Affordability Update

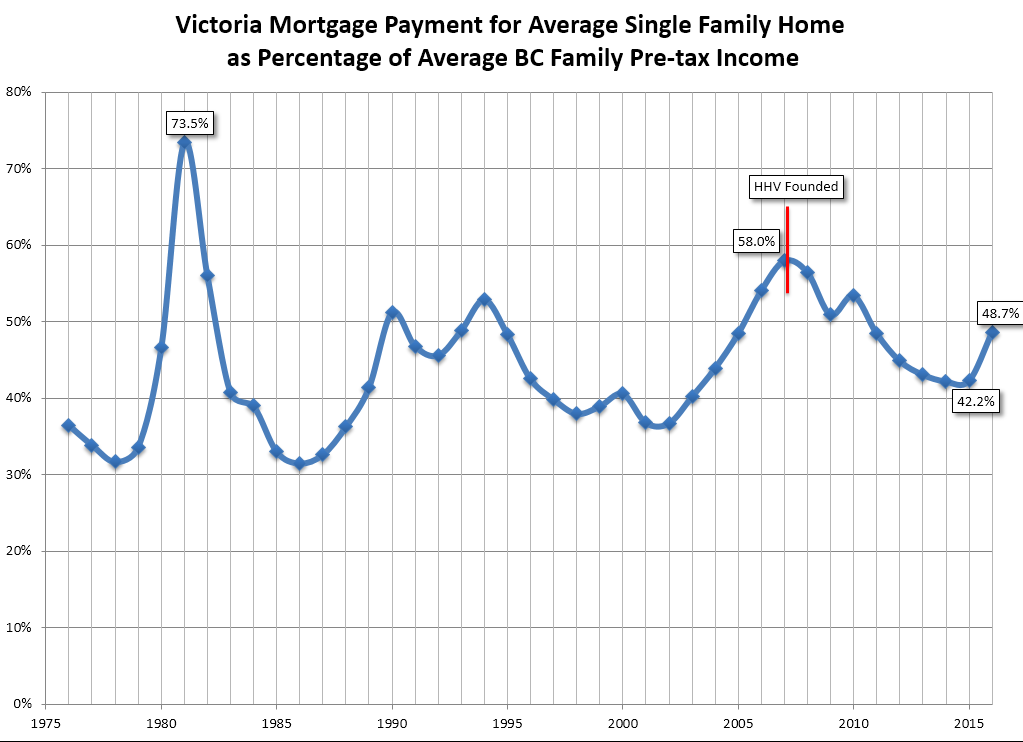

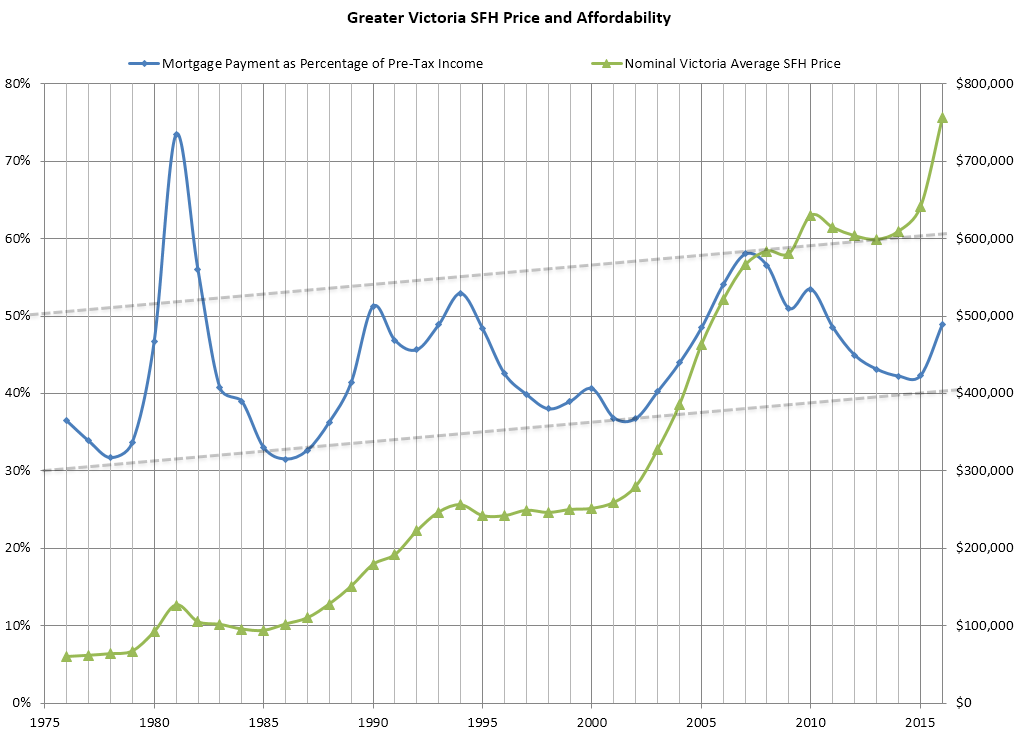

Last time we looked at affordability, it was still pretty tame. But of course with the big jump in prices, these things change quickly.

Taking the 2016 price as the average of the last 3 months ($750k), let’s redo the graph.

Just in the last few months, mortgage payments have jumped a lot relative to income, going from a relative low to middle of the road. Consider this is happening while mortgage rates have continued to move down. I don’t think that rates are going up anytime soon, but I don’t think there is nearly as much headroom in this rally as previous ones.

For SFH affordability, we seem to move in a band that moves up slowly over time which makes sense in a densifying city. In the past we’ve had dropping mortgage rates that helped sustain price booms, but unless the market completely detaches from local buyers, I can’t see that happening this time around.

“Still, simple statements have to stand up to friggen analysis.”

By whose standards ? Yours ? An anonymous person on the internet ? LOL.

New monday update. So much for the slowdown: https://househuntvictoria.ca/2016/06/20/june-20-market-update/

Agreed.

Still, simple statements have to stand up to friggen analysis. But I can agree there is nothing wrong with renting if it works for you.

Triple A, people on a whole cause damage. That’s why Home Depot exists. If you’re making big $ as a property king it comes with the territory. I’ve heard from numerous landlords that doctors and lawyers are worse tenants than welfare cases.

Yes we never hear from loser homeowners that would never come on here to confess their going bankrupt from the last downturn in 2008, only the boasters with too much time on their hands.

I think you drink too much coffee in the morning totoro. Let’s not complicate a simple statement into a frigging analysis thesis.

Tenants as a rule cause damage. They’re not generally respectful, but from time to time you get a decent one, only to find required repairs that the tenant failed to report. I would budget +50% more $ to an annual repair budget if you have tenants.

In a way Hawk, you’re the one strapping the homeowner to endless fix ups and breakdowns.

Love the saving money arguments from renters. Like a gambler at the casino who only brags about their winnings not their greater losses.

Speaking of dicks…My renting experience isn’t so good thus far. Landlord in Rotterdam is being difficult with giving the damage deposit back. Will probably get a lawyer just to spite him…. Landlords here in Vic treat us with little respect. The no caring for the house is nice but the non communication etc is irritting…. I can’t wait to not be a renter again!

Great. Hopefully you have taken taxation into account taxation and realistically compared the ROI to the leveraged and tax exempt gains home owners have experienced during your time period as a renter investing the savings from renting. Then you can compare the “huge money” you’ve made based on a realistic assessment of ROI based on both scenarios.

There is no guarantee that any asset will continue to appreciate but you can look at past performance over the long-term as the best indicator. Normally this could mean about 7% on stocks if your management fees are very low (say $120,000 tax free or taxable if outside TFSA or RRSP earning $8400/year compounding) with non-leveraged funds and 4% on RE on the entire leveraged amount (with $120,000 down say $600,000 value plus equity pay down earning $36,000 per year tax free less increased costs of ownership – say $12,000 per year if no offsetting rental income – or net $24,000 compounding – more if suite).

The big issue is risk of having to sell at a loss or not being able to afford the leveraged costs if interest rates rise. I’d agree this can be a stress cost and there is the hassle/time factor of owning vs. renting. Not sure how to quantify that as it seems like it varies based on individual tolerance. I personally find renting way more stressful than owning as I want to feel like my home is mine to manage and determine when I will leave/what I will do with it. The opposite is likely true for many.

“Speaking if dicks.. bearkilla you are a complete dick.”

I’ll second that. Most anal poster on here. My renting experience is great as well, extra money saved has been making huge money in the markets the last few months. If I was a homeowner I’d be strapped paying off the monthly expenditures of never ending fix ups and break downs.

Heard of a decent looking place that was pumped as per the Thursday to Saturday viewing, put your bids in Saturday by 5 deal, in prime family entry level area of town. Zero, zilch, nada bids, not even a low ball. Agents are stunned. Just another red flag, the market is now on to the over valuation game. More price slashes to come.

Later on its just a friendly monthly reminder that you’re that much closer to death. 🙂

Agreed.

If you are going to make an economic argument for renting or buying do you your homework. Short term thinking that focuses on some specific out of pocket costs is a waste of time. It is like saying it is better to rent a car than buy it because you don’t have to maintain it while ignoring comparative cost per km over time.

You need to input the data for all expenses and account for appreciation and equity over time to accurately determine what “your dime” turns into at the end of the day. Looking back, your dime has been eroded into negative equity by the power of inflation plus appreciation on house prices in Victoria. Will this be the same in the future? I don’t know, but it appears more likely than not over the longer term given the historical appreciation rates.

We purchased a place in 2012 when everyone thought the market would decline and we thought it might too. This has led to a lot of out of pocket costs including repairs and renovations. On a monthly basis it was way more than renting for a while. Now that the house has appreciated and we have rental income our ownership dime is way better than a rental dime would have turned out.

If you are weighing the equation on the hassle factor of being responsible for an asset like a house I’d agree renting wins – at least until you are asked to move.

Yes, there are other (good) ways to invest money. But most renters are living paycheque to paycheque; they have no money to invest. And the renters who aren’t living paycheque to paycheque are generally seeking to buy a property.

StatsCan numbers show a wide disparity in net worth between owners and renters.

Nope, I’m a Canadian dick. You’re correct; I should be spelling it with two l’s. Will endeavour to do so from now on, thanks.

Nobody is sweating the $75 average Saanich property tax increase, I can tell you that.

bearkilla

“It’s been a complete and utter blood bath for bears this spring season. Let’s all take some time to reflect on how bad life must be for fo-renters like Hawk and the other losers out there.”

Speaking if dicks.. bearkilla you are a complete dick.

Life aint so bad as a renter here on the sidelines. Gardener comes by once a week, not on my dime. Some general maintenance on the house is done, not on my dime. Don’t have to worry about the property taxes, again, not on my dime. House Insurance, once again, not on my dime.. and so on..

Anyone considering going all in on housing needs to take a serious gut-check on where things may be in the next 5 – 10 years.

@Leo, I assume not a deal overall to get it early and would not dispute what you say but the monthly cash outlay is much less for my first product so it sure feels like it.

Life insurance vs. Mortgage insurance: they base the premium on a 25 year term with mortgage insurance, that’s why the premium stays the same as you pay it down, they’ve done the math and that is what the price should be for the average amount of insurance for 25 years. Mortgage insurance is underwritten after you die, so if you lied or didn’t declare a health issue they can decline it, where 3rd party life insurance they can’t when you die.

I work for Island Savings and the 2 life insurance brokers we have working for us are paid on salary + commission, and they end up doing lots of term life insurance, as what they sell has a small impact on their income.

As for buying insurance, it always costs the appropriate amount given the actuarial tables. There is no deal for buying it earlier.

About to become a non-issue. http://nihp.viha.ca

@introvert are you american? “canceled” – I think this is at least the second time I’ve seen you pick the American spelling over the correct way. Could explain your propensity to being a dick.

“Speaking of life insurance: does anyone have a good experience with a company? I am shopping.”

I had a really good experience with Mitch Brooks at The Cooperators on Quadra/Mckenzie (next to the London Drugs). I told him straight up I was only interested in term life insurance and he did not try and sell me Universal Life, etc etc. He didn’t talk down to me and didn’t waste my time.

As others have stated, get it sooner, rather than later, as prices go up every year you get older. He even backdated the application a bit as my spouse had just had his birthday. Only once we were approved, did we cancel the mortgage life insurance with the bank.

A couple years ago I went to the park by the new Westshore Y (before the Y was built) on a weekday, during the day while kids were in school, and I had to admit, the park itself was very nice, lots of little kids and families there. But the only thing I could think was how I would HATE to be living in one of the houses directly behind the park because of the active construction going on in the area. It was noisy, lots of hammering and drilling and I could see there would be blasting and heavy machinery (beep beep backing up!) at times as well. And then there is the dust:

http://www.timescolonist.com/news/local/developers-face-fine-for-not-controlling-construction-dust-1.2277463

Between retires, people that work in the westshore or remotely, and people who underestimate the communiting costs, I think there’ll be plenty of demand for those new houses at Royal bay (especially if they have ocean views). There’s just not that much out there for new homes. The new Y and other developments out there are appealing as well.

We checked out the Royal Bay / Colwood gravel pit development this weekend and I thought I would share the experience. There are 14 homes for sale for “low 500’s to mid 600’s” in the first batch that will be completed in the next month or so for July / August move in dates. I had driven out there a few weeks ago to check out the showhomes, there are 2 directly across form the Royal Bay highschool that are 2 story in the front, 3 story behind with walk-out basements to a yard and a detached 2 car garage that backs onto a paved lane way. This is what I thought we’d have access to purchase this weekend at the grand opening.

We checked out the interiors of the 2 showhomes and they’re very nice layouts, open floor plans great use of space. The basements were not completed but there are hookups and both looked like you could add a suite.

We found out after viewing the 2 showhomes that these style homes, with the third level walk-out / potential room for a suite, were not available to buy. They have no date set when these type of houses will be completed, the ones that are actually for sale do not have the 3rd level but instead have a 4ft crawl space.

3 bedrooms 2.5 bathrooms 1500 sq ft start at 539k – 560k depending on the lot and the larger homes go up to 1900 sq ft with an extra bedroom and an office for 650k.

I did not go in with high hopes for affordability but was really disappointed with these prices and the fact the showhomes are not the style homes available for purchase. at 539k to start for a 3-bedroom in basically Metchosin that has 0 potential to add a suite I’ll assume most working families will not be able to afford these. We would be commuting to and from Vic for work so the addition of driving time, parking/fuel/vehicle costs in my mind add up to a lot and the savings were not there. It will be very interesting to see how fast these first waves of homes sell and if others agree these are out of reach for the family demographic they seem to try to be wooing. More schools are slated to be built, some shopping, a couple of parks… and 2800 homes. I saw 2 families with kids checking out the houses, some retirees, and a few rental cars.

It’s been a complete and utter blood bath for bears this spring season. Let’s all take some time to reflect on how bad life must be for fo-renters like Hawk and the other losers out there.

Agree that upisland is very beautiful, but another reason why retirees or families tend to like Victoria is access to big hospitals. Spent too long in hospital wards hearing stories of long trips from upisland, and how they want to move here to avoid it. It becomes harder when the trips are more frequent, especially as people age, as you can imagine – that’s when all the serious illnesses really start to get hard to manage, and you need repeated treatments.

Speaking of life insurance: does anyone have a good experience with a company? I am shopping.

Introvert “renters never prosper”

– you do know there are other ways to invest money, right? One could argue there are more profitable,more liquid, and less risky ways. Home ownership is not God.

In Comox and Parksville you can get an okay home in a working class neighbourhood for about $400,000 right now. New builds are comparable to Langford prices. Total seller’s market so expect to pay far above BC Assessment prices. So it is much cheaper than Victoria core, but it is not incredibly cheap. Other communities may be more affordable.

As far as lifestyle goes, if you are not tied to a job and like small town living it is going to work for you. There is certainly a more relaxed feel in these communities – but way more rainfall in winter and missing the urban feel of Victoria.

I personally am happier to raise kids in Victoria due to the proximity of UVic. They can go to school for many types of degrees not offered at VIU and they don’t feel like they need to spread their wings and get out of a small town like I did at 17. In addition, if we want to downsize later the higher prices here mean there will be more tax-free money in retirement.

If I was just starting out with a family and could not afford Victoria I would prefer being a homeowner over staying.

Some Vancouver lottery-winners move to Victoria, helping create some Victoria lottery-winners who move to the Comox Valley, helping create some Comox Valley lottery-winners who move to Gold River — and on and on it goes.

The take-away from this trickle down effect? Own a home. You can’t hope to win the lottery if you don’t buy a ticket.

Am I suggesting you are guaranteed to win? Heck no. In fact, your ticket may be your downfall if you’re unwise or you’re unlucky. But what we do know is: generally speaking, renters never prosper.

In case anyone missed it, Victoria is now Canada’s 3rd most expensive rental market, after Vancouver and Toronto:

http://blog.padmapper.com/2016/06/14/canada-average-rent-report-june-2016/

Because the market is so hot right now, it’s probably hard to remember times in Victoria (during real recessions, not necessarily 2008) that it was hard for owners to find renters, so suites would sit empty for many months (and landlords would drop rents or add incentives). Now they’re snapped up immediately. That’s another reason why it’s very risky to totally depend on rental income to fund a mortgage.

Trudeau seems hesitant to do anything, but I agree with this statement he made:

“We’re on a trajectory that doesn’t have any good outcomes.”

From an outsiders perspective you could argue that Comox is more desirable living, or Campbell River for that matter. Yes, breath deep before you get upset with such a stark reply but consider the activities: Skiing, Mountain Biking, compatible Golf, decent Fishing, for a fraction of the price of Victoria homes. I tend to hear of a lot of Americans and Albertans moving there, and further up island, even if only for seasonal living.

Again, the notion of desireable areas is being rethought island-wide by buyers with no pre notions. Victoria is beautiful, but so are many other areas on the island, within the province, or in this country.

So we are the region’s Vancouver. There’s probably a HouseHuntGoldRiver where they’re fretting about people from Victoria selling their $500,000 Langford house, buying for $200,000 and retiring early.

Yes, just get life insurance…. I also recommend getting it early. I have gone for two rounds. It’s was much cheaper in my 30’s then my 40’s. I also recommend getting it for the sake of your family. I just had an fiend pass away and he has left his wife with a new house and no way to pay for it….

We’ve had 154 house sales in the core districts in the first 15 days of June. That’s down from the first 15 days of May when there was 167.

And it’s the same for condos in the core as they are down from 158 to 123 for the first 15 days of the month.

But what about new listings?

For houses they are almost identical at 175 to 174

Condos are down from 189 in May to 144 in June

Typically we see a drop in new listing in June such as in condos. But so far this has not happened in houses.

I spoke with a retired couple that just sold their home for $650,000. They didn’t have to sell they could have kept on living in their paid off home. But they chose to sell and move to Comox. Buy a home and have cash in the bank. For them Victoria had changed over the last decade and they didn’t like the way it was heading.

I think people are beginning to realize that this might be the time to cash in that housing lottery ticket.

Foreign investment in business and the economy is generally good. Foreign investment buying up residential real estate? I don’t see what city needs that. You are trading a short term boost for long term pain.

The greatest concern is unemployment not interest rates going up, potentially through any measures enacted to foreign ownership. This is a problem, a disease, but we’re all infected now with this problem. No one complained back in 2008 when we started to notice more buyers from overseas as Chinese markets roiled, but now that this is obviously spilling over to Victoria it’s an issue. In these regards I agree with Hawk however the time has sailed to deal with this properly and we, especially the younger generations will pay a heavy price. What that means, no one knows.

From the Sun:

“Trudeau, who met Friday with Vancouver experts to discuss this city’s housing affordability crisis, says that while he wants to fix the problem, he warns of “unintended consequences” if a rushed policy initiative ends up backfiring on cities like Montreal, Calgary and Halifax, which need foreign investment.”

Interesting Montreal is brought up being that investors bypass Quebec and funnel into BC as “Residents.” I get the sense that any change Liberals make would be like flushing the toilet to fix a broken septic system.

Some thoughts on bond yields as they relate directly to fixed rate mortgages:

“.. as a result of its quantitative-easing programs, the Federal Reserve has over $4 trillion, or about 24% of gross domestic product (GDP), in bonds on its balance sheet.”

“The current yields in major bond markets imply little expectation for central banks to raise rates or for inflation to rebound over the course of the next decade.”

http://www.barrons.com/articles/beware-of-global-bonds-in-a-world-without-yield-1466173328

The hope has been going strong since 2007, when HHV was founded!

I love it when sharp individuals like totoro and JD lay the occasional intellectual spanking on someone.

This is like asking, Are there any prime spots at Hartland Landfill?

No part of Langford is really “near” the ocean.

We also got pressured into getting this insurance. The rep from our mortgagee, Coast Capital Savings, literally told us it was “mandatory” when we asked her whether it was. A few months later and after a bit of research, we realized she lied to us. We canceled our policy immediately. In my opinion, that’s some shady shit coming from a credit union, which is supposed to be slightly less evil than the big banks.

Just Jack is right: mortgage life insurance is a bad deal compared to term life, as your premiums stay the same while the amount for which you are covered is constantly decreasing as you pay down your mortgage.

Not that I can tell. If you compare you will likely get a better price for life insurance.

However, here is what our broker suggested. We didn’t have life insurance, so he said take the mortgage insurance because you are automatically approved. Then apply for life insurance, and they will do their medical test. If you are approved, cancel the mortgage life insurance . If for whatever reason you fail it, you still have your insurance. If you apply for the life insurance and fail the medical first, then you have to disclose that when you apply for mortgage life insurance so better to have it up front.

Saanich East listings are at a two month high of 87 since I have started tracking them and have not dropped below 70 in over a month. The inventory may be starting to stabilize and begin to build into the summer months as the buyer pool exhausts itself.

If Justin comes through with new foreign money walls and increased scrutiny of source of funds, then inventory may build much faster as buyers back off to wait and see.

With your mortgage life insurance, as you pay down the mortgage the less you would paid if something were to happen, but you still pay the same premiums. It’s a bit of a rip off.

When you’re asking if there are any areas like Oak Bay in the Westshore, I suppose this means are there areas of mostly expensive housing.

The Westshore doesn’t have many old homes like Oak Bay. Most of the homes have been built since 2000 and tend to be large, luxury homes with views.

Mostly this ultra housing is near the top of Bear Mountain because of the incredible views. Half of the million dollar plus sales in the Westshore occurred at the top of Bear Mountain. Another special area is lakefront along Langford and Glen lakes. The same with Royal Bay in Colwood which is made up extensively of custom built houses with water views. I doubt that those buying these properties have to worry about commuting to work.

If it has been years since you’ve been out of the City, a drive out to Bear Mountain and Royal Bay would impress most people. Every house along the street is stunning. And this is what you expect to see for a million plus dollars.

When we looked at it regular life insurance was cheaper.

“the mtg life insurance (we didn’t know any better then)”

I’m curious about opinions on this type of insurance. Is mortgage life insurance (where the mortgage is paid off up for $500,000 or something like that) ever worth it?

Ash, that’s what I’ve been seeing as well – the locations that used to be considered less desirable (to oldtime locals) have started to have the same “sold” prices as traditionally more desirable neighbourhoods. The ones that stand out are Fernwood, Oaklands, Hillside, Jubilee, as well as houses on busier streets like Cook or Fernwood.

Speaking of affordability, Andy Yan says that $1M dollar line has given way to the $2M line in Vancouver

http://bc.ctvnews.ca/1m-line-for-vancouver-homes-has-vanished-off-the-map-research-shows-1.2949581

“As of 2016, the line separating the area of Vancouver where most single-family homes are worth more than $1 million has disappeared off the map …It’s instead given way to a $2 million line”

I noticed a lot of Oak Bays more desirable areas have less listings last month and I think it’s carried over into this one. Makes sense with seasonal patterns.

As for Langford, around Royal Bay there is a small pocket but that’s Colwood technically. Good quality homes less than 10 years old.

Prime neighbourhoods in the core seem to be South Oak Bay and South Fairfield. Does anyone know where the prime neighbourhoods are in Langford?

I rarely drive around Langford (read ‘never’), but I did recently and I was stunned by the rapid pace of development; I didn’t recognize some areas because they have changed so much in the past five years. Are there any prime ‘villages’ in Langford, similar to Oak Bay Village or Cook Street Village? Are their any prime neighbourhoods near the Ocean?

If prices are plateauing is that possibly because of a relative increase in sales of less desirable properties and locations as the market strength ripples outward?

Under the same rationale that prices spiked so quickly because the best areas were on fire while others were not?

Hmmm.. Another couple months of that and you might convince me on your plateau argument. That would make month 4 of essentially unchanged avg prices.

You know Justin is hearing it from those in the financial world outside of Canada as well as inside. Housing is in a crisis like never before and Justin is trying to borrow billions for his master plan from bond sellers in the US who have major concerns of a market collapse and their money.

To ignore the financial outsiders as those who know nothing would be extremely naive.

“This is a bubble. A very big bubble. And it is going to end in tears,” wrote Capital Economics’ chief North America economist, Paul Ashworth.

“The Bank’s claim that the risk of a housing downturn is small because there is little risk of either a spike in the unemployment rate or a jump in long-term interest rate risk premiums is naïve in the extreme,” he added.

Plus, he pointed out that the gains in housing prices in these regions now “far exceed” those in the US at the peak of its housing bubble.”

http://www.businessinsider.com/canadian-housing-bubble-2016-6

Deryk,

Good point.

A better way to phrase this point is how many homes have an average price (or assessment) above a few different benchmarks.

2011 census has 300,000+ homes in greater Vancouver. Same census 65,000 in Victoria.

Scale?!

Interesting that the article on the round table discussion on Vancouver real estate makes the usual mistake of saying that the “Average price of a Vancouver home is $1.5million” when in fact …..that is more like the average price of the “Greater” Vancouver region and not the “Vancouver” region. The difference is several million dollars. A post war, tear down house in Kitsilano is more like $2.5 million. So why do I see this mistake being made in just about every article I read on the subject? The difference is staggering and it would help people understand the scale of the problem in “Vancouver”.

The last three days we have seen 52 new detached house listings to 27 sales in the core districts.

Median price for a house in the core so far this month is unchanged from the previous several months at $758,000

At the same time condos in the core saw 29 new listings to 31 sales. The median price for condos is up to $339,000 so far this June.

I appreciate all of the commenters on here. A lively discussion with different perspectives.

By and large, Michael says the craziest s&$! on here out of everyone, and out of everyone since he started posting about 1 year ago, his predictions have been by far the most accurate.

I’m not saying it hasn’t happened…I’m just amazed by the histrionics constantly on display here. Sure it’s possible for everything to go tits up. And? There’s so many assumptions followed by spurious conclusions thrown around here, followed by insults back and forth. Very strange.

By the way I’m not a ‘perma hawk in the development industry’…far from it. But you cherry pick and selectively hear things.

I think they will actually. There is a pretty decent pattern of affordability getting very bad, then correcting for many years, then getting bad again. Unless we assume that foreigners will drive the entire market, that will likely continue.

In my opinion, affordability is one of the key factors. Prices are more or less irrelevant because people buy a monthly payment not the full price. Once that monthly payment can’t be carried, it has to go down.

Speaking of affordability and personal experiences that help make this blog so enriching:

I happen to keep all my financial records dating back to when I bought my house in Oct 2008.

Under the cover of anonymity I have no problems disclosing we purchased our 1940’s house for $435,000 with 20% down, and I mean, EXACTLY 20% down. There was nothing left over to pay the property transfer tax $6700, the new washer/dryer $2800 (sellers took their snazzy Miele appliances), the house insurance $740, the house inspection $394.25 and the appraisal $315, which all went on the unsecured LOC. Within 1 mth of moving in we also had a heat pump installed to the existing oil furnace for another $8032.50. So on top of the mortgage we now had $18,981.75 of debt on the LOC.

At that time our family income was $87,500, our mortgage was originally set at 35 years, and the rate was 5.769%. Our monthly mtg was $1912.58 or 26% of our gross income. Doesn’t sound that bad, but once you threw in the prop taxes and the mtg life insurance (we didn’t know any better then), it came down to 40% of our NET income. We were also paying for 2 new cars, 20% of our net, and paying about $500/mth on that darn LOC, so 9% of our net. Once we added insurance on those 2 vehicles, cable, phone, internet, hydro, cellphones we were left with about $900 for food, gifts, household, clothes, gas, other.

I found this to be pretty tight for our family of 3, and we didn’t even have daycare costs! So after a few months we sold the second vehicle even though it meant I had to pony up another $1500 to pay out the car loan.

Fast forward to 2016 we are in a MUCH better position financially, but I thought this was a pretty typical scenario for a first-time homebuyer. Perhaps someone househunting and landing on this page may find it applicable to their current situation.

JD, these things really happened to people – when real estate dropped or stagnated for many years, and the economy turned sour, people lost jobs, they had to move and sell at a loss. I think Hawk is just trying to say people need a safety buffer, that has to make them through difficult economic times, sometimes for years,and the sad thing is a lot of people have been convinced that they don’t need one.

I dunno when I was in my 20s and 30s I took history seriously. There’s some experts that say people can’t plan for worse times anymore because they’re living too much in the present, influenced by bank marketing and HGTV.

Fictitious ? LOL. How about the reality of a whole country’s economy tanking ? A major recession causes massive job losses last time I looked. Another perma bull in the developer bizz who can’t handle the truth.

“If prices drop 45% there’s a good chance you are in negative equity, a chance of unemployment or forced into lower income job…”

Sure, I mean, why stop there. Let’s create a whole fictitious scenario and then get upset by it. Also, my dog died and Hoyne went out of business.

JD,

If prices drop 45% there’s a good chance you are in negative equity, a chance of unemployment or forced into lower income job, plus you would have a serious chance the bank will make you pony up cash on mortgage renewal time. If you got a HELOC with any of the above , you are screwed.

Banks are lending 60% of take home pay. If one of you loses your job even now, and can’t find new work in a hurry, you are in a dire predicament.

“So what ? A 45% drop would probably wipe you out along with half of Canada. Is this the New Paradigm thinking ?”

If you bought your house to live in and are not a speculator, and can afford your mortgage payment, it really doesn’t matter. Just as you cannot directly benefit from your house’s paper gain, likewise you would not ‘be wiped out’ if the market corrected.

“The market goes down 25%? So what. Goes down 45%? So what. ”

Triple A,

So what ? A 45% drop would probably wipe you out along with half of Canada. Is this the New Paradigm thinking ?

As per Cassidy Olivier @cassidyolivier 1h1 hour ago

Coming out of roundtable, attendees say Trudeau expressed sense of urgency, willingness to take heat if measures unpopular

Thank you for those who appreciate my posts. I try to show the reality, as I have been a homeowner several times since the late 70’s and have seen the peaks, the valleys, the joy of home ownership and unfortunately the pain of friends and family who got in at the wrong time over the years and paid dearly, some in bankruptcy and divorces.

I also have family looking to get in now and it scares the shit out of me but thankfully they are priced out for the time being.

I plan to be a future homeowner for a good chunk of the rest of my life but at a reasonable price, not in some over bloated, over pumped market built on a false economy of easiest credit in history and foreign money that can change on a whim.

As Cadborosaurus just posted, Justin’s round table discussion sounds extremely serious he is about to something that won’t be popular. Let’s hope he does the right thing.

To those trash talker homeowners who come here to have their hands held because they all think they are rich forever, and don’t like me posting the latest news written by the Bank of Canada, CREA, BMO, TD, BNS, bankruptcy trustees, economists, and other independent sources with zero bias from the real estate industry, you can put your comments where the sun don’t shine.

Last time I looked this blog was for sharing opinions and real estate news that’s happening today, not yesterday. Seems the new homeowners don’t like the reality of a bubble popping which is your problem for jumping into the frying pan, not mine. You could always start a support group on your own blog. 😉

http://www.bnn.ca/News/2016/6/17/Ottawa-action-on-Vancouver-housing-could-backfire-elsewhere-Trudeau-warns.aspx

from the interview.

Basically we got a problem but we like the capital inflow and we do not want to damage the economy so we are going to take awhile to study and talk and talk and talk some more.

The catalyst will not be government action or interest rates. Economy is the wild card.

TripleArated, a lot of people come here to read the general market analyses too. Many posters who have bought years ago repeatedly post about the general state of the market – this blog is very useful because it helps confirm news reports through personal local experiences.

From Admin’s post in the “About” area, it’s about “a lively exchange of opinions about real estate”

•examining the financial and social trends affecting real estate in Victoria,

•exchanging information and experiences regarding home purchasing and ownership, and

•allowing a lively exchange of opinions about real estate.

Hawk I appreciate your posts and articles they are a breath of fresh air compared to the “buy now before the houses are all 1 million!” Delusional opinions I seem to hear on here and from family and friends on a daily basis. We will be one of those families getting into a house with 5 – 10% down and signing our lives away to the bank so it’s nice to see some hope of a correction coming.

I was reading today that Trudeau is in Vancouver discussing their housing crisis… although not directly affecting Vic, some Fed controls of the global foreign investment capital should have some indirect positives for us looking to buy in Victoria. I wonder what they’re thinking of doing now? It might be too little too late.

Article by a real estate lawyer – explains why so many people are willing to keep out-bidding each other, re-selling, out-bidding again – he describes the money laundering scene and how it’s impacted prices:

https://www.linkedin.com/pulse/cooling-off-bc-real-estate-market-from-top-down-kenneth-pazder?trk=mp-reader-card

“the only explanation which seems to make any sense is that some foreign purchasers are using the Canadian real estate system to launder their money.”

“Once a house is purchased in BC the seller has effectively washed it and it can be moved anywhere in the world easily by selling the property (as the seller then has the contract of sale and all the documents necessary from the lawyer’s office to “prove” that his funds came from the legitimate sale of Canadian real estate). ”

“Stemming the flow of dirty money into Canadian real estate would terminate a number of high end purchases, which may push down some of the prices at the $10M – $15M range which would in turn push down the medium high end prices and so on …”

“As the BC government is perpetually short of money for every worthwhile endeavor (hospitals, schools, pubic housing, seniors, homeless shelters, transit, mental health, child poverty -the list is endless), it would seem obvious … to increase Property Transfer Tax and municipal property taxes on foreign buyers …

An appropriate rate would be perhaps 20% Property Transfer Tax and triple current property taxes for those who choose to evade paying Canadian income tax”

(Agree – enjoy reading Hawk’s posts and everyone’s sense of humour on here. Without differences of opinion it would be a tad boring.)

Michael ignore Hawk. He is just bitter he missed the upswing and is hoping that we see an unraveling of the market for his benefit. He is getting tired of the apartment. Keep posting and just ignore him.

“…24 per cent of all insolvencies we performed were for people who owned a home.”

Do you even read the articles you post, Hawk?

Huffington, Zerohedge, Profitconfidential… They’re all the same. Written by freelance (emphasis on free) journalists that spin negative news for their own benefit. They sell ad space just like everyone else and your repeat visits to those sites are generating more revenue for more bad publishing.

This site is dedicated to people that have decided to purchase a home in Victoria and want more information on neighborhoods and amenities. This isn’t a website dedicated to self proclaimed housing prophets. The market goes down 25%? So what. Goes down 45%? So what. Yes, there are always going to be speculation that drives a certain portion of the market. But to keep hammering us with how indebted every single buyer is insulting to anyone who’s worked hard, saved hard, and done due diligence.

From time to time Hawk has the odd article that I find helpful. But lately it’s becoming personal against other posters within this site who are providing information to others that you disagree with.

Not my intention to cause any grief on here, I just like discussing the market and trying to predict/profit from where it’s headed. If it weren’t for investors/capitalism we’d still be in the dark ages for standards of living. Simple example, our latest acquisition more than doubles the number of people that will be happily living on a fully updated property, thereby reducing pressure on the overall market.

Hawk thank you for all you are doing. There are many that think just like you, with a lot of cash waiting for the inevitable. Oh what fun will be to watch all those indebted people trying to get rich with zero brain investment

Hawk not to bitter are you! Maybe go for a walk and get out of the apartment will make you a tad less upset at the market

BTW even your TD article said do not expect anything before 2017. Not exactly pop at anytime. LOL

“Interesting how after the last oil crash of ’86, Alberta saw 7 straight years of out-migration.”

You mean more people with no jobs and no money are moving to Victoria ? What happened in 1941 ? 😉

Here’s a good bankruptcy trustee for you Mike. I see you’re on overtime today at the office with all the open houses lined up. Good time for potential buyers to reflect on the ugly side when this market begins to tilt downward as the banks say it soon will.

Don’t Let Real Estate FOMO Set You Up For An Ugly Bankruptcy

“Real estate agents can talk about the upside of buying right now, but they don’t explain the downside of carrying massive debt. Yes, you may build some equity if you purchase a home, but if you’ve mortgaged 90 per cent of it, very little of your payments in your first five to 10 years will go towards repaying principal.

Yet, during this time, you will have other financial pressures: houses need repairs, property taxes go up and children come along. The economy can (and will) turn on a dime, threatening your job. Illnesses happen. I see many clients who, because of these uncontrollable events, find themselves not only heavily mortgaged, but deep in credit card debt as well.”

http://www.huffingtonpost.ca/douglas-hoyes/real-estate-debt_b_10457316.html?ncid=tweetlnkcahpmg00000006

Thought this bar chart was worth posting. Helps explain our market.

http://i.cbc.ca/1.3639625.1466117969!/fileImage/httpImage/image.png_gen/derivatives/original_620/alberta-provincial-migration.png

Interesting how after the last oil crash of ’86, Alberta saw 7 straight years of out-migration.

Vicbot, here’s the link for the 7.2% wage growth in ‘Occupations in education, law and social, community and government services’.

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/labr69k-eng.htm

Thanks for posting these. The reason Victoria’s pop growth is so low of course, is we don’t have the land like Langford to grow. Hence why Langford & Surrey are usually the top two cities in BC for pop growth.

Another big 5 bank says the bubble is going to pop anytime. You know they are tightening the lending screws by the hour. Turn out the lights, will ya Mike. 😉

Canada’s hot housing markets ‘ripe for correction,’ TD says

“Canada’s hottest housing markets are “ripe for a correction,” a major bank is cautioning.

In its latest quarterly economic forecast, TD Bank said that while housing investment currently remains strong, “the party will come to an end.”

http://www.cbc.ca/news/business/canada-td-outlook-1.3640368

This information below was published by BC Business magazine in Dec of last year. They rank the best places to work based on income, income growth, population growth, etc. every year. Link: http://www.bcbusiness.ca/hot-lists/best-cities-for-work-in-2016-the-ranking

The list works the better the city to work in the further down the list you go. What’s important to see here is for example the population growth of a number of these areas. Compare for yourself the average income of North Vancouver of $130,000 vs $88,000 in Victoria. As much as some posts here want to believe that house prices alone have rewarded people from Vancouver, let’s face it, they have much higher paying jobs. Even those under 35 have much higher incomes which is why you’re seeing some of these folks cash out and move over.

Also, look at the population growth. Most areas are double or triple Victoria’s growth.

Victoria

Avg income $88,263

Under 35 $62,778

Unemployment 6.6%

Population growth 3.7%

Vancouver

Avg income $88,024

Under 35 $63,922

Unemployment 6.1%

Population growth 3.7%

Richmond

Avg income $87,026

Under 35 $69,385

Unemployment 6.1%

Population growth 6.5%

Kelowna

Avg income $87,555

Under 35 $68,245

Unemployment 6.8%

Population growth 5.7%

Port Coquitlam

Avg income $100,569

Under 35 $79,326

Unemployment 6.1%

Population growth 6.9%

Delta

Avg income $108,061

Under 35 $88,946

Unemployment 6.1%

Population growth 4.6%

Surrey

Avg income $95,139

Under 35 $73,228

Unemployment 6.1%

Population growth 10.9%

Langley

Avg income $107,591

Under 35 $92,294

Unemployment 6.1%

Population growth 9.5%

Coquitlam

Avg income $94,205

Under 35 $72,190

Unemployment 6.1%

Population growth 8.3%

Squamish

Avg income $99,174

Under 35 $72,217

Unemployment 6.1%

Population growth 10.4%

North Vancouver

Avg income $130,035

Under 35 $114,479

Unemployment 6.1%

Population growth 5.3%

Vicbot,

As you notice Mike has a tendency to BS 99% of the time. The other 1% is up for debate. His overtime blogging bill for Marko will be huge. 😉

No one got 7% wage hikes in teaching or government services unless your on Christy Clark’s deleting team.

Meanwhile the people who keep the machine working are in decline unless you are in the low paying tourism short term/ part time jobs. The nurses like all unionized public sector workers only got 1% wage hike or nothing, and that speaks louder in an aging demographic.

Construction jobs down 4700 positions is major red flag as well as the backbone transportation industry.

“There were declines in the transportation and warehouse sector, which dropped to 5,700 positions from 7,900 in 12 months.

Also, jobs fell to 7,000 from 9,800 in the information, cultural and recreation category.

Construction jobs slid to 10,000 from 14,700.”

Michael, the link you included doesn’t show May 2015 to May 2016 – it seems to only show data to 2013, and 2012-2013 is 3.6%. All other data shows Canadian wages are falling behind inflation, and private sector earns less than public sector.

eg., this press release from Stats Can shows a 0.4% increase YOY to 2016.

http://www.statcan.gc.ca/daily-quotidien/160331/dq160331b-eng.htm

“Compared with 12 months earlier, average weekly earnings were little changed (+0.4%).”

Wages not keeping up with inflation:

http://www.statcan.gc.ca/daily-quotidien/160219/cg-a003-eng.htm

More in this article here:

http://www.huffingtonpost.ca/2016/04/04/inflation-outpacing-wage-growth-earnings-shrinking_n_9611794.html

“That’s far slower than inflation. The consumer price index shows prices were 2 per cent higher in January than a year earlier. This suggests inflation-adjusted wages have fallen by some 1.6 per cent over the past year.”

Also, gov’t workers have notoriously higher salaries & higher increases than private sector.

http://www.ctvnews.ca/canada/private-sector-workers-earn-less-work-more-report-1.2292650

“The average public sector employee makes 18 to 37 per cent more than a comparable employee working in the private sector, according to a new report from the Canadian Federation of Independent Business.”

The reason why Vancouver’s median is lower than Victoria’s is probably because of the higher population of lower wage groups in the service/manufacturing/retail industries.

Cool.

Yeah I think it’s reflected in the data; I just don’t think it should follow that SFH price gains will drop off once they’re considered to be unaffordable. Affordability in the present configuration isn’t always what drives land prices – as is clear it’s often speculation through land assembly and such. I think this is an under-appreciated factor in Vancouver land prices; there is an inevitability to density. We have such immense political pressure to maintain core area SFH in Canadian cities despite this being increasingly unrealistic. Whether this is a crisis which will end in a correction alone is debatable – I tend to think that densification will be a significant factor in maintaining affordability.

Wage growth will help keep us affordable. For example, 7.2% jump in wages this past year (May to May) in BC for ‘Occupations in education, law and social, community and government services’.

I would think Vic now has one of the highest median incomes, next to Ottawa – also surprising how much higher Vic’s household income is than Van’s.

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/famil107a-eng.htm

Would definitely be good. Needs more access to data.. I’m working on it. Probably around Fall timeframe.

I think your comment about SFH affordability is reflected in the data. As the city densifies the band of how much of the average income it takes to buy an average SFH goes up.

I’ll do the same thing with condos, I bet it would not be increasing to the same extent, but we also have less data there..

Has anyone used floor area rather than SFH as an affordability measure? Using SFH as a benchmark for affordability is flawed when you consider a growing population and a finite land supply. It’s also a very crude measure when you consider the variability in SFH. I don’t think that maintaining the assumption that people should be able to afford a house is realistic; what you see in larger centres, traditionally, is not the erosion of affordability alone so much as the erosion of floor area per unit and the increase in density in order to maintain affordability.

More scum developer/agent behavior coming out of the woodwork. I’m sure it’s happening here as well. Correct me if I’m wrong but I recall JJ exposing this sleazy activity a long ways back.

Vancouver condo developers shutting out average buyers with insider sales

“Major condo developers in Vancouver are shutting out average buyers by selling their most affordable new units privately – to clients of select realtors and “family and friends” – before their advertised sale dates, The Globe and Mail has learned.

The typical sales contracts also allow those insiders to legally flip the units under construction (known as presale) before closing as long as the developer gets a cut from that transaction. Like shadow flipping with houses, flips of presale condos have been controversial in Vancouver. When supply is scarce and prices are escalating, flipping leaves buyers who want units to live in feeling ripped off or shut out.”

Several realtors told The Globe deals with insiders are widespread and quietly encouraged by developers. In Vancouver’s wildly expensive market, it is yet another obstacle for people who feel the deck is stacked against them.”

http://www.bnn.ca/News/2016/6/17/Vancouver-condo-developers-shutting-out-average-buyers-with-insider-sales.aspx