What happens in the spring?

A few times now the point has been brought up that buyers are better off waiting until the spring if they want to buy. The theory is that more listings will come on the market in the spring, and you won’t be fighting over the scraps that are left over by the winter.

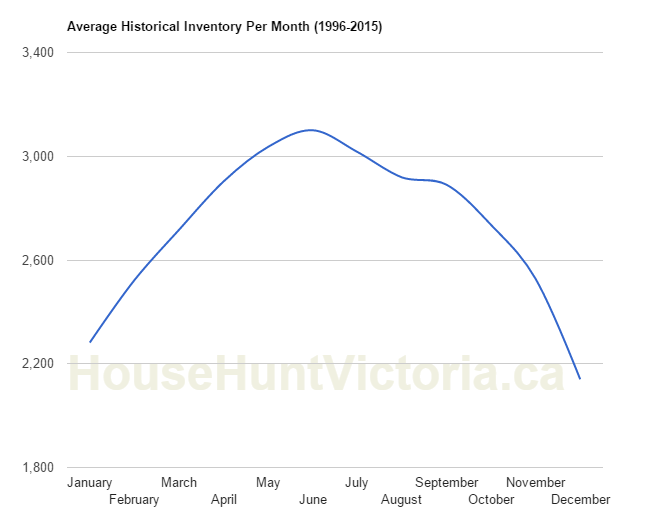

It’s undeniably true that the spring brings more listings, as we can see by looking at the last 20 years of data.

Sure enough, inventory usually increases by some 50% from January to the peak in June. So most definitely you will have more to choose from as the spring market develops. If there is nothing at all you want to buy out there, then that’s really the only choice you have.

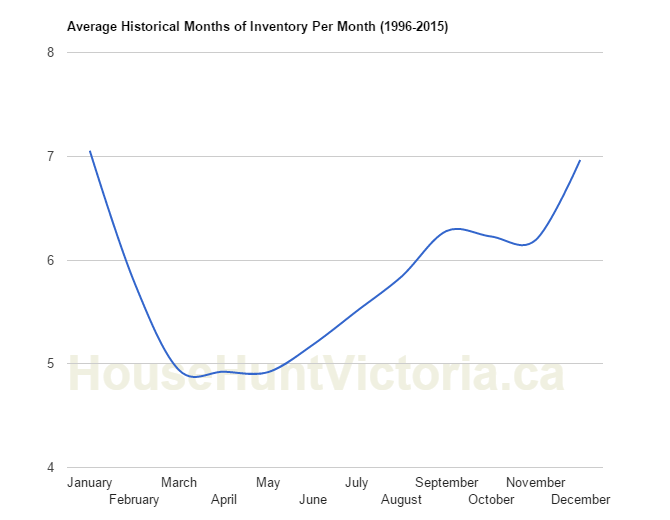

But does more inventory actually mean the market will be more relaxed? Well in the average year, the answer is no, and in fact quite the opposite is the case. January is usually when the market is slowest. There isn’t much inventory but there are even fewer sales, so the months of inventory reach a high point for the year. Every month after that generally shows the market getting more active, and tilted more towards sellers than buyers.

On average, the market drops from 7 months of inventory in January to only 5 in the spring. In other words, it goes from the high end of a balanced market to the edge of a sellers market. So unless this year is an exception (notable recent ones being 2010 and 2008), the market should heat up even further in the coming months. And given the absolute insanity of January, that is not going to be good for those looking to buy.

Spring will bring more choice but probably even more competition.

All this madness is not going unnoticed by the provincial government. The finance minister is promising a “double-barrelled” response to overheated housing markets in the budget coming February 16th. That is likely to come in the form of increased property transfer tax, because the best kind of crisis is one that can serve as an excuse for more taxes. And I’m sure that the people buying those $2.5 million dollar Vancouver crack shacks will suddenly back off at the prospect of an extra couple bills in tax. Luckily the measures – whatever they turn out to be – have been designed to be 100% ineffective from the start given that the dear minister doesn’t want to “degrade the equity of existing homeowners”.

In any case, when the state gets jumpy, times get interesting. This will be a spring to watch.

Forgot the link.

http://business.financialpost.com/news/economy/flashing-warning-signs-canadian-markets-bracing-for-dramatic-bank-of-canada-action-and-a-recession

For those who keep thinking the bottom is in and bleeding profusely from catching all those falling knives, it looks like a horror show coming that will eventually hit the west coast.

‘Flashing warning signs’: Canadian markets bracing for ‘dramatic’ Bank of Canada action — and a recession

“An ominous signal has been cropping up in the past month as corporate bonds and government of Canada bonds have seen their spreads widen, a move that usually precedes a recession. Meanwhile, yields on the five-year Government of Canada bond have begun creeping below the central bank’s overnight lending rate of 0.5 per cent. On Tuesday, they traded at roughly five basis points below that mark.”

“This is real. There is something going on here,” he said. “Usually one of the most powerful indicators is widening of credit spreads, and that’s happening not just in the energy sector, but also more broadly.”

Thanks Just Jack. Yes, I would definitely arrange my own appraisal if I needed an accurate reflection of market value. I appreciate the insight into the process.

The Purpose of the Appraisal was to estimate Market Value. The Function of the Appraisal was to assist in financing the Property. The Intended User and Client of the Appraisal was XYZ bank.

You’re simply the applicant. Although you may be paying the bank for the appraisal, the appraiser has to meet the requirements and guidelines of the lender. Sometimes those requirements and guidelines are not to your benefit. As far as the bank is concerned the appraiser has met the purpose and function of the assignment.. The report is then filed and no one else ever sees the report unless a court case arises. CRA or BC Assessment does not get a copy of the report. It is private and confidential between you and your lending institution.

You may wish to speak with the appraiser and ask him what his reasoning may have been for estimating a lower value than what your thoughts on price. The reason could be simply that there were not enough comparable sales within the last 90 days within your price range. And since the appraised value met the minimum value to assist in financing, it wasn’t necessary to develop a more in depth analysis that may have delayed the lender receiving the appraisal and possibly collapsed the deal. The appraiser sacrificed accuracy for speed. There is always a trade off between speed and accuracy in mortgage appraisals. As I’ve mentioned before mortgage appraisals are the lowest level of service in appraising.

You can have it good or you can have it fast – pick one.

If you want an accurate appraisal you need to hire the appraiser yourself so that you become the client. Never rely on an appraisal performed for someone else as the appraiser and that person may have had discussions that do not appear in the report.

You may call the appraiser and he’ll get permission from the bank to discuss the appraisal with you. Since the appraiser’s client is the bank he will be courteous and discuss how he achieved the value estimate but he will not negotiate on value.

Question! Should a person care if their mortgage appraisal seems low, so long as it’s above the value they need for the deal to happen? Does the appraisal have any other significance or value?

What some are calling a “hot market” is characterized by low months of inventory, low number of new listings replacing sold properties and low days on market.

Those same characteristic represents a shallow and dysfunctional marketplace leading to irrational bids on some properties in excess of market value.

Historically what has happened in the Greater Victoria market is that prices decline immediately after this irrational period. So some of those buying today will find their homes to be worth less in the future even if the market were to just stabilize.

A prudent lender should reduce the quantity of mortgages approved as the market transitions into this buying frenzy to protect its shareholders from potential losses and its depositors from higher banking fees in the future. Or lenders could reduce the interest rate discount they give to those buying in “hot spots” thereby increasing the bank’s revenue.

CMHC, Genworth and Canada Guarantee could do the same simply by monitoring the market and reducing or increasing the number of approvals by postal code or charging a higher premium in “hot spots”.

The Months of Inventory for the remaining areas of the core districts which are Vic West, Esquimalt, View Royal and Saanich West is around 2 months with some 85 houses for sale. Asking prices ranging from a low of $320,000 to a high of $5.4 million with half the homes listed between $320,000 to $590,000.

In the last 30 days another 49 homes have been listed for sale. That’s a ratio of one home listed for every one that sold. Half the homes selling in the last 90 days between $310,000 to $555,000. The median exposure to sell a home is 38 days on the market

$555,000 would be a 50 year old, 2,000 square feet home on a 7,400 square feet lot in Saanich West

The Months of Inventory for Victoria Proper, Oak Bay and Saanich East is under 2 months with some 145 houses for sale. Asking prices ranging from a low of $399,000 to a high of $15,000,000 with half the homes listed between $399,000 to $950,000.

In the last 30 days another 69 houses have been listed for sale. That’s a ratio of half a house being listed for every one that sold. Half of the homes selling in the last 90 days between $340,000 to $685,000. The median exposure to sell a home is 17 days on the market.

$685,000 would be a 60 year old 2,200 square feet home on a 7,300 square feet lot in Saanich East

The Months of Inventory for Langford and Colwood is over 3 months with some 170 houses for sale. Asking prices ranging from a low of $300,000 to a high of 1.9 million with half the properties being listed for sale between $300,000 to $525,000.

In the last 30 days another 103 houses have been listed for sale. That’s a ratio of two new listings for every one property that sold. Half the homes selling in the last 90 days ranged between $325,000 to $530,000. The median exposure to sell a home is 57 days on the market.

$530,000 would be an eight year old, 2,400 square feet home on a 7,000 square feet lot in the cities of Langford or Colwood.

Tue Feb 9, 2016 8:25am:

Feb Feb

2016 2015

Net Unconditional Sales: 165 542

New Listings: 307 1,108

Active Listings: 2,472 3,480

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Vancouver Realtors are about to feel the heat for the crazy activities in the Vancouver market. Gotta blame someone…

http://globalnews.ca/news/2505021/some-b-c-real-estate-agents-laundering-cash-ndp/

I also find it interesting that the lots in Blenkinsop are likely to be $600,000 starters on 8000-10000 sqft once Alberg property is developed…(I assume the developers are expecting land prices to escalate)…

That is pretty much what they are worth today actually. A few factors that push these up would include..

1/ Large at 8,000 to 10,000 sq/ft.

2/ No old house to tear down.

3/ Services will be in place.

4/ Premium to be in a controlled subdivision versus on a street surrounded by old home.

Fort Mac has 40% plus potential , buying at 20 % is way too early. Credit markets are looking scary again with gold on a nice roll. This just the start of another market cleansing. BC real estate is next.

Maybe, or it turns out that the oil in the oil sands will not be economically feasible to extract again. For another year or two the price will probably be too low. After that it’s only a matter of time before other technologies reduce dependence on oil, and the first oil to be abandoned will be the hardest to extract. Already they are finding it impossible to build pipelines to get the oil out. That will get harder every year.

The sudden negative attention the Vancouver agents are getting may be the catalyst that breaks the camels back. How can you be a buyer in this market not knowing you may be the next sucker that overpaid by hundreds of thousands. All BC agents will be getting scrutinized from here on in and long overdue.

Interesting graph at the end of this news article. Apologies if someone already posted this… I don’t read everything on this site:

http://globalnews.ca/news/2504112/interest-rates-alone-cant-safeguard-economy-bank-of-canada-says/

On a brighter note, Australia is bouncing back strongly after a soft patch. Melbourne’s price forecast for 2016 is for 8-13% growth.

http://www.afr.com/real-estate/sydney-melbourne-auctions-bounce-back-20160207-gmnkpw

Great time to be buying in Alberta, especially Fort Mac.

Why Albertans are starting to walk away from their mortgages

http://www.cbc.ca/news/canada/calgary/jingle-mail-alberta-housing-1.3430867

Prediction: Britain’s House Price Crash – 2016:

http://truepublica.org.uk/united-kingdom/britains-house-price-crash-2016-predictions-mount/

We’ve had some more significant rule changes that had no discernible effect on the market. I don’t expect anything noticeable to come from the graduated down payments.

I also find it interesting that the lots in Blenkinsop are likely to be $600,000 starters on 8000-10000 sqft once Alberg property is developed…(I assume the developers are expecting land prices to escalate)…

I don’t think the down payment changes will have much of an effect on the market under $500,000. This is a low budget for the core but fine for the western communities. Most likely there will be more homes on the market soon but prices will not be lower, maybe even a bit higher, and I think there are a lot of buyers out there right now.

Thanks for all the answers…

I guess I worded that poorly… I was referring to Supply… as in:

a) will there be less SFH offered under $500,000 vs buyers …(everyone scooping them up?prioritizing)

b) increased buyers? because they have tighter budgets?

c)people more reluctant to step up?

or are minimum deposits really only a marginal constraint in Canadian markets?

It sounds like the graduated down-payment is really a minimal inconvenience…

@db

I think that’s why the academics/realtors were predicting apts/THs will now start to outperform (after February), as SFH slow for a year like they did in Van 2014, after its 300k increase of 2013..

But there would be no change for a house under 500k… if you can find one.

No change at all. You will need the exact same 5% down for everything under $500k as you do now.

For a $999,999 home, you will now need $75,000 down instead of the $50,000 you would have needed previously. At 1 million you need 20% down as before.

There probably should be a rule against realtor’s buying their own listings. There is an inherent conflict of interest when you are advising on pricing and have an intention to purchase. The use of an independent appraisal signed off by the seller does go a long way to mitigate this, but if there are no current rules mandating this it seems like a problem.

As for the rule changes, 5% down will be required on the first $500,000, and 10% down will be required on the next $500,000. Pretty minor change given that most are not buying with 5% down anyway and first time homebuyers in most markets might not be too much over $500,000 (average is $293,000). It is estimated the rule change will only affect 4% of borrowers.

Does anyone have an idea if the down-payment changes will impact SFH in Victoria at the $500,000 or less level? ie make them obsolete? (or is it minimal impact?)

I think part of what is going on with these assignments is the market is out of control, not just ethics or lack of. Just last week I told a seller to list at X amount (based on my research and because I had a buyer in the area I had seen all the comparable first hand). Seller says, okay, we’ll give you the listing but we want to list at X amount + $55,000. They get a full price offer plus a back-up offer. I wasn’t trying to be unethical, just the market is totally nuts. That is why on attractive listings everyone is now delaying offers 3-4 days….there is a large risk of underpricing and that 3-4 delay brings it up to market price by allowing potential buyers to view the property and drive the price up via bidding war.

I’ve been involved in a few deals in recent years where I or friends/family have bought my own listing. I don’t think I would try to buy my own listing in the current market as I think the liability increases dramatically with prices are going up this fast. You might be offering the seller market value today but in three months when it comes time to complete the seller might be bitter cause the place across the street went in an insane bidding war.

This is how I’ve approached it in the past….

Make the offer subject to seller’s lawyer approval and the seller approving and signing an independent appraisal (or multiple appraisals). I always have the seller contract the appraisal company of their choice. Then I make the seller sign the appraisal and waive the subject. If the appraisal is substaintally higher than the agreed upon price the seller has the option of pulling out, or if they are just not happy with the appraisal period, could be lower too. I also waive 100% of the commission in these circumstances.

It has worked well in the past. Most recently a seller I did this with used me to buy a subsequent property so I take it they didn’t feel ripped off.

It seems that the assignments described in the article violate the ethical (not legal) premise that an agent should be working in the best interests of the client. The most egregious example would occur when the agent buys the place themselves – blatantly admitting that they knew the property was undervalued. I think it makes good sense for the gov to want rein in that sort of thing.

True. Being an inadvertent landlord I can now see the benefit of capital gains with minimal cash cost. It’s just that it costs something. In my case, $9k/year in true all in cost. In another 18 years it will be cash flow positive if I never build there 🙂

Hard to buy a property in Victoria that is cash flow positive let alone Van…

You can swing cash flow neutral based on 20% down on some properties in Victoria. Point is someone renting out a property in Victoria can hold out a lot longer in a down/flat market than someone in Vancouver who will be mega cash flow negative.

Hard to buy a property in Victoria that is cash flow positive let alone Van…

Ya, I agree Totoro. PTT on assignments isn’t the way to go. There should be enough tax on the transaction anyway since it should be taxed as income. It is an area to look at however. Correct me if I’m wrong but a lot of contracts only go in one direction. UP. So a presale buyer can’t sell for a loss to get out. It seems like it’s a logical mechanism intended to provide flexibility that has been perverted into a tool that benefits developers and estate agents.

In a lot of ways the 500k then larger downpayment more looks like a way shift money from SFH towards condo sales which will goose that market more and make thus make housing less affordable.

That chart is truly astonishing. I’m adding a prediction for 2016 which is that Garth might actually be right for a change. I can’t see Vancouver sustaining this all year and it seems impossible to recover gracefully now.

Another problem in Vancouver is that at these prices everything is pretty much cash flow negative if rented; therefore, I don’t think the hold and rent through a drop is a strategy that can be employed.

Hoarding is nothing new to our society. What is different is that the low interest rate and ease of financing over the last decade has made it possible for me people to try to corner the market.

Such is life. Those that aren’t hoarding have access to the same ease of finance.

LeoS,

Funny part is Garth isn’t calling for a crash just a correction that he seems to change in percentages all the time, which is kinda ridiculous when you see that chart. Guess it would upset his investor clients, and REIT’s and preferred shares he pumps as it would mean the stock markets will tank as well.

Vancouver is becoming nuts in every sense. I was on business in Vancouver recently and pulled up to a gas station to refuel. Across from me a 18-22 yrd old in pajamas filling up an orange Lambo Aventador. In front of me a BMW i8 (have yet to see one in Victoria).

It is very rare for an assignment to be needed during regular transactions where the motivation isn’t speculation as I’m sure Marko can confirm.

I’ve only been involved in executed condo assignments personally (on a side note, wholy crap are pre-sale assignment complicated these days…….I stay away from doing it if I can). I’ve had a few single family home buyers over the years be offered an assignment on a contract but it was never anything significant (like 10k to 15k) and they wanted the home to live in (not driven by speculation) so nothing ever transpired.

Condo assignments have many reasons (health status, relationship status, etc. can change of the course of 2-3 years, etc.) but I would agree regular transaction assignemnts are fueled by speculation, or the buyer gets smoked by a bus and the seller isn’t willing to release the other party/estate from the contract (rare).

That chart is truly astonishing. I’m adding a prediction for 2016 which is that Garth might actually be right for a change. I can’t see Vancouver sustaining this all year and it seems impossible to recover gracefully now.

All this talk for the past few days about penalizing foreign RE buyers is ignoring the agreements, laws, and treaties on reciprocity between countries.

https://en.m.wikipedia.org/wiki/Reciprocity_(international_relations)

This is the same data (provided by Marko) discussed in the last post here.

Citified looks like a good resource for those looking to buy new-build condos, although it would be more useful if it was a database of all floorplans and pricing for comparison between buildings. I guess the developers want to drive traffic to their own sales sites and not share that stuff.. Run by Mike, same guy as VibrantVictoria.

Oops, I see that totoro already posted that one article. Guess I should read before posting. My apologies.

Does someone need a hug?

https://youtu.be/1AfR8ITv7g4

This is an interesting website concerning Victoria real estate that I didn’t know about until today: http://victoria.citified.ca/

From the above’s News section:

Origin statistics quell concerns over foreign ownership of Victoria real-estate

http://victoria.citified.ca/news/origin-statistics-quell-concerns-over-foreign-ownership-of-victoria-real-estate/

Also:

Alberg family farm in Saanich’s Blenkinsop Valley sold to developers

http://victoria.citified.ca/news/alberg-family-farm-in-saanichs-blenkinsop-valley-sold-to-developers/

I really don’t know what can be done to curb the meteoric rise in prices without causing economic fall-out as JJ stated.

Incremental measures like increasing down payments, decreasing terms and increasing interest rates slightly can maybe help slow things without causing too much hardship, but if history is any predictor then maybe it has to burst or remain flat for a long time to keep pace somewhat with historical norms?

And I just don’t know enough about the Vancouver market to know if this is a bubble or a new high point like Victoria’s run up was. Will flat be next or will prices deflate like they did in the 90s? It is a risky gamble for people wanting to enter the market. Vancouver is unaffordable for families with median incomes who want to own houses with yards and don’t have trust funds. I don’t think I would have chosen to raise kids there if I was priced out. Maybe more Vancouver families will settle in the Okanagan and on the Island.

Fair enough. Probably not the best idea in the world. Just occurred to me that they might want to target speculation more directly, rather than just making higher priced homes more expensive which affects everyone.

My point is that attaching an additional PTT to an assignment is just bad policy.

I do not believe it will have the effect you are hoping for on the Vancouver market and it will have some unintended consequences in, say, Victoria that are not good for the market here which has no need of such regulation. Speculation will happen in any rapidly rising market and it is a normal part of the cycle – it will not be stopped by PTT fees. Speculation’s natural limit is risk. Engage in high risk behaviour and it is not going to work out a good amount of the time. And let’s not forget that the Vancouver homeowners that sold to speculator’s high benefited from a windfall to start with and made the decision to sell of their own free will.

Assignments serve a valid business purpose, including allowing an agent to act on your behalf and allowing you to sell a property that you have had a change of heart on prior to possession without penalty. I don’t see any need to regulate the Vancouver market specifically – it will correct as free market systems do. I do see a need to regulate taxation of off-shore investors that removes loopholes from PTT and income tax.

With what exactly? That making it easier to speculate in a market drives prices? That is pretty well accepted. There is a lot more volatility in markets where speculation is high.

Did anyone ever claim that? No. But they are used for speculation the vast majority of the time, either as described in the article, or when assigning condo pre-sales. It is very rare for an assignment to be needed during regular transactions where the motivation isn’t speculation as I’m sure Marko can confirm.

The problem is when the law has not caught up to a practice which is clearly negative.

What exactly are you trying to argue anyway? Do you think the market in Vancouver is normal or healthy for the city? It is in all of our interest to make sure that the people involved in the real estate market are there because they are buying houses for their own use, or to develop them, or to rent them out. Houses being used as chip pieces to be traded between the rich does no one any good. Yes it will have to correct itself eventually, but in the meantime it is causing a lot of damage.

And just to put the foreign buyers are driving up prices fear-mongering to rest, foreign buyers represented only 2.03% of purchasers last year in Greater Victoria. Of the foreign buyers, Americans were the largest group at .83% followed by Chinese at .68%. Also refer to Leo’s graph on this. Basically, foreign buyers appear to not be greatly interested in Victoria.

http://victoria.citified.ca/news/origin-statistics-quell-concerns-over-foreign-ownership-of-victoria-real-estate/

Where is the evidence of Victoria RE hoarding? Given that there is an almost 70% rate of home ownership in Canada how does this go along with multiple properties owned by one person causing an issue in the local market – as far as I can tell this is not causing any issue. Seems like another red herring track/theory that fails to provide data to back it up. Also are you calling any accumulation of wealth hoarding or just real estate? Anyone who has a rental property is a hoarder? Even though there is not enough rental housing available? And what residential property is being built for investment? What does that even mean? Residential RE in the Victoria area is not what I’d call a great investment beyond a primary residence. You have to be quite well off with a high income and credit rating to match to buy a second home and just think back on the last seven years – flat and incomes generally don’t cover rents.

What the stats show is that very few Canadians own more rental property. There are; however, a number of corporations and individuals owning multiple commercial properties in Victoria ie. some very wealthy families and, for example, groups of dentists, own a lot of the commercial stuff. Are you suggesting that this should not be permitted? If so, you are basically advocating for something other than the free market system. That has been tried and I see no evidence it works. In fact the words spectacular failure come to mind.

This isn’t simply foreigners. We have to look at ourselves for being a part of the problem. As a society we are hoarding real estate. By doing so we lower supply and cause a demand for new housing to be built which stimulates the economy creating new jobs and more demand for housing by potential home owners and more investors.

Hoarding is nothing new to our society. What is different is that the low interest rate and ease of financing over the last decade has made it possible for me people to try to corner the market.

In the past we would build housing to meet home ownership needs. Today we build housing to meet home ownership needs and investors needs. And those investors may be foreign and they may be local.

Do we want to put restrictions on investors? Any government that does so runs the risk of collapsing the real estate market, driving up unemployment and putting the province into a recession.

No government wants that label hung on them by the voters.

In 1980, the US government changed the leverage ratio on silver and that caused hoarders like the Hunt brothers to not meet there margin requirements and they had to sell off their silver which collapsed the silver market.

This month the government is going to increase the down payment (leveraging) requirement beginning at an arbitrary number of $500,000 in order to cool but not collapse the market. I don’t think that will have an effect on most middle income home ownership buyers. But I’m no so sure on what the effect will be on some investors who bought and fixed up housing and are selling to a niche market of cash strapped buyers who couldn’t afford a fixer upper and pay for needed repairs but can finance a freshly remodeled home at a higher price?

https://youtu.be/FXv1IauLKqU

Yeah, I just disagree. Permit assignments – they are a normal part of the contract. PTT is not going to stop people from profiting in a market that gains a million in a month nor is it going to stop the home from appreciating. And people who do this on spec are taking huge risks, they stand a good chance of getting burned somewhere along the line.

Again, assignments are not used for speculation alone. There are good business reasons to keep them in any market and putting a fee on them is not going to stop anything anyway never mind the implementation nightmare.

A vacancy tax would just cause people to rent or permit their places to be occupied by caretakers or family friends.

Lawyers have a constitutional exemption from Fintrac so I don’t know why you are including them. RE agents have to report and fill in the forms. Most reports come in from banks. There are active investigations by CRA and FINTRAC audit for Vancouver RE in progress.

If people are breaking the law then they should be held to account. It seems to me that what is occurring most is actually not law-breaking by foreign investors (depending on where the funds come from), but aggressive tax planning. I do believe our tax laws need to be amended to prohibit non-resident income from being exempt while permitting a resident relative such as a child who is going to school here live in the house and claim PTT. Of course wealthy Canadians are likely using this strategy in a rising market as well…

Yes but it its not just a one way thing that price increases lead to speculation like this. The ability to easily speculate leads to price increases. That would be a reason to clamp down on this kind of thing, to avoid nutty situations where properties gain a million dollars in 3 months.

Yes but in reality with condo pre-sales they are overwhelmingly used for speculation. In the article they said some developers are not allowing assignments to curb speculation.

Overall when you have people buying up tons of properties with no intention of ever taking possession of them that is pure speculation and bad for anyone that is actually trying to buy a place to live in.

If the Health Care system is out of control…giving it a quick fix by taxing other sources (ie;foreign) isn’t going to resolve the problem. It just encourages it’s addiction to financing until that (taxed) financing disappears due to the massive correction you are calling for, thereby leaving the Heath Care system even deeper in the hole and dependant on your next quick fix solution…

I think foreign investors should pay a 20% purchase vacancy tax. If they are just here to stash their cash and leave their places vacant and not contributing to the community then this cash would help finance our out of control health care system.

“That is why we have laws”

Well it’s very evident from the endless investigative journalists articles that many say “screw the laws” , especially the offshore money. When there is no proper oversight by the authorities and extremely high percentage of agents or lawyers don’t report suspicious activity, then your faith in the law is pretty naive.

Assignments are rare overall but they are also used by the ordinary person. Charging for them makes no sense to me.

Posters appear to be assuming that they are being used only by people wanting to make a quick buck – which only works in limited circumstances – but assignments are also commonly used with condo pre-sales where there is a long closing. It allows a buyer to buy but still be able to transfer their interest if their personal circumstances change and this type of agreement underpins the marketability of pre-sales.

Assignments can also be used to deal with buyer cold feet before closing, some people might even sell at a discount rather than incurring the PTT in a flat or depreciating market where their circumstances have changed (ie. job loss).

Hawk you are talking about unethical behaviour which occurs in every type of transaction and there are already laws against this. I can find a case about most any transaction that was fraudulent. That is why we have laws.

RE is a free market system and I’m not sure when government regulation should be further engaged. I would say that it appears most likely to me that an increase in PTT would be levied on high end properties and the exemption on PTT should be increased in Vancouver for lower end properties. The increase on high end does not seem an effective measure to curb prices to me, but it would be attractive to government and supported by the majority most likely.

I don’t know what the big deal about the assignments is…..they’ve been around forever (I’ve done a few in the past) and realistically can only last for a few months. The reason we don’t seem them in Victoria is the hottest segment of the market (SFH in the core) are up 10% YOY….so let’s say 1% per month. When the completion is 3-4 out max no opportunity to assign with that type of appreciate. What we are seeing in Vancouver can’t be sustained over a long period of time.

Regarding Fintrac forms huge waste of time. I have to fill them out, legally, even on repeat clients where I am 99.9% sure there is no illegal activity going on.

Greed and unethical behavior eventually causes market crashes. Blow off top charts never fail to explode.

http://www.greaterfool.ca/wp-content/uploads/2016/02/VAN-CHART.jpg?8f4c78

“Assignment deals can also lead to litigation. Broker Leo Zhang of Sincere Real Estate Services is accused by seller Wen Hsien Tsai of devising a scheme to acquire Mr. Tsai’s home for less than it was worth, then make a profit assigning the contract. ”

“The resulting distortions threaten to strain the public’s trust in the real estate brokerage business, according to some in the profession, while others openly question the sustainability of a market they are heavily invested in – and helped create.”

I would rather a tax on an assignment then mortgage restrictions. One affects the common man the other not…

Trying to charge a fee on an assignment would be impossible for government to monitor at this point imo. There is no registration of the assignment because no land is transferred. It is an option at the point it is written.

Not sure how you are going to attach a fee, never mind a tax, and the cost to implement or administer a system would be greater than the fees imo given the small number of transactions this applies to. Not to mention it would restrict all assignments and assignments are very useful when you have an agent acting on your behalf. I also think it would do little to stop the transfers for profit and that this issue will correct when the market corrects – you aren’t going to pop or slow a bubble by instituting this change imo.

If government wants to stop the market from rising like it is then more mortgage regulation might have a greater impact. If foreign ownership is really contributing significantly to the rise of prices amendments to the income tax act are required – these should be implemented anyway imo to ensure foreign owners are paying PTT or income tax and not being able to avoid both.

My take is that the market will correct on its own as it always has. Prices do not keep rising like a meteor forever. There will be a turn at some point, or a long flat period like we had in Victoria.

I agree to a point. Absolutely the original sellers have nothing to complain about. They sold the place, and by selling the place they give up all right to influence whether it is immediately flipped or not. Those whiners are driven by greed because they feel they missed out on some profit.

But I do think the assignments drive speculation. If you can flip the house 5 times before it would have normally transferred once, that turns houses into a commodity that are driven up purely by speculation. High levels of speculation are very strong signs of bubbles.

Could be a similar type of tax though.

Assignments seem like a normal part of any contract for purchase to me and can be useful in a number of circumstances.

Why does it matter who the home is ultimately is sold to? If someone is going to sell the right of assignment for profit good for them – that is a part of the open market that may only exist where prices are rising rapidly – very time limited. Usually happens when the successful bidder gets an offer from someone who was unsuccessful but really wants the home.

There is nothing unethical about this imo unless you are the realtor dealing for the seller and purchaser and subsequent purchaser – that should not be permitted due to conflict of interest. Where the realtor has nothing to gain from a subsequent assignment I see no issue.

My view is that you cannot charge PTT on an assignment – there is no transfer of the land that the tax could be attached to.

Marko, my understanding from the fintrac forms is that federal oversight is triggered by the reporting of a suspicious transaction. If you haven’t reported one on your forms, and most realtors haven’t because they don’t actually deal with the transfer of anything but the deposit, then the federal government would not be involved.

PPT on assignments is a great idea! It will help track them and bring in a new asshole tax revenue!

As it is, the Canadian government doesn’t have the resources to enforce Fintrac.

I fill out hundreds of Fintrac forms every year….not sure what the purpose is as no one from the feds looks at them.

I wonder if that’s what’s coming in the budget.. Land transfer tax owing on assignments.. That might be a good idea to put a damper on this kind of easy speculation.

I had a REALTOR® friend call me from the lower mainland a few days ago asking for help in writing up an assignment for his buyers and it was like a $50,000 premium for a contract that was only entered into 3 weeks ago. Just insane.

So easy! Thanks.

To quote something, put a > at the start of the line and then paste in what you want to quote.

Put your comment on a new line below that

You can do all sorts of formatting.. Check here for the quick reference https://en.support.wordpress.com/markdown-quick-reference/

Not all of it seems to work in comments though

Leo S, how do you do those fancy quotations with the big quotation mark at the front? I want to do them too.

I wonder if that’s what’s coming in the budget.. Land transfer tax owing on assignments.. That might be a good idea to put a damper on this kind of easy speculation.

I believe the homeowner feels ripped off because the agent didn’t do what he was hired to do and that was get top dollar for him, and not an inside job where the agent and his secret buyer had a plan knowing full well there was a bigger fish waiting in the wings. I would be pissed too. The agent used the client which is extremely shady and unethical. Oh right, where does a salesman have ethics with that much money to be made.

Here’s what the headline should be: “Insatiable homeowners are angry they only made 5 million dollars through no effort of their own”

Total nonsense. Sellers receive market value. Market value goes up, future sellers receive market value which is higher.

Soo.. Just like any other owner then.

Yes the market in Vancouver is completely unhinged, and yes reality will set in eventually. But the audacity of a home owner complaining about other people cashing in on the same racket just shows the level of unbelievable greed that has taken over.

Another reason people despise agents. Tell me this isn’t happening here with all this panic buying. One more sign this house of cards is going to crash and burn to a crisp.

http://www.theglobeandmail.com/news/investigations/the-real-estate-technique-fuelling-vancouvers-housing-market/article28634868/

You’ve stated a lot of things.

The one that I was responding to in the pp was the statement that you can pay whatever you want for a primary residence property where the purpose is to avoid paying tax by assigning a value to a residential property far out of line with market which has nothing to do with Fintrac.

As for transparency in RE, we have enough transparency imo. Any issues with foreign funds being used to purchase properties with cash are not due to a lack of transparency in transactions on Canada’s side.

If you are specifically referring to the issue of people moving money from mainland China to the Vancouver RE market it appears that the issue is not lack of information or use of corporations to hold RE, but rather one of Canada’s tax regime not being set up to collect from foreign millionaires who earn money overseas and have homes and family in Canada.

In other words, it would be fairly easy for someone with assets to become a permanent resident but have assets in the name of their spouse/child and they themselves claim that they are non-resident for tax purposes so don’t pay income tax in Canada while relatives claim the primary resident exemption upon sale. The methods used to move funds into Canada and avoid taxes have been clearly set out in the high profile divorce cases where assets have been traced.

As it is, the Canadian government doesn’t have the resources to enforce Fintrac. You should likely be focussing on this issue rather than “greater transparency” if you are concerned about this matter.

Back to the Victoria market, I see little to no effect on our local residential market from foreign funds. Not sure about the commercial market.

I posted my sources and the dates. What I’ve stated is nothing new than what has been reported by the Province, National Post and the Globe and Mail.

My opinion was that increasing the property purchase tax would not be the solution to the housing problem. What we need is transparency in real estate transactions. That would allow FINTRAC to do it’s job. It would also discourage those that abuse our system.

Your frustration comes from your unsuccessful attempts at strawman arguments in an attempt to move the discussion off my original statement. Eventually sinking to the lowest level of debating an issue being that of a personal attack.

https://youtu.be/FD50OTR3arY

You might want to reconsider that advice. If you need a good lawyer to get you out of the trouble your accountant has gotten you into you have the wrong accountant.

JJ your post is a mishmash of ideas that are not logically organized, and without getting into it further, your views on valuation, cra, market value, anti-avoidance rules and related transactions are just way off base.

It is not magic and “all relative”. It is also not about whether you can argue something in court, the point is to avoid getting to a reassessment in the first place unless you have money and time to burn.

And just for you Introvert, a wave of different price increases.

District Percentage Change

Oak Bay 55.8 %

Saanich East 13.9 %

Colwood 22.3 %

Victoria 8.7 %

Esquimalt 14.0 %

Saanich West 16.0 %

View Royal 0.9 %

Langford 15.0 %

Sooke 1.9 %

Today’s report shows Victoria leads y/o/y employment growth by a wide margin…

Vic 5.9%

Toronto 4.8%

Van 4.6%

Edmonton 3.6%

FValley 3.1%

Montreal 0.8%

Calgary -2.2%

To answer the question above…I’m betting we break lots of market records this spring.

I’m sorry I got lost when you said 2 million and grossly inflated. I never mentioned that at anytime.

One of the most expensive houses to sell in Vancouver sold at $51,000,000. Was that grossly inflated? Can you tell the difference between a $30,000,000 home and a $50,000,000 home?

Could you prove it?

The cost of Premier Clarke’s deck was argued for weeks in court with no definitive answer as what it should cost to build that deck. Try that on a $30,000,000 home. It’s a battle that CRA wouldn’t even try to argue, because in the end it’s just what someone wanted to pay.

I was brought in to determine the value of the land and improvements excluding furniture and a medical practice in the lower level of a mansion in Fairfield. And a unique log home in Langford that sold along with the business that built log homes. The only reason why I was asked was because they needed a mortgage.

If it had been a cash deal, nothing would have red flagged CRA.

A property bought for 6.6 million and less than two years later sells for $8,000,000. Would that red flag CRA. Not at all. And you could never prove which was at market value and more important it doesn’t matter. People are allowed to overpay for real estate and pay the inflated property purchase tax too.

I’ll quote my father on this one who said…

“You need two people in life. A good accountant to get you into trouble and a good lawyer to get you out of it”

Good point.

Not sure why you are often triggering the spam detection code, but I try to approve them quickly.

CRA would almost certainly be able to prove tax avoidance where a value is placed on something such as a primary residence that is $50 million when market is actually $2 million and there is a windfall capital gains exemption as a result. Particularly where there was an assignment of values between an business and a property.

I’m saying that in transactions someone or some corporation is not allowed to pay whatever they want for a property where the purpose of such a grossly inflated payment is to avoid paying tax. That is illegal.

“3. Subsection 245(2) states that where a transaction is an avoidance transaction, the tax consequences to a person shall be determined as is reasonable in the circumstances in order to deny a tax benefit that would result from that transaction or from a series of transactions that includes that transaction.

An avoidance transaction is defined in subsection 245(3) as a single transaction or one that is a part of a series of transactions where the single transaction or the series results directly or indirectly in a tax benefit, unless the transaction is carried out primarily for bona fide purposes other than to obtain the tax benefit.”

Again, where are you getting your information from because I’m starting to suspect you are just making it up.

Your data on appraisals is really excellent JJ, but some of the other stuff you post is so… wrong.

And Leo there is a fee but it is pretty minimal with an account. I think that this barrier to entry is okay myself and that people should have to register to access otherwise the telemarketers/uninvited solicitations will descend en masse.

Thank you totoro and bearkilla!

Looks like you still have to pay for each request. I think they should integrate that info into eValue BC and make it free.

No Totoro I am not trying to say what you want to set up as straw argument. I’m saying what I wrote.

That we need transparency in real estate transactions. Legitimate people will still buy real estate. Others will just move on to a different province or country.

http://www.peacearchnews.com/news/299374191.html

The only good government website I’ve seen recently is eValue BC. The overhauled site is really excellent.

Totoro, if you can tell me how you would prove tax avoidance then I’ll explain it to you.

Since a property purchase tax was paid on the property. Or are you saying that someone is not allowed to pay whatever we have agreed to for my home?

You see what happened is this person who had a business similar to mine was wishing to expand into Canada and I invited him over to my home. He was so smitten with the property that he offered to buy my home as he needed a home after buying my business.

Hard to prove tax avoidance when someone has paid a property purchase tax.

The numbers are not important, think of it as 10,000,000 company and 5,000,000 in Lands End if that helps.

You can find out who the property owner is. And so what if it is a corporation or individual. There is also no logic in distinguishing between a “numbered” company and any other company name.

The only legitimate reason for the average layperson to know this information imo is to contact them about a property-related matter such as making an offer to purchase or asking them to deal with something, including a debt.

If what you are trying to say is that the RCMP and CRA are not catching fraudulent transactions in Victoria, or you have evidence leading you to believe all numbered companies are up to no good if they own property, there are several numbers to report to including the RCMP, CRA and CMHC fraud line. Do you think you know better than they do and that Joe Public should be out scrutinizing corporate records?

I personally have no desire or vigil ante inclination to spend my time on this – or even discussing it without real data or a practical implication or a mandate to do so. Busy-bodying into others’ private financial lives is outside my comfort zone and I see no merit in it or reason to open up the corporate records of a private firm. And it is hypocritical imo unless you’d like to open up your personal ownership interests in any stocks in corporations to a publicly searchable database and the same for sources of your income.

You can’t search by name in order to follow the transactions or find out the owner (s) of a BC numbered company.

You use to be able to search by name but that was changed after the Privacy Act was implemented in BC by the Liberal Government.

I’ll try to remember to put a Totoro disclaimer on for you. 馬鹿

In that I agree with you bearkilla – very confusing site. I used to use it through BC online and it was much easier to navigate.

You need to register for a LTSA Explorer account.

You have to sign up for an account to pull titles. Check out https://ltsa.ca/online-services/myltsa-explorer. I fully admit the government websites are designed by people who have no place doing so.

And yes, Western Communities and core markets are surprisingly different it seems.

No, as JJ has informed us so many times over the years, what happens in the West Shore will always affect the core, like an ocean wave.

God I love that wave metaphor. Too bad his hypothesis is totally wrong.

“What is more likely to occur is that a $100,000,000 company is purchased along with the principle residence. The business is shown as sold for $50,000,000 and the house as $50,000,000.”

Um, no – anti-avoidance rules will get you there JJ unless that really is a 50 million dollar home.

Also you are mixing transactions.

If the corporate purchase includes the home as a corporate asset there is no principal residence exemption and gains would be taxed at the highest marginal tax rate upon sale. In addition, the first time the property is purchased by the corporation there would be PTT. And you better have been paying rent to occupy the corporate asset or you will be assessed a retroactive taxable benefit including penalties and interest.

http://tax.moodysgartner.com/personal-use-assets-owned-by-a-corporation/

Where in the world are you getting your information from?

Well I really am dense then. I can’t find any way to search online there. It says the options are to hire a professional, submit a request by mail or go down to the office.

The only search I can see on that page is the site search, and it doesn’t return any results when putting in a legal description so it seems to be only searching the site pages.

You can order title here: https://ltsa.ca/property-information/search-title

Land titles are public information and no privacy legislation has to be amended JJ. This includes ownership information. https://ltsa.ca/docs/Personal-Information-Protection-Policy.pdf

JJ, I thought you were discussing the Victoria RE market. If you want to switch to Vancouver please put this in your post and I won’t respond. I have minimal interest or expertise in that market – and no interest in alarmist talk of bankruptcies, fraud and money laundering that have little relevance or risk to our local market as far as I can tell.

The capital gains exemption is 800k not 500 and does not include your primary residence exemption. My understanding is that you don’t qualify for the capital gains exemption on properties held by a corporation with fewer than five employees engaged ft in the active business of the corporation. You should get professional advice if you are involved in anything remotely like this.

The life time exemption of $800,000 applies to businesses. What is more likely to occur is that a $100,000,000 company is purchased along with the principle residence. The business is shown as sold for $50,000,000 and the house as $50,000,000.

The principle residence is capital gains tax free. Sure there is a property purchase tax to be paid but the amount is less than what the capital gains tax would be on the entire business.

More money in your pocket.

Red flags that would spot this could include. That it was an all cash transaction for the house. The property was never listed for sale. No past sales history.

Something for you IT guys/gals to remember when it comes time to sell your business.

If you watched the 60 Minutes episode last week you will see that 90% of high level lawyers will help you bring in dirty money. To say it doesn’t exist here because it’s not on Google is a joke.

The Province has been publishing endless investigative stories of dirty money by the billions coming into Vancouver. Vancouver is the money laundering capital of the world. To think none of it winds up in Victoria is completely naive.

Totoro, the point of money laundering is not to leave any evidence that can be followed back to the person or persons.

Money laundering is found when it is associated with a crime that initially sparks the investigation such as an illegal drug operation, murder investigation, human trafficking etc.

And that’s because convicting someone for money laundering is really difficult.

Google this one

Follow the money: Evidence submitted at fraud probe points to concerns about Vancouver real estate market

I’m dense. Where can you do that?

But capital gains in excess of the life-time exemption of $500 K will be taxable?

The Privacy Act would have to be amended to not include real property transactions.

Not all numbered companies are laundering money.

But money launderers do use numbered companies and nominees to hide their identity. Not having to register the new owner makes it easier to do a transaction through a lawyer where the money is layered through multiple transactions.

Lawyers are exempt from reporting to FINTRAC suspicious transactions.

Google search the following from the National Post

Cash buys and illicit money: Federal audit probes Vancouver’s real estate industry for money-laundering

NO ALL lawyers will do this. I suspect that only a few are knowingly involved. Lawyers want to protect their reputation and if it were common knowledge that they assisted in money laundering that might be linked to criminal activity they would lose their credibility among their peers including the courts.

If you make real estate transaction transparent then money launders and tax evaders move onto somewhere else where it is much easier to do their business.

It’s like putting an alarm system label on your door. It doesn’t stop a burglar, it just makes them chose a different house to rob.

I’m merely looking ahead to our next 5-year population growth and predicting it will blow away all gov`t projections. The economic among other changes underway are simply too far beyond the gov’s scope.

My guess is Vic gets a larger chunk of migrants than the last time the ‘stars were aligned this way’, partly due to Van‘s affordability, but also for reasons like Vic having the highest employment growth. And remember fine fellow bloggers, disagreement is what makes this site so much fun.

Ordering title online is pretty easy to do and ownership is public information.

Also, as far a I’m aware ordinary people are not forming companies to avoid PTT on residential property purchases. The reason they are not is that they will not access their tax exemption for a primary residence. Any appreciation will be taxed at the highest marginal tax rate as passive business investment income which defeats the purpose of saving on PTT.

Some non-residents who buy very high end properties here might benefit from this strategy. Bare trusts can be used on big commercial deals with significant impacts.

Sorry JJ, I thought you were continuing the conversation about the Victoria RE market but it appears you may have been commenting on the US, TO or Vancouver instead. I did google it first btw and found no evidence to support this in Victoria.

You can order a title online. Pretty easy to do, I’ve done it a few times.

It’d be interesting to see how they could “stop” this so-called “loop-hole”. Transfer tax on the sale of companies? Boy that’d be a sure fire way to chase away businesses.

Numbered companies owning Real Estate is NOT indicative of fraud or corruption or HAM hiding transaction. That incorrect assertion is made repeatedly by one poster on this site.

The reason for the increase in numbered companies holding real estate is primarily due to the exorbitant RE transfer tax.

Ordinary people are now forming a numbered company before purchasing a house, then when they purchase a house they purchase in the name of their numbered company. Then when they sell the house they sell the company to the purchaser and the company’s assets are the house. In this transaction there is zero Property Transfer Tax because the house did not sell, the company was sold/purchased. Property Transfer Tax is only payable when there is an ownership transfer registered st LTO.

It’s legal and it’s catching on with savvy RE investors. But the government calls it a legal loophole and they want to stop it.

Would be nice to have this online… Although I guess privacy might be an issue. Right now privacy is protected via a process that is a pain in the butt, so not a real protection.

No Totoro, once again you are taking what I said out of context.

I DID NOT say that Victoria is a haven for money laundering. And before you jump off the handle at every single thing I write – Google it!

“Canada’s banking and insurance regulator highlighted fraudulent mortgage practices as a key threat to the country’s financial system, prompting consultations with lenders over how to ensure that the system can withstand a severe housing market downturn.

“It has come to light that institutions have been, I would say inadvertently, making mortgages to people whose income has been falsified,” said Jeremy Rudin, superintendent of financial institutions.”

source Globe & Mail December 14, 2015

“The U.S. Treasury Department has launched a new initiative aimed at identifying anonymous cash buyers of luxury properties.

Currently, purchasers can hide their identities by acquiring real estate through limited liability companies or other shell vehicles that prevent their names from being linked to any specific address. The new rule requires title insurance companies to identify cash buyers of properties above $3-million (U.S.) in Manhattan and above $1-million in Miami – the two metropolitan centres being initially targeted under the project.”

source The Globe and Mail January 18, 2016

If you would like to compare Victoria to Vancouver this may help.

However, Vancouver’s substitute would be the Fraser Valley. Victoria’s substitute would be the Westshore.

Neither are Vancouver and Victoria good compliments to each other as there rise and falls are not similar.

Condominium Median Core Districts Of Greater Victoria

(sample size +/- 500 sales per quarter)

Q1 2015 $287,443

Q4 2015 $283,000

minus 1.5%

Last 90 day median (November, December, January) $276,500

now down to minus 3.8%

Detached House (as above)

Q1 $600,000

Q4 $654,450

plus 9 percent

Last 90 day median $648,575

now down to plus 8 percent

Michael I don’t believe those are the figures for Victoria. There has been no marked increase in migration to Victoria as far as I can tell from the stats. Perhaps most folks end up in and around Vancouver? In any event, those stats appear to be for BC overall which is a big place and we have the specific stats for Victoria so I would use these or your results will be misleading and unreliable. My view is that Leo is correct, the numbers have not and will not increase at the pace you are asserting.

JJ you can access the owners names of properties through land titles, this is publicly available information. I guess your assertion is that there is a huge contingent of folks in Victoria with numbered companies hiding laundered money buying up the market and CRA doesn’t know about it. I do not believe this is correct in Victoria for the residential market but perhaps you have stats or reliable information that indicates otherwise.

Mortgage fraud does not appear to be a significant issue as far as I can tell or it would be reflected in early default rates, which are extremely low and not rising. And I’m not sure what identity theft has to do with the mortgage industry as I was unable to find any evidence that this is a significant problem in Victoria – or Canada for that matter. Biometric data is likely coming, but it will probably appear at border crossings first.

And yes, Western Communities and core markets are surprisingly different it seems.

Yep, when you see those agents and real estate writers/TV producers pumping out segments on 30% and 40% gains for Victoria SFH’s this year you know the top is in. Utterly clueless in Victoria.

I don‘t believe the condo thing… it’s realtors, a RE writer, and some UrbanAnalytics chump in Van that are starting to say condos will outperform.

http://www.vancouversun.com/opinion/columnists/barbara+yaffe+will+2016+year+condo/11698027/story.html

The benchmark for condos are only up ~20% y/o/y for Van, whereas SFH is up ~27%.

I think it’s already underway (see quarterly numbers below) and I don’t think it has anything to do yet with a retirement wave… it’s more of an economic migration similar to the last oil crash. As a reference oil bottomed ~Jan ‘86 after a ~70% crash.

Annual Net Migration

1986 11,518

1987 37,666

1988 54,533

1989 66,753

1990 68,673

1991 55,874

1992 69,055

1993 72,274

1994 77,116

Quarterly Net Migraton

2015

July-Sep +17,416 (no wonder our market has gone ballistic lately!)

Apr-Jun +8,076

Jan-Mar +6,121

2014

Oct-Dec +308

Increasing property transfer tax isn’t going to do much.

What is needed is transparency in real estate transactions. The owners of real estate should be made public knowledge. Their name and address should appear on the title and not a BC numbered company or nominee. That makes it easier to follow the money. Money launderers want to hide the money trail. Removing their ability to hide behind multiple transactions through numbered companies and nominees will do that.

This won’t stop money laundering but it will make them move to a different province or country where it is easier to layer and place their money.

We might even think about finger printing property owners. That would go a long way to eliminating identity theft and mortgage fraud in BC.

I think duplexes are kind of a weird deal. Most people don’t seek them out. If you’re looking at strata it’s townhouse/condo and if you’re looking detached it’s not duplex. Top that off with a bad location right on the main road to the community with a huge retaining wall in the back yard and it’s not surprising that place on clearwater is not selling.

Totoro – Mentioned “Core and Surrounding” – I only posted that property as it was a recent relist.

Your point of market softness in western communities is valid and I misjudged the condo market discrepancies from WC and Core. I was simply surprised that with all the hot takes on price increases that there are a few nicer units that are sitting on the market and taking price drops. Perhaps some realtors are hoping that market commentary and news reports of surging prices will be help with their overestimated list price.

Isn’t that Langford? The core is comprised of the City of Victoria and the District Municipalities of Saanich, Esquimalt, and Oak Bay, which are all adjacent to it.

The market in the Western Communities includes the cities of Colwood and Langford, the town of View Royal, and the District Municipalities of Highlands, Metchosin, and Sooke, which lie generally west of Esquimalt Harbour and Portage Inlet.

https://en.wikipedia.org/wiki/Greater_Victoria

I don’t follow the market in the Western Communities but from pp it has not experienced a significant run up in prices as the core areas, particularly Saanich, OB and Victoria, have. There is a very limited and densifying land base in the core that partly explains market differences.

Some interesting condo/multi properties in core and surrounding. i have seen a few relists lately.

1219 Clearwater Place – Listed Dec 15 and dropped 5K yesterday.

https://www.realtor.ca/Residential/Single-Family/16556639/1219-Clearwater-Pl-Victoria-British-Columbia-V9B0J2

Small price drop so it could be a realtor-seller issue, but still sitting on the market for almost 60 days.

Yeah condos have been lagging a bit. All the price increases are in detached homes.

3 new prime area condos on Belcher still haven’t sold after 3 months from finished stage. Probably 2 years since pre-build. Doesn’t sound like a hot condo market to me.

I don’t think there’s such a thing. Condos can always be added. If prices rise a lot more will be built and put a damper on it. In a densifying city, detached homes will outperform until they are torn down to put multis in.

Not going to happen. Despite all the talk about the retirement wave that should have started arriving in the last 10 years, net migration hasn’t budged. Heck at the last census the population of Sydney even decreased.

We’ll see if the uptick in mainland buyers persists, but there’s no way we will hit anywhere near 5000 new households per year by 2020. Maybe 2100.