 2012 that we only had 462 sales for August. 2010 was even worse at 425 sales.

Marko, are you able to send sales per month per year for the history of the VREB? then, I can tell if it is actually significantly higher or within the expected range of variation.

But will it be the highest sales to list in August ever?

August will be the highest sales August in the history of the VREB. Obviously it will be lower than previous months due to seasonality.

I dont pretend to be a real estate expert but Victoria seems to be composed of two very different types of purchasers: retiree’s and people employed in Victoria. Some areas like Oak Bay seem dominated by retiree’s.

How much of the price increases are dominated by baby boomers retiring? Has anyone seriously looked at the demographics in terms of future house prices here in Victoria?

Turning to another topic on this thread, if you are worried about earthquakes and tsunamis you should probably buy in Rockland near the Gov’s Mansion; solid granite and about 180 feet about sea level.

Marko was obviously referring to this month being a record-breaking August…which would signify strength following that tax introduction.

And yes Jack we’re all aware that most Augusts have lower sales than the previous six months in every city on the continent (it’s called seasonality/summer holidays), but thanks for pointing it out to us every year 🙂

“I suspect that the difficulty Vancouverites are having in selling their homes may be causing fewer sales here.”

All you have to do is look at Westside Vancouver and Richmond on the MLS. Looks like panic city with hundreds of listings all asking $2 million up. The Great Vancouver Buyer Boat just got sunk like the Titanic. I thought they ran out of land? 😉

“August is a complete bloodbath for Oak Bay though. Sales have declined by more than 3 over last year at this time.”

“Aug 12

Last August Oak Bay had 22 house sales.”

Why are we surprised Bearkilla can’t subtract 12 from 22 ?

here’s a sickening thought.

Could it be that the slowdown in Vancouver is just a time out while all the foreign buyers find lawyers to set up numbered companies for them?

Here are the month sales since the beginning of the year. We might break the number of sales in February but August will still have the lowest number of sales in the last six months.

Month Sales, Number of

Jan 522

Feb 768

Mar 1106

Apr 1238

May 1295

Jun 1162

Jul 950

Aug 752 so far this month

Yeh, Oak Bay house sales got hit hard like West Vancouver did. So far none of the 12 house sales in Oak Bay were to Vancouverites. Sales are back to what they were in the middle of winter.

Month Sales, Number of

Jan 13

Feb 26

Mar 34

Apr 55

May 39

Jun 26

Jul 17

Aug 12

Last August Oak Bay had 22 house sales.

August is a complete bloodbath for Oak Bay though. Sales have declined by more than 3 over last year at this time.

How could that be? The bears assured us the market died a month ago 🙂

Maybe the Vancouver tax has had an effect?

In July we had 86 properties out of a total of 950 sales purchased by someone from Vancouver. So far this month we are down to 44 out of 736 sales.

A 49% drop in Vancouver buyers versus a 22% drop in total month over month sales.

I suspect that the difficulty Vancouverites are having in selling their homes may be causing fewer sales here.

And it’s credit tightening that has me worried and paying close attention to what’s going on. I’m almost ready to apply for my construction loan… almost….

Like in the late – mid 2000’s prices will appear sticky but if you gotta sell you will have to capitulate. Like that 1.5 acre beach front property up island that we didn’t buy. Listed since 2008 for 1.2 million. Sold for $620 in 2010… interest rates were pretty low then too.

“People are buying because people are buying”

If credit lending tightens then less people can buy. Buyers increased this past year due to Vancouver mania and media hype of FOMO. Alberta workers had limited effect, with construction workers down 5000 from a year ago. The shift the other way is just beginning.

I agree Dasmo. Fundamentals will not cause a crash – bubbles and crashes are driven by irrational group behaviour. A crash in a market might be triggered by a catalyst, but the overreaction that causes the crash is not based on that change in interest rates or new tax or whatever. It’s caused by panic.

Predictions in this department are futile; in the last two weeks, for instance, some posters here have been unable to distinguish a market correction from a long weekend.

If it was all to do with credit we would not have been dead in 2012… Don’t make me tell my Fairfield story again. It might push Hawk off the deep end.

I would argue that credit only enables the activity. It’s physiology that drives the market. People are buying because people are buying. It can quickly shift the other way. No one was buying in 2012 and rates were just as low…. Only difference between then and now is no one is leaving for the oil patch and their are pot shops everywhere…

“I think it will actually help sales a bit. Not only did new listings pick up but I am actually seeing a half decent house here and there. New listings on Asquith and Morley are both nice homes and were packed when I went through this weekend.”

Those are nice. Taxes are high on Morley. 6400 dollars. Victoria I guess is higher than other areas. Was Morley sold in the last couple of years? I saw it on sale for 895k with no furniture in the photos in 1 listing.

“Things in terms of credit aren’t as simple as walking into a bank and walking out with a mortgage.”

It is if you are a foreign student with daddy’s 35% down, with no income verification where CIBC is lending on campus. That’s high risk lending to a complete stranger to Canada. 35% doesn’t cover a 50% loss.

http://www.greaterfool.ca/page/3/

Just look at those new listings pick up!

I think it will actually help sales a bit. Not only did new listings pick up but I am actually seeing a half decent house here and there. New listings on Asquith and Morley are both nice homes and were packed when I went through this weekend.

Wrong again. Easy credit is the largest factor bar none. When that changes, interest rates mean nothing. It’s all about banks/mortgage brokers risk levels to lend.

But this has been changing for the last 10 years. Wasn’t the CMHC $1 million cap, amongst many other credit restrictions, suppose to tank the Vancouver market?

Earlier this year Van City along with a few other banks/credit unions started doing 0.65 LTV on rental properties, for example. Things in terms of credit aren’t as simple as walking into a bank and walking out with a mortgage.

Just look at those new listings pick up!

“Looks like August will be another record breaking month. It’s already the second best August since 1990 only second to 2007 (846 sales) but with three days left will surpass that.”

What’s the sales $$ volume totals ? That’s the key.

“This year the topic of interest rates has disappeared from the blog but it is by far the largest factor driving prices.”

Wrong again. Easy credit is the largest factor bar none. When that changes, interest rates mean nothing. It’s all about banks/mortgage brokers risk levels to lend.

Looks like August will be another record breaking month. It’s already the second best August since 1990 only second to 2007 (846 sales) but with three days left will surpass that.

Mon Aug 29, 2016:

Aug Aug

2016 2015

Net Unconditional Sales: 784 741

New Listings: 1,039 952

Active Listings: 2,127 3,688

Victoria is not as terrible for cash flow as Vancouver, but it is pretty bad.

Your condo example only works because you bought long enough ago and, even then, I’m not sure that you are actually cash flow positive accounting for all expenses and income tax on the profits which include the equity pay down portion of the mortgage.

In terms of condos I had a listing in a newer concrete downtown building that just sold for $262,500. Currently rents for $1,100 per month and could be re-rented for $1,200 to $1,250. You can almost make that work.

As far as houses I’ll give you an example of a house I just went through yesterday and it also sold unconditionally last night. 3140 Service Street went for $740,000 (listed $699k). A few hundred feet to Camosun Lansdowne Campus. Three bedroom suite that could rent easily for $1,500 per month. Maybe you even stretch is to $550 per student or $1,650.

You you go with a $600,000 variable mortgage 30 year amort you are around $2,000 per month of which half is going against the principal. You have taxes, insurances and maintenance to cover but still ends up being cheaper than renting the upstairs of a house.

This year the topic of interest rates has disappeared from the blog but it is by far the largest factor driving prices. In my opinion interest rates need to go up for a meaningful correction in Victoria, or the rental market tanks, or we have an earthquake, etc.

“We really need a shift in interest rates for any sort of crash in my opinion. When you can get a 2.05% variable mortgage and 20 people are willing to line up to rent your dingy core suite I just don’t see too much desperation to unload out there.”

Nice thoughts but if you’re banking on interest rates to cause a crash, you’re SOL. It will be a catalyst effecting a credit tightening environment which we have already started to see with 2 banks stating they have already begun to tighten the noose.

Then the foreign money begins to leave which is early signs say it is, wether you want to wait 3 months or a year to find out, so be it, but if I’m a buyer I’m waiting. Vancouver decline will absolutely effect our market psychologically. It’s what pumped us up $150K in a few months and shit rolls down hill.

Vancouver insanity caused how many bidding wars here up to $300K over ask the past 6 months ? Too many to count. We’re not different if this unravels.

Appears inaccurate to me too. Median is likely a better measure because the high end fall off is skewing the average and the data period is short.

Yes.

Victoria is not as terrible for cash flow as Vancouver, but it is pretty bad.

Your condo example only works because you bought long enough ago and, even then, I’m not sure that you are actually cash flow positive accounting for all expenses and income tax on the profits which include the equity pay down portion of the mortgage.

If you are paying $900 a month on the principal on your mortgage and you are in the 46% tax brackety on your marginal income that needs to be properly factored in. Is it?

Right now a house that is selling in Victoria for $800k is renting for $3000 a month. No way you are breaking even. Seems the same with condos.

The only way you make money on a rental property in Victoria is through appreciation imo. When appreciation levels off or drops you will lose money if you have to sell and that is the big risk in a market like ours for homeowners too. You need to be prepared to wait it out.

To whoever mentioned it, the Zolo figures definitely do not correct for sales mix – and since they are using average, and the very top end of the market seems to be tanking, the number looks worse than it likely is…since the average of all sales was skewed up by Chinese ballers dropping $4 million on west side tear downs, and Richmond McMansions. So to say there is a 26% decrease in the average price is probably dishonest. It simply reflects the fact that SFD sales, and moreover high-end SFD sales account for a smaller share of the entire market.

The rest of the data seems to supports this. It shows that sales of McMansions at the high end have dropped off a cliff, and specifically, in areas where foreign investment was highest. Meanwhile, the attached market is chugging along. At least for now. How it all plays out, nobody knows. Like I said, I think it’s headed for a major correction, but some areas (and segments) will clearly be hit harder than others. For whatever reason, people want to live in Vancouver even though it rains every day and people would rather look at their shoes than say hello to you. So let’s not get carried away.

Furthermore, as others have pointed out, it’s not like a major correction will suddenly make areas like Kerrisdale affordable for your buddy Jim that works in IT at SFU, even if Kerrisdale sees a 50% decline. It just means that a bunch of rich folks are shit out of luck, and some other rich folks are in luck. Whatever the case, enjoy the show people.

We really need a shift in interest rates for any sort of crash in my opinion. When you can get a 2.05% variable mortgage and 20 people are willing to line up to rent your dingy core suite I just don’t see too much desperation to unload out there.

No-one has been able to reliably predict future prices since this board started and you are I are no exceptions. All the statements about “the crash” have been proven incorrect over time.

The market might fall in Victoria, or it might not. Hard to think the Vancouver market trends won’t impact Victoria, but we didn’t follow their dramatic trajectory up and I doubt we’ll follow it down the same way either should that occur – at least not without other indicators such as interest rate changes and an increase in inventory.

If you have a rental property now does not seem to be the best time to sell to me, unless you want to for reasons other than fearing a crash.

If have a investment properties, it’s a great time to sell. Better to sell before everyone else starts selling.

Problem with selling investment properties is capital gains, rents have gone up a lot, and carrying costs have gone down especially for those with variable mortgages. The last condo I re-rented the positive mostly cash flow doubled.

Victoria isn’t quite yet like Vancouver where you have a $800,000-$900,000 Coal Harbour condo that only rents out for $2,200 – $2,500 per month.

Most lots can easily accommodate a Duplex. Why not allow MFH on certain blocks? This could easily double the housing stock in the next decade.

You can’t explain this to the average person. Victoria is primarily anti-development, anti-density, but somehow the same people complain about affordability in the same sentence. If someone has a better idea would love to hear it.

As the population grows (impossible for anyone to argue this fact) there are really only two possibilities; increase density with condos/townhomes/duplexes or start clear cutting Langford to Sooke.

Totoro: I think prices are going to trend down steady over the next 3-5yrs. Both in Vancouver and here. We’ll lag behind Vancouver by 2-3 months I bet, but we’ll follow them down.

One would be insane to buy a house/townhouse/condo right now. If have a investment properties, it’s a great time to sell. Better to sell before everyone else starts selling.

This fellow seems to take a reasonable approach to the Vancouver data:

http://www.vancitycondoguide.com/demystifying-latest-vancouver-market-stats/

Vancouver RE prices are taking a breather after an unsustainable run up over the last 24 months; however the prices of historically desirable areas even if they correct 50% will be out of reach for most Vancouverites.

Unlike Victoria, where there are affordable options like the Westshore, there are limited choices there for the budget conscious. IMO the market in Vancouver will go down only moderately (less than 10% on avg and more so in the upper end mkt $3MM+) and banks will loosen the purse strings again and with interest rates going nowhere, you’ll see medium price budge up again because of vent up demand.

This happened in Singapore and Hong Kong after their Stamp (Foreigner) tax was introduced also. I believe this will play out the same way in Vancouver.

Instead of pointing fingers, which has never solved any problems in history, the local government needs to be a little more pragmatic in fixing supply side issues in Vancouver AND Victoria. What’s the difference between having a SFH or a Duplex zoning? Most lots can easily accommodate a Duplex. Why not allow MFH on certain blocks? This could easily double the housing stock in the next decade.

Because this is a political hot potato, no one wants to touch this. Our culture of NIMBYism is strong and well. and BTW for many of the posters who have lived in Vancouver before, it was always unaffordable versus Victoria whether it was 40 years ago or today.

AG,

Ross Kay said the price drop is already down 26% from 6 months ago, not 30 days. It’s in the interview.

Looks like the foreigners decided to keep on flying east. Not so far to go from Quebec now. 😉

John O’Dowd @John980AM 4h4 hours ago

TOMORROW: Toronto developer says business is booming since Vancouver introduced foreign buyers tax. Tune into @CKNW from 7:30am #VanRE

haha, what a whiner. 🙂

https://twitter.com/rafferty_tom/status/765028039881175041

Ok, how about some sales drops stats in Van….

https://twitter.com/EmilyLazatin980/status/769033857924468738

Hawk: I bet lots of these people dropping their prices will be chasing the market down for a while.

I thought the issue with the Zolo numbers was they didn’t adjust for sales mix. So the “26% drop” just signifies a larger proportion of condo sales vs SFHs.

Clearly the price is dropping in Van, but a typical detached house is not 26% lower than it was a month ago. Give it a year and that might happen, who knows.

Sales ? They fell off a cliff Marko , where have you been ? If a Westside Van house slashes 600K the chances are it was priced accordingly to recent sales. Since there are many more like it then they must be all over priced ? Sounds like panic in agent land.

I think it’s great news if Van prices see a solid drop. They’re completely out of reach over there. But I think it’s going to take several months until we know if this is a sustained drop underway or if this is just a post tax blip.

Why is everyone posting price slashes….would it make more sense to post sales?

If I list a $3 million dollar home for $3.6 million and slash the price $600,000 the sky is not falling.

Why don’t you tweet those two guys Marko instead of asking us for examples. Afterall they are your colleagues.

Marko: Why don’t you connect with these guys?

https://www.zolo.ca/vancouver-real-estate/trends

I’m sure they can give you a few examples….

.

Heck, to make it easier, why don’t you just email press@zolo.ca . 🙂

Those are some serious price slashes of $200K up to $600K. Won’t be long til that starts happening here. Manias all end in this manner, just like Beanie Babies. Every one wants one , then they don’t. 😉

Yea, wow. The 1944 Bungalow dropped from a cool $3 million to $2,849,000. What a deal, you get a 5000 sq/ft lot too.

I really would like to see concrete examples of sales that are comparable to see this 26% drop.

Some excellent price drops in this thread…

https://twitter.com/SteveSaretsky/status/768263624192241664

The government listens to voter polls not the real numbers nor the phony numbers from GVREB.

Good plan Triple A, using a solid paid service is well worth it to stay ahead of the herd if you want to make above average profits. There are some shitty ones out there too so have to check them out closely.

So the government brought in the tax because the market has been tanking for the last 6 months?

The 26% drop was the largest drop ever over a 6 month period, not 30 days.

70% sounds on the high side, no?

Probably the most dangerous segment of the market is the $500k to $1M as only 5% is required.

This would probably be 70% of home purchases now and made by duel incomes and likely rental income. It wouldn’t be hard to find yourself underwater if any number of variables were to change. I maintain that unemployment will be the driver of any ‘significant’ downturn.

After $1M mandatory 20% down so therefore even a YOY loss of 20% treads water net of any closing costs less principle paid down.

I pay more than $1000 annually for an online brokerage that provides excellent insight. My returns would be not be anywhere as strong without the market analysis and individual stock recommendations. I encourage anyone seeking strong returns to do the same. The last recession lost faith in the industry but was particularly unfair to excellent advisors. I won’t provide the name of whom I’m using but Bloomberg TV has a number of reputable brokerage houses daily

26% drop price in Vancouver is the largest North America has ever seen

So what you are telling me is a house that was $1,000,000 million 30 days ago is now $740,000? Would love to see some examples of these deals.

Interesting story about the banker Bizznitch. My buddy knows a credit counselling guy who was telling him he believes 70% of Victoria is teetering on heavy debt loads and is a paycheck or layoff away from disaster based on what he’s been seeing for a long time now. When your friends and neighbors are off tromping around the globe, doing major renos etc, odds are it’s all on easy credit. They just won’t tell you that part.

Ash ,

The MSM is only just now beginning to print real numbers after years of denial of money laundering and shady realtors and foreign cash because they have no choice when lawsuits and criminal charges are laid.

I know a couple in the media and they have been consistantly blocked by the advertisers threats when a bad news story is going to come out. Big money controls the show wether you want to believe it or not. When have you seen a real investigative story in the TC ?

I’ve just grown tired of this claim that shows up here time and again: that if only the MSM had more balls, or was less afraid of losing money, they’d speak the “truth”. I guess the logic is that papers are run on advertising paid for by the real estate industry, who would pull their money in an instant if they didn’t like what they read. I just don’t buy it.

In any case the Sun and the Globe have been pretty outspoken about the local industry and the turning market conditions as of late, so I’m hoping we can put that old theory to rest.

Inventory will flood the Vancouver detached as soon as September hits. This is my guess.

Hawk: I agree, as the correction in Vancouver deepens, it’s most likely banks will tighten up their lending standards. I think it’s already happening now. In fact, I know a banker who’s wife is itching to buy a house, and he says “Just wait, the time isn’t good. It’s going to correct”. I’m sure he sees a lot more numbers than most of us can access.

Also, I think if there’s no pick up in the market in Vancouver in September, agents will be encouraging their clients there to sell, sell sell. Speaking of that, I’m sure there’s a few realtors here in Victoria bailing off their RE investments. They’re the canary in the coalmine. 😉

Yes, every major city in our country shot up after he claimed peak and is now higher…

Some Teranet examples from Apr 8, 2012:

Calgary up from a bottom of 153 then to 179 now

Winnipeg up from 180 to now 203

Hamilton up from 132 to 188

“I have no doubt that the Vancouver market is headed for a major correction – but as with all corrections, it won’t be an across the board drop.”

Eventually it will be across the board. We all borrow from the same banks who will be tightening lending bigtime and scrutinizing employment and credit scores for all levels with these scary numbers.

Banks will be making changes as fast as any other financial lending entity would when a market shows crash potential. You can bet they are not in “wait and see” mode behind the scenes.

@Rook and RE: the Vancouver market, the drop in sales and prices is most apparent at the very top end, which should come as no surprise. Sales of Chinese McMansions with 3 wok kitchens and a servant’s quarters are tanking. It looks like West Vancouver, Richmond, and the west side are all taking a beating, which is exactly what you would expect to see in the face of a 15% tax aimed at Chinese speculators. Meanwhile, the white flight eastern suburbs are, so far, doing fine.

I have no doubt that the Vancouver market is headed for a major correction – but as with all corrections, it won’t be an across the board drop. Obviously, the market segments most affected by foreign speculation are bound to be hit harder than, say, Maple Ridge. As for how it affects us, who knows? Probably a few less white flight Vancouverites heading over to make stupid over payments on mediocre housing to enjoy our mediocre climate where summer comes but for a week or so, and then in the blink of an eye, it’s back to partly sunny skies with southeasterly winds gusting at 30 km/h, and a temperature not quite warm enough to enjoy a dip in the lake. But I digress…

The stats here tell the story:

https://www.zolo.ca/vancouver-real-estate/trends

Mike’s getting angry now the cat’s out of the bag and has to resort to 3 year old stories. What’s next the McLeans pic Mike ?

I don’t read Zero Hedge all that often but they do have legit charts from government sources that the MSM ignores. Part of the story was quoting local agents as well as Reuters so I guess they know shit too?

Easy to call anything bait-click these days but I never see any of you people’s post your top info sites. Instead you just cut down anything that shows something that goes against your perm-bull thesis. The TC business section maybe where never a negative word is ever spoken according to company rules ? LOL.

Might even be Mike’s new job around here to pump the local condo/developer rag for more bait clicks. 😉

Ash: how is that different from any other newspaper?

Michael: aside from the phenomenon in Van and Toronto was he way off? Also, would you include a photo of yourself if we are judging reliability with looks?

“Like them or not they publish the charts and analysis the mainstream are afraid to publish.”

I doubt it, the Sun and the Province love juicy headlines, good or bad as they sell papers and advertisers make money. Only problem is they need to maintain credibility for the long term.

I have no problem with Just Jack’s #’s, I find them very informative and have no reason to doubt them.

My counter is every blog post such as zerohedge is traffic driving. I’ve never doubted the potential for a downturn however I usually side in the middle. Goes for Target Prices as well. Just my opinion.

Lol, Ross Kay starts by suggesting a class-action lawsuit… talk about calling the kettle black!

Here’s just an example of the rubbish this Garth minion has been peddling over the years…

He sort of looks like Garth too… ?w=500

?w=500

“Sure displays the inadequacy of the monthly median, especially when trying to figure out how much prices have risen in a year (undoubtedly worse in months like Aug, Dec)… hence why boards moved to HPIs.”

Which is why HPI is bullshit the way GVREB and VREB use the info but the fools like Mike suck it up like kool-aid. Ross Kay was part of designing the HPI, I think he knows his shit.

The public has been bamboozled. Which mainstream media source will be the first to have the guts to put this out there? The NDP will run wild this with this so won’t be long til MSM has no choice to show these boards are corrupt.

Ross Kay is calling for major lawsuits coming against the agents. This should be an interesting fall as the ass covering begins.

Zerohedge is on about the same level as fool.com or breitbart. They’ve been proclaiming the end of the world for years now. Good clickbait, but not so useful for impartial analysis.

A interesting and valuable update with a outlook for the very near future in Vancouver RE and the province from Ross Kay. Victoria is mentioned in this segment. 26% drop price in Vancouver is the largest North America has ever seen, but no one seems to know that this is currently happening. If you disagree with Ross Kay on this one I would love to hear your reason with evidence.

Start listening at 8:15

http://www.howestreet.com/2016/08/21/this-week-in-money-61/

So you’re saying the article is not true TripleA ? Like them or not they publish the charts and analysis the mainstream are afraid to publish.

Just like Jack posts numbers here that that VREB or agents won’t ever show you or the local media will never publish in order to not offend the advertisers that keep their paychecks rolling in.

Not a fan of zero hedge.

http://rationalwiki.org/wiki/Zero_Hedge

Sorry guys, more reality for you to digest. The rich are leaving and stashing their cash while they can. No worries, Van will be a blip and Victoria and bank stocks are going to the moon.

“I’ve Never Seen Anything Like This Before” – The Housing Markets In The Hamptons, Aspen And Miami Are All Crashing

One month ago, we said that “it is not looking good for the US housing market”, when in the latest red flag for the US luxury real estate market, we reported that sales in the Hamptons plunged by half and home prices fell sharply in the second quarter in the ultra-wealthy enclave, New York’s favorite weekend haunt for the 1%-ers.

Reuters blamed this on “stock market jitters earlier in the year” which damped the appetite to buy, however one can also blame the halt of offshore money laundering, a slowing global economy, the collapse of the petrodollar, and the drastic drop in Wall Street bonuses. In short: a sudden loss of confidence that a greater fool may emerge just around the corner, which in turn has frozen buyer interest.”

http://www.zerohedge.com/news/2016-08-27/%E2%80%9Ci%E2%80%99ve-never-seen-anything-housing-markets-hamptons-aspen-and-miami-are-all-crashing

You’re forgetting about dividends.

2-4% annually depending on the bank.

There’s been some great returns on US banks in the last 2 years (outside of the major banks).

I don’t see strong financial growth in the banking sector. There are better places to put your money.

In uncertainty I’m using high yield ETFs with low MERs while market has declined.

Fabrication is your forte Mike. I stand corrected as I was looking at Royal Bank US stock chart(on my phone, bad me) where it is still down about 8% from 2 years ago. Though if you were a US holder it dipped 35%, versus 20% dip in Canada over last 2 years due to exchange rates, and is up only 10% over 2 years.

Bit of a rough go for banks that are raking in billions daily. What will happen when the bottom falls out of Vancouver and all those mortgages to foreigners bite the dust ?

My handful of stocks are still doing just great AG. How’s your 2.2 % going ?

@ Just Jack “here is a frequency table of house sales and how they are distributed over $100,000 increments in the core between the two years.”

Maybe I am one of the people getting lost on statistics, but the 2015 column totals 1025, while the 2016 column totals only 378. If it’s just the number of houses sold in each price range, shouldn’t the the totals be much closer?

Michael – remember that Hawk’s portfolio is up “more than 300%” so far this year. I’m sure that his basement suite is full of Bloomberg terminals and support staff by now. As a peerless investment genius, nothing that he says should be questioned 🙂

Lol…hawk, XFN has never been higher.

You should really do the 2 seconds of research before you fabricate stuff.

http://i.imgur.com/RmFxbde.png

Sure displays the inadequacy of the monthly median, especially when trying to figure out how much prices have risen in a year (undoubtedly worse in months like Aug, Dec)… hence why boards moved to HPIs.

Guess Mike is making up for losses after buying at the high back late 2014 when bank stocks were higher. Two years of gut wrenching loases of 40% then back up for 4%. Grasping at straws is a popular perma bull habit these days.

Here’s an interesting stat. If you look at prices for all types of properties that sold in the core the year over year median for August has NOT increased.

Sale Price, Median

Month 2015 2016

Jan $422,500 $451,200

Feb $472,000 $510,000

Mar $512,850 $547,950

Apr $487,000 $585,000

May $524,500 $549,450

Jun $499,900 $551,000

Jul $468,500 $520,000

Aug $520,000 $520,000

Cdn bank stocks are predicting good things as they broke out to new highs this week… congrats to wise investors who added at the start of the year, shrewdly collecting their 4+% dividends.

http://stockcharts.com/h-sc/ui?s=xfn.to

Oh, and I ran some beargression analysis and there’s a 98.8% probability that the same bears predicting a crash last year and this year will be predicting a crash next year.

Lochwood is a delayed offer or blind auction. That is only being shown for 4 days with the offers to be presented by August 30. That’s going to bring a lot of buyers out all at once on a weekend. Especially when it has been well under priced to garner more attention.

Your bidding on a home that should be listed for $200,000 more. Why not throw a bid in to see what happens. I’d be surprised if the owners didn’t get at least 10 initial bids on the property.

These auctions can back fire on the owner too. They might get a better price if they exposed the home to the market for longer than 4 days.

How many cars at all the other open houses? Cherry picking one house is lame, especially with Vancouver just stepping off a cliff into the abyss.

Over 25 cars parked today at Lochwood open house.

OK, JJ, I see where you are coming from. However, without a measure of normal variance, change is impossible to properly interpret because you can’t know whether a drop or an increase in any variable is meaningful. I went to the VREB stats to see if there was any way to glean a measure of variance from their data site, but I didn’t see it. Not publishing variance stats is a very easy way for the VREB to convince people of whatever they want.

HAVEN”T DONE STATS IN A LONG TIME SO CAVEAT EMPTOR

the data you sent is interesting. I’ll acknowledge but ignore the larger intervals at the high end, so bear in mind that these numbers might not be exactly accurate. If you can break those categories down, I can redo this. Having larger intervals toward the end means that data in those intervals could skew things.

I am using a liberal alpha of .1. In 2015, on average, about 100 houses were sold across all price ranges with a standard deviation of about 72 sales (lots of variability across price ranges). If I plot the sales and standard deviations across all price ranges, I can see that significantly more houses were sold in the 500-600 and 600 to 700 thousand dollar ranges.

In 2016, on average across all price range, about 38 houses were sold. with a standard deviation of 21 (again high variability). If I plot the standard deviation across all price ranges, I can see that significantly fewer houses were sold in the 300 thousand dollar range and significantly more in the 600 thousand dollar range.

I can also see that the average number of houses sold in 2015 is higher than the average number of houses sold in 2016. I can run an analysis of variance and find that the difference in number of houses sold across all price ranges between 2015 and 2016 is statistically significant p=.014033 This is solidly significant. I feel confident concluding that the number of sales in Victoria core has dropped by an amount larger than would be expected by chance.

If I plot trend lines I can see that in 2015 the bulk of the sales was in the 900 or less category whereas number of sales across price ranges in 2016 are quite flat. I hypothesize that the drop in sales in the 900 and under category is the reason for the significant drop in number of sales from 2015 to 2016. so, dividing the data into two categories (under 900 and over 900) and running a two-way analysis of variance (year by category), I find a significant effect for year (p = .0043) and for under vs over 900 (p = .0139) and a significant year by category interaction (p = .0885). Post-hoc analysis shows that the interaction between year and price category is due to a significant drop in the number of sales in the under 900 category for 2016.

so, I am confident (within certain constraints of the data) concluding that the decline in sales from 2015 to 2016 is because of low sales in the under 900 category.

Back of the napkin limitations include: only 10 data points, non-normal distributions (2015 has a positive skew, 2016 is platykurtotic or flat), violation of homoscedasticity (equal variances). not sure whether sales dropped because of fewer buyers or because of fewer listings.

thanks for sharing the numbers. Very interesting indeed!

When it comes to condos in the core, there is a lot more pressure on prices to rise relative to houses with higher sales activity and lower months of inventory than houses. Yet the median and average prices for condos have not been rising over the last few months when they seemed to have peaked in May.

Occasionally you’ll here someone tell you that the market is hot for condos but not close to the level you hear when it comes to houses. And that’s due to the days-on-market. Right now the median days on market for a condo is 18 compared to that of a house at 11. To some that may seem insignificant, but it seems to be enough to substantially reduce the amount of bidding wars on condos and make the marketing practice of deferring offers to entice multiple bids less effective.

At this time, I consider the DOM to be the most important indicator to be tracking as it is measuring the feelings of how “hot” buyers consider the market. If it were to rise from 11 to 20 for houses in the core that could signal a significant change in how buyers perceive the stand alone housing market and substantially reduce the number of multiple bids on a property.

That indcator has been dragging along the bottom at 9 or 10 days since the big expansion in prices in February and I don’t expect it to change radically in the next few months. But it is something to watch – just in case.

Funny how Leo is able to take the same data, chart it with reasonable comparisons and make reasonable conclusions and formulate defensible hypotheses as a result – losing no-one in the process.

I didn’t show any data on condos in the western communities if that’s what you mean by nether regions?

Standard deviations? Really? On this blog?

Once you go to the bother of calculating the standard deviations, you have to come to some understanding in what those standard deviations mean. I lose most readers when I bring up the mode, skewing and fat tails.

But if you want to see something interesting here is a frequency table of house sales and how they are distributed over $100,000 increments in the core between the two years.

Sales, Number of

Sold Price 2015 2016

$0 – 200

$200 – 300

$300 – 400 25 4

$400 – 500 163 29

$500 – 600 223 62

$600 – 700 192 71

$700 – 800 150 56

$800 – 900 80 50

$900 – 1,000 52 25

$1,000 – 1,250 52 35

$1,250 – 1,500 40 22

$1,500+ 48 24

This will give you a good visualization of how the standard deviation around the mode has changed. Plot this and see what you think.

Actually there are more new listings of houses in the core this August compared to the same time last August. 185 versus 260 this year.

However, the reason why you may feel there are less is because the asking prices are now out of your price range. All prospective purchasers will have varying prices ranges that they can afford. If money is no object then you have over 270 houses in the core to choose from today. I highly doubt that the range of quality in the houses has changed in the core. What has changed is that homes that need repairs are in your price range. So it is very much a personal opinion when you say there is a “chronic” shortage. Since there is enough houses for sale in the core today, to keep the median house price from rising. If there was a chronic shortage, the median would be increasing.

Month Sale Price, Median

Jan $655,500

Feb $681,500

Mar $740,000

Apr $759,500

May $760,000

Jun $743,000

Jul $754,500

Aug $729,250

OK, I’ll weigh in on JJ’s numbers. Hard to say what they really mean without knowing standard deviations, but 113 and 116 is probably non-significant change in the Oak Bay, Saanich East and Victoria zone. Things still chugging along there. The traditionally cheaper hoods appear to be attracting more buyers but can’t say whether this is a significant uptic or a predictable pattern because no data over time.

Can you tell from your data if it’s condos in the core that are selling or condos in the netherregions (Western communities)? If condos in the core, I would consider speculation a possible explanation (?foreign buyers evading the GVA tax) , if it’s condos in the western communities, I would say it’s probably high ratio buyers trying to get in.

Ozzie Jurrock just said Vancouver sales as of Friday down 68%, East Van down 78%, Westside down 54%. That’s some serious “wait and see”. The longer the buyers wait, the more pressure on sellers to drop the prices. Coming soon to Victoria once the reality that the downside is in full motion.

Agents keep saying it will take several months to play out. Good luck with that. Bagholders will be aplenty by then as projects begin to be delayed or cancelled and inventory finally starts to increase.

VicWest always has low inventory of SFH. There are few of them there….

JJ, in your view what is the surprise?

Surely you need to adjust for the chronic lack of inventory in the core? There are so few decent homes coming on the market in Oak Bay, for example, and many of the homes that have been listed for a while have problems or are badly mispriced. That has to affect sales all through the core. I’m guessing that Vic West etc haven’t seen the same drop in inventory.

I think that using MOI would be much more relevant than a simple comparison of sales numbers.

Well that’s two different replies so far reflecting

1) The Theory of Substitution

2) Cognitive Dissonance

Gwac: I have the same thoughts when I look at JJ’s stats.

I think this is showing that there is somewhat of an upper price ceiling here that people can afford or are willing to pay. People who figure their $500k houses are going to be worth $1.2m in five years etc. should really look at these figures and give their head a shake.

I believe the same kind of thing is happening in Vancouver (People buying more condos than SFH there).

Marko: Do you have to have a real estate license to sell real estate in BC? This one article suggests otherwise. Mind boggling if true.

https://twitter.com/SteveSaretsky/status/769312997902725120

Uh, condos look popular again? Otherwise just noise…

JJ looks like people are tapped out and buying in the cheaper hoods or buying condos

How about single family homes in the combined areas of

Oak Bay, Saanich East and Victoria 113/116 = -3%

versus

Vic West, Esquimalt, View Royal and Saanich West 55/35 = +57%

Still no surprises for anyone?

So where are we relative to the same time last August.

683 total sales of all kinds in all areas versus 565 a year ago. A 21% incease

Broken down by location as:

Victoria Core 384/298 = +29%

Western Communities 168/126 = +33%

Saanich Peninsua 60/80 = -25%

Other 71/61 = +16%

And property type

Victoria Core

Single family 168/151 =11%

Condo 169/109 = +55%

Townhouse 26/25 = 0

Other 21/13= +61

Any surprises for anyone?

If any current BC Liberal officials were tied to large scale Invested AirBnBs it would be game over next May.

That’s what makes regulating AirBnB so difficult – there are investors with dozens or hundreds of properties that are basically operating as “virtual hotels,” but not paying hotel taxes or following the same city zoning & safety regulations that registered hotels or B&Bs need to follow. Then increasing concentrations of AirBnBs in condos or rental buildings causes reductions vacancy rates, which in turn increases rents – according to Laane.

“One thing they found is that a lot of properties weren’t owned by individuals advertised as “verified ID local hosts” but by bigger investors that had dozens of these properties, eg., “Danielle & Lexi” in the Laane study.”

This is often an issue with suites and other rentals. It’s not possible to regulate for user; only use. It’s not lawful to restrict secondary suites to owner-occupied buildings (much as Councils try to do this or do this) or restrict suite occupancy to relatives, or permit short-term rentals only in a person’s primary residence. The use is all that matters, and it’s completely separate from tenure. You can require that a bed and breakfast exist in a residential occupancy, meaning that the business must exist in a residential occupancy use, but that person does not need to be the owner.

Bizznitch,

The NDP is really ramping it up. If 95% of the population agreed with the foreign tax, they will be all be on board with this too. Christy has no choice to follow suit or lose.

At any rate the writing is on the wall for the foreign buyer having anymore serious impact. They will be looking elsewhere outside of BC. Now we have to see how many locals like buying at the top or catching the falling knife.

I guess if you value your time at zero this would be the case. I pay for a cleaner for my house and I value the job she does. $65 seems pretty good for taking a lived-in space with kitchen and bedding and making it hotel level clean and ready for a guest – I think you are severely underestimating the time and effort vs. shipping. When I book on Airbnb I combine the nightly rate with the cleaning fee and it is still less than a hotel with way more amenities for a family.

Also agree JD. On the surface, RE looks like a ticket to wealth and happiness (a la HGTV), but it’s not really – it’s place to park your stuff while you go out and do other things. (anyone who’s experienced a real downturn like the 80s understands this all too well).

Yes there are a few places that I remember that I could have bought, but I don’t dwell on them, because life is too complicated for that. If I had bought them, I may not have earned or saved as much money, or been ready to pounce on our current place so fast.

I’ve also had to deal rental properties that I’ve hated at times, because of the unexpected expensive repairs, & great looking credit-checked tenants that turned out to be jerks.

RE is interesting – it provides you and/or your renters with shelter – but it shouldn’t become the place where you gain all your self-worth – or all your returns either.

For AirBnB, other cities have done studies on negative impact of AirBnB (eg., Laane.Org study on LA) maybe Victoria or Vancouver would do the same at some point. They focused on “whole apts or houses” – most likely to be rented long term. One thing they found is that a lot of properties weren’t owned by individuals advertised as “verified ID local hosts” but by bigger investors that had dozens of these properties, eg., “Danielle & Lexi” in the Laane study.

“Can’t you just count the amount of airbnb adverts in the core to get a solid number of how many long term rentals are being removed by this website?”

No, because as he said earlier it’s not guaranteed that someone with a short-term rental ad would otherwise be renting the suite or rooms long-term. You can’t even be sure that the AirBnB suite is really a suite – it could be a proper bed and breakfast without a separate kitchen.

Marko Juras

“In my opinion it is really tough to peg how much long term rental supply is removed by AirBnbs.”

Can’t you just count the amount of airbnb adverts in the core to get a solid number of how many long term rentals are being removed by this website?

New NDP election promises…

https://twitter.com/SteveSaretsky/status/769225579929358337

Meanwhile the rot in Vancouver continues…

https://twitter.com/EmilyLazatin980/status/769033857924468738

It’ll be coming here next…

The disgraceful agent behavior continues. Tip of the iceberg.

Realtor suspended over association with Chinese website

Alban Wang paid $208,881 out of his commissions by 17 deals referred to him from Chinese real estate website