March 29th Market Update

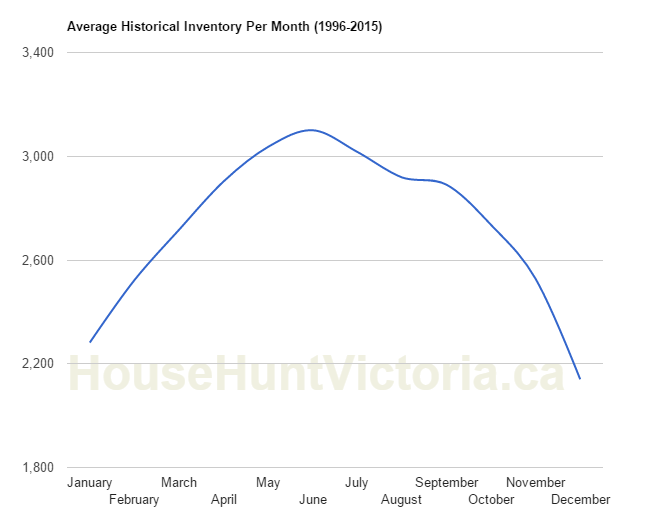

It’s still only the first month of the traditional three month hot spring market. If you recall from the article a few weeks ago, inventory should be building all the way until the peak around June.

But what’s happening this year? Inventory actually dropped from the last week, which is incredible for this time of year. Months of inventory is going to come in around 2.4, which is less than half the level of last year.

| Mar 2016 |

Mar

2015

|

||||

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 193 | 447 | 696 | 983 |

734

|

| New Listings | 304 | 619 | 946 | 1254 |

1448

|

| Active Listings | 2564 | 2576 | 2597 | 2577 |

3769

|

| Sales to New Listings |

63%

|

72% | 74% | 78% |

51%

|

| Sales Projection | 1073 | 1068 | 1040 | 1104 | |

| Months of Inventory |

5.1 |

||||

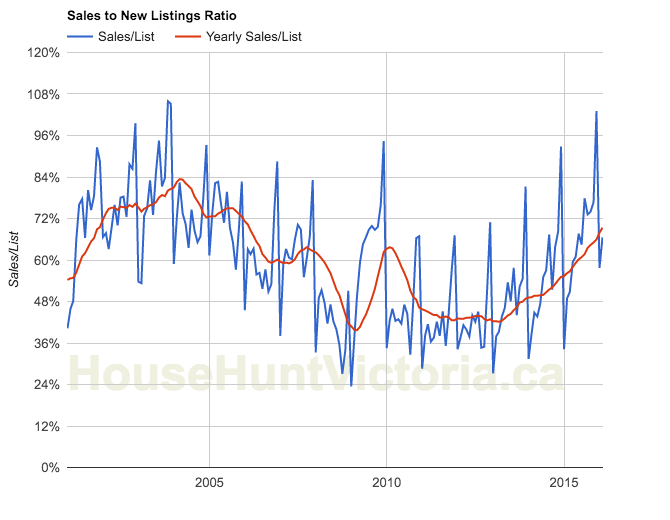

The sales to list isn’t record breaking, but we have to look back at the market between 2001 and 2006 to find similar ratios. Surprisingly enough there’s still quite a bit of headroom there.

On another topic, Mike Grace has written a very interesting article about whether to choose variable or fixed mortgage rates in this environment of measly discounts and ultra-low fixed rates. In the past it’s almost always been better to choose variable, but I wonder if we’re reaching the end of that period. Assuming of course that rates will start going up soon; a scenario that has been trotted out as a given for at least as long as I’ve been following the market and yet just never seems to materialize.

Assessed value is meaningless to me. Numbers concocted by cubicle dwellers that bear no relation to reality. Mine went down by $30K, my neighbour’s by $100K. Both of us know we could sell for $400-500K more than assessment.

This will slow down the SFH sales

http://victoria.citified.ca/news/crds-cut-the-sizzle-levy-to-tax-barbecues-open-fire-cooking/

April Fools for sure.

Last word on 331 St Charles – 68% over assessed. (Assessed @ $603,500, sold $1,016,000). If this is the norm I think it’s great and I’m selling for 350k more than I thought my house was worth!

This will slow down the SFH sales

http://victoria.citified.ca/news/crds-cut-the-sizzle-levy-to-tax-barbecues-open-fire-cooking/

I’m using the same assessment year as at July 1, 2015. Don’t need to do any corrections for different assessment years. A simple apple to apple comparison. It’s that simple.

And most of that is in the last few months. It’s Hyper inflation…. Going to be 10%/month for the spring I bet….

I agree with Numbers. This is all to do with too much money out there combined with a low dollar and a fear of the stock market. Lots of free money piling in…. What a difference from even last year. Even rents are in hyper inflation right now. Rented a SFH in Gordon Head for 2400. One across the street rented for 3000. What is happening???

Preview of month summary: https://househuntvictoria.ca/2016/04/01/march-preview/

March stats are out. The core is running at 16.4% y/o/y.

Oak Bay at 18.9%. Langford for comparison is at 4.7%.

Just Jack – are your year to year comparisons to assessed value corrected for the average increases in assessed value from 2015 to 2016? If so, then Victoria is running at 14% higher prices than last year. If not, then it would be the 14% higher price + the increase in assessments from 2015 to 2016, say 10%, for a total increase of, say, 24%.

I’m confident Oak Bay’s median will be near 2 million by the end of this cycle (early 2020s).

@JJ

Most informative post this year-!

If u want to win a bidding war just take BC assessed X 3 months avg over assessment.

BTW BMWs are way too over rated, but where is the Tesla neighbourhood?

Here’s a bit more of a breakdown of sales by district and type in the core.

Victoria proper

54 house sales ranging from $380,000 to $2,250,000 43 of the house sales sold over asking price, 13 sold for more than 10 percent of the asking price, 4 sold for more than 20 percent of the asking price

115 condo sales ranging from $115,000 to $1,000,000. 26 sold for more than asking price, None sold for more than 10 percent of asking price

Saanich East

132 house sales ranging from $395,000 to $2,990,000. 82 sold over asking price. 26 sold for more than 10 percent over asking price and 2 sold for more than 20 percent over asking price.

38 condo sales ranging from $132,500 to $980,000. 3 sold over asking price. None sold for more than 10 percent over asking price.

Oak Bay

34 house sales ranging from $730,000 to $6,200,000. 33 sold over asking price. 9 sold over 10 percent of the asking price and 4 sold 20 percent over the asking price.

7 condo sales ranging from $212,000 to $495,000. 4 sold over asking price. None sold for more than 10 percent of the asking price.

Now using the asking price as a foundation for determining how prices are increasing is shit. Canadian courts and lenders will not accept list prices as evidence in market values. Because list prices are unreliable. But the public heavily relies on them because they don’t have access to very much data on house sales. It’s better than nothing – but not much better.

BC Assessment estimates actual; (market) value for properties as at July 1. This is mass appraising and while the estimate may be off on an individual house basis, the overall value estimates are very accurate. They should be since the BC Assessment budget is massive and they charge the city for this service that you pay for on your property taxes. The assessed value therefore provides a constant that you can relate to current prices. That’s the number one question people ask me as an appraiser “how does the assessed value compare to current prices”

So let’s see how the current sale prices relate to the assessed value. The median Sales to Assessment ratio for Victoria City house sales in March was 124%. The typical home in the city was selling for 124% more than its assessed value. The month before it was 123%. The year before in March 2015 it was 110 percent. That indicates very little increase on a month to month basis and about a 13% increase in year over year basis. But, the number of sales are low, so the size of the error may be as much as 5%

Saanich East has more sales and the types of properties are more homogeneous than Victoria. The median sales to assessment ratio for March was 123%. The month before it was 116% and the year before it was 110%. Which seems to be the similar to Victoria proper.

Oak Bay is off the charts. This is wannabee land.

March sales to assessment rate was 132%. The month before was 120%. And the year before was 105%. You might as well be buying on Mars when it comes to Oak Bay. Not everyone, but a lot of people are buying into Oak Bay for prestige. Like buying a new BMW, it’s not that the car is many times better than another. You buy the car to show others that you can buy a new luxury car. When you buy in Oak Bay you’re showing your peers that you can buy in Oak Bay. The hotter the market the more you’ll pay for that prestige. And because the number of listing are so low, this is also a market that can be manipulated.

Blame game is starting. Sounds like a lot of whining to me. You can still get a new house 45 mins from downtown for under 500,000.

The real culprit is all the Quantitive Easing by central banks. Canada’s population didn’t double in the last decade, but the amount of money in circulation has doubled. It is mostly in property and the stock market. Yes HAM and boomers have an effect, but the root cause is QE and effects on interest rates causing an unprecedented rise in real assets.

@VicInv1983

That’s a horrible corner lot of two busy streets Gonzales & Rockland (hence the 21000 sq ft lot).

It’s been for sale on and off for a couple years.”

So that boring looking house across from Thrifty’s in Fairfield where the semi’s pull in and out all day with a couple thousand cars day going by just went for $1 million from $500’s a couple of years ago makes a difference ? Some serious money laundering going on here in my humble opinion. Just “horrible” indeed.

@Michael: not as busy as you might think. Plus, there are crap loads of other homes on busy/undesirable streets going way over asking.

@VicInv1983

That’s a horrible corner lot of two busy streets Gonzales & Rockland (hence the 21000 sq ft lot).

It’s been for sale on and off for a couple years.

Market is pretty crazy but not everything is going over asking. 1/2 acre 5000sqf house in Rockland just went for 1.58. Ask 1.7. Assessment 1.5. So it appears there are still some deals out there esp. for more expensive segment.

50’s house on a busy street across from a busy loading dock vs. MLS 361942, 362328, 362306, etc. Or for a touch more a water view from a big old house: 361125. That seems normal? I think I should list our old house in Fairfield…

“impacting prices I’m surprised nobody took notice of 331 St. Charles which I mentioned previously.

Doesn’t seem odd to me….bungalows with far fewer and lower quality renos in inferior areas (Oaklands/Camosun) are starting to push $800k.”

That seems even more odd. $800K for an old box in Oaklands is a joke.

“She sold it for $700,000 and shortly after an identical unit in the building was sold for $1.2 million,” Connell said. “I am tired of my clients and other vulnerable, unsuspecting people getting screwed.”

Even though the number of insane over bids of the 16% Jack has calculated, I don’t get that joe average who happened to make some good coin on real estate in Van would suddenly lose their mind by bidding $200K to $300K over for houses that aren’t that shit hot.

Wholesalers have to be involved on a bigger scale than we think. Too bad the local media has no balls to dig deeper like the Vancouver media is doing, and only want to pump the story for advertisers.

impacting prices I’m surprised nobody took notice of 331 St. Charles which I mentioned previously.

Doesn’t seem odd to me….bungalows with far fewer and lower quality renos in inferior areas (Oaklands/Camosun) are starting to push $800k.

Fri Apr 1, 2016 8:25am:

Mar Mar

2016 2015

Net Unconditional Sales: 1,121 734

New Listings: 1,445 1,448

Active Listings: 2,618 3,769

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

With the talk of money laundering, etc. impacting prices I’m surprised nobody took notice of 331 St. Charles which I mentioned previously. This one seems particularly odd – a modest house (apparently sold a few years back for $529) facing a busy loading dock going for over ask and over a million. Considering what you can get in the area this sale, at that price, seems idiotic. Why would someone spend so much on that particular house?

How meaningful is an inflation measure if it doesn’t track the things you buy to consume? It isn’t. Ignoring house price increases properly in inflation calcs ( not including some bs imputed rent nonsense) is one of the things that has allowed the situation to get to where it is. Like putting a frog in the pot of water set to boil and while he feels the temperature of the water warming up, constantly pointing to the temperature of a cup of water in the side of the stove and telling him it’s not heating up that fast.

@introvert. “Inflation” is BS. They just substitute EZ cheese for cheddar and boom only 2% inflation! Right on target! Meanwhile houses are doubling in a year….

https://twitter.com/rcarrick/status/715618591861641216

20% of househuntvictoria.ca visitors in March were from Vancouver….

Experts say that money laundering, fraud and tax evasion in B.C.’s speculative real estate market could be impossible to tackle unless data from BC and federal agencies can be combined through a computer program (RCMP, Fintrac, CRA, BC Hydro, CBSA)

http://www.theprovince.com/business/real-estate/real+estate+scams+need+high+tech+attention+vancouver/11821831/story.html

“Software would flag questionable deals for further investigation, as opposed to the current system in which various agencies get tips and do one-off investigations.”

“Prominent West Vancouver realtor Grant Connell told The Province he recently came across a Lower Lonsdale condo deal in which a realtor represented both the buyer and seller in an unlisted sale, and seems to have caused the seller to lose $500,000. ‘I am tired of my clients and other vulnerable, unsuspecting people getting screwed.’”

https://ca.finance.yahoo.com/blogs/insight/early-signs-of-a-real-estate-ripple-effect-160747965.html

“As Vancouverites grapple with a red hot real estate market, some homeowners are cashing in and moving to the suburbs, or further to Vancouver Island, to capitalize on more reasonable housing prices.”

Hmmm… Yeah I sympathize with the guy, but he’s not exactly making it easy. Yes it sucks, but he doesn’t own the property and he has no right to stay forever. Begrudging the owners for selling is understandable, but he does go pretty far with it, saying they have no right to sell and capitalize on the market.

Looks like he is a writer and editor of a website. So why live in Victoria at all? Seems like that work could be done most anywhere.

I’m glad you enjoyed the story.

But with all due respect, I think it’s a bit far-fetched for someone with a $750k home buying budget to consider him/herself “swimming hard to stay afloat.” You’re floating better than most people.

Welcome to the Future: Middle-Class Housing Projects

In many booming white-collar cities, such as Palo Alto, with its median property value of $2.5 million, even six-figure earners struggle to find affordable housing.

http://www.newyorker.com/culture/cultural-comment/welcome-to-the-future-middle-class-housing-projects

@Introvert – Thanks for the link to the story about the evicted Victoria tenant who is seeing a repeat of his Vancouver housing woes. You know, my first thought was not sympathy for him, but, rather wondering where this house was and why I missed out on buying it if it was a good house. There is the problem with such a competitive environment: if more people are swimming hard to stay afloat we tend to be less concerned with those drowning around us.

https://mobile.twitter.com/m_r_stewart/status/715716565270790145

Shits gettin real! Kicking “evictors” off “his property”.

Since when did putting $800 down payment and paying rent (below what the homeowners mortgage payments are) become owning. When you rent you didn’t have to save up money, nor bare the risk of home ownership.

The comments on his whiny blog post are hilarious. Yeah if you want to live near Uplands in a nice house for cheap your gonna probably have to move. Move to Sooke or Langford! Lots of families out there!

Complaining about only having Chinese neighbours. Wow.

Looks like we will cross 1,100 sales for the month by midnight. All time record for any month, any year.

Admin we were higher than the financial capital in 2000s. Btw whether it is a financial capital. It is a about supply and demand. Vancouver is not a financial capital and the average price is 50% more than Toronto. Doubt we will get to Vancouver prices but the 1 million average in Toronto for a sfh is possible in the next 3 to 4 years.

6k is an executive lot?? Will go still for 600k plus.

It’s 43,248 square feet (106 x 408). Divided by seven equals 6,178 square feet.

I posted a set of tweets from this guy a few days ago. Here’s his blog post on Rabble:

We’ve now witnessed firsthand the hollowing out of communities in three Vancouver neighbourhoods and now it’s happening here in Victoria. This isn’t even gentrification anymore in any recognizable sense. In fact, gentrification seems like a folksy, tenderhearted word for what is now happening.

http://rabble.ca/blogs/bloggers/michael-stewart/2016/03/we-tried-to-escape-vancouvers-housing-nightmare-vancouver-fol

So you’re saying prices in the financial capital of canada are higher than here? . Well we must be about to reach the same house prices here given how similar we are to toronto.

How big is an executive lot in Gordon Head.

About the size of a tennis court divided by seven. to judge from the satellite view:

https://www.google.ca/maps/place/1715+Blair+Ave,+Victoria,+BC+V8N+1M6/@48.4723629,-123.3291176,161m/data=!3m1!1e3!4m2!3m1!1s0x548f71602cdfc8af:0x41fcb1147a452cc2

Continuing higher GDP translates to rates going up. Banks will be under the gun in next few months when oil companies debts come home to roost and lending tightens up overnight. This could turn faster than one can imagine. Inventory creeping up is the first positive sign.

“Catch up” is just a wannabe catch phrase for “greed”. “Blow off top” is a T&A chart term for those who bought too late.

SweetHome – agree. I’m concerned that whole communities will be destroyed before another downcycle in real estate happens. It happened faster than anyone thought in Vancouver – it’s permanently affected people’s lives. Should we form some kind of “watchdog” group that raises awareness and bugs the BC and federal politicians into action?

I’d be interested in contributing to the effort, I’m sure we have people with various expertise to get this going (if they have time).

Speaking of Feng Shui, Victoria has Canada’s “first auspicious Feng Shui site” in Saanich. http://www.saanich.ca/parkrec/parks/documents/LochsideRegionalTrailSwanLakeFengShui.pdf

Also just got an email from a friend near UBC today. After living there for 10 years, their family has to move out past North Van (instead of biking, they’ll have to commute by car 1 hour into town) because they’re having a 2nd kid and there’s no “affordable decently-sized kid-friendly housing.”

If what you are saying had any validity then it would be happening in all areas and all types of properties. Since it is so localized in one asset type this isn’t an established trend. One late ferry ride from Vancouver and the market would go sideways on you. If your friends wanted a real deal they should have bought on Salt Spring. All the benefits of the West Coast without the price. More houses for sale on Salt Spring than Victoria and Oak Bay combined.

Last year in March we had 231 house sales in the core. So far this month we’ve had 309. Another 78 sales or one bus load of buyers isn’t going to keep me awake. But I understand how people can easily manipulated into over buying these days. They see 30 cars at an open house and they think that will turn into 30 offers.

Those kind of stories don’t phase me. I’ve seen these markets come and go and how people have lost big time by over reacting.

Well GWAC, I suppose when Victoria grows by 10 times I’ll start to worry. But right now living on an island is bad Feng Shui. Besides they still have to work through the Fraser Valley and just the City of Surrey has more people living in it than all 13 municipalities in Greater Victoria.

@ Gwac: when you’re borrowing at record levels to consume & invest at record low interest rates, anything is possible GDP wise. That formula doesn’t care where the money comes from as long as it gets spent.

The things that people do the help others, especially those that live in other countries to support all the importing we do are what are really meaningful to the economic health of Canada. Hopefully it’s the low dollar that is bolstering the exports part of the formula, not increased debt that is supporting the consumption part. Although it is probably a bit of both.

Example of what happened in my area. Toronto couple bought 2 weeks ago paid 300k above assessed in an auction against a few others . Paid 70% of their home sale in Toronto and got a larger home here. This market is playing catch up so do not expect the good areas to fall. There is a line up of people on the sidelines who want the best hoods and do not want to miss out. BTW see this morning GDP. Economy is doing kind of good even with commodities in the crapper.

JJ that philosophy did not really work in Toronto or Vancouver 3 or 4 years ago. That is how you get priced out of the better area markets. Victoria is playing catch up. Still has 50% or more to get the same gains that happened in the rest of Canada after 2009.

House listings in Victoria proper are now over 60 from 34 a month ago.

Saanich East is about to break 100

And Oak Bay is waffling around 45 house listings

In a few months we may have house listings in Victoria proper break 100, Saanich East 200 and Oak Bay 100?

These high prices are causing inventory to increase.

Personally, I wouldn’t bother looking at any house that has been listed less that 15 days. Too many games are being played and I’d rather bid against the sane rather than the insane.

If some mainland Chinese wholesaler or stubble faced millennial wants to pay the price, then let them. I’ll get another chance when it goes into foreclosure.

@CS – Thanks for the “on the ground” report re: Musgrave. I thought it was priced low to start a bidding war. I also noticed an outhouse in the neighbour’s yard from the pictures, so I thought there must be a new building going up.

I hope people who are buying in Oak Bay and Fairfield are prepared to live in a demolition and construction zone. Also, are people in Gordon Head ready to live in a rental village? All those neighbourhoods could also end up with vacant houses. The things that made them peaceful, stable areas in which to live are evaporating. Even those who can afford to live there will see their quality of life decline, which is back to the societal ramifications I mentioned in previous posts.

So, it seems like most people on this site are opposed to the way things are going in the Victoria housing market. What are we going to about it? Should we be writing letters? To what level of government? Should we be protesting? Where? Would it make a difference?

How big is an executive lot in Gordon Head. That will make a difference. Got to figure 600k plus though.

Today I saw there’s a sign up at 1715 Blair Avenue, in Gordon Head, advertising the seven “Executive Lots” that will soon be available there.

It’s not a bad location: far enough from the noise and pollution of Shelbourne; tucked away from Blair, which can be a little busy at times; and extremely walkable (Tuscany Village, University Heights, and Torquay Village all metres away).

I wonder what these lots will go for.

https://goo.gl/maps/XSiW1r7G6F32

Walked by the open house on Musgrave yesterday. People pouring in and out. SUV’s pulling up and drawing out from the kerb. $749K for a nice, but very compact, bung. (1300 square feet) next door to an envelope home going up by Seba Construction that’s gonna block their light.

This kind of mania cannot be sustained indefinitely. The Chinese may be crazy to park their money offshore (does anyone know what percent of sales in Victoria are to investors, is it anything like Vancouver’s 30%?), but they seem to be a flightly lot, so at any sign of a market reversal they’re likely to cash out in a panic.

Meantime, many of those who might have wanted to move up are staying put because moving up now costs so much, which means reduced inventory, which may induce frenzy among those who are determined to buy. A year from now, or even a month, the market could look very different.

As for a 2000 sq ft house costs 300-400/ sq ft, $6-800,000, that’s only for architect designed high-end construction, unless prices have doubled since last year when I estimate the cost of the house at 2760 Lincoln Road (with cedar siding, steel roof, landscaping and fencing) cost 273 per square foot, and that included the carrying cost of both construction and land. Costs of renovations and additions, are no guide to costs of constructing a new house.

http://www.timescolonist.com/news/b-c/cash-bonuses-for-b-c-real-estate-agents-called-into-question-1.2221064 cash to agents. I think BC agents are going to need a PR firm. Seems a lot needs to be cleaned up.

Depreciation relates to a loss in utility. That comes from many factors including age. That’s why land never depreciates it doesn’t lose utility.

But don’t let that fool you – land does fall in price. It just doesn’t depreciate.

Well said Vicbot.

I also agree that the government should do something here. I would not oppose a tax on foreign ownership or on empty housing, as both have negative effects on communities.

Marko – for my part the inclination to own a SFH was partly a lifestyle choice, but just as much an investment one. As many have noted, land is valuable and appreciates over time; improvements can present capital gains (reward for sweat equity of development or renos), but depreciate over time. I guess based on that logic, townhomes would be better investments than condos, since they have larger (though still small) land components.

Something some folks don’t realize is that OB is not just mansions and fine heritage homes. There are a lot of outdated little 1,100sq ft crappers. Today’s families can’t or won’t live in them and renoing them is not worth the time, money and headaches.

It’s the dichotomy of this market that is so confusing. One sees these incredibly over asking prices and yet in other properties there has been little to no increase in price.

A second floor condo in Langford bought in September 2007 at$269,500 resells today at $251,000.

A ground floor condo along Rockland in Victoria that was bought in April 2004 at $305,000 resells a little over a decade later at $322,000.

A house in Brentwood Bay that has had some recent renovations was bought in August 2007 at $530,000 and just re-sold (over asking price) at $593,000.

But then you have the crazy ones.

Yesterday there were 11 sales in the core and 6 went over asking price with one person paying 15% over asking in an auction. The home went for $225,000 more than it was bought for less than two years ago and $273,000 more than the current assessed value.

The same thing the day before when 10 homes sold and 6 went over asking price with one selling 24 percent over asking in an auction and $230,000 over assessed value.

I had one potential client call me yesterday to ask if I could value one of their properties. I explained to them that I estimate market value but I don’t do crazy.

Agree with you, Hawk and Just Jack.

The real estate industry has created a self-fulfilling prophecy with circular logic, all in the name of “get rich quick schemes.“

They build higher density and luxury homes, sell condos to non-resident investors and any highest bidder, push prices up, tell residents to “get used to living in a box” and push them further out of town. They justify it by saying “we just the middleman”. No offense to honest brokers, but that’s the reality now.

Then politicians are willing to ignore money launderers by saying they “don’t want to reduce the equity people have built up in their homes” partly because “there’s going to be a wealth transfer to the next generation.”

Have people lost the ability to connect the dots? There isn’t going to be a “wealth transfer.” The elderly are going to need the money to pay for their own retirement homes, and our health care system is floundering because it can’t collect enough taxes to pay for all the hip replacement surgeries needed (people are waiting 12-24 months including my mom).

Does “ethics” mean anything anymore.

Hawk

agreed re mailbox stuffing. This is the first time since we purchased in fall 2008 that we have been getting substantial numbers of real estate flyers PLUS offers of private sales.

Totally agree Jack. Why can’t they create large companies with all their money ? Because they don’t want to pay more than sweat shop wages and want to fire people without any repercussions and don’t have to answer to human rights abuse. They can break copyright laws, steal software and copy art, music etc, with zero threat from a law suit. With the money they have they could revolutionize the west coast, not destroy it.

If the provincial and federal governments could somehow channel foreign investors away from real estate and into Canadian companies that might cause a change in cities like Vancouver. The governments created this monstrosity with their investor programs.

The Federal government understands the problems with these Canadian passports floating around the world and that’s why there are now two distinct types of Canadians. One has voting rights and the other doesn’t.

In the last election if you had not resided in Canada during the last five years you could not vote in the Federal election. The feds may want the investors’ money but they sure the hell don’t want them to have the right to vote. They don’t want Beijing determining who will be our next Prime Minister.

Maybe foreign investors should not be allowed to own real estate until they fulfill the residency requirement too. You would have to live in Canada for the last five years before you can purchase real estate.

Then again you could always specialize.

https://www.youtube.com/watch?v=2g6qioPIV8k&feature=youtu.be

“I can’t wrap my mind around why people can’t be happy in condos/townhomes/duplexes. The obessions with SFHs is nuts.”

Maybe they grew up in a box apartment in a commie country and always dreamed of a SFH with 5 bathrooms. Everyone has different hopes and wants and if they have the money then so what ?

Maybe they like grass, gardens, and plants and having a nice deck for Bar-B-Q and entertaining with family and friends ? Maybe they just like “space” to relax after busting their ass all day.

Your industry promotes the shit out of it so not sure what you actually expect.

“We now have 5 bathrooms in our house. We use 1, the other 4 are for re-sale.”

Then why did you build them ? Some people like an ensuite so there is one for the company or when two people are trying to get ready for work at the same time. This house obsession bashing is getting lame. Your part of it and profit from it. Hypocritical much ?

Vicbot,

I posted a few weeks back these wholesalers were down in Fairfield stuffing the mailboxes. There should be new laws to stop these vermin.

The Walrus article was excellent. Do you want your Victoria neighborhood to be destroyed into a wasteland like in Van ? Keep on cheering the wholesalers and $200K overbidders.

The only G7 country without a housing policy is a disgrace.

Interesting – both my parents and I have received these types of notes in our mailboxes (mine came today, my parents 1 month ago):

“I am not a developer. I was raised in your neighbourhood and I am interested in your property. Please contact me directly because private purchases have many benefits for both parties.”

We also noticed a black car driving down the street, a guy hanging out the window with his camera, Click Click Click at all the houses on the block.

Obviously, I’m suspicious that these are illegal “wholesalers”, who have been operating in Vancouver and now maybe Victoria:

http://news.nationalpost.com/news/canada/were-not-realtors-former-wholesaler-reveals-hidden-dark-side-of-vancouvers-red-hot-real-estate-market

I wonder how much this is happening in Victoria.

Yes Victoria is one of the best, safest places in the world to live, but Canada has a lot of land – why are we selling our PRIME real estate to money launderers?

Now we’re supposed to downgrade our expectations because BC can’t make the real estate transactions fair so that only law-abiding citizens can purchase a home?

Also, what concerns me is that, just as Vancouver has done, we are building condos in Victoria that just end up in the hands of non-resident investors.

It creates a false economy where people are pushed out of their communities (and local businesses go bankrupt), just because “We will build it and they will come (from somewhere) – no questions asked. As long as we make a profit today. Who cares if anyone is living here tomorrow.” That’s exactly what happened in Vancouver.

The Walrus article said it well:

… what a healthy housing market looks like, the kind that’s on display across the border in Seattle and Portland. Those cities have manufacturing, major company headquarters, successful start-ups, old historical buildings that contain thriving shops and galleries—and a housing market that remains linked to local incomes.”

“Foreign investment has caused house prices to spike above the $1 million mark throughout Burnaby, Richmond, Port Moody, Coquitlam, South Surrey, Tsawwassen, Vancouver Island, and other areas in the region.”

Developers and industry types have always preferred to blame lack of affordability on lack of supply … others point to low interest rates … downsizing boomers … but even taken together, these factors cannot explain the wildly out-of-sync price-to-income ratio … For Yan and others, the connection between Vancouver’s escalating property prices and the arrival of offshore buyers is clear.”

jetted tubs are a negative

When I worked in intensive care at VIHA saw a few people die from legionella picked up in shitty old hot tubs that don’t air purge once shut down……anything jetta….no thnx here.

How’s the mood of buyers out there? Are people downgrading their expectations?

Mood sucks but people don’t seem to be downgrading their expectations and certainly no one is changing their lifestyle to help facilitate a home purchase. Long weekend actually wasn’t too bad for me as a lot of my buyers skipped down on trips, etc….fair enough I guess. Personally, if I was in a position where I didn’t own property I would probably buckle down, buy a home with a suite and move into the suite just too put my foot into the market.

Things are so crazy right now and with zero significant market corrections in Victoria in the last 30 years my feeling is when the craziness ends price will flatten out versus drop.

I am hearing some crazy rental stories from my clients too. Like 62 emails in 24 hours for a suite in Maplewood. 13 showings in one day and 13 rental applications as a result.

I’ll get over it, but I just want to point out that this housing situation has quality of life impacts that run through society.

House and quality of life is all relative. We are ridiculously spoiled in North America with the whole SFH thing in my opinion. I can’t wrap my mind around why people can’t be happy in condos/townhomes/duplexes. The obessions with SFHs is nuts.

Ensuites are total non-sense too. We happily lived with one bathroom for 5 years, but ensuites are on all my clients’ lists. If not a must, than a want.

We now have 5 bathrooms in our house. We use 1, the other 4 are for re-sale.

@Marko. How’s the mood of buyers out there? Are people downgrading their expectations?

Ensuite is just another bathroom. I’ll definitely take it. But we only have 2 not six so kind of important.

Amen! Previous owner put some jetted monstrosity in the main bath. The little bubble jet covers always fall off and the jets grow mold. I would much rather have a normal tub.

Mt Stephen for 800k….wow! How things have changed.

At the end of 2014 I emailed four couples I was working with about 2631 Avebury as I knew it was going to be coming to market and I thought it was an amazing opportunity (1995 built, 2,550 sq/ft, legal suite, 6,400 sq/ft, etc)….and I had replies of “don’t like the colour of the house.” House sold for 650k Nov 2014…my guess is now over 800k. Three of the couples still looking….it’s interesting when the market sucks you can’t seem to sell anything to anyone even if amazing opportunity.

I agree – I don’t care about an ensuite – and jetted tubs and hot tubs are a negative. And that article about Vancouver is both well-written and extremely alarming. Victoria may be turning into a haven for Vancouver housing refugees.

As the sale price of Mt. Stephen shows, one has to look at a sales list rather than just the list price to really get an appreciation of where houses prices have gone, which is crazy!

I’m not saying you can’t get any house in Victoria or Saanich East for $750K (I gave on Oak Bay long ago), but the money that would have bought a nice house two years ago now means settling for some or all of the following: a dodgy or remote neighbourhood, a shabby house, or a small lot.

I’ll get over it, but I just want to point out that this housing situation has quality of life impacts that run through society. I read in some article that psychologists in Vancouver are seeing many clients in distress over housing woes.

Same with number of bathrooms. I remember seeing a three bedroom house with six bathrooms. Who cleans them? Not me!!!!!

+1 dasmo

I don’t get the en-suite obsession… I don’t want my wife to smell my shit when snuggling in bed…

It is a very nice house, but does need another ~50K to bring the bedroom/bathroom area up-to-date (e.g, combine the two small bedrooms and add an en-suite to make a nice master suite).

Pretty clear. Oak bay is full of the nearly dead, hence the low income.

Income is not really an accurate measure of wealth or what you can afford – net worth is. People with higher net worth can buy with more down and less financing. They also tend to do aggressive tax planning which results in tax deferral and lower annual incomes.

I hear ya stepbystep. That kind of price appreciation is terrible for almost everyone and the city as a whole. I’m concerned about the ramp up here and hope it won’t turn into something similar. Even though we own the value of our house is completely immaterial to me. It makes zero difference, all the increase is doing is make the city less attractive to workers and make it less likely that our kids would ever stay.

@admin – that is an incredible article. It has so many threads in it including: fewer secondary suites, real estate prices/income ratios beyond places such as New York, eclectic building styles on streets, empty houses, no taxes but using schools/health care, people exiting the city, environmental issues, and so on. I’m stunned at how broad and devastating this has become. Am I the only one feeling that way?

Mt Stephen goes for 800k even. Guess it’s out of sweethome’s range after all.

Very good article on the vancouver situation http://thewalrus.ca/the-highest-bidder/

Victoriaobserver97 are you implying that this market upswing is caused only by upper middle income households?

And I don’t understand what you’re implying about Oak Bay.

The reason why you have a contradiction between Gordon Head and Oak Bay is because what you really need to know is not what the incomes in the neighborhoods are but what are the incomes of the people buying into that market today. As the buyers can still be middle income earners but with a large down payment. You would get that information from the bank applications of those buyers.

I don’t have that information and more importantly neither do you. But I can tell you that the style of housing is predominantly that of middle income. Not custom and not economy. That you can get $1,500 for a two-bedroom suite in Saanich East is a BIG mortgage helper for middle income households to qualify for a larger mortgage too.

In contrast Oak Bay has homes that from the day they were built were considered custom houses and not middle income. Inlaid mahogany Oak floors, over height ceilings, leaded glass windows, solid Oak doors, plaster details, etc.

So when I say it’s a middle income neighborhood, I’m saying the neighborhood has standard construction housing consistent with the needs of middle income families.

I think it’s a weird approach. As a consumer I care about the product. Is the product that I’m being sold the best product I can get? How much commission is collected is completely beside the point, the only thing that matters is what I’m being sold competitive with the market.

I think the focus should be on banks instead of mortgage brokers. How about cracking down on idiotic posted rates? How about cracking down on obtuse IRD calculations and penalties and forcing lenders to show a simple table of dollar penalties for each mortgage?

What about banning the collateral charge mortgages?

Just seems like there are so many low hanging fruit that have a much larger effect on the market.

I would support some kind of regulation that if a mortgage recommended to a client is more than 10 or 15 basis points above the best available rate for the type of mortgage, then the broker or bank needs to show the cheaper product and justify why they are recommending something else.

Looks like 2646 Mt. Stephen Avenue (nice MCM house on market since last Friday with asking price 700K) is sold. Anyone knows the sold price? My guess is probably close to 800K.

Oil price collapse could cost CMHC $7 billion a year in lost profits

http://business.financialpost.com/personal-finance/mortgages-real-estate/oil-price-collapse-could-cost-cmhc-7-billion-a-year-in-lost-profits

Just Jack, I say that the thinking that Saanich East is the preserve of the middle income family isn’t entirely a complete statement. I say that an “upper middle” income is typical for Saanich East which gives us a rationale behind the big price jumps there.

I’m going to say that Saanich West and increasingly, Langford, is the true preserve of the “middle income family”.

If we look at the stats for many parts of SE, the incomes rival or exceed much of Oak Bay. There are the obvious parts of SE where six figure incomes are to be expected – like Ten Mile Point, Queenswood or Broadmead. No surprise there.

What I found surprising is the number of Gordon Head neighbourhoods with six figure incomes – some areas not even close to the water. For example, if you look at the Hillcrest area of Gordon Head (inland – not waterfront area), the figures show that the average family income is $250,000+! To put this in perspective, that’s considerably higher than the incomes in South Oak Bay neighbourhoods (even some of the waterfront ones like Gonzales) and on par with about half of the Uplands(!).

This tells me that those big price jumps in Gordon Head are perfectly sustainable and there probably is a lot of room for more price growth.

SweetHome, it may be time for you to re-evaluate your life.

I know. Don’t get me started on our sleazebag mayor (who, incidentally, can’t go five minutes without telling someone that he once worked for Apple).

But my point is that, when a city is run half-decently (yes, it’s more of a theory), it still needs to increase property taxes each year to account for inflation. If taxes remained static, city spending would decrease in real terms.

@mooselessness

Agreed. Rate-Hub does a great job of keeping people educated on the current rate environment – although its sometimes like comparing apples to oranges depending on any number of factors.

Definitely a good starting point however.

The best argument I could make is that compensation disclosure might lead buyers to investigate other options: “Maybe there’s a broker who takes a smaller cut or who can connect me with different lenders with better terms?”

But a broker’s customers are already better informed than many people out there — the ones who just walk into their home bank.

I think you’d inform more people by requiring every bank, microlender, or broker to print out the day’s RateHub web page and hand it to the buyer.

Seems useless to me. What’s the point in knowing how much you make? What is it solving?

Curious what the HHV community thinks of this new development:

http://www.mortgagebrokernews.ca/news/ficom-proceeding-with-plans-205126.aspx

Personally, I already disclose my compensation to clients so it’s not really a big deal to me, but I know for some brokers this will be an extremely difficult change to make.

Jesus! Is it a big surprise that such an insane development failed? Sheesh…. totally out of scale for Sooke. They over anticipated the wave of Boomers wanting to downsize I think….

An hour and 40 minutes each way by those who want to use transit in low traffic. Yikes, no thanks. 1.5 hours by car with traffic from the downtown core.

I see many basement suites for $1500 to $1600 range in town that aren’t slums. Bit of an exaggeration.

Sooke is a growing community and people certainly do choose to be there for a number of reasons that are personal to them. I likely would not be my choice to commute every day to Sooke but many do it. Just like many people commute into Vancouver from as far as Chilliwack or east Burnaby etc. Everyone’s needs are different.

One thing I do find with these forums is how evident it is that people see the glass half full all the time and some people see the glass as half empty. Some people see problems and some people see opportunities. This is very evident when you read peoples blogs which is not a judgement ….it is just something I find interesting:)

Yes…that was a shame that the development had trouble. New projects like that built at the wrong time and very likely poorly planned have trouble. But it is not Sooke that is the problem. I mean…the same could be said about the Oak Bay Beach hotel which went into receivership as well….. but not because Oak Bay is the wrong place to buy a home.

I don’t know whether it is an amazing deal or not – that really depends on whether you need to commute or not. If you do, it probably isn’t a good deal because generally, folks are much worse at putting a price on the commute than Sooke realtors are at convincing you “It isn’t that bad”. Either way, I’d be surprised if for a dual income family driving in each day the commute had less than $500,000 value. Meaning not only would they financially better off with a $900,000 house in Oak Bay than a $400,000 house in Sooke but they would also get to brag about it too.

Meanwhile in Miami…..

Another Condo Bust Looms in Miami

Developers, seeing sharp drop in sales, inventory surge, take steps to avoid a ‘bloodbath’

“Developers in Miami’s condo market have started canceling projects, slashing prices and offering incentives such as private-jet access to spur sales, an ominous echo of the housing crash that pounded South Florida especially hard.”

http://www.builderonline.com/newsletter/crane-strain-miami-shifts-to-damage-control_c

Sooke looks like it has it’s downside when you can’t sell waterfront condos.

Mariner’s Village in Sooke in receivership; tenants face eviction

http://www.timescolonist.com/business/mariner-s-village-in-sooke-in-receivership-tenants-face-eviction-1.2135009

The last one was built one year ago Nan. You are right about building costs going up though. One year ago builders were happy just to keep their workers working. Now…they can charge a bit more because everyone is busy. My main point is that Sooke is an incredible deal. You get amazing value. Same with Langford.

There are a lot of military families in Sooke. The fellows spend a lot of time away at sea and then spends a good number of days back home. So Sooke works well for them.

I made no comment about Sooke – if I could afford the commute or avoid it I would probably live out there too. What year did you build the houses and how big were they? Costs have gone up a lot even recently.

Sorry Nan…but you are way out on your numbers about the cost to build a modest house. We have had three houses built out in Sooke for $200,000.00 The lots sold for $120,000.00 The house cost $200,000.00 to build. The builder pocketed about $70,000.00 for his profit. (He builds two houses a year) The houses sold for $375,000.00 All built to code. All with a legal suite in them. All with appliances.

I agree with someone else’s point that it is a longer commute……. but not so bad.People do it. (In Vancouver, it is common for people to drive in from as far away as Chilliwack)

Sooke is only 45minutes. As far as a rental pool….Sooke is also terrific. We have had people lined up to rent because you get a lovely new house with three bedrooms and a den for $1,500.00 a month. In Victoria you get a slum. That’s why Sooke is swarming with young people pushing strollers. Many work from home or in the shops or with local government. It’s an amazing community actually.

“Some 58% of the sales in the last month went over asking price. But only 16% went for more than 10 percent over asking price.”

Interesting. So much for the “I’m so giddy cause my house is now worth $200K over too” mantra.

So what is happening in Langford and Colwood these days?

In the last 30 days some 96 houses have sold at a median price of $503,500. That bought a five year old , 2,100 square foot home on a 6,000 square foot lot. The month before the median was $488,500 for a similar home and 20 less houses had sold.

The year before there were just 53 sales in the same time period at a median price of $475,000 for a similar home as described above.

So why haven’t we seen reported increases in Langford and Colwood like in Victoria? Well there are over 200 houses for sale and new listings are being added at the rate of almost 1.5 new listings for every home that sells. And houses take longer to sell, than in Victoria, with half of the listings requiring more than 3 weeks to find a buyer.

That is still considered to be a market that favors sellers but with adequate selection and little panic among prospective purchasers.

Compare that to an inner city area of middle income families such as Saanich East;

138 houses have sold in the last 30 day period at a median price of $749,500. That bought a 43 year old, renovated 2,300 square foot home on a 8,500 square foot lot. The additional suite income in this area would allow for a couple hundred grand more in the size of the mortgage.

The month before there was 55 fewer sales and the median price was $745,000 that bought you a similar home. And the year before there were 80 fewer house sales in the same time period at a median price of $630,000 for a similar home that has been selling during this last 30 day period.

Why such a big increase? There are only 92 homes for sale and half are selling under 8 days. New listings are coming to the market at a low rate of 1.1 new listings for every one that sells. This is a market that is near the extreme end of a market that brings out the over asking bids. It is also a market that can be manipulated if it were not for the limitation of the income of middle income families.. Some 58% of the sales in the last month went over asking price. But only 16% went for more than 10 percent over asking price.

Have you ever driven in from Sooke five days a week Deryk ? Not pleasant even on the best days as well as the twice or thrice weekly accident shutting it down for hours. I wouldn’t imagine you will have quality rental pool out there either.

Are you tearing down near Uptown ? Easier said than done to just say “tear it down,slap something up and you’re in the game”. Not everyone is into the headaches of demolition and rebuilding nor is it simple like it’s playing with lego blocks.

If you have $200,000 to build a house with, you will get 500sq ft. 2000 sq ft house costs 300-400/ sq ft, $6-800,000. I just renoed 600 sq ft and it was $50,000. My buddy renoed his basement, $100k. Both were done nicely and had new bathrooms, etc but $200,000 k is chump change to build with.

Kit home maybe.

Just a thought…. for “SweetHome”. Have you thought of buying in Sooke? You say you can afford $750,000.00 In Sooke you can buy a one year old house close to schools and the village core for $395,000.00 It comes with a legal one bedroom suite that would rent for $800.00 per month. The wave is going out. My advice is buy ahead of the wave. (It is just about to reach Sooke but it is not there yet.) With your budget you could just about buy two. Live in one with the rental income from the suite. Then rent the other house out for a total of $2,300.00 a month.

Or……buy a tear down in town near Uptown for $550,000.00 and tear it down…. and build a new one for two hundred thousand dollars with a suite. (Or even bring in a Kit house which are built to full building code and come in amazing, modern, updated designs these days. I’m not talking a trailer home by the way. These houses are built to full building code with 2X6 construction etc.) Think outside the box. Buy from a private seller for example. These tend to have no multiple bids because people shy away from the experience. They don;t appear on MLS and so you are not competing with foreign buyers etc.

That’s crazy considering what you can get in the neighbourhood for that price, and it was over asking. The way housing is these days it makes more sense to speculate in real estate than work. The only reason for a job is to qualify for a mortgage so you can make some real money. Seems kinda strange…

I phoned the agent and he said it went for $1016,000.00 which is astonishing in some ways because it is next to the exit of the mall down there and has a view of the garbage compactor. Big trucks are always backing up into their unloading zone also. But I believe that any property in Victoria will be at the million dollar mark in a short time. They would still be much more than half what they are in Vancouver which would sell for two and a half million. (Reporters keep making the same mistake when they talk about Vancouver prices. They keep quoting what the “Greater Vancouver” market average is and that includes all the way out to Hope as well as even Bowen island. Plus…. most of the lots in “Vancouver” are half the size found in Victoria. So it only makes sense that Victoria prices still have a lot of room to rise. I keep hearing agents say it is a good time to sell. But in fact…..if you own a house in Victoria it will earn you tens of thousands of dollars if you hang in for another year. And that income is not taxable if it is your principle residence and so you will benefit greatly by not listing your property. This is one of the reasons people are not listing their property. It is making too much money for them every month of waiting.

I wish we had Zillow in Canada so I could put our house up with a “Make me move”.

Does anyone know what 331 St. Charles St. went for? I’m amazed it sold so quickly when it has a view of Thriftys loading dock.

Somehow I don’t think SweetHome will be happy outside of Oak Bay or Fairfield in anything less then the “perfect” home.

$750,000 buys you a very, very nice house in the core, it’s just a matter of status that is the issue.

Or 1048 Lyall st for 699…

Or how about 2646 Mt Stephen Ave for 700k. Nice mid century modern. Offer 750 no conditions tomorrow morning, they will take it…

Where on Allenby? That was the first street I ever lived on in Victoria. Our landlord offered to sell to us for $200,000 which felt like a king’s fortune at the time.

Or you could drop a cool million on Allenby street just east foul bay like someone just did…insane

611k gets you that 4 bed home in the 2700 block of Shakespeare. A nice 10 minute drive inland from the beach to keep the chill off, as Hawk was saying.

611k gets you that 4 bed home in the 2800 block of Shakespeare. A nice 10 minute drive inland from the beach to keep the chill off, as Hawk was saying.

With MOI near 2 for the whole market it’s impossible for the west shore to be all that slow. Maybe it hasn’t hit sooke yet but the rest is going to come along pretty quick.

Anecdotally I keep hearing about the market heating up in the westshore. Spoke with some people from out there and they just seemed downright giddy about the prospect of their houses going up in value, not something they could enjoy for some time now. Talking about places selling in one day with multiple offers out there etc., that’s the kind of news that spreads fast.

Oh come on…. $750 is enough to buy a nice house still. Do you need me to give you some mls links?

Omg Sweethome your posts are getting increasingly depressing! Should we all chip in to help him/her out?

I really hope things work out for you. It might be tough to swallow but looking west of the trans Canada or making other sacrifices might help bring your costs down.

We have just had a two-week period with spring break and Easter, which was earlier than usual. Possibly some people just decided to wait until that was over to list, which caused the dip in new listings. I guess we’ll find out in the next week or two, but that’s too late for me, since I have to decide if I want to put an offer in on a so-so house before someone else does.

I have come to realize that the joy I was hoping to experience at home ownership is never going to materialize. To get a house for my budget of around $750K means a list of compromises that add up to a bitter pill to swallow. I have had the same budget for the past 3 years and it’s hard to drive by houses that I could have owned and compare them to the crap I can now own for the same price. Now I have to be happy if I end up with nothing at all (or a dreaded condo, which is only better than nothing until the building gets old).

I dunno Introvert. You and me are going to get a nice increase to pay for things like throwing out the old city manager. What did that cost us? $450,000 or so? There’s some nice inflation.

From the previous thread:

Very true, Leo. And I’m glad you’re underscoring this misconception. However, it’s not just additional spending that would cause taxes to rise slightly; it’s also a city’s need to account for annual inflation.