That new house smell

Ahh the smell of toxic offgassing in the morning. It’ll knock a couple months of your life but where would we be without new construction? Probably all living in tent city.

In the end like any market it comes down to supply and demand. We’ve discussed the disproportionate effect that out of town buyers have on the market as they create demand without adding to supply. Those buyers are balanced against the sellers moving away or dying. But of course there is a third factor and that is new construction. They ain’t making more land but they are making plenty of new little boxes to go on it.

So is construction going to ramp up to even out the market? Well builders tell me they are crazy busy and waiting for new land to become available to build on. Let’s take a look at the data.

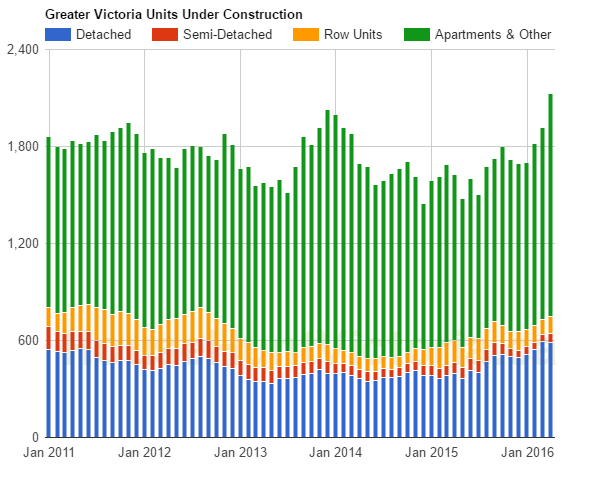

Nothing too dramatic, although the units under construction in April seems to be ticking upwards. Might be starting to react to the market conditions and rising prices. Detached home construction is on a reasonably solid looking upward trend.

For perspective, let’s look a bit further back where we can see the condo boom we had just before the financial crisis.

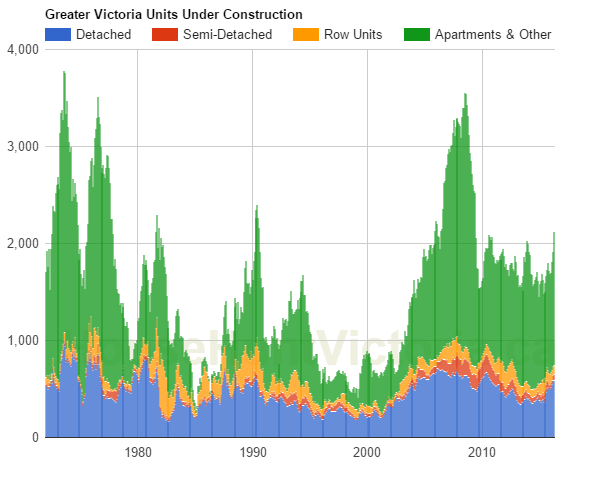

At the peak in July 2008 there were 2616 condos under construction versus only 1379 now. No wonder condos languished longer than detached houses, that supply overhang took a few years to work its way through.

In fact – looking at the complete history – it seems specifically condo building booms often coincide with price tops. It happened in 1976, 1981, 1994, and 2008. So watch out when the builders start going crazy, it could be the top of the market.

Another way to look at it is what percentage of total stock is attached vs detached, which you can play with in the interactive version below.

The over asking prices are a bit of a ruse, a marketing scheme.

The ordinary consumer relies on the asking price and how long a property takes to sell to gauge the market. The sign goes up, the property sells in under 10 days at more than asking price and the sold sticker is slapped onto the sign.

But what really is happening here? If a property is intentionally under priced that home is going to get a lot of activity in a very short time as opposed to a home that is reasonably priced. Does how much the property sell over asking and how few days on the market have any meaning then?

Or are we just drawing future demand forward?

And we don’t know the answer to that question. We would need information from the banks on the number of mortgage applications being made. For most of us then, by the time it became obvious with falling month over month sales it would be too late to do anything about it.

Most of us are just here for the ride. We don’t get to choose when to get off or when to get on. But for some it is important that they should be made aware of the possibility that a lot of what is happening is just a marketing scheme to draw those sitting on the fence to buy now rather than later. Later on falling sales activity may lead to lower prices and we may see that this has just been a one trick pony market.

But to reiterate from previous posts, I believe that we have to overhaul the real estate act in BC. Real estate has become too important in people’s lives for it to be manipulated. That is something that should be discussed in the upcoming election.

What about those days-on-market?

Stand alone houses in the core averaged a market exposure of 19 days this month, but half of those sold in under 10 days. The days-on-market varied from 0 days to 348 days to sell.

Note: Zero days usually refers to a property that was exclusively listed and sold before being placed on the data system.

So who pays more for a home in the core. The rabbit or the turtle? The person getting constant emails of new hot listings and burning rubber to the next open house or the person willing to wait for a calmer time to make an offer.

The median price paid for homes that sold after nine days on the market was $764,000 ($820,208 was the average). And the median exposure for these properties was just another 10 days or 20 days-on-the-market.

The median price paid for homes that sold under 10 days was $755,000 ($817,247 average). The median DOM in this sub group was 4 days.

Statistically not much difference between the two groups. That’s interesting because almost all of the auctions and the majority of over asking prices happen in the under 10 day market. And there are a lot of them. 41 percent of the sales that occurred this month for houses in the core sold for more than 5% over asking price.

Of course there are some crazy prices being paid for housing these days and it seems that a few posters are quick to point out those extreme cases but are they the rule or are they the exception? Are they simply outlyers that have no effect on the marketplace?

And for those that may be interested out-of-town purchasers do pay more for housing than those from Victoria. About 4% more.

Hmm.. Sales/day down a bit recently. https://househuntvictoria.ca/2016/05/30/march-30-market-update/

1 million for that. Need to fill it up with uvic students to make it work. The updated interior is lovely.

A friend who’s been searching to buy for about 3 months just got outbid by over $140k. Bidding wars are still happening. Never fear – prices will be rising this year for a long time yet, though probably not as rapidly as in the spring. You don’t blast through all-time price and volume records and suddenly find demand all dried up. August 3-month median prices will be at least a few percent higher than May 3-month medians. That’s my prediction, freely given!

Could we get the buyer’s origin for these way above asking deals? I bet more than half of them, if not more, are from out of town. Also do we know what percentage of all sales are way above asking? If we do know the answer for both questions, we may finally have a answer to our old debate on HHV: if outside people do chose to move to Victoria?

Teakwood goes for a million (ask: 699k). Realtor updated the description: “THIS ACTUALLY HAPPENED”

VicInvestor1983, you read everything I wrote. Where did I claim the bidding wars have slowed!

You’re just making this stuff up now.

Marko have the market price gains or bidding wars slowed as JJ claims?

That’s not true Michael. That’s how you have been misinterpreting what I’ve been writing about. Most of last year I was wondering why prices had not increased.

If you continue to be fixated on prices then you will continue to miss the point. Yes, prices have typically in the past moderated lower but not in all years. In hot markets prices continued to rise. And that moderation in typical years started in June not like this year as it seems to have started earlier in April.

Just to put things in a context that you may be more familiar with. No one has a crystal ball of how events will be changing over the rest of the year. However, this year started with an early ejaculation in prices and then appears to have gone flaccid and generally that isn’t good for anyone.

Mike, you best listen those who run the show…. “the peak has passed” bud. You and your partners had your chance to flog your flophouse, best list it ASAP.

After long boom, Canada’s housing shows some signs of cooling as high prices create ‘a vicious circle’

“VANCOUVER/TORONTO — Seven years into a Canadian housing boom that many have warned will end in a bust, there are signs of a sales slowdown in the two hottest cities, with some economists and real estate agents saying the peak has passed.

A cooling of sales activity in Toronto and Vancouver, the two tent poles holding up an otherwise soggy national housing market, could bring the two markets into line with the rest of the country’s tepid economy.

“There are reasons to believe maybe we’ve hit the peak in those two markets,” Gregory Klump, chief economist for CREA, said on Friday.”

http://business.financialpost.com/personal-finance/mortgages-real-estate/after-long-boom-canadas-housing-shows-some-signs-of-cooling-as-high-prices-create-a-vicious-circle

Seems like every late Spring 🙂 our good friend Jack begins trying to convince us yet again that the normal seasonal deceleration across Can & US must mean the market is about to drop.

http://charts.equityclock.com/wp-content/uploads/2015/02/CS-NATIONAL-HPI_thumb-205×150.png

Mon May 30, 2016:

May May

2016 2015

Net Unconditional Sales: 1,204 905

New Listings: 1,343 1,485

Active Listings: 2,421 4,043

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Really Michael, – falls for stagnate prices?

Here are the sales count for detached houses in the core since January

Month Sales

Jan 122

Feb 228

Mar 318

Apr 377

May 301 as at May 30

And here are the active listings since January

Month Active Listings

Jan 347

Feb 378

Mar 418

Apr 398

May 384

And here are the new listings since January

Month New Listings

Jan 173

Feb 300

Mar 398

Apr 415

May 332

So despite all of this intense pressure for prices to be escalating in this extreme bull market where the months of inventory is close to 1 month. New listings are only being added at the rate of roughly one to every one that sells. And half the houses take less than 9 days to sell what is happening to median prices?

Here are the median sale price trends for stand alone houses in the core since January

Month Median Sale Price

Jan $655,500

Feb $681,500

Mar $740,000

Apr $758,000

May $752,000 as at May 30

They have flat lined.

Why?

Simply put the answer is affordability. Every chart you have ever conjured up shows the same thing for Victoria. Once the cost of ownership becomes onerous on buyers, market prices drop.

This year we have had an increase in out-of-town buyers. But for the first time we are now seeing month to month sale volumes decline as fewer Victorians can buy and that’s the same for out-of-town buyers. Because it is fiction that out-of-town buyers are all rich. They have financial constraints the same as we do. And high prices impact them too.

1598 Wilmot Place, seller did not take the highest offer.

I think it’s a fair statement that by May end, most of the planned listings by folks intending to sell have been brought to market.

The pretty houses command pretty prices. You know them when you see them come online. These ones could be the ones over inflating the rest and last only days.

The rest become inventory. If I’m an outside buyer, I’m only looking for a house that’s finished and tidy or possibly a fixer upper but only in desirable locations.

Victoria needs to rethink their definition of desirable because a there has been a lot of houses and lots of very good value that are being passed over.

As for foreign buyers… Perhaps some of us moved away so that we could start careers and then come back down the road. Perhaps some of us have been gone long enough to value the CRD region without being tied to names of areas or opinions. Because if there’s one thing Victoria does best it’s linear thinking.

Is that how you read my posts VicInvestor1983?

That I am denying this bull market is happening??? Because I am not.

I have explained how the months of inventory, listings to sales ratio and day-on-market are strongly in favor of sellers.

I am probably more bullish on real estate than you are. There are properties that one can still make money buying. I’m just not stuck in thinking it has to be my house.

You want a property that you can buy, clean up and re-sell and make money.

6919 Sellars Road in Sooke.

But would you buy it? No you would not, because you have a myopic view on real estate that it has to be properties like yours. You made one choice in life that worked out for you and now you sit on your arse and think of yourself as a bull. You’re more bullshit than bull.

I highly doubt anyone here falls for Jack’s weekly pitch of stagnant and falling prices.

“Many are selling and taking that profit”

The foolish always sell near bottoms only to then regret their decision. There usually is no profit as they are typically the ones who bought near the previous top, satisfied to now get out without taking a loss.

@Hawk: I bought a house to live in for the next 25 years, not a place to flip for profit. I’m too conservative to enter real estate flipping.

Your stock picking & market-timing claims are based on ZERO evidence. Hardly anyone can beat the market over the long term. Yes, there are some lucky years & a lottery or two once in a while but most who try will underperform. If you have some great foresight & investing prowess as you claim, you should have leveraged in Vancouver R/E & become a multi-millionaire like a family member of mine (who btw took big risks & just got lucky).

And, it’s funny seeing Hawk & JJ still denying the obvious bull housing market we’re in. Face it guys, prices have increased substantially. It is what it is.

“If the median price for April and May is unchanged despite the substantial number of over asking price sales reported by biased sources, what does that mean for the market as the velocity of sales is decreasing?””

It means Vicinvestor will get upset because it’s a negative fact that may effect his lottery win.

Nan,

You bought a house to live in and made money, congrats. Many are selling and taking that profit, just like any investment that pays off faster than expected and can’t resist the easy money you will never see again, or was their prime purpose for buying.

Some buy and hold stocks forever, some look for undervalued or undiscovered stocks with unusual upside potential just like in real estate. To each their own, but as Jack said:

“If this was a stock, and you were watching prices flatten and daily sales declining would you buy more or sell?”

When they start cruising my street and filling my mailbox pleading to take their free money from the bank, I’d be selling in a heartbeat.

The blind auction is not unfair to the buyer…stupid is as stupid does. It’s unfair to the market that get’s goosed by it. It allows for a few silly purchases to drive the market mania higher. IMO there should be no blind auctions in RE. People obviously need a helping hand here. Just make all bids available to to all agents. This would at least give agents more value….

Blind auctions ensure the winning bidder gets a worse deal than they would if there was a free flow of information. The price they pay includes the price of the house plus a fear of loss/ information asymmetry premium.

This premium is any amount over the price of the next best bid. e.g. second best bid is 1,000,000 and you bid 1,200,000, you just paid $199,999 “fear of not getting the house premium” that theoretically would have been $1 if the bids were public and you knew you only needed to bid $1,000,001.

Blind auctions = heavily favor the seller, which is why I don’t participate in them. The presence of another seller not only makes you compete for the highest price, but you also need to pay that additional premium in addition to the fair value of the house as defined by the next best bidder + $1

This is why bidding wars are so powerful in BC. Fear premium = big bucks for sellers and faster price increases when things turn nutty.

I wouldn’t be surprised if price escalation slowed down substantially if the rules were changed and bids were freely circulated.

Yes Maqlaq that’s true. But they are also not paying fair market value. As you said, they have chosen for personal reasons to pay substantially more. Maybe after a couple of trips on the Ferry they have decided that paying a hundred or two hundred grand more is worth not making the trips back and forth just to be outbid. That is not acting with reason. And the definition of Market Value is that the buying must be acting in a reasonable manner.

You can pay $50,000 for a 1980 Ford Pinto because it was the car you took to the Prom but that doesn’t make all 1980 Ford Pintos worth $50,000.

The auction undermines the fair market system and if there are enough of them then the median and average may become distorted.

Hence the reason why the HP Index may be important as it relies on virtual sales and not actual sales. However, subjective opinion goes into the construction of that index. If there is just one person working in the basement of the real estate board that can calculate the index how can that index be verified by an independent source as reasonable or reliable?

If the median price for April and May is unchanged despite the substantial number of over asking price sales reported by biased sources, what does that mean for the market as the velocity of sales is decreasing?

If this was a stock, and you were watching prices flatten and daily sales declining would you buy more or sell?

Real estate isn’t magic. It follows the laws of supply and demand like everything else. Now you can be oblivious to those laws and for a short time take a contrarian attitude and be correct but the longer the current imbalance persists all you’re doing is living in the lag before the market corrects to equilibrium.

Then the headmaster, Mr. Market, takes the cane out the closet and gives you one heck of a thrashing.

People bidding their max bid in a “blind auction” doesn’t affect the other bidders. They weren’t going to win it anyway. It only affects the eventual buyer, who theoretically pays more than they might have needed to. However, the buyer isn’t taken advantage of; they understand the benefits and drawbacks of the decision they are making by entering that bid. It’s a decision I wouldn’t make, but it could be reasonable to a person who “has” to have a certain house and that need outweighs the extra cost they may be incurring.

“So if China falters again, do we once again gain from their pain?”

Agree – it’s a very complicated question! You have to look at the data about the economy & add up the risks vs rewards for yourself personally. For me, I already took some risks, I got the reward – I don’t need to take risks with real estate right now – I did my buying before the rise in prices. I think it’s riskier now.

People with a lot of cash to buy homes might want to take some risks; but people who are living paycheck to paycheck have to be very careful – look at what’s happened with Alberta just with a drop in oil prices – the economy can change fast. They are the ones that will suffer the most from an economic downturn in Canada/Victoria.

Looking at China, you have some opposing forces: (a) people funneling money out to flee China’s risky investment/economy, but (b) a credit bubble that’ll eventually explode, Chinese gov’t is cracking down on “economic fugitives” worldwide, and millions of factory workers are losing jobs because they’re being replaced by robots.

http://www.mediamaxnetwork.co.ke/features/224013/foxconn-replaces-60000-factory-workers-with-robots/

Also, Chinese companies are defaulting on their debts, housing inventory is too high.

What % of wealth have the millionaires already funneled to offshore accounts & real estate? How much money will people have left after their own credit bubble bursts?

This is the first generation of Mainland Chinese to ever own homes (they started in the 1990s) so they’ve never experienced a real estate crash before – they don’t know what it’s like to lose value in their investments. That’s partly why they have been extremely reckless & have gambled on too many 2nd homes & vacation properties.

Then you have the risk to Canadian banks – such easy credit, people getting multiple mortages (including international investors, who cannot be pursued if their well of money runs dry).

Things look precarious and I guess it’s important to have enough savings to weather the storm.

Wouldn’t you have liked to have known that the bidding for the property dropped off significantly with the second highest bid coming in at 1.2 million?

If this had been an auction at Lunds or Killshaws you would have known how the bidding was advancing.

Is this really a fair market auction then?

1598 Wilmot Place sold in 3 days.

Asked $1.1 mil, sold $1.435 mil

30.5% over ask.

@ Hawk – you mean like I did by buying a house in the core in early 2015?

Most people would personally attribute credit for this and call it “smartly timing the market”.

And then keep buying houses. Or selling, or whatever.

I don’t believe my house buying experience & outsized results are any different from your stock buying experience (& outsized results?)

I needed a house when I bought mine. It was a good decision to buy whether it went up or not. It ended up going up. Yay me.

A reasonable decision that worked out is all it was.

Lots of luck made it work out better than I expected but believing I can replicate that luck with any amount of intention is false in my opinion.

Buy and hold, keep costs low and you will be fine. Start trying to win and you will almost certainly lose.

You’re right. Also you only have to win the lottery once.

This month is shaping up to have fewer house sales in the core than in April. And it seems that the median price for houses in the core has remained mostly unchanged from the months of April and March.

Although some may wish it were different. Victoria is a market dominated by local purchasers. And that is being shown in fewer sales and only a minor if any increase in the median price as Victorians exit the marketplace.

There have been some exceptional sales but most of the market has been pumped by agents under listing properties to get impressive headlines in the media. In my opinion, the practices of intentionally under listing, shortened exposure and a blind auction where the listing agent is both auctioneer and listing agent is a conflict of interest and undermines the fair market system.

A true auction is carried out by an unbiased third party where the bidding process is public. That typically involves a licensed auctioneer or the courts.

There are no fair rules to a “blind” auction. The bidding process and bids are cloaked in secrecy. And when you have the listing agent acting also as the auctioneer there is the possibility or at least the perception of irregularities behind closed doors. Which damages the public’s opinion of the real estate profession.

Then there is the question that is the listing agent providing a service in the best interest of his client or in their own interest to obtain a speedier sale. That if the property had been sold under normal marketing conditions would the seller have achieved a higher price?

The Province quickly moved to shut down shadow flipping to protect sellers’ interests. If the Province did the same for unregulated auctions it would be in the best interest of both the public and the real estate profession in BC.

“you might get lucky enough to make a few trades that feel solid but you are kidding yourself that you can beat these guys over the long term ”

You only have to beat them for a few in the short term to not have to worry about the long term.

“@Hawk, but Inda is just going to take their place. Why do you think Apple is pushing so heavy into India?”

You mean India is now going to drain their currency to buy up Vancouver real estate ? That’s a good one. Apple is running out of options for growth.

The 6.8% is net of fees. Same as the UVIc. So CPP actually earned about a percent more than UVic’s passive fund but the costs ate up all the profit.

Completely agree with you by the way. Especially the CPP should not be playing that game. This was a way to allow them to pay their cronies fat paychecks and nothing else.

I haven’t taken a careful look at the CPP stuff, but if UVic performed @ 6.7% @ low cost and CPP performed @ 6.8%, there is still the 1% or so admin fee to factor in meaning it is possible that @ 6.8%, the CPP actually underperformed the index by 0.9% (assuming a 1% fee of course).

If I am incorrect in assuming the fees were left out, there is still only a 0.1% bump in return which in my mind hardly justifies the 90% probability that they will underperform over any measured 30 year period (it is well established that the more parties you have contributing to a return, the closer the returns approximate the index before costs and after costs, lag significantly)

Someone already mentioned that “The markets are too unpredictable & the world too complex for me or anyone on this site to market-time or engage in consistent successful active management”

I believe this to be true. To out perform the indices after costs, you either need to be an insider trading on either early or illegal information (virtually all of Wall Street) or benefit from market moving influence (Soros, Buffett, etc).

If you live in Victoria BC and receive information hours after the day traders plugged right into the exchange have acted on it and not soon enough to have any illegal advantage, you might get lucky enough to make a few trades that feel solid but you are kidding yourself that you can beat these guys over the long term – it is impossible to tell the future and probability isn’t on your side.

@Hawk, but Inda is just going to take their place. Why do you think Apple is pushing so heavy into India?

Mike,

China wasn’t the big player back then as they are now. Again, old charts with no meaning to today’s world.

Vicbot,

Vicinvestor says he’s Mr. Conservative and in for the long haul, but can’t handle anything that suggests that the global market may negatively influence his first SFH. Why he wastes so much time trying to debunk an analyst from the World Bank is beyond me. Maybe he’s a mortgage broker in disguise and the the thought of a serious market correction will put him in the poor house.

China dragging the world down with them when they just spent the last decade pumping us up goes against all common logic to say it can’t possibly happen. They are siphoning their money out of there like a vacuum cleaner for a reason, it’s a time bomb.

Sure, but does it affect us negatively or positively? While China prices were plummeting from 1998-’03, our prices had already bottomed by ’97/98 and were increasing.

So if China falters again, do we once again gain from their pain?

http://www.globalpropertyguide.com/template/assets/img/CO-HKP-I01.gif

Million-dollar-home count triples across Seattle area in 4 years

Million-dollar homes are no longer widespread just in Manhattan, Beverly Hills and San Francisco: They’re now popping up all over the Seattle area, like mushrooms.

In all, 7 percent of all single-family homes in the region are worth seven figures, up from 2.5 percent in 2012.

http://www.seattletimes.com/business/million-dollar-home-count-triples-across-seattle-area-in-4-years/

VicInvestor1983, I agree that people are divided about how things will unfold, but I take everyone’s opinion with a grain of salt & I’m very interested in reading the wide range of news articles about Silicon Valley, China, Europe, and US – whatever happens there eventually affects Victoria, and the companies/gov’ts I invest in.

Here’s an example of how it helped me personally: before & during the 2008 financial crisis, I followed the relevant news & reviewed what happened during the Great Depression & the 1980s Japanese asset bubble. I also lived in Vancouver so gathered data “in the field” so to speak.

All that data gathering helped me make some key investment decisions that I benefited from, eg., when I moved from Vancouver to Victoria, and how I figured they weren’t going to raise interest rates for many many years – much longer than what the “experts” predicted, and I took advantage of that.

So that’s why current news is very relevant to how I decide to handle my finances & real estate – and I wouldn’t want to discourage that type of knowledge sharing here.

@admin: active management & market-timing are not only bad for your bank account but also for your psychological health.

Interesting read: http://www.amazon.com/Incredible-Shrinking-Alpha-Escape-Clutches/dp/0692336516/ref=sr_1_2?ie=UTF8&qid=1464584350&sr=8-2&keywords=swedroe

Exactly. The math does not add up not just on that transaction but the others as well. I would generally not buy a rental townhouse or condo in Victoria myself. You are going to be cash flow negative. Maybe prices will go up but that is a gamble and transaction costs are high. Put your money into your primary residence with a suite if you want to be a landlord before anything else, then TFSA/RESP/RRSP and then other types of investments. I personally no longer look in Victoria for rentals. The numbers don’t make sense for our purposes.

As a reference, the UVic pension fund is passively invested in 55% equities, 35% bonds, and 10% real estate. Their 10 year net return is 6.7%. So CPP and their high priced active management and private equity was worth an extra 0.1%.

Good overview of the crock that is the CPP’s new direction. http://news.nationalpost.com/full-comment/andrew-coyne-canada-pension-plans-active-management-strategy-is-a-crock

Here is CPP’s ten year update on the decision to go active management: http://www.cppib.com/en/public-media/headlines/2016/Ten-Years-Active-Management.html

They hold it up as a success but I think it is the opposite. Their portfolio outperformed the passive reference in 6 of the 10 previous years. So basically hardly over 50-50. They say “We have generated a nominal rate of return of 6.8%” annually over the 10 year period 2006 to 2016. Not exactly something to write home about. In the meantime they have grown massively in size and costs.

Yes they are eeking out more returns than extra costs, but not by much. And now that their employee numbers has increased so dramatically, it is impossible to go back. It has become a self-justifying machine.

@Eve, what were your investments that are getting you 6% in dividends out of curiousity? Also I ran the numbers on your town house and get a negative cash flow of -$813/month and a cap rate of 3.58% (based on 4% yearly appreciation and have $0 for maintaince, vacancy or management) your math doesn’t add up…

@Vicbot: I already know all this stuff. I read the news too (but should probably read less). The problem is that Hawk makes grand predictions. The Chinese slowdown & debt issues are what they are. However, economists & so called experts are divided how this will unfold. A retail investor like me can read all the news in the world. At the end, so what? I need to make decisions regarding my family’s finances. IMHO, there is little one can do beside the following: earn as much as possible & spend within means, diversify investments, reduce bad debt, & avoid excessive leverage. The markets are too unpredictable & the world too complex for me or anyone on this site to market-time or engagement in consistentently succesful active management.

@Eve your contract is for the term. The bank has no obligation to renew your mortgage when your term is up and can then just require you pay them in full. Odds are your HELOC can be frozen at their discretion so no drawing from that to save your ass. So you got ten years. What does your situation look like when you need to renew at 6.5% and your HELOCs are at 7.5%? Or your condo you purchased has to pony up 100k for a re-skin of the exterior and your equity is all maxed? I had a buddy get his line of credit frozen on him in the states during that meltdown. He was a builder and that simple action meant he couldn’t pay his crew. This meant he couldn’t finish his projects and thus proceeded to lose everything….

VicInvestor 1983, that article from Hawk was reprinted from the South China Morning Post, a very reputable publication with great investigative journalism:

http://m.scmp.com/business/article/1952783/how-credit-fuelled-chinas-incredible-boom

Why all the denial about how the Chinese economy is affecting the world. It’s a fact in plain view of the entire world of economists and policy makers.

“Coast Capital is a BC lender, they have loser lending policies than the big national banks.” hehehehe Freudian slip? I know you meant looser. 😉

@Hawk: Do you have any more conspiracy websites, lol? Maybe you also subscribe to ProfitConfidential!!

Wikipedia re: ZeroHedge

“The site was described by CNNMoney as offering a “deeply conspiratorial, anti-establishment and pessimistic view of the world.”[9] Other writers have characterized the site as conspiratorial.[10][11] A Forbes article described the site as a source of hysteria and occasionally misleading information”

Credit unions are the first to go under in a financial crisis and will be tightening the leash faster than the banks.

A little more education for the China deniers. Interesting video showing where they created the free cash and why it’s about to come home to roost.

China’s Credit-Fuelled Economy Is “Gyrating Like A Spinning-Top That’s Out Of Momentum”

“China’s hard landing has already begun, warns economist Richard Duncan as the nation’s credit-fuelled economic boom ended in 2015 and a protracted slump lies ahead. He has published a series of videos explaining why China’s economic development model of export-led and investment-driven growth is now in crisis leaving “China’s economy resembles a spinning top that is running out of momentum. It is wobbling and gyrating erratically.”

http://www.zerohedge.com/news/2016-05-25/chinas-credit-fuelled-economy-gyrating-spinning-top-thats-out-momentum

As for using or not using the suite income. It depends on what lending institution you get your financing from. Coast Capital is a BC lender, they have loser lending policies than the big national banks. Legal or not legal may not be that of an issue for them. Making the mortgage may be more important to them since rarely do illegal suites get shut down. It’s a risk they are will to take.

ScotiaBank sets its lending regulations from Toronto. And those regulations are uniform for ALL of Canada. Unfortunately all of Canada is not the same when it comes to legality and conformity of suites.

That might make Coast Capital a better choice but because they are a smaller lender they will be more aggressive when it comes to mortgage defaults. A Chartered Bank might take 6 months to a year or more to foreclose on a property. The smaller Credit Unions can have you out of the house in 3 months and sometimes less.

When selecting a lender it isn’t just about the interest rate.

Went to the open house today. Basement finished but the 2br suite has a completely bizarre layout. No living room at all. Built to a budget.

Kitchen redone but windows remain crappy aluminum frame. Plasterboard got a coat of paint but isn’t looking so great. Still very much a 50s house with cramped layout.

Listed $900k. Open house swarming. Accepting offers on Tuesday. Maybe it’ll sell for $950,000.

Sickening

Huh. So the genius real estate investor didn’t bother doing a 5 second Google search before putting $50k into an RESP. As JJ would say: “things that make you say hmmmmm….”

When we bought in 2009, Coast Capital Savings (our mortgagee) knew our home’s suite was illegal, factored it into their calculations, and didn’t care one bit. In our case, our mortgage loan insurance was from Genworth, not CMHC.

@Eve2 – there certainly is a yearly max to be eligible for the grant @ $5000 per-child :

Canada Education Savings Grants (CESGs)

The federal government pays a subsidy for each child that is a beneficiary of an RESP from the day the child is born until his/her 17th birthday.25 The current annual maximum CESG per beneficiary is $500 (i.e., 20% of the first $2,500 of contributions paid annually). Each child is entitled to a cumulative limit of $7,200.

A family that did not contribute to its child’s RESP for a year or more can receive a grant of not more than $1,000 as a CESG in a year (i.e., on a maximum contribution of $5,000).26

The maximum annual grant on the first $500 contributed per child is increased slightly for low- and mid-income families.

http://www.taxplanningguide.ca/tax-planning-guide/section-2-individuals/registered-education-savings-plans-resps/

or:

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/resp-reee/cesp-pcee/csg-eng.html

@ Eve2 “The Basic Canada Education Savings Grant will give you 20% on every dollar of the first $2,500 you save in your child’s RESP each year.”

If you put in $50,000 at once you only get a total grant of $500 instead of the $7200 you would get by spreading it out over 14 years,

http://www.servicecanada.gc.ca/eng/goc/cesg.shtml

Unless you’re saying the service Canada site is wrong on this topic

I just find your numbers don’t add up. I’ve never tried to qualify for a mortgage using illegal suite income myself but the cmhc rules are pretty clear.

Banks don’t care if its legal or not if you are doing a 20% + fixed term, especially a 10 year.

Isn’t this a housing info blog, don’t these posters post here daily for many years, and don’t know this basic info?? Wow

I mean come on people, this isn’t rocket science.

Leo: What are you talking about?? Since 2007 there is no limit yearly. I can’t believe you didn’t check that before answering.

We qualify for the grant still.

See: http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/resp-reee/cntrbtns/vrcntrbtns-eng.html

Toronto, totally off. You didn’t factor in our suite in your guesstimating post.

Dasmo, what the heck are you talking about? “Banks calling in the loan” what is that.

When you sign a legal agreement with the bank as long as you make payments they can’t suddenly revoke your house because of a “squeeze”

Where are you guys getting your info.

You know that these properties are rented right? And in 10-15+ years rent will be higher and he mortgages will be lower.

Sometimes I wonder.

Also who says we don’t have liquid assets to cover if in 5-10 years when we renew our mortgage payments go up? That’s part of our calculations.

Remember all these mortgages we are getting is being vetted at 5% plus rate! And as JD said, banks are very very thorough and tight with lending.

StepbyStep

Naturally we hope for her every success.

However, we went through the last bubble in Vancouver and I remember that at the height of the frenzy when people started dog piling on there was standing room only at the Realtor courses (it wasn’t on line then)… soon after the market started to slide.

I am an old Vancouverite… now living on the island… love it!!

@Eve2 You can’t “Smith Maneuver” into a TFSA or RESP. Smith Maneuver only works for investment vehicles where you have a taxable gain, dividend or interest.

I have a feeling you are talking out of your cap or are making decisions based on fragments of information, not whole pieces.

Banks care about it if you are CMHC backed. They will only permit legal suite income to be accounted for: http://www.canadianmortgagetrends.com/canadian_mortgage_trends/2015/07/cmhc-to-allow-100-of-suite-income.html

This information indicates that when the space is a room in your house, or income from a non-permitted (illegal) suite (basement, garage, etc.) that income is generally not allowed to be factored into qualifying by lenders as the municipality could force you to shut down your suite. http://www.richardsmortgagegroup.ca/buy-home-with-a-rental-suite

@anitap “My Sooke neighbour’s 26 year old housekeeper just quit… she is taking the course to become a Realtor! Me thinks the canary is about to stop singing.”

This is a great move – why shouldn’t the housekeeper cash in on the boom. She would know houses better than many people and how people try to ‘hide’ flaws, etc. I really like these types of stories. I also appreciate reading @Hawk’s viewpoints – different perspectives add value to this site.

Dasmoalderon, didn’t the bank charge you for a missed payment? Which they would just add to the mortgage.

I use to work for one credit union that if you were late in the payments they would start proceedings which included appraisal, legal fees and penalties that added another $3,500 to the mortgage. During the last BC recession, I was getting up to a dozen assignments a day. Very few ever became Conduct of Sale but the Credit Union was making some good coin.

Oh…and the bank can turn on you quickly. I missed a mortgage payment without noticing once. I have overdraft on all my accounts except this new one I made for the house. I didn’t know this and I was set up for weekly payments. So… I didn’t notice when my account was shy and a payment was missed. Things carried on and I continued to ignore the robo calls from the bank until I got a letter that the bank was going to start foreclosure proceedings! Even though payments were continuing etc they considered the mortgage 3 months delinquent! When I went into the bank I also found out my credit rating was a D as well! I was able to clean up the mess pretty quickly but that was because it was an obvious error. Where was the call or email from a human? Anyway this gave me a warning call that the bank wIll turn quickly on you and will not be considerate. I for one don’t want to be in a position where they hold all the power when that time comes. The longer we are in this era of free money, the higher the risk is of that day coming.

@Eve “What’s the risk here?” Wow…. I think rates will be low for a while but not forever. Your risk is very obvious. Leveraged to the max at a huge dollar amount with nowhere near the liquid assets to cover after rates go up. The bigger risk is that more than rates go up but we do get some sort of credit squeeze and the bank calls in your loans. You simply haven’t given yourself any headroom for when the bank turns on you… I give you poor odds of long term success…

Having once lived in a 1800 sq ft 4 bed house I can tell you it’s pretty cramped. Mind you I have kids.

If you fill up the RESP completely in one year you are giving up the grant. Stupid move.

Are you sure? I thought the banks don’t care about suite legality. That is a municipal issue.

I’ve just looked up the criteria and terms applicable to a second mortgage. If you are doing this you are extremely foolish imo. As far as I can see this would only be a step to take if you had loads of high interest credit card debt you couldn’t pay.

Eve, your style of posting and syntax are very similar to a pp but he was located in Oak Bay.

So you have remortgaged at 80%? Makes more sense but there are still a few things that don’t add up and perhaps you can help:

Your 450k mortgage at 4.3 at 25 years was approx. $2,440.84 vs. 880k at 3.74 is $4,505.79.

But it appears what you are saying is that you refinanced your first mortgage and got both a HELOC and second mortgage? Even so, you have to include the financing costs of these funds in your overall payment on the house and the townhouse, and you don’t appear to have accounted for this.

It appears you might be eligible for a $265,000 HELOC due to the restriction on borrowing more than 65% of value less mortgage by my calculations.

To refinance would have cost a penalty of about $4000. A second mortgage could give you access to up to an an additional 15% of equity. By your numbers it seems it might be 155k?

I didn’t realize that you could get a HELOC and then borrow again, effectively bringing your overall debt servicing outside of 65% ltv. Seems like that defeats the purpose of the HELOC rules through the back door – but I’m not expert on that – haven’t done it.

So if I understand you correctly you have accessed an additional $155k through a second mortgage. What is the rate? I understand it is usually higher than for first?

How is it that when you add the second mortgage payment plus your first you are paying $350/month less than before when your mortgage was much less – those numbers don’t add up for me.

Your townhouse is not cash flow positive as I read it. You haven’t added your sewer/water/garbage payments or any of your expected repairs. Nor, it appears, the borrowing costs on the 25% down and repairs made? You have 100% financed this purchase and repairs. It appears that you will have used up the entire second mortgage of $155k for a down payment and then paid the ppt, and repairs from financed funds as well? I’m not sure how you will be able to get any HELOC on the new place even though the value went up due to the HELOC ltv restrictions unless you instead pay the penalties and refinance immediately with a second mortgage?

The 155k down payment plus PTT and repairs and refinance fee and you are at what – 185k? Add RESP and you are at 285k extra debt. Add TFSA maximization and what.. 300-350k? This leaves you with 80-130k remaining that can be accessed. Where are you getting 300k leftover from?

Are you including the gross of rental income from your suite in your annual income or your net? You need net to get income. In addition, banks will only take rental income of a suite into account if it is a legal suite – very few of those in Gordon Head.

Two sons make more sense. And no, you cannot over contribute to a RESP without incurring a penalty. Over-contributions are subject to a 1% per month tax levied against the subscriber on the subscriber’s share of the excess amount for each full month an over-contribution exists. To reduce the tax penalty, a subscriber needs to withdraw the over-contribution. It has nothing to do with the grant.

Any stats available on the number of active realtors?

What’s wrong with 4 beds, 7000 sqft, and 1800 floor space?

My Sooke neighbour’s 26 year old housekeeper just quit… she is taking the course to become a Realtor! Me thinks the canary is about to stop singing.

That’s the accepted misconception, but if you look at the data on Victoria for instance, prices usually follow the Fed rate higher.

http://i.imgur.com/tJKpSs4.png

“Montrose was a 1920s 1800sq ft 4 bedroom house on a 7000 sq ft lot. That’s quite a pretty penny for that.”

It certainly is and it’s shocking. But I think that what’s happening is that non-Victorians (or Victorians who are priced out of all but the truly crappy houses in OB/Fairfield) are valuing the ocean/mountain views in that neighbourhood. 3119 Somerset will be interesting because it’s slightly outside of what I think of as the best part of that neighbourhood (Smith Hill, as Ash mentioned) and so has no view, but it’s been fully renovated and has a suite.

@JD. Did you get your house reassessed by bank?

Did you use 20% doen payment, min? (Hope so!)

Have you improved the house in 5 years?

If it’s worth 1.1 mil, you can borrow 80% on a second mortgage after reassessment.

Why use a heloc for debt? Why not roll debt into mortgage and extract equity to invest?

@Totoro, kinda close, but not really.

1.1 mil, second mortgage is allowed 80%

1.1m minus our 460k mortgage allowed us $420k in “second mortgages” note the plural.

50k in resp is only if you want to not have option of 7200 gov grant. We have 2 sons, so we maxed each one. So good point, but there again is reason why we hit the exact limit before grant.

Next: mortgage on townhouse after down payment of 154k is 1980.00 + strata and prop of 347. So technically we are cash flow positive.

And again, can borrow 80% on second mortgage on that! So run your numbers again w 80% and see much more cash available then you estimated.

So we have 2 mortgages. And one heloc. The heloc is min down payment and we are using the smith maneuver with that for our resp/tfsa investments of 6% drips. So we are earning ~ 2% on free leveraged money. Plus we write off the interest payments on our income lowering our bracket.

So, not sure what you mean, we have over 300,000 available to use for a 3rd mortgage at anytime, we plan to do 25% down on the condo, and then we have plenty left over for more.

Where is the risk here?

The 10 Year was on our primary, we had a brutal 4.3% 10 year left over from 6 years ago when everyone thought a massive crash would happen. So it’s easy to refinance at today’s low 3.7% 10 year rate (look up rate hub) and Lower our monthly by $350.

Also, little trick since you obviously are not caught up to date on pretty basic stuff here, a 10 year at a bank will open many doors for you.

Worse case is massive crash, we both lose jobs, and in 5 years we have to supplement rent for a while and in 10 years we have to pay more mortgage. We calculated worse case and it would take a massive 75% crash sustained over 12 years and rents dripping 60% for 16 years for us to then after that time of zero employment to sell our places. By that time the payments will have given us room to sell the houses for a profit even at 50% reduction from last years prices.

Our combined income plus money from suite in primary is $220k year.

I don’t buy that Eve story for one second. We bought 5 years ago for $585k off Oak Bay Ave and I guarantee it’s worth at least as much as a $675k house in Gordon Head bought last year. We just applied for a HELOC to consolidate a line of credit to a lower interest rate and to do some small renos, and the bank isn’t exactly allowing us to do ‘all sorts of fun stuff’ with the equity, even though as two professionals we’re making more than three times the median family income in Victoria. Lending has tightened since we bought, as far as I can tell – at least with the major banks. I would not have access to that equity. I would not be able to buy a townhouse and a condo at the moment.

Even if this story is somehow true, it’s far from ‘no risk’. Prices may be going up more, sure, but we may also likely be at a regulatory peak here. Global money is driving this asset inflation. The US Fed tightening like they’re hinting will slowly firm up the bond market and make it less attractive to park money in hard assets. In turn, the banks will see lending money for mortgages as higher risk than in the past, and therefore will be less likely to do so. It’s a double-whammy of added carrying cost which will (hopefully gradually) deflate housing valuations. Add a big question mark of other external factors like foreign economies, domestic regulatory changes, etc. and it is indeed a big grab-bag of unknowns.

I’m happy with one large investment in housing. The rest goes to high-yield dividend stocks, guitar amplifiers and spey rods.

@VicInvestor1983

“However, rental price increases will creep up substantially in the next few years as renovictions continue & rental leases expire.”

This again misses the point. Landlords, including myself, who are free to set any rent they want, are forced to set rents low, not because of the Tenancy Act but because it is the only way to get and hold tennants. Ask too much and, ironically, you will get tenants who are more likely to be late on payments, cause damage etc. Good tenants know how to manage their money, so they don’t overpay, and Victoria rents are inexpensive. I wish it were otherwise.

And I’m not a bear, by the way. I think Victoria will go up long term, though I’d say the odds of a correction starting in Vancouver or triggered by a global credit crisis are high enough (I’d say more than 50%) that any sensible investor should have that figured in.

Oh, good. Another one with a crystal ball. They must be on sale.

Maybe prices will go up more, maybe not. At some point interest rates will rise.

As far as your $2350 rent goes, well by my calculations you are cash flow negative each month. Covering a mortgage is only part of the costs of owning. Strata, taxes, insurance, sewer/water/garbage, repairs… And you’ll be cash flow negative on a rental condo too.

So you bought last year for $670k. – 20% down? So mortgage is about $530. At 1.1 million you get to borrow 65% on a HELOC so wouldn’t that equal a $185k HELOC or am I misunderstanding things and you refinanced the mortgage cause you mention the “available HELOC” used to 1. pay down payment and purchase costs 2. 100k in RESP and 3. maxing TFSA (all of which add up to more than the 185k HELOC you could have accessed) and then state that the bank packaged everything up in a five and ten year mortgage package.

Are you saying the bank give you a mortgage of 880k and you access 350k? And your overall payment on a 880k mortgage at a five year fixed rate is now $350/month less than your 530k mortgage was at a rate obtained last year? That doesn’t really add up somehow.

Then you bought a townhouse at 620k with 25% down equals 465k on current 735k value. 65% of 735k is 478. You won’t be able to access any equity through a HELOC on this place.

And you must have a super high income to qualify for all that extra debt given that the banks will only take into account 50% of the rents. And what about all those refinancing costs each time and the bank rates for a 10-year mortgage – lowest available being 3.74…

Also interesting how you contributed 100k to a RESP when the lifetime limit is 50k.

I look forward to hearing more about all this.

Vic West / Esq are also experiencing similar price increases – 1048 lyall st recently sold for $801k (asking $699k) and that’s not even in one the most popular neighbourhood in Esq. Similarly 525 Macaulay sold for $700k. Before this year, hardly anything ever sold for more than 600k in the same area.

Agree with Marko that high prices for hoods like fernwood, mayfair and hillside could be related to new comers that don’t have preconceived notions and just want to be near downtown. But then again if it’s all about proximity shouldn’t we see the same effect in vic west/esquimalt?

I wonder if Vic is just behaving like vancouver on a mini scale, where traditional working class areas (east Van) go up with the tide. Will be interesting to see long term if these trends stick (aka gentrification) or if they revert back in the next downturn. Areas like Mt Pleasant seem to be undergoing a more permanent shift.

@Eve

This has to be that troll who posts under multiple names?

@Eve. Oh good another person that owns several houses and doesn’t understand risk.

Montrose was a 1920s 1800sq ft 4 bedroom house on a 7000 sq ft lot. That’s quite a pretty penny for that. If that’s a new benchmark then the bears might as well accept defeat.

I’m not sure if anyone here actually knows what’s happening. Let me put it clearly. We are in the very beginning of a large increase in prices.

Our house we bought for 670k in Gordon Head 1 year ago, got appraised by our bank a month ago. And guess what, the bank assessed it at 1.1 million.

Probably would sell for high nines. So assessment is a little off.

So basically, the bank is allowing us to use the equity to do all kinds of fun things.

We immediately bought a townhouse in the core, even though prices for townhouses are up 100k since Jan. Townhouse was 620k ours in a bidding war. We just got it reassessed after countertops and new paint and it came in at 735.

We are combining all the new equity and buying a new condo as close to the core as possible.

With 25% down payments, the two places we buy/are buying will rent immediately (townhouse rented for 2350 mo, 40 applications in a few hours.).

We also took money out of available heloc and maxed out TFSA, as well as put 100k into our sons RESP. That money is now invested well and earning 6% dividend drip.

The bank then remortgaged and repackaged everything for us with very very low fixed 5 and 10 year rates.

Our monthly mortgage on our main home is now $350 a month less then before. Plus we have covered our child’s uni, and made substantial actual real cash investments towards retirement.

If prices go up another 10% by winter we will go to bank and get all 3 places reassessed and rince and repeat. Our banker said she could see us owning 2 more rental cash flow positive houses in Royal Bay development by next spring at the latest.

This is just one middle class/low middle class family. No risk, rents cover more then costs.

Some of Hawks doom is borderline poetic, Garth – style. It’s actually fun to read.

You’ve gotta hand it to him for maintaining such staunch views through the most rip roaring market we’ve ever seen. Just imagine his posts when the market actually starts to slow.

Montrose is an excellent street and the surrounding area around summit hill is a hidden gem imo. Ocean/mtn views in vic proper for 900k doesn’t seem that weird to me in the context of this hot market. But I’ve always thought that area was undervalued.

On the other side, government is discussing a proper “Living Wage.” There is little argument minimum wage has been suppressed for years. In fact you could argue that foreign worker program was instrumental in this.

Rents surely are going up, but expect wages to also rise in Clarks campaign promises in 2017. She has many coffers, sure, but the people vote.

The Chinese money that has come in the last 15 years isn’t going anywhere. There children are getting older and have houses in their names. There may have been a time to have stopped this, but that was maybe 5 years ago. Weve undergone a significant change in this country in the major centres, and this is probably just the start.

Vicinvestor, where were you 3 years ago when rentals were giving away free rent? People leave, they don’t sit there and suffer like a fool. They make new plans and go somewhere else. It’s a mobile world ICYMI.

LeoM,

Best look at the gold chart in 2008,you are again clueless. Gold tanked from $1025 to under $700. It only came back due to massive QE.

Lehman Brothers and Bear Sterns never got an advanced warning and neither will you. They were supposedly too big to fail. You will wait like most did praying for a miracle bailout that doesn’t come. You think this time around 1000 others highly leveraged like you won’t be hitting the sell button at the same time? Dream on.

@Hawk: rental vacancy is at historic lows. Supply & demand, right? Can you please explain how rents could drop or stagnate when people can’t even find suites to rent?

Not sure whose sweating bullets more,Vicinvestor or LeoM. Not a bull or a bear but rents are going up big time ? Doesn’t fit logic based on incomes and wage growth.

As newcomer stated you are at the breaking point for rents now. A ton of broke homeowners will have an empty basement soon if they think they can gouge any higher.

Wage hikes are near zero and people who make big money will buy in Westshore versus supporting someone else’s mortgage. The millineals will soon start to leave as in past market peaks.

Hawk, you’re grasping at straws. Do you really think your doom and gloom will happen suddenly, with massive overnight catastrophic crashes in multiple markets? Any sell-offs of gold or treasuries or real estate will be a long drawn out process.

Any correction will happen in slow motion and when it happens (yes, ..when not if) it will be more like a long slow burn, more like stagnation with an annual decline of few percent points in ‘at risk’ sectors coupled with annual inflation of up to 3%. If might even start this winter if the Americans follow through and raise rates a couple more times.

And one more thing Hawk; you’ll never have your crash and burn and a simultaneous sell off of gold bullion!! Gold spikes and stays high during economic crash and burns.

@Hawk: here we go again with your doom & gloom predictions. Now it’s the Trump presidency leading to a market crash. These are just assumptions & random forecasts Hawk. There is absolutely no certainty what will happen to the economy/markets if Trump wins.

LeoM,

About your gold theory, I think you missed the boat. You think China will sell gold in an orderly market when they are in panic need of over a trillion plus ? They would crash the gold market and send the US dollar on a roller coaster as they sell off billions in US treasuries. It eould tank the loonie and Canadian banks who lent billions in mortgages to “investors”. No one would step in to help, especially if Trump gets in.It would be bedlam.

@Newcomer: yes, you’re right that rents haven’t kept up with asset prices. However, rental price increases will creep up substantially in the next few years as renovictions continue & rental leases expire.

All asset classes are now in over-priced/bubble territory. What is one to do? Perhaps Newcomer & Hawk can enlighten all of us as to where to park our $$. But, they won’t. Why? Because they are as clueless as the rest of us. I am neither a bull or a bear. I bought a house to live in for the next 20+ years, have a diversified investment portfolio, and make a decent income from my career.

Saying, “Owners should be able to increase rents as the underlying asset price rises,” misses the reality of the situation. Owners are free (under the law) to increase rents when the tenants change and yet, despite a large increase in the underlying asset prices, rents for new tenants only increased 2.6% this year. That is because that is all the market will bear. Because renters do not borrow from the bank to pay their rent, lax lending conditions do not affect rents, which is why they do not rise with purchase prices. Welcome to the free market 🙂

Then we have Christy Clark selling us out as she greases the real estate industry’s palms. I’m sure this will get her re-elected.Not. Stick a fork in it, she’s done like dinner.

B.C. real estate companies join Christy Clark on trade mission to Asia

‘It’s bad optics,’ says critic, pointing to concern over how foreign investment may be pushing up prices

Representatives of two real estate companies are travelling with the B.C. Premier on a trade mission to Asia, raising questions about the optics of the perceived partnership at a time when many are calling for an end to foreign real estate investment.

Information about B.C. properties for sale — translated into Chinese from the Multiple Listing Service used by agents —was published through a Shanghai-based company to give clients a jump on bidding, according to the Victoria Times Colonist report on April 13.

“It’s bad optics,” said University of British Columbia business professor Tsur Somerville.

“At a time when people in the Lower Mainland are very concerned about the extent to which foreign capital is driving up prices here and contributing to affordability options, it seems a little bit politically dicey to take [brokerage] firms … along on a trip to Asia.”

http://www.cbc.ca/news/canada/british-columbia/bc-christy-clark-trade-mission-asia-real-estate-1.3604817

LeoM,

The credibility is in the data and numbers. Keep your head in the sand bud, though if I was over leveraged into this bubble I would be scared shitless and doing the same thing.

Did you miss the part about what happens when the China banks shut down ? How would that effect all those money launderers who are scrambling to get their cash out of that hell hole ? They would be screwed in spades. Canadian banks would tighten credit overnight.

“SOE debt could easily overwhelm China’s banking system”

Lets not look at Toronto’s condo boom about to be bust, nor Miami’s when you have one ethnic group invest heavily and they all want out at once. How about London’s luxury market?

What happens other places with hot markets eventually shows up here wether you want to be in denial or not. It’s a global market like you always preach.

Miami’s Condo Frenzy Ends With Inventory Piling Up in New Towers

“Miami’s crop of new condo towers, built with big deposits from Latin American buyers and lots of marketing glitz, are opening with many owners heading for the exits.”

http://www.bloomberg.com/news/articles/2016-05-27/miami-s-condo-frenzy-ends-with-inventory-piling-up-in-new-towers

Toronto condo market is in ‘high risk zone’ of overbuilding, RBC says

“Canada’s biggest bank has sounded the alarm about overbuilding in Toronto’s condo boom, saying the level of new units coming online coupled with existing ones that are yet to sell have the market in ‘high risk’ territory.

In a report Friday, economists Robert Hogue and Craig Wright wave a red flag about activity in the condominium segment in many cities, but single out Toronto with being especially problematic.”

If the theory that Vancouverites moving to Victoria is a significant reason for our local rapid price increases, then it’s safe to say there will be a correction in Vancouver first, before it spreads to Victoria. And that means we will have advance warning of the impending doom that Hawk predicts on an hourly basis.

Hawk, your daily rants about China’s debt lacks credibility. China’s debt is a fraction of its liquid assets; just their US Treasury holdings are well over one trillion USD. China’s gold holdings are staggering and their annual gold production is the highest in the world, and China’s gold production is owned by the government and most of their gold stays in China …PLUS… China buys tonnes gold annually on the open market. Sorry Hawk, but you need to find something else to rant about.

Someone needs to put up one of these signs at every new development in Langford:

https://twitter.com/cbcnewsbc/status/736007271977766913

Vicinvestor,

You might want to educate yourself on the China debt bomb that’s liable to go off at any moment and Vancouver will be selling off like fireworks at Chinese New Year. Toss in a Trump win and the markets will tank on two major fronts.

Not to forget Japan’s inability to convince the G7 to admit there are serious global financial risks and a couple of interest rate hikes by Christmas and you have a neutron bomb about to explode at any time.

Enjoy bragging about your paper profits while you can.

Chinese banks sitting on $1.7 trillion debt time bomb

Chinese banks are looking down the barrel of a staggering RMB 8 trillion – or $1.7 trillion – worth of losses according to the French investment bank Societe Generale.

Key points:

China’s non-financial debt grew more than 15pc last year to 250pc of GDP

More than a quarter of China’s state-owned firms are loss-making

China’s banks could lose half their capital base prompting a financial crisis

Put another way, 60 per cent of capital in China’s banks is at risk as authorities start the delicate and dangerous process of reining in the debt-bloated and unprofitable state-owned enterprise (SOE) sector.

Disturbingly though, debt is not only not shrinking, it is accelerating, making the eventual reckoning far worse.

SOE debt could easily overwhelm China’s banking system

“Although contributing to less than one-third of economic output and employment, SOEs take up nearly half of bank lending (RMB 37 trillion) and more than 80 per cent of corporate bond financing (RMB 9.5 trillion),” Societe Generale found.

http://www.abc.net.au/news/2016-05-24/chinese-banks-1.7-trillion-debt-time-bomb/7439844

“@Michael: agree. Owners should be able to increase rents as the underlying asset price rises. Tenants get way too much protection in BC. It’s outrageous what tenants get away with!”

Too much protection ? You’re the problem Vicinvestor, all greed and no morals. Slumlords like Mike get away with murder. New rules are coming in to protect both sides but to say rents should go up because some idiots paid $200K over in an auction is totally asinine.

Just another reason the market will tank. First time house owner lets a parabolic market go to his head. How many more houses have you put bids on this weekend Vicinvestor if you’re so confident the market will never go down ?

Owners stuck in gridlock unable to move up http://www.financialpost.com/m/wp/news/blog.html?b=business.financialpost.com/investing/toronto-and-vancouver-suffering-buyer-gridlock-as-even-existing-homeowners-cant-afford-to-move&pubdate=2016-05-28

I posted about Montrose, JJ – not VicInvestor1983.

The Montrose price is exceptional but maybe becoming the new norm around there given the Alder price. I’m still shocked by it though since I’ve always thought of that neighbourhood as somewhat affordable. I’ll be very curious to see what happens with the fully renovated house that’s for sale on Sommerset right now.

Montrose is a nice street on a hill and the view of downtown from that house is likely pretty great. But people who are from Victoria haven’t coveted that spot in nearly the same way as they value Fairfield or Oak Bay. That’s likely because it isn’t anywhere near the water and it’s a little way back from Fernwood, which has the advance of being closer to downtown. I can definitely see, however, how someone coming from out of town would take one look at Montrose/the Rise/Blackwood/Prior/Jackson/Vista Heights/Summit (or at least the parts of those streets that are up on the hill between Hillside/Quadra/Finlayson/Cook) and think that that’s a very pretty neighbourhood with interesting geography and views. It’s just that if you’re busy dreaming of living in the traditionally “good” neighbourhoods in town it wouldn’t register. I’d love to know where the buyers of Montrose are from.

I find the rental legislation in BC to be pretty fair to both parties really. If you want to be sure you can raise rents then always use leases that specify the tenant has to leave at the end. Then if you feel you could get a lot more all you have to do is not renew the lease.

Watching this flip: 4310 Torquay bought in October for $522,500. Fully renovated listed now for $900k. https://www.realtor.ca/Residential/Single-Family/16997818/4310-Torquay-Dr-Victoria-British-Columbia-V8N3L2

@JS. Good point. Rapidly rising rents will help those buying with suites

@Michael: agree. Owners should be able to increase rents as the underlying asset price rises. Tenants get way too much protection in BC. It’s outrageous what tenants get away with!

@Marko Juras: definite insanity. Is there any data or decently reliable evidence regarding who the buyers are? It’s hard to draw conclusions from VREB official data, because it doesn’t properly capture source of capital (i.e Vancouver guy who moved here 6 months ago with now a Victoria address is counted as ‘local’ or rich new immigrant with foreign sources of cash is counted as a Canadian buyer).

This apt unit just caught my eye right next to that renoviction bldg I linked to.

Assess 184, ask 349, sold 411 for a 1974 build! (no underground parking, no insuite laundry)

You’ll start seeing more large-scale renovictions to double rents. You can’t blame them when you see what it does for the bottom line. We still only renovate on vacancies. BC needs to lose the yearly cap like other provinces, and the market would become far more efficient.

http://victoria.citified.ca/news/residents-renovicted-from-fairfield-apartment-block/

The market has officially reached new levels on insanity…

1615 Ryan Street for $580,000

3145 Alder for $852,000

1264 Montrose for $902,000

Well, info has finally gone silent and is no longer posting her Victoria real estate update on Garth’s site urging all you “girls and guys” not to buy and wait for the crash. That must be a sign of something.

I’m amazed at the price Montrose fetched. I agree that these high prices in areas locals don’t particularly find attractive are likely a result of out of town buyers who don’t hold the same views. I know when I look outside of Victoria at properties I don’t have a preconceived notion of the area I want to buy in. I look primarily at whether the area seems nice enough, what the house amenities and condition are, and proximity to town.

There is really no question that people who bought in Victoria fairly recently, but prior to the current spike in prices, have ended up in a better financial position than renters due to mortgage pay down and, primarily, tax-free appreciation.

I’d suggest that if demand for rentals has increased due to the surge in prices then this doesn’t necessarily mean that it is cheaper to rent than own over the long term: it means fewer people can afford to buy into the market.

@Hawk: don’t worry about my household finances. We’re in top shape & have nothing to worry about.

The inevitable crash? Seriously Hawk, why do you talk with such conviction about the world? Such views are nothing but narcissistic & biased. If you had such great market-timing skills, you would gone & bought buncha homes in Van in 2001 & sold them just about now. But you didn’t. You didn’t because of the ‘inevitable crash’ that never materialized. I have enough humility to admit that tomorrow is unpredictable. I buy what I can afford & diversify across asset classes.

1264 Montrose for $902,000 (assessed at $543,000; asking $739,000). Wow. I guess Hillside/Quadra/Mayfair has now gone crazy.

My feeling is out of town buyers are more concerned will proximity to downtown than perception of area; therefore, this sudden spike in prices in areas that haven’t before been know to support 800-900k prices.

Huh? I have one name. Anyhow.

The Montrose sale is crazy JJ. That is NOT a desirable neighborhood and the house is sub par. This sale price means that most homes in desirable neighbourhoods (Oak Bay/Fairfield/etc) should now be minimum minimim $1 million. Let’s just admit that we’re in a bull market & prices are rapidly appreciating.

Vicinvestor,

Monthly increase ? Have you never rented before ? I get a 3% annual hike and not every year either. A few years ago when the millennials left Victoria in droves they didn’t raise it for a couple of years as they were begging for renters. I’m sure we’re at that point again where they will realize Victoria is over rated for what they are charging and the cycle will begin again.

I’m still pay only 20% of household income after taxes, how about you ? Free heat and hot water to boot so I’m rolling in the extra cash and freedom. How’s your 10% tax increase doing?

Did you miss this part ? Rental demand is up because it’s cheaper to rent than own and zero risk for a massive crash that’s inevitable.

“The gap between the cost of buying and the cost of renting is a factor driving rental demand, said Canada Mortgage and Housing Corp.”

Now to be fair VicInvestor1983 or whatever your are calling yourself this week, the Montrose property is not typical of the market place.

One out of every five houses that sold this month in the core went for asking price or less. And 65% of house sales this month went for less than 5% over asking price.

Properties like Montrose only represent 5% of the market but get 99% of the attention.

Montrose was way under priced. Originally purchased in September 2006 at $620,000. The median price has increased from $486,000 to $755,000 or 55% since then. Either the agents were incompetent in their pricing or they wanted to create a lot of initial interest on the property to get multiple bids.

And perhaps the short exposure and auction may not have resulted in the best price for the property. A longer exposure on the market for an unusual property such as this may have resulted in a higher sale price.

Sometimes an auction will not get you a better price. Sometimes you’ll get less than if you had exposed the property for a longer time to the market. Another 10 or 20 days might have gotten the home owners another $60,000.

I would be skeptical of any agent that is pushing to sell your home by an auction.

My Wife and I bought a house with a suite last year, and the bank wanted a rental appraisal – they estimated the suite was worth $1200 a month in rents. We put it up for $1375 and rented it out pretty quickly. We sold our house in March, and the winning bid requested to do an open house (to have it rented shortly after they took possession). They asked $1500 and got it after one open house.

For what it’s worth, our realtor also thought $1200 was FMV for the suite when we bought last year.

@VicInvestor1983

The article reports a 2.6% rent increase, which is not out of line with the current inflation rate 1.7% or the long term average inflation rate of 3.6%, so despite the headline, the article doesn’t indicate unusual pressure on rents.

@Hawk: better get ready for your monthly rent increase!

http://www.timescolonist.com/business/renters-suffer-in-greater-victoria-s-hot-real-estate-market-1.2265304

1264 Montrose for $902,000 (assessed at $543,000; asking $739,000). Wow. I guess Hillside/Quadra/Mayfair has now gone crazy.

Isn’t interest rate rigging what central banks do every day? 😉

If you’re only getting 1% raises time to find a new job.

“Risky strategy since millions of millionaire retirees are headed this way over the next decade”

Millions ? Mike starts drinking earlier on Fridays… or else he’s one of the scamsters preaching at the seminars.

Just another sign the top is in when the sheep are lining up to learn about all the magic tricks that don’t exist.

B.C. real estate seminars prey on house hunters, promise insider tips: lawyer

“Almost every month, real estate seminars in and around Vancouver promise ordinary people the insider tips and tricks needed to find a backdoor into the region’s frenzied housing market.

Inevitably, many of these free seminars end with the promise that attendees will learn real secrets and even get connected with a group of mysterious private investors if they pay thousands, on the spot, for another workshop or a mentorship.

Meanwhile, the Better Business Bureau warned people contemplating this weekend’s course to exercise caution after it logged more than 150 recent complaints from U.S. and Canadian participants about SuccessPath and several affiliated companies. Most of these complainants said misleading and manipulative marketing practices led them to pay $2,000 to more than $70,000 for classes and mentorships that ultimately had little or no value.”