The Spaghetti West

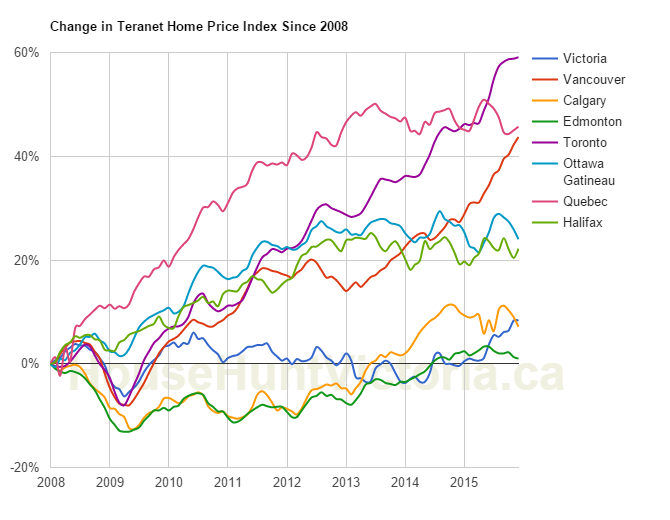

As we know, Victoria has long been a laggard compared to the rest of the country when looking at prices movements since 2008 when we first started peaking out. Even with the recent price surges, we are still only 8% above the level of 8 years ago. A truly miserable rate of appreciation that puts us near the bottom of the heap in Canada, while other cities have appreciated anywhere from two to six times as much.

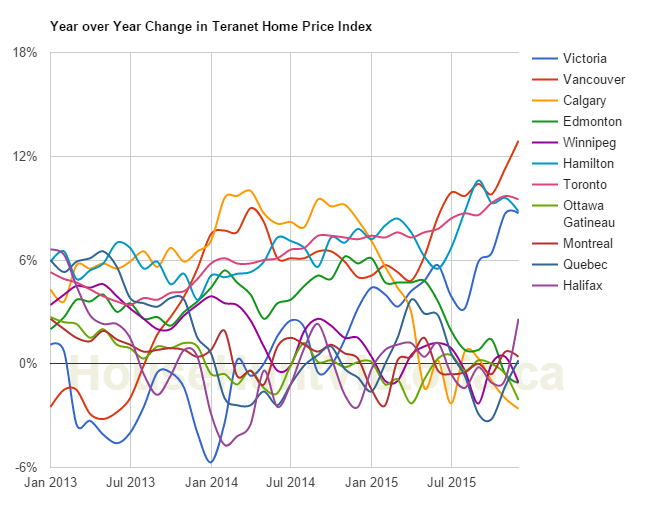

That’s the wide view. But what’s going on recently? Looking at year over year price changes, we see the spaghetti of price changes gathering into groups. Across most markets, prices are stalling out or falling. Calgary, Edmonton, Winnipeg, Ottawa, Montreal, Quebec, and Halifax all have converged around the big zero and are going nowhere.

Meanwhile Toronto and Vancouver are going stratospheric, and Hamilton and our own Victoria are being sucked into their vortex. When those two markets correct, will we get sideswiped as well? The thing about corrections is, they tend to over-correct, and while I don’t see large risk in Victoria’s market, the capital of risk is just across the straight.

Also a Monday stats update courtesy of the VREB via Marko Juras.

| February 2016 |

Feb

2015

|

||||

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 165 |

542

|

|||

| New Listings | 307 |

1108

|

|||

| Active Listings | 2472 |

3480

|

|||

| Sales to New Listings |

54%

|

49%

|

|||

| Sales Projection | 660 | ||||

| Months of Inventory |

6.4 |

||||

Sales still running near 40% ahead of the first week of February 2015, although the family day might confuse that a bit.

Now that I’m back in town and not wanting to kick out the tenants nor live too long in my basement suite I am experiencing the rental market. Brutal…. I am no longer a Halibut. I am bullish on house prices in Vic. Rents are going up if you can get a place, the inventory sucks, there is a lot of competition and it’s near impossible to find a full house. They always neglect to clarify its not actually a full house for rent… It’s easier to buy… It’s just how much are you willing to overpay….

I wonder if we’re going to get more commercial in Gordon head. Outside of Township it’s a wasteland. I heard that the church might be developing some of that land.

Real estate markets are going stratospheric as job quality in Canada continues to fall:

http://www.theglobeandmail.com/report-on-business/economy/job-quality-in-canada-sinks-to-all-time-low-cibc-index-shows/article23303996/

And BC hourly wages fall 5% in 2015.

http://www.theglobeandmail.com/report-on-business/economy/canada-average-wage-declines-led-by-resource-rich-provinces/article28715838/

To the site admins here, I really like the five minutes “Click to Edit” feature. Kudos!

I’ll have to check out that new Red Barn soon. Unfortunately it’s no closer to me than the Mattick’s Farm location.

Speaking of grocery stores, Pepper’s in Cadboro Bay Village is my go-to place. It’s fantastic and has lots of organic food. For Good Measure, the bulk food store right beside it, is similarly excellent. I like to support local business, so I don’t mind zooming the short distance from Gordon Head to Caddy Bay.

Don’t mind bearkilla, he’s hurting bad from all those oil stocks he loaded up on a couple months back. If he read the many Province investigative articles the past few months he would see there are multiple fraud cases before the courts. By the sounds of the reporter’s tweets the real estate board is ignoring the problem and is in damage control. Where there’s smoke there’s fire.

By the Sea, by the Sea, by the beautiful Sea. Sidney

A quaint little Hamlet encompassing 5.1 kilometers squared, set along the eastern shore of the Peninsula known for its book shops, sunrises and retirement lifestyle. A population of 11,200 living in some 5,800 dwellings. Which is about half the density of Victoria.

There are about 23 houses for sale ranging from a low of $436,000 for a 30 year old retirement rancher to a high of 2.4 million for new waterfront homes. On average for the last three months, 7.3 homes have sold each month. Ranging from a low of $400,000 to a high of $900,000 with the median price paid at $492,000 and a median exposure of 12 days on the market. During the same time period another 17 homes were listed.

MOI 3.5

NLS Ratio 22:17 or 1.3 new listings for every home that sold

DOM 12 days

$492,000 will get you a well maintained 30 year old,1,300 square foot home on a 6,500 square foot lot just off of runway 27

The median price for the last 90 days was $492,000. The median price for the last 90 to 180 days was $489,000. The median price for the 90 day period one year ago was $447,000.

This would be considered a bullish market that favors sellers with prospective purchasers having little negotiating power in price and terms. Prospective purchasers are paying between 91 to 131 percent of the assessed value depending on condition. Most purchasers are paying about 107 per cent of the Property’s current BC assessed value.

Which is far better than Oak Bay where buyers are paying 128 per cent of the assessed value or Saanich East/Victoria at 114 per cent. Making Sidney good value for the money relative to some parts of the core districts.

Nice strawman bearkilla – could you be a little less obvious?

Yeah ONE CASE is a huge unraveling and surely indicates that the entire industry MUST be fraudulent

Looks like the tip of the BC mortgage fraud scams are beginning to unravel. I expect to see many more in the coming days.

Surrey mortgage broker ordered to ‘cease and desist’

Ranminder Kaur Gill’s realtor husband under investigation for recommending unregistered broker-wife

B.C.’s Financial Services Commission (FICOM) issued a cease and desist order against Ranminder Kaur Gill last month after she allegedly advised an undercover investigator to lie on a mortgage application.

“This conduct demonstrates a willingness to deceive lenders when submitting applications to them,” the order says.

“Not only are lenders put at risk of providing mortgage funds based on inaccurate information, but borrowers may find themselves in a mortgage they cannot afford.”

http://www.cbc.ca/news/canada/british-columbia/surrey-mortgage-broker-ordered-to-cease-and-desist-1.3444572

How is Sidney doing price-wise?

Condominiums with age restrictions are still taking a bashing in Victoria. A third floor condo in Fairfield selling this week for $50,000 less than when it was purchased in August 2009.

40 years ago, age restrictions were seen as a way to keep prices up in a strata complex. As retirees did not want to have children playing in the hallways or babies crying in the middle of the night. That was back when Victoria was a place to retire. When retirees moving to the city outnumberd those moving to care facilities, up island or their final resting place being a jar in someone’s closet.

In 2015, condos in the core without age restrictions outsold condos with age restrictions 2.5 to 1 and for 17 per cent more.

Anyone else not seeing the reply comment box on the mobile site periodically?

For those cheering on the ridiculous price gains of late and pray nightly for Vancouver prices, you need to fathom the future of Victoria. You can’t get a family doctor of any quality in this town and it’s only going to get worse as it reaches into other sectors of high demand professions.

A crisis in Vancouver: The lifeblood of the city is leaving

“For many young adults, however, the city increasingly represents a place of which they no longer can afford to be a part. Consequently, Vancouver faces an almost existential threat; what happens when the lifeblood of any community, those in their 20s and 30s, decide to leave?”

“Vancouver risks becoming an economic ghost town, a city with no viable economy – other than the service industry catering to wealthy residents and tourists,” Mr. Holmes wrote.”

http://www.theglobeandmail.com/opinion/a-crisis-in-vancouver-the-lifeblood-of-the-city-is-leaving/article28730533/

There may be some relief from higher prices in some areas of Victoria.

Higher prices have led to slowing sales in the more expensive hoods of the core which is adding to unsold inventory, increasing months of inventory and days to sell in the upper income hoods.

That won’t be much help for those wanting to buy in the core’s middle income hoods as prospective purchasers continue to bludgeon each other with their check books.

But not everyone is caught up in bidding wars. Prices in Langford and Colwood have remained reasonably stable over the last 12 months.

Condo prices have remained stable in the city and may be declining in the Westshore.

Unless you’re a masochist bent on financial humiliation, this may be a market just to sit back and watch as the middle income market implodes. Because I doubt that anyone who can afford a home today, without resorting to high ratio financing, is going to be priced out of the market in the near future.

https://youtu.be/6EuAZsz_z_U

Prices down nationally in January.

“In January the Teranet–National Bank National Composite House Price Index™ was down 0.1% from the previous month, a second consecutive monthly decrease. A January decline has happened only three times in 17 years. For the first time in 11 months, prices were down on the month in seven of the 11 metropolitan markets surveyed

Prices were up in January in Hamilton (+1.0%) Vancouver (+0.9%), Victoria (+0.7%) and Winnipeg (+0.3%). For Vancouver it was the thirteenth consecutive month without a decline, for Victoria the fifth.”

Red Barn has the best bacon, but it can be on the pricey side. That’s a stretch a small grocery store is going to push up real estate prices, but I guess if you live in that hood that’s want you want to think will happen. Out with the poor, in with the rich, so much for the diversity of Victoria.

“I think the Jubilee and Fairfield/Gonzales neighbourhoods on either side are going to experience a bump up in values due to gentrification.”

“Gentrification is a trend in urban neighborhoods, which results in increased property values and the displacing of lower-income families and small businesses.”

Cadboro Bay sold for $780,000.

@Marko – Do you know the status of the 2747 Cadboro Bay Road listing?

266 Beechwood listed for $599,888 with offers being presented on Monday at 4:00 pm. Will be interesting to watch what it goes for. Listed in 2014 for 303 days at $579,000 before the listing expired.

Red Barn is awesome and open already. Been there several times. And their hours are great 5:30am to 9:00pm. Plus they hired one of the kids 🙂 Not sure what they have on for Saturday but I bet it is busy – changes the whole feel of the neighbourhood. That stretch between Foul Bay and Richmond on Oak Bay Avenue is really changing. I think the Jubilee and Fairfield/Gonzales neighbourhoods on either side are going to experience a bump up in values due to gentrification.

2000 GDX of a partial load ? Sorry Mike, we can’t hang, you’re out of my league, that’s Union Club levels, not my crowd. Good to see you …or shall I say “we” finally made some money though. Will make up for those other 20 stocks you’re down on. 😉

Global Stocks Slide Into Bear Market Amid Oil Rout as Yen Jumps

http://www.bloomberg.com/news/articles/2016-02-10/dollar-nurses-losses-on-yellen-rate-comments-oil-back-below-28

totoro, you must be getting excited about the Red Barn’s grand opening in Oak Bay!

Btw Hawk I think you’re better off in large cap than the juniors (if you’re still in) when you add this spring… for instance notice how much better GDX has performed than GDXJ since Jan 19. I sold 2000 of my gdx shares this morning…best to start taking a little off at key levels.

“Amazing how some of the biggest companies like ABX have more than doubled lately.”

Actually none have “more than doubled” the last month or so, more like 70% tops for a few of them. The well managed juniors will be doing 10 baggers at this rate. Liking my double so far and the news hasn’t even started. 😉

Come on Hawk buddy, we bugs have to stick together. I still think you & I could become good pals.

btw the correlation I was referring was with Van prices… after all it makes sense as it is the gold mining capital of the world. Amazing how some of the biggest companies like ABX have more than doubled lately.

Food for thought on why buying over priced real estate right now could be the worst mistake of your life. Wonder why gold is up over $60 today ?

Why the next recession could be different — and far more dangerous

“There are other apparent proof points to the developing recession story, and you can see a bunch of them when you look at credit spreads — the yield difference between corporate bonds and government bonds, which provides a measure of the premium bond buyers demand to take on the higher risk over benchmark.”

“Bond spreads are, in short, widening. In other words, investors are demanding a higher premium, suggesting a perception of higher risk.

The troubling bit is that this is happening not just in riskier corporate paper (like high-yield debt, especially in the U.S. energy sector, which built up during the oil boom years), but across the wider spectrum of credit.”

http://business.financialpost.com/investing/investing-pro/why-the-next-recession-could-be-different-and-far-more-dangerous

Gee Mike, I thought you said you hated gold a month ago ? It’s just getting started as the global recession kicks in. Glad you like the GDXJ chart you posted back then saying gold is dead. Next thing you’ll be telling us you sold your “transient” rental. 😉

Speaking of parabolic… Hawk old buddy, we be loving the miners past month. I’m taking a little off today for the short term, but looking good for the long haul.

The potential relationship between real estate regulation and provincial campaign donations:

https://twitter.com/INTEGRITYBC/status/696830322361503744

Just Jack, that has to be one of the dumbest things you’ve ever written — and you’ve written a lot of dumb things over the years.

Other Canadian cities got new highways, dug sewers and added jobs during that time, and their prices didn’t do what ours did.

In the end, the only person that can decide is you. Without knowing anything about your finances, where you want to buy, what type of home, the best anyone can do is guess. So here goes:

The market out there is absolutely miserable for buyers as you well know. It is insane, you get no chance to contemplate a purchase, and you will be paying ask or over in many cases. You may have to forego an inspection or financing conditions or compromise on closing dates to please the seller. Essentially you have about zero leverage.

That said, I still think it’s not a bad time to buy. Yes last year was better, and the year before even better. But overall we have been pretty close to flat for close to a decade. Risk has gone out of the market with real house prices declining, rates decreasing, and incomes increasing in that time period. Maybe the increase in lower mainland buyers is driving a bit of the market, but overall it’s locals buying that has caused the recent activity.

It could correct. Vancouver could collapse and hit us as a side effect. Or it could not and we could have another year of strong price appreciation. Hot markets always end, but they might not end anytime soon. We saw in the mid 2000s how they can continue for quite a long time. Personally I would not risk waiting out this market if you can afford to buy.

Make a list of the absolute must haves, must have-nots in a house, but stay flexible on the rest. I think the houses with a suite in the core are overheated right now. I would look at a different segment. Maybe a smaller rancher if you can make it work? Maybe up the peninsula a bit? Make sure you can stay there for at least 5, preferably 10 years and make sure you can still pay the mortgage at 6%. Otherwise remain open to different options even if not quite as you envisioned and look at maybe a weaker part of the market. Good luck.

Absolutely correct. Starting in 2008 doesn’t take into account the previous outperformance. I had the charts from 2003 and 1999 on the old site.

http://househuntvictoria.blogspot.ca/2013/12/november-numbers-and-another.html

58 SFH sales in the core since February 1st, 2016.

Average List Price – $781,251

Average Sale Price – $783,175

The snowbirds profits will be going into their bank accounts as stats show savings are increasing. Most will not be buying overpriced west coast real estate with a recession looming.

They will be preserving cash for life emergencies that may require 50K knee operations in the US because they are tired of waiting 2 years for a simple operation but are in major pain.I know several that are in this predicament.

Houses are not the be all end all to a happy retirement, having cash to survive it is.

I know a few snowbirds who have rental properties in the US and they’re just keeping the US profits for their US travels. No plans to sell out, only wishing they had bought more.

The main reason Vic fell from 2010-14 was all of us were buying US instead of Vic. Now we’re starting to sell US homes that have more than doubled after currency exchange, and buy Vic. The boomer bulge is turning 56 this year and the ones escaping winter will once again be choosing our coast over the US.

http://www.cbc.ca/news/business/snowbirds-loonie-real-estate-1.3425322

I do think it makes good sense to buy during long periods of flat as the risk diminishes (assuming for inflation) For example, buying during 1998-2011 and 2012-2014.

My experience is trying to time the market is not a good strategy if you want to be a homeowner. Buy the best house you can when you are ready and have the down payment and financing in place and do plan to be able to hold through a rise in interest rates and any downturn.

+1. Impossible to predict the market.

Our inflation in prices began earlier than most cities because of the massive economic injections of capital from highway improvement and sewer extension that opened up new areas of housing creating jobs.

Housing prices peaked sooner than the rest of the country but flattened out because of low household income growth over the last several years.

Mind you, Victoria experienced exceptional appreciation in the handful of years prior to that eight-year window, appreciation that exceeded — with few exceptions — every other major city in Canada.

Apparently, only Vancouver prices can appreciate steeply forever.

You and your partner should sit down and write a list of what you want in a home. The age, house style, house size and lot size and other factors.

Then you can start shopping around for the homes in different locations that meet your budget and trade off lot size for a better location or age for price, etc. But first you need to know what kind of house you want and will be happy living in for the next decade or more.

Otherwise you’ll be bouncing around looking at anything in your price range and settling for less house than you’ll need for the future. And no matter what price you pay, that house will always be one you’ll hate to live in because it is too small, too old or in such bad condition that you can’t afford repairs.

Today there isn’t very much on the market in the core districts but that will change and you will have a better selection. These shallow and dysfunctional markets do not last forever and history has shown that prices decline after periods of irrationality. All that is needed to bring prices down is for the months of inventory to return to a normal balance in the three to five month range.

Your fear is that prices will continue to rise and you’ll be pushed out further from the core areas. Or that you will be priced out forever in certain locations. That causes people to panic buy which I am seeing today.

Buy in haste repent at leisure.

Van went parabolic 2010, 2013, 2015… I’m just guessing the next parabolic move up after this one will be around 2017/18. But I do think it will correct (like ’14) or at least move sideways for a while before the next step up.

I agree, but if you are having doubts about it and feeling pressure to buy I’d keep renting.

Mike,

It already has gone parabolic, you’re using an old chart once again. Try Garth’s chart from the other day that continues straight up after yours ended.

totoro,

If people knew they were having a relationship breakdown, they wouldn’t buy. Trying to avoid it is a bit ridiculous. Of course a down market causes relationship breakdowns which is unpreventable so plan your divorce accordingly. 😉

My experience is trying to time the market is not a good strategy if you want to be a homeowner. Buy the best house you can when you are ready and have the down payment and financing in place and do plan to be able to hold through a rise in interest rates and any downturn.

Housing has historically appreciated at about 4% a year. There may be a drop or another long flat period to even out gains, but prices will eventually recover. In the meantime, you will have perhaps saved more, built equity and may also benefited from appreciation which could allow you to sell and buy a different home in the future if you want to.

The main thing to avoid if possible is buying if there is a reasonable prospect that you would have to sell in a down market, usually through a relationship breakdown.

My guess is Van gives up a couple hundred thousand later this year and consolidates before moving much higher, similar to what it did in 2014 after its parabolic run of ‘13. Love the spaghetti charts.

http://www.mikestewart.ca/wp-content/uploads/2015/07/June-2015-Real-Estate-Board-of-Greater-Vancouver-Price-Chart-from-1977.png

I would like to own a house. I’ve been renting for ages and have been waiting for the “right time” to buy in Victoria. I have missed opportunities in buying in neighbourhoods which are now over my budget.

I wonder what all ya’lls take is for a first time buying looking to spend less than 500k on a home. Is buying now while the interest rates are low a good idea, or waiting longer to see if there will be a correction in housing prices in Vancouver,big or small, that may spill over to Victoria. But if there is a correction, won’t it be from rising interest rates? Would I just be better buying a house now keeping in mind my mortgage may be at 6or7% in 5 years?

Thanks. Live versions are at the bottom of this page https://househuntvictoria.ca/stats/

Still working on a few things to make embedding them into regular posts easier.

Fixed. Projecting the first week is always somewhat dubious. 40% over last year would be 758 which seems too crazy to even post for February (highest ever was 707 in Feb 2007), so I just did straight linear estimate based on sales pace of 33/business day for the month.

If sales for week 1 are ~40% above last year why is the projected sales for the month so much lower than last year?

Awesome graphs