A brief history of prices

Updated: 2021 Q1.

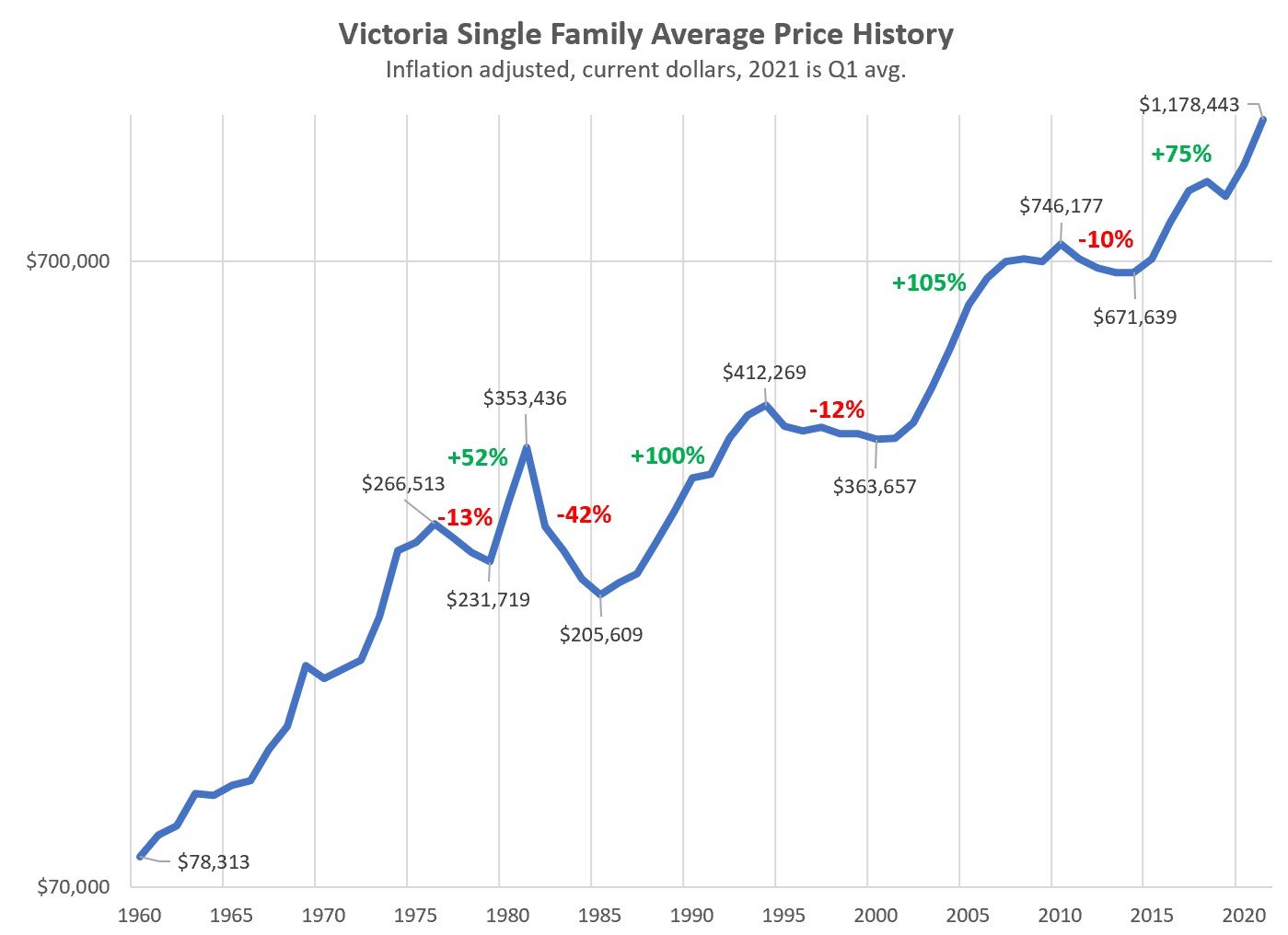

Here’s an updated version of our inflation adjusted price history on a log scale.

So how fast has the Victoria single family home market been appreciating in the last 55 years? If we draw a best fit line on this graph, the equation is . To convert that to a percentage yearly increase, we just take the equation for compound interest (

) and solve for the rate. In the end end we have:

How long can that kind of appreciation continue?

You don’t have the guts to buy.

JJ, already own, not happy about extra property tax, also not happy I missed this recent uptick because I wanted to buy investment property and missed out on 200k easy profit, I’m still buying though because this is just the beginning.

I’m not bending that in any way bearish or bullish. Those are the numbers and they don’t look bearish to me. Maybe you should try to read the post rather than always assuming that the world is against you.

Besides if you were really bullish on housing you wouldn’t be sitting on your ass reading this blog, you would be out there buying.

Just Jack, I like how you always select info to try to bend it bearish.

So let me get this right, 50+ buyers in a couple small areas (ob, ff, gh) in 3 weeks said they were from out of town!!! That’s insane.

And we all know a bunch of the “locals” are actually recent arrivals who have been looking for a while.

I told you guys last night, I heard Carloss Place sold “well” over asking. 752k, seems like a deal to me, a block from ocean w a suite and huge land!

Those who want a livable nice house in Fairfield w a suite for under 800 are smoking crack, those prices are from 2003.

Movie related to aging and real estate.. good movie “My old lady” starring Kevin Kline…available at the library…

“Are you sure the “main reason” isn’t that there were precisely half the number of births in 1940 (present day 76yr-olds) as there were in 1960 (present day 56yr-olds)? Iow, if you look at the 75-79 bar, it’s not surprisingly about half the size of the 55-69 bar.”

Why do the 2016 bars get shorter at about the same rate as the 1986 bars chart?

http://www.statcan.gc.ca/pub/82-624-x/2014001/article/14009/c-g/c-g-02-eng.gif – see how the chart gets steeper at 70? And there are more people heading into those years.

The median price for a house in the combined areas of Saanich East, Victoria and Oak Bay is now $750,000.

Up from $629,000 for the same time period one year ago.

The number of sales is also up from 130 to 190.

136 out of the 190 sales indicated their were from Victoria. Up from 93 the year before.

And 23 out of the 190 stated that they were from Vancouver. Up from 12 the year before.

In Langford and Colwood the median price for a house is up from $485,000 to $501,000. Sales are up from 51 to 84.

If you’re truly bullish on real estate then you should be buying more property as you would expect Langford and Colwood to follow the core. And if you’re truly bearish then you should be selling and reaping the windfall profit on your investments.

Instead – you’re reading this blog. What are you waiting for? The light to get greener?

I went looking in Fairfield for a finished “livable” house under 800k in 2011-2012 and they were all fixer uppers in some way our another. This is how I landed on a bulldozer special on a large lot for half that…. A finished livable house in Fairfield for under 800k seems unlikely now.

@Marko Thanks for the numbers, new post up: https://househuntvictoria.ca/2016/03/21/march-21-market-update/

I wonder if we’ll see a million median core by 2020? 🙂

2019?

2018?

Never thought I would ever see this type of price appreciation in my career. I just assumed the absolute figures had increased to such a huge point that anything beyond 10-12% yoy was impossible.

Carloss went unconditionally for $752,000. Last year in June the listing expired unsold at $638,000.

“If the house sells for $400k. Oil tanks, vermiculite, drain, roofs, windows might cost 15% of their new homes. But now, those repairs are pocket change compare to the sale price. Of course, get caught up in the emotion as well.”

Pocket change ? Are you nuts ? What if the oil tank drained on to your neighbors property like many cases the past few years ? What if it drained on to city property ? You have serious money problems to the tune of 60K for your own property plus $100K plus if it hits the neighbors on top of law suits and over the top stress.

Most seem to be paying $100K over to get the zero conditions aren’t paying $400K for their houses, more like $700K range. Yes money grows on trees in BC, until it doesn’t.

http://www.timescolonist.com/news/local/leaking-home-heating-oil-tank-leaves-financial-nightmare-for-saanich-neighbours-1.567924

Mon Mar 21, 2016 8:25am:

Mar Mar

2016 2015

Net Unconditional Sales: 696 734

New Listings: 946 1,448

Active Listings: 2,597 3,769

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

If the house sells for $400k. Oil tanks, vermiculite, drain, roofs, windows might cost 15% of their new homes. But now, those repairs are pocket change compare to the sale price. Of course, get caught up in the emotion as well.

Are those out of town buyers in-town? or they are buying unseen?

The trash for sale with multiple bidders is atrocious. Heard of some real ugly crap out there, brutally warped and uneven floors, one bedroom dumps chopped up and being called a 3 bedroom with decors that looked like the Adams Family lived there. Biggest sign the top is in. Sell, sell, sell while the sheep don’t see the wolf.

When the US sales tank with much lower household debt levels then you know BC is a ticking time bomb.

Existing Home Sales Crash Most In 6 Years: NAR Blames Slowing Economy, Bubbly Home Prices

I really don’t understand why the bears wish the RE crashes, then the price will be “fair” to potential buyers.

FFS, They were sitting on the sideline while the prices are flat for years (and laughing at home owners’ maintenance expenses), now they are crying for missed opportunities.

They think every old houses are teardown. You know what, there are families living in those houses in those condition before listing for sale. Princess needs her castle.

Ok, they want pseudo 4-star new home on their own land to impress their friends. Again, 30-45 min drive away from DT, lots of choices. (guess what, 5 years from now, the prices are risen too. They’ll cry for missed opportunities again)

Be flexible. Prepare for sweat equity. Sort out priorities.

This past weekend was another brutal one batting 0 for 5 on offers. I have resorted to all sorts of strategies with my buyers such as doing a portion of the deposit like $5,000 non-refundable (if conditions not removed for any reason including horrible inspection seller keeps the $5,000). Has not helped when most properties are now going 100% unconditional. People don’t seem to give a sh1t about oil tanks, vermiculite, or anything else anymore and apparently everyone has cash and doesn’t need financing 🙂

This weekend in the offers I was involved in came up against Calgary buyer going 100k+ over ask unconditional, Vancouver buyer going 70k+ over ask unconditional and someone from Toronto as well.

This morning in my system the last 7 homes reported as sold are all well over asking price.

Out of 7 only 3 buyers from Victoria.

While the stats indicate the local market is around 70ish % my feeling is that on attractive properties in the core it is more like 50% local/50% out of town.

Money Sense article: Could my mortgage go underwater? Hint #4 at the bottom of the article is worth considering – Don’t overpay. http://www.moneysense.ca/spend/real-estate/mortgages/how-to-avoid-the-underwater-mortgage/

Good read: Article starts with: Canadian politicians, keen to stimulate B.C.’s economy, are responsible for creating the conditions that created Metro Vancouver’s housing affordability crisis, according to a new study.

Mid article: The 10-year visas, instituted in 2012, provide all the flexibility that most Asian and other millionaires want in order to invest and live seasonally in Metro Vancouver, he said.

Later in the article: A study by SFU researcher Andy Yan found that Metro’s university-educated adults earn the lowest wages on average in Canada’s 10 largest cities, Ley said. Many are “disillusioned” and leaving the city.

So…where are they leaving the city to go?

http://www.theprovince.com/business/blame+politicians+metro+vancouver+housing+price+crisis/11797902/story.html

@househunting You are wise and this is a great time to follow the market and gain more information. Information lets you consider other options that maybe weren’t in your plans and figure out the gap where the majority isn’t interested. We may be one of the only people to admit that we’ve previously sold a house for less than our purchase price. It happens. I’m baffled that people are willing to take on such large mortgages for the proverbial ‘bricks and mortar’.

I’ve been waiting to see where prices go for the last few years and had hoped to buy in Fairfield. Given that prices there have just taken a huge leap I don’t think I’ll be able to. Any guesses out there as to whether a liveable house in Fairfield (as opposed to a tear down) will sell for under $800,000 in the next year?

@househunting, there are a ton of great starter homes out there within a very tiny 15-25 min commute.

Maybe if you want to live near the water with views in one of the best locations on the entire island with a suite and a huge yard, yeah you are going to pay maybe 700k

With that suite though, your mortgage would be 1200 with only 650 going towards interest and the rest into equity.

That’s seriously cheap actual monthly cost to be like half a block from pristine private beaches.

If you can’t afford that monthly, try a townhouse in Langford to start… Because realistically, Carloss Place isn’t really a “starter home”.

And to be fair, a house like that anywhere on the mainland would be 1.5-2 million.

From a buyers perspective, we’re done.

Carlos Pl really drove home how manic the market is out there right now and it’s time to opt out. No comment to be made here to the bears or bulls, the crystal ball is very cloudy on either outcome. I wish the best of luck to all players, buyers and sellers, bulls and bears – play safe and keep your stick on the ice.

Word of caution to any buyers out there – do your math! The price points are crazy for anyone looking for a starter home, or any home for that matter. Run your numbers, all the numbers, weigh that albatross and make sure it won’t break you.

out.. mike drop…

Anti-intellectualism is so sad.

@dasmoalderon – * wishing

“whishing” in the wind; that would be a nice analogy for the situation the buyers are in out there. 😉

No attempt here to offend or humiliate, just a timely typo to call out.

I heard via the grapevine Carloss already sold for well over asking. First come first serve.

Is there something wrong with Carloss or is it just underpriced? I mean the place is suited on a quiet road in cordova bay with some water views. Seems too low, so I can understand the swarm of people there to check it out.

I scanned it, beeny baby pic, other cheesy housing bubble charts, and a basic “well diversified” pitch.

There was maybe 1 hour put into that, scare tactics and short bull sh** summaries you could find in any $5 investment guide for dummies.

I’m still house hunting and regretting not making an offer on a particular property last week. This news about the frenzy over Carloss is depressing! I didn’t look at it because I remembered it from last year and figured there must be something wrong with it because it sat on the market so long. I didn’t really like the driveway sloping into the house (aesthetically unappealing and may have water problems).

It seems the housing market is now like closing time at the bar when ugly people get much more attractive after several drinks and the fear of going home alone set in!

Nice to see you didn’t read it, given the newsletter says it’s pointless to market time or predict the top of bubbles and just buy a set of well diversified index funds. I thought it was funny he/his firm would write that, given his other life.

That “investment” memo has less work put into it then a high school presentation.

I’ll stick with an index fund and cash flow positive housing investments thank you.

I really truly wonder how many investors he has ruined. It’s like a gambler loosing money, and keeps going back to the drum, beating it louder and louder and louder hoping that this hand he will be right, this time, if only this time he will be right and get his money back to zero.

Thought this newsletter from TurnerInvestments (yes that Turner) was a good read: http://www.turnerinvestments.ca/pdfs/Bubble-Baths-Feb2016.pdf

Is this frenzy confined to the $500,000 to $1,100,000 range?

For instance, I am seeing $2,000,000 waterfront homes in the core asking for/selling for what they basically sold for pre-2008.

Am I correct?

Is there still value to be had as you go into the seven figures?

Hawk this post shows a 60 year tend line with an upward slope.

Please correct the grammar. It’s a dying art that needs people to carry the torch. I come from a long line of ignorant intellectuals so I take no offence to being righted where I’m wrong. I also find it entertaining when it’s towards others…whishing I too had such powers of humiliation….

I bet most new buyers/commenters that read this blog wouldn’t be able to afford the new 100-200k uptick in prices if they haven’t bought into the market a year or two ago.

Something to think about.

So yes, a lot of people are getting in now before they get priced out. Lock it in while you can instead of hoping and wishing for a major crash that will magically put that mansion in Oak Bay within the average wage.

Priced out forever…. Nice to see the bogeymen from the last boom are back in force

@Marko – I was one of those 30 cars, it was more like a run on a bank! Crazy considering this property failed to sell last year, and back on the market this year with no upgrades. Truly manic out there, or desperate is probably a better word.

@Introvert – appreciate the correction, don’t worry I won’t respond in a fit of peek..

Sounds like the bulls are worried bigtime. Families making 70K getting rejected by a bank for a $750K mortgage but the broker does some “tweaking” and bingo you’re a property king.

If you have an ounce of brain cells you know this will be one mofo of an ugly disaster when basic economics are thrown out the window. Young couples will be divorcing in droves, as lawyers will reap the rewards. Lineups will be down at the courthouse, not at open houses.

Sad times ahead when the banks are shorted by the pros who know what’s coming.

“Realtors are now openly forecasting that the national average price – currently sitting at the highest level in recorded history – will bloat another 8% in 2016. That would be four times the expected rate of inflation and about six times the anticipated wage gains experienced by the average family. In other words, if true, it would signal a further descent into unprecedented household debt. Yep, held mostly by the big banks.”

http://www.greaterfool.ca/2016/03/20/the-little-short/

Carloss Place is a little rough around the edges, was very affordable a couple years ago, 300k less then now.

Hawk is clearly this info everyone talks about, always referencing the super douche loser greater fool. I wonder if in another 12 years he/she still posting from their basement or apartment?

The young couples are now freaking out and jumping in after reading Hawks comments for the last 10 years about a crash.

I feel sorry for anyone that listened to him, lost tens or hundreds of thousands of dollars, life changing money. Just like he has.

I personally know most younger couples are now actively looking to buy now that prices are going up, it’s crystal clear if they don’t get in now they locked out forever. They read the Vamcouver Sun, they see what happened all over Canada in the last 10 years.

It’s easy to get financing, most young tech types make 80k each.

Marko: How do you figure these young couples get financing for these places? Massive down payment from the bank of mom and dad etc?

bearkilla, your shack will be the first to tank living in the sticks.

Garth had a great quote from Warren Buffet that so many like to fawn over. Enjoy the pandemonium while it lasts, the fallout will be historical.

“By the way, Warren Buffet figured this out a while ago when he looked at how real estate destroyed the US middle class:

“The basic cause, you know, embedded in psychology, was a pervasive belief that house prices couldn’t go down and everyone, virtually everybody, succumbed to that. But that’s the only way you get a bubble is when basically a very high percentage of the population buys into some originally sound premise. It’s quite interesting how that develops.

“The originally sound premise that becomes distorted as time passes and people forget the original sound premise and start focusing solely on the price action. So the media investors, the mortgage bankers, the public, me, my neighbor… you name it — people overwhelmingly came to believe that house prices could not fall significantly. And since it was biggest asset class in the country and it was the easiest class to borrow against, it created probably the biggest bubble in our history.”

Nobody’s certain how things will ultimately be resolved. We just know those who believe prices will go up, forever, are wrong. The rest of us should probably get out of the way.”

http://www.greaterfool.ca/2016/03/20/the-little-short/

Incorrect math should be corrected because it leads to incorrect conclusions. Incorrect grammar just leads to pedants getting annoyed.

Correct a person’s math and odds are she’ll thank you. Correct a person’s grammar and watch her lose her shit.

I’ll correct people’s grammar whenever I feel like it, thanks very much.

Over 30 cars outside of 4731 Carloss Pl today and it wasn’t even an open house. Can’t say I’ve ever seen anything close to it….it was a zoo. So many young couples at the house….I just don’t understand where all these people were in 2011-2014? Markets are really difficult to grasp.

BTW Mike, you haven’t made squat til you’ve sold

Haven’t given thought to what my personal home is worth given the insane market. When you own a home you don’t go home thinking how much your place is worth…..I typically drive down my driveway thinking what shrubs I should plant that the deer won’t eat.

Just happy that I don’t have to deal with the chaos. Also lucked out on the build….framing alone would have set me back another $20,000 to $25,000 right now. You would think with all the layoffs in Alberta construction labour costs wouldn’t be skyrocketing but they are.

Thanks for posting all the great stats. So what’s causing MOI to be so low? (since we know that correlation and cause-and-effect are different things)

Seattle area also has low MOI and these are reasons given in the US that may apply to Victoria/Vancouver:

Builders are too focused on the Multi-Family & Luxury markets, so not enough options for middle-class families. Might be the explain the competition in $500k-$1M range?

In the past few years, home owners have signed such unprecedented low-rate, long-term mortgages that they can’t sell now without risk.

Generational shift – seniors aren’t motivated to sell but millenials are starting families

Chinese stock market crash at start of 2016 moved more money out, worldwide. Especially to Canada because it’s so easy to avoid taxes

http://www.theglobeandmail.com/report-on-business/economy/housing/the-real-estate-beat/foreign-investors-avoid-taxes-by-buying-real-estate-in-canada/article26683767/

(We might also argue that Saanich has a higher rate of sell-price-over-asking because it’s closest to UVic)

A sure sign of a crash is when the market is going up. That’s known as the “bear rule”. In fact as a market rises so does bear genius in terms of calling a top. What doesn’t matter is whether said bear is right or not because it’s the market that’s wrong and rigged. A bear is never wrong because it’s always external factors and mysterious forces that are plotting against them.

“God I love capitalism”

BTW Mike, you haven’t made squat til you’ve sold, until then your glee club is all built on a wing and a prayer that this doesn’t collapse in a heap of rubble.

Houses are trading like thinly traded hyped up stocks with huge spreads, low bids, and high asks. or as in housing ,”nothing” on the ask.

Worst kind of market you can ever participate in, basically a suicide market where the bottom can fall out when the limited amount of buyers willing to roll the dice eventually peter out.

“I don’t think anyone is here for a grammar lesson. ”

Grammer nazis usually don’t have a life.

I stand corrected but was everything exactly the way it was 3 years ago ?

Sellers are making the bucks, but the “brilliant” buyers are getting hosed up the doo wah. Wait til they finally get it through their thick skulls they got sucked into a mania, not a true valued market.

Who would want to watch the daily funeral processions flow by your front window 7 days a week. Talk about depressing.

@ dasmoalderon

Leo’s 3.74% was real not nominal.

Yes, I get that.

My house I just sold after owning it over 12 years was 8%/year not including what I put into it. So probably close to Leo’s number if I included my improvements….

Which is quite conceivable. But it does not have much bearing since we don’t know what you put into it and anyway we cannot ascertain a trend from a single case. Certainly it does not refute my point; namely, that:

“The assumption that a 3.74% compound annual rate of increase in the price of a single family home means that the price paid for a family home is rising at a 3.74% compound annual rate is false.”

and also that:

“The assumption that home prices in Victoria are bound to rise because there’s no more land is false.”

And it is false for the reasons I stated a yard or two below.

Why?

Don’t want to have to buy in this frenzy.

Looks like a $100K reno. Takeaway real estate fees and property transfer tax etc and not as much profit as appears.

I showed the home in 2012 and 2013 (took a few years to sell). It was already extensively renovated at such time.

Brilliant! I figure the seller made ~$170k tax free in only 2 years 3 months! The only 2 differences I see in the 2013 to now pictures are the exterior paint job and lighter flooring in kitchen. The 2013 buyer may have spent ~20K max. God I love capitalism.

Before:

http://shaneking.ca/mylistings.html/details-31376629

After:

http://www.remax.ca/bc/victoria-real-estate/na-4636-falaise-dr-na-wp_id138833157-lst/

@ Introvert

I don’t think anyone is here for a grammar lesson. I would like to draw attention to your comment on Leo’s previous post:

“Wait a minute, Leo. Sort of fixed.”

Grammatically, that paragraph is absolutely terrible. However, I think everyone understood what you meant. Similarly, if you had written “peaked” instead of “piqued” I’m sure we would have got your drift.

“4636 Falaise sold in 2013 for $490,000. Re-sold yesterday for $700,000. 42% increase.”

Looks like a $100K reno. Takeaway real estate fees and property transfer tax etc and not as much profit as appears.

Why?

Private sales are on the rise in Vancouver, but not the kind you would expect: http://www.theglobeandmail.com/life/home-and-garden/real-estate/private-sales-rising-across-all-ends-of-the-vancouver-real-estate-market/article29289929/

A few of my clients where their listings expired or were cancelled in previous years (2012-2015) have emailed me this year to note people are knocking on their doors trying to make offers. But none are interested in selling now.

You mean “piqued.”

So many people (on the blog and in life) make this mistake: connecting two complete sentences with a comma. A semicolon is correct.

4636 Falaise sold in 2013 for $490,000. Re-sold yesterday for $700,000. 42% increase.

929 Easter went for $545,022….probably someone walked by the sign and said here is 20k above ask unconditional before you take it to market.

Does anyone know what 929 Easter Road sold for? It went from “Coming Soon” to “Sold” without ever hitting my PCS list.

“The exception is in Oak Bay where other factors are causing the months of inventory to be tied with the highest level in the core districts.”

Thanks for the data, Just Jack. Just wondering what you mean by the above comment?

What’s hot and what’s not.

The percentage of sales over asking price since the beginning of the year by neighborhood.

Saanich East at 46.9% MOI 1.3

Oak Bay at 35.7% MOI 2.5

Victoria at 34.6% MOI 0.7

Esquimalt at 34.3% MOI 1.1

Saanich West at 30.4% 2.13

View Royal at 23.9% MOI 2.5

Vic West at 18.2% INSUFFICIENT DATA

Langford/Colwood at 9.8% MOI 3.8

There does seem to be correlation between months of inventory and sale prices over asking. The exception is in Oak Bay where other factors are causing the months of inventory to be tied with the highest level in the core districts.

As the months of inventory moves to a balanced position, which is generally between 5 to 7 months, the percentage of sale prices over ask prices drops off.

This is a market driven by supply shortages not demand. If it were driven by the economy improving then prices of all properties in all areas would be shifting together.

There is a lot money to be made in this market. If you know what to buy and what to sell.

27 Powell? Its great inside but does it look a bit overvalued?

They are looking at offers Monday night, will find out!

if this place doesn’t sell above asking it would be a very strong argument against using a mere posting.

It’s not the mere posting that is the problem in this scenario, it is the fact that the seller is using an out of province mere posting service.

This is how the system works; listing is always upload to local real estate board database, such as the VREB. PCS accounts, REALTORS®, etc., all use the local database source. Realtor.ca scrapes the data from all the local boards across Canada twice a day.

So this listing is uploaded through an Ontario real estate board (REALTORS® in Victoria don’t see it, PCS users (majority of serious buyers) don’t see it, etc.) Then the company in Ontario pins it on the realtor.ca map as in Victoria.

The public assumes Realtor.ca is all they need so they are happy just to see their home on MLS®….see numbers below. You miss out on #1 and #2 with an out of town mere posting company. #1 has increased YOY for 5 years in a row.

VREB Survey 2015 – How did your buyer first learn about this property?

The buyer located the property on a REALTOR®’s automated listing search serv 1285 38.9%

A REALTOR® (you or another) located the property and informed the buyer 1155 35.0%

REALTOR.ca 410 12.4%

Your personal website 84 2.5%

OpenHousesVictoria.ca 54 1.6%

Other website 41 1.2%

Real estate sign 92 2.8%

Relative or friend 77 2.3%

Real estate tabloid (Real Estate Victoria, The Real Estate Book, etc.) 4 0.1%

Classified ad 7 0.2%

Other 63 1.9%

Don’t know 29 0.9%

Total Responses 3301 100.0%

Did anyone else get to the open house at 427 Powell? Its great inside but does it look a bit overvalued?

@Marko / Leo – I happened to take a look see at Amphion earlier today. Judging by the 8 or so pairs of shoes at the door there were at least two groups inside, and another prospect besides myself looking for parking.

I only happened across the Open House sign on Foul Bay, and that’s what peaked my curiosity. People are doing their homework ~ if this place doesn’t sell above asking it would be a very strong argument against using a mere posting.

Can you post the full table of how buyers find their home? I assume this is from the survey?

Has anyone been inside 255 Government St? Even looking at the pictures gives me a headache!

Interesting. I had no idea I thought if you were on MLS you would show up in the PCS. Good to know!

“Is Hawk and Info the same person?”

Funny, I thought I was Jack the other day. Paranoia will destroy ya.

Ahhh..didn’t see that as I don’t use realtor.ca….

The one huge problem with mere posting companies out of Ontario is you aren’t on the local VREB system. Reason I say huge problem is only 1 in 8 (12.5% buyers) use realtor.ca to find their home. You miss out on all the serious buyers which are using the PCS system.

Not to mention the 1250 realtors in Victoria doesn’t use realtor.ca

It is really only 1/8th on MLS® market exposure so the odds of a bidding war drop off the cliff.

Marko, that place on Amphion also has a mere listing so it is on the realtor.ca website too. This will be interesting to see if a ‘for sale by owner’ on MLS can generate a bidding war. Keep us posted Marko.

https://www.realtor.ca/Residential/Single-Family/16710222/1609-AMPHION-ST-Victoria-British-Columbia-V8R4Z5

This looks nice: http://www.century21.ca/Property/BC/V8T2S9/Victoria/1416_Tovido_Lane

Seems under priced? But backs onto Finlayson? 1555 sq ft finished, 1075 unfinished

Since we just bought, gotta stop looking!

Let me know if anyone checks it out (will have to live vicariously through others!)

Off to clean my bathtub.

Is Hawk and Info the same person?

Marko. That is a deal. I would think that is a 1.5m dollar house.

For the first time in my career I am seeing some great private deals on craigslist and usedvictoria….basically sellers who aren’t aware of what has happened in the last 2-3 months in the marketplace.

For example, this would go in a huge bidding war if it was on MLS®

http://www.usedvictoria.com/classified-ad/New-Custom-Home-Oak-Bay-Area_27051615

If working with a REALTOR® as a buyer certainly helps if your REALTOR® if willing to bring private properties to your attention.

Thiis curious to see the stats. To see if this is a broad increase or pockets of insanity.

@Halibut – I would agree with your 15-20% lower a year ago. 1982 Kings seems to have undergone quite a transformation. It will be interesting to see if it makes it to its open house on Sunday. It’s my neighbourhood so I’m quite interested. I wish everyone fixed up their homes so nicely. Still can’t believe Adanac!

That price for Adanac is unreal and at least 10% above where it would have sold a year ago, maybe closer to 15-20%

Based on that price I’m very curious what 1982 Kings Rd goes for.

Money laundering has to be happening here too. Wondering if many of those buyers are saying they are from Victoria but are using their agent or brokers/wholesalers addresses like in Vancouver.

Vancouver housing market ‘vulnerable’ to money laundering

“Federal examiners visited 80 realty offices in the Vancouver area to delve into their paperwork and procedures. In 55 instances – most involving brokerage firms and some focusing just on individual agents – they found practices significantly lacking. In an undisclosed number of additional cases, the violations are serious enough to warrant fines.”

“FinTRAC found that some real estate agents were neglecting to get proper ID from clients, such as drivers’ licences or passports.”

“Attempts to verify sources of money were found to be inadequate or non-existent”

“It’s too easy to become a Realtor in British Columbia, so the level of compliance is going to be a problem,” said Keith Roy of Re/Max Select. “The No. 1 way to increase public protection is to have more than a 10-week online course to get your licence.”

http://www.theglobeandmail.com/news/national/vancouver-housing-market-vulnerable-to-money-laundering/article29285770/

Wow – 1732 Adanac in north Jubilee: sold $701k, asking $569k, assessed $515k. I went in the open house yesterday and agent told me he had 5 offers coming that evening so far. It was poorly laid out because walls were removed and bathroom opened into living/dining room, two steps up to bedroom. 1 bedroom and lots of space downstairs. No real driveway – more like parking on front lawn – it was odd, I couldn’t figure out the walkway that started part way up the lawn, etc. Anyway – what the heck caused this sale price – lucky people!

CRA should really have better guidance on this, it’s clear as mud. Back when I spoke to a CRA advisor about this, they weren’t much help either.

Ash, the first question the CRA auditor asked me was “Is the basement suite self-contained?”

I think it’s an urban myth that the size of the suite matters. From my experience, CRA was only interested in whether or not the suite was self-contained, with a private entrance. The suite was about 75% of the lower level with the remaining 25% being shared for laundry and storage. The percentages were only used by CRA for calculating the Capital Gains; not to determine whether or not CG tax was payable.

True, the order of magnitude of both “sell price over asking” and “sell price over assessed” is nuts, even for the most sought after properties – which is probably what’s driving the 9% year-over-year increases.

It also doesn’t seem to matter if there’s a basement. 1504 Oak Crest in Cedar Hill sold over-asking today – no basement, no suite potential. (& $100k over assessed)

Stannard has a 6’8” undeveloped basement so IF it’s developed it’ll be 6’6”.

2 days ago a house on Hewlett sold with a 6’5” basement, sold for $860k = ask price. (assessed $673k)

Don’t remember ever seeing homes very consistently selling $100k or $200k over assessed, all over the city.

There’s always going to be some homes that sit for months for a lot of reasons, eg., lot position & size & makeup (eg., rocks vs soil), unusual layouts or unusually sized rooms, cost & time of building on empty lots without existing services, etc.

It’s the market craziness in the 500k-1 million range (like Stannard) that made me stretch my budget & move into the 1.5 million range to buy something that is actually worth the selling price. These mid range homes are getting way over-bidded & not worth the selling prices!

@LeoM. I’m surprised to hear that you had to pay CGs. What % of your house did you declare as rented?

Makes me think those couple ranchers for $500k in Gordon head are not a bad buy

At this point it looks like Fairfield, Oak Bay and Golden Head will be average 1m by end of summer.

omg @ 420 Stannard at $859,420 for a 2 bedroom 1 bath house.

Just when I think things cannot get any more insane they do.

True I guess the larger die-off doesn’t start until 80ish. Still, greater proportion of older people means larger housing turnover. You’re probably right the large impact is 10-15 years out.

Oops, “55-69 bar” should’ve been “55-59 bar”

Capital gains will be assessed if you are renting out the majority your basement as a self-contained suite; I know because CRA audited me. I knew the rules, so I reported the capital gains and paid my taxes, but CRA audited me too, just to be certain I paid everything due.

The terms “relatively small” or “ancillary” is used by CRA to mean things like renting out a bedroom as room & board for an international student, but not if you rent that same room to a stranger on Airbnb. The student boarder is often though to be an act of kindness, but Airbnb is deemed to be a profit making business venture.

The best advice is quite simply, Don’t screw CRA, because they will screw you ten-times worse in return.

Are you sure the “main reason” isn’t that there were precisely half the number of births in 1940 (present day 76yr-olds) as there were in 1960 (present day 56yr-olds)? Iow, if you look at the 75-79 bar, it’s not surprisingly about half the size of the 55-69 bar.

Straight from Statscan…

http://www.statcan.gc.ca/daily-quotidien/070921/c070921b.gif

Thus the blow off top begins it’s predictable unhappy ending. Now just a matter of how fast. Me thinks some of those buyers gave their heads a serious shake…. or their parents funding them did. Was it good for you too ? 😉

Looking at sales over past week in my areas/price range, there are some shockers, but it appears that not everything is selling immediately for $100K over asking. In Gordon Head, Longview has a second week of open house. I’m not sure about Casa Marcia, but it’s still listed on MLS.

Also some houses are selling for less than list, although usually not much less, and not really in the “core” areas. Maybe the craziness is levelling off, although a brief scan of assessed vs. sale prices shows many houses now $200K over assessed, whereas a few years ago there was a pretty close match.

It does seem like there are people willing to pay a premium for a specific “product”. I guess we are all wondering how many of them there are to keep soaking up new inventory.

4 homes went over asking price so far today. The other 16 sold under asking price.

1 in Fairfield

1 in View Royal

1 in Mt Doug

1 in Fernwood

All 4 were basement style homes suitable for suites or had a suite.

That’s why you will find one-storey ranchers still up for sale and with price reductions.

And you still find homes in choice neighborhoods up for sale after over 200 days on the market in Fairfield, Gordon Head, Ten Mile Point, Cordova Bay and Rockland.

This is a narrow focused group of buyers.

The good news for buyers that are not looking for this type of home is that the number of listings in Victoria City has jumped from 35 to 52 in just a week.

We are still below the normal number of listings but the numbers are rising. So far there are 287 houses for sale in the core, 329 condominiums, 75 town homes and 41 other.

That means the months of inventory is starting to climb out of a strong sellers market as inventory begins to build due to the slowing effect of higher prices on sales.

You gotta love 275 years of economic theory – it never let’s down. And that’s why it is called the “Law” of Demand. Not the theory, not the principle, not the “I think this might happen”.

And how about the demand for vacant building lots. A vacant lot on Tudor Avenue just resold for $955,000. Too bad it was purchased at $1,050,000 in October 2009.

Surely with all these crazy house prices, vacant lots must have increased dramatically. Nope A vacant 5,400 square foot lot in Fairfield just 1 1/2 blocks to the ocean sold at $525,000. Or a Vacant lot along Fairfield that sold at $400,000 at the end of February.

I think it should be clear to most people by now that this segment of the market is unsustainable.

That’s not the main reason. The main reason the bars get shorter is because people start dying off at a high rate.

I feel like an idiot for saying this a dozen times already but it seems people still don’t understand why elderly people become net sellers. It’s not because they are voluntarily leaving their homes. They are being forced out due to death or lack of ability to remain independent.

Yes, but do you understand the age chart I posted (and again below) is for Victoria?

Absolutely, there were far fewer births during the depression and WW2… especially when compared to the enormous birth boom that followed.

Au contraire, in fact the 3 tall bars (Vic boomers) will get taller as they plow forward 15yrs – why, because other boomers will continue joining the Vic retirement party.

http://i.imgur.com/lRqhZtT.png

Yeah the Belmont sale is making recent Fairfield sales look not so bad. I guess the 2 bed suite with separate laundry is a draw for some. But still, a small lot and you’re only a handful of doors from a busy road…

@Halibut. I think it is very clear you can rent a portion of your property without triggering capital gains on later sale. From the CRA guidance I posted earlier:

You are usually considered to have changed the use of part of your principal residence when you start to use that part for rental or business purposes. However, you are not considered to have changed its use if:

• your rental or business use of the property is relatively small in relation to its use as your principal residence;

• you do not make any structural changes to the property to make it more suitable for rental or business purposes; and

• you do not deduct any CCA on the part you are using for rental or business purposes. .

The only ambiguity is “relatively small”. I think you are golden if you are renting out 1 of 3 floors (basement in a two story house). But what if you rent out the entire basement in a house with only one above ground story? The two floors might have exactly the same area though perhaps you could make the case that the basement was smaller in a utility/value. I discussed this with my accountant seven years ago. He didn’t think there was a concern with my situation which involved renting 70% of the basement (in a house that has two stories above ground) and providing the tenant with exclusive use of about 10% of the yard

@bearkilla, researchers from the University of Toronto and the London School of Economics, drawing on data from Highway Performance and Monitoring System, publishing in the peer-reviewed American Economic Review is not “a group of environmentalists” cherry-picking data. There are other similar studies linked from that page as well, if you want more research.

If you have an actual study that supports your opposing hunch, let me know. I really would be interested in reading it. But just wishing something is “nonsense” doesn’t make it so.

Note that the authors also don’t propose transit as the main response, as you seem to believe. They support congestion pricing. You don’t even have to read the paper to see that; it’s right on that same page.

Deferring taxes until you sell is great, but I think the tendency for many is to move frequently, every 7 years or so?

“2325 Belmont Ave goes for 869k. Listed at 775k. Fernwood’s looking like Fairfield prices circa 1-3 years ago.”

This wasn’t even a 6000 sq.ft. lot. I don’t think that’s much lower than Fairfield is now. How did Fernwood suddenly become an upscale neighbourhood? It must be out-of-town buyers that don’t really know the difference between areas.

Caveat – We all agree on that. The question is whether renting out an “ancillary” portion of your home (maybe 25-50%) will trigger the same capital gain? I think we’re all assuming the seller has not claimed any CCA either.

Ash – renting out the main part of the house and then converting to primary residence later WILL trigger a capital gain, but according to their guidance you can still defer paying taxes on it till you actually sell the house, which in some cases could be decades later.

You can also rent out your whole house for up to 4 years and still have it be your principal residence for CRA purposes as long as you (1) don’t claim another primary residence, (2) don’t claim CCA on the property, (3) report your income on the property. So principal residence tax concerns don’t have to hold you back from that year living in the Provence.

Michael – I see a pile of tall green bars just in front of the 70-74 age cohort and it is clearly a fact the Victoria’s age demographics are older than BC as a whole so I don’t get your point. And you do get why the bars get substantially shorter at 70 and beyond? In 15 years the people in those 3 tall bars will be cut in half.

@LeoM. I’m just going by CRA’s own guidance that says, with certain criteria met, one can avoid CG’s when renting out their basement suite. And that the same cannot be said for someone considering the manouver mentioned by Marko – renting out the main house, in which case you’re guaranteed to get hit with CG’s. Important to know for people considering doing this to get into the market.

PS I think my earlier use of the term “manouver” may have caused confusion. (I was not referring to a manouver to avoid tax).

Interesting LeoM. I assumed by not making any deduction claims that would qualify the rental part as ancillary? If not claim everything!

Unless you are wealthy:

http://www.cbc.ca/news/business/canada-revenue-kpmg-secret-amnesty-1.3479594

2325 Belmont Ave goes for 869k. Listed at 775k. Fernwood’s looking like Fairfield prices circa 1-3 years ago.

No Ash, you can not assume that you can avoid Capital Gains Taxes; that’s impossible on a house with a rental suite, unless you cheat on your income tax.

Tax planning to minimize tax is legal, but any ‘manoeuvre’ to avoid tax is illegal. You simply can not out-manoeuvre CRA to avoid capital gains when you rent a suite in your home. But you can do tax planning to minimize the related tax you pay yearly. All this assumes you are declaring your monthly suite rental on your yearly income tax return. Get caught cheating and CRA is merciless in their pursuit of their tax dollars for back taxes, penalties, interest, and capital gains.

This article by CRA is written for those people who don’t cheat and want to follow the basic rules, but it’s only a simple overview and does not cover any complex situations; like a deemed disposition.

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/rprtng-ncm/lns101-170/127/cmpltng/rlstt/x1_pf-eng.html

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/ntrst/menu-eng.html

http://www.cbc.ca/beta/news/business/taxes/airbnbers-and-uber-drivers-be-warned-your-income-is-taxable-1.2969158

@Dasmo. The portion rented needs to be small or ancillary to the rest of the house. Can’t see how the main floor would qualify.

The real shame about Langford is the spoiled opportunity…. This is such a beautiful place and deserving of respect of its natural beauty through equally great infrastructure and design that respects the local. Way too much Alberta style destroy everything first….

@Ash. Wrong. If you buy the place and live in half and rent the other half without claiming any deductions you are good to go…

it’s a wasteland of mediocrity”. Is how I would describe Langford….

Or, as Gertrude Stein said about Oakland, “there’s no there, there”

Wow it’s getting literally insane out there, much more intense then anything I saw in Vancouver. It’s like the last 5 years of van compressing into this spring and summer.

I don’t want higher property tax, but at this rate my house will be worth 500k more then January by the end of this year.

Sad, I would have loved my doctor and lawyer friends to be able to join me in Cadboro Bay.

So I think we can summarize that renting out the basement suite while living in the main house allows one to avoid capital gains altogether, while the opposite manouver gurantees you are subject to capital gains (when you sell).

And even if the boomers did start at age ~75, the retirement demographics for bloomtoria are incredibly positive for approximately 15 years.

http://i.imgur.com/lRqhZtT.png

I think it’s worth mentioning the CRA’s position on change of use if you’re simply renting out a suite in your house and not living in the basement suite while renting out the upstairs:

It is the CRA’s practice not to apply the deemed disposition rule, but rather to consider that the entire property retains its nature as a principal residence, where all of the following conditions are met:

a) the income–producing use is ancillary to the main use of the property as a residence;

b) there is no structural change to the property; and

c) no CCA is claimed on the property.

@CS Leo’s 3.74% was real not nominal. My house I just sold after owning it over 12 years was 8%/year not including what I put into it. So probably close to Leo’s number if I included my improvements….

The Capital Cost Allowance is good for depreciating assets such as a car but are not beneficial for appreciating properties such as real estate. Of course that can depend on where you live.

Port Renfrew for example has not had any appreciation for years in their real estate. In fact it has lost market value.

If anyone is contemplating the manoeuvre described by Marko – buying a house and then renting out the better part of it for a few years – the relevant tax guidance for you to read is here http://www.cra-arc.gc.ca/E/pub/tg/t4037/t4037-e.html.

Bottom line is:

1) LeoM is correct that it is a “deemed disposition” when you convert the mostly rental property into mostly your principal residence

2) However my claim that you wouldn’t have to pay capital gains tax till you sell is also true. As long as you haven’t claimed depreciation on the property then you can make an election to defer the capital gain.

I think the general rule is probably don’t claim depreciation on anything that was, is, or will be your principal residence as you jeopardize a huge tax break.

Twist it as you might.. I will leave you to ponder… (it was illustrative and correct)

Shadow flippers gone, spec tax next, FINTRAC flushing out dirty money launderers, and scum realtors. Bye bye HAM, down she goes. Good thing Christy reads my posts. 😉

The assumption that a 3.74% compound annual rate of increase in the price of a single family home means that the price paid for a family home is rising at a 3.74% compound annual rate is false.

In 1960, very few people purchased apartments for owner occupation. BC’s first condominium act was legislated in 1966 and it was many years before a substantial supply of high quality condominiums came to market. Thus, between 1960 and 2016 there has been a major change in the type of property acquired for family occupancy. In the 1960s, virtually all home buyers purchased either a house or a duplex. Today, a large proportion of buyers, particularly first-time buyers and retirees, purchase a condo, not a house or a duplex (does anyone have the percentages?). So if one is interested in the trend in what families in Victoria are paying for a home, it is necessary to compare like with like, and that means looking at the trend in condos + SFHs. On that basis, the upward trend in price would be very much less than the trend in SFH price, since the average condo price is much lower than the average SFH price.

The assumption that home prices in Victoria are bound to rise because there’s no more land is false.

As the trend to condo living continues, multi-story, multi-family buildings replace lower density residential buildings. The net result, for many decades to come, will be a decrease, not an increase, in land cost per residential unit.

The assumption that SFH purchases from 1960 through 2016 are by the same socio-economic segment of the population is almost certainly false, for the following reasons:

The proportion of renters to owners has almost certainly not remained constant. (Does anyone have relevant data?).

The proportion of properties purchased by high net worth out-of-towners has increased with (a) increased air travel including travel by private plane, (b) greater exposure of the Victoria RE market to the world via the Internet, and (c) increased recognition of Canada as a tax haven for non-domiciled property owners.

So for SFH prices in Victoria to continue climbing at a rate that far exceeds either the earning or borrowing power of the local population it will be necessary for one or more of the following conditions to be true:

(a) Continued increase in total population combined with a reduction in the proportion of the population owning SFH’s (i.e., a continual upward shift in the socio-economic status of SFH buyers) .

(b) A reversal in the current downward trend in real incomes, which cannot happen under the current globalization regime.

(c) The indefinite continuation of negative or near negative real interest rates and low nominal interest rates (a return to Info’s “normal” interest rates would mean RE market devastation, something that as I’ve indicated before, is a logical outcome of a Donald Trump US Presidency.)

As for Totoro’s expectation of 4% annual compound gain on rental property, good luck. Not only is that better than the 55-year trend of 3.74 for SFH prices in general, but it assumes that those too poor to purchase a home of their own will enjoy increases in income sufficient to cover a real 4% compound rate of rent increases. That seems inconceivable except under a Trump-like economic program which would destroy RE values.

Well Db did the son who built a home for himself and his parents have a house to sell?

Because that would mean two houses were sold to buy one house for both himself and his parents.

Now that seems like a workable solution if there is only one child. Once you add siblings to the equation it can get really messy when the parents die. If the parents contributed to the ownership of the new house then the son that built the house has to pay off the siblings on the increased value of the home.

And what happens in a few years when the son feels that mom or dad needs to go into a nursing home because they have dementia? What happens to the house that he built if there are siblings.

It can be done but you have to decide how to structure the ownership because if there is a sibling that feels the son is less than forthright, then most of the money will go to lawyers and appraisers.

I get calls from executors handling the estate and they ask me what is the first thing they should do? I tell them to change the locks on the home. They tell me that isn’t necessary as there are no problems among the siblings so what would be the next thing they should do? And I tell them to change the locks on the home.

When it comes to estates there are a lot of frictions among the best of siblings. Change the locks.

Capital gains taxes are due for the portion of your house you rent out as a suite, when you sell or when you stop renting the suite and begin using the space as part of your principle residence. If you stop renting your suite but do not sell your house, it’s called a deemed disposition from you to you. Capital gains are calculated and paid to CRA at that time. Failure to declare and pay your capital gains is tax evasion and penalties and interest will be assessed when you’re caught.

One of the most common ways CRA learns about your suite and your undeclared rental income and capital gains is from a disgruntled former tenant or that neighbour you pissed-off. These days, with the CRA computers, they are also starting to cross-reference addresses of taxpayers to find suites in private homes.

Actually, you are correct.. but the sale of principle home doesn’t prevent the parent from gifting cash to an adult child who then does exactly what I just said… builds their own bigger better and suite for parents…

And there are other ways of splitting assets so one child does acquire the homestead… besides adult care (being a factor to settle this issue)

So not easy to dismiss, as much as you may want to…

When the retirees pass their home onto their children that is a deemed disposition and property purchase taxes are payable. If the retirees are going into a retirement home then the sale of the property will pay the monthly expenses of the home.

Since I deal with considerable number of estates, I find that while one of the kids may want the family home, the reality is that they have to split the inheritance with their siblings.

In the end most decide that is easier just to sell the home and take the money. Rather than take out a large mortgage at their age to pay off the siblings and property taxes.

JJ I was referring to seniors selling off inventory rentals.

I agree with you on infrastructure. I think we need to spend big time on infrastructure in BC all over.

Why GWAC in Vancouver but not Victoria? Is Vancouver getting a new bridge and sewer system?

Victoria City Hall spends more money per capita than Vancouver city hall.

What we have in Victoria is a city hall that spends more money than a drunk sailor in a whore house.

Shadow flipping done in BC. Clark just announced

One other point on elderly transitions… some are contributing to the primary purchases because they will occupy the suite of their kids, providing natural in-home support.. so title may actually transition to offspring, but this doesn’t change the demand…

Know a relative who did this exact thing.. sold the parents home and son bought and built a larger home to provide basement suite to care for elderly parents all in the greater Victoria area…so no change in supply/demand..

I expect new roads to increase the number of vehicles using it especially as that new road opens up new areas for development.

You would never get the government to build a new road if it the opposite was expected to happen. To spend billions on a road that fewer people will use?

That doesn’t mean you should stop building roads because more people will use them.

That kind of policy just leads to grid lock in the city. Vancouver is the worst city in Canada for being anti road construction. It takes Vancouverites more time than any other city to travel 5 kilometers.

Cars and trucks are here to stay. And they will still be here a hundred years from now.

So, get over it and start building some roads.

And Mayor Lisa can start by fixing the road in front of my house otherwise I’ll start sending city hall my bills for front end alignments and bent bike wheels.

There are getting to be more pot holes on my road than at the Battle of the Somme.

Also don’t forget, with Victoria being a retirement village, many elderly are passing their homes down to their kids either through sales, live-in daycare, or inheritance. Meanwhile many offspring transition to/or back to Victoria (having a natural enclave)… so OLD doesn’t mean must sell…(besides the property tax-deferral and reverse mortgages make staying put easier)

The more kids you have, the higher the odds that one of them will choose to keep (or relish) the homestead .

Now, once we get past the Boomer generation reaching 80 plus, it will be another story in about 20 years as they also had fewer offspring by choice/circumstances…

Just my opinion/observation…

JJ maybe Vancouver but I doubt that will have a noticeable impact on a yearly basis in Victoria core. Not a lot of people in Victoria in that boat.

What I see is that retirees don’t want to move. They prefer to stay in their homes.

However, economics causes many to move.

The property taxes and monthly costs on a large home are too costly now that they are on a smaller fixed income. Those ownership costs have been rising more than the increase in pensions and that will continue into the future.

I have never expected the selling of owner occupied homes to cause a big increase in inventory. What I expect will happen is that as people enter into retirement they will sell off their investment condos and rental houses.

I was speaking with a lady yesterday who is nearing retirement and she now has 18 investment condos in Vancouver and Victoria.

This is where the big increase of inventory will come from.

Reasonfirst I have not idea. The point I was making is that the older generation does not run off to seniors homes. My area has a lot of couples and singles in their 70

s and 80s in their 3000 to 4000 sq ft houses, The point I was making is I do not expect a lot of inventory in the next 15 years do to demographics that will change the supply issue. Interest rates and our economy are the factors that will determine our pricing in the future.mooselessness your article demonstrates my point exactly. A group of environmentalists have concluded that building more roads is futile and the only solution is to force people into transit and then set out to prove their conclusion. The idea that building roads INCREASES congestion is complete and utter nonsense which is why sane people reject the notion.

“They seem to stay in their homes until they can no longer take care of themselves.”

This is a Victoria phenomenon?

Ash – I think you are right. The portion of capital gains that occurred when the house was mostly rented might not be subject to the principal residence exemption. That said those capital gains would potentially be many years into the future (assuming they keep the house for a long time). Plus there would be perfectly legal ways to minimize that as the valuation at the time they moved back upstairs would be quite fuzzy absent an actual transaction (they could for instance use the assessed value which often lags a true market value in a rising market).

I went to have a look at 1204 Hewlett Place last week. Beautiful house, but it has a long shared driveway with the house next door (part of the same development). And when you take out the driveway, it has very little in the way of outdoor space.

My question is: who wants to spend $1.9m on a house and share a driveway?

I’m not a tax expert. But my understanding is that the portion that’s rented is subject to CG’s over the period that it’s rented, unless the portion that’s rented is (among other things) small in relation to the whole house. So to me the main floor would not be “small”. There’s others on here that know more and can correct me .

Ash – what capital gains? If you move upstairs after a few years, the house remains your principle residence and no sales transaction has taken place. Therefore no capital gains taxes. If you sell before moving up, that’s a different story.

Renting the main floor while living in the basement is innovative but for me would have too many downsides. For one, you have to trust that your tenants aren’t going to put some serious wear and tear onto the main floor – after the 5 years of living downstairs you don’t want to have to do a bunch of work to get it back to where it was when you bought it.

Second, you’d lose the principal residence status on the house and could all but lose any profits after accounting for capital gains (especially in this rising market).

Then again if the alternative means you’re shut out of the market completely it may still be worth it, especially if you plan to stay for a while and therefore can defer payment of capital gains tax.

Leo S, I’m still experiencing website refreshing issues on my end. For example, this whole thread didn’t show up for me until a few hours ago — WTF! Maybe it’s because I’m the only person in the world accessing the site from a non-mobile device?

Please keep debugging, if possible.

It’s not a bad idea, except that “denting” the mortgage principal in the first five years is tough to do (no matter what one does), with such a high percentage of one’s payments going to interest in the early years.

They might be able to give the mortgage a serious surface abrasion.

It’s getting to the point where two staple income professions (nurse, teacher, engineer, etc.) can’t afford a single family home in the core or pretty much the way things have been in Europe since the dawn of time.

Is it good? No it is not, wouldn’t it be awesome if we all worked 9 to 5 with “flex Fridays,” stat holidays always off and paid, we walked our kids to Willows Elementary and Pro-D days that lined up with flex Fridays we could spend at Willows Beach….

Unfortunately that is not reality…maybe pre-2002 real estate prices. At this point either you adapt to the environment, or you don’t.

There are many different ways to adapt such as living at home into your mid-20s, working harder, more education, etc. I had a young couple approach me the other day with an idea of buying a home in the core with a suite, living in the suite for approx. 5 years (renting upstairs) and then moving upstairs once they felt the mortgage had been dented sufficiently. Never crossed my mind before but it makes sense for those willing to make a few sacrifices to enter the market in the core as there may, or may not, be another opportunity.

That being said I think there will always be opportunity on the Westshore to enter the housing market…Westhills has a long way to go in terms of a build-out!

Langford has lots of great things going for it. Newer homes, larger lots, lower taxes, 25 minutes closer to skiing and surfing, big parks nearly on your doorstep, great rec facilities.

The problems are (1) a peak hour commute to downtown that can easily be 45 minutes – although on occasion it can be as little as 25 minutes, (2) seemingly a total lack of urban planning, (3) lack of attractive neighbourhoods.

Those three are enough to ensure that it will always have a hefty discount to nice old neighbourhoods in Saanich, Oak Bay, and Vic. A new interchange that knocks 5 or even ten minutes off the downtown peak hour commute won’t change that.

Or buy a road bike and then you will never again complain that it takes 30 minutes to get from downtown to Gordon Head.

it will become saturated fairly quickly over time, that’s observed fact from many locations. That doesn’t make it pointless. Even if it slows sown to what it was before you are still moving more people.

Agreed, Vicbot. 2-5% per year sounded great. 20% per year and whole neighbourhoods transforming before our eyes sounds really bad. Sure- we could sell our place and move to Ottawa and pocket a couple hundred thou, but we actually like it here and don’t particularly have any interest in seeing gentrification on overdrive.

VicBot : I guess if a Realtor reports it, it must be true? We’ll have to see the official stats later in the year.

@Buzznitch, agree on “Don’t assume past performance will be repeated in the future.” But instead of trying to predict what “will” or “will not” happen, look at the story behind the numbers – the fact is that there are competing offers from both local and non-local buyers.

A local might win the bidding war, but multiple offers are coming from anywhere in the world. Buyers just have to look at a virtual tour on their smartphone – no need to show up in person. This exact thing happened to a friend of mine.

Just 1 example of many:

http://www.vancouversun.com/sports/Buying+wave+sparks+bidding+battles+Victoria+real+estate/11757037/story.html?__lsa=e83a-3028

“A local buyer beat out the competition with an unconditional offer at $152,000 above the asking price. The successful bidder prevailed against buyers from California, Paris, Vancouver and another from Victoria”

4 cities are driving the Teranet index up: Vancouver, Victoria, Toronto, Hamilton.

http://www.cbc.ca/news/business/teranet-composite-price-1.3490596

And I don’t like it because my property taxes are going up.

Instead of burying head in the sand – ask yourself why those cities. It’s not just the locals.

@bearkilla, It looks like there’s academic evidence for induced demand, the idea that new roads fill up quickly with new traffic.

http://journalistsresource.org/studies/environment/transportation/fundamental-law-road-congestion-evidence-u-s-cities

Have you seen studies that say otherwise?

Hawk getting angry now. The fact is prices are going up. Fantasy is believing a crash is right around the corner. We all need a fantasy to believe in I guess.

Freedom 1.92m for that. Omg that is nuts.

Gwac, whose wasting time? I’m debating the facts. I can’t help it if you can’t handle it. My life is full thanks for asking, lots of spare cash to have fun with. Why would I want to hang out at the Hartland dump with you ? Sounds boring, like your posts.

Bang on Bizznitch. The buying pool will dry up as fast as it started and bag holders will be left wondering what hit them after they paid 200K over for a 200K reno. 400K down the drain.Ouch!

Funny how people think they can actually impact prices through this site. Enjoy the spring as the dream keeps getting more expensive.

Ran into a realtor today, he told me that 1800 Jade Place sold for more than 120K over asking in 2 days. We were in there for open house. There is a bed in every room other than kitchens/living/dining, so total 8 rooms used to sleep, instead of 6 bedrooms as described. Even the small “studio” under the deck, with about 6ft ceiling height and little insulation and a plug-in heater, no inside access to washroom and kitchen, is used as a bedroom for a student. Holy crap.

The realtor asked if we want to list our house as he is listing another house nearby, I said we need a home to live. He said people are selling their homes near UVic and moving to Langford. Ha Ha …

http://rwglobal.com/~patmeadows/images/complete%20jade.pdf

This market will dry up from the bottom up once all the local buyers finish flogging their houses to each other and eventually drive up prices so much that there’s nothing affordable for many new buyers to get into the market.

The locals need to realize that 747’s full of Chinese carrying suitcases bulging with cash and gold bullion will not be sweeping into town to buy up whole neighbourhoods. We will always have people from Vancouver buying. We always did. It’s nothing new.

Victorians also need to realize that the Coho Ferry will not be pulling in next week, full of Americans with chequebooks in hand, who want to buy out James Bay. These are all local dreams which get gossiped all over town, and continue to inflate this bubble.

People should step back and look at the big picture. Look at the numbers. They collectively say the opposite of these dreams of Chinese buying houses from helicopters sight unseen etc. It’s not the people from YVR who are driving this thing. It’s the local people who live here. The amateur investors who see a few extra people downtown one day and then assume things are rip roaring along.

Don’t assume past performance will be repeated in the future.

Omg. Hawk buy yourself a mtb go to hartland and enjoy life on the trails. Life is good. Waiting for shit to happen is a waste of precious time.

“it’s a wasteland of mediocrity”. Is how I would describe Langford….

Gwac,

You may want to build one soon. The little fat maniac is about to set off WW3. Imagine the flood of multi-millions into China, that would be killer for their economy over night. HAM would be Spam.

North Korea launches ballistic missiles

http://edition.cnn.com/2016/03/17/asia/north-korea-missile-launch/index.html?eref=edition

“Get ready,Victoria…..”….. yeah, for the crash.

Canadians’ household debt climbs to highest in G7 in world-beating borrowing spree

http://business.financialpost.com/investing/outlook-2016/canadians-household-debt-highest-in-g7-with-crunch-on-brink-of-historic-levels-pbo-warns

Hawk you kill me. I bet if you where living in the 50’s you would have had a bomb shelter. Sitting in there with 100 years of food and a tin construction hat on waiting for Russia to bomb us.:)

“Overheard at the next table at a local restaurant were a group of obviously rich, recently settled in the area, Chinese “astronaut” wives talking about properties and $$$$$.”

I assume they were just out of their ESL class or do you understand mainland Chinese ? Sounds like a crock of bullshit.

Posh school ? Who uses that term ? There’s only two St Mike’s or Glenlyon, big friggin deal.

I know of a family moving out of there for the same reason and advising others to not buy there due to the influx. There goes the neighborhood as they say. They can have it. As Jack said about Gordon Head, “it’s a wasteland of mediocrity”.

“Stephen agents are now going door to door in Gordon head to find people to sell.”

And when the inventory starts to inevitably rise they won’t be harassing people anymore like a bunch of desperate vacuum salesmen. They will be too busy trying to find buyers as the so called pent up demand deteriorates.

Sorry but the whole argument that if you build new road infrastructure it will become saturated rapidly and is therefore a pointless exercise is anti-car agitprop.

Stephen agents are now going door to door in Gordon head to find people to sell. As long as there is a university. Up up and away. Not my cup of tea but I get why it is desirable.

I give up arguing. I have listen to the Bears for 7 years about a crash. I will enjoy the next 7 as they get priced out of the market. :).

The chart that should be posted is interest rates from peak of 1981 til now crossed with household debt levels. That’s when this 35 year credit bomb began.

It’s a credit event that will end this easy credit experiment as the amount of room to lower rates is almost zero versus from where this started.

I remember the real fear of the Japanese taking over the world in late 80’s as they bought up everything in North America. Banks, huge companies, real estate etc. Didn’t end well for them did it, and won’t end well for the HAM driving this insanity.

There really isn’t much purpose for Gordon Head to exist except to supply rooms to foreign students. It’s a wasteland of mediocrity.

“Golden Head” (lol!). You know that with monikers like that, the neighbourhood can only go up, up and up . . . . it is true that Chinese LOVE that area and the price increases are reflecting that fact.

In Vancouver, similar middle class areas now are extremely expensive and desirable places. Marpole is an example of a fairly middle income area that once favoured by Chinese buyers quickly became ultra-expensive.

Who would have thought that GH would be seen in this light by purchasers?

In the 80’s and 90’s when I attended a posh, high end, private school in Victoria (I’m now in Vancouver), Gordon Head was seen as the sort of place where the “poor kids” or the “kids on scholarships” (aka the parents with engineer, teacher or professor parents who actually worked for a living!) in the class lived.

If your folks couldn’t afford Uplands, Ten Mile Point or South Oak Bay – your family lived in Gordon Head.

But now I see that GH is the place to be and there is nothing stopping it.

I visited a friend last weekend in “Golden Head.”

Overheard at the next table at a local restaurant were a group of obviously rich, recently settled in the area, Chinese “astronaut” wives talking about properties and $$$$$.

Get ready, Victoria . . . .

Won’t be long til Gordon Head turns into a ghost neighborhood. Most HAM buy to hide cash, the kids are in school for a mere few years.

I agree with Jack on the drive to Gordon Head. Start at Government St and see how many red lights you hit all the way there. Almost every one , on top of travelling 30kmh between iights. It can take 30 minutes easy.

JJ – hate to burst your bubble, but 1-you were going against traffic, and 2-it’s spring break now, and all the Westshorers in my office have noted that traffic is incredibly low this week. I agree – try it in a month at 4:30 pm and tell us how much more than 18 minutes it is.

The new interchange will help, for a time, and probably shave ~5 minutes of most Westshore commutes, and lead to a mild increase in demand among some individuals. And then, like all traffic projects, equilibrium will be reached again with the increased vehicle density, and it will slow down to current levels. I reckon it could take 3-4 years for the full cycle to come back to square 1.

Agree with AG, “place of origin” isn’t always recorded or accurate. And the trend is up for out-of-towners buying.

Also, Victoria and Vancouver aren’t that much different in “world class ness” … what they both have are sought-after universities with respected degrees in engineering, business, law, etc in safe towns.

The reasons why out-of-towners are buying Vancouver real estate (and pushing locals to other cities) aren’t because it’s a world financial center like London, Paris, or New York. Even as a major port city Vancouver is only #49 in the world.

The reason is because they’re buying a 2nd home (vacation) or a place for the kids to go to school because of safety & quality of education. And it’s harder to do it in Australia because of foreign ownership rules. It’s also easier today than 10 years ago because of technology and new web sites all over the world selling foreign real estate.

That’s why Gordon Head is popular – it’s close to UVic (sometimes known by out-of-towners as “Golden Head”). Oak Bay has always been popular but now there’s now a new reason.

Everybody probably saw this:

http://www.timescolonist.com/news/b-c/vancouver-real-estate-a-buyers-market-for-mainland-china-study-1.2101326 “the study shows that of all self-declared occupations among owners, on homes worth an average $3.05 million, 36 per cent were housewives or students with little income.”

Which is exactly the point. Statistically those 80 year olds are not going to be independent in their homes all that much longer.

And this is what happened to prices for houses in the core after that February, 2013 post. They did what I said – they trended down for the rest of the year.

Month Sale Price, Median

Jan $540,000

Feb $590,000

Mar $574,750

Apr $610,000

May $551,250

Jun $585,000

Jul $570,000

Aug $556,100

Sep $575,000

Oct $579,500

Nov $555,500

Dec $571,750

The stats I showed are a moment in time. They are not showing how inventory increases and decreases with economic conditions. To say that listings will never increase would be similar to saying that BC will never again have a recession.