All buyers are equal, but some are more equal than others

A fear is gripping Victoria, and that is the fear of outside buyers coming in to take our jerbs; or at least our homes. Nothing scarier to Victorians than an elderly couple who discovers that their Point Grey house they bought in 1948 for a dot cent is now worth $3.6Million. Or even worse, mobile young professionals (everyone is scared of those) that have discovered they can live in Oak Bay on the cheap while making their dough in Vancouver.

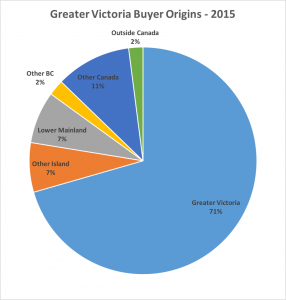

We know of course that this market is not made by those out of towners. They exist, they seem to be up in numbers somewhat, and they are certainly contributing to the active market we have here. But in the end, in 2015 71% of buyers were still local Victorians. Even if The Outsiders are up a bit since then, the large majority of buyers are still locals.

Are those buyers all equal though? If I move up the property ladder I would be one of those local buyers adding to the demand, but at the same time I would be adding an equal amount of supply to the market. Net effect zero. So while there might be thousands of local move-up buyers in this market, I’m not sure if they actually make any difference to market conditions.

Now an outside buyer is quite different. They add to the demand and don’t add to the supply. So it might be that the 600 lower mainland buyers in 2015 had more of an impact than all the move up buyers put together. Of course local first time buyers behave the same way. They add to the housing demand, but only add to the rental inventory.

So what really makes the market is the balance between first time buyers and out of town buyers on the demand side, and people selling to rent, move out of town, or die on the other side.

Out of town buyers we have stats on, first time buyers I believe is still part of the VREB realtor survey, selling to rent is likely minimal and can be left out. What’s left is the outflow which we can’t easily measure. For that I expect the key determinants will be demographics and unemployment. What other factors could influence this balance?

“The comment isn’t honest”

That’s a weird way to phrase a reply. I suppose Adam Smith might take exception to the comment. But since he’s been dead for over 225 years we will never know.

The principle of substitution is simply stating when the cost of one good becomes too high it will be substituted for another.

One example would be that if buying a house in Oak Bay was out of your price range you would chose another less expensive neighborhood.

Another example is that if the cost of building a new home was less than acquiring an existing home then you would buy the new home.

I’ve never heard the loathe to give up your favorite beer one? And since I prefer Salisbury Steak to Prime Rib it would be an easy substitute for me. I also have many favorite types of beer. So if Caffrey’s Ale became too expensive, I could easily switch to Guinness.

So you see, people make compromises all the time.

I mean your wife did!

@db

If someone offered me enough money – I would happily sell my home and rent. I’d be laughing all the way to the bank.

@Hawk

Thanks for posting the link to that video about the newly confirmed fault line. The odds are now greater than 30% of a large earthquake in the next 50 years.

@BJRowlingPoodle

I’m glad that you are restricting yourself to a “healthy” 10 hours per day, averaging about one post per hour. You don’t want to overdo it! 😉

@ HappyRenter

Yeah, I agree that there are a lot of “ugly” houses in Victoria, especially the 1970/80’s “spec” houses that fill up a lot of Saanich neighbourhoods. Although functional, they are completely unappealing. Disclaimer: my own house is one of these “ugly” houses.

Just Jack and Hawk thank you very much for all your contribution! There are a lot of people that agree 100% with what you think! How people pay those amounts of money for ugly ugly houses (most of the houses in Victoria) and are so proud is unbelievable! We are high income earners and living in a rental and it is a paradise believe it or not! Our only worry is planning to spend nonstop quality time with the kids after their homework. Our sons friends only know their “famous basements” as a fun time. The irony is they feel bad for renters 🙂 and we can buy a house without mortgage at all! Please don’t feel bad, you can’t imagine how we feel about the greater fools!!! As I said ugly houses, and we have lived in many wonderful cities before (North America)

Rising prices will have the effect of lowering purchases and encouraging more people to list their homes for sale.

That comment isn’t honest…. people don’t sell their ONLY security/living space because of price alone…the law of substitution argues that someone is loathe to give up their favourite beer or wine for a change in price unless a better SUBSTITUTE CAN BE READILY FOUND.

No way are you exchanging your Prime Rib for Salisbury steak based on price alone…!!!!!

and if you are.. you are lying to yourself…

Inventory can not stay tight forever. Rising prices will have the effect of lowering purchases and encouraging more people to list their homes for sale.

Homeowners by the dozen posting 24/7 instead of off enjoying the fruits of their labor in the rain by the seaside, busy defending insane bidding wars. Yep, now THAT is what you call sad. If I owned a home this would be the last place I would be hanging out.

Just Jack and Hawk seem to post at the same time or within a few minutes of each other, from 5am till 2am… 22 hours a day ready to respond with a negative slant, for over 8-9 years… What is going on, so so sad.

Jack – cute video, but what you need to google is this:

Difference between ‘movement along the demand curve’ and ‘change in demand’. Fundamentally different, and where you are currently failing Econ 101.

Wow, that is so, so sad… Just Jack, maybe it’s time for a change of scenery? That long with the same exact thinking? Maybe move to another town and try living life more.

Your comment about how inventory will climb soon and prices drop… What about Econ 101… Inventory stays very tight and prices rise? There is no reason why this would not happen, and this is what most people think will happen, as you may be aware, there are more and more people coming here, not less and less.

It’s called supply and demand.

Anyways, why all the focus on the core, why not talk about the western communities? Me thinks you want to own in Oak Bay, but just can’t afford it.

actually it isn’t so simple… people are bidding up lifestyles…because if they were actually buying real estate instead of depreciating buildings..they would be focussing on the land values and there are a number of properties that are selling closer to land assessments…

It looks like you’ve been ‘banging the crash drum’ for ~7 years…

Median prices went up ~50k right after you made that comment.

Returning to a balance between buyer and seller is not saying the market is going to crash and burn.

In some areas and types of properties we have a strong sellers market with less than a month of inventory, new listings are only keeping up with sales and the days on market is less than a fortnight. That has lead to some irrational bidding on some select properties in the more desirable areas.

What is being debated is if irrational behavior by a few bidders constitute a shift in demand to higher prices?

We have always had some people pay more than the asking price for real estate. This year it has been about double that of the year before in the three hottest areas.

Is this sustainable into the future? Quite possibly for the short term but in the long term supply will increase to meet demand and prices will decline as they have always done to meet local lending levels. The last time this happened was in 2013.

when you have 5% equity 95% margin…a drop of 5% is a crash and burn..

when you have 20% equity and 80% margin… a drop of 20% is a crash and burn

when you have 50% equity and 50% margin… a drop of 50% is a crash and burn

when you have 100% equity and no margin… a drop of 5% 20% 50% is a buying opportunity 😉

to each his own… (meanwhile when you have no exposure and constant fear.. any drop is a crash and burn because you spend all your time looking in the rear view mirror at the coming apocalypse..)

Who said the market was about to crash and burn?

you aren’t tied down… you can get out now 😉

Not so comfortable when the 15th floor starts shaking 🙂

I’m not sure why these housing blogs attract these super negative conspiracy / doom and crash types. I’m sure a physiologist would have a hayday analyzing them.

No matter what the facts on the ground, everything is about to crash and burn.

If it is so expensive here, rainy, and just horrible, why not move?

We had a few on our local TO blog for ages, and as far as I could gather they were all single renters.

As Garth Turner just reminded all on his blog, only 8% of US owners became distressed that caused the crash. When the deep pockets with no brains subsides, the turn the other way could be disastrous like a tsunami.

Just five kilometres from downtown Victoria is an earthquake threat we never knew was so close: the Devil’s Mountain Fault Line.

http://vancouverisland.ctvnews.ca/video?clipId=822632

MillionMedianCore2020

I’m having T-shirts made up 🙂

Just trying to lighten the mood, although I am curious if there are as many doubters now…

Great points fireecology1 & BJRowl.

Do you really want me to link you to an economic 101 course!

Okay I will

The Law of Demand 1:55

https://youtu.be/QvGLcCTXk9o

For the record, what you said was ‘If this was a stock – I’d short it’.

You’re supposed to (if making money is the objective) short stocks that are dropping in value. Thus your comment implies that you think prices are about to drop. I said I’d take that bet. The evidence, whether you’re looking at fundamentals (labour reports, Canadian dollar) or technical patterns (strongly rising price and volume curves, moving average lines) all suggest rising prices for the near future.

No Jack – your economics is wrong. Prices don’t eliminate demand – demand causes prices to rise! You have the cause-effect relationship totally ass-backwards. Rising prices is a symptom of high demand, not something external that mysteriously will cause people to lose interest. Individuals are priced out of the market, and tough luck for them; buyers as a whole are not priced out of a rising market – they are what causes the market to rise.

The only other variable of interest is volume, and you’re right to pay attention to that. Low volume in the core is interesting, I agree, but recent price wars in Fernwood, Oaklands and various areas of Saanich East suggest much higher demand than supply. At this point, an increase in listings would probably be absorbed easily.

As for areas – sure, there are big regional differences, and I don’t even know why the VREB pays attention to the Gulf Islands. But if the stats are for this aggregate area, then that’s what we have records for. Prices rising 15% YoY for this larger area undoubtedly includes some areas rising 25% per year and some rising 1% per year. But it doesn’t matter, because that’s how the data have consistently been presented and what provide the historical context.

Also poodle I think you may be confusing average with median. I’d agree the average gets skewed pretty easily.

You would really have to have a lot of retirees like yourself to skew the median household income stat. I think the amount of retirees in your position is very small relative to our economy. Your an exception, not the rule.

First of all Fireecology you’re going to have to tell me what you think I guessed? Because I don’t think you know?

What I have made very clear all along is that I am referring to detached houses in Victoria, Saanich East and Oak Bay. Of which there were 158 house sales last month and 164 house sales the year before in March. To date there have been 35 house sales in these three areas. This is the “HOT” market that you’re reading about.

The thousand would refer to all sales on the real estate board. Now there isn’t 10 offers on every property that sold on the real estate board. What you are mixing up is what is happening in select areas of Victoria, Saanich East and Oak Bay and extrapolating that to all sales in all areas.

But if you like, I will talk about the Gulf Islands where there are 239 properties for sale and only 24 sold last month. That’s ten months of inventory with some island prices back to that of the early 1990’s. Or Sooke with 200 properties for sale and only 30 sales last month for 6.5 months of inventory.

Compare that to Victoria, Saanich East and Oak Bay that have 179 homes for sale and 158 sold last month. That’s ONE (1) month of inventory. There isn’t a thousand homes selling in these areas.

Now what happens when prices rise? Fewer people can afford to buy them. They don’t have to move away. And that’s what I see happening with local buyers, they are being priced out of the market. For a time being they are being replaced by deep pocket buyers but that is not sustainable over the long term.

Some of you may prefer an example of such a buyer. I just finished working with a buyer that was back from the tar sands. Laid off from the job but with lots of money and wanted a house. The buyer was and is a part of the wave of recent laid off workers. That wave will end. And then the market will revert back to the local buyers that don’t have deep pockets.

Yeah, you are new but my take is that most people on this blog can do math and analyze stats. You might want to review some of the archived posts.

And yes, thanks, I know how to maintain income at a low marginal tax rate. Does not just work for the retired, it works those who own businesses and keep retained earnings instead of taking dividends too.

The fact is though that most people ( 68.5% of the population is working age) are not doing this (retired (18%) and business owners (about 10%) are a minority – the majority earn incomes here) and I think the median is fairly representative of the entire population. Couples with children do have a higher median of just over 100k.

There are some fairly detailed stats available through stats can on debt and demographics that have been extensively analyzed on this blog over the years. In addition, CMHC has all sorts of data on housing. And you don’t have to include Langford or any particular area, the stats exist on the sub areas and stats separating condos for SFH exist in each sub area as well – look to the Victoria Real Estate Board for detailed information.

Here are some links to more Victoria information:

http://www.victoria.ca/EN/main/community/about/census.html

https://www12.statcan.gc.ca/census-recensement/2011/as-sa/fogs-spg/Facts-cma-eng.cfm?LANG=Eng&GK=CMA&GC=935

“I would happily make a $1000 bet that average prices will be higher at the end of the summer than they are now.”

Absolutely. Like it or not the short term reality is rising prices. I had previously expected things to slow down later this year. I’ve kind of adjusted my expectations. Once the market gets this kind of momentum I think it usually tends to continue a while (barring some major external shock).

I agree with BJ Rowling’s earlier comment. There is still a lot of affordable housing in Victoria even within a 30 minute cycle commute (15 minute drive) of downtown. Most cities eventually reach the point where desirable neighbourhoods near downtown lose affordability for first time buyers. Victoria seems to have reached that point.

We bought in Fairfield and love it. However when we did our Victoria house hunt in 2008 we checked out a lot of fantastic livable neighbourhoods including parts of Esquimalt, View Royal and big chunks of Saanich.

I’m no cheerleader for rising real estate prices, but I don’t think the plight of the first time Victoria home buyer is all that dire either.

The “median family income” data is very very skewed here because of people like me and my husband that are retired and pull out the absolute minimum to cover our expenses as to save taxes.

I’m not sure if you know how that works, but the goal is to keep investments in retirement accounts making gains rather then taxed.

I would only rely on data that showed the first time buyers age, and real income. The “median” is never ever a reliable indicator.

Plus, if you want to talk median income, you have to include other areas like Langford and Condos.

I highly suspect there is a lot of high income young families in Victoria, with family money also.

Also the debt to income stats are completely off… If you just look at assets vs debt in the last 10 years Canadians have grown their Assets 4x while debt has marginally gone up. And I suspect that debt is very very cheap mortgage debt.

Why pay down payment money into a house when you can put the majority into market at get a 5% return when the Veriable rate is 2.7% on the loan.

To think that Canadians can’t do basic math like that is to ignore reality.

CBC News: CMHC looks for new ways to track foreign money into Canadian real estate

http://www.cbc.ca/news/business/cmhc-foreign-housing-1.3479247

On track for ~1000 sales this month. Will we break 4 digits? From Marko’s data (http://vibrantvictoria.ca/forum/index.php?/topic/3733-victoria-real-estate-board-statistics/page-30), only two months have every exceeded 1000 sales: April and May 1991.

Just Jack – If you shorted this stock, you would lose money! I would happily make a $1000 bet that average prices will be higher at the end of the summer than they are now. Not sure what you’re after with your guess. When 10 people make offers on a house, and one (the highest bidder) buys it, it means the other 9 were very serious about buying, and this contributes to pent-up demand for the next similar place. They don’t (often) suddenly move away or change their minds about housing choices. IMO, now is the time enterprising flippers are going to buy in to take profits in October or next spring.

I’m not pumping here; we are thinking about buying a bigger place, and would prefer if prices were steady (or even dropping) as we look at more expensive properties. But there’s no sense pretending – the core is mega hot right now.

The rules on 5% down only apply to the first 500k so the minimum down plus closing on an 800k home is more like 72k. But that is neither here not there in the end – most people are putting more than the minimum down.

The median family income here is 80k so the majority are going to need to look elsewhere for a home without family help. I don’t know that too many folks in this income bracket are looking to buy in Fairfield/OB.

What you do have on this blog are some people who sold hoping for a downturn. They’ve waited and now prices have gone up instead. Could they afford 800k? Maybe. But many people are concerned about being able to afford the home if rates go up as they have done historically.

What you also have happening are some very rapid price increases this year. Like places that used to be a million last year are now going for 1.3 million. We haven’t had that for quite some time in Victoria so it is has taken locals off guard – I was not expecting it. I’d gotten used to flat and minor increases. I would imagine it is very annoying for someone who was waiting for more inventory and got a price increase instead.

I think what is interesting about your comments is that your frame of reference is TO and so for you this is still affordable. Locals think ten years ago was affordable.

I’m new here so not sure why the obsession with Oak Bay and Gordon Head needing to be affordable to first time “local” buyers.

Victoria has a ton of very affordable brand new housing only a few minute commute away. Wouldn’t the first time buyers start there?

It seems like there is a lot of built up frustration on this blog by a couple posters that the high end old established areas near the ocean and town are becoming out of reach for said posters.

Victoria has it all, great new very affordable areas a few min away, that helps first time buyers (who can’t afford a major renovation/major maintenance and tax bills).

Once these buyers age and kids grow up and they want to upgrade to near town, they can easily do that I would imagine.

I’m sorry but an 800k house is only $40k down payment, and with two medium/ok wages it is still very affordable as a percentage of earnings. First time buyers in their 30s with dual incomes of 140-200k (very easily obtained in this town) can still afford first time very very nice home in Oak Bay.

I would forget the bay’s of the core and let’s talk about the new buildings going up all over the general area that are historically very very affordable and only 10-20 min commute, which compared to TO is luxury. .

“If this was a stock – I’d short it.”

Booyah JJ !

Mike, you mean Home Capital that announced a $150 million share buyback program a month ago to prop up the price and squeeze the shorts, after their large team of shady brokers milked the company out of $1.75 billion of mortgages that shouldn’t have been approved ? Can only imagine how many other 1000’s of scam mortgages are out there.

Share buy backs is what’s propping up this market and only helping the management wallets. Not short a thing as I said before twice, but looking tempting very soon unless another round of QE gets announced.

CMHC is digging deeper into all these students with million dollar homes, this should scare off the last of the HAM that scammed their money out of commie land.

“Canada’s national housing agency is starting to use new tools to get a handle on just how much foreign money is flowing into the country’s housing market.

The Canada Mortgage and Housing Corporation (CMHC) told CBC News on Monday that the housing agency has been in contact with police agencies that track money laundering and tax authorities in order to beef up its data collection on the impact of foreign buyers.”

http://www.cbc.ca/news/business/cmhc-foreign-housing-1.3479247

Nothing has occurred locally to stimulate prices. No big company moving to the city, no increase in government hiring. This is all to do with an external stimulus that can’t be sustained. Prices can only be sustained through local market conditions.

I first started to see this change in the stats in October of 2015. Something was happening and that was showing up in the stats in the different hoods. The stats have gotten more out of line with historical base lines since January.

The most similar year we had to this one was 2013. But this market is far more skewed than 2013. I’m happy for those Victorians that are cashing in on this windfall but I also know what will likely happen next.

Since the beginning of the year, I figure these higher prices have knocked out some 30% of local buyers relative to the same time period last year for the areas of Victoria, Saanich East and Oak Bay. And the reason why I can’t see this wave as anything but temporary as it isn’t happening in all properties in all areas.

If this was a stock – I’d short it.

Nope still a baby bull… You would have to have your head in the sand to not see prices are going up. The debate at this point is how much

Hold onto your chair JJ – I agree with you.

In Oak Bay there are only eight houses listed under one million with way more buyers looking to buy at this price point.

With so few house listings in Victoria (there are 36 homes listed in the City) it is very easy for a few buyers with deep pockets to effect prices. But the local market is suffering. As the local market is out priced we should see the number of listings increase and balance between buyer and seller return to the market.

That’s not going to help anyone wanting to buy in the next few months.

At least we aren’t alone in this recent wave of over asking offers. The same thing is happening in other cities across Canada and the world. It’s the flight of capital. People are afraid and want to store their money in real estate. Ironically by doing so they make real estate much more risky to own.

It’s fun to look at the most shorted Canadian lenders lately like Home Capital…

http://stockcharts.com/h-sc/ui?s=hcg.to

Credit cycle must be alive and well. Our big 6 banks sure are soaring lately. (I should probably whisper, someone’s probably short a bunch of them)

Mike Grace, I think this may be their new guidelines from Dec?

http://www.streetcapital.ca/appraisals/20151207_SCFC_Appraisal_Guidelines_01.12.2015.pdf

In case Jack isn’t around.

The situation on the ground as witness this weekend personally is absolutely beyond chaotic.

Mon Mar 7, 2016 8:25am:

Mar Mar

2016 2015

Net Unconditional Sales: 193 734

New Listings: 304 1,448

Active Listings: 2,564 3,769

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

@ Just Jack

I’m curious. Would you be willing to share Street Capital’s new appraisal guidelines with me? I’d be really interested to read them. mgrace@mortgagegroup.com

Problem is Mike you never post when you buy so bragging about paper profits are a waste of time to make yourself feel good. 2 of your 4 claims were not doubles. Of course you only buy at absolute bottom, and we never hear about a single loser, righto !

Larry Berman on BNN says the Hong Kong effect will hit Vancouver over the next year. How can they sell their properties to buy here when no one is buying there and prices in free fall ? Think Canadian banks are going to lend against declining Hong Kong real estate while tightening the noose here ? House of cards waiting for a gust of wind.

Dasmo, I thought you were a bull 2 days ago ? Now you’re a halibut again ?

Certainly lots of pumping going on here but that’s a sign in and of itself. I doubt the majority of sales are over list but a few years ago there were none. Don’t expect to see burning houses on the cover of McLeans this year…

As for what could influence more retired boomers moving here? The Internet is one, their friends doing it, kids staying at home for too long so not minding having a little distance, more money to do it…. In other words it’s possible.

I am also less confident of a repeat in price increases. The pressure now comes from existing house equity and a long flat market. No rate major drops or wage increases or some sort of industry boom right now. Don’t see a double in five years.

1530 Pembroke Street.

Ask: 699,500

Sell price: $875,000

What the hell. Ok, so it was a really nice house – Do people just pull offers out of their ass and offer the highest amount they could possibly afford just because they want it? It makes no sense.

btw, Hong Kong prices fell ~60% between ’98-04 and that was a great thing for Vic/Van. Not that HK has even fallen much yet.

Here’s the latest 750k over ask. What’s impressive is that’s 59% over list price!

http://www.newwestrecord.ca/news/queen-s-park-home-sale-historic-in-new-west-1.2190025

@Hawks, Hong Kong housing market trend probably has more to do with its current political environment than other factors, remember the housing market crash there in 1997? In that sense, of course, Victoria is different from Hong Kong.

Don’t we all?

http://www.cbc.ca/news/business/snowbirds-loonie-real-estate-1.3425322

I suppose you missed the US boat for stocks/RE too Hawk? I forgot, you only like to short things 🙂

Well Hawk, you can never say I didn’t try to help you see what was about to happen to Victoria last spring. I couldn’t have made it any more obvious.

(btw, +200% is a triple on CHK… you need brush up on your math skills)

You’re just young, you’ll eventually smarten up with experience.

“Hawk, you’re getting people and things you’ve read confused again.”

Mike, you need to remember which story you told and when. You’ve stated several times over last months that you have friends/family cashing out in the US to come here. Just like 50% is a double.

You house pumpers are underestimating that this recent insanity is built on something other than psychology and the herd mentality.

Look at Hong Kong, an area limited in land with high density and prices and sales have fallen off a cliff. Why ? Because people decided to “wait”. What a concept.

You would think all these educated Canadians with buckets of money and credit would sit back and force the market their way. Looks like Hong Kong’ers have an entitlement problem and decided they do want a house, but at cheaper prices. Prices are forecast for a 30% drop this year. Can’t happen here cause we’re different.

Hong Kong Home Sales Tumble 70% as Slowdown Intensifies

Hong Kong residential home sales plunged 70 percent in February from a year earlier to a 25-year low, as falling prices and economic uncertainty deterred buyers.

“The newspapers keep on saying the market is going down and buyers think they can get a cheaper house half-a-year later or one year later, and so are waiting,” said Thomas Fok, a property agent at Centaline Property Agency in Hong Kong’s upscale Mid-levels West district where he hasn’t made one sale this year.”

http://www.bloomberg.com/news/articles/2016-03-07/hong-kong-residential-sales-plunge-70-as-slowdown-intensifies

When things are changing quickly last year’s stats don’t tell all that much. Ok so over all of 2015 29% of buyers were from out of town. But I want that stat for Feb 2016, when over-asks are a thing, not last year when things were relaxed.

It is significant that 27 percent of buyers come from outside Victoria, but from within Canada, and 11 percent from another province. Given that Victoria is the top retirement destination some of this cohort are going to be retirees or soon to be retirees. As the top reason to move is weather among those who were planning on moving and financial consideration were next it seems very likely that Victoria would be attractive to some wealthy Canadians as a retirement destination. It seems less likely that retirees with limited income will retire here. Wealthy Canadians can also afford flights to visit family. If I was in to or Vancouver or to with a house i would strongly consider early retirement to Victoria based on the amount I could get for my house. I think it is more likely that buyers in this group will make the move is n their fifties rather than sixties. So maybe there are more buyers out there like poodle. Buyers used to hot markets and with cash to bid up prices.

@BJRowlingPoodle, I think you are correct, it is outside money and people like you who bring the pressure here to our market, and force local people to join the push.

BTW we moved back here from Ottawa 9 years ago. Ottawa is probably colder than TO, but I don’t remember we ever had 9 months of winter, 6 or 7 the most. Also this year we had good weather in Victoria, normally winter here is a 4 months rainy season, so some retired people head south for sunshine in the winter, as rain birds.

Not we don’t like Victoria (we love it here), just some facts learned after you stay here for a while.

“Age and gender appear to be differentiating factors: those under 65 years of age are twice as likely to relocate as those 65 years and older”

Or rather: Lots of people talk about moving somewhere else, and when they actually retire they are very likely to stay where they are.

So the top three reasons to relocate are weather, financial, and family and friends.

Weather – This might cause some people to come here. We have good weather.

Financial – In other words, people are looking for cheaper cost of living and to liberate some equity in their homes. As a high priced market, this counts against us.

Family / Friends – That means either staying where you are, or moving to family, which is more than likely not Victoria.

Interest rates went down, wages went up. Prices went down.

Compare 2007 with 2014 on this graph: http://i0.wp.com/househuntvictoria.ca/wp-content/uploads/2015/12/yiraffordability.jpg

There was a huge change in those years.

Eventhough Victoria is #1 spot to retire, surprisingly small-town ON collectively rivals Victoria…

I’d agree with Leo. Affordability was pretty good in 2015 because prices had not risen in about seven years. If you go back in the archived posts you’ll see the data supporting this.

And the over asking sales really hit this year. I don’t think all prices are up 25% yoy but there is just a lot of competition when a decent house hits the market and these homes might be up this much now.

There is some data at the provincial level on where Canadians plan to retire.

Almost all BC seniors are staying in BC. A lot of Albertans are considering moving to BC. In deciding to move the top consideration was weather, then financial (housing costs), then family & friends.

Some of the more popular retirement destinations in BC are Penticton, Nanaimo and Parksville.

https://www.bmo.com/pdf/mf/prospectus/en/BMO_Retirement_Institute%20Report_En.pdf

Hmm, I’m not sure what you mean… How did it get so affordable here that prices went up 25% in 14 months? Was it wages? What increased 25% that allowed this increase? Interest rates are the same, and a lot of places are paid all cash.

I really suggest thinking that it is outside money and boomers arriving here that are pushing prices up.

Partially yes. Victoria in 2015 was relatively affordable compared to historical norms. However I don’t think we are in for a doubling in prices because that would require either a complete unhinging from local fundamentals (like Vancouver), or a rapid rise in incomes (which is unlikely).

Past price jumps have happened because interest rates dropped considerably, so things got more affordable without prices having to drop a lot. With rates having not much further to drop, rising prices will quickly make affordability very poor again, which will limit appreciation.

Leo S. So you are saying that Victoria is at the beginning of a new cycle? That Victoria today is actually very affordable still, and that prices will go up another 125% or more in the next few years? Just like before?

I get your point Leo, but I think you’re underestimating the shear size & wealth of the “droves” of the baby boomer cohort. Perhaps only the same percent of their generation move here, but that percent equates to many more people than their parents generation.

Hawk, you’re getting people and things you’ve read confused again.

5 more house sales than the usual 15 last month in Sidney. Yep they’re busting down the doors.

Michael , when are these friends actually coming ? It’s been months since you told us of their plans and they’re losing money by the hour.

What do you think is the reason behind the 140% uptick in prices from 2000 to 2010? What do you think is the reason behind the 170% uptick in prices between 1985 and 1994?

Same as it always has been. Affordability gets better and people start buying. Affordability gets worse and people stop buying.

Victoria has been advertising itself as a great city for retirees and tourists since at least 1936. The idea that it is only now, 80 years later that seniors will suddenly start arriving in droves is laughable. Yes people come to retire in Victoria. No, we are not about to be overrun by hundreds of thousands of boomers.

http://www.youtube.com/watch?v=NwREABOLzZc

Interesting Leo S. You seem quite sure of your opinion.

What do you think is the reason behind the 25% uptick in prices since Jan 2015 in Victoria?

It’s funny because you lumped Victoria together with Vancouver. Other world class cities: Surrey, Langley, Nanaimo. I hope the poors there don’t get upitty and think they will be able to buy a house in those world class cities.

So it’s starting just in the last year? Huh, I guess all that talk about boomers swarming the city for the last 10 years was just that.

Boomers are human (well, some of them), and humans like to stay close to their kids. Very few will move across the country away from all children and grandchildren just because it rains less here.

Except there is really only two cities where someone could sell and buy in Victoria for less. The rest of the country can’t afford Victoria in retirement anyway. I will buy a bit of an influx from Vancouver, but the impact from Toronto boomers will be very very small.

The Okanagan is in the rain shadow. Now the owners are defending the last 3 months of rain storms instead of insane market conditions. Next thing they’ll be defending tent city as an AirnB rest stop.

No basement here dasmo, I have a penthouse suite with a marvelous ocean view and half the city. Lots of fresh air up here. 😉

Some of the explanations are cheap US prices enticed our would-be buyers from ’10-’14, our above-par loonie greatly exacerbated the trend, financial crisis kept some working longer, the eldest and fewest boomers are only late 60s in age, and the bulk are still only mid-50s and working for another 5-10yrs.

If you don’t buy any of those explanations, Sidney prices being up 13% since Feb’15 is a sign to me that boomer retirement buying has begun. Recall too the numerous media stories lately of boomers who bought US a few ago, are now cashing out after doubling their money and looking back to places like Victoria.

Leo S. I think the older generation of retirees were the war generation, and stuck to their long term houses and retirement homes.

The baby boom generation is much, much different. We are more mobile, we are connected on the Internet, we love traveling, we are flexible, and we see opportunity to move from one location to another and pocket millions.

We are just counting our lucky stars we are arriving here at the front of the wave…

I always find it interesting how poors believe that simply being born in a top world class city like Vancouver or Victoria means they are entitled to being able to afford a house.

The western entitlement generation is very interesting.

I have bad lungs so I feel the air. Victoria is second only to Hawaii. Once you have a kid you feel the weather. In Victoria you are going to the beach all year!!!! Get out of the basement suite and off the internet Hawk. The weather is outside not online… I’m in Van right now and it’s supposed to be raining all weekend. Instead it’s been great. Capilano park yesterday, today snowshoeing on cypress and the beach in the afternoon. Only a little rain here and there.

Victoria is not in the rain forest. It’s in the rain shadow of the outer coast mountains (in the lee of the Olympics) relative to most storms. As a result we get much less (like 40-50% less) rain than Vancouver, and the native ecosystems for greater Victoria are dominated by open Garry oak-Douglas fir savannahs, not closed forest. This is the area called the Coastal Douglas-fir biogeoclimatic zone. Most of the west coast is in the much wetter Coastal Western Hemlock zone.

I know full well what the island is. A paradise with fresh water clean air and many different ecosystems. Rain forest being one. Try living in Rotterdam where it is always raining and windy. How have you been enjoying the sunny March so far?

I have yet to hear a single explanation as to why all those retiring people haven’t already come here. There are 5.7 million people over 65 in Canada. Why is it that they aren’t here already? There’s nothing about the boomers that makes them different than the seniors that came before them. And as Victoria grows it becomes less attractive as a quiet retirement destination, not more so.

The population of Sidney declined in the last census. Don’t you think that’s odd given it is basically ideal for seniors?

Yes there will be more seniors with the boomers, but if the seniors aren’t coming then that really doesn’t matter.

Guess you’re not familiar with the term “rain forest” nor the words “damp” “mildew” nor “mold” as in “leaky condo”.

ICYMI, here’s the weather report for the next week, same as the last 20 weeks.

http://weather.gc.ca/city/pages/bc-85_metric_e.html

The rain and grey???? You gotta get out in the world….

Ah yes I asked our Realtor about Noelle and it was my mistake, we did get contact with listing agent. We decided not to put a bid in as we are looking for that really right place. We are looking at 700-1.1m range, as it seems there are amazing places under 1m still in Victoria, though I suspect, just like Toronto, that won’t last long.

Or Salt Spring

https://youtu.be/Q8jhb5NnADM

Or Duncan

https://youtu.be/2Jx2jEPvh88

I can see the allure of so many wealthy people moving to Canada’s western outpost.

https://youtu.be/umS3XM3xAPk

This fixation every wealthy person in Canada wants to uproot from family and familiar surroundings to move to a place they know no one to live out the rest of their lives is a joke. Many prairie people I have met desire the Okanagan because they like the snow and four seasons.

The rain and grey is a major depressor plus it’s much cheaper up there by 30% or more and you can drive anywhere without the ferry hassle. As bearkilla always says: “it’s over rated”. Not to mention over valued for what it is.

Wait til they digest the massive earthquake fault just discovered off Clover Point . Tsunami evacuation drills may be a regular Oak Bay / Fairfield reality.

Noelle they maybe spent 3-5k on some very minor updates. I’m pretty sure it already sold near $800,000 or more as our Realtor can’t even get ahold of the listing agent.

Noelle is my listing and still available, looking at offers tonight at 7 pm; there are multiple offers already written.

Welcome to cloud nine, BJRowl.

There are only about 9 million wealthy boomers in Canada that are average age ~57 (more than 1.5 billion in world)… so I’m not sure if that will put any pressure on Victoria property prices over the next two decades?? 🙂

BJRowlingPoodle you should have no problems buying a house if you have no or little concern of what to pay.

But something tells me that you do care what you pay for a property and you’e not willing to pay hundreds of thousands over asking price just to get any home. Otherwise you would have bought by now.

Now a little education for you. There are not many homes on 12,000 square foot lots within 2 or 3 minute walk to the Ocean in Victoria or Oak Bay. Any lots that size would have been re-developed by now. Unless you’re thinking Uplands and then you can kiss that suite good-bye. If that’s your dream then you may want to look farther Up Island like in Mill Bay

I think that is something a lot of people from bigger cities like Vancouver and Toronto have a hard time grasping. Victoria is a small city without the selection of housing you find in bigger cities.

Years ago, I was at a building site when a couple from Toronto asked a builder where the brick houses are? He pointed east and said “three thousand miles that way”

“On Thursday I was emailed the new lending appraisal guidelines for Street Capital. I doubt any of the properties that have been mentioned on this blog would meet their new guidelines. BNS, BMO and Home Equity are the same. That means you’ll need a very large down payment or risk having the sale collapse and lose your deposit.”

As predicted… thus the end of the credit cycle begins as the banks start to tighten the noose. 😉

A rapid private debt binge is nearly over, Macquarie says.

“Canada’s private sector nonfinancial debt to GDP ratio (includes household debt and non-financial business debt) has skyrocketed since 2005, rising by over 60 percentage points,” he wrote. “This is a greater magnitude of increase than occurred for the forty years prior (1965 to 2005).”

As a result of this prolonged binge, Canada’s private sector non-financial debt-to-GDP exceeds the comparable U.S. ratio by its highest level on record:

http://www.bloomberg.com/news/articles/2016-02-19/canada-s-credit-cycle-has-never-been-this-desynchronized-from-the-united-states

I really don’t get the draw of Fairfield,Oak Bay and Gordon Head I really don’t. I’ve lived in Victoria all my life and those places are way overrated. All the excuses about why they’re so great can be applied to any area on the south island except most other areas don’t have such a high concentration of “character homes” that should have been torn down a long time ago.

@JustJack – thanks, I need some encouragement. I guess it depends what price range these collapsed offers were in. For the past several years, we were looking to buy in the $600-700K range, and now it looks like we have to push that to $800K. If we can’t find anything that doesn’t need major renovations at that price in the next few months, we will have to look at strata properties (shudder).

I consider $800K to be a lot of money relative to average family incomes anywhere in Canada, and it shocks me that there are so many wealthy people who can plunk down over $1 million so easily. Ten years ago, I thought $500K was a huge amount of money for a house. I guess that’s the hollowing out of the middle class in action, and the way it’s going with real estate, the rich are only getting richer.

I guess from our perspective, this is our lifelong dream place to retire. And oak bay Fairfield and Gordon head are our dream locations.

After a lifetime of hard work we have an opportunity to live by the ocean in amazing areas.

Our house in TO is very old, musty, and should really be torn down. Our lot is 4500 square feet with about 5 feet between buildings. It is cold in the winter, which lasts for ages, house costs a fortune to heat (literally $950 w month in the cold season, which is 9 months).

This house went up in value $145k in Feb alone this year. Because of this, we view the (let’s be honest, not all houses are over asking) slight increase in cost to buy in our dream area is literally nothing to us, we would bid $145k over asking or more on a place we found that we loved without even a question.

We are not alone also, we have friends that are looking at their old houses selling for 1.5-2 million and when they visit us and it’s sunny and 14 degrees out like today, they are really looking into buying here and retiring 5-7 years earlier.

A beautiful renovated home on 12,000sf within 2-3 minute walk to pristine oceans and year round green, with an income suite for suite for family to stay in, for $900,000 less then a teardown in TO.

Makes sense to me, makes me think this is literally just the beginning of a larger move here of wealthy people my age (57), and I am not letting anyone get in the way of my dream home, even if it was $400,000 over asking it would still be a deal to me and my husband.

What’s changing?

BJRowlingPoodle you might still get a second chance on buying as there are least four listings back on the market where the offer collapsed because of the inability to get financing.

People can over pay for a property, but banks don’t over lend.

Hopefully the original “buyers” will get some of their deposit back.

On Thursday I was emailed the new lending appraisal guidelines for Street Capital. I doubt any of the properties that have been mentioned on this blog would meet their new guidelines. BNS, BMO and Home Equity are the same. That means you’ll need a very large down payment or risk having the sale collapse and lose your deposit.

@BJRowlingPoodle – “into the market at any price” is the mindset that is driving up the house prices. It’s like a stampede for the exit; we could all get out alive if we just stay calm. Coming from outside Victoria, you have no perspective of where prices have been, and you just see the frothy market now. Why is there a tremendous upside? Victoria is not Vancouver or Toronto, which many bears have said here, but it’s true.

For perspective, I remember in 2001 when an acquaintance could not sell his house on Asquith for months in the $200K range; he was elderly and really needed to sell it. Also, with exception of a few nicer parts, Gordon Head has always been, at best, a middle-class neighbourhood. I recently saw an agent describe it as “prestigious” Gordon Head, and I laughed.

Mind you, I am now stuck without a house because I thought prices should have corrected more after 2008 and was waiting for the fall when interest rates rose as our economy recovered. Good theory, but reality played out differently. I never counted on outside buyers causing such a sudden jump in prices; I thought I would have more time to react. I am still looking to buy, but am staying away from the over-heated areas.

Unless one is working downtown or at UVIC (which, granted, is a large part of the working population of Victoria), I don’t understand the allure of Oak Bay, Fairfield, or Gordon Head. If you come from Toronto or Vancouver, what’s a 20 to 30 minute drive for a nicer, newer house? Sooke is too far, and probably Sidney, but there are areas in-between.

Sure a lot of us had paper routes growing up. Not sure our parents gave up their weekends to do it too, which I think is what Marko is saying – there’s a difference there.

Ash, Noelle they maybe spent 3-5k on some very minor updates. I’m pretty sure it already sold near $800,000 or more as our Realtor can’t even get ahold of the listing agent.

At this point, we are just trying to get into the market at any price as it is clear to us it has a long way up to go. Remember we have lived through the price appreciation in TO, where last month our house went up $145,000 in value in 3-4 weeks!!!

The longer this psychotic bidding war game keeps up, the more it will effect any big businesses plans for expansion, and/or any large companies were thinking about entering the Victoria market. Their rents/leases will go up higher than projected, planning for employees to move here from out of town and their ability to find or afford a place will be seriously effected. This is not Vancouver and the limitations here will be exposed in short order.

Keep paying 100K over fools, someone needs to be left holding the bag after every mania boom. Flippers in US see a market top, they know what a market crash is all about.

Home flipping reached 10-year high: Can you say froth?

“When home flipping numbers go up, it is usually an indication that the housing market is in trouble,” said Matthew Gardner, chief economist at Windermere Real Estate in Seattle, who was quoted in the RealtyTrac report. ”

http://www.cnbc.com/2016/03/03/home-flipping-reached-10-year-high-can-you-say-froth.html

“Even for those born and raised in Victoria, this was pretty typical when I was a kid. I started delivering the daily Colonist when I was eleven and then graduated onto delivering the Pennysaver newspaper for a few more teenage years. ”

Had many a paper route from 9 to 12 years old. It was a badge of honor to have a route, not an immigrant stamp of poverty. We were junior businessmen collecting cash monthly, learning how to talk to some very rich people in some instances on a monthly basis, while having more money than all our buddies who relied on meager 25 cent per week allowances. Bought my first ten speed with the cash when having one was a rarity and a luxury. Oops, guess I’m chest beating. 😉

I recall Noelle being listed in 2015 and thinking the relatively low asking price at that time made sense given the awkward positioning of the lot and little yard privacy it offered. Tell me the sellers at least did some work to it for it to go up that much in one year? Exterior looks like it might have been done?

Great post topic (as always), Leo. I love the “Animal Farm” reference in the topic title.

@Marco

Even for those born and raised in Victoria, this was pretty typical when I was a kid. I started delivering the daily Colonist when I was eleven and then graduated onto delivering the Pennysaver newspaper for a few more teenage years. My brother-in-law used to be one of those kids selling newspapers downtown on the street corner in the 1980’s.

Maybe things were different for us Gen-Xer’s versus Millenials?

Househunting, we were there also at the open house, wow so many serious looking buyers.

I have a feeling that house will sell for closer to $800,000 after a bidding war the way a few couples were looking around.

Gordon Head area is attracting a lot of over asking, more so then Oak Bay it seems.

Popped into the open house on Noelle Pl this afternoon, nicely surprised to see a familiar name on the For Sale sign.

This house sold for $562,000 in Jan 2015, now listed for $669,900. That’s quite a jump but I don’t think it is out of reason all things considered. Anyhow, the open house was hopping and I expect this place will go for somewhere in the mid 700’s in a bidding war.

Crazy times out there right now. Under different circumstances we’d likely be preparing an offer on this place.

I think it all comes down to time and risk. Do you have the time to manage Airbnb, and are you ok with the number of people in and out?

Another thing to consider is what your hourly rate ends up being when taking into account the work that goes into it and what the opportunity cost is. When you’re self employed and can turn time into money I’d say it’s probably more lucrative to spend the extra time on enhancing your main business.

I feel there is some relevance to the argument that airbnb is removing supply from Victoria’s long term rental market. All it takes is a quick look at the map of Victoria on airbnb to see the huge number of places being offered.

My wife and I are planning a new build with a semidetached suite. Our conversations right now waver between offering it to airbnb, or just as a long term rental.

Both have advantages/disadvantages. With the short supply of long term rentals, rents will no doubt increase making airbnb less palatable, as it is quite a bit more work.

Interested to see what you all think?

I guess VictoriaVv didn’t manage to sell her house over asking….

Thanks Sweethome, I agree with you, it would be around the 940-1.1 mil range in those areas. Land is much more expensive in Oak Bay then Oaklands and that fully renovated house is worth at least 350-450k. To build a new house like that new would probably cost 600-700k these days.

Just Jack, interesting point, I never would have thought of it like that. I’m just wondering what you think the house is worth, $650k? It was bought not long ago for 460k and the renovation did not cost 300k.

How would you assess that house? $520? $540?

Just curious as to what you think the real value of that house is, and what about the multiple bids on the place over 700k? Are all buyers completely over paying for everything these days? Are you expecting a large crash in the market?

@BJRowlingPoodle – for comparison, 2738 Dunlevy is a newly listed in the very popular Estevan area of Oak bay for $1.1M – it will be sold this weekend, likely for over asking. I think the house itself is nicer than Asquith, but no legal suite (I’m not sure if Oak Bay even allows legal suites).

My guess is Asquith would be under $1 M in Oak Bay, but I have only been tracking houses up to $900K. A house with a legal suite that is turn-key ready will always get a premium because it also appeals to investors who just want to rent it out, in addition to families who can apply rental income to get approved for a higher mortgage. If you’re not in either of those positions, you can probably find better value elsewhere (or at least that’s why I passed on even looking at Asquith).

How much would Asquith cost if it were in Oak Bay or Caddy Bay?

About the same price around $750,000.

What you’re trying to do is make an irrational behavior by one buyer fit into the range of what reasonable people pay for similar properties.

People can pay whatever they want for a property that doesn’t mean they are paying fair market value.

But there is a price for over paying for a home.

If the fair market value of the property is $650,000 rather than the purchase price of $750,000 and prices go up by 10% what’s the property worth then? Or worse if if prices go down by 10 percent?

The buyer simply shoveled a hundred grand of equity into the fireplace and set in on fire. And for the next 25 years they might also be paying interest on that money.

https://youtu.be/vt9q-WChfeM

Here is the question, how much would Asquith cost if it was in Oak Bay, Cadboro Bay?

1.1 or 1.2 mil? 940?

I was going to sell it then and probably should have. I’m not even break even on it so I’m not celebrating yet.

I feel 2612 Asquith was a lesson in how to flip – love that kitchen & wow they did a lot to clear that yard. (chop chop chop!)

Pre-flip photos here: http://2612asquith.info/

post-flip http://www.remax.ca/bc/victoria-real-estate/na-2612-asquith-st-na-crea_id16644940-lst/

high price for 750k but legal suite, nice staging & nicely done i’d say

How is $25 to $38 or $3.5 to $5.50 a double ? You said gas back then not the stocks. Not short a thing at the moment but looks like it’s almost that time again.

More like blessed are the HAM for laundering their money in truck loads before China crashes…. and sucking in the locals while they’re at it. When the HAM stops it will be sudden and I wouldn’t want to be on that ride.

Meanwhile in Calgary, the people who loaded up on high priced real estate are the ones losing big. That’s the risk they took.

“Joel Semmens, a realtor in Calgary with Re/Max, said that while the average home price in Calgary is only down by a few per cent, homes worth more than $1 million have seen their value drop by much more.”

http://www.cbc.ca/news/canada/calgary/jingle-mail-alberta-housing-1.3430867

Interesting when you look at the recent Van house that sold for 9 million (the one that went over ask a million that the sellers bought for 498k in 1986).

That’s over 10% per year average appreciation for 30 years!!! Blessed are the boomers.

The natgas stocks I bought (CHK, ECA, APC, LNG) have nearly doubled, thanks for noticing Hawk. But I agree they’ve underperformed the other sectors I’ve added lately. How are all your shorts doing?

Vic&Van – that place on Mileva Lane is on a cliff of dirt that might slide into the ocean just like that place on the Gorge. Great views, but any erosion is the responsibility of the homeowner and the land laws of BC include provisions that could change your property boundaries due to erosion.

https://help.ltsa.ca/cms/web/ltsa/natural-boundaries-erosion-and-accretion#

Mike , what about your natural gas call when UNG was kissing $9 and now under $6 ? Bear market short squeeze rallies have not ended well so far. No LNG for you.

OK – I am reading lots of angst about $750,000 Oakland bungalows and $900,000 -$1,000,000+ Fairfield/Oak Bay shacks but it seems there is still some OK value in the “core”.

For instance, what about 1586 Mileva Lane for $900,000? This is waterfront in a hot area (Gordon Head). That sounds like good value to me but it looks like that place has been on the market for a long time. It seems a way better investment than putting the same amount of money into a crummy shack on a small lot in Oak Bay. And don’t tell me that Oak Bay is a more exclusive area. I clicked the demographic section on the internet listing and it shows a household income of $257,000/yr – like Uplands and way higher than South Oak Bay! ! But it hasn’t sold.

2841 Tudor is $1.2 million but comes with a lot of land in prime area – 1 acre in Ten Mile Point. Again, it seems like good value to me.

What does everyone think?

My bad dasmo, just that when I looked back to mid-Jan, I said

“Energy must be about to flip… consensus is $10 and dasmos everywhere are jumping ship.”

You replied

Good thing you held SDRL, it looks like it will survive.

Cheers Hawk….we should all consult a mystic 😉

http://www.dailymail.co.uk/news/article-3476221/Brazilian-businessman-lost-25BILLION-financial-crash-throws-130-000-gold-coins-ocean-mystic-told-angered-Queen-Sea.html

I exited Imperial oil and TNK for profit. Couldn’t stomach the loss on SDRL so I held it….

Risk is a double edged sword.

People who risked everything a few years ago and loaded up on high priced RE are now reaping rewards.

People who risked everything few years ago and sold their RE in anticipation of buying back into the market after the ‘Crash’ are now suffering the financial consequences.

As for those who waited for a downturn to buy, well, if you waited this choice did not pay off. Again, so what, it could have but now it is a sunk cost. I spend zero time worrying about sunk costs and I have definitely had some.

I’ve always thought there is only the deal of the day. There is no crystal ball. I just kept buying when I had the down payment and financing to do so and we are still doing this – currently looking for another house even in this crazy market.

Wow, Hawk is a really bitter and jealous person.

I think the main point is that you can get ahead in Canada – work hard, save your money, invest and eventually it pays off. Not every country works that way.

And if we are swapping I’m so poor stories you don’t have to be an immigrant to grow up poor. I had no financial help with anything after high school, including education and housing. No place to live for free while I was at university. Never mind flyers on the weekends, I delivered papers every day starting at 12 until I got a better job. I remember ironing my money because I was so excited to have some.

So what. I never spent any time complaining about it or how hard it is to get ahead or to buy. I was thrilled the first time I was able to borrow to buy a house. And so what if housing prices are rising or someone else is making a fortune. Come up with a plan. Do some reasonable financial forecasting. Make long-term choices.

For people who spent their 20s spending, well, you are where you are and just get started if you have a goal. Prices are currently appreciating quickly, but the market will level off at some point. If you don’t want to make lifestyle compromises for long term benefits I don’t have much sympathy.

I do feel sorry for older people who have made poor financial decisions, but it is a bit annoying to hear complaints about the effects of this and “the system”. Poor attitudes stop acceptance of what is, which is likely pretty good anyway if you have your health, and analysis of what could be.

Chest-thumping is a fools game.

Then again why waste 100K on a masters degree when you can take a 3 month salesman course, flog houses, troll blogs, boast about your personal wealth and property holdings while shooting down your friends.

Sure, and I don’t think many people feel sorry for grasshoppers who spend their money on ski trips and trucks while others live frugally and save.

My complaint wasn’t about bulls or investors in general. It was about the posters who cackle over the problems of people who waited to buy because they thought waiting was a smart financial move.

But of course getting people to respond to their needling is the whole point of their visits here, so if I was stronger, I would have just rolled my eyes and moved on.

Marko in another life:

http://www.youtube.com/watch?v=aKpgb2WrGo0

Doom and gloom ? Its 90% bulls on here. I thought you went to UBC for 4 years ?

Not everyone has the ability or financial means to get a master’s degree and go into massive debt nor desires to work at VIHA. Life isn’t a perfect box.

We all come from different backgrounds Mike with different challenges wether we immigrated or came from struggling single parents.

I truly respect people like Marko who immigrate here and inadvertantly show us how lazy, dumb and entitled we are

I was still in elementary school when my parents moved here so I wasn’t your true immigrant, for kids it is really easy to adapt.

I did live in a communist style apartment block in Croatia long enough to realize how entitled people are in North America with this single family home stuff.

It was pretty immigrant growing up though. We delivered flyers on Saturdays/Sundays for the first 4-5 years in Canada….fuk was that annoying when you are 12 yrs old especially when it is raining.

I’ve introduced a few friends to the blog but people usually have better things to do than read the same doom and gloom for 9 years straight 🙂

The silver spoon of Vic High and living in an upstairs room of a bungalow 🙂 Never had the basement, I wish, my parents have had it rented since 1996. A lot of people have an opportunity to live at home, but once they start making good money they move out because they can versus perhaps saving/investing/upgrading education.

The problem with making bad decisions in your 20s is you can’t get the early advantage of things starting to compound for you financially. I’ve been to Europe 6 times (each time for 1 month+) between 21 and 30 so I am not promoting living like a hermit by any means but buying an Audi A3, dog, $5,000 mount bike in your early 20s when you could go back and get a master’s degree which may push you from a $75k to $100k VIHA job for life is a questionable financial decision. The one that always gets me is when people buy crappy rental restricted condos in their 20s and then they face a huge problem when they want to upgrade to a home and the condo market sucks and they can’t rent out the condo…..how can you possibly not think ahead more than 5 years?

I truly respect people like Marko who immigrate here and inadvertantly show us how lazy, dumb and entitled we are 🙂

Dasmo, I thought you bailed in Jan.

Glad to hear you held some.

Hope your friends don’t read this blog. I was successful early on starting before I was 23 but didn’t feel the need to trash my friends decisions. Some of them had success later on so in the in end it didn’t matter. You’re only young once.

I didn’t have a silver spoon or mommy’s basement to live in til I was 25 so had to work harder. Once the market eventually corrects or crashes your friends may have the last laugh. Keeping score is a fools game when life can throw you curve balls in a flash.

The tough market for buyers is a just a punchline for our trollish bulls, but I know real people who are losing sleep because they see their choices suddenly narrowing — for reasons that are hard to explain. The lack of sympathy is mildly sickening; are you like this with people in real life?

I personally feel sympathetic towards people who have had legitimate poor luck in life or health problems; however, many of my friends making good $ (they qualify for 500-600k) that are being priced out as the market skyrockets with Oaklands bungalows now going for 750k made piss poor life/financial choices which has put them in the exact spot they are in right now.

I remember when I was 21 yrs old, working at VIHA at the time (respiratory therapist ~ $75k job with a tad of overtime), I had a BBQ at my parents’ house that summer (2007) and invited a bunch of VIHA friends. Pretty much everyone that showed up had bought a new car after graduation, moved out and rented places, dogs (what’s that like ~ $2,000/year?) and maxed out on the 75k/year lifestyle. I continued living at home until 25, no dog, while my friends went skiing on weekends I went to Vancouver/UBC to get my masters. While friends were buying new mountain bikes I was loading up on shares of Coastal Contacts for five consecutive years until the company was bought out. I took a calculated risk in quitting my VIHA job to do my own business, etc.

Instead of buying a 800 sq/ft condo I liked 6.5 years ago (which I had the means to do so), I bought a cheap 530 sq/ft condo I knew would make for a much better rental investment when I had the means to move on to something else. aka thinking forward.

Do I feel bad that now I have a new house and I sleep like a rock collecting over $6k/month from my 5 tenants and some of my friends can’t afford an entry level home? No, I don’t. It is not like anyone gave me anything for free and no I’ve never used CMHC insurance for any of my purchases.

And also an observation….none of my friends are making any sacrafices with the recent run up in the market. Everyone is still going skiing to Whistler and living the same lifestyle 🙂 I don’t see any, “let’s clamp down for a bit and buy a house first.”

That’s my two cents.

I’ll probably be more symphatetic towards a younger crop of buyers in 5-10 years who can’t afford a SFH depsite solid financial choices.

4938 Lochside – 900k. Purchased in 2011 for 845k.

$751,875 for the Oaklands bunaglow….that is just insane. My parents bought their bunaglow two blocks over with the same west facing yard for $180k in 1996 🙂

One of my clients that I helped buy a home 4 years in the core ago emailed me today that they had 120 emails for their $800/month suite (small but nice)….wtf?

Hi househunting!

Yes we both are out of town first time buyers, but we have lived here over a year so technically would say we are local buyers.

Speaking of seadrill…. It was up over 120% just today! So at least I was right not to sell at the bottom! Will be interesting to see if the market continues its rally next week. If it does expect more. As we can all see now buying begets buying…

Wow… 750k. Crazy. Successful flip that’s for sure.

It was listed for that but sold for $508K or so. It does have 3 beds on the main which isn’t common for that era in that location, but still…750k seems high.

2612 Asquith sold less than a year ago for 469k (I think). It was renovated and legally suited but that did not cost $280k. Someone did well.

I’ll steal one of Marko’s daily over ask reports…2612 Asquith goes for 750k, 100k over ask. Gotta be a record for an Oaklands bungalow.

Curious here if people think that buyers are getting value for their money? Does it matter?

Personally I just shake my head when I see a crap property go for 800k+ and count my blessings I’m not that guy holding the bag.

@BRowlinPoodle – we’re in a similar situation, moved out here last summer from the big smoke – putting us both as out of town first time buyers. My advice would be to broaden the search outside of Oak Bay or Fairfield. Oak Bay / Fairfield is a feeding frenzy right now and IMO very poor value for the price point.

@fireecology1 – I’m not Marko, but 1215 Duke sold for $785K (one can find on an agent’s website by Googling address). We saw Duke at an open house: had a nice view but kind of a sombre atmosphere and possibly top floor was added at some point (major renovations to original structure make me nervous).

I don’t know about Lochside. We never saw it in person, but it looked like good value for size. We didn’t know what we’d do with all that space and still a little above our price range.

The Airbnb theory is interesting. They say there are over 300 whole house rentals in Victoria on that site so it will certainly take away units that previously would have been rented or sold

Business is business introvert. I can’t have a prime suite renting for below market value!

But no it’s all good. We do part time daycare, part time with her.

Trust me, I worked as hard as I could to depress property values!

(We joked that if the sellers didn’t accept our offer and held open houses, we’d have to post “So, you have bedbugs” pamphlets on the fridge.)

Here’s a question I was curious about: do private sales show up in VREB figures or other aggregate data?

Tell me your MIL is not now living in the Tent City, Leo.

Given how many HHV readers have bought in the last year I think the run up was entirely made on this blog. Everyone blame mooselessness!

I like how up island is all backwoods lazy and uneducated. Someone is going crazy with the label maker.

I have to admit I’m feel a bit startled by the pace of appreciation. Remember the good ol days when Leo s and patriotz were still holding out?

Airbnb is being seen as one of the many reasons for a shortage of long term rentals in Vancouver and probably in Victoria too.

What I would like to see is the purpose built hotel/motel taxes and their property taxes reduced so that the hotel/motel chains can undercut airbnb’s rates. Putting the airbnb’s out of business. Then these condo owners would have to rent to long term renters.

The hotel industry should refuse to remit the hotel tax, until the Legislature solves this issue of unfair taxation.

Don’t worry VV. I’m an equal opportunity deleter. I just have work to do during the day so I can’t get to every post right away. All opinions welcome, but let’s stay on topic at least somewhat.

Marko –

Can you tell me how much 1215 Duke and 4938 Lochside sold for?

Many thanks.

Um, I’m not that offended by VictoriaVV’s chest-thumping. It adds….some colour, keeping things fresh. I don’t find it that useful, but I don’t find other poster’s long rants that useful either.

But I didn’t see anything ‘crazy sexist’ in Bman’s latest screed.

I certainly feel Victoria / Vancouver island is ONE of the best places to live on the planet… having breathing issues lets you feel it in a real way…

Simmer down folks. I’ve had to delete a few posts that were 100% useless.

It’s friday, it’s going to be sunny at least one day. Cheer up!

Promises, promises. We’ve heard that before….three times at least. I heard there’s a houseboat on Dallas up for sale real cheap. Better get on it.

Long time reader first time poster. We are originally from Ontario, and have been looking for an affordable house in Oak Bay or Fairfield near the water for some time now.

With prices going up so quickly, we are expanding our search areas away from the water and even looking further north. There is quite a lot of affordable housing still in Victoria compared to Toronto, so we are basically ready to pounce and bid on a place that we feel will be our new home in retirement.

This weather is amazing, sun rain flowers everywhere, beats Toronto any day. One quick note is that our Toronto house is up 12% again in Feb alone, we are waiting to time that market as it it rising much faster then Victoria.

Don’t worry Jerry, I’ll soon be gone, leave you alone with the negative nellies, I guess the saying misery loves company is true.

Is there an app that will filter gaseous twaddle? Or maybe just one which will excise posts from people who have too many “V”‘s in their handle? Up until a week ago this was a pleasant place to hang out.

One trend I’m hearing about via the grapevine is Vancouver boomers pulling out a very small amount of equity out of homes in Van in advance of selling, and buying condos here in Victoria. The goal is to buy a place to move to before staging the Vancouver house.

Long term they plan on buying the dream home in the good areas, and rent the condo out via Airbnb.

This would explain the very fast absorption of condos available on the market.

Vancouver home sells for more than $1M over asking price

http://www.cbc.ca/news/canada/british-columbia/vancouver-real-estate-over-asking-bellevue-point-grey-1.3476617

Shit VictoriaVv is making my new horns shrink… I might devolve back into a Halibut….

I don’t think any disparaging comments stem from you being a woman VictoriaVv….

I’m glad you’ve noticed. Also, I suspect we’re very close to each other in age.

A very Mustachian sentiment! But I’m confused. I thought your mother-in-law lived with you guys and looked after your (at the time, one) kid while you were at work. Please tell me you didn’t evict your mother-in-law.

Let’s be honest here. Victoria is absolutely NOT the best place in the world to live. It’s one of the worst no question. It is probably one of the better places in Canada to live. I still find it hilarious that Canadians see themselves as “modest”. Nothing but a bunch of pompous boobs.

Think of all the poor guys not getting any while they go through this horror show.We’re talking months ! Fighting through crowds of rampant bidders waving fists of dollars. Scouting the competition in the herds for signs of wealth and bigger check books.

Talk about a love life killer as the wifey fumes about losing out on ANOTHER bidding war. It’s like a bad B grade movie. Then again, one pompous owner may not be getting any either. 😉

There is plenty of research to suggest that luck is a major component of success. Rags to riches is the exception.

VictoriaVV, I don’t know if your attention span is sufficient, but this is a pretty good, plain language book about that very thing:

http://www.amazon.ca/Outliers-Story-Success-Malcolm-Gladwell/dp/0316017930

Agreed. Similarly, if you recognized the opportunity a month ago in resource equities, you could have bought quality canadian mining & energy companies that have since tripled.

And even though Leo studied the market, I bet it was still somewhat difficult to buy his family a house in 2013 when no one else was buying. I admire people who take risk and seize opportunities.

from the last thread… RE my future landlords rental house burning down…It was a nightmare for them and a number of years to resolve…. They are fine and have done well with their multiple real estate holdings. My point is property is also a liability. Simply piling up a highly leveraged collection of property has risks beyond the basic financial ones of the market, rates and your own personal income stability.

Hahaha I love baiting haters, always it’s some outside luck that makes other people rich… Easier to tell yourself that to justify your position in life 😉

Begrudging others for taking on more risk and gaining greater rewards is a waste of time.