Property Disclosure Statements

The property disclosure statement is a form that allows the seller of a house a convenient way to disclose any latent defects on the property that they know about. It’s sold as a way for sellers to be clear about what they’ve disclosed about a property, and for buyers to know more about a property’s history.

In reality, it was invented by the BC Real Estate Association in 1992 in order to shift some risk off of the agents on to the seller. That’s why your realtor will probably try to push you into it by saying it’s mandatory part of an MLS listing, which it is. However it doesn’t need to contain any actual information so you are free to cross out the questions instead of answering them.

The other argument you might hear is that the PDS can protect the seller by eliminating claims of misrepresentation by the buyer after the sale but this is nonsense. The buyer can still claim misrepresentation based on something that was said to them with or without a PDS in place.

The reason property disclosure statements are dangerous for the seller is because if they are included in the contract they survive the doctrine of merger. In other words, a seller can be sued for what they put in the PDS even after a sale completes because those statements can act as a warranty. So if you guessed on the PDS that the roof is 10 years old when it’s actually 20, the buyer could come back to you after they take possession and find a receipt for the roof in a floor vent. There’s nothing but downside for the seller in filling these things out.

And for the buyers? Well it’s no real advantage either. You can’t rely on the statements because they’re worded as “are you aware” and in the present tense. So if there was a flood 5 years ago but it was repaired, they can say no to the question of whether they are aware of any water damage because there is none at this instant.

In short: If you’re going to fill out the PDS be extremely judicious about it. Limit your disclosure to latent defects (those that can’t easily be found through inspection). Everything else can come back to bite you. If you’re buying, don’t believe anything you read on the property disclosure statement and have everything checked yourself.

Edit: If you want the opposite opinion you can read this article. However outside of some odd analogies that PDS is like an air bag, I don’t see any good reason why it protects a seller. As they say, the seller won in court when sued, but would have not even been sued if they didn’t fill out the PDS.

Gwac, I looked back at what I wrote. Nope, not there. I never said “telling people to sell”

No one is going to “tell” you to sell gwac. However there may come a time when you will not be able to safely live in your home anymore. While you may never sell your home that doesn’t mean it won’t be sold.

Obviously this would require a lot of input but there should be many solutions that could be implemented considering our aging community that would not require the destruction of our ecology and lowering of our life style.

We have to work with those that have not closed off their minds to other points of view and only see problems and not solutions.

New post up: https://househuntvictoria.ca/2016/08/22/august-22-market-update/

Staying downtown vancouver in an AirBnB tonight. $57/night right in the heart of downtown. Doing my part to contribute to the rental crisis!

JJ

That is not a solution telling people to sell. There is nowhere for people to go. No rentals. I would sell under no circumstance. Population is always growing and land they do not make anymore.

Solution is more TH and high rise and getting empty land out of that stupid farm crap. People need to move on from the sfh dream. Not everyone was meant to afford a sfh.

gwac I told you the solution and that isn’t enough for you!

What would make you sell?

Perhaps Leo can confirm this, but this market IS mostly about home owners not selling. It seems the crazy low inventory has less to do with insane sales numbers than low listings…. The recent price gains would feel more solid if the low inventory was because of huge sales numbers but it’s not. It’s fearful or greedy or previously unsuccessful sellers not listing yet buying. The unsuccessful ones have now been landlords for a bit and must be contemplating selling now (like some friends). The greedy ones have got to be feeling the top and maybe don’t want to rent longer than a year (like my landlords). The fearful ones who wouldn’t list until they bought just need to feel a change in momentum and the urge is the opposite…. I think at the very least there will be a more civil market coming up with more inventory. Possibly more room to negotiate which will be needed because asking prices will be higher….

Regarding the criteria to convert from a sellers market to a buyer’s market, JustJack said:

“Sellers just have to outnumber buyers.”

That’s probably the best, most succinct, bit of common sense logic that has been posted on this blog in recent months.

Conversely, to stay a sellers market, Buyers just have to outnumber Sellers.

Thanks Jack.

“you wish to create affordable housing in any city. What city council should be doing is getting people to list their existing homes for sale”

So where do these people go exactly. Camp in a park or live in their car?

Or maybe as a plan to destroy the economy and tax base “please leave the city for a better one.” That could be the commercial..

Bearkiller, you don’t need to have 2000 more listings to turn the market from a sellers to a buyers. You just need a drop in sales. We could have a buyers market with today’s level of listings.

The real estate market is only made up of 3 or 4 percent of the total stock of housing. And only those actively bidding and listing their homes make up the marketplace. That’s why prices in New York and London can decline. Sellers just have to outnumber buyers.

If you wish to create affordable housing in any city. What city council should be doing is getting people to list their existing homes for sale. Building new homes just stimulates the economy and increases demand.

@ Hawk:

Fitch’s 20% over-value opinion was for Canada at large, not Vancouver specifically.

The PDS is written by the real estate board’s E & O lawyers to shift a law suit away from the agent and onto the seller. It isn’t written for the benefit of the buyer or the seller.

Now to say that a signed PDS doesn’t increase the number of law suits is naive. Of course it does. The buyer has a signed document that shows the vendor lied and that makes the buyer more likely to pursue the matter in court. Otherwise it would be just one person’s word against another and most attorneys would be reluctant to take the case. And I have been in enough cases where the buyer ends up acting as their own lawyer to know that this never works out well for the plaintiff.

The person you really want to sue is the agent. They have the E & O insurance. The deep pockets. If you can show that the agent and the seller acted together to misrepresent the property then you will be guaranteed compensation. That’s why the PDS shifts the focus away from the agent and onto the seller. The agent may simply state that he relied on the home owner’s statement. Although I would find that difficult to believe as anyone can be taught in under 5 minutes what the differences are between a 6 year old roof and a 20 year old roof.

More difficult and more relevant to Greater Victoria are grow operations. You may have bought a home that had been a grow op and since then you’ve cleaned it up. Now are you going to tell the truth on the PDS or lie? And what about your agent who knew the home had a grow op before? If you write NO are they going to go along with this and perjure themselves if it goes to court?

Victoria is late to the game as usual following Vancouver trends from real estate, to fashion, to music. Long standing tradition of being slow out of the gate. Fitch is being generous.

Vancouver home values don’t match fundamentals: Fitch Ratings

VANCOUVER (NEWS 1130) – Home prices in the Vancouver area are overvalued by more than 20 per cent, according to a US-based credit rating agency. Fitch Ratings says local home values are too high when “compared to growth in long-term fundamentals, leaving markets increasingly exposed to downside risk.”

It says the recent decrease in the number of sales “suggests the city’s market may have already begun to cool.”

“Throughout this past weekend we were honoured to meet with close to 200 interested and motivated groups of potential homeowners. As a result, over 100 of our 119 residences have now been spoken for.”

You mean 100 flippers put some loose change down from flipping thousands of houses and condos the past years and plan to do it again, as they have figured out how to scam the new laws. Let us know when they close and move in.

With only 2000 more listings to go before a complete bloodbath I know I’m starting to get really worried. The long awaited bear crash meltdown is upon us. All the bears will emerge from their moldy caves with the bags of money they’ve been “saving” and plunk it down to buy houses with no financing.

“Those active listing are surging. This market is turning only another 2000 active to go and it will be buyers market.” Looks like the went down from last week. How does that work exactly, 240 more listings last week and 203 sales, and yet active listings go down by 40. Must be 80 people taking their house off the market?

The majority REALTORS® I have talked to that have been in business for 20+ years have never been involved in a lawsuite. The percentage of transactions that result in a lawsuite are extremely small.

I think if every seller & buyer had legal training, then risks to both parties would be low and people would always choose the right answers to PDS questions. Yes/No/Don’t Know.

The biggest problems – I think – are when people have to waste time & money in court, and also when they under-estimate the complexity of home repairs. You think you’ve fixed one problem adequately, and it may not be enough for the buyer, or another problem is created down the road.

eg., Lance vs. Wright, Supreme Court of British Columbia in 1997 https://ontariorealestatesource.wordpress.com/2010/05/28/two-real-estate-agents-sued-over-false-disclosure/

“first you were sued, then you were let out of the lawsuit. Then you were sued again, but let out a second time. Then you were told you might be sued later.”

The seller, buyer, & realtor may all have different interpretations of what Yes/No/Don’t Know mean – and what the problems and fixes really are.

Luxury condo building pre-sale launch in Coal Harbour by BOSA ($1,500 per square foot and up). Not sure if the Vancouver market is totally dead.

“Throughout this past weekend we were honoured to meet with close to 200 interested and motivated groups of potential homeowners. As a result, over 100 of our 119 residences have now been spoken for.

Property law varies from province to province as it is legislated provincially and interpreted by that province’s court so there are some significant differences unless you are referencing a matter decided by the Supreme Court of Canada.

The SPIS form in Ontario is their version of the PDS and is an extra page long and contains some ambiguous questions that are difficult to answer without advice, and some different questions and advice. Our form is replicated below already – pretty straight-forward imo.

The claim that the forms are causing litigation in BC is, imo, mostly inaccurate imo except where there is bad advice from a realtor on filling them in or, more likely, an intention to deceive a latent defect. If you look at the cases on this you’ll find that generally the allegations are that the sellers were less than truthful – and where they are successfully sued, the courts find the sellers wilfully misled the buyers – not by innocent mistakes.

This is generally how it works in BC:

http://davidsonpringle.com/disclosure-obligations-for-real-estate/

This is how BC Courts treat the PDS:

http://www.westerncanadabusinesslitigationblog.com/real-estate/bcca-confirms-that-buyer-beware-still-rules-the-day-in-real-estate-transactions-why-property-disclosure-statements-dont-tell-the-whole-story/

Here is case commentary on the case Leo was referencing:

http://www.bcrea.bc.ca/news-and-publications/publications/legally-speaking/legally-speaking—january-2016-(483)

BC is not Ontario, and the law is different there on this, so trying to apply commentary from Ontario lawyers on the SPIS to the BC PDS will result in some inaccurate advice and assessment of risk.

Filling out a PDS only opens the seller up to future problems. I would never fill one out as a seller.

This real estate lawyer thinks the PDS is a risk to sellers:

https://www.thestar.com/life/homes/2014/07/25/sellers_form_still_troubling_the_real_estate_industry.html

The effectiveness of the PDS depends on how the seller & realtor interpret the questions.

If the real estate agent advises incorrectly, or just keeps their mouth shut when you innocently answer “no” (and they think you should say “yes”), then you might be exposed. I’ve seen a realtor do this – and later told us that they believed we had answered incorrectly but didn’t want to hold up the deal ! (in actual fact, we had answered truthfully and correctly – but he admitted casually he kept his mouth shut based on a false assumption of something he had seen!)

Examples: “Are you aware of any damage due to wind, fire or water?”

“Are you aware of any moisture and/or water problems in the walls, basement or crawl space?

Imagine if you re-did the weeping tile, got rid of the moisture problem, then discovered after an unusual rainstorm that the place you sold had moisture problems again because the contractor didn’t do the job properly & they’re out of business.

In the Overackers case, they believed this question meant “are you aware of any current damage?” Totally understandable. They responded “no”, but their fix didn’t hold up …

“In 2008, the Overackers listed the house for sale with Jack Mallon. He gave them a Seller Property Information Statement (SPIS) to complete and advised them — incorrectly — on some of the answers. He told them that if a problem had been fixed, it was not an issue for the disclosure form.

“After receiving Mallon’s advice, the sellers answered “no” to questions asking if the property was subject to flooding, if they were aware of moisture and/or water problems, if they were aware of any damage due to water, and whether they were aware of roof leakage.

“After closing, the buyers had problems with the sump pump and found water had saturated the septic bed. They sued the sellers for misrepresentation, arguing that had they known there were problems, they’d never have done the deal … The buyers walked away with a cheque for 30% of the house sale price”

Those active listing are surging. This market is turning only another 2000 active to go and it will be buyers market.

Mon Aug 22, 2016:

Aug Aug

2016 2015

Net Unconditional Sales: 599 741

New Listings: 811 952

Active Listings: 2,139 3,688

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Triple A , you need to go scrape the moss off the roof and quit reading the blog. You have 24 years and 8 months to go on your mortgage so you’re just punishing yourself critiquing news sites according to your personal standard.

High end real estate declining by half a billion dollars no matter which US market is news worthy wether you like it or not. As per Miami, New York, London or Hong Kong , the signs of a topping market and excessive credit lending beginning the downhill slide is evident. It’s not my fault you bought at the top.

Allow me to state for the record that I agree with more than half your posts. I find many of them insightful, and collectively global.

Then there’s these other random finds from the economic “X Files”

I think if you limited your internet time to 45 mins a day, and a single post, your contributions would be far more relevant, interesting.

Comparing Aspen to Victoria.

Seriously… As they say, I guess this is a thing.

Way to stay on point.

I was shopping yesterday and caught myself drifting off while standing in line being hypnotized by the National Enquirer. I understand now how you live 24/7 ;P

Dasmo,

As Garth always states, it only took 8% of the US mortgage holders to default to bring it all down. If you have over 60% foreign buying influencing the high end markets (according to Westside Van agents), then removing them because they don’t feel welcome anymore will have a massive effect on market psyche.

Looks like they have taken a liking to Calgary overnight instead of Victoria. Shows how fast they can change their mind just like when they play the stock markets.

Thanks StepbyStep, missed the interesting comments. I liked this quote speaking of emotion buying:

“Bubbles are irrational. They spring from the amygdala, not the cortex. Fear and greed and other base emotions rule, not cold logic and calculable returns.”

Looks like Aspen is having it’s first ever major decline and sounds like Victoria where the last correction was a blip, and now it’s getting whacked:

“The summer crowds are dense in Aspen. Sales tax revenues are soaring. Lodging occupancy is high. So why is Aspen’s high-end real estate market — one of the most robust in the country, with dozens of options for buyers ready to spend more than $10 million — in its first-ever sustained nosedive?

High-end sales that fuel Aspen’s $2 billion-a-year real estate market are evaporating, pushing Pitkin County’s sales volume down more than 42 percent to $546.45 million for the first half of the year from $939.91 million in the same period of 2015.

Ask a dozen market watchers why, and you’ll get a dozen answers. Uncertainty around the presidential election. Fear of Trump. Fear of Clinton. Growing trade imbalances with China. Brexit. Roller-coaster oil prices. Zika. Wobbling economies in South America. The list goes on.

“People are worried about all kinds of stuff these days,” says longtime Aspen broker Bob Ritchie. “I’ve never seen anything like this before.”

Aspen is historically immune to the macro temblors that rattle most real estate markets. Yes, it slid in 2009 after the economy collapsed, but not by much. And it rebounded spectacularly, reaching pre-recession levels in 2012 and then getting back to setting records in 2014.”

JJ, it is similar. Consider how few sales created the bump and the president to go unconditional and over ask…. A small amount of sales seems to have a big influence on things….

Dasmo, the author has mixed up market price and market value. If the rare painting had sold at market value then it wouldn’t matter if the highest bidder had been stuck in traffic, the painting would have sold at the same price.

In real estate, the marginal buyer always buys at market value. Someone can bid more than market value but they will not effect the marketplace.

And I have seen it happen in an auction at Lunds and at Kilshaws. An item has come up for bid. The bidding is down to two bidders and then the highest price gets the item. And on some rare occasions, the highest bidder backs out and the item comes up for auction again. And sells at the same price! I don’t know why it happens – it just does. And that’s why you can ask the auctioneer before the auction what his estimate is for the item – and most of the time his estimate is right on the button.

In real estate the marginal buyer is defined as buying at market value. If the price they bid is clearly outside of the market value range they are not considered a marginal buyer. One sale does not make a market. As an appraiser, I estimate market value. I can’t estimate what a crazy person will bid but I can estimate what a marginal buyer will most likely pay for the property. Or as I say to some people – I don’t do crazy.

The mistake that a lot of writers make is that they assume real estate acts in the same manner as other financial instruments. Real estate uses most of the same math formulas but it doesn’t act in exactly the same manner. Because a house is not a can of soup or a ton of coal where every unit is exactly the same. Residential real estate is run by emotions not always common sense.

And the interesting thing about the marginal buyer and their influence is they are only a small percentage of the buyers in the auction house but they set the price. Hmmmm maybe 10% foreign buyers has more influence than projected previously… Another indication of the fragility of our market right now….

Where are you voluntarily exposing yourself with no upside? You are required to disclose material latent defects and that is what form is mostly about. The upside is the seller sets out what they know right now (not past rectified issues) “to the best of their knowledge” and this protects them from a later claim that something was not disclosed that should have been.

Your premise is that the seller was sued because they got the age of the roof wrong and if they had not disclosed it on the PDS they would not have been sued. This is, imo, incorrect as I’ve already stated because of the way the law works on latent defects and deceit – the PDS does not increase risk where the claims are made on this basis as most claims will be because that is where you can get damages. And if a seller is not deceitful and doesn’t fail to disclose latent defects on the PDS then this protects them from later claims.

Because that is generally where the liability is, and based on this or failure to disclose known latent defects and that actually was what that case you cited was about. The PDS helps you here if you answer it honestly. And most people are going to ask these questions anyway and want answers. Wouldn’t you?

And the form itself sets out the law on this:

This is the same with other representations depending on the facts.

Maybe. Maybe not. I’ve never been asked for a receipt. That is your interpretation of the standard, but we are talking about a patent defect here readily discoverable through a home inspection. I’d say you are unlikely to be sued for this and it would be an unsuccessful case based on the difference in age where there was innocent misrep unless it induced you to enter the contract and you can prove it. Very very unlikely. Very difficult to see how the other questions can lead to liability if answered truthfully. Most of them are worded with “to the best of your knowledge” or “are you currently aware of”.

Although the property condition disclosure statement forms part of the agreement for a purchase and sale, it is not necessarily a warranty. Its main purpose is to put purchasers on notice with respect to known problems. The disclosure statement merely indicates that the statements therein are true according to the seller’s current actual knowledge and these are representations. The buyer still has to check the information out themselves where the issues are not hidden. The form itself says this:

AND

AND

In Arsenault v. Pederson, [1996] B.C.J. No. 1026, 63 A.C.W.S. (3d) 166, the British

Columbia Supreme Court stated:

I’d agree. You are free to have a difference of opinion.

FWIW imo you are not going to be sued over a stove being ten years old instead of five and no reasonable person would be induced to buy based on a five year difference in the age of the stove. There is a very high dollar value where it is worth it to sue and that is why the items on the form are as they are imo and do not include things like appliances.

The issue is reasonable risk management based on legal risk of contract damages and rescission and this form makes an attempt to clarify high risk issues.

Do your own if you disagree or sell as is where is and see how it goes. I’m going to continue to fill in the forms myself and require them from a vendor unless there is some reasonable excuse for why it can’t be provided.

@Hawk – did you read the comments section too? Quite good. I was surprised that Vancouver was cited by a few commenters when it’s a US writer. I think the ‘charleshughsmith’ comment is excellent

Excerpt:

Zero yields have distorted global markets to such a degree, it’s hard to know what the “real” price of anything should be except as a business proposition, i.e. does it generate a net profit after expenses.

Obviously. But there’s a big difference between you making those statements in the contract and making them outside. You can’t argue with that fact. So why voluntarily expose yourself when there’s no upside to doing so?

We’re not talking about fraudulent misrepresentation here, not sure why you keep bringing it up.

This is not correct. Any competent realtor would have asked the seller the age of the roof. When the sellers says “about 7 years” they need to ask if they have documentation. Given that they didn’t have any, they would answer questions from buyers like “the seller estimates about 7 years but cannot be sure as they don’t have the receipts. Please verify condition”. That kind of professional competence is what realtors are paid to have.

You’re the one that said it was reasonable to include the age of the roof in the PDS because it’s a common question. So why not the age of every other thing in the house that are equally common questions?

I am not. I am cautioning that it’s a bad idea to voluntarily increase your potential liability by including written warranties about a property you cannot be sure are correct. This is necessary because the people advising sellers have a conflict of interest in this area.

And you are not asked to in the PDS. Of all those questions only the age of the roof is on the PDS and only if known. Just say you don’t know. Most of the rest of the stuff is stuff you need to disclose to avoid latent defect issues imo.

LAND

A. Are you aware of any encroachments, unregistered easements or unregistered rights-of-way?

B. Are you aware of any past or present underground oil storage tank(s) on the Premises?

C. Is there a survey certificate available?

D. Are you aware of any current or pending local improvement levies/charges?

E. Have you received any other notice or claim affecting the Premises from any person or public body?

SERVICES

A. Indicate the water system(s) the Premises use:

Municipal ___ Community ___ Private ___ Well ___ Not connected ___

Other _________________________________________

B. Are you aware of any problems with the water system?

C. Are records available regarding the quantity and quality of the water available?

D. Indicate the sanitary sewer system the Premises are connected to:

Municipal ___ Community ___ Septic ___ Lagoon ___ Not connected ___

Other _________________________________________

E. Are you aware of any problems with the sanitary sewer system?

F. Are there any current service contracts (i.e. septic removal or maintenance)?

G. If the system is septic or lagoon and installed after May 31, 2005, are maintenance records available?

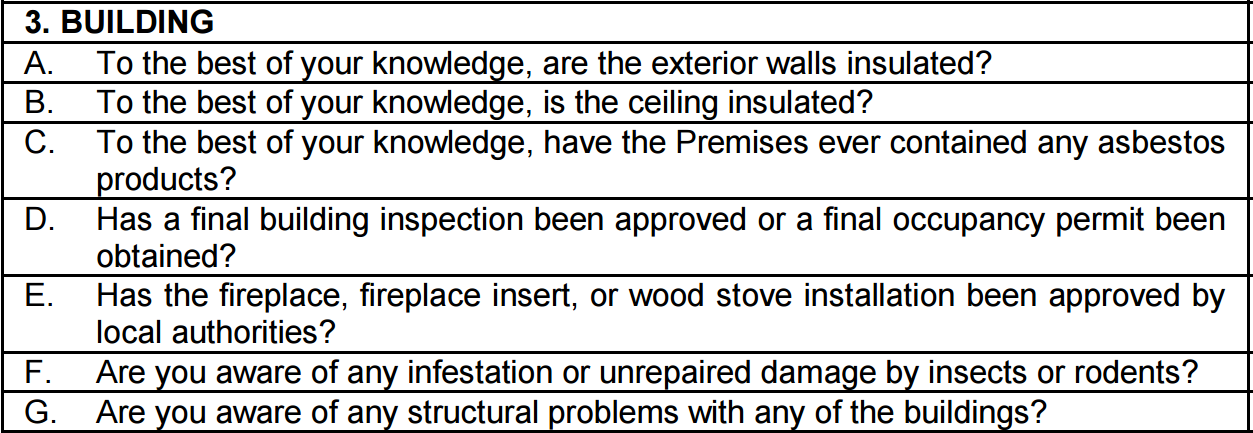

BUILDING

A. To the best of your knowledge, are the exterior walls insulated?

B. To the best of your knowledge, is the ceiling insulated?

C. To the best of your knowledge, have the Premises ever contained any asbestos products?

D. Has a final building inspection been approved or a final occupancy permit been obtained?

E. Has the fireplace, fireplace insert, or wood stove installation been approved by local authorities?

F. Are you aware of any infestation or unrepaired damage by insects or rodents?

G. Are you aware of any structural problems with any of the buildings?

H. Are you aware of any additions or alterations made in the last sixty days?

I. Are you aware of any additions or alterations made without a required permit and final inspection, e.g. building, electrical, gas, etc.?

J. Are you aware of any problems with the heating and/or central air conditioning system?

K. Are you aware of any moisture and/or water problems in the walls, basement or crawl space?

L. Are you aware of any damage due to wind, fire or water?

M. Are you aware of any roof leakage or unrepaired roof damage? (Age of roof if known: ______ years)

N. Are you aware of any problems with the electrical or gas system?

O. Are you aware of any problems with the plumbing system?

P. Are you aware of any problems with the swimming pool and/or hot tub?

Q. Do the Premises contain unauthorized accommodation?

R. Are there any equipment leases or service contracts, e.g. security systems, water purification, etc.?

BUILDING (continued):

S. Were these Premises constructed by an “owner builder”, as defined in the Homeowner Protection Act, with construction commencing, or a building permit applied for, after July 1, 1999? (If so, attach required Owner Builder Declaration and Disclosure Notice.)

T. Are these Premises covered by home warranty insurance under the Home Protection Act?

U. Is there a current “EnerGuide for Houses” rating number available for these Premises?

i) If yes, what is the rating number? _______

ii) When was the energy assessment report prepared? _________________

GENERAL

A. Are you aware if the Premises have been used as a marijuana grow operation or to manufacture illegal drugs?

B. Are you aware of any material latent defect as defined in Real Estate Council of British Columbia Rule 5-13(1)(a) or Rule 5-13(1)(a)(ii) in respect of the Premises?

Great article StepbyStep. This quote rings so true to what could happen here after almost a decade of central bank printing to prop up markets.

“Note how the sudden disappearance of the marginal buyer can set off a vicious downwards chain reaction, as it exposes how far prices must fall to become affordable to the next marginal buyer. And, of course, in a correcting market, few want to attempt to catch a falling knife — so the potential population of marginal buyers shrinks as they sit on the sidelines waiting for the carnage to abate.

That’s the main point of this article: the marginal buyer can evaporate faster than you think. That is the nature of an asset bubble’s unavoidable destiny to “pop”.”

Yes, exclusions are often helpful and protect against liability, but exclusionary clauses do not always stand up – they have limits if, for example, they are unconscionable or contrary to public policy they may not be enforceable. You are missing this point and it leads you to overemphasize the important of PDS statements and underestimate the impact of other representations or failures to disclose where there is no PDS as you appear to be suggesting is the way to go. Basically you are ringing an urgent alarm here on the liability resulting from the PDS and nefarious realtor shifting of liability when the law is more complicated and fact driven and the PDS does a fair bit to protect a seller imo.

Statements you make or fail to make outside of the contract can be used against you in some circumstances despite the clear exclusionary clause and the “doctrine of merger”.

Deceit in the performance of a contract may expose you to a claim in damages that an exclusion clause cannot prevent. You don’t get to knowingly induce someone to enter the contract with completely false information and get away with causing loss just because you have an exclusion clause in your contract. For this reason exclusion clauses do not work against material latent defects known but not disclosed by a seller even if there is no PDS statement or representation.

What I am saying is that in the case you referenced is not clear that they were sued because the PDS info was “part of the contract”. The claim was for a known but not disclosed latent defect and, as a fall back, deceit which you cannot contract out of. The age of the roof set out in an email would have been as good of a reason to sue as the PDS to this effect if there had been fraud or failure to disclose a material latent defect (which would have required no disclosure to be actionable – and there was none)- the vendors were unsuccessful because the judge found this was not the case – the misrep was innocent and there was no latent defect.

Here is an explanation:

http://www.canadianappeals.com/2014/11/24/what-tangled-webs-we-weave-the-bcca-provides-guidance-on-the-tort-of-deceit-and-exclusion-of-liability-clauses/

And here is an overview on the forms that seems pretty balanced:

http://www.remonline.com/the-truth-about-property-disclosure-statements/

As for the age of the roof being a common question. Here are some other common questions:

How old is the furnace?

How old are the appliances?

How old is the hot water tank?

When were the perimeter drains done?

How old are the windows?

When was the kitchen remodeled?

How old are the floors?

When did you insulate the attic?

All perfectly reasonable for a buyer to ask and perfectly reasonable for a seller to answer in good faith. Doesn’t mean you should be making written warranties on any of them.

Getting the feeling this boom may implode on itself as the lack of workers will effect the building costs on all these billion dollar projects.

If the construction employment is down 5000 workers from a year ago, and the construction business is going to go on a social media blitz to attract workers ASAP, then where are 5000 workers supposed to live if they come here broke from their last layoff ? This city can’t absorb that amount of people on short notice with a rental crisis.

This will have an effect on financing of projects if they get delayed due to lack of workers and risk the possibility of being cancelled entirely should the global economy go in the tank in the coming year or Vancouver crashes causing Victoria to follow suit.

All the signs of the end of the cycle coming down from the peak.

http://www.timescolonist.com/business/island-construction-companies-searching-for-workers-amid-boom-1.2327049

Re: PDS Comments. I’d like to see statistics on which jurisdictions still use these. I’ve lived in many across Canada and these documents are not in use, often stopped in the past decade. There’s a reason for this change. So, argue away with myopic perspectives on Victoria.

A good read on the marginal buyer. This may explain what is now being observed in the market such as the earlier comment on Oak Bay’s low sales level:

http://www.peakprosperity.com/blog/100798/marginal-buyer-holds-pin-pops-every-asset-bubble?utm_campaign=weekly_newsletter_245&utm_source=newsletter_2016-08-19&utm_medium=email_newsletter&utm_content=node_title_100798

Totoro, do you understand and accept the difference between making a written warranty in a contract that specifically survives the doctrine of merger compared to saying something to a buyer before the contract completes when a contract specifically says no other warranties apply?

No it is not.

A PDS acts to protect the buyer imo from failing to disclose latent defects. Honesty is filling in the form is important as well as understanding it and I agree some stuff in it could be confusing so ask your realtor. I’d agree you can do a separate type of disclosure as to latent defects but you are still going to get questions about the wett certificate, age of roof etc. I would not buy a house without reasonable responses to reasonable questions unless there was a reasonable explanation (ie. estate sale).

Pretty good imo. The sellers would have likely been sued anyway with or without the PDS. They were sued for latent defect and deceit probably due to the falling market in 2008 combined with buyer regret and the legal advice that there was a latent defect. The PDS did not cause the lawsuit. The court dismissed the latent defect claim and they were left with deceit which was not a strong claim on the facts but they went with it. Would have been a claim whether or not in the PDS (ie. verbal or email rep instead) as and the exclusion clause would not have stood up against a successful latent defect or deceit claim.

Realtors do not have to independently verify the age of a roof when told what it is by a vendor if there is no PDS. if there is any reason to doubt the validity of the disclosure made by the vendor, a vendor’s agent has an obligation to make further inquiries but otherwise they only have to verify to the extent reasonable for a realtor. A roof age is not within the special knowledge of a realtor – it is known by a seller who replaced it and it should be inspected by a buyer’s home inspector who does have the expertise. Realtor’s can’t encourage a vendor to lie or misrepresent or cover up information and they have to be accurate on some things such as square footage in a listing which is why there is a disclaimer on the listings stating if important it is to be verified by buyer where there is no professional measurement available.

As for shifting the liability for disclosure onto vendors, it would be more accurate to say that the PDS provides a way of setting out in writing if there are latent defects, along with the answers to some common questions. Without this type of document there would probably be more reasons to sue a buyer AND realtor which is not something that should be encouraged imo. There is a good reason for caveat emptor and as a buyer get the house checked out properly. As a seller disclose hidden defects and don’t lie when asked about other stuff.

In a rising market liability for all of this goes way down. Be more concerned in a falling market.

This Vancouver real estate blog link has been posted here in the past; but it will be interesting to watch again during the next few weeks as Vancouver real estate market seems to be imploding:

https://vreaa.wordpress.com

“A lot of crash talk on this blog.

I just don’t see any real adjustment happening. There are too many factors of a healthy economy here coupled with low interest rates.”

Sounds like another agent who has to pump a market teetering on very shaky legs telling buyers to get off this blog and go get a second job. Yes the “haves” must be feeling the heat as we await the Vancouver fallout. I thought this was a blog aimed at house hunters, not the “haves”.

If you do some research, in 2007 they were preaching the same thing until all the cranes stopped and multiple holes appeared all over this town.

Vibrant poster needs to realize this is a global economy driven by free money and easy credit and that is what will blow this up, along with some government foreign intervention.

Maybe Vibrant needs to take off the rose colored glasses. A global and US recession is a real possibility over the next year when you can’t raise rates a meager 1/4 point without blowing the world up.

Funny how soon people forget what a business cycle looks like and think good times are here forever.

What is happening with unfinished developments post-boom

“Holes in the ground, price discounts, auctions of unsold condos, construction delays — they’re all signs of a worldwide slowdown in multi-unit residential construction that is being felt in Greater Victoria. ”

“Banks want more equity, more pre-sales and more deposits before considering financing, he says. “It is just a different world than it was three years ago when the market was hot and everyone wanted to jump on board.”

“There are so few lenders out there that are willing to be involved and then when you talk about all this calamity going on in the real estate market, nobody knows what to do. So it just seems to take about four times as long and probably two to three times the work to get anything started.”

http://thetrac.ca/resources/docuploads/2009/05/05/What%20is%20happening%20with%20unfinished%20Victoria%20developments%20post%20boom.pdf

It’s real simple. Your statements on the PDS survive the contract. Why would you open yourself up to potential liability on dozens of issues for zero benefit? Disclose the defects you know about, don’t say anything about those you don’t know about. Sure you can answer “don’t know” instead of leaving it blank if you like.

What are the chances that case would have ended up in court if the claim wasn’t part of the contract?

Without the PDS the buyer would have asked about the roof, the seller would have said it’s about 7 years old, and the REALTOR’s responsibility would have been to verify that info before passing it on to the buyer. It would have been at the agent’s risk to pass on unverified info. With the PDS the seller assumed the risk and it cost him a huge amount of wasted time in court. Who cares if he won in the end. The time is worth way more than the roof.

Also, the standard contract contains a section that says “There are no representations, warranties, promises, or agreements other than those set out in this contract”. So even if you had emailed the buyer that the roof was 7 years old the buyer wouldn’t likely be able to sue you for that after completion.

The BCREA disagrees. They talk about PDS as a tool for risk management and say “for REALTORS it shifts much of the risk onto parties to the transaction”. A logical goal to have, but certainly not in the interest of the seller.

Sorry Leo, I disagree with your conclusion. If we went through the disclosure statement line by line you’d find the majority deal with latent defects and there is a box that specifically asks if you are aware of a material latent defect and a definition of this is given.

The age of the roof is a common question and a reasonable one imo. If you know the answer, answer it. If you do not, say so. The Nixon case just doesn’t show you’ll be liable for innocent misrep ie. you reasonably believed something was true and it was not: it shows the opposite.

You are a bit confused as to how this all operates and what is fair in the circumstances in my opinion. You’ve been carried away by the idea of being liable for something you sign on the PDS based on a case that found someone was not liable for negligent misrep while failing to address the significant issue of liability for not stating latent defects and the fact that refusing to answer known facts about the home is a poor marketing strategy and there is pretty much zero liability for transmitting facts truthfully.

The disclosure statement acts to protect a seller from future claims more than it does to shift liability from a realtor. A listing agent relies on the representations of the seller as they don’t know the history of the house. This is an appropriate spot for the liability as the seller alone may have this information. If you are selling a home you are responsible for disclosing latent defects – not the realtor. If you are asked reasonable questions about the state of the home you are also responsible for the information you provide so don’t lie and, again, if you don’t know just say so – so what.

Caveat emptor doesn’t mean you can’t ask questions, it only means the obligation is on the purchaser to ask questions and investigate independently where the defects are not latent. If you don’t ask or investigate you cannot later claim for damages except where the defects are hidden or there was a misrepresentation.

I think if you spent some time considering all the roles, not just that of the seller, you might find it is reasonable for the seller to provide disclosure when asked and the buyer to do independent inspection and for the realtor to rely on the seller’s representations.

It really doesn’t. It encourages the disclosure of all sorts of things that wouldn’t be considered latent defects. The age of the roof is a prime example.

If the form was designed to encourage disclosure of latent defects then it should mention the risk of not disclosing such in the preamble.

The PDS form encourages laypeople to essentially write parts of a legally binding contract when in fact they don’t understand the risks and aren’t capable of doing so. That is dangerous, and the motivation of the PDS is to protect the industry, not the sellers.

Good points though. I’ve updated the conclusion somewhat.

If you’re concerned about being sued by the purchaser then advertise the property as a “potential development property, caveat emptor.”

Simple and effective.

If you try to hide your un-permitted, sub-standard renovations or known defects; you’ll likely get sued.

Maybe but you will get asked questions anyway – usually a buyer will ask their realtor and your realtor will ask you and the response will be by email. The forms encourages disclosure of latent defects which people don’t know they have to disclose. A better point would be to answer I don’t know if you do not know.

Quite possibly. The issue with the PDS is it encourages you to make representations when you really shouldn’t be.

I’d say the case law shows a very disgruntled buyer who is trying to get out of a deal due to buyer regret or a falling market will likely lose their case where there has been innocent misrepresentation. I agree you shouldn’t mark yes or no if you don’t know. Just say you don’t know. In the Nixon case they thought the roof was six years old. Even if they answered the question verbally they would likely have been sued for misrepresentation – and the buyers would have lost. I think the form is useful for latent defects, unpermitted work and as a way of cutting to the chase on issues such as buried oil tanks where known.

I’m not saying you can hide latent defects by not filling out the PDS. Obviously if there are latent defects you have to disclose them. But case law shows you can end up in court for other things on the PDS that are not latent defects. Win or lose, as soon as you end up having to defend yourself in court you’ve already lost.

I’m saying a filled out PDS that may have an innocent error on it can be used against you.

As for them not being common, maybe that’s because sellers have been sold on something that is purely a negative for them under the guise that it will protect them. I would say under a realtors fiduciary duty they should not be able to push something that is purely for their own benefit at the detriment of their client.

Maybe with more education the filled out PDS will become less common and be seen by buyers as irrelevant as it is.

You might want to research material latent defects before giving advice. And not filling the form in is going to mean some buyers will pass on your home. I would be put off by this. You would probably not be able to, for example, understand if electrical or plumbing was done without a permit without disclosure. I’d say getting sued is always a risk in a purchase, particularly in a falling market – pretty low risk if you answer honestly and say you don’t know if you don’t. I’d agree the form is more likely to help with protecting against being sued for a material latent defect than it is to harm – unless you lie.

What about marking them all as don’t know?

Most of them are not answerable anyway. Does my house have exterior insulation? Almost certainly. Would I say yes if I haven’t inspected the inside of all 4 walls? Hell no. There is some odd looking drywall patches in the master bedroom. Maybe that’s how they got the jetted tub in and who knows whether they re-insulated it?

Am I aware of any local improvement levies? No. But what if I really should be? Maybe they mailed me a letter and I threw it out by accident. Better not to make any claim at all.

If house prices do moderate here and supply gets added, trust me there are a LOT of people waiting to trade houses right now.

Definitively have a lot of clients wanting to trade up/down/sideways but not wanting to do it in this market.

If you are living in the home you are selling and you cross out the PDS it will throw a red flag for the majority of buyers. It is not common to see the PDS crossed out on owner-occupied homes; however, very common on rentals properties, estate sales, or very elderly seller sales.

Good advice, but most buyers want this form filled out, and by not filling one out they get suspicious and it could end a potential sale.

A lot of crash talk on this blog.

I just don’t see any real adjustment happening. There are too many factors of a healthy economy here coupled with low interest rates.

Vancouver will correct a bit in the high end of course, but the high end was mostly outsiders trading hands, it was detached from locals.

If house prices do moderate here and supply gets added, trust me there are a LOT of people waiting to trade houses right now.

Only thing stopping this market is policy changes by the government that tries to stop the economy, or interest rates go up drastically, or supply gets added at a shocking rate, or rental availability gets added at a shocking rate.

Best case things slow down to historic 4% inflation yearly (we are below this by the way, last 10 years has only seen 1.2% rise yearly).

There are a lot of angry priced out people that are posting multiple times a day drowning out the few balanced insights. If you are looking to buy a home, please buy one, just make sure you can afford it and plan to live in it for a longer period of time.

It’s also ok to be stuck renting, no need to wish economic destruction on the haves, maybe try to get off this blog all day and get a second job and save up for that starter condo.