June 6 Market Update

Weekly stats update courtesy of the VREB. Thanks to Just Jack for sending these while Marko is on vacation.

| June 2016 |

June

2015

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 187 |

910

|

|||

| New Listings | 226 |

1346

|

|||

| Active Listings | 2354 |

4003

|

|||

| Sales to New Listings | 83% |

68%

|

|||

| Sales Projection | — | ||||

| Months of Inventory |

4.4 |

||||

Start of the month is where we see a jump in new listings, but we are still at a high sales/list. However months of inventory is taking a tick upwards, and sales/day are still down at the same level as last week. This could be either the start of the fall slowdown or just a symptom of inventory getting down to such low levels that there isn’t much left to buy.

New post. What’s up with the increase in condo sales? https://househuntvictoria.ca/2016/06/09/the-not-so-remarkable-increase-in-condo-sales/

Ash seems like a total gut. Layout looks choppy and small lot. Although I still think in that area would have gone higher. Deals are still available.

2313 Foxington Pl just sold for 790k. To me this looks like good value in this market given the location (Arbutus/ Queenswood area). Shouldn’t this area go for a premium above GH?

BTW Mike, what happened to 1984 to 1994 period? Guess you had to chuck that one out. Next it will be the Mexican war and the Civil war period. Looks more the Tulip Bulb period to me but your chart skipped that one. 😉

Mike, put down the pipe dude. The ponzi scheme is coming to an end. 1% to 2% interest rate rise will crush the housing market as well as emerging markets. You are truly clueless.

re: rates

It’s not different this time. Bond markets follow a ~60yr cycle, so we’re about to enter a 1947-1981 period where both mortgage rates & home prices went up approximately 10-fold together. The 10-yr bond yield bottomed in 2012.

http://www.ritholtz.com/wp-content/uploads/2010/09/60-year_Cycle.gif

An interesting statistic from a Bank of England economist: we now have the lowest interest rates in 5000 years.

http://www.globalresearch.ca/worst-economy-in-5000-years/5529911

So is it really different this time? Are rates about to plunge on down into negative territory? Or we about to see a reversal in the secular trend, with rates rising and house prices falling for decades to come?

It may be fair to say that Japan’s yen manipulation contributed to the asset bubble, but it wasn’t the direct cause. A major factor was loose Japanese bank lending to both individual households & corporations.

Also, the value of the yuan isn’t the only thing that’s affecting China’s economy – it’s been corruption & manipulation of stock markets & real estate, to the point where companies are defaulting on their debts and there’s a huge over-supply of real estate, with people only now beginning to realize that they don’t even own the land underneath their real estate holdings – it’s a big economic mess. Added to that, there’s an over-population of males, affecting birth rates and also potential unrest.

“China has no intention of crashing their economy to appease the Americans”

They are doing a fine job themselves as they build ghost cities, steal software and other copyrighted materials etc while changing to a consumer society from a producer society. They are pouring trillions into debt to pay off previous bad debt.

They are just like Japan, an aging demographic nightmare.

China’s Coming Demographic Crash

“It’s already too late,” says Yi Fuxian of the University of Wisconsin-Madison and a critic of Chinese population policies. “China’s population is aging quickly and will start to shrink soon.”

“Speaking to the South China Morning Post, Yi predicts that China will soon find it difficult to increase fertility, and he looks to be correct. Once declining birth rates are baked into a society, they are extremely difficult to reverse. Governments can provide subsidies, but payments only accelerate births that would have occurred anyway. Even the removal of birth restrictions may not mean much when relentless indoctrination has taken hold, as it has in China.”

http://www.worldaffairsjournal.org/blog/gordon-g-chang/china%E2%80%99s-coming-demographic-crash

Hawk, you’ve got that 1980’s Japanese issue a bit wrong and a bit right. The Japanese economy was strong in the 1970’s and early 1980’s, and the Japanese were swamped with cash and they started to use that cash to buy hard assets abroad. Sound similar to China today? But here is where the similarity ends; the Americans started threatening Japan that they were manipulating their yen value, keeping it low, to gain an unfair advantage in the global economy, so the USA threatened Japan with massive penalties unless they allowed their yen to appreciate in value. Japan eventually complied with the American dictate and allowed their yen to appreciate in value to the point where Japanese workers were earning roughly the same pay for the same work as their American counterparts. In other words, a typical Japanese person’s annual salary closely matched the typical American salary for similar jobs, housing costs were about equal in both countries, monthly grocery bills were about equal, a new Sony tv cost the same in both countries, etc. By rapidly increasing the value of the Japanese yen, the Japanese economy crashed and has never fully recovered. The vacuum created by the Japanese crash was quickly filled by China.

Now here is the huge difference: when the Americans ordered Japan to quit manipulating their yen to gain an economic advantage, the Japanese complied, albeit reluctantly. But when China, in recent years, was ordered by the Americans to quit manipulating their yuan, the Chinese told the Americans to PFO (please F-off). China has stuck to international currency standards with their basket of currencies setting the value of the yuan and the Chinese have repeatedly exposed the currency manipulation tactics of the Americans. China will not kow-tow to the Americans like the Japanese did in the 1980’s. Japan was forced to appreciate their yen by almost 300% (from 300 yen per dollar to 100), whereas China has appreciated their yuan from about 8yuan to about 6yuan per USD. China has no intention of crashing their economy to appease the Americans, who are the real currency manipulators, even the Wall Street Journal has articles on the American manipulation of the USD, but this article says it clearly.

https://m.mic.com/articles/17742/ron-paul-warned-us-united-states-not-china-is-biggest-currency-manipulator#.kClUEHLkk

So far this month there have been 407 new listings, 348 sales

74 price reductions

13 price increases

77 expired listings

Median price so far this month for detached houses in the core districts is down to $739,000 from $760,450 in May.

In contrast median condo prices in the core are up to $359,700 from $325,000 in May.

“Vancouver will drop. Victoria will rise.”

Well, that would be the first time in history but highly improbable. The bulls are getting out of control and need some prozac, making outlandish predictions based on…… hmmm, what is it based on ? First time buyer wing and a prayer. 😉

I’m not so sure. BC business magazine published a set of tables about 6? Months ago. Broke Municipalities down, and also separately for under 30. Was a great read and very informative.

I see now how Stats Can can be misleading. I’m more bullish than before on Victoria either way. As Hawk will tell you, investments climb a wall of worry

Triple

Victoria family income is higher on here than Toronto and Van

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/famil107a-eng.htm

I 100% agree with gwac.

Prices in Kerrisdale are now $3.5-$4.5. Basic tear downs are $2.5.

Median income in Vancouver is only 20% higher, yet ‘comparable sales’ are 3x+ higher.

Vancouver will drop. Victoria will rise.

db,

Don’t think all the hundreds of couples with a little one in the oven, and bank of ma and pa in tow, lining up to overpay 100’s of thousands think too deep about fiat currencies. Most probably don’t know what the word fiat means. They are caught up in FOMO,HGTV, and media hype.

It’s not different this time, every bubble has a crater as the BOC honcho says. With so much effort by all sources of banks,economists and government, they will pop this sucker one way or the other then blame you the borrower for being so stupid.

Market crashes are inevitable and great at cleaning out the greed like they have for decades.

http://www.zerohedge.com/news/2016-06-09/visual-history-all-market-crashes-1956

I’ve been meaning to explain why my premise is that those FATCA targets won’t sell..

SO here it is in a most simple analogy.

Say you have an Apple Pie… (ie: the Apple pie is your house)

In Canada you can sell the Apple pie and get a bigger or smaller Apple pie with the proceeds (less commissions), either pocketing the value or not, or simply buying another Apple pie, or Lemon Merengue as my wife is more likely to appreciate.

Now with FATCA, the IRS is going to go after you for their slice of the pie…So you are not going to get another Apple or Merengue of equal value…

So naturally, if you know you are going to be targeted for a big chunk of that pie… You are more likely to just put it in the freezer and tell the IRS to go eat someone else’s pie…

Unless you are a masochist…

So no, I do not see FATCA as an incentive to dispose of Beautiful British Columbia property in a mass exodus…let them eat cake 🙂

I think Victoria and Vancouver are completely 2 different markets. I have no issue with Victoria pricing and would buy now. Market has not moved in 7 or 8 years so a 50% up move is conceivable.

Vancouver I would not touch. That is scary. Guy said on bnn said you can look up at some condo buildings at night and there are little to no lights on.

Victoria people are living or renting in what they buy it is not sitting empty.

BOC has not raised rates in close to 8 years. Mind boggling how pathetic the world economy is when they are basically giving money away. This happens when you try to micro manage the economy and do not let natural events happen. In all this home prices keep rising. NASDAQ is still around its 2000 high. Not sure how this will all play out but I think we are in for some interesting times.

Triple A,

Your article’s a year old and right before the Chinese stock market blew up last year. The cat’s out of the bag and they have a debt bomb worse than the US in 2008.

Pity Poor China: There’s No Easy Fix To The S-Curve

This decline is inevitable in fast-expanding economies that depended on export growth and investment booms.

“The fundamental context of China’s economy is that it has traced out an S-Curve – as did previous fast-developing nations such as Japan and South Korea.”

“As the economy weakens, everything that worked in the boost phase no longer works: expanding credit no longer boosts growth, inflating yet another real estate bubble no longer generates a widespread wealth effect, and every effort to shift from being an export-dependent economy to a self-supporting consumer economy fails to achieve liftoff.”

http://www.zerohedge.com/news/2016-06-09/pity-poor-china-theres-no-easy-fix-s-curve

Crunchy Clark is hoping the election will come and go before the real estate SHTF so she can pretend the BC economy is doing ok. She needs something, Northern Gateway is dead, the world has a natural gas glut with Oz and the USA already operating half a dozen or more LNG terminals while BC and Canada blow smoke.

http://www.marketwatch.com/story/is-china-really-so-japanese-2015-06-23

An insight to China today vs. Japan in 80’s since you brought it up.

Hawk

Have you seen the debt clock? http://www.usdebtclock.org/

Notice they added something new – Gold and Silver

Now don’t go negative on me… I am only the messenger

But they even admit something horrifying when you see what they have done to the dollar…

I am sure you will figure it out…(you are good at that)

Are we basing all economic (101) decisions on a fiat paper system where the casino owns the chips and prints as many as they want…there is just no way to check out of Hotel California with those chips though 😉 just keep dancing 🙂 such a lovely place …

https://www.youtube.com/watch?v=iqODbP1T3nk

Hawk,

That’s a picture of a completely generalized Penny Stock or Pink Sheet. I believe your MO here is to educate anyone who’s planning to buy property in Victoria as an “Investor” that the smart money is coming off the table.

I don’t know what sector you bring to the table but do us a favour and work out over a 5 year period how much say, a $1M property would have to go down before Renting would be preferred over buying. And for fun, what if you could also add in the maximum pay down annually on a fixed mortgage of 10%.

Try to imagine that most of us here have a degree or two, and/or common sense. I feel like grabbing an umbrella when I read your posts.

I’d be saying the same thing Mike, if I was up to my ass in maxed out debt. You’re in the denial phase, even the bankers who lend the money say it’s “passed the peak”.

http://2.bp.blogspot.com/-ZWsQNhB12M4/Tf161ZP8iFI/AAAAAAAAAu4/iEFXxNao1KU/s1600/800px-Stages_of_a_bubble.png

Tardeau & Moroneau won’t do anything to the housing market other than jawboning. Most of Canada is flat or falling (and yes, we will continue rising).

CuriousCat, it’s also unusual for Robertson, Trudeau, Poloz, and Morneau to all make public statements about the housing market within the same 2 or 3 days, like they’re sending signals to banks & buyers to prepare for new rules coming in, whatever those may be … (unless it’s just all talk again!)

Vicbot, I read that sentence and raised my eyebrow as well. Are they trying to tell the lenders they shouldn’t lend based on selling prices? Don’t give out HELOCs? It’s kinda vague. If they want to implement more guidelines, they should do so, not make these cryptic statements.

Leo S, any regulatory changes will probably end up coming from the federal govt, as I think Christy Clark is too scared to rock the boat and anger the real estate machine. She doesn’t even want to admit there IS a problem.

Interesting comparison to when Japan was supposed to be taking over the world in the late 80’s with their endless pot of cash and everyone was freaking out as they bought out US banks, real estate etc. We all know how that ended.

Credit crater spreading under Canadian asset markets

“Many naively believe/argue that home buyers can ‘afford’ these prices or that Asian cash buyers are an endless stream. The same foolish thinking was dominant in the late 80’s as Japanese buyers moved capital into North American real estate and out of their own bubbling markets at home. This chart shows what happened to realty prices in both the US and Japan over the full cycle. If Canadian realty was included, it would show similar movements both in the 1985 to 1995 period, and also in the price boom between 2005 to date.”

http://jugglingdynamite.com/2016/06/09/credit-crater-spreading-under-canadian-asset-markets/

How much did 951 Claremont sell for? Thanks

Hawk, maybe that comment was supposed to be directed to StepbyStep? but yes, the 4% may have driven up prices, like in Vancouver (friends had personal experience with this), and in Tony’s own words, “those buyers are willing to pay ‘top dollar!’”

Interesting Poloz’s warning: “prospective homebuyers and their lenders should not extrapolate recent real estate performance into the future when contemplating a transaction.”

http://www.theglobeandmail.com/report-on-business/economy/bank-of-canada-financial-system-review/article30363984/

“I think there is going to be big regulatory change this year, either federally or provincially”

For the sake of sane real estate markets I hope you are right! I am betting on some fairly token changes that won’t really dent the housing market but will allow government to say that “we are being prudent”.

I do believe some significant changes could be in store for how RE agents are regulated in BC. That would be a popular move and wouldn’t really directly affect the market.

Poloz says the risks of a correction are increasing as he sits in his chair. Buying now thinking prices will keep climbing are going to be disappointed.

The bubble is about to be popped with talk of increasing just mortgage rates and banks being forced to take on more risk. Banks won’t like that and will be the beginning of the credit squeeze I have mentioned many times as the key catalyst.

Vicbot,

I would bet that 4% were the ones paying the highest prices pushing the average prices up which is what is happening in Vancouver, and showing up here as well as the Tony’s and others try to sell us out.

Government is always the wildcard out there that has the power to make or break the market very quickly. I think there is going to be big regulatory change this year, either federally or provincially.

@Hawk re: New Zealand – it’s 4% of buyers:

“The evidence is that foreign buyers are a negligible impact on the housing market.”

Dr Smith said he was not worried about the move, or any signal it sent about the housing market and risks within it.

Data released by Land Information New Zealand (LINZ) last month showed that 474 out 11,955 houses sold between January and March went to non-residents.

Coming soon to Canada ?

New Zealand banks shut out foreign buyers

“Westpac and ANZ will no longer lend to overseas-based buyers of New Zealand property – with other banks expected to follow the move to shut the door on foreign investors.

The restrictions follow moves by Australian banks to stop lending to foreign buyers of property.

Westpac New Zealand has announced that from today it will no longer lend to non-resident borrowers with overseas income.

Borrowers on temporary resident visas will only be accepted if they have both a New Zealand address and a New Zealand-based income.

ANZ has also announced restrictions that will effectively shut out most non-resident, overseas-based borrowers, including restricting lending to owner-occupied properties.”

http://m.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11653623&ref=NZH_Tw

http://www.bnn.ca/News/2016/6/9/Trudeau-Canadas-hot-housing-sector-a-real-drag-on-Canadas-economy.aspx

Triple/Vic/ Curious

Some great posts on here today.

As I get older all I want is time to enjoy things. Most of those things cost zero.

Vicbot,

Good post.

How about just providing a decent life for your family. If happiness is a moving target you’ll never be happy. When I was younger I looked up to those clowns who drove expensive cars, souped them up and drove endless loops around Wharf and Govt streets. So I spent all my hard earned cash with no loan and bought a late model sports car. And I drove the living piss out of it. Sure enough, I blew the motor twice in 2 years. But I was living fast, and not actually dying young. I spent stupid money on stupid things like $500 Decks and 12″ Rockford Subs. Yes, that was me. Same guy who annoyed your neighbors went out and had the best times at places like the Boom Boom Room, Darcy’s, Sugar and Legends. Let’s face it, it was a much different Victoria. One prior to smartphones and Tinder where a Triple Gin and Tonic cost $1.50, and Denny’s grand slam was, well, free if you could run fast enough.

At some point, you get your _____ together and figure it out. That it’s a hollow life trying impress anyone, or keep up with a Jones. Strangely, anyone with a last name Jones was, well, normal, and strikingly now, very dateable, and probably making a great spouse somewhere just being a Jones.

I was told by a friend of my late grandfather that people out here on the West Coast just don’t know how good they have it. And truthfully, he was right.

Victoria has changed, is changing. Neighborhoods won’t be what you remembered them as. But maybe that’s a good thing and can keep us focusing on the only thing that matters. Sharing your memories with your closest friends and family.

“The fact that “number of luxury vehicles” is a factor in the best places to live equation is seriously screwed up.”

Agree, that’s a weird metric – you probably have more luxury vehicles per capita in big city gangsta neighbourhoods. Even the “Access to health care” is not defined, eg., Ottawa gets no checkmark but Saanich gets a checkmark, yet no definition.

As for keeping up with the Joneses, every neighbourhoood on earth has those showoffs – whether it’s Langford, Oak Bay, or Saanich. Be it their houses, monster boats/trucks, or Italian suits. I think happiness comes from being happy for those who have prospered and generous to those who haven’t (and celebrating every one of your own successes!)

The fact that “number of luxury vehicles” is a factor in the best places to live equation is seriously screwed up. It’s pretty much a proven fact that keeping up with the Joneses is a happiness reducing activity.

Garth has never been wrong. Trudeau will do nothing that will impact this all ready fragile economy. You can bank on that.

According to Garth tonite, Justin is about to pop this bubble with a big shiny new housing policy, going after the foreigners as well as easy lending via CMHC…..told ya. Mike better get busy polishing up Marko’s for sale signs. 😉

Curious nice analysis

Last Tidbit. Nobody seems to care what people do for a work here. The least amount of work is like a badge of honour. Oakville what you do defines you to others. Oakbay is closest to Oakville. Whenever I hear I live in oakbay and my kid goes to Glen or mikes. I just roll my eyes. It only seems to impress other people living in Oakbay. Nobody else gives a shit.

“Only thing I miss is my snowblower. I loved using it.”

The most Canadian thing anyone’s ever said on here.

Oh ya. The weather is the worst here. So much better in AB…. Good grief. The climate here is one of the best on earth. Clean air, water, not too hot not too cold, summer days in Febuary and September, gardens grow, cars don’t rust, people don’t age. Only problem is the people from out east in shorts and a t-shirt in the winter complaining about the “wet cold”….

Interesting observation about the cars, and supported by the facts!

Oakville:

Vehicles 2013 Model Year Or Newer: 23.7%

Luxury Vehicles 2013 Model Year Or Newer: 1.15%

West Vancouver:

Vehicles 2013 Model Year Or Newer: 23.0%

Luxury Vehicles 2013 Model Year Or Newer: 1.25%

Winnipeg:

Vehicles 2013 Model Year Or Newer: 19.3%

Luxury Vehicles 2013 Model Year Or Newer: 0.66%

Saanich:

Vehicles 2013 Model Year Or Newer: 11.7%

Luxury Vehicles 2013 Model Year Or Newer: 0.55%

Victoria:

Vehicles 2013 Model Year Or Newer: 10.7%

Luxury Vehicles 2013 Model Year Or Newer: 0.55%

In BC nothing beat Richmond:

Vehicles 2013 Model Year Or Newer: 26.9%

Luxury Vehicles 2013 Model Year Or Newer: 1.30%

The only other cities to go above 1% for luxury vehicles were Vancouver BC (1.03%) Grande Prairie AB (1.05%) Aurora ON(1.17%) Vaughan ON(1.2%) Richmond Hill ON(1.21%) Markham ON(1.23%) Toronto ON(1.11%)… then there is lots of keeping up “avec les Tremblays” in Quebec!! Montreal (1.1%) Blainville (1.41%) Levis (1.01%) Quebec (1.01%) Brossard (1.07%) Sherbrooke (1.01%) Laval (1.05%) Dollard-Des Ormeaux (1.19%) Magog (1.04%) Alma (1.04%). St.John’s NL (1.07%) is the only one east of Quebec.

#1 in the country for luxury vehicles… Boucherville QC – 1.57%

Also interesting about this survey is that 73/219 cities are in Ontario. Fully a third of the cities for this “Best place in Canada to live” are from one province!!! That’s messed up.

Curious

One thing I found and loved is little of keeping up with the jones here. Oakville kids all had to have the lastest fashions. Samething with

the ladies. Had to have a bmw or Mercedes to keep up. Here nobody seems to give a shit what people drive or wear. Forgot I had to pay 2.5k for go train. Here it cost me 0 to get to work. So that is another savings. Only thing I miss is my snowblower. I loved using it.

I lived 20 years in Winnipeg and everything you said about Oakville applies there too. Property taxes are double our rates. Hydro, natural gas and transportation costs are way more. Everything is very spread out, like Vancouver. Middle class families in Winnipeg live in the suburbs within these contained developments of 2400sqft+ homes with double attached garages and full basements. To see them from the air, it’s as if someone dropped 500 cookie-cutter homes in a middle of a field, put in about 3 man-made “ponds” with fountain(!) and no trees. The community has a park and an elementary school but little else requiring everyone to own 2+ vehicles to get to shopping/jobs.

Because of the isolation, you become great friends with your neighbours, kids take turns going to each other’s houses, parents socialize in each others homes/yards and drink alcohol and walk to their respective homes at midnight once the kids are worn out. Keeping up with the Joneses is very important – neighbour with the pool is perceived as having a higher status, and come May, the RVs come out of storage and taking a walk along the neighbourhood you see RV after RV parked proudly in the driveway. Your dinky little tent trailer will not last long before the wife wants a 30 footer of her own! So of course one of the vehicles you must own is a gas-guzzling truck to pull the beast, and then the husband ends up using this vehicle to drive the 30kms to work everyday, driving up the daily commuting cost. In the summer, every weekend there is a mass exodus of people leaving the city to go camping in their air-conditioned RVs with flat-screen TVs to enjoy the great outdoors (mosquitoes? no problem! Just stay inside the RV.) If you don’t have an RV, then it’s because you own a cabin. The city and your neighbourhood is a ghost-town on the weekends.

We don’t need to leave Victoria and drive 2 hrs to find a lake to enjoy, or nice bike trail, or a sandy beach, or to take a hike. We don’t need a swimming pool in our backyard as we have VERY nice pools just minutes from our homes. I was in Wpg visiting family during spring break and shockingly, there is not even ONE indoor swimming pool with a lazy river or waterslide that isn’t inside a hotel. Sure the city is flat, but there are barely any bike lanes and nothing like the Galloping Goose. No helmet law either.

But if you like the idea of living in a cul-de-sac with your 3 kids playing street hockey with the other 10 kids on the street while you sit and have a mojito on your front porch, then Wpg is the place for you. There are positives and negatives for every city. It’s just not for me.

DB

Heat and cold are expensive to deal with. Furnace is usually on either with heat or air-conditioning. Here not so much. Cheaper options with a heat pump.

40 degrees with humidity and -20 with wind-chill. Sorry I will pass.

BTW a good chunk of people in Oakville have pools. So that is more hydro and expense. Google Images shows that.

gwac

That is a pretty significant savings … (6000 or $500 per month after-tax)

(particularly for the elderly on fixed incomes who crave heat where I have to strip down to a short sleeve shirt to visit even in Victoria)

Just about pays for a rental suite alone… (hint hint you Easterners 😉

Oakville I paid 5500 for a 600K assessment. 3500 for a 750k assessment in Victoria. About 10 years ago. 4k more in Natural Gas and 2k more in Hydro and 10k more is income tax. So I saved 18k to say goodbye.

When outside people talk and think about Victoria, it is really the Greater Victoria region which has thirteen municipalities. But these crime stats were municipality based, so it is very misleading to outside people, as one small municipality with bad number happens to have the same name as the whole region.

gwac,

We lived in Ottawa for almost 20 years, higher property tax there is mostly due to cost of winter snow removal.

Actually we know one of these ” cubicle dweebs”, David Aston, his mother and sister live in Victoria, he comes here at least once a year, and sometimes stay a month or two to help his mother when the sister is way in winter.

Winter weather here is grey but not a big deal, as most of us do need away vacations, just plan yours between Jan and Feb. It is funny that in winter, we go away to be sunbirds, but others come to here to be snowbirds. 😉 But we do have a serious issue of family doctor shortage here and probably in BC in general.

Curiouscat

I lived through Toronto amalgamation. A disaster. Services slower. Taxes higher. Salaries are raised to the highest city. It was a joke.

from the city calculator a 500k house in Ottawa 5800 dollars

http://ottawa.ca/cgi-bin/tax/tax.pl?year=24&property_type=110&tr=1&f=8&sw=5&rss=Y&assessment=500000&submit=Submit+Query&lang=en

Property Tax Estimator

The property tax estimator will give you an estimate of what your total annual property taxes could be. This useful tool is intended for the convenience of property owners; however, you should remember that it only provides you with an estimate. The estimator will calculate taxes based on the area you choose and the services selected.

Disclaimer 2016

Please use the 2016 Phased-in Assessment value to obtain an estimation on the associated tax impact of your new assessed value. The calculations are estimates only. They also do not reflect any budgetary increases that may be imposed in future years.

Please be aware that the following tax rate tables cannot accommodate the specific charges of every property (e.g. municipal drains, local charges or business improvement area charges), and therefore will provide ESTIMATED TAXES ONLY. The Tax Rate Tables can only be used in conjunction with January 1, 2012 values as stated in your Assessment Notice provided by the Municipal Property Assessment Corporation (MPAC) in October of 2008 or any updated notice issued to reflect any property/ownership changes.

Assessment Amount: $ 500,000.00

Service

Rate %

Amount

City Wide [info]

0.479442 $ 2,397.21

Ottawa Police Services [info]

0.142339 $ 711.70

Capital Tax Levy [info]

0.000000 $ 0.00

Conservation Authority Levy [info]

0.006230 $ 31.15

Transit Zone [info]

0.154287 $ 771.44

Fire Services [info]

0.081948 $ 409.74

Sewer surcharge 0.106862 $ 534.31

Solid Waste\Garbage [info]

FIXED $ 82.00

Sub Total 0.971108 $ 4,937.55

Education [info]

0.188000 $ 940.00

Total Estimated Taxes

1.159108 $ 5,877.55

gwac – I agree! Most people outside of our sphere do not realize that “Victoria” only represents a small area (geographically speaking). I wish there was a vote on amalgamation, I would definitely be on the yes side.

I gotta ask…

Is the average property tax really? really? only $1026

or did the press not do it’s fact finding?

I wonder what the criteria for “good weather” is? Only 5 cities out of 216 were considered to have good weather: Kelowna, Penticton, Salmon Arm, Kamloops and Vernon.

http://www.moneysense.ca/canadas-best-places-to-live-2016-full-ranking/

Their facts on Saanich

Population: 115,401

Annualized Population Change: 0.59%

Estimated Unemployment Rate (%): 5.2

Median Household Income: $79,932

Average Household Discretionary Income: $42,136

Average Household Net Worth: $767,319

Average Value Of Primary Real Estate: $602,692

Home to Income Ratio: 6.47

Rent to Income Ratio: 14.8%

Average Income Tax for Individual Earning $50,000: $8,372

Sales Tax: 12.0%

Property Tax: 2.71%

Average Property Tax: $2,494

Average Income Tax for Individual Earning $50,000: 2.68%

Vehicles 2013 Model Year Or Newer: 11.7%

Luxury Vehicles 2013 Model Year Or Newer: 0.55%

Travel To Work By Walking: 3.7%

Travel To Work By Bicycle: 3.3%

Travel To Work By Public Transit: 8.2%

Total Annual Rainfall (mm): 886.27

Days With Precipitation Greater Than Or Equal To 0.2 mm: 158.5

Days With Rainfall Greater Than Or Equal To 0.2 mm: 156.1

Days With Daily Min Temperature Greater Than 0°C: 334.0

Days With Daily Max Temperature Greater Than 20°C: 70.5

Days Above 24°C: 0.2

Crime Rate – 5-Year Change: -35.9%

Crime Rate Per 100,000: 7,523.77

Crime Severity Index: 66.8

Violent Crime Severity Index: 44.8

Owned Homes: 54.8%

Employed In Health Care: 6.6%

Offices Of Doctors Of Medicine Per ‘000: 3.1

Doctors Per ‘000: 2.5

Employed In Arts And Rec: 5.3%

CuriousCat

Again what a stupid article. Victoria is 91 and Saanich 13. What the hell is the difference. All the bad stuff happens downtown. Most people do not live DT in Victoria.

JohnK

You got it. Hated Toronto, Hated Oakville. Traffic is a nightmare. Taxes in Oakville were twice as much. Lets not talk about the people. Victoria is amazing. Best thing about Ontario, was leaving.

You want to own a cottage. Have fun on the 404.

I clicked thru the slideshow at the bottom of the article, Saanich made the list at #13 (last year 12) for Canada’s Best Places to Live.

gwac,

yep. These kinds of articles are concocted by cubicle dweebs who have never actually visited the places they talk about.

go figure Victoria 5th best place to retire

http://www.moneysense.ca/save/retirement/canadas-best-places-to-retire-2016/image/6/

totoro

All the bike theft probable. 🙂 and the one dude breaking into all those saanich houses. Sorry I feel a lot safer here than Oakville and Toronto.

LeoM

it’s a shame you assume I don’t understand FATCA… as I was in the heat of it, being interviewed by Financial Sense Newshour a few years back.

I also spent 2 financially imperiling years fighting the US to prove successfully that I wasn’t a US Citizen.

So NO I guess I don’t know of what I speak…

I’ll leave you to focus on supporting a country (via support for FATCA) that doesn’t even abide by it’s own constitution anymore yet wants to force every country and bank in the world to do it’s bidding by means of the US$

I can see TripleArated’s point about amalgamating Victoria’s municipalities. Example is the “municipality” or City of Vancouver, population 600k, with neighbourhoods like Kerrisdale, Kits, South Van, downtown, Gastown, Chinatown. They all seem to take ownership of crime/homelessness as being a multi-regional issue.

Burnaby has acknowledged how lack of homeless shelters in Burnaby has caused serious issues of encampments & crime in Surrey because they ride the Skytrain further along the line and walk to Newton. The same may be true in Greater Victoria – Saanich & Oak Bay don’t have as many (or any?) shelters, so the homeless & drug addicted can only access services in downtown areas. It needs to be more of a multi-municipality solution.

Meanwhile, Oak Bay, Saanich and North Saanich have some of the lowest crime rates in Canada for municipalities over 10,000.

http://www.vicnews.com/news/221352441.html

And crime. The combination of high housing cost and a relatively high crime rate seem to knock Victoria out here.

https://www.pardonapplications.ca/articles/canadas-most-dangerous-cities/

http://www.macleans.ca/canadas-most-dangerous-cities-the-rankings/

Who would expect Victoria to make a list which has “affordability” as one of the main criteria considered?

Sorry I lived in Oakville. Cannot be even compared to the island. What was money sense criteria?

Too funny. Oakville is 10 times the Oakbay for all the bad reasons. The only thing important to people in Oakville is money and having better stuff than your neighbour.

Where’s Victoria?

http://www.huffingtonpost.ca/2016/06/08/best-places-to-live-canada-2016_n_10354322.html

“Almost everyone I know from Ontario and Alberta will say that they’d rather have snow then the deluge of grey and darkness. Until you get used to it, winters here are awful.”

Haha no. I’ve spent close to a decade living in Calgary and the balance on the coast. It’s not even close. Yes we have a wet colder period November-February in Victoria. In Calgary the first good winter storm happens by Halloween and there’s threat of snow until May. Then, you get rain in May and June. July – September is nice, though I awoke to snow on my balcony on September 5 one year. Going for a nice stroll outside in -28C is lovely, especially in the winter when you get home in December and there’s no nice sunny day because it’s pitch black at 4:30.

James

I lived in Quebec and Toronto. I will take our winter. I rather be able to bike and be outside than deal with the cold and snow. I also did not enjoy my 4k in Gas charges for heating in the winter. and the 2k for air conditioning. You can always take a winter vacation. :). Flowers in Feb is nice also. Toronto and Victoria has the same rainfall per year 700mm.

“If I was a retiree living in Alberta, shovelling snow in winter and being eaten alive by mosquitos in summers, then this video would make me dream of life in Victoria.”

Until you get here and actually experience winter.

Almost everyone I know from Ontario and Alberta will say that they’d rather have snow then the deluge of grey and darkness. Until you get used to it, winters here are awful.

by the way, thanks for answering, db. It seems that your point is that FATCA won’t cause someone to sell their home. LeoM, it seems FATCA would help catch tax cheats, but it also perhaps unfairly targets both Canadians & Americans who had no intention of evading taxes? eg.,

Court Fight to Stop FATCA Impacts Every Canadian

http://www.huffingtonpost.ca/cleo-hamel/foreign-account-tax-compliance-act_b_8133274.html

More news on illegal vacation rentals impacting rental vacancy rate …

http://www.cbc.ca/news/canada/british-columbia/vancouver-airbnb-research-1.3621539

UBC study suggests 77% of Airbnb revenue comes from renting out something other than primary residence

“Victoria is looking to regulate Airbnb in some way, which Marjoribanks says is easier said than done …because Airbnb protects the identity of hosts … if the service was no longer offered in Vancouver, the rental vacancy rate would double from 0.8 to up to two per cent.

Related article on sharing economy …

http://www.cbc.ca/news/canada/british-columbia/uber-airbnb-sharing-economy-1.3526114

“I grew up steeped in what might be termed the “sharing economy” of its day. It’s probably technically better described as ‘the “grey market … If you knew someone who could get you eggs, give you a haircut, or rewire your home at a fraction of the over-the-table price, surely only a fool would shell out the extra cash.”

“There’s the hypocrisy of applying terms like “sharing” and “new” to an economy that may better utilize resources, but still generates a lot of wealth for a handful of people tapping into the age-old custom of making money by helping someone else cut corners.”

“Homeowners with dollar signs in their eyes are appalled at the prospect of being taxed for turning their suites into hotel rooms … It’s hard to appear suitably concerned about low-income housing and affordability while silently celebrating your paper status as a millionaire homeowner.”

Here’s an article about property taxes in Vancouver and it talks about assessments going up with new builds. I have to admit that it is hard to feel badly for these folks when they’ve gained so much in tax-free house value if it’s their primary residence. If it is an investment property then that’s part of the investment risk IMO.

http://www.theprovince.com/news/metro+vancouver+property+taxes+through+roof/11971180/story.html

Who wins the cuppee doll?

2080 Carrick

2015 assessed. 574800

2016 assessed 670500

Now it can be yours in $1,185,000

https://m.realtor.ca/PropertyDetails.aspx?PropertyId=17041428

No improvements or it says steps from the beach. 2km is more than a few steps haha

db- you don’t quite understand FATCA or as the IRS auditors say; FatCats (Foreign Accounts Tax Compliance Act Targets)

The targets you refer to are just one small segment. If you want to understand the FATCA scope and how invasive FATCA is, you can read our defacto treaty:

https://www.fin.gc.ca/treaties-conventions/pdf/FATCA-eng.pdf

The CRA and IRS are phasing in compliance, starting with easy targets. The digital cross-referencing of Canadian and American residents is just beginning, and additionally, every border crossing you make is now recording entry and exit details. The news items you refer to are just minor players who have routinely been nabbed for years before FATCA was implemented; FATCA just makes it easier to catch them.

Read this to get an idea of the global reach of FATCA:

https://www.treasury.gov/resource-center/tax-policy/treaties/Pages/FATCA.aspx

You’ll be reading lots of news in the coming months as FATCA and the Panama Papers start to shake out the cheaters.

Who can possibly debate how those in need have been denied. Not all homeless are the same. Some mental issues, some drug, some alcohol and some with just no opportunity to get skill sets.

Just my opinion but Greater Victoria has 9 Municipalities too many. How many millions of dollars have been wasted in the last 30 years. Sure, amalgamation has its drawbacks. But how many side deals have you seen in your own that you discovered years later? I think Combining areas will actually give us all more of a voice, more public pressure and more public support.

Im not suggesting that amalgamation solves homelessness or crime. But it would provide a good solid % towards a number of defiecinies that Provincial government could match. After all, the Bird cage is in the very core.

Once you understand what I have posted below…

You will conclude that in fact… the opposite of what LeoM speculated will occur…

NO US Citizen living as a Canadian resident would likely sell Canadian property without considering the US taxation implications…ergo…easier to stay put…

I will try to explain…

LeoM made a big issue out of the FATCA and US Citizens having to sell out of Victoria. (mass exodus)

What he didn’t realize nor would acknowledge is that the article he proclaimed was about US criminals avoiding tax, was in fact about Canadians who by virtue of US birth, US parentage, failure to renounce US Citizenship, etc are in fact still deemed to be US Citizens by the US… These are NOT necessarily US criminals trying to avoid taxation.. simply victims of the UNIQUE residency rules the US invokes globally against all other nations…Whereas NON-RESIDENTS citizens of the U.S.A are still subject to US taxes…

I am pointing out that in this case, it is pretty obvious Mr. Bryant and wife are US Citizens and probably didn’t renounce US citizenship. It is very difficult to do. The US does not easily allow renounciations.

The added fact that his kids (one at least) operates in the US suggests further that his ties to the US never ceased.

I feel he is another Canadian? Resident? who will fall prey to the US FACTA injustice.

So, bottom line…his gains will not be tax free… Though I wish they were…He will likely be victimized.

Again, what you read in the press is not necessarily the truth , the whole truth and only the truth…

Just saying…

db, What should we read between the lines about 1983, Berkeley, and Peace Corps? Vancouver wasn’t really well known outside of Canada until after Expo 86. Is it because he is/was a US citizen?

Related to the homeless, have to agree that in my experience it’s gotten worse since the 80s when they seemed to be mostly affable drunks & hippies on weed passing through town. Now there’s more aggression and hardline encampments, maybe from harder drugs or more untreated mental illness.

I did…

Did you not notice he had no idea where Vancouver was… was Peace Corps…

Berkley University

etc..

read between the lines…

Hi @db, it is a fact: owners are UBC professor Ken Bryant and his wife who lived in the house for over 30 years, buyers are Gurinder and Urvashi Arora who are business owners local to Vancouver, all are real people with real names, as reported in the paper. Why don’t you read the article and find out more yourself?

Are you sure?

I regret to hear that this may be a case of the guy who fell off his chair…

or he doesn’t know it yet… (not one of those criminal tax avoiding americans LeoM is so fond of)

Misery loves company..

Karma

https://www.oakbay.ca/public-safety/police-department/community/crime-maps

Oak Bay collects and publishes stats. Also stats can compares crime rates for municipalities.

Remember the story of a tear down house in Vancouver sold for $2.48M recently? Have a look of the real story behind it, published on G&M last Sat. Actually neither the owner nor the buyer are foreigners.

http://www.theglobeandmail.com/real-estate/vancouver/the-story-behind-vancouvers-24-milliontear-down/article30278810/

Triple A,

The homeless problem is nothing like 1980. I live 2 miles from town and needles wind up in my parking lot and getting worse. It’s rampant and I see no end. Many homeless druggies are flocking here from all over Canada and the drug problem has never been this bad.

You can’t even begin to compare to Oak Bay, though it’s worse there than it ever has been. Ever since they shut down Essendale and Riverview they have lost control.

“They NEVER reported that the west side of their property was any more dangerous than the east side.”

I needed that. LOL

totoro – as it says in the article you linked the crime data is still available and updated at crimereports. just not linked from the police website anymore. OB doesn’t provide data to the system so my contention that crime in OB is the same or minimally different from outlying areas of Victoria can’t be directly tested.

On reflection it is probable that Victoria has a slightly higher rate than OB even outside of downtown as age and crime correlate and OB has a median age ten years older than Vic.

I think that is what I just said CE? The crime pattern is concentrated in the downtown area and there has been a spike around tent city. Of course there is no magical tweed crime curtain but crime falls off the further you get from downtown – the crime map here is not completely up to date but somewhat representative. Interesting that it was removed after complaints about failing to record the spike in crime around tent city.

http://victoriabuzz.com/2016/03/victoria-police-remove-online-crime-map-from-their-website/

totoro – crime in Victoria is heavily concentrated in downtown and a lot of it relates to homeless/drug issues concentrated there and then also drunken rowdiness associated with the many events that happen downtown and draw in folks from throughout the region. Once you are a short distance from downtown I doubt there is much difference between Oak Bay and Vic for crime even though Victoria looks way worse on the overall statistics.

Anecdotally speaking – my grandparents used to live on a lot that straddled the municipalities. They paid a portion of taxes to both Oak Bay and Vic. They NEVER reported that the west side of their property was any more dangerous than the east side.

Oak Bay is a lot safer than Victoria for both violent and non-violent crimes. And look at the crime maps, most of the crime is centered around the downtown Victoria area and there has been a spike in crime rates around tent city. I’m a fan of social supports for mental illness and addiction but I absolutely do not support measures that entrench an encampment like this that has already been deemed to be a danger to youth in particular. I would not buy in this area and I’d be surprised if the market in the vicinity has not been negatively impacted.

https://www.oakbay.ca/public-safety/police-department/news/oak-bay-ranked-one-canadas-safest-communities

I remember Victoria in the early 90s when I was working downtown and the homeless issue was not nearly as visible or violent. Heck, ten years ago Pandora did not look like it does now. I’d say the change has been dramatic.

Hawk,

Read my previous post on value. About 10 days ago. If you pay $200k over asking then yes, I agree.

It’s getting to the point where I don’t believe any articles in the news. A novel point.. Talk to people! Go to open houses and talk to the people in the neighbourhood with their experience.

Tent city? There has always been homeless downtown, at least back to 1980’s. If you’d walked around then you’d notice not that much change. How about in 1994 during the CW games when we sent homeless on one-way bus tickets. An infamous rumor, yet Tofinos population soared during that same period.

Lastly, take a look at published weekly crime. Oak Bay is not much safer than elsewhere. Due diligence.

“Anectodal:

Got my ass kicked in selling my condo in downtown. Bought 18months ago for $430, sold last month for $500 (+16%). One floor up & exact layout now just sold a month after us for $550!!! Talk about price appreciation!! We got screwed.”

What are you talking about Vic, you market timed it perfect. If you were a real “investor” you would have kept the condo and been up on the house as well. At any event you made the same on your “luxury” pad.

LeoM,

Retirees in Alberta can move into condos like mine relatives did there and don’t have to shovel snow and have screened in decks. Then can spend that extra money down in Arizona for 6 months.

Just read an article about the Canadians exiting the US snowbird markets. With the uptick in values and the 30% exchange gain they are pulling out profits. Perhaps this is yet another driver?

“Condos went from 125k to 330k between ’01-07. I expect at least a double from now to 2022ish, but with boomer retirement & impending inheritance, a triple wouldn’t surprise me.”

More BS. Concert and the rest of the developers will start flooding the town with twice what they are now if they can make that kind of cash. Lets not forget all the leakers out there still and the future fix up costs that will be coming in waves. Worst time to buy a condo. More la la land talk from someone in the bizz but afraid to say it.

“My point, if house prices drop by 30% after 5 years you still are ahead of where you would be if you were renting, inclusive of all selling costs. ”

Says the guy that just bought, lol. That’s if you bought 5 years ago of course, what about now and you pay $200K over and it goes down 30% ?

Who says the 5 years ago crowd were prudent cheapskates and didn’t need 2 vehicles being on the Westshore, plus other toys coming with typical families. LOC’s are a given, thus the 170% household debt numbers heading off the charts. It’s a nice thought tho in a perfect world, which it isn’t.

I do agree with the retirees flooding here,not going to happen. Especially with all the national media coverage of the out of control homeless/mental health problems with tent city.

Will retirees from other Provinces move to Victoria? I think this is a very small percentage. Keep in mind these folks would be leaving neighbors and friends behind to a new community, based on an Island, and as we all know is somewhat ‘cliquey.’ Personally my relatives in other areas such as Edmonton love it there. It’s a way of life. The argument for “Best place on Earth” is a sales pitch for tourism, and when sold within our country, is arrogant. We love it here. And they love it there.

That being said, there is a small percentage who will move. Exception rather than the rule.

Same holds true for Americans. Almost none of them are aware that their currency is worth $1.30 for every bone of theirs. How many of you were buying property in the US when we were at $1.10 the other way?

The single largest driver for prices right now is the $500k to $999k is a bottleneck. Above that? Require 20% and a rigid Appraisal unless your upscaling from RE increases elsewhere and/or bought more than 3-4 years ago. The rush is on. Gift letters are prevelant.

All this talk of buyers from other regions. How about the Westshore owners. Suggest that someone bought for $400k in 2011. Now worth $600k (new builds, small lots, tight grouping for $550 today). You’d have increased home by $200k increase alone and potentially another $100k plus in principal paid, and if you were 30 or younger when you did so could relocate into the core with a new 25 year mortgage at up to $1M house for a $700k mortgage. And your wages probably increased by 2% per year or career advanced making this a possible choice. Or make a splash into the area north of $1M and eliminate a considerable number of buyers.

Houses are not tech or bio or gold stocks that can go to zero in a minute. Hawks commentary should be taken with a grain of salt if residential, but a pound of purchasing as either investment or rental income (Airbnb, Vrbo included – Bylaw changes, legislation potential). My point, if house prices drop by 30% after 5 years you still are ahead of where you would be if you were renting, inclusive of all selling costs. This is the danger of regurgitated, hyperlinked news, fear and loathing in Victoria.

LeoM

Victoria sucks if you like mountains:

https://www.youtube.com/watch?v=L82_jHs8FgA

I don’t know if the same pattern with condos would happen in Victoria as did in Vancouver, but in Vancouver condo developments started in the 80s (Victoria’s surge came in the 90s) & all real estate took a dive in 1994, then it took until the 2000s to get back up to where it was before.

The important thing with condos vs. houses is that developers can just keep building more and more density. In Vancouver, as newer condos came on the market in 2000s, older condos (eg., 80s/90s era) didn’t increase in price to the same extent, but there were so many more newer condos, that the average & median price increased. Honestly by 2015, there was probably a $100k-$200k premium on new condos over 30-year-old condos, simply because they were new & huge marketing campaigns helped sell them.

That’s why I think it’s quite deceiving to just look at just dollar values with condo “appreciation” – it’s important to compare the same condos over 30+ years, and Victoria doesn’t have enough history.

Another reason it’s deceiving is because Victoria started out with much much lower condo prices (around $60k) in the 90s compared to Vancouver’s. So Victoria’s had a longer way to move up & jump in price, as real estate became easier to buy from “across the pond” over the Internet in the late 90s/2000s – increasing exposure to different (non-local, wealthier) types of buyers.

Who knows longer term, but that’s why I think condos are good for singles & people that don’t want to do a lot of maintenance, but they really don’t increase in value as much because they are so easy to “replace” with “exciting” new builds.

Except condos always lag SFHs over the long run

Will do. I’ll put up a new post with the interactive version since it seems there is interest.

@Michael: are you saying that it was a mistake, from a capital appreciation point of view, for me to sell condo & buy a large detached property in the core? Or, if condos are appreciating, so will detached market.

Similar to the start of previous cycles, condos lag then lurch forward. They may now outperform on a %-basis until they play some catch-up.

Condos went from 125k to 330k between ’01-07. I expect at least a double from now to 2022ish, but with boomer retirement & impending inheritance, a triple wouldn’t surprise me.

@admin: could you please post a non-normalized bar chart, so that we can compare the numbers from one month to the next? Thanks.

Here is another reason so many people want to move to Victoria:

https://youtu.be/45ejFm2vRT4

If I was a retiree living in Alberta, shovelling snow in winter and being eaten alive by mosquitos in summers, then this video would make me dream of life in Victoria.

Anectodal:

Got my ass kicked in selling my condo in downtown. Bought 18months ago for $430, sold last month for $500 (+16%). One floor up & exact layout now just sold a month after us for $550!!! Talk about price appreciation!! We got screwed.

“If you read the study, the majority of the $750 billion will go to the richest boomers over the next decade.”

If you listened to Kevin O’Leary yesterday on BNN, the majority of the large inheritors will be taking their billions out of the country and most likely to the US due to the high tax rates here for the rich.

The rich do everything to avoid taxes and will easily spend half their year in the US or other places to save millions and not buy some shack in Mecca Victoria.

Victoria eyes regulating vacation rentals

http://www.timescolonist.com/news/local/victoria-eyes-regulating-vacation-rentals-1.2271981

Yip, I don’t expect any inheritance. All I ask is don’t leave me with your debt!

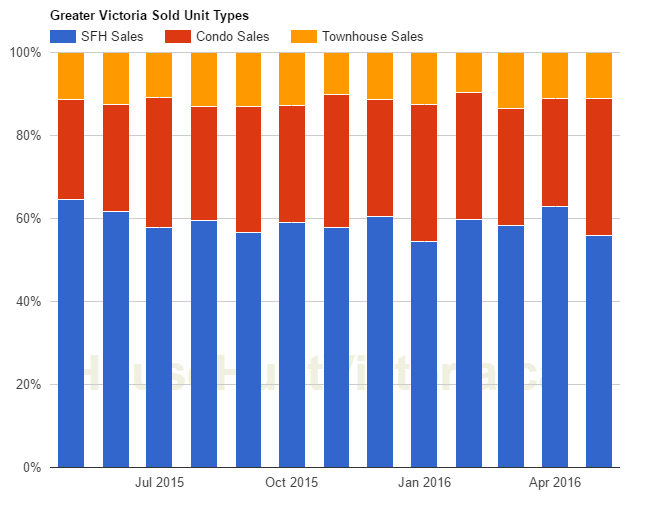

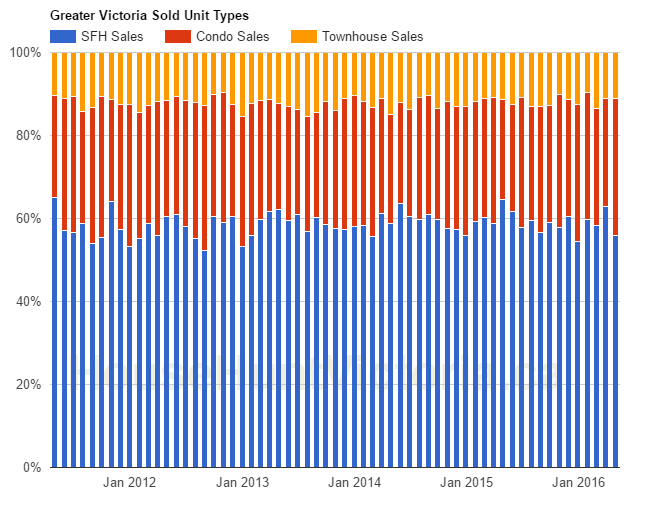

Yes. Which at first seems significant. But look at the chart below that shows the percentage distribution of house sales vs condos vs townhouses. Yes house sales are down a bit from April an and condos are up, but it’s nothing at all unusual. Lots of other months have similar splits.

Here it is zoomed in to the last year only.

@LeoM: wasn’t there a ~40% jump in condos sales volume last month with a drop in house sales last month? What did you discover when reviewing the data?

If you read the study, the majority of the $750 billion will go to the richest boomers over the next decade.

I thought there was an extraordinary shift towards condos in May. Turns out that it was just noise after all. No matter how long you look at the data you still get fooled by the month to month variations:

Yeah I don’t expect any inheritance either, and my parents the boomers inherited little. Old age health care will suck up the wealth of those who have money. The rest of us will pay for those who don’t.

“While boomer parents have more wealth than previous generations of retirees much of that wealth is annuitized [Pensions, Social Security], so that a smaller share is bequeathable. And whatever resources remain to bequeath will be split among more recipients because the boomers have, on average, more siblings than their parents had. The amount boomer parents have to leave their children may be reduced further because parents will live longer than any previous set of retirees … Evidence shows that many boomer parents neither expect to leave significant bequests to their children nor believe it is important to do so.”

This. My dad is 69, one of 7 siblings. His mother is living in an old folks home. Any inheritance will be miniscule, if any, as my grandfather passed fairly young (40s). Meanwhile my father retired at the age of 56 with a db pension, so that income will end, and I have 3 siblings. I expect no inheritance. My father believes we should make our own way, but he’s not purposely spending everything he has, he’s just not altering his lifestyle to “leave” anything for us, nor do I want or expect him to. I have no idea how much equity he has, and I would never ask him for money either. However I do have friends who expect and count on an inheritance to fund their own retirement to the point where they are not saving any money and putting all their eggs in the real estate basket. This expectation is now causing them stress as there is fighting happening amongst the siblings ALREADY (meanwhile the mother is still only in her 50s and still in great health!!) We are Gen X.

That’s what was said during the previous peak.

The listing for 2021 Carnarvon was cancelled

Don’t get me wrong Hawk, I do agree with you on a few things, one being that Victoria house prices can’t go much higher. I suppose if it became a trend with Vancouver retirees to sell soon, reap the real estate lottery, then move en masse to Victoria with all their friends, then prices will continue to climb in Victoria. But they can’t go much higher because the locals are 75% of buyers and locals seem to have reached a price limit.

Anyone see what 2021 Carnarvon sold for?

The market is made up of those actively selling and those actively looking to buy. Sure there may be lots of retirees but are they buying or selling? If not, then they have no effect on market prices. There have always been rich retirees in the world and the real estate market still had its ups and downs.

If there are more home owners with debt problems that could turtle the market even with all of these rich retirees sitting in their houses watching Oprah. About half of the Baby Boomers (58 to 71) are now past their prime real estate buying years. The back half is now aged 57 to 52. They’ll be passing that age very soon.

Vicbot,

They are also assuming everyone’s parent owns a house clear title in a large city. Another myth. I have several friends that are getting squat or close to it because their parents lived in a small town and blew money along the way or got divorced in their later years. They give seniors easy credit too, thus the huge increases in seniors going bankrupt. A lot of bunk, as they don’t look at real life.

Yes there’s evidence that all that inheritance talk is very much over-blown – see study below …. (I’m also puzzled by the simplistic view that CIBC takes on this – do they not remember the things that researchers discovered on this topic many years ago? Are they trying to justify all their mortgage debt as being risk-free?)

http://boston.cbslocal.com/2011/06/07/money-matters-retirement-myth-2-i-am-going-to-inherit-mom-and-dad%E2%80%99s-money/feed/

“The media has been reporting for years that there is mega money coming … But that may not happen; according to a study done by two economists, Jagadeesh Gokhale and Laurence J. Kotlikoff, working for the Federal Reserve Bank of Cleveland, Boomers as a group will inherit more than their parents did, but they concluded that Boomers still need to plan on funding their own retirement by saving and investing during their working years.”

Here’s their research study:

http://people.bu.edu/kotlikof/1001.pdf

“While boomer parents have more wealth than previous generations of retirees much of that wealth is annuitized [Pensions, Social Security], so that a smaller share is bequeathable. And whatever resources remain to bequeath will be split among more recipients because the boomers have, on average, more siblings than their parents had. The amount boomer parents have to leave their children may be reduced further because parents will live longer than any previous set of retirees … Evidence shows that many boomer parents neither expect to leave significant bequests to their children nor believe it is important to do so.”

LeoM,

It only took 8% of the US housing market to go under to tank it. Canada can easily surpass that number with 170% household debt far past the US.

So you expect houses to keep on going up another 200K next year with rising US interest rates effecting 5 year mortgages another 1% or more LeoM? That would put debt up to the 200% level easy.

“750,000,000,000! That means millions of ~60yr old retiring boomers are about to become millionaires, if they weren’t already.”

When the market tanks you can chop that in half. Most of my friends parents have died and we’re in our mid to late 50’s. They also had 3 to 4 other siblings to split it with and only came away with similar number to the BNN article of $180K. Not exactly a huge windfall.

Others have one parent gone and the survivng parent is in the assisted living stage that costs big bucks and can drag on for another decade. A declining inheritance due to medical health has not been taken into consideration. More pumper hype trying to validate a massive credit bubble.

BTW , is Mike subbing in for Marko in the office ? Seems like it with all his ancient posts being regurgitated. 😉

Hawk, I don’t believe your debt-bomb is as bad as you suggest. Its net worth that matters most. If a family has $350,000 in debt but net worth of $600,000 then your scenarios start to fall apart. A quick Google search for “net worth by country” or “total net worth of Canadians” has some interesting facts that might surprise you. I agree with you Hawk that some people are overloaded with debt, but it’s always been that way with every generation; there are always a few gamblers.

http://www.freedomthirtyfiveblog.com/resources/median-and-average-net-worth

http://www.moneysense.ca/save/financial-planning/the-all-canadian-wealth-test-2015-charts/