Foreign Buyers and a Market Update

So the province is running scared these days. After trying in vain to pretend there is no problem, they are now desperate to fix it or at least act as if they are fixing it before the election. This time they have hit with a meaty sounding tax of 15% on home purchases by foreign buyers in the greater Vancouver area.

It’s funny though. At that thesis defense I went to they specifically said you have to apply any additional property transfer tax equally across jurisdictions or it will just push people to other areas and shift the problem elsewhere. A week later they implement a region specific tax and do exactly what was not recommended.

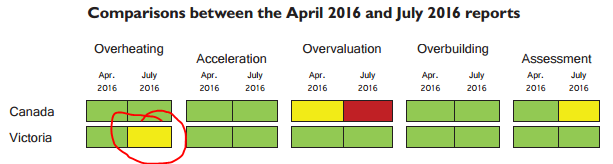

Look, either there’s a problem with foreign buyers or there isn’t. Just because the rest of the country hasn’t reached the insanity of Vancouver doesn’t make it any less of an issue. How about we try to fix the problem province-wide before it goes off the rails rather than after? Instead they are going to remain reactionary by shifting demand outside of Vancouver, then moving the tax around, or reducing it to try to bring some balance back. I can’t see how we won’t end up with more buyers in Victoria from this move unless it swiftly gets adopted here as well.

Also a weekly stats update courtesy of the VREB via Marko Juras.

| July 2016 |

July

2015

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 265 | 512 | 744 |

796

|

|

| New Listings | 354 | 630 | 930 |

1235

|

|

| Active Listings | 2240 | 2214 | 2219 |

3942

|

|

| Sales to New Listings | 75% | 81% | 80% |

64%

|

|

| Sales Projection | — | 1002 | 1002 | ||

| Months of Inventory |

4.95 |

||||

Oh look we gained 5 listings last week!

I’m sure the white guy in the flyer has binders full of overseas buyers…

Anyway! New post: https://househuntvictoria.ca/2016/08/02/uncharted-territory/

This is going to get interesting.

“I’ve been getting that flyer at my house for a long time.”

Same here. Funny how it says “Vancouver, China … AND Abroad”

Also Global did a piece on Vancouver’s home sales today as well …

http://globalnews.ca/news/2861138/metro-vancouver-home-sales-dropped-by-75-after-foreign-buyer-tax-announcement-realtor/

Oh man, this is getting very telling what’s coming down the pipe. Scotia CEO banker sells mansion only 6 months after buying it, then sells mass amount of insider stock.

The REALLY Big Short: The $13.7 Billion Dollar Bet Against Canadian Banks Over Housing And Insider Sales

“BMO led the pack of five, with their executives selling $27,877,194 more shares than they purchased – this includes $500k worth of shares being sold by their CEO, and a whopping $9,242,320 being sold by their CFO Thomas Flynn in just the past year.

Scotiabank is by far the most interesting however, since the bank’s CEO Brian Porter has been the most vocal about housing prices. In addition to the bank making aggressive moves to reduce housing related risk, bank executives have sold $14 million more shares than they have purchased in the past year. Porter, who has said he’s “a little concerned about housing prices in the Greater Vancouver area and Toronto”, seems to be putting his money where his mouth is. He put up his mansion for sale just six months after purchasing it, and has let go of $11.9 million worth of shares. Making CFO Sean McGunckin’s $500k worth of sales seem tame in contrast.”

https://betterdwelling.com/the-really-big-short-the-13-7-billion-dollar-bet-against-canadian-banks-over-housing-and-insider-sales/

“Active listings in Victoria at the lowest ever (for time of year) since data collection began in 1996.”

With prices at extreme highs and rapid appreciation. Doesn’t sound like a healthy combo. I’m getting HaliBearish from this point…. It’s a weird market. Flat for years with good buying opportunities. Nothing changes and pow we start getting huge sales numbers and 30% appreciation and ridiculously low rental vacancies and extreme low inventories. Combine this with rates being very low for a long long time and a regulatory environment that is talking crisis and implementing extreme measures like this tax? Rates will probably go down a bit but that’s because our economy is sucking. The Dollar will go down increasing the cost of goods. No wage inflation just more debt and higher housing and living costs. Looking forward do y’all see rates dropping in half and amortizations increasing and lending regulations loosening and wages increasing? I don’t…. I see rates staying about the same, regulations tightening and wages flat lining….How can anyone expect another 30% next year? Sure we are not as crazy as Van but it’s what happens there that will affect all other markets…

Active listings in Victoria at the lowest ever (for time of year) since data collection began in 1996.

Good link Local Fool. Talk about a walk off a cliff. So much for those fancy green arrows. Let’s do the time warp again… 1981 style. 😉

Sales of Detached Single Family Homes for the Week of July 25-31, 2016

Richmond: 3 sales

Burnaby: 3 sales

Vancouver West: 1 sales

Vancouver East: 5 sales

Saw this on Twitter today:

https://twitter.com/mtthwbyd/status/760589837044813824

I’ve been getting that flyer at my house for a long time. I can’t believe people fall for that crap, but the majority do.

A buyer from out of town is not going to fly into town to ONLY take a look at a handful of listings realtor “Bob,” has listed. The out of town buyer will take a look at all that is available.

Building on Hawk’s post, there are some pretty disturbing (or encouraging, depending on your POV) numbers coming out of VANRE.

http://www.vancitycondoguide.com/impact-of-foreign-buyer-tax/

This is almost certainly in part due to a market shock from the new tax; I’ll be curious to see if this proves to be the pin, or it somehow readjusts and keeps on going.

Saw this on Twitter today:

https://twitter.com/mtthwbyd/status/760589837044813824

Looks like it’s working so far. Previous weeks 14 and 27.

Steve Saretsky @SteveSaretsky 1h 1 hour ago

Since foreign buyer tax introduced July 24 there have been 3 SFH sales in Richmond. #VanRE

For lower New Listings have to go back to 2010 and 2005.

Victoria Real Estate Board

Tue Aug 2, 2016:

Jul Jul

2016 2015

Net Unconditional Sales: 972 796

New Listings: 1,127 1,235

Active Listings: 2,161 3,942

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

Big difference for sure. A big part of the last run up was due to more easily available credit. CMHC used to have regional limits…

Add another aspect to the differences between the last run up and this one. Regulations were loosening and there was zero talk of a crises let alone implementing new taxes.

Interesting anecdotes from the Vancouver jungle on how speculation can cause professionals with families as far out as the Fraser Valley to consider moving – which maybe BC gov’t is finally recognizing as a threat to the economy …

http://www.bnn.ca/a-chance-to-compete-how-vancouver-s-new-property-tax-will-affect-homebuyers-1.535122

Darren Joneson, doctor in residence:

“There has been a big shift in people buying up homes here, throughout the Fraser Valley, and that’s driven up the number of tenants and created a rental crisis here. A lot of homeowners are taking advantage by jacking up rents … When I start practicing medicine, I’m absolutely considering moving … We need to have a fundamental change in how we view housing. It’s viewed as an investment and almost played as a stock exchange right now. ”

Justin Fong, software developer:

“we have looked at living in Seattle … At least now, there’s an opportunity for us not to have to take on a crippling amount of debt … having that opportunity is very crucial if we want to keep young families in the city.”

Thanks for input. Guess then more people who are buying a rental property are banking on prices going up then or don’t really know what they are doing. Crazy….

Exactly. The titles at the Falls (downtown condo) are what happens when amateurs plow into the market. The Falls was being pre-sold 2006-2009 during the boom. I often look at titles and this is what they would look like….

For example, 3 original owners

Bob Smith, Teacher, Edmonton

Joe Todd, Teacher, Edmonton

Suzy James, Teacher, Edmonton

1 bedroom – purchase price $505,000.

At one point there were 500k units selling for 350-380ish. Now they are back up to mid 400s.

People were buying on pure speculation. That $505,000 unit on completion in 2009 was rentable for maybe $1,500 at most.

The unit I bought at the Promontory was around $195ish. From day one I was renting it for $1,150 so it was cash flow positive (25% down just because my credit union didn’t do 20%).

The rent is now $1,300 (maybe I could squeeze out closer to $1,400) and my book cash flow is very high; however, given I could ditch it for $300,000 the return isn’t the great on the rent anymore.

I would ditch it if it wasn’t for capital gains. By the time I pay transaction costs and tax I am maybe pocketing $260-265ish. So really I look at it $1,300 on $265,000 (what I would have to re-invest in something else).

Thanks for input. Guess then more people who are buying a rental property are banking on prices going up then or don’t really know what they are doing. Crazy….

When you have a growing family and live and work here a rental suite is almost needed to be a mortgage helper.

No. The larger your down payment the lower your ROI as with rental RE in a low interest HCOL market it is leverage that gives you the best returns for a number of reasons including low rent to value ratios, taxation and the impact of appreciation. Basically, do the math and you’ll see – there are calculators out there online.

If you have to put half down to make a rental property cash flow you are losing the truly passive returns you could get on that down payment elsewhere. Ie. 400k down on an 800k means you are losing $28,000 in returns on the down payment if invested elsewhere, particularly TFSA and tax preferenced investments .

My advice would be to invest in a market where you can put 20% down and make it carry itself if you are dead set on owning a rental, and that is not Victoria as far as I can tell. Your very best returns will be in a primary residence with a suite imo and that still works here if you want to take on the landlord role.

If you are buying a house to live in this is where you should go to the upper end of what you can afford if you are planning to sell later as the capital gains tax exemption is a huge benefit.

Looking back, if you were super wealthy you would have generally been better off to buy expensive waterfront to live in and wait for appreciation than buy a cheaper primary residence and a rental house because of the capital gains exemption primarily. Totally different in some markets in the US where prices are cheap and rents are high and places really do cash flow.

Just my two cents based on experience and a lot of spreadsheets – others may have a different view.

“I noticed the same thing when I went to Coombs this weekend. You’re forgetting that’s it’s summer and there’s more tourists. All those bus loads of Chinese you see right now are not here to snap up houses left right and center.”

Agreed Bizznitch, I saw large groups in Sidney and they weren’t buying up the town, they’re tourists like every other summer. Perma-bulls are grasping at the “foreigners will save Victoria from the inevitable downturn” mantra. Ain’t gonna happen.

Even Tony Joe said it on TV the other night that they won’t suddenly come pouring in here and that’s his new market. We’re a completely different dynamic than Vancouver.

I’m sure many of them coming the past few days getting stuck in 3 hour ferry waits in both directions will pass that on to their friends back home.

I’m not going to argue the numbers regarding foreign ownership in Vancouver because it is irrelevent to the stupidity that Canadians have indulged in over the last 7 -10 years.

I was born in Vancouver and have lived in B.C. for close to 60 years. It is one thing for our youth to be suckered into this mother of all gasbags, it is quite another to see my contempories dipping into unrealized equity to purchase investment homes here and more astoundingly the U.S.A., regardless of Garth’s recommendations to those who were financially capable, I presume.

I understand greed but every one of these boomers lived through previous crashes. I personally listed my home in 2002 and watched my equity disappear as I futilely followed the market down to try and save some shred of equity.

If this is indeed the turning point, we will be realizing the biggest recession this country has ever encountered. We may all be to blame for this bubble but the media, realtors and boomers collectively pushed our kids over that cliff…..and yes I do realize a minority of people have been responsible….just not enough.

These are headlines over the last several years. Wow.

Canadians, which had led international purchases since 2008, ranked second with US$11.2 billion in spending and a 14 per cent share of sales.

http://business.financialpost.com/personal-finance/mortgages-real-estate/move-over-canadians-chinese-buyers-now-leading-foreign-purchases-of-u-s-homes-for-first-time

Cash is king

Some of those multiple bids are actually coming from other Canadians. It’s still extremely difficult for all but the most credit-worthy Americans to get financing, so Canadians who can make all-cash offers – as most Canadian buyers do – still have a big advantage.

Since Canadian real estate prices have not collapsed the way they did in the U.S., home equity lines of credit are frequent sources of that cash.

http://www.cbc.ca/news/canada/canadian-buyers-face-more-competition-as-u-s-housing-recovers-1.1143312

Jerry Jarson, a 74-year-old retiree from Shanty Bay, Ont. said he was able to use the equity in his Canadian home to buy his condo. ‘‘We never had any money but the bank has lots,’’ he said about the line of credit on his Canadian home he was able to use to finance the purchase.

There’s no country that even comes close to Canada when it comes to buying, with No. 2 United Kingdom accounting for 7% of all international purchases.

Canada has been number one for seven straight years, cooling on Florida real estate after a 2011 peak but rebounding since.

http://business.financialpost.com/personal-finance/mortgages-real-estate/foreign-buyers-taking-over-this-time-its-canadians-in-florida

A few people I have spoke to who had investment condos/houses and sold them currently said they have made more on the sale then the told amount of rent collected over the years.

It’s a small rental return especially when buying high I agree but guess when have a large downpayment it must still be lucrative for a investor?

Anyone how much the 184/186 st Charles st place went for?

@nan

This isn’t true. Marko has made a good case for his small condos he bought. And cheaper houses have also worked out as rentals. Yes returns are lower here than in many other cities, but the blanket statement is certainly not correct.

Triple A rated: ” If you’ve taken a ferry in the last 2 weeks, the increase in Mandarin is unmistakable.”

I noticed the same thing when I went to Coombs this weekend. You’re forgetting that’s it’s summer and there’s more tourists. All those bus loads of Chinese you see right now are not here to snap up houses left right and center.

From the original post:

Look, either there’s a problem with foreign buyers or there isn’t.

From this weekend Globe and Mail:

“The tax could also produce a host of unintended and unwanted consequences. Top among them is that Vancouver’s problem could simply shift elsewhere as foreign buyers seek to avoid the tax. Cities such as Toronto and Victoria are already bracing for knock-on effects.”

As the tax taxes effect starting Tuesday, It will be interesting to hear this week if there in fact is a spillover effect, particularly during open houses. If you’ve taken a ferry in the last 2 weeks, the increase in Mandarin is unmistakable.

“investors don’t reduce supply. They just shift supply from the ownership pool to the rental pool. ”

“Shift supply” is another way of saying “subtracting from ownership pool and adding to rental pool.” It’s a feedback loop: more competitors for SFHs for sale > investors win with bigger offers > families rent for longer than desired > more investors pile into market with cash > more families need rentals > etc.

Families want homes to buy, not only to rent – it’s not just prices, it’s inventory that’s decreasing because of investors. Investors are buying a higher % of properties now that would normally have been purchased buy owner-occupiers in the past (see WSJ article), which then forces families to stay renting longer.

Besides the Guardian article, here’s the WSJ article that says that exact thing:

http://www.wsj.com/articles/investors-with-cash-edging-out-first-time-home-buyers-1455656617

“investors have moved up from bank-owned properties and now are competing for traditional, low-price homes that normally would be fodder for first-time buyers.”

“cash and investor buying in some cities remains far above historical levels. That creates difficulty for buyers of low-price homes because more buyers are competing for fewer properties.”

“investors are still swarming over local housing markets, offering all-cash deals and creating headaches for the first-time home buyers who compete with them.”

“Investor Ken Weiner, a former financial-services executive … has closed with an investment partner on six homes and on another three on his own … he said he plans to close on at least another seven properties by mid-year.”

No one has bought an investment property in Victoria in 10 years who can say they had a reasonable expectation of return on investment through cash flow after factoring in the interest rate risk, opportunity cost of down payment, transactions costs and all the other costs. If they think they did they’re just bad at math. Prices can’t be too high when 100% of the returns are expected to come from prices going higher.

Buying and renting are only substitutes for a short period of time, when you’re young. Once you have a family, they are no longer substitutes. With investors buying everything they can get their hands on and not investing in other assets, first time buyers are forced into a less preferable housing consumption arrangement.

Portfolio investment in residential real estate shifts the ownership benefits of housing stock to work for the already rich ( investors) instead of those who aren’t (workers). The already rich investor class is much better positioned as a rule to take advantage of low interest rates / govt regulation changes etc when things change and always have a leg up on those who are less wealthy or less connected. Prices go up, workers hesitate hoping things will normalize because they can’t afford the risk of being wrong and investors keep buying only widening the gap further.

And the investment returns less. Which means the scenario of investors owning everything will never happen. Investors are in it for the returns. When prices are too high relative to rents they stop buying (minus the offshore investors just trying to get money out of their countries).

Those two things are not related.

What is this, logic by assertion?

House hoarders and investors compete with first time buyers (renters) for properties. When the investor class wins the bidding war they prevent renters (potential first time buyers) from purchasing and they drive-up prices. Renters’ attempts to become homeowners are thwarted by investors and house hoarders.

When renters are prevented from purchasing a home, that decreases rental vacancy rates because thousands of ‘units’ are removed from the rental pool and converted to vacation rentals. If the investor leases the unit as a yearly rental, that action does not decrease rental vacancy rates but it still drives up house prices and thereby prevents renters from buying.

Is that simple enough for you Totoro and LeoS? You both are trying to alter my point to suit your argument, but my point is crystal clear, logical, and simple.

If you still don’t understand my simple point, then I suggest you google the news from New Zealand, Australia, UK, San Francisco, Shanghai, or a hundred other places where the governments have identified hoarders and investors as the root cause of the current global commoditization of real estate that they are targeting with new rules and new taxes.

The market doesn’t work like that so I don’t see the point of your scenario. I gave a real life situation of renters being thrown out in a dysfunctional market like we have. I have seen this happen.

First of all, the only sensible definition of a house hoarder is someone that buys houses and leaves them vacant. Someone who buys houses to rent them out is not a hoarder so let’s drop that term.

Secondly, I don’t know how clearer I can show you that investors don’t reduce supply. They just shift supply from the ownership pool to the rental pool. Given that we have an incredible shortage of rentals this is not a bad thing. I’ve said it three times already: Not being able to find a rental is way worse than not being able to find a house to purchase.

Now if you want to talk about AirBnB then I agree with you. The city needs to crack down hard on that immediately.

Good try Totoro, more spin to deflect the issue.

My main point is neither the quality of the investment or nor what the investors do with their property investment.

The simple point that you are trying to deflect is that investors and house hoarders are the root cause of our current housing shortages and supply and cost. This problem is directly due to investors and house hoarders.

“One of the reasons is that “investors” are not going to buy houses in Victoria to rent out imo – the numbers do not work. ”

Yes the numbers don’t work, but the problem doesn’t stem from people that understand that. The problem is with amateur investors that don’t add up the numbers – and there’s a lot out there being encouraged by banks & low interest rates. Class example was the couple in Vancouver that had $1.8M in mortgages & the numbers didn’t make sense.

For this very reason – excessive RE speculation – the UK recently imposed extra stamp duty on 2nd homes and buy-to-lets. Depending on the home’s value, the extra tax ranges from 3% to 15% if over 1.5M pounds.

San Francisco is also offering proposals for an anti-speculation tax (24%) that would apply to properties re-sold within a certain time period.

Good article here from The Guardian:

https://www.theguardian.com/business/2016/feb/03/introduce-annual-capital-gains-charge-property-housing-crisis-niesr-thinktank

“A growing number of economists have argued for an annual tax on land and property to end what many have called the UK’s addiction to property speculation. The boom in buy- to-let since the late 1990s, when banks relaxed their criteria for offering commercial mortgage loans, has also fuelled speculation by investors.”

“Booms and busts in the UK housing market are the worst in the developed world, according to the Organisation for Economic Co-operation and Development. The worst trends highlighted in the report were:

More houses being bought for investment purposes, raising the cost of housing

The older generation “underoccupying” and even “hoarding” property

The number of new homes being built being lower than the number of new families”

The fact that condo pre-sales could be “in chaos” shows the level of speculation:

http://www.theprovince.com/business/real-estate/condo+27presales+could+left+chaos+industry+warns/12084803/story.html

I was responding to the facts presented:

You know, the one where “landlords have access to unlimited funds”…

Not going to happen imo for the reasons I posted – and many others.

Now you are presenting a new theory. One where the houses are not bought foreigner and Canadian landlords and rented back to people long-term, but one where all the houses are being bought up for illegal Airbnb rentals.

Okay, here is what I’d say about the second. Every market has its limit and the laws can change or be enforced at any time as we’ve seen in places like Portland.

If a municipality or country wants to regulate vacation rentals it has the tools to do so and many do. Investing in a property at Victoria prices for this purpose knowing that the regulatory environment is a huge risk is pretty foolish imo.

I’d guess there are very few “investors” buying up houses specifically to do this, although maybe some of the people looking to buy are hoping to do this with a basement suite so they can afford their mortgage and improvements. Others on limited incomes are probably renting out rooms.

This also may be more common in strata buildings judging from the listings, but strata council can crack down on that pretty easily and impose daily fines. Not really a smart way to invest unless you can manage with long term rentals. With Victoria house prices I don’t think many can now so they have to be gambling on appreciation and have enough income to backstop negative cash flow – which is not the situation most people I know are in.

The investors and house hoarders are spinning the information to deflect criticism. But it won’t convince many thinking people.

Totoro said: “there is a shortage of rental housing in Victoria.”

Of course there is Totoro because the investors and hoarders are buying up a large percentage of rental units then illegally renting them on AirBnB, and other vacation rental sites. This is just one part of the problem Totoro, but don’t try to deflect and minimize the problem with a simplistic statement like “there is a shortage of rental housing in Victoria”.

The root cause of our current housing shortages and supply and cost, is directly due to investors and house hoarders.

I have to disagree with Kathy Hogan of the UDI, it’s the community that is taking the risk. Once the developer has sold the units, made their profits and is long gone, the communtiy is left with the effects of hasty decision making for the next 100 years. Especially when the developer has pushed hard for smaller and smaller units that no longer meets the needs of family life but those of an AirBnB. AirBnBs that drive up house prices and remove month to month rentals from the community. The City has to keep focused on the future and not on the needs of developers. Do you want to live in a planned community or do you want to live in someone’s business plan.

LeoM there is a shortage of rental housing in Victoria.

One of the reasons is that “investors” are not going to buy houses in Victoria to rent out imo – the numbers do not work. There will probably be less rental houses as landlords who bought a SFH rental when the numbers were better decide to sell and retire.

Even if you have a paid off house in Victoria and are renting it for $2500 a month you are only getting about 1700/month pre-tax on an asset that is probably worth $750,000. Sell and invest the after capital gains tax profits in an index fund and you’ll be able to withdraw more than this to live on indefinitely.

Those banking on appreciation and interest rates are taking a risk. Given the expense level/cash flow Victoria is just not where I’d put my money as a landlord.

We don’t have a huge rate of foreign investment in Victoria. I doubt it will suddenly increase, and if it does, the province will likely impose the PTT. If anything, I expect prices to stop escalating and “investors” to continue to look elsewhere and the rate of home ownership by Canadians to continue at 70% or so. Floor space might decrease but we have a very strong culture of owning and appreciation won’t continue like this forever.

I do agree we need more purpose built rentals. There are a lot of disincentives to building this type of project in Victoria though: http://www.vicnews.com/business/371802561.html

LeoS- I know you’re an intelligent guy based on what you contribute to this blog, but I can’t understand your position on renters vs ownership vs runaway home prices.

These days are radically different; never before has any living generation had access to nearly unlimited amounts of nearly interest-free money. Plus, never before has there been a tsunami of wealthy foreigners wanting to buy a BILLION dollars of real estate per month in Vancouver. And never before have our living accommodations been turned into a commodity for investors.

Times are different these days.

You need to look beyond today. You can’t contemplate long term consequences on society based on your short term vision of what has happened up to today. The long term consequences matter today when our housing-stock is rapidly becoming an investment commodity.

Here’s a hypothetical simple scenario to make my point: let’s say that Victoria has just 100 houses and 100 families; and each family owns one house. If person #1 buys person #100’s house then rents it back to person #100 we now have 99 owners, one renter and one landlord. Next year person #2 buys person #99’s house and person #1 buys another rental property from person #98. Now we have two landlords, two renters, and 98 home owners. Continue this pattern for 12 years by adding a new ‘investor’ each year, with each investor buying another place each year, then after 12 years 90% of the houses are owned by 12 landlord/owners and the other 88 people are renters. Continue this cycle for another few years and you have three landlords and everyone else is a renter. Now bring in a foreign investor with buckets of cash who out-bids on every place and before long we are all tenants to a foreign landlord.

In this scenario it’s not just first time buyers who are unable to buy, everyone becomes a lifelong renter in a short time when investors have access to unlimited funds. Sounds just the the game of Monopoly; in the end there is just one winner.

Of course it will never get that bad because the youth and renters would revolt and revolutions are nasty on landlords.

I have friends living in Germany. Had to pay a years rent in cash…. Cash…. Things aren’t always as they appear….

We also have to look at the reason why so many Germans rent – it’s because of proactive government policies dating back to WWII, which created high quality rental housing for families. There was more partnership between government and private entities than any other country, and their housing market is more stable because of stricter rental rules & home-owner deposit & lending rules – then people don’t have to worry about price volatility & having to move. Good article here: http://qz.com/167887/germany-has-one-of-the-worlds-lowest-homeownership-rates/

In any case, it seems that Canada’s housing market is riskier than places like Germany – for both renters & home owners – because of the greater market volatility & lower supply of family-friendly rentals. That’s why people (families in particular) like the security of home ownership – it protects them from having to move unexpectedly and out of their control.

Not saying home ownership is the best goal for everybody, but there are good reasons why it’s more popular. Many home owners rent out their basement suites on yearly leases that don’t have to be renewed (so they can increase the rent, or not have “too many” kids in the suite). Great for the owner, but stressful for the renters.

Buying wasn’t considered a “luxury” back when speculators weren’t playing the market as much. It’s unfortunate that because of the excess speculation it’s being considered a luxury to own. Our limited population growth doesn’t account for the increase in demand.

Decent article talking to long time and recent chinese immigrants in Vancouver

http://www.theglobeandmail.com/real-estate/vancouver/meet-the-wealthy-immigrants-at-the-centre-of-vancouvers-housingdebate/article31212036/

But it can’t be just objectively looking at it. Buying is a luxury. If you can’t buy you have to live somewhere, and that means renting.

Let’s take your semi-professional family. Either they

1. Can’t buy and are renting or

2. Are thrown out of their rental house due to renoviction or family pretending to move in and they can’t find any place else to live that will take their 3 kids and dog.

Which is worse?

The rental market is far more important to people being able to have security in their place to live than the ownership market. Yes there’s a culture of ownership here, but other places like Germany it’s perfectly fine to rent, and not such a fetish as here.

Renting only sucks if it’s not secure, which happens in a shitty market like we have. In a healthy market landlords don’t throw out good tenants.

I’ll do this one so Leo doesn’t get bothered….

1.86 million in debt.

primary residence with two suites and a rental property.

Mortgage=$7,241.48

property tax $460 (seems low)

insurance= $120 (also seems low)

Maintenance reserve 20%= $920

Vacancy allowance 5% = $230

Expenses total = $8971.48

net rental income for tax purposes is $24,156 so @40% that’s a tax bill of $9662.4. So their net after tax rental income is $45537.6 or $3794.8/month

Their monthly expenses are $3288 taking savings out.

Total after tax expenses = 12259.48

Their net after tax income is $7900/month + $3794.8/month = 11694.8

Negative $564.68 a month.

Or a cash flow of $566 a month with no maintenance reserve or vacancy allowance. (If their properties are in Van I’m pretty sure their property tax and insurance would be higher) The vacancy allowance is not very high on three rental suites…

Anyway, My point is the math is outright wrong in the article. They claim cash flow positive with a maintenance reserve and savings of over $700/month. Total BS…

124 St Charles sold for $790k (48×60 lot)

That just seems so high for the house on Granite – 191k over assessed for a house in tear down condition… catching up with the million dollar shacks in Vancouver.

The current housing situation has long been in the making. People need to remind themselves:

1/ the # of houses in the core has stayed flat for years

2/ their are more people living here

3/ people are living longer, seniors are staying in their homes much longer than previous generations for lifestyle reasons

4/ younger people want to live in the core and close to all amenities

5/ and yes demand from investors/foreigners/ with access to cheap and plentiful credit

This problem will not go away anytime soon; but the reality is that millenials/Gen Xers do have choices and there is affordable housing available for purchasing, but just not in the core.

I think everyone should be able or have the opportunity to own a home. Renting is fine but if want to own should be able to have option. Plus families have more control over owned home then renting.

Also is it worth renting in this market with renting bidding wars too? Not sure what’s better purchase bidding wars or renting bidding wars….

I believe that Grainte place sold for $716. Still some hyped up market out there. I wondered how much the 124 Charles st duplex conversion went for didn’t last too long…foreign investment/vrbo property or tear down build new?

Does anyone know what 1957 Granite sold for? Tx.

LeoS said: “I think the lack of vacancy in the rental market is a much bigger problem than house prices.”

I completely disagree with you LeoS; I think the lack of affordable housing, based on average wages of semi-PROFESSIONAL 30 year olds, is a much bigger problem than a lack of rentals.

Thirty year old people want to buy but they are forced to remain renters because investors, home hoarders, and foreigners are driving up the prices of starter homes.

Marko – you’re right that some 30-something people mismanage their finances with $50k SUVs and other toys, but those are not the one’s I’m talking about…they are deservedly lifer-renters.

Yes but that low vacancy rate is why it’s safer for a family or seniors to own their own place – they won’t have to face renovictions to make way for new condos, or be tossed out because their landlord doesn’t want to renew the lease for a higher rent. So we need both – investors to stop creating competition with SFHs, and more rental buildings. It would be great if those investors would pool their money into rental buildings instead.

I think the lack of vacancy in the rental market is a much bigger problem than house prices. No one needs to buy. If you can’t afford it, rent. But if you can’t rent you might be on the street and then everything else quickly goes downhill.

“Why is it preferable to keep those units in the hands of owner occupiers and not renters?”

Because buying a SFH (or TH) is preferable for most families – for stability (they don’t have to move their kids, schools, etc if their landlord wants them to move out), and long-term security (for helping to pay for old-age care, or to leave a relatively tax-free investment for the kids/grandkids).

If the prices go up exponentially, families can get stuck renting when they don’t want to.

Sure. But it increases supply in the rental market. Why is it preferable to keep those units in the hands of owner occupiers and not renters?

LeoS, where I have a different point of view is that if you have both investors and “occupiers” competing to buy the same SFH, that increases competition and increases the price.

Victoria has such a low inventory of quality SFHs (due to geography) that there’s really not that much extra room for all these investors that have crawled out of the woodwork taking risks with low interest rates. That’s partly what happened in Vancouver and it just snowballed – wouldn’t want to see the same thing here.

I don’t see a problem with this. You’re adding to the rental pool where the demand is also desperate. No one needs to buy a condo, but everyone needs a place to live.

No it comes out of their vacancy and maintenance allowance. They aren’t cash flow negative but if there’s a big maintenance expense they don’t have the cash for it and will have to dig into HELOC.

In other words everything is peachy until rates rise or prices drop and there is one unforeseen expensive event

“a young couple who probably took today off their government job to stretch it into a 4-day weekend so they can go up to Whistler in their $50,000 SUV”

I know some people are addicted to debt, but I don’t think everyone is like this – there are a lot of families who are struggling to make ends meet, don’t take fancy vacations, don’t buy toys.

Have to say, I feel the same way as LeoM, why put my money into extra SFHs or condos when they were originally built for families or singles to buy, not for me to rent out. We need more apartment buildings purposefully built for renting – and if a group of investors wants to buy into that, great. At least leave the SFHs for owner occupiers.

1.86 million in debt. YES.

primary residence with two suites and a rental property. YES.

Mortgage=$7,241.48 YES

property tax $460 (seems low) YES

insurance= $120 (also seems low) YES

You vacancy is probably wrong as there is close to zero vacancy in the lower mainland.

Your maintenance is most certainly wrong unless it is an old run down house needing a lot of repaairs. The same house that costs a million in Van costs $350k in Parksville so a percentage makes no sense imo.

You haven’t accounted for CCA on the rental house.

(Expenses total = $8971.48

net income for tax purposes is $24,156 so $9662.4 so their net after tax rental income is $45537.6 or $3794.8/month.) I don’t understand these calculations.

I use a calculator too and my numbers are different. I don’t think they have provided enough information to properly analyze this, but it is clear they are taking a risk on appreciation. My numbers show they can currently afford what they are doing – for now.

but I refuse to compete with and out-bid young people who are trying to buy their first home and thereby contribute to the commoditization of homes. I don’t mean this in a self-righteous way, but it’s simply not right that those of us with the means prevent the younger generation from buying their first home.

So you are refusing to out-bid a young couple who probably took today off their government job to stretch it into a 4-day weekend so they can go up to Whistler in their $50,000 SUV?

I come across a lot of younger generation buyers buying their first home and you would be surprised by how some of them live.

I simplified the math and left out the write offs but let’s spell it out in greater detail then.

1.86 million in debt.

primary residence with two suites and a rental property.

Mortgage=$7,241.48

property tax $460 (seems low)

insurance= $120 (also seems low)

Maintenance reserve 20%= $920

Vacancy allowance 5% = $230

Expenses total = $8971.48

net income for tax purposes is $24,156 so $9662.4 so their net after tax rental income is $45537.6 or $3794.8/month

Their monthly expenses are $3288 taking savings out.

Total after tax expenses = 12259.48

Their net after tax income is $7900/month + $3794.8/month = 11694.8

Negative $564.68 a month. Most likely on their credit cards rolled into home equity loans every few years…..

Ahhhh yes, the HST…..every time I have to do accounting I need to remind myself of that idiotic decision to revoke.

Totally agreed. It’s just not a good precedent to set. It’s not about feeling sorry for anyone, it’s about a business environment that is predictable. Grandfathering in existing deals is standard practice for new laws.

But that’s what happens when you wait until it’s too late and then react in a panic. Next time maybe they’ll not stick their head in the sand for so long.

BC doesn’t really have a great record of prudent decision making. Revoking the HST being the other prominent example.

Marko, the 1%ers I refer to are any of us who invest in homes as a commodity, when those homes might otherwise be available to first time buyers at a reasonable price. Any of us 1%ers who have the financial means and who treat homes as an investment commodity are the people I refer to. Developers like your father and hundreds of other builders who provide a valuable service by rejuvenating and rebuilding homes do not usually hoard houses and condos, but a few probably do.

I likely have the financial means to bid on several condos in Victoria today with 20% downpayments, but I refuse to compete with and out-bid young people who are trying to buy their first home and thereby contribute to the commoditization of homes. I don’t mean this in a self-righteous way, but it’s simply not right that those of us with the means prevent the younger generation from buying their first home. A home is our castle and every young Canadian who works hard, is frugal, and saves should not have to compete with us 1%er investors for their first home. Increasing the supply to meet the runaway demand is not the answer because that will just increase the commoditization of housing.

Land tenure, related property rights, and housing accessibility have spawned many revolutions with ruling governments overthrown for this very reason.

Conditions come off after a certain point, well before closing. You don’t have an accepted offer that is binding until this happens. No seller in their right mind is going to agree to a conditional offer that lasts until closing/possession as they could never plan for where and when they are going to go next – or make an offer on the next place.

What we have here are offers that were made and accepted and conditions lifted (usually financing and inspection) when there was no extra PTT or even a thought it could apply to that deal. Completely unfair in my opinion. If you are going to let foreigners buy in Canada to start with then create business certainty for everyone. It is BC that messed up in permitting these deals to go on for so long to the disadvantage of residents. Foreign buyers should not be penalized for BC’s incompetence – they should not have to pay a surprise $100,000 or more in tax.

I agree with the tax, just not how it was implemented.

There is a difference between unconditional offers and unconditional contracts. An unconditional contract was more than likely a conditional offer to start.

It would be like a young family buying a new home in the Westhills for $600,000+GST (5%) and during the course of construction for the government to introduce an 15% additional tax, payable on completion, irrelevant of when the contract was entered into?

But this is okay because it is foreigners? Still horrible business practice that doesn’t instill confidence in doing business in B.C.

Also goes against some of the things the government has done earlier this year in various bills. For example, I ordered a Tesla and during the order period the government took away the $5,000 EV rebate, but they still honoured it when the car was eventually delivered based on the date of the order (as long as it was ordered before the announcement).

I think it made sense as the reason I ordered new versus buying used was only two reasons and one of them was the $5,000 rebate (only on new).

Once again, no issue with the 15% tax just the fact it is being applied to buyers who made decisions not knowing at all that it was coming and they can’t get out of their unconditional contract.

Those who made unconditional offers and are foreigners can afford to take the risk and have don’t feel sorry for them. That’s the risk they take and fault for not putting conditionals….a lawyer would have advised them to add conditions. The Canadian family that has to compete and pressure to make unconditional offers I sympathize.

The net rental income is $24,156/year or $2,013/month. They are not taxed on the gross of $55,200, only the net. After tax this adds about $15k to their net (albeit in home equity not cash) on the balance sheet.

This net rental income already accounts for the deduction of mortgage interest paid from the mortgage payments of $7241 (about 2.5-3k/month perhaps). I think you may be double counting here by taxing them on the gross and then deducting the whole mortgage payment from the net?

I have no sympathy for foreigners or Canadians who are greedy profiteers who are commoditizing homes for their personal gains. However I have great respect for people or developers who buy old delapidated properties and rejuvenate them, or demolish and build new places. “Amateur Investors”, as Marko calls them, who buy up places and hope to profit just from appreciation caused by their ilk and foreigners can all go bankrupt with no sympathy from me. Basic housing needs should never be allowed to become just another commodity to be exploited by the 1%ers.

The 1%ers are the developers? Your “amateur investor,” is some Joe that heard prices were going up so they pick up a few condos downtown to run AirBnbs or to rent out, even though the numbers make no sense at these prices.

I think applying the tax to unconditional contracts is really dumb. Can’t really do business like that.

There was a way around the last minute buying….ONLY unconditional contracts the day of the announcement are exempt. All others with conditional contracts feel free to collapse.

Make announcement around 5 pm so people wouldn’t have enough time to scramble to unconditional.

“4029 Providence Pl in Gordon Head purchase in 2013 for $868,000.

Listed today for $1,680,000.”

Yes, this does seem like a crazy high asking price. Maybe in Oak Bay… although I’ll admit I don’t really know the $1M plus range.

So, what did 1549 Granada near Mt. Doug just sell for (2050 sq.ft., dated 1980 house, 6750 sq.ft. lot, no suite potential)? It was priced at only $665K, so I thought prices must be coming down, but maybe it sold for much more. Certainly the one on Providence is not work 2.5 times more, even if it is a newer, larger house with suite.

deryk houston said he objects to how the tax was implemented.

I say, Tough!!!

The tax was done properly; any other way would have encouraged massive last minute buying by foreigners. The Liberals did the right thing at the right time. The only improvement to the implementation would have been an immediate implementation on the date of announcement and a 25% tax.

I have no sympathy for foreigners or Canadians who are greedy profiteers who are commoditizing homes for their personal gains. However I have great respect for people or developers who buy old delapidated properties and rejuvenate them, or demolish and build new places. “Amateur Investors”, as Marko calls them, who buy up places and hope to profit just from appreciation caused by their ilk and foreigners can all go bankrupt with no sympathy from me. Basic housing needs should never be allowed to become just another commodity to be exploited by the 1%ers.

Ok let’s make it simple.

Mortgage=$7,241.48

property tax $460 (seems low)

insurance= $120 (also seems low)

(no other expenses like vacancy, maintenance etc.)

$7821 just the basic expense of the properties

Their net after tax rental income is $2760/month (40% marginal rate at their incomes)

let’s just leave write-offs out of this since I’m not even including any expenses etc. (those are all in the calculator I have)

so negative $5161 with basic calculations.

Their monthly expenses are $3288 taking savings out.

so outflow is $8,449

Their net income is $7900/month

They absolutely can’t afford it and are cash flow negative….

Somewhere between $500-$1000 cash flow negative at historic low interest rates…. No savings and no contingency. only equity which they will draw on to pay for this mess.

This is a BS pumper article. “See even you can over extend and invest in over inflated properties!”

This activity is what brought the US down…

Their net is $7900/month from working income alone, so that is after tax and before living expenses.

In addition, their gross from rental income is $55,200 and their net is $24,000 or so. I don’t know how they get to net as they have rental income from two properties, one used as a primary residence.

Their mortgage payments total $7,241.48 if 30 year at 2.4%.

This means that the amount of mortgage payments not covered by rental income is $31,371.36 or $2,614.28/month. They can afford this and they are not cash flow negative.

I agree the numbers are unclear and the way of accounting makes it hard to determine what the bottom line is.

Land titles has crashed

http://www.nationalpost.com/m/land+registry+crashes+people+rush+close+deals+before/12092510/story.html

That article is off. I ran the numbers on their properties combined with their equity and debt and rental income and get a negative cash flow of $5437 / month @2.5% over 25 years. At 4% interest it’s $6929! their take home pay is $7,900 leaving them 2,463/ month for everything else. Their monthly expenses are $3288 taking savings out. They are screwed now, just wait until rates go up and they have added more to their debt load….

Foreign tax I think is going in right direction although would like to see some action federally or at least more then just one city. If some one buying a house they aren’t living in in a country they aren’t living in, working etc (not a permeant resident) then they can afford the extra tax as a second home is a luxury item or a investment gamble…not a necessity. Yes sucks was implemented cut throat but that’s risk take when buying in a foreign grounds.

If don’t like it or want change whine to your premier. She sent me a lovely email back.:)

premier@gov.bc.ca

Cc: FIN.Minister@gov.bc.ca, oppositionleader@leg.bc.ca

andrew.weaver.mla@leg.bc.ca

carole.james.mla@leg.bc.ca

Looking at some numbers in Oak Bay and wow.

Median Single Family Deatached

May 2014 May 2016

$789,000 $1,260,000

If we isolate for Uplands even more insane

May 2014 May 2016

$1,355,834 $2,723,500

Misread on my part…..if they are grossing $160 to $190k/year they will be fine. Two suites in their personal home plus the rental property I wouldn’t consider them ridiculously high risk.

They are in a way better position than someone buying a 999k home with 5% down and no suites, grossing 190k/year.

I wouldn’t buy an investment property if I couldn’t get out at least $500 gross per month per $100,000 capital investment. Basically I would want $5,000/month on a $1,000,000 purchase.

Mortgage industry is against the tax, must be an effective one.

Can you feel the passion?

“officially out of control”

“Provincial leaders have just molested international homebuyers”

http://www.canadianmortgagetrends.com/canadian_mortgage_trends/2016/07/an-isolationist-tax.html

Ditto. Not to mention the late night court games conveniently illuminated by the street and school lights.

Sure. Has happened before, will happen again. Maybe not by September but certainly this year.

Day to day stats are highly variable. Not worth considering much at all.

Yes – somewhere between 160-190k. And their net disposable income is 10k/month with rental income.

They also have at least $1000 a month that they could save in their budget on entertainment, eating out, travel and misc. and they are currently also saving $790/month.

That gives them about 2k a month that could be used to service additional debt if need be.

Their home mortgage is not an issue imo and they have two rental suites in it. That was probably a very good buy and has given them a good return and a place to live.

The real issue is the 1.18 million dollar rental property with a 1.18 million dollar mortgage that has to be rented out for about $3000/month looking at the figures they have posted. They have to be gambling on lower mainland appreciation because there is no way it is carrying itself even now – they are mixing the rental income from their primary residence into the figures posted so it is not clear.

Buying for appreciation is a risk. One you don’t have much choice about in that market if you want to invest in real estate – the numbers don’t work for cash flow. Time will tell, their gamble could pay off. It is not a risk we would take, but then that might be why we have not made Vancouver-like profits either.

I do think there is a strong likelihood that Vancouver prices will not keep appreciating at the pace they have over the next year.

I personally would never buy next to a park or school. Listening to a basketball ball all day long would drive me crazy. House looks nice though.

4029 Providence might be a fishing expedition to potentially capitalize on the 15% tax panic. It’s listed at about $800K over assessed, which is ridiculous.

How much would the price of that house increase… say if you have a good PokeStop or PokeGym near by? Tnx.

Marko,

I read the article as $7900/mo take home.

This is just under $95k in pocket annually net or $190k yearly combined gross.

I think 29/32 is still the right time to take on calculated risk. If they go bankrupt by 35 they still have enough time to recover by 65.

I am all for risk but $1,800,000 in mortgages on less than $100,000 yearly income is really ballsy.

Marko

It has a basketball court though.:)

4029 Providence Pl in Gordon Head purchase in 2013 for $868,000.

Listed today for $1,680,000.

OlympicBound,

I appreciate the level of hypocrisy you’ve attained in only a couple of sentences. Just Jack more often than not presents actual data (that’s what the little numbers are) opposed to the hyperbole that you’re relentlessly foaming. What is your agenda by the way?

So I challenge you. If you’ve “never seen anything like it” when talking about this unprecedented “wall of pending” listings, please do share some actual facts. If they exist, I’d actually be interested in seeing them.

As you say, anyone can just make up “fantasy stuff”.

This is a forum to educate each other – whatever side of the fence you’re on.

So many negative nellies on this board, it should be called househuntgarthturner.ca.

Hasn’t anyone looked at their PCS lately? I have one for all of greater Victoria in all price ranges and I literally just see a wall of “pending” with only a few new/recycled listings.

I’ve never seen anything like it. I think y’all will be in for a shock come end of July and early August.

I’m not making up fantasy stuff like Just Jack does everyday, desperately trying to talk the market into a crash, I’m talking actually what I see in my PCS.

I bet we get well under 2000 available homes by Sept.

“1.8 mm in mortgages”

These two are 29 and 32 and have accumulated no wealth. 400k from parents, the balance of their 750k or so looks undersized if they bought more than 6 months ago.

The thing about risk is that when you get money for free you don’t appreciate what it means to earn it, which leads to silly purchases with silly risk profiles, like this.

Im sure there are thousands of couples out there in similar situations.

“Frankly, I wouldn’t mind seeing some economic cleansing of the real estate market. ”

This cleansing has been long over due. Anyone who thinks this was sustainable had a biased and most likely highly leveraged interest and will be learning some painful lessons.

Parabolic charts always tank in spades. This cleansing will include a detox and an enema.

Jeff Lee @SunCivicLee 2 hours ago

I’m hearing multiple cases of local buyers rescinding offers because they think the market will soften. #vanRE

Steve Saretsky

@SteveSaretsky

@SunCivicLee @VancouverSun I can confirm hearing similar things

It looks like there will be more condominium than house sales in the core this month as house sales have been declining for four consecutive months now. Sales for this July are project to be below those of 2007 and 2009 and possibly 2015.

We are now back to core house sale levels similar to most previous years after having a massive spike of home sales in the first six months of the year. And while sales activity generally declines in the summer the rate of decline this year is steeper than previous years.

The good news is that median prices have held firm, although high end sales still dominate and skew the data upwards.

More new listings in the high end have been coming to the market, I would expect the mean, medium and mode to moderate lower during this demand driven downturn. That doesn’t necessarily mean that prices in all price groups will be declining. One would have to look at each sub market of housing to determine how prices are changing for that particular group.

I think the tax is being implemented exactly as it should be. Otherwise it would just cause panic buying. As it stands its a solid firing across the bow. It has gotten out of hand in Van for way too long. It’s not like it’s a ban, or the transparency that JJ seeks, Or raising the down payments to 25% or increasing renters rights or a general change to the tax rules on the gains received with housing etc. This is supposed to affect a small part of the market remember. A part that is not Canadian, not a resident, not an immigrant. Just some rich person somewhere else trying to convert their money into dirt in a politically safe country…. They can still do that, they just need to provide an over the table kickback of 15%. That’s not too bad.

The Case-Shiller index for Seattle is in interesting because it shows the flight of foreign capital out of Seattle. And that money went north into the Vancouver market.

The index might also allude to what may happen to BC if foreign investors were to leave and return to the US market in greater numbers than they have been.

Frankly, I wouldn’t mind seeing some economic cleansing of the real estate market. As it is now the marketplace is underestimating the risk of holding real estate as we have not had a bear or soft market for a long time. We need those soft markets to gauge the level of risk so that we can make better investment decisions.

http://business.financialpost.com/personal-finance/family-finance/couple-has-gone-all-in-on-b-c-real-estate-but-a-secure-retirement-will-mean-getting-out-at-the-right-time

Couple has 1.8m in BC mortgages. What are people thinking. Wonder if they are sleeping after this week.

I agree with Dasmo, this isn’t investing.

But, it isn’t just foreigners. Canadians have been buying properties with little to negative cash flow and betting on appreciation. In the past these amateur investors would have been pounded by fluctuating interest rates and stringent lenders. Instead more amateur investors have been buying up properties sometimes using several different lenders to make qualifying for a loan easier.

Perhaps we should be measuring the speculative bubble by the number of brokers per capita? Or the strength of the market by the number of estate agents per capita?

Understood – that’s why I pointed out that the Australia and NZ banks implemented their new rules almost overnight. To be honest, I think BC is trying to send some signal to foreign buyers that this isn’t the place to put your money if Australia and NZ aren’t easy hideouts anymore. Also, maybe there really would have been panic buying and new tax evasion schemes created if there was too much notice.

To Vic Bot…… I never said that Canada should not be imposing a tax on foreign investors in Canadian real estate.

It is interesting that people can’t distinguish between The tax and How the Tax is implemented. I have been talking about how it is implemented. This is the problem.

Read the article before you comment. THis is “Not” about having a tax or not having a tax. It is about how the tax is implemented that is the problem. How many times does a person have to point this out?????

“Another reason this tax was not grandfathered is to reduce the possible spillover effect. ”

Great point Fustercluck, could you imagine the panic buying that would have ensued if they gave it a one or two month warning ? The prices would be popping another 10 or 20% and that would defeat the whole purpose of the tax.

Look what happened when Justin changed the down payment rules and gave a couple months warning. Prices popped. It should have been done within a week or two like this new law.

You take chances doing any major deal in a foreign country, tough shit I say.

Deryk, I think it’s more of a a risk to the Canadian economy when countries around the world are increasing their foreign buyer taxes and Canada isn’t, and when China is enforcing more capital controls. The fact is that foreign capital is looking around the world for safe havens, and Canada cannot become the only place left for investors (legal and not) to easily hide their money.

Canada is finally starting to meet international standards (like Australia, UK, and NZ have been doing). “Alan Oster, National Australia Bank’s chief economist, said … the inflow of foreign money was a short-term boon for the economy but could become a risk if Chinese buyers suddenly wanted to withdraw.”

http://www.ft.com/cms/s/0/be4857ae-0c36-11e6-9cd4-2be898308be3.html#axzz4FoCoKBxu

When Australia and NZ banks stopped issuing mortgages to foreign buyers, the new rules happened almost overnight.

The Australia real estate industry tried to issue similar warnings when the government increased foreign buyer taxes, eg., Glen Byres at the Property Council of Australia said it “put at risk Australia’s reputation on the global stage.” (It didn’t)

As Hawk said it’s ironic that “The foreigners were supposed to be having zero effect on the price rise and now it’s going to destroy market confidence and bring down the whole construction industry.” eg., now Cressey is saying half of their buyers of $20M of RE are foreign. Not exactly prudent.

It’s not investing, it’s buying up. Investing would be putting money in to grow something that benefits Canada and our economy.

People buying houses and then collecting on low income subsidies does not benefit us. We don’t need that investment.

Does anyone honestly take someone named “Fustercluck”seriously?

Canada is viewed as a safe place to invest because we have laws that meet international standards. What “Fustercluck” and his type will never fathom is how the implementation of this new tax law will erode that confidence and damage our reputation as a safe place to invest around the world.

@Fustercluck. Good point. That is exactly why to do it that way. Otherwise there would be a scramble everywhere making it worse. This way they do it in Van where it is well deserved and spread the fear elsewhere….

Another reason this tax was not grandfathered is to reduce the possible spillover effect. The government has shown their authority as a reminder that they’re not obligated to give anyone the benefit of the doubt. They can and will change the playing field at any time. So those expecting auto price surges in Victoria underestimate the foreign buyer hesitancy this may cause for all regions in BC.

A number of years back I had an opportunity to buy some land in South America. After doing some research, do you know why I chose not to? Because buying land in a foreign country is beyond risky.

I wasn’t the least bit naive to hold some idealistic view that a purchase in a foreign land should be treated as fair. The bottom line is that any safeguarding government should have the right to enact anything – without boundaries – that protects domestic interests. Period.

Anyone arguing about fairness sounds ridiculous and self-serving. Canada first. Sorry dear realtor/foreign investor, that your gravy train came to a sudden halt. These were always the risks – you just opted to ignore them.

Seattle just recovered their 2007 peak

http://seattlebubble.com/blog/wp-content/uploads/2016/07/Case-Shiller_SeaTiers_2016-05.png

Yeah that’s not going to fly.

Suppose the tax does work with a high capture rate.

Is 15% enough to either deter purchases in Vancouver and/or cancel out of existing deals prior to completion.

I would argue that Victoria is somewhere between 2.5x to 3.5x comparible properties. It’s just a vague assumption and none of us here will agree on exactly what compares to what. Point Grey vs Uplands? Burnaby vs Quadra? Kitsilano vs Oak Bay ? You get the idea…

Buying a $4M house in Van and paying $600k out of pocket for a ludicrous tax or paying $1.5M in Victoria. That comparible (sans argument) effectively just became a 3.5x from a 2.5x.

This, of course, if this is not implemented province, or better yet, country wide. And again, strip the Quebec investor program out.

I agree that they should have planned this better and implemented it with foresight and fairness. The tax alone has enough big loopholes to make it void though.

http://www.cbc.ca/beta/news/business/bc-foreign-homebuyer-tax-housing-market-toronto-1.3696511

All current buyers and sellers have to do is agree to renegotiate contracts into the future while the buyer sets up a corporation and fills it with money and someone (anyone really) can be the Canadian with voting rights.

Since it’s only applying to a small % of all sales in the slower season… How many people are really going to be caught out? Maybe 20, 30 people?

Most will quickly adjust paperwork, these guys that are moving this kind of money internationally are not weak and scare easily like Hawk and JJ did. They will continue on, business as usual.

This does make international buyers hire better tax lawyers and spend more on complex paperwork though 😉

Onwards and upwards!

Edit: my last post was written and posted before I could read Deryks post, which I agree with. The severity of the consequences I don’t really agree with, tis a little “sky is falling”

This message is to “OlympicBound”.

What part of changing tax rules “retroactively” do you not understand????

Anyone Buying or Selling a house in Victoria could easily be caught in the same mess if the government decides that they want to change the rules at any time during your contract.

Real estate is very often a chain of people at all stages trying to complete their deal. As a result this will not only hurt foreign buyers but Canadian sellers who thought they had just sold their house and now find the buyer can’t complete their part of the bargain because they have a huge tax expense that they hadn’t expected. Everyone get’s hurt.

How come you haven’t bought your 15% off sale yet ? If I was really house hunting for a $950K house I would have bought yesterday. Nice try troll, lol.

This small tax is same or less then most other similar places around the world, think Sydney/New Zealand, etc.

It will put a small 1% damper on the growth. But as we all know the majority of this boom is just a cycle. Has anyone seen the building boom everywhere? It’s just getting warmed up, these usually last 4-5 years and we are 1.5 years in.

The fact that Victoria just became ANOTHER 15% cheaper and is reported in all papers as a place people will go, will have a fairly large bump to our prices.

I’m seeing nothing but pending on my PCS, with almost no new listings!!! I think the lul around Canada day is ramping up already.

Even if the new tax makes 20 worldwide buyers think and buy in Victoria, that is enough to push prices up 15% easily! Think it through.

The price jump will be very fast. If I was looking, I would buy as fast as possible to get in before law changes.

Deryk Houston: I agree with what you’re saying. However, this has happened before. Federally, with the Conservatives and income trusts. This isn’t the last tax (or law) that’s coming down the pipe that will have a negative impact on housing in BC. If I was living on the edge financially with a massive mortgage, I’d be selling asap. No sense chasing the market down.

Leo is right in that this tax should be province-wide. It probably should be even higher as well.

Totally agree Deryk. Torpedoing existing contracts is a terrible idea. The tax itself is great although it really needs to apply province wide.

Anyone who buys “Anything” should know what the tax is going to be when they sign a contract. It is unfair and dangerous to cripple people in the middle of a deal. I believe that there will be lawsuits and misery of this short sighted money grab. Any tax should not include transactions already in place. Put the tax at any level if you must. This is not about the tax. It is about ensuring that people and business can have a predictable outcome to a contract that they sign on to. Otherwise you invite chaos.

https://www.change.org/p/the-bc-provincial-government-the-bc-government-needs-to-exempt-all-current-transactions-from-the-15-purchase-tax?recruiter=20889516&utm_source=share_for_starters&utm_medium=copyLink

Excellent point Hawk!!

Hawk said: “The foreigners were supposed to be having zero effect on the price rise and now it’s going to destroy market confidence and bring down the whole construction industry.”

Home Capital stock took a beatdown today as well on poor earnings and market sentiment changing.

Home Capital Group Inc shares fall the most since facing mortgage-fraud fallout in 2015

http://business.financialpost.com/investing/market-moves/home-capital-group-inc-shares-fall-the-most-since-facing-mortgage-fraud-fallout-in-2015?__lsa=2951-38aa

Time to take off the party hats perma-pumpers, it’s SHTF time. From a non-fictional Van agent:

Steve Saretsky @SteveSaretsky 11 minutes ago

My talks with many realtors lately- everyone is scared shitless for what might happen to market. #VanRE

Maybe there will be less unconditional offers now at least. A cold bucket of water needed to be tossed on this market. So the greedy get burned in the short term if there is a reversal in the market. In the end prices will find their natural equilibrium. This tax is not some sort of killer. It is a slight damper on selling out our land to the international money market. I see no issues with that. I just hope it doesn’t snowball and create a credit freeze….

Sure, I meant once it is unconditional

Marko any insite on what the market reaction is in Victoria to the Vancouver tax?

Marko

Any insite on how this is playing out in Victoria?

So? Getting cold feet about the market is not grounds to get out of a contract.

My guess is 50% of contracts are collapsed because of cold feet from personal experiences. So many ways out; inspection, not happy with financing, etc. That is why sellers regularly take 10-50k less from an unconditional offer.

Contract doesn’t say you have to secure financing but that you have to secure financing on terms you as the buyer are happy with. I am simply not happy enough with a 1% mortgage.

Whole Vancouver industry created this mess. Now than can deal with the shit. Gov did the right thing since these people can not regulate themselves.

Cressy expects half of the resident buyers to rescind!

There is a nifty way of measuring those that want a home to live in versus those that are buying for speculation.

Half

If Cressy’s assertions are reliable, Vancouver is in a heap of trouble.

Also from the G&M article that jumped out at me:

“He also reminded the Premier of his company’s support, saying, “ITC has been a big supporter of you and the B.C. Liberals” through subsidiary companies.”

You can read a lot into that…..

So? Getting cold feet about the market is not grounds to get out of a contract.

This is hilarious. The foreigners were supposed to be having zero effect on the price rise and now it’s going to destroy market confidence and bring down the whole construction industry.

This is what a bubble popping looks like when the first catalyst hits as I have mentioned too many times on here.

Next comes the credit freeze up as the books are opened up on all the bloated lending deals as the foreigners and locals rush to the exits. Look out below.

B.C. realtors voice unease over new foreign-buyer tax

“In a letter on Wednesday to Premier Christy Clark, Cressey Development Group president Scott Cressey warned that it expects to see buyers – half local, half foreign – rescind on $20-million worth of sales contracts by Friday.

“The resident buyers who are rescinding are concerned that this new taxation might destroy the confidence in the real estate market,” Mr. Cressey said in the letter, a copy of which was obtained by The Globe and Mail.

And he warned that banks will likely want to do audits of all projects under construction in the Lower Mainland to determine whether financing – which depends in part on presales of units – can continue.

In a separate letter to Ms. Clark, also obtained by The Globe, a construction company spokesman warned that the new tax could cast a pall over the construction sector – one of the province’s biggest employers.

“The imposition of this foreign buyers tax is a real threat to the state of development in the Greater Vancouver Area and thus a threat to employment within the construction industry,” said Doug MacFarlane, president of ITC Construction Group.”

http://www.theglobeandmail.com/news/british-columbia/bc-realtors-voice-unease-over-new-foreign-buyer-tax/article31145792/

So, I ask: what would prevent that contract from containing a clause which voids the contract if new taxes are introduced?

JD, agents are regulated and are not permitted to work without a written contract to purchase. The agents have to have the new May 16 legislation regarding assignment in the contract to purchase.

It is extremely rare to have a verbal contract to purchase real estate and it is not advisable to do so.

Can I ask a question of the realtors/lawyers:

What would prevent a seller’s agent from including a condition in a purchase agreement which would void the contract if additional taxes etc were imposed on the deal before the purchase was finalized? It seems to me that all the realtors crying foul over ‘grandfathering existing contracts’ (which is not possible, especially given the assertions below that some purchase agreements are apparently not even in writing) are really just negligent in their own contract negotiations.

I would imagine that any realtor who doesn’t have such a condition in their boilerplate at the moment will do so in the future (and learn a valuable lesson in the process).

Land interests have to be in writing.

It is based on the Statute of Frauds.

Pretty sure real estate contracts in B.C. have to be in writting.

China’s capital controls seem to be having some effect on the US real estate market:

http://www.bloomberg.com/news/articles/2016-07-26/end-of-an-era-as-china-s-love-affair-with-u-s-real-estate-fades

“The residential-property market here, especially for those priced between $2.5 million to $3 million, has been affected by China’s measures to control capital flight …”

“Meanwhile, illegal foreign-exchange transactions from underground banking were brought to regulators’ attention, as China busted the nation’s biggest underground bank, which handled $62 billion … Chinese buyers’ 26.7 percent share of international purchases surpassed the total share of the next four biggest countries of origin, Canada, India, Mexico and the U.K.”