Uncharted Territory

On the one side we have crazy hot market conditions with residential inventory the lowest it has ever been in any recorded July. On the other hand we have a regulatory environment that is becoming increasingly hostile with every passing day. So far the seesaw is still planted to the ground with the market conditions dominating, but the government continues to pile on weight to the other side. Thing is when you pile it on in big chunks some pretty sudden things can happen to the market.

As for that inventory, we have to go back to 2003 to see anything similar. That July there were 1710 active residential listings. By December that had dropped to 1092. A similar decline from current levels would put us below 1000 active listings. Once you take into account that the population has grown by 10% since then it’s even more insane.

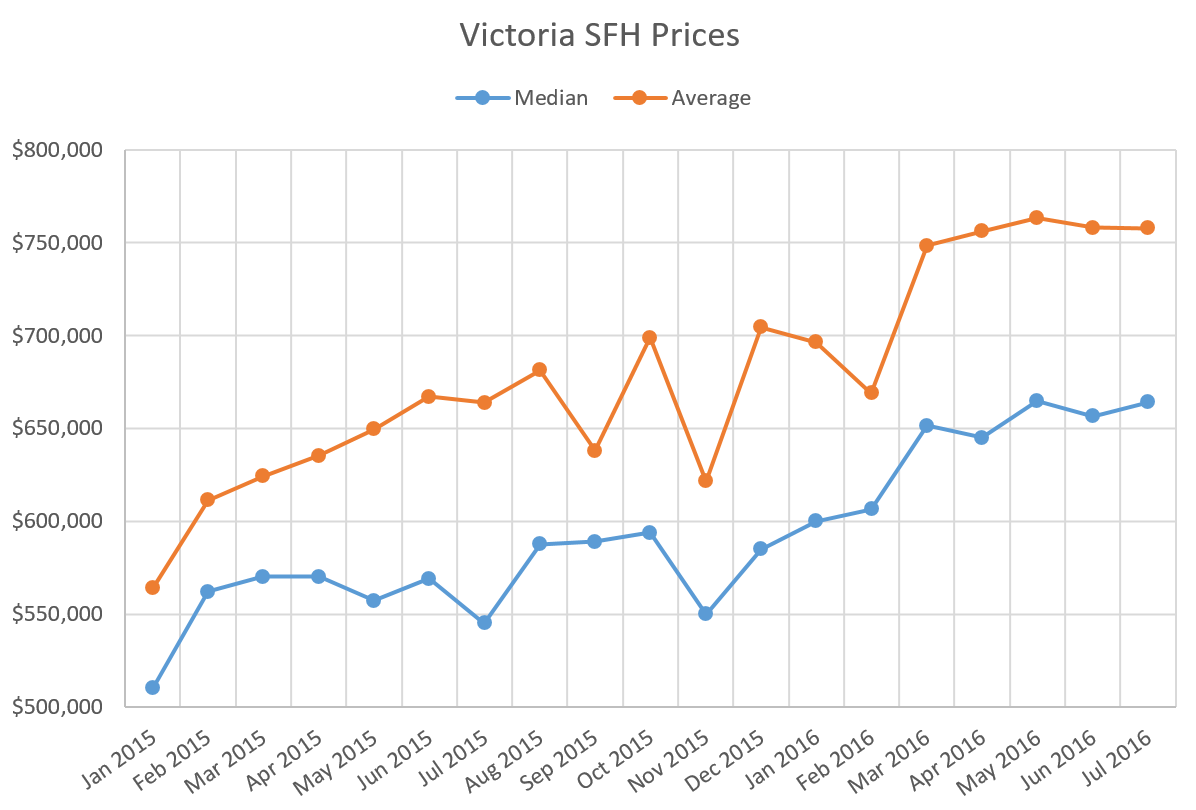

Prices are doing some interesting things. Now I firmly do not believe in the possibility of price plateaus in a hot market. I have never seen it happen and I haven’t seen any convincing rationale that would explain how it could happen. That said, after a quantum leap in the spring, detached house prices have been quite boring at more or less the same levels. While I usually post the moving average, here is the raw data so you can make your own decision.

You can see that between July 2015 and Feb 2016 one could have made the argument that prices were flat as well. Until they weren’t. Given the propensity of average and medians to make large jumps, I predict we will see another large jump this year or early next unless the market turns around before then.

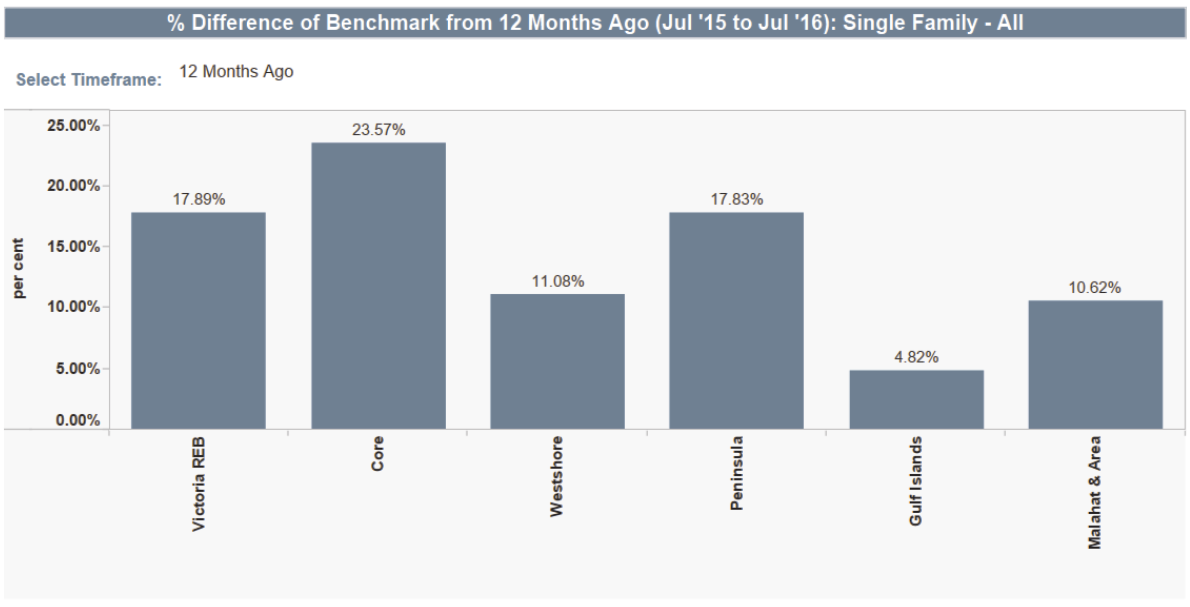

As can be expected, the core sees the most gains while the westshore and our islands within the island lose out.

One thing that could get us out of this market is a flood of listings, but even there we aren’t really hitting the marks. New listings have drifted downward since 2008 and it seems there aren’t many people out there eager to cash in their chips.

Expect sales to continue to decline until we hit the October bump so people can put their Christmas trees in their new houses.

What is going to be absolutely fascinating is whether the chaos on the other side of the ferry buffet makes its way over here. Yes we have very few foreign buyers here, but it’s all a connected chain. The foreign buyers stop buying, the local Vancouver owners can’t sell, which means they can’t come over here in as great of numbers. What compounds all this is emotion. Once public sentiment turns negative it won’t turn back on a dime. There might be just as much gnashing of teeth and frustrated appeals to reason on the way down as there was on the way up.

In the past cycle market conditions changed quite slowly, especially when they were cooling off. But when a black swan hits it can turn quickly. https://househuntvictoria.ca/2016/08/05/how-fast-can-the-market-change/

Were not in a bubble, we are just next to one of the largest bubbles on earth. If it pops we won’t remain unscathed. It’s like a stock shooting up 50% overnight because they declare a large dividend but they are massively in debt, their fundamentals are beyond out of whack, their sales are flat and new government regulations are coming into place that are unfavourable to their product. Would you invest?

@Olympicbound – “There hasn’t been a large bump in prices in Victoria in almost a decade, sure a 9-12% in that time period, but that certainly doesn’t look like a bubble to me.”

I don’t necessarily think we are in a bubble either, but I disagree with the 9-12% based on my experience house hunting (off-and-on) for over a decade. The areas I was primarily interested in were Fairfield, certain areas of Oak Bay, and parts of Saanich East. Apparently the rest of the world was also interested in those areas because I recall prices escalating approximately 100% from 2001 until the crash (end of 2008/beginning 2009). That is, houses in the $300K range ended up in the $600K range.

In the subsequent eight years, prices in those areas might have declined a bit, then held flat, then they recently increased 25-50%, depending on the sub-areas. If I could have found a house that only went up 12%, I would have jumped on it. Instead, I ended up paying approximately 30% more for my house than I would have approximately a year ago. Compared to 2001, the overall increase in a house like the one I bought is approximately triple (i.e. 300%).

Now, one can say there are all kinds of other good areas that have not increased as much, which is true, but public transit to many areas is crappy and traffic is increasing every year, so we are not really comparing apples to apples if one works in the core.

However, despite that large recent price increase, I don’t think it tells us much about where prices are going in the future, which is why I finally gave in and bought. I don’t think prices are likely to go up another 300% in the next 15 years, but who knows?

The world is changing. It just occurred to me that the price of some food also went up at least 300% in same time period. Does this mean there is a bubble in food prices and one should hold off buying food until after the crash? Well, probably not for your personal food consumption, even if there were a practical way to do that. As an investor, though, it may be a different story.

The increase in food prices is complicated, as is the increase in real estate prices. The fact that there has been globalization of markets plays a role in both. Environmental and political factors also play a role in both. Bottom line: I think it gets harder all the time to make predictions based on past performance, even for the “experts”.

@Olympicbound

I’m not digging what you’re spiking for one second. Your posts are nothing but continuous unsubstantiated drivel. In my opinion, a pathetic attempt to incite some sort of ‘fear of missing out’.

Are you selling a Hyundai or trying to scaremonger with that BS classic “you better get in before you get priced out”?

Sadly it really tarnishes a great forum for exchanging ideas and facts.

1 fact to back up your claims. I dare ya.

There has been a few days of hand wringing and spazzing out, and yes a couple people got caught in the gears of change, but they either will suck it up, close early, or sue. Either way, I bet it’s only a few lawsuits.

It’s dead calm in the news and things are back to normal. I’m seeing a ton of over asking and sold signs everywhere still. I bet August will be a record breaking one for many reasons, one being that “it’s time to hurry it up” and get into the market if you are not from here. This will push up a lot of on the fence buyers from out of country.

Even if we jumped to inventory of 2012 by end of year, prices would just stay put. And with inventory dropping even more this month then expected, you better get in before you get priced out.

There hasn’t been a large bump in prices in Victoria in almost a decade, sure a 9-12% in that time period, but that certainly doesn’t look like a bubble to me.

I’m sceptical at the assertion that the Vic market is anywhere near approaching bearish or an easier time for buyers.

But housing markets generally look strong until they slump, so there’s nothing in the charts to mark a top. For example:

https://www.google.ca/search?q=real+estate+prices+toronto+historical+chart&rlz=1C1PRFC_enCA588CA588&espv=2&biw=1440&bih=775&source=lnms&tbm=isch&sa=X&ved=0ahUKEwjSo8iJ-6rOAhVL3mMKHc4OAs4Q_AUIBygC#tbm=isch&q=Canada+house+price+historical+chart&imgrc=ETI2sQNmV7hyXM%3A

So on what basis can one be skeptical or otherwise concerning the future of house prices in Victoria?

Strong interprovincial and international numbers for BC this year: http://vancouversun.com/news/local-news/canadians-flock-to-b-c-in-search-of-jobs

Agreed on “stupidly bullish” out there. No one wants to see prices drop more than me since I’ve been waiting on the sidelines for ages, but it’s not happening. The housing stock in the core is bad right now and anything decent is going for big money.

Yeah I don’t get it either. Sales don’t matter. Months of inventory matters. Sales/new listings matters. DOM matters although I’m not sure it gives us any new info. And those are all still stupidly bullish.

I’m sceptical at the assertion that the Vic market is anywhere near approaching bearish or an easier time for buyers. Of course the sales figures are less and less impressive – core sfh inventory is almost non existent and what’s out there is largely unattractive.

Now BC & Quebec are finally getting serious about Quebec’s Immigrant Investor Program:

http://www.scmp.com/news/world/united-states-canada/article/1998883/vancouver-quebec-millionaire-migration-has-gone-real

“Should new millionaire migrants forfeit their C$800,000 ‘investment’ if they do not submit Canadian tax returns, and show they live in Quebec?”

“When people come into Quebec, as investor immigrants, they [Quebec’s government] want them to spend the money there, and they want them to stay there,” said Clark on Thursday … So, we’re going to work together on it, and we’re going to try and support him [Couillard] and find ways to make sure their program, their investor program, is for Quebec, and for Quebec alone, and when people come into Quebec, that’s where they stay.”

What defines an “unconditional contract” exactly? The fact is we tax the transfer of properties and not the “contracts”. So not sure how some kind of grandfather clause could even work.

What exactly did the government gain by imposing the tax on unconditional contacts? The revenue from these deals will be nominal especially after half of the deals fail to complete and end up in dispute. Sends a horrible message to the international business community (expect the unexpected when entering into a contract in B.C.).

They should have made the announcement late in the day and made the cut-off midnight for unconditional contacts. The following day anyone with a conditional contract would have a chance to collapse the deal on conditions. There would have been zero last minute buying frenzy with this approach, if they were concerned about that?

Absolutely not. It is a good idea implemented with some negative effects. However the negative effects are temporary and limited, while the positive effects are enduring and unlimited. So overall still a good move

Inevitably, as a city grows and land prices increase, the proportion of the population living in apartments, townhouses and duplexes will increase relative to the proportion occupying single family homes. That being the case, while single family home prices rise, the average or median price of a home of any type may not.

Further, as single family home prices increase, the proportion of single family homes in which the owner rents rooms or a suite increases also.

To determine trends in what families pay for accommodation, it seems necessary, therefore, to look the trend for all types of home, i.e., all types considered together, with single family home prices adjusted according to the value of space within those homes that is rented.

But such data are probably unavailable!

How would a so called “grandfather” clause work exactly? There’s not exactly some kind of standard real estate contract out there. So how would you even define the terms of a grandfather clause? The can of worms that would entail is the exact reason why there wasn’t one put in place. I’m 100% against this tax and all those cheering it are just now waking up and realizing that this was a stupid idea but just can’t quite bring themselves to admit it just yet. “I’m in favour of this tax but…”. Yeah sure.

Leo S, Maybe that is the case, but I think it could be argued (I’m not a lawyer obviously) that had the buyer known about the imposed tax, they would not have made the offer they did, so in that sense, the government is changing a material aspect of the agreement.

“An offer is an expression by one person or group of persons, or by agents on his behalf, made to another, of his willingness to be bound to a contract with that other on terms certain or capable of being rendered certain.” (Halisbury’s laws of England)

In the case of these uncompleted sales, the terms were certain and all parties were in consensus. Then along comes a third party who interferes with the completion of the contract. Again, not a lawyer, but if I recall from my two dismal years in law school, this is tortious interference. Any lawyers want to weight in?

But they aren’t changing the terms of the contract. Nowhere in the contract does it say anything about a foreign buyer tax not applying.

This will all play out in the courts. Offer + acceptance + consideration = contract. will the courts decide that the contract was completed prior to the transfer of property? All parties to the contracts were in agreement. A third party changing the terms of a contract, I think, will be looked on very dimly by the courts and the court will send this back to the government to sort out and the government will or risk being sued themselves. The Liberals have flouted centuries of case law. these are the kinds of things that happen in dictatorships not democracies, so I’ll sit back and watch the courtroom dramas unfold. I agree that the tax was needed but I agree that existing contracts needed to be grandfathered in. The government will need to advise that they are working out the kinks and for the ime being existing contracts without transfer will need to be registered by the tax not enforced. That way, once the courts have made a determination, the liberals can go after people for the tax or not as the case may be.

This might also play out on an international scale because of NAFTA?

Anyway, just some crystal balling without my glasses on so I can’t check for speeling, sorry.

Sure, Van market needed to be reigned in. But this is an issue that is years if not decades in the making. Trying to avoid a couple extra days of sales while screwing with existing purchases made in good faith was a really stupid move.

Totoro has it right, it just shows how asleep at the wheel they are and when they finally wake up they can’t apply even the most basic of reasoned governance.

And never mind the sad Iranian and the poor American just trying to escape trump. What about all the Chinese buyers that are being equally screwed? It’s just not a way for a supposedly stable democracy to behave.

There is no arguing that the collateral damage sucks and it was knee jerk but I still think the market it Van was/is out of control and we will see how big the foreign buyer issue truly is now. A few months ago it was nothing and only a tiny fraction of the market. Now maybe not…. Their mistake was definitely the inaction that lead to this hasty move.

Not only nothing wrong with it – this unfair result was completely foreseeable. More than any other issue to date this one inspires a loss of confidence in government for me. Ignore the issue and fail to collect readily available data for years and then implement this measure hastily and with retroactive effect when short-term data is finally collected. All with legal advice probably pointing out the risks and unfairness of the retroactive tax and potential for government liability. Knee jerk reaction to thinking in stereotypes imo. Like somehow no hard working folks with limited means who were following laws would be impacted – only greedy corrupt foreigners. This is how things get decided? Ridiculous!

@Leo S – I heard a radio interview with the young Iranian engineer discussed in your link below. It is a sad story. He pointed out that his sale was made in May; just his closing date was August 5th (because the seller had a tenant). He did everything legally correctly at the time of purchase, and he is still going to be sued because he can’t come up with the extra 15%. The seller is Canadian, and so is the seller of the seller’s newly-purchased property. So, the tax is setting up a roadblock for for three parties.

I was all for government intervention to cool the market, but purchasers shouldn’t have been blindsided after they had made accepted offers. Sales that were pending with conditions removed should have been allowed to close at the original specified closing date without the tax. What would have been wrong with that?

Just another reason to grandfather the law. http://www.cbc.ca/beta/news/canada/british-columbia/foreign-real-estate-tax-bc-1.3706527

http://www.cbc.ca/beta/news/canada/british-columbia/foreign-buyer-real-estate-tax-collapse-1.3705368

Rook said,

“Just Jack, thank you for providing information on the market as always. Your efforts to keep an unbiased approach to the housing market is appreciated.”

Seconded…

Just Jack, thank you for providing information on the market as always. Your efforts to keep an unbiased approach to the housing market is appreciated.

@Leo, sounds like you are leaning to Halibearish too….

Thanks Roger. Nice to see you are still around. Will be interesting for sure.

My point is there is likely no need to explain it and it is just due to the natural variability in the prices. Just like there is no need to explain why I rolled three sixes in a row. Just chance

I would think that a significant number of those job losses were itinerant. And that may have been a reason for a jump in sales and house prices in the first quarter of this year as the itinerant Alberta workers returned back to Victoria and bought property.

That wave of buyers seems to be over and sale volumes are dropping back to historical norms for this time of year.

But will prices decline now that the volume of sales has dropped?

Victoria house prices are they driven by jobs that itinerant or internet based?

Is Vancouver effecting us?

It might be.

As the number of properties coming back onto the market has increased in the last few days. But the number is very very small. 7 in the last 24 hours and a total of 10 in the last 7 days. And they seem to be all types, all prices and all areas.

July was a very interesting month.

@Hawk

Bang on about Calgary.

The so-called numbers are not depicting the reality. The best guess is that 43,000 Albertans lost their jobs in oil and gas since the downturn began in late 2014 to May 2016 (Labour Force Survey).

This does not include indirect job losses, which could easily double+ the number.

And remember, there are a whole pile of severance packages now coming to an abrupt end.

If you are like the majority of prospective buyers on this blog you are looking for a detached house in the core. So let’s just look at that sub market. July turned out to be a reverse of some trends. The months of inventory of houses in the core improved for the second month in a row!

Month Months of Inventory

Jan 2.84

Feb 1.66

Mar 1.31

Apr 1.06

May 1.09

Jun 1.26

Jul 1.86

1.86 is still low and well within what would be called a bull or sellers market that heavily favors sellers. Will this trend continue? Historically the answer is yes. The months of inventory has increased in most August months.

How about sales of houses in the core. Big drop from June to July of almost 30% in house sales in the core last month. That’s the biggest one month decline in a decade. The same with the dollar volume of house sales in the core of around 30%.

Month Sales, Number of

Jan 122

Feb 228

Mar 318

Apr 376

May 338

Jun 291

Jul 206

Month Sales, $ Volume

Jan $89,881,193

Feb $177,112,657

Mar $272,816,923

Apr $332,368,217

May $301,601,912

Jun $245,327,602

Jul $169,672,300

This is in the core housing market. This is suppose to be our strongest market.

And how about the Days-On-Market?

Month Days to Sell, Median

Jan 17

Feb 10

Mar 9

Apr 10

May 9

Jun 9

Jul 11

The DOM seems to be trending higher. That’s good news because if it gets high enough a lot of those delayed offers / blind auctions will fizzle and agents will elect to market the stock of housing in the core in the traditional manner by setting a reasonable asking price and presenting offers to their clients as they occur.

@Leap

I get it, you’re jacked about your windfall and hoping for more.

Here’s your answer: no one knows what happens next.

But if you’re trusting a blog to validate a gamble, you’re in trouble.

With unprecedented runs come unprecedented falls.

“But how reliable is the DOM when the exposure time has imposed restrictions of 4 days, the properties are under listed and marketed using delayed offers or blind auctions to entice multiple bids? The gauge you are using to determine “hot” is being muddled with.”

Great points and stats Jack. If I hear the local media say “red-hot real estate market” once more I may puke….. but advertisers pays big money to have those words rammed down our throats on a daily basis. Too bad they don’t have an investigative reporter worth a shit in this town who will go rogue.

LeoS – Nice graphs and your commentary is right on the mark. The next few months should prove very interesting. With a provincial election on the horizon I suspect the Liberals will be watching the Victoria market for signs of increased activity by foreign buyers. They could pull the trigger on a 15% tax surcharge in the CRD if it looks politically advantageous.

Holy shit eh … . and they said there’s nothing to see here folks, just move along.

15,000 foreign property transfer applications were filed before foreign buyers tax kicked in

http://vancouversun.com/news/local-news/foreign-buyers-tax-realtors-begin-to-report-sales-deals-collapse

Sometimes an analogy helps to illustrate what is happening in our market than just looking at numbers.

Consider Victoria and other cities as being clothing stores. You’re looking to buy a pair of jeans. You go from store to store looking at the selection and the price.

In the Victoria store the shelves are only one-third full making the selection poor and the prices high.

What do you do? You go and look at other stores.

And the Victoria store does have to compete with other stores that are within the same travelling times such as Surrey, Langley, Maple Ridge, Abbotsford, Kelowna, Nanaimo, Kamloops, Vernon, Sechelt, etc. These cities are all competing for the Vancouver purchaser.

For most of the last two decades we have had people pouring into Vancouver for jobs from rural BC. Now that may be starting to reverse itself as people leave Vancouver and move to smaller cities and towns.

Maybe it is your interpretation of what is meant by a “hot” market. If you’re basing what a hot market is simply on how quickly properties are selling, multiple offers and over asking price then you might be missing some important details to explain why median prices have stayed flat and average prices are declining.

May, June and July had the steepest decline in both dollar volumes and the number of sales in the last decade.

Month Sales, $ Volume

Jan $239,437,554

Feb $388,776,966

Mar $584,374,090

Apr $691,074,266

May $697,704,989

Jun $610,079,409

Jul $488,912,179

Month Sales, Number of

Jan 466

Feb 702

Mar 1000

Apr 1131

May 1174

Jun 1032

Jul 834

Yet the days-on-market remained very low or “hot”

Month Days to Sell, Median

Jan 35

Feb 19

Mar 16

Apr 16

May 15

Jun 15

Jul 16

But how reliable is the DOM when the exposure time has imposed restrictions of 4 days, the properties are under listed and marketed using delayed offers or blind auctions to entice multiple bids? The gauge you are using to determine “hot” is being muddled with.

So is it the market or the marketing of the properties that makes things hot? The steak or the sizzle?

“It feels a bit quieter but we still had a record breaking July.”

It feels quiet because Victoria just woke up to the crash potential in Vancouver from heaving buying to nothing. July is history, this is a brand new story.

Sales are still down 20% range in a month in the hottest market of all time. Seasonal swings should not deter a true bull market, summer or not, if Victoria is supposed to be immune from Vancouver as the perma-bulls have been preaching for months now.

Prices will be sticky at first then the foreigners with dirty cash invested may well decide to dump and get out before CRA and Gregor come knocking to see whose home with the grass 3 feet high and papers stacking up.

Here are a few numbers/examples to show the potential impact of the new tax on Vancouver’s downtown condo market.

One billion dollars of foreign investment in Vancouver in 5 weeks prior to the new tax.

New condo towers in downtown Vancouver average about 300 units at an average value of less than one million per unit.

Foreigners were buying the equivalent of one of these towers every ten days before the new tax; three towers per month bought by foreigners!!!

That’s the thing. Vancouver is hyper dangerous. Propped up by foreign money and local mania. Victoria is not like that. I would say best case for this tax is a sharp moderation in market conditions back to balanced. I don’t see any significant price declines in the near future.

@Leap

Oct is usually just a mild sales bump, not prices. As for the 30% jump, nothing is guaranteed. Thing is, unless you are leaving Victoria for a lower priced market, selling doesn’t really get you anything. Renting sucks right now, and everything else has appreciation just as much as your place so the gains are entirely on paper.

“Sales in Calgary are down for 20 months in a row, oil is howevering around $40 a barrel, and prices have dropped a huge 4%”

Ross Kay disputes those numbers. 25000 jobs left Calgary, much more damage to come. This is just beginning.

“Ross Kay @rosskay 21h21 hours ago

I remain amazed not a single story on how real price declines on homes in Calgary has not made headlines.”

Extensive story in Bloomberg about Vancouver’s “wild ride” with real estate:

http://www.bloomberg.com/features/2016-vancouver-real-estate-market/

“The Canadian Housing Boom Fueled by China’s Billionaires

Five scenes from Vancouver as it transforms into a playground for the rich.”

“Vancouver is now outpacing price gains in New York, San Francisco and London over the past decade”

Interesting quote from one of the sellers who moved to Qualicum Beach: “one factor driving her to sell quickly was the risk of the market cooling. ‘It’s not going to get more silly,’ she said.”

@LeoM did they really stop buying, or are they just being cautious and seeing where things settle? If you were making 30% returns and now that’s cut in half, that’s still a hell of a return!

@totoro thanks, that makes sense. You’re right I could just test the waters and see… I really don’t have any plans for the equity, no idea what I’d do with it! Keeping it in just keeps it safe from me using it to buy a sport car and boat.

@MarkoJuras So it’s likely a sellers market for the next year with the potential for another increase? Would Oct or April be a good time to list? Also, if Victoria implements the same foreigner tax, would we really see any impact from that since we probably don’t have many foreign buyers here? Tnx

I’d say a lot of people are sitting back at the moment and waiting to see how the tax plays out in the Victoria market so the multiple bids and prices might be impacted. Not sure if you are seeing this Marko?

It feels a bit quieter but we still had a record breaking July.

Sales in Calgary are down for 20 months in a row, oil is howevering around $40 a barrel, and prices have dropped a huge 4%.

People forget that only a few years ago in Victoria we had over 5000 active listings, half the sales, and prices weren’t budging and the rental market wasn’t what it is now.

It would take well into next year for inventory to recovery even with a flood of listings and a drop in sales.

If you are truly indifferent as to when you sell and you are ready to list you could try the market now. It is usually a lot of work to get a place ready for listing so factor this in.

It is not as good to sell now as it was two weeks, but maybe it will go well. I’d say a lot of people are sitting back at the moment and waiting to see how the tax plays out in the Victoria market so the multiple bids and prices might be impacted. Not sure if you are seeing this Marko?

Will prices be higher in the future? Yes, some day. Not sure how long so either you test the waters now with a view to accepting a good offer or stepping back if you don’t get the price you would like, or wait until the market is higher than now. Last time this took seven years.

If you don’t have to sell and you have seven years to wait if need be you are in the driver’s seat. It really depends on your age/stage and what your plans for the equity are I guess.

@leap – Sell…

“Know when to hold ’em, know when to fold ’em”. If you’re playing RE like a Crap(s) Table, it’s time to cash out..

With this new tax, and considering the sales numbers Hawk posted for metro Vancouver; if I had investment properties I’d be dumping them starting tomorrow because a flood of listing might hit the market soon and drive down prices. The evidence is not all in yet, but it is starting to look like Hawk was right when he predicted the investors would suddenly stop buying at some point, and that point seems to have occurred after the new tax on foreigners was announced. No one believed it when Hawk said the foreigners were spending hundreds of millions of dollars on Vancouver real estate, but he was right – it wasn’t just hundreds of millions, it was over one thousand millions in five weeks!!!!

So… if I’m thinking of selling one of my SFH’s… should I wait for both the Oct bump and the next 30% jump?! Getting the same rush here as playing roulette at the casino… watching it all spin hoping I increase returns and don’t go bust! Odds seem about the same? I’ve viewed teardowns in Van, and I would have never imagined they would be worth so much… just like now I can’t imagine houses in Victoria doing this… but it actually happened! It’s so temping to just ride it out and see how high it’ll go… high risk = high reward? Or is a bird in the hand worth two in the bush? Plus what’s the worst that can happen, they drop in price and I’ll just wait it out as they’ll recover after 5-10 years?

First!