Are condos an OK buy, and do you care?

Well this place is called HouseHuntVictoria, and quite fittingly very little attention has been paid to the condo market over the years. Personally we were never seriously looking at condos so it was not a big focus of mine. In a down market, I saw no point in buying a condo as a stepping stone to a house. Another issue is that most new condos don’t go through the VREB system so the sales numbers we have access to don’t actually reflect the complete condo market.

However with the recent run-up in single family home prices, condos deserve a second look to see if there is value in a market that has not yet been swept up in the insanity.

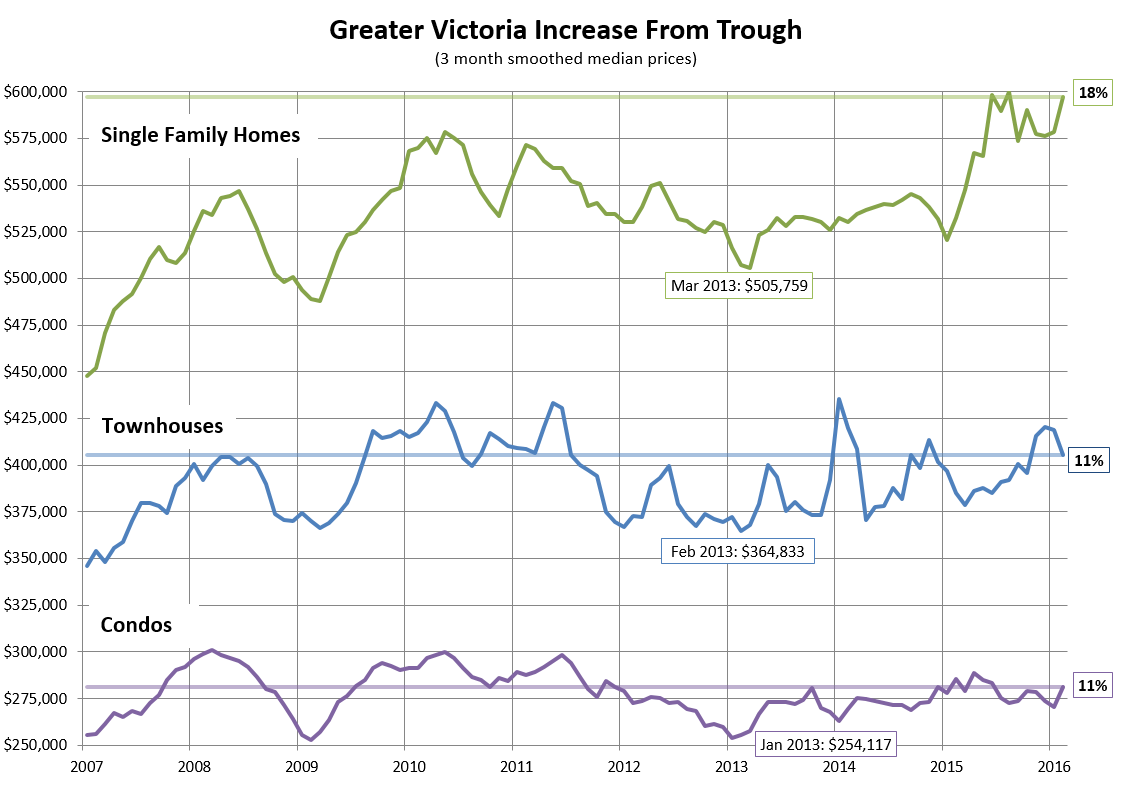

Given that we are in a solid uptrend, I think we can retire our “Decline From Peak” charts for the time being. Here a final version with the peak to trough drops in Victoria for single family homes, townhouses, and condos.

Only to be immediately recycled as the increase from trough graph…

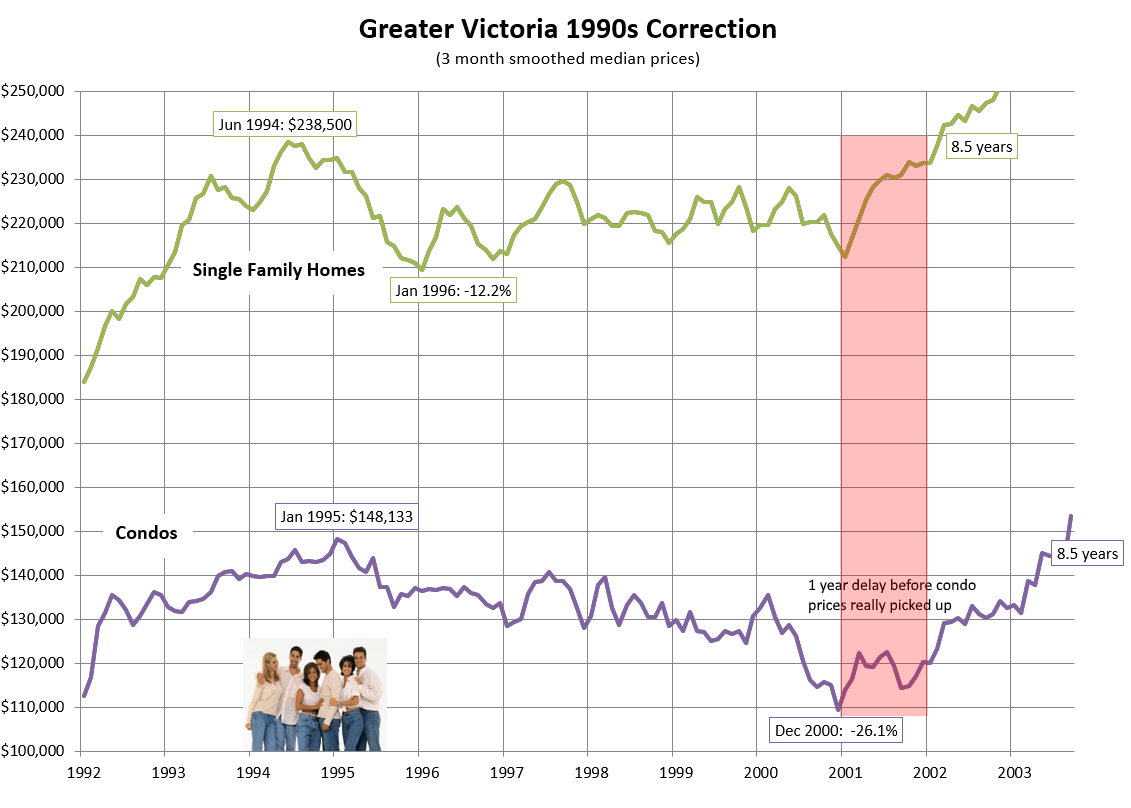

As we can tell, re-sale condos (and townhouses) haven’t appreciated nearly as much as SFHs, and are still below the peaks of 2008 and 2010. However with inventory pressures being as they are, this might change very soon. If we look at the last time the market picked up after a long stagnation (in 2000), we can see there was a delay between when single family homes started appreciating and when condos picked up.

What do you think? Is there still an opportunity in condos or is that last month’s news? How many people even care about condos? Do you want more attention paid to condo stats on HHV? Let me know in the comments.

What do you think about condos?

- If I must. Not thrilled but may be an option given house prices. (37%, 36 Votes)

- Awesome! Modern, environmentally friendly, and no lawn to mow! (30%, 29 Votes)

- Yech. We don't allow those skyboxes here in the uplands. (18%, 17 Votes)

- They're OK. A good stepping stone to a house down the road. (15%, 15 Votes)

Total Voters: 97

Market Update March 29th. Inventory actually dropped! Crazy. https://househuntvictoria.ca/2016/03/29/march-29th-market-update/

Inventory will show up when headlines like these hit our shores. All the early indicators in 2008 started in UK and EU,with the latter in shambles, and could be the first catalyst of a global credit squeeze. New York, London…..whose next ? Vancouver ?

Lenders ‘Freaking Out’ Over London Luxury Home Woes

“Lenders are charging higher interest rates for development loans for London luxury homes as slumping commodity prices and increased taxes deter overseas buyers, fueling concern the market is oversupplied.”

“Everyone is freaking out,” Sandhu, whose firm has loaned close to 1 billion pounds ($1.4 billion) to developers, said in an interview. “There has been nervousness for a while in the super prime market and there is also now nervousness in prime.”

http://www.bloomberg.com/news/articles/2016-03-29/lenders-freak-out-at-london-luxury-home-woes-hike-loan-costs

Plus Vancouver has proven the insanity can last a long time…

I think JJ brought up a good point. Only a small amount of buyers are dictating prices so if inventory stays low this could last a few years at least.

I never said it was stopping, but if new hard rules for foreigners are brought in or FINTRAC steps it up bigtime like they say then it will stop. It may take a year to play out. When 40% of a market force is cut out then it’s inevitable what happens.

@Hawk: I agree Vancouver prices have gone mad, but you have zero evidence that price appreciation is stopping or reversing. Last time I checked, prices were still on the rise.

But why did the market change ? Because Vancouver is having a blow off top and some sellers there who believe it can’t go higher are selling.

Some are moving here or up island and the paid off local media pump the real few that are buying here from outside into something bigger than reality (which Jack has shown many times) which fuels the mania further. CHEK just pumped a segment tonite because one waterfront property for $2 million sold.

How long can the mania last is the question… and how fast does the downside hit when supply shows up ? Once foreigner buying rules of more disclosure like the US just implemented and is why luxury New York City sales are tanking. It all starts at the top end or the bottom end that says to hell with it I’m outta here.

Vancouver is consistently rated in the top 3-4 best citites on the planet. Thus, Victoria is a top small city on the planet. I have traveled extensively & can attest that Vancouver/Victoria have few rivals in the world. While some Europeans citites are rated ahead of Vancouver, you must remember that ethnic people/immigrants are victims of racism/racial tension in many parts of Europe. Thus the draw of Canadian cities for many rich immigrants. For example, Vienna is one of the top cities, but this is the only place I’ve visited where I was denied access to bars/restaurants due to “colour of your skin”.

While I partially agree with Hawk that fundamentals are a bit off, this is a very desirable place of live & will continue to attract home buyers from rest of Canada & abroad.

Hawaii is paradise….

Of course markets can change. They just have…. I do agree that this price spike is not supported by fundamentals. I also see record debt and little wage growth which is why I’m a Bullear. I see greater risk of a decline in the future because of this but for now you can’t deny the steep incline…..

No doubt this winter in Victoria was pretty bad when compared to previous ones in Victoria. It still beats edmonton where it was actually below freezing most of the time. If you like that you might disagree but I’m not a fan of insanely cold temperatures and don’t mind the rain so much.

Victoria probably has the worst climate in world if you compare it to say Hawaii or something though. No question, Hawaii wins that contest. WTF am I doing here ha ha.

One thing for sure, when the prices are up the handbags are out, come on boys, shake hands and give it up! Bragging about living in 4 or 5 places makes no difference, most of us have travelled extensively and, if we are lucky, lived in other countries and it doesn’t make us experts. The only thing living in more than one place does for us is give us a slightly wider view of the world and other people are still entitled to their opinion. I for one hope the up and up is going to level off, I believe that more will become available on the market when this happens. If the market continues to go up it will be so hard for young people to stay here and who wants a town full of the wealthy and crusty, I know I don’t!

Yes your one track perspective that markets can’t change to the downside over the next year or so is a bit ridiculous with record household debt, almost zero wage growth and average incomes that don’t support the recent price gains for much longer.

When you have your financial life on the line I get it, but saying it is past ever happening til up 40% more is again ignorant to global markets in tatters. Worldly guys should see that better than most.

Re: Condo Restrictions

I realize it’s a bit judgemental to assume owners are better than renters.

My condo has about 5 units of owners that live here & then 20 units that are rented. If the rented units are mostly all students who do things like illegally fill up visitor parking, make dents in the elevator & throw everything including-the-kitchen-table in the dumpster when they move out every 6 months, you can see how it starts to wear on the 3 owners who are on the strata council (reporting them for such activities.)

If it’s purely a place to live (more than it is an investment), doesn’t limiting some rentals make sense?

I realize being able to to rent out easily to students also increases the value, so maybe it breaks even. Perhaps the key is to fine violations often & recoup the $ for the trouble?

Our condo is quite a large percentage of well-off (judging by the cars!) international students.

I’m a renter-turned-owner so I can see both sides!

(We happen to be voting on this issue soon. I was going to vote for restrictions as I don’t plan to sell for 30+ years & enjoying my stay is more important to me than appreciation. But I could be swayed!

I do see how it is unfair for owners to screw over the investors (ie. all units currently for sale would be in big trouble I’d assume!) So you guys may have switched my opinion!

We are attacking each other…. Again lack of perception. I can admit to being an asshole. For impolightly speaking my opinion. Sorry but I find the one track negative perspective from you a little ridiculous now that we are so obviously not crashing. Doesn’t mean you shouldn’t do it or aren’t welcome to post it. Never said that….

San Diego is nice…. Like the restaurant district and the funky beach boardwalks. Health care in the Netherlands was also better…. 75 EU for two INCLUDING DENTAL! Children totally free dental!

I’m neither dasmo but you are both. You took a simple comment about a wetter winter than usual and spun it into some arrogant misperception of reality when you weren’t even here most of last 5 months.

The longer you attack me for dare discussing the potential of a crash based on economics that preluded other financial crashes ,the more ignorant and less “worldly” you appear to be.

I do agree with you though…you are the biggest asshole on here. 😉

I have lived in four provinces, owned houses in three countries, lived and worked in five countries. Why am I in this dump called Victoria? Because it has the best quality of life of any of the above.

Climate? San Diego is hands-down the best. But Vic is temperate and never uncomfortable. When it rains I get my umbrella and go outside where I can smell the earth. Sure beats anywhere else in Canada beyond SWBC. Winter in Ontario, Quebec and NS is a long slog through vile weather that rots your car from under you. Summer humidity and bugs offer bonus points.

Our bureaucracies are actually helpful. Not so in France and much of Europe where they are a privileged class and don’t give much of a poop about the peons. Also not so in Asia where if you don’t pay, you don’t get (don’t ask about trivial stuff like zoning, police and fire services).

Euro taxes are very high but so is the standard of health care and infrastructure. Food and culture hard to beat.

Asia has low taxes, just don’t expect much and be prepared to pass along a backhander to get attention.

America is laudable in many ways but the politics are lunatic and you could get shot anywhere for anything. Not to mention they don’t use Canuckbucks and health care can bankrupt you unless you have very expensive insurance.

Victoria ain’t perfect but here’s a bulletin for the uninformed and wilfully ignorant, no other place is perfect either.

I still like the EU. Love the old cities. Love the bike network. Love the history. But yes, I wouldn’t want to live there…. My son has asthma in Rotterdam and he doesn’t here!!!! ISIS is on the doorstep blowing crap up. It’s illegal to home school your kids…. Not here….

It’s not arrogance it’s perspective. It’s arrogant to keep your vision narrow to what you want to see because “have an exaggerated sense of one’s own importance or abilities”. I at least adapt and can admit my failings or if I’m wrong. (which isn’t often). I mean goodness. How can you keep preaching for the same crash when we have long passed that and have entered a new phase of hyper inflation. It feels like a greater risk of a crash in the future because of this inflation but that is now further out after what will be an obvious increase in values….If the situation changes it changes. I’m not longer a Halibut. I’m a bullear. I can adapt and see what is around me…. This isn’t arrogance….

Actually, you sound very arrogant Dasmo! Netherlands is so bad and everything in Victoria a paradise…The fact that you compare those beautiful European cites with such a small town si unbelievable! And I have seen them all.

I’ve lived in Alberta, Ottawa, the Netherlands and Victoria. I have spent extended work trips in South Africa, Kuwait, China, Taiwan and all through the states. I have traveled throughout Europe and other exotic locations. The only other place that compares to here is Hawaii…. Most places you visit with the umbrella drinks are too hot in the summer…. Or there is a third world outside the resort walls….

I may be arrogant but you are ignorant…. I would rather be the first….

China & money laundering: http://news.nationalpost.com/news/world/from-cyber-scammers-to-drug-lords-why-china-has-become-a-global-money-laundering-hub

“China is emerging as a global hub for money laundering, not just for Chinese but for criminals around the world, The Associated Press has found. There are a number of options in China for cleaning dirty money, including through major state-run banks, import-export schemes, and informal money transfer systems that date back a millennium, according to recent police investigations and lawsuits in Europe and the United States.”

“Hawk – you better avoid Fairfield, South oak bay and frankly anywhere near the water. 20 gusting 30 describes most of our sunny days in the summer if you live near the Strait.”

Been there done that a few times, it sucked. It can be 25-30 degrees in town, head home from work for a nice Bar-BQ and the marine air moves in and drops it to 10 with the fog. Nice place for a walk or hang out, but totally over rated to live by. Heating bills were through the roof and houses always felt damp and moldy. 10 mins inland is just perfect.

“Golf is a year round sport here Hawk”

It usually is for 10 months, but not this year. Guess you never heard of El Nino. You don’t have to be “worldly” to know it wasn’t a good year as usual. That’s where your arrogance comes from when one claims to know more because he’s been more places but Rotterdam is all we hear, whoop dee doo.

Paying $75 to play golf in the wind and rain and under 10 degrees is a waste of cash but you don’t sound like you play. Yesterday was great, saw quite a few kites along Dallas Rd. So you’re a para-glider with a death wish ?

CS – yes that figure is based on a household consumption rate of 300 cubic meters per year – which is not ‘notional’ – that is a lot of water – more than a household of six would use in the U.K. The CRD publishes a comparison of municipal water rates that will come up if you google it. OB is the cheapest. As for a water bill of that amount, assuming that amount is just for water, either you are consuming about 10x average or perhaps you have a leak? I’d be looking at water conservation measures if consumption is the issue.

Every year I plant my garden too early.

I think the weather is better than it really is.

But the plants know better and just die.

Sometimes I google the beaches in the world I’ve been to – and a tear comes to my eye. White sand, a cool breeze floating in over a blue azure sea as I sip a drink made from 5 different rums in a cup made from the coconut tree that grew beside me. My lunch is shrimp the size of a fist caught this morning just 50 feet from where I sit. A bucket of beer chills with a half dozen companions all for under 10 bucks. Back in my room a return ticket to Canada is tucked into a side pocket of my luggage and like a jailer rattling the bars of my prison awakens me.

LeoM, you’re believing all the hype. House prices in the core have not increased by $200,000 in the last few months. You’re likely judging that by over asking sale prices. But if the asking price was intentionally under priced that makes that metric of no value.

Last March the median price in the core was $630,000 and this March it looks like the median will be around $740,000. However, this months median is heavily skewed with a dis-proportionally larger amount of high prices paid for houses in the multi million range.

Oak Bay sales are really fu^&ing the stats up.

If we just looked at Saanich East, the land of the middle income family, we would see that the median price in the last three months of 2015 was $700,000 for a house. For the first three months of this year the median is $730,000.

But when you list $840,000 houses at $650,000 you can deceive a lot of people into believing prices have increased by $200,000 in just a few months.

I have lived in Victoria off and on since I was a young lad moving here in 1979. It doesn’t matter that I missed one winter….

Golf is a year round sport here Hawk…. Plus when it is windy its nice for kite flying or para gliding or sailing etc…. People live where they live and adapt…. Friends said it was a nice summer in the Netherlands because there was a few weeks of sun (and way too hot)…. It was crap. My son and I didn’t get a single good kite flying day in because even the wind sucked. Too gusty. To complain about the weather in Victoria simply tells me you have very little world experience….

It isn’t impossible for the recent increase in prices to be erased but first the rate of increase has to slow and then go negative. And that doesn’t happen very quickly. Unless there is some economic trigger that would make a market appreciating at 10 percent to reverse quickly to a negative 10 percent. For housing in the core that would mean our market would have to move from one that is extremely weighted in favor of sellers to one that is heavily weighted towards buyers such as the Salt Spring Island market.

The market that is happening in the core doesn’t appear to be spreading out to the Western Communities or Saanich Peninsula. It’s very localized being driven by a shortage of listings. That suggests to me that we will have a pull back in prices as demand decreases and/or supply increases. I don’t think it would take much either. If the number of houses for sale in the core went from 57 to 100 that would put an end to the increasing prices. If inventory was at 200, prices would likely be coming down.

Hawk – you better avoid Fairfield, South oak bay and frankly anywhere near the water. 20 gusting 30 describes most of our sunny days in the summer if you live near the Strait.

For some reasons the bears that post here always seem to believe these two “facts” must be joined at the hip.

1) Victoria homes are over priced

2) Victoria (especially the weather) is crappy.

For the information of the bears these are two independent statements. Either, both, or neither could be true.

I’ve always wondered why people that kinda hate it here are so concerned about house prices.

“that’s Max gust not an average wind speed.”

It’s all perceptions dasmo, you come from a crappy place where millions still seem to like it there, but I see people swimming at Willows Beach and Dallas Rd when it’s 2 degrees out. I’m sure they think it’s “amazing” and came from somewhere else where it sucks, but most who have lived here a long time say they’re nuts.

20KMH on the low side gusting to 30 to 50KMH per hour makes for a shitty day in my neck of the woods but it’s probably the norm for you. Since you missed most of the winter I think most would agree. We needed the rain bad, but after awhile it interferes with the golf game and all the new people who moved here expecting Palm Springs north were disappointed.

JJ said “a decline in prices in the core is still a way off so you’ll have plenty of notice before any big decline.”

Jack, are you saying that prices can not decline at the same rate they have increased?

Are you saying that all these $200,000 increases in the past 3 months could not be eliminated in the next 3 months?

For condo rentals, there are legitimate reasons for some buildings to choose to have rental restrictions.

In areas where there’s a lot of middle-aged to older people, a restriction on rentals can increase property value (which is the case in the building I used to own). They didn’t want people moving in & out regularly (this definitely increased theft from every part of the building, no matter how many cameras we had – mailboxes, furniture, exercise equipment, people’s condos – because so many strangers aside from the tenant ended up with access, doors left open, owners/tenants who didn’t understand the rules of the building or didn’t screen tenants or their guests).

Also they didn’t want non-resident investors buying the building and voting who didn’t have a stake in the day-to-day lives and safety of the residents.

In areas with a lot of young people that want lifestyle flexibility, and non-resident investors, the property can increase in value with rentals.

Not to scare anybody but the reality is that renting comes with risks. If you’re willing to do that fine, but it’s not all sunshine and lollipops.

Even in my safe, really nice neighbourhood, before the restrictions were put in place, some owners in my building racked up repeated fines for tenant disturbances, and they didn’t care, because they had enough money to pay.

All these things have happened to real people – and it’s actually impacting a friend of mine as I speak:

http://globalnews.ca/news/2595835/we-were-naive-canadian-landlords-share-their-worst-tenant-stories/?utm_source=Article&utm_medium=Outbrain&utm_campaign=2015

You have to make sure people are following some rental rules for building security, if they are willing to listen.

@Marco – why would so many residents of the condo want to restrict rentals? Is there evidence that the renters are ‘bad apples’? Otherwise, a renter is not of concern to the owner today and in the future, as you said, a potential to rent may be the attraction for a future purchaser.

@justjack “Market values are set by a small fraction of the total house inventory. However, the more listings that come to market the more house prices would decline.”

Volume is not sufficient to indicate demand & price pressures. Velocity (or market throughput) is key, such as days on market. Combine that with behaviours such as overbidding and no inspections and that’s a better model for price prediction.

Buying a Condo you are buying into a community of course there will be restriction. I can’t do whatever I want if I own a house…. There are broader bylaws that prevent that.

@justjack – brilliant! I don’t think (and I welcome examples) any other provincial jurisdiction in Canada allows for this type of discrimination. Your idea is absolutely brilliant.

Sort of along the lines Marko was saying about restricting rentals in condominiums.

I think any complex that has restrictions on who can or can not buy in the building, the owners in the complex should lose the home owners’ property tax grant.

Our governments, with the taxes we pay, shouldn’t be subsidizing condo owners that discriminate against others.

And that’s Max gust not an average wind speed. The contrast coming back here from Rotterdam was insane…. You simply have no clue and choose to wear storm coloured glasses. You are better off to see things as they are instead of how you want them to be. It prevents you from doing stupid things like selling your house with the hope a major crash will happen so you can buy back in at a discount….

We’re up to 57 house listings from 34 a month ago in the City of Victoria. That’s low for a City with some 24,000 detached homes and another 24,000 strata homes.

Oak Bay is up to 45 house listings now from around 30 last month. Again low for a town of some 7,000 detached houses

Saanich East is still lagging at around 90 house listings. I don’t have a break down between Saanich East and West but for all of Saanich there are some 45,000 detached houses. And that’s very low for listings.

Knowing the above, can anyone hypothesize why our house prices are high!? Or what would happen if just another 1 percent of home owners decided to sell today? Or if half a percent of home owners started to miss their mortgage payments on a regular basis. or even if we matched Langford with 179 house listings out of an inventory of 12,000 detached houses?

Market values are set by a small fraction of the total house inventory. However, the more listings that come to market the more house prices would decline.

Your house only has a market value of $700,000 because there are only 57 houses up for sale. And that will change. As it already has started with the number of listings increasing.

And before Totoro and Introvert go looney toons on me, a decline in prices in the core is still a way off so you’ll have plenty of notice before any big decline. Enough time to have the house painted and the interior updated.

.4mm doesn’t count….

dasmo, I see 70% of precip days….you failed to note that most of the clear days were crappy with winds between 30 and 50KMH plus but I guess if you’re a dog you would find it “amazing”. December (when you weren’t here) had only 7 dry days and November 9 dry days. It’s been a shitty wet winter, get over it.

Wow…. Quite the reversal.

Tue Mar 29, 2016 8:30am:

Mar Mar

2016 2015

Net Unconditional Sales: 983 734

New Listings: 1,254 1,448

Active Listings: 2,577 3,769

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

And there is nothing normal about bidding 200k over ask but that is what is happening….

Here is all the proof I need. About half the days since Jan were without rain. Only a handful of seriously rainy days… http://climate.weather.gc.ca/climateData/dailydata_e.html?StationID=114&timeframe=2&cmdB1=Go&Year=2016&Month=3&cmdB1=Go#

I don’t think education level is the problem; moreso, the common sense

The thing about strata corporation meetings is they are so boring that everyone talks as much as possible to avoid listening to other boring people talking. Under those circumstances, the discussion tends to be short on both logic and relevance. Only with a ruthless chairperson can there be any hope of a useful discussion.

Also, the average oak bay water bill is less than all other greater Victoria areas – less than 400 per year

Hm, I paid over a thousand dollars for a recent four-month period and Oak Bay assured me that my meter was working correctly!

I think the $400 you mentioned is just the notional cost, based on consumption of 300 cubic meters per year.

In any case the rate, at more than $1.00 per cubic meter (including the fixed cost) is crazy. It makes using city water for a back yard garden economically insane, since it takes between one and two cubic meters of water to grow a kilogram of anything.

Sounds like the bulls are getting very worried this spring fantasy might just go poof. You can’t bring up a simple fact like it really has actually rained for the majority of the last 100 days but somehow I’m some ogre who hates the city ? Mass psychology at it’s finest.

Or that $200K over asking is somehow a normal occurrence and is now set in stone forever ? Common sense indeed, you homeowners need to get out of the house instead of sitting on here obsessing about the next house sale in Oak Bay.

As Jack says, put your money where your mouth is and go out and buy a few more condos or houses. It’s guaranteed right ?

Maybe you should all go call your banker and try to secure your new $200K HELOC increase and come back and tell us how it went with the paperwork to prove it.

The arguments here sometimes I wonder what education level and/or common sense is going on.

I don’t think education level is the problem; moreso, the common sense 🙂

But it isn’t just on here….should have heard the arguments at the special general meeting called at the Bayview Promontory I attended a few weeks ago. I was lucky that I emailed all my clients in the building to help me barely vote down a proposed rental bylaw restriction. The majority was in favor of restrictions but they didn’t quite have enough 75% of the vote to push it through.

People don’t seem to think two minutes ahead such as the idea of that they may need to sell in the future despite being owner-occupants currently. (Rental restrictions heavily influence re-sale values). It was more of a owner-occupier vs inventor type tone debate but guaranteed all the owner-occupiers would be complaining come their re-sale time…

This real estate market might crash but after its gone up 40% from here so it will still be up. The market is in hyper inflation fight now so there is increased risk of a crash in the future but Hawk is still repeating the same thing as if nothing has changed….

I have been living in my basement! But I never wear shorts….

Hawk, you’re starting to sound like Gollum. The weather view from your cave might appear constantly wet and miserable but once you get outside the weather is splendid, just an occasional bit if drizzle, but rarely rain. I’m outside everyday, all winter, walking, playing tennis, meeting friends for coffee in outdoor cafe patios. The weather only looks dreadful from indoors, but once you’re outside it’s glorious. Victoria’s weather is probably the overall best in Canada, 365 usable days per year.

Watchout for that negative attitude Hawk, it will consume you… “Real estate will crash and burn soon”… “Victoria is a terrible place”… “The weather here is horrible”… “The economy is crumbling… “People are idiots”…”people are sheep”…

Foreign buyers declining in New York City. HAM having to disclose their details isn’t going over well. Wait til BC brings in tougher disclosure laws soon. As they say, “trees don’t grow to the sky”.

This real estate market is about to crash

http://www.cnbc.com/2016/03/28/this-real-estate-market-is-about-to-crash-commentary.html

Agreed re. Mill rates – higher prices do not mean higher property taxes. Rates are budget based – when assessments rise mill rates usually drop.

And comparing homes of different values is apples to oranges particularly when appreciation is factored in.

Yes average values are higher but there are exceptions including many condos. You can own a similarly priced home per square foot in Fairfield rockland and Gonzales and you’ll pay more taxes.

Only the saddest person will complain the weather here in Victoria. We make snow angles out of cherry blossom petals…. The winters are mild, the summers are mild. A few stormy nights in winters, a week or two dry heat in summers, that’s it. No typhoon/hurricane/tornado, no wild fire.

Are we living in the same planet?

No – I’ve posted previously on what the rules are for helocs. If prices are up 20% or more in ob and appraisals reflect market based on comparables including your neighbour’s sale (probably highest weight if similar to yours) then a lot more people would qualify give that most have at least 20% equity.

Because values are higher. Property taxes actually paid by residents are about the same as elsewhere or higher.

People still don’t get the idea of mill rates. Several times on here people have said that the recent runup in prices will increase their property tax bill. It won’t unless your house appreciated significantly more than the average. If every house magically doubled this year mill rates would be about half next year and taxes would stay about the same (minus the inevitable increase to cover additional government spending).

Totoro, you’re saying you can go to the bank tomorrow and get a 200K HELOC increase based on neighbor selling 200K higher ?

Dasmo, so you missed 60% of last 100 days. I’d say you’ve been living in your basement and in denial. 70% of last 90 days have had rain. Lost track how many wind and rain storms this winter on top of weeks of steady rain and showers. You must be one of those odd dudes who wears shorts and sandals when it’s below zero.

Gains can be heloc’d or reverse mortgaged or crystallized by sale. They are not inaccessible. Also, the average oak bay water bill is less than all other greater Victoria areas – less than 400 per year. Property tax rates are lower too.

Heck if it’s good weather you want move to Sequim, WA. 8 inches fewer rain! Bonus: A rancher only costs a quarter as much: http://www.realtor.com/realestateandhomes-detail/50-Poplar-Ct_Sequim_WA_98382_M28486-91202

Hawk, I think a storm cloud just follows you everywhere….

It pays for no water unless you extract it.

I have been back for 40 days most of which have been awsome. One bad storm. Sunday was Easter outside in Gorden head all day in the sun….

More like temporary tax free appreciation. Price gains based on auctions run by amateur auctioneers (with a 10 week online how-to- be-a- real estate agent course)allows for potential of huge price swings to the downside when the supply picks up or the buyer pool runs empty. One of the two will happen.

$200,000 in tax-free appreciation pays for a lot of water.

That’s why the nearer to Oak Bay the better.

Where you pay thousands a year to irrigate the lawn!

That’s why the nearer to Oak Bay the better.

http://www.olympicrainshadow.com/images/satellite.jpg

Annual Precipitation:

Port Renfrew – 138 inches

North Van – 99 inches

Duncan – 59 inches

Sooke – 55 inches

Nanaimo – 46 inches

Sidney – 35 inches

Oak Bay – 21 inches

Dasmo , you always fail to read the detail as you stated you skim past all my posts. I never said it’s always awful, just the better part of the last 100 days and generally crappy most winters as per rain storms. Thats why the Brits always loved it here, they like the rain. It’s a fact and I believe you stated you weren’t here for most if it.

ICYMI, north of Royal Oak yesterday it monsooned for hours off and on that high speed wipers couldn’t keep up. Looks like a nice stretch coming up but let’s not bend the truth.

I don’t hope for four percent – it is just my best guess based on past performance. Houses have been getting less affordable relative to income for much longer than 16 years. My view is that with globalization and the Internet Victoria will become more competitive for housing over time. As I’ve posted many times there can be a new less affordable normal as conditions change. Dasmo’s experience in Europe mirrors my own international experiences with having to pay way more for way less space in many countries relative to income. This can result in a much greater percent of lifelong renters. I don’t think we are immune to this – it is a long-term trend. Doesn’t mean prices won’t ever fall – just that I think that is the long-term trend. I could be wrong but I’ve made investment decisions based on my viewpoint.

As far as bidding wars on homes go I’m in favour of free market supply and demand with appropriate regulations for ethics. There are, imo, some issues with how realtor ethics are regulated but the sealed bidding process is not one of them. Fabricating bids would be a different story. Also I don’t see underpricing homes as unfair either. In a competitive over ask market it is free market that regulates pricing. Again this is a locus of control issue – buyers are in charge of their bid not evil external forces and are they are limited by lending criteria including appraised value and down payment. I don’t see that the system is broken – we are just in an up cycle after a long period of flat. It won’t go on forever this way if the past is a good predictor of trends – which appears a reasonable assumption to me.

Hawk, the weather here is simply amazing. You either live north of Victoria or never leave your computer to go outside. To characterize Victoria’s weather as awful simply frames you as incredible. Have a child that needs to be outside, or a dog and live in true shit weather and you will understand. Victoria weather is amazing. I was on Gyro beach on Saturday and people were messing around with no shirts on! In March!!! I have been to many places in this world and Victoria is one of the best climates….

So there was no wind at the beach yesterday or 90% of the last 100 days dasmo ? It was raging. Where were you ? Oh right, in Rotterdam. Can’t help it you came from a crappy place built on dikes.

Although BC’s RE is being bid up by massive (one house in three in Vancouver) Chinese speculative investment, the long-term trend in house prices is unlikely to reflect what has happened during the last 16 years. Canadians spend 43% of income on housing related costs, chiefly interest and rent. Moreover, real incomes in Canada have been almost flat since 1981 and have trended down since 2008. So Totoro’s hope of 4% annual real rent increases over the next 20 years or so looks out of the question.

Canadians spend more income on housing than almost anyone in the world

http://www.theglobeandmail.com/globe-investor/personal-finance/household-finances/canadians-spend-more-of-their-income-on-housing-than-almost-anyone-in-the-world/article21369414/

The Evolution of Canadian Wages over the Last Three Decades

http://www.statcan.gc.ca/pub/11f0019m/2013347/part-partie1-eng.htm

It looks as though we are headed either for a debt jubilee or an economic dark age.

@Recentlymovedhere

You’re quite naive if you think housing here is a free market. Here are just three reasons why not:

Government subsidy. A large part of bank lending is underwritten by the government, in the form of the CMHC. That makes mortgage lending a risk-free game for the banks. You could put a monetary value on that support – it would be quite high.

Zoning.

Imperfect information. Buyers don’t know who is bidding or how much. Its not easy to find listing history or other pertinent information. Much information is controlled by gatekeepers (realtors) who may or may not wish to share it. Its pretty much impossible to find it out by yourself.

I have owned property in a few different places/countries, including BC. Of all of them, BC is probably the least ‘free market’ out of any of them.

I agree LeoM. Inventory will continue to be low because of Hyper inflation. Selling is also loaded with fear….

Hawk you live up island or something? The weather is AMAZING here! Summer at the beach in March? You have no idea. Try living in Rotterdam. There it does rain all the time AND it’s windy all the time…. This is why they always come back….

@LeoS we need a Zillow here…. Shows a total sales history of houses. There are societal issues surrounding housing so I am open to regulation on how they are sold. I’m not one for a nanny state but what has happened in Van is not good for Van. We are now experiencing hyper inflation and nothing will be done about it since house sales don’t count on the CPI. I could support no blind auctions allowed on RE sales. Sure people were dumb not to buy only a few years ago but the sheeple need help and now they are all following each other of the cliff. Being an owner of two properties I benefit from this hyper inflation but I don’t like it one bit. No blind auctions would be very fair IMO. Ask what you want and if it gets bid up fantastic but there is way to much stoking the flames with fear going on. It’s HAM or Van buyers, buy now or never, your bid will fail, etc. Wasn’t it Marko’s story of the fool bidding way over asking because there was a competing bid that was actually under ask? We have major Govermental intervention to control inflation yet this is ignored. Inflation is good hyper inflation is not.

LeoM I agree, but 2 other things. Nowhere to go and fear of being priced out of the market.

Interesting why 7,148 people would leave The Best Place on Earth last quarter. Yes more came by a few thousand, but that is a lot of people leaving to go somewhere else in Canada where the weather is colder and the jobs are scarcer. Maybe the last 100 days of rain did them in on top of the high cost of living.

The Perfect Storm indeed, just like 2008 all over again. They got greedy and then they got burnt.

https://www.youtube.com/watch?v=Z8CR7jaYNsI

Low inventory of houses for sale is not a phenomenon of Victoria, Vancouver, and Toronto; it is happening world-wide in every desirable city.

Boston, San Jose, San Diego, LA, NYC, Shanghai, the south of England, Munich, Melbourne, Istanbul, Amsterdam, and many others.

Low inventory in all these cities around the world is causing bidding wars as prices go nuts this year.

There is obviously a ‘Perfect Storm’ causing this crazy market, but none of the experts have yet defined this global perfect storm.

Deflation is often defined as; People refuse to buy anything because they know prices will be cheaper next month. I wonder if our current inflation of house prices is just the opposite; People refuse to sell because they know prices will be higher next month.

It is essential in a free capitalist/socialist country that markets are free to decide the price of anything. This is the entire premise of our economy. There are a lot of protections in place to prevent monopolies.

How is having the ability for someone who really loves a house to willingly and happily pay more then another person a problem???

The arguments here sometimes I wonder what education level and/or common sense is going on.

My wife and I (thank God) were able to out-bid another couple on an amazing house. If the market was slanted towards this odd “no offers accepted” that Just Jeck has been proposing, not only would we lose out on an amazing house that fit our needs (and now is worth maybe 20% more), but the seller would lose out on the fair “real” market value.

Market value in a free market is the top price someone is willing to pay for anything.

Anything less is absurd and verging on some kind of Russian Oligark market theory. “You must pay the price that some random person said is the right price, hail”

Supply and demand creates an auction. Nobody has a gun to anyone’s head. If you do not want to play the game look at the older listings.

Why was there no auctions the last 7 years. Lots of supply and not so much demand. Someone selling their house has every right to get the most for it. Nobody is force to buy it.

When the agent advertises that all offers will be opened at 7:00 PM on Sunday night that would show an intent to start an auction.

Let’s be clear that this isn’t the same kind of auction that happens in Lunds or Kilshaws.

People put in absentee bids at these establishments that are conducted by licensed auctioneers. And the auction is conducted in public so that all bidders can monitor the bidding process.

You can put an absentee bid on a clock at $250 and either attend the auction or not. When the auction begins the bidders in the audience may bid the price of the clock up in $25 increments to a maximum of $125.

You would win the clock at the next increment at $150 not at $250.

That isn’t what happens with unregulated real estate auctions. You pay the amount of your bid which in the case of the clock would be $250, Since the auction is unregulated the agent is free to do what ever they wish as the process is cloaked in anonymity. Real estate agents are not licensed to conduct auctions and this process should be restricted and regulated. Or at least scrutinized by a licensed auctioneer, lawyer or notary that the process has been conducted in fair manner to all parties.

Outside of government intervention, what do you think would be the most valuable types of information that could be given to consumers looking to buy/sell real estate?

15 million

JJ is right. The housing market with the help of Media and HAM illusions/scare can move prices 20% in almost every neighbourhood in Victoria with 15 mill or less.

“SW BC is where, and this group now closer to retirement may drive the market for a sustained period to come rather than a blip. Relative to Van this place is actually affordable for many.”

This is another fable, they all want to come to Victoria but most won’t. The polls have been taken for the last 40 years and few follow through. They have their kids, grandkids etc they are extremely close to. A few weeks away to Florida, Mexico or Hawaii usually fills their void for heat.

Medical reasons also prevent them, they can’t find a family doctor out here and if they have certain conditions and in with specialists etc, they don’t want some clinic doctor making the call on their life. A few will move here but for most it’s a myth they plan to really do it, especially once they see prices are going into stupid land.

Not sure if this sudden condo craze can keep up but you need to know who is buying them and for what purpose. If they are buying to rent out great,helps the rental pool. If they are buying to move in then where did they come from ? I don’t see Vancouver people coming here to live in a box, nor many young single people laying down $350K and paying a whole paycheck to have a box they can’t party in.

Most couples will feel claustrophobic in no time if they are living in 440 Sq Ft. A sure fire way to a quickie divorce. There’s a limit to what young people will pay for what it is, a box with some granite.

@Just Jack,

two successful agents we know have told us they just don’t know where to set prices, things are so fluid.

On another point, how would intent to set up bidding wars be proved?

@Michael,

the largest bulge on your chart are the boomers aged 50-60. This cohort likely have been at work steadily for 25+ years, many have post-sec education, good salaries with decent pension plans and mortgage-free or close to it with good houses to sell.

They are still on the job in places like Montreal, Toronto, Ottawa, London, Wpg, Calgary and Edmonton but planning their next phase of life. Winter gets you down in those places, US health ins can be costly, some are turned off by the politics, Mexico projects a scary image to a lot of people. Where are they gonna go?

SW BC is where, and this group now closer to retirement may drive the market for a sustained period to come rather than a blip. Relative to Van this place is actually affordable for many.

If an agency is intentionally under pricing properties to get 30 prospective buyers bidding on listings – are they being deceptive in their pricing? From time to time properties will sell over asking price but when you see specific agencies dominating a market by consistently under pricing by 20 percent and more – is that fair to the consumer?

Bait-and-switch is a form of fraud used in retail sales but also employed in other contexts. First, customers are “baited” by merchants’ advertising products or services at a low price, but when customers visit the store, they discover that the advertised goods are not available, or the customers are pressured by sales people to consider similar, but higher priced items (“switching”).

In some countries, courts have held that the purveyor using a bait-and-switch operation may be subject to a lawsuit by customers for false advertising.

The Province has made a stance on shadow flipping. Should unregulated auctions of real estate also be curtailed under the Real Estate Act?

Personally, I don’t consider this to be an activity that promotes the real estate industry in a positive manner to the public. An agent should price a property fairly and if their intention is to create an auction they should possess the educational skills to conduct the auction under special regulations to promote fairness among the bidders. Failure to do so would allow the consumer to sue the agent and the agencies for false advertising.

Perhaps in commercial and industrial properties the buyer beware stance in real estate is acceptable. However residential real estate is different. You have the Goliath of marketing practices against the David of the consumer. The David needs to be given a sling shot for protection.

I dunno. When we bought 3 years ago, the townhouses in Gordon head on top of Township Coffee were selling in the high 500s (589 maybe?). I thought that was insane at the time because houses were selling for that price as well. Just recently I saw one for sale for I believe over $700k. It’s now down to $686k but still seems crazy high for a townhouse on a busy bus route. https://www.realtor.ca/Residential/Single-Family/16630920/104-4343-TYNDALL-Ave-Victoria-British-Columbia-V8N3R9

Are the HAM leaving BC and throwing in the towel ? Since they have been the dominant immigrant group you have to think most of them are. This number is just in the past quarter.

“However, international net in-migration totalling −2,362 offset this gain and was mainly driven by a decrease (−8,157) in the number of non-permanent residents (NPRs). ”

http://www.bcstats.gov.bc.ca/Files/753a5017-b6ce-4d69-9259-caa1c838aa9f/PopulationHighlights2015Q4.pdf

Interesting comments about townhouses. A few years ago THs at Uplands Estates were relatively pricey, $5-600K. More recently SFH prices have left them in the dust and they don’t seem to have buyer stampedes even though they offer 1600+ sq ft, backing on a golf course, quiet, private etc.

get a local realtor

@Marko I guess the key would be representing those Vancouver buyers. Do you find they’re working with their Vancouver realtors?

No, the majority do get a realtor. It isn’t just the Vancouver buyers, I’ve been involved in a few multiple offer situations where Calgarians are going in 100k+ over ask unconditional and then you have locals too which make up the majority of unconditional offers on an absolute number basis.

The millenials will soon enough be the largest group in Canada, but especially for Victoria, I think you want to consider where the $ group will be buying.

http://i.cubeupload.com/u5EhyR.png

@Marko I guess the key would be representing those Vancouver buyers. Do you find they’re working with their Vancouver realtors?

The boomers are not everything. Townhouses might be perfectly fine for millenials and they are the bigger group.

Marko I cannot believe 815k for 3170 service, That is unbelievable. Owners must think they hit the jackpot.

One problem with the typical townhouse is the 3 to 4 flights of stairs – won’t perform that well as ~10 million boomers turn 75 over the next 20 years.

Townhouse seems to be the financial loser (worst of both worlds?)

Townhomes have their benefits; no elevators, no parkade membranes to leak, no generators, etc., etc….the special assessment risk is lower in terms of cost.

I personally really like strata duplexes. I find a lot of realtors don’t set their clients up on search criteria for strata duplexes so sometimes you can find good value and no strata fees, no meetings, no BS (unless your neighbour is nuts).

We went for two open houses for our friends who plan to move back to Canada and retire in Victoria (I also have referred Marko to them).

Not taking on any new buyers until July/August. Kind of pointless right now, I’ve had only 2 of my last 25 written offers accepted. It’s going to be a while until my list of current buyer clients drops to a more managable number. I am running a ratio of 5 sold listings to 1 represented buyer right now but I would say 70% of my time is spent with buyers showings houses and writting unsuccessful offers. Business wise makes more sense to focus on listings until the market becomes less insane.

One is 3170 Service, in good shape, but already had three offers on Friday at 2pm, after only 3 days on market, probably will go above asking

Sold for $815,000 unconditionally. Is that what a $815,000 house looks like these days? Things have changed in the last 12 months.

Good point! House-with-a-suite wins, without a doubt, as the financial no-brainer.

Townhouse seems to be the financial loser (worst of both worlds?)

We compared houses vs condo for years & in my calculations, a house costs about $1,000 more per month (including taxes, hydro, strata fees, mortgage, insurance, upkeep, etc) -figured this adds up to 12k extra to invest per year (which I realize could be gobbled up with a special assessment -however after 10 years, you could have 120k invested.)

Suite makes a big difference. I ran the calculations too before we bought our patch of land in Saanichton and our new house, factoring in the suite, is significantly cheaper per month than the condo we were considering (1,160 sq/ft unit at Bayview Promontory on 19th floor).

I would probably prefer living in the condo but even if the monthly cost was the same, which it is not, the house will completely destroy the condo over 20 years in terms of appreciation.

We compared houses vs condo for years. In my calculations, a house costs about $1,000 more per month (including taxes, hydro, strata fees, mortgage, insurance, upkeep). This adds up to 12k extra to invest per year, which I realize could be gobbled up with a special assessment; however after 10 years, you could have 120k invested. This thinking only works if you are happy to stay in the condo for a long time (& I realize these savings are likely negated when you sell, as a lot of the extra house costs become equity.)

In certain areas, I figured a 375k condo is comparable to a 600k house (obviously not for space, yards & garages, but) if you are looking for newer, big windows, walk-in closets, open concept, more storage in closets, decent sized bathrooms. So it all depends on what people value.

I do ponder what will happen to all these buildings in 80-100 years. Guess we won’t be alive to find out.

The strata council is the law. You would have to find a building where such rentals are permitted. Personally, I would not buy into that. Condos are homes first, not businesses.

The boat has sailed on this one…..condos where the city zoning allows for short term rentals (example would be Era, Union, etc.) have seen some massive gains in the last 3-4 months.

http://victoria.citified.ca/news/victoria-condo-fetches-astonishing-resale-premium-thanks-to-airbnb/

I am on the strata council at the Era and we haven’t had any problems with our 8-9 AirBnB operations. Actually, I don’t think we’ve had one complaint so far. Most of our complaints are in regardings to long terms tenants partying or owners smoking, etc.

From previous thread…..

The actions of a handful of agencies has led to the destabilization of the Oak Bay residential market. While the volume of sales in the core has increased 28 percent from last year, in Oak Bay the auctions have led to the elimination of an entire economic class of buyers that were buying at the $700,000 range last year. The number of buyers has stagnated, at last years level, but prices are now at the $1,250,000 price range.

The low level of listings has allowed a few opportunistic firms to exploit the market with skulduggery tactics. We should have new laws in BC to protect consumers from these selling tactics. We need a real estate fair pricing policy in BC and compensation paid to the victims of what would be in any other industry an activity in violation of the Business Practices and Consumer Protection Act.

There should be special regulations governing auctions that all bids are made known to all bidders during the auction.

Do you think that REALTORS® have any sort of influence on the market place? The cause of “destabilization” is fairly obvious to me….when I pull up to a non-open house and there are 30 cars parked outside that’s the problem, not the listing REALTOR® collecting the offers and presenting to seller.

The last mere posting I listed sold for $76,000 over asking price, how do you explain that? No opportunistic firm, just a random guy selling his house representing himself, doing his own open houses, etc.

As I’ve said before there are no “auctions,” taking place in Happy Valley. If you want to live in Oak Bay and you want to bid $200,000 over asking so your kids can go to Willows Elementary, your call.

It’s not like the price of milk is being bid up. We are talking the price of homes in the most desirable neighbourhood of the city, in one of the most desirable cities in the country, in one of the more desirable countries in the world.

What would special regulations have anyway? Half the properties would go for less than current top bid and the other half would get bid up past the highest bid. Net result = zero.

If the condo is cash flow positive or neutral (highly unlikely unless you lived in 500 sq/ft) I would keep it; if negative I would unload it.

He he

Chinese proverb say only cat live in sky box.

@VicInvestor. RE selling condo. Consider these angles…. The market is hot now so you will most likely sell fast for a good dollar. This will erase a solid portion of debt and free some cash that you can invest inside a TFSA earning 7%ish a year tax free. Without the liabilities that RE include like; 70,000 bills for redoing the windows or the nice young couple you rented too split up because the wife was just getting her crack habit going and they split up and the house turns into a crack shack and it gets trashed (both true stories)….. Or you carry it for a year or two and maybe the market goes up another 20%-40% or so. (You are already up 30%)….Or the market finally does tank….

So going with the pot odds I would say….If you have no other investments or other liquid assets then sell and get some. If you have about half your debt load in liquid assets then hold.

I’d generally rather rent a condo than own it

We rented at the Bayview One for a number of years while the three condos we owned at the time we rented out. We had friends come by our place at the Bayview One and often I received comments of………”So let me get this straight, you own 3 condos including one in the building next door but you rent this one?”

Our rental unit at Bayview One – 782 sq/ft one bedroom – value approx $400,000 – rent $1,350 per month. Landlord expenses: strata fees approx $350, property taxes $185 per month.

Our investment condo at Bayview Promontory (50′ away from Bayview One) – 440 sq/ft one bedroom – paid less than $200,000 for it – rent $1,150 (11 rental applications at this rate). Our expenses: strata fees approx $160, property taxes $120 per month.

$1,350 – $350 – $185 = $815

$1,150 – $160 – $120 = $870

Only after a few basic expenses we netted more on our 200k condo than our landlord on his 400k condo.

High-end condos are so much cheaper to rent than to own; however, at this point in my life if I was to live in a condo I would buy none the less despite the horrible numbers. You get to point in your life where the risk of being given notice or the unit going up for sale outweighs the numbers. I rather work a bit more to cover the extra cost of a owning a luxury condo versus having to do an unexpected move given my personal circumstances.

If I had a regular 9 to 5, M to F, type job I would definitively rent a higher-end condo, no question there.

My guess is condos play some catch up to houses this year. I think I’ve said before and as JJ points out, supply/demand right now seems to indicate increasing prices. I think Marko was saying a little while back that up until recently you could buy new downtown condos, rent them out and be immediately cashflow positive – so sounds like lots of room for growth.

My general view on condos is they can be great for certain pple at certain stages of life, it’s just what you’re into. Do your homework on the strata/ building condition and they can be relatively low stress compared to a house. I once lived in a condo where one guy on the strata basically looked after everything for years and years and ran a tight ship (i.e. spending wisely).

@SweetHome

Thanks for your reply. My worry is excessive leverage & overexposure to RE. I understand that massive leverage has made some Vancouverites filthy rich in RE but I am somewhat conservative & a long-term investor. Having an expensive home & a condo in my 30’s seems significantly under-diversified. I’ll probably sell the condo so I can sleep at nights.

@VicInvestor1983

Congratulations on buying a house! I hope you found something you will enjoy living in, even though it likely cost you more than you wanted to spend (the position all current buyers are in).

From what I recall, you were in a very comfortable position relative to monthly income, but you likely bought an expensive house, so your total assets in real estate would be large (over $1.5 million) if you kept your condo.

Others can’t really give you advice without knowing your entire financial and personal picture. However, I will add my opinion, for what it’s worth.

It has been mentioned that condos are not likely to appreciate as much over time as houses are. I think this is especially true in the short-term with the number of new condo projects soon to be built in Victoria. With your house, you already have a lot of “eggs” in the Victoria real estate basket (an analogy for Easter). I guess the question is: are those enough “eggs” in your given situation?

Perhaps it would be good to pretend you didn’t already own the condo and look at it like any other investment. Ask yourself if you would buy it today for the likely price you will get if you sell it. Also, Marko has mentioned that one-bedroom condos worked out better for him relative to return-on-investment, so you would have to consider if the specifics of your condo really make it a good investment property. You could sell it and buy a different condo, but of course that would have transaction fees and you wouldn’t know the potential pitfalls of a new building as well as you do for your own.

Main reason coops don’t appreciate as much here and are cheaper than condos is the lack of ability to finance them and buy with only a small down payment.

totoro said, “There are; however, some on Beach Drive that are pretty good value with great views – a couple of them are co-ops (cheaper but don’t appreciate much).”

The Rudyard Kipling is a co-op and has appreciated quite nicely in the past few years. One benefit is significantly lower city taxes, perhaps because the land is owned/taxed separately.

Co-op structures are not that common in Canada so I’m guessing some potential buyers are unfamiliar and not completely comfortable with them. In Manhattan virtually all the great vintage apartments around Central Park are co-ops with the advantage of being able to reject applicants deemed “unsuitable”. Gloria Vanderbilt’s (Anderson Cooper’s mama) BF Bobby Short was rejected from one because he was a musician! Keeps the riffraff out, I guess.

I’d say risk right now is relatively low. But understand the extended leverage. I would try to hang on for a year if it wasn’t too much exposure. Depends on the stability of your job as well.

@Michael: I don’t think it’s a guarantee that the market will double. In fact, I think doubling is a stretch. Who knows what will happen but I wanted to reduce my RE exposure risk.

@VicInv1983

So, the previous owner sat through 7 years of down and you’re wondering if you should sell it right before it’s about to double in our upcycle? 🙂 As long as you can come close to carrying it… shouldn’t be a problem with how much rents are going up.

There’s been a few pieces in the media lately arguing that condos will now outperform houses for a while on a % basis… I suppose it’s possible once you consider factors like demographics & price/affordability gap.

I also wouldn’t hang onto a condo after buying a house. I used to own a condo.

There’s too much risk of special assessments going beyond what you can afford (every 5-10 years, expect extra repair costs for common areas & windows, elevators, plumbing, roof, parking lot pavement, balconies, etc.) Try to pay for those, and maintain a house at the same time.

Condos are best for singles or anyone who doesn’t want to (or can’t) maintain a house. (best are concrete, away from road noise, with views, walking distance to shops)

Problems are: lack of control with the way strata spends money, not great for families, condos don’t appreciate – in the long term – as much as houses (value is in the land), and builders can build another 1000 new condos next door to yours, affecting your property value, views, neighbourhood noise & traffic congestion.

(Condos aren’t always “Environmentally Friendly”. The problem is that it’s too easy for too many condos to get built. When that happens – no worries – builders/realtors will go out of town to find buyers, pushing locals further out of town to less expensive areas, as the most “walkable” condos sit empty.)

As per previous posts by freedom_2008, Hawk, Jack, StepbyStep: “Somehow we have lost a fundamental respect for our society’s future at the expense of ‘getting ahead’ quickly via the real estate market” …

If anyone has any ideas on who to “complain” to beyond a local MLA or MP, let us know, because the political process is slow, and the greed seems to be growing faster than ever.

I’d generally rather rent a condo than own it for some of the reasons already pointed out by Hawk – plus having kids and a dog. There are; however, some on Beach Drive that are pretty good value with great views – a couple of them are co-ops (cheaper but don’t appreciate much). I’ve noticed the prices have already gone up on these.

I don’t understand why someone would buy one of the new condos on OB & Foul Bay or OB & Richmond rather than Beach Drive. You’d save several hundred thousand, have a better view and a good renovation budget left over.

As far as selling or holding a condo, it is no longer your primary residence so you’ll need to factor capital gains in on any future profits. Prices probably will go up more. JJ’s advice not to lease is good in case things change and you want to get the equity out.

If it is true that Vancouver buyers are using their home equity and borrowing power to buy in Victoria – which seems likely to me (I remember seeing this happen in the Terrace area five years ago) – prices on everything will probably go up for a while.

I wonder if this effect will eventually be felt in other retirement areas of the island like Parksville, Qualicum, Courtnenay and Comox? I was trying to figure this out and quickly realized that this blog has way better info than anything available in other markets that I could locate.

Another condo nightmare. I’ll stay renting thanks.

Condo buyers caught off guard by sky-high closing costs

Residents of a development on Birchmount Road scrambling to come up with tens of thousands of dollars

http://www.cbc.ca/news/canada/toronto/scarborough-condo-closing-costs-1.3486212

If you’re selling a home in the core these days, you’ll get your best offer in the first 14 days of the listing. Houses listed over 14 days mostly sell under asking price.

Conversely, if you don’t want to get caught up in a bidding war for a home you should only bid on homes that have been listed in excess of 14 days.

I don’t know the building that you are in, so things could be different in your scenario. However, looking at the general condo market you should get sufficient warning if things change for the worse. Prices don’t normally change as quick as they have done over the last three months. And most certainly for prices to reverse you would have to see a solid increase in listings and longer exposures before prices began to decline.

Keep the condo but don’t sign a year lease with the tenant. Even an airBNB would keep you more flexible if the economy was to change and you had to fire sale the condo.

Good to see the condo market picking up. I bought my 2006 steel/concrete condo in 2014 at almost the same price the seller had bought it in 2006. I have now bought a detached house & am hoping to sell the condo to help cushion my finances. If I get the price I anticipate, I will have lived for free for 2 years & will make a small profit. Although I make a very strong salary, the detached home has put us into significant debt. Would anyone recommend holding onto the condo to benefit from even higher prices?

Hmm I did kind of suspect this article should have been written 2 months ago…

The 7 year cycle is ending Mike, you missed the memo. Volumes coincide with Toronto condo crash of early 90’s.

Post Olympic boost should be changed to “massive increase in money laundering as yuan devalues.”

There are currently 300 strata titled condos for sale in the core. And 205 sold in the last 30 days. That’s 1.5 months of inventory. The replenishment rate is just one listing for each one that sells. Market exposure is down to 26 days on the market. Median price is up almost 10 percent from the month before and is now $312,000. Condo sales are up 75 percent over the same time last year. And about 20 percent of the condos that have sold in the core in the last 30 days went over asking price.

If you’re a real bull you should be out there buying up all the condos that you can and not on this blog.

You can predict both attached & detached by looking at Van’s 7-year cycle.

Vic tends to lag Van by about a year.

Condos in Van are now rising at a 17.7% yearly pace as of Feb.

Van is only about 1.5 years into its 7-year upcycle.

http://i.imgur.com/ZpbRVlg.png

You need at lest one other choice: Condos can meet the needs of some people based on their life stage, health, mobility, desire to live in a city core, and/or concern (or lack of) with leaving a legacy.

“The one thing boomers do know after a life of owning houses is how costly they are to maintain, so the economies of scale of strata fees will seem like a good deal to them.”

If they make it til mid 80’s without a problem they’ll be there til they drop barring any sudden medical problem. Gardner comes once a week to mow the lawn for $40 each 10 months of they year, and the old people like to tinker in their gardens. Until they need assisted living I see them staying as long as possible. If family is around they come over and help out as well to save costs. They can defer and property taxes on top of that.

I’ve experienced the condo thing and know others that are new owners and sound like they are regretting it. The condo committees can be a royal pain in the ass, nit picking, complaining of noise at the drop of a hat and have nothing better to do than spend their days creating crisis after crisis over how to spend the strata money on fix ups that aren’t needed.

Apartment rentals in a good building are one thing if you got a good group around you. If you don’t, you can complain and the problem is fixed, or you can easily move. Once you get stuck with a kid underneath or beside you who likes his Xbox on at 2 AM, or the old lady who can’t handle the slightest noise after 8 PM then you have major problems that will not go away easy. Most condos aren’t any more sound proof as any apartment. Forget it.

The strata council is the law. You would have to find a building where such rentals are permitted. Personally, I would not buy into that. Condos are homes first, not businesses.

Vacationers like to have fun and sometimes are not attentive to others (think hotels in Mexico). Coming home late, loud, slamming doors, revolving door of strangers next door because airbnb is mainly a short-term biz. Airbnb customers have no stake in the building, no obligation to respect owner residents and there is no screening process to filter out rowdies who want to rent a party place for a few days.

Here’s a question for everyone. Are there any condo buildings with transient zoning? I’m thinking of somewhere that you can run an airbnb/vrbo rental without falling victim to a potential condo board ruling banning that kind of activity. Any thoughts?

Someone just paid a million bucks for a unit in Mike Miller’s Village Walk. Doh! Much better condos out there for way less.

Depends what stage of life someone is in, I think. If I were younger I wouldn’t look at half-million dollar shoeboxes because you need to find someone younger or dumber to take it off your hands in order to get something better. All dwellings require maintenance. At my age I would rather write a monthly cheque than climb ladders. Like everything, caveat emptor.

Looks like the skyboxes are starting to go ~15% over too.

503-327 Maitland St, ask 329k, sold 375k.

What I still shake my head at are the barely over 1000ft ones on busy intersections going for 1M, and not even Oak Bay.

Maybe it makes sense when you look at how many more Victorians will be between 60-79 over the next ten years (2026 are the bars on the right). However, at what age do boomers give up all the house work to downsize is the question. The one thing boomers do know after a life of owning houses is how costly they are to maintain, so the economies of scale of strata fees will seem like a good deal to them.

http://i.imgur.com/KMy8YYs.png

I really don’t like condos because I value my independence a great deal. The regulations are getting more complex every year and it results in higher fees. You have very little control of decisions made by a few people that decide one day that they think the windows should be replaced, the sliding patio doors need replaced or they don’t like the look of the balconies and so they should be replaced. I know people who have been faced with seventy thousand dollar bills for what amounts to cosmetic changes. Meanwhile….. what they really need is a bigger power supply to the building so that the suites can have their own laundry facilities!

If you own your own little house you can decide to simply patch your roof instead of replacing the entire roof. I’ve seen perfectly good roofs thrown into the landfill when a simple repair would have seen the building through another five years of good use.