Birds of a feather

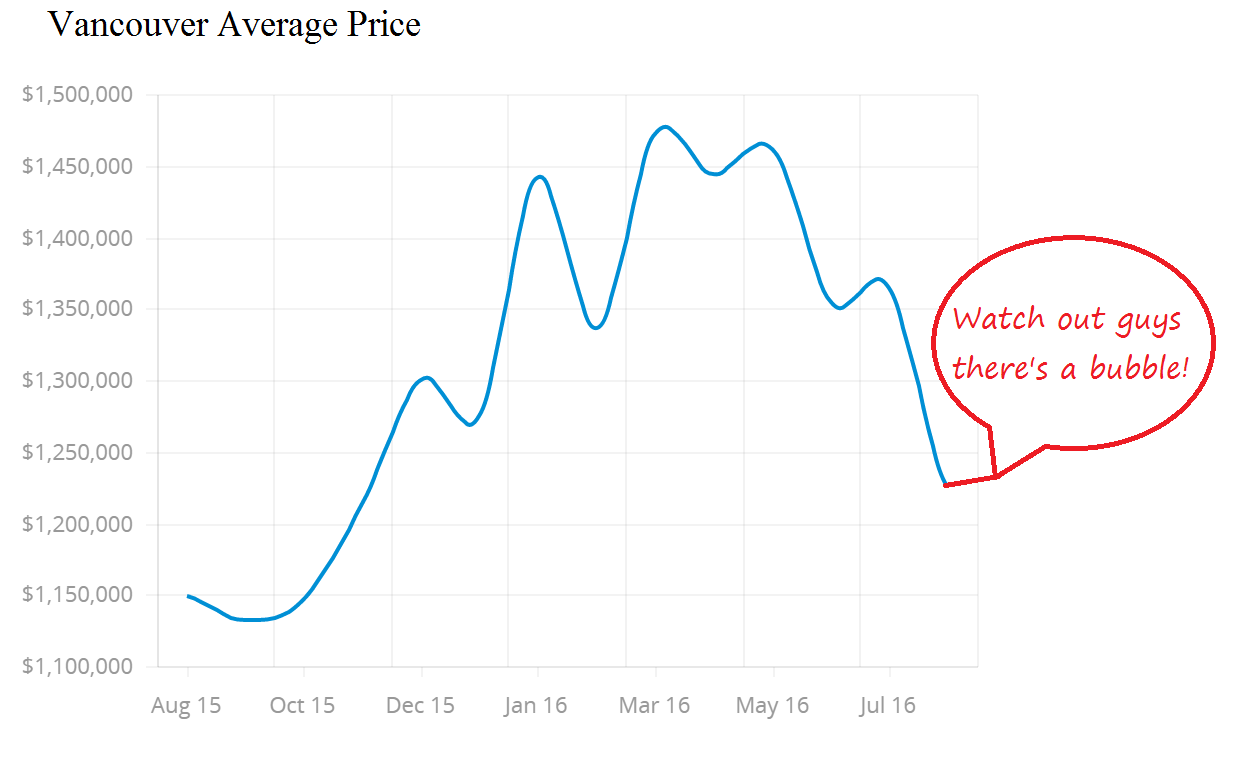

I know this is super late to the party, but my mind still boggles at the CMHC housing market “analysis” they like to publish quarterly. Last quarter they finally woke up to the fact that something may be wrong in Vancouver. Hilariously this may have come when the bubble was already well on it’s way to deflating.

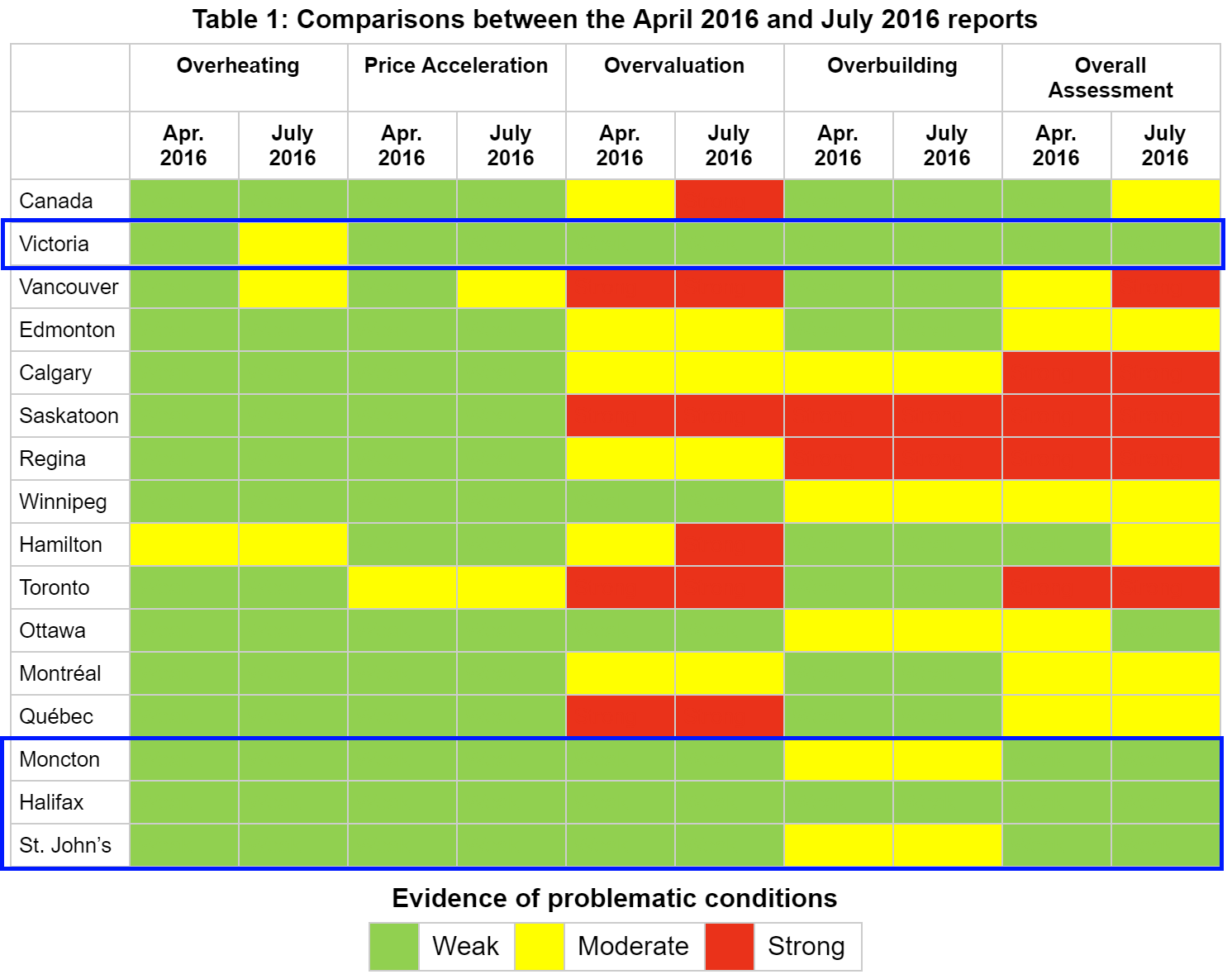

We covered the previous quarterly report when it came out, but I might as well mock them again. As little attention as the Victoria report received in the media, it apparently received even less attention by the people writing it. The note at the bottom of the page says “Results are based on data as of the end of December 2015” which is exactly what it said 3 months ago. So either they haven’t updated their data or (more likely) they tossed the report together on a Friday afternoon and didn’t worry too much about proofreading.

The report for Victoria? Mostly green across the board, although the “Overheating” category (sales/new list ratio) has moved to moderate as it passed 80% for Q1 2016. The overall assessment is green though so it’s all peachy. In fact it seems we are most similar to the Atlantic coast among such cities as Halifax, Moncton, and St. Johns.

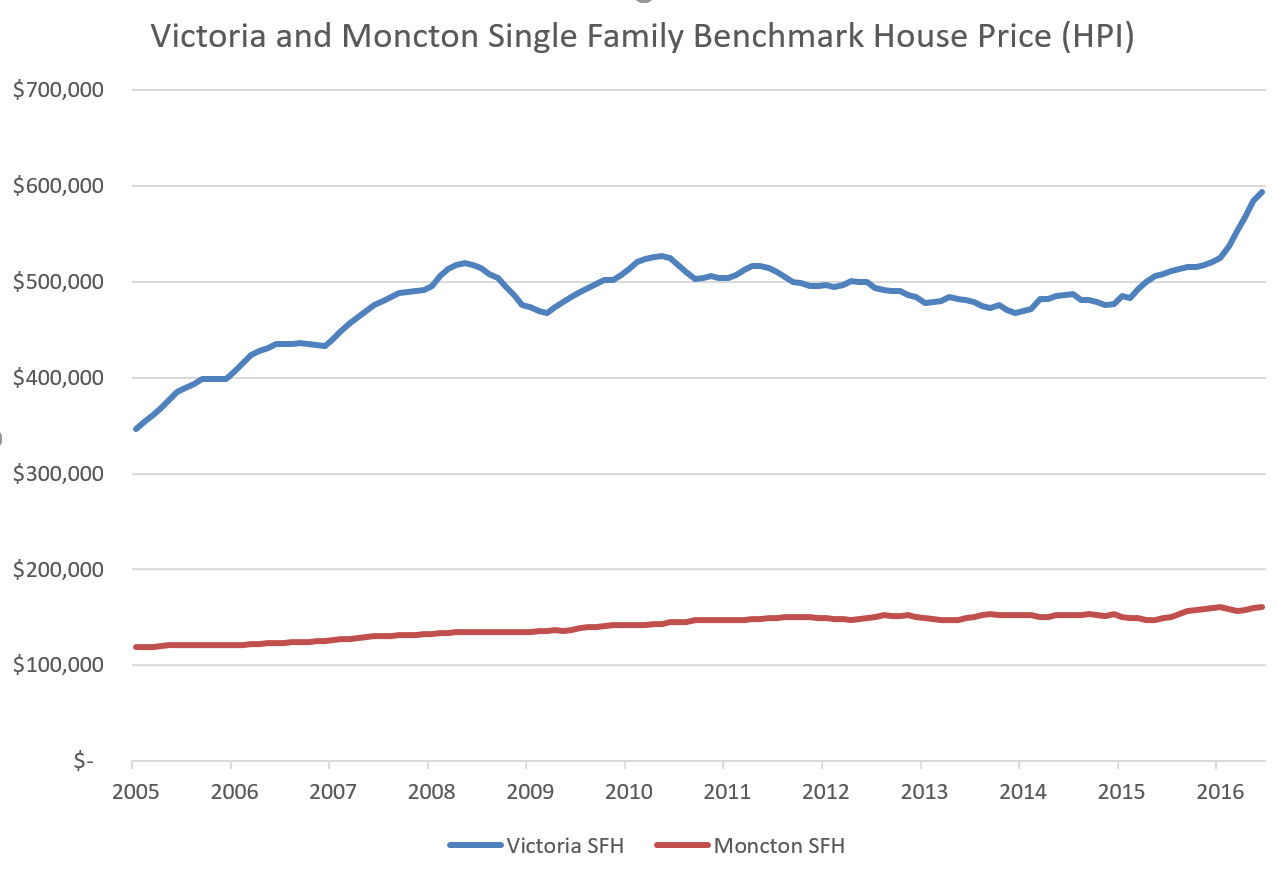

So what’s happening in Moncton that makes it so similar to Victoria? Well this is a market that is so fantastically boring they last bothered to update their statistics over a year ago. Back then the average house cost $155,000 and it hasn’t gone anywhere exciting since.

But wait. Isn’t the Atlantic coast a depressed economic region? I’m sure their incomes are a fraction of ours so the house prices make sense in the local context.

Nope. Turns out those bogtrotters make almost the same as us!

The thing is, I may have accepted the argument that we must compare to historical norms. That price to income has been high historically in Victoria so we have to see the current levels in that context. But that’s not what the CMHC is saying. They say that the overvaluation metric is defined by fundamentals such as incomes, the cost of financing, and population. Well incomes are about the same, the cost of financing is identical, and Moncton’s population is growing at over twice the rate of ours. And yet the CMHC is squinting their eyes at that graph and saying “Those are about the same, eh?”

Friend of mine does web work. Spent the last year travelling around the world with his wife and kid. Didn’t affect his income one bit. For many people it’s not necessary to stay in one place and hold down a job like it used to be.

Also interesting to see inventory up: https://househuntvictoria.ca/2016/08/15/august-15-market-update/

Gives you enough to live on in a LCOL country. In Canada a paid off house and 1M in assets will see you through to 60-65 when you collect a pension even if you retire at 30. Being low income and having kids pays off in Canada with the child benefit system as it is.

Did anyone hear the Local CBC radio interview of Victoria mayor Lisa Helps today on affordable housing? I can’t find a link to it.

$1M should give them about $40k/year in income in perpetuity (based on historical market returns). They claim to spend $30-40k/year so it should work especially if they can adjust that in downturns.

Given they plan on doing the odd consulting job on the side it should be pretty easily done.

So far the only significant expense from our kids is daycare. Not necessary when you’re not working. And the value of a fixed address is debatable, but either way that fixed address can be in a low cost of living area.

Their point is to get out of those markets. Of course that only works if you can make high incomes like they did.

This is why you do CREDIT checks on perspective tenants. I don’t even call references because it’s all bullshit. If you do it long enough you can spot a deadbeat a mile away. First thing I check out is their car and then their shoes. Then Facebook and then I search court services online.

I’ve seen some insane flips this year in the $1 million plus range.

Doesn’t really seem fair to me…..rich person buys house for $1.5 million, for example, sells it for $2.0 million 12 months later and pockets $400,000ish tax free. The person buying and selling the home is probably in a really high tax bracket income wise by they are exempt from raking it in tax free because of the “principal residence” rule. Average Joe can’t bank $400,000 in a life time.

@Leo S – re: the millennials who retired after using $500K to invest vs. buying a house

http://www.cbc.ca/beta/news/business/house-investment-wealth-1.3716641

These millennials make it sound like they “beat the system”, but they only have $1M in assets, and this might not give them enough income in the future. I don’t really think they are truly retired, despite what they say. They seem to be taking time off to travel and enjoy life. Things will change if they have kids because life will get much more expensive and they will need a fixed address. Hopefully they can get back into the job market if they need to.

As Michael said, they would have been better off incorporating a house purchase in their overall financial plan. For someone faced with the decision today, the potential upside of buying seems less than in 2010. However, I don’t consider renting an escape, since the rental market has become much tighter as real estate prices increased in Vancouver and Victoria. I don’t think there is a way to “beat the system”. Things are so unpredictable now that future success has as least as much to do with luck as skill.

@ Hawk,

“I would have cut off their hydro meter/breakers and water then see how long they stay.”

While I have to confess to being tempted to do the same, the reality is that can make it worse by giving your tenants a means to raise a lengthy complaints process against you and/or also give your tenants grounds for appeal in any proceedings you may have had against them.

The perfect example why I never would play landlord, and I’m sure there are hundreds more stories just like it. I would have cut off their hydro meter/breakers and water then see how long they stay.

What a nightmare, gwac.

It makes me realize how lucky we’ve been with our tenants so far. I’m happy to have a suite that’s only really big enough for a single person. We’re not against a couple if they think it would work for them but both times we listed the suite we had so many responses that we were able to have our pick.

Leo from your link. An owner could lose their house with this crap.So less than a month you can kick someone out quickly after that it is a nightmare. Thus AirBnB over longterm rental.

“Nothing specific to Victoria, so far as I’m aware the specific rules are provincial.

But a close friend of ours, who is a lawyer(!), spent almost a year trying to force non-paying tenants to leave. He sent me a long summary he wrote up for his MP, I’ll put a shortened version here:

•The tenants paid two months’ rent, then stopped.

•On month three, the landlord served notice to end tenancy, tenants disputed.

•It took two months to get a court date, which tenants postponed at last minute.

•Almost two months after that, tenants predictably lose in court (don’t show up).

•Landlord applied for (and gets) order of possession from the courts (another few months), tenants don’t leave.

•Landlord calls police, police decline; they don’t have authority without a writ of possession from the Supreme Court of BC.

(Note that throughout, tenants have been calling the police for all sorts of stupid reasons, like hot water running out or garbage not being taken to curb.)

•Landlord spends three months getting a writ of possession (at this point it’s become his hobby), then presents to tenants. Police give tenants a month to leave, tenants comply on day 29.

Epilogue is that the tenants are now doing this to another landlord, after faking their references. My friend is representing the new landlords out of spite.

After hearing that story, we gave up on having some nice college kids, instead we’re going to put in a rec room or something. But you can bet that anyone who’s buying real estate as an investment isn’t risking their profits by taking a tenant.

We might AirBnB though… So long as they’re not there for a month, it’s safe. (This is apparently why Vancouver is overflowing with AirBnB and starved for looking-term leases.)”

Rental thread on reddit. Desperate times. https://www.reddit.com/r/VictoriaBC/comments/4xqktc/can_anyone_explain_to_me_how_the_hell_our_rental/

Dasmo

Here you go hope this helps, seems the answer is not to work.

Assistance for People with Low Incomes

MSP Premium Assistance

If you have a low income, or are facing temporary financial hardship, you may be eligible for premium assistance to reduce or eliminate your monthly MSP premiums for a certain period.

Depending on your circumstances, you may be eligible for regular or temporary premium assistance.

If you are eligible for premium assistance, MSP also provides full or partial coverage for supplementary health care benefits such as acupuncture and therapeutic massage.

To find out if you are eligible for premium assistance:

We have free healthcare? How do I get that?

The so called rich could lose any or all. Like I said it is always looks good to screw high income earners.

Hope you’re right.

JJ

The gov will never touch pensions/free healthcare and the non capital gains on housing for Canadians.

While the conservatives did the right thing raising from 65 to 67 it cost them and no one gets elected doing the right thing.

You can bank on that.

Taxing the so called rich and non canadians is always a winner tax….

Governments bring in new taxes all the time and they still get elected.

If you’re a bureaucrat looking for new revenue sources for the government the housing industry is a fat cow. Right now we tax real estate at the beginning with transfer taxes what we haven’t done yet is tax housing at the end such as in an estate.

Most of these massive profits made by people is due to government initiative why shouldn’t the government get a bigger piece of the pie. At least you get something in the end which is better than if you hadn’t bought. You just don’t get as much as you did before.

Half a loaf is better than none.

You can already deduct interest anyways on a mortgage so we will leave it at that since no government who want to ever get elected again would do that.

gwac, I don’t see why they have to have the same rules. Stocks are not real estate.

You don’t live in a stock. So as long as you live in real estate then it would be capital gains exempt.

I’m sure there would be hardship exemptions, but those can be treated separately.

What we have done in the last decades is to turn real estate into a commodity for personal profit and not as a place to live. Now we can see how devastating that has been for places like Vancouver, Toronto and maybe Victoria.

Is it really fair that some home owners have profited greatly because of government initiatives and banking policies that all of us pay for? Sure home owners won’t like it, but we do live in a socialistic society.

As a home owner, think of it as money that can be used for more policing or bigger prisons to keep you safe from all those people that have less than you.

The problem with using year over year gains is that you may be comparing completely different markets.

Last year in Victoria our prices were declining, so even if our prices have been flat for the last several months the year over year would be rising.

Sale Price, Median

Month 2015 2016

Jan $542,500 $655,500

Feb $597,500 $681,500

Mar $625,000 $740,000

Apr $631,200 $759,500

May $620,250 $760,450

Jun $629,450 $743,000

Jul $610,000 $754,500

JJ

Than what is the difference between a stock/bond or real-estate. Have to have the same rules

Just because the US makes interest deductible there is no reason why Canada has to.

Canada and the USA don’t even calculate mortgage payments the same why would we have to allow interest rates to be deductible just because the USA does?

CBC’s latest article on the housing market would appear to be misleading, at least in the context of YVR. They are using the YOY metric to argue that prices in the Vancouver market are “soaring”, when in fact the detached market is currently in correction mode.

I don’t know if it’s sloppy journalism, or the writers/editors have an interest here. I would think info from CREA or any other vested agency should be given a bit more scrutiny.

http://www.cbc.ca/news/business/crea-price-sales-1.3721141

JJ

That is similar to how the US works. You do that you have to make interest deductible.

Maybe Michael is on to something here.

Perhaps the gains on your personal home should remain tax free as long as you buy another home in the next 12 or 24 months. Otherwise some of the gains would become taxable.

Maybe it’s time to close the loop hole on properties. The tax exemption is for home ownership. If you sell and then not re-buy then it should be considered a taxable investment.

Am I really suppose to feel sorry for this guy.

http://www.theglobeandmail.com/news/world/vancouvers-real-estate-tax-sparks-backlash-from-chinese-buyers/article31404771/

Good question, I got the chart from an article on the auto loan debt bomb, though it is unrelated. If the US is showing delinquency rates increasing long before Canada you have to wonder if Canada’s numbers are legit with much higher personal and household debts levels.

http://jugglingdynamite.com/2016/08/15/subprime-auto-debt-crisis-in-the-making/

Mon Aug 15, 2016:

Aug Aug

2016 2015

Net Unconditional Sales: 396 741

New Listings: 571 952

Active Listings: 2,174 3,688

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Interesting. Wonder what is causing That delinquency spike. Haven’t heard anything about it

Looks like another US debt bomb about to explode.

http://jugglingdynamite.com/wp-content/uploads/2016/08/Default-cycle-2016.png

“They’d be far better off had they bought with down payment and put the rest into stocks. Toronto house prices have nearly doubled since 2010 and the return tax free.”

Funny how hindsight is always a convenient argument for Mike and his magic 8 ball.

They’d be far better off had they bought with down payment and put the rest into stocks. Toronto house prices have nearly doubled since 2010 and the return tax free.

Interesting read. Got lucky on the time period for investing but a good example of what I’ve been saying. If you’re young and in a big city, rent or get out. At these (Vancouver/Toronto) price levels it’s not worth throwing your life away for a house

http://www.cbc.ca/beta/news/business/house-investment-wealth-1.3716641

Thought this was interesting: https://vancouverhousingblog.com/2016/06/09/is-it-supply-are-we-stupid/

All that talk about supply issues, and yet when the music stops in the market that supply magically appears.

That’s an insightful news article Hawk and it might soon be hindsight for Canadians. It’s the usual sheep vs wolf article that hits the mainstream news service when unexpected, sudden changes, become obvious to everyone. Will Toronto, Vancouver, and Victoria be next?

The amateur investors and house hoarders in Florida are being decimated from being wealthy paper millionaires to foreclosure experts in mere months.

“Would have…, should have…, could have…”

Amazing what happens when you start taxing foreigners and making them expose who they really are. Just a matter of time til we see the listings increase in Vancouver, then here.

Major US renting markets are starting to crumble

“This is how it is happening in Miami: A heroic building boom in Greater Downtown has created a phenomenal condo glut just when federal regulators decided earlier this year to track down money laundering in the real estate sector. It coincided with Brazil and Venezuela – Miami’s largest feeder markets – falling into political turmoil and economic chaos respectively. The “strong” dollar doesn’t help. And buyers from abroad have become scarce.”

“A similar scenario is playing out in other “primary markets,” such as New York City, San Francisco, San Jose, and Houston, but all with different dynamics, according to AXIOMetrics’ new report on rents. In fact, rent declines in those key markets “drove down” the national averages.”

http://www.businessinsider.com/major-us-renting-markets-are-starting-to-crumble-2016-8

@ JJ:

To create a housing bubble and a construction boom, obviously.

numbers,

I believe we’re talking canola/rapeseed(China article), not total oilseed production/demand. The only reference to Canada is one line pertaining to disease, not GMO.

China has stopped supporting the farmers there to drive prices lower like they did here when they dropped the news back in January.

I think you both are mixing up two different topics. There is a glut of China produced canola oil at higher prices and the Chinese public are opting for the cheaper Canadian canola which the government obviously don’t want to see.

So they imply there is a disease risk and you have an excuse. If it was GMO related it would have been in the Globe article, not some conspiracy theory.

Seems to me they don’t like lower priced competition.

Policy

The government stopped its price support to rapeseed production in MY15/16 (although some provinces provided some limited subsidy to farmers) and rapeseed prices decreased dramatically. Government policies used to encourage rapeseed production through a “minimum price purchase program” and a direct seed subsidy. In MY14/15, the government maintained the rapeseed purchase floor price at RMB5,100/ton (or $822/ton, Chart 4), significantly higher (about RMB800 to 1,000/ton) than the price for imported rapeseed. Currently, the government maintains a planting seed subsidy of RBM150($24)/Ha to farmers.

Citing phytosanitary concerns, China’s rapeseed import policy restricting entry of imports to only nonrapeseed producing regions remains unchanged. However, the recent establishment of rapeseed

crushing plants in non-rapeseed areas (namely Guangdong, Guangxi and Fujian provinces as stated

above), has minimized this policy’s impact on imports from China’s two major suppliers, Canada and Australia. Additionally, AQSIQ has reached similar agreements with Russia and Mongolia on rapeseed imports for crushing.”

Canada vs the World since 1996 Scotia Economics Benchmarks:

see page 6:

The entire world is getting more expensive…look at Sweden 3X on AVERAGE as a nation since 1996. Ouch.

http://www.gbm.scotiabank.com/English/bns_econ/retrends.pdf

@Hawk Off Topic, but of interest to me, LeoM is being truthful.

China Oilseed 2016 Prod’n: 53 MM Tons

China Oilseed 2016 Demand: 143MM Tons, 90MM Ton shortfall

Source USDA:

http://gain.fas.usda.gov/Recent%20GAIN%20Publications/Oilseeds%20and%20Products%20Annual_Beijing_China%20-%20Peoples%20Republic%20of_3-29-2016.pdf

Why everyone hates Monsanto from MIT:

http://modernfarmer.com/2014/03/monsantos-good-bad-pr-problem/

http://web.mit.edu/demoscience/Monsanto/index.html

LeoM,

Just to clarify your canola story on the previous thread, could you show me some proof of what you were posting ? From what I can see this is about worries over blackleg disease, (which are so far unfounded) and not from Monsanto GMO worries.

This sounds more like just another China attempt to hoard and dominate an industry and now it’s backfiring on them.

“Some traders in both countries have said they believe China’s main motivation for the new standard is a desire to slow imports due to its large domestic rapeseed oil stocks.”

http://www.producer.com/daily/china-delays-implementation-of-new-canadian-canola-standard-chinese-embassy/

As far as I can tell it looks like 99% of the listings are by different people.

And lets follow the logic path on that: who owns 25 places to start with? N0-one I know. And how about we consider vacancies when doing up the calculations and think about whether there is a difference between gross and net. Pesky facts getting in the way of hyperbole.

I’d agree that this market needs regulation and should be limited to owner occupiers.

They really need to crack down on that. Owner operated only, and a max of 1 or 2 units per owner.

Just Jack, interesting point re. air b-n-bs.

looking at downtown air b-n-b lisitings, there’s a serious problem–80% of listing is hosted by 1 or 2 pro hosts…. this tells me she makes about : 25 listing($150-$200)/day25 days (booking)=100k/month

Interesting, the Globe, Financial Post, Bloomberg and CBC are the most common I post and you say they are doom and gloom, though they show charts and the numbers to back up the story ? Very strange perception.

If you like I could post a few from King World News ?

China Is About To Shock The World With Its Next Move

http://kingworldnews.com/china-is-about-to-shock-the-world-with-its-next-move/

The best thing about this weather for bears is finally the mold will stop growing in the basement suite. It’s too bad theyll stay socked in with the blinds closed like a vampire. Just sad really.

No, the websites I mentioned that you hyperlink are poorly written, negatively speculative as though the world is coming to an end. But everyone is self fulfilling anyhow. I have a few friends that have been looking for 9 months, keeping in the loop.

4 months ago we closed. And no I don’t have either a huge mortgage or a 30+ year amortization. Previous crashes were a different recipe, this is a different cake that I’m not anyone knows who’s making it. I have a good home I’m happy with.

Every article of business news with new information on market changes I post is poison to TripleA because he just bought a house a month ago and is now saddled with a huge mortgage.

Maybe you should just stop reading this blog TripleA as the news is only going to get worse from here on in. Maybe try some of the realtor sites where you’ll be the last to know. Better yet just go mow the lawn and de-stress. 😉

Until we can get the housing shortage under control we should restrict immigration. What is the point of bringing more people into Canada when we can’t house them?

Developers have convinced city hall that the only way to make housing affordable is to build higher and smaller. All that is doing is creating hotel rooms for air b-n-b’s. It doesn’t solve the housing or rental shortage but stimulates the economy with temporary jobs.

Now you have a new high rise downtown tower where X percent are bought by speculators for wealth preservation, Y percent are bought by investors for air b-n-bs and the remainder are bought by people with new jobs in construction wanting to get onto the property ladder.

So every time you build a new tower of condos very few of them trickle down to solving the housing and rental shortage. And because so many new temporary jobs are created what city hall has done is increased the demand for housing but added very little supply. It is a disaster awaiting the next recession when all those temporary workers leave the city and go back to rural BC and Alberta. Leaving a glut of tiny condos that no one wants to buy.

Vicbot,

wholeheartedly agree with you. I believe densification benefits development, not only keeping housing prices sustainable but also creates a new market and demand for that product. It’s normally packaged with Transit initiatives.

On a side note our immigration minister has proposed increasing immigration while also removing removing the LMIA (Labour Market Assesment) to foreigners. As it stands now, Foreign workers need a letter from an employer, as well as an impact study that no Canadian is available to fill the vacancy. This is the fallout of Trade Deals. The TPP will be the single worst piece of legislation that will harm our future.

http://www.cbc.ca/beta/news/politics/john-mccallum-substantially-increase-immigration-labour-shortages-1.3718831

Stop posting this poison.

Motley is a sham of journalism, a single step below Huffington, and on the same level as profit confidential.

“…Stock Buy Alert Hits Astounding 96% Success Rate!”

“…*96% accuracy includes restaurant stock recommendations from Motley Fool U.S. services Stock Advisor, Rule Breakers, Hidden Gems, Income Investor and Inside Value since each services inception. Returns as of 5/27/16”

Any website that generates fear and then tries to provide a safe solution is pure scripted crap.

Mike can’t remember which year he’s in. One chart it’s 1986, another it’s 1941, now it’s 1989. One chart is a 7 year and now he invents a 14 year, next it will be a 21 year. Talk about time warp BS.

ICYMI Mike “We are here” at 2016, at the top of a parabolic chart explosion fueled by more cheap credit and laundered money never seen before in Canadian history.

Why Royal Bank of Canada Is in Trouble if This Latest Report Is Accurate

“A recent report by Capital Economics, however, found that the risk in the Canadian housing market is even more severe than the Bank of Canada assumed. The report stated that the Canadian housing market is in a “very big bubble,” and based this conclusion on several different facts.”

“Not only do Canadians lose in this scenario, but so do the banks, and Royal Bank of Canada (TSX:RY)(NYSE:RY) is the most exposed.”

http://www.fool.ca/2016/08/12/why-royal-bank-of-canada-is-in-trouble-if-the-latest-report-is-accurate/

Van’s average price will show a healthy correction (’89-like), especially now with the new ‘mansion tax’, but Teranet’s repeat sales won’t (see latest m/m % of index). I suppose it’s a 14-year cycle (7+7).

http://i.imgur.com/5qkS7td.png

In the Province article, Sullivan claims that the people who fought densification are getting rich.

Disagree. The problem has become inappropriate densification. The people getting the most rich are developers selling their thousands of pre-sale condos to their buddies, families, & offshore investors, who then flip them for profit and trade them like stock.

In case Sullivan hasn’t noticed, these unaffordable mini condos are now being built in every suburb, 1 hour commute from downtown.

Sam Sullivan himself tried to profit from it – trademarking the term “EcoDensity” in his name (later transferred to the city). Now Sullivan is a Liberal MLA, whose party gets huge donations from developers.

http://www.theglobeandmail.com/news/national/trademark-application-sparks-furor/article688390/

“In a statement yesterday, Vision Vancouver said ‘Mayor Sullivan would have full legal rights any time ‘EcoDensity’ is used in books, magazines, newsletters or reports.'”

Nowadays, the new “talk of the town” in cities around the world is the limitations of density and Jane Jacobs’s ideas: (The Daily Beast & WSJ have had a good articles as well) http://www.slate.com/articles/business/metropolis/2016/05/happy_100th_birthday_jane_jacobs_it_s_time_to_stop_deifying_you.html

“Governments (no doubt swayed by the urban planners whose graduate programs hew to Jacobs’ philosophies) spend millions on implementing Jacobs’ recommendations—making streets more walkable, supporting new, local businesses, de-emphasizing cars—and nearly everywhere they do, gentrification and displacement follow. ”

“The same neighborhood Jacobs lauded for its diversity in the 1960s and ’70s is today a nearly all-white, aesthetically suburban playground for the rich … small, community-oriented businesses have been replaced by banks and restaurant chains, upscale cocktail bars, and expensive shoe stores … a two-bedroom apartment is about $5,000 a month. “

In The Province on densification; “In our interview, Sullivan describes Vancouver as a Venice surrounded by a Phoenix, where the refusal to densify means that environmentally sensitive areas are getting mowed down to build sprawling, car-dependent suburbs.”

Link: http://www.theprovince.com/news/alberta-politics/david+staples+fight+over+housing+density+generational/12120232/story.html

From article in yesterday’s Globe on the 80% rule for BC stratas: “We will be another pair of people with a pocket full of money going to Victoria.”

Link: http://www.theglobeandmail.com/real-estate/vancouver/bcs-new-strata-laws-mean-some-owners-may-be-forced-to-sell/article31387492/

Your top chart shows we’re at the “denial” stage of the bubble popping. Expect to see lots of whining by realtors who revel in the media exposure as they try to blame the government and the media for causing all those poor lottery winners to have to cut back on the prime rib and Maseratis.

http://2.bp.blogspot.com/-ZWsQNhB12M4/Tf161ZP8iFI/AAAAAAAAAu4/iEFXxNao1KU/s1600/800px-Stages_of_a_bubble.png

Yikes. It’s obvious discrepancies like this that make Hawk’s general prognostications impossible to outright dismiss, hyperbolic though they are.

Do we have any data on price-to-rent ratios?

I recently fiddled around with craigslist/realtor.ca and zillow.com to get a rough idea for Victoria, Vancouver, and some expensive US locations. My tiny sample of unprincipled data seemed to suggest Victoria could be ~50% higher than San Francisco, Silicon Valley (Menlo Park), and Manhattan. Vancouver, as expected, was just ludicrous (price-to-rents were twice as high).

I’ve mostly seen reports focus on price-to-income, which while atrocious in Vancouver, isn’t so far off other bubbly cities. It’d be interesting if Vancouver’s price-to-rents were comparatively much worse. A Victoria comparison would also be interesting, of course.